UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02739 and 811-10179

Name of Fund: BlackRock Basic Value Fund, Inc. and Master Basic Value LLC

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Basic Value Fund, Inc. and Master Basic Value LLC, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2015

Date of reporting period: 12/31/2014

Item 1 – Report to Stockholders

DECEMBER 31, 2014

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock Basic Value Fund, Inc.

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | |

| | | |

| | |  | | Shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual shareholder reports and prospectuses by enrolling in the electronic delivery program. Electronic copies of shareholder reports and prospectuses are also available on BlackRock’s website. TO ENROLL IN ELECTRONIC DELIVERY: Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages: Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service. Shareholders Who Hold Accounts Directly with BlackRock: 1. Access the BlackRock website at blackrock.com 2. Select “Access Your Account” 3. Next, select “eDelivery” in the “Related Resources” box and follow the sign-up instructions |

| | | | | | |

| 2 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

Dear Shareholder,

After an extended period of calm, market volatility increased over the course of 2014, driven largely by higher valuations in risk assets (such as equities and high yield bonds), rising geopolitical risks and expectations around global central bank policies. Several key trends drove strong performance in U.S. markets, particularly large-cap stocks, Treasuries and municipal bonds, while markets outside the U.S. were more challenged.

Investors began the year in search of relatively safer assets due to heightened risks in emerging markets, slowing growth in China and weakening U.S. economic data. As a result, equities globally declined in January while bond markets strengthened despite the expectation that interest rates would rise as the U.S. Federal Reserve had begun reducing its asset purchase programs. Strong demand for relatively safer assets pushed U.S. Treasury bond prices higher and thus kept rates low in the United States. This surprising development, as well as increasing evidence that the soft patch in U.S. economic data had been temporary and weather-related, brought equity investors racing back to the market in February.

In the months that followed, interest rates trended lower in a modest growth environment and more investors turned to equities in search of yield. Markets remained relatively calm despite rising tensions in Russia and Ukraine and further signs of decelerating growth in China. Strong corporate earnings, increased merger and acquisition activity and signs of a strengthening recovery in the U.S. and other developed economies kept equity prices moving higher. Not all segments benefited from these trends, however, as investors ultimately became wary of high valuations, resulting in a broad rotation into cheaper assets.

Volatility ticked up in the summer as geopolitical tensions escalated and investors feared that better U.S. economic indicators may compel the Fed to increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened, ultimately putting a strain on investor flows, and financial markets broadly weakened in the third quarter.

Several themes dominated the markets in the fourth quarter, resulting in higher levels of volatility and the outperformance of U.S. markets versus other areas of the world. Economic growth strengthened considerably in the United States while the broader global economy showed signs of slowing. The European Central Bank and the Bank of Japan took aggressive measures to stimulate growth while the Fed moved toward tighter policy. This divergence in central bank policy caused further strengthening in the U.S. dollar versus other currencies. Oil prices, which had been falling gradually since the summer, plummeted in the fourth quarter due to a global supply-and-demand imbalance. Energy stocks sold off sharply and oil-exporting economies suffered, resulting in the poor performance of emerging market stocks.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of December 31, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 6.12 | % | | | 13.69 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 1.65 | | | | 4.89 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | (9.24 | ) | | | (4.90 | ) |

Emerging market equities

(MSCI Emerging Markets Index) | | | (7.84 | ) | | | (2.19 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month U.S. Treasury

Bill Index) | | | 0.01 | | | | 0.03 | |

U.S. Treasury securities

(BofA Merrill Lynch

10- Year U.S. Treasury

Index) | | | 4.33 | | | | 10.72 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 1.96 | | | | 5.97 | |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 3.00 | | | | 9.25 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | (2.84 | ) | | | 2.46 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | | 3 | |

| | | | |

| Fund Summary as of December 31, 2014 | | | BlackRock Basic Value Fund, Inc. | |

BlackRock Basic Value Fund, Inc.’s (the “Fund”) investment objective is to seek capital appreciation and, secondarily, income by investing in securities, primarily equity securities, that management of the Fund believes are undervalued and therefore represent basic investment value.

|

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | | For the six-month period ended December 31, 2014, through its investment in Master Basic Value LLC (the “Master LLC”), the Fund underperformed its benchmark, the Russell 1000® Value Index. |

What factors influenced performance?

| Ÿ | | The Fund’s exposure to the energy sector was the leading detractor from performance relative to the benchmark index over the six-month period. A significant decline in the price of oil over the fourth quarter of 2014 caused the overall energy sector to perform poorly. The Fund was overweight energy, and stock selection within the sector also hindered performance, most notably exposure to oil producers Marathon Oil Corp. and Apache Corp. |

| Ÿ | | Within financials, the Fund’s investment in insurance company Genworth Financial, Inc. was a significant detractor. The company’s shares declined as it missed earnings expectations by a wide margin and announced larger-than-expected reserve charges related to its long-term care business. As a result, the company’s debt was downgraded and investors began to anticipate further reductions to earnings estimates. |

| Ÿ | | A significant underweight in utilities, combined with negative stock selection in the sector, also detracted during the period. |

| Ÿ | | A significant underweight combined with stock selection in industrials generated positive relative performance. The Fund’s modest weighting in |

| | | the sector has been concentrated in aerospace & defense, where expectations for substantial U.S. defense budget cuts led to value opportunities in select companies. This exposure worked well for the Fund during the period, as holdings of defense contractors Raytheon Co. and Northrop Grumman Corp. rose on the expansion of the U.S. campaign against ISIS. |

| Ÿ | | The leading individual contributors within the Fund came from the health care sector, specifically the pharmaceuticals industry. Hospira, Inc. outperformed after reporting better-than-expected third quarter sales and earnings growth and raising forward guidance. Teva Pharmaceutical Industries Ltd. also performed well, while large underweights to Merck & Co. and Johnson & Johnson added value. |

Describe recent portfolio activity.

| Ÿ | | During the period, the investment advisor increased the Fund’s investments in the information technology (“IT”) and telecommunication services sectors, and reduced exposure to energy. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the Russell 1000® Value Index, the Fund ended the period with the largest sector overweights in health care, IT and consumer discretionary, while the most significant underweights were industrials and utilities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 4 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| | | | BlackRock Basic Value Fund, Inc. | |

|

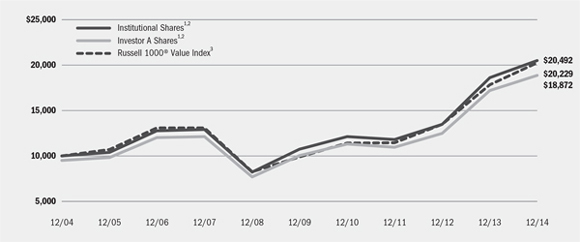

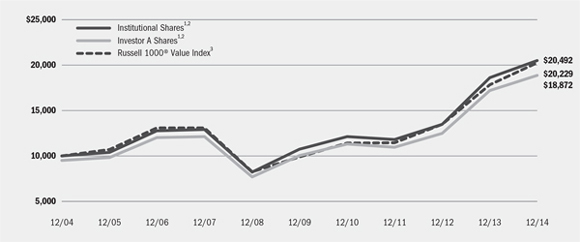

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | The Fund invests all of its assets in the Master LLC. The Master LLC invests primarily in equity securities that the investment advisor of the Master LLC believes are undervalued, and therefore represent basic investment value. |

| | 3 | An unmanaged index that is a subset of the Russell 1000® Index that consists of those Russell 1000® securities with lower price-to-book ratios and lower expected growth values. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Summary for the Period Ended December 31, 2014 | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | | 2.31 | % | | | 10.07 | % | | | N/A | | | | 13.82 | % | | | N/A | | | | 7.44 | % | | | N/A | |

Investor A | | | 2.17 | | | | 9.74 | | | | 3.98 | % | | | 13.48 | | | | 12.27 | % | | | 7.13 | | | | 6.56 | % |

Investor B | | | 1.63 | | | | 8.68 | | | | 4.71 | | | | 12.35 | | | | 12.10 | | | | 6.37 | | | | 6.37 | |

Investor C | | | 1.77 | | | | 8.89 | | | | 8.03 | | | | 12.58 | | | | 12.58 | | | | 6.28 | | | | 6.28 | |

Class R | | | 1.99 | | | | 9.38 | | | | N/A | | | | 13.10 | | | | N/A | | | | 6.78 | | | | N/A | |

Russell 1000® Value Index | | | 4.78 | | | | 13.45 | | | | N/A | | | | 15.42 | | | | N/A | | | | 7.30 | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | Actual | | Hypothetical6 | | |

| | | Beginning

Account Value

July 1, 2014 | | Ending

Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Beginning

Account Value

July 1, 2014 | | Ending Account Value

December 31, 2014 | | Expenses Paid

During the Period5 | | Annualized

Expense Ratio |

Institutional | | $1,000.00 | | $1,023.10 | | $2.80 | | $1,000.00 | | $1,022.43 | | $2.80 | | 0.55% |

Investor A | | $1,000.00 | | $1,021.70 | | $4.13 | | $1,000.00 | | $1,021.12 | | $4.13 | | 0.81% |

Investor B | | $1,000.00 | | $1,016.30 | | $9.55 | | $1,000.00 | | $1,015.73 | | $9.55 | | 1.88% |

Investor C | | $1,000.00 | | $1,017.70 | | $8.14 | | $1,000.00 | | $1,017.14 | | $8.13 | | 1.60% |

Class R | | $1,000.00 | | $1,019.90 | | $5.85 | | $1,000.00 | | $1,019.41 | | $5.85 | | 1.15% |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Because the Fund invests significantly in the Master LLC, the expense table reflects the net expenses of both the Fund and the Master LLC in which it invests. |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 6 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 5 |

| Ÿ | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| Ÿ | | Investor B Shares are subject to a maximum CDSC of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and distribution reinvestments by current holders and for purchase by certain employer-sponsored retirement plans. |

| Ÿ | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

| Ÿ | | Class R Shares are not subject to any sales charge (front-end load) or deferred sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance table on the previous page assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense example shown on the previous page (which is based on a hypothetical investment of $1,000 invested on July 1, 2014 and held through December 31, 2014) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in this Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| 6 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Statement of Assets and Liabilities | | | BlackRock Basic Value Fund, Inc. | |

| | | | |

December 31, 2014 (Unaudited) | | | |

| | | | |

| Assets | | | | |

Investments at value — Master LLC (cost — $3,020,082,813) | | $ | 4,175,491,415 | |

Withdrawals receivable from the Master LLC | | | 17,624,176 | |

Capital shares sold receivable | | | 6,798,661 | |

Prepaid expenses | | | 69,927 | |

| | | | |

Total assets | | | 4,199,984,179 | |

| | | | |

| | | | |

| Liabilities | | | | |

Capital shares redeemed payable | | | 24,422,837 | |

Service and distribution fees payable | | | 763,402 | |

Transfer agent fees payable | | | 694,044 | |

Other affiliates payable | | | 79,647 | |

Officer’s and Directors’ fees payable | | | 351 | |

Other accrued expenses payable | | | 22,735 | |

| | | | |

Total liabilities | | | 25,983,016 | |

| | | | |

Net Assets | | $ | 4,174,001,163 | |

| | | | |

| | | | |

| Net Assets Consist of | | | | |

Paid-in capital | | $ | 3,053,260,983 | |

Distributions in excess of net investment income | | | (1,880,551 | ) |

Accumulated net realized loss allocated from the Master LLC | | | (32,787,871 | ) |

Net unrealized appreciation/depreciation allocated from the Master LLC | | | 1,155,408,602 | |

| | | | |

Net Assets | | $ | 4,174,001,163 | |

| | | | |

| | | | |

| Net Asset Value | | | | |

Institutional — Based on net assets of $1,969,959,776 and 72,859,031 shares outstanding, 400 million shares authorized, $0.10 par value | | $ | 27.04 | |

| | | | |

Investor A — Based on net assets of $1,741,301,688 and 64,996,527 shares outstanding, 200 million shares authorized, $0.10 par value | | $ | 26.79 | |

| | | | |

Investor B — Based on net assets of $10,976,274 and 409,143 shares outstanding, 400 million shares authorized, $0.10 par value | | $ | 26.83 | |

| | | | |

Investor C — Based on net assets of $435,347,820 and 17,976,190 shares outstanding, 200 million shares authorized, $0.10 par value | | $ | 24.22 | |

| | | | |

Class R — Based on net assets of $16,415,605 and 641,878 shares outstanding, 400 million shares authorized, $0.10 par value | | $ | 25.57 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 7 |

| | | | |

| Statement of Operations | | | BlackRock Basic Value Fund, Inc. | |

| | | | |

Six Months Ended December 31, 2014 (Unaudited) | | | |

| | | | |

| Investment Income | |

Net investment income allocated from the Master LLC: | | | | |

Dividends — unaffiliated | | $ | 47,320,042 | |

Foreign taxes withheld | | | (533,959 | ) |

Securities lending — affiliated — net | | | 357,446 | |

Dividends — affiliated | | | 5,230 | |

Expenses | | | (9,226,002 | ) |

Fees waived | | | 11,066 | |

| | | | |

Total income | | | 37,933,823 | |

| | | | |

| | | | |

| Fund Expenses | | | | |

Service — Investor A | | | 2,236,765 | |

Service and distribution — Investor B | | | 65,633 | |

Service and distribution — Investor C | | | 2,277,463 | |

Service and distribution — Class R | | | 45,217 | |

Transfer agent — Institutional | | | 1,142,229 | |

Transfer agent — Investor A | | | 1,074,891 | |

Transfer agent — Investor B | | | 29,210 | |

Transfer agent — Investor C | | | 359,013 | |

Transfer agent — Class R | | | 18,911 | |

Registration | | | 60,539 | |

Professional | | | 46,442 | |

Printing | | | 37,873 | |

Officer and Directors | | | 1,075 | |

Miscellaneous | | | 17,758 | |

| | | | |

Total expenses | | | 7,413,019 | |

Less transfer agent fees reimbursed — Class R | | | (31 | ) |

| | | | |

Total expenses after fees reimbursed | | | 7,412,988 | |

| | | | |

Net investment income | | | 30,520,835 | |

| | | | |

| | | | |

| Realized and Unrealized Gain (Loss) Allocated from the Master LLC | | | | |

Net realized gain from investments | | | 227,655,140 | |

Net change in unrealized appreciation/depreciation on investments | | | (168,298,891 | ) |

| | | | |

Net realized and unrealized gain | | | 59,356,249 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 89,877,084 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 8 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Statements of Changes in Net Assets | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | |

| Increase (Decrease) in Net Assets: | | Six Months Ended December 31, 2014 (Unaudited) | | | Year Ended June 30, 2014 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 30,520,835 | | | $ | 55,311,889 | |

Net realized gain | | | 227,655,140 | | | | 706,669,733 | |

Net change in unrealized appreciation/depreciation | | | (168,298,891 | ) | | | 195,770,052 | |

| | | | |

Net increase in net assets resulting from operations | | | 89,877,084 | | | | 957,751,674 | |

| | | | |

| | | | | | | | |

| Distributions to Shareholders From1 | | | | | | | | |

Net investment income: | | | | | | | | |

Institutional | | | (30,015,150 | ) | | | (33,276,128 | ) |

Investor A | | | (22,369,589 | ) | | | (20,610,546 | ) |

Investor C | | | (2,797,835 | ) | | | (2,640,916 | ) |

Class R | | | (170,594 | ) | | | (172,754 | ) |

Net realized gain: | | | | | | | | |

Institutional | | | (357,235,177 | ) | | | (254,868,337 | ) |

Investor A | | | (320,026,829 | ) | | | (192,471,471 | ) |

Investor B | | | (2,136,433 | ) | | | (2,158,252 | ) |

Investor C | | | (88,281,019 | ) | | | (52,030,010 | ) |

Class R | | | (3,305,630 | ) | | | (2,078,707 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | (826,338,256 | ) | | | (560,307,121 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital share transactions | | | 472,534,038 | | | | (51,302,000 | ) |

| | | | |

| | | | |

| Net Assets | | | | | | | | |

Total increase (decrease) in net assets | | | (263,927,134 | ) | | | 346,142,553 | |

Beginning of period | | | 4,437,928,297 | | | | 4,091,785,744 | |

| | | | |

End of period | | $ | 4,174,001,163 | | | $ | 4,437,928,297 | |

| | | | |

Undistributed (distributions in excess of) net investment income, end of period | | $ | (1,880,551 | ) | | $ | 22,951,782 | |

| | | | |

| | 1 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 9 |

| | | | |

| Financial Highlights | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Institutional | |

| | | Six Months

Ended

December 31,

2014 (Unaudited) | | | Year Ended June 30, | |

| | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 33.05 | | | $ | 30.22 | | | $ | 25.64 | | | $ | 26.94 | | | $ | 21.27 | | | $ | 18.99 | |

| | | | |

Net investment income1 | | | 0.27 | | | | 0.48 | | | | 0.52 | | | | 0.48 | | | | 0.40 | | | | 0.43 | |

Net realized and unrealized gain (loss) | | | 0.20 | | | | 6.63 | | | | 6.36 | | | | (1.07 | ) | | | 5.68 | | | | 2.31 | |

| | | | |

Net increase (decrease) from investment operations | | | 0.47 | | | | 7.11 | | | | 6.88 | | | | (0.59 | ) | | | 6.08 | | | | 2.74 | |

| | | | |

Distributions from:2 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.50 | ) | | | (0.49 | ) | | | (0.56 | ) | | | (0.48 | ) | | | (0.41 | ) | | | (0.46 | ) |

Net realized gain | | | (5.98 | ) | | | (3.79 | ) | | | (1.74 | ) | | | (0.23 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | (6.48 | ) | | | (4.28 | ) | | | (2.30 | ) | | | (0.71 | ) | | | (0.41 | ) | | | (0.46 | ) |

| | | | |

Net asset value, end of period | | $ | 27.04 | | | $ | 33.05 | | | $ | 30.22 | | | $ | 25.64 | | | $ | 26.94 | | | $ | 21.27 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 2.31 | %4 | | | 25.22 | % | | | 28.67 | % | | | (2.05 | )% | | | 28.76 | % | | | 14.28 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets5 | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.55 | %6,7 | | | 0.54 | %6 | | | 0.55 | %6 | | | 0.56 | %6 | | | 0.55 | %6 | | | 0.55 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.55 | %6,7 | | | 0.54 | %6 | | | 0.55 | %6 | | | 0.56 | %6 | | | 0.55 | %6 | | | 0.55 | % |

| | | | |

Net investment income | | | 1.66 | %6,7 | | | 1.51 | %6 | | | 1.89 | %6 | | | 1.88 | %6 | | | 1.57 | %6 | | | 1.93 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,969,960 | | | $ | 2,136,401 | | | $ | 2,069,166 | | | $ | 2,066,925 | | | $ | 2,552,926 | | | $ | 1,956,794 | |

| | | | |

Portfolio turnover rate of the Master LLC | | | 16 | % | | | 47 | % | | | 53 | % | | | 38 | % | | | 64 | % | | | 48 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

| | 5 | | Includes the Fund’s share of the Master LLC’s allocated net expenses and/or net investment income. |

| | 6 | | Includes the Fund’s share of the Master LLC’s allocated fees waived of less than 0.01%. |

See Notes to Financial Statements.

| | | | | | |

| 10 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Financial Highlights (continued) | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Investor A | |

| | | Six Months

Ended

December 31,

2014 (Unaudited) | | | Year Ended June 30, | |

| | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 32.76 | | | $ | 29.99 | | | $ | 25.45 | | | $ | 26.75 | | | $ | 21.12 | | | $ | 18.86 | |

| | | | |

Net investment income1 | | | 0.23 | | | | 0.39 | | | | 0.44 | | | | 0.40 | | | | 0.32 | | | | 0.36 | |

Net realized and unrealized gain (loss) | | | 0.20 | | | | 6.58 | | | | 6.33 | | | | (1.07 | ) | | | 5.64 | | | | 2.30 | |

| | | | |

Net increase (decrease) from investment operations | | | 0.43 | | | | 6.97 | | | | 6.77 | | | | (0.67 | ) | | | 5.96 | | | | 2.66 | |

| | | | |

Distributions from:2 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.42 | ) | | | (0.41 | ) | | | (0.49 | ) | | | (0.40 | ) | | | (0.33 | ) | | | (0.40 | ) |

Net realized gain | | | (5.98 | ) | | | (3.79 | ) | | | (1.74 | ) | | | (0.23 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | (6.40 | ) | | | (4.20 | ) | | | (2.23 | ) | | | (0.63 | ) | | | (0.33 | ) | | | (0.40 | ) |

| | | | |

Net asset value, end of period | | $ | 26.79 | | | $ | 32.76 | | | $ | 29.99 | | | $ | 25.45 | | | $ | 26.75 | | | $ | 21.12 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 2.17 | %4 | | | 24.86 | % | | | 28.35 | % | | | (2.39 | )% | | | 28.36 | % | | | 13.97 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets5 | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.81 | %6,7 | | | 0.81 | %6 | | | 0.83 | %6 | | | 0.86 | %6 | | | 0.84 | %6 | | | 0.86 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.81 | %6,7 | | | 0.81 | %6 | | | 0.83 | %6 | | | 0.86 | %6 | | | 0.84 | %6 | | | 0.86 | % |

| | | | |

Net investment income | | | 1.39 | %6,7 | | | 1.24 | %6 | | | 1.61 | %6 | | | 1.59 | %6 | | | 1.28 | %6 | | | 1.62 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,741,302 | | | $ | 1,808,120 | | | $ | 1,594,656 | | | $ | 1,439,411 | | | $ | 1,652,159 | | | $ | 1,461,423 | |

| | | | |

Portfolio turnover rate of the Master LLC | | | 16 | % | | | 47 | % | | | 53 | % | | | 38 | % | | | 64 | % | | | 48 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

| | 5 | | Includes the Fund’s share of the Master LLC’s allocated net expenses and/or net investment income. |

| | 6 | | Includes the Fund’s share of the Master LLC’s allocated fees waived of less than 0.01%. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 11 |

| | | | |

| Financial Highlights (continued) | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Investor B | |

| | | Six Months

Ended

December 31,

2014 (Unaudited) | | | Year Ended June 30, | |

| | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 32.52 | | | $ | 29.65 | | | $ | 25.08 | | | $ | 26.27 | | | $ | 20.69 | | | $ | 18.45 | |

| | | | |

Net investment income1 | | | 0.05 | | | | 0.05 | | | | 0.15 | | | | 0.14 | | | | 0.08 | | | | 0.16 | |

Net realized and unrealized gain (loss) | | | 0.22 | | | | 6.52 | | | | 6.25 | | | | (1.02 | ) | | | 5.53 | | | | 2.23 | |

| | | | |

Net increase (decrease) from investment operations | | | 0.27 | | | | 6.57 | | | | 6.40 | | | | (0.88 | ) | | | 5.61 | | | | 2.39 | |

| | | | |

Distributions from:2 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | (0.09 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.15 | ) |

Net realized gain | | | (5.96 | ) | | | (3.70 | ) | | | (1.74 | ) | | | (0.23 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | (5.96 | ) | | | (3.70 | ) | | | (1.83 | ) | | | (0.31 | ) | | | (0.03 | ) | | | (0.15 | ) |

| | | | |

Net asset value, end of period | | $ | 26.83 | | | $ | 32.52 | | | $ | 29.65 | | | $ | 25.08 | | | $ | 26.27 | | | $ | 20.69 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 1.63 | %4 | | | 23.57 | % | | | 26.94 | % | | | (3.31 | )% | | | 27.15 | % | | | 12.88 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets5 | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.88 | %6,7 | | | 1.89 | %6 | | | 1.92 | %6 | | | 1.87 | %6 | | | 1.81 | %6 | | | 1.79 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.88 | %6,7 | | | 1.89 | %6 | | | 1.92 | %6 | | | 1.86 | %6 | | | 1.81 | %6 | | | 1.79 | % |

| | | | |

Net investment income | | | 0.31 | %6,7 | | | 0.18 | %6 | | | 0.54 | %6 | | | 0.58 | %6 | | | 0.32 | %6 | | | 0.73 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 10,976 | | | $ | 14,930 | | | $ | 24,282 | | | $ | 41,283 | | | $ | 75,481 | | | $ | 101,508 | |

| | | | |

Portfolio turnover rate of the Master LLC | | | 16 | % | | | 47 | % | | | 53 | % | | | 38 | % | | | 64 | % | | | 48 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

| | 5 | | Includes the Fund’s share of the Master LLC’s allocated net expenses and/or net investment income. |

| | 6 | | Includes the Fund’s share of the Master LLC’s allocated fees waived of less than 0.01%. |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Financial Highlights (continued) | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Investor C | |

| | | Six Months

Ended

December 31,

2014 (Unaudited) | | | Year Ended June 30, | |

| | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 30.13 | | | $ | 27.89 | | | $ | 23.80 | | | $ | 25.03 | | | $ | 19.78 | | | $ | 17.70 | |

| | | | |

Net investment income1 | | | 0.09 | | | | 0.13 | | | | 0.21 | | | | 0.18 | | | | 0.11 | | | | 0.17 | |

Net realized and unrealized gain (loss) | | | 0.17 | | | | 6.09 | | | | 5.89 | | | | (0.99 | ) | | | 5.29 | | | | 2.15 | |

| | | | |

Net increase (decrease) from investment operations | | | 0.26 | | | | 6.22 | | | | 6.10 | | | | (0.81 | ) | | | 5.40 | | | | 2.32 | |

| | | | |

Distributions from:2 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.19 | ) | | | (0.19 | ) | | | (0.27 | ) | | | (0.19 | ) | | | (0.15 | ) | | | (0.24 | ) |

Net realized gain | | | (5.98 | ) | | | (3.79 | ) | | | (1.74 | ) | | | (0.23 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | (6.17 | ) | | | (3.98 | ) | | | (2.01 | ) | | | (0.42 | ) | | | (0.15 | ) | | | (0.24 | ) |

| | | | |

Net asset value, end of period | | $ | 24.22 | | | $ | 30.13 | | | $ | 27.89 | | | $ | 23.80 | | | $ | 25.03 | | | $ | 19.78 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 1.77 | %4 | | | 23.90 | % | | | 27.29 | % | | | (3.16 | )% | | | 27.36 | % | | | 13.01 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets5 | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.60 | %6,7 | | | 1.60 | %6 | | | 1.63 | %6 | | | 1.67 | %6 | | | 1.66 | %6 | | | 1.68 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.60 | %6,7 | | | 1.60 | %6 | | | 1.63 | %6 | | | 1.67 | %6 | | | 1.66 | %6 | | | 1.68 | % |

| | | | |

Net investment income | | | 0.60 | %6,7 | | | 0.45 | %6 | | | 0.81 | %6 | | | 0.77 | %6 | | | 0.46 | %6 | | | 0.80 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 435,348 | | | $ | 459,708 | | | $ | 387,027 | | | $ | 365,319 | | | $ | 465,007 | | | $ | 413,806 | |

| | | | |

Portfolio turnover rate of the Master LLC | | | 16 | % | | | 47 | % | | | 53 | % | | | 38 | % | | | 64 | % | | | 48 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

| | 5 | | Includes the Fund’s share of the Master LLC’s allocated net expenses and/or net investment income. |

| | 6 | | Includes the Fund’s share of the Master LLC’s allocated fees waived of less than 0.01%. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 13 |

| | | | |

| Financial Highlights (concluded) | | | BlackRock Basic Value Fund, Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class R | |

| | | Six Months

Ended

December 31,

2014 (Unaudited) | | | Year Ended June 30, | |

| | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 31.51 | | | $ | 28.99 | | | $ | 24.63 | | | $ | 25.90 | | | $ | 20.48 | | | $ | 18.31 | |

| | | | |

Net investment income1 | | | 0.16 | | | | 0.28 | | | | 0.34 | | | | 0.30 | | | | 0.23 | | | | 0.27 | |

Net realized and unrealized gain (loss) | | | 0.19 | | | | 6.34 | | | | 6.12 | | | | (1.03 | ) | | | 5.46 | | | | 2.23 | |

| | | | |

Net increase (decrease) from investment operations | | | 0.35 | | | | 6.62 | | | | 6.46 | | | | (0.73 | ) | | | 5.69 | | | | 2.50 | |

| | | | |

Distributions from:2 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.31 | ) | | | (0.31 | ) | | | (0.36 | ) | | | (0.31 | ) | | | (0.27 | ) | | | (0.33 | ) |

Net realized gain | | | (5.98 | ) | | | (3.79 | ) | | | (1.74 | ) | | | (0.23 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | (6.29 | ) | | | (4.10 | ) | | | (2.10 | ) | | | (0.54 | ) | | | (0.27 | ) | | | (0.33 | ) |

| | | | |

Net asset value, end of period | | $ | 25.57 | | | $ | 31.51 | | | $ | 28.99 | | | $ | 24.63 | | | $ | 25.90 | | | $ | 20.48 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 1.99 | %4 | | | 24.47 | % | | | 27.92 | % | | | (2.73 | )% | | | 27.89 | % | | | 13.51 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets5 | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.15 | %6,7 | | | 1.12 | %6 | | | 1.18 | %6 | | | 1.22 | %6 | | | 1.23 | %6 | | | 1.22 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.15 | %6,7 | | | 1.12 | %6 | | | 1.16 | %6 | | | 1.20 | %6 | | | 1.23 | %6 | | | 1.22 | % |

| | | | |

Net investment income | | | 1.04 | %6,7 | | | 0.93 | %6 | | | 1.29 | %6 | | | 1.23 | %6 | | | 0.93 | %6 | | | 1.27 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 16,416 | | | $ | 18,769 | | | $ | 16,655 | | | $ | 18,785 | | | $ | 24,155 | | | $ | 19,858 | |

| | | | |

Portfolio turnover rate of the Master LLC | | | 16 | % | | | 47 | % | | | 53 | % | | | 38 | % | | | 64 | % | | | 48 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

| | 5 | | Includes the Fund’s share of the Master LLC’s allocated net expenses and/or net investment income. |

| | 6 | | Includes the Fund’s share of the Master LLC’s allocated fees waived of less than 0.01%. |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Notes to Financial Statements (Unaudited) | | | BlackRock Basic Value Fund, Inc. | |

1. Organization:

BlackRock Basic Value Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, open-end management investment company. The Fund is organized as a Maryland corporation. The Fund seeks to achieve its investment objective by investing all of its assets in Master Basic Value LLC (the “Master LLC”), an affiliate of the Fund, which has the same investment objective and strategies as the Fund. The value of the Fund’s investment in the Master LLC reflects the Fund’s proportionate interest in the net assets of the Master LLC. The performance of the Fund is directly affected by the performance of the Master LLC. At December 31, 2014, the percentage of the Master LLC owned by the Fund was 98.8%. As such, the financial statements of the Master LLC, including the Schedule of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund offers multiple classes of shares. All classes of shares have identical voting, dividend, liquidation and other rights and are subject to the same terms and conditions, except that each bears certain expenses and may have a conversion privilege as outlined below. Institutional Shares are sold only to certain eligible investors. Investor B and Class R Shares are only available through exchanges and distribution reinvestments by current holders and for purchase by certain employer-sponsored retirement plans. Investor A and Investor C Shares are generally available through financial intermediaries. Each class has exclusive voting rights with respect to matters relating to its shareholder servicing and distribution expenditures (except that Investor B shareholders may vote on material changes to the Investor A distribution and service plan). For distribution and service fee breakdown see Note 3.

| | | | | | |

| Share Name | | Initial Sales Charge | | CDSC | | Conversion |

Institutional Shares | | No | | No | | None |

Investor A Shares | | Yes | | No1 | | None |

Investor B Shares | | No | | Yes | | To Investor A Shares after 8 years |

Investor C Shares | | No | | Yes | | None |

Class R Shares | | No | | No | | None |

| | 1 | | Investor A Shares may be subject to a CDSC for certain redemptions where no initial sales charge was paid at the time of purchase. |

2. Significant Accounting Policies:

The Fund’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund:

Valuation: U.S. GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund’s policy is to fair value its financial instruments at market value. The Fund records its investment in the Master LLC at fair value based on the Fund’s proportionate interest in the net assets of the Master LLC. Valuation of securities held by the Master LLC is discussed in Note 2 of the Master LLC’s Notes to Financial Statements, which are included elsewhere in this report.

Investment Transactions and Investment Income: For financial reporting purposes, contributions to and withdrawals from the Master LLC are accounted for on a trade date basis. The Fund records daily its proportionate share of the Master LLC’s income, expenses and realized and unrealized gains and losses. Realized and unrealized gains and losses are adjusted utilizing partnership tax allocation rules. In addition, the Fund accrues its own expenses. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Distributions: Distributions paid by the Fund are recorded on the ex-dividend date. The character and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or the applicable class. Other operating expenses shared by several funds are prorated among those funds on the basis of relative net assets or other appropriate methods. Expenses directly related to the Fund and other shared expenses prorated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods.

3. Investment Advisory Agreement and Other Transactions with Affiliates:

The PNC Financial Services Group, Inc. is the largest stockholder and an affiliate, for 1940 Act purposes, of BlackRock, Inc. (“BlackRock”).

The Fund entered into an Administration Agreement with BlackRock Advisors, LLC (the “Administrator”), an indirect, wholly owned subsidiary of BlackRock, to provide administrative services (other than investment advice and related portfolio activities). The Fund pays the Administrator no fees pursuant to the agreement and does not pay an investment advisory fee or investment management fee.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 15 |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Basic Value Fund, Inc. | |

The Fund entered into a Distribution Agreement and a Distribution and Service Plan with BlackRock Investments, LLC (“BRIL”), an affiliate of the Administrator. Pursuant to the Distribution and Service Plan and in accordance with Rule 12b-1 under the 1940 Act, the Fund pays BRIL ongoing service and distribution fees. The fees are accrued daily and paid monthly at annual rates based upon the average daily net assets of the relevant share class of the Fund as follows:

| | | | | | | | | | | | | | | | |

| | | Investor A | | | Investor B | | | Investor C | | | Class R | |

Service Fee | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Distribution Fee | | | — | | | | 0.75 | % | | | 0.75 | % | | | 0.25 | % |

Pursuant to sub-agreements with BRIL, broker-dealers and BRIL provide shareholder servicing and distribution services to the Fund. The ongoing service and/or distribution fee compensates BRIL and each broker-dealer for providing shareholder servicing and/or distribution related services to Investor A, Investor B, Investor C and Class R shareholders.

Pursuant to written agreements, certain financial intermediaries, some of which may be affiliates, provide the Fund with sub-accounting, recordkeeping, sub-transfer agency and other administrative services with respect to sub-accounts they service. For these services, these entities receive an asset based fee or an annual fee per shareholder account, which will vary depending on share class and/or net assets. For the six months ended December 31, 2014, the Fund paid the following amounts to affiliates of BlackRock in return for these services, which are included in transfer agent — class specific in the Statement of Operations:

| | | | |

Institutional | | $ | 182,008 | |

Investor A | | $ | 98 | |

The Administrator maintains a call center, which is responsible for providing certain shareholder services to the Fund, such as responding to shareholder inquiries and processing transactions based upon instructions from shareholders with respect to the subscription and redemption of Fund shares. For the six months ended December 31, 2014, the Fund reimbursed the Administrator the following amounts for costs incurred in running the call center, which are included in transfer agent — class specific in the Statement of Operations:

| | | | | | | | | | |

| Institutional | | Investor A | | Investor B | | Investor C | | Class R | | Total |

| $16,828 | | $17,657 | | $670 | | $3,067 | | $44 | | $38,266 |

The Administrator contractually agreed to waive and/or reimburse fees or expenses in order to limit expenses of Class R Shares to 1.22% of Class R Shares average daily net assets, excluding interest expense, dividend expense, tax expense, acquired fund fees and expenses and certain other fund expenses, which constitute extraordinary expenses not incurred in the ordinary course of the Fund’s business. The Administrator has agreed not to reduce or discontinue this contractual waiver or reimbursement prior to November 1, 2015, unless approved by the Board, including a majority of the Independent Directors.

For the six months ended December 31, 2014, affiliates earned underwriting discounts, direct commissions and dealer concessions on sales of the Fund’s Investor A Shares of $63,184.

For the six months ended December 31, 2014, affiliates received CDSCs as follows:

| | | | |

Investor A | | $ | 4,327 | |

Investor B | | $ | 1,840 | |

Investor C | | $ | 16,918 | |

Certain officers and/or directors of the Fund are officers and/or directors of BlackRock or its affiliates. The Fund reimburses the Administrator for a portion of the compensation paid to the Fund’s Chief Compliance Officer, which is included in officer in the Statement of Operations.

4. Income Tax Information:

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies, and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

The Fund files U.S. federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s U.S. federal tax returns remains open for each of the four years ended June 30, 2014. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

| | | | | | |

| 16 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Basic Value Fund, Inc. | |

Management has analyzed tax laws and regulations and their application to the Fund’s facts and circumstances and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of June 30, 2014, the Fund had a capital loss carryforward available to offset future realized capital gains of $14,184,480, all of which is due to expire June 30, 2017. This capital loss carryforward is subject to annual limitation.

5. Capital Share Transactions:

Transactions in capital shares for each class were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

December 31, 2014 | | | | | Year Ended

June 30, 2014 | |

| | | Shares | | | Amount | | | | | Shares | | | Amount | |

Institutional | | | | | | | | | | | | | | | | | | |

Shares sold | | | 7,416,978 | | | $ | 232,643,402 | | | | | | 17,555,650 | | | $ | 562,234,269 | |

Shares issued in reinvestment distributions | | | 13,546,445 | | | | 350,716,535 | | | | | | 8,929,415 | | | | 263,684,657 | |

Shares redeemed | | | (12,746,257 | ) | | | (408,071,232 | ) | | | | | (30,313,295 | ) | | | (953,176,660 | ) |

| | | | | | | | | | |

Net increase (decrease) | | | 8,217,166 | | | $ | 175,288,705 | | | | | | (3,828,230 | ) | | $ | (127,257,734 | ) |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Investor A | | | | | | | | | | | | | | | | | | |

Shares sold and automatic conversion of shares | | | 3,332,229 | | | $ | 104,698,326 | | | | | | 7,962,712 | | | $ | 251,676,114 | |

Shares issued in reinvestment distributions | | | 12,062,404 | | | | 309,519,239 | | | | | | 6,542,337 | | | | 191,818,586 | |

Shares redeemed | | | (5,586,715 | ) | | | (175,278,120 | ) | | | | | (12,490,634 | ) | | | (393,370,594 | ) |

| | | | | | | | | | |

Net increase | | | 9,807,918 | | | $ | 238,939,445 | | | | | | 2,014,415 | | | $ | 50,124,106 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Investor B | | | | | | | | | | | | | | | | | | |

Shares sold | | | 7,408 | | | $ | 239,170 | | | | | | 40,030 | | | $ | 1,255,709 | |

Shares issued in reinvestment distributions | | | 74,690 | | | | 1,920,274 | | | | | | 63,395 | | | | 1,854,287 | |

Shares redeemed and automatic conversion of shares | | | (132,052 | ) | | | (4,102,703 | ) | | | | | (463,186 | ) | | | (14,360,176 | ) |

| | | | | | | | | | |

Net decrease | | | (49,954 | ) | | $ | (1,943,259 | ) | | | | | (359,761 | ) | | $ | (11,250,180 | ) |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Investor C | | | | | | | | | | | | | | | | | | |

Shares sold | | | 972,905 | | | $ | 28,159,774 | | | | | | 2,060,684 | | | $ | 59,797,393 | |

Shares issued in reinvestment distributions | | | 3,475,584 | | | | 80,632,360 | | | | | | 1,751,735 | | | | 47,435,274 | |

Shares redeemed | | | (1,730,210 | ) | | | (49,362,160 | ) | | | | | (2,430,186 | ) | | | (70,557,275 | ) |

| | | | | | | | | | |

Net increase | | | 2,718,279 | | | $ | 59,429,974 | | | | | | 1,382,233 | | | $ | 36,675,392 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Class R | | | | | | | | | | | | | | | | | | |

Shares sold | | | 73,764 | | | $ | 2,276,689 | | | | | | 206,507 | | | $ | 6,268,987 | |

Shares issued in reinvestment distributions | | | 141,699 | | | | 3,471,620 | | | | | | 79,698 | | | | 2,251,455 | |

Shares redeemed | | | (169,189 | ) | | | (4,929,136 | ) | | | | | (265,114 | ) | | | (8,114,026 | ) |

| | | | | | | | | | |

Net increase | | | 46,274 | | | $ | 819,173 | | | | | | 21,091 | | | $ | 406,416 | |

| | | | | | | | | | |

Total Net Increase (Decrease) | | | 20,739,683 | | | $ | 472,534,038 | | | | | | (770,252 | ) | | $ | (51,302,000 | ) |

| | | | | | | | | | |

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 17 |

| | | | |

| Notes to Financial Statements (concluded) | | | BlackRock Basic Value Fund, Inc. | |

6. Subsequent Events:

Management’s evaluation of the impact of all subsequent events on the Fund’s financial statements was completed through the date the financial statements were issued and the following items were noted:

On February 9, 2015, the Fund ceased to invest in the Master LLC as part of a “master-feeder” structure and will instead operate as a stand-alone fund. In connection with this change, the Fund entered into a management agreement with BlackRock Advisors, LLC, the terms of which are substantially the same as the management agreement between BlackRock Advisors, LLC and the Master LLC, including the management fee rate. Additionally, the change to a stand-alone structure is not expected to change the fees and expenses borne by the Fund or create a taxable event for the Fund or its shareholders.

| | | | | | |

| 18 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Master LLC Portfolio Information As of December 31, 2014 | | | Master Basic Value LLC | |

| | |

| Ten Largest Holdings | | Percent of Long-Term Investments |

| | | | |

Pfizer, Inc. | | | 4 | % |

JPMorgan Chase & Co. | | | 4 | |

Cisco Systems, Inc. | | | 4 | |

Citigroup, Inc. | | | 4 | |

Marathon Oil Corp. | | | 3 | |

The Kroger Co. | | | 3 | |

Medtronic, Inc. | | | 3 | |

Wells Fargo & Co. | | | 3 | |

Discover Financial Services | | | 3 | |

Capital One Financial Corp. | | | 2 | |

| | |

| Sector Allocation | | Percent of Long-Term Investments |

| | | | |

Financials | | | 30 | % |

Health Care | | | 18 | |

Information Technology | | | 14 | |

Energy | | | 12 | |

Consumer Discretionary | | | 10 | |

Consumer Staples | | | 5 | |

Industrials | | | 4 | |

Telecommunication Services | | | 3 | |

Materials | | | 2 | |

Utilities | | | 2 | |

For Master LLC compliance purposes, the Master LLC’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 19 |

| | | | |

| Schedule of Investments December 31, 2014 (Unaudited) | | | Master Basic Value LLC | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Aerospace & Defense — 3.1% | | | | | | | | |

Honeywell International, Inc. | | | 142,955 | | | $ | 14,284,064 | |

Northrop Grumman Corp. | | | 227,423 | | | | 33,519,876 | |

Raytheon Co. | | | 584,804 | | | | 63,258,249 | |

Spirit AeroSystems Holdings, Inc., Class A (a) | | | 485,700 | | | | 20,904,528 | |

| | | | | | | | |

| | | | | | | | 131,966,717 | |

Airlines — 0.1% | | | | | | | | |

American Airlines Group, Inc. | | | 94,710 | | | | 5,079,297 | |

Auto Components — 1.1% | | | | | | | | |

Lear Corp. | | | 492,525 | | | | 48,306,852 | |

Automobiles — 1.4% | | | | | | | | |

General Motors Co. | | | 1,665,579 | | | | 58,145,363 | |

Banks — 12.4% | | | | | | | | |

Citigroup, Inc. | | | 3,124,221 | | | | 169,051,598 | |

JPMorgan Chase & Co. | | | 2,983,744 | | | | 186,722,700 | |

KeyCorp | | | 1,553,170 | | | | 21,589,063 | |

Regions Financial Corp. | | | 3,288,614 | | | | 34,727,764 | |

Wells Fargo & Co. | | | 2,040,024 | | | | 111,834,116 | |

| | | | | | | | |

| | | | | | | | 523,925,241 | |

Capital Markets — 1.2% | | | | | | | | |

KKR & Co. LP (a) | | | 36,800 | | | | 854,128 | |

Morgan Stanley | | | 1,006,500 | | | | 39,052,200 | |

State Street Corp. | | | 131,482 | | | | 10,321,337 | |

| | | | | | | | |

| | | | | | | | 50,227,665 | |

Chemicals — 2.1% | | | | | | | | |

Akzo Nobel NV — ADR | | | 2,021,430 | | | | 46,088,604 | |

Cabot Corp. | | | 19,530 | | | | 856,586 | |

Celanese Corp., Series A | | | 223,260 | | | | 13,386,670 | |

LyondellBasell Industries NV, Class A | | | 372,870 | | | | 29,602,149 | |

| | | | | | | | |

| | | | | | | | 89,934,009 | |

Communications Equipment — 6.4% | | | | | | | | |

Cisco Systems, Inc. | | | 6,207,400 | | | | 172,658,831 | |

QUALCOMM, Inc. | | | 583,330 | | | | 43,358,919 | |

Telefonaktiebolaget LM Ericsson — ADR | | | 4,533,180 | | | | 54,851,478 | |

| | | | | | | | |

| | | | | | | | 270,869,228 | |

Construction & Engineering — 0.1% | | | | | | | | |

Jacobs Engineering Group, Inc. (a)(b) | | | 67,110 | | | | 2,999,146 | |

Consumer Finance — 5.6% | | | | | | | | |

Capital One Financial Corp. | | | 1,264,068 | | | | 104,348,813 | |

Discover Financial Services | | | 1,640,805 | | | | 107,456,319 | |

SLM Corp. | | | 2,268,180 | | | | 23,112,754 | |

| | | | | | | | |

| | | | | | | | 234,917,886 | |

Containers & Packaging — 0.3% | | | | | | | | |

Crown Holdings, Inc. (a) | | | 217,480 | | | | 11,069,732 | |

Diversified Financial Services — 2.0% | | | | | | | | |

Intercontinental Exchange, Inc. | | | 28,300 | | | | 6,205,907 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Diversified Financial Services (concluded) | | | | | | | | |

The NASDAQ OMX Group, Inc. | | | 1,658,467 | | | $ | 79,540,077 | |

| | | | | | | | |

| | | | | | | | 85,745,984 | |

Diversified Telecommunication Services — 1.7% | | | | | | | | |

Verizon Communications, Inc. | | | 1,494,010 | | | | 69,889,788 | |

Electronic Equipment, Instruments & Components — 0.8% | | | | | |

Avnet, Inc. | | | 528,840 | | | | 22,750,697 | |

Corning, Inc. | | | 463,850 | | | | 10,636,081 | |

| | | | | | | | |

| | | | | | | | 33,386,778 | |

Energy Equipment & Services — 0.1% | | | | | | | | |

Halliburton Co. | | | 43,210 | | | | 1,699,449 | |

Noble Corp. PLC | | | 64,580 | | | | 1,070,091 | |

| | | | | | | | |

| | | | | | | | 2,769,540 | |

Food & Staples Retailing — 3.5% | | | | | | | | |

CVS Health Corp. | | | 273,440 | | | | 26,335,006 | |

The Kroger Co. | | | 1,867,015 | | | | 119,881,033 | |

| | | | | | | | |

| | | | | | | | 146,216,039 | |

Food Products — 0.5% | | | | | | | | |

Kellogg Co. | | | 33,300 | | | | 2,179,152 | |

Tyson Foods, Inc., Class A | | | 446,840 | | | | 17,913,816 | |

| | | | | | | | |

| | | | | | | | 20,092,968 | |

Gas Utilities — 0.5% | | | | | | | | |

UGI Corp. | | | 508,594 | | | | 19,316,400 | |

Health Care Equipment & Supplies — 5.9% | | | | | | | | |

Baxter International, Inc. | | | 1,024,670 | | | | 75,098,064 | |

Hologic, Inc. (a)(b) | | | 1,156,930 | | | | 30,936,308 | |

Medtronic, Inc. | | | 1,591,506 | | | | 114,906,733 | |

Zimmer Holdings, Inc. | | | 250,216 | | | | 28,379,499 | |

| | | | | | | | |

| | | | | | | | 249,320,604 | |

Health Care Providers & Services — 3.9% | | | | | | | | |

Cigna Corp. | | | 81,840 | | | | 8,422,154 | |

Community Health Systems, Inc. (a) | | | 1,217,490 | | | | 65,647,061 | |

Laboratory Corp. of America Holdings (a) | | | 141,210 | | | | 15,236,559 | |

Quest Diagnostics, Inc. | | | 1,122,600 | | | | 75,281,556 | |

| | | | | | | | |

| | | | | | | | 164,587,330 | |

Household Durables — 1.9% | | | | | | | | |

Newell Rubbermaid, Inc. | | | 1,763,482 | | | | 67,171,029 | |

Tupperware Brands Corp. | | | 195,180 | | | | 12,296,340 | |

| | | | | | | | |

| | | | | | | | 79,467,369 | |

Household Products — 0.5% | | | | | | | | |

Energizer Holdings, Inc. | | | 151,139 | | | | 19,430,430 | |

Independent Power and Renewable Electricity Producers — 1.6% | | | | | |

AES Corp. | | | 4,787,950 | | | | 65,930,071 | |

| | |

| Portfolio Abbreviations |

| ADR | | American Depositary Receipts |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements.

| | | | | | |

| 20 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Schedule of Investments (continued) | | | Master Basic Value LLC | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Insurance — 7.3% | | | | | | | | |

ACE Ltd. | | | 187,833 | | | $ | 21,578,255 | |

Aflac, Inc. | | | 41,713 | | | | 2,548,247 | |

CNO Financial Group, Inc. | | | 577,500 | | | | 9,944,550 | |

Genworth Financial, Inc., Class A (a) | | | 3,853,200 | | | | 32,752,200 | |

The Hartford Financial Services Group, Inc. | | | 1,304,553 | | | | 54,386,815 | |

Lincoln National Corp. | | | 1,129,351 | | | | 65,129,672 | |

MetLife, Inc. | | | 327,326 | | | | 17,705,063 | |

Prudential Financial, Inc. | | | 570,753 | | | | 51,630,316 | |

The Travelers Cos., Inc. | | | 132,105 | | | | 13,983,314 | |

XL Group PLC | | | 1,142,583 | | | | 39,270,578 | |

| | | | | | | | |

| | | | | | | | 308,929,010 | |

IT Services — 1.4% | | | | | | | | |

Total System Services, Inc. | | | 264,000 | | | | 8,965,440 | |

The Western Union Co. | | | 980,319 | | | | 17,557,513 | |

Xerox Corp. | | | 2,404,170 | | | | 33,321,796 | |

| | | | | | | | |

| | | | | | | | 59,844,749 | |

Machinery — 0.5% | | | | | | | | |

Stanley Black & Decker, Inc. | | | 221,600 | | | | 21,291,328 | |

Media — 3.3% | | | | | | | | |

Cablevision Systems Corp., Class A | | | 574,930 | | | | 11,866,555 | |

Comcast Corp., Special Class A | | | 372,940 | | | | 21,468,291 | |

The Interpublic Group of Cos., Inc. | | | 683,280 | | | | 14,191,726 | |

Time Warner Cable, Inc. | | | 84,210 | | | | 12,804,973 | |

Viacom, Inc., Class B | | | 1,061,391 | | | | 79,869,673 | |

| | | | | | | | |

| | | | | | | | 140,201,218 | |

Multiline Retail — 0.4% | | | | | | | | |

Macy’s, Inc. | | | 255,900 | | | | 16,825,425 | |

Oil, Gas & Consumable Fuels — 11.8% | | | | | | | | |

Apache Corp. | | | 1,457,596 | | | | 91,347,541 | |

Gulfport Energy Corp. (a) | | | 923,180 | | | | 38,533,533 | |

Marathon Oil Corp. | | | 4,289,133 | | | | 121,339,573 | |

Marathon Petroleum Corp. | | | 737,466 | | | | 66,563,681 | |

Suncor Energy, Inc. | | | 2,031,560 | | | | 64,562,977 | |

Total SA — ADR | | | 559,127 | | | | 28,627,302 | |

Valero Energy Corp. | | | 1,811,680 | | | | 89,678,160 | |

| | | | | | | | |

| | | | | | | | 500,652,767 | |

Personal Products — 0.2% | | | | | | | | |

Nu Skin Enterprises, Inc., Class A (b) | | | 199,090 | | | | 8,700,233 | |

Pharmaceuticals — 8.3% | | | | | | | | |

Hospira, Inc. (a) | | | 1,436,141 | | | | 87,963,636 | |

Pfizer, Inc. | | | 6,091,005 | | | | 189,734,806 | |

Teva Pharmaceutical Industries Ltd. — ADR | | | 1,271,470 | | | | 73,122,240 | |

| | | | | | | | |

| | | | | | | | 350,820,682 | |

Real Estate Investment Trusts (REITs) — 1.0% | | | | | | | | |

Outfront Media, Inc. | | | 1,525,764 | | | | 40,951,506 | |

Real Estate Management & Development — 0.1% | | | | | | | | |

Jones Lang LaSalle, Inc. | | | 42,010 | | | | 6,298,559 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Semiconductors & Semiconductor Equipment — 0.8% | | | | | |

Teradyne, Inc. | | | 1,713,600 | | | $ | 33,912,144 | |

Software — 4.3% | | | | | | | | |

Microsoft Corp. | | | 1,496,171 | | | | 69,497,143 | |

Oracle Corp. | | | 1,747,307 | | | | 78,576,396 | |

Symantec Corp. | | | 1,373,030 | | | | 35,225,085 | |

| | | | | | | | |

| | | | | | | | 183,298,624 | |

Specialty Retail — 2.3% | | | | | | | | |

The Gap, Inc. | | | 587,120 | | | | 24,723,623 | |

GNC Holdings, Inc., Class A | | | 1,579,800 | | | | 74,187,408 | |

| | | | | | | | |

| | | | | | | | 98,911,031 | |

Wireless Telecommunication Services — 1.3% | | | | | |

Telephone & Data Systems, Inc. | | | 1,682,054 | | | | 42,471,863 | |

United States Cellular Corp. (a) | | | 356,459 | | | | 14,197,762 | |

| | | | | | | | |

| | | | | | | | 56,669,625 | |

Total Common Stocks — 99.7% | | | | | | | 4,210,901,338 | |

| | | | | | | | |

| Preferred Stocks | | | | | | |

Food Products — 0.2% | | | | | | | | |

Tyson Foods, Inc., 4.75% (c) | | | 230,678 | | | | 11,612,331 | |

Machinery — 0.1% | | | | | | | | |

Stanley Black & Decker, Inc., 6.25% (c) | | | 31,000 | | | | 3,649,940 | |

Total Preferred Stocks — 0.3% | | | | | | | 15,262,271 | |

Total Long-Term Investments (Cost — $3,060,603,448) — 100.0% | | | | 4,226,163,609 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.04% (d)(e) | | | 17,349,337 | | | | 17,349,337 | |

| | | Beneficial

Interest

(000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.20% (d)(e)(f) | | $ | 7,891 | | | | 7,891,241 | |

Total Short-Term Securities (Cost — $25,240,578) — 0.6% | | | | 25,240,578 | |

Total Investments (Cost — $3,085,844,026) — 100.6% | | | | 4,251,404,187 | |

Liabilities in Excess of Other Assets — (0.6)% | | | | (26,567,007 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 4,224,837,180 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | 21 |

| | | | |

| Schedule of Investments (concluded) | | | Master Basic Value LLC | |

| (d) | During the six months ended December 31, 2014, investments in issuers considered to be affiliates of the Master LLC, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares/ Beneficial

Interest

Held at

June 30,

2014 | | | Net Activity | | | Shares/ Beneficial

Interest

Held at

December 31,

2014 | | | Income | | | Realized

Gain | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 20,862,659 | | | | (3,513,322 | ) | | | 17,349,337 | | | $ | 5,281 | | | $ | 1,455 | |

BlackRock Liquidity Series, LLC, Money Market Series | | $ | 107,213,645 | | | $ | (99,322,404 | ) | | $ | 7,891,241 | | | $ | 361,075 | | | | — | |

| (e) | Represents the current yield as of report date. |

| (f) | Security was purchased with the cash collateral from loaned securities. The Master LLC may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| Ÿ | | For Master LLC compliance purposes, the Master LLC’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Master LLC has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Master LLC’s own assumptions used in determining the fair value of investments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Master LLC’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Master LLC’s policy regarding valuation of investments, refer to Note 2 of the Notes to Financial Statements.

As of December 31, 2014, the following table summarizes the Master LLC’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments1 | | | $ | 4,226,163,609 | | | | | — | | | | | — | | | | $ | 4,226,163,609 | |

Short-Term Securities | | | | 17,349,337 | | | | $ | 7,891,241 | | | | | — | | | | | 25,240,578 | |

| | | | | |

Total | | | $ | 4,243,512,946 | | | | $ | 7,891,241 | | | | | — | | | | $ | 4,251,404,187 | |

| | | | | |

1 See above Schedule of Investments for values in each industry. | |

|

| The Master LLC may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of December 31, 2014, such assets and/or liabilities are categorized within the disclosure hierarchy as follows: | |

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | | | | | | | | | | |

Cash | | | $ | 6,211,530 | | | | | — | | | | | — | | | | $ | 6,211,530 | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | | — | | | | $ | (7,891,241 | ) | | | | — | | | | | (7,891,241 | ) |

| | | | | |

Total | | | $ | 6,211,530 | | | | $ | (7,891,241 | ) | | | | — | | | | $ | (1,679,711 | ) |

| | | | | |

During the six months ended December 31, 2014, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| 22 | | BLACKROCK BASIC VALUE FUND, INC. | | DECEMBER 31, 2014 | | |

| | | | |

| Statement of Assets and Liabilities | | | Master Basic Value LLC | |