Municipal bonds generally produced positive total returns over the reporting period due to falling interest rates and demand supported by investors’ desire for tax-free income. The fund underperformed the Index, primarily due to hedging activity.

Over the reporting period, several shifts in investor sentiment and behavior occurred. During September 2018, markets were still enjoying momentum from strong summer 2018 returns, despite continued concerns over trade disputes, geopolitical disagreements and the possibility of slowing global growth. In October 2018, the U.S. Federal Reserve (the “Fed”) made comments that led investors to believe it was set to proceed down a hawkish trajectory in terms of 2019 interest-rate hikes. This, along with softness in earnings of cyclical companies, increasing corporate leverage, and continued global political uncertainty unnerved investors and sparked a period of volatility that lasted throughout the fourth quarter of 2018.

Investor sentiment and market performance shifted once again in January 2019 after comments by the Fed, which emphasized its focus on data as a driver for rate-hike decisions and its ability to suspend additional rate increases when the data is not supportive. After the Federal Open Market Committee (FOMC) meeting, spreads narrowed and risk asset valuations recovered. Prices of fixed-income instruments continued to rally throughout much of the latter half of the period, with high yield securities outperforming much of the broader market. Corporate earnings were generally in line with expectations, and the performance of cyclical sector debt, such as automobile, energy and chemical companies, has continued to improve since the end of 2018. At its July 2019 meeting, the Fed continued its accommodative policies by cutting the federal funds rate by 25 basis points. Throughout much of 2019, rates generally fell, and the Treasury and municipal yield curves flattened.

The financial condition of Pennsylvania has stabilized throughout the last several years due to an improved budgetary process. This has reassured investors, and the state spreads have narrowed. Pennsylvania enjoys a diverse economy, which helps to provide steady revenues.

The fund’s performance relative to the Index was hindered during the reporting period due in part to hedging activity, which was one of the largest detractors from relative performance during the 12 months. The fund utilizes interest-rate futures, which had a material effect on performance during the period. An overweight to shorter-maturity bonds also detracted. In addition, positioning within pre-refunded debt provided a headwind to results, as did a small cash position. Shorter duration and maturity positioning within bonds issued by New Jersey, Illinois, and Puerto Rico also detracted relative to the Index.

Conversely, its concentrated exposure to bonds issued by Pennsylvania was beneficial to portfolio performance. Investments in AA, A and AAA rated debt also contributed. An overweight to bonds maturing between 2034 and 2038 bolstered results, along with duration positioning and issue selection within local general obligation, education and health care bonds. Transportation credits also benefited returns.

As we watch economic growth rates moderate, we remain guarded and are keeping an eye on global events and dynamics. We believe that the U.S. continues to be tethered to global interest rates. As non-U.S. sovereign rates stay low, so do rates in the U.S. We think this trend will persist, with the Fed possibly continuing to unwind its previous rate increases throughout the rest of 2019. It is our opinion that rates will stay range-bound, but the yield curve may steepen. In this environment, we feel it is prudent to maintain neutral duration positioning to potentially help mitigate the impact of interest-rate changes on relative performance. In aiming for this goal, we have been reducing our exposure to bonds with zero-to-three-year maturity profiles and 20+ year maturity profiles.

For the period from September 1, 2018 through August 31, 2019, as provided by Mary Collette O’Brien and Stephen J. O’Brien, portfolio managers

Market and Fund Performance Overview

For the 12-month period ended August 31, 2019, BNY Mellon Massachusetts Intermediate Municipal Bond Fund’s Class M shares produced a total return of 8.28%, and Investor shares produced a total return of 7.93%.1 In comparison, the fund’s benchmark index, the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”), produced a total return of 8.42%,2 and the fund’s former benchmark, the S&P Municipal Bond Intermediate Index, produced a total return of 8.41% for the same period.3,4

Municipal bonds generally produced positive total returns over the reporting period due to falling interest rates and demand supported by investors’ desire for tax-free income. The fund underperformed the Index, primarily due to hedging activity.

The Fund’s Investment Approach

The fund seeks as high a level of income exempt from federal and Massachusetts state income taxes as is consistent with the preservation of capital. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in municipal bonds that provide income exempt from federal and Massachusetts state personal income taxes. The fund’s investments in municipal and taxable bonds must be rated investment grade (i.e., Baa/BBB or higher) at the time of purchase or, if unrated, deemed of comparable quality by the investment adviser.5 Generally, the fund’s average effective portfolio maturity will be between three and ten years and the average effective duration of the fund’s portfolio will not exceed eight years.

A Tale of Two Markets

Over the reporting period, several shifts in investor sentiment and behavior occurred. During September 2018, markets were still enjoying momentum from strong summer 2018 returns, despite continued concerns over trade disputes, geopolitical disagreements and the possibility of slowing global growth. In October 2018, the U.S. Federal Reserve (the “Fed”) made comments that led investors to believe it was set to proceed down a hawkish trajectory in terms of 2019 rate hikes. This, along with softness in earnings of cyclical companies, increasing corporate leverage, and continued global political uncertainty unnerved investors and sparked a period of volatility that lasted throughout the fourth quarter of 2018.

Investor sentiment and market performance shifted once again in January 2019 after comments by the Fed, which emphasized its focus on data as a driver for rate-hike decisions and its ability to suspend additional rate increases when the data is not supportive. After the Fed’s meeting, spreads narrowed and risk asset valuations recovered. Prices of fixed income instruments continued to rally throughout much of the latter half of the period, with high yield securities outperforming much of the broader market. Corporate earnings were generally in line with expectations, and the performance of cyclical sector debt such as automobile, energy and chemical companies, has continued to improve since the end of 2018. At its July 2019 meeting, the Fed continued its accommodative policies by cutting the federal funds rate by 25 basis points. Throughout much of 2019, rates generally fell, and the Treasury and municipal yield curves flattened.

Massachusetts is doing well from an economic and credit perspective. Revenue increases have been mitigating budgetary strains. The state benefits from diversified sources of revenue. Challenges remain regarding pension funding, but increased revenue flows have improved funding rates. Fiscal discipline keeps the state in a healthy financial condition.

Hedging Activity Dampens Fund Results

The fund’s performance relative to the Index was hindered during the reporting period due in part to hedging activity, which was one of the largest detractors from relative performance during the 12 months. The fund utilizes interest-rate futures, which had a material effect on performance during the period. An overweight to shorter-maturity bonds also detracted. A small cash position provided a headwind to returns, as did shorter-duration positioning within the transportation sector, bonds issued by New Jersey, and investments in A rated credit.

Conversely, the fund’s concentrated exposure to bonds issued by Massachusetts was beneficial to portfolio performance along with securities in the BBB rating category. An overweight to bonds maturing between 2034 and 2038 bolstered results, along with positioning in education, health care, utility and Industrial Development Revenue/Pollution Control Revenue (IDR/PCR).

Constructively Positioned for Low Rates

As we watch economic growth rates moderate, we remain guarded and are keeping an eye on global events and dynamics. We believe that the U.S. continues to be tethered to global interest rates. As non-U.S. sovereign rates stay low, so do rates in the U.S. We think this trend will persist, with the Fed possibly continuing to unwind its previous rate increases throughout the rest of 2019. It is our opinion that rates will stay range-bound, but the yield curve may steepen. In this environment, we feel it is prudent to maintain neutral duration positioning to potentially help mitigate the impact of interest-rate changes on relative performance. In aiming for this goal, we have been reducing our exposure to bonds with zero-to-three-year maturity profiles and 20+ year maturity profiles.

September 16, 2019

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes for non-Massachusetts residents, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are taxable.

2 Source: Bloomberg L.P. — The S&P Municipal Bond Investment Grade Intermediate Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard & Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The S&P Municipal Bond Intermediate Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Investors cannot invest directly in any index.

4 The S&P Municipal Bond Investment Grade Intermediate Index was first calculated on March 19, 2013. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period.

5 The fund may continue to own investment-grade bonds (at the time of purchase), which are subsequently downgraded to below investment grade.

Bonds are subject generally to interest-rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines. The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the fund’s investments in municipal bonds. Other factors include the general conditions of the municipal bond market, the size of the particular offering, the maturity of the obligation, and the rating of the issue. Changes in economic, business, or political conditions relating to a particular municipal project, municipality, or state in which the fund invests may have an impact on the fund’s share price.

The fund may use derivative instruments, such as options, futures, options on futures, forward contracts, and swaps. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

7

DISCUSSION OF FUND PERFORMANCE(Unaudited) (continued)

For the period from September 1, 2018 through August 31, 2019, as provided by John F. Flahive and Gregory J. Conant, portfolio managers

Market and Fund Performance Overview

For the 12-month period ended August 31, 2019, BNY Mellon New York Intermediate Tax-Exempt Bond Fund’s Class M shares produced a total return of 8.28%, and Investor shares produced a total return of 8.00%.1 In comparison, the fund’s benchmark index, the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”), produced a total return of 8.42%,2 and the fund’s former benchmark, the S&P Municipal Bond Intermediate Index, produced a total return of 8.41% for the same period.3,4

Municipal bonds generally produced positive total returns over the reporting period due to falling interest rates and demand supported by investors’ desire for tax-free income. The fund underperformed the Index, primarily due to hedging activities.

The Fund’s Investment Approach

The fund seeks as high a level of income exempt from federal, New York state and New York city income taxes as is consistent with the preservation of capital. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in municipal bonds that provide income exempt from federal, New York state and New York city personal income taxes. These municipal bonds include those issued by New York state and New York City as well as those issued by territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, or multistate agencies and authorities, and certain other specified securities. Generally, the fund’s average effective portfolio maturity will be between three and ten years.

A Tale of Two Markets

Over the reporting period, several shifts in investor sentiment and behavior occurred. During September 2018, markets were still enjoying momentum from strong summer 2018 returns, despite continued concerns over trade disputes, geopolitical disagreements and the possibility of slowing global growth. In October 2018, the U.S. Federal Reserve (the “Fed”) made comments that led investors to believe it was set to proceed down a hawkish trajectory in terms of 2019 interest-rate hikes. This, along with softness in earnings of cyclical companies, increasing corporate leverage, and continued global political uncertainty unnerved investors and sparked a period of volatility that lasted throughout the fourth quarter of 2018.

Investor sentiment and market performance shifted once again in January 2019 after comments by the Fed, which emphasized its focus on data as a driver for rate-hike decisions and its ability to suspend additional rate increases when the data is not supportive. After the Federal Open Market Committee (FOMC) meeting, spreads narrowed and risk asset valuations recovered. Prices of fixed-income instruments continued to rally throughout much of the latter half of the period, with high yield securities outperforming much of the broader market. Corporate earnings were generally in line with expectations, and the performance of cyclical sector debt, such as automobile, energy and chemical companies, has continued to improve since the end of 2018. At its July 2019 meeting, the Fed continued its accommodative policies by cutting the federal funds rate by 25 basis points. Throughout much of 2019, rates generally fell, and the Treasury and municipal yield curves flattened.

New York’s fiscal condition continues to benefit from a diverse economy. The state also employs strong fiscal controls and relatively high funding requirements for public pensions, when compared with other states. New York boasts a long history of being supportive to its bondholders and continues to enjoy an AA rating.

Hedging Activity Dampens Fund Results

The fund’s performance relative to the Index was hindered during the reporting period due in part to hedging activity, which was one of the largest detractors from relative performance during the 12 months. The fund utilizes futures, which had a material effect on performance during the period. An overweight to shorter-maturity bonds also detracted. A small cash position provided a headwind to returns, as did its shorter-duration positioning within transportation and housing debt. Shorter duration and maturity positioning within bonds issued by New Jersey, Illinois, and Puerto Rico also detracted relative to the Index.

Conversely, its concentrated exposure to bonds issued by New York was beneficial to portfolio performance. Investments in AA rated debt were standout contributors, but all credit qualities yielded positive performance for the period. An overweight to bonds maturing between 2034 and 2038 also bolstered results, along with positioning in tax-supported, education and utility debt.

Constructively Positioned for Low Rates

As we watch economic growth rates moderate, we remain guarded and are keeping an eye on global events and dynamics. We believe that the U.S. continues to be tethered to global interest rates. As non-U.S. sovereign rates stay low, so do rates in the U.S. We think this trend will persist, with the Fed possibly continuing to unwind its previous rate increases throughout the rest of 2019. It is our opinion that rates will stay range-bound, but the yield curve may steepen. In this environment, we feel it is prudent to maintain neutral duration positioning to potentially help mitigate the impact of interest-rate changes on relative performance. In aiming for this goal, we have been reducing our exposure to bonds with zero-to-three-year maturity profiles and 20+ year maturity profiles.

September 16, 2019

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes for non-New York residents, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable. The fund’s returns reflect the absorption of certain fund expenses by BNY Mellon Fund Advisers pursuant to an agreement in effect through December 31, 2019, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Bloomberg L.P. — The S&P Municipal Bond Investment Grade Intermediate Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard & Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The S&P Municipal Bond Intermediate Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, neither index is subject to charges, fees, and other expenses and is not limited to investments principally in New York municipal obligations. Investors cannot invest directly in any index.

4 The S&P Municipal Bond Investment Grade Intermediate Index was first calculated on March 19, 2013. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period.

Bonds are subject generally to interest-rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

The fund may use derivative instruments, such as options, futures, options on futures, forward contracts, and swaps. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

8

For the period from September 1, 2018 through August 31, 2019, as provided by John F. Flahive, portfolio manager

Market and Fund Performance Overview

For the 12-month period ended August 31, 2019, BNY Mellon Municipal Opportunities Fund’s Class M shares produced a total return of 7.77%, and Investor shares produced a total return of 7.50%.1 In comparison, the fund’s benchmark, the Bloomberg Barclays U.S. Municipal Bond Index (the “Index”), produced a total return of 8.72% for the same period.2

Municipal bonds generally produced positive total returns over the reporting period due to falling interest rates and demand supported by investors’ desire for tax-free income. The fund underperformed the Index for the period, partly due to the hedging activity of the fund.

The Fund’s Investment Approach

The fund seeks to maximize total return consisting of high current income exempt from federal income tax and capital appreciation. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in U.S. dollar-denominated, fixed-income securities that provide income exempt from federal income tax (municipal bonds). While the fund typically invests in a diversified portfolio of municipal bonds, it may invest up to 20% of its assets in taxable fixed-income securities, including taxable municipal bonds and non-U.S. dollar-denominated, foreign-debt securities, such as Brady bonds and sovereign debt obligations.

The fund’s portfolio manager seeks to deliver value-added excess returns (“alpha”) by applying an investment approach designed to identify and exploit relative value opportunities within the municipal bond market and other fixed-income markets. Although the fund seeks to be diversified by geography and sector, the fund may at times invest a significant portion of its assets in a particular state or region or in a particular sector due to market conditions.

A Tale of Two Markets

Over the reporting period, several shifts in investor sentiment and behavior occurred. During September 2018, markets were still enjoying momentum from strong summer 2018 returns, despite continued concerns over trade disputes, geopolitical disagreements and the possibility of slowing global growth. In October 2018, the U.S. Federal Reserve (the “Fed”) made comments that led investors to believe it was set to proceed down a hawkish trajectory in terms of 2019 interest-rate hikes. This, along with softness in earnings of cyclical companies, increasing corporate leverage, and continued global political uncertainty, unnerved investors and sparked a period of volatility that lasted throughout the fourth quarter of 2018.

Investor sentiment and market performance shifted once again in January 2019 after comments by the Fed, which emphasized its focus on data as a driver for rate-hike decisions and its ability to suspend additional rate increases when the data is not supportive. After the Fed’s meeting, spreads narrowed, and risk asset valuations recovered. Prices of fixed-income instruments continued to rally throughout much of the latter half of the period, with high yield securities outperforming much of the broader market. Corporate earnings were generally in line with expectations, and the performance of cyclical sector debt, such as automobile, energy and chemical companies, has continued to improve since the end of 2018. At its July 2019 meeting, the Fed continued its accommodative policies by cutting the federal funds rate by 25 basis points. Throughout much of the latter half of the period, rates generally fell, and the Treasury yield curve flattened.

Hedging Activity Dampens Fund Results

The fund’s performance relative to the Index was hindered during the reporting period due in part to hedging activity, which was one of the largest detractors from relative performance during the 12 months. The fund utilizes interest-rate swaps and futures, which had a material effect on performance during the period. In addition, an out-of-index position in bonds that matured in 2018 provided a drag on results, as did a cash position. An overweight to bonds issued by Texas also produced a headwind during the period.

Conversely, investments in AA and A rated debt were beneficial to portfolio performance, due primarily to successful duration positioning and issue selection. A generous overweight to BBB rated securities also provided a tailwind to results. Bonds issued by California, New York, Massachusetts and Puerto Rico also bolstered returns. An overweight to bonds maturing in 2039 and beyond also helped.

Constructively Positioned for Low Rates

As we watch economic growth rates moderate, we remain guarded and are keeping an eye on global events and dynamics. We believe that the U.S. continues to be tethered to global interest rates. As non-U.S. sovereign rates stay low, so do rates in the U.S. We think this trend will persist, with the Fed possibly continuing to unwind its previous rate increases throughout the rest of 2019. It is our opinion that rates will stay range-bound, but the yield curve may steepen. In this environment, we feel it is prudent to maintain neutral duration positioning to potentially help mitigate the impact of interest-rate changes on relative performance.

September 16, 2019

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable.

2 Source: Lipper Inc. — The Bloomberg Barclays U.S. Municipal Bond Index covers the U.S. dollar-denominated, long-term, tax-exempt bond market. Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

The fund may use derivative instruments, such as options, futures, options on futures, forward contracts and swaps. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets

9

FUND PERFORMANCE(Unaudited)

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon National Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Intermediate Index (the “Index”)

| | | | |

Average Annual Total Returnsas of 8/31/19 | | | |

| | 1 Year | 5 Years | 10 Years |

Class M shares | 8.26% | 3.14% | 3.83% |

Investor shares | 7.92% | 2.87% | 3.57% |

S&P Municipal Bond Intermediate Index | 8.41% | 3.50% | 4.38% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon National Intermediate Municipal Bond Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date.All dividends and capital gain distributions are reinvested.

Effective 7/1/2013, the fund changed its benchmark from the S&P Municipal Bond Intermediate Index to the S&P Municipal Bond Investment Grade Intermediate Index because the new benchmark index is more reflective of the credit quality of the fund’s portfolio holdings. The S&P Municipal Bond Investment Grade Intermediate Index was launched on 3/19/13. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period. Performance information for the fund versus the S&P Municipal Bond Investment Grade Intermediate Index is included in the graph and table on the next page.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of three years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

10

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon National Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | Inception Date | 1 Year | 5 Years | From Inception |

Class M shares | 7/1/13 | 8.26% | 3.14% | 3.46% |

Investor shares | 7/1/13 | 7.92% | 2.87% | 3.19% |

S&P Municipal Bond Investment Grade Intermediate Index | 7/1/13 | 8.42% | 3.43% | 3.93%††† |

†† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon National Intermediate Municipal Bond Fund on 7/1/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard& Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

††† For comparative purposes, the value of the Index on 6/30/13 is used as the beginning value on 7/1/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

11

FUND PERFORMANCE(Unaudited) (continued)

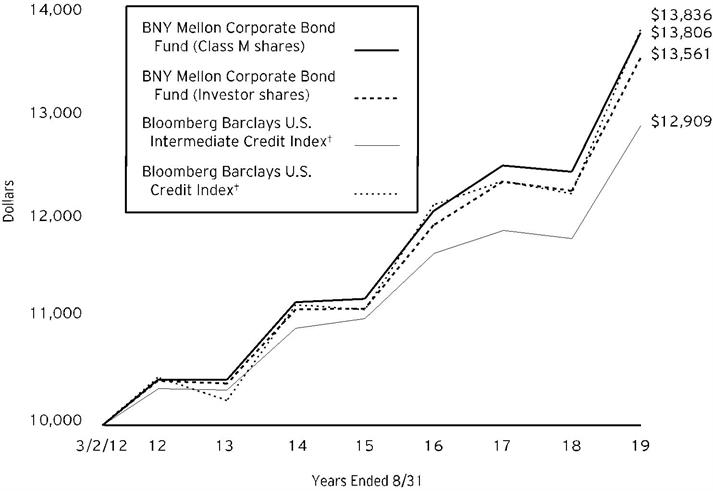

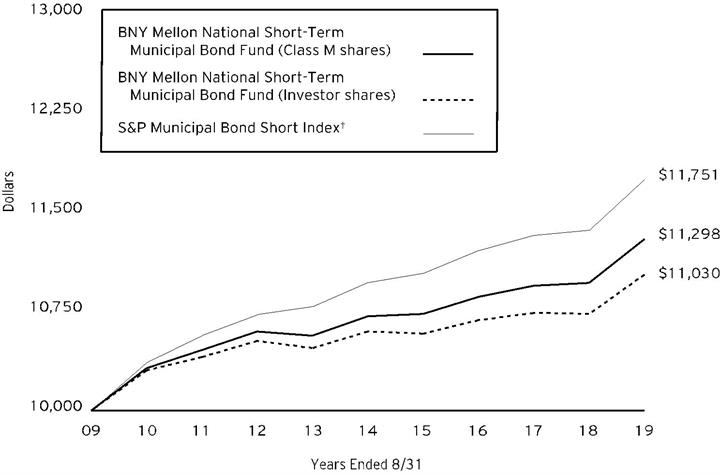

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon National Short-Term Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Short Index (the “Index”)

| | | | |

Average Annual Total Returnsas of 8/31/19 | | | |

| | 1 Year | 5 Years | 10 Years |

Class M shares | 3.03% | 1.07% | 1.23% |

Investor shares | 2.78% | 0.80% | 0.99% |

S&P Municipal Bond Short Index | 3.39% | 1.38% | 1.63% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon National Short-Term Municipal Bond Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Effective 7/1/2013, the fund changed its benchmark from the S&P Municipal Bond Short Index to the S&P Municipal Bond Investment Grade Short Index because the new benchmark index is more reflective of the credit quality of the fund’s portfolio holdings. The S&P Municipal Bond Investment Grade Short Index was launched on 3/19/13. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Short Index until the S&P Municipal Bond Investment Grade Short Index has been calculated for a 10-year period. Performance information for the fund versus the S&P Municipal Bond Investment Grade Short Index is included in the graph and table on the next page.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of six months and a maximum maturity of up to, but not including, four years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

12

Comparison of change in value of a $10,000 investment in Fund Class M shares and Investor shares of BNY Mellon National Short-Term Municipal Bond with a hypothetical investment of $10,000 in the S&P Municipal Bond Investment Grade Short Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | Inception Date | 1 Year | 5 Years | From Inception |

Class M shares | 7/1/13 | 3.03% | 1.07% | 1.11% |

Investor shares | 7/1/13 | 2.78% | 0.80% | 0.86% |

S&P Municipal Bond Investment Grade Short Index | 7/1/13 | 3.36% | 1.35% | 1.40%††† |

†† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon National Short-Term Municipal Bond Fund on 7/1/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard& Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. For the avoidance of doubt, the lowest rating is used in determining if a bond is eligible for the index. S&P Dow Jones Indices looks at the long term rating, either insured or uninsured, and the underlying rating for index inclusion. Bonds that are pre-refunded or escrowed to maturity are included in this index. All bonds must also have a minimum maturity of six months and a maximum maturity of up to, but not including, four years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

††† For comparative purposes, the value of the Index on 6/30/13 is used as the beginning value on 7/1/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

13

FUND PERFORMANCE(Unaudited) (continued)

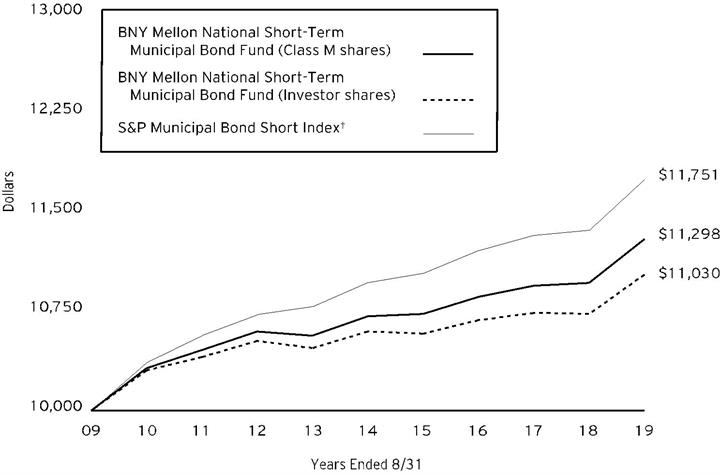

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon Pennsylvania Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Intermediate Index (the “Index”)

| | | | |

Average Annual Total Returnsas of 8/31/19 | | | |

| | 1 Year | 5 Years | 10 Years |

Class M shares | 8.09% | 3.06% | 3.47% |

Investor shares | 7.83% | 2.79% | 3.21% |

S&P Municipal Bond Intermediate Index | 8.41% | 3.50% | 4.38% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon Pennsylvania Intermediate Municipal Bond Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Effective 7/1/2013, the fund changed its benchmark from theS&P Municipal Bond Intermediate Index to the S&P Municipal Bond Investment Grade Intermediate Index because the new benchmark index is more reflective of the credit quality of the fund’s portfolio holdings. The S&PMunicipal Bond Investment Grade Intermediate Index was launched on 3/19/13. Accordingly, the fund will continue to report the performance of theS&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period. Performance information for the fund versus the S&P Municipal Bond Investment Grade Intermediate Index is included in the graph and table on the next page.

Unlike the Index, the fund invests primarily in Pennsylvania investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of three years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

14

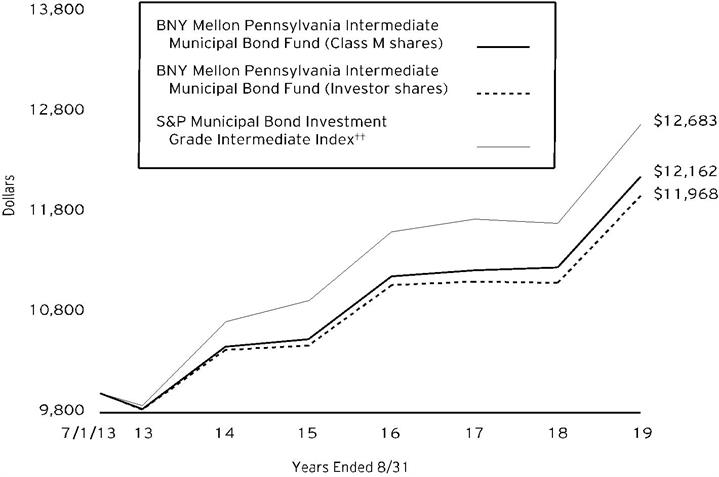

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon Pennsylvania Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | Inception Date | 1 Year | 5 Years | From Inception |

Class M shares | 7/1/13 | 8.09% | 3.06% | 3.22% |

Investor shares | 7/1/13 | 7.83% | 2.79% | 2.95% |

S&P Municipal Bond Investment Grade Intermediate Index | 7/1/13 | 8.42% | 3.43% | 3.93%††† |

†† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon Pennsylvania Intermediate Municipal Bond Fund on 7/1/13 to a hypothetical investment of $10,000 made in the Index on that date.All dividends and capital gain distributions are reinvested.

Unlike the Index, the fund invests primarily in Pennsylvania investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard&Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

††† For comparative purposes, the value of the Index on 6/30/13 is used as the beginning value on 7/1/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

15

FUND PERFORMANCE(Unaudited) (continued)

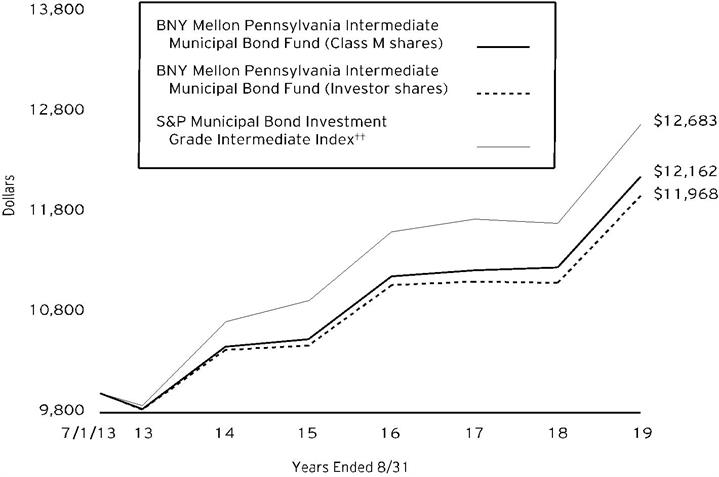

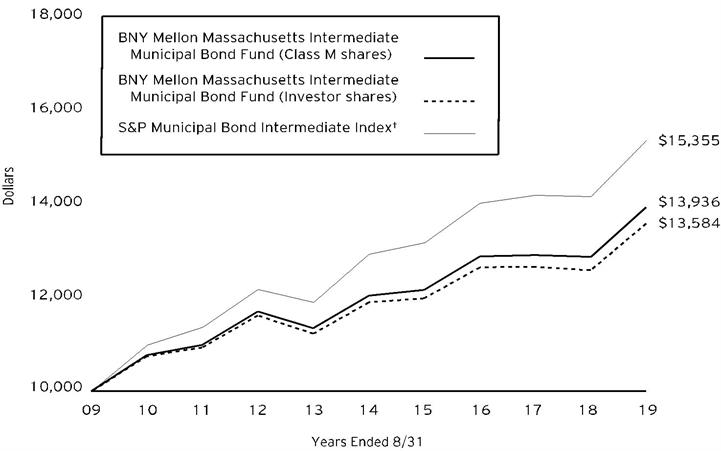

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon Massachusetts Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Intermediate Index (the “Index”)

| | | | |

Average Annual Total Returnsas of 8/31/19 | | | |

| | 1 Year | 5 Years | 10 Years |

Class M shares | 8.28% | 2.96% | 3.38% |

Investor shares | 7.93% | 2.68% | 3.11% |

S&P Municipal Bond Intermediate Index | 8.41% | 3.50% | 4.38% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon Massachusetts Intermediate Municipal Bond Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Effective 7/1/2013, the fund changed its benchmark from the S&P Municipal Bond Intermediate Index to the S&P Municipal Bond Investment Grade Intermediate Index because the new benchmark index is more reflective of the credit quality of the fund’s portfolio holdings. The S&P Municipal Bond Investment Grade Intermediate Index was first calculated on 3/19/13. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period. Performance information for the fund versus the S&P Municipal Bond Investment Grade Intermediate Index is included in the graph and table on the next page.

Unlike the Index, the fund invests primarily in Massachusetts investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of three years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

16

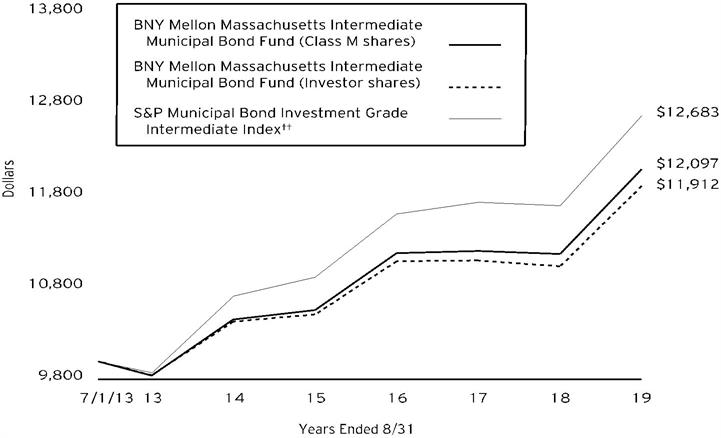

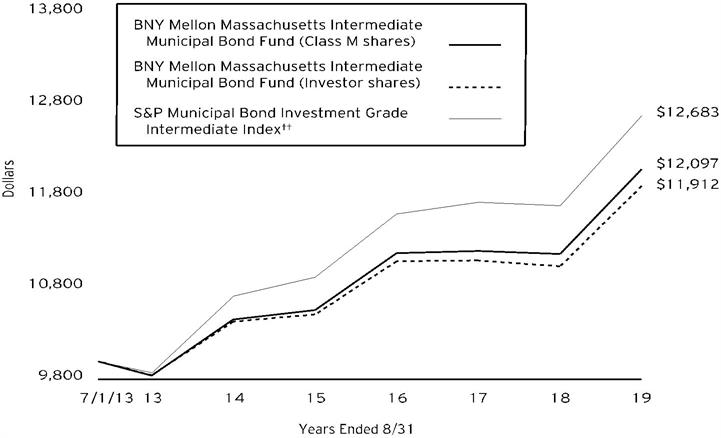

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon Massachusetts Intermediate Municipal Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | Inception Date | 1 Year | 5 Years | From Inception |

Class M shares | 7/1/13 | 8.28% | 2.96% | 3.13% |

Investor shares | 7/1/13 | 7.93% | 2.68% | 2.88% |

S&P Municipal Bond Investment Grade Intermediate Index | 7/1/13 | 8.42% | 3.43% | 3.93%††† |

†† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon Massachusetts Intermediate Municipal Bond Fund on 7/1/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Unlike the Index, the fund invests primarily in Massachusetts investment-grade municipal bonds. The fund invests primarily in Massachusetts investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard& Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

††† For comparative purposes, the value of the Index on 6/30/13 is used as the beginning value on 7/1/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

17

FUND PERFORMANCE(Unaudited) (continued)

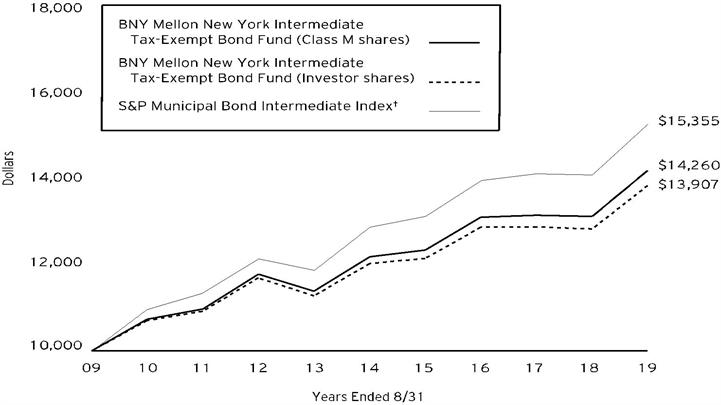

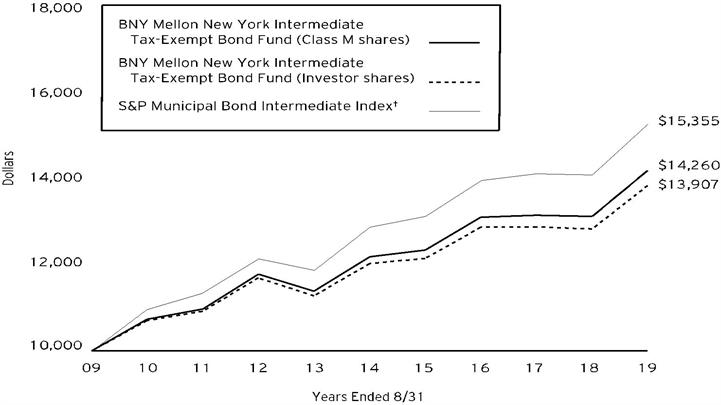

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon New York Intermediate Tax-Exempt Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Intermediate Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | 1 Year | | 5 Years | 10 Years |

Class M shares | 8.28% | | 3.14% | 3.61% |

Investor shares | 8.00% | | 2.88% | 3.35% |

S&P Municipal Bond Intermediate Index | 8.41% | | 3.50% | 4.38% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon New York Intermediate Tax-Exempt Bond Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Effective 7/1/2013, the fund changed its benchmark from the S&P Municipal Bond Intermediate Index to the S&P Municipal Bond Investment Grade Intermediate Index because the new benchmark index is more reflective of the credit quality of the fund’s portfolio holdings. The S&P Municipal Bond Investment Grade Intermediate Index was launched on 3/19/13. Accordingly, the fund will continue to report the performance of the S&P Municipal Bond Intermediate Index until the S&P Municipal Bond Investment Grade Intermediate Index has been calculated for a 10-year period. Performance information for the fund versus the S&P Municipal Bond Investment Grade Intermediate Index is included in the graph and table on the next page.

As of the close of business on September 12, 2008, substantially all of the assets of another investment company advised by an affiliate of the fund’s investment adviser, BNY Hamilton New York Intermediate Tax-Exempt Fund (the “predecessor fund”), a series of BNY Hamilton Funds, Inc., were transferred to BNY Mellon New York Intermediate Tax-Exempt Bond Fund in a tax-free reorganization and the fund commenced operations. The performance figures for the fund’s Class M shares represent the performance of the predecessor fund’s Institutional shares prior to the commencement of operations for BNY Mellon New York Intermediate Tax-Exempt Bond Fund and the performance of BNY Mellon New York Intermediate Tax-Exempt Bond Fund’s Class M shares thereafter. The performance figures for Investor shares represent the performance of the predecessor fund’s Class A shares prior to the commencement of operations for BNY Mellon New York Intermediate Tax-Exempt Bond Fund and the performance of BNY Mellon New York Intermediate Tax-Exempt Bond Fund’s Investor shares thereafter. Investor shares are subject to a Shareholder Services Plan.

Unlike the Index, the fund invests primarily in New York investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of three years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

18

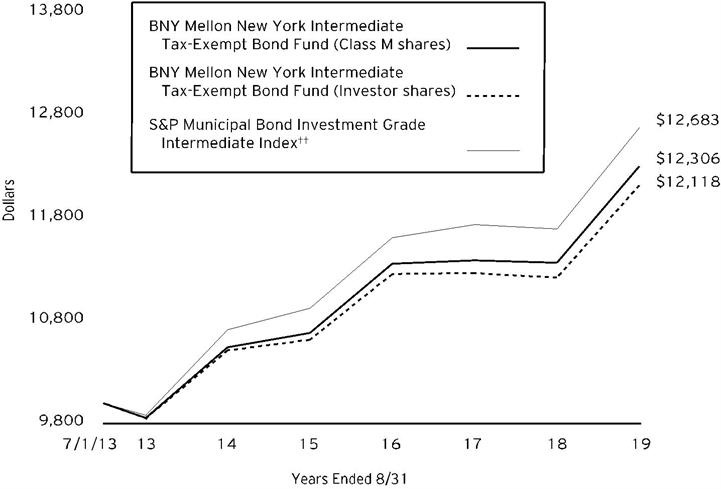

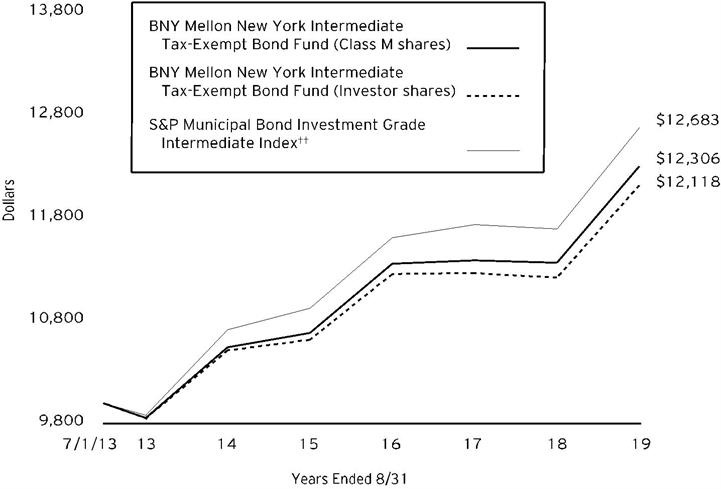

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon New York Intermediate Tax-Exempt Bond Fund with a hypothetical investment of $10,000 in the S&P Municipal Bond Investment Grade Intermediate Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | Inception Date | 1 Year | 5 Years | From Inception |

Class M shares | 7/1/13 | 8.28% | 3.14% | 3.42% |

Investor shares | 7/1/13 | 8.00% | 2.88% | 3.16% |

S&P Municipal Bond Investment Grade Intermediate Index | 7/1/13 | 8.42% | 3.43% | 3.93%††† |

†† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon New York Intermediate Tax-Exempt Bond Fund on 7/1/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

Unlike the Index, the fund invests primarily in New York investment-grade municipal bonds. The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by Standard&Poor’s, Baa3 by Moody’s or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of 3 years and a maximum maturity of up to, but not including, 15 years as measured from the rebalancing date. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

††† For comparative purposes, the value of the Index on 6/30/13 is used as the beginning value on 7/1/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

19

FUND PERFORMANCE(Unaudited) (continued)

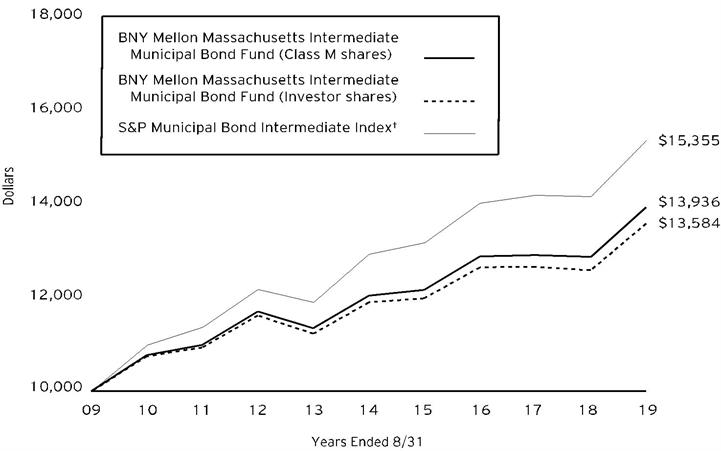

Comparison of change in value of a $10,000 investment in Class M shares and Investor shares of BNY Mellon Municipal Opportunities Fund with a hypothetical investment of $10,000 in the Bloomberg Barclays U.S. Municipal Bond Index (the “Index”)

| | | | | |

Average Annual Total Returnsas of 8/31/19 | | | | |

| | | 1 Year | 5 Year | 10 Years |

Class M shares | | 7.77% | 4.32% | 5.67% |

Investor shares | | 7.50% | 4.07% | 5.42% |

Bloomberg Barclays U.S. Municipal Bond Index | | 8.72% | 3.85% | 4.62% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class M and Investor shares of BNY Mellon Municipal Opportunities Fund on 8/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class M and Investor shares. The Index covers the U.S. dollar-denominated long-term tax-exempt bond market. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

20

UNDERSTANDING YOUR FUND’S EXPENSES(Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in each class of each fund from March 1, 2019 to August 31, 2019. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | | | | | | | | | |

assuming actual returns for the six months ended August 31, 2019 | | | | | | | | | |

| | | | | | | | | Class M | | | | | | Investor Shares | | |

BNY Mellon National Intermediate

Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.59 | | | | | | $3.89 | | |

Ending value (after expenses) | | | | | | | $1,058.50 | | | | | | $1,056.50 | | |

Annualized expense ratio (%) | | | | | | | .50 | | | | | | .75 | | |

BNY Mellon National Short-Term

Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.55 | | | | | | $3.82 | | |

Ending value (after expenses) | | | | | | | $1,020.10 | | | | | | $1,018.80 | | |

Annualized expense ratio (%) | | | | | | | .50 | | | | | | .75 | | |

BNY Mellon Pennsylvania

Intermediate Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.63 | | | | | | $4.92 | | |

Ending value (after expenses) | | | | | | | $1,056.00 | | | | | | $1,054.00 | | |

Annualized expense ratio (%) | | | | | | | .70 | | | | | | .95 | | |

BNY Mellon Massachusetts

Intermediate Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.75 | | | | | | $4.04 | | |

Ending value (after expenses) | | | | | | | $1,057.10 | | | | | | $1,055.00 | | |

Annualized expense ratio (%) | | | | | | | .53 | | | | | | .78 | | |

BNY Mellon New York

Intermediate Tax-Exempt Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.06 | | | | | | $4.35 | | |

Ending value (after expenses) | | | | | | | $1,058.20 | | | | | | $1,056.80 | | |

Annualized expense ratio (%) | | | | | | | .59 | | | | | | .84 | | |

BNY Mellon Municipal

Opportunities Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.74 | | | | | | $5.03 | | |

Ending value (after expenses) | | | | | | | $1,060.00 | | | | | | $1,058.60 | | |

Annualized expense ratio (%) | | | | | | | .72 | | | | | | .97 | | |

† Expenses are equal to each fund’s annualized expense ratios as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

21

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)(continued)

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS(Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | | | | | | | |

assuming a hypothetical 5% annualized return for the six months ended August 31, 2019 | | | |

| | | | | | | | | Class M | | | | | | Investor Shares | | |

BNY Mellon National Intermediate

Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.55 | | | | | | $3.82 | | |

Ending value (after expenses) | | | | | | | $1,022.68 | | | | | | $1,021.42 | | |

Annualized expense ratio (%) | | | | | | | .50 | | | | | | .75 | | |

BNY Mellon National Short-Term

Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.55 | | | | | | $3.82 | | |

Ending value (after expenses) | | | | | | | $1,022.68 | | | | | | $1,021.42 | | |

Annualized expense ratio (%) | | | | | | | .50 | | | | | | .75 | | |

BNY Mellon Pennsylvania

Intermediate Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.57 | | | | | | $4.84 | | |

Ending value (after expenses) | | | | | | | $1,021.68 | | | | | | $1,020.42 | | |

Annualized expense ratio (%) | | | | | | | .70 | | | | | | .95 | | |

BNY Mellon Massachusetts

Intermediate Municipal Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $2.70 | | | | | | $3.97 | | |

Ending value (after expenses) | | | | | | | $1,022.53 | | | | | | $1,021.27 | | |

Annualized expense ratio (%) | | | | | | | .53 | | | | | | .78 | | |

BNY Mellon New York

Intermediate Tax-Exempt Bond Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.01 | | | | | | $4.28 | | |

Ending value (after expenses) | | | | | | | $1,022.23 | | | | | | $1,020.97 | | |

Annualized expense ratio (%) | | | | | | | .59 | | | | | | .84 | | |

BNY Mellon Municipal

Opportunities Fund | | | | | | | | | | | | | | | |

Expenses paid per $1,000† | | | | | | | $3.67 | | | | | | $4.94 | | |

Ending value (after expenses) | | | | | | | $1,021.58 | | | | | | $1,020.32 | | |

Annualized expense ratio (%) | | | | | | | .72 | | | | | | .97 | | |

† Expenses are equal to each fund’s annualized expense ratios as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

22

STATEMENT OF INVESTMENTS

August 31, 2019

| | | | | | | | | | |

| |

BNY Mellon National Intermediate Municipal Bond Fund |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 101.3% | | | | | |

Alabama - 1.1% | | | | | |

Alabama 21st Century Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 6/1/2021 | | 1,240,000 | | 1,317,624 | |

Alabama 21st Century Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 6/1/2020 | | 1,500,000 | | 1,540,800 | |

Auburn University, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 6/1/2030 | | 5,000,000 | | 5,998,450 | |

Black Belt Energy Gas District, Revenue Bonds, Refunding (Project No. 4) Ser. A1 | | 4.00 | | 12/1/2025 | | 16,500,000 | | 18,710,175 | |

| | 27,567,049 | |

Alaska - .5% | | | | | |

Alaska, GO, Ser. A | | 5.00 | | 8/1/2028 | | 5,560,000 | | 6,741,556 | |

Alaska Industrial Development & Export Authority, Revenue Bonds, Refunding (LOC; Bank of Tokyo-Mitsubishi UFJ) | | 1.39 | | 4/1/2034 | | 100,000 | a | 100,000 | |

Alaska International Airports, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 10/1/2032 | | 5,000,000 | | 5,951,900 | |

| | 12,793,456 | |

Arizona - 2.6% | | | | | |

Arizona, COP, Refunding, Ser. A | | 5.00 | | 10/1/2026 | | 10,450,000 | | 13,150,175 | |

Arizona Industrial Development Authority, Revenue Bonds (Great Lakes Senior Living Community) Ser. A | | 5.00 | | 1/1/2029 | | 675,000 | | 834,077 | |

Arizona Industrial Development Authority, Revenue Bonds (Great Lakes Senior Living Community) Ser. A | | 5.00 | | 1/1/2025 | | 650,000 | | 757,497 | |

Arizona Industrial Development Authority, Revenue Bonds (Great Lakes Senior Living Community) Ser. A | | 5.00 | | 1/1/2028 | | 1,000,000 | | 1,223,680 | |

Arizona Industrial Development Authority, Revenue Bonds (Great Lakes Senior Living Community) Ser. A | | 5.00 | | 1/1/2026 | | 600,000 | | 713,370 | |

Arizona Industrial Development Authority, Revenue Bonds (Great Lakes Senior Living Community) Ser. A | | 5.00 | | 1/1/2027 | | 525,000 | | 635,098 | |

Maricopa County Industrial Development Authority, Revenue Bonds, Refunding (Banner Health Obligated Group) | | 5.00 | | 1/1/2034 | | 10,000,000 | | 12,269,700 | |

Maricopa County Industrial Development Authority, Revenue Bonds, Refunding (Banner Health Obligated Group) | | 5.00 | | 1/1/2027 | | 5,000,000 | | 6,305,550 | |

Maricopa County Special Health Care District, GO | | 5.00 | | 7/1/2035 | | 6,000,000 | | 7,540,500 | |

Maricopa County Special Health Care District, GO | | 5.00 | | 7/1/2029 | | 5,000,000 | | 6,458,750 | |

Mesa Utility System, Revenue Bonds, Refunding, Ser. B | | 4.00 | | 7/1/2033 | | 5,000,000 | | 5,522,650 | |

Phoenix Civic Improvement Corp., Revenue Bonds, Refunding, Ser. B | | 4.00 | | 7/1/2028 | | 10,000,000 | | 11,257,100 | |

| | 66,668,147 | |

California - 13.5% | | | | | |

Alameda Corridor Transportation Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. B | | 5.00 | | 10/1/2035 | | 2,050,000 | | 2,477,138 | |

Alameda Corridor Transportation Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 10/1/2036 | | 1,500,000 | | 1,783,245 | |

Anaheim Housing & Public Improvement Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 10/1/2036 | | 1,750,000 | | 1,985,813 | |

Anaheim Housing & Public Improvement Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 10/1/2035 | | 2,485,000 | | 2,823,358 | |

Bay Area Toll Authority, Revenue Bonds, Refunding | | 4.00 | | 4/1/2035 | | 10,000,000 | | 11,509,100 | |

Bay Area Toll Authority, Revenue Bonds, Refunding, Ser. A | | 2.63 | | 4/1/2026 | | 10,000,000 | | 10,845,900 | |

California, GO | | 5.25 | | 9/1/2029 | | 10,000,000 | | 11,602,800 | |

California, GO | | 5.25 | | 10/1/2039 | | 5,000,000 | | 6,155,200 | |

California, GO, Refunding | | 4.00 | | 9/1/2031 | | 10,000,000 | | 11,675,100 | |

California, GO, Refunding | | 5.00 | | 12/1/2023 | | 12,500,000 | | 14,558,500 | |

California, GO, Refunding | | 5.00 | | 12/1/2023 | | 2,500,000 | | 2,911,700 | |

California, GO, Refunding | | 5.00 | | 10/1/2029 | | 5,000,000 | | 6,179,700 | |

California, GO, Refunding | | 5.00 | | 10/1/2025 | | 5,000,000 | | 6,163,350 | |

California, GO, Refunding | | 5.00 | | 4/1/2033 | | 5,000,000 | | 5,813,500 | |

23

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

BNY Mellon National Intermediate Municipal Bond Fund (continued) |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 101.3% (continued) | | | | | |

California - 13.5% (continued) | | | | | |

California, GO, Refunding | | 5.00 | | 4/1/2031 | | 9,900,000 | | 13,071,762 | |

California Health Facilities Financing Authority, Revenue Bonds | | 4.00 | | 11/15/2047 | | 1,120,000 | | 1,239,862 | |

California Health Facilities Financing Authority, Revenue Bonds, Refunding (Adventist Health System) Ser. A | | 4.00 | | 3/1/2033 | | 7,500,000 | | 8,013,450 | |

California Health Facilities Financing Authority, Revenue Bonds, Refunding (St. Joseph Health System) Ser. A | | 5.00 | | 7/1/2033 | | 10,000,000 | | 11,331,600 | |

California Health Facilities Financing Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 11/15/2035 | | 5,100,000 | | 6,449,664 | |

California Health Facilities Financing Authority, Revenue Bonds, Ser. A | | 5.00 | | 11/15/2024 | | 1,600,000 | | 1,800,944 | |

California Health Facilities Financing Authority, Revenue Bonds, Ser. A | | 5.00 | | 11/15/2023 | | 1,500,000 | | 1,690,410 | |

California Infrastructure & Economic Development Bank, Revenue Bonds, Ser. A | | 4.00 | | 10/1/2045 | | 8,275,000 | | 9,270,979 | |

Evergreen School District, GO | | 4.00 | | 8/1/2041 | | 5,000,000 | | 5,504,250 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2025 | | 1,115,000 | b | 1,309,902 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2026 | | 1,170,000 | b | 1,411,827 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2027 | | 2,460,000 | b | 3,038,469 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2024 | | 1,060,000 | b | 1,211,622 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2021 | | 1,955,000 | b | 2,038,870 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2022 | | 2,055,000 | b | 2,212,392 | |

Fairfield-Suisun Unified School District, GO, Refunding | | 5.00 | | 8/1/2023 | | 2,030,000 | b | 2,252,975 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2024 | | 650,000 | b | 751,433 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2025 | | 500,000 | b | 595,780 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2026 | | 500,000 | b | 612,675 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2021 | | 500,000 | b | 523,330 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2022 | | 715,000 | b | 774,774 | |

Glendale Unified School District, GO, Refunding | | 5.00 | | 9/1/2023 | | 530,000 | b | 593,621 | |

Golden State Tobacco Securitization Corp., Revenue Bonds, Refunding, Ser. A1 | | 5.00 | | 6/1/2032 | | 5,000,000 | | 6,074,650 | |

Golden State Tobacco Securitization Corp., Revenue Bonds, Refunding, Ser. A1 | | 5.00 | | 6/1/2029 | | 3,500,000 | | 4,232,655 | |

Golden State Tobacco Securitization Corp., Revenue Bonds, Refunding, Ser. A1 | | 5.00 | | 6/1/2033 | | 1,000,000 | | 1,211,510 | |

Golden State Tobacco Securitization Corp., Revenue Bonds, Ser. A | | 5.00 | | 6/1/2029 | | 9,080,000 | | 10,403,864 | |

Long Beach Unified School District, GO, Ser. A | | 4.00 | | 8/1/2038 | | 10,300,000 | | 11,720,164 | |

Los Angeles Department of Airports, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 5/15/2024 | | 1,080,000 | | 1,264,540 | |

Los Angeles Department of Airports, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 5/15/2026 | | 1,500,000 | | 1,850,415 | |

Los Angeles Department of Airports, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 5/15/2025 | | 1,240,000 | | 1,492,228 | |

Los Angeles Department of Airports, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 5/15/2023 | | 825,000 | | 937,365 | |

Los Angeles Department of Airports, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 5/15/2026 | | 9,060,000 | | 11,196,167 | |

Los Angeles Unified School District, GO, Refunding, Ser. A | | 5.00 | | 7/1/2026 | | 5,000,000 | | 6,266,200 | |

New Haven Unified School District, GO (Insured; Assured Guaranty Corp.) | | 0.00 | | 8/1/2033 | | 4,000,000 | c | 2,920,400 | |

Newport Mesa Unified School District, GO, Refunding | | 5.00 | | 8/1/2026 | | 1,060,000 | b | 1,288,239 | |

Newport Mesa Unified School District, GO, Refunding | | 5.00 | | 8/1/2025 | | 1,300,000 | b | 1,538,030 | |

Newport Mesa Unified School District, GO, Refunding | | 5.00 | | 8/1/2024 | | 1,000,000 | b | 1,150,590 | |

Pittsburg Successor Agency Redevelopment Agency, Tax Allocation Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 5.00 | | 9/1/2026 | | 6,610,000 | | 8,211,074 | |

Port of Oakland, Revenue Bonds, Refunding, Ser. O | | 5.00 | | 5/1/2023 | | 1,875,000 | | 1,989,769 | |

24

| | | | | | | | | | |

| |

BNY Mellon National Intermediate Municipal Bond Fund (continued) |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 101.3% (continued) | | | | | |

California - 13.5% (continued) | | | | | |

Redondo Beach Unified School District, GO, Refunding | | 5.00 | | 8/1/2029 | | 875,000 | b | 1,123,570 | |

Redondo Beach Unified School District, GO, Refunding | | 5.00 | | 8/1/2030 | | 930,000 | b | 1,184,615 | |

Redondo Beach Unified School District, GO, Refunding | | 5.00 | | 8/1/2027 | | 805,000 | b | 998,651 | |

Redondo Beach Unified School District, GO, Refunding | | 5.00 | | 8/1/2028 | | 840,000 | b | 1,062,088 | |

Riverside County Transportation Commission, Revenue Bonds, Refunding, Ser. A | | 5.25 | | 6/1/2023 | | 5,000,000 | d | 5,802,450 | |

Sacramento County Sanitation Districts Financing Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Corp.) Ser. B, 3 Month LIBOR x .67 +.53% | | 2.22 | | 12/1/2035 | | 10,000,000 | e | 9,698,300 | |

Sacramento County Water Financing Authority, Revenue Bonds (Water Agency Zones 40 & 41) (Insured; National Public Finance Guarantee Corp.) Ser. B, 3 Month LIBOR x .67 +.55% | | 2.24 | | 6/1/2034 | | 8,000,000 | e | 7,630,720 | |

San Francisco City & County, COP, Refunding (Moscone Convention Center Expansion Project) | | 4.00 | | 4/1/2037 | | 7,000,000 | | 7,824,810 | |

San Francisco City & County Airport Comm-San Francisco International Airport, Revenue Bonds, Refunding, Ser. D | | 5.00 | | 5/1/2024 | | 4,375,000 | | 5,110,087 | |

San Francisco Community College District, GO, Refunding | | 5.00 | | 6/15/2029 | | 5,000,000 | | 6,065,500 | |

San Francisco Public Utilities Commission, Revenue Bonds, Refunding (Green Bond) Ser. D | | 5.00 | | 11/1/2035 | | 10,025,000 | | 12,799,920 | |

Southern California Public Power Authority, Revenue Bonds (Apex Power Project) Ser. A | | 5.00 | | 7/1/2033 | | 3,380,000 | | 3,969,303 | |

Southern California Public Power Authority, Revenue Bonds (Project No. 1) Ser. A | | 5.25 | | 11/1/2020 | | 4,000,000 | | 4,179,480 | |

University of California, Revenue Bonds, Refunding (Limited Project) Ser. I | | 5.00 | | 5/15/2030 | | 11,000,000 | | 13,325,070 | |

University of California, Revenue Bonds, Refunding (Limited Project) Ser. K | | 4.00 | | 5/15/2037 | | 5,000,000 | | 5,640,450 | |

University of California, Revenue Bonds, Refunding, Ser. AO | | 5.00 | | 5/15/2031 | | 9,000,000 | | 10,880,190 | |

| | 343,228,059 | |

Colorado - 1.5% | | | | | |

Adams & Arapahoe Joint School District 28J Aurora, GO, Refunding (Insured; State Aid Withholding) Ser. A | | 5.00 | | 12/1/2030 | | 5,000,000 | | 6,259,800 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health) Ser. A | | 5.00 | | 8/1/2034 | | 4,000,000 | | 5,029,440 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health) Ser. B | | 5.00 | | 8/1/2025 | | 3,000,000 | | 3,551,040 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health) Ser. B | | 5.00 | | 8/1/2026 | | 5,000,000 | | 6,026,400 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 8/1/2033 | | 1,500,000 | | 1,891,155 | |

Colorado Housing & Finance Authority, Revenue Bonds (Insured; Government National Mortgage Association) Ser. F | | 4.25 | | 11/1/2049 | | 5,000,000 | | 5,583,400 | |

Public Authority for Colorado Energy, Revenue Bonds | | 6.13 | | 11/15/2023 | | 5,350,000 | | 5,929,458 | |

Regional Transportation District, COP, Refunding, Ser. A | | 5.00 | | 6/1/2020 | | 2,700,000 | | 2,778,948 | |

Regional Transportation District, COP, Refunding, Ser. A | | 5.50 | | 6/1/2022 | | 450,000 | | 464,166 | |