UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09877

CALVERT RESPONSIBLE INDEX SERIES, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2021

Date of Reporting Period

| Item 1. | Reports to Stockholders |

| % Average Annual Total Returns1,2 | Class Inception Date | Performance Inception Date | One Year | Five Years | Since Inception |

| Class A at NAV | 06/19/2015 | 06/19/2015 | 27.06% | 21.82% | 17.65% |

| Class A with 4.75% Maximum Sales Charge | — | — | 21.03 | 20.64 | 16.74 |

| Class I at NAV | 06/19/2015 | 06/19/2015 | 27.40 | 22.18 | 18.02 |

| Russell 1000® Growth Index | — | — | 27.32% | 22.82% | 18.76% |

| Calvert US Large-Cap Growth Responsible Index | — | — | 28.04 | 22.59 | 18.37 |

| % Total Annual Operating Expense Ratios3 | Class A | Class I |

| Gross | 0.67% | 0.42% |

| Net | 0.49 | 0.24 |

| Growth of Investment | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class I | $100,000 | 06/19/2015 | $283,368 | N.A. |

| Top 10 Holdings (% of net assets)* | |

| Apple, Inc. | 9.2% |

| Microsoft Corp. | 8.2 |

| Alphabet, Inc., Class A | 6.2 |

| Amazon.com, Inc. | 4.7 |

| Tesla, Inc. | 2.6 |

| NVIDIA Corp. | 2.1 |

| Visa, Inc., Class A | 1.6 |

| Home Depot, Inc. (The) | 1.4 |

| Mastercard, Inc., Class A | 1.3 |

| PayPal Holdings, Inc. | 1.3 |

| Total | 38.6% |

| * | Excludes cash and cash equivalents. |

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 1 | Russell 1000® Growth Index is an unmanaged index of U.S. large-cap growth stocks. Calvert US Large-Cap Growth Responsible Index (the “Calvert Index”) is composed of common stocks of large growth companies that operate their businesses in a manner that is consistent with the Calvert Principles for Responsible Investment. Large growth companies are selected from the 1,000 largest publicly traded U.S. companies based on market capitalization and growth style factors, excluding real estate investment trusts and business development companies. The Calvert Principles of Responsible Investment serve as a framework for considering environmental, social and governance factors that may affect investment performance. Stocks are weighted in the Calvert Index based on their float-adjusted market capitalization within the relevant sector, subject to certain prescribed limits. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/22. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Additional Information | |

| S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Dow Jones Industrial Average® is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. Russell 1000® Index is an unmanaged index of 1,000 U.S. large-cap stocks. Russell 2000® Index is an unmanaged index of 2,000 U.S. small-cap stocks. |

| Beginning Account Value (4/1/21) | Ending Account Value (9/30/21) | Expenses Paid During Period* (4/1/21 – 9/30/21) | Annualized Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $1,114.10 | $2.60 ** | 0.49% |

| Class I | $1,000.00 | $1,115.40 | $1.27 ** | 0.24% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,022.61 | $2.48 ** | 0.49% |

| Class I | $1,000.00 | $1,023.87 | $1.22 ** | 0.24% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

| Common Stocks — 99.4% |

| Security | Shares | Value | |

| Aerospace & Defense — 0.1% | |||

| Axon Enterprise, Inc.(1) | 1,013 | $ 177,295 | |

| Curtiss-Wright Corp. | 180 | 22,712 | |

| HEICO Corp. | 750 | 98,903 | |

| Hexcel Corp.(1) | 792 | 47,037 | |

| $ 345,947 | |||

| Air Freight & Logistics — 0.5% | |||

| Expeditors International of Washington, Inc. | 1,861 | $ 221,701 | |

| FedEx Corp. | 364 | 79,822 | |

| GXO Logistics, Inc.(1) | 1,389 | 108,953 | |

| United Parcel Service, Inc., Class B | 4,655 | 847,675 | |

| $ 1,258,151 | |||

| Airlines — 0.3% | |||

| Alaska Air Group, Inc.(1) | 1,463 | $ 85,732 | |

| American Airlines Group, Inc.(1) | 7,014 | 143,927 | |

| Delta Air Lines, Inc.(1) | 7,636 | 325,370 | |

| JetBlue Airways Corp.(1) | 3,136 | 47,950 | |

| Southwest Airlines Co.(1) | 4,040 | 207,777 | |

| $ 810,756 | |||

| Auto Components — 0.2% | |||

| Aptiv PLC(1) | 3,099 | $ 461,658 | |

| Autoliv, Inc. | 389 | 33,345 | |

| Gentex Corp. | 2,079 | 68,566 | |

| Lear Corp. | 169 | 26,445 | |

| $ 590,014 | |||

| Automobiles — 2.6% | |||

| Harley-Davidson, Inc. | 912 | $ 33,388 | |

| Tesla, Inc.(1) | 8,645 | 6,704,025 | |

| $ 6,737,413 | |||

| Banks — 0.2% | |||

| First Citizens Bancshares, Inc., Class A | 15 | $ 12,648 | |

| First Financial Bankshares, Inc. | 733 | 33,681 | |

| First Republic Bank | 832 | 160,476 | |

| Signature Bank | 111 | 30,223 | |

| SVB Financial Group(1) | 482 | 311,796 | |

| Western Alliance Bancorp | 314 | 34,170 | |

| $ 582,994 | |||

| Beverages — 1.1% | |||

| Coca-Cola Co. (The) | 32,961 | $ 1,729,464 | |

| Security | Shares | Value | |

| Beverages (continued) | |||

| PepsiCo, Inc. | 6,988 | $ 1,051,065 | |

| $ 2,780,529 | |||

| Biotechnology — 3.9% | |||

| AbbVie, Inc. | 21,368 | $ 2,304,966 | |

| Acceleron Pharma, Inc.(1) | 718 | 123,568 | |

| Alnylam Pharmaceuticals, Inc.(1) | 1,570 | 296,432 | |

| Amgen, Inc. | 5,455 | 1,160,006 | |

| Arrowhead Pharmaceuticals, Inc.(1) | 1,254 | 78,287 | |

| Biogen, Inc.(1) | 1,000 | 282,990 | |

| BioMarin Pharmaceutical, Inc.(1) | 1,080 | 83,473 | |

| Blueprint Medicines Corp.(1) | 789 | 81,117 | |

| Denali Therapeutics, Inc.(1) | 1,118 | 56,403 | |

| Exact Sciences Corp.(1) | 2,149 | 205,122 | |

| Exelixis, Inc.(1) | 3,838 | 81,135 | |

| Gilead Sciences, Inc. | 16,085 | 1,123,537 | |

| Halozyme Therapeutics, Inc.(1) | 1,864 | 75,828 | |

| Horizon Therapeutics PLC(1) | 2,974 | 325,772 | |

| Incyte Corp.(1) | 1,575 | 108,328 | |

| Ionis Pharmaceuticals, Inc.(1) | 2,036 | 68,287 | |

| Moderna, Inc.(1) | 4,331 | 1,666,829 | |

| Neurocrine Biosciences, Inc.(1) | 1,233 | 118,257 | |

| Regeneron Pharmaceuticals, Inc.(1) | 1,299 | 786,129 | |

| Sarepta Therapeutics, Inc.(1) | 1,086 | 100,433 | |

| Seagen, Inc.(1) | 1,737 | 294,943 | |

| Ultragenyx Pharmaceutical, Inc.(1) | 866 | 78,105 | |

| United Therapeutics Corp.(1) | 233 | 43,007 | |

| Vertex Pharmaceuticals, Inc.(1) | 3,327 | 603,485 | |

| $ 10,146,439 | |||

| Building Products — 0.6% | |||

| Advanced Drainage Systems, Inc. | 920 | $ 99,516 | |

| Allegion PLC | 1,156 | 152,800 | |

| Armstrong World Industries, Inc. | 118 | 11,266 | |

| AZEK Co., Inc. (The)(1) | 931 | 34,009 | |

| Carlisle Cos., Inc. | 780 | 155,056 | |

| Carrier Global Corp. | 1,336 | 69,151 | |

| Fortune Brands Home & Security, Inc. | 743 | 66,439 | |

| Johnson Controls International PLC | 2,396 | 163,120 | |

| Lennox International, Inc. | 568 | 167,089 | |

| Masco Corp. | 2,196 | 121,988 | |

| Trane Technologies PLC | 1,654 | 285,563 | |

| Trex Co., Inc.(1) | 1,193 | 121,603 | |

| $ 1,447,600 | |||

| Security | Shares | Value | |

| Capital Markets — 2.3% | |||

| Affiliated Managers Group, Inc. | 100 | $ 15,109 | |

| Ameriprise Financial, Inc. | 1,115 | 294,494 | |

| Ares Management Corp., Class A | 278 | 20,525 | |

| BlackRock, Inc. | 509 | 426,878 | |

| Blackstone, Inc. | 1,486 | 172,881 | |

| Cboe Global Markets, Inc. | 430 | 53,260 | |

| Charles Schwab Corp. (The) | 6,943 | 505,728 | |

| CME Group, Inc. | 649 | 125,504 | |

| Evercore, Inc., Class A | 209 | 27,937 | |

| FactSet Research Systems, Inc. | 481 | 189,889 | |

| Hamilton Lane, Inc., Class A | 483 | 40,968 | |

| Houlihan Lokey, Inc. | 422 | 38,866 | |

| Intercontinental Exchange, Inc. | 2,793 | 320,692 | |

| KKR & Co., Inc. | 1,004 | 61,123 | |

| LPL Financial Holdings, Inc. | 733 | 114,905 | |

| MarketAxess Holdings, Inc. | 423 | 177,952 | |

| Moody's Corp. | 1,934 | 686,783 | |

| Morningstar, Inc. | 331 | 85,739 | |

| MSCI, Inc. | 976 | 593,740 | |

| Nasdaq, Inc. | 702 | 135,500 | |

| S&P Global, Inc. | 2,926 | 1,243,228 | |

| SEI Investments Co. | 1,047 | 62,087 | |

| T. Rowe Price Group, Inc. | 1,891 | 371,960 | |

| Tradeweb Markets, Inc., Class A | 1,129 | 91,201 | |

| $ 5,856,949 | |||

| Chemicals — 1.1% | |||

| Air Products & Chemicals, Inc. | 1,582 | $ 405,166 | |

| Axalta Coating Systems, Ltd.(1) | 3,312 | 96,677 | |

| Eastman Chemical Co. | 469 | 47,247 | |

| Ecolab, Inc. | 3,071 | 640,672 | |

| FMC Corp. | 1,918 | 175,612 | |

| International Flavors & Fragrances, Inc. | 1,598 | 213,685 | |

| PPG Industries, Inc. | 2,096 | 299,749 | |

| Sherwin-Williams Co. (The) | 3,568 | 998,077 | |

| $ 2,876,885 | |||

| Commercial Services & Supplies — 0.6% | |||

| ADT, Inc. | 1,220 | $ 9,870 | |

| Cintas Corp. | 747 | 284,353 | |

| Clean Harbors, Inc.(1) | 125 | 12,984 | |

| Copart, Inc.(1) | 2,314 | 320,998 | |

| IAA, Inc.(1) | 1,606 | 87,639 | |

| MSA Safety, Inc. | 563 | 82,029 | |

| Republic Services, Inc. | 1,015 | 121,861 | |

| Stericycle, Inc.(1) | 435 | 29,567 | |

| Security | Shares | Value | |

| Commercial Services & Supplies (continued) | |||

| Tetra Tech, Inc. | 401 | $ 59,885 | |

| Waste Management, Inc. | 3,357 | 501,402 | |

| $ 1,510,588 | |||

| Communications Equipment — 0.7% | |||

| Arista Networks, Inc.(1) | 675 | $ 231,957 | |

| Ciena Corp.(1) | 489 | 25,110 | |

| Cisco Systems, Inc. | 17,135 | 932,658 | |

| F5 Networks, Inc.(1) | 663 | 131,791 | |

| Juniper Networks, Inc. | 965 | 26,557 | |

| Lumentum Holdings, Inc.(1) | 194 | 16,207 | |

| Motorola Solutions, Inc. | 1,951 | 453,256 | |

| $ 1,817,536 | |||

| Construction & Engineering — 0.1% | |||

| EMCOR Group, Inc. | 422 | $ 48,690 | |

| MasTec, Inc.(1) | 276 | 23,813 | |

| Quanta Services, Inc. | 620 | 70,569 | |

| Valmont Industries, Inc. | 151 | 35,503 | |

| $ 178,575 | |||

| Construction Materials — 0.2% | |||

| Martin Marietta Materials, Inc. | 898 | $ 306,829 | |

| Vulcan Materials Co. | 1,968 | 332,907 | |

| $ 639,736 | |||

| Consumer Finance — 0.1% | |||

| American Express Co. | 2,193 | $ 367,393 | |

| Credit Acceptance Corp.(1)(2) | 15 | 8,780 | |

| $ 376,173 | |||

| Containers & Packaging — 0.3% | |||

| AptarGroup, Inc. | 438 | $ 52,275 | |

| Avery Dennison Corp. | 850 | 176,129 | |

| Ball Corp. | 3,354 | 301,759 | |

| Crown Holdings, Inc. | 489 | 49,281 | |

| Packaging Corp. of America | 230 | 31,611 | |

| Sonoco Products Co. | 25 | 1,490 | |

| WestRock Co. | 636 | 31,692 | |

| $ 644,237 | |||

| Distributors — 0.1% | |||

| Genuine Parts Co. | 915 | $ 110,925 | |

| LKQ Corp.(1) | 85 | 4,277 | |

| Pool Corp. | 394 | 171,158 | |

| $ 286,360 | |||

| Security | Shares | Value | |

| Diversified Consumer Services — 0.1% | |||

| Bright Horizons Family Solutions, Inc.(1) | 772 | $ 107,632 | |

| Chegg, Inc.(1)(2) | 1,783 | 121,280 | |

| Terminix Global Holdings, Inc.(1) | 1,040 | 43,337 | |

| $ 272,249 | |||

| Diversified Financial Services — 0.1% | |||

| Equitable Holdings, Inc. | 4,521 | $ 134,002 | |

| $ 134,002 | |||

| Diversified Telecommunication Services — 0.0%(3) | |||

| Iridium Communications, Inc.(1) | 1,574 | $ 62,724 | |

| $ 62,724 | |||

| Electric Utilities — 0.2% | |||

| NextEra Energy, Inc. | 6,201 | $ 486,903 | |

| $ 486,903 | |||

| Electrical Equipment — 0.8% | |||

| Acuity Brands, Inc. | 243 | $ 42,129 | |

| AMETEK, Inc. | 2,908 | 360,621 | |

| Eaton Corp. PLC | 1,995 | 297,873 | |

| Emerson Electric Co. | 3,208 | 302,194 | |

| Generac Holdings, Inc.(1) | 985 | 402,540 | |

| Hubbell, Inc. | 295 | 53,298 | |

| nVent Electric PLC | 2,693 | 87,065 | |

| Regal Beloit Corp. | 25 | 3,758 | |

| Rockwell Automation, Inc. | 1,013 | 297,862 | |

| Sensata Technologies Holding PLC(1) | 2,164 | 118,414 | |

| Sunrun, Inc.(1) | 1,006 | 44,264 | |

| Vertiv Holdings Co. | 4,655 | 112,139 | |

| $ 2,122,157 | |||

| Electronic Equipment, Instruments & Components — 0.9% | |||

| Amphenol Corp., Class A | 7,976 | $ 584,082 | |

| Corning, Inc. | 2,438 | 88,963 | |

| II-VI, Inc.(1)(2) | 725 | 43,036 | |

| IPG Photonics Corp.(1) | 349 | 55,282 | |

| Keysight Technologies, Inc.(1) | 2,855 | 469,048 | |

| Littelfuse, Inc. | 258 | 70,504 | |

| National Instruments Corp. | 1,596 | 62,611 | |

| Novanta, Inc.(1) | 520 | 80,340 | |

| Teledyne Technologies, Inc.(1) | 585 | 251,304 | |

| Trimble, Inc.(1) | 3,994 | 328,506 | |

| Zebra Technologies Corp., Class A(1) | 652 | 336,054 | |

| $ 2,369,730 | |||

| Security | Shares | Value | |

| Entertainment — 3.1% | |||

| Activision Blizzard, Inc. | 8,641 | $ 668,727 | |

| AMC Entertainment Holdings, Inc., Class A(1) | 585 | 22,265 | |

| Electronic Arts, Inc. | 3,119 | 443,678 | |

| Liberty Media Corp.-Liberty Formula One, Class A(1) | 250 | 11,762 | |

| Live Nation Entertainment, Inc.(1) | 1,258 | 114,642 | |

| Netflix, Inc.(1) | 5,100 | 3,112,734 | |

| Roku, Inc.(1) | 1,281 | 401,401 | |

| Take-Two Interactive Software, Inc.(1) | 1,312 | 202,140 | |

| Walt Disney Co. (The)(1) | 17,271 | 2,921,735 | |

| Warner Music Group Corp., Class A | 1,223 | 52,271 | |

| Zynga, Inc., Class A(1) | 10,810 | 81,399 | |

| $ 8,032,754 | |||

| Food & Staples Retailing — 0.1% | |||

| Costco Wholesale Corp. | 296 | $ 133,008 | |

| Sysco Corp. | 647 | 50,789 | |

| $ 183,797 | |||

| Food Products — 0.5% | |||

| Darling Ingredients, Inc.(1) | 1,651 | $ 118,707 | |

| Freshpet, Inc.(1) | 621 | 88,610 | |

| Hershey Co. (The) | 1,491 | 252,352 | |

| Hormel Foods Corp.(2) | 871 | 35,711 | |

| Ingredion, Inc. | 989 | 88,031 | |

| Kraft Heinz Co. (The) | 6,563 | 241,650 | |

| Lamb Weston Holdings, Inc. | 2,175 | 133,480 | |

| Lancaster Colony Corp. | 184 | 31,061 | |

| McCormick & Co., Inc. | 1,777 | 143,990 | |

| Mondelez International, Inc., Class A | 1,109 | 64,521 | |

| $ 1,198,113 | |||

| Health Care Equipment & Supplies — 6.2% | |||

| Abbott Laboratories | 21,135 | $ 2,496,677 | |

| ABIOMED, Inc.(1) | 557 | 181,315 | |

| Align Technology, Inc.(1) | 930 | 618,850 | |

| Baxter International, Inc. | 4,668 | 375,447 | |

| Becton, Dickinson and Co. | 2,105 | 517,451 | |

| Boston Scientific Corp.(1) | 17,714 | 768,610 | |

| Cooper Cos., Inc. (The) | 9 | 3,720 | |

| Danaher Corp. | 7,081 | 2,155,740 | |

| DENTSPLY SIRONA, Inc. | 2,925 | 169,796 | |

| DexCom, Inc.(1) | 1,236 | 675,919 | |

| Edwards Lifesciences Corp.(1) | 7,872 | 891,189 | |

| Envista Holdings Corp.(1) | 2,096 | 87,634 | |

| Globus Medical, Inc., Class A(1) | 1,025 | 78,535 | |

| Hill-Rom Holdings, Inc. | 258 | 38,700 | |

| Security | Shares | Value | |

| Health Care Equipment & Supplies (continued) | |||

| Hologic, Inc.(1) | 680 | $ 50,191 | |

| IDEXX Laboratories, Inc.(1) | 1,093 | 679,737 | |

| Insulet Corp.(1) | 869 | 246,996 | |

| Integra LifeSciences Holdings Corp.(1) | 852 | 58,345 | |

| Intuitive Surgical, Inc.(1) | 1,489 | 1,480,289 | |

| Masimo Corp.(1) | 616 | 166,757 | |

| Medtronic PLC | 9,053 | 1,134,794 | |

| Neogen Corp.(1) | 1,648 | 71,573 | |

| Nevro Corp.(1) | 35 | 4,073 | |

| Novocure, Ltd.(1) | 1,174 | 136,384 | |

| Penumbra, Inc.(1) | 434 | 115,661 | |

| Quidel Corp.(1) | 436 | 61,541 | |

| ResMed, Inc. | 1,867 | 492,048 | |

| STAAR Surgical Co.(1) | 609 | 78,275 | |

| STERIS PLC | 1,064 | 217,354 | |

| Stryker Corp. | 4,462 | 1,176,719 | |

| Teleflex, Inc. | 630 | 237,226 | |

| West Pharmaceutical Services, Inc. | 915 | 388,454 | |

| Zimmer Biomet Holdings, Inc. | 2,034 | 297,696 | |

| $ 16,153,696 | |||

| Health Care Providers & Services — 0.3% | |||

| Amedisys, Inc.(1) | 442 | $ 65,902 | |

| Chemed Corp. | 226 | 105,117 | |

| DaVita, Inc.(1) | 420 | 48,829 | |

| Encompass Health Corp. | 419 | 31,442 | |

| Guardant Health, Inc.(1) | 1,142 | 142,761 | |

| HCA Healthcare, Inc. | 1,225 | 297,332 | |

| HealthEquity, Inc.(1) | 989 | 64,048 | |

| LHC Group, Inc.(1) | 341 | 53,506 | |

| Molina Healthcare, Inc.(1) | 24 | 6,512 | |

| Progyny, Inc.(1) | 722 | 40,432 | |

| R1 RCM, Inc.(1) | 1,750 | 38,518 | |

| $ 894,399 | |||

| Health Care Technology — 0.4% | |||

| Cerner Corp. | 2,622 | $ 184,903 | |

| Change Healthcare, Inc.(1) | 1,226 | 25,672 | |

| Inovalon Holdings, Inc., Class A(1) | 709 | 28,566 | |

| Omnicell, Inc.(1) | 522 | 77,480 | |

| Teladoc Health, Inc.(1)(2) | 1,932 | 244,997 | |

| Veeva Systems, Inc., Class A(1) | 1,597 | 460,208 | |

| $ 1,021,826 | |||

| Hotels, Restaurants & Leisure — 2.3% | |||

| Aramark | 1,311 | $ 43,079 | |

| Security | Shares | Value | |

| Hotels, Restaurants & Leisure (continued) | |||

| Booking Holdings, Inc.(1) | 486 | $ 1,153,701 | |

| Chipotle Mexican Grill, Inc.(1) | 414 | 752,453 | |

| Choice Hotels International, Inc. | 426 | 53,834 | |

| Darden Restaurants, Inc. | 1,477 | 223,721 | |

| Domino's Pizza, Inc. | 578 | 275,683 | |

| Expedia Group, Inc.(1) | 1,021 | 167,342 | |

| Hilton Worldwide Holdings, Inc.(1) | 1,983 | 261,974 | |

| Hyatt Hotels Corp., Class A(1) | 527 | 40,632 | |

| Marriott International, Inc., Class A(1) | 1,879 | 278,261 | |

| Marriott Vacations Worldwide Corp. | 193 | 30,365 | |

| Planet Fitness, Inc., Class A(1) | 893 | 70,145 | |

| Royal Caribbean Cruises, Ltd.(1) | 1,891 | 168,204 | |

| Starbucks Corp. | 15,299 | 1,687,633 | |

| Texas Roadhouse, Inc. | 1,013 | 92,517 | |

| Travel + Leisure Co. | 175 | 9,543 | |

| Vail Resorts, Inc.(1) | 347 | 115,915 | |

| Wendy's Co. (The) | 2,374 | 51,468 | |

| Wyndham Hotels & Resorts, Inc. | 983 | 75,878 | |

| Yum! Brands, Inc. | 4,222 | 516,393 | |

| $ 6,068,741 | |||

| Household Durables — 0.2% | |||

| D.R. Horton, Inc. | 875 | $ 73,474 | |

| Helen of Troy, Ltd.(1) | 251 | 56,395 | |

| NVR, Inc.(1) | 55 | 263,674 | |

| Tempur Sealy International, Inc. | 2,133 | 98,992 | |

| TopBuild Corp.(1) | 455 | 93,189 | |

| $ 585,724 | |||

| Household Products — 0.8% | |||

| Church & Dwight Co., Inc. | 1,909 | $ 157,626 | |

| Clorox Co. (The) | 886 | 146,730 | |

| Colgate-Palmolive Co. | 6,825 | 515,834 | |

| Kimberly-Clark Corp. | 691 | 91,516 | |

| Procter & Gamble Co. (The) | 8,445 | 1,180,611 | |

| $ 2,092,317 | |||

| Independent Power and Renewable Electricity Producers — 0.0%(3) | |||

| AES Corp. (The) | 3,301 | $ 75,362 | |

| Brookfield Renewable Corp., Class A | 1,103 | 42,807 | |

| $ 118,169 | |||

| Industrial Conglomerates — 0.3% | |||

| 3M Co. | 1,747 | $ 306,459 | |

| Roper Technologies, Inc. | 1,089 | 485,835 | |

| $ 792,294 | |||

| Security | Shares | Value | |

| Insurance — 0.4% | |||

| American International Group, Inc. | 634 | $ 34,800 | |

| Brown & Brown, Inc. | 1,434 | 79,516 | |

| Erie Indemnity Co., Class A | 176 | 31,402 | |

| Marsh & McLennan Cos., Inc. | 3,923 | 594,060 | |

| MetLife, Inc. | 2,622 | 161,856 | |

| Primerica, Inc. | 44 | 6,760 | |

| RLI Corp. | 64 | 6,417 | |

| Willis Towers Watson PLC | 331 | 76,944 | |

| $ 991,755 | |||

| Interactive Media & Services — 6.8% | |||

| Alphabet, Inc., Class A(1) | 6,018 | $ 16,089,243 | |

| Angi, Inc.(1) | 1,810 | 22,335 | |

| Match Group, Inc.(1) | 3,086 | 484,471 | |

| Snap, Inc., Class A(1) | 11,323 | 836,430 | |

| TripAdvisor, Inc.(1) | 250 | 8,463 | |

| Zillow Group, Inc., Class C(1) | 1,948 | 171,697 | |

| ZoomInfo Technologies, Inc., Class A(1) | 2,137 | 130,763 | |

| $ 17,743,402 | |||

| Internet & Direct Marketing Retail — 5.1% | |||

| Amazon.com, Inc.(1) | 3,757 | $ 12,341,895 | |

| Chewy, Inc., Class A(1)(2) | 948 | 64,568 | |

| eBay, Inc. | 5,551 | 386,738 | |

| Etsy, Inc.(1) | 1,331 | 276,795 | |

| Stitch Fix, Inc., Class A(1) | 702 | 28,045 | |

| Wayfair, Inc., Class A(1)(2) | 735 | 187,800 | |

| $ 13,285,841 | |||

| IT Services — 7.2% | |||

| Accenture PLC, Class A | 6,638 | $ 2,123,629 | |

| Akamai Technologies, Inc.(1) | 1,904 | 199,139 | |

| Automatic Data Processing, Inc. | 2,610 | 521,791 | |

| Broadridge Financial Solutions, Inc. | 1,142 | 190,303 | |

| Cognizant Technology Solutions Corp., Class A | 2,439 | 180,998 | |

| Concentrix Corp.(1) | 522 | 92,394 | |

| EPAM Systems, Inc.(1) | 666 | 379,940 | |

| Euronet Worldwide, Inc.(1) | 605 | 77,004 | |

| Fidelity National Information Services, Inc. | 701 | 85,298 | |

| Fiserv, Inc.(1) | 6,911 | 749,843 | |

| Gartner, Inc.(1) | 1,027 | 312,085 | |

| Genpact, Ltd. | 1,188 | 56,442 | |

| Jack Henry & Associates, Inc. | 868 | 142,404 | |

| Mastercard, Inc., Class A | 9,992 | 3,474,018 | |

| MAXIMUS, Inc. | 263 | 21,882 | |

| Okta, Inc.(1) | 1,692 | 401,579 | |

| Security | Shares | Value | |

| IT Services (continued) | |||

| Paychex, Inc. | 2,146 | $ 241,318 | |

| PayPal Holdings, Inc.(1) | 12,702 | 3,305,187 | |

| Square, Inc., Class A(1) | 4,659 | 1,117,415 | |

| Switch, Inc., Class A | 902 | 22,902 | |

| TTEC Holdings, Inc. | 268 | 25,066 | |

| Twilio, Inc., Class A(1) | 1,909 | 609,066 | |

| VeriSign, Inc.(1) | 1,179 | 241,707 | |

| Visa, Inc., Class A | 18,805 | 4,188,814 | |

| WEX, Inc.(1) | 492 | 86,661 | |

| $ 18,846,885 | |||

| Leisure Products — 0.1% | |||

| Brunswick Corp. | 333 | $ 31,725 | |

| Callaway Golf Co.(1) | 35 | 967 | |

| Hasbro, Inc. | 312 | 27,837 | |

| Mattel, Inc.(1) | 1,912 | 35,487 | |

| YETI Holdings, Inc.(1) | 950 | 81,405 | |

| $ 177,421 | |||

| Life Sciences Tools & Services — 2.7% | |||

| 10X Genomics, Inc., Class A(1) | 1,125 | $ 163,778 | |

| Agilent Technologies, Inc. | 3,816 | 601,134 | |

| Avantor, Inc.(1) | 6,987 | 285,768 | |

| Bio-Rad Laboratories, Inc., Class A(1) | 12 | 8,951 | |

| Bio-Techne Corp. | 473 | 229,202 | |

| Bruker Corp. | 1,478 | 115,432 | |

| Charles River Laboratories International, Inc.(1) | 609 | 251,316 | |

| Illumina, Inc.(1) | 1,871 | 758,896 | |

| IQVIA Holdings, Inc.(1) | 2,445 | 585,675 | |

| Medpace Holdings, Inc.(1) | 425 | 80,444 | |

| Mettler-Toledo International, Inc.(1) | 284 | 391,170 | |

| NeoGenomics, Inc.(1) | 1,455 | 70,189 | |

| PerkinElmer, Inc. | 1,375 | 238,274 | |

| PPD, Inc.(1) | 1,583 | 74,069 | |

| Repligen Corp.(1) | 697 | 201,426 | |

| Syneos Health, Inc.(1) | 958 | 83,806 | |

| Thermo Fisher Scientific, Inc. | 4,713 | 2,692,678 | |

| Waters Corp.(1) | 765 | 273,335 | |

| $ 7,105,543 | |||

| Machinery — 2.0% | |||

| AGCO Corp. | 25 | $ 3,063 | |

| Caterpillar, Inc. | 4,101 | 787,269 | |

| Chart Industries, Inc.(1) | 398 | 76,062 | |

| CNH Industrial NV | 2,814 | 46,741 | |

| Colfax Corp.(1) | 1,915 | 87,899 | |

| Security | Shares | Value | |

| Machinery (continued) | |||

| Crane Co. | 46 | $ 4,361 | |

| Cummins, Inc. | 396 | 88,926 | |

| Deere & Co. | 2,143 | 718,055 | |

| Donaldson Co., Inc. | 1,040 | 59,706 | |

| Dover Corp. | 849 | 132,019 | |

| Flowserve Corp. | 195 | 6,761 | |

| Gates Industrial Corp. PLC(1) | 1,738 | 28,277 | |

| Graco, Inc. | 2,797 | 195,706 | |

| IDEX Corp. | 889 | 183,979 | |

| Illinois Tool Works, Inc. | 3,274 | 676,507 | |

| Ingersoll Rand, Inc.(1) | 3,654 | 184,198 | |

| ITT, Inc. | 1,333 | 114,425 | |

| John Bean Technologies Corp. | 404 | 56,782 | |

| Lincoln Electric Holdings, Inc. | 605 | 77,918 | |

| Middleby Corp. (The)(1) | 753 | 128,394 | |

| Nordson Corp. | 590 | 140,508 | |

| Oshkosh Corp. | 65 | 6,654 | |

| Otis Worldwide Corp. | 5,401 | 444,394 | |

| Parker-Hannifin Corp. | 742 | 207,478 | |

| Pentair PLC | 733 | 53,238 | |

| RBC Bearings, Inc.(1) | 352 | 74,694 | |

| Rexnord Corp. | 806 | 51,818 | |

| Snap-on, Inc. | 130 | 27,164 | |

| Stanley Black & Decker, Inc. | 238 | 41,724 | |

| Timken Co. (The) | 60 | 3,925 | |

| Toro Co. (The) | 1,579 | 153,810 | |

| Watts Water Technologies, Inc., Class A | 210 | 35,299 | |

| Westinghouse Air Brake Technologies Corp. | 32 | 2,759 | |

| Woodward, Inc. | 512 | 57,958 | |

| Xylem, Inc. | 2,112 | 261,212 | |

| $ 5,219,683 | |||

| Media — 0.6% | |||

| Altice USA, Inc., Class A(1) | 1,715 | $ 35,535 | |

| Cable One, Inc. | 57 | 103,348 | |

| Charter Communications, Inc., Class A(1) | 1,040 | 756,662 | |

| Comcast Corp., Class A | 1,110 | 62,082 | |

| Discovery, Inc., Class A(1) | 50 | 1,269 | |

| Interpublic Group of Cos., Inc. (The) | 150 | 5,501 | |

| Liberty Broadband Corp., Class C(1) | 1,954 | 337,456 | |

| New York Times Co. (The), Class A | 2,061 | 101,546 | |

| Sirius XM Holdings, Inc.(2) | 13,353 | 81,453 | |

| $ 1,484,852 | |||

| Security | Shares | Value | |

| Metals & Mining — 0.0%(3) | |||

| Steel Dynamics, Inc. | 25 | $ 1,462 | |

| $ 1,462 | |||

| Multiline Retail — 0.2% | |||

| Dollar General Corp. | 1,147 | $ 243,325 | |

| Nordstrom, Inc.(1)(2) | 25 | 661 | |

| Ollie's Bargain Outlet Holdings, Inc.(1)(2) | 587 | 35,384 | |

| Target Corp. | 1,246 | 285,048 | |

| $ 564,418 | |||

| Oil, Gas & Consumable Fuels — 0.0%(3) | |||

| New Fortress Energy, Inc.(2) | 902 | $ 25,031 | |

| $ 25,031 | |||

| Paper & Forest Products — 0.0%(3) | |||

| Louisiana-Pacific Corp. | 592 | $ 36,331 | |

| $ 36,331 | |||

| Personal Products — 0.3% | |||

| Coty, Inc., Class A(1) | 450 | $ 3,537 | |

| Estee Lauder Cos., Inc. (The), Class A | 2,499 | 749,525 | |

| $ 753,062 | |||

| Pharmaceuticals — 2.9% | |||

| Bristol-Myers Squibb Co. | 26,779 | $ 1,584,513 | |

| Catalent, Inc.(1) | 2,003 | 266,539 | |

| Elanco Animal Health, Inc.(1) | 3,508 | 111,870 | |

| Eli Lilly & Co. | 9,652 | 2,230,095 | |

| Jazz Pharmaceuticals PLC(1) | 449 | 58,464 | |

| Merck & Co., Inc. | 27,607 | 2,073,562 | |

| Organon & Co. | 3,045 | 99,846 | |

| Royalty Pharma PLC, Class A | 1,302 | 47,054 | |

| Zoetis, Inc. | 6,032 | 1,171,053 | |

| $ 7,642,996 | |||

| Professional Services — 0.8% | |||

| ASGN, Inc.(1) | 396 | $ 44,803 | |

| Booz Allen Hamilton Holding Corp. | 533 | 42,294 | |

| CoStar Group, Inc.(1) | 4,860 | 418,252 | |

| Dun & Bradstreet Holdings, Inc.(1)(2) | 1,990 | 33,452 | |

| Exponent, Inc. | 633 | 71,624 | |

| FTI Consulting, Inc.(1) | 326 | 43,912 | |

| IHS Markit, Ltd. | 4,720 | 550,446 | |

| ManpowerGroup, Inc. | 25 | 2,707 | |

| Nielsen Holdings PLC | 4,332 | 83,131 | |

| Robert Half International, Inc. | 894 | 89,695 | |

| Security | Shares | Value | |

| Professional Services (continued) | |||

| TransUnion | 2,264 | $ 254,270 | |

| TriNet Group, Inc.(1) | 407 | 38,494 | |

| Upwork, Inc.(1) | 865 | 38,951 | |

| Verisk Analytics, Inc. | 1,916 | 383,717 | |

| $ 2,095,748 | |||

| Real Estate Management & Development — 0.2% | |||

| CBRE Group, Inc., Class A(1) | 3,847 | $ 374,544 | |

| eXp World Holdings, Inc.(2) | 1,129 | 44,900 | |

| Redfin Corp.(1)(2) | 1,536 | 76,954 | |

| $ 496,398 | |||

| Road & Rail — 0.8% | |||

| Avis Budget Group, Inc.(1) | 665 | $ 77,479 | |

| J.B. Hunt Transport Services, Inc. | 649 | 108,526 | |

| Kansas City Southern | 828 | 224,090 | |

| Landstar System, Inc. | 329 | 51,923 | |

| Norfolk Southern Corp. | 1,087 | 260,065 | |

| Old Dominion Freight Line, Inc. | 1,219 | 348,609 | |

| Saia, Inc.(1) | 342 | 81,406 | |

| Union Pacific Corp. | 3,765 | 737,978 | |

| XPO Logistics, Inc.(1) | 1,040 | 82,763 | |

| $ 1,972,839 | |||

| Semiconductors & Semiconductor Equipment — 7.4% | |||

| Advanced Micro Devices, Inc.(1) | 14,097 | $ 1,450,581 | |

| Allegro MicroSystems, Inc.(1) | 400 | 12,784 | |

| Analog Devices, Inc. | 3,629 | 607,785 | |

| Applied Materials, Inc. | 10,643 | 1,370,073 | |

| Broadcom, Inc. | 3,969 | 1,924,687 | |

| Brooks Automation, Inc. | 1,043 | 106,751 | |

| Cree, Inc.(1) | 409 | 33,019 | |

| Enphase Energy, Inc.(1) | 1,406 | 210,858 | |

| Entegris, Inc. | 1,689 | 212,645 | |

| Intel Corp. | 3,486 | 185,734 | |

| KLA Corp. | 1,816 | 607,470 | |

| Lam Research Corp. | 1,664 | 947,066 | |

| Lattice Semiconductor Corp.(1) | 1,491 | 96,393 | |

| Marvell Technology, Inc. | 6,558 | 395,513 | |

| Microchip Technology, Inc. | 3,128 | 480,117 | |

| Micron Technology, Inc. | 13,348 | 947,441 | |

| MKS Instruments, Inc. | 697 | 105,184 | |

| Monolithic Power Systems, Inc. | 522 | 253,003 | |

| NVIDIA Corp. | 26,040 | 5,394,446 | |

| ON Semiconductor Corp.(1) | 4,782 | 218,872 | |

| Power Integrations, Inc. | 791 | 78,301 | |

| Security | Shares | Value | |

| Semiconductors & Semiconductor Equipment (continued) | |||

| Qorvo, Inc.(1) | 1,294 | $ ���216,344 | |

| Silicon Laboratories, Inc.(1) | 521 | 73,023 | |

| Skyworks Solutions, Inc. | 1,865 | 307,315 | |

| SolarEdge Technologies, Inc.(1) | 557 | 147,728 | |

| Teradyne, Inc. | 2,469 | 269,541 | |

| Texas Instruments, Inc. | 10,875 | 2,090,284 | |

| Universal Display Corp. | 541 | 92,489 | |

| Xilinx, Inc. | 2,998 | 452,668 | |

| $ 19,288,115 | |||

| Software — 16.2% | |||

| Adobe, Inc.(1) | 5,436 | $ 3,129,614 | |

| Altair Engineering, Inc., Class A(1) | 367 | 25,301 | |

| Alteryx, Inc., Class A(1) | 566 | 41,375 | |

| Anaplan, Inc.(1) | 1,195 | 72,764 | |

| ANSYS, Inc.(1) | 998 | 339,769 | |

| Appfolio, Inc., Class A(1) | 282 | 33,953 | |

| Appian Corp.(1)(2) | 314 | 29,048 | |

| Aspen Technology, Inc.(1) | 753 | 92,468 | |

| Autodesk, Inc.(1) | 2,616 | 746,005 | |

| Avalara, Inc.(1) | 964 | 168,478 | |

| Bill.com Holdings, Inc.(1) | 869 | 231,980 | |

| Black Knight, Inc.(1) | 1,170 | 84,240 | |

| Blackline, Inc.(1)(2) | 604 | 71,308 | |

| Cadence Design Systems, Inc.(1) | 3,266 | 494,603 | |

| Citrix Systems, Inc. | 1,425 | 153,002 | |

| Cloudera, Inc.(1) | 1,559 | 24,897 | |

| Coupa Software, Inc.(1) | 838 | 183,673 | |

| CrowdStrike Holdings, Inc., Class A(1) | 96 | 23,595 | |

| DocuSign, Inc.(1) | 2,214 | 569,950 | |

| Dolby Laboratories, Inc., Class A | 667 | 58,696 | |

| Duck Creek Technologies, Inc.(1) | 856 | 37,869 | |

| Dynatrace, Inc.(1) | 2,084 | 147,901 | |

| Fair Isaac Corp.(1) | 349 | 138,878 | |

| Five9, Inc.(1) | 814 | 130,028 | |

| Guidewire Software, Inc.(1) | 901 | 107,102 | |

| HubSpot, Inc.(1) | 511 | 345,482 | |

| Intuit, Inc. | 3,149 | 1,698,917 | |

| Manhattan Associates, Inc.(1) | 735 | 112,477 | |

| McAfee Corp., Class A(2) | 350 | 7,739 | |

| Microsoft Corp. | 76,135 | 21,463,979 | |

| MicroStrategy, Inc., Class A(1)(2) | 99 | 57,262 | |

| NCR Corp.(1) | 958 | 37,132 | |

| NortonLifeLock, Inc. | 3,284 | 83,085 | |

| Nuance Communications, Inc.(1) | 3,828 | 210,693 | |

| Nutanix, Inc., Class A(1) | 100 | 3,770 | |

| Oracle Corp. | 17,822 | 1,552,831 | |

| Security | Shares | Value | |

| Software (continued) | |||

| Palo Alto Networks, Inc.(1) | 1,129 | $ 540,791 | |

| Paycom Software, Inc.(1) | 588 | 291,501 | |

| Paylocity Holding Corp.(1) | 473 | 132,629 | |

| Pegasystems, Inc. | 507 | 64,440 | |

| PTC, Inc.(1) | 1,338 | 160,279 | |

| Q2 Holdings, Inc.(1) | 573 | 45,920 | |

| Rapid7, Inc.(1)(2) | 670 | 75,723 | |

| RingCentral, Inc., Class A(1) | 974 | 211,845 | |

| salesforce.com, inc.(1) | 11,083 | 3,005,931 | |

| ServiceNow, Inc.(1) | 2,339 | 1,455,490 | |

| Smartsheet, Inc., Class A(1) | 1,522 | 104,744 | |

| Splunk, Inc.(1) | 1,858 | 268,871 | |

| SS&C Technologies Holdings, Inc. | 2,637 | 183,008 | |

| Synopsys, Inc.(1) | 1,799 | 538,639 | |

| Teradata Corp.(1) | 1,351 | 77,480 | |

| Trade Desk, Inc. (The), Class A(1) | 5,258 | 369,637 | |

| Tyler Technologies, Inc.(1) | 473 | 216,941 | |

| VMware, Inc., Class A(1)(2) | 954 | 141,860 | |

| Workday, Inc., Class A(1) | 2,181 | 545,010 | |

| Workiva, Inc.(1) | 448 | 63,150 | |

| Zendesk, Inc.(1) | 1,312 | 152,704 | |

| Ziff Davis, Inc.(1) | 523 | 71,452 | |

| Zoom Video Communications, Inc., Class A(1) | 2,589 | 677,024 | |

| Zscaler, Inc.(1) | 884 | 231,802 | |

| $ 42,336,735 | |||

| Specialty Retail — 3.2% | |||

| Advance Auto Parts, Inc. | 8 | $ 1,671 | |

| American Eagle Outfitters, Inc.(2) | 1,255 | 32,379 | |

| AutoZone, Inc.(1) | 218 | 370,162 | |

| Bath & Body Works, Inc. | 390 | 24,582 | |

| Burlington Stores, Inc.(1) | 744 | 210,976 | |

| CarMax, Inc.(1) | 327 | 41,843 | |

| Carvana Co.(1)(2) | 782 | 235,804 | |

| Five Below, Inc.(1) | 599 | 105,909 | |

| Floor & Decor Holdings, Inc., Class A(1) | 1,181 | 142,653 | |

| GameStop Corp., Class A(1) | 144 | 25,268 | |

| Home Depot, Inc. (The) | 11,101 | 3,644,014 | |

| Leslie's, Inc.(1)(2) | 1,101 | 22,615 | |

| Lowe's Cos., Inc. | 5,762 | 1,168,879 | |

| O'Reilly Automotive, Inc.(1) | 715 | 436,908 | |

| RH (1) | 174 | 116,042 | |

| Ross Stores, Inc. | 3,839 | 417,875 | |

| TJX Cos., Inc. (The) | 11,949 | 788,395 | |

| Tractor Supply Co. | 1,154 | 233,812 | |

| Ulta Beauty, Inc.(1) | 546 | 197,062 | |

| Victoria's Secret & Co.(1) | 130 | 7,184 | |

| Security | Shares | Value | |

| Specialty Retail (continued) | |||

| Williams-Sonoma, Inc. | 503 | $ 89,197 | |

| $ 8,313,230 | |||

| Technology Hardware, Storage & Peripherals — 9.4% | |||

| Apple, Inc. | 169,525 | $ 23,987,788 | |

| Dell Technologies, Inc., Class C(1) | 509 | 52,956 | |

| NetApp, Inc. | 2,038 | 182,931 | |

| Pure Storage, Inc., Class A(1) | 2,539 | 63,881 | |

| Seagate Technology Holdings PLC | 1,320 | 108,927 | |

| Western Digital Corp.(1) | 3,823 | 215,770 | |

| $ 24,612,253 | |||

| Textiles, Apparel & Luxury Goods — 1.2% | |||

| Capri Holdings, Ltd.(1) | 869 | $ 42,068 | |

| Columbia Sportswear Co. | 337 | 32,298 | |

| Crocs, Inc.(1) | 700 | 100,436 | |

| Deckers Outdoor Corp.(1) | 271 | 97,614 | |

| Hanesbrands, Inc. | 3,222 | 55,289 | |

| Levi Strauss & Co., Class A | 385 | 9,436 | |

| lululemon Athletica, Inc.(1) | 1,248 | 505,066 | |

| NIKE, Inc., Class B | 13,148 | 1,909,484 | |

| PVH Corp.(1) | 781 | 80,279 | |

| Ralph Lauren Corp. | 277 | 30,758 | |

| Skechers USA, Inc., Class A(1) | 1,063 | 44,774 | |

| Tapestry, Inc. | 1,138 | 42,129 | |

| Under Armour, Inc., Class A(1) | 327 | 6,599 | |

| VF Corp. | 2,712 | 181,677 | |

| $ 3,137,907 | |||

| Trading Companies & Distributors — 0.4% | |||

| Fastenal Co. | 5,710 | $ 294,693 | |

| MSC Industrial Direct Co., Inc., Class A | 35 | 2,806 | |

| SiteOne Landscape Supply, Inc.(1) | 508 | 101,331 | |

| United Rentals, Inc.(1) | 943 | 330,927 | |

| Univar Solutions, Inc.(1) | 1,340 | 31,919 | |

| W.W. Grainger, Inc. | 366 | 143,860 | |

| WESCO International, Inc.(1) | 325 | 37,479 | |

| $ 943,015 | |||

| Water Utilities — 0.1% | |||

| American Water Works Co., Inc. | 1,170 | $ 197,777 | |

| Essential Utilities, Inc. | 892 | 41,103 | |

| $ 238,880 | |||

| Security | Shares | Value | |

| Wireless Telecommunication Services — 0.1% | |||

| T-Mobile US, Inc.(1) | 2,398 | $ 306,369 | |

| $ 306,369 | |||

| Total Common Stocks (identified cost $161,383,218) | $259,096,648 | ||

| Short-Term Investments — 0.3% | |||

| Affiliated Fund — 0.2% | |||

| Description | Units | Value | |

| Calvert Cash Reserves Fund, LLC, 0.04%(4) | 556,863 | $ 556,919 | |

| Total Affiliated Fund (identified cost $556,863) | $ 556,919 | ||

| Securities Lending Collateral — 0.1% | |||

| Security | Shares | Value | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.03%(5) | 315,306 | $ 315,306 | |

| Total Securities Lending Collateral (identified cost $315,306) | $ 315,306 | ||

| Total Short-Term Investments (identified cost $872,169) | $ 872,225 | ||

| Total Investments — 99.7% (identified cost $162,255,387) | $259,968,873 | ||

| Other Assets, Less Liabilities — 0.3% | $ 859,042 | ||

| Net Assets — 100.0% | $260,827,915 | ||

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. | |

| (1) | Non-income producing security. |

| (2) | All or a portion of this security was on loan at September 30, 2021. The aggregate market value of securities on loan at September 30, 2021 was $1,568,167. |

| (3) | Amount is less than 0.05%. |

| (4) | Affiliated investment company, available to Calvert portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of September 30, 2021. |

| (5) | Represents investment of cash collateral received in connection with securities lending. |

| September 30, 2021 | |

| Assets | |

| Investments in securities of unaffiliated issuers, at value (identified cost $161,698,524) - including $1,568,167 of securities on loan | $ 259,411,954 |

| Investments in securities of affiliated issuers, at value (identified cost $556,863) | 556,919 |

| Receivable for capital shares sold | 1,229,641 |

| Dividends receivable | 90,842 |

| Dividends receivable - affiliated | 40 |

| Securities lending income receivable | 410 |

| Receivable from affiliate | 36,991 |

| Directors' deferred compensation plan | 47,652 |

| Total assets | $261,374,449 |

| Liabilities | |

| Payable for capital shares redeemed | $ 24,834 |

| Deposits for securities loaned | 315,306 |

| Payable to affiliates: | |

| Investment advisory fee | 26,407 |

| Administrative fee | 26,407 |

| Distribution and service fees | 10,747 |

| Sub-transfer agency fee | 2,503 |

| Directors' deferred compensation plan | 47,652 |

| Accrued expenses | 92,678 |

| Total liabilities | $ 546,534 |

| Net Assets | $260,827,915 |

| Sources of Net Assets | |

| Paid-in capital | $ 159,963,009 |

| Distributable earnings | 100,864,906 |

| Total | $260,827,915 |

| Class A Shares | |

| Net Assets | $ 50,963,269 |

| Shares Outstanding | 1,025,232 |

| Net Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $ 49.71 |

| Maximum Offering Price Per Share (100 ÷ 95.25 of net asset value per share) | $ 52.19 |

| Class I Shares | |

| Net Assets | $ 209,864,646 |

| Shares Outstanding | 4,184,332 |

| Net Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $ 50.15 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. |

| Year Ended | |

| September 30, 2021 | |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $50) | $ 1,637,804 |

| Dividend income - affiliated issuers | 534 |

| Securities lending income, net | 3,017 |

| Total investment income | $ 1,641,355 |

| Expenses | |

| Investment advisory fee | $ 243,497 |

| Administrative fee | 243,497 |

| Distribution and service fees: | |

| Class A | 101,895 |

| Directors' fees and expenses | 9,381 |

| Custodian fees | 24,452 |

| Transfer agency fees and expenses | 139,931 |

| Accounting fees | 45,803 |

| Professional fees | 31,533 |

| Registration fees | 66,726 |

| Reports to shareholders | 16,782 |

| Miscellaneous | 13,464 |

| Total expenses | $ 936,961 |

| Waiver and/or reimbursement of expenses by affiliate | $ (347,018) |

| Net expenses | $ 589,943 |

| Net investment income | $ 1,051,412 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities | $ 4,403,235 |

| Investment securities - affiliated issuers | 2 |

| Net realized gain | $ 4,403,237 |

| Change in unrealized appreciation (depreciation): | |

| Investment securities | $ 39,140,260 |

| Investment securities - affiliated issuers | 78 |

| Net change in unrealized appreciation (depreciation) | $39,140,338 |

| Net realized and unrealized gain | $43,543,575 |

| Net increase in net assets from operations | $44,594,987 |

| Year Ended September 30, | ||

| 2021 | 2020 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $ 1,051,412 | $ 855,558 |

| Net realized gain | 4,403,237 | 1,717,768 |

| Net change in unrealized appreciation (depreciation) | 39,140,338 | 34,162,532 |

| Net increase in net assets from operations | $ 44,594,987 | $ 36,735,858 |

| Distributions to shareholders: | ||

| Class A | $ (540,452) | $ (263,535) |

| Class I | (2,398,807) | (1,322,504) |

| Total distributions to shareholders | $ (2,939,259) | $ (1,586,039) |

| Capital share transactions: | ||

| Class A | $ 13,625,518 | $ 6,032,987 |

| Class I | 64,222,299 | 8,832,344 |

| Net increase in net assets from capital share transactions | $ 77,847,817 | $ 14,865,331 |

| Net increase in net assets | $119,503,545 | $ 50,015,150 |

| Net Assets | ||

| At beginning of year | $ 141,324,370 | $ 91,309,220 |

| At end of year | $260,827,915 | $141,324,370 |

| Class A | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 39.77 | $ 29.65 | $ 29.83 | $ 24.35 | $ 20.66 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.15 | $ 0.19 | $ 0.20 | $ 0.17 | $ 0.21 |

| Net realized and unrealized gain | 10.49 | 10.39 | 0.96 | 5.84 | 3.64 |

| Total income from operations | $ 10.64 | $ 10.58 | $ 1.16 | $ 6.01 | $ 3.85 |

| Less Distributions | |||||

| From net investment income | $ (0.15) | $ (0.17) | $ (0.20) | $ (0.19) | $ (0.16) |

| From net realized gain | (0.55) | (0.29) | (1.14) | (0.34) | — |

| Total distributions | $ (0.70) | $ (0.46) | $ (1.34) | $ (0.53) | $ (0.16) |

| Net asset value — End of year | $ 49.71 | $ 39.77 | $ 29.65 | $ 29.83 | $24.35 |

| Total Return(2) | 27.06% | 36.14% | 4.51% | 25.03% | 18.76% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $50,963 | $29,021 | $16,361 | $14,036 | $ 6,214 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 0.66% | 0.67% | 0.77% | 0.82% | 1.53% |

| Net expenses | 0.49% | 0.49% | 0.51% | 0.57% | 0.57% |

| Net investment income | 0.32% | 0.56% | 0.72% | 0.63% | 0.92% |

| Portfolio Turnover | 25% | 53% | 34% | 54% | 75% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Class I | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value — Beginning of year | $ 40.08 | $ 29.88 | $ 30.02 | $ 24.45 | $ 20.74 |

| Income (Loss) From Operations | |||||

| Net investment income(1) | $ 0.27 | $ 0.27 | $ 0.28 | $ 0.26 | $ 0.28 |

| Net realized and unrealized gain | 10.57 | 10.46 | 0.97 | 5.87 | 3.66 |

| Total income from operations | $ 10.84 | $ 10.73 | $ 1.25 | $ 6.13 | $ 3.94 |

| Less Distributions | |||||

| From net investment income | $ (0.22) | $ (0.24) | $ (0.25) | $ (0.22) | $ (0.23) |

| From net realized gain | (0.55) | (0.29) | (1.14) | (0.34) | — |

| Total distributions | $ (0.77) | $ (0.53) | $ (1.39) | $ (0.56) | $ (0.23) |

| Net asset value — End of year | $ 50.15 | $ 40.08 | $ 29.88 | $ 30.02 | $ 24.45 |

| Total Return(2) | 27.40% | 36.42% | 4.82% | 25.46% | 19.20% |

| Ratios/Supplemental Data | |||||

| Net assets, end of year (000’s omitted) | $209,865 | $112,304 | $74,948 | $60,367 | $40,821 |

| Ratios (as a percentage of average daily net assets):(3) | |||||

| Total expenses | 0.41% | 0.42% | 0.52% | 0.58% | 0.58% |

| Net expenses | 0.24% | 0.24% | 0.24% | 0.22% | 0.22% |

| Net investment income | 0.57% | 0.81% | 1.00% | 0.98% | 1.26% |

| Portfolio Turnover | 25% | 53% | 34% | 54% | 75% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $ 259,096,648(1) | $ — | $ — | $ 259,096,648 |

| Short-Term Investments: | ||||

| Affiliated Fund | — | 556,919 | — | 556,919 |

| Securities Lending Collateral | 315,306 | — | — | 315,306 |

| Total Investments | $259,411,954 | $556,919 | $ — | $259,968,873 |

| (1) | The level classification by major category of investments is the same as the category presentation in the Schedule of Investments. |

| Year Ended September 30, | ||

| 2021 | 2020 | |

| Ordinary income | $1,293,558 | $704,231 |

| Long-term capital gains | $1,645,701 | $881,808 |

| Undistributed ordinary income | $ 2,717,034 |

| Undistributed long-term capital gains | 2,374,117 |

| Net unrealized appreciation | 95,773,755 |

| Distributable earnings | $100,864,906 |

| Aggregate cost | $164,195,118 |

| Gross unrealized appreciation | $ 96,858,539 |

| Gross unrealized depreciation | (1,084,784) |

| Net unrealized appreciation | $ 95,773,755 |

| Remaining Contractual Maturity of the Transactions | |||||

| Overnight and Continuous | <30 days | 30 to 90 days | >90 days | Total | |

| Common Stocks | $315,306 | $ — | $ — | $ — | $315,306 |

| Name | Value, beginning of period | Purchases | Sales proceeds | Net realized gain (loss) | Change in unrealized appreciation (depreciation) | Value, end of period | Dividend income | Units, end of period |

| Short-Term Investments | ||||||||

| Calvert Cash Reserves Fund, LLC | $3,288,932 | $56,887,033 | $(59,619,126) | $2 | $78 | $556,919 | $534 | 556,863 |

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 459,928 | $ 21,081,845 | 319,128 | $ 10,754,978 | |

| Reinvestment of distributions | 12,185 | 516,884 | 8,095 | 250,466 | |

| Shares redeemed | (176,621) | (7,973,211) | (149,236) | (4,972,457) | |

| Net increase | 295,492 | $ 13,625,518 | 177,987 | $ 6,032,987 | |

| Class I | |||||

| Shares sold | 2,108,850 | $ 97,474,428 | 1,750,290 | $ 57,817,474 | |

| Reinvestment of distributions | 55,026 | 2,350,142 | 42,402 | 1,319,561 | |

| Shares redeemed | (781,346) | (35,602,271) | (1,499,446) | (50,304,691) | |

| Net increase | 1,382,530 | $ 64,222,299 | 293,246 | $ 8,832,344 | |

Boston, Massachusetts

November 22, 2021

| Name and Year of Birth | Corporation Position(s) | Position Start Date | Principal Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Interested Director | |||

| John H. Streur(1) 1960 | Director and President | 2015 | President and Chief Executive Officer of Calvert Research and Management (since December 31, 2016). President and Chief Executive Officer of Calvert Investments, Inc. (January 2015 - December 2016); Chief Executive Officer of Calvert Investment Distributors, Inc. (August 2015 - December 2016); Chief Compliance Officer of Calvert Investment Management, Inc. (August 2015 - April 2016); President and Director, Portfolio 21 Investments, Inc. (through October 2014); President, Chief Executive Officer and Director, Managers Investment Group LLC (through January 2012); President and Director, The Managers Funds and Managers AMG Funds (through January 2012). Other Directorships in the Last Five Years. Portfolio 21 Investments, Inc. (asset management) (through October 2014); Managers Investment Group LLC (asset management) (through January 2012); The Managers Funds (asset management) (through January 2012); Managers AMG Funds (asset management) (through January 2012); Calvert Impact Capital, Inc. |

| Independent Directors | |||

| Richard L. Baird, Jr. 1948 | Director | 2000 | Regional Disaster Recovery Lead, American Red Cross of Greater Pennsylvania (since 2017). Volunteer, American Red Cross (since 2015). Former President and CEO of Adagio Health Inc. (retired in 2014) in Pittsburgh, PA. Other Directorships in the Last Five Years. None. |

| Alice Gresham Bullock 1950 | Chair and Director | 2016 | Professor Emerita at Howard University School of Law. Dean Emerita of Howard University School of Law and Deputy Director of the Association of American Law Schools (1992-1994). Other Directorships in the Last Five Years. None. |

| Cari M. Dominguez 1949 | Director | 2016 | Former Chair of the U.S. Equal Employment Opportunity Commission. Other Directorships in the Last Five Years. Manpower, Inc. (employment agency); Triple S Management Corporation (managed care); National Association of Corporate Directors. |

| John G. Guffey, Jr. 1948 | Director | 2000 | President of Aurora Press Inc., a privately held publisher of trade paperbacks (since January 1997). Other Directorships in the Last Five Years. Calvert Impact Capital, Inc. (through December 31, 2018); Calvert Ventures, LLC. |

| Miles D. Harper, III 1962 | Director | 2005 | Partner, Carr Riggs & Ingram (public accounting firm) since October 2014. Partner, Gainer Donnelly & Desroches (public accounting firm) (now Carr Riggs & Ingram) (November 1999 - September 2014). Other Directorships in the Last Five Years. Bridgeway Funds (9) (asset management). |

| Joy V. Jones 1950 | Director | 2000 | Attorney. Other Directorships in the Last Five Years. Conduit Street Restaurants SUD 2 Limited; Palm Management Restaurant Corporation. |

| Name and Year of Birth | Corporation Position(s) | Position Start Date | Principal Occupation(s) and Other Directorships During Past Five Years and Other Relevant Experience |

| Independent Directors (continued) | |||

| Anthony A. Williams 1951 | Director | 2016 | CEO and Executive Director of the Federal City Council (July 2012 to present); Senior Adviser and Independent Consultant for King and Spalding LLP (September 2015 to present); Executive Director of Global Government Practice at the Corporate Executive Board (January 2010 to January 2012). Other Directorships in the Last Five Years. Freddie Mac; Evoq Properties/Meruelo Maddux Properties, Inc. (real estate management); Weston Solutions, Inc. (environmental services); Bipartisan Policy Center’s Debt Reduction Task Force; Chesapeake Bay Foundation; Catholic University of America; Urban Institute (research organization); The Howard Hughes Corporation (real estate development). |

| Name and Year of Birth | Corporation Position(s) | Position Start Date | Principal Occupation(s) During Past Five Years |

| Principal Officers who are not Directors | |||

| Hope L. Brown 1973 | Chief Compliance Officer | 2014 | Chief Compliance Officer of 39 registered investment companies advised by CRM (since 2014). Vice President and Chief Compliance Officer, Wilmington Funds (2012-2014). |

| Deidre E. Walsh(2) 1971 | Secretary, Vice President and Chief Legal Officer | 2021 | Vice President of CRM and officer of 39 registered investment companies advised by CRM (since 2021). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| James F. Kirchner(2) 1967 | Treasurer | 2016 | Vice President of CRM and officer of 39 registered investment companies advised by CRM (since 2016). Also Vice President of Eaton Vance and certain of its affiliates and officer of 138 registered investment companies advised or administered by Eaton Vance. |

| (1) Mr. Streur is an interested person of the Fund because of his positions with the Fund’s adviser and certain affiliates. | |||

| (2) The business address for Ms. Walsh and Mr. Kirchner is Two International Place, Boston, MA 02110. | |||

| Privacy Notice | April 2021 |

| FACTS | WHAT DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does Eaton Vance share? | Can you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For our investment management affiliates to market to you | Yes | Yes |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| To limit our sharing | Call toll-free 1-800-368-2745 or email: CRMPrivacy@calvert.comPlease note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call toll-free 1-800-368-2745 or email: CRMPrivacy@calvert.com |

| Privacy Notice — continued | April 2021 |

| Who we are | |

| Who is providing this notice? | Eaton Vance Management, Eaton Vance Distributors, Inc., Eaton Vance Trust Company, Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd., Eaton Vance Global Advisors Limited, Eaton Vance Management’s Real Estate Investment Group, Boston Management and Research, Calvert Research and Management, Eaton Vance and Calvert Fund Families and our investment advisory affiliates (“Eaton Vance”) (see Investment Management Affiliates definition below) |

| What we do | |

| How does Eaton Vance protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We have policies governing the proper handling of customer information by personnel and requiring third parties that provide support to adhere to appropriate security standards with respect to such information. |

| How does Eaton Vance collect my personal information? | We collect your personal information, for example, when you■ open an account or make deposits or withdrawals from your account ■ buy securities from us or make a wire transfer ■ give us your contact informationWe also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| Definitions | |

| Investment Management Affiliates | Eaton Vance Investment Management Affiliates include registered investment advisers, registered broker- dealers, and registered and unregistered funds. Investment Management Affiliates does not include entities associated with Morgan Stanley Wealth Management, such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.■ Our affiliates include companies with a Morgan Stanley name and financial companies such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.■ Eaton Vance does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.■ Eaton Vance doesn’t jointly market. |

| Other important information | |

| Vermont: Except as permitted by law, we will not share personal information we collect about Vermont residents with Nonaffiliates unless you provide us with your written consent to share such information.California: Except as permitted by law, we will not share personal information we collect about California residents with Nonaffiliates and we will limit sharing such personal information with our Affiliates to comply with California privacy laws that apply to us. | |

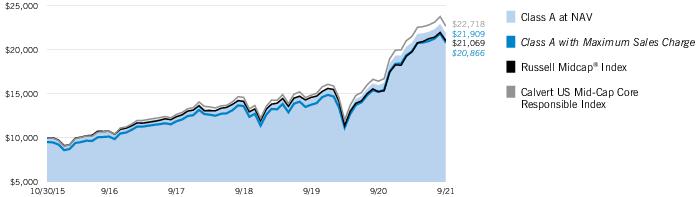

| % Average Annual Total Returns1,2 | Class Inception Date | Performance Inception Date | One Year | Five Years | Since Inception |

| Class A at NAV | 10/30/2015 | 10/30/2015 | 24.74% | 10.00% | 8.43% |

| Class A with 4.75% Maximum Sales Charge | — | — | 18.81 | 8.94 | 7.54 |

| Class I at NAV | 10/30/2015 | 10/30/2015 | 25.07 | 10.33 | 8.76 |

| Class R6 at NAV | 02/01/2019 | 10/30/2015 | 25.08 | 10.34 | 8.77 |

| MSCI World ex USA Index | — | — | 26.50% | 8.87% | 7.38% |

| Calvert International Responsible Index | — | — | 26.38 | 10.70 | 8.90 |

| % Total Annual Operating Expense Ratios3 | Class A | Class I | Class R6 |

| Gross | 0.74% | 0.49% | 0.46% |

| Net | 0.54 | 0.29 | 0.26 |

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class I | $100,000 | 10/30/2015 | $164,442 | N.A. |

| Class R6 | $1,000,000 | 10/30/2015 | $1,645,131 | N.A. |

| Top 10 Holdings (% of net assets)* | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2.5% |

| Samsung Electronics Co., Ltd. | 1.7 |

| Nestle S.A. | 1.7 |

| ASML Holding NV | 1.5 |

| Roche Holding AG PC | 1.4 |

| Toyota Motor Corp. | 1.2 |

| AstraZeneca PLC | 1.0 |

| Novartis AG | 0.9 |

| LVMH Moet Hennessy Louis Vuitton SE | 0.9 |

| Linde PLC | 0.9 |

| Total | 13.7% |

| * | Excludes cash and cash equivalents. |

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 1 | MSCI World ex USA Index is an unmanaged index of equity securities in the developed markets, excluding the United States. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Calvert International Responsible Index (the “Calvert Index”) is composed of common stocks of large companies in developed markets, excluding the U.S. Large companies in developed markets are the 1,000 largest publicly traded companies, excluding real estate investment trusts and business development companies, in markets that Calvert Research and Management determines to be developed markets based on a set of criteria including level of economic development, existence of capital controls, openness to foreign direct investment, market trading and liquidity conditions, regulatory environment, treatment of minority shareholders, and investor expectations. The Calvert Principles of Responsible Investment serve as a framework for considering environmental, social and governance factors that may affect investment performance. Stocks are weighted in the Calvert Index based on their float-adjusted market capitalization, by country and by sector, subject to certain prescribed limits. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. |

| Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R6 is linked to Class I. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. Performance presented in the Financial Highlights included in the financial statements is not linked.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. | |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/22. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Additional Information | |

| S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. MSCI Golden Dragon Index is an unmanaged index of common stocks traded in China, Hong Kong and Taiwan. MSCI World Index is an unmanaged index of equity securities in the developed markets. MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. |

| Beginning Account Value (4/1/21) | Ending Account Value (9/30/21) | Expenses Paid During Period* (4/1/21 – 9/30/21) | Annualized Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $1,043.10 | $2.77 ** | 0.54% |

| Class I | $1,000.00 | $1,044.70 | $1.49 ** | 0.29% |

| Class R6 | $1,000.00 | $1,044.70 | $1.33 ** | 0.26% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,022.36 | $2.74 ** | 0.54% |

| Class I | $1,000.00 | $1,023.61 | $1.47 ** | 0.29% |

| Class R6 | $1,000.00 | $1,023.76 | $1.32 ** | 0.26% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2021. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

| Common Stocks — 97.6% |

| Security | Shares | Value | |

| Australia — 4.8% | |||

| Afterpay, Ltd.(1) | 8,673 | $ 753,467 | |

| APA Group | 48,708 | 303,392 | |

| ASX, Ltd. | 6,590 | 380,478 | |

| Australia & New Zealand Banking Group, Ltd. | 99,782 | 2,003,876 | |

| BlueScope Steel, Ltd. | 42,161 | 610,896 | |

| Brambles, Ltd. | 60,859 | 467,972 | |

| Cochlear, Ltd. | 2,658 | 415,877 | |

| Coles Group, Ltd. | 56,113 | 681,604 | |

| Commonwealth Bank of Australia | 58,481 | 4,339,894 | |

| Computershare, Ltd. | 19,984 | 258,414 | |

| CSL, Ltd. | 17,330 | 3,620,776 | |

| Domino's Pizza Enterprises, Ltd. | 2,558 | 292,580 | |

| Endeavour Group, Ltd. | 50,223 | 251,321 | |

| Insurance Australia Group, Ltd. | 93,184 | 325,424 | |

| Macquarie Group, Ltd. | 12,642 | 1,633,299 | |

| Magellan Financial Group, Ltd. | 4,082 | 102,461 | |

| National Australia Bank, Ltd. | 114,863 | 2,265,215 | |

| Qantas Airways, Ltd.(1) | 36,704 | 148,028 | |

| QBE Insurance Group, Ltd. | 54,289 | 447,243 | |

| Ramsay Health Care, Ltd. | 7,163 | 354,974 | |

| REA Group, Ltd. | 1,852 | 208,592 | |

| Reece, Ltd. | 9,001 | 121,393 | |

| Seek, Ltd.(2) | 10,950 | 240,716 | |

| Sonic Healthcare, Ltd. | 18,823 | 543,969 | |

| Suncorp Group, Ltd. | 48,105 | 427,749 | |

| Sydney Airport(1) | 58,543 | 343,813 | |

| Telstra Corp., Ltd. | 158,012 | 442,765 | |

| TPG Telecom, Ltd.(2) | 10,500 | 52,835 | |

| Transurban Group | 124,637 | 1,256,150 | |

| Wesfarmers, Ltd. | 50,061 | 1,991,096 | |

| Westpac Banking Corp. | 128,443 | 2,375,359 | |

| WiseTech Global, Ltd. | 4,265 | 161,743 | |

| Woolworths Group, Ltd. | 57,592 | 1,617,659 | |

| $ 29,441,030 | |||

| Austria — 0.2% | |||

| Erste Group Bank AG | 10,315 | $ 452,923 | |

| Raiffeisen Bank International AG | 4,769 | 124,731 | |

| Verbund AG | 2,426 | 245,353 | |

| Voestalpine AG | 9,727 | 359,302 | |

| $ 1,182,309 | |||

| Belgium — 0.7% | |||

| Ageas S.A./NV | 4,198 | $ 207,887 | |

| Anheuser-Busch InBev S.A./NV | 26,363 | 1,495,240 | |

| Security | Shares | Value | |

| Belgium (continued) | |||

| D'Ieteren Group | 524 | $ 76,891 | |

| Elia Group S.A./NV | 1,052 | 125,714 | |

| Etablissements Franz Colruyt NV | 1,557 | 79,426 | |

| Groupe Bruxelles Lambert S.A. | 3,160 | 347,586 | |

| KBC Group NV | 6,885 | 621,058 | |

| Proximus S.A. | 3,652 | 72,472 | |

| Sofina S.A. | 417 | 165,691 | |

| Solvay S.A. | 1,953 | 242,265 | |

| UCB S.A. | 3,574 | 400,207 | |

| Umicore S.A. | 6,023 | 356,318 | |

| $ 4,190,755 | |||

| Canada — 8.6% | |||

| Air Canada(1)(2) | 14,593 | $ 266,490 | |

| Algonquin Power & Utilities Corp.(2) | 24,855 | 364,407 | |

| Alimentation Couche-Tard, Inc., Class B | 39,577 | 1,514,212 | |

| Bank of Montreal | 24,377 | 2,433,658 | |

| Bank of Nova Scotia (The) | 45,648 | 2,809,662 | |

| BCE, Inc. | 11,852 | 593,723 | |

| Brookfield Asset Management Reinsurance Partners, Ltd., Class A | 334 | 18,512 | |

| Brookfield Asset Management, Inc., Class A | 55,713 | 2,985,348 | |

| BRP, Inc. | 1,369 | 126,718 | |

| CAE, Inc.(1) | 12,105 | 361,640 | |

| Canadian Imperial Bank of Commerce(2) | 16,636 | 1,851,947 | |

| Canadian National Railway Co.(2) | 29,609 | 3,431,240 | |

| Canadian Pacific Railway, Ltd. | 27,710 | 1,809,485 | |

| Canadian Tire Corp., Ltd., Class A | 2,243 | 313,871 | |

| CCL Industries, Inc., Class B | 6,028 | 312,203 | |

| CGI, Inc.(1) | 9,073 | 770,696 | |

| Constellation Software, Inc. | 784 | 1,284,396 | |

| Dollarama, Inc. | 11,007 | 477,439 | |

| Empire Co., Ltd. | 6,989 | 212,992 | |

| FirstService Corp. | 1,634 | 295,426 | |

| George Weston, Ltd.(2) | 3,499 | 377,415 | |

| GFL Environmental, Inc. | 7,802 | 290,065 | |

| Gildan Activewear, Inc. | 7,981 | 291,616 | |

| Great-West Lifeco, Inc. | 9,759 | 296,946 | |

| Hydro One, Ltd.(3) | 13,919 | 329,019 | |

| IGM Financial, Inc.(2) | 2,863 | 102,282 | |

| Intact Financial Corp. | 5,695 | 753,039 | |

| Loblaw Cos., Ltd. | 7,551 | 518,185 | |

| Lundin Mining Corp. | 61,547 | 442,676 | |

| Magna International, Inc. | 11,738 | 883,167 | |

| Manulife Financial Corp. | 73,690 | 1,418,413 | |

| Metro, Inc. | 11,228 | 548,635 | |

| National Bank of Canada | 12,179 | 935,396 | |

| Northland Power, Inc.(2) | 9,501 | 298,547 | |

| Security | Shares | Value | |

| Canada (continued) | |||

| Nutrien, Ltd.(2) | 23,290 | $ 1,511,662 | |

| Open Text Corp. | 10,343 | 504,819 | |

| Power Corp. of Canada(2) | 20,037 | 660,465 | |

| Quebecor, Inc., Class B | 6,493 | 156,917 | |

| Rogers Communications, Inc., Class B | 14,766 | 689,570 | |

| Royal Bank of Canada | 47,296 | 4,706,075 | |

| Saputo, Inc. | 11,212 | 285,124 | |

| Shaw Communications, Inc., Class B | 18,446 | 536,224 | |

| Shopify, Inc., Class A(1) | 3,744 | 5,076,040 | |

| Sun Life Financial, Inc.(2) | 22,334 | 1,149,674 | |

| TELUS Corp. | 17,731 | 389,729 | |

| TFI International, Inc. | 3,514 | 359,501 | |