UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

the arbitrage funds

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-295-4485

Date of fiscal year end: May 31

Date of reporting period: November 30, 2021

Item 1. Reports to Stockholders.

Semi-Annual Report

November 30, 2021

Arbitrage Fund

Water Island Event-Driven Fund

Water Island Credit Opportunities Fund

TABLE OF CONTENTS

Arbitrage Fund | |

Portfolio Information | | | 1 | | |

Portfolio of Investments | | | 3 | | |

Water Island Event-Driven Fund | |

Portfolio Information | | | 18 | | |

Portfolio of Investments | | | 20 | | |

Water Island Credit Opportunities Fund | |

Portfolio Information | | | 33 | | |

Portfolio of Investments | | | 35 | | |

Statements of Assets and Liabilities | | | 46 | | |

Statements of Operations | | | 50 | | |

Statements of Changes in Net Assets | | | 54 | | |

Financial Highlights | |

Arbitrage Fund - Class R | | | 58 | | |

Arbitrage Fund - Class I | | | 60 | | |

Arbitrage Fund - Class C | | | 62 | | |

Arbitrage Fund - Class A | | | 64 | | |

Water Island Event-Driven Fund - Class R | | | 66 | | |

Water Island Event-Driven Fund - Class I | | | 68 | | |

Water Island Event-Driven Fund - Class A | | | 70 | | |

Water Island Credit Opportunities Fund - Class R | | | 72 | | |

Water Island Credit Opportunities Fund - Class I | | | 74 | | |

Water Island Credit Opportunities Fund - Class A | | | 76 | | |

Notes to Financial Statements | | | 78 | | |

Disclosure of Fund Expenses | | | 103 | | |

Additional Information | | | 106 | | |

Arbitrage Fund Portfolio Information

November 30, 2021 (Unaudited)

Performance^ (annualized returns as of November 30, 2021)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Arbitrage Fund, Class R | | | 1.28 | % | | | 2.83 | % | | | 2.02 | % | | | 3.85 | % | |

Arbitrage Fund, Class I | | | 1.54 | % | | | 3.08 | % | | | 2.27 | % | | | 3.05 | % | |

Arbitrage Fund, Class C** | | | -0.42 | %# | | | 2.04 | % | | | N/A | | | | 1.41 | % | |

Arbitrage Fund, Class A*** | | | -1.50 | % | | | 2.30 | % | | | N/A | | | | 2.07 | % | |

ICE BofA 3-Month Treasury Bill Index | | | 0.05 | % | | | 1.15 | % | | | 0.63 | % | | | 1.51 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com. This table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

^ After sales charge.

* Class R inception: 9/18/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R shares.

# Class C One Year return includes load.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed within 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 2.75% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $250,000 or more purchased without a front-end sales charge and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 1.74%, 1.49%, 2.49% and 1.74%, respectively. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA U.S. 3-Month Treasury Bill Index (formerly named, ICE BofA Merrill Lynch U.S. 3-Month Treasury Bill Index) tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

An investor may not invest directly in an index.

Semi-Annual Report | November 30, 2021

1

Arbitrage Fund Portfolio Information (continued)

November 30, 2021 (Unaudited)

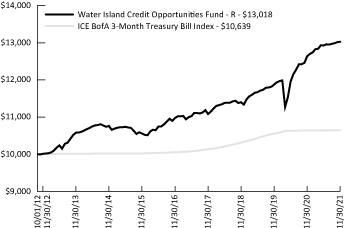

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund over ten years. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

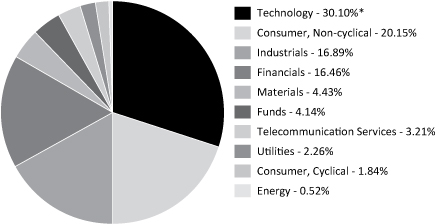

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: If a large percentage of mergers or event-driven investment opportunities taking place within the U.S. are within one industry over a given period of time, the Fund may invest a large portion of its assets in securities of issuers in a single industry for that period of time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

www.arbitragefunds.com | 1-800-295-4485

2

Arbitrage Fund Portfolio of Investments

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 89.19% | |

Aerospace & Defense - 1.53% | |

Aerojet Rocketdyne Holdings, Inc.(a) | | | 595,012 | | | $ | 25,014,304 | | |

Auto Parts & Equipment - 0.91% | |

Veoneer, Inc.(b) | | | 417,772 | | | | 14,872,683 | | |

Banks - 1.15% | |

Sbanken ASA(c) | | | 1,000,885 | | | | 10,457,528 | | |

TriState Capital Holdings, Inc.(a)(b) | | | 278,000 | | | | 8,314,980 | | |

| | | | 18,772,508 | | |

Biotechnology - 1.77% | |

Dicerna Pharmaceuticals, Inc.(b) | | | 497,772 | | | | 18,920,314 | | |

Swedish Orphan Biovitrum AB(b) | | | 412,659 | | | | 10,083,609 | | |

| | | | 29,003,923 | | |

Chemicals - 4.75% | |

Atotech Ltd.(a)(b) | | | 1,250,756 | | | | 30,193,250 | | |

Kraton Corp.(b) | | | 227,237 | | | | 10,466,536 | | |

Rogers Corp.(b) | | | 136,732 | | | | 37,275,878 | | |

| | | | 77,935,664 | | |

Commercial Services - 9.52% | |

Afterpay Ltd., ADR(a)(b) | | | 85,696 | | | | 6,639,726 | | |

Bakkt Holdings, Inc.(b)(d)(e) | | | 171,827 | | | | 2,682,219 | | |

Europcar Mobility Group(b)(c) | | | 13,799,346 | | | | 7,981,422 | | |

GreenSky, Inc., Class A(a)(b) | | | 1,393,804 | | | | 15,805,737 | | |

IHS Markit Ltd. | | | 705,607 | | | | 90,190,687 | | |

Moneylion, Inc.(b)(d) | | | 1,911,916 | | | | 8,068,286 | | |

RR Donnelley & Sons Co.(b) | | | 2,344,009 | | | | 24,752,735 | | |

| | | | 156,120,812 | | |

Computers & Computer Services - 1.02% | |

Avast Plc(c) | | | 826,453 | | | | 6,658,597 | | |

McAfee Corp., Class A | | | 386,544 | | | | 9,992,162 | | |

| | | | 16,650,759 | | |

Construction Materials - 0.95% | |

Forterra, Inc.(b) | | | 654,034 | | | | 15,559,469 | | |

Diversified Financial Services - 0.83% | |

Sanne Group Plc | | | 1,128,610 | | | | 13,629,033 | | |

Electric - 1.50% | |

PNM Resources, Inc. | | | 500,365 | | | | 24,637,973 | | |

Electronics - 2.57% | |

Coherent, Inc.(a)(b) | | | 162,981 | | | | 42,200,670 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

3

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 89.19% (Continued) | |

Energy - Alternate Sources - 0.56% | |

Falck Renewables SpA | | | 929,039 | | | $ | 9,124,381 | | |

Engineering & Construction - 1.45% | |

Akka Technologies(b) | | | 73,852 | | | | 4,003,518 | | |

Sydney Airport(b) | | | 3,347,206 | | | | 19,804,258 | | |

| | | | 23,807,776 | | |

Food - 1.55% | |

Sanderson Farms, Inc. | | | 131,779 | | | | 24,745,461 | | |

Stryve Foods, Inc., Class A(b)(d) | | | 171,198 | | | | 667,672 | | |

| | | | 25,413,133 | | |

Healthcare - Products - 2.92% | |

Hill-Rom Holdings, Inc.(a) | | | 275,459 | | | | 42,833,874 | | |

Itamar Medical Ltd., ADR(a)(b) | | | 165,000 | | | | 5,057,250 | | |

| | | | 47,891,124 | | |

Healthcare - Services - 4.52% | |

PPD, Inc.(a)(b) | | | 1,571,929 | | | | 74,037,856 | | |

UpHealth, Inc.(b)(d) | | | 48,973 | | | | 127,819 | | |

| | | | 74,165,675 | | |

Insurance - 6.33% | |

Athene Holding Ltd., Class A(a)(b) | | | 198,929 | | | | 16,296,264 | | |

TOWER Ltd. | | | 8,008,907 | | | | 3,716,935 | | |

Willis Towers Watson Plc(a) | | | 371,136 | | | | 83,817,354 | | |

| | | | 103,830,553 | | |

Internet - 0.50% | |

Zix Corp.(b) | | | 967,225 | | | | 8,192,396 | | |

Machinery - Diversified - 3.44% | |

Neles Oyj | | | 346,525 | | | | 5,175,733 | | |

Welbilt, Inc.(a)(b) | | | 2,171,005 | | | | 51,148,878 | | |

| | | | 56,324,611 | | |

Real Estate Investment Trusts - 8.94% | |

Columbia Property Trust, Inc.(a) | | | 1,085,326 | | | | 20,838,259 | | |

Cominar Real Estate Investment Trust | | | 1,340,987 | | | | 12,050,985 | | |

Corepoint Lodging, Inc.(b) | | | 635,729 | | | | 9,809,298 | | |

CoreSite Realty Corp. | | | 191,235 | | | | 32,710,747 | | |

CyrusOne, Inc. | | | 278,240 | | | | 24,768,925 | | |

MGM Growth Properties LLC, Class A(a) | | | 399,165 | | | | 14,613,431 | | |

Monmouth Real Estate Investment Corp.(a) | | | 1,527,305 | | | | 31,722,125 | | |

| | | | 146,513,770 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

4

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 89.19% (Continued) | |

Retail - 0.76% | |

GrandVision N.V.(b)(c) | | | 131,148 | | | $ | 4,224,075 | | |

Vivo Energy Plc(c) | | | 4,662,407 | | | | 8,185,013 | | |

| | | | 12,409,088 | | |

Semiconductors - 7.44% | |

DSP Group, Inc.(b) | | | 742,785 | | | | 16,333,842 | | |

Magnachip Semiconductor Corp.(b) | | | 727,164 | | | | 13,147,125 | | |

Xilinx, Inc.(a) | | | 404,997 | | | | 92,521,565 | | |

| | | | 122,002,532 | | |

Software - 16.87% | |

Blue Prism Group Plc(b) | | | 999,131 | | | | 17,261,037 | | |

Change Healthcare, Inc.(a)(b) | | | 1,778,570 | | | | 36,069,400 | | |

Five9, Inc.(a)(b)(e) | | | 223,523 | | | | 31,814,029 | | |

Inovalon Holdings, Inc., Class A(b)(f) | | | 405,270 | | | | 16,616,070 | | |

Kaleyra, Inc.(b) | | | 134,591 | | | | 1,410,514 | | |

MINDBODY, Inc., Class A(b)(f) | | | 843,793 | | | | 31,503,602 | | |

Momentive Global, Inc.(b) | | | 735,254 | | | | 15,021,239 | | |

Nuance Communications, Inc.(a)(b) | | | 1,344,404 | | | | 74,600,978 | | |

Onemarket Ltd.(b)(f) | | | 111,800 | | | | — | | |

Playtech Plc(b) | | | 898,242 | | | | 8,911,842 | | |

Pluralsight, Inc., Class A(b)(f) | | | 1,000,062 | | | | 23,016,627 | | |

QAD, Inc., Class A(b)(f) | | | 232,603 | | | | 20,352,762 | | |

| | | | 276,578,100 | | |

Telecommunications - 1.76% | |

NeoPhotonics Corp.(b) | | | 1,073,920 | | | | 16,506,150 | | |

Vonage Holdings Corp.(b) | | | 599,396 | | | | 12,359,546 | | |

| | | | 28,865,696 | | |

Transportation - 4.73% | |

Kansas City Southern(a) | | | 211,712 | | | | 61,576,435 | | |

Ocean Yield ASA | | | 1,740,000 | | | | 7,795,088 | | |

Teekay LNG Partners LP | | | 486,015 | | | | 8,228,234 | | |

| | | | 77,599,757 | | |

Water - 0.92% | |

Suez SA | | | 674,971 | | | | 15,106,847 | | |

TOTAL COMMON STOCKS

(Cost $1,413,963,691) | | | 1,462,223,237 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

5

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

RIGHTS(b) - 0.17% | |

Bristol-Myers Squibb Co. CVR | | | 857,631 | | | $ | 857,631 | | |

CA Immobilien Anlagen AG CVR(f) | | | 221,534 | | | | — | | |

Contra Adamas Pharmaceuticals, Inc. CVR,

Expires 12/31/2024(f) | | | 1,150,652 | | | | 69,269 | | |

Contra Adamas Pharmaceuticals, Inc. CVR,

Expires 12/31/2025(f) | | | 1,150,652 | | | | 69,154 | | |

Contra Flexion Therapeutics, Inc. CVR, Expires 12/31/2030(f) | | | 1,411,000 | | | | 877,642 | | |

Contra Pfenex, Inc. CVR, Expires 12/31/2021(f) | | | 1,108,177 | | | | 928,874 | | |

Elanco Animal Health, Inc. CVR, Expires 12/31/2021(f) | | | 1,124,589 | | | | — | | |

Media General, Inc. CVR(f) | | | 613,589 | | | | — | | |

NewStar Financial, Inc. CVR, Expires 12/17/2021(f) | | | 1,514,945 | | | | — | | |

TOTAL RIGHTS

(Cost $3,058,131) | | | 2,802,570 | | |

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CONVERTIBLE CORPORATE BONDS - 1.23% | |

Auto Manufacturers - 0.13% | |

Lightning eMotors, Inc.(c) | | 05/15/2024 | | | 7.500 | % | | $ | 2,596,000 | | | $ | 2,179,460 | | |

Healthcare - Services - 0.19% | |

UpHealth, Inc.(c) | | 06/15/2026 | | | 6.250 | % | | | 3,613,000 | | | | 3,127,065 | | |

Pharmaceuticals - 0.69% | |

Flexion Therapeutics, Inc. | | 05/01/2024 | | | 3.375 | % | | | 11,311,000 | | | | 11,254,445 | | |

Software - 0.22% | |

Kaleyra, Inc.(c) | | 06/01/2026 | | | 6.125 | % | | | 3,525,000 | | | | 3,573,834 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $20,989,193) | | | 20,134,804 | | |

| | | Shares | | Value | |

MUTUAL FUNDS - 4.44% | |

Water Island Event-Driven Fund, Class I(g) | | | 6,605,365 | | | $ | 72,791,125 | | |

TOTAL MUTUAL FUNDS

(Cost $60,632,644) | | | 72,791,125 | | |

PRIVATE INVESTMENTS(b)(d)(f)(h) - 0.17% | |

Fast Capital LLC | | | 290,700 | | | | 290,700 | | |

Fuse LLC | | | 725,800 | | | | 2,230,399 | | |

Fuse Sponsor Capital, Z2 Shares | | | 72,580 | | | | 293,868 | | |

TOTAL PRIVATE INVESTMENTS

(Cost $1,036,875) | | | 2,814,967 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

6

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

WARRANTS(b) - 0.03% | |

Auto Manufacturers - 0.02% | |

Lightning eMotors, Inc., Exercise Price $11.50,

Expires 05/18/2025(d) | | | 225,739 | | | $ | 316,035 | | |

Commercial Services - 0.01% | |

Moneylion, Inc., Exercise Price $11.50, Expires 06/01/2027 | | | 290,320 | | | | 229,353 | | |

Healthcare - Services - 0.00%(i) | |

UpHealth, Inc., Exercise Price $11.50, Expires 07/01/2024 | | | 4,897 | | | | 2,350 | | |

TOTAL WARRANTS

(Cost $0) | | | 547,738 | | |

PREFERRED STOCKS - 0.09% | |

Entertainment - 0.09% | |

1317774 B.C. Ltd. | | | 29,562 | | | | 1,515,588 | | |

TOTAL PREFERRED STOCKS

(Cost $2,400,434) | | | 1,515,588 | | |

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(b) - 0.40% | |

Call Options Purchased - 0.21% | |

Acceleron

Pharma, Inc. | | 12/2021 | | $ | 180.00 | | | $ | 0 | | | | 904 | | | $ | 0 | | |

Advanced Micro

Devices, Inc. | |

| | | 12/2021 | | | 145.00 | | | | 8,615,872 | | | | 544 | | | | 875,840 | | |

| | | 12/2021 | | | 150.00 | | | | 5,527,462 | | | | 349 | | | | 433,632 | | |

Canadian Pacific

Railway Ltd. | |

| | | 12/2021 | | | 78.00 | | | | 15,357,579 | | | | 2,193 | | | | 87,720 | | |

| | | 12/2021 | | | 80.00 | | | | 15,357,579 | | | | 2,193 | | | | 38,378 | | |

Sportsman's

Warehouse

Holdings, Inc. | | 12/2021 | | | 17.50 | | | | 3,390,673 | | | | 1,991 | | | | 94,573 | | |

Trillium

Therapeutics,

Inc. | | 12/2021 | | | 20.00 | | | | 0 | | | | 1,844 | | | | 0 | | |

Zendesk, Inc. | | 12/2021 | | | 95.00 | | | | 21,116,348 | | | | 2,068 | | | | 1,840,520 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $2,919,138) | | | 3,370,663 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

7

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(b) - 0.40% (Continued) | |

Put Options Purchased - 0.19% | |

Bakkt Holdings, Inc. | |

| | 12/2021 | | $ | 25.00 | | | $ | 426,153 | | | | 273 | | | $ | 308,490 | | |

| | 12/2021 | | | 30.00 | | | | 452,690 | | | | 290 | | | | 472,700 | | |

Five9, Inc. | |

| | 12/2021 | | | 145.00 | | | | 13,991,039 | | | | 983 | | | | 830,635 | | |

| | 12/2021 | | | 150.00 | | | | 15,585,135 | | | | 1,095 | | | | 1,281,150 | | |

| | 12/2021 | | | 155.00 | | | | 2,291,513 | | | | 161 | | | | 239,890 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $2,165,210) | | | 3,132,865 | | |

TOTAL PURCHASED OPTIONS

(Cost $5,084,348) | | | 6,503,528 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 3.18% | |

Money Market Funds | |

Morgan Stanley Institutional Liquidity

Fund - Government Portfolio | | | 0.026 | %(j) | | | 26,057,176 | | | $ | 26,057,176 | | |

State Street Institutional U.S. Government

Money Market Fund, Premier Class | | | 0.063 | %(j) | | | 26,057,176 | | | | 26,057,176 | | |

| | | | | | | | 52,114,352 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $52,114,352) | | | 52,114,352 | | |

Total Investments - 98.90%

(Cost $1,559,279,668) | | | 1,621,447,909 | | |

Other Assets in Excess of Liabilities - 1.10%(k) | | | 17,953,271 | | |

NET ASSETS - 100.00% | | $ | 1,639,401,180 | | |

Portfolio Footnotes

(a) Security, or a portion of security, is being held as collateral for short sales, written option contracts or forward foreign currency exchange contracts. At November 30, 2021, the aggregate fair market value of those securities was $319,525,490, representing 19.49% of net assets.

(b) Non-income-producing security.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of November 30, 2021, these securities had a total value of $46,386,994 or 2.83% of net assets.

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

8

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

(d) Restricted securities (including private placements) - The Fund may own investment securities that have other legal or contractual limitations. At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $14,676,998 or 0.90% of net assets.

Restricted Security | | Acquisition Date | | Acquisition Cost | |

Bakkt Holdings, Inc. | | 10/06/2021 | | $ | 1,718,270 | | |

Fast Capital LLC | | 08/18/2020 | | | 300,786 | | |

Fuse LLC | | 06/19/2020 | | | 669,078 | | |

Fuse Sponsor Capital, Z2 Shares | | 06/19/2020 | | | 67,011 | | |

Lightning eMotors, Inc., Exercise Price $11.50,

Expires 05/18/2025 | | 04/28/2021 | | | — | | |

Moneylion, Inc. | | 09/14/2021 | | | 16,344,382 | | |

Stryve Foods, Inc. | | 07/09/2021 | | | 1,711,980 | | |

UpHealth, Inc. | | 05/25/2021 | | | 489,730 | | |

Total | | | | $ | 21,301,237 | | |

(e) Underlying security for a written/purchased call/put option.

(f) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of November 30, 2021, the total fair market value of these securities was $96,248,967, representing 5.87% of net assets.

(g) Affiliated investment.

(h) Represents a holding that is a direct investment into a private company and is not a listed or publicly traded entity.

(i) Less than 0.005% of net assets.

(j) Rate shown is the 7-day effective yield as of November 30, 2021.

(k) Includes cash held as collateral for short sales.

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (12.20%) | |

Commercial Services - (0.44%) | |

Bakkt Holdings, Inc. | | | (35,484 | ) | | $ | (553,905 | ) | |

Square, Inc., Class A | | | (32,136 | ) | | | (6,694,893 | ) | |

| | | | (7,248,798 | ) | |

Diversified Financial Services - (0.42%) | |

Raymond James Financial, Inc. | | | (69,500 | ) | | | (6,831,155 | ) | |

Electronics - (0.57%) | |

II-VI, Inc. | | | (148,313 | ) | | | (9,274,012 | ) | |

Entertainment - (0.09%) | |

Penn National Gaming, Inc. | | | (29,562 | ) | | | (1,514,461 | ) | |

Internet - (1.03%) | |

Zendesk, Inc. | | | (165,432 | ) | | | (16,892,262 | ) | |

Machinery - Diversified - (0.28%) | |

Valmet Oyj | | | (113,547 | ) | | | (4,661,609 | ) | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

9

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (12.20%) (Continued) | |

Semiconductors - (6.76%) | |

Advanced Micro Devices, Inc. | | | (697,967 | ) | | $ | (110,537,034 | ) | |

MKS Instruments, Inc. | | | (1,656 | ) | | | (251,977 | ) | |

| | | | (110,789,011 | ) | |

Transportation - (2.61%) | |

Canadian Pacific Railway Ltd. | | | (610,577 | ) | | | (42,758,707 | ) | |

TOTAL COMMON STOCKS

(Proceeds $159,504,546) | | | (199,970,015 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $159,504,546) | | $ | (199,970,015 | ) | |

WRITTEN OPTIONS | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

Written Call Options | |

Bakkt Holdings, Inc. | | 12/2021 | | $ | 40.00 | | | $ | (426,153 | ) | | | (273 | ) | | $ | (6,142 | ) | |

Dicerna

Pharmaceuticals,

Inc. | | 01/2022 | | | 40.00 | | | | (4,051,866 | ) | | | (1,066 | ) | | | (29,315 | ) | |

TOTAL WRITTEN CALL OPTIONS

(Premiums received $216,325) | | | (35,457 | ) | |

TOTAL WRITTEN OPTIONS

(Premiums received $216,325) | | $ | (35,457 | ) | |

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Goldman

Sachs &

Co./

Monthly

| | Equiniti

Group

Plc

| | Paid

1 Month

SONIA

Plus

95 bps

(0.995%) | |

05/10/2022 | | $ | — | | | $ | — | | | $ | — | | | GBP | 5,494,300 | | | $ | — | | |

Goldman

Sachs &

Co./

Monthly

| | GCP

Student

Living

Plc

| | Paid

1 Month

SONIA

Plus

47 bps

(0.516%) | | 07/16/2022 | | | — | | | | — | | | | — | | | GBP | 5,959,391 | | | | — | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

10

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Goldman

Sachs &

Co./

Monthly

| | Meggitt

Plc

| | Paid

1 Month

SONIA

Plus

55 bps

(0.596%) | |

08/04/2022 | | $ | — | | | $ | — | | | $ | — | | | GBP | 12,315,265 | | | $ | — | | |

Goldman

Sachs &

Co./

Monthly

| | Sanne

Group

Plc

| | Paid

1 Month

SONIA

Plus

45 bps

(0.496%) | |

08/31/2022 | | | — | | | | — | | | | — | | | GBP | 5,637,963 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | Zardoya

Otis SA

| | Paid

1 Week

ESTR

Plus

60 bps

(0.031%) | |

09/27/2022 | | | — | | | | — | | | | — | | | EUR | 5,320,590 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | CNP

Assurance

| | Paid

1 Week

ESTR

Plus

55 bps

(0.000%) | |

11/01/2022 | | | — | | | | — | | | | — | | | EUR | 17,405,027 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | Alstria

Office

REIT - AG

| | Paid

1 Week

ESTR

Plus

45 bps

(1.000%) | |

11/08/2022 | | | — | | | | — | | | | — | | | EUR | 7,527,000 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | ICA

Gruppen

AB

| | Paid

1 Month

STIBOR

Plus

50 bps

(0.447%) | |

11/14/2022 | | | — | | | | — | | | | — | | | SEK | 14,151,000 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | Distell

Group

Holdings

Ltd.

| | Paid

1 Month

JIBAR

Plus

150 bps

(4.992%) | |

11/18/2022 | | | — | | | | — | | | | — | | | ZAR | 59,573,067 | | | | — | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

11

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Monthly

| | Apollo

Global

Management,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | $ | — | | | $ | — | | | $ | — | | | USD | 16,183,847 | | | $ | — | | |

Morgan

Stanley &

Co./

Monthly

| | iShares

MSCI

Australia

ETF

| | Received

1 Month-

Federal

Rate

Minus

153 bps

(-1.440%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 1,384,999 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Goldman

Sachs

Group,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 15,930,716 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | iShares

Russell 2000

ETF

| | Received

1 Month-

Federal

Rate

Minus

88 bps

(-0.800%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 3,423,087 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | MKS

Instruments,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 10,253,149 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | NortonLifeLock,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 618,914 | | | | — | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

12

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Monthly

| | S&P

Global,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | $ | — | | | $ | — | | | $ | — | | | USD | 91,260,388 | | | $ | — | | |

Morgan

Stanley &

Co./

Monthly

| | Vici

Properties,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/11/2023 | | | — | | | | — | | | | — | | | USD | 14,831,045 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Amasten

Fastighets

AB

| | Paid

1 Month

STIBOR

Plus

150 bps

(1.401%) | |

11/17/2023 | | | — | | | | — | | | | — | | | SEK | 15,984,000 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Distell

Group

Holdings

Ltd.

| | Paid

1 Month

SABOR

Plus

125 bps

(4.590%) | |

11/17/2023 | | | — | | | | — | | | | — | | | ZAR | 20,969,869 | | | | — | | |

| | | | | | | | | | | | | $ | — | | | | | $ | — | | |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

USD | 21,001,261 | | | AUD | 28,625,400 | | | Morgan Stanley & Co. | | 12/15/2021 | | $ | 592,864 | | |

USD | 12,647,355 | | | CAD | 15,756,600 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 311,488 | | |

EUR | 7,660,600 | | | USD | 8,676,258 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 15,493 | | |

USD | 101,387,780 | | | EUR | 85,923,900 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 3,898,139 | | |

USD | 44,805,921 | | | GBP | 32,974,900 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 942,070 | | |

USD | 26,334,361 | | | NOK | 228,861,700 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 1,032,337 | | |

USD | 4,573,196 | | | NZD | 6,447,100 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 173,562 | | |

SEK | 3,893,000 | | | USD | 429,023 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 2,971 | | |

USD | 11,243,576 | | | SEK | 97,111,300 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 467,434 | | |

| | | $ | 7,436,358 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

13

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

AUD | 1,044,400 | | | USD | 758,087 | | | Morgan Stanley & Co. | | 12/15/2021 | | $ | (13,486 | ) | |

EUR | 37,436,200 | | | USD | 43,783,071 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (1,307,791 | ) | |

GBP | 3,573,700 | | | USD | 4,861,047 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (107,242 | ) | |

NOK | 53,104,700 | | | USD | 6,221,459 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (350,418 | ) | |

NZD | 1,001,000 | | | USD | 700,064 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (16,960 | ) | |

SEK | 4,290,300 | | | USD | 491,851 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (15,769 | ) | |

USD | 662,561 | | | SEK | 6,024,800 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (5,993 | ) | |

| | | $ | (1,817,659 | ) | |

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

United Kingdom | | | 14.83 | % | |

Australia | | | 1.62 | % | |

Sweden | | | 1.53 | % | |

Bermuda | | | 1.49 | % | |

France | | | 1.41 | % | |

Norway | | | 1.11 | % | |

Canada | | | 0.83 | % | |

Republic of Korea | | | 0.80 | % | |

Italy | | | 0.65 | % | |

Isle of Man | | | 0.54 | % | |

Czech Republic | | | 0.41 | % | |

Finland | | | 0.32 | % | |

Israel | | | 0.31 | % | |

Netherlands | | | 0.26 | % | |

Belgium | | | 0.24 | % | |

New Zealand | | | 0.23 | % | |

Austria | | | 0.00 | %(b) | |

United States | | | 72.32 | % | |

Other Assets in Excess of Liabilities | | | 1.10 | % | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

(b) Less than 0.005% of net assets.

Abbreviations:

AB - Aktiebolag is the Swedish term for a limited company.

ADR - American Depositary Receipt

ASA - Allmennaksjeselskap is the Norwegian term for public limited company.

AUD - Australian dollar

bps - Basis Points. 100 Basis Points is equal to 1 percentage point.

CAD - Canadian dollar

CVR - Contingent Value Rights

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

14

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

ESTR - Euro Short-term Rate

ETF - Exchange-Traded Fund

EUR - Euro

GBP - British pound

JIBAR - Johannesburg Interbank Agreed Rate

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

NOK - Norwegian krone

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

NZD - New Zealand dollar

Oyj - Osakeyhtio is the Finnish equivalent of a public limited company.

Plc - Public Limited Company

REIT - Real Estate Investment Trust

SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company.

SABOR - South African Benchmark Overnight Rate

SEK - Swedish krona

SONIA - Sterling OverNight Index Average

S&P - Standard & Poor's

SpA - Societa per Azione

STIBOR - Stockholm Interbank Offered Rate

USD - United States Dollar

ZAR - South African rand

The following table summarizes the Arbitrage Fund's investments and derivative financial instruments categorized in the fair value hierarchy as of November 30, 2021:

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Aerospace & Defense | | $ | 25,014,304 | | | $ | — | | | $ | — | | | $ | 25,014,304 | | |

Auto Parts & Equipment | | | 14,872,683 | | | | — | | | | — | | | | 14,872,683 | | |

Banks | | | 18,772,508 | | | | — | | | | — | | | | 18,772,508 | | |

Biotechnology | | | 29,003,923 | | | | — | | | | — | | | | 29,003,923 | | |

Chemicals | | | 77,935,664 | | | | — | | | | — | | | | 77,935,664 | | |

Commercial Services | | | 156,120,812 | | | | — | | | | — | | | | 156,120,812 | | |

Computers & Computer Services | | | 16,650,759 | | | | — | | | | — | | | | 16,650,759 | | |

Construction Materials | | | 15,559,469 | | | | — | | | | — | | | | 15,559,469 | | |

Diversified Financial Services | | | 13,629,033 | | | | — | | | | — | | | | 13,629,033 | | |

Electric | | | 24,637,973 | | | | — | | | | — | | | | 24,637,973 | | |

Electronics | | | 42,200,670 | | | | — | | | | — | | | | 42,200,670 | | |

Energy - Alternate Sources | | | 9,124,381 | | | | — | | | | — | | | | 9,124,381 | | |

Engineering & Construction | | | 23,807,776 | | | | — | | | | — | | | | 23,807,776 | | |

Food | | | 25,413,133 | | | | — | | | | — | | | | 25,413,133 | | |

Healthcare - Products | | | 47,891,124 | | | | — | | | | — | | | | 47,891,124 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

15

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Healthcare - Services | | $ | 74,165,675 | | | $ | — | | | $ | — | | | $ | 74,165,675 | | |

Insurance | | | 103,830,553 | | | | — | | | | — | | | | 103,830,553 | | |

Internet | | | 8,192,396 | | | | — | | | | — | | | | 8,192,396 | | |

Machinery - Diversified | | | 56,324,611 | | | | — | | | | — | | | | 56,324,611 | | |

Real Estate Investment Trusts | | | 146,513,770 | | | | — | | | | — | | | | 146,513,770 | | |

Retail | | | 12,409,088 | | | | — | | | | — | | | | 12,409,088 | | |

Semiconductors | | | 122,002,532 | | | | — | | | | — | | | | 122,002,532 | | |

Software | | | 185,089,039 | | | | — | | | | 91,489,061 | | | | 276,578,100 | | |

Telecommunications | | | 28,865,696 | | | | — | | | | — | | | | 28,865,696 | | |

Transportation | | | 69,804,669 | | | | 7,795,088 | | | | — | | | | 77,599,757 | | |

Water | | | 15,106,847 | | | | — | | | | — | | | | 15,106,847 | | |

Rights | | | — | | | | 857,631 | | | | 1,944,939 | | | | 2,802,570 | | |

Convertible Corporate Bonds** | | | — | | | | 20,134,804 | | | | — | | | | 20,134,804 | | |

Mutual Funds | | | 72,791,125 | | | | — | | | | — | | | | 72,791,125 | | |

Private Investments | | | — | | | | — | | | | 2,814,967 | | | | 2,814,967 | | |

Warrants | | | 547,738 | | | | — | | | | — | | | | 547,738 | | |

Preferred Stocks

Entertainment | | | — | | | | 1,515,588 | | | | — | | | | 1,515,588 | | |

Purchased Options | | | 6,503,528 | | | | — | | | | — | | | | 6,503,528 | | |

Short-Term Investments | | | 52,114,352 | | | | — | | | | — | | | | 52,114,352 | | |

TOTAL | | $ | 1,494,895,831 | | | $ | 30,303,111 | | | $ | 96,248,967 | | | $ | 1,621,447,909 | | |

Other Financial Instruments*** | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 7,436,358 | | | $ | — | | | $ | 7,436,358 | | |

Equity Swaps | | | 0 | | | | 0 | | | | — | | | | 0 | | |

Liabilities | |

Common Stocks** | | | (199,970,015 | ) | | | — | | | | — | | | | (199,970,015 | ) | |

Written Options | | | (35,457 | ) | | | — | | | | — | | | | (35,457 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (1,817,659 | ) | | | — | | | | (1,817,659 | ) | |

TOTAL | | $ | (200,005,472 | ) | | $ | 5,618,699 | | | $ | — | | | $ | (194,386,773 | ) | |

* Refer to footnote 2 where leveling hierarchy is defined.

** Refer to Portfolio of Investments for sector information.

*** Other financial instruments are instruments such as written options, securities sold short, equity swaps and forward foreign currency exchange contracts.

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

16

Arbitrage Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund's assets and liabilities during the period ended November 30, 2021:

Investments

in Securities | | Balance as of

May 31, 2021 | | Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance as of

November 30,

2021 | | Net change in

Unrealized

Appreciation

(Depreciation)

from

investments

still held as of

November 30,

2021 | |

Common

Stocks | | $ | 85,217,245 | | | $ | 3,261,325 | | | $ | (1,386,807 | ) | | $ | 36,590,099 | | | $ | (32,192,801 | ) | | $ | — | | | $ | — | | | $ | 91,489,061 | | | $ | 1,599,123 | | |

Rights | | | 1,135,875 | | | | 464,601 | | | | 25,000 | | | | 1,012,898 | | | | (693,435 | ) | | | — | | | | — | | | | 1,944,939 | | | | 47,051 | | |

Convertible

Corporate

Bonds | | | 6,433,715 | | | | — | | | | 328,097 | | | | — | | | | — | | | | — | | | | (6,761,812 | ) | | | — | | | | — | | |

Private

Investments | | | 1,016,499 | | | | — | | | | 1,795,077 | | | | 3,391 | | | | — | | | | — | | | | — | | | | 2,814,967 | | | | 1,795,077 | | |

Total | | $ | 93,803,334 | | | $ | 3,725,926 | | | $ | 761,367 | | | $ | 37,606,388 | | | $ | (32,886,236 | ) | | $ | — | | | $ | (6,761,812 | ) | | $ | 96,248,967 | | | $ | 3,441,251 | | |

The following table summarizes the quantitative inputs used for investments categorized as Level 3 of the fair value hierarchy as of November 30, 2021:

Investments in

Securities | | Fair Value at

November 30,

2021 | | Valuation

Technique | | Unobservable

Input | | Range of

Values | | Weighted

Average | |

Common Stocks

| | $ | 91,489,061

| | | Deal Value,

Liquidation

Value

| | Final

determination

on Dissent,

Final

Liquidation

Value | | $23.02-$41

| | $45.56

| |

Rights

| | | 1,944,939

| | | Discounted,

probability

adjusted

value | | Discount

Rate,

Probability

| | 10%, 16.14%-42.25%

| | 10%, 29.72%

| |

Private

Investments | | | 2,814,967

| | | Cost, Model

Driven | | Cost, Model

Price | | $1, $3.07-$4.05

| | $1, $3.19

| |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

17

Water Island Event-Driven Fund Portfolio Information

November 30, 2021 (Unaudited)

Performance^ (annualized returns as of November 30, 2021)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Water Island Event-Driven Fund Class R | | | 3.02 | % | | | 4.14 | % | | | 2.16 | % | | | 2.37 | % | |

Water Island Event-Driven Fund Class I | | | 3.24 | % | | | 4.41 | % | | | 2.42 | % | | | 2.62 | % | |

Water Island Event-Driven Fund, Class A** | | | -0.41 | % | | | 3.46 | % | | | N/A | | | | 1.78 | % | |

ICE BofA 3-Month Treasury Bill Index | | | 0.05 | % | | | 1.15 | % | | | 0.63 | % | | | 0.58 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com. This table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

^ After sales charge.

* Class R and Class I inception: 10/1/10; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R and Class I shares.

** Class A shares are subject to a maximum front-end sales load of 3.25% of the offering price and are also subject to a 1.00% contingent deferred sales load on purchases at or above $250,000 purchased without a front-end sales charge and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I and Class A are 1.98%, 1.73% and 2.00%, respectively. The Adviser has contractually agreed to limit the total annual operating expenses of the Fund, not including taxes, interest, dividends on short positions, brokerage commissions, acquired fund fees and expenses, and other costs incurred in connection with the purchase or sale of portfolio securities so they do not exceed 1.69%, 1.44% and 1.69% for Class R, Class I and Class A, respectively. The agreement remains in effect until September 30, 2022, unless terminated earlier by the Board of Trustees. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA U.S. 3-Month Treasury Bill Index (formerly named, ICE BofA Merrill Lynch U.S. 3-Month Treasury Bill Index) tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

An investor may not invest directly in an index.

www.arbitragefunds.com | 1-800-295-4485

18

Water Island Event-Driven Fund Portfolio Information (continued)

November 30, 2021 (Unaudited)

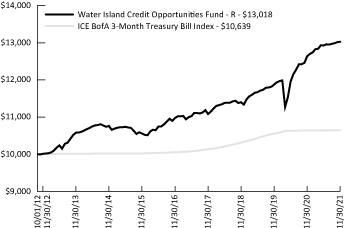

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund over ten years. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

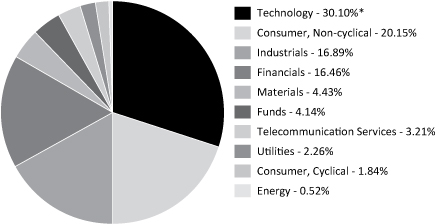

Sector Weighting

The following chart shows the sector weightings of the Water Island Event-Driven Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: If a large percentage of mergers or event-driven investment opportunities taking place within the U.S. are within one industry over a given period of time, the Fund may invest a large portion of its assets in securities of issuers in a single industry for that period of time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

Semi-Annual Report | November 30, 2021

19

Water Island Event-Driven Fund Portfolio of Investments

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 99.69% | |

Aerospace & Defense - 2.36% | |

Aerojet Rocketdyne Holdings, Inc.(a) | | | 71,960 | | | $ | 3,025,198 | | |

Auto Parts & Equipment - 1.08% | |

Veoneer, Inc.(a)(b) | | | 39,002 | | | | 1,388,471 | | |

Biotechnology - 2.28% | |

Dicerna Pharmaceuticals, Inc.(b)(c) | | | 50,337 | | | | 1,913,309 | | |

Swedish Orphan Biovitrum AB(b) | | | 41,244 | | | | 1,007,826 | | |

| | | | 2,921,135 | | |

Chemicals - 3.93% | |

Kraton Corp.(b) | | | 21,400 | | | | 985,684 | | |

Recticel SA | | | 31,826 | | | | 598,437 | | |

Rogers Corp.(a)(b) | | | 12,674 | | | | 3,455,186 | | |

| | | | 5,039,307 | | |

Commercial Services - 11.32% | |

Afterpay Ltd., ADR(a)(b) | | | 6,899 | | | | 534,534 | | |

Bakkt Holdings, Inc.(b)(c)(d) | | | 29,314 | | | | 457,591 | | |

GreenSky, Inc., Class A(b) | | | 128,417 | | | | 1,456,249 | | |

IHS Markit Ltd.(a) | | | 71,806 | | | | 9,178,243 | | |

Moneylion, Inc.(b)(d) | | | 218,409 | | | | 921,686 | | |

RR Donnelley & Sons Co.(b) | | | 187,844 | | | | 1,983,633 | | |

| | | | 14,531,936 | | |

Computers & Computer Services - 1.14% | |

Avast Plc(e) | | | 66,516 | | | | 535,909 | | |

McAfee Corp., Class A | | | 35,725 | | | | 923,491 | | |

| | | | 1,459,400 | | |

Construction Materials - 1.04% | |

Forterra, Inc.(b) | | | 56,115 | | | | 1,334,976 | | |

Diversified Financial Services - 0.60% | |

Intertrust N.V.(b)(e) | | | 16,836 | | | | 389,512 | | |

Sanne Group Plc | | | 31,615 | | | | 381,781 | | |

| | | | 771,293 | | |

Electric - 1.77% | |

PNM Resources, Inc. | | | 46,113 | | | | 2,270,604 | | |

Electronics - 3.32% | |

Coherent, Inc.(a)(b) | | | 16,467 | | | | 4,263,800 | | |

Engineering & Construction - 1.55% | |

Sydney Airport(b) | | | 335,297 | | | | 1,983,836 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

20

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 99.69% (Continued) | |

Entertainment - 0.16% | |

Cineplex, Inc.(b) | | | 23,133 | | | $ | 212,234 | | |

Food - 1.90% | |

Sanderson Farms, Inc.(a) | | | 12,392 | | | | 2,326,970 | | |

Stryve Foods, Inc., Class A(b)(d) | | | 29,191 | | | | 113,845 | | |

| | | | 2,440,815 | | |

Healthcare - Products - 3.35% | |

Hill-Rom Holdings, Inc.(a) | | | 27,672 | | | | 4,302,996 | | |

Healthcare - Services - 4.70% | |

PPD, Inc.(a)(b) | | | 127,530 | | | | 6,006,663 | | |

UpHealth, Inc.(b)(d) | | | 8,340 | | | | 21,767 | | |

| | | | 6,028,430 | | |

Home Furnishings - 0.51% | |

Casper Sleep, Inc.(b) | | | 99,776 | | | | 652,535 | | |

Insurance - 6.73% | |

Hartford Financial Services Group, Inc. (The) | | | 5,355 | | | | 353,965 | | |

Willis Towers Watson Plc(a) | | | 36,658 | | | | 8,278,843 | | |

| | | | 8,632,808 | | |

Internet - 0.37% | |

Just Eat Takeaway.com N.V.(b)(e) | | | 7,623 | | | | 477,131 | | |

Lodging - 0.21% | |

Crown Resorts Ltd.(b) | | | 33,674 | | | | 264,530 | | |

Machinery - Diversified - 3.59% | |

Neles Oyj | | | 27,894 | | | | 416,628 | | |

Welbilt, Inc.(b) | | | 177,792 | | | | 4,188,779 | | |

| | | | 4,605,407 | | |

Real Estate Investment Trusts - 10.76% | |

Columbia Property Trust, Inc. | | | 102,222 | | | | 1,962,662 | | |

Cominar Real Estate Investment Trust | | | 122,842 | | | | 1,103,938 | | |

Corepoint Lodging, Inc.(b) | | | 51,091 | | | | 788,334 | | |

CoreSite Realty Corp. | | | 19,283 | | | | 3,298,357 | | |

CyrusOne, Inc.(a) | | | 25,622 | | | | 2,280,871 | | |

MGM Growth Properties LLC, Class A(a) | | | 32,000 | | | | 1,171,520 | | |

Monmouth Real Estate Investment Corp.(a) | | | 153,905 | | | | 3,196,607 | | |

| | | | 13,802,289 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

21

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - 99.69% (Continued) | |

Retail - 0.51% | |

Vivo Energy Plc(e) | | | 376,395 | | | $ | 660,774 | | |

Semiconductors - 10.64% | |

DSP Group, Inc.(b) | | | 69,106 | | | | 1,519,641 | | |

Magnachip Semiconductor Corp.(b) | | | 72,698 | | | | 1,314,380 | | |

Xilinx, Inc.(a) | | | 47,335 | | | | 10,813,681 | | |

| | | | 13,647,702 | | |

Software - 18.36% | |

Blue Prism Group Plc(b) | | | 80,477 | | | | 1,390,325 | | |

Change Healthcare, Inc.(a)(b) | | | 251,567 | | | | 5,101,779 | | |

Five9, Inc.(b)(c) | | | 22,305 | | | | 3,174,671 | | |

Inovalon Holdings, Inc., Class A(b)(f) | | | 37,435 | | | | 1,534,835 | | |

Kaleyra, Inc.(b) | | | 22,292 | | | | 233,620 | | |

MINDBODY, Inc., Class A(b)(f) | | | 48,463 | | | | 1,809,400 | | |

Momentive Global, Inc.(a)(b) | | | 68,535 | | | | 1,400,170 | | |

Nuance Communications, Inc.(a)(b) | | | 125,032 | | | | 6,938,026 | | |

Pluralsight, Inc., Class A(b)(f) | | | 85,955 | | | | 1,978,271 | | |

| | | | 23,561,097 | | |

Telecommunications - 1.92% | |

NeoPhotonics Corp.(a)(b) | | | 85,994 | | | | 1,321,728 | | |

Vonage Holdings Corp.(b) | | | 55,303 | | | | 1,140,348 | | |

| | | | 2,462,076 | | |

Transportation - 4.42% | |

Kansas City Southern | | | 17,191 | | | | 5,000,003 | | |

Teekay LNG Partners LP | | | 39,712 | | | | 672,324 | | |

| | | | 5,672,327 | | |

Water - 1.17% | |

Suez SA | | | 66,940 | | | | 1,498,216 | | |

TOTAL COMMON STOCKS

(Cost $122,637,381) | | | 127,911,323 | | |

RIGHTS(b) - 0.05% | |

Bristol-Myers Squibb Co. CVR | | | 67,803 | | | | 67,803 | | |

CA Immobilien Anlagen AG CVR(f) | | | 18,714 | | | | — | | |

TOTAL RIGHTS

(Cost $110,781) | | | 67,803 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

22

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CORPORATE BONDS - 1.03% | |

Telecommunications - 1.03% | |

Cincinnati Bell, Inc.(e) | | 07/15/2024 | | | 7.000 | % | | $ | 1,305,000 | | | $ | 1,327,837 | | |

TOTAL CORPORATE BONDS

(Cost $1,311,908) | | | 1,327,837 | | |

CONVERTIBLE CORPORATE BONDS - 2.55% | |

Auto Manufacturers - 0.27% | |

Lightning eMotors, Inc.(e) | | 05/15/2024 | | | 7.500 | % | | | 403,000 | | | | 338,337 | | |

Entertainment - 0.28% | |

Cineplex, Inc.(e) | | 09/30/2025 | | | 5.750 | % | | | 392,000 | | | | 361,501 | | |

Healthcare - Services - 0.42% | |

UpHealth, Inc.(e) | | 06/15/2026 | | | 6.250 | % | | | 616,000 | | | | 533,150 | | |

Pharmaceuticals - 1.12% | |

Dermira, Inc. | | 05/15/2022 | | | 3.000 | % | | | 1,430,000 | | | | 1,440,725 | | |

Software - 0.46% | |

Kaleyra, Inc.(e) | | 06/01/2026 | | | 6.125 | % | | | 584,000 | | | | 592,091 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $3,325,276) | | | 3,265,804 | | |

| | | Shares | | Value | |

WARRANTS(b) - 0.05% | |

Auto Manufacturers - 0.04% | |

Lightning eMotors, Inc., Exercise Price $11.50,

Expires 05/18/2025(d) | | | 35,043 | | | $ | 49,060 | | |

Commercial Services - 0.01% | |

Moneylion, Inc., Exercise Price $11.50, Expires 06/01/2027 | | | 22,640 | | | | 17,886 | | |

Healthcare - Services - 0.00%(g) | |

UpHealth, Inc., Exercise Price $11.50, Expires 07/01/2024 | | | 834 | | | | 400 | | |

TOTAL WARRANTS

(Cost $0) | | | 67,346 | | |

PREFERRED STOCKS - 0.11% | |

Entertainment - 0.11% | |

1317774 B.C. Ltd. | | | 2,753 | | | | 141,158 | | |

TOTAL PREFERRED STOCKS

(Cost $223,571) | | | 141,158 | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

23

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

PRIVATE INVESTMENTS(b)(d)(f)(h) - 0.17% | |

Fast Capital LLC | | | 22,800 | | | $ | 22,800 | | |

Fuse LLC | | | 56,600 | | | | 173,933 | | |

Fuse Sponsor Capital, Z2 Shares | | | 5,660 | | | | 22,917 | | |

TOTAL PRIVATE INVESTMENTS

(Cost $80,993) | | | 219,650 | | |

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(b) - 0.57% | |

Call Options Purchased - 0.27% | |

Acceleron Pharma, Inc. | | 12/2021 | | $ | 180.00 | | | $ | 0 | | | | 84 | | | $ | 0 | | |

Advanced Micro

Devices, Inc. | |

| | | 12/2021 | | | 145.00 | | | | 1,013,568 | | | | 64 | | | | 103,040 | | |

| | | 12/2021 | | | 150.00 | | | | 649,317 | | | | 41 | | | | 50,943 | | |

Canadian Pacific

Railway Ltd. | |

| | | 12/2021 | | | 78.00 | | | | 1,246,534 | | | | 178 | | | | 7,120 | | |

| | | 12/2021 | | | 80.00 | | | | 1,246,534 | | | | 178 | | | | 3,115 | | |

Sportsman's Warehouse

Holdings, Inc. | | 12/2021 | | | 17.50 | | | | 272,480 | | | | 160 | | | | 7,600 | | |

Trillium

Therapeutics, Inc. | | 12/2021 | | | 20.00 | | | | 0 | | | | 148 | | | | 0 | | |

Zendesk, Inc. | | 12/2021 | | | 95.00 | | | | 1,970,723 | | | | 193 | | | | 171,770 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $275,909) | | | 343,588 | | |

Put Options Purchased - 0.30% | |

Bakkt Holdings, Inc. | |

| | | 12/2021 | | | 25.00 | | | | 82,733 | | | | 53 | | | | 59,890 | | |

| | | 12/2021 | | | 30.00 | | | | 85,855 | | | | 55 | | | | 89,650 | | |

Five9, Inc. | |

| | | 12/2021 | | | 145.00 | | | | 1,394,834 | | | | 98 | | | | 82,810 | | |

| | | 12/2021 | | | 150.00 | | | | 1,565,630 | | | | 110 | | | | 128,700 | | |

| | | 12/2021 | | | 155.00 | | | | 227,728 | | | | 16 | | | | 23,840 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $278,397) | | | 384,890 | | |

TOTAL PURCHASED OPTIONS

(Cost $554,306) | | | 728,478 | | |

Total Investments - 104.22%

(Cost $128,244,216) | | | | | | | | | | | 133,729,399 | | |

Liabilities in Excess of Other Assets - (4.22%)(i) | | | | | | | | | | | (5,415,990 | ) | |

NET ASSETS - 100.00% | | | | | | | | | | $ | 128,313,409 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

24

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Portfolio Footnotes

(a) Security, or a portion of security, is being held as collateral for short sales, written option contracts or forward foreign currency exchange contracts. At November 30, 2021, the aggregate fair market value of those securities was $45,217,824, representing 35.24% of net assets.

(b) Non-income-producing security.

(c) Underlying security for a written/purchased call/put option.

(d) Restricted securities (including private placements) – The Fund may own investment securities that have other legal or contractual limitations. At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,783,599 or 1.39% of net assets.

Restricted Security | | Acquisition Date | | Acquisition Cost | |

Bakkt Holdings, Inc. | | 10/06/2021 | | $ | 293,140 | | |

Fast Capital LLC | | 08/18/2020 | | | 23,591 | | |

Fuse LLC | | 06/19/2020 | | | 52,176 | | |

Fuse Sponsor Capital, Z2 Shares | | 06/19/2020 | | | 5,226 | | |

Lightning eMotors, Inc., Exercise Price $11.50,

Expires 05/18/2025 | | 04/28/2021 | | | — | | |

Moneylion, Inc. | | 09/14/2021 | | | 1,868,733 | | |

Stryve Foods, Inc. | | 07/09/2021 | | | 291,910 | | |

UpHealth, Inc. | | 05/25/2021 | | | 83,400 | | |

Total | | | | $ | 2,618,176 | | |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of November 30, 2021, these securities had a total value of $5,216,242 or 4.07% of net assets.

(f) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of November 30, 2021, the total fair market value of these securities was $5,542,156, representing 4.32% of net assets.

(g) Less than 0.005% of net assets.

(h) Represents a holding that is a direct investment into a private company and is not a listed or publicly traded entity.

(i) Includes cash held as collateral for short sales and written option contracts.

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (15.69%) | |

Commercial Services - (0.48%) | |

Bakkt Holdings, Inc. | | | (4,747 | ) | | $ | (74,101 | ) | |

Square, Inc., Class A | | | (2,587 | ) | | | (538,950 | ) | |

| | | | (613,051 | ) | |

Construction Materials - (0.06%) | |

Forterra, Inc. | | | (3,048 | ) | | | (72,512 | ) | |

Electronics - (0.73%) | |

II-VI, Inc. | | | (14,985 | ) | | | (937,012 | ) | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

25

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

| | | Shares | | Value | |

COMMON STOCKS - (15.69%) (Continued) | |

Entertainment - (0.13%) | |

Cineplex, Inc. | | | (3,228 | ) | | $ | (29,615 | ) | |

Penn National Gaming, Inc. | | | (2,755 | ) | | | (141,139 | ) | |

| | | | (170,754 | ) | |

Internet - (1.23%) | |

Zendesk, Inc. | | | (15,420 | ) | | | (1,574,536 | ) | |

Machinery - Diversified - (0.29%) | |

Valmet Oyj | | | (9,150 | ) | | | (375,648 | ) | |

Semiconductors - (10.07%) | |

Advanced Micro Devices, Inc. | | | (81,577 | ) | | | (12,919,350 | ) | |

Transportation - (2.70%) | |

Canadian Pacific Railway Ltd. | | | (49,579 | ) | | | (3,472,017 | ) | |

TOTAL COMMON STOCKS

(Proceeds $15,100,583) | | | (20,134,880 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $15,100,583) | | $ | (20,134,880 | ) | |

WRITTEN OPTIONS | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

Written Call Options | |

Bakkt Holdings, Inc. | | 12/2021 | | $ | 40.00 | | | $ | (82,733 | ) | | | (53 | ) | | $ | (1,192 | ) | |

Dicerna

Pharmaceuticals,

Inc. | | 01/2022 | | | 40.00 | | | | (406,707 | ) | | | (107 | ) | | | (2,943 | ) | |

TOTAL WRITTEN CALL OPTIONS

(Premiums received $39,601) | | | (4,135 | ) | |

TOTAL WRITTEN OPTIONS

(Premiums received $39,601) | | $ | (4,135 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

26

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Goldman

Sachs &

Co./

Monthly

| | Equiniti

Group

Plc

| | Paid

1 Month

SONIA

Plus

95 bps

(0.995%) | |

05/10/2022 | | $ | — | | | $ | — | | | $ | — | | | GBP | 451,084 | | | $ | — | | |

Goldman

Sachs &

Co./

Monthly

| | Sanne

Group

Plc

| | Paid

1 Month

SONIA

Plus

45 bps

(0.496%) | |

06/16/2022 | | | — | | | | — | | | | — | | | GBP | 453,682 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | GCP

Student

Living

Plc

| | Paid

1 Month

SONIA

Plus

47 bps

(0.516%) | |

07/16/2022 | | | — | | | | — | | | | — | | | GBP | 282,407 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | Meggitt

Plc

| | Paid

1 Month

SONIA

Plus

55 bps

(0.596%) | |

08/04/2022 | | | — | | | | — | | | | — | | | GBP | 994,204 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | CNP

Assurance

| | Paid

1 Week

ESTR

Plus

55 bps

(0.000%) | |

11/02/2022 | | | — | | | | — | | | | — | | | EUR | 1,400,842 | | | | — | | |

Goldman

Sachs &

Co./

Monthly

| | Distell

Group

Holdings

Ltd.

| | Paid

1 Month

JIBAR

Plus

150 bps

(4.992%) | |

11/18/2022 | | | — | | | | — | | | | — | | | ZAR | 4,770,211 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | S&P

Global,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | (-0.320 | %) | | 08/08/2023 | | | — | | | | — | | | | — | | | USD | 9,286,866 | | | | — | | |

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

27

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Monthly

| | Vici

Properties,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/08/2023 | | $ | — | | | $ | — | | | $ | — | | | USD | 1,188,966 | | | $ | — | | |

Morgan

Stanley &

Co./

Monthly

| | Goldman

Sachs

Group,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/18/2023 | | | — | | | | — | | | | — | | | USD | 1,467,954 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | iShares

Russell

2000

ETF

| | Received

1 Month-

Federal

Rate

Minus

88 bps

(-0.800%) | |

08/18/2023 | | | — | | | | — | | | | — | | | USD | 523,172 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | NortonLifeLock,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.320%) | |

08/18/2023 | | | — | | | | — | | | | — | | | USD | 50,048 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Distell

Group

Holdings

Ltd.

| | Paid

1 Month

SABOR

Plus

125 bps

(4.590%) | |

11/17/2023 | | | — | | | | — | | | | — | | | ZAR | 1,738,046 | | | | — | | |

| | | | | | | | | | | | | $ | — | | | | | | | $ | — | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

28

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

USD | 2,407,188 | | | AUD | 3,279,000 | | | Morgan Stanley & Co. | | 12/15/2021 | | $ | 69,434 | | |

CAD | 33,800 | | | USD | 26,449 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 13 | | |

USD | 1,945,664 | | | CAD | 2,440,400 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 35,073 | | |

EUR | 55,800 | | | USD | 62,996 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 315 | | |

USD | 6,565,224 | | | EUR | 5,554,200 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 263,404 | | |

USD | 2,138,640 | | | GBP | 1,581,400 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 35,031 | | |

SEK | 439,700 | | | USD | 48,480 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 313 | | |

USD | 1,129,923 | | | SEK | 9,759,500 | | | Morgan Stanley & Co. | | 12/15/2021 | | | 46,942 | | |

| | | $ | 450,525 | | |

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

AUD | 142,400 | | | USD | 103,081 | | | Morgan Stanley & Co. | | 12/15/2021 | | $ | (1,557 | ) | |

CAD | 264,100 | | | USD | 209,967 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (3,205 | ) | |

EUR | 3,234,600 | | | USD | 3,792,123 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (122,131 | ) | |

USD | 109,062 | | | EUR | 96,600 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (542 | ) | |

GBP | 248,400 | | | USD | 336,715 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (6,289 | ) | |

SEK | 431,700 | | | USD | 49,490 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (1,586 | ) | |

USD | 66,214 | | | SEK | 602,100 | | | Morgan Stanley & Co. | | 12/15/2021 | | | (599 | ) | |

| | | $ | (135,909 | ) | |

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

United Kingdom | | | 15.50 | % | |

Australia | | | 2.17 | % | |

Sweden | | | 1.87 | % | |

Canada | | | 1.42 | % | |

France | | | 1.17 | % | |

Republic of Korea | | | 1.02 | % | |

Netherlands | | | 0.68 | % | |

Bermuda | | | 0.52 | % | |

Belgium | | | 0.47 | % | |

Czech Republic | | | 0.42 | % | |

Finland | | | 0.32 | % | |

Italy | | | 0.18 | % | |

Austria | | | 0.00 | %(b) | |

United States | | | 78.48 | % | |

Liabilities in Excess of Other Assets | | | (4.22 | )% | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

(b) Less than 0.005% of net assets.

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

29

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Abbreviations:

AB - Aktiebolag is the Swedish term for a limited company.

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

AUD - Australian dollar

bps - Basis Points. 100 Basis Points is equal to 1 percentage point.

CAD - Canadian dollar

CVR - Contingent Value Rights

ESTR - Euro Short-term Rate

ETF - Exchange-Traded Fund

EUR - Euro

GBP - British pound

JIBAR - Johannesburg Interbank Agreed Rate

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

Oyj - Osakeyhtio is the Finnish equivalent of a public limited company.

Plc - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company.

SABOR - South African Benchmark Overnight Rate

SEK - Swedish krona

SONIA - Sterling OverNight Index Average

S&P - Standard & Poor's

USD - United States Dollar

ZAR - South African rand

The following table summarizes the Water Island Event-Driven Fund's investments and derivative financial instruments categorized in the fair value hierarchy as of November 30, 2021:

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Aerospace & Defense | | $ | 3,025,198 | | | $ | — | | | $ | — | | | $ | 3,025,198 | | |

Auto Parts & Equipment | | | 1,388,471 | | | | — | | | | — | | | | 1,388,471 | | |

Biotechnology | | | 2,921,135 | | | | — | | | | — | | | | 2,921,135 | | |

Chemicals | | | 5,039,307 | | | | — | | | | — | | | | 5,039,307 | | |

Commercial Services | | | 14,531,936 | | | | — | | | | — | | | | 14,531,936 | | |

Computers & Computer Services | | | 1,459,400 | | | | — | | | | — | | | | 1,459,400 | | |

Construction Materials | | | 1,334,976 | | | | — | | | | — | | | | 1,334,976 | | |

Diversified Financial Services | | | 771,293 | | | | — | | | | — | | | | 771,293 | | |

Electric | | | 2,270,604 | | | | — | | | | — | | | | 2,270,604 | | |

Electronics | | | 4,263,800 | | | | — | | | | — | | | | 4,263,800 | | |

Engineering & Construction | | | 1,983,836 | | | | — | | | | — | | | | 1,983,836 | | |

Entertainment | | | 212,234 | | | | — | | | | — | | | | 212,234 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

30

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Food | | $ | 2,440,815 | | | $ | — | | | $ | — | | | $ | 2,440,815 | | |

Healthcare - Products | | | 4,302,996 | | | | — | | | | — | | | | 4,302,996 | | |

Healthcare - Services | | | 6,028,430 | | | | — | | | | — | | | | 6,028,430 | | |

Home Furnishings | | | 652,535 | | | | — | | | | — | | | | 652,535 | | |

Insurance | | | 8,632,808 | | | | — | | | | — | | | | 8,632,808 | | |

Internet | | | 477,131 | | | | — | | | | — | | | | 477,131 | | |

Lodging | | | 264,530 | | | | — | | | | — | | | | 264,530 | | |

Machinery - Diversified | | | 4,605,407 | | | | — | | | | — | | | | 4,605,407 | | |

Real Estate Investment Trusts | | | 13,802,289 | | | | — | | | | — | | | | 13,802,289 | | |

Retail | | | 660,774 | | | | — | | | | — | | | | 660,774 | | |

Semiconductors | | | 13,647,702 | | | | — | | | | — | | | | 13,647,702 | | |

Software | | | 18,238,591 | | | | — | | | | 5,322,506 | | | | 23,561,097 | | |

Telecommunications | | | 2,462,076 | | | | — | | | | — | | | | 2,462,076 | | |

Transportation | | | 5,672,327 | | | | — | | | | — | | | | 5,672,327 | | |

Water | | | 1,498,216 | | | | — | | | | — | | | | 1,498,216 | | |

Rights | | | — | | | | 67,803 | | | | — | | | | 67,803 | | |

Corporate Bonds** | | | — | | | | 1,327,837 | | | | — | | | | 1,327,837 | | |

Convertible Corporate Bonds** | | | — | | | | 3,265,804 | | | | — | | | | 3,265,804 | | |

Warrants | | | 67,346 | | | | — | | | | — | | | | 67,346 | | |

Preferred Stocks | |

Entertainment | | | — | | | | 141,158 | | | | — | | | | 141,158 | | |

Private Investments | | | — | | | | — | | | | 219,650 | | | | 219,650 | | |

Purchased Options | | | 728,478 | | | | — | | | | — | | | | 728,478 | | |

TOTAL | | $ | 123,384,641 | | | $ | 4,802,602 | | | $ | 5,542,156 | | | $ | 133,729,399 | | |

Other Financial Instruments*** | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 450,525 | | | $ | — | | | $ | 450,525 | | |

Equity Swaps | | | 0 | | | | 0 | | | | — | | | | 0 | | |

Liabilities | |

Common Stocks** | | | (20,134,880 | ) | | | — | | | | — | | | | (20,134,880 | ) | |

Written Options | | | (4,135 | ) | | | — | | | | — | | | | (4,135 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (135,909 | ) | | | — | | | | (135,909 | ) | |

TOTAL | | $ | (20,139,015 | ) | | $ | 314,616 | | | $ | — | | | $ | (19,824,399 | ) | |

* Refer to footnote 2 where leveling hierarchy is defined.

** Refer to Portfolio of Investments for sector information.

*** Other financial instruments are instruments such as written options, securities sold short, equity swaps and forward foreign currency exchange contracts.

See Notes to Financial Statements.

Semi-Annual Report | November 30, 2021

31

Water Island Event-Driven Fund Portfolio of Investments (continued)

November 30, 2021 (Unaudited)

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund's assets and liabilities during the period ended November 30, 2021:

Investments

in Securities | | Balance as of

May 31, 2021 | | Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance as of

November 30,

2021 | | Net change in

Unrealized

Appreciation

(Depreciation)

from

investments

still held

as of

November 30,

2021 | |

Common

Stocks | | $ | 6,055,654 | | | $ | 247,381 | | | $ | (120,283 | ) | | $ | 1,512,151 | | | $ | (2,372,397 | ) | | $ | — | | | $ | — | | | $ | 5,322,506 | | | $ | 107,467 | | |

Rights | | | 43,889 | | | | 81,275 | | | | (3,858 | ) | | | — | | | | (121,306 | ) | | | — | | | | — | | | | — | | | | — | | |

Convertible

Corporate

Bonds | | | 1,081,737 | | | | — | | | | 55,939 | | | | — | | | | — | | | | — | | | | (1,137,676 | ) | | | — | | | | — | | |

Private

Investments | | | 79,400 | | | | — | | | | 139,984 | | | | 266 | | | | — | | | | — | | | | — | | | | 219,650 | | | | 139,984 | | |

Total | | $ | 7,260,680 | | | $ | 328,656 | | | $ | 71,782 | | | $ | 1,512,417 | | | $ | (2,493,703 | ) | | $ | — | | | $ | (1,137,676 | ) | | $ | 5,542,156 | | | $ | 247,451 | | |