UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10145 |

|

Baillie Gifford Funds |

(Exact name of registrant as specified in charter) |

|

1 Greenside Row

Edinburgh, Scotland, UK, | |

EH1 3AN

|

(Address of principal executive offices) | | (Zip code) |

|

Gareth Griffiths

1 Greenside Row

Edinburgh, Scotland, UK, EH1 3AN |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 011-44-131-275-2000 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

BAILLIE GIFFORD FUNDS

International Equity Fund

EAFE Fund

EAFE Choice Fund

EAFE Pure Fund

Emerging Markets Fund

Global Alpha Equity Fund

Long Term Global Growth Equity Fund

International Choice Fund

Annual Report

December 31, 2015

Index

Page Number | | | |

| | 01 | | | Management Discussion | |

| | 17 | | | Fund Expenses | |

| | | International Equity Fund | |

| | 21 | | | Industry Diversification Table | |

| | 23 | | | Portfolio of Investments | |

| | 28 | | | Statement of Assets and Liabilities | |

| | 29 | | | Statement of Operations | |

| | 30 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 32 | | | Selected Data for Class 2 | |

| | 33 | | | Selected Data for Class 3 | |

| | 34 | | | Selected Data for Class 5 | |

| | | EAFE Fund | |

| | 35 | | | Industry Diversification Table | |

| | 36 | | | Portfolio of Investments | |

| | 40 | | | Statement of Assets and Liabilities | |

| | 41 | | | Statement of Operations | |

| | 42 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 44 | | | Selected Data for Class 2 | |

| | 45 | | | Selected Data for Class 3 | |

| | 46 | | | Selected Data for Class 4 | |

| | 47 | | | Selected Data for Class 5 | |

| | | EAFE Choice Fund | |

| | 48 | | | Industry Diversification Table | |

| | 50 | | | Portfolio of Investments | |

| | 54 | | | Statement of Assets and Liabilities | |

| | 55 | | | Statement of Operations | |

| | 56 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 57 | | | Selected Data for Class 1 | |

| | 58 | | | Selected Data for Class 2 | |

| | 59 | | | Selected Data for Class 3 | |

| | | EAFE Pure Fund | |

| | 60 | | | Industry Diversification Table | |

| | 61 | | | Portfolio of Investments | |

| | 64 | | | Statement of Assets and Liabilities | |

| | 65 | | | Statement of Operations | |

| | 66 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 67 | | | Selected Data for Class 2 | |

| | | Emerging Markets Fund | |

| | 68 | | | Industry Diversification Table | |

| | 70 | | | Portfolio of Investments | |

| | 74 | | | Statement of Assets and Liabilities | |

| | 75 | | | Statement of Operations | |

| | 76 | | | Statements of Changes in Net Assets | |

Page Number | | | |

| | | Financial Highlights | |

| | 77 | | | Selected Data for Class 2 | |

| | 78 | | | Selected Data for Class 4 | |

| | 79 | | | Selected Data for Class 5 | |

| | | Global Alpha Equity Fund | |

| | 80 | | | Industry Diversification Table | |

| | 82 | | | Portfolio of Investments | |

| | 87 | | | Statement of Assets and Liabilities | |

| | 88 | | | Statement of Operations | |

| | 89 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 90 | | | Selected Data for Class 2 | |

| | 91 | | | Selected Data for Class 3 | |

| | | Long Term Global Growth Equity Fund | |

| | 92 | | | Industry Diversification Table | |

| | 93 | | | Portfolio of Investments | |

| | 95 | | | Statement of Assets and Liabilities | |

| | 96 | | | Statement of Operations | |

| | 97 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 98 | | | Selected Data for Class 1 | |

| | 99 | | | Selected Data for Class 2 | |

| | 100 | | | Selected Data for Class 4 | |

| | | International Choice Fund | |

| | 101 | | | Industry Diversification Table | |

| | 103 | | | Portfolio of Investments | |

| | 107 | | | Statement of Assets and Liabilities | |

| | 108 | | | Statement of Operations | |

| | 109 | | | Statements of Changes in Net Assets | |

| | | Financial Highlights | |

| | 110 | | | Selected Data for Class 1 | |

| | 111 | | | Selected Data for Class 2 | |

| | 112 | | | Selected Data for Class 3 | |

| | 113 | | | Notes to Financial Statements | |

| | 139 | | | Report of Independent Registered Public Accounting Firm | |

| | | Supplemental Information | |

| | 140 | | | Federal Income Tax Information | |

| | 141 | | | Management of the Trust | |

| | 143 | | | Board Considerations Regarding 2015 Contract Renewal | |

Management Discussion (unaudited)

Annual Report December 31, 2015

International Equity Fund

Market Conditions and Review of Performance during 2015

During 2015, markets were fairly volatile, and the MSCI ACWI ex U.S. Index fell 5.25%. Much of the headlines were dominated by newsflow surrounding growth prospects for the Chinese economy and those emerging markets that depend on it, falling oil and commodity prices and rate rises in the U.S. While markets inevitably move on such news, our mentality during turbulent periods is to remember that the long-term value of equities is rarely altered by single events, and that the markets tend to overreact to headlines. We focus instead on company fundamentals, and often view market volatility as an inefficiency to exploit by adding to companies that may have been unfairly punished in share price terms.

The International Equity Fund Class 2 returned -1.89% during 2015, outperforming the MSCI ACWI ex U.S. Index which returned -5.25% for the year.

A number of diversified financial holdings contributed to this relative outperformance, including the exchanges Japan Exchange Group, Hong Kong Exchanges and Clearing and Deutsche Boerse (European exchange operator) who benefitted from increased trading volumes as a result of market volatility. Amlin (UK insurer) and Hargreaves Lansdown (UK on-line retail investing platform) were also among the top performers. Elsewhere, Ryanair (European low cost airline), which now offers passengers flights between a greater number of primary airports and a friendlier approach, has been a fairly consistent contributor throughout the year.

The low oil price had an effect on relative performance with Tullow Oil (oil exploration and production company) and Seadrill (offshore drilling company) among the significant detractors for the year. Rio Tinto (low cost iron-ore producer) also detracted, seeing weakness in their shares due to falling commodity prices. In this tough environment, success in the sector comes down to balance sheet strength, cost flexibility and embedding lifting costs. We continue to believe that Rio Tinto is well positioned in this regard. Bitauto (Chinese online car distributor) was also among the top detractors. This was held for an unusually short period of less than a year. It has shifted its business model from

purely online to a mixture of online and offline (leasing vehicles, car insurance and financing). This is more capital intensive than pure online advertising and has seen cash flow and our expectations for future profitability deteriorate quite rapidly.

We continue to find exciting investment opportunities for the portfolio. For example, we have taken holdings in Alibaba (Chinese e-commerce giant), Constellation Software (holding company of niche software businesses), Sumitomo Mitsui Trust Holdings (Japanese independent trust bank) and Nidec (Japanese manufacturer of specialist small motors). The Fund comprises a diverse range of companies, but we remain focussed on those that have durable competitive advantages, good management, and strong financial characteristics.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above that of the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The ACWI ex U.S. Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long-term prospects for the Fund's holdings and make changes where appropriate.

Outlook

As stock pickers, our focus, as always, remains on company fundamentals. The Portfolio Construction Group will continue to work hard on monitoring the investment case for existing holdings, and look out for new long-term growth opportunities for the Fund.

01

Management Discussion (unaudited)

Annual Report December 31, 2015

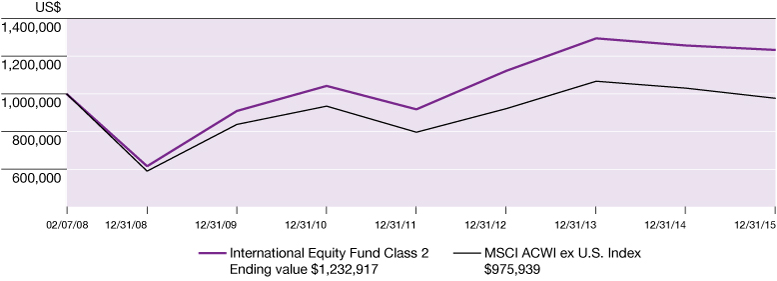

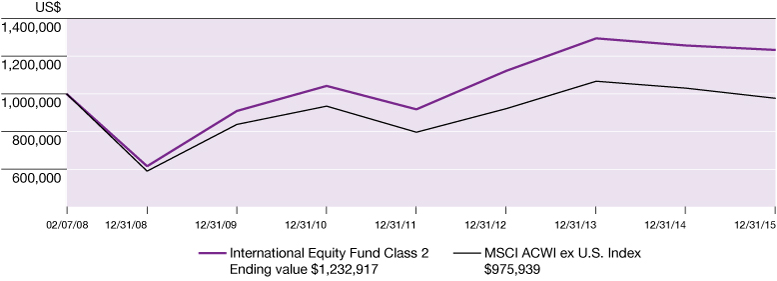

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(February 7, 2008) | |

The International Equity Fund Class 2* | | | -1.89 | % | | | 3.42 | % | | | 2.68 | % | |

MSCI ACWI Ex U.S. Index | | | -5.25 | % | | | 1.51 | % | | | 0.83 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: -1.82% for Class 3 and -1.75% for Class 5. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

02

Management Discussion (unaudited)

Annual Report December 31, 2015

The EAFE Fund

Market Conditions and Review of performance during 2015

2015 was a volatile year for international equities. Early enthusiasm, following additional stimulus from the European Central Bank, turned to fear as Greece's stand-off with its creditors led to an unsatisfactory last ditch solution. Market sentiment was then further shaken following the release of weak Chinese growth data (in spite of the fact that this had been widely forecast), and a rout set in when the Chinese government introduced a series of well intended, but poorly conceived, policy measures. That international markets largely recovered from these falls has been less newsworthy, but it reminds us of the importance of patience when investing over the long term.

The EAFE Fund Class 2 produced a return of -3.07% during 2015, underperforming the MSCI EAFE Index which returned -0.39%.

The Fund's exposure to bank stocks hurt performance. In Europe, Banco Popular, Banco Santander, and Svenska Handelsbanken suffered under the weight of increased regulatory oversight, higher capital requirements and muted loan growth. Likewise Standard Chartered and Credicorp, the emerging markets focussed banks, were weak as the macro backdrop in their geographies deteriorated. Industrial holdings also detracted as falling commodity prices and lower investment impacted broader industry trends. For example, Rolls Royce, the UK engineering company, was impacted by lower offshore oil and gas activity and reduced defence spending; however, we remain optimistic about the long-term growth potential of its civil aerospace division where Rolls Royce enjoys a duopoly position in a structural growth market. For Volkswagen (the German car manufacturer) the challenge was more company specific, and we sold the Fund's holding following the emissions scandal.

Moving to the contributors, companies such as Tencent (Chinese internet company), Zalando (online fashion retailer), and, within its niche, New Oriental Education & Technology (Chinese education provider) are driving the transition towards internet based commerce. Zalando was only founded in 2008 but has already achieved annual sales of €3bn. Healthcare holdings, such as Celltrion (Korean biopharmaceutical company), Christian Hansen (Danish enzyme specialist),

M3 (Japanese online medical portal), and Genmab, also appreciated strongly. Genmab, which is focused on developing humanised antibodies to treat cancer, was strong following FDA approval for one of its new drugs.

Two of the most prominent investment themes within the Fund are the vital force of technological change and the growing importance of emerging market consumers, the new holding in Ctrip embodies both of these themes. Ctrip, China's largest online travel company, has a highly scalable business model and a huge market opportunity, furthermore we believe that recent consolidation in the sector should lead to improved margins. Staying with technology, the demand for ever more powerful (and mobile) computers is a tailwind for companies with specialist skills within the semiconductor industry, and the Fund took new positions in AMS and Dialogue Semiconductor. AMS makes analogue semiconductors which act as the interface between the digital and the real world, enabling digital devices to sense and regulate the real world in a growing range of devices. Separately we anticipated that Dialog Semiconductor will benefit from increasing demand for its power management chips, which help to extend the battery life in ever more powerful mobile devices. New holdings were funded by sales in a range of companies where we felt that the future growth prospects were not similarly impressive, examples being Heidelberg Cement, Meggitt, Porsche, and Mail.ru.

Investment Strategies used to manage the Fund

The investment strategy remains unchanged. The investment managers follow a growth strategy with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The EAFE Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction in their continuing holdings.

03

Management Discussion (unaudited)

Annual Report December 31, 2015

Outlook

The New Year will no doubt herald many new events about which the media, and investors generally, will obsess. As we saw in 2015, noisy headlines are generally a distraction in the search for long duration growth trends. On a recent investment visit to China, amidst the blaring western headlines of Chinese weakness undermining global growth, we found management teams talking of growth and the myriad of opportunities driven by the scale of the market, immature infrastructure and the pace of mobile development. Offline goods and

services are being cannibalised by the move online in both developing and developed economies. This research has reinforced our positive views on the social networks and e-commerce innovators the Fund's invest in on your behalf such as Baidu, Alibaba, Tencent, Zalando and Kinnevik, and we remain as excited as ever by the potential rate and duration of growth for these businesses, despite inevitable short-term fears. Similarly, there is little doubt that healthcare will look very different in five to ten years' time, such is the acceleration of our understanding of human biology. It is hard to overstate the potential benefits to society should new medical technologies deliver on their potential.

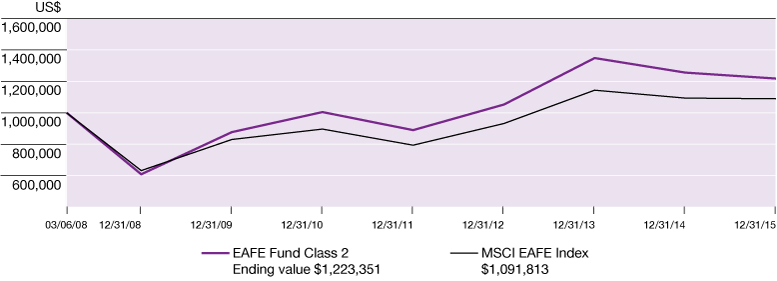

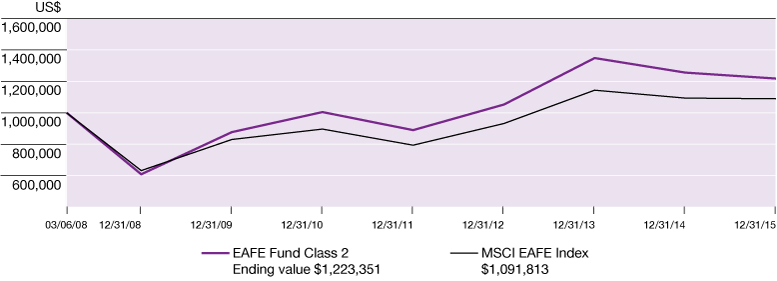

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | Five Year | | Since Inception

% p.a.% p.a.

(March 6, 2008) | |

The EAFE Fund Class 2* | | | -3.07 | % | | | 4.00 | % | | | 2.63 | % | |

MSCI EAFE Index | | | -0.39 | % | | | 4.07 | % | | | 1.19 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: -3.02% for Class 3, -2.99% for Class 4 and -2.94% for Class 5. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

04

Management Discussion (unaudited)

Annual Report December 31, 2015

The EAFE Choice Fund

Market Conditions and Review of performance during 2015

On the face of it, 2015 was a lacklustre year for international markets. The oil price continued its decline, but it was not alone; during December, most major commodities reached their lowest price levels since the Global Financial Crisis. Other significant events which punctuated the year included the Greek debt crisis, volatility in Chinese stock markets, escalating tensions in the Middle East and the devastating terrorist attack in Paris. It was pleasing, therefore, to end the year on a more positive note. By initiating the first interest rate rise for almost a decade, the Federal Reserve exhibited some confidence that there may be more stable economic times ahead. However, whilst individual macro events can, undoubtedly, have an impact on short term investment performance, predicting such events is a fruitless endeavour. Rather than attempting to do so, the International Focus Team is dedicated to identifying high quality growth businesses, run by trustworthy management, trading at attractive valuations. Twelve months is far too short a time period to assess the merits of this approach, but maintaining faith in this established investment philosophy will, we believe, offer the best opportunity for attractive long-term returns.

The EAFE Choice Fund Class 2 produced a return of 2.16% during 2015, outperforming the benchmark which returned -0.39% for the year.

The UK market finished the year in negative territory (weighed down by the troubles of the energy sector) but that did not stop two domestically focussed, UK-listed names being the Fund's top performers during the period. Buoyed by rising house prices, particularly in London, Rightmove, the online real estate portal enjoyed a stellar year. Despite the best efforts of its competitors, the company maintains a dominant position, enjoying an 80% market share. The management team, led by CEO and co-founder Nick McKittrick, has demonstrated a sensible long-term approach, implementing gradual price increases and broadening the company's range of services. Whilst retaining sufficient capital to enable continued R&D investment, the company has a good record of returning excess cash to shareholders. Having started in 2007, Rightmove has bought back over one third of its shares in issuance.

The other UK-listed business amongst the top performers was Hargreaves Lansdown. The leading domestic online financial services platform saw strong inflows during the year, partly as a result of government

initiatives announced in 2014 and 2015. The reforms enable greater tax free savings and increased flexibility regarding pension assets. With the baby boomer generation reaching retirement age, Hargreaves Lansdown is well placed to continue to benefit from favourable structural demographics. At more than three times the size of its nearest competitor, the company's scale should help to ensure that it can continue to generate strong revenues despite the sector facing increasing pressure over fees.

Another strong contributor to performance during the year was Danish pharmaceutical business, Novo Nordisk. The world leader in the treatment of diabetes, the company employs over 40,000 people throughout 75 countries. Novo Nordisk has a long history of heavy investment in R&D and it received positive news flow around its new insulin drug, Tresiba. Having been approved by the FDA, the product is expected to be launched during the first quarter of 2016. The longer-term opportunity also looks bright for Novo Nordisk, with only about 6% of the diabetic population currently receiving effective care.

Emerging markets endured a challenging year and, within the fund, this was most clearly manifested in the weakness of banking stocks Standard Chartered, United Overseas Bank (UOB) and Garanti Bankasi. The former has a strong presence in commercial and trade related finance throughout Asia and Africa which may present long-term growth opportunities. However, a series of challenging events including regulatory fines, management change and capital raising prompted us to reconsider the holding. Whilst the new management team have established what appears to be a credible restructuring process, we fear that there will be more pain before the benefits are reaped. We also sold Garanti Bankasi as the political and economic situation in Turkey has rather engulfed the original investment case. We remain more positive about the growth prospects for Singaporean bank, UOB and see the expanding wealth management business as an important driver of future returns.

Johnson Matthey is one of the largest suppliers of environmental catalysts used in the manufacturing of automobiles. Supported by significant changes in environmental legislation, the long term investment case for Johnson Matthey looks attractive. However, during 2015 the share price was weak due to the uncertainty surrounding the Volkswagen emissions scandal. Around half of the cars in Europe are diesel and this is an important market for Johnson Matthey. The ramifications of the emissions fraud are yet to become clear; the bull case for Johnson Matthey is that tighter controls create an increased demand for more sophisticated products.

05

Management Discussion (unaudited)

Annual Report December 31, 2015

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyse industry background, competitive advantage, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made, where applicable.

Outlook

There are a number of uncertainties on the horizon as we enter 2016: fluctuating oil prices, the transitioning Chinese economy, instability in the Middle East and rising interest rates. However, while the individual nature of these opportunities and threats may be slightly different from previous years, our approach to managing the Fund remains unchanged. Our focus continues to be the discovery of exciting growth companies, based on a consistent investment process and fundamental analysis. The fortunes of companies can change markedly in the short term, often based on the irrational behaviour of the market. However, identifying companies with growing franchise business run by sensible, aligned management teams will give us every chance of generating outperformance over the long-term. The Fund represents an eclectic mix of business and we already have an exciting list of potential new ideas for the year ahead. Indeed, this is an excellent time for long-term stock pickers.

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | % p.a.

Five Year | | Since Inception

% p.a.

(December 17, 2009) | |

The EAFE Choice Fund Class 2* | | | 2.16 | % | | | 4.78 | % | | | 7.03 | % | |

MSCI EAFE Index | | | -0.39 | % | | | 4.07 | % | | | 5.08 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for the other share classes are as follows: 2.10% for Class 1 and 2.25% for Class 3. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

06

Management Discussion (unaudited)

Annual Report December 31, 2015

The EAFE Pure Fund

Market Conditions and Review of performance during 2015

On the face of it, 2015 was a lacklustre year for international markets. The oil price continued its decline, but it was not alone; during December, most major commodities reached their lowest price levels since the Global Financial Crisis. Other significant events which punctuated the year included the Greek debt crisis, volatility in Chinese stock markets, escalating tensions in the Middle East and the devastating terrorist attack in Paris. It was pleasing, therefore, to end the year on a more positive note. By initiating the first interest rate rise for almost a decade, the Federal Reserve exhibited some confidence that there may be more stable economic times ahead. However, whilst individual macro events can, undoubtedly, have an impact on short term investment performance, predicting such events is a fruitless endeavour. Rather than attempting to do so, the International Focus Team is dedicated to identifying high quality growth businesses, run by trustworthy management, trading at attractive valuations. Twelve months is far too short a time period to assess the merits of this approach, but maintaining faith in this established investment philosophy will, we believe, offer the best opportunity for attractive long-term returns.

The EAFE Pure Fund Class 2 produced a return of 4.61% during 2015, outperforming the benchmark which returned -0.39% for the year.

The UK market finished the year in negative territory (weighed down by the troubles of the energy sector) but that did not stop two domestically focussed, UK-listed names being the Fund's top performers during the period. Buoyed by rising house prices, particularly in London, Rightmove, the online real estate portal enjoyed a stellar year. Despite the best efforts of its competitors, the company maintains a dominant position, enjoying an 80% market share. The management team, led by CEO and co-founder Nick McKittrick, has demonstrated a sensible long-term approach, implementing gradual price increases and broadening the company's range of services. Whilst retaining sufficient capital to enable continued R&D investment, the company has a good record of returning excess cash to shareholders. Having started in 2007, Rightmove has bought back over one third of its shares in issuance.

The other UK-listed business amongst the top performers was Hargreaves Lansdown. The leading domestic online financial services platform saw strong

inflows during the year, partly as a result of government initiatives announced in 2014 and 2015. The reforms enable greater tax free savings and increased flexibility regarding pension assets. With the baby boomer generation reaching retirement age, Hargreaves Lansdown is well placed to continue to benefit from favourable structural demographics. At more than three times the size of its nearest competitor, the company's scale should help to ensure that it can continue to generate strong revenues despite the sector facing increasing pressure over fees.

Another strong contributor to performance during the year was Danish pharmaceutical business, Novo Nordisk. The world leader in the treatment of diabetes, the company employs over 40,000 people throughout 75 countries. Novo Nordisk has a long history of heavy investment in R&D and it received positive news flow around its new insulin drug, Tresiba. Having been approved by the FDA, the product is expected to be launched during the first quarter of 2016. The longer term opportunity also looks bright for Novo Nordisk, with only about 6% of the diabetic population currently receiving effective care.

Although not held directly, emerging markets endured a challenging year and, within the Fund, this was most clearly manifested in the weakness of banking stocks Standard Chartered and United Overseas Bank. The former has a strong presence in commercial and trade related finance throughout Asia and Africa which may present long-term growth opportunities. However, a series of challenging events including regulatory fines, management change and capital raising prompted us to reconsider the holding. Whilst the new management team have established what appears to be a credible restructuring process, we fear that there will be more pain before the benefits are reaped. We remain more positive about the growth prospects for Singaporean bank, UOB and see the expanding wealth management business as an important driver of future returns.

Johnson Matthey is one of the largest suppliers of environmental catalysts used in the manufacturing of automobiles. Supported by significant changes in environmental legislation, the long term investment case for Johnson Matthey looks attractive. However, during 2015 the share price was weak due to the uncertainty surrounding the Volkswagen emissions scandal. Around about half of the cars in Europe are diesel and this is an important market for Johnson Matthey. The ramifications of the emissions fraud are yet to become clear; the bull case for Johnson Matthey is that tighter controls create an increased demand for more sophisticated products.

07

Management Discussion (unaudited)

Annual Report December 31, 2015

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyse industry background, competitive advantage, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made, where applicable.

Outlook

There are a number of uncertainties as we enter 2016: fluctuating oil prices, the transitioning Chinese economy, instability in the Middle East and rising interest rates. However, while the individual nature of these opportunities and threats may be slightly different from previous years, our approach to managing the Fund remains unchanged. Our focus continues to be the discovery of exciting growth companies, based on a consistent investment process and fundamental analysis. The fortunes of companies can change markedly in the short term, often based on the irrational behaviour of the market. However, identifying companies with growing franchise business run by sensible, aligned management teams will give us every chance of generating outperformance over the long term. The Fund represents an eclectic mix of business and we already have an exciting list of potential new ideas for the year ahead. Indeed, this is an excellent time for long-term stock pickers.

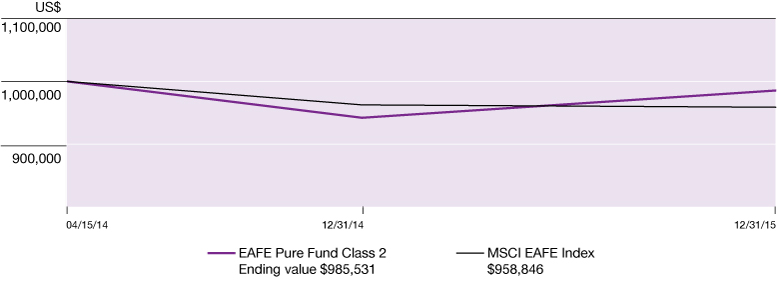

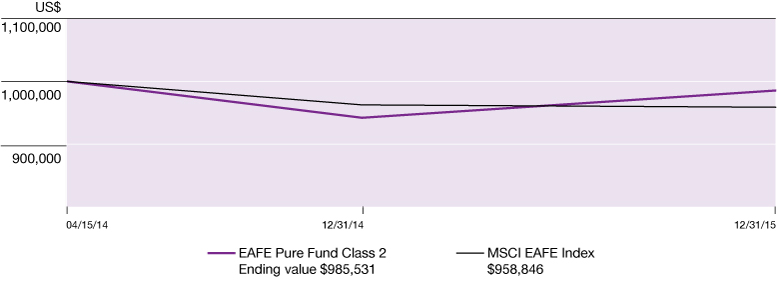

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | Since Inception

% p.a.

(April 15, 2015) | |

The EAFE Pure Fund Class 2* | | | 4.61 | % | | | -0.82 | % | |

MSCI EAFE Index | | | -0.39 | % | | | -2.42 | % | |

* The returns for Class 2 shares have been provided.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

08

Management Discussion (unaudited)

Annual Report December 31, 2015

The Emerging Markets Fund

Market Conditions and Review of Performance during 2015

It has been a forgettable year for emerging markets (EM) with the MSCI EM Index down over 14% in U.S. dollar terms. It would be easy in a year dominated by substantial swings in markets and sensationalist headlines to believe that much has changed within the emerging markets universe: evaporating growth, rampant China fears, collapsing commodity prices and currency sell-offs, have all dominated the scaremongering. However, there is little here that is really new.

The problems associated with falling commodity prices and U.S. dollar debt in a number of the larger EM economies, chief amongst them Brazil, Russia and South Africa, are well known. Economic growth has been scarce therefore, and the currencies of these countries have been extremely weak against the U.S. dollar over the last 12 months.

India's economic outlook has undoubtedly been given a helping hand by the collapse in oil prices, on account of the country being a large net importer. The narrowing of the current account deficit and the decline in inflation has allowed the Reserve Bank of India to cut interest rates, but the scope for further policy stimulus remains substantial. Whilst many political reforms have stalled during the year, there has been incremental progress, especially in the financial sector.

In China, the macroeconomic picture is unfolding much as we had expected. The industrial north is in recession while the consumption and services sectors continue to enjoy decent growth. The scope for policy stimulus is still substantial, with cuts to benchmark lending rates being made during the year, as well as to the banks' reserve requirement ratios. Over the past 12 months, there has been plenty of coverage of volatility in the A-share market, the so-called 'devaluation' of the renminbi and the slowdown in headline GDP. What matters far more than the size of China's GDP, is its shape. Beijing's efforts to rebalance the economy away from the investment-led model of recent decades, towards a more consumption-oriented approach, appears to be on track.

The Emerging Markets Fund Class 5 shares fell by 8.24% during 2015, outperforming the MSCI Emerging Markets Index which fell by 14.60%.

Dragon Oil, the Turkmenistan oil exploration and production business, was the top performance contributor over 2015. The company had been subject to a number of

failed takeover bids, but was eventually bought by the Emirates National Oil Company in August. The final bid of 800p per share followed pressure from Baillie Gifford and another investor on ENOC to raise its offer. The cash that was received by the fund as a result of the takeover was redeployed into a number of new holdings.

China was the top country contributor and a range of holdings displayed strong share price performance, including the internet businesses, Tencent and JD.com, property developer, China Vanke and telecoms equipment maker, ZTE Corp. Though the Chinese market has been volatile, we are encouraged by the operational performance at a number of companies, particularly the internet businesses. Tencent for example, is displaying rapid growth in revenues (3Q15, 34%) and operating profits (3Q15, 37%), and is reinvesting meaningfully in its future growth as it builds out its robust ecosystem further.

The markets in Brazil, Greece and South Africa were weak during the year and the underweight positions in each of these countries has helped performance. Brazil has had a particularly troubled time, mired by political scandal and the economy is shrinking in U.S. dollar terms, whilst unemployment is rising and debt levels are spiralling.

The Fund's underweight position in Russia detracted from performance as the stock market did better in 2015 than many of its EM counterparts. From our perspective, we still believe that the macro environment looks troubled. Inflation is running at 15.5% and nominal wage growth fell to a historic low of just 4.5% in October; Russia's recession rumbles on.

Also amongst the detractors was Mexico as Cemex detracted from performance. A strong U.S. market failed to offset weakness in Latin America. Nonetheless, the company continues to restructure, disposing of non-core assets and paying down debt; patience will be required for the benefits of this streamlining to take effect and for stabilisation in markets such as Colombia.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse the industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for

09

Management Discussion (unaudited)

Annual Report December 31, 2015

the Fund's holdings on a regular basis to ensure that our expectations are being met.

The emerging markets investment team is responsible for the overall strategy and stock selection process, led by the most senior investment managers. The team meets regularly to discuss both buy and sell ideas and to determine the level of conviction in the Fund's holdings.

Outlook

The investment environment is clearly dynamic, but our long term investment approach has not changed. As ever, for Baillie Gifford it's about company fundamentals first and foremost. We look forward to the years ahead in the knowledge that for stock pickers, the divergence in fortunes across emerging markets makes this a fascinating time. For some individual stock-specific

winners, we think it is quite possible that the growth opportunity may be far larger than anything EM investors have seen before, with the gap between the winners and the losers likely to be far more profound.

Commodity producing countries and companies continue to be hamstrung by weak demand and over-supply, yet have still to reach the crisis levels that may make renewed long term investment attractive. Even if companies are managing to grow in local currency terms, hard currency returns remain elusive.

This is a time of great disruption in emerging markets as the mobile internet blows away the inefficient and underdeveloped 'bricks and mortar' infrastructure in retail, media, gaming, travel, finance and a host of other areas. Never has it been more important to have active management in these stock markets to pick the 'new' winners and discard the 'old' losers: the index is not a safe place to hide.

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | % p.a.

Five Year | | % p.a.

Ten Year | | Since Inception

% p.a.

(April 4, 2003) | |

The Emerging Markets

Fund Class 5 | | | -8.24 | % | | | -2.75 | % | | | 6.19 | % | | | 13.61 | % | |

MSCI Emerging Markets Index | | | -14.60 | % | | | -4.47 | % | | | 3.94 | % | | | 11.51 | % | |

* Returns for Class 5 shares have been provided. Class III shares were converted into Class 5 shares effective January 1, 2015. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 5 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares

10

Management Discussion (unaudited)

Annual Report December 31, 2015

The Global Alpha Equity Fund

Market Conditions and Review of Performance during 2015

Global Markets were once again volatile over the year, with the MSCI All Country World Index falling 1.84% over the period. However, the Global Alpha Equity Fund Class 3 outperformed the index over the twelve months, returning 1.84%.

As we review the financial headlines, it's clear that three events have dominated the animal spirits of the markets. The first was the widely anticipated and much discussed rise in U.S. interest rates. The 0.25% increase in December marks the end of an extraordinary period of government intervention in financial markets. For us, such 'normalisation' of monetary policy is a positive sign that the patient is coming off life support.

The second event driving sentiment has been weakness in oil and other commodity markets which saw Brent crude fall to approximately $40/barrel. This has had a particularly egregious effect on those emerging market countries whose economies are largely centred on commodity exports.

Finally, slowing GDP growth and a depreciating currency in China affected markets around the world. We strongly believe that the reorientation of the economy away from fixed asset investment to consumption and services is a sensible strategy, a view somewhat validated by the IMF's decision in November to include the renminbi in its benchmark 'Special Drawing Rights' currency basket.

In contrast to a tightening of monetary policy in the U.S., the European Central Bank decided to extend its quantitative easing programme by an extra six months. This policy divergence with the U.S. is driven by a fear of the eurozone slipping into a spiral of deflation that would threaten a recovery in household spending and, perhaps more importantly, push back business investment.

As we would expect, the majority of performance of the Fund was driven by stock selection. Amongst the top performers were Amazon, Royal Caribbean Cruises, Alphabet (Google) and Ryanair. Amazon (ecommerce) was the top performing stock as it saw rapid growth in Prime membership and in its cloud computing business, Amazon Web Services (AWS). AWS has 20% market share of the cloud computing industry, and with 25% operating margins now accounts for over 50% of group operating profits. Alphabet, which is the new name for Google Inc, also had a good year, with strong growth in

mobile search being particularly pleasing. Six of Googles products (Search, Android, Play, Maps, Chrome and YouTube) now have over 1bn users each. We continue to strongly believe in the growth opportunities that these internet platforms present. Their ability to invest heavily in auxiliary services and revenues helps to cement their competitive positions and we think that there is increasing evidence that many parts of the internet will prove to be 'winner takes all' markets. Another strong contributor was Royal Caribbean Cruises (cruise ship operator). The company is benefitting from resurgent demand, disciplined capacity growth and lower unit costs supported by a softening fuel price. Ryanair, the budget airline, is another positive beneficiary of a low oil price. However, a revamped website, increased routes and greater use of hub airports have had a much more significant impact by boosting the growth in passenger numbers.

The two largest stock detractors were Ultra Petroleum (oil and gas exploration & production) and Harley-Davidson (heavy motorbikes). Continuing weakness in energy markets has inevitably weighed on the Ultra Petroleum share price. Although production levels have been higher and costs lower than expected, the company's total net debt levels remain high. Harley-Davidson announced disappointing numbers with a decline in total sales and a drop in its share of the U.S. motorbike market to about 50%. The company is struggling to compete against European and Japanese motorbike producers which have used currency weakness to aggressively price their bikes in the US market. Harley also announced a number of product recalls, costing the company around $30m.

Being long-term investors, portfolio turnover remains low and so changes from one year to the next tend not to be dramatic.

Over the past year we have continued to sell companies where we think the outlook is uninspiring — these have included Arcos Dorados (McDonald's franchisee in Latin America), Tokyo Electron (semiconductor equipment manufacturer) and Jyske Bank (Danish retail bank). We have also sold holdings where valuations now look stretched. For example Roche (pharmaceuticals) and Bunzl (UK based supplier of consumables).

We have tended to re-invest the proceeds in young companies that demonstrate disruptive innovation and that pose a threat to mature incumbents. In this regard, we took a holding in Zillow (online real estate portal), Grubhub (the leading U.S. online food takeaway platform), Alnylam Pharmaceuticals (early stage biotech company) and Autohome, (a Chinese auto website that is feeding off a rapidly growing primary market for cars). As stated above, we believe that the U.S. economy is on

11

Management Discussion (unaudited)

Annual Report December 31, 2015

the road to recovery and we're trying to get more exposure to domestic beneficiaries of this rebound. This led to the purchase of CH Robinson, a third party logistics provider that should benefit both from a cyclical recovery in volumes but also secular growth in the shipping broker market.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The Global Alpha investment team is responsible for the overall strategy and stock selection process. They meet regularly as part of a Portfolio Review Group, along with representatives from each of Baillie Gifford's regional investment teams, to discuss both buy and sell ideas and the level of conviction in their continuing holdings.

Outlook

As we enter 2016, we are encouraged by the number of possible investment opportunities competing for entry into the Fund. Markets inevitably will remain volatile but our job is to look through such short-term noise and identify those businesses that can sustainably grow their cash flows and earnings at above market rates. This focus on long-term fundamentals and an ever-expanding opportunity set leaves us confident that we can continue to deliver strong performance for our clients going forward.

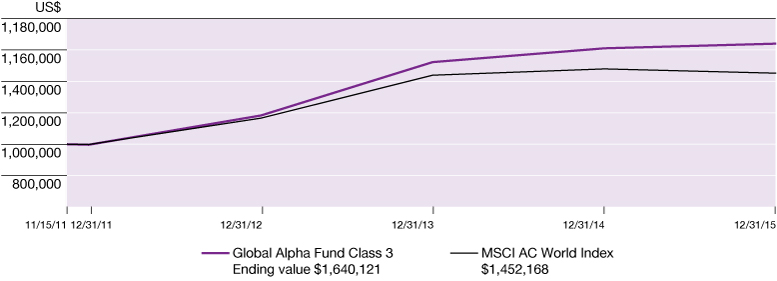

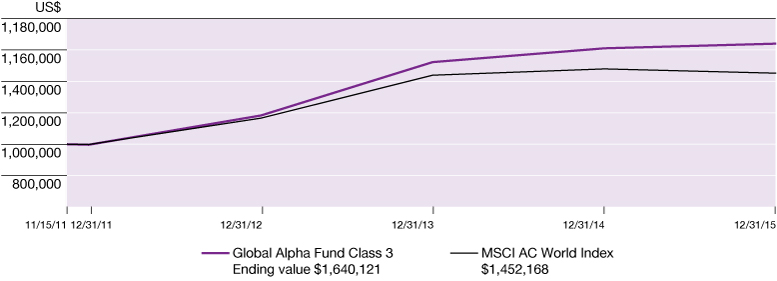

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | Since Inception

% p.a.

(November 15, 2011) | |

The Global Alpha Fund Class 3* | | | 1.84 | % | | | 12.15 | % | |

MSCI AC World Index | | | -1.84 | % | | | 9.71 | % | |

* The returns for Class 3 shares have been provided. One-year return figures for the other share classes are as follows: 1.75% for Class 2. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 3 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

12

Management Discussion (unaudited)

Annual Report December 31, 2015

The Long Term Global Growth Equity Fund

Market Conditions and Review of Performance during 2015

As long-term investors, we focus on companies and their prospects over five to ten years so we typically place more emphasis on performance attribution over much longer periods than the inception date of this fund currently allows. Nevertheless, the Long Term Global Growth Equity Fund Class 2 returned 11.79% p.a. since the Fund's inception on 10th June 2014, whereas the MSCI All Country World Index returned -1.95% p.a. over the period.

Amazon was a strong contributor to performance, driven not only by the impressive growth of their e-commerce platform, but also by the size of the Fund's position which reflects our high level of conviction in both the management team and the scope for substantial further growth. Amazon's addressable market is expanding into media content and new categories within its physical ecommerce offering. Meanwhile, the technology powering Amazon's business gets better and cheaper every year and AWS, Amazon's hosted computing platform, offers another very large long-term opportunity for the company.

The shares of Chinese online travel agency Ctrip also performed strongly on the news that the company is teaming up with Qunar, its closest competitor. This has left Ctrip with a near-monopoly in China's online travel market. The company grew its top line at 45% during the 2015. With only 5% of the Chinese population holding a passport, we anticipate very strong long term growth.

Tencent's strong share price reflected strong operational progress. The company's WeChat messaging platform is underpinning an increasingly wide range of applications and the growing use of the platform for online payments is particularly striking.

Meanwhile, Baidu, the Chinese search engine, detracted from performance. The stock market seems concerned about the company's continued determination to invest for the future but we are very supportive of this strategy. Baidu has successfully managed the transition from desktop to mobile and the long term opportunity is broadening out as a result of the company's investments in online mapping and a range of local services. We are also monitoring the company's longer term aspirations in artificial intelligence and driverless cars and this remains a large position in the portfolio.

The Fund's holding in Stratasys, the 3D printing company was very weak over the period. The opportunity for the company's technology to transform a range of industries such as health care and high end manufacturing remains very large but the market is increasingly concerned about weak sales and the company's competitive advantage. We share many of these concerns and we are also looking at the company's corporate culture carefully following a merger with an Israeli competitor.

Although we expect stock market performance to remain volatile in the coming months, we remain confident in the prospects for substantial growth in our holdings over the longer term.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The Long Term Global Growth team is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long-term prospects for the Fund's holdings and make changes where appropriate.

Outlook

For some time now, we have believed that rapid technological progress will underpin substantial long-term change in a range of industries. The Fund now has several holdings that reflect this view. For example, at the very end of 2014 we made an initial investment in Lending Club which is using the internet to transform financial services. The company disintermediates consumer lending, which is a $3 trillion market in the US alone. The central premise behind Lending Club's business model is that it is possible to separate the two core elements of a traditional bank (operations and capital) and provide both more efficiently, allowing it to

13

Management Discussion (unaudited)

Annual Report December 31, 2015

run a profitable business on narrower spreads and provide better terms for savers and lenders.

Similarly we believe the incumbents within healthcare are at risk, with the traditional 'big pharma' business model depending on finding, protecting and marketing effective formulations on a mass, rather than a personalised basis. As we now have a greater knowledge of the genetic basis of diseases, thanks to genome sequencing, treatment regimes have evolved and their effectiveness is now based on fact rather than serendipity. The advances made in sequencing and understanding the genome have enabled companies such as Ionis Pharmaceuticals and Bluebird Bio, Inc both added to your Fund this year, to develop cures for previously untreatable rare diseases.

In general, share prices were strong for much of the period. We are looking again at prospects for some of the companies and their potential to grow to many multiples of their current size over the next five to ten years. We continue to see substantial upside from here as most of the holdings in the Fund are still in the early stages of driving change in large addressable markets. Encouragingly, the management teams of these companies remain committed to investing for the long term, even if this depresses short-term earnings. We believe that this is the right approach and is in sharp contrast to many benchmark incumbents who are focused on maximising near-term earnings, even though many of them look vulnerable on a ten year view.

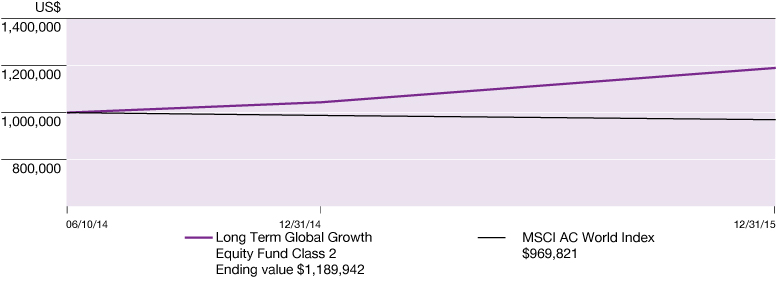

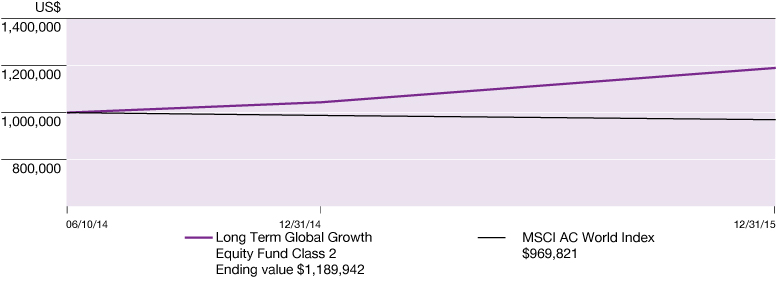

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | Since Inception

% p.a.

June 10, 2014 | |

The LTGG Equity Fund Class 2* | | | 13.99 | % | | | 11.79 | % | |

MSCI AC World Index | | | -1.84 | % | | | -1.95 | % | |

* The returns for Class 2 shares have been provided. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

14

Management Discussion (unaudited)

Annual Report December 31, 2015

The International Choice Fund

Market Conditions and Review of Performance during 2015

On the face of it, 2015 was a lacklustre year for international markets. The oil price continued its decline, but it was not alone; during December, most major commodities reached their lowest price levels since the Global Financial Crisis. Other significant events which punctuated the year included the Greek debt crisis, volatility in Chinese stock markets, escalating tensions in the Middle East and the devastating terrorist attack in Paris. It was pleasing, therefore, to end the year on a more positive note. By initiating the first interest rate rise for almost a decade, the Federal Reserve exhibited some confidence that there may be more stable economic times ahead. However, whilst individual macro events can, undoubtedly, have an impact on short-term investment performance, predicting such events is a fruitless endeavour. Rather than attempting to do so, the International Focus Team is dedicated to identifying high quality growth businesses, run by trustworthy management, trading at attractive valuations. Twelve months is far too short a time period to assess the merits of this approach, but maintaining faith in this established investment philosophy will, we believe, offer the best opportunity for attractive long-term returns.

The International Choice Fund Class 2 produced a return of 1.56% during 2015, outperforming the benchmark which returned -5.25% for the year.

The UK market finished the year in negative territory (weighed down by the troubles of the energy sector) but that did not stop two domestically focussed, UK-listed names being the Fund's top performers during the period. Buoyed by rising house prices, particularly in London, Rightmove, the online real estate portal enjoyed a stellar year. Despite the best efforts of its competitors, the company maintains a dominant position, enjoying an 80% market share. The management team, led by CEO and co-founder Nick McKittrick, has demonstrated a sensible long-term approach, implementing gradual price increases and broadening the company's range of services. Whilst retaining sufficient capital to enable continued R&D investment, the company has a good record of returning excess cash to shareholders. Having started in 2007, Rightmove has bought back over one third of its shares in issuance.

The other UK-listed business amongst the top performers was Hargreaves Lansdown. The leading domestic online financial services platform saw strong

inflows during the year, partly as a result of government initiatives announced in 2014 and 2015. The reforms enable greater tax free savings and increased flexibility regarding pension assets. With the baby boomer generation reaching retirement age, Hargreaves Lansdown is well placed to continue to benefit from favourable structural demographics. At more than three times the size of its nearest competitor, the company's scale should help to ensure that it can continue to generate strong revenues despite the sector facing increasing pressure over fees.

Another strong contributor to performance during the year was Danish pharmaceutical business, Novo Nordisk. The world leader in the treatment of diabetes, the company employs over 40,000 people throughout 75 countries. Novo Nordisk has a long history of heavy investment in R&D and it received positive news flow around its new insulin drug, Tresiba. Having been approved by the FDA, the product is expected to be launched during the first quarter of 2016. The longer-term opportunity also looks bright for Novo Nordisk, with only about 6% of the diabetic population currently receiving effective care.

Emerging markets endured a challenging year and, within the fund, this was most clearly manifested in the weakness of banking stocks, Standard Chartered, United Overseas Bank (UOB) and Garanti Bankasi. The former has a strong presence in commercial and trade related finance throughout Asia and Africa which may present long-term growth opportunities. However, a series of challenging events including regulatory fines, management change and capital raising prompted us to reconsider the holding. Whilst the new management team have established what appears to be a credible restructuring process, we fear that there will be more pain before the benefits are reaped. We also sold Garanti Bankasi as the political and economic situation in Turkey has rather engulfed the original investment case. We remain more positive about the growth prospects for Singaporean bank, UOB and see the expanding wealth management business as an important driver of future returns.

Johnson Matthey is one of the largest suppliers of environmental catalysts used in the manufacturing of automobiles. Supported by significant changes in environmental legislation, the long-term investment case for Johnson Matthey looks attractive. However, during 2015 the share price was weak due to the uncertainty surrounding the Volkswagen emissions scandal. Around half of the cars in Europe are diesel and this is an important market for Johnson Matthey. The ramifications of the emissions fraud are yet to become clear; the bull case for Johnson Matthey is that tighter controls create an increased demand for more sophisticated products.

15

Management Discussion (unaudited)

Annual Report December 31, 2015

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyse industry background, competitive advantage, management capabilities, financial strength and valuation. From the outset, we also consider aspects which may derail the investment case and revisit the thesis for the Fund's holdings on a regular basis to ensure that our expectations are being met.

The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. It meets regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. Ongoing monitoring of the long-term prospects for the Fund's holdings enables appropriate changes to be made, where applicable.

Outlook

There are a number of uncertainties on the horizon as we enter 2016: fluctuating oil prices, the transitioning Chinese economy, instability in the Middle East and rising interest rates. However, while the individual nature of these opportunities and threats may be slightly different from previous years, our approach to managing the Fund remains unchanged. Our focus continues to be the discovery of exciting growth companies, based on a consistent investment process and fundamental analysis. The fortunes of companies can change markedly in the short term, often based on the irrational behaviour of the market. However, identifying companies with growing franchise business run by sensible, aligned management teams will give us every chance of generating outperformance over the long term. The Fund represents an eclectic mix of business and we already have an exciting list of potential new ideas for the year ahead. Indeed, this is an excellent time for long term stock pickers.

Fund Performance for periods ended 12/31/15 (Average Annual Total Returns)

| | One Year | | Since Inception

% p.a.

April 9, 2013 | |

The International Choice Fund Class 2* | | | 1.56 | % | | | 3.49 | % | |

MSCI ACWI ex U.S. Index | | | -5.25 | % | | | 1.10 | % | |

* The returns for Class 2 shares have been provided. One-year return figures for other share classes are as follows: 1.48% for Class 1 and 1.63% for Class 3. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $1,000,000 investment in the Fund's Class 2 shares and the Index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares..

16

Fund Expenses (unaudited)

Annual Report December 31, 2015

As a shareholder of the Baillie Gifford International Equity Fund, the Baillie Gifford EAFE Fund, the Baillie Gifford EAFE Choice Fund, the Baillie Gifford EAFE Pure Fund, the Baillie Gifford Emerging Markets Fund, the Baillie Gifford Global Alpha Equity Fund, the Baillie Gifford Long Term Global Growth Equity Fund and the Baillie Gifford International Choice Fund (together, the "Funds") you incur two types of costs: (1) transaction costs, which may include purchase fees and redemption fees and (2) ongoing costs, including management fees, shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in the other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2015 to December 31, 2015.

Actual Expenses

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as purchase fees and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

17

Fund Expenses (unaudited)

Annual Report December 31, 2015

| | | Beginning

Account Value

7/01/15 | | Ending

Account

Value

12/31/15 | | Annualized

Expense Ratios

Based on the Period

7/01/15 to 12/31/15 | | Expenses Paid

During Period | |

Baillie Gifford International Equity Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 924.20 | | | | 0.61 | % | | $ | 2.96 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.13 | | | | 0.61 | % | | $ | 3.11 | | |

Baillie Gifford International Equity Fund — Class 3 | |

Actual | | $ | 1,000 | | | $ | 924.50 | | | | 0.54 | % | | $ | 2.62 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.48 | | | | 0.54 | % | | $ | 2.75 | | |

Baillie Gifford International Equity Fund — Class 5 | |

Actual | | $ | 1,000 | | | $ | 924.90 | | | | 0.47 | % | | $ | 2.28 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.84 | | | | 0.47 | % | | $ | 2.40 | | |

Baillie Gifford EAFE Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 902.40 | | | | 0.62 | % | | $ | 2.97 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.08 | | | | 0.62 | % | | $ | 3.16 | | |

Baillie Gifford EAFE Fund — Class 3 | |

Actual | | $ | 1,000 | | | $ | 902.60 | | | | 0.55 | % | | $ | 2.64 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.43 | | | | 0.55 | % | | $ | 2.80 | | |

Baillie Gifford EAFE Fund — Class 4 | |

Actual | | $ | 1,000 | | | $ | 902.70 | | | | 0.52 | % | | $ | 2.49 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.58 | | | | 0.52 | % | | $ | 2.65 | | |

Baillie Gifford EAFE Fund — Class 5 | |

Actual | | $ | 1,000 | | | $ | 902.90 | | | | 0.47 | % | | $ | 2.25 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.84 | | | | 0.47 | % | | $ | 2.40 | | |

Baillie Gifford EAFE Choice Fund — Class 1 | |

Actual | | $ | 1,000 | | | $ | 946.80 | | | | 0.76 | % | | $ | 3.73 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.37 | | | | 0.76 | % | | $ | 3.87 | | |

Baillie Gifford EAFE Choice Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 947.10 | | | | 0.68 | % | | $ | 3.34 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.78 | | | | 0.68 | % | | $ | 3.47 | | |

18

Fund Expenses (unaudited)

Annual Report December 31, 2015

| | | Beginning

Account Value

7/01/15 | | Ending

Account

Value

12/31/15 | | Annualized

Expense Ratios

Based on the Period

7/01/15 to 12/31/15 | | Expenses Paid

During Period | |

Baillie Gifford EAFE Choice Fund — Class 3 | |

Actual | | $ | 1,000 | | | $ | 947.50 | | | | 0.61 | % | | $ | 2.99 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.13 | | | | 0.61 | % | | $ | 3.11 | | |

Baillie Gifford EAFE Pure Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 964.70 | | | | 0.66 | % | | $ | 3.27 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.88 | | | | 0.66 | % | | $ | 3.36 | | |

Baillie Gifford Emerging Markets Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 889.90 | | | | 0.88 | % | | $ | 4.19 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,020.77 | | | | 0.88 | % | | $ | 4.48 | | |

Baillie Gifford Emerging Markets Fund — Class 4 | |

Actual* | | $ | 1,000 | | | $ | 985.50 | | | | 0.76 | % | | $ | 1.22 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.37 | | | | 0.76 | % | | $ | 3.87 | | |

Baillie Gifford Emerging Markets Fund — Class 5 | |

Actual | | $ | 1,000 | | | $ | 890.00 | | | | 0.72 | % | | $ | 3.43 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.58 | | | | 0.72 | % | | $ | 3.67 | | |

Baillie Gifford Global Alpha Equity Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 971.90 | | | | 0.68 | % | | $ | 3.38 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.78 | | | | 0.68 | % | | $ | 3.47 | | |

Baillie Gifford Global Alpha Equity Fund — Class 3 | |

Actual | | $ | 1,000 | | | $ | 972.10 | | | | 0.61 | % | | $ | 3.03 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.13 | | | | 0.61 | % | | $ | 3.11 | | |

Baillie Gifford Long Term Global Growth Equity Fund — Class 1 | |

Actual** | | $ | 1,000 | | | $ | 1,029.80 | | | | 0.85 | % | | $ | 4.21 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,020.92 | | | | 0.85 | % | | $ | 4.33 | | |

Baillie Gifford Long Term Global Growth Equity Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 1,033.00 | | | | 0.77 | % | | $ | 3.95 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.32 | | | | 0.77 | % | | $ | 3.92 | | |

19

Fund Expenses (unaudited)

Annual Report December 31, 2015

| | | Beginning

Account Value

7/01/15 | | Ending

Account

Value

12/31/15 | | Annualized

Expense Ratios

Based on the Period

7/01/15 to 12/31/15 | | Expenses Paid

During Period | |

Baillie Gifford Long Term Global Growth Equity Fund — Class 4 | |

Actual*** | | $ | 1,000 | | | $ | 1,113.10 | | | | 0.67 | % | | $ | 1.65 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.83 | | | | 0.67 | % | | $ | 3.41 | | |

Baillie Gifford International Choice Fund — Class 1 | |

Actual | | $ | 1,000 | | | $ | 944.50 | | | | 0.72 | % | | $ | 3.53 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.58 | | | | 0.72 | % | | $ | 3.67 | | |

Baillie Gifford International Choice Fund — Class 2 | |

Actual | | $ | 1,000 | | | $ | 944.90 | | | | 0.64 | % | | $ | 3.14 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,021.98 | | | | 0.64 | % | | $ | 3.26 | | |

Baillie Gifford International Choice Fund — Class 3 | |

Actual | | $ | 1,000 | | | $ | 945.20 | | | | 0.57 | % | | $ | 2.79 | | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,022.33 | | | | 0.57 | % | | $ | 2.91 | | |

* Commencement of operations on November 2, 2015.

** Commencement of operations on July 6, 2015.

*** Commencement of operations on October 7, 2015.

Expenses are calculated using the annualized expense ratio for the Funds, which represents the ongoing expenses as a percentage of net assets for the year or period ended December 31, 2015. Expenses are calculated by multiplying the annualized expense ratio by the average account value for the period; then

multiplying the result by the number of days in the most recent fiscal half-year; and then dividing that result by the number of days in the calendar year. Expense ratios for the most recent fiscal year may differ from expense ratios based on the one-year data in the financial highlights.

20

Industry Diversification Table

Annual Report December 31, 2015

December 31, 2015 (unaudited)

Baillie Gifford International Equity Fund

| | | Value | | % of Total

Net Assets | |

Aerospace | | $ | 8,037,135 | | | | 0.5 | % | |

Aerospace/Defense | | | 29,108,412 | | | | 1.8 | | |

Airlines | | | 51,247,069 | | | | 3.1 | | |

Apparel | | | 20,533,933 | | | | 1.2 | | |

Apparel Retailers | | | 41,053,411 | | | | 2.4 | | |

Asset Managers | | | 22,225,574 | | | | 1.3 | | |

Auto Manufacturers | | | 18,899,558 | | | | 1.1 | | |

Auto Parts | | | 23,429,230 | | | | 1.4 | | |

Banks | | | 144,075,709 | | | | 8.6 | | |

Beverages, Food & Tobacco | | | 47,343,870 | | | | 2.9 | | |

Biotechnology | | | 19,692,060 | | | | 1.2 | | |

Building Materials & Fixtures | | | 14,969,527 | | | | 0.9 | | |

Business Support Services | | | 24,530,608 | | | | 1.5 | | |

Chemicals | | | 14,414,907 | | | | 0.9 | | |

Clothing & Accessories | | | 27,088,282 | | | | 1.7 | | |

Commercial Services | | | 41,661,103 | | | | 2.4 | | |

Construction & Building Materials | | | 44,216,137 | | | | 2.7 | | |

Containers & Packaging | | | 18,370,430 | | | | 1.1 | | |

Distillers & Vintners | | | 13,751,144 | | | | 0.9 | | |

Distribution/Wholesale | | | 20,871,060 | | | | 1.3 | | |

Diversified Financial Services | | | 58,327,037 | | | | 3.6 | | |

Electrical Components & Equipment | | | 16,598,910 | | | | 1.0 | | |

Electronic & Electrical Equipment | | | 51,708,237 | | | | 3.1 | | |

Exploration & Production | | | 5,971,316 | | | | 0.4 | | |

Food Producers & Processors | | | 36,253,541 | | | | 2.1 | | |

Food Products | | | 46,875,331 | | | | 2.8 | | |

Food Retailers & Wholesalers | | | 14,881,066 | | | | 0.9 | | |

Healthcare — Products | | | 17,826,778 | | | | 1.1 | | |

Industrial Engineering | | | 9,925,830 | | | | 0.6 | | |

Industrial Machinery | | | 77,502,300 | | | | 4.7 | | |

Industrial Suppliers | | | 23,371,844 | | | | 1.4 | | |

Insurance | | | 94,111,590 | | | | 5.6 | | |

Integrated Oil & Gas | | | 15,911,307 | | | | 1.0 | | |

Internet | | | 80,956,435 | | | | 4.8 | | |

Investment Companies | | | 2,851,517 | | | | 0.2 | | |

Investment Services | | | 32,984,606 | | | | 2.0 | | |

Machinery — Diversified | | | 16,970,552 | | | | 1.0 | | |

Media & Photography | | | 47,622,734 | | | | 2.9 | | |

Medical Equipment | | | 15,399,168 | | | | 0.9 | | |

Mining & Metals | | | 22,392,688 | | | | 1.3 | | |

21

Industry Diversification Table

Annual Report December 31, 2015

| | | Value | | % of Total

Net Assets | |

Mobile Telecommunications | | $ | 14,650,066 | | | | 0.9 | % | |

Oil & Gas | | | 12,454,594 | | | | 0.8 | | |