UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-09903 |

| | |

| | BNY Mellon Funds Trust | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 08/31 | |

| Date of reporting period: | 08/31/22 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

The BNY Mellon Funds

| |

BNY Mellon Tax-Sensitive Large Cap Multi-Strategy Fund |

BNY Mellon Income Stock Fund |

BNY Mellon Mid Cap Multi-Strategy Fund |

BNY Mellon Small Cap Multi-Strategy Fund |

BNY Mellon Focused Equity Opportunities Fund |

BNY Mellon International Fund |

BNY Mellon Emerging Markets Fund |

BNY Mellon International Equity Income Fund |

BNY Mellon Asset Allocation Fund |

| | |

ANNUAL REPORT August 31, 2022 |

| |

Contents

T H E F U N D S

F O R M O R E I N F O R M AT I O N

Back Cover

| |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed herein are current to the date of this report. These views and the composition of the funds’ portfolios are subject to change at any time based on market and other conditions. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

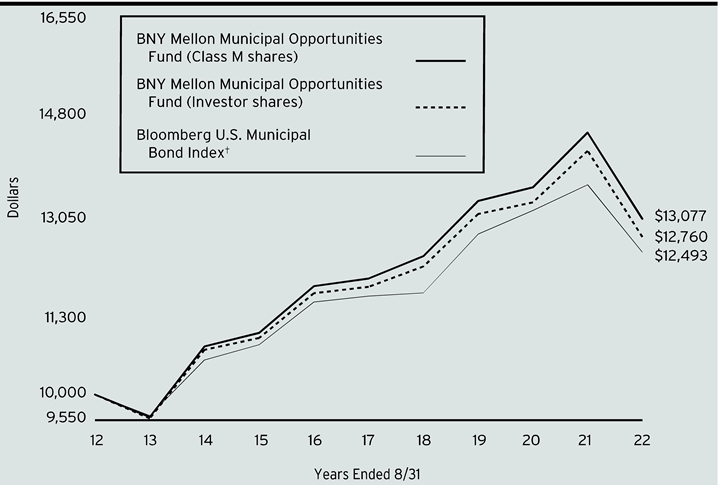

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from September 1, 2021, through August 31, 2022, as provided by Alicia Levine, Primary Portfolio Manager responsible for investment allocation decisions

Market and Fund Performance Overview

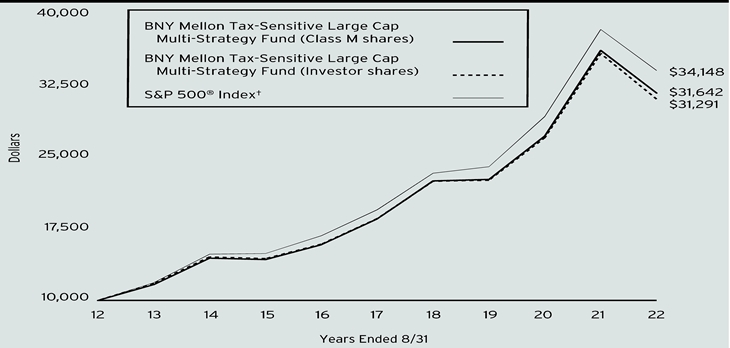

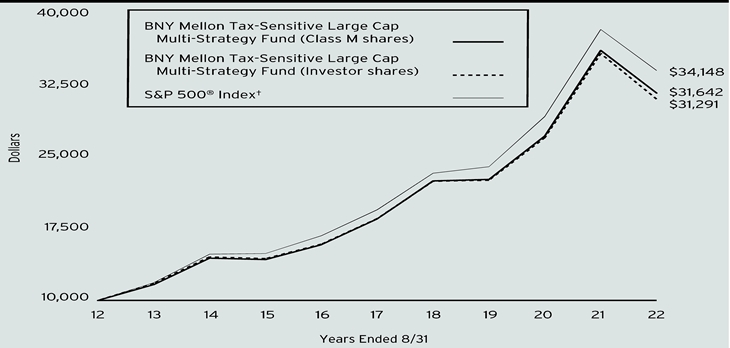

For the 12-month period ended August 31, 2022, BNY Mellon Tax-Sensitive Large Cap Multi-Strategy Fund’s (the “fund”) Class M shares produced a total return of −12.73%, and Investor shares produced a total return of −12.93%.1 In comparison, the S&P 500® Index (the “Index”), the fund’s benchmark, produced a total return of −11.22% for the same period.2

Large-cap stocks lost ground over the reporting period as investors took note of rising inflation, higher interest rates and slowing economic growth. The fund lagged the Index primarily due to unfavorable contributions from three underlying strategies.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of large-cap companies. The fund currently considers large-cap companies to be those companies with total market capitalizations of $5 billion or more at the time of purchase. The fund normally allocates its assets among multiple investment strategies employed by BNY Mellon Investment Adviser, Inc. or its affiliates that invest primarily in equity securities issued by large-cap companies. The fund is designed to provide exposure to various large-cap equity portfolio managers and investment strategies and styles, and uses tax-sensitive strategies to reduce the impact of federal and state income taxes on the fund’s after-tax returns.

The fund allocates its assets among some or all of the following: the Large Cap Core Strategy, Large Cap Tax-Sensitive Strategy, Focused Equity Strategy, U.S. Large Cap Equity Strategy, Dynamic Large Cap Value Strategy, Large Cap Growth Strategy, U.S. Large Cap Growth Strategy, Income Stock Strategy, Appreciation Strategy, and Large Cap Dividend Strategy—all of which are more fully described in the fund’s prospectus. The fund invests directly in securities or in other mutual funds as advised by the fund’s investment adviser or its affiliates, referred to as underlying funds.

BNY Mellon Investment Adviser, Inc. has the discretion to change the investment strategies, including whether to implement a strategy by investing directly in securities or through an underlying fund, as well as the target allocations and ranges when the investment adviser deems it appropriate.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns, in response to a reemergence of the pandemic, continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Growth-Oriented Performance Hurt Fund Returns

The fund’s relative return was hindered primarily by the performance of three of the six underlying strategies. The fund’s returns were hampered mostly by the performance of the growth-oriented category, which lagged its benchmark, the Russell 1000® Growth Index. Relative returns in this category were hampered by the lagging returns of the underlying fund and by an overweight position in this category. The large-cap core category also detracted from performance. Both underlying funds, Focused Equity Strategy and the U.S. Large Cap Equity Strategy, lagged their benchmarks.

On the other hand, performance in the value category contributed positively to relative returns. The primary contributor was The Dynamic Large Cap Value Strategy, which significantly exceeded its benchmark. The Income Stock Strategy also added to performance. Though it slightly lagged its benchmark, the positive absolute return outpaced the overall Index. The Large Cap Tax-Sensitive Strategy also added to relative returns.

An Uncertain Outlook

We expect economic growth to continue slowing, particularly in Europe and China, but that the U.S. will remain the global leader. Headline inflation has likely peaked, and we expect it to decrease in the coming months, driven by easing supply chains and lower prices for goods and commodities. However, inflation is now broad-based and is likely to become stickier. Rising prices have shifted from goods into services, and into wages and housing, which take longer to adjust. The risk is that inflation could back off but remain at stubbornly elevated levels.

Given the deep sell-off and historically depressed sentiment, the risk/reward in equities has improved for long-term investors. In

2

the near term, we expect further equity weakness and a range-bound market, driven by earnings downgrades reflecting continued pressure on profit margins from slowing growth, elevated inflation and higher interest rates. We need further evidence that core inflation pressures have cooled before we’ll be convinced the Fed can pivot, and we need to see earnings adjust lower before we become more confident a market bottom has been reached. We expect volatility to continue and uncertainty to remain elevated.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The underlying funds’ underlying strategies may use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period of September 1, 2021, through August 31, 2022, as provided by John C. Bailer, Brian C. Ferguson, David S. Intoppa and Keith Howell, Portfolio Managers at Newton Investment Management North America, LLC (Newton), sub-adviser

Market and Fund Performance Overview

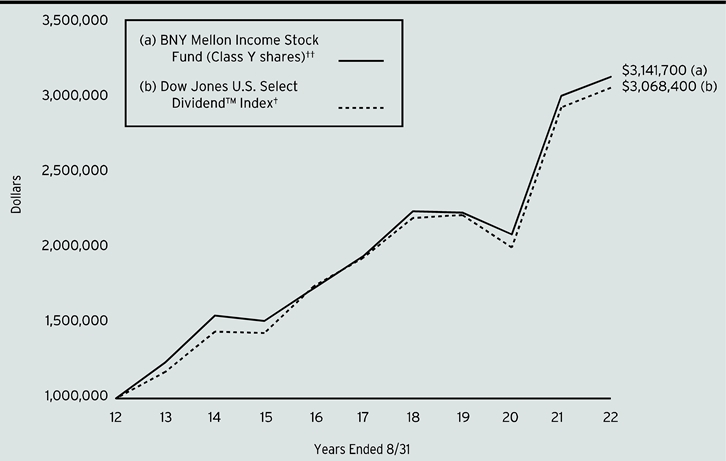

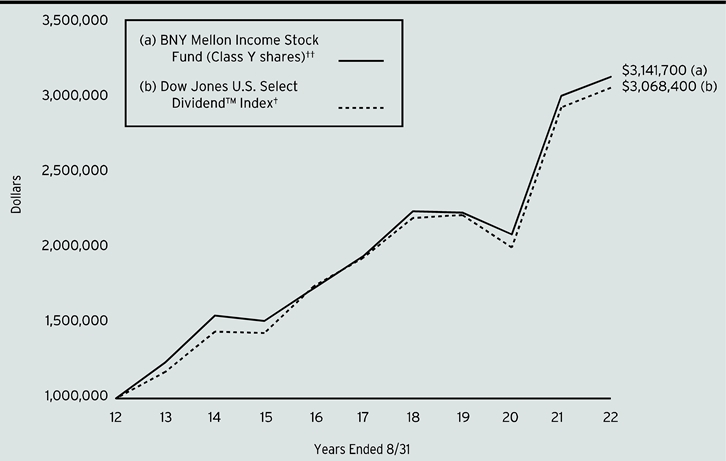

For the 12-month period ended August 31, 2022, BNY Mellon Income Stock Fund’s (the “fund”) Class M shares produced a total return of 4.22%, Investor shares produced a total return of 3.87%, Class A shares produced a total return of 3.85%, Class C shares produced a total return of 3.03%, Class I shares produced a total return of 4.13% and Class Y shares produced a total return of 4.21%.1 In comparison, the fund’s benchmark, the Dow Jones U.S. Select Dividend™ Index (the “Index”), produced a total return of 4.45% for the same period.2

Income-oriented stocks performed modestly despite declines in the broader market. The fund underperformed the Index, which skews toward higher-yielding, mid-cap companies, due to unfavorable asset allocation and security selection.

The Fund’s Investment Approach

The fund seeks total return (consisting of capital appreciation and income). To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund seeks to focus on dividend-paying stocks and other investment techniques that produce income. We choose stocks through a disciplined investment process that combines quantitative modeling techniques, fundamental analysis and risk management. The fund emphasizes those stocks with value characteristics, although it may also purchase growth stocks. The fund may invest in the stocks of companies of any size, although it focuses on large-cap companies. The fund’s investment process is designed to provide investors with investment exposure to sector weightings and risk characteristics generally similar to those of the Index.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns, in response to a reemergence of the pandemic, continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Performance Hindered by Unfavorable Allocation and Stock Selection

The fund’s underperformance versus the Index was driven primarily by sector allocation and stock selection decisions. The primary detractor was the fund’s underweight position in the utilities sector. Although the fund had a substantial position in utilities (8.9% on average over the period), this sector makes up an outsized portion of the Index (27% on average over the period), primarily because the Index is focused on stocks with higher dividend yields. The other primary detractor was stock selection in the financial sector, especially in the banking industry. Shares of JP Morgan Chase & Co. and other large banks that are sensitive to capital markets performed poorly. In addition, as interest rates have risen, these large banks, which are required to undergo stress tests, are required to set aside more capital, which also hurt performance. Another leading detractor were stock selections in the consumer discretionary sector. Shares of International Gaming Technology performed poorly due in part to the company’s exposure to the European economy. In addition, shares of General Motors also detracted from performance. The company’s results were hurt by supply-chain disruptions.

On a more positive note, an overweight position in the energy sector contributed positively to relative returns. Stock selections in this sector and also in the utilities and materials sectors contributed positively. In the energy sector, the fund’s position in Devon Energy performed well. The company’s fixed-plus-variable dividend policy, announced last year, has increased its dividend payout, attracting investors. Shares of EQT, a leading producer of natural gas, also contributed positively to performance. The company has benefited from higher natural gas prices. In the utilities sector, shares of Constellation Energy, a spin-off from Exelon, a power company, added to returns. Constellation Energy is a leading producer of nuclear power in the U.S., and nuclear received subsidies in the recently passed Inflation Reduction Act. In the materials sector, a position in CF Industries, a fertilizer manufacturer, also contributed positively. The company has gained from higher fertilizer prices and from natural gas prices that are lower in the U.S. than in other markets.

Inflation, Higher Interest Rates and Slower Growth Expected

We believe that inflation and interest rates are likely to remain elevated in the near term, and we have positioned the fund accordingly. The fund’s position in companies that benefit from higher inflation and interest rates, such as those in the energy

4

sector and in the insurance industry, respectively, are likely to perform well. We also anticipate that the economy will slow, and we believe that companies with value characteristics, including dividend payments and healthy cash flows, will perform better than other parts of the market. We continue to focus on avoiding “value traps” by looking for companies with strong momentum and healthy fundamentals.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through December 31, 2022, for Class A, Class C, Class I and Class Y, at which time it may be extended, terminated or modified. Had these expenses not been absorbed, the fund’s returns for those share classes would have been lower.

2 Source: Lipper Inc. – The Dow Jones U.S. Select Dividend™ Index is defined as all dividend-paying companies in the Dow Jones U.S. Index, excluding REITs, that have a non-negative, historical, five-year dividend-per-share growth rate, a five-year average dividend coverage ratio of greater than or equal to 167%, paid dividends in each of the previous five years, non-negative, trailing 12-month earnings-per-share (EPS), a float-adjusted market capitalization of at least U.S. $1 billion, and a three-month average daily trading volume of 200,000 shares. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets. The securities discussed should not be considered recommendations to buy or sell a particular security.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

5

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period from September 1, 2021, through August 31, 2022, as provided by Alicia Levine, Primary Portfolio Manager responsible for investment allocation decisions

Market and Fund Performance Overview

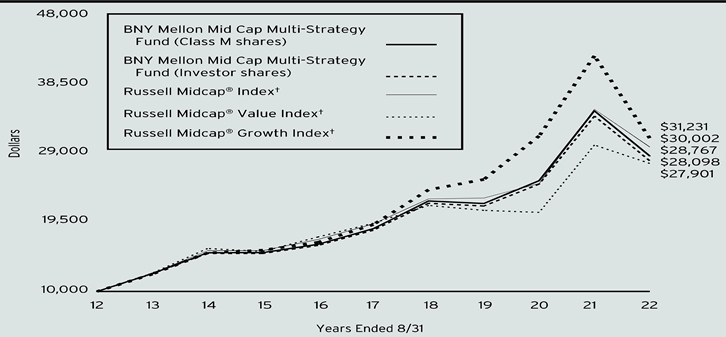

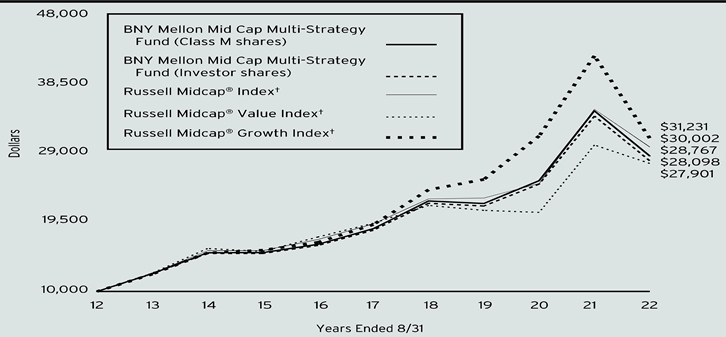

For the 12-month period ended August 31, 2022, BNY Mellon Mid Cap Multi-Strategy Fund’s (the “fund”) Class M shares produced a total return of −17.82%, and Investor shares produced a total return of −18.00%.1 In comparison, the fund’s benchmark, the Russell Midcap® Index (the “Index”), produced a total return of −14.82% for the reporting period.2 The Russell Midcap® Growth Index and Russell Midcap® Value Index, the fund’s secondary benchmarks, produced total returns of −26.69% and −7.80%, respectively, for the same period.3,4

Mid-cap stocks lost ground over the reporting period as investors took note of rising inflation, higher interest rates and a slowing economy. The fund lagged the Index due to underperformance by the growth-oriented category.

The Fund’s Investment Approach

The fund seeks capital appreciation. The fund pursues its goal by normally investing at least 80% of its net assets in equity securities of mid-cap companies. The fund considers mid-cap companies to be those companies with market capitalizations that are within the market-capitalization range of companies comprising the Index. Furthermore, the fund normally allocates assets across multiple investment strategies employed by BNY Mellon Investment Adviser, Inc. and affiliated and unaffiliated sub-advisers that invest primarily in equity securities issued by mid-cap companies. BNY Mellon Investment Adviser, Inc. determines the investment strategies and sets target allocations and ranges. The fund is designed to provide exposure to various investment strategies and styles, including the Mid Cap Tax-Sensitive Core Strategy, Opportunistic Mid Cap Value Strategy, Mid Cap Growth Strategy, Boston Partners Mid Cap Value Strategy, and Geneva Mid Cap Growth Strategy, all as more particularly described in the fund’s prospectus.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns, in response to a reemergence of the pandemic, continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Growth-Oriented Strategy Lagged

The fund’s relative performance was hindered primarily by lagging returns in the mid-cap, growth-oriented category, which lagged the overall Index. The primary detractor was the Mid Cap Growth Strategy, which also lagged the category benchmark. An overweight to the growth category also hindered the fund’s relative returns.

On the other hand, three underlying funds made positive contributions. The value-oriented category was the leading contributor. In this category, the Opportunistic Mid Cap Value Strategy performed well, beating the category benchmark as well as the overall Index. In addition, the Robeco Mid Cap Value Strategy also exceeded its benchmark and the overall Index. The Mid Cap Tax-Sensitive Core Strategy contributed positively to performance as well, as did the Geneva Mid Cap Growth Strategy, which outperformed the Russell Mid Cap Growth benchmark.

An Uncertain Outlook

We expect economic growth to continue slowing, particularly in Europe and China, but that the U.S. will remain the global leader. Headline inflation has likely peaked, and we expect it to decrease in the coming months, driven by easing supply chains and lower prices for goods and commodities. However, inflation is now broad-based and is likely to become stickier. Rising prices have shifted from goods into services, and into wages and housing, which take longer to adjust. The risk is that inflation could back off but remain at stubbornly elevated levels.

Given the deep sell-off and historically depressed sentiment, the risk/reward in equities has improved for long-term investors. In the near term, we expect further equity weakness and a range-bound market, driven by earnings downgrades reflecting continued pressure on profit margins from slowing growth, elevated inflation and higher interest rates. We need further evidence that core inflation pressures have cooled before we’ll be convinced the Fed can pivot, and we need to see earnings adjust lower before we become more confident a market bottom has been reached. We expect volatility to continue and

6

uncertainty to remain elevated. Diversification across asset classes may position the fund for a wide range of possible outcomes and help mitigate risk against increased volatility.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The Russell Midcap® Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true midcap opportunity set. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell Midcap Value® Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap value market. The Russell Midcap® Value Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap value market. Investors cannot invest directly in any index.

4 Source: Lipper Inc. — The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The Russell Midcap® Growth Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Stocks of small- and/or mid-cap companies often experience sharper price fluctuations than stocks of large-cap companies.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

7

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period of September 1, 2021, through August 31, 2022, as provided by Alicia Levine, Primary Portfolio Manager responsible for investment allocation decisions

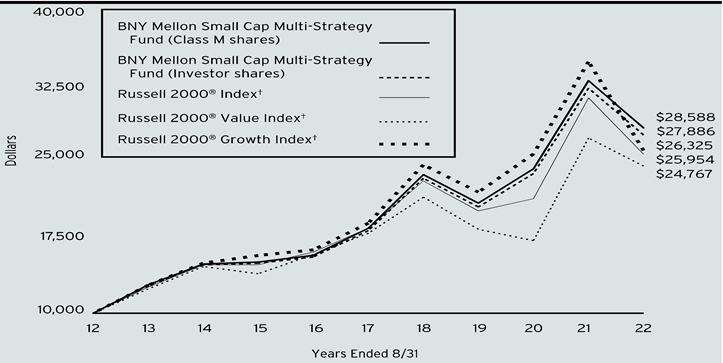

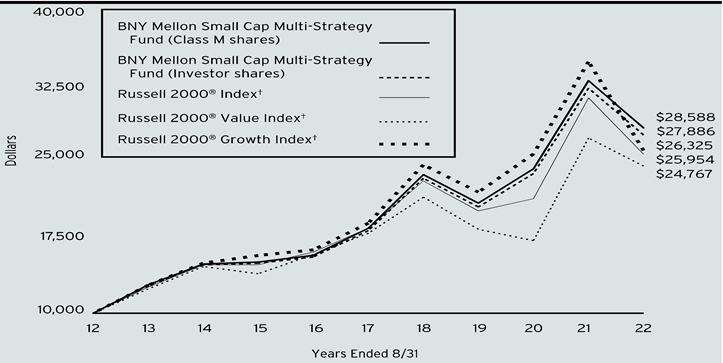

Fund and Market Performance Overview

For the 12-month period ended August 31, 2022, BNY Mellon Small Cap Multi-Strategy Fund’s (the “fund”) Class M shares produced a total return of −14.23%, and Investor shares produced a total return of −14.40%.1 In comparison, the fund’s primary benchmark, the Russell 2000® Index (the “Index”), produced a total return of −17.88% for the same period.2 The Russell 2000® Growth Index and Russell 2000® Value Index, the fund’s secondary benchmarks, produced total returns of −25.26% and −10.18%, respectively, for the same period.3,4

Small-cap stocks lost ground over the reporting period as investors took note of rising inflation, higher interest rates and a slowing economy. The fund outperformed the Index due to positive contributions from two out of three of the fund’s underlying strategies.

The Fund’s Investment Approach

The fund seeks capital appreciation. The fund pursues its goal by normally investing at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of small-cap companies. The fund currently considers small-cap companies to be those companies with market capitalizations that are equal to or less than the market capitalization of the largest company included in the Index. Furthermore, the fund normally allocates assets across multiple investment strategies employed by BNY Mellon Investment Adviser, Inc. and its affiliates that invest primarily in equity securities issued by small-cap companies. BNY Mellon Investment Adviser, Inc. determines the investment strategies and sets target allocations and ranges. The fund is designed to provide exposure to various investment strategies and styles, including the Opportunistic Small Cap Strategy, the Small Cap Value Strategy and the Small Cap Growth Strategy—all of which are more fully described in the fund’s prospectus.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns, in response to a reemergence of the pandemic, continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Value-Oriented Strategy Drove Relative Returns

The primary positive contributor to the fund’s returns versus the Index was the value-oriented category. The category outperformed the overall Index (the Russell 2000® Index), and the underlying strategy in this category outperformed the Russell 2000® Value Index (a secondary benchmark). In addition, a large overweight to this strategy also added to performance. A relatively strong performance by the underlying Opportunistic Small Cap Strategy benefited relative returns as well.

On the other hand, the weakest performance came in the Small Cap Growth category. The underlying fund in this category slightly beat the Russell 2000® Growth Index but lagged the overall Index. In addition, the slight overweight to this category produced a drag on the fund’s overall relative return.

An Uncertain Outlook

We expect economic growth to continue slowing, particularly in Europe and China, but that the U.S. will remain the global leader. Headline inflation has likely peaked, and we expect it to decrease in the coming months, driven by easing supply chains and lower prices for goods and commodities. However, inflation is now broad-based and is likely to become stickier. Rising prices have shifted from goods into services, and into wages and housing, which take longer to adjust. The risk is that inflation could back off but remain at stubbornly elevated levels.

Given the deep sell-off and historically depressed sentiment, the risk/reward in equities has improved for long-term investors. In the near term, we expect further equity weakness and a range-bound market, driven by earnings downgrades reflecting continued pressure on profit margins from slowing growth, elevated inflation and higher interest rates. We need further evidence that core inflation pressures have cooled before we’ll be convinced the Fed can pivot, and we need to see earnings adjust lower before we become more confident a market bottom has been reached. We expect volatility to continue and uncertainty to remain elevated. Diversification across asset

8

classes may position the fund for a wide range of possible outcomes and help mitigate risk against increased volatility.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Russell 2000® Growth Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set, and that the represented companies continue to reflect growth characteristics. Investors cannot invest directly in any index.

4 Source: Lipper Inc. — The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 2000 ®Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Russell 2000 ®Value Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set, and that the represented companies continue to reflect value characteristics. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Stocks of small- and/or mid-cap companies often experience sharper price fluctuations than stocks of large-cap companies.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

9

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period from September 1, 2021, through August 31, 2022, as provided by Donald Sauber and Thomas Lee, Portfolio Managers of BNY Mellon Investment Adviser, Inc.

Market and Fund Performance Overview

For the 12-month period ended August 31, 2022, BNY Mellon Focused Equity Opportunities Fund’s (the “fund”) Class M shares produced a total return of −16.85%, and Investor shares produced a total return of −17.07%.1 In comparison, the S&P 500® Index (the “Index”), the fund’s benchmark, produced a total return of −11.22% for the same period.2

Equities generally lost ground during the period under pressure from increasing inflationary pressures, rising interest rates, slowing economic growth and heightened geopolitical tensions. The fund underperformed the Index for the period, largely due to the underperformance of high-quality, growth-oriented stocks.

The Fund’s Investment Approach

The fund seeks capital appreciation. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities. The fund invests, under normal circumstances, in approximately 25-30 companies that are considered by BNY Mellon Investment Adviser, Inc. to be positioned for long-term earnings growth. The fund may hold growth or value stocks or a blend of both. The fund may invest in the stocks of companies of any size, although it focuses on large-cap companies. The fund invests primarily in equity securities of U.S. issuers but may invest up to 25% of its assets in the equity securities of foreign issuers, including those in emerging market countries.

The portfolio managers monitor sector and security weightings and regularly evaluates the fund’s risk-adjusted returns to manage the risk profile of the fund’s portfolio. The portfolio managers adjusts exposure limits, as necessary.

Inflation and Slowing Economic Growth Pressure Risk Assets

The reporting period began amid increasing inflationary pressures due to rising energy and commodity prices and global supply-chain disruptions. The U.S. Federal Reserve (the “Fed”), which expressed increasingly hawkish sentiments prior to the start of the period, indicated in September 2021 a willingness to consider reducing accommodative policies sooner rather than later due to the unexpected level and persistence of inflationary forces affecting the economy. As inflationary pressures continued to mount, Fed rhetoric grew increasingly emphatic. Increasing tensions between Russia and Ukraine in early 2022 and the eventual invasion of Ukraine by its larger neighbor further undermined investor sentiment and pressured international credit markets. The Fed began to take concrete action soon thereafter, raising the fed funds rate by ..25% in March, .50% in May, .75% in June and another .75% in July—its most aggressive series of rate increases in decades.

Stock prices declined under pressure from increasingly risk-off sentiment, with growth stocks underperforming value-oriented shares. Several factors drove the market’s rotation away from growth-oriented shares, particularly in information technology and, to a lesser degree, consumer discretionary. These factors included the unprecedented rate of financial tightening by the Fed, driving interest rates higher and undermining growth valuations; ongoing supply-chain problems caused by the COVID-19 pandemic; Chinese-imposed trading sanctions affecting U.S. companies and Chinese internal regulatory crackdowns on China-based multinational technology companies; and disruptions to global energy and food chains related to Russia’s invasion of Ukraine. Despite these pressures, risk-on sentiment gained ground in the closing weeks of the reporting period over hopes that slowing economic growth might soon prompt the Fed to ease the pace of monetary tightening. Over the entire reporting period, energy stocks generated the strongest performance in the Index by far on rising petroleum and natural gas prices, followed by mildly positive returns from utilities and consumer staples. The most significant detractors from a sector perspective included consumer discretionary, communication services and information technology.

The Fund’s Focus on Growth Stocks Undermines Relative Returns

The fund’s long-term investment strategy focusing on high-quality growth companies undermined performance relative to the Index as growth stocks remained out of favor during most of the reporting period. Risk-off sentiment took a toll on several of the Fund’s semiconductor holdings, including Advanced Micro Devices (AMD), NVIDIA and Lam Research. A slowdown in global e-commerce in the wake of widespread pandemic-related lockdowns also hurt holdings in digital payment stocks, such as Block (formerly known as Square) and PayPal Holdings. In the consumer discretionary sector, notable detractors included shares in vehicle maker General Motors, which declined over worries regarding a possible cyclical downturn, and travel services provider Royal Caribbean Cruises, which sank due to COVID-19 travel restrictions, labor shortages, high interest rates and the company’s heavily leveraged balance sheet.

On the positive side, relative performance benefited from the fund’s exposure to health care, particularly pharmaceutical company AbbVie, which was rewarded for its strong therapeutic drug pipeline, and managed care provider UnitedHealth Group, which benefited in a time of volatility from a profile of delivering reliable earnings and providing a stable outlook. In the financial sector, shares of futures and options exchange company CME Group benefited from high levels of market volatility, which led to increased exchange volumes.

Remaining Focused on the Long Term

Clearly, risks and uncertainties remain embedded in prevailing inflationary trends, the likelihood of central bank tightening and rising geopolitical tensions. However, we expect most of the disruptions that upset markets during the current reporting period will eventually dissipate. Accordingly, we have made few changes to the fund’s long-term strategy, which remains focused on investing in high-quality growth companies. However, we have increased the fund’s exposure to the energy sector, moving to an overweight position. This shift reflects our view that environmental concerns and the impact of ESG (environmental, social and corporate governance) policies have caused a degree of destruction to global fossil fuel production in the face of

10

persistently strong energy demand and inadequate alternatives, likely leading to higher prices for fossil fuels over the next couple of years.

September 15, 2022

1 Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the

reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

The fund is non-diversified, which means that a relatively high percentage of the fund’s assets may be invested in a limited number of issuers. Therefore, the fund’s performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing or legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

11

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period of September 1, 2021, through August 31, 2022, as provided by portfolio manager, James A. Lydotes, of Newton Investment Management North America, LLC, sub-adviser

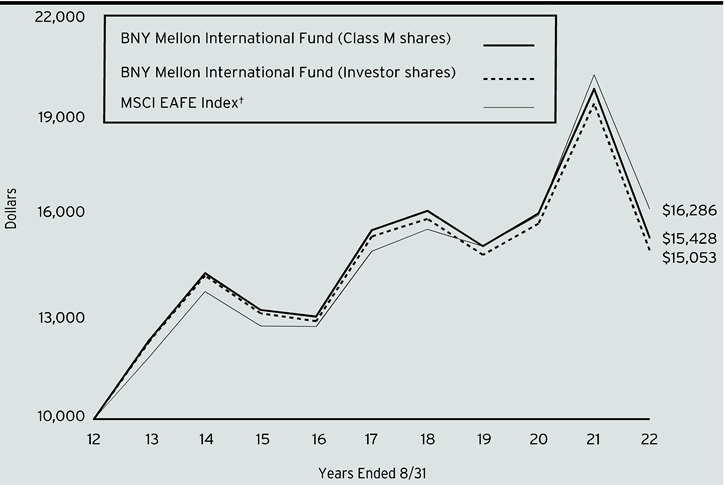

Market and Fund Performance Overview

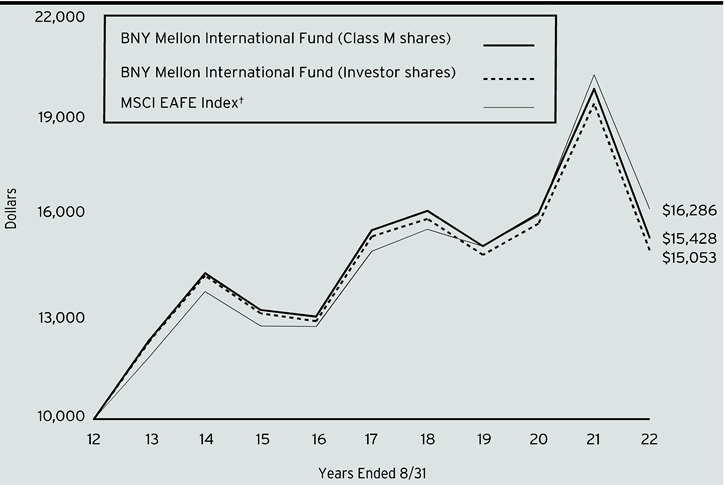

For the 12-month period ended August 31, 2022, BNY Mellon International Fund’s (the “fund”) Class M shares produced a total return of −22.39%, and Investor shares produced a total return of −22.57%.1 In comparison, the fund’s benchmark, the MSCI EAFE Index (the “Index”), produced a total return of −19.80% for the same period.2

International equity markets largely lost ground as investors took note of rising inflation, higher interest rates, a slowing economy and increased geopolitical risk. The fund underperformed the Index primarily due to unfavorable sector allocations to the information technology and energy sectors.

The Fund’s Investment Approach

The fund seeks long-term capital growth. To pursue this goal, the fund normally invests at least 65% of its total assets in equity securities of foreign issuers. Foreign issuers are companies, organized under the laws of a foreign country, whose principal trading market is in a foreign country or with a majority of their assets or business outside the United States. The fund may invest in companies of any size. Though not specifically limited, the fund ordinarily will invest in a broad range of (and in any case at least five different) countries. The fund will limit its investments in any single company to no more than 5% of the fund’s assets at the time of purchase.

The stocks purchased may have value and/or growth characteristics. The portfolio manager employs a “bottom-up” investment approach, which emphasizes individual stock selection. The stock selection process is designed to produce a diversified portfolio that, relative to the Index, has a below-average price/earnings ratio and an above-average earnings growth trend.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns in response to a reemergence of the pandemic continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Sector Allocations Hindered Results

The fund’s underperformance versus the Index was due primarily to unfavorable sector allocations. An overweight to the information technology sector was the primary detractor, followed by a modest underweight to the energy sector. Within the information technology sector, the fund’s positions in Fujitsu, a Japanese equipment and services company, and Advantest, a manufacturer of test equipment for the semiconductor industry, were especially detrimental. Shares of Logitech International, a Swiss-American maker of computer peripherals, also were a hindrance. In addition, in the materials sector, our position in HeidelbergCement weighed on performance, as concerns around the cost of natural gas led to investor concerns for the world’s largest aggregates producer (and world’s second-largest cement producer). At the country level, the UK was the leading detractor. A position in WPP, a global advertising firm, lagged as it failed to make gains in Internet advertising versus Google. In addition, shares of Ashtead Group, an equipment rental company, were hurt by a weakening residential housing market.

On a more positive note, shares of Swedish Match, a smokeless tobacco company, performed well due to its acquisition by Philip Morris International, which enabled the fund to exit its position at a premium to the market price. In the consumer discretionary sector, the fund’s position in LVMH, a France-based luxury goods conglomerate, also contributed positively to returns. Selections in the communication services sector were also a tailwind to performance, as certain legacy companies have taken steps to monetize their network infrastructure, including breaking out the financial reporting of their infrastructure operations. Companies that have benefited from these steps include Telstra in Australia and Nippon Telegraph & Telephone in Japan. These moves have helped these shares hold up well in a down market. At the country level, Sweden was the strongest performer for the fund, largely due to the fund’s position in Swedish Match.

Maintaining a Positive Outlook

Inflation remains a concern for stocks globally since it could result in demand destruction. However, we believe these concerns are largely priced into the market already. In addition, although the European Central Bank has lagged in its efforts to stem inflation, it has recently hiked its policy rate, becoming more hawkish. Geopolitical risks also remain a risk, given the

12

war in Ukraine, though Russia appears to be experiencing some setbacks.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted, market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards. These risks are enhanced in emerging market countries.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

13

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period of September 1, 2021, through August 31, 2022, as provided by portfolio manager, Julianne McHugh, of Newton Investment Management North America, LLC, sub-adviser

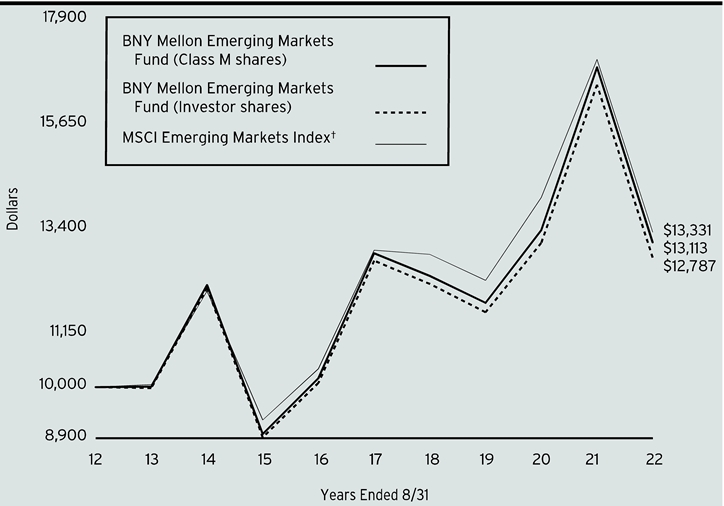

Market and Fund Performance Overview

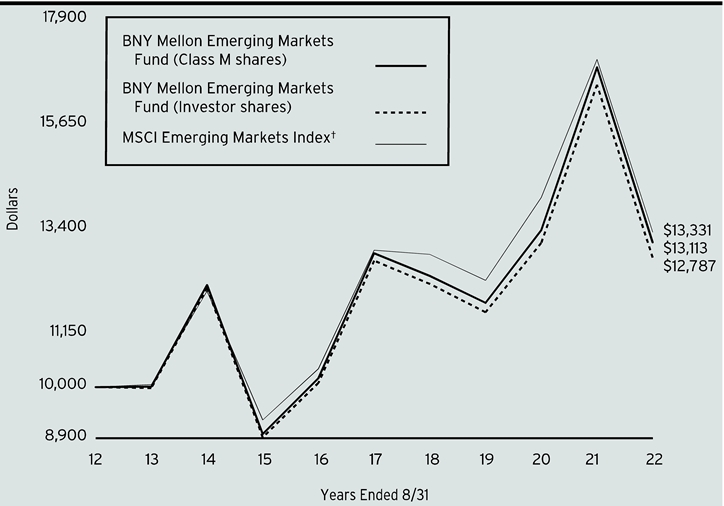

For the 12-month period ended August 31, 2022, BNY Mellon Emerging Markets Fund’s (the “fund”) Class M shares produced a total return of −22.31%, and Investor shares produced a total return of −22.52%.1 In comparison, the fund’s benchmark, the MSCI Emerging Markets Index (the “Index”), produced a total return of −21.80% for the same period.2

Stocks in emerging markets lost ground as concerns about inflation, higher interest rates, economic growth and geopolitical risk weighed on returns. The fund underperformed the Index, mainly due to positions in the financial sector and in Taiwan.

The Fund’s Investment Approach

The fund seeks long-term capital growth. To pursue its goal, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies organized, or with a majority of assets or operations, in countries considered to be emerging markets. Emerging market countries generally include all countries represented by the Index. The fund may invest in companies of any size.

Normally, the fund will invest in a broad range of (and in any case at least five different) emerging market countries. The stocks purchased may have value and/or growth characteristics. The portfolio managers employ a “bottom-up” investment approach, which emphasizes individual stock selection. The stock selection process is designed to produce a diversified portfolio that, relative to the Index, has a below-average price/earnings ratio and an above-average earnings growth trend.

Investor Sentiment, Inflation and Economic Weakness Hinder Markets

While the market remained buoyant early in the reporting period, a shift in sentiment early in 2022 led to steep market declines. Several concerns led to this shift, including rising inflation, tightening monetary policy, China’s “Zero COVID-19” policy, the Ukraine war and weakening economic data.

Inflation data continued to trend upward, reaching a 40-year high in the U.S., before moderating late in the period. Seeking to bring inflation down, the Federal Reserve (the “Fed”) raised the federal funds rate .25% in March 2022, .50% in May 2022 and .75% in both June and July 2022, bringing the target rate to between 2.25% and 2.50%. Most other central banks also raised their policy rates.

China’s intermittent shutdowns, in response to a reemergence of the pandemic, continued to hamper supply chains, which also contributed to rising prices around the globe. Geopolitics weighed on markets when Russia invaded Ukraine, amplifying a sell-off in the global equity markets as the impact of war exacerbated global inflation.

As the markets digested the winding down of accommodative pandemic-related policies, supply-chain snags and high inflation dampened the growth outlook. Investors noted that recession was becoming increasingly likely as it has historically been difficult for the Fed to achieve a “soft landing” for the economy. The challenge for the Fed is to raise interest rates enough to slow inflation without tipping the economy into recession.

This myriad of concerns impacted valuations, resulting in market weakness, but fundamentals have also been hindered due to rising input costs and labor shortages in some industries. Although the market rallied late in the period, the Fed’s reiteration in August 2022 of its commitment to fighting inflation weighed on returns at the end of the period.

Performance Hindered by Sector Allocations and Stock Selection

The strategy’s relative performance was driven by unfavorable sector allocations and stock selection. While an underweight position in the financial sector hurt performance, returns were further hindered by a position in Sberbank of Russia, a majority state-owned banking and financial services company. Shares of the Russian company were devastated by sanctions imposed in response to the Ukraine War and by the banning of access to the SWIFT international payments system. Relative returns were also hampered by weak stock selection in the Taiwan market. A position in the Taiwanese e-commerce company momo.com was especially detrimental. Following a strong performance in 2021, shares sold off as investors took profits on the expectation of weaker financial results relative to 2021. Also, the company’s management reduced guidance on profit margins due to a decision to invest more heavily in marketing.

On a more positive note, performance was assisted by strong returns in the energy sector and in China. In the energy sector, the fund’s holdings rose 63%. The primary driver of performance was the position in Petroleo Brasileiro (Petrobras), a Brazilian integrated oil and gas company. The company, which boasts attractive, upstream production growth and strong dividend payments, benefited from higher commodities prices. As a result of this position, Brazil was the fund’s strongest performing country. In addition to our position in Petrobras, the strategy’s position in consumer staples company Minerva also contributed to performance as the meat producer rose over 97% during the period. Stock selection in China, especially in the health care sector, was also a leading driver of performance. Our position in China Resources Sanjiu Medical & Pharmaceuticals, the largest manufacturer of non-prescription drugs in China, was particularly advantageous. Strong underlying over-the-counter demand was augmented by policy announcements during the period that support traditional Chinese medicine development.

Attractive Opportunities in the Energy and Utilities Sectors

We remain focused on stock-level fundamentals when constructing the portfolio, looking for stocks experiencing positive momentum drivers in the form of positive earnings revisions and trends, attractive valuations, and strong quality characteristics. We are finding attractive dynamics in the energy

14

and utilities sectors while remaining cautious on more consumer-facing sectors such as consumer staples. We also are cautiously positioned in the materials sector.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI Emerging Markets Index is a free float-adjusted, market capitalization-weighted index that is designed to measure equity market performance of emerging markets. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed, or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards. These risks are enhanced in emerging market countries.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

15

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period from September 1, 2021, through August 31, 2022, as provided by Peter D. Goslin, CFA, and Tao Wang of Newton Investment Management North America, LLC, sub-adviser

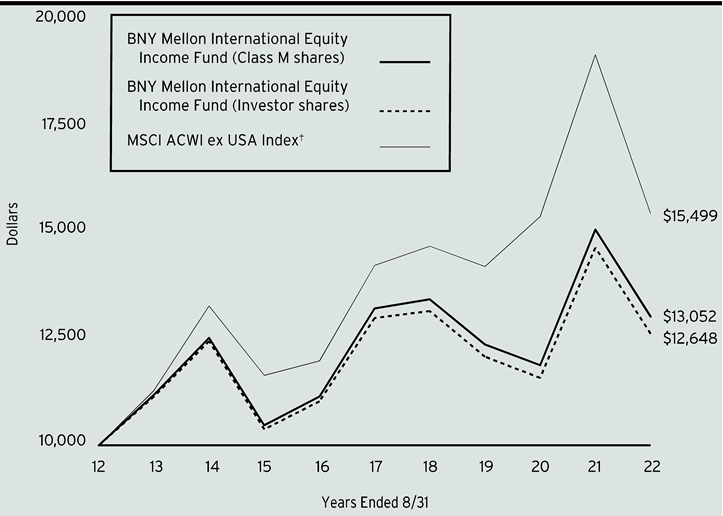

Market and Fund Performance Overview

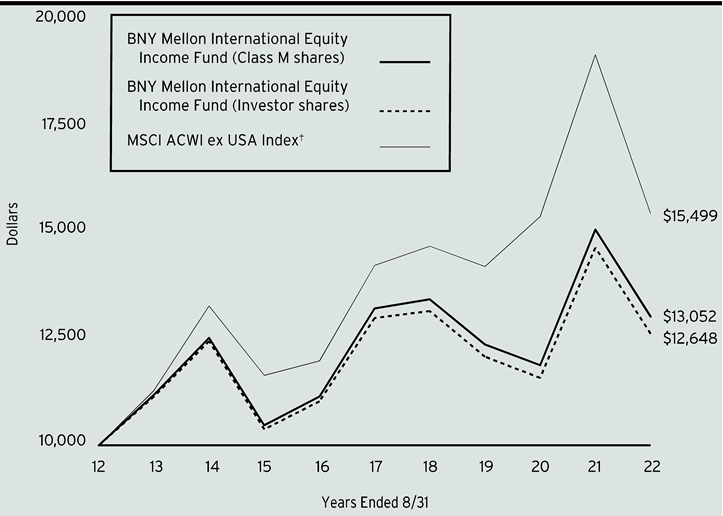

For the 12-month period ended August 31, 2022, BNY Mellon International Equity Income Fund’s (the “fund”) Class M shares produced a total return of −13.65%, and Investor shares produced a total return of −13.88%.1 In comparison, the fund’s benchmark, the MSCI ACWI ex USA Index (the “Index”), produced a total return of −19.52% for the same period.2

International equities generally lost ground during the period under pressure from increasing inflationary pressures, rising interest rates and heightened geopolitical tensions. The fund outperformed the Index for the period, largely due to its emphasis on high-dividend-paying stocks, which were favored by the market.

The Fund’s Investment Approach

The fund seeks total return (consisting of capital appreciation and income). To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities. The fund normally invests substantially all of its assets in the equity securities of issuers located outside the United States and diversifies broadly among developed and emerging market countries. The fund focuses on dividend-paying stocks of foreign companies, including those of emerging market countries. The fund may invest in the stocks of companies of any market capitalization.

We select stocks through a disciplined investment process using proprietary, quantitative computer models that analyze a diverse set of characteristics to identify and rank stocks according to earnings quality. Based on this analysis, we generally select from the higher-ranked, dividend-paying securities those stocks that we believe will continue to pay above-average dividends. We seek to overweight higher-dividend-paying stocks, while maintaining country and sector weights generally similar to those of the Index.

Risk Assets Retreat on Inflationary Pressures

The reporting period began amid increasing inflationary pressures due to rising energy and commodity prices and global supply-chain disruptions. The U.S. Federal Reserve (the Fed), which expressed increasingly hawkish sentiments prior to the start of the period, indicated in September 2021 a willingness to consider reducing accommodative policies sooner rather than later due to the unexpected level and persistence of inflationary forces affecting the economy. As inflationary pressures continued to mount, Fed rhetoric grew increasingly emphatic. Increasing tensions between Russia and Ukraine in early 2022 and the eventual invasion of Ukraine by its larger neighbor further undermined investor sentiment and pressured international credit markets. The Fed began to take concrete action soon thereafter, raising the fed funds rate by .25% in March, .50% in May, .75% in June and another .75% in July—its most aggressive series of rate increases in decades. Many other central banks in both developed and emerging markets followed suit, implementing a range of forceful monetary tightening measures designed to combat rising inflation.

Stock prices declined under pressure from increasingly risk-off sentiment, with growth-oriented stocks underperforming value-oriented shares, although risk-on sentiment gained ground in the closing weeks of the reporting period. Within the Index, high-dividend-paying stocks sharply outperformed low-dividend-paying issues, particularly in emerging markets. From a global perspective, emerging markets trailed developed markets. Regarding sectors, energy stocks significantly outperformed on rising petroleum and natural gas prices. The traditional growth-oriented sectors of consumer discretionary and information technology underperformed.

Benefiting from the Investor Preference for Dividend Yield

During a period in which dividend-paying equities were rewarded by the market, the fund captured the outperformance of such stocks in accordance with its benchmark-driven, risk-controlled focus on maximizing dividend-yield exposure. Returns relative to the Index further benefited from good stock selection in energy and information technology, while disappointing selection in materials and real estate detracted. Top performers included oil & gas exploration & production company Canadian National Resources, which rose on soaring energy prices; Czech utility CEZ, which reported better-than-expected earnings and revenues; and UK tobacco producer Imperial Brands, which benefited from investor sentiment in favor of steady, dividend-paying stocks. Notably weak holdings included Finland-based utility Fortum, which suffered from exposure to the Russian market, and UK-based home builder Persimmon, which came under pressure from rising interest rates and a slowdown in home building.

From a country perspective, the fund saw strong returns from positions in the oil-producing states of United Arab Emirates and Qatar, while shares in Russia and Poland lagged. Stock selection proved particularly favorable in Japan and Canada, while selection underperformed in Finland and South Africa. As the period progressed, the fund added to its exposure in Brazil and France, while trimming exposure in Japan and South Korea. Sector changes included increased exposure to industrials and reduced exposure to materials.

Maintaining a Diversified, Dividend-Focused Portfolio

The risks and uncertainties that weighed on equities during the past year appear likely to linger as central banks come to grips with stubbornly persistent inflationary forces, and as geopolitical conflicts continue to flare. In this environment, we believe the fund is well positioned to provide investors with diversified access to international, high-dividend-paying stocks that reflect the geographic, sector and market-capitalization characteristics of the Index. While the fund maintains weightings similar to those of the Index, it does hold modest overweights and underweights in some areas. As of August 31, 2022, sector overweights included energy, financials and utilities, while underweights included materials and consumer discretionary.

16

Country overweights included Taiwan and New Zealand, with underweights in India, South Korea and Denmark.

September 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI ACWI ex USA Index captures large- and mid-cap representation across developed market (DM) countries (excluding the U.S.) and emerging market (EM) countries. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

17

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

For the period from September 1, 2021, through August 31, 2022, as provided by Alicia Levine, Primary Portfolio Manager responsible for investment allocation decisions

Market and Fund Performance Overview

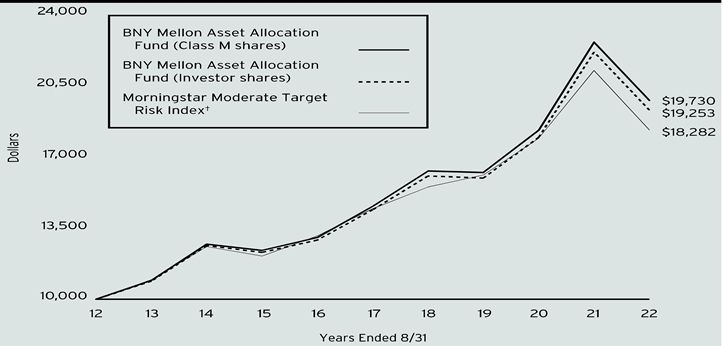

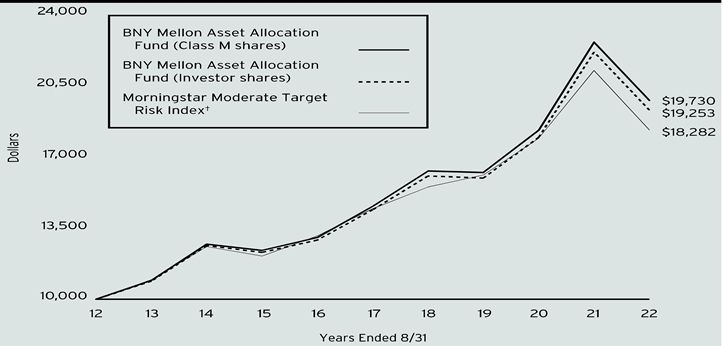

For the 12-month period ended August 31, 2022, BNY Mellon Asset Allocation Fund’s (the “fund”) Class M shares produced a total return of −12.62%, and Investor shares produced a total return of −12.85%.1 In comparison, the fund’s benchmark, the Morningstar Moderate Target Risk Index (the “Index”), produced a total return of −13.74% for the same period.2

Stocks and bonds generally lost ground during the period under pressure from increasing inflationary pressures, rising interest rates and heightened geopolitical tensions. The fund outperformed the Index, driven largely by allocations to large-cap, value-oriented equities and, to a lesser extent, high yield bonds.

The Fund’s Investment Approach

The fund seeks long-term growth of principal in conjunction with current income. The fund may invest in both individual securities and other investment companies, including other BNY Mellon funds, funds in the BNY Mellon Investment Adviser, Inc. Family of Funds and unaffiliated open-end funds, closed-end funds and exchange-traded funds (collectively, the “underlying funds”). To pursue its goal, the fund currently intends to allocate its assets, directly and/or through investment in the underlying funds, to gain investment exposure to the following asset classes: Large-Cap Equities, Small-Cap and Mid-Cap Equities, Developed International and Global Equities, Emerging Market Equities, Investment Grade Bonds, High Yield Bonds, Emerging Markets Debt, Diversifying Strategies and Money Market Instruments.

BNY Mellon Investment Adviser, Inc. (BNYM Investment Adviser) allocates the fund’s investments among these asset classes using fundamental and quantitative analysis and its outlook for the economy and financial markets. The underlying funds are selected by BNYM Investment Adviser based on their investment objectives and management policies, portfolio holdings, risk/reward profiles, historical performance and other factors, including the correlation and covariance among the underlying funds.

Inflation and Slowing Economic Growth Pressure Risk Assets

The reporting period began amid increasing inflationary pressures due to rising energy and commodity prices and global supply-chain disruptions. The U.S. Federal Reserve (the “Fed”), which expressed increasingly hawkish sentiments prior to the start of the period, indicated in September 2021 a willingness to consider reducing accommodative policies sooner rather than later due to the unexpected level and persistence of inflationary forces affecting the economy. As inflationary pressures continued to mount, Fed rhetoric grew increasingly emphatic. Increasing tensions between Russia and Ukraine in early 2022 and the eventual invasion of Ukraine by its larger neighbor further undermined investor sentiment and pressured international credit markets. The Fed began to take concrete action soon thereafter, raising the fed funds rate by ..25% in March, .50% in May, .75% in June and another .75% in July—its most aggressive series of rate increases in decades.

Stock prices declined under pressure from increasingly risk-off sentiment, with growth stocks underperforming value-oriented shares. From a global perspective, U.S.-based issues tended to maintain their value better than international equities, while emerging markets trailed developed markets. Bond prices trended lower as well as spreads widened and yields crept higher, with short-term rates rising faster than long-term rates, resulting in the yield curve flattening and eventually inverting. Corporate bonds underperformed government-issued securities and securitized instruments in a flight to safety. Short-duration instruments tended to outperform their longer-duration counterparts, while higher-rated, higher-quality issues tended to outperform lower-rated bonds. Floating-rate bonds and Treasury Inflation-Protected Securities (TIPS) performed relatively well, as both asset classes offer a degree of protection from rising interest rates.

Equity and Fixed-Income Allocations Outperform

The largest positive contributor to performance relative to the Index came from the fund’s allocation to large-cap blend equities. The fund’s allocation to mid-cap equities also provided a small boost to relative returns, with other equity styles detracting from relative performance. Manager selection in equities detracted from returns as well, as detailed below. Conversely, among fixed-income allocations, manager selection was the main driver of the fund’s relatively strong performance, with allocation making a slightly positive contribution. High yield provided the top positive contribution, followed by floating-rate income. Investment grade fixed income also enhanced relative performance, driven by the contribution from intermediate bonds.