QuickLinks -- Click here to rapidly navigate through this document

Exhibit 4

Solid

Growth

Annual Report 2004

TABLE OF CONTENT

COMPANY PROFILE — 3

MESSAGE TO SHAREHOLDERS — 4

PRODUCT PIPELINE — 8

ATRIUM — 14

Highlights 2004

MOST SIGNIFICANT EVENT OF THE YEAR: SUCCESSFUL COMPLETION OF THE SEVEN PHASE II TRIALS PROGRAM OF CETRORELIX, OUR LEAD COMPOUND IN ENDOCRINE THERAPY, FOR ENDOMETRIOSIS, UTERINE MYOMA, AND BENIGN PROSTATE HYPERPLASIA (BPH).

FEBRUARY

- •

- Partnership with the pharmaceutical company Roche in Brazil for miltefosine (Impavido®), a new compound to treat leishmaniasis, a devastating tropical disease known as black fever

MARCH

- •

- Subsidiary Atrium acquires Pure Encapsulations, a Boston-based company specialized in nutritional supplements

APRIL

- •

- Partnership agreement with Ardana Bioscience for LHRH antagonist teverelix which has potential in cancer and urology

MAY

- •

- Æterna Laboratories Inc. changes name to Æterna Zentaris Inc.

- •

- Cetrorelix: positive and statistically significant Phase II results in six trials in endocrinology and BPH

JUNE

- •

- Encouraging Phase I results for perifosine in combination with radiotherapy for different cancer types

AUGUST

- •

- License and collaboration agreement with Spectrum Pharmaceuticals on fourth generation LHRH antagonist D-63153 for prostate cancer and BPH

- •

- Perifosine Phase II trial initiated by Keryx Biopharmaceuticals for different cancer types

SEPTEMBER

- •

- Encouraging Phase II trial results for perifosine in monotherapy for soft tissue sarcoma

OCTOBER

- •

- License and collaboration agreement with Tulane University for GH-RH antagonists, a novel class of potential anti-cancer agents

- •

- Successful completion of the seven Phase II trials program for cetrorelix

NOVEMBER

- •

- Marketing approval obtained for miltefosine (Impavido®) from the regulatory agency in Germany for leishmaniasis

DECEMBER

- •

- Transfer of certain rights to Atrium, excluding North America, to market and distribute Æterna Zentaris' antiangiogenic product, Neovastat®

SUBSEQUENT TO YEAR END

- •

- Initiation of a Phase I trial with the cytotoxic conjugate AN-152 for ovarian and breast cancer

- •

- Acquisition of Echelon Biosciences in Salt Lake City, Utah, giving access to a complementary strategic fit for the signal transduction inhibitor platform

- •

- Subsidiary Atrium acquires MultiChem, a Canadian marketer of active ingredients and specialty chemicals

2 Æterna Zentaris Annual Report 2004

Æterna Zentaris

| |

|

|---|

| | | ÆTERNA ZENTARIS IS AN EMERGING INTERNATIONAL BIOPHARMACEUTICAL COMPANY HEADQUARTERED IN QUEBEC CITY. WE ARE INVOLVED IN THE DISCOVERY, DEVELOPMENT AND MARKETING OF DRUGS WITHIN THREE THERAPEUTIC AREAS: ONCOLOGY, ENDOCRINOLOGY, AND ANTI-INFECTIVES. |

|

|

THROUGH THE COMPANY'S PROPRIETARY DRUG DISCOVERY UNIT AND GLOBAL SCIENTIFIC NETWORK, ÆTERNA ZENTARIS PRODUCES A CONTINUAL FLOW OF INNOVATIVE COMPOUNDS THAT TREAT DISEASES WITH LOW SURVIVAL RATES AND LIMITED THERAPEUTIC OPTIONS. |

|

|

THE COMPANY ALSO HOLDS MAJORITY OWNERSHIP (61.1%) OF ATRIUM BIOTECHNOLOGIES, AN INTERNATIONAL DEVELOPER, MANUFACTURER AND MARKETER OF ADDED VALUE PRODUCTS FOR THE COSMETIC, CHEMICAL, PHARMACEUTICAL AND NUTRITION INDUSTRIES. |

OUR NEW NAME Following the acquisition of German-based Zentaris GmbH in 2002, the Company changed its name from Æterna Laboratories Inc. to Æterna Zentaris Inc. in May, 2004.

The new name emphasizes the evolution of Æterna Zentaris into an international company with a global network of partners and a wide-ranging pipeline that extends from preclinical compounds to proven and marketed products.

Æterna Zentaris Annual Report 2004 3

A YEAR OF DEVELOPMENT AND GROWTH: In 2004, our long-term strategy for creating shareholder and stakeholder value achieved a number of significant milestones. The year clearly demonstrated the established worth and steadily growing potential of our pipeline. In fact, the Company made important advances at every stage of the process that characterizes success in the biopharmaceutical industry: in the laboratory, in clinical testing, in alliance-making, in acquisitions, and above all, in accessing the marketplace.

Today, in many countries of the world, the products of Æterna Zentaris are treating patients. At the same time, with numerous other products under development to treat a diversity of diseases and conditions, the Company is coming closer to the patient.

STRATEGIC VISION: As a result of the strategic plan implemented over the last three years, we have achieved our fundamental business goal of offering compounds at all stages of clinical and preclinical development. Together with increasing revenues generated by our two already marketed products, Cetrotide® and Impavido®, this strategy ensures both the short-term vitality and long-term value creation capability of the Company.

We are one of the few companies in the biopharmaceutical sector that benefits from a multi-track line of scientific inquiry. In fact, Æterna Zentaris is now developing products through five therapeutic approaches, aimed at treating multiple forms of cancer, hormonal disorders, and infectious disease. Moreover, as we pursue acquisitions, we are constantly evaluating potential complements to our therapeutic approaches and products to increase the efficacy or broaden the application of our proprietary compounds.

Another key element of the Æterna Zentaris strategy involves our network of alliances. By entering into partnerships with resourceful biotech and pharmaceutical companies, we have blazed a path whereby the development costs of our compounds are largely borne by our partners, while we retain strategic rights compatible with our long-term vision.

4 Æterna Zentaris Annual Report 2004

MOVING DRUGS THROUGH THE PIPELINE:

OUR MAIN R&D ACHIEVEMENT IN CLINICAL DEVELOPMENT FOR 2004 WAS THE SUCCESSFUL COMPLETION OF OUR SEVEN PHASE II TRIALS PROGRAM OF CETRORELIX FOR ENDOMETRIOSIS, UTERINE MYOMA, AND BENIGN PROSTATE HYPERPLASIA (BPH).

Cetrorelix, already marketed under the name Cetrotide® forin vitro fertilization, enjoys a high safety profile for versions going into advanced clinical testing mainly in gynaecology. As we are approaching the final phase of development, our partner Solvay Pharmaceuticals will pursue further clinical trials of the drug for endometriosis.

Our other main R&D highlight for the year just ended, involved our lead oncology compound, perifosine, which targets multiple cancers. Phase I data on perifosine in combination with radiotherapy pointed at notable efficacy and has paved the way for Keryx Biopharmaceuticals, our North American partner for this product, to commence Phase II trials against various cancers. Encouraging data was also disclosed on a Keryx Phase II monotherapy trial for soft tissue sarcoma. As part of this ongoing clinical development program, we will also conduct our own Phase II trials combining perifosine with radiotherapy. Our recent acquisition of Echelon Biosciences in Salt Lake City provides a complementary strategic fit for perifosine; the ensuing synergy should enhance our understanding of the product's mechanism of action while pursuing development of other strategic signal transduction inhibitors like PI3K inhibitors. This acquisition is our first in the U.S. and represents a significant step in establishing our presence in this most important market.

Other compounds also progressed through the pipeline. With our partner Spectrum Pharmaceuticals, we have taken our promising compound for the treatment of hormone-dependent cancers and proliferative disorders, D-63153, into Phase II clinical studies. With our partner Ardana Bioscience, we have taken teverelix, our compound for the treatment of prostate cancer and BPH, into Phase II.

In April, we initiated a Phase I trial with EP-1572, a novel, orally-administered compound which can directly stimulate growth hormone secretion from the pituitary gland. Potential indications for this compound include treatment of growth hormone deficiency disorders in adults and children (short stature), frailty of the elderly, as well as metabolic complications associated with critical illnesses, such as AIDS-associated cachexia, cancer, and trauma. We also advanced AN-152 into clinical development by initiating a Phase I trial for patients with ovarian, endometrial or breast cancer. With this trial, all of our five therapeutic approaches have reached the clinical development stage.

These milestones exemplify our ability to move compounds systematically through our pipeline, and thereby steadily build value for the Company and its shareholders.

Æterna Zentaris Annual Report 2004 5

PROMISING PRECLINICAL ACTIVITY: In 2004, as part of our continuing strategy to strengthen our portfolio in oncology and endocrinology, we obtained worldwide exclusive rights to pursue the development and marketing of another novel class of compounds from Dr. Andrew Schally and his group at Tulane University. These compounds called growth hormone-releasing hormone (GH-RH) antagonists have potential as anti-cancer agents and endocrine disorder treatment.

The most prominent preclinical advances in our pipeline involve our development of second generation versions of established compounds. With our partner Solvay, for example, we have begun investigating the efficacy of luteinizing hormone releasing hormone (LHRH) antagonist peptidomimetics for the treatment of solid tumors and endocrine disorders. These new chemical entities are second generation versions of our highly successful cetrorelix. Whereas cetrorelix is now injectable, we feel that this new development program should, in the years ahead, enable us to make it orally bioavailable. Solvay is intent on maintaining and furthering its market leadership in this area. Impressed with both the track record of cetrorelix and the expertise of our laboratory, Solvay has asked Æterna Zentaris to develop this more potent, more easily administered successor compound. Finally, we began investigating ghrelin antagonists which are emerging as promising novel therapies targeting obesity, cancer, diabetes, and cardiovascular disease.

THE COMPANY'S NEW NAME: In May of 2004, we formally adopted our new name of Æterna Zentaris Inc. We believe that the name more readily indicates our international stature. Moreover, given the results obtained with our compounds and the integrated nature of our operations from the discovery stage to the marketplace, the name also underlines the suitability and precision of our Company's new motto: Committed to Cure.

SECURE FINANCIAL POSITION:

A WINNING COMBINATION ENCOMPASSING OUR BIOPHARMACEUTICAL SECTOR AND ATRIUM.

Over the course of 2004, consolidated revenues reached $233 million and we registered a positive consolidated cash flow from our operations of close to $13 million. As of December 31, 2004, our cash and short term position stood at nearly $58 million.

In the biopharmaceutical sector, we managed to control our burn-rate with the support of our partners and with revenues generated by our marketed products.

Atrium Biotechnologies, represents a strategic profitable subsidiary which, in the last few years, has generated substantial and constant increasing revenue. Atrium's continued growth in 2004 necessitated added executive talent and the implementation of a new two division structure to manage this growth and to allow for the nonstop broadening of the company's international expansion.

6 Æterna Zentaris Annual Report 2004

GROWTH STRATEGY AND GOALS:

ÆTERNA ZENTARIS IS READY AND POISED TO EXPAND. DURING 2005, WE WILL DEVELOP ADDITIONAL COMPOUNDS WHILE ACTIVELY CONTINUING OUR GROWTH STRATEGY THROUGH ACQUISITIONS. OUR ACQUISITION PROGRAM IS TARGETED MOSTLY AT ONCOLOGY COMPANIES. PURSUING SYNERGISTIC TECHNOLOGY THAT ENHANCES THE EFFICACY OF OUR COMPOUNDS WILL LEVER OUR ESTABLISHED EXPERTISE AND AUGMENT THE VALUE OF OUR PROPRIETARY TECHNOLOGY.

As well, we plan to enter new alliances to develop treatments for endocrine disorders. In this field, we shall continue to implement our proven model of partnering, which involves licensing our compounds to multinationals and receiving in return compensation on signature, milestone payments, and royalties on sales. However, as mentioned above, in relation to a trial of perifosine that we are undertaking with our own resources, it is the company's intent, in the field of oncology, to begin developing anti-cancer agents with our own resources.

Therefore, as part of our strategy of becoming a fully integrated biopharmaceutical company, we are preparing for the establishment of our own sales forces in Europe and North America for oncology and anti-infectives. With our own sales force in place, we could reap greater return from the marketing of our products. While we continue to partner the products from our other platforms, the initial focus of our sales team will be on the Company's commercially-attractive compounds in oncology.

A SOLID PRESENCE IN THE BIOPHARMACEUTICAL INDUSTRY: Soundness and strength in the biopharmaceutical environment are signified above all by a diversified pipeline. We have achieved such a pipeline through dedicated and breakthrough work in the laboratory, and through judicious acquisitions and effective alliances. The result is a deeply rooted company with sound risk management which enhances our appeal to investors and partners, and opens the door to a still greater flow of novel development projects.

We would like to take this opportunity to thank all the employees and stakeholders of Æterna Zentaris for their commitment and confidence. Together, we can look forward to many more exciting milestones of achievement and reward.

| |

|

|---|

| |  |

Gilles Gagnon, MSc, MBA

President & CEO | | Éric Dupont, PhD

Chairman of the Board |

Æterna Zentaris Annual Report 2004 7

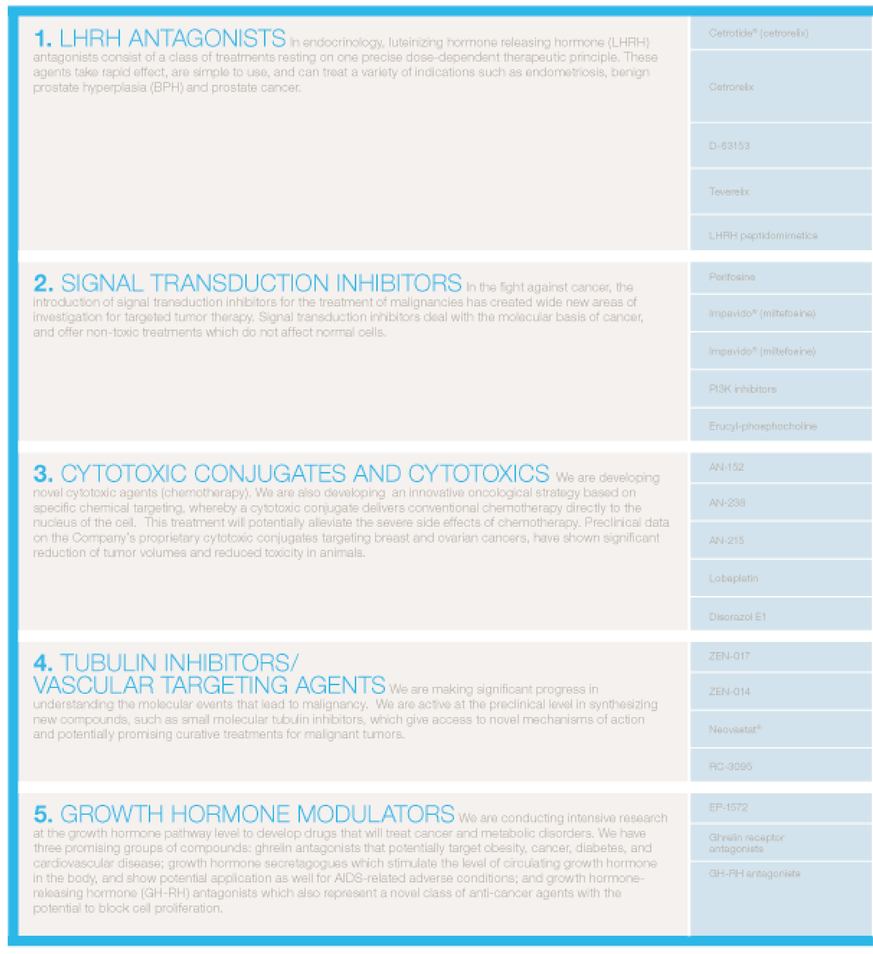

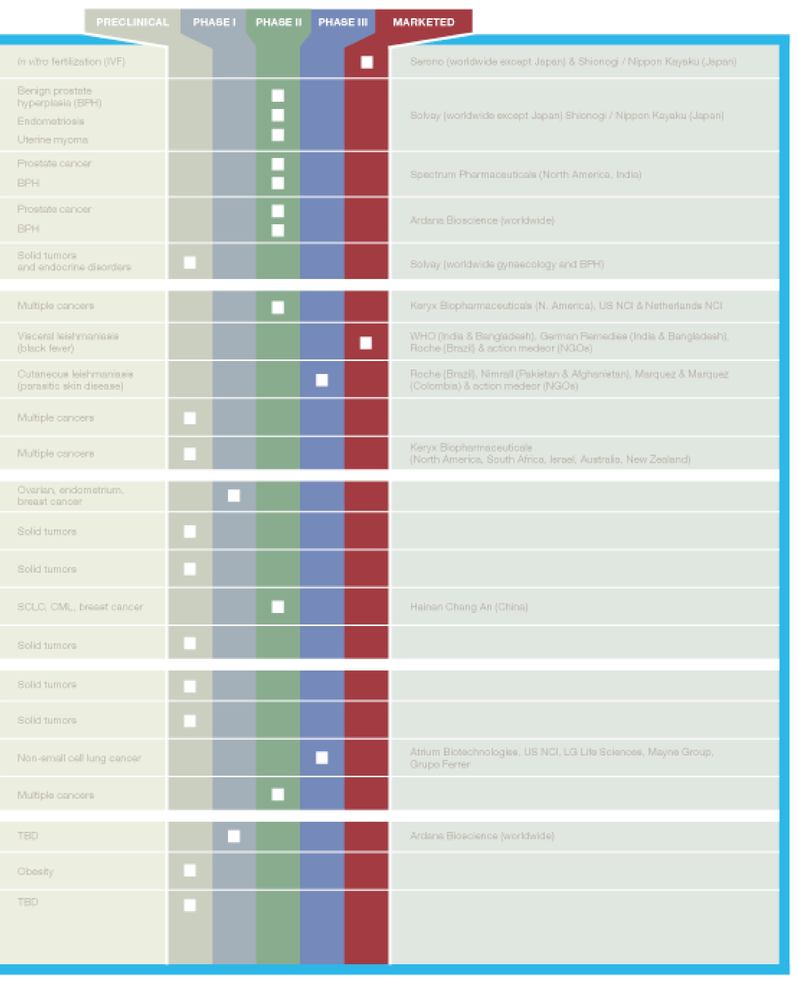

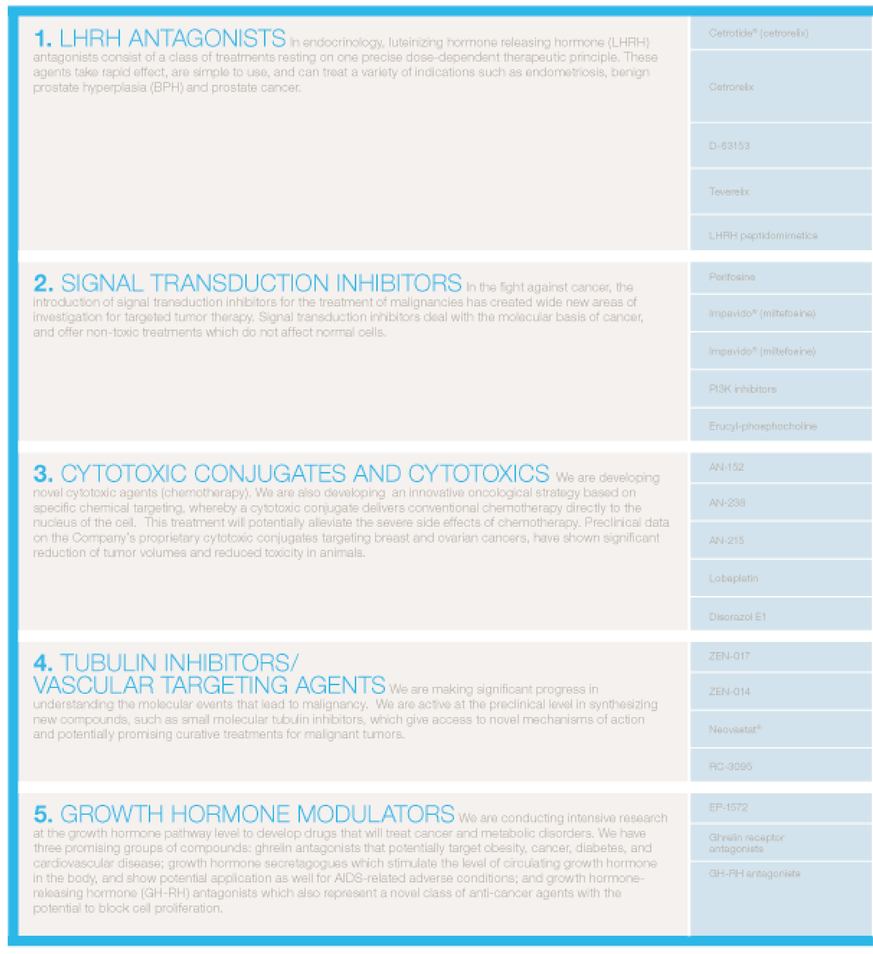

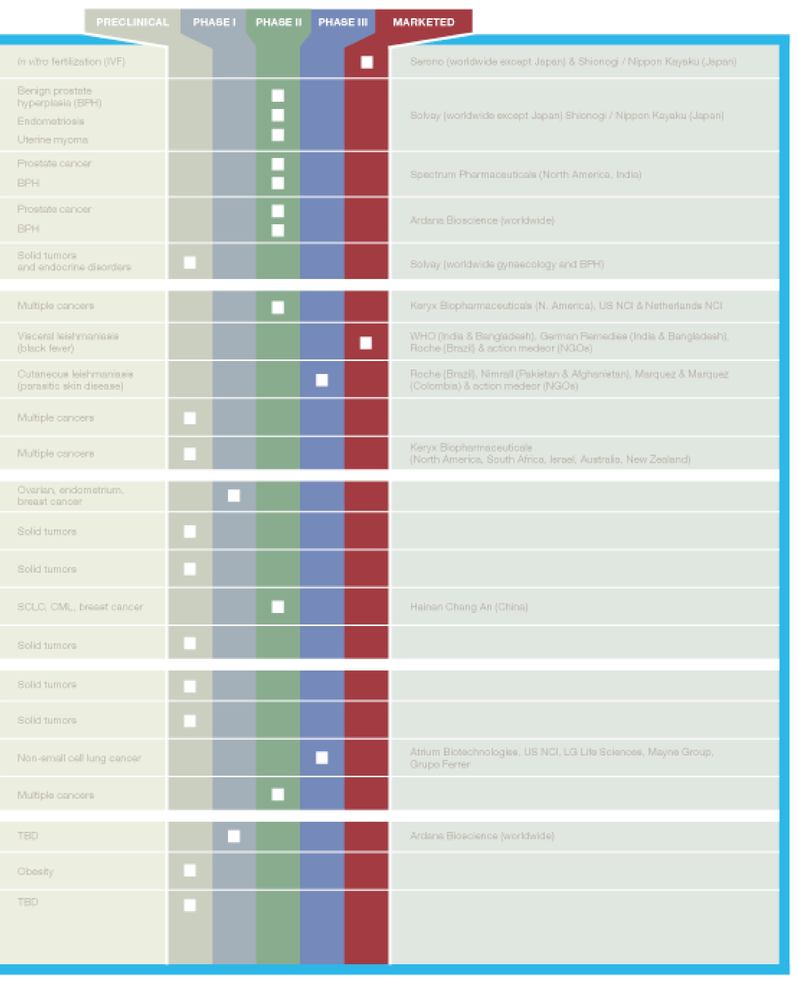

THE AETERNA ZENTARIS PRODUCT PIPELINE:

Five therapeutic approaches:

AT ÆTERNA ZENTARIS,BASIC RESEARCH AND DRUG DEVELOPMENT DONE EITHER IN ITS OWN LABORATORIES OR THROUGH COLLABORATIONS WITH SCIENTIFIC PARTNERS, RELY ON THE FOLLOWING FIVE THERAPEUTIC APPROACHES:

1. LHRH Antagonists 2. Signal Transduction Inhibitors 3. Cytotoxic Conjugates and Cytotoxics

4. Tubulin Inhibitors/Vascular Targeting Agents 5. Growth Hormone Modulators

8 Æterna Zentaris Annual Report 2004

Two Value Drivers

ROOTED IN ESTABLISHED

SCIENCE,LOOKING AHEAD WITH RESOLUTION, WE HAVE SET OUR SIGHT

ON A NUMBER OF BREAKTHROUGH THERAPEUTICS.

1. LHRH Antagonists 2. Signal Transduction Inhibitors

Æterna Zentaris Annual Report 2004 9

10 Æterna Zentaris Annual Report 2004

Æterna Zentaris Annual Report 2004 11

| |

|

|---|

1. LHRH ANTAGONISTS:PRODUCTS THAT TARGET ENDOCRINE DISEASE AND MULTIPLE FORMS OF HORMONE DEPENDENT CANCER

In Clinical Development

CETRORELIX During the past year, we successfully completed a seven Phase II trial program of our multi-indicated compound in endocrine therapy, cetrorelix. Three trials were in endometriosis, three in benign prostate hyperplasia (BPH), and one in uterine myoma. The results from all the studies were positive, with the most statistically significant data obtained from trials in endometriosis and BPH. If not treated, BPH can develop in some cases, into prostate cancer. Our partner, Solvay Pharmaceuticals, encouraged by the results and confident of further success, has made a payment to Æterna Zentaris of four million euros to signal its ongoing participation. Cetrorelix is already marketed forin vitro fertilization under the brand-name Cetrotide®.

D-63153 This fourth generation compound for the treatment of hormone- dependent cancers and proliferative disorders is now in Phase II for prostate cancer. Rights for North America and India have been licensed to Spectrum Pharmaceuticals for all indications. Æterna Zentaris received a cash and equity payment on signature, will receive payments as development and regulatory milestones are reached, and will receive royalties on potential sales. The Company has retained this compound's marketing rights for the rest of the world.

TEVERELIX Worldwide intellectual property rights to this compound currently in Phase II trials for the treatment of prostate cancer and BPH have been assigned to Ardana Bioscience of Scotland. Æterna Zentaris received a substantial upfront payment, will receive fixed annual guaranteed payments in 2005 and 2006, and will receive royalty income from potential sales. |

|

CETROTIDE® (CETRORELIX)

Cetrotide® was the first luteinizing hormone-releasing hormone (LHRH) antagonist treatment approved for in vitrofertilization. It is administered to women to prevent premature ovulation in order to increase fertility success rate. Infertility problems are found in 15% of couples in developed countries. Cetrotide® is the only treatment in its class to offer a choice of two highly effective dosage strengths which enable precise control. Due to its immediate onset of action, Cetrotide® permits a simplified, more convenient, and shorter treatment. It involves fewer injections and causes less side-effects than other forms of in vitrofertilization treatment. |

"The striking results we have seen with cetrorelix, particularly in endometriosis, deliver on the promise of LHRH antagonists and are the culmination of Dr. Andrew Schally's Nobel-Prize winning research in this field."(Dr. Jürgen Engel)

- •

- BPH AFFECTS 33 MILLION MEN, AND REPRESENTS A MARKET OF US$1.7 BILLION

- •

- ENDOMETRIOSIS AFFECTS 10% TO 20% OF WOMEN OF CHILDBEARING AGE, AND REPRESENTS A MARKET OF US$800 MILLION

- •

- OVER 540,000 CASES OF PROSTATE CANCER OCCUR WORLDWIDE ANNUALLY

12 Æterna Zentaris Annual Report 2004

| |

|

|---|

2. SIGNAL TRANSDUCTION INHIBITORS:BREAKING NEW GROUND IN TARGETED TUMOR THERAPY BY DEALING WITH CANCER AT THE MOLECULAR LEVEL WITH NON-TOXIC TREATMENTS

In Clinical Development

PERIFOSINE Encouraging results of a Phase I study of perifosine in combination with radiotherapy were disclosed at the ASCO conference in June. In addition to the responses, one major benefit was that perifosine did not induce any suppression of the bone marrow. These results pave the way for Æterna Zentaris to start its own trials of perifosine in combination with radiotherapy at the National Cancer Institute in the Netherlands.

The conclusions of a Phase II clinical trial conducted in partnership with Keryx Biopharmaceuticals and involving perifosine given as a single agent, showed evidence of anti-tumour activity in patients suffering from soft tissue sarcoma. Keryx is currently conducting other Phase II trials in monotherapy with perifosine for multiple types of cancer.

MILTEFOSINE (IMPAVIDO®) Miltefosine has successfully completed a Phase III trial targeting the cutaneous form of leishmaniasis (a parasitic skin disease), and is on track to obtain regulatory approval in South America. It is currently marketed in India for the visceral form of leishmaniasis (black fever) under the brand-name Impavido®.

• THERE ARE 2.4 MILLION NEW CASES ANNUALLY IN

PROSTATE, BREAST, HEAD AND NECK, AND

PANCREATIC CANCER, AS WELL AS SARCOMA

AND MELANOMA

• THERE ARE 12 MILLION PEOPLE SUFFERING FROM

LEISHMANIASIS WORLDWIDE WITH 1.5 MILLION

�� NEW CASES REPORTED ANNUALLY |

|

IMPAVIDO® (MILTEFOSINE)

Impavido® is the first marketed oral therapy for visceral leishmaniasis, a parasitic infection, also known as black fever. According to the World Health Organization, the disease is endemic in 88 countries with nearly 350 million people at risk. An estimated 12 million people currently suffer from the condition with 1 million to 1.5 million new cases reported annually. Leishmaniasis is a very virulent tropical disease, second only to malaria. If untreated, the visceral form will be lethal.

The cure rate of Impavido® is 95%, and has been proven less toxic than current therapies. Additionally, since the current injectable therapies require patient, hospitalization, an oral drug such as Impavido®, which can be administered once daily for 28 days, clearly represents a more convenient treatment for patients as well as an important means for incurring substantial savings in healthcare costs.

Impavido® has been marketed in India since 2003 through cooperation with German Remedies. In November of 2004, Æterna Zentaris obtained marketing approval for Impavido® in Germany from the German Food and Drug Agency (BfarM). This approval also enables Æterna Zentaris to receive a Free Sales Certificate (FSC), which can provide the basis for registration in countries where leishmaniasis is endemic, such as Colombia and Pakistan. |

Æterna Zentaris Annual Report 2004 13

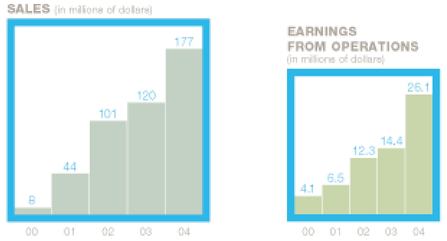

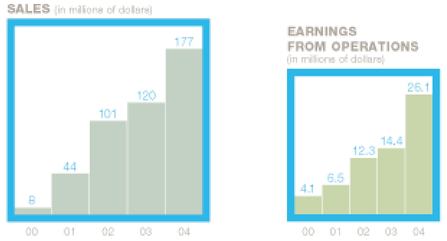

Atrium: 2004 sales

exceeded $177 million.

2004 AND SUBSEQUENT TO YEAR-END HIGHLIGHTS

ACQUISITION of Pure Encapsulations of Sudbury, Massachusetts, which develops, manufactures and markets high quality finished products in health and nutrition for healthcare professionals, a growing specialized sector generating annual sales of over US$1 billion in the United States alone

ACQUISITION of MultiChem, a privately-held Canadian company that markets active ingredients and specialty chemicals

LAUNCHING of 20 new products

SIGNING of 5 new marketing partnerships

RECIPIENT of the 50 Best Managed Corporations Award as a leading Canadian corporation for a third consecutive year

RECIPIENT of the Profit 100 Award for a third consecutive year. The Award recognizes Canadian companies registering the best growth in the last five years

CONTINUED GROWTH

SINCE ITS CREATION IN 2000, ATRIUM HAS DEMONSTRATED ITS ABILITY TO CONSTANTLY OUTPERFORM THE INDUSTRY. IN THAT SHORT TIME SPAN, SALES HAVE SOARED FROM $8 MILLION TO $177 MILLION, A COMPOUNDED ANNUAL INCREASE OF 117%, WHILE ITS EARNINGS FROM OPERATIONS HAVE A COMPOUNDED ANNUAL INCREASE OF 59%, FROM $4.1 MILLION TO $26.1 MILLION.

14 Æterna Zentaris Annual Report 2004

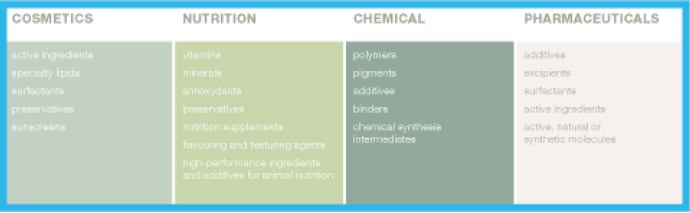

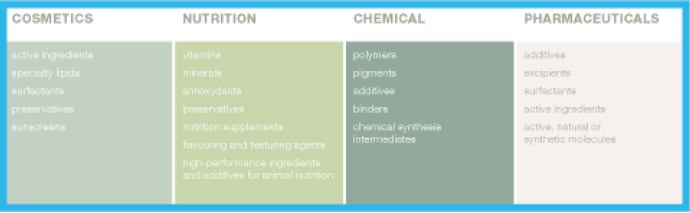

Atrium

ATRIUM BIOTECHNOLOGIES IS A LEADING DEVELOPER, MANUFACTURER AND MARKETER OF VALUE-ADDED PRODUCTS FOR THE COSMETICS, PHARMACEUTICAL, CHEMICAL AND NUTRITION INDUSTRIES. ATRIUM FOCUSES PRIMARILY ON GROWING SEGMENTS OF THE HEALTH AND PERSONAL CARE MARKETS WHICH ARE BENEFITING FROM THE TRENDS TOWARDS HEALTHY LIVING AND THE AGEING OF THE POPULATION.

ATRIUM MARKETS A BROAD PORTFOLIO OF ACTIVE INGREDIENTS AND SPECIALTY CHEMICALS, AS WELL AS HEALTH AND NUTRITION FINISHED PRODUCTS THROUGH ITS HIGHLY SPECIALIZED SALES AND MARKETING NETWORK IN MORE THAN 35 COUNTRIES, PRIMARILY IN NORTH AMERICA, EUROPE AND ASIA.

Æterna Zentaris Annual Report 2004 15

16 Æterna Zentaris Annual Report 2004

MESSAGE FROM THE PRESIDENT

At Atrium, 2004 has been a year of sustained growth and development. Compared to last year, our sales increased by 47% to $177 million, we launched 20 new products, signed 5 new commercial partnerships and pursued our acquisition program.

As a matter of fact, our main achievement of 2004 was the acquisition of Boston-based Pure Encapsulations which develops, manufactures and markets high quality finished products in health and nutrition sold to an important network of healthcare professionals in the United States. This acquisition allowed us to substantially increase our line of products and sales in this most strategic market. In January 2005, we also acquired MultiChem, a Canadian marketer of active ingredients and specialty chemicals. These two acquisitions were part of our 2004 strategy to better control access to the North American market as we had done in Europe a year earlier.

In order to adequately manage the sustained growth of the past few years and to meet the upcoming challenges, we hired seasoned executives with complementary and new expertise to complete our management team. With the same due regard for sound management and efficiency, we created two distinct divisions for our company activities: the Active Ingredients & Specialty Chemicals Division and the Health & Nutrition Division. The changes in both structure and personnel will allow us to generate added company growth. Finally, we judiciously used our financial leverages in order to pursue our growth plan throughout 2004.

The key to our sustained success lies within our six distinctive core strengths. First, we offer value-added products addressing specific needs in high-growth niche markets such as the health and personal care industry which is predicted to grow at a double-digit pace in the foreseeable future. We also benefit from long-standing and privileged relationships with industry leaders. This situation, coupled with our broad product portfolio and state-of-the-art logistics system, puts us in a position to become a preferred supplier of a growing number of products to our customers.

FURTHERMORE, OUR HIGHLY SPECIALIZED INTERNATIONAL SALES AND MARKETING NETWORK DRIVEN BY SKILLED AND SEASONED PROFESSIONALS, ENABLES US TO ACTIVELY MARKET OUR PRODUCTS AND SOLUTIONS DIRECTLY IN NORTH AMERICA AND EUROPE.

Fourth, we have a strong financial track record of delivering highly profitable growth generated at the organic level as well as through acquisitions. In just five years, revenue has increased from $8 million to over $177 million while earnings from operations progressed from $4.1 million to $26.1 million. Moreover, the seven acquisitions we made over the last five years are relevant examples of our proven acquisition and integration strategy in a highly fragmented marketplace. Once acquired, these products and/or companies are carefully integrated into our organization by a multidisciplinary team in collaboration with the local staff to build on their strengths. Last, we can count on an experienced and committed management team that possesses extensive development, finance, manufacturing and international marketing experience in each of our sectors of activity.

We are convinced that with all of these elements in place, we will be in a position to achieve our 2005 growth strategy goals with the focus on three key elements: make additional acquisitions in Europe and North America in order to better control access to these markets; complete our geographical coverage by mainly targeting Asia; and introduce new products either from our own biotechnological platform or through acquisitions. Attaining these objectives would enable us to increase our presence in our strategic markets and, therefore, strengthen our position as a leader in our activity sectors.

In closing, I would like to thank all our employees for the determined work and dynamism they displayed throughout the year.

Luc Dupont, President and CEO

Æterna Zentaris Annual Report 2004 17

Company Structure

and Product Pipeline

IN LATE 2004, IN ORDER TO MAXIMIZE THE COMPANY'S INTERNATIONAL EXPANSION, ATRIUM DECIDED TO STRUCTURE THE COMPANY INTO TWO DIVISIONS:

• Active Ingredients & Specialty Chemicals • Health & Nutrition

YVAN SERGERIE, Vice President International, Sales and Marketing, Health and Nutrition Division /RICHARD BORDELEAU, President, Health & Nutrition Division /CHARLES BOULANGER, President, Active Ingredients and Specialty Chemicals Division/SERGE YELLE, PhD, Vice President, Business Development /MANON DESLAURIERS, Vice President, Legal and Corporate Affairs, and Secretary /JOCELYN HARVEY, CA, Vice President, Mergers and Acquisitions /JOHN DEMPSEY, Vice President, Finance and Chief Financial Officer

ACTIVE INGREDIENTS AND SPECIALTY CHEMICALS DIVISION This division develops, manufactures and markets over 1,500 value-added active ingredients and specialty chemicals for the cosmetic, pharmaceutical, nutrition and chemical sectors, while also providing scientific, technical and regulatory support to some 2,000 customers including leading companies such as Aventis-Sanofi-Synthélabo, Estée Lauder, l'Oréal and Nestlé. Our portfolio includes additives, preservatives, excipients, specialty lipids, polymers and antioxidants geared to a market that yields above average growth annually.

HEALTH AND NUTRITION DIVISION This division focuses on the development, manufacturing and marketing of more than 350 high quality vitamins, minerals, specialized nutrition and health products to a network of some 30,000 healthcare professionals in the United States. According to Nutrition Business Journal, between 2000 and 2003, this market segment in the United States had an annual growth rate of more than 10%. In addition to the strong growth associated with trends towards healthy living and ageing of the population, we will also capitalize on the increasing awareness from governmental authorities of the economic benefits linked to a healthier society.

18 Æterna Zentaris Annual Report 2004

Æterna Zentaris:

AN INVESTMENT OPPORTUNITY

BRANCHING OUT, GROWING WITH A DETERMINED VISION, ÆTERNA ZENTARIS STANDS ENTRENCHED AND TALL ON THE CANADIAN BIOPHARMACEUTICAL STAGE.

- •

- A LEADING CANADIAN BIOPHARMACEUTICAL COMPANY FOCUSED ON DEVELOPING AND MARKETING NOVEL TREATMENTS FOR CANCER AND ENDOCRINE DISORDERS

- •

- A BUSINESS MODEL BASED ON ALLIANCES WITH 15 BIOTECH AND PHARMACEUTICAL PARTNERS WHO ASSUME MOST OF THE COSTS FOR COMPOUNDS UNDER DEVELOPMENT

- •

- 2 WIDELY MARKETED PRODUCTS

- •

- 10 COMPOUNDS IN CLINICAL DEVELOPMENT

- •

- 10 COMPOUNDS IN PRECLINICAL DEVELOPMENT

- •

- A LIBRARY OF 100,000 PROPRIETARY COMPOUNDS

- •

- EXPERIENCED TEAMS AT BOTH THE CORPORATE AND PHARMACEUTICAL DEVELOPMENT LEVELS WITH THE SKILLS REQUISITE TO DEVELOP AND TAKE COMPOUNDS FROM THE EARLIEST PRECLINICAL STAGE, THROUGH THE REGULATORY PROCESS, AND INTO THE GLOBAL MARKETPLACE

- •

- AN ADVANTAGEOUS CASH POSITION WHICH ALLOWS THE CONTINUITY OF OUR GROWTH STRATEGY

- •

- ATRIUM BIOTECHNOLOGIES, A PROFITABLE AND EMERGING SUBSIDIARY, WHICH REGISTERED EARNINGS FROM OPERATIONS OF $26.1 MILLION IN 2004

Æterna Zentaris Annual Report 2004 19

Financial Report 2004

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following analysis provides a review of Company's results of operations, financial condition and cash flows for the three-year period ended December 31, 2004. This discussion should be read in conjunction with the information contained in Æterna Zentaris Inc.'s annual consolidated financial statements and related notes for the years ended on December 31, 2004, 2003 and 2002. Our consolidated financial statements are reported in Canadian dollars and have been prepared in accordance with generally accepted accounting principles in Canada, or Canadian GAAP. Significant differences in measurement and disclosure from generally accepted accounting principles in the United States, or U.S. GAAP, are set out in note 24 of our consolidated financial statements.

COMPANY OVERVIEW

Æterna Zentaris Inc. ("Æterna Zentaris" or "the Company"), formerly Æterna Laboratories Inc., is an oncology and endocrine therapy focused biopharmaceutical company with proven expertise in drug discovery, development and marketing. The Company's broad 20 product pipeline leverages five different therapeutic approaches, including Luteinizing Hormone Releasing Hormone (LHRH) antagonists and signal transduction inhibitors. The lead LHRH antagonist compound, cetrorelix, is currently marketed forin vitro fertilization under the brand name Cetrotide®, and has successfully completed a broad Phase II program in endometriosis and benign prostatic hyperplasia (BPH). The lead signal transduction inhibitor compound, perifosine, is an orally-active AKT inhibitor that is in several Phase II trials for multiple cancers.

Æterna Zentaris also owns 61.1% of its subsidiary Atrium Biotechnologie Inc. ("Atrium"), a leading developer, manufacturer and marketer of value-added products for the cosmetics, pharmaceutical, chemical and nutrition industries focused primarily on growing segments of the health and personal care markets which are benefiting from the trends towards healthy living and the aging of the population. Atrium markets a broad portfolio of active ingredients, specialty chemicals and Health & Nutrition finished products through a highly specialized sales and marketing network in more than 35 countries, primarily in North America, Europe and Asia. As of February 17, 2005, Atrium filed a preliminary prospectus in each of the provinces of Canada in connection with an initial public offering of subordinate voting shares. The proceeds from the treasury offering will be used by Atrium primarily to pursue its acquisition strategy and for general corporate purposes.

The Company operates in three segments of operations which are: (i) Biopharmaceutical; (ii) Active Ingredients & Specialty Chemicals; and (iii) Health and Nutrition.

Æterna Zentaris, along with its wholly-owned subsidiary Zentaris GmbH, constitute the Biopharmaceutical segment. In addition, subsequent to the year 2004, the Company added to its Biopharmaceutical segment Echelon Biosciences Inc. ("Echelon") by acquiring all of its issued and outstanding shares.

To better address the needs of its customers, our subsidiary, Atrium, reorganized its business during the year under two business segments: (i) the Active Ingredients & Specialty Chemicals Division; and (ii) the Health & Nutrition Division. The Active Ingredients & Specialty Chemicals Division offers value-added products that include high-value proprietary active ingredients developed, acquired or in-licensed by Atrium. Through the Health & Nutrition Division, Atrium develops, manufactures and markets proprietary Health & Nutrition finished products.

Æterna Zentaris' growth strategy is based on improving and leveraging its extensive product portfolio and being active in in-licensing and acquisition of strategic compounds. Its long-term growth strategy includes the establishment of a sales force to become an integrated biopharmaceutical company. The Company also intends to remain a strategic shareholder of Atrium and to support its business growth.

Æterna Zentaris Financial Statements 2004

HIGHLIGHTS

Consolidated results-at-a-glance

| | Years ended December 31,

| |

|---|

(in thousands of Canadian dollars)

| | 2004

$

| | 2003

$

| | 2002

$

| |

|---|

| Revenues | | 233,248 | | 166,413 | | 101,204 | |

| R&D, net of tax credits and grants | | 30,367 | | 44,124 | | 24,129 | |

| Earnings (loss) from operations | | 17,170 | | (14,283 | ) | (20,566 | ) |

| Net loss | | (5,759 | ) | (28,147 | ) | (25,782 | ) |

In theBiopharmaceutical segment, our strategic objectives for 2004 were mainly focused on maximizing marketed compound revenues, signing new licensing and collaboration agreements, introducing new products in our portfolio and on obtaining timely results from our clinical studies. The following summarizes major milestones for each strategic objective.

Maximizing marketed compound revenues

We announced in December that we received German Food and Drug Agency (BfarM) market approval for miltefosine (Impavido®), the first-ever orally-administered therapy for visceral and cutaneous leishmaniasis, a parasitic disease estimated to affect millions of people worldwide. The approval enabled us to market Impavido® in Germany, as well as to receive a Free Sales Certificate (FSC), which can provide the basis for registration in countries where leishmaniasis is endemic, such as Colombia and Pakistan.

Impavido®, or miltefosine, is an alkylphospholipid that has been marketed in India since 2003 through cooperation with German Remedies (a member of Zydus Cadila). Visceral and cutaneous leishmaniasis is a parasitic infection also known as black fever which affects millions of people and is, according to the World Health Organization ("WHO"), endemic in 88 countries in the world with nearly 350 million people at risk. It is estimated that 12 million people currently suffer from this disease with 1 million-1.5 million new cases reported annually. Leishmaniasis is a very virulent tropical disease, second only to malaria.

We obtained significant revenues from Serono our world (ex-Japan) partner for the marketing of Cetrotide®, or cetrorelix, forin vitro fertilization. We believe that cetrorelix will be subject to further clinical development in benign indications with the collaboration of Solvay Pharmaceuticals B.V. ("Solvay"), Nippon Kayaku and Shionogi. These indications include endometriosis which affects 10% to 20% of women of child-bearing age, representing a market estimated at more than US$800 million a year, as well as BPH which affects approximately 33 million men and which represents a market of more than US$1.7 billion.

Licensing and collaboration agreements

We entered into an expanded agreement on April 2, 2004 for the LHRH antagonist, teverelix, with Ardana Bioscience, a specialty pharmaceutical company located in Edinburgh, Scotland. Ardana acquired full worldwide rights to the teverelix compound and the underlying microcrystalline suspension technology, including all related intellectual property. In return, we received upfront payments and are eligible to guaranteed payments both totalling €12 million until 2006, as well as potential future royalties on sales of teverelix or any other LHRH antagonist that could be combined with the microcrystalline suspension technology.

On August 12, 2004, we entered into a licensing and collaboration agreement for D-63153 with Spectrum Pharmaceuticals, Inc. ("Spectrum") (NASDAQ: SPPI), an oncology-focused pharmaceutical company based in the United States. This product is a LHRH antagonist that has the potential to treat hormone-dependent cancers as well as benign, proliferative disorders. The agreement came as we regained worldwide rights to D-63153 from Baxter Healthcare as a result of recent organizational changes and restructuring at Baxter's, and following a mutual understanding between the two companies aimed at maximizing the value of D-63153.

Æterna Zentaris Financial Statements 2004 1

In return of the grant of this exclusive license to develop and commercialize D-63153 for all potential indications in North America (including Canada and Mexico) and India, we received an upfront payment, at signature, which included cash and equity of Spectrum. We are also eligible to receive payments upon achievement of certain development and regulatory milestones, in addition to royalties on potential net sales. We retained exclusive rights for the rest of the world and will share with Spectrum upfront and milestone payments, royalties or profits from potential sales in Japan.

Introducing new products in the portfolio

In January 2004, we announced that we entered into an extensive collaboration agreement with Solvay to codevelop novel, low molecular weight and orally-bioavailable peptidomimetic LHRH antagonists. Potential indications include endometriosis, BPH, as well as malignant disorders such as breast and prostate cancer.

As part of the agreement, Solvay obtained exclusive worldwide rights to all gynecological indications as well as to BPH, and we retained exclusive rights to all other indications including oncology. The contract also provides us to receive, upon signature, an amount of $5 million resulting from an upfront payment, as well as proceeds from the coverage of past development costs. In addition, the agreement foresees for Solvay to fund further preclinical and clinical development activities to be performed by us, up to a fixed amount and to make milestone payments.

Following our ongoing interest in the area of LHRH antagonists, a drug discovery project aiming at the identification of peptidomimetic leads was initiated a few years ago. Such leads are expected to act on the LHRH receptor similar to decapeptides, however, with the crucial benefit of oral bioavailability. Having achieved proof-of-principle regarding oral bioavailability, we expect to have a preclinical development candidate available in the course of this year.

Subsequent to the year 2004, we completed in January 2005 the acquisition of all issued and outstanding shares of Echelon, a privately-held biopharmaceutical company based in Salt Lake City, Utah, USA.

Echelon's product pipeline is focused on the rapidly emerging field of transduction signalling technology. It has early therapeutic leads (mostly direct PI3K inhibitors) against some forms of cancer and is in a position to deliver new highlyeffective oncology therapeutics. The focus is also on small molecule agonists and antagonists to lipid-protein signalling interactions which are new and important therapeutic targets.

Obtaining timely clinical trial results

We announced statistically significant positive results from a completed Phase II clinical program designed to evaluate cetrorelix, a LHRH antagonist, in three different indications: endometriosis, presurgical treatment of uterine myoma and BPH. These results showed that patients can benefit from a targeted and controlled decrease in sex hormones, including estrogen and testosterone. The positive results of seven Phase II trials, which also demonstrated good tolerability in all these indications, will form the basis for further development of cetrorelix with Solvay, our exclusive worldwide partner (ex-Japan) and with Shionogi and Nippon Kayaku, our corresponding partners in Japan. This major achievement generated €4 million in milestone payments from Solvay.

Furthermore, we announced in June that our product, perifosine, an orally-active AKT inhibitor for the treatment of cancer, showed encouraging results in a Phase I trial in combination with radiotherapy. We also mentioned our intention to initiate a clinical program for perifosine through the ongoing collaboration with the Netherlands Cancer Institute of Amsterdam. In collaboration with the US NCI and as part of a large screening program in Phase I and II, our North American partner, Keryx Biopharmaceuticals ("Keryx") (NASDAQ: KERX), located in the United States, identified encouraging signs of anti-tumor activities and initiated several single-agent and combination studies testing perifosine as a treatment for various forms of cancer.

In theHealth & Nutrition segment, the integration of acquired Pure Encapsulations, Inc. ("Pure") in March 2004 is now completed. Pure is a company based in Sudbury, Massachusetts, in the United States, which focuses mainly on the development, manufacturing and marketing of nutritional supplements geared toward physicians and other healthcare professionals. Pure acquisition complements Atrium's actual products in this segment. This acquisition, combined with Atrium's internal growth has enabled our subsidiary to increase its earnings from operations in this segment by 188.1% to $12.1 million for 2004 in comparison with $4.2 million in 2003.

2 Æterna Zentaris Financial Statements 2004

In theActive Ingredients & Specialty Chemicals segment, we continued to improve our earnings from operations in this competitive segment from $10.2 million in 2003 to $14.0 million in 2004. We also announced in January 2005 the closing of the acquisition of the operating assets of MultiChem Import Export Inc. and MultiChem Trading Inc. ("MultiChem") for a total amount of $22.8 million. Founded in 1985, MultiChem is a privately-held Canadian company specialized in the marketing of Active Ingredients & Specialty Chemicals. It has a portfolio of over 400 products sold to more than 500 customers in Canada and the North Eastern United States through its offices in Montreal and Toronto. For the twelve-month period ended November 30, 2004, MultiChem sales exceeded $65 million. The MultiChem acquisition allows us to significantly increase our presence on the North American market.

Critical Accounting Policies and Estimates

Our financial statements are prepared in accordance with the Canadian Generally Accepted Accounting Principles ("GAAP"), and access to a summary of differences between Canadian and US GAAP is possible by consulting note 24 of our annual 2004 financial statements. These accounting principles require that management makes estimates that could have an impact on assets and liabilities in the financial statements. Actual results could differ from these estimates. The significant accounting policies which the Company believes are the most critical to aid in fully understanding and evaluating its reported financial results include the following:

Revenue recognition and deferred revenues

The biopharmaceutical segment is currently in a phase in which potential products are being further developed or marketed jointly with strategic partners. The existing licensing agreements usually foresee one-time payments (upfront payments), payments for research and development services in the form of cost reimbursements, milestone payments and royalty receipts for licensing and marketing product candidates.

In December 2003, the CICA Emerging Issues Committee (EIC) issued Abstracts No. 141 "Revenue Recognition" and No. 142 "Revenue Arrangements with Multiple Deliverables". The latter is based on Issue No. 00-21 entitled "Revenue Arrangements with Multiple Deliverables" issued in May 2003 by the Emerging Issues Task Force of the Financial Accounting Standards Board ("FASB") in the United States. EIC's 141 and 142 provide clarification guidelines for determining when and how revenue from the sale of goods and services must be recognized. The Company prospectively adopted these guidelines for contracts signed after January 1, 2004 and consequently revenues associated with multiple-element arrangements are attributed to the various elements based on their relative fair value.

- •

- Upfront payments received at the beginning of licensing agreements are not recorded as revenue when received but are amortized based on the progress to the related research and development work.

- •

- Milestone payments, which are generally based on developmental or regulatory events, are recognized as revenue when the milestones are achieved, collectibility is assured, and when there are no significant future performance obligations in connection with the milestones. In those instances where the Company has collected fees or milestone payments but has ongoing future obligations related to the development of the drug product, revenue recognition is deferred and amortized over the period of its future obligations.

- •

- Royalty revenue is recorded when the amount of the royalty fee is determinable and collection is reasonably assured.

- •

- Revenues from sales of products are recognized, net of estimated sales allowances and rebates, when title passes to customers, which is at the time goods are shipped, when there are no future performance obligations, when the purchase price is fixed and determinable, and collection is reasonably assured.

Research and development costs

All research and development ("R&D") costs which do not meet generally accepted criteria for deferral are expensed as incurred. Development costs which meet generally accepted criteria for deferral are capitalized and amortized against earnings over the estimated period of benefit. To date, no costs have been deferred.

Æterna Zentaris Financial Statements 2004 3

Impairment of long-lived assets and goodwill

Property, plant and equipment and intangible assets with finite lives are reviewed for impairment annually or when events or circumstances indicate that costs may not be recoverable. Impairment exists when the carrying value of the asset is greater than the undiscounted future cash flows expected to be provided by the asset. The amount of impairment loss, if any, is the excess of its carrying value over its fair value. Finite-lived assets are written down for any impairment in value of the unamortized portion. As at December 31, 2004, there were no events or circumstances indicating that the carrying value may not be recoverable.

Intangible assets with indefinite lives are tested for impairment annually or more frequently if events or circumstances indicate that the asset might be impaired. Impairment exists when the carrying amount of the intangible asset exceeds its fair value.

Finally, goodwill is tested annually, or more frequently if impairment indicators arise, for impairment in relation to the fair value of each reporting unit to which goodwill applies and the value of other assets in that reporting unit. An impairment charge is recorded for any goodwill that is considered impaired.

Accounting for income tax expense

We operate in multiple jurisdictions, and our earnings are taxed pursuant to the tax laws of these jurisdictions. Our effective tax rate may be affected by the changes in, or interpretations of, tax laws in any given jurisdiction, utilization of net operating losses and tax credit carry forwards, changes in geographical mix of income and expense, and changes in management's assessment of matters, such as the ability to realize future tax assets. As a result of these considerations, we must estimate our income taxes in each of the jurisdictions in which we operate. This process involves estimating our actual current tax exposure, together with assessing temporary differences resulting from differing treatment of items for tax and accounting purposes. These differences result in future tax assets and liabilities, which are included in our consolidated balance sheet. We must then assess the likelihood that our future tax assets will be recovered from future taxable income and establish a valuation allowance for any amounts we believe it will be more likely than not be recoverable. Establishing or increasing a valuation allowance increases our income tax expense.

Significant management judgment is required in determining our provision for income taxes, our income tax assets and liabilities, and any valuation allowance recorded against our net income tax assets. We recorded a valuation allowance as at December 31, 2004, due to uncertainties related to our ability to utilize some of our income tax assets. The valuation allowance was based on our estimates of taxable income by jurisdiction in which we operate and the period over which our income tax assets will be recoverable. In the event that actual results differ from these estimates or we adjust these estimates in future periods, we may need to amend our valuation allowance, which could materially impact our financial position and results of operations.

Stock-based compensation plans

On January 1, 2002, Æterna Zentaris adopted the recommendations issued by the CICA and, at that time, we had chosen not to use the fair value method to account for the stock-based compensation costs arising from awards to employees. The fair value method was only used for stock-based payments made in exchange for goods and services with non employees. Effective January 1, 2003, we decided to adopt the fair value method on a prospective basis, as permitted under the amendments made to the recommendations during 2003. According to this method, all stock-based compensations granted during 2003 and beyond will be recorded in the corresponding period without restatement of prior years. However, Æterna Zentaris is still required to provide pro forma disclosures relating to net loss and net loss per share as if stock-based compensation costs had been recognized in the financial statements using the fair value method for options granted to employees in 2002.

The following points detail the changes in critical accounting policies that have occurred since our most recent annual report:

Generally accepted accounting principles

In July 2003, the CICA issued new Handbook Section 1100 "Generally Accepted Accounting Principles" ("GAAP"), which is effective for fiscal years beginning on or after October 1, 2003. This new section defines GAAP, establishes the relative authority of various types of CICA Accounting Standards Board pronouncements, says what to do when the Handbook does not cover a particular situation and clarifies the role of "industry practice" in setting GAAP. The Company adopted this new standard on January 1, 2004 without having any significant effect on the Company's financial statements.

4 Æterna Zentaris Financial Statements 2004

General standards of financial statement presentation

In July 2003, the CICA issued new Handbook Section 1400 "General Standards of Financial Statement Presentation" which is effective for fiscal years beginning on or after October 1, 2003. This new section confirms that the financial statements of an entity must present fairly in accordance with Canadian Generally Accepted Accounting Principles its financial position, results of operations and cash flows. The Company adopted this new standard on January 1, 2004 without having any significant impact on the Company's financial statements.

Hedging relationships

The CICA has issued Accounting Guideline 13 "Hedging Relationships", which establishes certain conditions regarding when hedge accounting may be applied and which is effective for fiscal years beginning on or after January 1, 2004. AcG 13 addresses the identification, designation, documentation, and effectiveness of hedging transactions for the purposes of applying hedge accounting. It also establishes conditions for applying or discontinuing hedge accounting. Under this new guideline, the Company is also required to document its hedging transactions and explicitly demonstrate that the hedges are sufficiently effective in order to continue hedge accounting for positions hedged with derivatives. Any derivative instrument that does not qualify for hedge accounting will be reported on a mark-to-market basis in earnings. The Company adopted this guideline as at January 1, 2004 without having any significant impact on the Company's financial statements.

CONSOLIDATED RESULTS OF OPERATIONS

The following table sets forth certain Canadian GAAP consolidated financial data in thousands of Canadian dollars, except per share data.

| | Years ended December 31,

| |

|---|

| | 2004

$

| | 2003

$

| | 2002

$

| |

|---|

| Revenues | | 233,248 | | 166,413 | | 101,204 | |

| | |

| |

| |

| |

| Operating expenses | | | | | | | |

| Cost of sales | | 134,535 | | 98,048 | | 77,443 | |

| Selling, general and administrative | | 42,198 | | 29,103 | | 17,777 | |

| R&D, net of tax credit and grants | | 30,367 | | 44,124 | | 24,129 | |

| Depreciation and amortization | | 8,978 | | 9,421 | | 2,421 | |

| | |

| |

| |

| |

| | | 216,078 | | 180,696 | | 121,770 | |

| | |

| |

| |

| |

| Earnings (loss) from operations | | 17,170 | | (14,283 | ) | (20,566 | ) |

Interest income |

|

1,359 |

|

2,146 |

|

3,079 |

|

| Interest and financial expenses | | (8,168 | ) | (4,835 | ) | (508 | ) |

| Foreign exchange loss | | (920 | ) | (1,574 | ) | (195 | ) |

| | |

| |

| |

| |

| Earnings (loss) before income taxes | | 9,441 | | (18,546 | ) | (18,190 | ) |

Income tax expense |

|

(8,285 |

) |

(5,932 |

) |

(4,425 |

) |

| | |

| |

| |

| |

| Earnings (loss) before the following items | | 1,156 | | (24,478 | ) | (22,615 | ) |

Gain (loss) on dilution of investments |

|

(631 |

) |

(64 |

) |

424 |

|

| Non-controlling interest | | (6,284 | ) | (3,605 | ) | (3,591 | ) |

| | |

| |

| |

| |

| Net loss for the year | | (5,759 | ) | (28,147 | ) | (25,782 | ) |

| | |

| |

| |

| |

| Basic and diluted net loss per share | | (0.13 | ) | (0.65 | ) | (0.67 | ) |

| | |

| |

| |

| |

| Consolidated balance sheets data | | | | | | | |

| | |

| |

| |

| |

| Total assets | | 349,228 | | 295,779 | | 330,968 | |

| | |

| |

| |

| |

| Long-term liabilities | | 156,671 | | 108,216 | | 88,400 | |

| | |

| |

| |

| |

Æterna Zentaris Financial Statements 2004 5

Revenues

Revenues for 2004 were $233.2 million compared to $166.4 million for 2003 and $101.2 million for 2002. The increases from year over year come mainly from the acquisitions of Zentaris in 2002, Interchemical and Chimiray in 2003 and from the acquisition of Pure in 2004 as well as the internal growth. We expect continued growth in revenue for 2005 as we acquired all the assets of MultiChem and all outstanding shares of Echelon in January 2005.

Operating expenses

Cost of sales for 2004 was $134.5 million, an increase of $36.5 million compared to $98 million for 2003. The cost of sales for 2002 was $77.4 million. The increase in cost of sales is directly related to the sales increase generated by the acquisitions made in late 2002, as well as in 2003 and 2004. The acquisitions of MultiChem assets and Echelon in January 2005 and having a full year of operating results of Pure, acquired in March 2004, should increase our cost of sales for 2005.

Selling, general and administrative (SG&A) expenses for the year ended December 31, 2004 were $42.2 million, an increase of $13.1 million compared to $29.1 million for the same period in 2003. For the year ended December 31, 2002, SG&A expenses were $17.8 million. The increase in SG&A expenses over the years is primarily due to business acquisitions. In addition, the increase in 2004 is also due to increased in stock-based compensation costs and insurance costs as well as to non-recurring expenses related to the Company name change. We expect SG&A expenses to continue to increase since we already acquired MultiChem and Echelon at the beginning of 2005 and we intend to pursue our business acquisition program during the year.

R&D expenses, net of tax credits and grants (R&D) for the year ended December 31, 2004 were $30.4 million, a decrease of $13.7 million compared to $44.1 million for the same period in 2003, reflecting the realignment of the clinical development program initiated in December 2003, including the focus on R&D with respect to perifosine, cetrorelix and earlier stage products. For the year ended December 31, 2002, R&D expenses were $24.1 million. The increase between 2002 and 2003 is due to the acquisition of Zentaris in late December 2002. We expect R&D expenses to increase in 2005, due to the recent acquisition of Echelon, the emphasis on clinical development of existing products, in particular perifosine, as well as on certain product candidates at preclinical stage.

Depreciation and amortization (D&A) expense for 2004 was $9.0 million, a decrease of $0.4 million compared to $9.4 million for 2003. For the year ended December 31, 2002, D&A expense was $2.4 million. The increase in D&A expense between 2002 and 2003 is mainly attributable to amortization of intangible assets arising from the acquisition of Zentaris in late 2002.

Earnings from operations for 2004 were $17.2 million, an increase of $31.5 million compared to an operating loss of $14.3 million for 2003. Loss from operations was $20.6 million in 2002. The increase in earnings from operations in 2004 is principally due to income generated by non-recurrent milestone payments related to cetrorelix Phase II positive results, the realignment of the clinical development program initiated in December 2003 as well as by Atrium's earnings from operations generated by the acquisition of Pure in March 2004 combined with the achieved internal growth. The decrease in loss from operations between 2002 and 2003 was mostly due to the income generated by the subsidiary Atrium and the acquisition of Zentaris in late December 2002. The acquisition of MultiChem assets in January 2005 by Atrium combined with a full year of operating results of Pure, acquired in March 2004, should increase our earnings from operations for 2005 and this increase is expected to be offset by the increased R&D expenses combined with lower amounts of revenue from non-recurrent milestone payments expected in 2005.

Interest income for 2004, 2003 and 2002 were respectively $1.4 million, $2.1 million and $3.1 million. The decrease in interest income is principally due to decrease in interest yield offered on investment, as well as the use of our liquidity for business acquisitions over the years.

6 Æterna Zentaris Financial Statements 2004

Interest expense for 2004 was $8.2 million in comparison to $4.8 million in 2003 and $0.5 million in 2002. The year-over-year increase is mainly due to the expense related to the convertible term loans that were issued at the end of the first quarter of 2003 and to the increased debt level resulting from the acquisition of Pure in 2004. In addition, the Company elected during the second quarter of 2004, as permitted under the convertible term loan agreements, to add to the principal amount all corresponding unpaid accrued interest as of March 31, 2004 of a total amount of $3.0 million. In connection with the Pure acquisition, we also increased our long-term debt by $40 million. Because of the capitalization of unpaid accrued interest and since the debt portion of the convertible term loans are accounted for as discounted loans and are increasing in accretion, we expect financial expenses to continue to increase in 2005.

Foreign exchange losses for 2004 were $0.9 million in comparison to $1.6 million in 2003 and $0.2 million in 2002. The variations are attributable to the impact of the strengthening Canadian dollar and Euro on our working capital denominated in US dollars.

Income tax expense for 2004 was $8.3 million in comparison to $5.9 million for the same period last year and $4.4 million in 2002. The year-over-year increase is directly related to increase of taxable income of our subsidiaries. We recorded an income tax expense related to earnings generated by all our subsidiaries. For our Canadian operations in the Biopharmaceutical segment, we have to establish a valuation allowance to reduce future income tax assets as it is, at this time, unlikely that some or all of the future income tax assets will be realized.

We incurred aloss on dilution in 2004 for an amount of $0.6 million in comparison to a loss of $0.1 million in 2003 and to a gain of $0.4 million in 2002. The losses are attributable to the issuance of shares in subsidiaries pursuant to the exercise of stock options and the gain in 2002 is attributable to an issuance of Atrium shares to one of its officer.

Non-controlling interest for fiscal 2004 amounted to $6.3 million in comparison to $3.6 million for 2003 and 2002. Noncontrolling interest consists of minority interest in Atrium and its subsidiaries. The increase is directly attributable to the corresponding increase of net earnings of Atrium and its subsidiaries.

Net loss for 2004 was $5.8 million or $0.13 per basic and diluted share, compared to a net loss of $28.1 million or $0.65 per basic and diluted share for 2003 and $25.8 million or $0.67 per basic and diluted share for 2002. The improvement in 2004 net loss reflects higher net earnings from accretive acquisitions in the two segments operated by Atrium, as well as the realignment of the clinical development program initiated in December 2003, non-recurring milestone payments received in 2004 related to cetrorelix Phase II positive results and revenue from the termination of a licensing agreement with Baxter Healthcare on D-63153.

The weighted average number of shares outstanding used to calculate the basic and diluted net loss per share for 2004 was 45.6 million shares as compared to 43 million shares for 2003. This increase reflects the issuance of common shares following the exercise of stock options.

Total Assets

Total assets, which were $295.8 million as at December 31, 2003, reached $349.2 million as at December 31, 2004. This $53.4 million increase is mainly attributable to the acquisition of Pure in March 2004. Additional information on segment assets is provided in note 20 of the annual consolidated financial statements.

Æterna Zentaris Financial Statements 2004 7

BIOPHARMACEUTICAL SEGMENT RESULTS

| | Years ended December 31,

| |

|---|

(in thousands of Canadian dollars)

| | 2004

$

| | 2003

$

| | 2002

$

| |

|---|

| Revenues | | | | | | | |

| | Sales and royalties | | 25,355 | | 24,403 | | — | |

| | License fees | | 30,577 | | 21,703 | | 315 | |

| | |

| |

| |

| |

| | | 55,932 | | 46,106 | | 315 | |

| | |

| |

| |

| |

| R&D expense, net of tax credits and grants | | 29,397 | | 43,727 | | 23,670 | |

| Loss from operations | | (8,954 | ) | (28,679 | ) | (32,890 | ) |

Revenues for the year ended December 31, 2004, of the Biopharmaceutical segment were $55.9 million, an increase of $9.8 million, compared to $46.1 million for the same period in 2003. Revenues are derived from sales and royalties on Cetrotide® (cetrorelix) and Impavido® (miltefosine), as well as milestone payments, R&D contract fees and amortization of upfront payments received to date. Revenue from R&D contract fees and from the amortization of upfront payments is derived mainly from the ongoing development of cetrorelix and teverelix under existing collaboration agreements with our licensing partners Solvay and Ardana respectively. The revenue increase in 2004 is mainly attributable to a non-recurring $6.5 million milestone payment gained from our partner Solvay for cetrorelix in the second quarter of 2004. The remainder is attributable to a termination payment gained from Baxter Healthcare for D-63153 and to amortization of additional deferred revenues. In 2002, revenues were $0.3 million and were generated by our subsidiary Zentaris, acquired in late December 2002.

Our segment revenues are expected to slightly decrease in 2005 as we are not expecting to receive any important nonrecurring milestone payment this year. However, additional sales are expected to be generated from the acquisition of Echelon.

R&D expenses, net of tax credits and grants for the year ended December 31, 2004 were $29.4 million, a decrease of $14.4 million compared to $43.8 million for the same period in 2003, reflecting the realignment of the clinical development program initiated in December 2003, including the focus on the development of perifosine, cetrorelix and earlier stage products. For the year ended December 31, 2002, R&D expenses were $23.7 million. The increase between 2002 and 2003 is due to the acquisition of Zentaris in late December 2002. We expect R&D expenses to increase in 2005 due to the acquisition of Echelon in January 2005, emphasis on clinical development of existing products, as well as on certain product candidates at preclinical stage.

Loss from operations for 2004 was $9.0 million, a decrease of $19.7 million compared to an operating loss of $28.7 million for 2003. The operating loss was $32.9 million in 2002. The decrease in loss from operations in 2004 is principally due to the increase of revenues and to the realignment of the clinical development program initiated in December 2003. The decrease in loss from operations between 2002 and 2003 was mostly due to the income generated by Zentaris following its acquisition in late December 2002.

ACTIVE INGREDIENTS & SPECIALTY CHEMICALS SEGMENT RESULTS

| | Years ended December 31,

|

|---|

(in thousands of Canadian dollars)

| | 2004

$

| | 2003

$

| | 2002

$

|

|---|

| Revenues | | 144,983 | | 111,071 | | 92,745 |

| Earnings from operations | | 14,045 | | 10,170 | | Note |

Note: not provided because this information is not available and is not reasonably determinable.

8 Æterna Zentaris Financial Statements 2004

Revenues of the Active Ingredients and Specialty Chemicals segment were $145.0 million for fiscal 2004, representing an increase of $33.9 million or 30.5% over fiscal 2003 revenues of $111.1 million. Revenues for 2003 increased $18.4 million or 19.8% over fiscal 2002. These increases came primarily from newly-acquired Chimiray, Interchemical, Siricie and ADF Chimie and from growth in our proprietary active ingredients portfolio, offset by a rebalancing of Unipex's product portfolio to focus on higher-margin products.

Earnings from operations were $14.0 million for fiscal 2004, representing an increase of $3.8 million or 37.3% over 2003 of $10.2 million. Most of this increase came from Chimiray, Interchemical and Siricie. The balance of the increase is attributable to internal growth and the increased focus on higher-margin products.

HEALTH & NUTRITION SEGMENT RESULTS

| | Years ended December 31,

|

|---|

(in thousands of Canadian dollars)

| | 2004

$

| | 2003

$

| | 2002

$

|

|---|

| Revenues | | 32,333 | | 9,236 | | 8,144 |

| Earnings from operations | | 12,079 | | 4,227 | | Note |

Note: not provided because this information is not available and is not reasonably determinable.

Revenues of the Health & Nutrition segment were $32.3 million for fiscal 2004, representing an increase of $23.1 million or 251.1% over fiscal 2003 revenues of $9.2 million. This increase came primarily from newly-acquired Pure and from growth in our proprietary product portfolio. Revenues for 2003 were $9.2 million, representing an increase of $1.1 million or 13.6% over fiscal 2002 revenues of $8.1 million. This increase comes from growth in our proprietary product portfolio only.

Earnings from operations were $12.1 million for fiscal 2004, representing an increase of $7.9 million or 188.1% over fiscal 2003 of $4.2 million. Most of this increase came from the acquisition of Pure. The balance of the increase is attributable to internal growth and the increased focus on higher-margin products.

LIQUIDITY, CASH FLOWS AND CAPITAL RESOURCES

Our operations and our capital expenditures are mainly financed through cash flows from operating activities, the use of our liquidity, as well as the issuance of debt and common shares.

Our consolidated cash and short-term position remains at $58 million as of December 31, 2004. This represents a $6.3 million decrease in comparison to our financial position as at December 31, 2003. In our Biopharmaceutical segment alone, we had $43 million of cash and short-term position at the end of 2004.

In addition, we did not renew in 2004 a €1 million line of credit which has never been used. On the other hand, at the beginning of 2005, we refinanced part of Atrium's long-term debt through a revolving credit facility, renewable annually, for an authorized amount of $75 million. The Company believes that these liquidities, combined with the new credit facility and the cash flows from operations, will be adequate to meet operating cash requirements for the foreseeable future. However, possible additional operating losses and/or possible investment in or acquisition of complementary businesses or products may require additional financing.

The variation of our liquidity by activities is explained below, on a consolidated basis.

Operating Activities

Cash flows from our operations were $12.8 million during 2004 in comparison to cash flows used in our operations in 2003 and 2002 in the amount of $14.5 million and $21.9 million respectively. This cash inflow is mainly attributable to non-recurrent upfront and milestone payments of nearly $21 million received from our partners in the Biopharmaceutical segment and increased operating cash flows from Atrium. These cash inflows have been partly offset by timing differences in collection of some accounts receivable. Cash flows generated by our operations in 2005 are expected to be lower than in 2004 since we do not expect to receive significant non-recurrent upfront and milestone payments in 2005.

Æterna Zentaris Financial Statements 2004 9

Financing Activities

For the year ended December 31, 2004, cash flows generated by financing activities were $33.8 million, mostly coming from the issuance of long-term debt in the amount of $39.9 million. An amount of $9.3 million was used for the repayment of long-term debts and balance of purchase price. Following the exercise of stock options in Æterna Zentaris and in one of our subsidiaries, we also received $3.2 million. In the corresponding period in 2003, the cash flows from financing activities amounted to $17.9 million and were made up of cash received of $66.3 million from convertible term loans, the issuance of subordinate voting shares through a bought deal closed in July 2003 and a new long-term debt incurred following the acquisition of Chimiray/Interchemical. In counterpart, we disbursed for financing activities an amount of $48.4 million for the repayment of the promissory note, the balance of purchase price and payment of long-term debt. In 2002, cash flows from financing activities amounted to nearly $100 million and are explained by the issuance of subordinate voting shares through a private placement of $57 million concluded in April 2002, and a promissory note of $43 million issued for the acquisition of Zentaris in December 2002.

Investing Activities

Cash flows used in investing activities (excluding change in short-term investments) were $52.7 million for 2004, mainly for business acquisitions. For 2003, cash flows used in investing activities (excluding change in short-term investments) amounted to $20.7 million. An amount of $18.9 million was used for business acquisitions, while $1.8 million was used for the purchase of capital assets and intangible assets. In 2002, an amount of $45.3 million was used for acquisitions of companies, intangible assets and product lines, as well as for distribution agreements for the Health & Nutrition segment. Furthermore, an amount of $5.1 million represented capital investments mainly to increase the production capacity.

We have certain contractual obligations and commercial commitments. The following table indicates our cash requirements to respect these obligations:

| | Payments due by period

|

|---|

(in thousands of Canadian dollars)

| | Total

$

| | 2005

$

| | 2006-2008

$

| | 2009

$

|

|---|

| Long-term debt | | 51,498 | | 12,133 | | 30,508 | | 8,857 |

| Convertible term loans | | 28,000 | | — | | 28,000 | | — |

| Balance of purchase price | | 2,553 | | 2,553 | | | | |

| Operating leases | | 11,240 | | 2,828 | | 6,652 | | 1,760 |

| Commercial commitments | | 6,098 | | 5,911 | | 187 | | — |

| | |

| |

| |

| |

|

| Total contractual cash obligations | | 99,389 | | 23,425 | | 65,347 | | 10,617 |

| | |

| |

| |

| |

|

In October 2004, we also entered into a $2.9 million (€1.75 million) bank guarantee in favour of one of our future landlords in Germany. Liability under this guarantee will only come into effect upon transfer into new rented premises, which is expected to be in 2005. This guarantee is only applicable upon failure on certain financial criteria and will be in force for an initial rental period of four years.

OUTSTANDING SHARE DATA

Effective May 26, 2004, the Company created a new class of common shares. Each issued and outstanding subordinate voting shares were converted into common shares at that date. Finally, the Company repealed the subordinate voting shares and multiple voting shares.

As of March 10, 2005, there were 46,139,814 common shares issued and outstanding and there were 3,395,592 stock options outstanding. In addition, the convertible term loans can be converted into common shares of the Company at a conversion price of $5.05 per common share up to a maximum of 6,955,089 shares.

10 Æterna Zentaris Financial Statements 2004

Quarterly Summary Financial Information(Unaudited)

(in thousands of Canadian dollars, except per share data)

| | Quarter ended

December 31,

2004

$

| | Quarter ended

September 30,

2004

$

| | Quarter ended

June 30,

2004

$

| | Quarter ended

March 31,

2004

$

| |

|---|

| Revenues | | 53,541 | | 55,418 | | 65,840 | | 58,449 | |

| Earnings from operations | | 864 | | 5,545 | | 9,177 | | 1,584 | |

| Net earnings (loss)(note 1) | | (2,543 | ) | (1,996 | ) | 1,330 | | (2,550 | ) |

| Basic and diluted net earnings (loss) per share | | (0.06 | ) | (0.04 | ) | 0.03 | | (0.06 | ) |

| | Quarter ended

December 31,

2003

$

| | Quarter ended

September 30,

2003

$

| | Quarter ended

June 30,

2003

$

| | Quarter ended

March 31,

2003

$

| |

|---|

| Revenues | | 48,896 | | 37,829 | | 38,875 | | 40,813 | |

| Earnings from operations | | (6,434 | ) | (5,400 | ) | (1,128 | ) | (1,321 | ) |

| Net loss(note 1) | | (9,254 | ) | (9,335 | ) | (4,668 | ) | (4,890 | ) |

| Basic and diluted net loss per share | | (0.20 | ) | (0.20 | ) | (0.11 | ) | (0.12 | ) |

Note 1: Quarterly information from Q1 2003 to Q4 2003 has been restated for the effect of implementing the accounting policy for expensing stock-based compensation for all awards granted after January 1, 2003. We recorded total stock-based compensation expense for the twelve-month period ended December 31, 2003 in the amount of $0.5 million.

FOURTH QUARTER RESULTS