UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number |

| 811-09913 |

| AIM Counselor Series Trust (Invesco Counselor Series Trust) | ||

| (Exact name of registrant as specified in charter) | ||

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Address of principal executive offices) (Zip code) | ||

| Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Name and address of agent for service) | ||

| Registrant’s telephone number, including area code: | (713) 626-1919 |

Date of fiscal year end: | 8/31 | |||

Date of reporting period: | 8/31/18 | |||

Item 1. Report to Stockholders.

| ||||

| Annual Report to Shareholders

| August 31, 2018 | ||

| ||||

Invesco American Franchise Fund

Nasdaq: A: VAFAX ∎ C: VAFCX ∎ R: VAFRX ∎ Y: VAFIX ∎ R5: VAFNX ∎ R6: VAFFX | ||||

Letters to Shareholders

| Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. In calendar year 2017, we witnessed highly unusual activity in the US stock market: stocks appreciated steadily, market indexes repeatedly reached all-time highs and volatility was historically low. While enactment of tax reform legislation in December 2017 helped boost US equities, volatility returned to US stock and bond markets early in 2018. Throughout the reporting period, US economic data remained positive; economic growth in the second quarter of 2018 was particularly strong. Unemployment remained at or near historically low levels and corporate profits were robust, which helped strengthen US equity returns. Meanwhile, amid rising interest rates and increasing volatility, US bond markets were largely weaker. Investors worried that the US Federal Reserve |

appeared willing to raise interest rates faster than previously expected and about the potential for trade wars between the US and some of its most important trading partners. These concerns, together with a strong US dollar, caused emerging markets to underperform developed markets in the second quarter of 2018. As the year progresses, we’ll see how the interplay of economic data, interest rates, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Short-term market volatility can prompt some investors to abandon their investment plans – and can cause others to settle for whatever returns the market has to offer. The investment professionals at Invesco, in contrast, invest with high conviction. This means that, no matter the asset class or the strategy, each investment team has a passion to exceed. We want to help investors achieve better outcomes, such as seeking higher returns, helping mitigate risk and generating income. Of course, investing with high conviction can’t guarantee a profit or ensure success; no investment strategy can. To learn more about how we invest with high conviction, visit invesco.com/HighConviction.

You, too, can invest with high conviction by maintaining a long-term investment perspective and by working with your financial adviser on a regular basis. During periods of short-term market volatility or uncertainty, your financial adviser can keep you focused on your long-term investment goals – a new home, a child’s college education or a secure retirement. He or she also can share research about the economy, the markets and individual investment options.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select “Log In” on the right side of the homepage, and then select “Register for Individual Account Access.”

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

| 2 Invesco American Franchise Fund |

| Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. ∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| ∎ | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| ∎ | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

| 3 Invesco American Franchise Fund |

Management’s Discussion of Fund Performance

Performance summary For the fiscal year ended August 31, 2018, Class A shares of Invesco American Franchise Fund (the Fund), at net asset value (NAV), underperformed the Russell 1000 Growth Index, the Fund’s style-specific benchmark. Your Fund’s long-term performance appears later in this report.

|

| ||||

Fund vs. Indexes | |||||

Total returns, 8/31/17 to 8/31/18, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

| ||||

Class A Shares | 20.30% | ||||

Class C Shares | 19.43 | ||||

Class R Shares | 19.99 | ||||

Class Y Shares | 20.63 | ||||

Class R5 Shares | 20.64 | ||||

Class R6 Shares | 20.75 | ||||

S&P 500 Index▼ (Broad Market Index) | 19.66 | ||||

Russell 1000 Growth Index▼ (Style-Specific Index) | 27.23 | ||||

Lipper Large-Cap Growth Funds Index∎ (Peer Group Index) | 25.46 | ||||

Source(s): ▼FactSet Research Systems Inc.; ∎Lipper Inc. | |||||

Market conditions and your Fund As the fiscal year unfolded in the later months of 2017, several major US stock market indexes repeatedly reached new highs amid improving economic data, strong corporate profits and the prospect of tax reform legislation. Stock market volatility remained exceedingly low – a hallmark of 2017. At the outset of 2018, US equity markets continued to steadily move higher in January as investors remained enthused about the passage of the Tax Cuts and Jobs Act signed into law in late December 2017, which significantly cut corporate tax rates. However, in February 2018, volatility returned to the US stock and bond markets. Worries about how rising interest rates might affect economic growth, concerns about a potential trade war and heightened geopolitical tensions, caused the US stock market to pull back and, volatility to increase. In addition, in April 2018, the yield on the 10-year US Treasury bond climbed above 3% – a psychologically important level – for the first time since December 2013.1 | Despite a disappointing first quarter, US equity markets generally recovered in the second quarter of 2018. Strong US retail sales and low unemployment continued to buoy US equity markets. In the final months of the fiscal year, US equities moved higher, despite several potential headwinds including trade tensions, tariff announcements and contagion concerns over a Turkish currency crisis. Ultimately, the fiscal year ended the same way it began with several US equity indexes reaching new record highs. Given signs of a strong economy, the US Federal Reserve raised interest rates three times during the fiscal year: in December 2017 and in March and June 2018.2 In contrast, the European Central Bank and central banks in several other countries maintained extraordinarily accommodative monetary policies. While US stock market indexes rose for the fiscal year, individual market sectors performed very |

differently from one another. Information technology (IT) and consumer discretionary were the strongest-performing sectors, with returns over 30%, while utilities, consumer staples and telecommunication services were the weakest-performing sectors, with low single-digit returns.3

In this environment, the Fund’s Class A shares at NAV produced a double-digit gain but underperformed the style-specific benchmark during the fiscal year. Stock selection in the IT and health care sectors was the largest detractor from the Fund’s relative performance. Stock selection in telecommunication services and consumer staples sectors also detracted, although underweight exposure to these sectors was beneficial to Fund performance.

Positively, the Fund benefited from stock selection in the consumer discretionary and materials sectors. Overweight exposure to the IT and consumer discretionary sectors, as well as underweight exposure to the materials and real estate sectors contributed to relative returns during the fiscal year.

Within the IT sector, Alphabet and Mastercard were among the top absolute and relative contributors for the fiscal year. Alphabet benefited from diminished pressure regarding increased privacy regulation following Facebook’s Cambridge leak, as well as signs that the European Union’s General Data Protection Regulation would not have a negative impact on advertising momentum. Mastercard experienced strong results following payment volume growth due to its thoughtful approach toward investments within the business-to-business payments arena,

Portfolio Composition | |||||||||||

By sector | % of total net assets | ||||||||||

Information Technology | 46.5% | |||||||||

Consumer Discretionary | 22.5 | |||||||||

Health Care | 13.7 | |||||||||

Industrials | 7.0 | |||||||||

Energy | 3.3 | |||||||||

Materials | 2.3 | |||||||||

Consumer Staples | 2.2 | |||||||||

Financials | 2.2 | |||||||||

Money Market Funds | ||||||||||

Plus Other Assets Less Liabilities

| 0.3

| |||||||||

| Top 10 Equity Holdings* | ||||||||||

| % of total net assets | ||||||||||

1. Amazon.com, Inc. | 9.9 | % | ||||||||

2. Alphabet Inc.-Class A | 7.5 | |||||||||

3. Facebook, Inc.-Class A | 5.0 | |||||||||

4. Alibaba Group Holding Ltd.-ADR | 4.0 | |||||||||

5. UnitedHealth Group Inc. | 3.5 | |||||||||

6. Mastercard Inc.-Class A | 3.5 | |||||||||

7. Apple Inc. | 3.5 | |||||||||

8. Microsoft Corp. | 3.0 | |||||||||

9. Lowe’s Cos., Inc. | 2.9 | |||||||||

10. salesforce.com, inc.

|

| 2.9

|

| |||||||

Total Net Assets | $11.6 billion | |||||||||

Total Number of Holdings*

|

| 68

|

| |||||||

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings.

Data presented here are as of August 31, 2018.

| 4 Invesco American Franchise Fund |

blockchain technology and fast ACH processing. Conversely, underweight exposure to Apple and Microsoft were the largest relative detractors within the IT sector. Our overall position in these stocks is quite large; however we maintain underweight exposure relative to the style-specific benchmark. We believe Apple may face margin pressure on the iPhone, which represents a key revenue driver for the company. While Microsoft is well-positioned for the enterprise technology environment, we believe a large amount of legacy business may impact the stock’s ability to outperform, especially given a valuation that appears reasonable. We continue to view both stocks positively, but reduced exposure during the fiscal year in favor of higher conviction holdings.

Holdings in the health care sector detracted from the Fund’s performance relative to its style-specific benchmark for the fiscal year. Specifically, Allergan and Celgene were key detractors. Allergan, a specialty pharmaceutical company, suffered from negative market sentiment as a result of trying to shield an expiring patent on its flagship product Restasis, as well as competition concerns regarding its key aesthetics product Botox. Celgene is a biopharmaceutical firm focused on products for the treatment of cancer and other severe, immune and inflammatory conditions. Celgene suffered amid concerns around the risk of generic competition following key patent expirations, as well as negative clinical and regulatory developments on its pipeline. We continue to hold positions in both stocks; however, we reduced our exposure during the fiscal year in favor of higher conviction holdings.

Within the consumer discretionary sector, Amazon.com and Lowe’s were among top contributors on an absolute and relative basis for the fiscal year. Retail and e-commerce giant Amazon.com reported strong revenue growth across all segments and strong profit margins in its retail and Amazon Web Services (AWS) segments. AWS provides on-demand cloud computing services enabling retailers to increase operational efficiency in order to have a global reach and gain scale quickly. Retail home improvement and hardware chain Lowe’s performed well following a sharp rebound in same store sales in the spring of 2018. Additionally, the announcement that Marvin Ellison, former chief executive officer (CEO) at JC Penney (not a Fund holding) and Home Depot, would become CEO at Lowe’s was viewed favorably, as the company’s culture and business strategy were expected to improve.

At the end of the fiscal year, the Fund’s largest overweight positions relative to the style-specific benchmark were in the consumer discretionary, IT and energy sectors. The largest underweight exposures were in the industrials, consumer staples, financials and real estate sectors.

The traditional business cycle recovery has not fully materialized, as results over the last several years have been mixed, depending on which sector we evaluate. However, it is possible that this is just a very slow normalization, and there is some evidence we may yet see a more classic recovery and reacceleration in growth. Near-term economic growth seems uncertain despite US consumer and business confidence being strong. Given this scenario, we are seeking opportunities in companies that are taking share within their respective industries. Though we anticipate a possible slowdown in the economy, we continue to prudently balance the Fund between dynamic growth opportunities and more durable growth opportunities.

Thank you for your commitment to Invesco American Franchise Fund and for sharing our long-term investment horizon.

| 1 | Source: US Treasury Department |

| 2 | Source: US Federal Reserve |

| 3 | Source: Lipper Inc. |

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| Erik Voss Chartered Financial Analyst, Portfolio Manager, is lead manager of Invesco American Franchise Fund. He joined | |

| Invesco in 2010. Mr. Voss earned a BS in mathematics and an MS in finance from the University of Wisconsin. | ||

| Ido Cohen Portfolio Manager, is manager of Invesco American Franchise Fund. He joined Invesco in 2010. | |

| Mr. Cohen earned a BS in economics from The Wharton School of the University of Pennsylvania. | ||

| 5 Invesco American Franchise Fund |

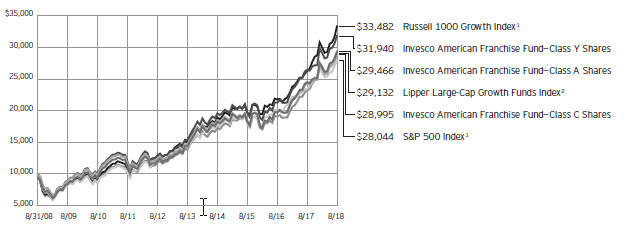

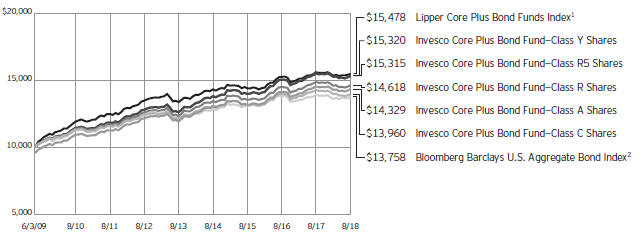

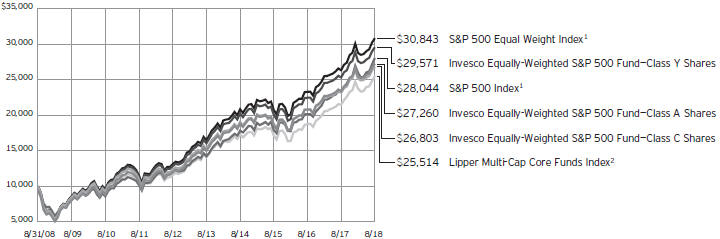

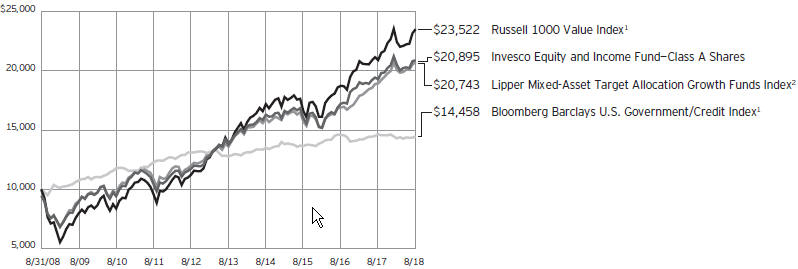

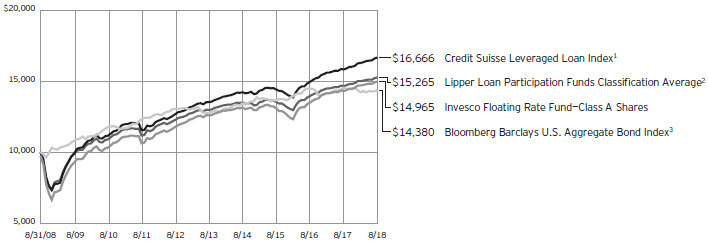

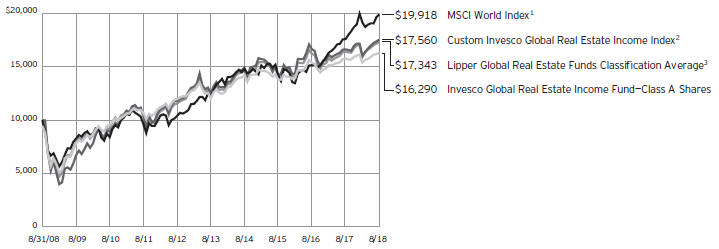

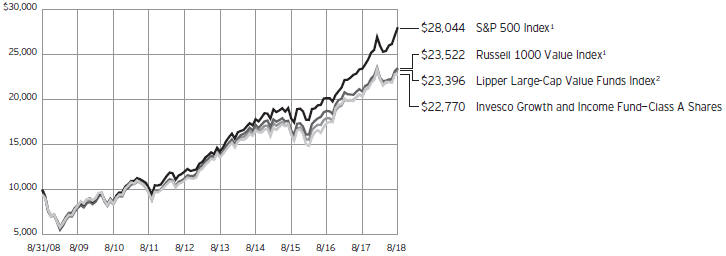

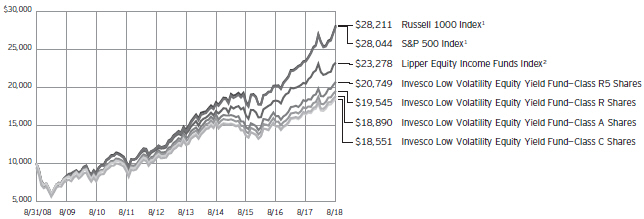

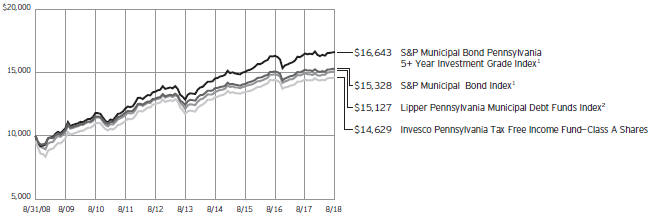

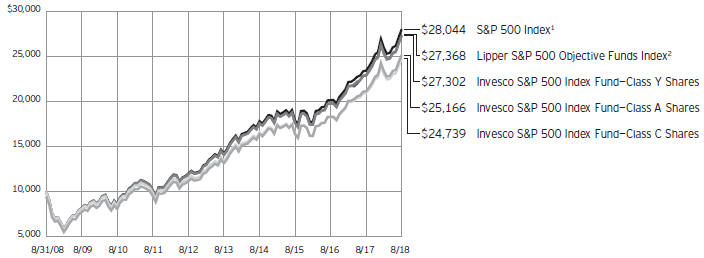

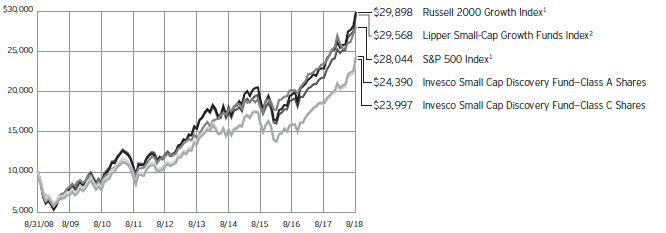

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 8/31/08

1 Source: FactSet Research Systems Inc.

2 Source: Lipper Inc.

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management fees. Index results include reinvested dividends, but they do not reflect sales charges.

Performance of the peer group, if applicable, reflects fund expenses and management fees; performance of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| 6 Invesco American Franchise Fund |

Average Annual Total Returns |

| ||||

| As of 8/31/18, including maximum applicable sales charges |

| ||||

Class A Shares | |||||

Inception (6/23/05) | 9.49 | % | |||

10 Years | 11.41 | ||||

5 Years | 14.23 | ||||

1 Year | 13.68 | ||||

Class C Shares | |||||

Inception (6/23/05) | 9.15 | % | |||

10 Years | 11.23 | ||||

5 Years | 14.66 | ||||

1 Year | 18.43 | ||||

Class R Shares | |||||

10 Years | 11.76 | % | |||

5 Years | 15.23 | ||||

1 Year | 19.99 | ||||

Class Y Shares | |||||

Inception (6/23/05) | 10.21 | % | |||

10 Years | 12.31 | ||||

5 Years | 15.81 | ||||

1 Year | 20.63 | ||||

Class R5 Shares | |||||

10 Years | 12.35 | % | |||

5 Years | 15.92 | ||||

1 Year | 20.64 | ||||

Class R6 Shares | |||||

10 Years | 12.33 | % | |||

5 Years | 16.01 | ||||

1 Year | 20.75 | ||||

Effective June 1, 2010, Class A, Class C and Class I shares of the predecessor fund, Van Kampen American Franchise Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class C and Class Y shares, respectively, of Invesco Van Kampen American Franchise Fund (renamed Invesco American Franchise Fund). Returns shown above, prior to June 1, 2010, for Class A, Class C and Class Y shares are blended returns of the predecessor fund and Invesco American Franchise Fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R shares incepted on May 23, 2011. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares, restated to reflect the higher 12b-1 fees applicable to Class R shares.

Class R5 shares incepted on December 22, 2010. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares.

Average Annual Total Returns |

| ||||

| As of 6/30/18, the most recent calendar quarter end, including maximum applicable sales charges |

| ||||

Class A Shares | |||||

Inception (6/23/05) | 9.09 | % | |||

10 Years | 11.38 | ||||

5 Years | 14.49 | ||||

1 Year | 12.20 | ||||

Class C Shares | |||||

Inception (6/23/05) | 8.76 | % | |||

10 Years | 11.21 | ||||

5 Years | 14.91 | ||||

1 Year | 16.80 | ||||

Class R Shares | |||||

10 Years | 11.73 | % | |||

5 Years | 15.50 | ||||

1 Year | 18.44 | ||||

Class Y Shares | |||||

Inception (6/23/05) | 9.81 | % | |||

10 Years | 12.29 | ||||

5 Years | 16.08 | ||||

1 Year | 19.00 | ||||

Class R5 Shares | |||||

10 Years | 12.31 | % | |||

5 Years | 16.19 | ||||

1 Year | 19.08 | ||||

Class R6 Shares | |||||

10 Years | 12.30 | % | |||

5 Years | 16.30 | ||||

1 Year | 19.21 | ||||

Class R6 shares incepted on September 24, 2012. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares was 1.06%, 1.81%, 1.31%, 0.81%, 0.72% and 0.64%, respectively. The expense ratios presented above may

vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 7 Invesco American Franchise Fund |

Invesco American Franchise Fund’s investment objective is to seek long-term capital appreciation.

| ∎ | Unless otherwise stated, information presented in this report is as of August 31, 2018, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| ∎ | Class R shares are generally available only to employer sponsored retirement and benefit plans. Please see the prospectus for more information. |

| ∎ | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| ∎ | Class R5 shares and Class R6 shares are available for use by retirement plans that meet certain standards and for institutional investors. Class R6 shares are also available through intermediaries that have established an agreement with Invesco Distributors, Inc. to make such shares available for use in retail omnibus accounts. Please see the prospectus for more information. |

Principal risks of investing in the Fund

| ∎ | Foreign securities risk. The Fund’s foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility. Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. |

| ∎ | Growth investing risk. Growth stocks tend to be more expensive relative to the issuing company’s earnings or assets compared with |

other types of stock. As a result, they tend to be more sensitive to changes in, or investors’ expectations of, the issuing company’s earnings and can be more volatile. |

| ∎ | Management risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. |

| ∎ | Market risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value. |

| ∎ | Mid-capitalization companies risk. Mid-capitalization companies tend to be more vulnerable to changing market conditions and may have more limited product lines and markets, less experienced management and fewer financial resources than larger companies. These companies’ securities may be more volatile and less liquid than those of more established companies, and their returns may vary, sometimes significantly, from the overall securities market. |

| ∎ | Sector focus risk. The Fund may from time to time invest a significant amount of its assets (i.e. over 25%) in one market sector or group of |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| related industries. In this event, the Fund’s performance will depend to a greater extent on the overall condition of the sector or group of industries and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries. |

About indexes used in this report

| ∎ | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| ∎ | The Russell 1000® Growth Index is an unmanaged index considered representative of large-cap growth stocks. The Russell 1000 Growth Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. |

| ∎ | The Lipper Large-Cap Growth Funds Index is an unmanaged index considered representative of large-cap growth funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| ∎ | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| ∎ | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| 8 Invesco American Franchise Fund |

Schedule of Investments(a)

August 31, 2018

| Shares | Value | |||||||

Common Stocks & Other Equity Interests–99.74% |

| |||||||

| Aerospace & Defense–3.24% |

| |||||||

Airbus S.E. (France) | 691,721 | $ | 85,328,789 | |||||

BAE Systems PLC (United Kingdom) | 14,029,147 | 110,207,058 | ||||||

Boeing Co. (The) | 285,807 | 97,971,782 | ||||||

Raytheon Co. | 404,775 | 80,728,326 | ||||||

| 374,235,955 | ||||||||

| Agricultural & Farm Machinery–0.30% |

| |||||||

Deere & Co. | 240,771 | 34,622,870 | ||||||

| Application Software–4.02% |

| |||||||

Adobe Systems Inc.(b) | 502,549 | 132,426,687 | ||||||

salesforce.com, inc.(b) | 2,174,266 | 331,966,933 | ||||||

| 464,393,620 | ||||||||

| Biotechnology–1.88% |

| |||||||

Alexion Pharmaceuticals, Inc.(b) | 844,748 | 103,261,995 | ||||||

BioMarin Pharmaceutical Inc.(b) | 178,023 | 17,798,740 | ||||||

Celgene Corp.(b) | 1,013,153 | 95,692,301 | ||||||

| 216,753,036 | ||||||||

| Cable & Satellite–1.19% |

| |||||||

Altice USA, Inc.–Class A(c) | 1,470,320 | 26,348,135 | ||||||

Charter Communications, Inc.–Class A(b) | 359,783 | 111,676,643 | ||||||

| 138,024,778 | ||||||||

| Commodity Chemicals–0.53% |

| |||||||

LyondellBasell Industries N.V.–Class A | 540,154 | 60,918,568 | ||||||

| Communications Equipment–1.26% |

| |||||||

Palo Alto Networks, Inc.(b) | 628,820 | 145,351,743 | ||||||

| Consumer Electronics–2.25% |

| |||||||

Sony Corp. (Japan) | 4,593,100 | 260,507,075 | ||||||

| Data Processing & Outsourced Services–7.49% |

| |||||||

Mastercard Inc.–Class A | 1,896,078 | 408,718,574 | ||||||

PayPal Holdings, Inc.(b) | 1,882,576 | 173,818,242 | ||||||

Visa Inc.–Class A | 1,929,864 | 283,477,723 | ||||||

| 866,014,539 | ||||||||

| Diversified Banks–0.49% |

| |||||||

Wells Fargo & Co. | 977,252 | 57,149,697 | ||||||

| Diversified Support Services–0.85% |

| |||||||

Cintas Corp. | 459,371 | 98,015,990 | ||||||

| Environmental & Facilities Services–1.22% |

| |||||||

Republic Services, Inc. | 1,088,224 | 79,832,113 | ||||||

Waste Management, Inc. | 678,949 | 61,716,464 | ||||||

| 141,548,577 | ||||||||

| Financial Exchanges & Data–1.40% |

| |||||||

London Stock Exchange Group PLC (United Kingdom) | 1,420,212 | 85,128,802 | ||||||

| Shares | Value | |||||||

| Financial Exchanges & Data–(continued) |

| |||||||

S&P Global Inc. | 369,977 | $ | 76,603,738 | |||||

| 161,732,540 | ||||||||

| Health Care Equipment–2.79% |

| |||||||

Boston Scientific Corp.(b) | 2,361,860 | 83,987,742 | ||||||

Intuitive Surgical, Inc.(b) | 221,878 | 124,251,680 | ||||||

Stryker Corp. | 675,259 | 114,409,132 | ||||||

| 322,648,554 | ||||||||

| Home Entertainment Software–6.24% |

| |||||||

Activision Blizzard, Inc. | 4,025,913 | 290,268,327 | ||||||

Electronic Arts Inc.(b) | 1,381,120 | 156,632,819 | ||||||

Nintendo Co., Ltd. (Japan) | 759,000 | 274,409,795 | ||||||

| 721,310,941 | ||||||||

| Home Improvement Retail–3.57% |

| |||||||

Home Depot, Inc. (The) | 369,466 | 74,177,689 | ||||||

Lowe’s Cos., Inc. | 3,116,327 | 338,900,561 | ||||||

| 413,078,250 | ||||||||

| Hotels, Resorts & Cruise Lines–2.40% |

| |||||||

Norwegian Cruise Line Holdings Ltd.(b) | 1,148,707 | 61,582,182 | ||||||

Royal Caribbean Cruises Ltd. | 1,759,787 | 215,714,691 | ||||||

| 277,296,873 | ||||||||

| Industrial Gases–0.73% |

| |||||||

Air Products and Chemicals, Inc. | 509,990 | 84,806,237 | ||||||

| Industrial Machinery–0.95% |

| |||||||

Stanley Black & Decker Inc. | 784,874 | 110,298,343 | ||||||

| Integrated Oil & Gas–1.09% |

| |||||||

Occidental Petroleum Corp. | 1,581,446 | 126,310,092 | ||||||

| Internet & Direct Marketing Retail–12.07% |

| |||||||

Amazon.com, Inc.(b) | 566,710 | 1,140,622,884 | ||||||

Booking Holdings Inc.(b) | 62,539 | 122,047,985 | ||||||

Netflix, Inc.(b) | 361,829 | 133,037,287 | ||||||

| 1,395,708,156 | ||||||||

| Internet Software & Services–16.48% |

| |||||||

Alibaba Group Holding Ltd.–ADR (China)(b) | 2,642,111 | 462,395,846 | ||||||

Alphabet Inc.–Class A(b) | 701,729 | 864,389,782 | ||||||

Facebook, Inc.–Class A(b) | 3,292,664 | 578,619,845 | ||||||

| 1,905,405,473 | ||||||||

| Investment Banking & Brokerage–0.34% |

| |||||||

Morgan Stanley | 812,111 | 39,655,380 | ||||||

| Life Sciences Tools & Services–3.43% |

| |||||||

Illumina, Inc.(b) | 448,737 | 159,225,350 | ||||||

IQVIA Holdings Inc.(b) | 799,255 | 101,577,318 | ||||||

Thermo Fisher Scientific, Inc. | 568,599 | 135,952,021 | ||||||

| 396,754,689 | ||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco American Franchise Fund

| Shares | Value | |||||||

| Managed Health Care–4.04% |

| |||||||

Anthem, Inc. | 218,534 | $ | 57,852,506 | |||||

UnitedHealth Group Inc. | 1,525,824 | 409,622,711 | ||||||

| 467,475,217 | ||||||||

| Movies & Entertainment–0.45% |

| |||||||

Vivendi S.A. (France) | 2,000,976 | 51,917,553 | ||||||

| Oil & Gas Exploration & Production–0.87% |

| |||||||

Noble Energy, Inc. | 1,680,050 | 49,931,086 | ||||||

Parsley Energy, Inc.–Class A(b) | 1,805,995 | 50,152,481 | ||||||

| 100,083,567 | ||||||||

| Oil & Gas Refining & Marketing–1.36% |

| |||||||

Andeavor | 1,029,187 | 157,249,482 | ||||||

| Packaged Foods & Meats–1.43% |

| |||||||

Mondelez International, Inc.–Class A | 1,299,254 | 55,504,131 | ||||||

Tyson Foods, Inc.–Class A | 1,746,652 | 109,707,212 | ||||||

| 165,211,343 | ||||||||

| Pharmaceuticals–1.53% |

| |||||||

Allergan PLC | 381,817 | 73,198,137 | ||||||

Zoetis Inc. | 1,142,734 | 103,531,700 | ||||||

| 176,729,837 | ||||||||

| Railroads–0.49% |

| |||||||

Canadian Pacific Railway Ltd. (Canada) | 267,858 | 56,397,502 | ||||||

| Restaurants–0.54% |

| |||||||

Starbucks Corp. | 1,159,475 | 61,973,939 | ||||||

| Semiconductor Equipment–2.13% |

| |||||||

Applied Materials, Inc. | 1,761,825 | 75,793,712 | ||||||

ASML Holding N.V.–New York Shares (Netherlands) | 831,687 | 170,537,419 | ||||||

| 246,331,131 | ||||||||

| Semiconductors–1.84% |

| |||||||

Broadcom Inc. | 349,167 | 76,478,048 | ||||||

NVIDIA Corp. | 486,849 | 136,648,777 | ||||||

| 213,126,825 | ||||||||

| Shares | Value | |||||||

| Specialty Chemicals–1.03% |

| |||||||

Sherwin-Williams Co. (The) | 260,057 | $ | 118,476,768 | |||||

| Systems Software–3.53% |

| |||||||

Microsoft Corp. | 3,051,566 | 342,782,409 | ||||||

ServiceNow, Inc.(b) | 329,305 | 64,662,330 | ||||||

| 407,444,739 | ||||||||

| Technology Hardware, Storage & Peripherals–3.48% |

| |||||||

Apple Inc. | 1,764,645 | 401,686,141 | ||||||

| Tobacco–0.81% |

| |||||||

Philip Morris International Inc. | 1,199,465 | 93,426,329 | ||||||

Total Common Stocks & Other Equity Interests |

| 11,530,072,349 | ||||||

Money Market Funds–0.02% |

| |||||||

Invesco Government & Agency Portfolio–Institutional Class, 1.85%(d) | 862,287 | 862,287 | ||||||

Invesco Liquid Assets Portfolio–Institutional Class, 2.07%(d) | 615,317 | 615,563 | ||||||

Invesco Treasury Portfolio–Institutional Class, 1.85%(d) | 985,471 | 985,471 | ||||||

Total Money Market Funds |

| 2,463,321 | ||||||

TOTAL INVESTMENTS IN SECURITIES (excluding investments purchased with cash collateral from securities on loan)–99.76% |

| 11,532,535,670 | ||||||

Investments Purchased with Cash Collateral from Securities on Loan |

| |||||||

Money Market Funds–0.00% |

| |||||||

Invesco Government & Agency Portfolio–Institutional Class, 1.85% | 114,884 | 114,884 | ||||||

TOTAL INVESTMENTS IN SECURITIES–99.76% |

| 11,532,650,554 | ||||||

OTHER ASSETS LESS LIABILITIES–0.24% |

| 27,390,594 | ||||||

NET ASSETS–100.00% |

| $ | 11,560,041,148 | |||||

Investment Abbreviations:

| ADR | – American Depositary Receipt |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at August 31, 2018. |

| (d) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of August 31, 2018. |

| (e) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco American Franchise Fund

Statement of Assets and Liabilities

August 31, 2018

Assets: | ||||

Investments in securities, at value (Cost $6,178,019,456)* | $ | 11,530,072,349 | ||

Investments in affiliated money market funds, at value (Cost $2,578,082) | 2,578,205 | |||

Cash | 355,530 | |||

Receivable for: |

| |||

Investments sold | 36,871,373 | |||

Fund shares sold | 2,395,431 | |||

Dividends | 5,885,814 | |||

Investment for trustee deferred compensation and retirement plans | 2,624,827 | |||

Other assets | 168,022 | |||

Total assets | 11,580,951,551 | |||

Liabilities: | ||||

Payable for: |

| |||

Investments purchased | 6,164,710 | |||

Collateral upon return of securities loaned | 114,884 | |||

Fund shares reacquired | 5,787,771 | |||

Accrued fees to affiliates | 5,392,197 | |||

Accrued trustees’ and officers’ fees and benefits | 22,738 | |||

Accrued other operating expenses | 534,757 | |||

Trustee deferred compensation and retirement plans | 2,893,346 | |||

Total liabilities | 20,910,403 | |||

Net assets applicable to shares outstanding | $ | 11,560,041,148 | ||

Net assets consist of: | ||||

Shares of beneficial interest | $ | 5,451,417,573 | ||

Undistributed net investment income (loss) | (14,133,061 | ) | ||

Undistributed net realized gain | 770,705,343 | |||

Net unrealized appreciation | 5,352,051,293 | |||

| $ | 11,560,041,148 | |||

Net Assets: | ||||

Class A | $ | 10,524,889,088 | ||

Class C | $ | 401,862,518 | ||

Class R | $ | 38,537,148 | ||

Class Y | $ | 368,991,262 | ||

Class R5 | $ | 86,177,030 | ||

Class R6 | $ | 139,584,102 | ||

Shares outstanding, no par value, |

| |||

Class A | 455,318,483 | |||

Class C | 18,930,690 | |||

Class R | 1,701,388 | |||

Class Y | 15,616,415 | |||

Class R5 | 3,638,601 | |||

Class R6 | 5,862,064 | |||

Class A: |

| |||

Net asset value per share | $ | 23.12 | ||

Maximum offering price per share |

| |||

(Net asset value of $23.12 ¸ 94.50%) | $ | 24.47 | ||

Class C: |

| |||

Net asset value and offering price per share | $ | 21.23 | ||

Class R: |

| |||

Net asset value and offering price per share | $ | 22.65 | ||

Class Y: |

| |||

Net asset value and offering price per share | $ | 23.63 | ||

Class R5: |

| |||

Net asset value and offering price per share | $ | 23.68 | ||

Class R6: |

| |||

Net asset value and offering price per share | $ | 23.81 | ||

| * | At August 31, 2018, securities with an aggregate value of $112,806 were on loan to brokers. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco American Franchise Fund

Statement of Operations

For the year ended August 31, 2018

Investment income: |

| |||

Dividends (net of foreign withholding taxes of $1,236,067) | $ | 89,095,128 | ||

Dividends from affiliated money market funds (includes securities lending income of $509,102) | 915,212 | |||

Total investment income | 90,010,340 | |||

Expenses: |

| |||

Advisory fees | 62,360,298 | |||

Administrative services fees | 798,231 | |||

Custodian fees | 486,979 | |||

Distribution fees: |

| |||

Class A | 24,389,576 | |||

Class B | 51,888 | |||

Class C | 3,813,905 | |||

Class R | 186,041 | |||

Transfer agent fees — A, B, C, R and Y | 16,267,958 | |||

Transfer agent fees — R5 | 73,689 | |||

Transfer agent fees — R6 | 9,800 | |||

Trustees’ and officers’ fees and benefits | 161,203 | |||

Registration and filing fees | 183,175 | |||

Reports to shareholders | 831,927 | |||

Professional services fees | 192,218 | |||

Other | 180,172 | |||

Total expenses | 109,987,060 | |||

Less: Fees waived and expense offset arrangement(s) | (253,033 | ) | ||

Net expenses | 109,734,027 | |||

Net investment income (loss) | (19,723,687 | ) | ||

Realized and unrealized gain (loss) from: |

| |||

Net realized gain (loss) from: |

| |||

Investment securities (includes net gains (losses) from securities sold to affiliates of $(867,611)) | 959,398,906 | |||

Foreign currencies | (785,831 | ) | ||

| 958,613,075 | ||||

Change in net unrealized appreciation (depreciation) of: |

| |||

Investment securities | 1,056,072,873 | |||

Foreign currencies | (1,464 | ) | ||

| 1,056,071,409 | ||||

Net realized and unrealized gain | 2,014,684,484 | |||

Net increase in net assets resulting from operations | $ | 1,994,960,797 | ||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco American Franchise Fund

Statement of Changes in Net Assets

For the years ended August 31, 2018 and 2017

| 2018 | 2017 | |||||||

Operations: |

| |||||||

Net investment income (loss) | $ | (19,723,687 | ) | $ | (15,730,028 | ) | ||

Net realized gain | 958,613,075 | 545,065,063 | ||||||

Change in net unrealized appreciation | 1,056,071,409 | 1,535,122,437 | ||||||

Net increase in net assets resulting from operations | 1,994,960,797 | 2,064,457,472 | ||||||

Distributions to shareholders from net realized gains: | ||||||||

Class A | (478,520,623 | ) | (315,582,028 | ) | ||||

Class B | (2,479,794 | ) | (3,787,985 | ) | ||||

Class C | (20,255,914 | ) | (14,719,337 | ) | ||||

Class R | (1,865,721 | ) | (1,131,439 | ) | ||||

Class Y | (13,953,873 | ) | (5,919,585 | ) | ||||

Class R5 | (3,494,510 | ) | (2,009,822 | ) | ||||

Class R6 | (6,684,184 | ) | (4,503,505 | ) | ||||

Total distributions from net realized gains | (527,254,619 | ) | (347,653,701 | ) | ||||

Share transactions–net: | ||||||||

Class A | (145,332,102 | ) | (483,952,097 | ) | ||||

Class B | (62,310,041 | ) | (66,076,907 | ) | ||||

Class C | (16,924,402 | ) | (58,433,043 | ) | ||||

Class R | (888,078 | ) | 440,489 | |||||

Class Y | 60,767,520 | 77,763,045 | ||||||

Class R5 | 7,510,265 | 2,940,200 | ||||||

Class R6 | (10,728,006 | ) | (12,016,209 | ) | ||||

Net increase (decrease) in net assets resulting from share transactions | (167,904,844 | ) | (539,334,522 | ) | ||||

Net increase in net assets | 1,299,801,334 | 1,177,469,249 | ||||||

Net assets: | ||||||||

Beginning of year | 10,260,239,814 | 9,082,770,565 | ||||||

End of year (includes undistributed net investment income (loss) of $(14,133,061) and $(2,747,008), respectively) | $ | 11,560,041,148 | $ | 10,260,239,814 | ||||

Notes to Financial Statements

August 31, 2018

NOTE 1—Significant Accounting Policies

Invesco American Franchise Fund (the “Fund”) is a series portfolio of AIM Counselor Series Trust (Invesco Counselor Series Trust) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is to seek long-term capital appreciation.

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Effective November 30, 2010, new or additional investments in Class B shares are no longer permitted. Existing shareholders of Class B shares were permitted to continue to reinvest dividends and capital gains distributions in Class B shares until their conversion to Class A shares. Also, shareholders in Class B shares were able to exchange those shares for Class B shares of other Invesco Funds offering such shares until they converted to Class A shares. Generally, Class B shares automatically converted to Class A shares on or about the month-end, which was at least eight years after the date of purchase. Redemptions of Class B shares prior to the conversion date were subject to a CDSC. Effective January 26, 2018, all of the Fund’s outstanding Class B shares were converted to Class A shares, in advance of their normally scheduled conversion. No CDSC was paid in connection with this early conversion.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services — Investment Companies.

13 Invesco American Franchise Fund

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

14 Invesco American Franchise Fund

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions — Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses — Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated to each share class based on relative net assets. Sub-accounting fees attributable to Class R5 are charged to the operations of the class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending — The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated money market funds and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated money market funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

| J. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, |

15 Invesco American Franchise Fund

| interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts — The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to the daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund accrues daily and pays monthly an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| Average Daily Net Assets | Rate | |||||||

First $250 million | 0 | .695% | ||||||

Next $250 million | 0 | .67% | ||||||

Next $500 million | 0 | .645% | ||||||

Next $550 million | 0 | .62% | ||||||

Next $3.45 billion | 0 | .60% | ||||||

Next $250 million | 0 | .595% | ||||||

Next $2.25 billion | 0 | .57% | ||||||

Next $2.5 billion | 0 | .545% | ||||||

Over $10 billion | 0 | .52% | ||||||

For the year ended August 31, 2018, the effective advisory fees incurred by the Fund was 0.58%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, will pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2019, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares to 2.00%, 2.75%, 2.25%, 1.75%, 1.75% and 1.75%, respectively, of average daily net assets (the “expense limits”). Prior to their conversion to Class A shares, the expense limit for Class B shares was 2.75% of average daily net assets. In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2019. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits or reduce the advisory fee waivers without approval of the Board of Trustees. The Adviser did not waive fees and/or reimburse expenses during the period under this expense limit.

Further, the Adviser has contractually agreed, through at least June 30, 2020, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash (excluding investments of cash collateral from securities lending) in such affiliated money market funds.

For the year ended August 31, 2018, the Adviser waived advisory fees of $31,113.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended August 31, 2018, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.

16 Invesco American Franchise Fund

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. IIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. All fees payable by IIS to intermediaries that provide omnibus account services or sub-accounting services are charged back to the Fund, subject to certain limitations approved by the Trust’s Board of Trustees. For the year ended August 31, 2018, expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

Shares of the Fund are distributed by Invesco Distributors, Inc. (“IDI”). The Fund has adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act, and a service plan (collectively, the “Plans”) for Class A, Class C and Class R shares to compensate IDI for the sale, distribution, shareholder servicing and maintenance of shareholder accounts for these shares. Under the Plans, the Fund will incur annual fees of up to 0.25% of Class A average daily net assets, up to 1.00% of Class C average daily net assets and up to 0.50% of Class R average daily net assets. Prior to their conversion to Class A shares, the Fund paid an annual rate of 1.00% of the average daily net assets of Class B shares. The fees are accrued daily and paid monthly.

With respect to Class C shares, the Fund is authorized to reimburse in future years any distribution related expenses that exceed the maximum annual reimbursement rate for such class, so long as such reimbursement does not cause the Fund to exceed the Class C maximum annual reimbursement rate, respectively. With respect to Class A shares, distribution related expenses that exceed the maximum annual reimbursement rate for such class are not carried forward to future years and the Fund will not reimburse IDI for any such expenses.

For the year ended August 31, 2018, expenses incurred under these arrangements are shown in the Statement of Operations as Distribution fees.

Front-end sales commissions and CDSC (collectively, the “sales charges”) are not recorded as expenses of the Fund. Front-end sales commissions are deducted from proceeds from the sales of Fund shares prior to investment in Class A shares of the Fund. CDSC are deducted from redemption proceeds prior to remittance to the shareholder. During the year ended August 31, 2018, IDI advised the Fund that IDI retained $776,359 in front-end sales commissions from the sale of Class A shares and $5,037, $161 and $11,336 from Class A, Class B and Class C shares, respectively, for CDSC imposed on redemptions by shareholders.

For the year ended August 31, 2018, the Fund incurred $70,622 in brokerage commissions with Invesco Capital Markets, Inc., an affiliate of the Adviser and IDI, for portfolio transactions executed on behalf of the Fund.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |