UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10145 |

|

Baillie Gifford Funds |

(Exact name of registrant as specified in charter) |

|

1 Greenside Row Edinburgh, Scotland, UK | | EH1 3AN |

(Address of principal executive offices) | | (Zip code) |

|

Gareth Griffiths 1 Greenside Row Edinburgh, Scotland, UK, EH1 3AN |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 011-44-131-275-2000 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2017 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

BAILLIE GIFFORD FUNDS

EAFE Fund

EAFE Choice Fund

EAFE Pure Fund

Emerging Markets Fund

Global Alpha Equity Fund

Global Select Equity Fund

International Concentrated Growth Fund

International Equity Fund

Long Term Global Growth Equity Fund

Positive Change Equity Fund

U.S. Equity Growth Fund

International Choice Fund

Annual Report

December 31, 2017

Index

Page Number | | | |

| | 01 | | | Management Discussion | |

| | 21 | | | Fund Expenses | |

| | | EAFE Fund | |

| | 28 | | | Industry Diversification Table | |

| | 29 | | | Portfolio of Investments | |

| | 34 | | | Statement of Assets and Liabilities | |

| | 35 | | | Statement of Operations | |

| | 36 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 38 | | | Selected Data for Class 2 | |

| | 39 | | | Selected Data for Class 3 | |

| | 40 | | | Selected Data for Class 4 | |

| | 41 | | | Selected Data for Class 5 | |

| | 42 | | | Selected Data for Class K | |

| | 43 | | | Selected Data for Institutional Class | |

| | | EAFE Choice Fund | |

| | 44 | | | Industry Diversification Table | |

| | 46 | | | Portfolio of Investments | |

| | 51 | | | Statement of Assets and Liabilities | |

| | 52 | | | Statement of Operations | |

| | 53 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 54 | | | Selected Data for Class 2 | |

| | 55 | | | Selected Data for Class 3 | |

| | 56 | | | Selected Data for Class K | |

| | 57 | | | Selected Data for Institutional Class | |

| | | EAFE Pure Fund | |

| | 58 | | | Industry Diversification Table | |

| | 59 | | | Portfolio of Investments | |

| | 63 | | | Statement of Assets and Liabilities | |

| | 64 | | | Statement of Operations | |

| | 65 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 66 | | | Selected Data for Class 2 | |

| | 67 | | | Selected Data for Class 3 | |

| | 68 | | | Selected Data for Class K | |

| | 69 | | | Selected Data for Institutional Class | |

| | | Emerging Markets Fund | |

| | 70 | | | Industry Diversification Table | |

| | 71 | | | Portfolio of Investments | |

| | 76 | | | Statement of Assets and Liabilities | |

| | 77 | | | Statement of Operations | |

| | 78 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 80 | | | Selected Data for Class 2 | |

| | 81 | | | Selected Data for Class 3 | |

| | 82 | | | Selected Data for Class 5 | |

| | 83 | | | Selected Data for Class K | |

| | 84 | | | Selected Data for Institutional Class | |

| | | Global Alpha Equity Fund | |

| | 85 | | | Industry Diversification Table | |

| | 87 | | | Portfolio of Investments | |

| | 93 | | | Statement of Assets and Liabilities | |

| | 94 | | | Statement of Operations | |

| | 95 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 97 | | | Selected Data for Class 2 | |

| | 98 | | | Selected Data for Class 3 | |

| | 99 | | | Selected Data for Class 4 | |

| | 100 | | | Selected Data for Class K | |

| | 101 | | | Selected Data for Institutional Class | |

| | | Global Select Equity Fund | |

| | 102 | | | Industry Diversification Table | |

| | 104 | | | Portfolio of Investments | |

| | 109 | | | Statement of Assets and Liabilities | |

| | 110 | | | Statement of Operations | |

| | 111 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 112 | | | Selected Data for Class K | |

| | 113 | | | Selected Data for Institutional Class | |

| | | International Concentrated Growth Fund | |

| | 114 | | | Industry Diversification Table | |

| | 115 | | | Portfolio of Investments | |

| | 118 | | | Statement of Assets and Liabilities | |

Page Number | | | |

| | 119 | | | Statement of Operations | |

| | 120 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 121 | | | Selected Data for Class K | |

| | 122 | | | Selected Data for Institutional Class | |

| | | International Equity Fund | |

| | 123 | | | Industry Diversification Table | |

| | 125 | | | Portfolio of Investments | |

| | 131 | | | Statement of Assets and Liabilities | |

| | 132 | | | Statement of Operations | |

| | 133 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 135 | | | Selected Data for Class 2 | |

| | 136 | | | Selected Data for Class 3 | |

| | 137 | | | Selected Data for Class 4 | |

| | 138 | | | Selected Data for Class 5 | |

| | 139 | | | Selected Data for Class K | |

| | 140 | | | Selected Data for Institutional Class | |

| | | Long Term Global Growth Equity Fund | |

| | 141 | | | Industry Diversification Table | |

| | 142 | | | Portfolio of Investments | |

| | 145 | | | Statement of Assets and Liabilities | |

| | 146 | | | Statement of Operations | |

| | 147 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 148 | | | Selected Data for Class 2 | |

| | 149 | | | Selected Data for Class 4 | |

| | 150 | | | Selected Data for Class K | |

| | 151 | | | Selected Data for Institutional Class | |

| | | Positive Change Equity Fund | |

| | 152 | | | Industry Diversification Table | |

| | 153 | | | Portfolio of Investments | |

| | 156 | | | Statement of Assets and Liabilities | |

| | 157 | | | Statement of Operations | |

| | 158 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 159 | | | Selected Data for Class K | |

| | 160 | | | Selected Data for Institutional Class | |

| | | U.S. Equity Growth Fund | |

| | 161 | | | Industry Diversification Table | |

| | 162 | | | Portfolio of Investments | |

| | 164 | | | Statement of Assets and Liabilities | |

| | 165 | | | Statement of Operations | |

| | 166 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 167 | | | Selected Data for Class K | |

| | 168 | | | Selected Data for Institutional Class | |

| | | International Choice Fund | |

| | 169 | | | Industry Diversification Table | |

| | 171 | | | Portfolio of Investments | |

| | 176 | | | Statement of Assets and Liabilities | |

| | 177 | | | Statement of Operations | |

| | 178 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 179 | | | Selected Data for Class 2 | |

| | 180 | | | Selected Data for Class 3 | |

| | 181 | | | Selected Data for Class 4 | |

| | 182 | | | Notes to Financial Statements | |

| | 210 | | | Report of Independent Registered Public Accounting Firm | |

| | | Supplemental Information | |

| | 211 | | | Federal Income Tax Information | |

| | 213 | | | Management of the Trust | |

| | 215 | | | Board Considerations Regarding New Funds' Advisory Agreement Approval | |

Management Discussion (unaudited)

Annual Report December 31, 2017

EAFE Fund

Market Conditions and review of performance during 2017

International equity markets enjoyed a very strong year with the MSCI EAFE index producing a return of 25.62% and the EAFE Fund returning 46.09% for class 2 shares. This is an impressive return by any standards. Equity markets have been underpinned by improving global growth, accommodative central banks, and strong corporate operating performance. While the political backdrop retains the capability to cause periodic disruptions to markets, the growth opportunities available around the world remain abundant.

We invest for the Fund in companies that we believe can grow significantly faster than the market for many years, possibly decades. These opportunities are quite rare, and owning them requires patience. But we think it pays to back our convictions, so the Fund has become a little more concentrated over the last 12 months. We need to be supportive long-term shareholders and encourage great growth-oriented companies to put long-term goals before the market's obsession with short-term targets.

A new breed of company has emerged in recent years that has little need of capital and benefits from the effects of having a large network. For example, in Tencent and Alibaba, we own companies that exemplify these traits and are now capable of dominating across different parts of the economy. Although these companies have contributed well to returns over many years, we believe the prospects for patient shareholders remain good. Both Tencent and Alibaba contributed to a notably strong period of performance for the Fund. Stock selection was the key driver of relative performance and these two Chinese internet companies were significant contributors, once again thanks to strong operating fundamentals.

In Tencent's case, the most recent set of results saw revenue growth accelerate from the mid 50s to over 60% year on year. Smartphone games were the key driver, based on the huge popularity of games such as Honour of Kings. Elsewhere, the WeChat app continues to grow the number of active users, and interestingly is being used as a payment option in physical stores three times as often as this time last year. And its YouTube equivalent, Tencent Video, now has the largest paying subscriber base of any video streaming service.

Alibaba too is achieving the feat of generating accelerating revenue growth from an already high base,

at very similar rates to Tencent. The core e-commerce business goes from strength to strength. Its 'Singles Day' event on November 11th lived up to its reputation as the world's biggest twenty-four hour shopping event, with a 39% increase in sales over the same period in 2016.

Luxury car manufacturer Ferrari also performed exceptionally well. The company has been liberated following the spin off from Fiat Chrysler Automobiles, and the share price has responded to strong performance in both volumes and margins. The company has set out a long-term growth plan, with the intention of increasing annual sales from 8,000 to 14,000 cars per year.

Amongst the negative contributors were Spanish based global retailer Inditex, Swedish bank Svenska Handelsbanken and Japanese e-commerce stock Rakuten. The share price of the first two actually rose over the year, but simply lagged a strong index, while Rakuten's share price saw a single digit decline.

Inditex, the owner of the Zara retail chain, is a remarkable company with strong growth prospects as its 'fast fashion' model remains attractive around the globe, both offline and online. In the shorter term, however, it has been facing some currency headwinds. Svenska Handelsbanken has underperformed despite very stable profitability and robust capital ratios. Return on equity in its core domestic market sits at the mid-teens level, for example. This is a conservatively run bank however, and it has typically been more in favour during periods of higher volatility. We remain admirers of its distinctive business model. Rakuten meanwhile has delivered generally insipid results. Most recently, gross merchandise volume in the domestic ecommerce business grew 14%, which was at the low end of expectations. In the Fintech segment, top line growth was solid, but there were increased costs associated with the introduction of new systems in the Rakuten Card business. More recently, some sell side analysts have been worrying about the potential costs associated with the company's reported intention to acquire domestic telecoms wireless spectrum. We watch with interest to see if CEO Mikitani can execute with what he calls 'last mobile carrier advantage', given that they have little of the legacy baggage of incumbent wireless providers.

Investment Strategies used to manage the Fund

The investment strategy remains unchanged. The Fund invests in growth stocks based on bottom-up company analysis. In determining the potential of a company, we

01

Management Discussion (unaudited)

Annual Report December 31, 2017

analyse industry background, competitive advantage, management attitudes, financial strength, and valuation. We also consider whether we have a different view from the wider market. We think that the market, in general, is too short term and inward looking. Our ability to add value is derived from having a much longer time horizon and from our differentiated sources of information.

Annual turnover in the fund was 9% last year, which implies a typical holding period of over seven years. We believe that our ability to be patient, and our reputation as a long-term investor, allows us to develop much deeper relationships with management teams and to have more meaningful conversations with company leaders. Additionally, when formulating an investment opinion we

pay little heed to broker research, preferring to listen to alternative voices such as academia, authors, and independent experts.

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

Delivery Hero, Nidec, Umicore, Wix.Com

Complete Sales:

Aggreko, Celltrion, JD.Com, NAVER, Novo Nordisk

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(March 6, 2008) | |

EAFE Fund Class 2* | | | 46.09 | % | | | 11.44 | % | | | 6.25 | % | |

MSCI EAFE Index | | | 25.62 | % | | | 8.39 | % | | | 3.48 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 46.20% for Class 3, 46.24% for Class 4, 46.31% for Class 5, 22.62% for Class K and 22.62% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

02

Management Discussion (unaudited)

Annual Report December 31, 2017

EAFE Choice Fund

Market Conditions and Review of Performance during 2017

The past year once again demonstrated our belief that it is very difficult to predict short term market outcomes, and therefore not worthwhile trying to do so. As we reflect on 2017 and look forward to the future we continue to focus on the individual companies and the long term investment opportunities they present in international equity markets. This is not always an easy endeavour but we think it remains a very worthwhile one and one that will become increasingly so as the world changes around us at an ever faster rate. For those prepared to think optimistically about the long term it could be argued that there has seldom been a more exciting time, as new technologies enable the creation of new business models and set on course structural growth trends that could play out over decades. From ecommerce to artificial intelligence, electric vehicles to personalised medicine, the prizes for the winners could be vast, and the disruption for the losers catastrophic.

After three years of lacklustre returns, 2017 delivered a more encouraging year in international equity markets. The MSCI EAFE index returned 25.62% for the year as a whole, with returns for the Fund meaningfully ahead of this at 31.28% for class 2 shares.

Your portfolio's performance continues to be driven by stock selection rather than thematic or sector views; exactly as we would expect given our bottom-up stock picking approach to investment. Over the last year this has been particularly notable in the Consumer Staples and Healthcare sectors. Whilst both sectors have lagged behind the broader market at the index level, your holdings have contributed strongly to your portfolio's performance.

A number of technology innovators and enablers contributed favourably to performance over the past year. Continued robust operational delivery from companies such as Australian hearing implant manufacturer Cochlear, SMC — the Japanese factory automation component manufacturer, and Hargreaves Lansdown — the UK online savings platform have been strongly supportive to performance.

Over the year, the main detractors included Japanese manufacturer of bicycle components Shimano, Australian pallet pool operator Brambles, and UK online vehicle retail platform Auto Trader. Shimano has downgraded its

earnings forecasts; we believe that this reflects weakness in the overall bicycle market rather than a loss of share or competitiveness at the company itself. Brambles has seen challenges in its US business, where its main competitor has been pricing more aggressively, and where cheaper 'white wood' pallets have become more prevalent. Auto Trader's weakness reflects some cyclical concerns about the market for both new and used cars following the recent challenges in the diesel market.

The Fund holdings continue to offer exposure to a range of growing consumer franchises across the globe. This includes those such as luxury goods company Richemont, where centuries of history and heritage create a barrier to entry, to those such as online fashion retailer Zalando that are disrupting the established order in industries where an attachment to the past could prove a terminal disadvantage. With structural growth opportunities such as those highlighted above, and worldwide economic indicators looking as encouraging as at any time in recent years, there would appear to be plenty of reason to enter 2018 with an optimistic outlook. We believe that the Fund holds some of the most interesting growth companies across international markets, steered by high quality management teams, and we see the long-term opportunity for growth in these businesses as being undervalued by the short-term market valuations attached to them.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. Bottom-up investing is an investment approach that focuses on the analysis of individual stocks and deemphasizes the significant of economic cycles and market cycles. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyze industry background, competitive advantages, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met. The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made where applicable.

03

Management Discussion (unaudited)

Annual Report December 31, 2017

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

AIA, ASML, Advantest, MakeMyTrip, Raia Drogasil, Sartorius, Softbank, U-Blox

Complete Sales:

Asahi, Imagination Technologies, Pax Global Technology, Roche, Samsung Fire & Marine Insurance, Swatch, Unilever

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(December 17, 2009) | |

EAFE Choice Fund Class 2* | | | 31.28 | % | | | 9.38 | % | | | 8.94 | % | |

MSCI EAFE Index | | | 25.62 | % | | | 8.39 | % | | | 6.98 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 31.37% for Class 3, 15.63% for Class K and 15.68% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

04

Management Discussion (unaudited)

Annual Report December 31, 2017

EAFE Pure Fund

Market Conditions and Review of Performance during 2017

The past year once again demonstrated our belief that it is very difficult to predict short term market outcomes, and therefore not worthwhile trying to do so. As we reflect on 2017 and look forward to the future we continue to focus on the individual companies and the long term investment opportunities they present in international equity markets. This is not always an easy endeavour but we think it remains a very worthwhile one and one that will become increasingly so as the world changes around us at an ever faster rate. For those prepared to think optimistically about the long term it could be argued that there has seldom been a more exciting time, as new technologies enable the creation of new business models and set on course structural growth trends that could play out over decades. From ecommerce to artificial intelligence, electric vehicles to personalised medicine, the prizes for the winners could be vast, and the disruption for the losers catastrophic.

After three years of lacklustre returns, 2017 delivered a more encouraging year in international equity markets. The MSCI EAFE index returned 25.62% for the year as a whole, with returns for the Fund meaningfully ahead of this at 28.59% for class 2 shares.

Your portfolio's performance continues to be driven by stock selection rather than thematic or sector views; exactly as we would expect given our bottom-up stock picking approach to investment. Over the last year this has been particularly notable in the Consumer Staples and Healthcare sectors. Whilst both sectors have lagged behind the broader market at the index level, your holdings have contributed strongly to your portfolio's performance.

A number of technology innovators and enablers contributed favourably to performance over the past year. Continued robust operational delivery from companies such as Australian hearing implant manufacturer Cochlear, SMC — the Japanese factory automation component manufacturer, and Hargreaves Lansdown — the UK online savings platform have been strongly supportive to performance.

Over the year, the main detractors included Japanese manufacturer of bicycle components Shimano, Australian pallet pool operator Brambles, and UK online vehicle retail platform Auto Trader. Shimano has downgraded its

earnings forecasts; we believe that this reflects weakness in the overall bicycle market rather than a loss of share or competitiveness at the company itself. Brambles has seen challenges in its US business, where its main competitor has been pricing more aggressively, and where cheaper 'white wood' pallets have become more prevalent. Auto Trader's weakness reflects some cyclical concerns about the market for both new and used cars following the recent challenges in the diesel market.

The Fund holdings continue to offer exposure to a range of growing consumer franchises across the globe. This includes those such as luxury goods company Richemont, where centuries of history and heritage create a barrier to entry, to those such as online fashion retailer Zalando that are disrupting the established order in industries where an attachment to the past could prove a terminal disadvantage. With structural growth opportunities such as those highlighted above, and worldwide economic indicators looking as encouraging as at any time in recent years, there would appear to be plenty of reason to enter 2018 with an optimistic outlook. We believe that the Fund holds some of the most interesting growth companies across international markets, steered by high quality management teams, and we see the long-term opportunity for growth in these businesses as being undervalued by the short-term market valuations attached to them.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. Bottom-up investing is an investment approach that focuses on the analysis of individual stocks and deemphasizes the significant of economic cycles and market cycles. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyze industry background, competitive advantages, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met. The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made where applicable.

05

Management Discussion (unaudited)

Annual Report December 31, 2017

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

AIA, ASML, Advantest, Sartorius, Softbank, U-Blox

Complete Sales:

Asahi, Imagination Technologies, Roche, Swatch, Unilever

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | Since Inception

% p.a.

(April 15, 2014) | |

EAFE Pure Fund Class 2* | | | 28.59 | % | | | 6.54 | % | |

MSCI EAFE Index | | | 25.62 | % | | | 5.57 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 18.25% for Class 3 return for Class 3 is from inception date of 03/24/2017, 14.39% for Class K, and 14.39% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

06

Management Discussion (unaudited)

Annual Report December 31, 2017

Emerging Markets Fund

Market Conditions and Review of Performance during 2017

We conclude 2017 in a positive vein, happy that the strong operational performance exhibited by many companies in the portfolio has been well rewarded by the market. However, with a weak 2016 still relatively fresh in mind, we remind ourselves that short term volatility is a prerequisite in the pursuit of long term returns in the Emerging Markets Fund, and ask shareholders to continue to judge performance over 3-5 years and beyond, which is the investment horizon of the fund.

The conditions for EM investors have been strong and sentiment to the asset class has significantly improved as a result: relatively stable commodities and EM currencies, combined with a strong global growth tailwind are very appealing conditions for US$ based EM equity investors.

The way we operate remains unchanged. There have been no changes to the investment managers running the fund and no change to our investment beliefs. We continue to seek out companies that we believe can double their earnings over five years and have faith that returns will follow.

Over 2017, the portfolio returned 53.25% for class 5 shares in US$ terms, significantly more than the MSCI EM index, which returned 37.75%. Many technology companies continued to perform well both operationally and in share price terms. Tencent and Alibaba were all amongst the leading lights. Both continue to display operational excellence within their core businesses of gaming and ecommerce, as well as in other 'non-core' operations.

Amongst this year's detractors were a number of stocks where further patience will be required. Cemex continues its slow deleveraging but cement remains a business with a unique attraction; it is heavy, but relatively low cost, making it uneconomic to transport long distances. It therefore lends itself to local and regional monopoly pricing. Magnit, the Russian convenience store retailer, has spent much of the year investing in a total refurbishment of its stores. This has crimped margins and sales in the short term, but should lead to a significant uplift in profitability when completed.

The improved prevailing conditions across Emerging Markets do mean that the number of attractive opportunities across the region has increased, in our view. This has meant that whilst we retain enthusiasm for many

of the structural growth stories in the Fund, the portfolio changes in 2017 have seen some more cyclical growth stocks enter the Fund, such as banks in several countries. We are enthusiastic on the prospects for credit growth in a low inflation and low (and in many countries, falling) interest rate environment.

Hopefully, 2018 will be a quieter year than 2017. This would allow the markets to focus on economic and company fundamentals, rather than the newest sound bite or the latest outbreak of 'fake news'. In terms of the fundamentals, a continued improvement in the global economy would be helpful to the emerging markets asset class and provide a broader range of potential investments. However, whatever the environment, we will continue to scour the emerging markets for the best long-term growth opportunities, wherever we may find them.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse the industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met. The emerging markets investment team is responsible for the overall strategy and stock selection process, led by the most senior investment managers. The team meets regularly to discuss both buy and sell ideas and to determine the level of conviction in the Fund's holdings.

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

Bank Mandiri, Bank Rakyat Indonesia, BM&F Bovespa, China Merchants Bank, CNOOC, Garanti Bankasi, Grupo Financiero Banorte, Kasikorn Bank, Kroton Educacional, Maruti Suzuki, Minth Group, Netmarble Games, Norilsk Nickel, SEA Ltd, Siam Commercial Bank

07

Management Discussion (unaudited)

Annual Report December 31, 2017

Complete Sales:

Axis Bank, China Life Insurance (Taiwan), China Overseas Land, China Pacific Insurance, CTBC Financial Holding Co Ltd, Ctrip.com International, Delta Electronics, Embraer, Fubon Financial Holding Co,

Infosys Ltd, Interpark, Oracle Financial Services, Orion Holdings, POWSZECHNY ZAKLAD UBEZPIECZE, President Chain Store, Samsung SDI Co Ltd, SEA Ltd ADR, X5 Retail Group GDR

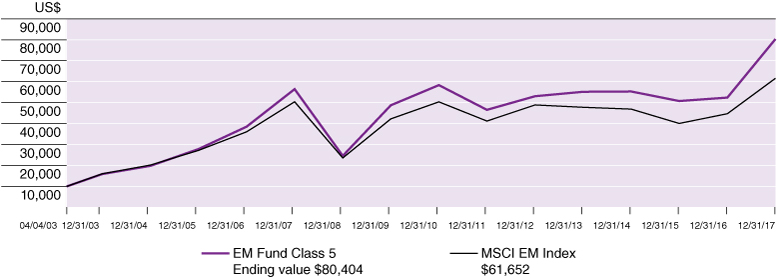

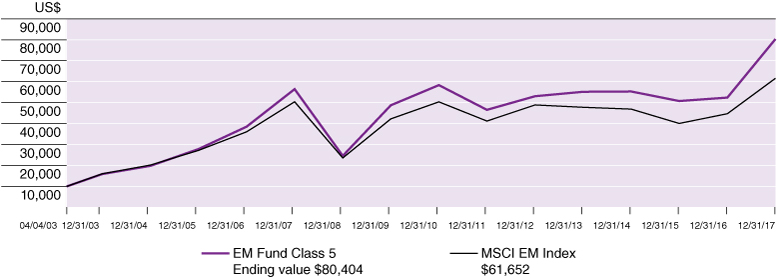

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | % p.a.

Five Year | | % p.a.

Ten Year | | Since Inception

% p.a.

(April 4, 2003) | |

Emerging Markets Fund Class 5* | | | 53.25 | % | | | 8.64 | % | | | 3.59 | % | | | 15.19 | % | |

MSCI Emerging Markets Index | | | 37.75 | % | | | 4.73 | % | | | 2.02 | % | | | 13.13 | % | |

* The returns for Class 5 shares have been provided. Effective January 1, 2015, the share class structure of The Emerging Markets Fund was changed, and shares previously designated as Class III shares were converted to Class 5 shares. The performance information provided in the Fund Summary for Class 5 reflects the performance for Class III for periods prior to January 1, 2015. Class III shares were subject to a higher shareholder service fee than Class 5 shares, and no adjustment has been made to the performance information shown for Class 5 to reflect its different expense structure. One-year return figures for the other share classes are as follows: 53.02% for Class 2, 53.13% for Class 3, 27.57% for Class K and 27.61% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 5 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

08

Management Discussion (unaudited)

Annual Report December 31, 2017

The Global Alpha Equity Fund

Market Conditions and Review of Performance during 2017

Some good things happened in the world during 2017. A quick look at the website for the Brookings Institution (a US-based think tank) lists, among other things, the unprecedented rate at which people entered the global middle class, falling poverty in the US, the extension of the limits of human longevity and an increasing number of countries in the world who have managed to grow their economies, whilst simultaneously reducing their emissions of greenhouse gasses. You may have missed some of these stories. The media seem to have a preference for more arresting headlines focussing on dysfunctional politics, natural disasters, conflicts and a 'little rocket man' with his finger on a nuclear button.

This mood music may have contributed to the sense that the dramatic gains we have seen in global equity markets since their nadir in the aftermath of the global financial crisis, have constituted the most unloved bull market in history. While the MSCI AC World index has returned over 185% (in USD) since the start of 2009, this has seemingly been accompanied by remarkably little enthusiasm. The one area of notable exception, has been in relation to a small number of companies loosely categorised as 'technology stocks'. This group, including companies such as Facebook, Amazon, and Alphabet in the US and Alibaba and Tencent in China, have been responsible for an outsized share of the overall market gains. As bottom-up optimistic investors the operational progress that many of these companies are reporting is not a surprise. Whilst a broadening of the global economic recovery has been supportive, they continue to prosper more by their own endeavours: identifying growth markets, retaining strong competitive positions through differentiated products and services, and maintaining a flexible managerial approach.

In the context of strong relative performance throughout 2017, a number of the portfolio's 'technology stocks' once again saw strong share price gains, most notably Amazon and Naspers. Amazon's latest results show that both e-commerce and Amazon Web Services' sales continue apace, and Alexa (voice activated personal assistant) has expanded its user base by more than 5x over the last year. Furthermore, success in sales of its own brand range of products (Amazon Essentials), the launch of its core ecommerce offering in Australia and promising signs of growth at Whole Foods Market (which it acquired last year) have all supported the share price. Naspers has been selling non-core assets to focus on its most attractive growth opportunities, indeed, 77% of Naspers' revenues is now derived online, up from 11% in 2007. These assets are

often in Emerging Markets where growth is supported by expanding middle classes, for example Naspers holdings in Tencent (China) and Mail.ru (Russia). The former continues to go from strength to strength. Tencent's payment platform (TenPay) more than tripled volumes last year, WeChat (social media) now has more than 900m monthly active users and Tencent's gaming business continues to grow its revenues handsomely.

Of course not everything goes to plan and the Fund's biggest detractors over the period include Apache (oil and gas exploration company) and First Republic Bank (US financial institution). The market has been growing increasingly impatient with Apache's operational performance. Whilst the most recent set of results showed a return to profitability, volumes were down, in part, the consequence of the company's cut in spending across 2016. Looking longer term, we believe Apache possesses an attractive asset base and the company will continue to leverage its advanced drilling techniques to support its return-focused approach. First Republic Bank's (FRB) customer base is predominantly high net worth individuals. Under US tax law, individuals are permitted to deduct mortgage interest payments from their taxable income. President Trump's recent tax legislation reduced the maximum loan amount that could qualify for deductibility to $750k from $1m. The market is now predicting a slowdown in the bank's loan book growth. We maintain enthusiasm for FRB's ability to prudently grow book value over the long term (+16% CAGR since 2010) and maintain its differentiating high-touch service model whilst expanding into new markets out with its Californian homeland.

Given the strong momentum enjoyed by a number of the Fund's holdings over the last year or so, we have continuously re-evaluated our enthusiasm. We have considered the remaining opportunities available to these businesses and ensured that we still retain a sufficiently differentiated view. Where we believe the market has caught up with our assessment, we have reinvested this capital elsewhere. Over the course of 2017, we have reduced the weightings of a number of the Fund's US-exposed cyclical companies. These include Martin Marietta Materials (construction aggregates and cement), Lincoln Electric (welding equipment and consumables), CarMax (second hand autos) and TD Ameritrade (online broking). Some of this capital has been put to work in the Fund's increasing exposure to Emerging Markets. In the past twelve months there were additions to two Indian financial holdings, ICICI Bank and HDFC. We made initial purchases of Banco Bradesco, one of the leading private sector banks in Brazil and 58.com, a Chinese online company that specialises in classified advertising for small businesses and individuals.

Overall, Fund turnover remains low. In the last twelve months it has been 15% on average with annual rate of 27%,

09

Management Discussion (unaudited)

Annual Report December 31, 2017

which implies that we own companies for 6-7 years on average.

We continue to cast the net widely for new ideas, with investment trips to Russia, India, China, Japan, Brazil, Europe and the US punctuating last year's research efforts. We fully expect there to more underappreciated good news stories during 2018. Our task is to continue to build a diverse collection of companies that see ongoing change in the world as an opportunity rather than a challenge.

Investment Strategies used to manage the Fund

We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis

to ensure that our expectations are being met. The Global Alpha investment team is responsible for the overall strategy and stock selection process. They meet regularly as part of a Portfolio Review Group, along with representatives from each of Baillie Gifford's regional investment teams, to discuss both buy and sell ideas and the level of conviction in their continuing holdings.

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys: 58.Com, ABIOMED, Advanced Micro Devices, Advantest, AJ Gallagher & Co, AP Moller Maersk, Banco Bradesco, Infineon Technologies, Pernod Ricard, Persol Holdings, Philips Lighting, Siteone Landscape Supply, Thermo Fisher Scientific,

Complete Sales: Brambles, Carlsberg, Colgate-Palmolive, Ferrari, Intuitive Surgical, Monsanto, Qiagen, Rolls-Royce, TripAdvisor, Wolseley

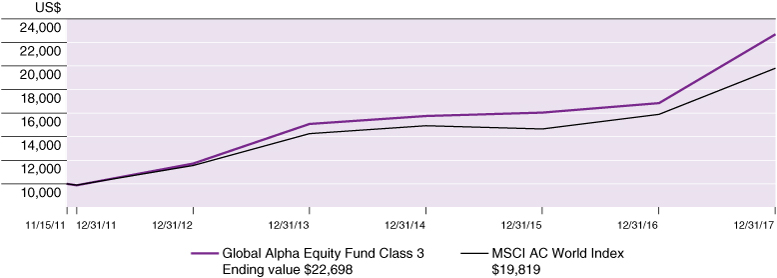

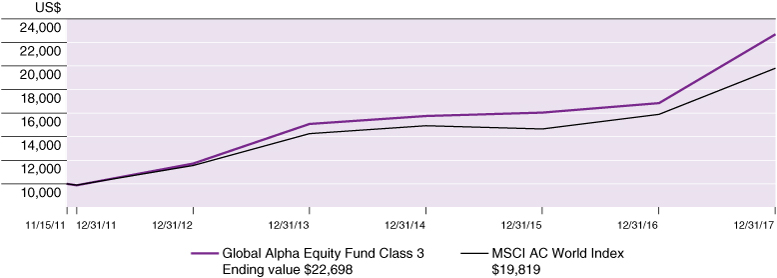

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(November 15, 2011) | |

Global Alpha Equity Fund Class 3* | | | 34.65 | % | | | 14.13 | % | | | 14.32 | % | |

MSCI AC World Index | | | 24.62 | % | | | 11.40 | % | | | 11.81 | % | |

* The returns for Class 3 shares have been provided. One-year return figures for the other share classes are as follows: 34.56% for Class 2, 12.87% for Class 4, return for Class 4 is from inception date of 07/10/2017, 17.97% for Class K, and 18.03% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 3 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

10

Management Discussion (unaudited)

Annual Report December 31, 2017

The International Equity Fund

Market Conditions and Review of Performance during 2017

2017 was an exceptional year for international equity markets. The MSCI ACWI ex U.S. Index rose 27.77%, its strongest performance since 2009, with all regions posting positive returns. Emerging Markets led the way, followed by Europe, Developed Asia, the UK and Canada.

The global economy gained momentum over the year, supported by notable pick ups in investment, trade, and industrial production, coupled with strengthening business and consumer confidence. The period was marked by a revival of the interest rate cycle with tightening from the low rates implemented in the wake of the financial crisis taking place in several markets, including the U.S. and the U.K.. Central banks have been lessening support of liquidity with quantitative easing programs ending or scaling back. Inflation has increased across most of the developed markets, though wage growth generally remains muted, despite tighter labor markets. GDP growth has been positive with Europe, a laggard in recovering from the financial crisis, experiencing an acceleration over the year and Japan continuing to experience strong growth in the wake of the 'Abenomics' stimulus. Despite concerns over geopolitical risks, Emerging Markets also fared well over 2017, outstripping their developed market counterparts in the international indices. In China, higher domestic demand has driven growth and emerging Europe and Russia also gained momentum. In Brazil, strong export performance and a diminished pace of contraction in domestic demand allowed the economy to return to positive growth after a protracted period of decline.

All good news, and the International Equity Fund generated substantial outperformance over the period. However, it is important for future expectations to remain well grounded. In the investment world we have a habit of dividing performance into quarters and years for reporting purposes. In reality, investment is a long game with no distinct finishing line. When researching potential investments for inclusion in the fund, we look out at least five years. It takes time for businesses to execute their long-term plans, to reap the enduring rewards, and for the stock market to recognise this success. Performance should be assessed over a similarly long period, and indeed, the fund has delivered strong

outperformance over three and five years, as it has since inception (February 7, 2008).

The International Equity Fund Class 2 returned 34.96% during 2017, outperforming the MSCI ACWI ex U.S. Index which returned 27.77% for the year.

A number of stocks contributed to this relative outperformance, lead by Naspers, the South African media conglomerate. One of the key challenges for the market remains establishing the value of the diverse investments held within the group beyond its large and listed Tencent (China) stake. To address this, the company focused its December capital markets day on various steps it plans to take to lower the share price discount to Net Asset Value (NAV). The company plans to improve disclosure around the Internal Rates of Return (IRR) it has achieved on investments outside of Tencent. Greater transparency should help investors better value the company's Portfolio of assets and more fully reflect the skill management have demonstrated in allocating capital.

Other contributors to outperformance include MercadoLibre, the South American e-commerce platform with an associated payments business. In order to avert the competitive threat posed by Amazon entering some of their markets, MercadoLibre has introduced a number of initiatives. Free delivery, akin to Amazon Prime, has proven the most successful of these, with the corresponding increase in Gross Merchandise Value (GMV) topping 68% in Brazil and 128% in Mexico year over year. Whilst this rollout has impacted short term margins (much as when Amazon launched Prime) we believe that the investment is a sensible one.

Samsung Electronics, the electronics company, was also among the top contributors to outperformance. Having also performed very well through 2016, on the back of anticipated corporate changes, namely increased pay-outs and share buybacks, a number of earnings reports through 2017 have highlighted rising memory prices and higher content in low and mid-end smartphones.

In terms of stocks which detracted from performance over the year, the Russian food retailer, Magnit, was first amongst these. The company is currently undergoing a new store roll out program in addition to an existing store refurbishment program. Both of these initiatives will be detrimental to near term margins for the benefit of long term margins and profitability. This has been known to us for some time.

Svenska Handelsbanken, the Swedish universal bank, produced strong financial numbers during the fourth

11

Management Discussion (unaudited)

Annual Report December 31, 2017

quarter but the stock has nevertheless been under pressure for much for the past year and detracted from performance. There was little negative news of long term significance, with the 'macro' picture cited as the biggest on-going concern. Swedish house prices are falling and housing starts are rising, which in combination could put pressure on mortgage volumes. Costs are rising as the bank invests more in information technology and in preparation for Brexit, as it transforms its U.K. operation from a branch structure to a subsidiary. We believe that both of these are temporary factors.

Another detractor is Shimano, the Japanese leisure company, which has built an enviable market share position in bicycle components, fishing equipment and related leisure pursuits, but like many stocks, now looks to China as its main growth market. Having grown strongly between 2011 and 2014, the market turned down in subsequent years. The key to further growth relies on higher component share per bicycle and the higher value of those components as new cycling enthusiasts trade up. With 70% share of the world market, we still believe Shimano is best positioned to exploit this opportunity.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above that of the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We

meet the management of companies within our investment universe and revisit the investment case for the portfolio's holdings on a regular basis to ensure that our expectations are being met.

The ACWI ex US Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long-term prospects for the Fund's holdings and make changes where appropriate.

Trading over the period:

The new buys and complete sales for International Equity Fund during 2017, in alphabetical order are as follows:

New Buys:

Boohoo

Discovery

Grifols

Credit Suisse Group

Kingspan Group

Kroton Educacional

Complete sales:

LafargeHolcim

MS&AD Insurance

Tullow Oil

Volvo

Yandex

12

Management Discussion (unaudited)

Annual Report December 31, 2017

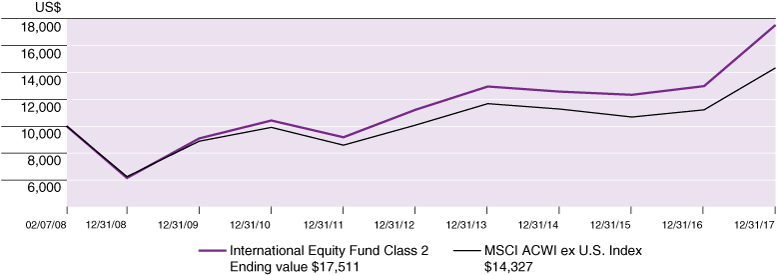

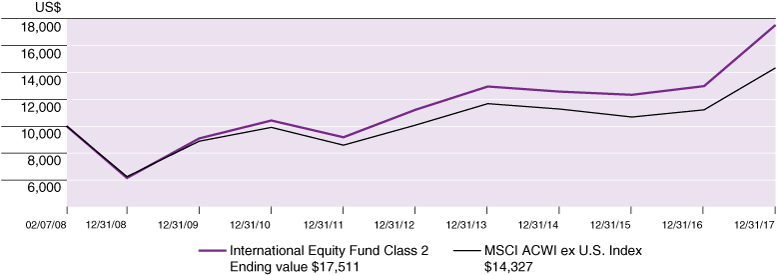

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(February 7, 2008) | |

International Equity Fund Class 2* | | | 34.96 | % | | | 9.29 | % | | | 5.82 | % | |

MSCI ACWI Ex U.S. Index | | | 27.77 | % | | | 7.29 | % | | | 3.70 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 35.05% for Class 3, 12.60% for Class 4, return for Class 4 is from inception date of 07/10/2017, 35.16% for Class 5, 18.19% for Class K and 18.25% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

13

Management Discussion (unaudited)

Annual Report December 31, 2017

The Long Term Global Growth Equity Fund

Market Conditions and Review of Performance during 2017

The operational performance of the portfolio has been remarkably strong over the past 12 months. While headlines during the year raised the spectre of nuclear war with North Korea, the return of the far-right in Germany's parliament and the ongoing uncertainty of Brexit (to cite just a few), we have endeavoured to ignore short-term market noise and focus instead on the long-term business fundamentals and opportunities for the holdings in the Fund.

Tencent and Alibaba were among the key positive contributors to performance. Tencent continues to impress and the most recent set of results has seen revenue growth accelerate to over 60% year on year. While games continue to account for around half of total sales, the company's ubiquitous WeChat social messaging platform (the largest of its kind in China) is also expanding its functionality, extending from chat to service use, to payments, and — most recently — to gaming. With so much on offer, this is an example of a large innovative company growing by broadening its scope into new areas.

Alibaba too is accomplishing the feat of generating accelerating revenue growth from an already high base: its most recent results report total revenues growing at over 60% year on year, and interestingly international ecommerce revenues (albeit relatively small) growing at 115%. 'Singles' Day' lived up to its reputation as the world's biggest 24 hour shopping bonanza. But while e-commerce remains the dominant top-line driver, Alibaba is also expanding into other areas: for instance, revenue growth of its cloud computing services is growing at nearly 100% year on year.

Among the key detractors from performance over the 12 month period, Under Armour's share price suffered last year following slowing sales growth in its domestic US market. Underlying these numbers is a shift away from wholesale customers and an increase in direct-to-consumer sales, which should be a long-term positive for the brand. We met with founder and CEO, Kevin Plank, and we were impressed with how receptive he was to our constructive feedback. Whilst we still admire the strength of the brand that he helped to cultivate through differentiated technical sports products and an astute recruitment of sporting talent, we think there is scope for

improvement in several areas, including board composition. As the largest outside shareholder of the company we can, and should, help Under Armour to address these areas through a combination of support and pressure for evolution. International sales, though only just over 1/5th of total sales continue to grow strongly at 35% year on year. We added on weakness in Q2 2017.

Also among the key detractors was Inditex, whose share price fell approximately 10% in 2017. The stronger Euro impacted the company's international revenues and profits. Nevertheless, its most recent results report sales growth at a group level of around 11% year on year, and positive across all geographies, with net income rising by 6%. Inditex now operates over 7,500 stores in 94 markets and continues to expand the regions covered by its online platform — notably launching Zara online in India in October 2017, and Singapore, Malaysia, Thailand and Vietnam earlier in the year. Zara accounts for about two-thirds of total sales with Oysho, Uterque, Bershka and Pull&Bear also performing strongly last year.

As ever, our focus remains on finding and holding companies that can appreciate five-fold over the next five or so years; this is a high bar, but we aim to own a small number of exceptional growth companies. Global equity markets continue to reach new highs, but generally operational performance among their constituents remains weak — as illustrated by the MSCI ACWI delivering 24.62% performance in 2017 while the compound annual revenue growth of its constituents has stagnated over the past five years. In contrast, the Fund continues to experience strong share price performance (the LTGG Fund Class 2 NAV performance was 54.07% in 2017), but which is outpaced by the strong aggregate operational performance of its holdings. In this environment, our role as stock-pickers therefore remains as relevant as ever in order to identify the small number of companies with the most compelling operational performance and opportunities for long-term growth.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the

14

Management Discussion (unaudited)

Annual Report December 31, 2017

investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The Long Term Global Growth team is responsible for the overall strategy and stock selection process. They interact regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long-term prospects for the Fund's holdings and make changes where appropriate.

Trading over the period:

Our new buy and complete sale decisions, which are a result of our bottom-up stock research, are listed below:

New Buys: ASML, NetEase

Complete Sales: Splunk, TripAdvisor

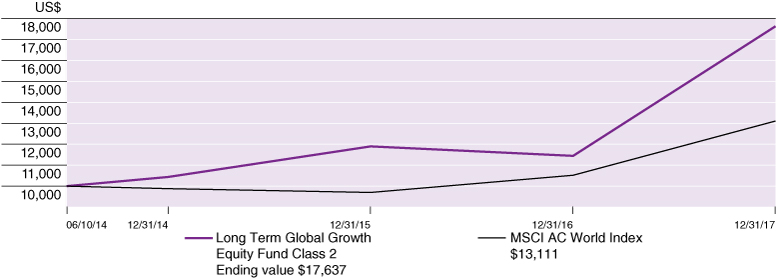

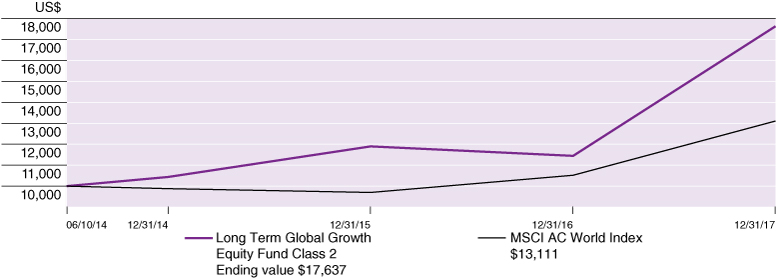

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | Since Inception

% p.a.

(June 10, 2014) | |

Long Term Global Growth Equity Fund Class 2* | | | 54.07 | % | | | 17.28 | % | |

MSCI AC World Index | | | 24.62 | % | | | 7.91 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 54.22% for Class 4, 24.21% for Class K, and 24.21% for Institutional Class, returns for Class K and Institutional Class are from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

15

Management Discussion (unaudited)

Annual Report December 31, 2017

The U.S. Equity Growth Fund

Market Conditions and Review of Performance during 2017

2017 was a year of firsts: the first year of President Trump; the first time the Dow Jones industrial average rose 5,000 points in a year in its 121 year history. 2017 witnessed the most radical reform to U.S. tax legislation for a generation; and the first time since 2004 that annualised U.S. GDP figures were above 3% for consecutive quarters. Yet it was also the first time in 60 years that the Doomsday Clock was reset to 2 minutes, 30 seconds to midnight reflecting the ominous developments in North Korea's nuclear weapon capabilities, and the President's responses through twitter diplomacy, "fire and fury" statements and eventual UN-backed sanctions. And it was the year that saw the first country announce that it was pulling out of the Paris climate change agreement (the U.S.). Dramatic though this backdrop undoubtedly is, as stock-pickers we focus on the progression of a few exceptional businesses which are often disrupting their markets, creating new industries and changing the way we consume, or improving our chances of living longer, healthier lives.

2017 marked the first full year of investment returns for Baillie Gifford's U.S. Equity Growth Fund. We launched the U.S. Equity Growth Fund because we believe the U.S. equity market to be one of the most attractive asset classes for growth investors. The U.S. economy grew at a decent rate in 2017, unemployment is low and there are few signs of inflation which allows the Federal Reserve to gradually raise interest rates and withdraw stimulus. Most importantly from a stock market perspective, company level revenue and earnings growth have been strong which has contributed to healthy returns for investors. The Fund's K class share returned 34.75%, significantly outperforming the S&P 500 index return of 21.83%. While we are quietly pleased with this level of performance, it is still a short term performance number and must be viewed in the context of our five year investment horizon.

We construct the Fund's portfolio on a 'bottom-up' basis. As a result the majority of performance was driven by stock selection. Two of the top performing holdings in the Fund in 2017 were innovative ecommerce platforms: Amazon and Grubhub. Amazon, the internet platform and cloud computing behemoth, continued to grow its revenues in its major business segments: ecommerce, Prime membership and Amazon Web Services. And the

company continues with its high-investment, low-profit strategy. Amazon's $13.7bn acquisition of healthy grocery store chain, Whole Foods, in August, was seen by many in the market as a significant strategic move that could have far reaching consequences for other grocery companies, retailers, food delivery companies and even restaurant chains. Furthermore, developments such as Amazon Echo, Amazon's smart speaker product with its virtual assistant Alexa, offer exciting new avenues of growth with tens of thousands of developers now integrating Alexa into their products.

Grubhub, the online food ordering company, saw its share price appreciate particularly strongly. The main drivers for this were some key acquisitions of rival food ordering companies, such as Eat24, Foodler and OrderUp, and the announcement of a strategic long-term partnership with Yelp, the online crowd-sourced review app and booking service, which should be beneficial for both companies. Following these acquisitions, Grubhub now has access to over 75,000 restaurants in the U.S. and is four times larger than the next biggest online food delivery platform. We believe Grubhub is both benefiting from, and helping to direct, the secular shift in food consumption behaviours in America.

Holdings in the Healthcare sector contributed to outperformance. We've invested in a number of innovative health care businesses who are at the leading edge of data-driven, machine learning and/or therapeutic research which offers reduced costs, earlier diagnosis and significantly improved outcomes for patients. One notable contributor to performance this year was Alnylam Pharmaceuticals. It announced positive results for the Phase 3 trial of Patisiran, an RNA inhibitor (RNAi) treatment which effectively 'silences' a disease-causing gene in a rare debilitating genetic disease. The trial results demonstrated the best-case scenario in terms of both efficacy and safety. The results are exciting because they potentially herald a new era of highly targeted and specific interventions in genetic diseases.

Two of the main detractors to the Fund's performance were the sports apparel company, Under Armour, and the San Francisco-based bank, First Republic. Under Armour faced significant headwinds during the year, and its share price suffered as a result. Bankruptcies in several sportswear chains in 2016 led to an excess of inventory, which in turn led to a significant discounting of products. As a result, it released disappointing 2016 earnings data. The company's fortunes didn't improve during the year: it struggled in its traditional market, North America, with its sports apparel seemingly off-trend as rivals took

16

Management Discussion (unaudited)

Annual Report December 31, 2017

market share; October saw its first quarterly sales decline since it became a public company in 2005. While the opportunity in the footwear market and international expansion offer growth opportunities for Under Armour, we are watching it closely to see how it progresses.

First Republic Bank underperformed. The market reacted negatively to its announcement that it wasn't earning as much money from loans as anticipated and that expenses were higher than expected. We view the market's reaction as overly short term: compression in the net interest margin was largely due to increased deposit costs, which management view as a one-off adjustment to catch up with the interest rates being offered at other banks; the higher than expected expense growth was driven by investments in new initiatives (such as the student loan business, which we expect to drive faster growth in the long term) and higher technology spending.

One other notable detractor was online travel site, TripAdvisor. The investment case for TripAdvisor was based on the network effect of the community of reviewers creating strong content which would attract other travellers. The company has been trying to change its business model so that more users book directly through its site, however this transition has encountered several difficulties exacerbated by more users engaging via mobile devices. With strong competitors in the shape of Priceline and Expedia, we became increasingly worried that the costs of driving such user changes will keep margins significantly lower for longer. We think growth rates going forward are unlikely to match those achieved historically therefore decided to sell the holding at the end of 2017.

Over the past year we have invested in a wide range of innovative growth companies which meet our requirements of possessing a differentiated culture and

sustainable competitive advantage while at the same time addressing a large growth opportunity.

Investment strategies used to manage the fund

The Fund seeks to meet its objective by identifying the exceptional growth businesses and owning them for long enough that the advantages of their business models and cultural strengths become the dominant drivers of their stock prices. Our long-term time horizon allows us to capture the disproportionate impact of successful investments, harnessing the asymmetry of returns inherent in equity markets.

In our terms, an exceptional growth business has a special culture, addresses a large market opportunity and possesses an edge that will allow it to deliver high future returns. Such opportunities are rare. The Fund is concentrated as we do not want to dilute the impact of exceptional companies in the name of diversification.

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

Activision Blizzard, Denali Therapeutics, Glaukos Corp, HEICO, New Relic, Redfin, Shopify, Stitch Fix

Complete Sales:

Bristol Myers Squibb, Brown-Forman, CarMax, Chipotle Mexican Grill, Harley-Davidson, M&T Bank, O'Reilly Automotive, TripAdvisor

17

Management Discussion (unaudited)

Annual Report December 31, 2017

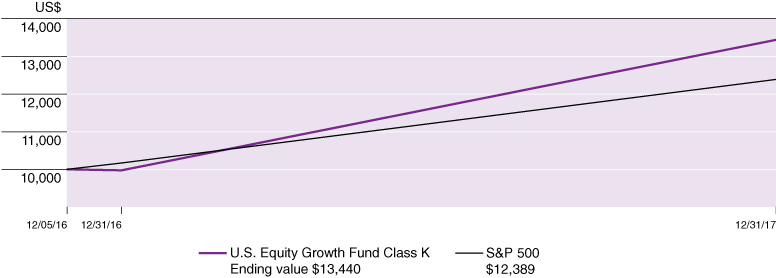

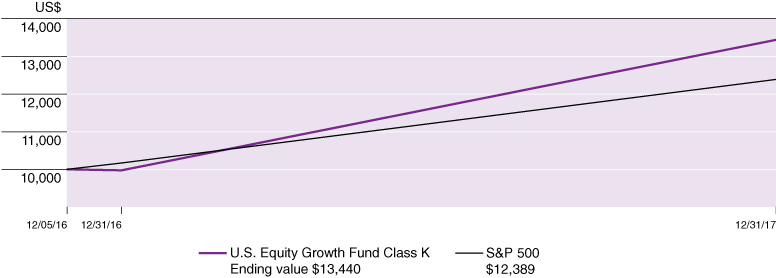

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | Since Inception

% p.a.

(December 5, 2016) | |

U.S. Equity Growth Fund Class K* | | | 34.75 | % | | | 31.79 | % | |

S&P 500 | | | 21.83 | % | | | 22.26 | % | |

* The returns for Class K shares have been provided. The inception date for The U.S. Equity Growth Fund is December 5, 2016, when Baillie Gifford International, LLC purchased Class 1 shares. Classes 1-5 of The U.S. Equity Growth Fund were terminated effective May 1, 2017, and Class 1 was converted to Class K. For the purposes of the total return data and other data reflected in the Fund's management discussion, the Fund has used December 5, 2016 as its inception date for Class K. One-year return figures for the other share classes are as follows: 17.01% for Institutional Class, return for Institutional Class is from Class inception date 04/28/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class K share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

18

Management Discussion (unaudited)

Annual Report December 31, 2017

International Choice Fund

Market Conditions and Review of Performance during 2017

The past year once again demonstrated our belief that it is very difficult to predict short term market outcomes, and therefore not worthwhile trying to do so. As we reflect on 2017 and look forward to the future we continue to focus on the individual companies and the long term investment opportunities they present in international equity markets. This is not always an easy endeavour but we think it remains a very worthwhile one and one that will become increasingly so as the world changes around us at an ever faster rate. For those prepared to think optimistically about the long term it could be argued that there has seldom been a more exciting time, as new technologies enable the creation of new business models and set on course structural growth trends that could play out over decades. From ecommerce to artificial intelligence, electric vehicles to personalised medicine, the prizes for the winners could be vast, and the disruption for the losers catastrophic.

After three years of lacklustre returns, 2017 delivered a more encouraging year in international equity markets. The MSCI ACWI ex US index returned 27.77% for the year, with returns for the Fund meaningfully ahead of this at 31.45% for class 2 shares.

Your portfolio's performance continues to be driven by stock selection rather than thematic or sector views; exactly as we would expect given our bottom-up stock picking approach to investment. Over the last year this has been particularly notable in the Consumer Staples and Healthcare sectors. Whilst both sectors have lagged behind the broader market at the index level, your holdings have contributed strongly to your portfolio's performance.

A number of technology innovators and enablers contributed favourably to performance over the past year. Continued robust operational delivery from companies such as Australian hearing implant manufacturer Cochlear, SMC — the Japanese factory automation component manufacturer, and Hargreaves Lansdown — the UK online savings platform have been strongly supportive to performance.

Over the year, the main detractors included Japanese manufacturer of bicycle components Shimano, Australian pallet pool operator Brambles, and UK online vehicle retail platform Auto Trader. Shimano has downgraded its

earnings forecasts; we believe that this reflects weakness in the overall bicycle market rather than a loss of share or competitiveness at the company itself. Brambles has seen challenges in its US business, where its main competitor has been pricing more aggressively, and where cheaper 'white wood' pallets have become more prevalent. Auto Trader's weakness reflects some cyclical concerns about the market for both new and used cars following the recent challenges in the diesel market.

The Fund holdings continue to offer exposure to a range of growing consumer franchises across the globe. This includes those such as luxury goods company Richemont, where centuries of history and heritage create a barrier to entry, to those such as online fashion retailer Zalando that are disrupting the established order in industries where an attachment to the past could prove a terminal disadvantage. With structural growth opportunities such as those highlighted above, and worldwide economic indicators looking as encouraging as at any time in recent years, there would appear to be plenty of reason to enter 2018 with an optimistic outlook. We believe that the Fund holds some of the most interesting growth companies across international markets, steered by high quality management teams, and we see the long-term opportunity for growth in these businesses as being undervalued by the short-term market valuations attached to them.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. Bottom-up investing is an investment approach that focuses on the analysis of individual stocks and deemphasizes the significant of economic cycles and market cycles. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyze industry background, competitive advantages, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met. The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made where applicable.

19

Management Discussion (unaudited)

Annual Report December 31, 2017

Trading over the period

Our new buy and complete sale decisions, which are a result of our bottom up stock research are listed below:

New Buys:

AIA, ASML, Advantest, Asian Paints, Fairfax, HDFC, Magnit, MakeMyTrip, Naver, Raia Drogasil, Sartorius, Shopify, Softbank, U-Blox

Complete Sales:

Asahi, Imagination Technologies, Pax Global Technology, Roche, Swatch, Unilever

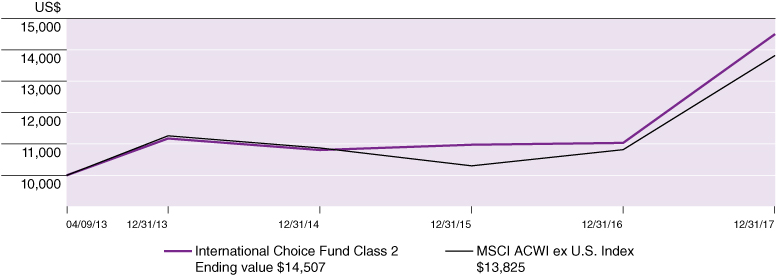

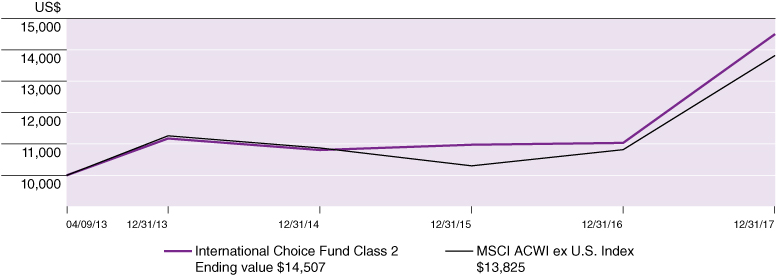

Fund Performance for the periods ended 12/31/17 (Average Annual Total Returns)

| | | One Year | | Since Inception

% p.a.

(April 9, 2013) | |

International Choice Fund Class 2* | | | 31.45 | % | | | 8.20 | % | |

MSCI ACWI ex U.S. Index | | | 27.77 | % | | | 7.78 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 31.54% for Class 3 and 19.56% for Class 4, return for Class 4 is from inception date of 04/03/2017. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 Investment in the Fund's Class 2 share and the index.

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

20

Fund Expenses (unaudited)

Annual Report December 31, 2017

As a shareholder of the Baillie Gifford EAFE Fund, the Baillie Gifford EAFE Choice Fund, the Baillie Gifford EAFE Pure Fund, the Baillie Gifford Emerging Markets Fund, the Baillie Gifford Global Alpha Equity Fund, the Baillie Gifford Global Select Equity Fund, the Baillie Gifford International Concentrated Growth Fund, the Baillie Gifford International Equity Fund, the Baillie Gifford Long Term Global Growth Equity Fund, the Baillie Gifford Positive Change Equity Fund, the Baillie Gifford U.S. Equity Growth Fund and the Baillie Gifford International Choice Fund (together, the "Funds") you incur ongoing costs, including management fees, shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in the other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2017 to December 31, 2017.

Actual Expenses

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes