UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

the arbitrage funds

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-295-4485

Date of fiscal year end: May 31

Date of reporting period: May 31, 2023

Item 1. Reports to Stockholders.

Annual Report

May 31, 2023

Arbitrage Fund

Water Island Event-Driven Fund

Water Island Credit Opportunities Fund

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Arbitrage Fund | |

Manager Commentary | | | 3 | | |

Portfolio Information | | | 5 | | |

Portfolio of Investments | | | 7 | | |

Water Island Event-Driven Fund | |

Manager Commentary | | | 19 | | |

Portfolio Information | | | 21 | | |

Portfolio of Investments | | | 23 | | |

Water Island Credit Opportunities Fund | |

Manager Commentary | | | 34 | | |

Portfolio Information | | | 36 | | |

Portfolio of Investments | | | 38 | | |

Statements of Assets and Liabilities | | | 46 | | |

Statements of Operations | | | 50 | | |

Statements of Changes in Net Assets | | | 54 | | |

Financial Highlights | |

Arbitrage Fund - Class R | | | 57 | | |

Arbitrage Fund - Class I | | | 58 | | |

Arbitrage Fund - Class C | | | 59 | | |

Arbitrage Fund - Class A | | | 60 | | |

Water Island Event-Driven Fund - Class R | | | 61 | | |

Water Island Event-Driven Fund - Class I | | | 62 | | |

Water Island Event-Driven Fund - Class A | | | 63 | | |

Water Island Credit Opportunities Fund - Class R | | | 64 | | |

Water Island Credit Opportunities Fund - Class I | | | 65 | | |

Water Island Credit Opportunities Fund - Class A | | | 66 | | |

Notes to Financial Statements | | | 67 | | |

Report of Independent Registered Public Accounting Firm | | | 91 | | |

Disclosure of Fund Expenses | | | 92 | | |

Additional Information | | | 95 | | |

Approval of Investment Advisory Agreements | | | 96 | | |

Liquidity Risk | | | 101 | | |

Trustees & Officers | | | 102 | | |

The Arbitrage Funds Shareholder Letter

Dear Fellow Shareholders,

The fiscal year ending May 31, 2023, marked yet another challenging 12 months for both event-driven strategies and broader credit and equity markets. We continued to witness heightened volatility over the period, as many of the same challenges we discussed in our letter one year ago remain – such as the Russia/Ukraine conflict and the Federal Reserve's ("Fed") fight to tame inflation with interest rate hikes. We also saw new hazards emerge, such as a regional banking crisis that led to the failures of multiple large regional banks in the U.S. and yet another battle over the U.S. federal government's debt ceiling in Congress.

Within our event-driven universe, regulatory headwinds persisted throughout the course of the year, as antitrust regulators around the globe attempted to block several large transactions, in turn driving sympathetic volatility in deal spreads throughout the merger arbitrage universe. At times, we have found the logic behind the regulators' recent cases to be perplexing – particularly in the U.S., where the Department of Justice ("DOJ") and the Federal Trade Commission ("FTC") have sought to block deals, in our opinion, based on novel legal theories with little basis in historical precedent or antitrust law.

While the FTC and DOJ have succeeded in causing some companies to abandon their planned tie-ups rather than pursue costly litigation, and their actions may have had a chilling effect on future mergers and acquisitions ("M&A") in certain sensitive industries or by large acquirers, the regulatory pendulum may be starting to swing back to the other side. At this point, of the cases that have gone to trial, the FTC and DOJ under the Biden administration have lost more than they have won, and we believe acquirers may increasingly take a bolder stance in fighting regulatory objections. Furthermore, within the ranks of agency staff, there has been considerable brain drain, which may be a result of skepticism regarding the current regime's approach. In the past two years, for example, senior-level attorneys at the FTC have departed the agency at the fastest rate since 2000, which could make future enforcement actions more challenging.

While we are cognizant of the challenges that remain, amidst this environment, we believe the return opportunities in merger arbitrage are compelling. Volatility and rising interest rates are bolstering wider deal spreads, which have reached average levels we haven't seen since the Global Financial Crisis. According to Dealogic data, the average day-one spread (i.e., the spread the day after deal announcement) of pending deals as of May 31, 2023, exceeded 12% – more than double the rate just 12 months prior. And while M&A deal flow has slowed somewhat, with deal volumes in 2023 declining from the already subdued levels of the second half of 2022, activity still remains above pre-pandemic 2019 levels, according to Refinitiv and PwC data – providing plentiful event-driven investment opportunities.

As the Fed gets closer to its goal of combating inflation and interest rates begin to stabilize, we anticipate business leaders will increasingly seek to drive growth through strategic M&A, spurring further consolidation activity. Furthermore, financial acquisitions continue to comprise a large segment of M&A activity, and private equity firms remain flush with cash, with approximately $2.5 trillion on their books waiting to be deployed. All told, we believe the opportunity in the merger arbitrage space remains quite attractive. For our broader event-driven portfolio, given ongoing volatility, we expect to maintain our focus on these and other hard catalyst investments given their more definitive timelines and outcomes, introducing select soft catalyst investments – which typically have greater sensitivity to broader market moves – only when we believe the potential reward outweighs the potential risk and when we can construct appropriate risk mitigation strategies. For our credit portfolio, we see attractive opportunities not just in

Annual Report | May 31, 2023

1

The Arbitrage Funds Shareholder Letter (continued)

merger-related credits, but also other hard catalyst opportunities such as refinancings, as well as less definitive opportunities involving credits near the top of the capital structure, such as term loans.

Sincerely,

The Investment Team

Water Island Capital

The discussion of market trends and companies throughout this commentary are not intended as advice to any person regarding the advisability of investing in any particular security. Some of our comments are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. Our views are a reflection of our best judgment at the time of the commentary and are subject to change any time based on market and other conditions, and we have no obligation to update them.

Glossary

Coupon: The annual interest rate paid on a bond.

Deal Flow: The volume of announced mergers and acquisitions activity.

Deal Spread (also "merger spread" or "spread"): The difference between the price at which a target company's shares currently trade and the price an acquiring company has agreed to pay, which forms the rate of return in a merger arbitrage investment.

Global Financial Crisis: A period of severe stress in global financial markets and banking systems between mid-2007 and early 2009.

Hard Catalysts: Situations with more defined potential outcomes and higher probabilities of reaching a successful conclusion.

Soft Catalysts: Situations with less defined potential outcomes and relatively lower probabilities of reaching a successful conclusion.

www.arbitragefunds.com | 1-800-295-4485

2

Arbitrage Fund Manager Commentary

Arbitrage Fund | Tickers: ARBNX, ARBFX, ARBCX, ARGAX

The Fund's Goal and Main Investments

The Fund seeks to achieve capital growth by engaging in merger arbitrage. Merger arbitrage is a sub-set of a broader event-driven investment strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically, merger arbitrage is a low volatility strategy pursued by absolute-return-minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets.

Investment Strategy

The strategy's focus is to capture returns from corporate events, generate market neutral capital growth, preserve capital, generate consistent and positive returns, and achieve low correlation and low volatility. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations, and other corporate reorganizations. The Fund's investment adviser uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition's completion. That difference, or "spread," is the primary driver of returns for this investment strategy. There is no limit to the number of stocks the Fund can hold; however, the Fund typically invests in 40 to 80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock-for-stock deal) and, in many cases, associated derivative positions for hedging purposes.

Fiscal Year Highlights

Arbitrage Fund Class I (ARBNX) returned -0.75% for the fiscal year ended May 31, 2023. Investments in the European region contributed to returns, while the Americas and Asia-Pacific regions detracted from returns. Industrials and health care were the top performing sectors, while financials and information technology detracted the most from returns.

The Fund may utilize derivatives for several purposes, primarily to implement position-level hedges, portfolio-level hedges, or currency hedges. During the fiscal year, the Fund's investments in derivative instruments detracted from returns. Derivative performance was in line with expectations given prevailing market conditions over the period.

The Fund's top contributor for the period was its investment in the acquisition of Twitter by Elon Musk. In April 2022, Elon Musk – CEO of Tesla and SpaceX and one of the richest people in the world – launched an unsolicited bid to personally acquire the 91% of U.S. social media company Twitter that he did not already own for $54.20 per share in cash. Musk put together a financing package combining commitments from a group of banks led by Morgan Stanley and private equity firms with his own personal assets, including loans backed by his holdings in Tesla stock. Musk's commitment to the deal seemingly wavered in line with the fortunes of Tesla shares, which traded down significantly after Twitter's board agreed to the transaction. Musk's capriciousness led to significant volatility in the deal spread, as he attempted to back out of the deal and Twitter filed suit in the Delaware Court of Chancery to enforce the original merger agreement. Rather than undergo litigation, Musk ultimately capitulated and agreed to close the deal on its original terms. Our analysis of the strength of the merger agreement (and thus Musk's likelihood of losing in court) gave us the confidence to maintain exposure to this deal throughout its life. Volatility

Annual Report | May 31, 2023

3

Arbitrage Fund Manager Commentary (continued)

throughout the deal timeline allowed us to trade around the spread and add exposure at attractive rates of return, and the Fund was rewarded when the deal was completed in calendar Q4 2022.

The second-largest contributor for the fiscal year was the Fund's position in the acquisition of Change Healthcare by UnitedHealth Group. In January 2021, Change Healthcare, a U.S.-based medical software and technology provider, agreed to be acquired by OptumInsight, a subsidiary of UnitedHealth Group (which also owns the country's largest health insurer) providing medical information technology services, for $8.8 billion in cash. After a lengthy regulatory review, the DOJ sued to stop the transaction in February 2022, alleging the combination would harm competition in multiple markets. In September, however, a federal judge ruled against the DOJ's attempt to intervene in the deal, allowing the merger to proceed. The deal subsequently closed early in Q4, leading to gains for the Fund.

Conversely, the top detractor in the portfolio was the Fund's position in the failed acquisition of First Horizon by Toronto-Dominion Bank ("TD"). In February 2022, First Horizon – a regional bank based in Tennessee that operates throughout the Southeast U.S. – agreed to be acquired by TD – a Canada-based multinational banking and financial services corporation – for $13.4 billion in cash. While First Horizon was not directly connected to Silicon Valley Bank, the company's shares were a casualty of indiscriminate selling across the U.S. regional banking industry following the news of Silicon Valley Bank's failure. This, combined with an extended regulatory review in Canada as well as rumors of a potential price cut, pressured the deal's spread. Through the volatility, we opted to maintain exposure to the transaction as mere weeks prior TD had publicly reaffirmed its commitment to the transaction – which, due to First Horizon's relatively small size, would have been one of very few paths for TD to gain scale via acquisition – and our outlook on the deal fundamentals had not changed. As the regional banking crisis continued to unfold, leading to the additional failures of Signature Bank and First Republic, volatility in First Horizon shares escalated. Eventually, in May 2023, when no progress had been made on the antitrust review front, First Horizon and TD mutually agreed to terminate the merger due to "uncertainty" as to when the deal might gain the lagging regulatory approvals.

The second-largest detractor for the period was the Fund's position in the failed acquisition of Tegna by Standard General. In February 2022, TEGNA – a U.S.-based broadcast television and digital media company which owns or operates 66 stations in 54 markets – agreed to be acquired by Standard General – a U.S.-based investment company – for $5.3 billion in cash. In February 2023, the U.S. Federal Communications Commission ("FCC") designated the deal for judicial review based on concerns it could raise prices for consumers, sending TEGNA shares lower. Such hearings are typically lengthy and have historically led deals to collapse. Standard General filed a lawsuit in response, describing the FCC's move as "an unprecedented and legally improper maneuver," as it had not previously expressed any concerns with the transaction during its nearly year-long review. After the United States Court of Appeals ruled against Standard General's appeal, the companies were forced to terminate the merger in May 2023, as the FCC would not commit to reviewing the deal before Standard General's financing expired, after which point the company claimed it would not be able to secure financing with comparable interest rates.

www.arbitragefunds.com | 1-800-295-4485

4

Arbitrage Fund Portfolio Information

Performance (annualized returns as of May 31, 2023)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Arbitrage Fund, Class R | | | -1.03 | % | | | 1.86 | % | | | 1.81 | % | | | 3.50 | % | |

Arbitrage Fund, Class I | | | -0.75 | % | | | 2.12 | % | | | 2.06 | % | | | 2.72 | % | |

Arbitrage Fund, Class C** | | | -2.69 | % | | | 1.10 | % | | | 1.05 | % | | | 0.93 | % | |

Arbitrage Fund, Class A*** | | | -3.75 | % | | | 1.36 | % | | | 1.55 | % | | | 1.55 | % | |

ICE BofA U.S. 3-Month Treasury Bill Index | | | 3.14 | % | | | 1.49 | % | | | 0.94 | % | | | 1.55 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com. This table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* Class R inception: 9/18/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R shares.

** Class C One Year return includes load. Shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed within 12 months of purchase.

*** After sales charge. Class A shares are subject to a maximum front-end sales load of 2.75% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $250,000 or more purchased without a front-end sales charge and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 1.62%, 1.37%, 2.37% and 1.62%, respectively. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

An investor may not invest directly in an index.

Annual Report | May 31, 2023

5

Arbitrage Fund Portfolio Information (continued)

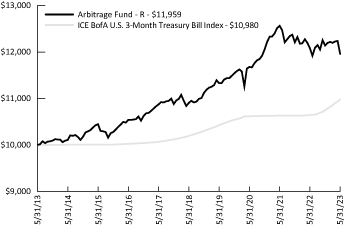

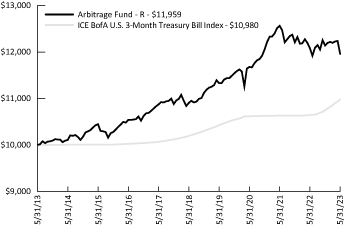

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund over ten years. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Sector Weighting

The following chart shows the sector weightings of Arbitrage Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: If a large percentage of mergers or event-driven investment opportunities taking place within the U.S. are within one industry over a given period of time, the Fund may invest a large portion of its assets in securities of issuers in a single industry for that period of time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

www.arbitragefunds.com | 1-800-295-4485

6

Arbitrage Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 87.62% | |

Aerospace & Defense - 3.56% | |

Aerojet Rocketdyne Holdings, Inc.(a) | | | 747,637 | | | $ | 40,731,264 | | |

Banks - 0.93% | |

First Horizon Corp.(b) | | | 1,029,513 | | | | 10,614,279 | | |

Biotechnology - 11.16% | |

BELLUS Health, Inc.(a) | | | 868,574 | | | | 12,689,866 | | |

CTI BioPharma Corp.(a) | | | 993,466 | | | | 8,990,867 | | |

Horizon Therapeutics Plc(a)(b) | | | 482,515 | | | | 48,265,976 | | |

IVERIC bio, Inc.(a)(b) | | | 160,295 | | | | 6,051,136 | | |

Prometheus Biosciences, Inc.(a) | | | 95,482 | | | | 18,972,274 | | |

Seagen, Inc.(a)(c) | | | 95,020 | | | | 18,595,414 | | |

Swedish Orphan Biovitrum AB(a) | | | 257,271 | | | | 5,168,274 | | |

VectivBio Holding AG(a) | | | 534,442 | | | | 8,845,015 | | |

| | | | 127,578,822 | | |

Chemicals - 2.41% | |

Diversey Holdings Ltd.(a) | | | 1,903,358 | | | | 15,854,972 | | |

Rogers Corp.(a) | | | 74,187 | | | | 11,682,227 | | |

| | | | 27,537,199 | | |

Commercial Services - 2.85% | |

Caverion Oyj | | | 1,405,496 | | | | 12,619,614 | | |

Moneylion, Inc.(a)(d) | | | 82,977 | | | | 924,367 | | |

RB Global, Inc. | | | 36,215 | | | | 1,886,077 | | |

Triton International Ltd.(c) | | | 207,913 | | | | 17,181,930 | | |

| | | | 32,611,988 | | |

Computers & Computer Services - 0.63% | |

Ordina N.V. | | | 1,185,517 | | | | 7,172,349 | | |

Distribution/Wholesale - 4.37% | |

Uni-Select, Inc.(a) | | | 266,989 | | | | 9,190,715 | | |

Univar Solutions, Inc.(a) | | | 1,145,739 | | | | 40,811,223 | | |

| | | | 50,001,938 | | |

Diversified Financial Services - 2.44% | |

Focus Financial Partners, Inc., Class A(a)(c) | | | 425,647 | | | | 22,171,952 | | |

Numis Corp. Plc | | | 1,386,619 | | | | 5,752,490 | | |

| | | | 27,924,442 | | |

Electric - 3.53% | |

PNM Resources, Inc. | | | 879,194 | | | | 40,372,588 | | |

Electronics - 3.08% | |

National Instruments Corp.(c) | | | 608,317 | | | | 35,160,723 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

7

Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 87.62% (Continued) | |

Food - 1.03% | |

Albertsons Cos., Inc., Class A(c) | | | 575,928 | | | $ | 11,725,894 | | |

Healthcare - Products - 0.35% | |

Globus Medical, Inc., Class A(a)(c) | | | 74,750 | | | | 4,046,217 | | |

Healthcare - Services - 1.41% | |

Medica Group Plc | | | 1,150,000 | | | | 3,018,444 | | |

Syneos Health, Inc.(a)(c) | | | 315,909 | | | | 13,141,814 | | |

| | | | 16,160,258 | | |

Insurance - 0.23% | |

TOWER Ltd. | | | 7,208,016 | | | | 2,626,540 | | |

Internet - 4.15% | |

Zendesk, Inc.(a)(e) | | | 601,789 | | | | 47,438,245 | | |

Iron/Steel - 0.30% | |

Kloeckner & Co. SE | | | 333,155 | | | | 3,432,895 | | |

Media - 3.91% | |

TEGNA, Inc.(c) | | | 2,554,217 | | | | 39,564,821 | | |

Telenet Group Holding N.V. | | | 243,254 | | | | 5,182,084 | | |

| | | | 44,746,905 | | |

Mining - 0.51% | |

Arconic Corp.(a) | | | 201,890 | | | | 5,836,640 | | |

Office Furnishings - 0.24% | |

Kimball International, Inc., Class B | | | 221,092 | | | | 2,719,432 | | |

Oil & Gas - 2.03% | |

PDC Energy, Inc. | | | 247,179 | | | | 16,961,423 | | |

Ranger Oil Corp., Class A | | | 168,768 | | | | 6,202,224 | | |

| | | | 23,163,647 | | |

Pharmaceuticals - 0.83% | |

Heska Corp.(a) | | | 78,792 | | | | 9,433,766 | | |

Pipelines - 3.91% | |

DCP Midstream LP(a)(c) | | | 899,158 | | | | 37,395,981 | | |

Magellan Midstream Partners LP(a)(c) | | | 121,687 | | | | 7,326,774 | | |

| | | | 44,722,755 | | |

Real Estate - 1.43% | |

Radius Global Infrastructure, Inc., Class A(a) | | | 1,103,580 | | | | 16,332,984 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

8

Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 87.62% (Continued) | |

Real Estate Investment Trusts - 3.05% | |

Bluerock Homes Trust, Inc.(a) | | | 38,628 | | | $ | 618,048 | | |

Indus Realty Trust, Inc. | | | 191,844 | | | | 12,815,179 | | |

Life Storage, Inc.(c) | | | 122,836 | | | | 15,648,078 | | |

Urstadt Biddle Properties, Inc., Class A | | | 297,585 | | | | 5,758,270 | | |

| | | | 34,839,575 | | |

Retail - 1.06% | |

Ruth's Hospitality Group, Inc. | | | 563,479 | | | | 12,075,355 | | |

Semiconductors - 1.71% | |

Magnachip Semiconductor Corp.(a) | | | 411,831 | | | | 4,213,031 | | |

Silicon Motion Technology Corp., ADR | | | 251,202 | | | | 15,383,611 | | |

| | | | 19,596,642 | | |

Software - 26.51% | |

Absolute Software Corp. | | | 1,011,602 | | | | 11,340,059 | | |

Activision Blizzard, Inc.(a) | | | 819,477 | | | | 65,722,055 | | |

Avalara, Inc.(a)(e) | | | 365,431 | | | | 34,587,094 | | |

Black Knight, Inc.(a) | | | 43,880 | | | | 2,535,386 | | |

Cvent Holding Corp.(a) | | | 1,781,078 | | | | 15,121,352 | | |

EMIS Group Plc | | | 201,882 | | | | 3,350,088 | | |

ForgeRock, Inc., Class A(a)(c) | | | 755,144 | | | | 15,201,049 | | |

Meltwater N.V.(a) | | | 4,708,259 | | | | 7,634,877 | | |

Momentive Global, Inc.(a) | | | 3,931,409 | | | | 37,191,129 | | |

OneMarket Ltd.(a)(e) | | | 111,800 | | | | — | | |

Qualtrics International, Inc., Class A(a) | | | 1,760,369 | | | | 31,827,472 | | |

Rovio Entertainment Oyj(f) | | | 586,900 | | | | 5,771,506 | | |

SimCorp A/S | | | 122,585 | | | | 12,704,294 | | |

Software AG | | | 160,338 | | | | 5,662,571 | | |

VMware, Inc., Class A(a)(c) | | | 398,878 | | | | 54,363,083 | | |

| | | | 303,012,015 | | |

Telecommunications - 0.00% | |

GCI Liberty, Inc.(a)(e) | | | 660,966 | | | | — | | |

TOTAL COMMON STOCKS

(Cost $1,078,099,156) | | | 1,001,615,357 | | |

RIGHTS(a) - 0.52% | |

Bristol-Myers Squibb Co. CVR(d) | | | 857,631 | | | | 857,631 | | |

Concert Pharmaceuticals, Inc. CVR,

Expires 12/31/2029(d)(e) | | | 1,669,338 | | | | 631,677 | | |

Contra Abiomed, Inc. CVR, Expires 12/31/2030(d) | | | 163,650 | | | | 286,388 | | |

Contra Adamas Pharmaceuticals, Inc. CVR,

Expires 12/31/2024(d)(e) | | | 1,150,652 | | | | 79,855 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

9

Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

RIGHTS(a) - 0.52% (Continued) | |

Contra Adamas Pharmaceuticals, Inc. CVR,

Expires 12/31/2025(d)(e) | | | 1,150,652 | | | $ | 79,740 | | |

Contra Albireo Pharma, Inc. CVR,

Expires 12/31/2027(d)(e) | | | 313,065 | | | | 688,962 | | |

Contra Amryt Pharma Plc CVR,

Expires 12/31/2024(d)(e) | | | 2,355,440 | | | | 57,261 | | |

Contra Amryt Pharma Plc CVR,

Expires 12/31/2024(d)(e) | | | 2,355,440 | | | | 38,182 | | |

Contra CinCor Pharma, Inc. CVR,

Expires 12/31/2027(d)(e) | | | 339,795 | | | | 1,066,820 | | |

Flexion Therapy CVR, Expires 12/31/2030(d)(e) | | | 1,411,000 | | | | 1,012,534 | | |

Resolute Forest Products, Inc. CVR,

Expires 6/30/2024(d)(e) | | | 803,806 | | | | 1,168,654 | | |

TOTAL RIGHTS

(Cost $5,955,302) | | | 5,967,704 | | |

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CONVERTIBLE CORPORATE BONDS - 0.48% | |

Healthcare - Services - 0.28% | |

UpHealth, Inc.(f) | | 06/15/2026 | | | 6.250 | % | | $ | 1,275,000 | | | $ | 368,953 | | |

UpHealth, Inc., Variable Rate,

(SOFR plus 9.00%)(f) | | 12/15/2025 | | | 14.060 | % | | | 3,506,000 | | | | 2,787,270 | | |

| | | | | | | | | | 3,156,223 | | |

Software - 0.20% | |

Kaleyra, Inc.(f) | | 06/01/2026 | | | 6.125 | % | | | 2,947,000 | | | | 2,324,938 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $7,728,000) | | | 5,481,161 | | |

| | | Shares | | Value | |

MUTUAL FUNDS(g) - 6.27% | |

Water Island Event Driven Fund | | | 6,605,365 | | | $ | 71,734,267 | | |

TOTAL MUTUAL FUNDS

(Cost $60,632,644) | | | 71,734,267 | | |

PRIVATE INVESTMENTS(a)(d)(e)(h) - 0.05% | |

Fast Capital LLC | | | 290,700 | | | | 581,400 | | |

TOTAL PRIVATE INVESTMENTS

(Cost $300,786) | | | 581,400 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

10

Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

WARRANTS(a) - 0.00%(i) | |

Commercial Services - 0.00%(i) | |

Moneylion, Inc., Exercise Price $11.50,

Expires 09/22/2026 | | | 290,320 | | | $ | 10,161 | | |

TOTAL WARRANTS

(Cost $0) | | | 10,161 | | |

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(a) - 0.15% | |

Call Options Purchased - 0.12% | |

Broadcom, Inc. | |

| | | 06/2023 | | $ | 810.00 | | | $ | 5,090,148 | | | | 63 | | | $ | 235,305 | | |

| | | 06/2023 | | | 815.00 | | | | 5,009,352 | | | | 62 | | | | 221,340 | | |

| | | 06/2023 | | | 810.00 | | | | 5,090,148 | | | | 63 | | | | 278,460 | | |

| | | 06/2023 | | | 815.00 | | | | 5,009,352 | | | | 62 | | | | 261,020 | | |

First Horizon Corp. | | 06/2023 | | | 12.00 | | | | 4,416,804 | | | | 4,284 | | | | 32,130 | | |

IVERIC bio, Inc. | |

| | | 07/2023 | | | 40.00 | | | | 3,042,650 | | | | 806 | | | | 18,135 | | |

| | | 09/2023 | | | 40.00 | | | | 3,042,650 | | | | 806 | | | | 32,240 | | |

MaxLinear, Inc. | | 09/2023 | | | 30.00 | | | | 2,847,975 | | | | 975 | | | | 326,625 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $1,334,247) | | | 1,405,255 | | |

Put Options Purchased - 0.03% | |

First Horizon Corp. | | 06/2023 | | | 9.00 | | | | 8,006,746 | | | | 7,766 | | | | 194,150 | | |

Horizon Therapeutics Plc | |

| | | 08/2023 | | | 95.00 | | | | 5,911,773 | | | | 591 | | | | 100,470 | | |

| | | 08/2023 | | | 100.00 | | | | 750,225 | | | | 75 | | | | 22,687 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $863,793) | | | 317,307 | | |

TOTAL PURCHASED OPTIONS

(Cost $2,198,040) | | | 1,722,562 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 3.34% | |

Money Market Funds | |

Morgan Stanley Institutional Liquidity

Funds - Government Portfolio | | | 4.997 | %(j) | | | 19,069,419 | | | $ | 19,069,419 | | |

State Street Institutional U.S. Government

Money Market Fund, Premier Class | | | 5.129 | %(j) | | | 19,069,419 | | | | 19,069,419 | | |

| | | | | | | | 38,138,838 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $38,138,838) | | | 38,138,838 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

11

Arbitrage Fund Portfolio of Investments (continued)

| | | Value | |

Total Investments - 98.43%

(Cost $1,193,052,766) | | $ | 1,125,251,450 | | |

Other Assets in Excess of Liabilities - 1.57%(k) | | | 17,940,942 | | |

NET ASSETS - 100.00% | | $ | 1,143,192,392 | | |

Portfolio Footnotes

(a) Non-income-producing security.

(b) Underlying security for a written/purchased call/put option.

(c) Security, or a portion of security, is being held as collateral for swaps, short sales, written option contracts or forward foreign currency exchange contracts. At May 31, 2023, the aggregate fair market value of those securities was $140,680,110, representing 12.31% of net assets.

(d) Restricted securities (including private placements) - The Fund may own investment securities that have other legal or contractual limitations. At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $7,473,471 or 0.65% of net assets.

Restricted Security | | Acquisition Date | | Acquisition Cost | |

Bristol-Myers Squibb Co. CVR | | 11/20/2020 | | $ | 1,185,787 | | |

Concert Pharmaceuticals, Inc. CVR, Expires 12/31/2029 | | 03/07/2023 | | | 617,655 | | |

Contra Abiomed, Inc. CVR, Expires 12/31/2030 | | 12/21/2022 | | | 166,923 | | |

Contra Adamas Pharmaceuticals, Inc. CVR, Expires 12/31/2024 | | 11/23/2021 | | | 69,039 | | |

Contra Adamas Pharmaceuticals, Inc. CVR, Expires 12/31/2025 | | 11/23/2021 | | | 69,039 | | |

Contra Albireo Pharma, Inc. CVR, Expires 12/31/2027 | | 03/03/2023 | | | 673,090 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024 | | 04/13/2023 | | | 58,886 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024 | | 04/13/2023 | | | 58,886 | | |

Contra CinCor Pharma, Inc. CVR, Expires 12/31/2027 | | 02/23/2023 | | | 1,039,773 | | |

Fast Capital LLC | | 08/18/2020 | | | 300,786 | | |

Flexion Therapy CVR, Expires 12/31/2030 | | 11/22/2021 | | | 874,820 | | |

Moneylion, Inc. | | 06/19/2020 | | | 17,080,470 | | |

Resolute Forest Products, Inc. CVR, Expires 6/30/2024 | | 03/01/2023 | | | 1,141,404 | | |

Total | | | | $ | 23,336,558 | | |

(e) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of May 31, 2023, the total fair market value of these securities was $87,430,424, representing 7.65% of net assets.

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2023, these securities had a total value of $11,252,667 or 0.98% of net assets.

(g) Affiliated investment.

(h) Represents a holding that is a direct investment into a private company and is not a listed or publicly traded entity.

(i) Less than 0.005% of net assets.

(j) Rate shown is the 7-day effective yield as of May 31, 2023.

(k) Includes cash held as collateral for short sales.

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

12

Arbitrage Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS SOLD SHORT - (4.83%) | |

Healthcare - Products - (0.08%) | |

NuVasive, Inc. | | | (22,425 | ) | | $ | (855,738 | ) | |

Office Furnishings - (0.06%) | |

HNI Corp. | | | (28,752 | ) | | | (733,176 | ) | |

Oil & Gas - (1.79%) | |

Baytex Energy Corp. | | | (999,240 | ) | | | (3,150,459 | ) | |

Chevron Corp. | | | (114,642 | ) | | | (17,267,378 | ) | |

| | | | (20,417,837 | ) | |

Pipelines - (0.40%) | |

ONEOK, Inc. | | | (81,165 | ) | | | (4,598,809 | ) | |

Real Estate Investment Trusts - (1.87%) | |

Extra Space Storage, Inc. | | | (82,454 | ) | | | (11,895,638 | ) | |

Public Storage | | | (12,873 | ) | | | (3,646,921 | ) | |

Regency Centers Corp. | | | (103,262 | ) | | | (5,810,553 | ) | |

| | | | (21,353,112 | ) | |

Semiconductors - (0.63%) | |

Broadcom, Inc. | | | (5,448 | ) | | | (4,401,766 | ) | |

MaxLinear, Inc. | | | (97,467 | ) | | | (2,847,011 | ) | |

| | | | (7,248,777 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $58,127,599) | | $ | (55,207,449 | ) | |

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Made | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Upon

Termination

| | Brookfield

Infrastructure

Corp.

| | Received

1 Month-

Federal

Rate

Minus

58bps

(-4.500%) | |

10/29/2024 | | $ | — | | | $ | — | | | $ | 28,068 | | | USD | 1,465,789 | | | $ | 28,068 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

13

Arbitrage Fund Portfolio of Investments (continued)

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Made | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Depreciation | |

Morgan

Stanley &

Co./

Upon

Termination

| | Broadcom,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40bps

(-4.680%) | |

10/29/2024 | | $ | — | | | $ | — | | | $ | (13,919,940 | ) | | USD | 22,271,820 | | | $ | (13,919,940 | ) | |

Morgan

Stanley &

Co./

Upon

Termination

| | Intercontinental

Exchange,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

67bps

(-4.400%) | |

10/29/2024 | | | — | | | | — | | | | (8,111 | ) | | USD | 308,997 | | | | (8,111 | ) | |

| | | | | | | | | | | | | $ | (13,928,051 | ) | | | | | | $ | (13,928,051 | ) | |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

CAD | 5,600,200 | | | USD | 4,117,524 | | | Morgan Stanley & Co. | | 06/15/2023 | | $ | 9,223 | | |

USD | 882,030 | | | CAD | 1,183,900 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 9,624 | | |

USD | 12,723,058 | | | DKK | 86,932,100 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 233,829 | | |

EUR | 207,100 | | | USD | 219,905 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 1,628 | | |

USD | 53,217,879 | | | EUR | 48,922,000 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 886,426 | | |

USD | 5,308,021 | | | GBP | 4,247,400 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 23,033 | | |

USD | 8,342,668 | | | NOK | 87,757,800 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 431,665 | | |

USD | 3,485,131 | | | NZD | 5,586,300 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 120,736 | | |

SEK | 3,087,300 | | | USD | 284,021 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 674 | | |

USD | 8,563,450 | | | SEK | 90,026,700 | | | Morgan Stanley & Co. | | 06/15/2023 | | | 261,668 | | |

| | | $ | 1,978,506 | | |

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

CAD | 73,851,300 | | | USD | 54,888,286 | | | Morgan Stanley & Co. | | 06/15/2023 | | $ | (467,808 | ) | |

USD | 63,217,626 | | | CAD | 86,452,600 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (488,657 | ) | |

USD | 453,116 | | | DKK | 3,167,900 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (2,005 | ) | |

EUR | 10,488,200 | | | USD | 11,438,154 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (219,015 | ) | |

GBP | 4,942,900 | | | USD | 6,173,509 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (23,118 | ) | |

USD | 26,855,574 | | | GBP | 21,977,400 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (490,640 | ) | |

NOK | 2,911,600 | | | USD | 272,871 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (10,403 | ) | |

NZD | 1,261,500 | | | USD | 789,031 | | | Morgan Stanley & Co. | | 06/15/2023 | | | (29,282 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

14

Arbitrage Fund Portfolio of Investments (continued)

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

SEK | 30,442,700 | | | USD | 2,953,677 | | | Morgan Stanley & Co. | | 06/15/2023 | | $ | (146,413 | ) | |

| | | $ | (1,877,341 | ) | |

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

United States | | | 84.37 | % | |

Canada | | | 3.07 | % | |

Finland | | | 1.61 | % | |

Bermuda | | | 1.50 | % | |

Taiwan | | | 1.34 | % | |

Netherlands | | | 1.30 | % | |

Denmark | | | 1.11 | % | |

United Kingdom | | | 1.06 | % | |

Germany | | | 0.80 | % | |

Switzerland | | | 0.77 | % | |

Belgium | | | 0.45 | % | |

Sweden | | | 0.45 | % | |

Republic of Korea | | | 0.37 | % | |

New Zealand | | | 0.23 | % | |

Australia | | | 0.00 | %(b) | |

Other Assets in Excess of Liabilities | | | 1.57 | % | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

(b) Less than 0.005% of net assets.

Abbreviations:

AB - Aktiebolag is the Swedish term for a limited company.

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

A/S - Aktieselskab is a Danish term for a stock-based corporation.

bps - Basis Points. 100 Basis Points is equal to 1 percentage point.

CAD - Canadian dollar

CVR - Contingent Value Rights

DKK - Danish krone

EUR - Euro

GBP - British pound

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

NOK - Norwegian krone

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

See Notes to Financial Statements.

Annual Report | May 31, 2023

15

Arbitrage Fund Portfolio of Investments (continued)

NZD - New Zealand dollar

Oyj - Osakeyhtio is the Finnish equivalent of a public limited company.

Plc - Public Limited Company

SE - SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States

SEK - Swedish krona

SOFR - Secured Overnight Financing Rate

USD - United States Dollar

The following table summarizes the Arbitrage Fund's investments and derivative financial instruments categorized in the fair value hierarchy as of May 31, 2023:

Investments in Securities at Fair Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Aerospace & Defense | | $ | 40,731,264 | | | $ | — | | | $ | — | | | $ | 40,731,264 | | |

Banks | | | 10,614,279 | | | | — | | | | — | | | | 10,614,279 | | |

Biotechnology | | | 127,578,822 | | | | — | | | | — | | | | 127,578,822 | | |

Chemicals | | | 27,537,199 | | | | — | | | | — | | | | 27,537,199 | | |

Commercial Services | | | 32,611,988 | | | | — | | | | — | | | | 32,611,988 | | |

Computers & Computer Services | | | 7,172,349 | | | | — | | | | — | | | | 7,172,349 | | |

Distribution/Wholesale | | | 50,001,938 | | | | — | | | | — | | | | 50,001,938 | | |

Diversified Financial Services | | | 27,924,442 | | | | — | | | | — | | | | 27,924,442 | | |

Electric | | | 40,372,588 | | | | — | | | | — | | | | 40,372,588 | | |

Electronics | | | 35,160,723 | | | | — | | | | — | | | | 35,160,723 | | |

Food | | | 11,725,894 | | | | — | | | | — | | | | 11,725,894 | | |

Healthcare - Products | | | 4,046,217 | | | | — | | | | — | | | | 4,046,217 | | |

Healthcare - Services | | | 16,160,258 | | | | — | | | | — | | | | 16,160,258 | | |

Insurance | | | 2,626,540 | | | | — | | | | — | | | | 2,626,540 | | |

Internet | | | — | | | | — | | | | 47,438,245 | | | | 47,438,245 | | |

Iron/Steel | | | 3,432,895 | | | | — | | | | — | | | | 3,432,895 | | |

Media | | | 44,746,905 | | | | — | | | | — | | | | 44,746,905 | | |

Mining | | | 5,836,640 | | | | — | | | | — | | | | 5,836,640 | | |

Office Furnishings | | | 2,719,432 | | | | — | | | | — | | | | 2,719,432 | | |

Oil & Gas | | | 23,163,647 | | | | — | | | | — | | | | 23,163,647 | | |

Pharmaceuticals | | | 9,433,766 | | | | — | | | | — | | | | 9,433,766 | | |

Pipelines | | | 44,722,755 | | | | — | | | | — | | | | 44,722,755 | | |

Real Estate | | | 16,332,984 | | | | — | | | | — | | | | 16,332,984 | | |

Real Estate Investment Trusts | | | 34,839,575 | | | | — | | | | — | | | | 34,839,575 | | |

Retail | | | 12,075,355 | | | | — | | | | — | | | | 12,075,355 | | |

Semiconductors | | | 19,596,642 | | | | — | | | | — | | | | 19,596,642 | | |

Software | | | 231,233,792 | | | | 37,191,129 | | | | 34,587,094 | | | | 303,012,015 | | |

Telecommunications | | | — | | | | — | | | | 0 | | | | 0 | | |

Rights | | | — | | | | 1,144,019 | | | | 4,823,685 | | | | 5,967,704 | | |

Convertible Corporate Bonds** | | | — | | | | 5,481,161 | | | | — | | | | 5,481,161 | | |

Mutual Funds | | | 71,734,267 | | | | — | | | | — | | | | 71,734,267 | | |

Private Investments | | | — | | | | — | | | | 581,400 | | | | 581,400 | | |

Warrants** | | | 10,161 | | | | — | | | | — | | | | 10,161 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

16

Arbitrage Fund Portfolio of Investments (continued)

Investments in Securities at Fair Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Purchased Options | | $ | 1,722,562 | | | $ | — | | | $ | — | | | $ | 1,722,562 | | |

Short-Term Investments | | | 38,138,838 | | | | — | | | | — | | | | 38,138,838 | | |

TOTAL | | $ | 994,004,717 | | | $ | 43,816,309 | | | $ | 87,430,424 | | | $ | 1,125,251,450 | | |

Other Financial Instruments*** | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 1,978,506 | | | $ | — | | | $ | 1,978,506 | | |

Equity Swaps | | | 28,068 | | | | — | | | | — | | | | 28,068 | | |

Liabilities | |

Common Stocks** | | | (55,207,449 | ) | | | — | | | | — | | | | (55,207,449 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (1,877,341 | ) | | | — | | | | (1,877,341 | ) | |

Equity Swaps | | | (13,928,051 | ) | | | — | | | | — | | | | (13,928,051 | ) | |

TOTAL | | $ | (69,107,432 | ) | | $ | 101,165 | | | $ | — | | | $ | (69,006,267 | ) | |

* Refer to Note 2 where leveling hierarchy is defined.

** Refer to Portfolio of Investments for sector information.

*** Other financial instruments are instruments such as securities sold short, equity swaps and forward foreign currency exchange contracts.

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund's assets and liabilities during the period ended May 31, 2023:

Investments

in Securities | | Balance as of

May 31, 2022 | | Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance as of

May 31, 2023 | | Net change in

Unrealized

Appreciation

(Depreciation)

from

investments

still held as of

May 31, 2023 | |

Common

Stocks | | $ | 68,815,638 | | | $ | 1,763,299 | | | $ | 2,633,534 | | | $ | 79,679,493 | | | $ | (70,866,625 | ) | | $ | — | | | $ | — | | | $ | 82,025,339 | | | $ | 3,360,714 | | |

Rights | | | 1,277,503 | | | | 402,225 | | | | 163,695 | | | | 3,589,694 | | | | (609,432 | ) | | | — | | | | — | | | | 4,823,685 | | | | 168,357 | | |

Private

Investments | | | 290,700 | | | | — | | | | 290,700 | | | | — | | | | — | | | | — | | | | — | | | | 581,400 | | | | 290,700 | | |

Total | | $ | 70,383,841 | | | $ | 2,165,524 | | | $ | 3,087,929 | | | $ | 83,269,187 | | | $ | (71,476,057 | ) | | $ | — | | | $ | — | | | $ | 87,430,424 | | | $ | 3,819,771 | | |

The following table summarizes the quantitative inputs used for investments categorized as Level 3 of the fair value hierarchy as of May 31, 2023:

Investments in

Securities | | Fair Value at

May 31, 2023 | | Valuation

Technique | | Unobservable

Input | | Range of

Values | | Weighted

Average | |

Common Stocks

| | $ | 82,025,339

| | | Final proceeds

| | Final

determination

on dissent | | | $78.8287-$94.6474

| | | | $85.50

| | |

Rights

| | | 4,823,685

| | | Discounted,

probability

adjusted value | | Discount rate,

probability

| | | 10%, 9.43%-65%

| | | | 10%, 38.64%

| | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

17

Arbitrage Fund Portfolio of Investments (continued)

Investments in

Securities | | Fair Value at

May 31, 2023 | | Valuation

Technique | | Unobservable

Input | | Range of

Values | | Weighted

Average | |

Private

Investments | | $ | 581,400

| | | Recovery

value | | Proceeds from

winding down | | | NA

| | | | NA

| | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

18

Water Island Event-Driven Fund Manager Commentary

Water Island Event-Driven Fund | Tickers: AEDNX, AEDFX, AGEAX

The Fund's Goal and Main Investments

The Fund seeks to provide capital growth by investing in credit and equity securities involved in specific corporate events, with a focus on low volatility and low correlation relative to the broader capital markets.

Investment Strategy

The Fund's investment process follows a disciplined, fundamental approach that values risk mitigation while identifying compelling risk/reward opportunities available to us as we screen catalyst-driven corporate events, such as mergers and acquisitions, restructurings, refinancings, recapitalizations, spin-offs, litigation, regulatory changes, and bankruptcy. We analyze these events through three core approaches: merger arbitrage, equity special situations, and credit opportunities. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event-driven investment strategy. This process and approach have been an integral part of the culture at Water Island Capital since the firm's inception.

Fiscal Year Highlights

Water Island Event-Driven Fund Class I (AEDNX) returned -0.91% for the fiscal year ended May 31, 2023. The merger arbitrage and credit opportunities sub-strategies contributed to returns for the period, while the equity special situations sub-strategy was a detractor overall. Investments in the European region contributed to returns, while the Americas and Asia-Pacific regions detracted from returns. Industrials and health care were the top performing sectors, while financials and information technology detracted the most from returns.

The Fund may utilize derivatives for several purposes, primarily to implement position-level hedges, portfolio-level hedges, or currency hedges. During the fiscal year, the Fund's investments in derivative instruments detracted from returns. Derivative performance was in line with expectations given prevailing market conditions over the period.

The Fund's top contributor for the period was its investment in the acquisition of Twitter by Elon Musk. In April 2022, Elon Musk – CEO of Tesla and SpaceX and one of the richest people in the world – launched an unsolicited bid to personally acquire the 91% of US social media company Twitter that he did not already own for $54.20 per share in cash. Musk put together a financing package combining commitments from a group of banks led by Morgan Stanley and private equity firms with his own personal assets, including loans backed by his holdings in Tesla stock. Musk's commitment to the deal seemingly wavered in line with the fortunes of Tesla shares, which traded down significantly after Twitter's board agreed to the transaction. Musk's capriciousness led to significant volatility in the deal spread, as he attempted to back out of the deal and Twitter filed suit in the Delaware Court of Chancery to enforce the original merger agreement. Rather than undergo litigation, Musk ultimately capitulated and agreed to close the deal on its original terms. Our analysis of the strength of the merger agreement (and thus Musk's likelihood of losing in court) gave us the confidence to maintain exposure to this deal throughout its life. Volatility throughout the deal timeline allowed us to trade around the spread and add exposure at attractive rates of return, and the Fund was rewarded when the deal was completed in calendar Q4 2022.

Annual Report | May 31, 2023

19

Water Island Event-Driven Fund Manager Commentary (continued)

The second-largest contributor for the fiscal year was the Fund's position in the acquisition of Change Healthcare by UnitedHealth Group. In January 2021, Change Healthcare, a US-based medical software and technology provider, agreed to be acquired by OptumInsight, a subsidiary of UnitedHealth Group (which also owns the country's largest health insurer) providing medical information technology services, for $8.8 billion in cash. After a lengthy regulatory review, the DOJ sued to stop the transaction in February 2022, alleging the combination would harm competition in multiple markets. In September, however, a federal judge ruled against the DOJ's attempt to intervene in the deal, allowing the merger to proceed. The deal subsequently closed early in Q4, leading to gains for the Fund.

Conversely, the top detractor in the portfolio was the Fund's position in the failed acquisition of First Horizon by Toronto-Dominion Bank ("TD"). In February 2022, First Horizon – a regional bank based in Tennessee that operates throughout the Southeast US – agreed to be acquired by TD – a Canada-based multinational banking and financial services corporation – for $13.4 billion in cash. While First Horizon was not directly connected to Silicon Valley Bank, the company's shares were a casualty of indiscriminate selling across the US regional banking industry following the news of Silicon Valley Bank's failure. This, combined with an extended regulatory review in Canada as well as rumors of a potential price cut, pressured the deal's spread. Through the volatility, we opted to maintain exposure to the transaction as mere weeks prior TD had publicly reaffirmed its commitment to the transaction – which, due to First Horizon's relatively small size, would have been one of very few paths for TD to gain scale via acquisition – and our outlook on the deal fundamentals had not changed. As the regional banking crisis continued to unfold, leading to the additional failures of Signature Bank and First Republic, volatility in First Horizon shares escalated. Eventually, in May 2023, when no progress had been made on the antitrust review front, First Horizon and TD mutually agreed to terminate the merger due to "uncertainty" as to when the deal might gain the lagging regulatory approvals.

The second-largest detractor for the period was the Fund's position in the failed acquisition of Rogers by DuPont de Nemours. In November 2021, Rogers – a US-based manufacturer and seller of specialty polymer composite materials and components – agreed to be acquired by DuPont – a US-based provider of chemicals, plastic materials, fibers, and consumer products – for $5.3 billion in cash. This transaction experienced an extended regulatory review at the State Administration for Market Regulation ("SAMR") in China. In November 2022, when the deal's termination date was reached with SAMR approval still outstanding, DuPont opted to walk away rather than agree to extend the timeline. This caught many arbitrageurs by surprise, as the companies had jointly reaffirmed their commitment to the merger and to achieving a resolution with SAMR just two months prior. Speculation around DuPont's reasons for walking away and year-end tax-loss harvesting drove event-driven investors to exit their positions en masse, which exacerbated the price reaction of Rogers shares, leading them to trade at depressed levels – well under what we believed to be a fair valuation. We opted to follow our deal break protocol and wait for more normalized trading levels, seeking to unwind our position in an orderly fashion. While we were rewarded as Rogers shares traded nearly 37% higher during calendar Q1 2023, overall, the deal break remained a top detractor for the Fund.

www.arbitragefunds.com | 1-800-295-4485

20

Water Island Event-Driven Fund Portfolio Information

Performance (annualized returns as of May 31, 2023)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Water Island Event-Driven Fund Class R | | | -1.11 | % | | | 2.88 | % | | | 1.65 | % | | | 1.94 | % | |

Water Island Event-Driven Fund Class I | | | -0.91 | % | | | 3.13 | % | | | 1.90 | % | | | 2.19 | % | |

Water Island Event-Driven Fund, Class A** | | | -4.38 | % | | | 2.20 | % | | | 1.32 | % | | | 1.32 | % | |

ICE BofA U.S. 3-Month Treasury Bill Index | | | 3.14 | % | | | 1.49 | % | | | 0.94 | % | | | 0.76 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. Performance numbers reflect fee waivers and/or expense reimbursements by the Adviser and any recoupment by the Adviser of waived fees. Absent any applicable waivers and/or expense reimbursements, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com. This table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* Class R and Class I inception: 10/1/10; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R and Class I shares.

** After sales charge. Class A shares are subject to a maximum front-end sales load of 2.75% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $250,000 or more purchased without a front-end sales charge and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I and Class A are 1.80%, 1.55% and 1.80%, respectively. The Adviser has contractually agreed to limit the total annual operating expenses of the Fund, not including taxes, interest, dividends on short positions, brokerage commissions, acquired fund fees and expenses, and other costs incurred in connection with the purchase or sale of portfolio securities, so they do not exceed 1.69%, 1.44% and 1.69% for Class R, Class I and Class A, respectively. The agreement remains in effect until September 30, 2024, unless terminated earlier by the Board of Trustees. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

An investor may not invest directly in an index.

Annual Report | May 31, 2023

21

Water Island Event-Driven Fund Portfolio Information (continued)

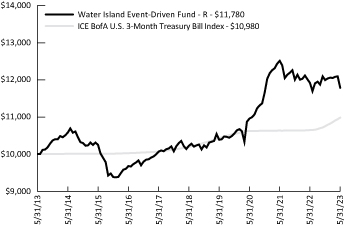

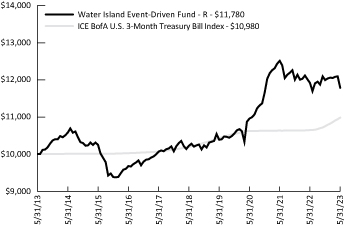

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund over ten years. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Sector Weighting

The following chart shows the sector weightings of Water Island Event Driven Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: If a large percentage of mergers or event-driven investment opportunities taking place within the U.S. are within one industry over a given period of time, the Fund may invest a large portion of its assets in securities of issuers in a single industry for that period of time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

www.arbitragefunds.com | 1-800-295-4485

22

Water Island Event-Driven Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 91.57% | |

Aerospace & Defense - 4.04% | |

Aerojet Rocketdyne Holdings, Inc.(a) | | | 84,946 | | | $ | 4,627,858 | | |

Banks - 1.04% | |

First Horizon Corp.(b) | | | 115,970 | | | | 1,195,651 | | |

Biotechnology - 13.26% | |

BELLUS Health, Inc.(a) | | | 105,718 | | | | 1,544,540 | | |

CTI BioPharma Corp.(a) | | | 123,138 | | | | 1,114,399 | | |

Horizon Therapeutics Plc(a)(b) | | | 54,866 | | | | 5,488,246 | | |

IVERIC bio, Inc.(a)(b) | | | 19,737 | | | | 745,072 | | |

Prometheus Biosciences, Inc.(a) | | | 11,757 | | | | 2,336,116 | | |

Seagen, Inc.(a)(c) | | | 11,571 | | | | 2,264,445 | | |

Swedish Orphan Biovitrum AB(a) | | | 31,025 | | | | 623,256 | | |

VectivBio Holding AG(a) | | | 65,041 | | | | 1,076,428 | | |

| | | | 15,192,502 | | |

Chemicals - 2.72% | |

Diversey Holdings Ltd.(a) | | | 234,929 | | | | 1,956,958 | | |

Rogers Corp.(a) | | | 7,325 | | | | 1,153,468 | | |

| | | | 3,110,426 | | |

Commercial Services - 3.17% | |

Caverion Oyj | | | 137,982 | | | | 1,238,907 | | |

Moneylion, Inc.(a)(d) | | | 8,781 | | | | 97,819 | | |

RB Global, Inc. | | | 4,275 | | | | 222,642 | | |

Triton International Ltd.(c) | | | 25,086 | | | | 2,073,107 | | |

| | | | 3,632,475 | | |

Computers & Computer Services - 0.73% | |

Crane NXT Co.(b)(c) | | | 2,519 | | | | 132,575 | | |

Ordina N.V. | | | 117,061 | | | | 708,216 | | |

| | | | 840,791 | | |

Distribution/Wholesale - 5.31% | |

Uni-Select, Inc.(a) | | | 32,998 | | | | 1,135,909 | | |

Univar Solutions, Inc.(a)(c) | | | 138,889 | | | | 4,947,226 | | |

| | | | 6,083,135 | | |

Diversified Financial Services - 2.26% | |

Focus Financial Partners, Inc., Class A(a) | | | 49,680 | | | | 2,587,831 | | |

Electric - 4.01% | |

PNM Resources, Inc. | | | 100,132 | | | | 4,598,061 | | |

Electronics - 3.79% | |

National Instruments Corp.(b)(c) | | | 75,184 | | | | 4,345,635 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

23

Water Island Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 91.57% (Continued) | |

Entertainment - 0.15% | |

Cineplex, Inc.(a) | | | 23,133 | | | $ | 166,660 | | |

Food - 1.01% | |

Albertsons Cos., Inc., Class A(c) | | | 56,581 | | | | 1,151,989 | | |

Healthcare - Products - 0.40% | |

Globus Medical, Inc., Class A(a)(c) | | | 8,537 | | | | 462,108 | | |

Healthcare - Services - 1.42% | |

Syneos Health, Inc.(a)(c) | | | 39,108 | | | | 1,626,893 | | |

Insurance - 0.32% | |

Hartford Financial Services Group, Inc. | | | 5,355 | | | | 366,925 | | |

Internet - 3.58% | |

Just Eat Takeaway.com N.V.(a)(e) | | | 7,623 | | | | 114,629 | | |

Zendesk, Inc.(a)(f) | | | 50,491 | | | | 3,980,140 | | |

| | | | 4,094,769 | | |

Iron/Steel - 0.29% | |

Kloeckner & Co. SE | | | 32,369 | | | | 333,537 | | |

Machinery - Diversified - 0.16% | |

Crane Co. | | | 2,519 | | | | 183,031 | | |

Media - 3.79% | |

TEGNA, Inc. | | | 238,865 | | | | 3,700,019 | | |

Telenet Group Holding N.V. | | | 29,802 | | | | 634,877 | | |

| | | | 4,334,896 | | |

Mining - 0.63% | |

Arconic Corp.(a) | | | 24,924 | | | | 720,553 | | |

Oil & Gas - 2.44% | |

PDC Energy, Inc.(c) | | | 30,082 | | | | 2,064,227 | | |

Ranger Oil Corp., Class A | | | 19,855 | | | | 729,671 | | |

| | | | 2,793,898 | | |

Pharmaceuticals - 1.49% | |

Bayer AG | | | 9,665 | | | | 538,654 | | |

Heska Corp.(a) | | | 9,725 | | | | 1,164,375 | | |

| | | | 1,703,029 | | |

Pipelines - 0.78% | |

Magellan Midstream Partners LP(a) | | | 14,792 | | | | 890,626 | | |

Real Estate - 1.71% | |

Radius Global Infrastructure, Inc., Class A(a) | | | 132,306 | | | | 1,958,129 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

24

Water Island Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 91.57% (Continued) | |

Real Estate Investment Trusts - 2.25% | |

Life Storage, Inc.(c) | | | 14,696 | | | $ | 1,872,123 | | |

Urstadt Biddle Properties, Inc., Class A(c) | | | 36,140 | | | | 699,309 | | |

| | | | 2,571,432 | | |

Retail - 1.30% | |

Ruth's Hospitality Group, Inc. | | | 69,599 | | | | 1,491,507 | | |

Semiconductors - 1.48% | |

Magnachip Semiconductor Corp.(a) | | | 37,044 | | | | 378,960 | | |

Silicon Motion Technology Corp., ADR | | | 21,531 | | | | 1,318,559 | | |

| | | | 1,697,519 | | |

Software - 27.70% | |

Absolute Software Corp. | | | 123,607 | | | | 1,385,635 | | |

Activision Blizzard, Inc.(a) | | | 85,927 | | | | 6,891,345 | | |

Avalara, Inc.(a)(f) | | | 30,735 | | | | 2,908,988 | | |

Black Knight, Inc.(a) | | | 5,104 | | | | 294,909 | | |

Cvent Holding Corp.(a) | | | 216,636 | | | | 1,839,240 | | |

EMIS Group Plc | | | 23,960 | | | | 397,599 | | |

ForgeRock, Inc., Class A(a)(c) | | | 83,238 | | | | 1,675,581 | | |

Momentive Global, Inc.(a) | | | 478,152 | | | | 4,523,318 | | |

Qualtrics International, Inc., Class A(a)(b) | | | 217,280 | | | | 3,928,422 | | |

Rovio Entertainment Oyj(e) | | | 57,073 | | | | 561,249 | | |

SimCorp A/S | | | 12,121 | | | | 1,256,179 | | |

Software AG | | | 19,399 | | | | 685,104 | | |

VMware, Inc., Class A(a)(c) | | | 39,503 | | | | 5,383,864 | | |

| | | | 31,731,433 | | |

Transportation - 0.34% | |

Exmar N.V. | | | 34,366 | | | | 393,052 | | |

TOTAL COMMON STOCKS

(Cost $112,274,366) | | | 104,886,351 | | |

RIGHTS(a) - 0.40% | |

Bristol-Myers Squibb Co. CVR(d) | | | 67,803 | | | | 67,803 | | |

Concert Pharmaceuticals, Inc. CVR, Expires 12/31/2029(d)(f) | | | 154,954 | | | | 58,635 | | |

Contra Abiomed, Inc. CVR, Expires 12/31/2030(d) | | | 13,890 | | | | 24,308 | | |

Contra Albireo Pharma, Inc. CVR, Expires 12/31/2027(d)(f) | | | 34,047 | | | | 74,927 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024(d)(f) | | | 204,285 | | | | 4,966 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024(d)(f) | | | 204,285 | | | | 3,311 | | |

Contra CinCor Pharma, Inc. CVR, Expires 12/31/2027(d)(f) | | | 39,632 | | | | 124,429 | | |

Resolute Forest Products, Inc. CVR, Expires 6/30/2024(d)(f) | | | 68,936 | | | | 100,226 | | |

TOTAL RIGHTS

(Cost $484,860) | | | 458,605 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

25

Water Island Event-Driven Fund Portfolio of Investments (continued)

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CONVERTIBLE CORPORATE BONDS - 0.94% | |

Entertainment - 0.26% | |

Cineplex, Inc.(e) | | 09/30/2025 | | | 5.750 | % | | $ | 392,000 | | | $ | 300,559 | | |

Healthcare - Services - 0.34% | |

UpHealth, Inc.(e) | | 06/15/2026 | | | 6.250 | % | | | 217,000 | | | | 62,795 | | |

UpHealth, Inc., Variable Rate,

(SOFR plus 9.00%)(e) | | 12/15/2025 | | | 14.060 | % | | | 409,000 | | | | 325,155 | | |

| | | | 387,950 | | |

Software - 0.34% | |

Kaleyra, Inc.(e) | | 06/01/2026 | | | 6.125 | % | | | 488,000 | | | | 384,991 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $1,402,394) | | | 1,073,500 | | |

| | | Shares | | Value | |

WARRANTS(a) - 0.00%(g) | |

Commercial Services - 0.00%(g) | |

Moneylion, Inc., Exercise Price $11.50, Expires 09/22/2026 | | | 22,640 | | | $ | 792 | | |

TOTAL WARRANTS

(Cost $0) | | | 792 | | |

PRIVATE INVESTMENTS(a)(d)(f)(h) - 0.04% | |

Fast Capital LLC | | | 22,800 | | | | 45,600 | | |

TOTAL PRIVATE INVESTMENTS

(Cost $23,591) | | | 45,600 | | |

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(a) - 0.15% | |

Call Options Purchased - 0.12% | |

Broadcom, Inc. | |

| | | 06/2023 | | $ | 810.00 | | | $ | 484,776 | | | | 6 | | | $ | 22,410 | | |

| | | 06/2023 | | | 815.00 | | | | 484,776 | | | | 6 | | | | 21,420 | | |

| | | 06/2023 | | | 810.00 | | | | 484,776 | | | | 6 | | | | 26,520 | | |

| | | 06/2023 | | | 815.00 | | | | 484,776 | | | | 6 | | | | 25,260 | | |

First Horizon Corp. | | 06/2023 | | | 12.00 | | | | 507,252 | | | | 492 | | | | 3,690 | | |

IVERIC bio, Inc. | |

| | | 07/2023 | | | 40.00 | | | | 373,725 | | | | 99 | | | | 2,227 | | |

| | | 09/2023 | | | 40.00 | | | | 373,725 | | | | 99 | | | | 3,960 | | |

MaxLinear, Inc. | | 09/2023 | | | 30.00 | | | | 245,364 | | | | 84 | | | | 28,140 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $131,238) | | | 133,627 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

26

Water Island Event-Driven Fund Portfolio of Investments (continued)

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(a) - 0.15% (Continued) | |

Put Options Purchased - 0.03% | |

Crane NXT Co. | | 06/2023 | | $ | 110.00 | | | $ | 131,575 | | | | 25 | | | $ | 0 | | |

First Horizon Corp. | | 06/2023 | | | 9.00 | | | | 907,280 | | | | 880 | | | | 22,000 | | |

Horizon Therapeutics Plc | |

| | | 08/2023 | | | 95.00 | | | | 670,201 | | | | 67 | | | | 11,390 | | |

| | | 08/2023 | | | 100.00 | | | | 90,027 | | | | 9 | | | | 2,723 | | |

National Instruments Corp. | |

| | | 06/2023 | | | 40.00 | | | | 254,320 | | | | 44 | | | | 0 | | |

| | | 06/2023 | | | 45.00 | | | | 236,980 | | | | 41 | | | | 0 | | |

Qualtrics International, Inc. | | 06/2023 | | | 12.50 | | | | 338,096 | | | | 187 | | | | 0 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $132,365) | | | 36,113 | | |

TOTAL PURCHASED OPTIONS

(Cost $263,603) | | | 169,740 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 4.34% | |

Money Market Funds | |

Morgan Stanley Institutional Liquidity Funds -

Government Portfolio | | | 4.997 | %(i) | | | 2,486,408 | | | $ | 2,486,408 | | |

State Street Institutional U.S. Government

Money Market Fund, Premier Class | | | 5.129 | %(i) | | | 2,486,407 | | | | 2,486,407 | | |

| | | | 4,972,815 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $4,972,815) | | | 4,972,815 | | |

Total Investments - 97.44%

(Cost $119,421,629) | | | 111,607,403 | | |

Other Assets in Excess of Liabilities - 2.56%(j) | | | 2,932,422 | | |

NET ASSETS - 100.00% | | $ | 114,539,825 | | |

Portfolio Footnotes

(a) Non-income-producing security.

(b) Underlying security for a written/purchased call/put option.

(c) Security, or a portion of security, is being held as collateral for swaps, short sales, written option contracts or forward foreign currency exchange contracts. At May 31, 2023, the aggregate fair market value of those securities was $ 18,129,170 representing 15.83% of net assets.

(d) Restricted securities (including private placements) - The Fund may own investment securities that have other legal or contractual limitations. At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $602,024 or 0.53% of net assets.

See Notes to Financial Statements.

Annual Report | May 31, 2023

27

Water Island Event-Driven Fund Portfolio of Investments (continued)

Restricted Security | | Acquisition Date | | Acquisition Cost | |

Bristol-Myers Squibb Co. CVR | | 11/20/2020 | | $ | 110,781 | | |

Concert Pharmaceuticals, Inc. CVR, Expires 12/31/2029 | | 03/07/2023 | | | 57,333 | | |

Contra Abiomed, Inc. CVR, Expires 12/31/2030 | | 12/21/2022 | | | 14,168 | | |

Contra Albireo Pharma, Inc. CVR, Expires 12/31/2027 | | 03/03/2023 | | | 73,201 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024 | | 04/13/2023 | | | 5,107 | | |

Contra Amryt Pharma Plc CVR, Expires 12/31/2024 | | 04/13/2023 | | | 5,107 | | |

Contra CinCor Pharma, Inc. CVR, Expires 12/31/2027 | | 02/23/2023 | | | 121,274 | | |

Fast Capital LLC | | 08/18/2020 | | | 23,591 | | |

Moneylion, Inc. | | 06/19/2020 | | | 1,926,136 | | |

Resolute Forest Products, Inc. CVR, Expires 6/30/2024 | | 03/01/2023 | | | 97,889 | | |

Total | | | | $ | 2,434,587 | | |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2023, these securities had a total value of $1,749,378 or 1.53% of net assets.

(f) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of May 31, 2023, the total fair market value of these securities was $7,301,222, representing 6.37% of net assets.

(g) Less than 0.005% of net assets.

(h) Represents a holding that is a direct investment into a private company and is not a listed or publicly traded entity.

(i) Rate shown is the 7-day effective yield as of May 31, 2023.

(j) Includes cash held as collateral for short sales and written option contracts.

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS SOLD SHORT - (5.79%) | |

Entertainment - (0.02%) | |

Cineplex, Inc. | | | (3,228 | ) | | $ | (23,256 | ) | |

Healthcare - Products - (0.08%) | |

NuVasive, Inc. | | | (2,561 | ) | | | (97,728 | ) | |

Oil & Gas - (2.12%) | |

Baytex Energy Corp. | | | (103,365 | ) | | | (325,895 | ) | |

Chevron Corp. | | | (13,952 | ) | | | (2,101,450 | ) | |

| | | | (2,427,345 | ) | |

Pipelines - (0.49%) | |

ONEOK, Inc. | | | (9,866 | ) | | | (559,007 | ) | |

Real Estate Investment Trusts - (2.24%) | |

Extra Space Storage, Inc. | | | (9,865 | ) | | | (1,423,224 | ) | |

Public Storage | | | (1,540 | ) | | | (436,282 | ) | |

Regency Centers Corp. | | | (12,541 | ) | | | (705,682 | ) | |

| | | | (2,565,188 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

28

Water Island Event-Driven Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS SOLD SHORT - (5.79%) (Continued) | |

Semiconductors - (0.84%) | |

Broadcom, Inc. | | | (884 | ) | | $ | (714,237 | ) | |

MaxLinear, Inc. | | | (8,355 | ) | | | (244,049 | ) | |

| | | | (958,286 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $6,893,868) | | $ | (6,630,810 | ) | |

WRITTEN OPTIONS | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

Written Call Options | |

Crane NXT Co. | | 06/2023 | | $ | 130.00 | | | $ | (131,575 | ) | | | (25 | ) | | $ | (2,563 | ) | |

TOTAL WRITTEN OPTIONS

(Premiums received $8,708) | | $ | (2,563 | ) | |

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Made | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Upon

Termination

| | Brookfield

Infrastructure

Corp.

| | Received

1 Month-

Federal

Rate

Minus

58bps

(-4.500%) | |

10/29/2024 | | $ | — | | | $ | — | | | $ | 3,387 | | | USD | 176,861 | | | $ | 3,387 | | |

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Made | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Depreciation | |

Morgan

Stanley &

Co./

Upon

Termination

| | Broadcom,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40bps

(-4.680%) | |

10/29/2024 | | $ | — | | | $ | — | | | $ | (1,165,673 | ) | | USD | 2,140,499 | | | $ | (1,165,673 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2023

29