UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10145

Baillie Gifford Funds

(Exact name of registrant as specified in charter)

1 Greenside Row

Edinburgh, Scotland, UK, EH1 3AN

(Address of principal executive offices) (Zip code)

Angus NG Macdonald

1 Greenside Row

Edinburgh, Scotland, UK, EH1 3AN

(Name and address of agent for service)

Registrant’s telephone number, including area code: 011-44-131-275-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

The registrant, an open-end investment company registered pursuant to Section 8(b) of the Investment Company Act of 1940 (the “Act”), has not filed a registrant statement that has gone effective under the Securities Act of 1933 (the “1933 Act”) because beneficial interests in the registrant are issued and sold solely in private transactions that do not involve any public offering within the meaning of Section 4(2) of the 1933 Act. Accordingly, this report is not filed under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Baillie Gifford Funds

International Equity Fund

International Choice Fund

EAFE Fund

EAFE Choice Fund

Emerging Markets Fund

Global Alpha Equity Fund

Annual Report

December 31, 2013

INDEX

INDEX (continued)

INDEX (concluded)

Management Discussion

The International Equity Fund

Market Conditions and Review of Performance during 2013

2013 has been a good year for international equity markets. Investors who have kept faith in this asset class have, on the whole, been rewarded. Nearly five years into a recovery from the lows reached in early 2009, equity markets have finally rediscovered some genuine optimism, with a notable shift in preference in the second half of 2013 from defensive stocks towards those with more substantial but less predictable growth prospects.

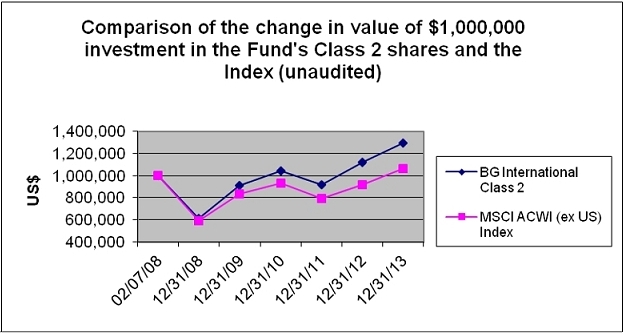

The International Equity Fund Class 2 returned 15.35% during 2013, underperforming the MSCI ACWI ex U.S. Index which returned 15.78% for the year.

During the first three months of 2013, markets were in positive territory overall, jollied along by the continued support of central banks and increasingly clear signs that the US economy had not only managed to make significant steps towards cleaning up its banking sector, but was also beginning to reap the growth benefits of an improving employment, housing and manufacturing backdrop. In Japan, Shinzo Abe’s government gave a strong policy steer to determinedly tackle deflation with the Bank of Japan undertaking quantitative easing, weakening the Yen against the dollar. Japan was the strongest of the large markets during the first quarter of 2013 as Japanese companies surged across the board. As we moved into the second quarter of 2013, markets reacted negatively to suggestions that the Federal Reserve’s ultra loose quantitative easing programme may begin to wind down. As we moved into the third quarter of 2013, it was a sobering summer for financial markets as the pre-announced September taper of the Federal Reserve’s quantitative easing programme loomed on the horizon. An air of resignation that the party was ending settled in. Liquidity began to drain from the Emerging Markets, particularly those with larger current account deficits, and gradual policy normalisation became the accepted wisdom. However, in mid-September the Federal Reserve eased back on their language with respect to the immediacy of tapering and equity markets were strong overall, particularly the developed markets, although Emerging Markets with large current account deficits continued to be the focus of liquidity withdrawals. This is a trend which continued into the final quarter of the year. After a long period of exceptional support from monetary authorities we do now appear to be entering a period of normalisation. However, interest rates are likely to remain low for the time being.

The portfolio slightly underperformed its benchmark over the year. Among the more significant detractors were the stocks that the portfolio holds in the Energy and Materials sectors. To a large extent, we would attribute this underperformance to the general sentiment towards these sectors, particularly fears over growth in China and the Emerging Markets. Tullow Oil (UK listed oil exploration and production company with African assets), Kunlun Energy (Chinese oil and gas exploration and production company) and China Shenhua Energy (China’s largest coal producer) all detracted from relative performance over the year. We took the decision to sell China Shenhua Energy as coal demand slowed and the advantage of its dedicated rail network appeared to be under threat. We also sold Kunlun Energy after corruption charges were brought against its Chairman (relating to the parent company, Petrochina). In addition, Antofagasta (Chilean low cost copper mines) and Rio Tinto (UK listed diversified miner) detracted from relative performance. In terms of what helped relative performance during 2013, stock selection in Emerging Markets was a big driver. Naspers (South African internet and media conglomerate), Baidu (Chinese search engine), Naver Corp (Korean search and messaging portal) and MercadoLibre (South American e-commerce platform) were all among the positive contributors over 2013. These contributions come against a backdrop of strong returns across internet companies. We suspect that a degree of excitement over several high profile IPOs (and rumoured IPOs) helped fuel this strong performance, but the most significant factor is that it is becoming increasingly clear that these companies are indeed able to monetise the large user bases that they rapidly acquire.

We continue to find exciting investment opportunities for the portfolio. For example, we have taken holdings in St James’ Place (UK wealth management business), SAP (a German company which is a global leader in enterprise software), Toyota Tsusho (Japanese listed distributor of cars with a strong position in developing markets) and Fanuc (Japanese manufacturer of factory automation equipment). The portfolio is dominated by well-financed businesses with attractive long-term growth prospects, and retains a bias towards companies that are well placed to benefit from rising domestic consumption in Emerging Markets. The portfolio has limited direct exposure to European banks, with Svenska Handelsbanken, a traditional well capitalised Swedish bank, the only such holding. A sharp recovery in lower quality financials therefore remains a risk to the portfolio, but we remain committed to our style of investing in well managed growth businesses. The portfolio comprises a diverse range of companies, but on the whole the attributes of a strong industry background, durable competitive advantage, good management and strong financial characteristics are important aspects of the holdings, and these should stand the portfolio in good stead over the longer term.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above that of the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The ACWI ex US Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long term prospects for the Fund’s holdings and make changes where appropriate.

Outlook

The operational performance of companies has generally been in line with our expectations and is a key barometer for our outlook. More broadly, we may be at a transitional point in the economic cycle; there is a risk that after a prolonged period of ultra low rates, the transition to a more normal rate regime may prove difficult. However, the potential for a US recovery and a return to growth in Southern Europe, the ambitious reform proposals emerging from China’s Third Plenum and the possibility that Abenomics in Japan will succeed, are all encouraging signs for sustainable global growth.

As stock pickers, our focus is on company fundamentals. Companies are not excessively leveraged, returns are high and demand in developed markets is improving. The long-term forces driving increased consumption and investment in the Emerging Markets remain in place, if currently subdued. Looking ahead to 2014 (and beyond), we are excited about the prospects for the companies held in The International Equity Fund. The team of investors in the Portfolio Construction Group will continue to work hard on monitoring the investment case for existing holdings, and looking out for new long-term growth opportunities.

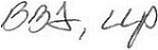

| Fund Performance for periods ended 12/31/13 (Average Annual Total Returns) | |

| | | | | | | Since Inception | |

| | | | | | | % p.a. | |

| | | One Year | | Five Year | | (February 7, 2008) | |

| | | | | | | | |

| The International Equity Fund Class 2* | | 15.35% | | 16.05% | | 4.47% | |

| | | | | | | | |

| MSCI ACWI ex U.S. Index | | 15.78% | | 13.31% | | 1.66% | |

| | | | | | | | |

*The returns for Class 2 shares have been provided. One-year return figures for other share classes are as follows: 15.10% for Class 1, 15.34% for Class 3, and 15.42% for Class 4.

Additional year-over-year returns for each class are available in the Financial Highlights section.

The International Choice Fund

Market Conditions and Review of Performance during 2013

During 2013, the MSCI ACWI ex U.S. benchmark delivered a return of 15.8% when measured in dollar terms. Stepping back from all the intraday breaking news updates from countless Federal Reserve watchers and the nervous procrastination of central banks on the precise timing of monetary policy adjustments, the broader picture remains an encouraging one: five years on from the financial crisis the world is steadily and finally moving on. The American economy at last seems to be building clear momentum going into 2014, no doubt taking many others on its coattails. As equity investors in growing international businesses, we welcome the suggestion that emergency injections of liquidity will not be required forever and even the radical suggestion that interest rates may not have to stay at zero indefinitely. The fundamental improvements allowing for this normalisation of policy conditions are heartening when thinking about the demand drivers and the business opportunities open to the corporate sector over the next few years. We are optimistic that a positive environment of steady improvement in the global economy will present interesting opportunities to own growing international companies at still very attractive prices.

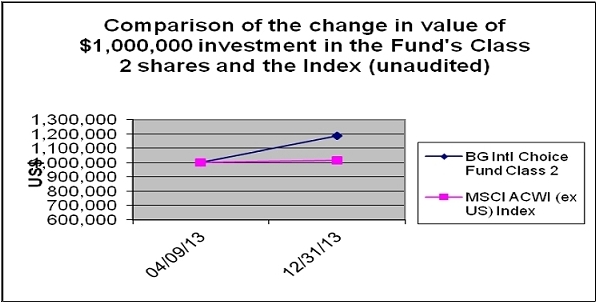

The International Choice Fund Class 2 produced a return of 19.19%* during 2013, outperforming the benchmark which returned 15.78% for the year.

A number of the portfolio’s e-commerce related holdings performed well over the year, with ASOS (UK listed online fashion retailer) and Kinnevik (a Swedish holding company with global exposure in telecoms, media and e-commerce) enjoying rising share prices. We believe there are some quite dramatic changes afoot in e-commerce and some brands are already showing that they could be significant global players. We continue to weigh up some rather off-putting short term valuation figures against the prospect of these businesses being many times their current size in five or ten years.

Hargreaves Lansdown, the UK saving platform, also performed well over the period. The impressive scale of new business inflows and high levels of customer loyalty are hopefully testament to the strength of Hargreaves Lansdown’s customer proposition. We believe that Hargreaves is providing a simple, efficient and valued service at an acceptable fee to the vast majority of its customer base. So long as customers continue to like what it does, it has the potential to grow for many years.

A significant detractor from performance over the period has been UK based graphics chip design business, Imagination Technologies. Although there is every reason to believe that end markets of smartphones, tablets and other consumer electronic gadgets will continue to grow for many years, Imagination appears to have hit something of an air pocket with a few of its end customers as they transition from older consumer devices to newer products. We hope that in five years time the long term growth trajectory of the business will have been re-established. Other significant detractors from performance included Cochlear, the Australian hearing implant manufacturer, and Garanti Bank, the Turkish retail bank.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long term prospects for the Fund’s holdings and make changes where appropriate.

Outlook

We do not and cannot know what will happen to the stock market over the next six or twelve months, however we remain optimistic that we are selecting stocks in a positive and helpful global environment for long term growth investors. We are confident the portfolio holds some excellent growth businesses. We have also been busy considering and debating a number of competing new ideas for the portfolio. Trading infrequently, the result of our long term approach to investing, allows existing holdings to grow, keeps down costs and reduces the occurrence of our tactical mistakes, so we still have an unashamed bias towards a low turnover approach to managing the portfolio.

The last six or seven years may at times have been a bumpy ride for international investment, but we enter 2014 feeling optimistic and excited, particularly on the basis of the attractive opportunities available to us as international growth managers.

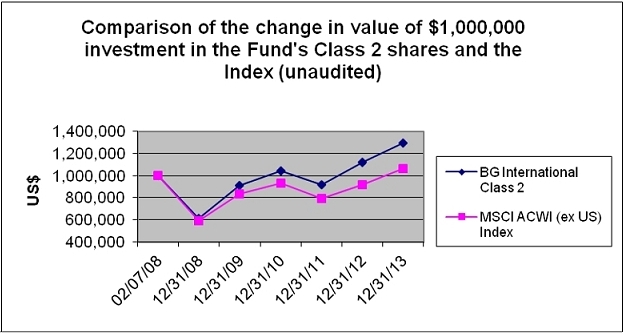

| Fund Performance for periods ended 12/31/13 (Average Annual Total Returns) |

| | | | | Since Inception % p.a. | |

| | | One Year | | (April 9, 2013) | |

| | | | | | |

| The International Choice Fund Class 2 | | 19.19%* | | 19.19%* | |

| | | | | | |

| MSCI ACWI ex U.S. Index | | 15.78% | | 15.78% | |

| | | | | | |

*The International Choice Fund Class 2 commenced on April 9, 2013, the return shown is therefore a synthetic return based on the performance of Class 2 since inception plus Class 1 performance from January 1, 2013 to April 8, 2013.

The EAFE Fund

Market Conditions and Review of performance during 2013

Nearly five years into a recovery from the lows reached in early 2009, equity markets have finally rediscovered some genuine optimism, with a notable shift in preference in the second half of 2013 from defensive stocks towards those with more substantial but less predictable growth prospects. We view this sea change in sentiment as a delayed response to the considerable progress made since the global financial crisis, both at a macro and company level. The broadening out of the US recovery, a return to growth in Southern Europe, and the ambitious reform proposals emerging from China’s Third Plenum and ‘Abenomics’ in Japan are all encouraging signs for sustainable global growth.

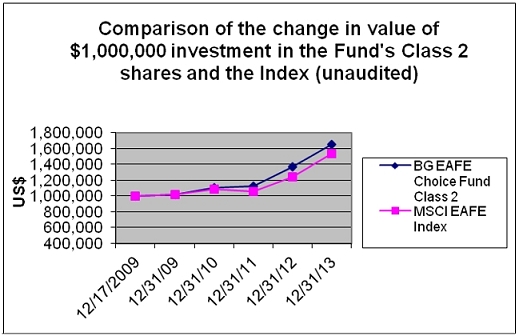

The EAFE Fund Class 2 produced a return of 28.69% during 2013, outperforming the MSCI EAFE Index which returned 23.29% for the year.

The vigour of the rise of some of the Fund’s technology holdings, such as Baidu (Chinese search engine), Tencent (Chinese social networking platform), Naver (South Korean search and messaging portal) and ARM (UK semiconductor chip designer), was evident over the past year. Although this can partly be attributed to the change in market sentiment referred to above, we have been encouraged by the substantial progress made by the internet companies in particular. While the market has been preoccupied by the uncertainty created by the transition from desktop computers to mobile devices, resulting in a pronounced de-rating of the sector over the past couple of years, these companies have been investing heavily for future growth. That investment is now bearing fruit, with considerable progress being made on the monetisation of mobile users.

E-commerce is another fast-growing sub-sector of mobile internet where we are enthusiastic about the long-term growth prospects. Softbank, the Japanese telecoms company with a large stake in the Chinese online marketplace Alibaba, is now one of the Fund’s largest holdings, reflecting strong performance and our growing level of conviction in the company. Other positive contributors in this area have been Swedish investment firm, Kinnevik, which is increasingly focussed on growing its online businesses (32% of its portfolio), ASOS, the UK-based online clothing retailer, and Schibsted, which is successfully shifting from its past as a Norwegian newspaper business to a structurally more profitable internet company.

These gains more than offset weakness in some holdings which are more exposed to concerns about the effect of US tapering on Emerging Markets, such as the Turkish bank, Garanti Bankasi, and the Brazilian stock exchange, BM&F Bovespa. Commodity and traditional energy-related areas have also been weak and, while we have sold several holdings in this area over the past 12 months, the Fund’s holding in SQM, a Chilean potash and lithium mining company, was weak following the collapse of the potash cartel. We think the reaction has been overly pessimistic and are excited by the growth prospects of the lithium business.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The EAFE Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction in their continuing holdings.

Outlook

We look into 2014 with a sense of optimism and with a rich seam of exciting companies, themes and countries that we want to learn more about. We are enthusiastic about the significant political and economic progress made over the past few years in Europe and are working to potentially unearth further growth franchises. We are similarly fascinated by the extent of the commitment to reform by the Chinese government which could open up our investment possibilities there. We plan to better our understanding of the scale of these opportunities and to continue to search for companies that might benefit the Fund.

| Fund Performance for periods ended 12/31/13 (Average Annual Total Returns) | |

| | | | | | | Since Inception

% p.a. | |

| | | One Year | | Five Year | | (March 6, 2008) | |

| | | | | | | | |

| The EAFE Fund Class 2* | | 28.69% | | 18.06% | | 5.40% | |

| | | | | | | | |

| MSCI EAFE Index | | 23.29% | | 12.95% | | 2.44% | |

| | | | | | | | |

*Returns for Class 2 shares have been provided. One-year return figures for other share classes are as follows: 28.48% for Class 1, 28.83% for Class 3, and 28.97% for Class 5. Additional year-over-year returns for each class are available in the Financial Highlights section.

The EAFE Choice Fund

Market Conditions and Review of performance during 2013

During 2013, the MSCI EAFE Index delivered a return of 23.29%. Stepping back from all the intraday breaking news updates from countless Federal Reserve watchers and the nervous procrastination of central banks on the precise timing of monetary policy adjustments, the broader picture remains an encouraging one: five years on from the financial crisis, the world is steadily and finally moving on. The American economy at last seems to be building clear momentum going into 2014, no doubt taking many others on its coattails. As equity investors in growing international businesses, we welcome the suggestion that emergency injections of liquidity will not be required forever and even the radical suggestion that interest rates may not have to stay at zero indefinitely. The fundamental improvements allowing for this normalisation of policy conditions are heartening when thinking about the demand drivers and the business opportunities open to the corporate sector over the next few years. We are optimistic that a positive environment of steady improvement in the global economy will present interesting opportunities to own growing international companies at still very attractive prices.

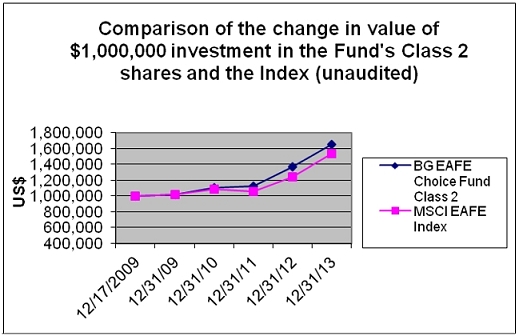

The EAFE Choice Fund Class 2 produced a return of 21.20% during 2013, underperforming the benchmark which returned 23.29% for the year.

A significant detractor from performance over the period has been UK-based graphics chip design business, Imagination Technologies. Although there is every reason to believe that end markets of smartphones, tablets and other consumer electronic gadgets will continue to grow for many years, Imagination appears to have hit something of an air pocket with a few of its end customers as they transition from older consumer devices to newer products. We hope that in five years time the long term growth trajectory of the business will have been re-established. Other significant detractors from performance included Cochlear, an Australian hearing implant manufacturer, and Garanti Bank, a Turkish retail bank.

A number of the portfolio’s e-commerce related holdings performed well over the year, with ASOS (UK-listed online fashion retailer) and Kinnevik (a Swedish holding company with global exposure in telecoms, media and e-commerce) enjoying rising share prices. We believe there are some quite dramatic changes afoot in e-commerce and some brands are already showing that they could be significant global players. We continue to weigh up some rather off-putting short term valuation figures against the prospect of these businesses being many times their current size in five or ten years.

Hargreaves Lansdown, the UK saving platform, also performed well over the period. The impressive scale of new business inflows and high levels of customer loyalty are hopefully a testament to the strength of Hargreaves Lansdown’s customer proposition. We believe that Hargreaves is providing a simple, efficient and valued service at an acceptable fee to the vast majority of its customer base. So long as customers continue to like what it does, it has the potential to grow for many years.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The International Focus Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings and will continue to monitor the long term prospects for the Fund’s holdings and make changes where appropriate.

Outlook

We do not and cannot know what will happen to the stock market over the next six or twelve months, however we remain optimistic that we are selecting stocks in a positive and helpful global environment for long term growth investors. We are confident the portfolio holds some excellent growth businesses. We have also been busy considering and debating a number of competing new ideas for the portfolio. Trading infrequently, the result of our long term approach to investing, allows existing holdings to grow, keeps down costs and reduces the occurrence of our tactical mistakes, so we still have an unashamed bias towards a low turnover approach to managing the portfolio.

The last six or seven years may at times have been a bumpy ride for international investment, but we enter 2014 feeling optimistic and excited, particularly on the basis of the attractive opportunities available to us as international growth managers.

| Fund Performance for periods ended 12/31/13 (Average Annual Total Returns) | |

| | | | | Since Inception % | |

| | | | | p.a. | |

| | | One Year | | (December 17, 2009)* | |

| | | | | | |

| The EAFE Choice Fund Class 2* | | 21.20% | | 11.30% | |

| | | | | | |

| MSCI EAFE Index | | 23.29% | | 8.54% | |

| | | | | | |

*Returns for Class 2 shares have been provided. Additional year-over-year returns for each class are available in the Financial Highlights section.

The Emerging Markets Fund

Market Conditions and Review of Performance during 2013

Over the course of 2013, the MSCI Emerging Markets Index posted negative returns, underperforming developed equity markets, as speculation surrounding tapering of the US Federal Reserve’s quantitative easing programme heightened investors’ fear. Concerns over a liquidity crunch in Chinese banks raised worries over possible bank failures, and civil unrest in a number of Emerging Market countries also weighed.

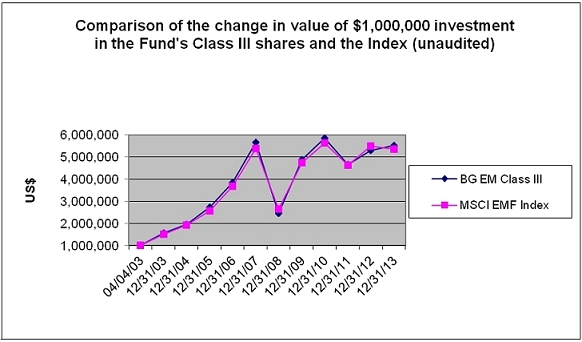

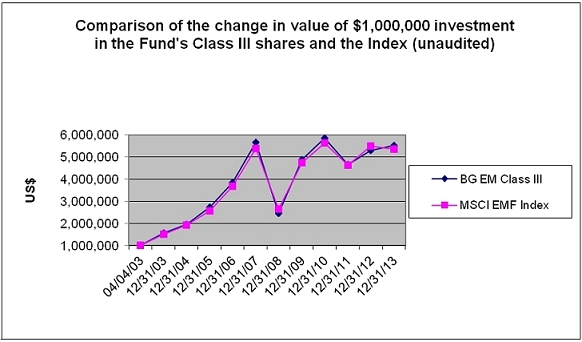

The Emerging Markets Fund Class III returned 3.98% during 2013, outperforming the MSCI Emerging Markets Index which returned -2.27% for the year.

The Taiwanese market was the best performing market in the MSCI Emerging Markets Index over the year as firmer global growth provided a favourable backdrop for Taiwanese exports, particularly technological and non-commodity goods. Ongoing expansion in global trade also buoyed the Korean market, the second largest index constituent. Elsewhere, further signs of economic stabilization and a steady pace of structural reform progress, most recently invigorated by the proposals unveiled by President Xi Jinping after the Third Plenum of the 18th Congress of the Communist Party, helped to sustain investor confidence in China, which also performed well. On the other hand, in a stark reversal of fortunes to its 2012 performance, Turkey was one of the hardest hit markets. Macroeconomic concerns about a slowdown in growth, depreciating currency and burgeoning current account deficit, coupled with widespread anti-governmental demonstrations, provided investors with numerous reasons for concern. The smaller ASEAN economies of Indonesia and Thailand fared no better. In Indonesia, with economic growth slowing due to falling demand for its commodities from China, a high current account deficit exposing its vulnerability to the tightening of US monetary policy, and ongoing inflationary pressures, investor sentiment towards Indonesia was weak. In a similar vein, and for almost identical reasons and in contrast to a very strong 2012 performance, the Thai market struggled. The portfolio ended 2013 with no holdings in Turkey, Indonesia or Thailand. Elsewhere, in Latin America, whilst the Mexican stock market benefitted over the year from the US recovery and ongoing structural reform, Brazil was notably weak. Investor concerns appeared centered on higher interest rates, government interference and a deteriorating fiscal outlook.

The stand-out sector performer over the year was Information Technology, where both the overweight position and stock selection contributed strongly towards performance. The Information Technology companies which performed best over the year were underpinned by varied and often uncorrelated growth drivers. Amongst the top positive contributors were Tech Mahindra (Indian Information Technology Outsourcer), Naver (South Korean search engine) and GCL-Poly Energy Holdings (Chinese polysilicon manufacturer). Whilst all three are examples of companies that MSCI designates as ‘Information Technology’, the businesses depend respectively upon global corporate Information Technology capital expenditure, internet penetration and online spending in South Korea, and an increase in global demand for cheaper and greener energy.

The Fund’s underweight position to the Materials sector also contributed towards relative performance. We remain extremely cautious on those broader areas of the market which have spent the past decade coat-tailing on Chinese commodity demand.

On the other hand, stock selection in the Energy sector was the largest drag on relative performance. These stocks are overwhelmingly newsflow driven and stock prices can be very volatile from one quarter to the next, often on little specific news. African Petroleum Corp (West Africa), Tullow Oil (Ghana) and Niko Resources Limited (India and Indonesia) all appear amongst the biggest detractors of the year. Whilst in 2012 Africa Petroleum was the Fund’s top performer, in the early part of 2013 the announcement that an oil discovery off the coast of Liberia was not commercial resulted a sharp decline in the share price from which it has yet to recover. Tullow Oil drilled a number of dry wells

and its success rate ran at approximately 30% over the year compared to around 50% historically. Niko failed to have any success with its Indonesian oil exploration and whilst it still has huge acreage, its stressed balance sheet means it will be very difficult to unlock the value of any of its assets and therefore we sold the holding. Conversely, Dragon Oil (Turkmenistan) appears amongst the top contributors over the year. Strong growth in production volumes from its operations and a trading update reiterating 10-15% production growth for 2014 were taken well by investors.

Investment Strategies used to manage the Fund.

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse the industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The Emerging Markets investment team is responsible for the overall strategy and stock selection process, led by the most senior investment managers. The team meets regularly to discuss both buy and sell ideas and to determine the level of conviction in the Fund’s holdings.

Outlook

The soothsayers are hard at work, divining whether 2014 will be a breakout or breakdown year for Emerging Markets. As stock pickers, we have no strong views on the relative emerging vs. developed trade, and observe that we rarely find headline market multiples to be particularly informative. Of more interest to us is the relatively polarised nature of valuations: for example, analysis from UBS suggests that the spread between the cheapest and most expensive quintiles of the MSCI EM Index is the highest it has been for more than 20 years. We continue to have little interest in those ‘bond-like’ equities that now find themselves among the most richly-valued segments of the market. We are also not particularly drawn to many of the stocks at the cheapest end either, especially since many of these are state-owned entities (notably financial and commodity companies) that may be called upon to support the national interest at a time of slowing economic growth. The case for a re-rating of these optically cheap headline multiples is not, in our view, persuasive.

Rather, it is in the middle-ground that we continue to find the richest seam of ideas: particularly those stocks with very substantial but less predictable growth streams that we believe have been left trading on anomalously low valuations given the fashion for safety in recent years. Indeed, we have been encouraged by tentative hints that this trend may finally be coming to an end. This has perhaps been most evident in the strong performance of a number of our favourite internet stocks in recent months. Have these stocks simply been hyped ahead of the Alibaba IPO, with valuations now looking stretched? We would suggest there is far more to it than this. The pace of technological change remains breathtaking and exploitable by entrepreneurial management teams. The operational performance of companies is the proof we require, and we hope the market continues to reward this, by becoming increasingly willing to join us in looking through the odd, inevitable quarterly blip.

| | | One Year | | Five Year | | 10 Year | | Since inception % | |

| | | | | | | | | p.a. (April 4, 2003) | |

| The Emerging Markets Fund Class III* | | 3.98% | | 17.53% | | 13.24% | | 17.24% | |

| | | | | | | | | | |

| MSCI Emerging Markets Index | | -2.27% | | 15.14% | | 13.83% | | 15.21% | |

| | | | | | | | | | |

*Returns for Class III shares have been provided. Additional year-over-year returns for each class are available in the Financial Highlights section.

The Global Alpha Equity Fund

Market Conditions and Review of Performance during 2013

It has been a strong year for equity markets and the most noticeable feature of the past twelve months has been the recovery in developed markets, with Emerging Market returns lagging significantly. Whilst fears over the sustainability of China’s strong growth and the gradual withdrawal of quantitative easing continue to weigh on sentiment, talk of tapering was better received during the fourth quarter than previously and we continue to see it as a positive. Signs of a move towards a more “normal” monetary policy surely mean that the US economy continues to strengthen.

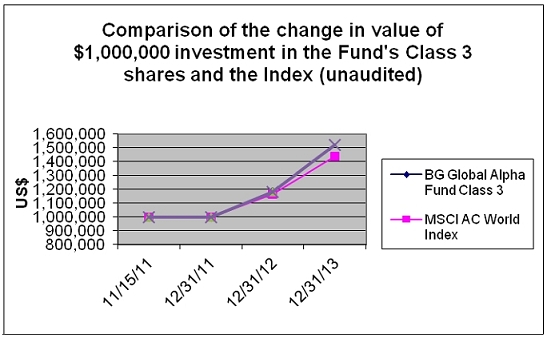

The Global Alpha Equity Fund Class 3 produced a return of 28.71% during 2013, outperforming the MSCI All Country World Index which returned 23.44% for the year.

As we would expect, stock selection drove performance. Amongst the top performers were Tesla Motors (electric car manufacturer) and Prudential (life insurer). Tesla, a new purchase for the portfolio during the first quarter, is seeking to create a new market for Electric Vehicles by pushing the boundaries of styling, battery life and range. Shortly after purchase the company reported its first quarterly profit, announced that it planned to pay back a $450m Department of Energy loan and that its Model S had received the highest ever rating (99/100) in a well regarded Consumer Reports survey. All of these factors conspired to lift Tesla’s shares very significantly and we felt it prudent to take some profits. Whilst we remain aware of the risks associated with the continued expansion of what is still a relatively early stage business, we also remain excited by its prospects as it moves from high end cars towards more mass market models.

Prudential, the life insurer, was also a strong contributor to the portfolio during 2013, despite an impressive three year run. Whilst Prudential is UK listed, we hold the company because of its strong Asian business. Prudential recently announced an expansion of its operations in Cambodia, Myanmar, Poland and Ghana in addition to strong existing business in Indonesia, Singapore, Vietnam, Thailand, the Philippines and Hong Kong. These markets have attractive characteristics: fast-growing GDP, young populations and low insurance penetration. In December, management set new objectives including increased free surplus generation targets and growth of pre tax operating profits in Asia, which again prompted the share price to react positively.

The most significant negative contributor to performance was Clicks. The South African pharmacy chain indicated that it wanted to curb increases in drug costs for customers despite rising pharmacist wages, leading to concerns that profitability would deteriorate. The company is also operating against a more challenging demand backdrop, with growth prospects looking weaker than we had hoped. We sold out of the stock during the third quarter in search of more exciting opportunities elsewhere.

Another detractor from performance was BM&F Bovespa. The Brazilian stock exchange operator’s share price was affected over the year by macroeconomic concerns including the reversal of the cheap dollar, a slow down in the end markets for the country’s commodities exports and some recent social tension. Coupled with this, company specific factors including soft trading volumes and a dispute with the Brazilian tax authority also contributed to the stock’s performance. Clearly, shareholders have had much to worry about this year. However, we think the long-term growth drivers remain in place for this company: they are geared into the development of a still immature stock market in a country with attractive demographics and a very low base of equity ownership. The company holds a dominant position in trading and clearing in Brazil and as such is able to earn attractive returns. We are confident that trading volumes and prospects will grow significantly over the longer term.

Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom-up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long-term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The Global Alpha investment team is responsible for the overall strategy and stock selection process. They meet regularly as part of a Portfolio Review Group, along with representatives from each of Baillie Gifford’s regional investment teams, to discuss both buy and sell ideas and the level of conviction in their continuing holdings.

Outlook

We appear to have moved into a new phase in the process of healing the global economy. Central banks and governments (notably in the US) are now seeking to reduce stimulus and rid their balance sheets of assets they acquired during the financial crisis. Inevitably this will continue to cause some unease amongst markets and so we would expect periods of volatility to continue.

Whilst other risks exist – notably the challenges of re-orientating the Chinese economy towards domestic consumption and stimulating growth in Europe, we think that the broad progress being made bodes well for corporate confidence. Indeed, we remain upbeat about the growth prospects for the types of high quality companies in which we invest for the fund.

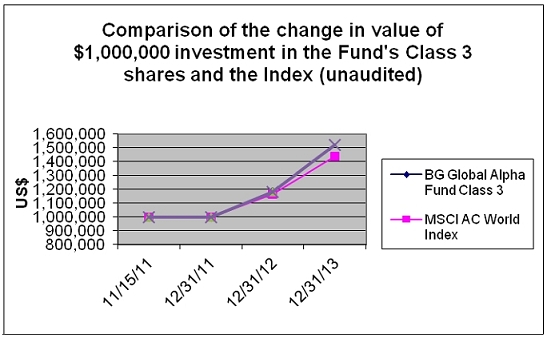

| Fund Performance for periods ended 12/31/13 (Average Annual Total Returns) | |

| | | | | Since Inception % | |

| | | | | p.a. | |

| | | One Year | | (November 15, 2011) | |

| | | | | | |

| The Global Alpha Fund Class 3* | | 28.71% | | 21.34% | |

| | | | | | |

| MSCI AC World Index | | 23.44% | | 19.06% | |

*Returns for Class 2 shares have been provided. Additional year-over-year returns for each class are available in the Financial Highlights section.

Fund Expenses (unaudited)

As a shareholder of the Baillie Gifford International Equity Fund, the Baillie Gifford International Choice Fund, the Baillie Gifford EAFE Fund, the Baillie Gifford EAFE Choice Fund, the Baillie Gifford Emerging Markets Fund and/or the Baillie Gifford Global Alpha Equity Fund (together, the “Funds”), you incur two types of costs: (1) transaction costs, which may include purchase premiums and redemption fees and (2) ongoing costs, including management fees, shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in the other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2013 to December 31, 2013.

Actual Expenses

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as purchase premiums and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses (unaudited)(continued)

| | | | | | | | | | |

| | | Beginning

Account Value

7/01/2013 | | Ending

Account

Value

12/31/13 | | Annualized Expense

Ratios Based on the

Period 7/01/13 to

12/31/13 | | Expenses Paid

During the Period

7/01/13 to 12/31/13 | |

| | | | | | | | | | |

| Baillie Gifford International Equity - Class 1 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,165.56 | | 0.78% | | $4.26 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.27 | | 0.78% | | $3.97 | |

| | | | | | | | | | |

| Baillie Gifford International Equity - Class 2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,165.89 | | 0.61% | | $3.33 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 | |

| | | | | | | | | | |

| Baillie Gifford International Equity - Class 3 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,165.59 | | 0.54% | | $2.95 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.48 | | 0.54% | | $2.75 | |

| | | | | | | | | | |

| Baillie Gifford International Equity - Class 4 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,167.20 | | 0.51% | | $2.79 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.63 | | 0.51% | | $2.60 | |

| | | | | | | | | | |

| Baillie Gifford International Choice - Class 2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,144.68 | | 0.65% | | $3.51 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.93 | | 0.65% | | $3.31 | |

| | | | | | | | | | |

| Baillie Gifford International Choice - Class 3 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,145.85 | | 0.56% | | $3.03 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.38 | | 0.56% | | $2.85 | |

| | | | | | | | | | |

| Baillie Gifford EAFE - Class 1 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,264.37 | | 0.78% | | $4.45 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.27 | | 0.78% | | $3.97 | |

| | | | | | | | | | |

| Baillie Gifford EAFE - Class 2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,265.17 | | 0.61% | | $3.48 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 | |

| | | | | | | | | | |

| Baillie Gifford EAFE - Class 3 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,266.53 | | 0.54% | | $3.08 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.48 | | 0.54% | | $2.75 | |

| | | | | | | | | | |

| Baillie Gifford EAFE - Class 4* | | | | | | | | | |

| Actual | | $1,000.00 | | $1,092.92 | | 0.52% | | $1.24 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.58 | | 0.52% | | $2.65 | |

| | | | | | | | | | |

| Baillie Gifford EAFE - Class 5 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,266.73 | | 0.46% | | $2.63 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.89 | | 0.46% | | $2.35 | |

| | | | | | | | | | |

| Baillie Gifford EAFE Choice - Class 1** | | | | | | | | | |

| Actual | | $1,000.00 | | $1,043.92 | | 0.27% | | $0.11 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,023.84 | | 0.27% | | $1.38 | |

Fund Expenses (unaudited)(concluded)

| Baillie Gifford EAFE Choice - Class 2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,153.23 | | 0.65% | | $3.53 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.93 | | 0.65% | | $3.31 | |

| | | | | | | | | | |

| Baillie Gifford Emerging Markets - Class II | | | | | | | | | |

| Actual | | $1,000.00 | | $1,128.19 | | 0.90% | | $4.83 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.67 | | 0.90% | | $4.58 | |

| | | | | | | | | | |

| Baillie Gifford Emerging Markets - Class III | | | | | | | | | |

| Actual | | $1,000.00 | | $1,128.58 | | 0.75% | | $4.02 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.42 | | 0.75% | | $3.82 | |

| | | | | | | | | | |

| Baillie Gifford Global Alpha Equity - Class 2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,149.94 | | 0.68% | | $3.68 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.78 | | 0.68% | | $3.47 | |

| | | | | | | | | | |

| Baillie Gifford Global Alpha Equity - Class 3 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,151.33 | | 0.61% | | $3.31 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 | |

| * | | Commencement of investment operations October 10, 2013. |

| ** | | Commencement of investment operations December 17, 2013. |

Expenses are calculated using the annualized expense ratio for the Funds, which represents the ongoing expenses as a percentage of net assets for the six-months ended December 31, 2013. Expenses are calculated by multiplying the annualized expense ratio by the average account value for the period; then multiplying the result by the number of days in the most recent fiscal half-year; and then dividing that result by the number of days in the calendar year. Expense ratios for the most recent fiscal half-year may differ from expense ratios based on the one-year data in the financial highlights.

| INDUSTRY DIVERSIFICATION TABLE | |

| December 31, 2013 (unaudited) | Baillie Gifford International Equity Fund |

| | | Value | | | % of Total

Net Assets | |

| | | | | | | | | |

| Aerospace | | $ | 28,415,819 | | | | 1.1 | % |

| Aerospace/Defense | | | 21,315,742 | | | | 0.8 | |

| Airlines | | | 32,655,490 | | | | 1.3 | |

| Apparel | | | 47,392,790 | | | | 1.9 | |

| Apparel retailers | | | 44,650,026 | | | | 1.8 | |

| Auto Manufacturers | | | 79,636,106 | | | | 3.1 | |

| Banks | | | 207,984,810 | | | | 8.2 | |

| Beverages, Food & Tobacco | | | 93,522,525 | | | | 3.7 | |

| Biotechnology | | | 24,807,397 | | | | 1.0 | |

| Chemicals | | | 24,176,000 | | | | 1.0 | |

| Commercial Services | | | 132,324,135 | | | | 5.2 | |

| Construction & Building Materials | | | 74,212,139 | | | | 2.9 | |

| Distribution/Wholesale | | | 24,159,084 | | | | 0.9 | |

| Diversified Financial Services | | | 102,997,607 | | | | 4.0 | |

| Diversified Industrials | | | 20,145,122 | | | | 0.8 | |

| Electronic & Electrical Equipment | | | 106,269,529 | | | | 4.2 | |

| Engineering & Construction | | | 19,487,203 | | | | 0.8 | |

| Engineering & Machinery | | | 136,103,729 | | | | 5.3 | |

| Exploration & Production | | | 28,154,201 | | | | 1.1 | |

| Food Producers & Processors | | | 144,330,305 | | | | 5.7 | |

| Food Retailers & Wholesalers | | | 37,754,746 | | | | 1.5 | |

| General Retailers | | | 9,768,021 | | | | 0.4 | |

| Healthcare - Products | | | 47,115,221 | | | | 1.9 | |

| Industrial Suppliers | | | 35,578,392 | | | | 1.4 | |

| Insurance | | | 164,047,902 | | | | 6.4 | |

| Internet | | | 135,762,468 | | | | 5.3 | |

| Investment Companies | | | 11,418,138 | | | | 0.4 | |

| Investment Services | | | 27,619,493 | | | | 1.1 | |

| Machinery - Diversified | | | 25,635,368 | | | | 1.0 | |

| Media & Photography | | | 105,601,568 | | | | 4.1 | |

| Mining & Metals | | | 95,251,742 | | | | 3.7 | |

| Mobile Telecommunications | | | 19,626,380 | | | | 0.8 | |

| Oil & Gas | | | 77,281,601 | | | | 3.0 | |

| Pharmaceuticals | | | 25,141,312 | | | | 1.0 | |

| Retailers - General | | | 27,142,296 | | | | 1.1 | |

| Semiconductors | | | 138,937,356 | | | | 5.5 | |

| Software | | | 47,826,100 | | | | 1.9 | |

| Telecommunication Services | | | 20,072,261 | | | | 0.8 | |

| Transportation | | | 33,464,718 | | | | 1.3 | |

| Travel & Leisure | | | 18,380,312 | | | | 0.7 | |

| | | | | | | | | |

| Total Value of Investments | | | 2,496,165,154 | | | | 98.1 | |

| Other assets less liabilities | | | 48,442,491 | | | | 1.9 | |

| Net Assets | | $ | 2,544,607,645 | | | | 100.0 | % |

| PORTFOLIO OF INVESTMENTS | |

| December 31, 2013 | Baillie Gifford International Equity Fund |

| | | Shares | | | Value |

| | | | | | | |

| COMMON STOCKS - 97.6% | | | | | | |

| ARGENTINA - 1.2% | | | | | | |

| MercadoLibre, Inc. | | | 291,009 | | | $ | 31,367,860 | |

| | | | | | | | | |

| AUSTRALIA - 3.0% | | | | | | | | |

| Brambles Ltd. | | | 3,046,989 | | | | 24,963,740 | |

| Cochlear Ltd. | | | 328,468 | | | | 17,306,028 | |

| Treasury Wine Estates Ltd. | | | 3,172,796 | | | | 13,684,243 | |

| Woolworths Ltd. | | | 665,267 | | | | 20,145,122 | |

| | | | | | | | 76,099,133 | |

| BERMUDA - 0.7% | | | | | | | | |

| Seadrill Ltd. | | | 417,902 | | | | 17,127,495 | |

| | | | | | | | | |

| BRAZIL - 0.8% | | | | | | | | |

| Embraer SA ADR | | | 662,391 | | | | 21,315,742 | |

| | | | | | | | | |

| CANADA - 2.7% | | | | | | | | |

| Cenovus Energy, Inc. | | | 427,789 | | | | 12,242,679 | |

| Fairfax Financial Holdings Ltd. | | | 90,368 | | | | 36,079,993 | |

| Ritchie Bros. Auctioneers, Inc. | | | 583,250 | | | | 13,373,922 | |

| Westport Innovations, Inc. (a) | | | 324,929 | | | | 6,359,401 | |

| | | | | | | | 68,055,995 | |

| CHINA - 5.7% | | | | | | | | |

| Baidu, Inc. ADR (a) | | | 201,964 | | | | 35,925,356 | |

| China Mobile Ltd. | | | 1,927,000 | | | | 20,072,261 | |

| Hang Seng Bank Ltd. | | | 1,310,700 | | | | 21,287,812 | |

| Hong Kong Exchanges and Clearing Ltd. | | | 2,122,400 | | | | 35,476,628 | |

| Sun Art Retail Group Ltd. | | | 6,916,500 | | | | 9,768,021 | |

| Want Want China Holdings Ltd. | | | 16,150,000 | | | | 23,374,627 | |

| | | | | | | | 145,904,705 | |

| DENMARK - 3.3% | | | | | | | | |

| DSV A/S | | | 1,019,255 | | | | 33,464,718 | |

| Novo Nordisk A/S, B Shares | | | 137,158 | | | | 25,141,312 | |

| Novozymes A/S, B Shares | | | 587,293 | | | | 24,807,397 | |

| | | | | | | | 83,413,427 | |

| FINLAND - 3.7% | | | | | | | | |

| Kone Oyj, B Shares | | | 1,198,168 | | | | 54,035,916 | |

| Sampo Oyj, A Shares | | | 794,875 | | | | 39,070,355 | |

| | | | | | | | 93,106,271 | |

| FRANCE - 3.1% | | | | | | | | |

| Compagnie Generale d’Optique Essillor International SA | | | 280,141 | | | | 29,809,193 | |

| Edenred | | | 709,497 | | | | 23,755,780 | |

| Lafarge SA | | | 322,538 | | | | 24,209,769 | |

| | | | | | | | 77,774,742 | |

The accompanying notes are an integral part of the financial statements.

| PORTFOLIO OF INVESTMENTS (continued) | |

| December 31, 2013 | Baillie Gifford International Equity Fund |

| | | Shares | | | Value |

| | | | | | | | | |

| GERMANY - 6.6% | | | | | | | | |

| Brenntag AG | | | 130,261 | | | $ | 24,176,000 | |

| Continental AG | | | 166,609 | | | | 36,602,378 | |

| Deutsche Boerse AG | | | 515,741 | | | | 42,741,677 | |

| SAP AG | | | 298,732 | | | | 25,906,629 | |

| Sky Deutschland AG (a) | | | 3,482,205 | | | | 38,489,105 | |

| | | | | | | | 167,915,789 | |

| INDIA - 0.4% | | | | | | | | |

| IDFC, Ltd. | | | 6,421,969 | | | | 11,418,138 | |

| | | | | | | | | |

| IRELAND - 3.2% | | | | | | | | |

| CRH Plc. | | | 826,064 | | | | 20,976,159 | |

| James Hardie Industries Plc. SE CDI | | | 2,501,025 | | | | 29,026,211 | |

| Ryanair Holdings Plc. ADR (a) | | | 695,834 | | | | 32,655,490 | |

| | | | | | | | 82,657,860 | |

| JAPAN - 9.3% | | | | | | | | |

| FANUC Corp. | | | 139,900 | | | | 25,635,368 | |

| Fast Retailing Co., Ltd. | | | 79,200 | | | | 32,711,413 | |

| Japan Exchange Group, Inc. | | | 971,700 | | | | 27,619,493 | |

| Rakuten, Inc. | | | 2,614,500 | | | | 39,017,314 | |

| Shimano, Inc. | | | 214,100 | | | | 18,380,312 | |

| SMC Corp. | | | 129,800 | | | | 32,760,032 | |

| Tokyo Electron Ltd. | | | 283,400 | | | | 15,616,112 | |

| Toyota Tsusho Corp. | | | 974,200 | | | | 24,159,084 | |

| Trend Micro, Inc. | | | 625,500 | | | | 21,919,471 | |

| | | | | | | | 237,818,599 | |

| NETHERLANDS - 2.7% | | | | | | | | |

| Heineken Holding NV | | | 535,772 | | | | 33,914,375 | |

| Unilever NV CVA | | | 840,789 | | | | 33,804,303 | |

| | | | | | | | 67,718,678 | |

| NORWAY - 0.8% | | | | | | | | |

| Aker Solutions ASA | | | 1,088,449 | | | | 19,487,203 | |

| | | | | | | | | |

| PERU - 1.0% | | | | | | | | |

| Credicorp Ltd. | | | 185,577 | | | | 24,631,635 | |

| | | | | | | | | |

| PORTUGAL - 0.3% | | | | | | | | |

| Galp Energia, SGPS, SA | | | 477,745 | | | | 7,829,923 | |

| | | | | | | | | |

| RUSSIA - 2.2% | | | | | | | | |

| Magnit OJSC GDR Reg S | | | 568,441 | | | | 37,754,746 | |

| Sberbank of Russia ADR | | | 1,488,930 | | | | 18,785,102 | |

| | | | | | | | 56,539,848 | |

| SINGAPORE - 1.4% | | | | | | | | |

| United Overseas Bank Ltd. | | | 2,149,175 | | | | 36,293,230 | |

| | | | | | | | | |

| SOUTH AFRICA - 3.1% | | | | | | | | |

| Massmart Holdings Ltd. | | | 983,469 | | | | 12,195,810 | |

| Naspers Ltd., N Shares | | | 641,154 | | | | 67,112,463 | |

| | | | | | | | 79,308,273 | |

The accompanying notes are an integral part of the financial statements.

| PORTFOLIO OF INVESTMENTS (continued) | |

| December 31, 2013 | Baillie Gifford International Equity Fund |

| | | Shares | | | Value |

| | | | | | | | | |

| SOUTH KOREA - 5.4% | | | | | | | | |

| Hyundai Mobis (a) | | | 59,368 | | | $ | 16,528,286 | |

| NAVER Corp. | | | 42,738 | | | | 29,451,938 | |

| Samsung Electronics Co., Ltd. | | | 55,930 | | | | 72,879,435 | |

| SK Telecom Co., Ltd. | | | 89,684 | | | | 19,626,380 | |

| | | | | | | | 138,486,039 | |

| SPAIN - 1.8% | | | | | | | | |

| Inditex SA | | | 270,423 | | | | 44,650,026 | |

| | | | | | | | | |

| SWEDEN - 5.1% | | | | | | | | |

| Atlas Copco AB, B Shares | | | 1,939,623 | | | | 49,307,781 | |

| Svenska Handelsbanken AB, A Shares | | | 1,250,324 | | | | 61,474,457 | |

| Volvo AB, B Shares | | | 1,531,041 | | | | 20,146,041 | |

| | | | | | | | 130,928,279 | |

| SWITZERLAND - 2.8% | | | | | | | | |

| Nestle SA | | | 959,289 | | | | 70,306,350 | |

| TAIWAN - 3.3% | | | | | | | | |

| Hon Hai Precision Industry Co., Ltd. GDR Reg S | | | 3,520,025 | | | | 18,726,533 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 18,418,000 | | | | 65,033,219 | |

| | | | | | | | 83,759,752 | |

| TURKEY - 1.1% | | | | | | | | |

| BIM Birlesik Magazalar A/S | | | 834,084 | | | | 16,845,025 | |

| Turkiye Garanti Bankasi A/S | | | 3,727,967 | | | | 12,084,336 | |

| | | | | | | | 28,929,361 | |

| UNITED KINGDOM - 22.3% | | | | | | | | |

| Amlin Plc. | | | 3,687,822 | | | | 28,073,969 | |

| Antofagasta Plc. | | | 1,172,755 | | | | 16,077,951 | |

| ARM Holdings Plc. | | | 3,205,638 | | | | 58,288,025 | |

| BG Group Plc. | | | 1,065,648 | | | | 22,931,113 | |

| BHP Billiton Plc. | | | 662,699 | | | | 20,563,599 | |

| British American Tobacco Plc. | | | 855,602 | | | | 45,923,907 | |

| Burberry Group Plc. | | | 582,700 | | | | 14,681,377 | |

| Capita Plc. | | | 2,081,258 | | | | 35,825,327 | |

| Experian Plc. | | | 1,862,523 | | | | 34,405,366 | |

| Hargreaves Lansdown Plc. | | | 1,103,172 | | | | 24,779,302 | |

| Petrofac Ltd. | | | 846,142 | | | | 17,150,391 | |

| Premier Farnell Plc. | | | 3,987,052 | | | | 14,663,561 | |

| Prudential Plc. | | | 1,934,385 | | | | 43,222,136 | |

| Rio Tinto Plc. | | | 1,037,166 | | | | 58,610,192 | |

| Rolls-Royce Holdings Plc. (a) | | | 1,343,443 | | | | 28,415,819 | |

| St James’s Place Plc. | | | 1,456,237 | | | | 17,601,449 | |

| Standard Chartered Plc. | | | 953,077 | | | | 21,527,212 | |

| Tullow Oil Plc. | | | 1,983,715 | | | | 28,154,201 | |

| Wolseley Plc. | | | 625,791 | | | | 35,578,392 | |

| | | | | | | | 566,473,289 | |

| UNITED STATES - 0.6% | | | | | | | | |

| PriceSmart, Inc. | | | 129,362 | | | | 14,946,486 | |

The accompanying notes are an integral part of the financial statements.

| PORTFOLIO OF INVESTMENTS (concluded) | |

| December 31, 2013 | Baillie Gifford International Equity Fund |

| | | Shares | | | Value |

| | | | | | | |

Total Common Stocks

(cost $1,891,512,932) | | | | | | $ | 2,484,264,128 | |

| | | | | | | | | |

| PREFERRED STOCKS - 0.5% | | | | | | | | |

| BRAZIL - 0.5% | | | | | | | | |

Itau Unibanco Holding SA ADR

(cost $14,189,621) | | | 877,010 | | | | 11,901,026 | |

| | | | | | | | | |

TOTAL INVESTMENTS - 98.1%

(cost $1,905,702,553) | | | | | | | 2,496,165,154 | |

| Other assets less liabilities - 1.9% | | | | | | | 48,442,491 | |

| NET ASSETS - 100.0% | | | | | | $ | 2,544,607,645 | |

| (a) Non-income producing security. |

| ADR | - | American Depositary Receipt. |

| CDI | - | Chess Depositary Interest. |

| CVA | - | Certificate Van Aandelen (Bearer). |

| GDR | - | Global Depositary Receipt. |

Reg S - is a safe harbor that defines when an offering of securities will be deemed to come to rest abroad and therefore is not subject to the registration obligations imposed under Section 5 of the 1933 Act. The regulation includes two safe harbor provisions: an issuer safe harbor and a resale safe harbor. In each case, the regulation demands that offers and sales of the securities be made outside the United States and that no offering participant (which includes the issuer, the banks assisting with the offer and their respective affiliates) engage in “directed” selling efforts. In the case of issuers for whose securities there is substantial U.S. market interest, the regulation also requires that no offers and sales be made to U.S. persons (including U.S. persons physically located outside the United States).

The accompanying notes are an integral part of the financial statements.

| STATEMENT OF ASSETS AND LIABILITIES | |

| December 31, 2013 | Baillie Gifford International Equity Fund |

| ASSETS | | | | |

| Investments, at value (cost $1,905,702,553) | | $ | 2,496,165,154 | |

| Cash | | | 49,299,032 | |

| Foreign cash, at value (cost $16) | | | 16 | |

| Dividends receivable | | | 1,324,521 | |

| Tax reclaims receivable | | | 1,580,211 | |

| Total Assets | | | 2,548,368,934 | |

| | | | | |

| LIABILITIES | | | | |

| Management fee payable | | | 1,546,716 | |

| Servicing fee payable | | | 1,325,673 | |

| Distribution payable | | | 248,607 | |

| Trustee fee payable | | | 17,488 | |

| Accrued expenses | | | 622,805 | |

| Total Liabilities | | | 3,761,289 | |

| | | | | |

| NET ASSETS | | $ | 2,544,607,645 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Paid-in capital | | $ | 1,987,702,192 | |

| Distributions in excess of net investment income | | | (2,620,701 | ) |

| Accumulated net realized loss on investments and foreign currency transactions | | | (30,991,759 | ) |

| Net unrealized appreciation in value of investments and foreign currencies | | | 590,517,913 | |

| | | $ | 2,544,607,645 | |

| | | | | |

| NET ASSET VALUE, PER SHARE | | | |

| | | | |

Class 1 ($27,187,071 / 2,300,569 shares outstanding),

unlimited authorized, no par value | | $ | 11.82 | |

| Maximum Purchase Price Per Share (Note D) | | $ | 11.84 | |

| Minimum Redemption Price Per Share (Note D) | | $ | 11.80 | |

| | | | | |

Class 2 ($637,144,206 / 54,049,766 shares outstanding),

unlimited authorized, no par value | | $ | 11.79 | |

| Maximum Purchase Price Per Share (Note D) | | $ | 11.81 | |

| Minimum Redemption Price Per Share (Note D) | | $ | 11.77 | |

| | | | | |

Class 3 ($1,268,490,034 / 106,294,654 shares outstanding),

unlimited authorized, no par value | | $ | 11.93 | |

| Maximum Purchase Price Per Share (Note D) | | $ | 11.95 | |

| Minimum Redemption Price Per Share (Note D) | | $ | 11.91 | |

| | | | | |

Class 4 ($611,786,334 / 50,149,826 shares outstanding),

unlimited authorized, no par value | | $ | 12.20 | |

| Maximum Purchase Price Per Share (Note D) | | $ | 12.22 | |

| Minimum Redemption Price Per Share (Note D) | | $ | 12.18 | |

The accompanying notes are an integral part of the financial statements.

| STATEMENT OF OPERATIONS | |

| For the Year Ended December 31, 2013 | Baillie Gifford International Equity Fund |

| INVESTMENT INCOME | | | | |

| Dividends (net of foreign withholding taxes of $5,748,801) | | $ | 51,924,539 | |

| Interest | | | 11,267 | |

| Total Investment Income | | | 51,935,806 | |

| | | | | |

| EXPENSES | | | | |

| Management fee (Note B) | | | 5,642,205 | |

| Shareholder Servicing fees - Class 1 Shares (Note B) | | | 255,253 | |

| Shareholder Servicing fees - Class 2 Shares (Note B) | | | 1,745,139 | |

| Shareholder Servicing fees - Class 3 Shares (Note B) | | | 2,050,734 | |

| Shareholder Servicing fees - Class 4 Shares (Note B) | | | 898,426 | |

| Fund Accounting | | | 1,115,048 | |

| Custody | | | 421,355 | |

| Legal | | | 237,493 | |

| Trustees’ fees | | | 59,636 | |

| Professional fees | | | 59,606 | |

| Transfer Agency | | | 40,131 | |

| Insurance | | | 34,713 | |

| Miscellaneous | | | 25,967 | |

| Total Expenses | | | 12,585,706 | |

| | | | | |

| Net Investment Income | | | 39,350,100 | |

| | | | | |

| | | | | |

| | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, IN-KIND AND FOREIGN CURRENCY TRANSACTIONS | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | (9,742,523 | ) |

| In-kind transactions | | | 490,670 | |

| Foreign currency transactions | | | 208,500 | |

| | | | (9,043,353 | ) |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 298,983,807 | |

| Translation of assets and liabilities in foreign currencies | | | (280,975 | ) |

| | | | 298,702,832 | |

| | | | | |

| Net realized and unrealized gain on investments and foreign currency transactions | | | 289,659,479 | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 329,009,579 | |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF CHANGES IN NET ASSETS | Baillie Gifford International Equity Fund |

| | | For the

Year Ended

December 31,

2013 | | | For the

Year Ended

December 31,

2012 | |

| | | | | | | | | |

| INCREASE IN NET ASSETS FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 39,350,100 | | | $ | 36,978,146 | |

| | | | | | | | | |

| Net realized loss from investments, in-kind and foreign currency transactions | | | (9,043,353 | ) | | | (27,992,641 | ) |

| Net change in unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies | | | 298,702,832 | | | | 319,771,176 | |

| Net increase in net assets from operations | | | 329,009,579 | | | | 328,756,681 | |

| | | | | | | | | |

| DIVIDENDS TO SHAREHOLDERS FROM: | | | | | | | | |

| Net investment income: | | | | | | | | |

| Class 1 | | | (453,185 | ) | | | (854,941 | ) |

| Class 2 | | | (10,361,979 | ) | | | (10,667,156 | ) |

| Class 3 | | | (20,845,482 | ) | | | (13,666,431 | ) |

| Class 4 | | | (10,043,073 | ) | | | (8,324,082 | ) |

| Total Dividends | | | (41,703,719 | ) | | | (33,512,610 | ) |

| | | | | | | | | |

| TRANSACTIONS IN SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Net proceeds from shares subscribed: | | | | | | | | |

| Class 1 | | | 681,659 | | | | 57,372,832 | |

| Class 2 | | | 91,672,424 | | | | 310,822,024 | |

| Class 3 | | | 276,657,991 | | | | 691,940,811 | |

| Class 4 | | | 49,900,000 | | | | 458,126,968 | |

| Purchase premiums: | | | | | | | | |

| Class 1 | | | 9,434 | | | | 79,717 | |

| Class 2 | | | 102,972 | | | | 652,621 | |

| Class 3 | | | 160,708 | | | | 386,643 | |

| Class 4 | | | 81,798 | | | | 197,554 | |

| Redemption fees: | | | | | | | | |

| Class 1 | | | 2,939 | | | | 6,852 | |

| Class 2 | | | 32,530 | | | | 59,689 | |

| Class 3 | | | 49,264 | | | | 41,412 | |

| Class 4 | | | 25,715 | | | | 21,095 | |

| Dividends reinvested: | | | | | | | | |

| Class 1 | | | 177,440 | | | | 621,138 | |

| Class 2 | | | 10,361,979 | | | | 10,667,156 | |

| Class 3 | | | 20,845,482 | | | | 13,666,431 | |

| Class 4 | | | 10,043,073 | | | | 8,324,082 | |

| Cost of shares redeemed: | | | | | | | | |

| Class 1 | | | (41,887,651 | ) | | | (72,816,528 | ) |

| Class 2 | | | (226,837,755 | ) | | | (615,053,580 | ) |

| Class 3 | | | (26,039,059 | ) | | | (302,097,134 | ) |

| Class 4 | | | (35,218,367 | ) | | | (11,067,960 | ) |

| | | | | | | | | |

| Increase in Net Assets from Transactions in Shares of Beneficial Interest | | | 130,822,576 | | | | 551,951,823 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 418,128,436 | | | | 847,195,894 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 2,126,479,209 | | | | 1,279,283,315 | |

| End of year (including distributions in excess of net investment income of $2,620,701 and $1,926,053, respectively) | | $ | 2,544,607,645 | | | $ | 2,126,479,209 | |

The accompanying notes are an integral part of the financial statements.

| FINANCIAL HIGHLIGHTS | Baillie Gifford International Equity Fund |

| Selected data for a Class 1 Share outstanding throughout each year: | | | | |

| | | | | |

| | | For the

Year Ended

December 31,

2013 | | For the

Year Ended

December 31,

2012 | | For the

Year Ended

December 31,

2011 | | For the

Year Ended

December 31,

2010 | | For the

Year Ended

December 31,

2009 |

| Net asset value, beginning of year | | $10.42 | | $8.65 | | $9.97 | | $8.86 | | $6.07 |

| | | | | | | | | | | |

| From Investment Operations | | | | | | | | | | |

| Net investment income(a) | | 0.18 | | 0.21 | | 0.17 | | 0.12 | | 0.16 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | 1.39 | | 1.70 | | (1.38) | | 1.15 | | 2.70 |

| Net increase (decrease) in net asset value from investment operations | | 1.57 | | 1.91 | | (1.21) | | 1.27 | | 2.86 |

| | | | | | | | | | | |

| Dividends and Distributions to Shareholders | | | | | | | | | | |

| Dividends from net investment income | | (0.17) | | (0.15) | | (0.11) | | (0.17) | | (0.08) |

| Distributions from net realized gain on investments | | - | | - | | (0.01) | | - | | - |

| Total Dividends and Distributions | | (0.17) | | (0.15) | | (0.12) | | (0.17) | | (0.08) |

| | | | | | | | | | | |

| Proceeds from Purchase Premiums and Redemption Fees(a) | | 0.00(e) | | 0.01 | | 0.01 | | 0.01 | | 0.01 |

| | | | | | | | | | | |

| Net asset value, end of year | | $11.82 | | $10.42 | | $8.65 | | $9.97 | | $8.86 |

| | | | | | | | | | | |

| Total Return | | | | | | | | | | |

| Total investment return based on net asset value(b) | | 15.10% | | 22.17% | | (12.07)% | | 14.44% | | 47.24% |

| | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | |

| Net assets, end of year (000’s omitted) | | $27,187 | | $61,940 | | $63,868 | | $72,366 | | $64,512 |

| Ratio of net expenses to average net assets | | 0.79% | | 0.80%(d) | | 0.84% | | 0.86% | | 0.93%(c) |

| Ratio of net expenses to average net assets, before waiver | | 0.79% | | 0.83%(d) | | 0.84% | | 0.86% | | 0.94%(c) |

| Ratio of net investment income to average net assets | | 1.65% | | 2.19% | | 1.72% | | 1.36% | | 2.17% |

| Portfolio turnover rate | | 16% | | 13% | | 11% | | 24% | | 17% |

| (a) | Calculated based upon average shares outstanding during the year. |

| (b) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

| (c) | Baillie Gifford Overseas Limited had contractually agreed to waive its fees and/or bear other expenses through March 31, 2009 to the extent that such Fund’s total annual operating expenses (excluding interest, taxes and extraordinary expenses) exceeded 0.90% for Class 1 Shares. |

| (d) | Baillie Gifford Overseas Limited had voluntarily agreed to waive its fees and/or bear other expenses through June 30, 2012, during which time Baillie Gifford Overseas Limited received annual management fee equal to 0.25% of the Fund’s average net assets. |

| (e) | Amount is less than $0.005 per share. |

The accompanying notes are an integral part of the financial statements.

| FINANCIAL HIGHLIGHTS (continued) | Baillie Gifford International Equity Fund |

| Selected data for a Class 2 Share outstanding throughout each year: | | |

| | | |

| | | For the

Year Ended

December 31,

2013 | | For the

Year Ended

December 31,

2012 | | For the

Year Ended

December 31,

2011 | | For the

Year Ended

December 31,

2010 | | For the

Year Ended

December 31,

2009 |

| Net asset value, beginning of year | | $10.39 | | $8.63 | | $9.95 | | $8.84 | | $6.07 |

| | | | | | | | | | | |

| From Investment Operations | | | | | | | | | | |

| Net investment income(a) | | 0.19 | | 0.22 | | 0.16 | | 0.13 | | 0.09 |

Net realized and unrealized gain (loss) on investments and

foreign currency transactions | | 1.40 | | 1.69 | | (1.36) | | 1.15 | | 2.80 |

Net increase (decrease) in net asset value from investment

operations | | 1.59 | | 1.91 | | (1.20) | | 1.28 | | 2.89 |

| | | | | | | | | | | |

| Dividends and Distributions to Shareholders | | | | | | | | | | |

| Dividends from net investment income | | (0.19) | | (0.16) | | (0.12) | | (0.18) | | (0.13) |

| Distributions from net realized gain on investments | | - | | - | | (0.01) | | - | | - |

| Total Dividends and Distributions | | (0.19) | | (0.16) | | (0.13) | | (0.18) | | (0.13) |

| | | | | | | | | | |

| Proceeds from Purchase Premiums and Redemption Fees(a) | | 0.00(e) | | 0.01 | | 0.01 | | 0.01 | | 0.01 |

| | | | | | | | | | | |

| Net asset value, end of year | | $11.79 | | $10.39 | | $8.63 | | $9.95 | | $8.84 |

| | | | | | | | | | | |

| Total Return | | | | | | | | | | |

| Total investment return based on net asset value(b) | | 15.35% | | 22.33% | | (11.94)% | | 14.65% | | 47.76% |

| | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | |

| Net assets, end of year (000’s omitted) | | $637,144 | | $682,452 | | $831,065 | | $447,232 | | $214,722 |

| Ratio of net expenses to average net assets | | 0.61% | | 0.62%(d) | | 0.67% | | 0.68% | | 0.70%(c) |

| | | | | | | | | | | |

| Ratio of net expenses to average net assets, before waiver | | 0.61% | | 0.64%(d) | | 0.67% | | 0.68% | | 0.70%(c) |

| Ratio of net investment income to average net assets | | 1.72% | | 2.27% | | 1.74% | | 1.43% | | 1.12% |

| Portfolio turnover rate | | 16% | | 13% | | 11% | | 24% | | 17% |

| (a) | Calculated based upon average shares outstanding during the year. |

| (b) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

| (c) | Baillie Gifford Overseas Limited had contractually agreed to waive its fees and/or bear other expenses through March 31, 2009 to the extent that such Fund’s total annual operating expenses (excluding interest, taxes and extraordinary expenses) exceeded 0.72% for Class 1 Shares. |

| (d) | Baillie Gifford Overseas Limited had voluntarily agreed to waive its fees and/or bear other expenses through June 30, 2012, during which time Baillie Gifford Overseas Limited received annual management fee equal to 0.25% of the Fund’s average net assets. |

| (e) | Amount is less than $0.005 per share. |

The accompanying notes are an integral part of the financial statements.

| FINANCIAL HIGHLIGHTS (continued) | Baillie Gifford International Equity Fund |

| Selected data for a Class 3 Share outstanding throughout each period: | | | | | | |

| | | | | | | |

| | | For the

Year Ended

December 31,

2013 | | For the

Year Ended

December 31,

2012 | | For the

Year Ended

December 31,

2011 | | For the Period

September 1,

2010(a)

through

December 31,

2010 |

| Net asset value, beginning of period | | $10.52 | | $8.73 | | $10.06 | | $8.53 |

| | | | | | | | | |

| From Investment Operations | | | | | | | | |

| Net investment income(b) | | 0.19 | | 0.17 | | 0.17 | | 0.02 |

Net realized and unrealized gain (loss) on investments and

foreign currency transactions | | 1.42 | | 1.78 | | (1.37) | | 1.69 |

Net increase (decrease) in net asset value from investment

operations | | 1.61 | | 1.95 | | (1.20) | | 1.71 |

| | | | | | | | | |

| Dividends and Distributions to Shareholders | | | | | | | | |

| Dividends from net investment income | | (0.20) | | (0.17) | | (0.13) | | (0.19) |

| Distributions from net realized gain on investments | | - | | - | | (0.01) | | - |

| Total Dividends and Distributions | | (0.20) | | (0.17) | | (0.14) | | (0.19) |

| | | | | | | | | |