QuickLinks -- Click here to rapidly navigate through this document

Exhibit 6

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

and

MANAGEMENT PROXY CIRCULAR

Æterna Zentaris Inc.

March 7, 2005

NOTICE OF THE ANNUAL MEETING

OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Æterna Zentaris Inc. (the "Corporation") will be held at The Ritz-Carlton Hotel, 1228 Sherbrooke Street West, Montreal, Quebec, on Thursday, May 26, 2005, at 10:30 a.m. (Montreal time) for the following purposes:

- 1.

- to receive the audited consolidated financial statements of the Corporation for the financial year ended December 31, 2004, and the auditors' report thereon;

- 2.

- to elect directors;

- 3.

- to appoint auditors and authorize the directors to determine their compensation; and

- 4.

- to transact such other business as may properly come before the meeting.

Enclosed is a copy of the 2004 Annual Report of the Corporation including the financial statements and the auditors' report thereon, together with the Management Proxy Circular and a form of proxy.

By order of the Board of Directors,

Mario Paradis, CA

Corporate Secretary

Quebec City, Quebec, March7, 2005

Shareholders unable to attend the meeting are requested to complete and sign the enclosed form of proxy and return it in the stamped envelope provided. To be valid, proxies must reach the office of National Bank Trust Inc., Share Ownership Management, 1100 University Street, 9th Floor, Montreal, Quebec, H3B 2G7, no later than at the close of business on the last business day preceding the date of the meeting or any adjournment thereof.

Æterna Zentaris Inc., 1405 du Parc-Technologique Boulevard, Quebec City, Quebec, G1P 4P5

MANAGEMENT PROXY CIRCULAR

1. SOLICITATION OF PROXIES

This Management Proxy Circular is furnished in connection with the solicitation, by the Management of Æterna Zentaris Inc. (the "Corporation"), of proxies to be used at the annual meeting of shareholders of the Corporation (the "Meeting"), to be held on Thursday, May 26, 2005, at the time and place and for the purposes set forth in the Notice of Meeting or any adjournment thereof.

Unless otherwise indicated, the information contained in this Circular is given as of March 1, 2005. All dollar amounts in this Management Proxy Circular refer to Canadian dollars, unless otherwise indicated.

The solicitation will be conducted primarily by mail; some proxies may also be solicited directly in the case of directors, officers or employees of the Corporation, but without further compensation. The Corporation may also reimburse brokers and other persons holding the Corporation's common shares (the "Common Shares") on their behalf or on behalf of nominees, for costs incurred in sending the proxy documents to principals and to obtain their proxies. The Corporation will assume the costs of solicitation, which are expected to be minimal.

2. APPOINTMENT OF PROXYHOLDERS

The persons named as proxyholders in the enclosed form of proxy are directors or officers of the Corporation. A shareholder may appoint a person other than the persons indicated in such proxy form to act as his or her proxyholder. To do so, the shareholder must write the name of such person in the appropriate space on the form of proxy. In order to ensure they are counted, duly completed proxies must be received at the office of National Bank Trust Inc., Share Ownership Management, 1100 University Street, 9th Floor, Montreal, Quebec, H3B 2G7, no later than at the close of business on the last business day preceding the date of the Meeting or any adjournment thereof, or they may be delivered to the Chairman at the Meeting or at any adjournment thereof. A person acting as proxyholder need not be a shareholder of the Corporation.

3. REVOCATION OF PROXIES

A shareholder giving a proxy may revoke it at all times by a document signed by him or her or by a proxyholder authorized in writing or, if the shareholder is a corporation, by a document signed by an officer or a proxyholder duly authorized, given to the Corporate Secretary of the Corporation at 1405 du Parc-Technologique Boulevard, Quebec City, Quebec, G1P 4P5, until the last business day, inclusively, preceding the day of the Meeting or any adjournment thereof at which the proxy is to be used, or to the Chairman of such meeting on the day of the Meeting or any adjournment thereof.

1

4. NON-REGISTERED HOLDERS OF SHARES

The information set forth in this section should be reviewed carefully by the non-registered shareholders of the Corporation. Shareholders who do not hold their shares in their own name should note that only proxies deposited by shareholders who appear on the records maintained by the Corporation's registrar and transfer agent as registered holders of shares will be recognized and acted upon at the Meeting.

Non-registered shareholders may vote shares that are held by their nominees in one of two manners. Applicable securities laws and regulations, including National Instrument 54-101Communication with Beneficial Owners of Securities of a Reporting Issuer, require nominees of non-registered shareholders to seek their voting instructions in advance of the Meeting. Non-registered shareholders will receive (or will have received) from their nominees either a request for voting instructions or a proxy form for the number of shares held by them. The nominees' voting instructions or proxy forms will contain instructions relating to signature and return of the document and these instructions should be carefully read and followed by non-registered shareholders to ensure that their shares are accordingly voted at the Meeting.

Non-registered shareholders who would like their shares to be voted for them must therefore follow the voting instructions provided by their nominees.

Non-registered shareholders who wish to vote their shares in person at the Meeting must insert their own name in the space provided on the request for voting instructions or proxy form, as the case may be, in order to appoint themselves as proxyholder and follow the signature and return instructions provided by their nominees. Non-registered shareholders who appoint themselves as proxyholders should present themselves at the Meeting to a representative of National Bank Trust Inc. Non-registered shareholders should not otherwise complete the form sent to them by their nominees as their votes will be taken and counted at the Meeting.

All references to "shareholders" in this Management Proxy Circular and the accompanying form of proxy and Notice of Meeting are to registered shareholders unless specifically stated otherwise.

5. VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The shares conferring voting rights at the Meeting are Common Shares. Each Common Share confers the right to one vote. As at March 1, 2005, there were 46,139,814 Common Shares issued and outstanding.

Holders of Common Shares, entered on the list of shareholders compiled at the close of business (Montreal time) on March 28, 2005, will have the right to vote at the Meeting or at any adjournment thereof if they are present or represented by a proxyholder.

2

To the knowledge of the directors and officers of the Corporation, the only persons who are beneficial owners of, directly or indirectly, or exercise power or control over shares conferring more than 10% of the voting rights attached to each class of participating and issued and outstanding shares of the Corporation are indicated in the table below:

Name of shareholder

| | Common Shares

| | Total percentage of voting rights

|

|---|

| | (#)

| | (%)

|

|---|

| Solidarity Fund (QFL) | | 5,449,225 | | 11.81 |

| SGF Santé inc. | | 5,333,334 | | 11.56 |

6. PRESENTATION OF THE FINANCIAL STATEMENTS

The Annual Report including the audited consolidated financial statements of the Corporation for the financial year ended December 31, 2004 and the auditors' report thereon will be submitted at the Meeting.

7. EXERCISE OF VOTING RIGHTS BY PROXIES

The persons named as proxies will vote or withhold from voting the shares in respect of which they are appointed or vote for or against any particular question, in accordance with the direction of the shareholders appointing them.In the absence of such direction, such shares will be voted in favour of all matters identified in the attached Notice of Meeting. The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and to other matters which may properly come before the Meeting. As of the date of this Management Proxy Circular, the Management of the Corporation knows of no such amendment, variation or other matter expected to come before the Meeting other than the matters referred to in the Notice of Meeting.

3

8. ELECTION OF DIRECTORS

The Corporation's Articles provide that the Board of Directors (the "Board") of the Corporation shall be composed of a minimum of five and a maximum of fifteen directors. Directors are elected annually by the shareholders of the Corporation, but the directors may from time to time appoint one or more directors, provided that the total number of directors so appointed does not exceed one third of the number of directors elected at the last annual meeting of shareholders. Management of the Corporation proposes the nine persons named in the table below as candidates for election as directors. Each elected director will remain in office until adjournment of the next annual meeting of the shareholders or until his or her successor is elected or appointed, unless his or her post is vacated earlier. Each of the candidates proposed by Management of the Corporation is currently a director of the Corporation, although two of such directors, Messrs. Gérard Limoges and Jürgen Ernst, were appointed directors by the Board of Directors on December 14, 2004 and February 25, 2005, respectively, in order to fill vacancies on the Board.

Under the terms of a shareholders' agreement signed on November 12, 1999 between Fund QFL and the Corporation, Fund QFL was granted the right to designate one member of the Board of Directors of the Corporation, provided that Fund QFL holds at the relevant time at least 499,999 Common Shares. Likewise, under the terms of contractual agreements signed by the Corporation, SGF Santé and Dr. Éric Dupont, concerning, among other matters, the election of directors, provided that SGF Santé holds at least 5% in number of the Corporation's issued and outstanding voting shares, (a) the Corporation will propose for election as a director of the Corporation, at each annual meeting of the shareholders, (i) one candidate designated by SGF Santé, provided that the candidate receives a favourable recommendation from the Corporate Governance Committee, and (ii) one candidate jointly designated by SGF Santé and Dr. Éric Dupont, (b) the Corporation will solicit proxies from its shareholders for the election of such candidates as directors of the Corporation, and (c) Dr. Éric Dupont will exercise the voting rights conveyed by his Common Shares, concerning any resolution bearing on the election of directors to be submitted to the beneficial holders of any participating shares of the Corporation, in favour of the election of the candidates so designated. In this respect, these candidates remain to be selected.

Unless instructions are given to abstain from voting with regard to the election of directors, the persons whose names appear on the enclosed form of proxy will vote in favour of the election of the nine nominees whose names are set out in the table below. Management of the Corporation does not foresee that any of the following nominees listed below will be unable or, for any reason, unwilling to perform his or her duties as director. In the event that the foregoing occurs for any reason, prior to the election, the persons indicated on the enclosed form of proxy reserve the right to vote for another candidate of their choice unless otherwise instructed by the shareholder in the form of proxy to abstain from voting on the election of directors.

4

Name and place of residence

| | Principal occupation

| | Director

since

| | Number of Common

Shares held

|

|---|

Marcel Aubut

Quebec, Canada | | Managing Partner

Heenan Blaikie Aubut

(law firm) | | 1996 | | 45,000 |

Stormy Byorum(1)

New York, USA | | Senior Managing Director

Stephens Cori Capital Advisors

(strategic and financial advisory services company) | | 2001 | | 12,000 |

Éric Dupont, PhD(2)

Quebec, Canada | | Executive Chairman of the Board

Æterna Zentaris Inc. | | 1991 | | 3,758,413 |

Prof. Dr. Jürgen Engel

Frankfurt, Germany | | Chairman and Managing Director

Zentaris GmbH (a subsidiary of the Corporation)

Executive Vice President, Global R&D and Chief Operating Officer

Æterna Zentaris Inc. | | 2003 | | — |

Jürgen Ernst(3)

Brussels, Belgium | | Former General Manager

Pharmaceutical Sector of Solvay S.A.

(international chemical and pharmaceutical group) | | 2005 | | — |

Gilles Gagnon

Quebec, Canada | | President and Chief Executive Officer

Æterna Zentaris Inc. | | 2002 | | 70,617 |

Pierre Laurin, PhD(2)

Quebec, Canada | | Executive in Residence

HEC Montréal

(management faculty of university) | | 1998 | | 11,200 |

Gérard Limoges, FCA(1)(4)

Quebec, Canada | | Corporate Director | | 2004 | | — |

Pierre MacDonald(1)(2)

Quebec, Canada | | President and Chief Executive Officer

MacD Consult Inc.

(consulting company) | | 2000 | | 10,000 |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Corporate Governance Committee.

- (3)

- Mr. Ernst was appointed director in order to fill a vacancy on the Corporation's Board of Directors on February 25, 2005.

- (4)

- Mr. Limoges was appointed director in order to fill a vacancy on the Corporation's Board of Directors on December 14, 2004.

The Corporation does not have any direct information concerning shares beneficially owned by the above mentioned persons or concerning Common Shares over which such persons exercise control or direction. This information was provided by the directors and nominees individually.

Mr. Jürgen Ernst, a current member of Solvay Pharmaceuticals Board, has recently retired from his position of General Manager Pharmaceutical Sector of Solvay S.A. From 1989, Mr. Ernst has held various executive positions with Solvay. Mr. Ernst holds a Master's of Business Administration (MBA) degree from the University of Cologne in Germany.

Mr. Gérard Limoges served as the Deputy Chairman of Ernst & YoungLLP Canada until his retirement in September 1999. After a career of 37 years with Ernst & Young, Mr. Limoges has been devoting his time as a director of a number of companies. Mr. Limoges began his career with Ernst & Young in Montreal in 1962. After graduating from the Management School ofUniversité de Montréal (HEC Montréal) in 1966, he became a chartered accountant and partner of the firm in 1971.

5

After being appointed Managing Partner of the Montreal Office of Ernst & YoungLLP in 1979 and Chairman for Quebec in 1984, Mr. Limoges joined the National Executive Committee. In 1992, he was appointed Vice Chairman of Ernst & Young Canada. He has held the position of Deputy Chairman of the Canadian Firm since August 1, 1993, in addition to serving as Chairman for Quebec.

To the knowledge of the Corporation and based upon information provided to it by the nominees for election to the Board of Directors, no such nominee:

- (a)

- is, as at the date of this Management Proxy Circular, or has been, within 10 years before the date of this Management Proxy Circular, a director or executive officer of any company (including the Corporation) that, while such person was acting in that capacity:

- (i)

- was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

- (ii)

- was subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

- (iii)

- within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets with the exception of:

Mr. Marcel Aubut, who served as a director of Albums DF Ltée from September 5, 1997 to September 16, 2003. This company became bankrupt on December 6, 2003.

Mr. Pierre Laurin, who was, from May 1999 to May 2003, a director of Microcell Telecommunications Inc. ("Microcell"). Microcell entered into a Plan of Reorganization and of Compromise and Arrangement with its creditors and shareholders effective May 1, 2003 pursuant to theCompanies' Creditors Arrangement Act (Canada). Mr. Laurin was a member of the Special Committee of the Board of Directors of Microcell created in connection with the foregoing restructuring.

- (b)

- has, within the 10 years before the date of this Management Proxy Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

9. STATEMENT OF EXECUTIVE COMPENSATION

A. Compensation of Directors

Each outside director receives an annual base remuneration of $15,000. The Corporation has also granted to each of its outside directors, during the last quarter of 2004, options to purchase 15,000 Common Shares as an annual retainer for the years 2005, 2006 and 2007. The outside directors also receive an attendance fee of $1,500 for each Board meeting attended and a daily compensation of $1,500 for special work designated by the Board of Directors, if any. Attendance fees are reduced to $750 per meeting for a director participating in a Board meeting by telephone, teleconference or any other telecommunication device. The Chairs of the Audit Committee and the Corporate Governance Committee receive additional annual retainers of $20,000 and $5,000, respectively. In addition, an attendance fee of $1,000 is paid to each outside director attending committee meetings, such fee being reduced to $500 for participation by telephone, teleconference or by any other telecommunication device. During the financial year ended December 31, 2004, the Corporation paid an aggregate amount of $169,891 to all of its outside directors for services rendered.

6

B. Compensation of Executive Officers

The following table sets forth detailed information on the compensation of the President and Chief Executive Officer, the Vice President and Chief Financial Officer and the Corporation's three other most highly compensated executive officers (including the Executive Chairman of the Board) (collectively, the "Named Executive Officers"), for services rendered in all capacities during the financial years ended December 31, 2004, 2003 and 2002.

SUMMARY COMPENSATION TABLE

|

|---|

| |

| |

|

| |

|

| |

| | Long-term Compensation

| |

|

|---|

| |

| |

|

| |

|

| |

| | Awards

| |

| |

|

|---|

| |

| | Annual Compensation

| | Security

under

options/

SARs

granted

(#)

| | Shares or

units

subject to

resale

restrictions

($)

| | Payouts

| |

|

|---|

Name and principal

occupation

| | Year

| | Salary

($)

| | Bonus

($)

| | Other annual

compensation(1)

($)

| | LTIP

payouts

($)

| | All other

benefits

($)

|

|---|

|

Gilles Gagnon

President and Chief Executive Officer | | 2004

2003

2002 | | 250,000

248,302

191,300 | | | 150,000

125,000

100,000 | | | —

—

— | | 110,000

140,000

60,000 | | —

—

— | | —

—

— | | —

—

— |

|

Dennis Turpin

Vice President and Chief Financial Officer | | 2004

2003

2002 | | 160,000

159,321

150,000 | | | 100,000

90,000

75,000 | | | —

—

— | | 90,000

60,000

140,000 | | —

—

— | | —

—

— | | —

—

— |

|

Prof. Dr. Jürgen Engel

Executive Vice President, Global R&D and Chief Operating Officer | | 2004

2003

2002 | | 339,549

332,346

— | (2)

(3) | | 121,268

55,391

— | (2)

(3) | | —

—

— | | 100,000

120,000

— | | —

—

— | | —

—

— | | —

—

— |

|

Dr. Manfred Peukert

Vice President Medical Affairs | | 2004

2003

2002 | | 232,499

210,486

— | (2)

(3) | | 29,104

67,888

— | (2)

(3) | | —

—

— | | 50,000

35,000

— | | —

—

— | | —

—

— | | —

—

— |

|

Éric Dupont, PhD

Executive Chairman of the Board | | 2004

2003

2002 | | 252,083

300,000

300,000 | | | —

100,000

100,000 | | | —

—

— | | 90,000

75,000

175,000 | | —

—

— | | —

—

— | | —

—

— |

|

- (1)

- Perquisites and other personal benefits that do not exceed the lesser of $50,000 or 10% of annual salary and bonuses are not included in this column.

- (2)

- Amounts actually paid in Euros and converted to Canadian dollars at an average exchange rate of CDN$1.00 to € 0.6185.

- (3)

- Amounts actually paid in Euros and converted to Canadian dollars at an average exchange rate of CDN$1.00 to € 0.6319.

During the financial year ended December 31, 2004, the Corporation paid an aggregate amount of $2,368,161 to all of its executive officers (excluding outside directors).

7

C. Stock Option Plan Information

The Corporation has established a stock option plan for its directors, executive officers, employees, and persons providing continuous services to the Corporation (the "Plan") in order to attract and retain such persons, who will be motivated to work towards ensuring the Corporation's success. The Board has full and complete authority to interpret the Plan and to establish the applicable rules and regulations and to make all other determinations it deems necessary or useful for the administration of the Plan, provided that such interpretations, rules, regulations and determinations are consistent with the rules of all stock exchanges on which the securities of the Corporation are then traded and with all relevant securities legislation. Individuals eligible to participate under the Plan will be determined by the Board of Directors or the Corporate Governance Committee, as the case may be.

Options granted under the Plan may be exercised at any time within a maximum period of ten years following the date of their grant. The Board of Directors or the Corporate Governance Committee, as the case may be, designates, at its discretion, the option recipients to whom stock options are granted under the Plan and determines the number of Common Shares covered by each of such options, the grant date, the exercise price of each option, the expiry date, the vesting schedule and any other question relating thereto, in each case in accordance with the applicable rules and regulations of the securities regulatory authorities. The price at which the Common Shares may be purchased may not be lower than the greater of the closing prices of the Common Shares on the Toronto Stock Exchange (the "TSX") and the NASDAQ Stock Market (the "NASDAQ"), on the last trading day preceding the date of grant of the option. Options granted under the Plan generally vest in equal tranches over a three-year period (331/3% each year, starting on the first anniversary of the grant date) or as otherwise determined by the Board of Directors or the Corporate Governance Committee.

Unless the Board of Directors or the Corporate Governance Committee decides otherwise, optionholders cease to be entitled to exercise their options under the Plan: (i) immediately, in the event an optionholder resigns or voluntarily leaves his or her employment with the Corporation or one of its subsidiaries or the employment with the Corporation or one of its subsidiaries is terminated with cause; (ii) six months following the date on which employment with the Corporation or any of its subsidiaries is terminated as a result of the death of such optionholder; (iii) 30 days following the date on which an optionholder's employment with the Corporation or any of its subsidiaries is terminated for a reason other than those mentioned in (i) or (ii) above, including, without limitation, upon the disability, long-term illness, retirement or early retirement of the optionholder; and (iv) where the optionholder is a service supplier, 30 days following the date on which such optionholder ceases to act as such, for any cause or reason.

Optionholders may not assign their options (nor any interest therein) other than by will or the laws of succession.

The maximum number of Common Shares that may be issued under the Plan is currently 4,543,744. Under the Plan, no single optionholder may hold options to purchase more than 5% of the Corporation's issued and outstanding Common Shares.

8

The Board of Directors may, at any time, with the prior approval of the relevant regulatory authorities, amend, suspend or terminate the Plan in whole or in part, although in the event of a material amendment (including an increase in the maximum number of Common Shares issuable under the Plan) to, or a reduction in the exercise price of, an option, the approval of the holders of a majority of the Common Shares present and voting in person or by proxy at a meeting of shareholders of the Corporation shall be obtained. In addition to the foregoing, any material amendment to an option held by an insider, other than a person who is an insider solely by virtue of being a director or senior officer of a subsidiary of the Corporation or an associate of an insider, including a change in the exercise price or expiry date of an option, must be approved by a majority of votes cast at a meeting of shareholders, excluding votes attaching to Common Shares beneficially owned by the affected optionholder and his or her associates (i.e. a disinterested vote). Finally, the Plan provides that the acceleration of the expiry date of an option by reason of the fact that an optionholder ceases to be a director, officer, or employee does not constitute an amendment to the Plan or to an option granted thereunder.

Options granted during the most recently completed financial year

The following table indicates the individual grants of securities to the Named Executive Officers during the financial year ended December 31, 2004. The aggregate number of Common Shares covered by options granted during such period was 913,000 at prices varying from $6.80 to $11.62 per Common Share, establishing at 3,480,592 the total number of Common Shares covered by options granted and outstanding pursuant to the Plan as at December 31, 2004.

|

|---|

Name

| | Securities

under

options

granted

(#)

| | % of total

options

granted

during

financial year

(%)

| | Exercise

price or

basic price

per share

($ / security)

| | Market value of

securities

underlying

options on the

date of grant ($ / security)

| | Expiration date

|

|---|

|

| Gilles Gagnon | | 110,000 | | 12.0 | | 7.85 | | 7.85 | | December 13, 2014 |

|

| Dennis Turpin | | 90,000 | | 9.9 | | 7.85 | | 7.85 | | December 13, 2014 |

|

| Jürgen Engel | | 100,000 | | 11.0 | | 7.85 | | 7.85 | | December 13, 2014 |

|

| Manfred Peukert | | 20,000 | | 2.2 | | 7.85 | | 7.85 | | December 13, 2014 |

| | | 30,000 | | 2.3 | | 10.90 | | 10.90 | | May 25, 2014 |

|

| Éric Dupont, PhD | | 90,000 | | 9.9 | | 7.85 | | 7.85 | | December 13, 2014 |

|

Options exercised during the most recently completed financial year and financial year-end option values

The following table summarizes for each of the Named Executive Officers the number of Common Shares acquired on options exercised, if any, during the financial year ended December 31, 2004, the aggregate value realized upon exercise, the total number of Common Shares covered by unexercised options, if any, held at December 31, 2004, and the value of such unexercised options as at the same date. During the financial year ended December 31, 2004, an aggregate of 339,917 options were exercised at prices varying from $3.76 to $8.40 by all optionholders under the Plan.

9

|

|---|

Name

| | Securities acquired on exercise

(#)

| | Aggregate value realized

($)

| | Unexercised options at FY-end 2004

(#)

Exercisable/Unexercisable

| | Value of unexercised in-the-money options at FY-end 2004(1)

($)

Exercisable/Unexercisable

|

|---|

|

| Gilles Gagnon | | 66,667 | | 392,669 | | 175,333 / 234,667 | | 217,265 / 388,735 |

|

| Dennis Turpin | | — | | — | | 215,000 / 155,000 | | 263,400 / 194,600 |

|

| Jürgen Engel | | — | | — | | 38,000 / 182,000 | | 129,700 / 277,700 |

|

| Manfred Peukert | | — | | — | | 11,166 / 73,834 | | 38,656 / 81,894 |

|

| Éric Dupont, PhD | | — | | — | | 192,500 / 177,500 | | 315,000 / 254,500 |

|

- (1)

- The value of an unexercised in-the-money option at financial year-end is the difference between the exercise price of the option and the closing price of a Common Share on the TSX on December 31, 2004, namely $7.50. These values have not been and may never be realized. The options have not been and may never be exercised; and actual gains, if any, upon exercise will depend upon the value of the Common Shares on the date of the exercise. There can be no assurance that these values will ever be realized. Values of unexercised options are based on the exercise price varying from $3.76 to $5.70, as applicable at the specific grant dates.

D. Pension Plan

Some Named Executive Officers, namely Prof. Dr. Jürgen Engel and Dr. Manfred Peukert, participate in a non-contributory defined benefit pension plan. Benefits payable under this plan correspond to 40% of the average salary of the last twelve (12) months during the first five working years after initial participation in this plan and increase by 0.4% for each additional year of employment.

The normal retirement age is 65 years, but early retirement according to the social pension insurance is possible without reduction of the benefit. The following table shows total annual pension benefits payable pursuant to this plan. Upon the death of a participant, the surviving spouse and/or children of the participant will be entitled to a benefit equal to 60% of the benefit to which such participant was entitled. All benefits payable under this plan are in addition to government social security benefits. Only basic salary is taken into consideration in calculating pension benefits.

PENSION PLAN TABLE

|

|---|

| | Years of Service

|

|---|

Average Rmuneration ($)*

| | 15

| | 20

| | 25

| | 30

| | 35

|

|---|

|

| 200,000 | | $ | 88,000 | | $ | 92,000 | | $ | 96,000 | | $ | 100,000 | | $ | 104,000 |

|

| 300,000 | | $ | 132,000 | | $ | 138,000 | | $ | 144,000 | | $ | 150,000 | | $ | 156,000 |

|

| 400,000 | | $ | 176,000 | | $ | 184,000 | | $ | 192,000 | | $ | 200,000 | | $ | 208,000 |

|

| 500,000 | | $ | 220,000 | | $ | 230,000 | | $ | 240,000 | | $ | 250,000 | | $ | 260,000 |

|

- *

- Remuneration refers to annual basic salary only.

10

Years of credited service as at December 31, 2004 for the Named Executive Officers who are also beneficiaries of this plan are as indicated below:

Prof. Dr. Jürgen Engel: 28 years and 4 months

Dr. Manfred Peukert: 28 years and 4 months

E. Report of the Corporate Governance Committee on Executive Compensation

Composition of the Committee

On December 31, 2004, the Corporate Governance Committee (the "Committee") was composed of Dr. Éric Dupont, Dr. Pierre Laurin and Mr. Pierre MacDonald.

Mandate of the Committee

The Committee, which was formed on May 16, 1996, is entrusted with examining matters related to the appointment and compensation of the Corporation's executive officers, including the Executive Chairman of the Board and the President and Chief Executive Officer, in view of making recommendations to the Board. The Committee also reports to the Board on options granted. It reviews the composition of both the Board and its committees and proposes and recommends candidates for election or appointment to the Board. Finally, the Committee is responsible for examining the terms and conditions of the aggregate compensation plans of the Corporation and verifying the competitiveness thereof in relation to companies carrying on activities similar to those of the Corporation.

Executive Compensation Policy

An aggregate compensation policy has been established to acknowledge and reward the contributions of the executive officers to the Corporation's success and to ensure competitive compensation, in order that the Corporation may benefit from the expertise required to pursue its objectives.

In accordance with this policy, the compensation of the Corporation's executive officers is based on three principal elements: (i) basic salary; (ii) performance bonuses; and (iii) the award of stock options. The Corporation intends to pay a competitive aggregate compensation that includes an incentive related to the attainment of corporate results in addition to basic salary in accordance with a reference market. The incentive compensation is granted on the basis of criteria approved by the Committee.

Short-term Incentive Compensation

The short-term incentive plan sets out the allocation of incentive awards based on the financial results and the achievement of the Corporation's strategic objectives. These objectives are set at the beginning of each financial year as part of the revision of corporate strategies.

In the case of executive officers, incentive awards may vary in accordance with the attainment of the Corporation's financial and strategic objectives.

Long-term Compensation of Executive Officers

The long-term component of the officers' aggregate compensation is based mainly on the Corporation's Stock Option Plan. This Plan permits the granting of a number of options that varies in accordance with the contribution of the officers and their responsibilities.

11

Control and Revision of the Compensation Plan

The Committee must ensure that the compensation of the Corporation's officers is consistent with the aggregate compensation policy of the Corporation. The relative situation of the Corporation with regard to compensation is determined annually by means of studies, with respect to a reference market, composed of comparable businesses. Internal equity analyses are also conducted in order to make the required adjustments.

Compensation of the President and Chief Executive Officer

The compensation of the President and Chief Executive Officer is along the lines of the Corporation's policy on management compensation. The President and Chief Executive Officer's contract of employment also contains a non-competition clause but does not provide for any specific terms or modalities of remuneration.

Conclusion

In accordance with the Corporation's executive compensation policy, a significant portion of the compensation of its executive officers is related to the performance of the Corporation, the responsibilities inherent in their duties and, in particular, the performance of the Corporation's publicly traded Common Shares and their long-term appreciation. The Committee reviews the compensation programs of the executive officers annually in order to ensure their competitiveness and compliance with the objectives, values and strategies of the Corporation.

If the circumstances so require, the Committee may recommend employment conditions that are different from the policies in effect as well as the execution of non-standard employment contracts by the Corporation.

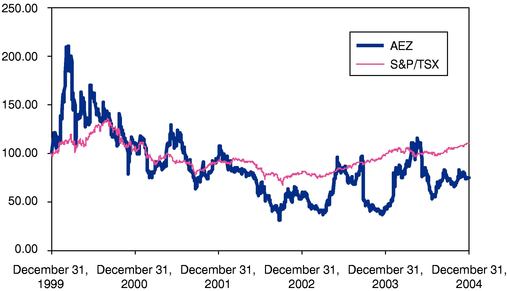

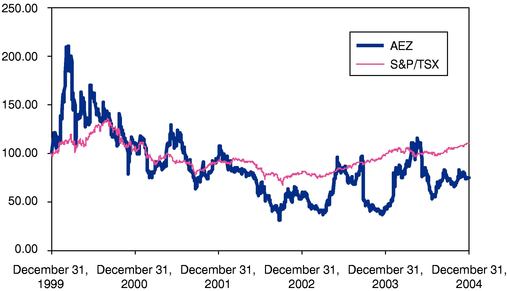

10. PERFORMANCE GRAPH

On December 31, 2004, the closing price of the Common Shares on the TSX was $7.50 per share. The following graph shows the cumulative return of a $100 investment in the Common Shares, made on December 31, 1999 on the TSX, compared with the total return of the S&P/TSX Composite Index for each financial year shown on this graph.

12

11. SECURITY BASED COMPENSATION ARRANGEMENTS

A. Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth, as at March 1, 2005, the information with respect to all of the Corporation's compensation plans pursuant to which equity securities of the Corporation are authorized for issuance.

|

|---|

Plan Category

| | (a)

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | (b)

Weighted-average exercise

price of outstanding options,

warrants and rights

($)

| | (c)

Number of securities

remaining available for

further issuance under

equity compensation plans

(excluding securities

reflected in column

(a))

|

|---|

|

| Equity compensation plans approved by securityholders | | 3,395,592 | | 6.52 | | 914,685 |

|

| Equity compensation plans not approved by securityholders | | — | | — | | — |

|

| TOTAL | | 3,395,592 | | 6.52 | | 914,685 |

|

B. Principal Terms of the Corporation's Security Based Compensation Arrangements and Other Required

Disclosure

Effective January 1, 2005, companies listed on the TSX are required to disclose on an annual basis, in their information circulars, or other annual disclosure documents distributed to all security holders, the terms of their security based compensation arrangements and any amendments adopted to such arrangements during the most recently completed financial year. Under the rules of the TSX Company Manual, security based compensation arrangements include, for example, stock option plans, stock purchase plans where the listed issuer provides financial assistance or where the listed issuer matches the whole or a portion of the securities being purchased, and any other compensation or incentive mechanism involving the issuance or potential issuance of securities of the listed issuer. In general, arrangements or plans that do not involve the issuance from treasury or potential issuance from treasury of securities of the listed issuer are not security based compensation arrangements for the purposes of the TSX Company Manual rules. The Corporation currently has in place only one such security based compensation arrangement, namely its stock option plan, the principal terms of which are described at Section 9.C of this Circular under the heading "STATEMENT OF EXECUTIVE COMPENSATION — Stock Option Plan Information".

During the financial year ended December 31, 2004, the Corporation amended its stock option plan by increasing to 4,543,744 the number of shares reserved for issuance under such plan and by re-designating the class of shares issuable under the Plan from Subordinate Voting Shares to Common Shares. These amendments were approved by a majority of the shareholders of the Corporation at its annual and special meeting of shareholders held on May 26, 2004.

13

As at March 1, 2005, 233,467 Common Shares had been issued and 914,685 Common Shares remain available for issuance under the Corporation's stock option plan representing, respectively, 0.5% and 2% of all issued and outstanding Common Shares. In addition, 3,395,592 Common Shares are issuable under unexercised options currently issued and outstanding, representing 7.4% of all issued and outstanding Common Shares.

12. STATEMENT OF CORPORATE GOVERNANCE PRACTICES

In compliance with the rules of the TSX, the Corporation must disclose information with respect to its corporate governance practices as compared to the guidelines provided for in the TSX Company Manual (the "TSX Guidelines"). The Board of Directors of the Corporation considers good corporate governance to be important to the effective operations of the Corporation. The Corporate Governance Committee of the Board of Directors makes recommendations regarding the compliance of the Corporation's practices with the TSX Guidelines and oversees disclosure obligations related thereto. The Corporate Governance Committee has also been reviewing the proposed amendments to the TSX Guidelines published in the spring and fall of 2002, as well as the proposed corporate governance practices and disclosure rules published by the Canadian Securities Administrators in January 2004. Once new guidelines or regulations are adopted and published in final form, the Board will re-assess its corporate governance practices and make any necessary changes. Schedule A to this Management Proxy Circular sets out a description of the Corporations' corporate governance practices in tabular form with reference to the TSX Guidelines but also taking into account, where appropriate, some of the proposed modifications and the effect of the recently enactedSarbanes-Oxley Act in the United States as well as the rules of the NASDAQ.

13. APPOINTMENT OF AUDITORS AND AUDIT COMMITTEE DISCLOSURE

A. Appointment of Auditors

The Board of Directors of the Corporation proposes that PricewaterhouseCoopersLLP, Chartered Accountants, be appointed as auditors of the Corporation and that the directors of the Corporation be authorized to determine their compensation. PricewaterhouseCoopers have acted as auditors of the Corporation since the financial year ended December 31, 1993.

Unless instructed to abstain from voting with regard to the appointment of auditors, the persons whose names appear on the enclosed form of proxy will vote in favour of the appointment of PricewaterhouseCoopers LLP and authorizing the directors of the Corporation to determine their compensation.

B. Audit Committee Disclosure

Multilateral Instrument 52-110 — Audit Committees ("MI 52-110") requires issuers to disclose in their annual information forms certain information with respect to the existence, charter, composition, and education and experience of the members of their audit committees, as well as all fees paid to external auditors. The Corporation is including such required disclosure with respect to its Audit Committee in this Management Proxy Circular and is incorporating this information by reference into its Annual Information Form. The charter of the Corporation's Audit Committee is attached as Schedule B to this Management Proxy Circular and is also accessible on the Corporation's website atwww.aeternazentaris.com.

14

Composition of the Audit Committee

Stormy Byorum, Gérard Limoges, FCA, and Pierre MacDonald are the members of the Corporation's Audit Committee, each of whom is independent and financially literate within the meaning of MI 52-110.

Education and Relevant Experience

The education and related experience of each of the members of the Audit Committee is described below.

Stormy Byorum — Ms. Byorum is currently Senior Managing Director of Stephens Cori Capital Advisors, a strategic and financial advisory services company. Before 1996, Ms. Byorum held various positions at Citicorp. Ms. Byorum holds a Master's of Business Administration (MBA) degree from the University of Pennsylvania.

Gérard Limoges — Mr. Limoges served as the Deputy Chairman of Ernst & YoungLLP Canada until his retirement in September 1999. After a career of 37 years with Ernst & Young, Mr. Limoges has been devoting his time as a director of a number of companies. Mr. Limoges began his career with Ernst & Young in Montreal in 1962. After graduating from the Management School ofUniversité de Montréal (HEC Montréal) in 1966, he became a chartered accountant and partner of the firm in 1971.

Pierre MacDonald — Mr. MacDonald is serving as Chairman and Chief Executive Officer of MacD Consult Inc., a consulting firm specializing in international finance and marketing. Since May 2000, Mr. MacDonald has served as the Vice Chairman of the Board of Directors of the Export Development Corporation, a Crown corporation that operates as a financial institution devoted exclusively to providing trade finance services in support of Canadian exporters and investors in up to 200 countries.

Pre-Approval Policies and Procedures

Form 52-110F1 requires the Corporation to disclose whether its Audit Committee has adopted specific policies and procedures for the engagement of non-audit services and to prepare a summary of these policies and procedures. The mandate of the Audit Committee (attached as Schedule B to this Management Proxy Circular) provides that it is such committee's responsibility to approve all audit engagement fees and terms as well as reviewing policies for the provision of non-audit services by the external auditors and, when required, the framework for pre-approval of such services. The Audit Committee delegates to its Chairman the pre-approval of such non-audit fees.

External Auditor Service Fees

In addition to performing the audit of the Corporation's consolidated financial statements and its subsidiaries, PricewaterhouseCoopersLLP provided other services to the Corporation and its subsidiaries and they billed the Corporation and its subsidiaries the following fees for each of the Corporation's two most recently completed financial years:

15

|

|---|

Fees

| | Financial Year

Ended December 31,

2004

($)

| | Financial Year

Ended December 31,

2003

($)

|

|---|

|

| Audit Fees(1) | | 359,193 | | 333,329 |

|

| Audit-Related Fees(2) | | 272,273 | | 3,000 |

|

| Tax Fees(3) | | 116,248 | | 45,616 |

|

| All Other Fees(4) | | 47,239 | | 60,850 |

|

| Total Fees: | | 794,953 | | 442,795 |

|

- (1)

- Refers to the aggregate fees billed by the Corporation's external auditor for audit services.

- (2)

- Refers to the aggregate fees billed for assurance and related services by the Corporation's external auditor that are reasonably related to the performance of the audit or review of the Corporation's financial statements and are not reported under (1) above, including professional services rendered by the Corporation's external auditor for accounting consultations on proposed transactions, and consultations related to accounting and reporting standards.

- (3)

- Refers to the aggregate fees billed for professional services rendered by the Corporation's external auditor for tax compliance, tax advice, and tax planning.

- (4)

- Refers to the aggregate fees billed for products and services provided by the Corporation's external auditor, other than the services reported under (1), (2) and (3) above. For the 2004 financial year, these fees were primarily incurred in connection with the preparation of a preliminary prospectus filed by the Corporation's subsidiary, Atrium Biotechnologies Inc., as part of its initial public offering, which was filed in February 2005.

14. INDEBTEDNESS OF DIRECTORS AND OFFICERS

Neither at any time during the financial year ended December 31, 2004 nor as at March 1, 2005 did any of the directors and officers of the Corporation owe it any amount in respect of the purchase of securities of the Corporation or otherwise. On March 29, 2004, the Board of Directors of the Corporation adopted a resolution formally prohibiting (i) the making of any new loans to its directors and officers, and (ii) modifying the material terms of any such existing loans.

15. INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

The Corporation is not aware that any of its "informed persons" has had an interest in any material transaction carried out since the beginning of the Corporation's last completed financial year or in any proposed transaction which has materially affected or is likely to materially affect the Corporation or any of its subsidiaries. Applicable securities legislation defines an "informed person" as meaning any one of the following: (a) a director or executive officer of a reporting issuer; (b) a director or executive officer of a person or company that is itself an informed person or subsidiary of a reporting issuer; (c) any person or company who beneficially owns, directly or indirectly, voting securities of a reporting issuer or who exercises control or direction over voting securities of a reporting issuer or a combination of both carrying more than 10 percent of the voting rights attached to all outstanding voting securities of the reporting issuer other than voting securities held by the person or company as underwriter in the course of a distribution; and (d) a reporting issuer that has purchased, redeemed or otherwise acquired any of its securities, for so long as it holds any of its securities.

16

16. INSURANCE OF DIRECTORS AND OFFICERS

The Corporation purchases liability insurance for the benefit of its directors and officers, which protects them against certain liabilities contracted by them while acting in such capacity. In 2004, this insurance provided a maximum coverage of $20,000,000 per event and policy year. For the financial year ended December 31, 2004, the premium paid by the Corporation was $1,006,000. When the Corporation is authorized or required to indemnify insured persons, a deductible of $250,000 applies, except for securities-based claims, for which the deductible is $500,000. It is anticipated that the amount of premium to be paid in respect of such insurance for the 2005 fiscal year will be approximately $710,000.

17. SHAREHOLDER PROPOSALS FOR NEXT ANNUAL MEETING OF SHAREHOLDERS

Shareholder proposals must be submitted no later than December 6, 2005 in order that the Corporation may include them in the Management Proxy Circular that will be prepared and mailed in connection with the Corporation's annual meeting of shareholders in 2006.

18. ADDITIONAL INFORMATION

The Corporation will provide the following documents to any person or company upon request to the Corporate Secretary of the Corporation, at its head office at 1405 du Parc-Technologique Boulevard, Quebec City, Quebec, G1P 4P5:

- (i)

- one copy of the audited annual financial statements of the Corporation for its most recently completed financial year together with the report of the auditors thereon, both contained in the Corporation's 2004 Annual Report, and one copy of any interim financial statements of the Corporation published subsequent to the financial statements for its most recent financial year; and

- (ii)

- one copy of this Management Proxy Circular.

In addition, the Corporation's Annual Information Form will be available from the date of its filing with the securities commissions or similar securities regulatory authorities in Canada as well as any other document incorporated by reference in such Annual Information Form. The Corporation may require the payment of reasonable expenses if a request is received from a person who is not a holder of securities of the Corporation, unless the Corporation makes a distribution of its securities pursuant to a short form prospectus, in which case such documents will be provided free of charge. Copies of the Corporation's public disclosure documents, including financial statements, Management Proxy Circulars and Annual Information Forms, are also available at the following websites: www.aeternazentaris.com, www.sedar.com, and www.sec.gov. Financial information related to the Corporation is provided in its comparative financial statements and Management's Discussion and Analysis thereon for the financial year ended December 31, 2004.

17

19. DIRECTORS' APPROVAL

The contents and the sending of this Management Proxy Circular were approved by the Board of Directors of the Corporation on March 7, 2005.

Dated at Quebec City, Quebec, March 7, 2005.

Mario Paradis, CA

Corporate Secretary

18

SCHEDULE A

ÆTERNA ZENTARIS INC.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

|

| TSX Corporate Governance Guidelines | | Comments |

|

| 1. | | Board should explicitly assume responsibility for stewardship of the Corporation specifically for: | | The mandate of the Board of Directors (the "Board") is to assume stewardship of the Corporation's overall administration and to oversee the management of the Corporation's operations. |

| | | | | | | In addition, on March 29, 2004, the Board of Directors adopted a "Code of Ethical Conduct", a copy of which is reproduced on the Corporation's website at www.aeternazentaris.com. The Code of Ethical Conduct includes specific provisions dealing with integrity in accounting matters, conflicts of interest and compliance with applicable laws and regulations. |

|

| | | (a) | | Adoption of a strategic planning process | | As part of the strategic planning process and prior to the beginning of each financial year, the Board receives and approves the annual budget and the strategic objectives of the Corporation, which are submitted to the Board by Management. Long-term corporate objectives are also presented by the Management and reviewed by the Board. In addition, significant matters, such as those related to the annual budget, strategic investments, as well as capital and operating expenditures exceeding a certain threshold of materiality, are submitted to the Board. |

|

| | | (b) | | Identification of principal risks, and implementing risk management systems | | The Board identifies the Corporation's principal risks and manages these risks through regular appraisal of Management's practices on an ongoing basis. |

|

| | | (c) | | Succession planning and monitoring senior management | | When choosing senior management members, the Board strives for quality and loyalty which are basic elements needed for the realization of the Corporation's objectives. Every year, the Corporate Governance Committee examines the performance, development and compensation of senior executives in light of these objectives. |

|

| | | (d) | | Communications policy | | The Vice President and Chief Financial Officer is responsible for the communications between Management and the Corporation's stakeholders. The Audit Committee reviews press releases containing the quarterly and annual results of the Corporation prior to their release, these press releases being the responsibility of the Vice President and Chief Financial Officer along with communications with institutions and financial analysts. In addition, all press releases of the Corporation are reviewed by the President and Chief Executive Officer. The communications policy has been established in accordance with the relevant disclosure requirements under applicable Canadian and United States securities laws. |

|

19

|

| TSX Corporate Governance Guidelines | | Comments |

|

| 1. | | (e) | | Integrity of internal control and management information systems | | The Audit Committee is responsible for assisting the Board in the fulfillment of its duties with respect to financial accounting and reporting practices as well as the adequacy and integrity of the Corporation's internal controls and management information systems. |

|

| 2. | | Majority of directors should be "unrelated" (independent of Management and free from conflicting interest) to the Corporation and the Corporation's significant shareholder, if any | | The Board is composed of nine directors, of which five are unrelated. The Executive Chairman of the Board, Dr. Éric Dupont, holds 8.15% of the voting rights of the Corporation, and SGF, for which the representative to the Board remains to be selected, holds more than 10% of the voting rights. The Board believes that the current majority of unrelated directors provides appropriate independent representation for the Corporation's public shareholders. |

|

| 3. | | Disclosure for each director whether he or she is related, and how that conclusion was reached | | Dr. Éric Dupont — Related — Executive Chairman of the Board of the Corporation. |

| | | | | | | Mr. Gilles Gagnon — Related — President and Chief Executive Officer of the Corporation. |

|

|

|

|

|

|

Prof. Dr. Jürgen Engel — Related — Managing Director, Zentaris GmbH (a significant subsidiary of the Corporation) — Executive Vice President, Global Research and Development and Chief Operating Officer of the Corporation. |

|

|

|

|

|

|

Mr. Marcel Aubut — Related — Senior partner of a law firm which provides legal services to the Corporation on a regular basis. |

|

|

|

|

|

|

For the remainder of the directors, none of them or their associates has any interest or any business or other relationship which could, or could reasonably be perceived to, materially interfere with the directors' ability to act with a view to the best interests of the Corporation, other than interests arising from shareholding. |

|

|

|

|

|

|

Stormy Byorum |

|

Unrelated |

| | | | | | | Jürgen Ernst | | Unrelated |

| | | | | | | Pierre Laurin | | Unrelated |

| | | | | | | Gérard Limoges | | Unrelated |

| | | | | | | Pierre MacDonald | | Unrelated |

|

|

|

|

|

|

The Board of Directors is of the view that each of its unrelated directors would also be "independent" within the meaning of Rules 4200 and 4200A of the Corporate Governance Rules of the NASDAQ as well as the proposed corporate governance practices and disclosure rules published by the Canadian Securities Administrators. |

|

| 4. | | (a) | | Appoint a committee of directors responsible for proposing to the full Board new nominees to the Board and for assessing directors on an ongoing basis | | The Corporate Governance Committee is responsible for proposing nominees to the Board of Directors or assessing directors performance on an ongoing basis. The Corporate Governance Committee is composed of a majority of unrelated directors. |

|

20

|

| TSX Corporate Governance Guidelines | | Comments |

|

| 4. | | (b) | | Composed exclusively of non-management directors, the majority of whom are unrelated | | See item 4(a) above. |

|

| 5. | | Implement a process for assessing the effectiveness of the Board, its committees and directors | | The Corporate Governance Committee is responsible for developing and monitoring the Corporation's corporate governance practices, the functioning of the Board and the powers, mandates and performance of the Board committees. |

|

| 6. | | Provide orientation and education programs for new directors | | The Board ensures that every new director possesses the capacities, expertise, availability and knowledge required to fill this position adequately. The Corporation also offers an orientation and training program to its newly elected Board members. |

|

| 7. | | Consider reducing size of Board, with a view to improving effectiveness | | The Corporate Governance Committee and Management of the Corporation considers that the size of its Board is adequate to maintain the Board's effectiveness and for the stewardship of the Corporation. |

|

| 8. | | Review compensation of directors in light of responsibilities and risks | | The Corporate Governance Committee reviews periodically the Corporation's compensation policies in light of market conditions and responsibilities. The Board has determined that the compensation paid to directors is adequate in light of the risks and responsibilities associated with their positions. Only outside directors are compensated in their capacity as members of the Board of Directors of the Corporation. |

|

| 9. | | Committees of the Board should generally be composed of outside (non-management) directors, a majority of whom are unrelated | | The Board has two committees, namely the Audit Committee and the Corporate Governance Committee. All members of the Audit Committee are external and unrelated and a majority of the Corporate Governance Committee are external and unrelated. |

| | | | | | | The Audit Committee and the Corporate Governance Committee consist of three members, respectively. |

|

|

|

|

|

|

Audit Committee |

|

|

|

|

|

|

|

|

Stormy Byorum |

|

Unrelated |

| | | | | | | Gérard Limoges, FCA | | Unrelated |

| | | | | | | Pierre MacDonald | | Unrelated |

|

|

|

|

|

|

Corporate Governance Committee |

|

|

|

|

|

|

|

|

Éric Dupont |

|

Related |

| | | | | | | Pierre Laurin | | Unrelated |

| | | | | | | Pierre MacDonald | | Unrelated |

|

21

|

| TSX Corporate Governance Guidelines | | Comments |

|

| | | | | | | The Board of Directors is of the view that each of the unrelated members of the Audit Committee and the Corporate Governance Committee as indicated above would be "independent" within the meaning of Rules 4200 and 4200A of the Corporate Governance Rules of the NASDAQ as well as the proposed corporate governance practices and disclosure rules published by the Canadian Securities Administrators. |

|

| 10. | | Board should expressly assume responsibility for, or assign to a committee general responsibility for, the approach to corporate governance issues | | The Corporate Governance Committee is responsible for developing and monitoring the Board's corporate governance practices. |

|

| 11. | | (a) | | Define limits to Management's responsibilities by developing mandates for: | | |

|

| | | | | (i) the Board | | The Board oversees the conduct and supervises the management of the business and affairs of the Corporation pursuant to the powers vested in it under theCanada Business Corporations Act and in accordance with the requirements thereof. The Board meets regularly to consider particular issues or conduct specific reviews whenever deemed appropriate. Any responsibility that is not delegated to senior management or a committee of the Board remains the responsibility of the Board. |

|

| | | | | (ii) the CEO | | See item 11 (b) below. |

|

| | | (b) | | Board should approve or develop CEO's corporate objectives | | The CEO and Management establish the corporate objectives of the Corporation annually which, in turn, are expected to be implemented by the CEO. These objectives receive Board approval. |

|

| 12. | | Establish procedures to enable the Board to function independently of Management | | The Corporation does not currently have a member of the Board that is responsible for ensuring that the Board properly discharges its duties, independent of Management. The Board does not deem it necessary to add structures to those that already exist to ensure its independence vis-à-vis Management. |

|

22

|

| TSX Corporate Governance Guidelines | | Comments |

|

| 13. | | (a) | | Establish an audit committee with a specifically defined mandate | | The Audit Committee reviews the Corporation's annual and interim financial statements before they are approved by the Board, oversees Management reporting on internal audits and controls and reviews the comments of the external auditors regarding internal control procedures. The Committee is also responsible for ensuring that the Corporation has in place adequate and efficient internal control systems to monitor the Corporation's financial information and that transactions involving the Corporation with related parties are made on terms that are fair to the Corporation. The Committee also examines the audit fees of the external auditors and submits the appropriate recommendations to the Board. |

|

|

|

|

|

|

The Audit Committee Charter was revised and approved by the Board of Directors on February 26, 2004. The revised version of such charter is attached as Schedule B to this Management Proxy Circular and is also accessible on the Corporation's website at www.aeternazentaris.com. |

|

| | | (b) | | All members should be outside or non-management directors | | The Audit Committee is composed entirely of outside and unrelated directors. The Board of Directors is of the view that each of the members of the Audit Committee would also be "independent" within the meaning of Rules 4200 and 4200A of the Corporate Governance Rules of the NASDAQ as well as the proposed corporate governance practices and disclosure rules published by the Canadian Securities Administrators. |

|

| 14. | | Implement a system to enable individual directors to engage outside advisors, at Corporation's expense | | The Corporation has a practice of permitting the Board, any committee thereof and any individual director to engage independent, external advisors at the Corporation's expense provided that such aforesaid Board, committee, or director has obtained the approval of the Chairman of the Board; this authorization is not necessary when advisors are engaged by the Audit Committee. |

|

23

SCHEDULE B

ÆTERNA ZENTARIS INC.

AUDIT COMMITTEE CHARTER

1. MISSION STATEMENT

The Audit Committee will assist the Board of Directors in fulfilling its oversight responsibilities. The Audit Committee will review the financial reporting process, the system of internal control, the audit process, and the company's process for monitoring compliance with laws and regulations and with the Code of Ethical Conduct. In performing its duties, the Committee will maintain effective working relationships with the Board of Directors, management, and the external auditors. To effectively perform his or her role, each Committee member will obtain an understanding of the detailed responsibilities of Committee membership as well as the company's business, operations, and risks.

2. POWERS

The Board authorizes the Audit Committee, within the scope of its responsibilities, to:

- 2.1

- Perform activities within the scope of its charter;

- 2.2

- Engage independent counsel and other advisers as it deems necessary to carry out its duties;

- 2.3

- Ensure the attendance of company officers at meetings as appropriate;

- 2.4

- Have unrestricted access to members of management, employees and relevant information;

- 2.5

- Establish procedures for dealing with concerns of employees regarding accounting or auditing matters;

- 2.6

- Establish procedures for the receipt, retention and treatment of complaints received by the company regarding accounting, internal accounting controls or auditing matters;

- 2.7

- Be directly responsible for the appointment, compensation, retention and oversight of the work of the external auditor;

- 2.8

- Approve all audit engagement fees and terms as well as reviewing policies for the provision of non-audit services by the external auditors and, when required, the framework for pre-approval of such services.

3. ORGANIZATION

Members

- 3.1

- The Audit Committee shall be formed of three members, each of which shall be a director not holding a management function.

- 3.2

- Each member shall provide a useful contribution to the Committee.

- 3.3

- All members shall be independent of management.

- 3.4

- The chairperson of the Audit Committee shall be appointed by the Board from time to time.

- 3.5

- The term of the mandate of each member shall be one year.

- 3.6

- The quorum requirement for any meeting shall be two members.

- 3.7

- The secretary of the Audit Committee shall be the secretary of the company or any other individual appointed by the Board.

24

Attendance at Meetings

- 3.8

- If deemed necessary, the Audit Committee may invite other individuals (such as the Senior Vice President and COO, the Executive Vice President or the Vice President and CFO).

- 3.9

- External auditors shall be invited, if needed, to make presentations to the Audit Committee.

- 3.10

- The Committee shall meet at least four times a year. Special meetings may be held if needed. If deemed necessary, external auditors may invite members to attend any meeting.

- 3.11

- The Audit Committee will meet with the external auditors at least once a year without management presence.

- 3.12

- The minutes of each meeting shall be recorded.

4. ROLE AND RESPONSIBILITIES

Internal Control

- 4.1

- Evaluate whether management is setting the appropriate tone at the top by communicating the importance of internal control and ensuring that all individuals possess an understanding of their roles and responsibilities.

- 4.2

- Understand the controls and processes implemented by management to ensure that the financial statements derive from the underlying financial systems, comply with relevant standards and requirements, and are subject to appropriate management review.

- 4.3

- Gain an understanding of the current areas of financial risk and how these are being handled by the management.

- 4.4

- Focus on the extent to which external auditors review computer systems and applications, the security of such systems and applications, and the contingency plan for processing financial information in the event of a systems breakdown.

- 4.5

- Gain an understanding of whether internal control recommendations made by external auditors have been implemented by management.

- 4.6

- Ensure that the external auditors keep the Audit Committee informed about fraud, illegal acts, deficiencies in internal control, and any other matter deemed appropriate.

Financial Reporting

a) General

- 4.7

- Review significant accounting and reporting issues, including recent professional and regulatory pronouncements, and understand their impact on the financial statements.

- 4.8

- Ask management and external auditors about significant risks and exposures and the plans to minimize such risks.

25

b) Annual Financial Statements

- 4.9

- Review the annual financial statements and determine whether they are complete and consistent with the information known to Committee members, and assess whether the financial statements reflect appropriate accounting principles and recommend their approval to the Board of Directors.

- 4.10

- Pay particular attention to complex and/or unusual transactions such as restructuring charges and derivative disclosures.

- 4.11

- Focus on judgmental areas such as those involving valuation of assets and liabilities including, for example, the accounting for and disclosure of obsolete or slow-moving inventory; loan losses; warranty, product, and environmental liability; litigation reserves and other commitments and contingencies.

- 4.12

- Meet with management and the external auditors to review the financial statements and the results of the audit.

- 4.13

- Consider management's handling of proposed audit adjustments identified by the external auditors.

- 4.14

- Review the MD&A and other sections of the annual report before its release and consider whether the information is adequate and consistent with members' knowledge about the company and its operations.

- 4.15

- Ensure that the external auditors communicate certain required matters to the Committee.

c) Interim Financial Statements

- 4.16

- Be briefed on how management develops and summarizes quarterly financial information, the extent to which the external auditors review quarterly financial information, and whether that review is performed on a pre- or post-issuance basis.

- 4.17

- Meet with management and, if a pre-issuance review was completed, with the external auditors, either by telephone or in person, to review the interim financial statements and the results of the review.

- 4.18

- To gain insight into the fairness of the interim statements and disclosures, obtain explanations from management and from the external auditors on whether.

- •

- Actual financial results for the quarter or interim period varied significantly from budgeted or projected results;

- •

- Changes in financial ratios and relationships in the interim financial statements are consistent with changes in the company's operations and financing practices;

- •

- Generally accepted accounting principles have been consistently applied;

- •

- There are any actual or proposed changes in accounting or financial reporting practices;

- •

- There are any significant or unusual events or transactions;

- •

- The company's financial and operating controls are functioning effectively;

- •

- The company has complied with the terms and conditions of loan agreements or security indentures; and

- •

- The interim financial statements contain adequate and appropriate disclosures.

- 4.19

- Ensure that the external auditors communicate certain required matters to the Committee.

26

External Audit

- 4.20

- Review the professional qualification of the auditors (including background and experience of partner and auditing personnel).

- 4.21

- Consider the independence of the external auditor and any potential conflicts of interest.

- 4.22

- Review on an annual basis the performance of the external auditors and make recommendations to the Board for the appointment, reappointment or termination of the appointment of the external auditors.

- 4.23

- Review the external auditors' proposed audit scope and approach for the current year in the light of the company's present circumstances and changes in regulatory and other requirements.

- 4.24

- Discuss with the external auditor any audit problems encountered in the normal course of audit work, including any restriction on audit scope or access to information.

- 4.25

- Discuss with the external auditor the appropriateness of the accounting policies applied in the company's financial reports and whether they are considered as aggressive, balanced or conservative.

- 4.26

- Review policies for the provision of non-audit services by the external auditor and where applicable the framework for pre-approval of audit and non-audit services.

- 4.27

- Ensure the company has appropriate policies regarding the hiring of audit firm personnel for senior positions after they have left the audit firm.

Compliance with Laws and Regulations

- 4.28

- Review the effectiveness of the system for monitoring compliance with laws and regulations and the results of management's investigation and follow-up (including disciplinary action) on any fraudulent acts or accounting irregularities.

- 4.29

- Periodically obtain updates from management, general counsel, and tax director regarding compliance.

- 4.30

- Be satisfied that all regulatory compliance matters have been considered in the preparation of the financial statements.

- 4.31

- Review the findings of any examinations by regulatory agencies.

Compliance with Code Ethical of Conduct

- 4.32

- Ensure that a Code of Ethical Conduct is formalized in writing and that all employees are aware of it.

- 4.33

- Evaluate whether management is setting the appropriate tone at the top by communicating the importance of the Code of Ethical Conduct and the guidelines for acceptable business practices.

- 4.34

- Review the program for monitoring compliance with the Code of Ethical Conduct.

- 4.35

- Periodically obtain updates from management and general counsel regarding compliance.

27

Other Responsibilities

- 4.36

- Meet with the external auditors and management in separate executive sessions to discuss any matters that the Committee or these groups believe should be discussed privately.

- 4.37

- Ensure that significant findings and recommendations made by the external auditors are received and discussed on a timely basis.

- 4.38

- Review, with the company's counsel, any legal matters that could have a significant impact on the company's financial statements.

- 4.39

- Review the policies and procedures in effect for considering officers' expenses and perquisites.

- 4.40

- If necessary, institute special investigations and, if appropriate, hire special counsel or expert to assist.

- 4.41

- Perform other oversight functions as requested by the full Board.

- 4.42