UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10041 |

|

JNL Investors Series Trust |

(Exact name of registrant as specified in charter) |

|

1 Corporate Way, Lansing, Michigan | | 48951 |

(Address of principal executive offices) | | (Zip code) |

|

225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606 |

(Mailing Address) |

|

Steven J. Fredricks Jackson National Asset Management, LLC 225 West Wacker Drive, Suite 1200 Chicago, Illinois 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 338-5800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

December 31, 2015

· JNL® Investors Series Trust

This report is for the general information of qualified and non-qualified plan participants, as well as contract/policyowners of the PerspectiveSM, Perspective II®, Perspective AdvisorsSM, Perspective Advisors IISM, PerspectiveSM L Series, Perspective Rewards®, Elite Access®, Elite Access Brokerage Edition®, Perspective AdvantageSM, Perspective Focus®, Fifth Third Perspective, Retirement Latitudes®, Perspective II (New York), Perspective Advisors II (New York), Perspective L Series (New York), Perspective Rewards (New York), Elite Access (New York), Elite Access Brokerage Edition (New York), Perspective Advisors (New York), and Perspective Focus (New York). Not all the portfolios are available in all of the products. Jackson® is the marketing name for Jackson National Life Insurance Company® (Home Office: Lansing, Michigan) and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York).

JNL Investors Series Trust

December 31, 2015

President’s Letter

Dear Investor,

Enclosed is the annual report for the JNL Investors Series Trust for the year ended December 31, 2015, together with Management’s Discussion of Fund Performance for each of the Funds.

December 2015 marked the much anticipated hike in the U.S. Federal Reserve (“Fed”) Funds rate, which conveyed the Fed’s stance that domestic economic conditions have sufficiently improved to warrant the commencement of interest policy normalization. Throughout 2015, the U.S. economy displayed a positive growth trend, albeit somewhat moderate, across many key factors. The unemployment rate fell to 5.0% in Q4 from 5.5% during Q1 2015. Non-farm payrolls surprised to the upside, the Conference Board’s consumer confidence measure ticked up on job and wage optimism, while domestic industries (such as housing and consumer spending) also remained robust. As 2015 drew to a close, however, an appreciating U.S. Dollar, weaker global demand precipitated by a slowdown in China, and drastically lower commodity prices weighed on the manufacturing sector, which slipped to contractionary levels. Against this backdrop, U.S. inflation expectations also remained fairly muted.

Domestic equities, as represented by the Russell 3000 Index, eked out their seventh consecutive year of gains, returning 0.48% for the year on a total return basis. After reaching new record highs in May, equities suffered a correction in the 3rd quarter, initially triggered by a surprise devaluation of the Chinese Yuan. Blue chip, large-cap equities broadly outperformed small- and mid-cap equities, despite earnings pressure from a stronger U.S. Dollar, which created headwinds for large multi-national companies. Consumer discretionary was the leading sector, returning 10.11%, while energy returned -21.12% due to sharply falling oil prices. From a style standpoint, growth significantly outperformed value equities, due in part to the significantly higher energy exposure within value equity indices.

Despite the continued growth in the U.S., most international markets were hampered by slowing growth, geopolitical tensions, falling commodity prices and deflation in some areas, including the Eurozone. Growth was also mixed for emerging market countries. Developed international equities, as represented by the Morgan Stanley Capital International (“MSCI”) EAFE Index, returned -0.81% during the year (in U.S. Dollar terms). However, in local currency terms, it returned 5.33%, reflecting slightly improving corporate fundamentals in addition to continued accommodative monetary policy by the European Central Bank and the Bank of Japan. Japanese equities fared the best, returning 9.57% (in U.S. Dollar terms). Australian equities, which were hampered by a commodity downturn, returned -9.95% (in U.S. Dollar terms).

Emerging market equities suffered their worst performance year since 2011, returning -14.92%. There were numerous headwinds for the asset class during 2015, including a strengthening U.S. Dollar, a slowdown of growth in China, sharply lower commodity prices, deteriorating fundamentals in certain countries, heightened geopolitical tensions and investor outflows. Within the “BRIC” countries, returns varied significantly: Brazilian equities returned -41.37%, Chinese equities returned -7.82%, Indian equities returned -6.12%, and Russian equities returned 4.21% (all in U.S. Dollar terms).

U.S. bonds, as represented by the Barclays U.S. Aggregate Bond Index, managed a slightly positive return of 0.55%. Treasury yields rose across the board, especially at the front end of the yield curve, as markets priced in an eventual Fed tightening that occurred late in the year. Agency mortgages and Treasuries were the leading sectors, returning 1.51% and 0.84% as measured by the Barclays U.S. Agency Fixed Rate MBS Index and Barclays U.S. Treasury Index, respectively. Meanwhile, both investment grade corporate and high yield bonds underperformed, with the latter falling sharply due in part to exposure to poor performing energy and materials sectors as well as pickup on volatility that led to spread widening. High yield bonds, as represented by the Barclays U.S. Corporate High Yield Bond Index, returned -4.47%. Non-U.S. Dollar bonds, including emerging markets debt, significantly underperformed due in part to a strengthening U.S. Dollar. For the second consecutive year, local currency emerging markets debt was the worst performing sector for the year, down 14.92% as measured by the JPMorgan GBI — Emerging Markets Global Diversified Index.

Alternative assets were mixed during the year and generally underperformed the broad market. A strengthening U.S. Dollar created significant headwinds for various alternative assets including commodities and global infrastructure. Commodities suffered their worst year since 2008, as the Bloomberg Commodity Index returned -24.66%. Global developed real estate managed to produce a slightly positive return of 0.05%, as measured by the FTSE/EPRA NAREIT Developed Index. Most alternative strategies also produced negative returns during the year, with the Wilshire Liquid Alternative Index returning -3.47%. Relative value strategies returned -2.80%; multi-strategy funds returned -2.95%, global macro strategies returned -2.96%, event driven strategies returned -4.00%, and equity hedged strategies returned -5.04%, all as measured by their respective Wilshire Liquid Alternative sub-index.

Looking ahead to 2016, we expect divergent economic growth and monetary policy among major developed and emerging market countries. Our base case is that the U.S. will have another year of modest gross domestic product (“GDP”) growth and the Fed will continue on the path of rate normalization in a gradual fashion. Meanwhile, Europe and Japan will likely continue their quantitative easing programs, which should be supportive of modest economic growth. We continue to expect weakness within emerging markets as China’s economy pivots more toward services and less infrastructure spending, which will present challenging conditions for countries tied to the commodity complex. How China transitions its economy and the impact of Fed rate normalization will be critical issues to monitor over the course of the year that could impact our outlook.

Ultimately, these converging trends may lead to heightened volatility in 2016. While this may cause gyrations in returns and uncertainty over the short term, it could also present long-term opportunities for active managers who are able to take advantage of valuation anomalies that are presented by dislocations.

Thank you for choosing Jackson for your investment needs.

| |

| |

Mark D. Nerud | |

Trustee, President and Chief Executive Officer | |

JNL Investors Series Trust | |

JNL/PPM America Funds

PPM America, Inc. (Unaudited)

Market Summary: Market returns for the Barclays 1-3 Year U.S. Government/Credit Index and the Barclays U.S. Aggregate Bond Index were 0.65% and 0.55%, respectively, for the year ended December 31, 2015. U.S. bonds managed a modestly positive return for 2015, despite rising Treasury yields across the board and the Fed's much anticipated rate hike in December. Government-backed mortgage securities and U.S. Treasuries were the leading sectors, returning 1.51% and 0.84%, respectively. Corporate bonds, both

investment grade and high yield, fell sharply, with high yield bonds negatively affected by falling energy prices that raised concerns about the stability of energy companies and their ability to service their debt. Foreign bonds, especially emerging markets debt, significantly underperformed in the face of the continued strength of the U.S. Dollar that reduced the value of locally-priced debt securities.

JNL/PPM America Low Duration Bond Fund

Portfolio Composition†:

Financials | | | 30.7 | % | |

Non-U.S. Government Agency ABS | | | 28.9 | | |

Government Securities | | | 12.7 | | |

Health Care | | | 3.7 | | |

Consumer Staples | | | 3.2 | | |

U.S. Government Agency

Mortgage-Backed Securities | | | 2.9 | | |

Utilities | | | 2.5 | | |

Energy | | | 2.4 | | |

Materials | | | 2.3 | | |

Industrials | | | 2.3 | | |

Consumer Discretionary | | | 1.4 | | |

Information Technology | | | 1.1 | | |

Telecommunication Services | | | 0.8 | | |

Short Term Investments | | | 5.1 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2015.

For the year ended December 31, 2015, JNL/PPM America Low Duration Bond Fund underperformed its benchmark by posting a return of 0.51% compared to 0.65% for the Barclays 1-3 Year U.S. Government/Credit Index. The investment results were positively impacted primarily by an overweight to corporate bonds and to the out-of-index allocation to asset-backed securities. Within corporate bonds, the Fund's investments in the banking sector contributed to relative performance. The Fund's cash position detracted from relative performance. The Fund invested in futures contracts, which are used to manage duration.

Positioning among sectors and credit quality was stable throughout the year. At the beginning of the year, the Fund held approximately 52% in corporate bonds, 26% in asset-backed securities ("ABS"), and 10% in Treasuries; this allocation

migrated to 53%, 23% and 6% by year end. Similarly, the Fund's average credit quality remained consistent during the year. The Fund's top five segments represented 56% of total assets: banking 22%, ABS car loan 10%, ABS other 9%, Treasuries 8% and consumer non-cyclical 7%.

JNL/PPM America Total Return Fund

Portfolio Composition†:

Financials | | | 25.2 | % | |

U.S. Government Agency

Mortgage-Backed Securities | | | 17.5 | | |

Government Securities | | | 14.7 | | |

Energy | | | 5.9 | | |

Non-U.S. Government Agency ABS | | | 5.1 | | |

Consumer Discretionary | | | 5.1 | | |

Utilities | | | 4.1 | | |

Industrials | | | 4.0 | | |

Health Care | | | 3.5 | | |

Materials | | | 2.6 | | |

Telecommunication Services | | | 2.4 | | |

Consumer Staples | | | 2.2 | | |

Information Technology | | | 2.0 | | |

Short Term Investments | | | 5.7 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2015.

For the year ended December 31, 2015, JNL/PPM America Total Return Fund underperformed its benchmark by posting a return of -1.11% compared to 0.55% for the Barclays U.S Aggregate Bond Index. The Fund's overweight to high yield corporate bonds and security selection within investment grade corporate bonds were the primary detractors from relative return. The Fund's non-allocation to agency and security selection within commercial mortgage-backed securities were positive contributors to relative return for the year. By sector, security selection within energy and basic industries were the top detractors, while security selection within banking and finance companies were positive contributors. The Fund also saw strong performance through security selection within the consumer non-cyclical sector. The Fund invested in futures to manage duration.

Positioning among sectors and credit quality was stable throughout the year. At the beginning of the year, the Fund held approximately 64% in corporate bonds, 19% in mortgage-backed securities and 12% in U.S. government bonds which migrated to 59%, 19% and 15%, respectively, by year end. Similarly, the Fund's average credit quality remained consistent during the year. The Fund was well diversified among industries at year end with the top five segments representing 32% of total assets: banking 17%, electric 5%, automotive 4%, finance companies 3% and cable and satellite 3%.

JNL/PPM America Funds (continued)

PPM America, Inc. (Unaudited)

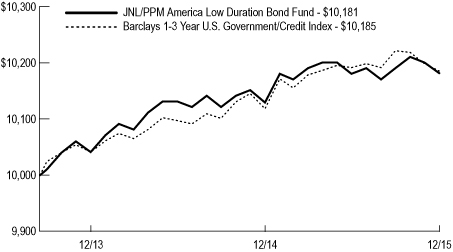

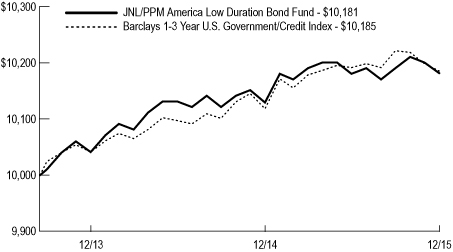

JNL/PPM America Low Duration Bond Fund

Average Annual Total Returns | |

| 1 Year | | | 0.51 | % | |

Since Inception | | | 0.78 | | |

(Inception date September 16, 2013) | |

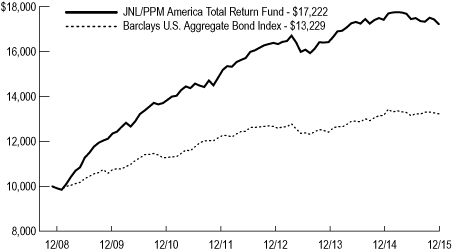

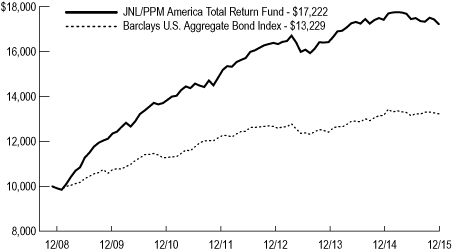

JNL/PPM America Total Return Fund

Average Annual Total Returns | |

| 1 Year | | | -1.11 | % | |

| 5 Year | | | 4.67 | | |

Since Inception | | | 8.07 | | |

(Inception date December 29, 2008) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

JNL Investors Series Trust

Schedules of Investments

December 31, 2015

| | Shares/Par † | | Value | |

JNL/PPM America Low Duration Bond Fund | | | | | |

NON-U.S. GOVERNMENT AGENCY ASSET-BACKED SECURITIES - 30.1% | | | | | |

AEP Texas Central Transition Funding III LLC, 0.88%, 12/01/17 | | $ | 395,653 | | $ | 394,082 | |

American Express Credit Account Master Trust, 1.26%, 06/15/17 | | 206,000 | | 205,573 | |

American Express Issuance Trust II, 0.78%, 03/15/18 (a) | | 1,775,000 | | 1,765,205 | |

AmeriCredit Automobile Receivables Trust | | | | | |

1.12%, 01/08/16 | | 334,645 | | 334,651 | |

0.90%, 09/08/16 | | 557,896 | | 557,077 | |

1.69%, 09/08/16 | | 1,493,000 | | 1,495,601 | |

1.31%, 11/08/17 | | 775,615 | | 775,635 | |

2.67%, 01/08/18 | | 93,742 | | 93,867 | |

0.96%, 04/09/18 | | 211,444 | | 211,357 | |

1.19%, 05/08/18 | | 775,000 | | 774,393 | |

1.58%, 09/10/18 | | 190,000 | | 190,005 | |

1.66%, 09/10/18 | | 960,000 | | 959,818 | |

1.79%, 03/08/19 | | 1,825,000 | | 1,826,537 | |

2.38%, 06/10/19 | | 219,000 | | 220,204 | |

Ascentium Equipment Receivables LLC | | | | | |

1.04%, 01/10/17 (b) | | 52,959 | | 52,931 | |

1.15%, 07/10/17 (b) | | 285,562 | | 284,852 | |

1.57%, 12/11/17 (b) | | 3,750,000 | | 3,736,895 | |

2.46%, 11/13/18 (b) | | 200,000 | | 200,791 | |

Banc of America Commercial Mortgage Trust REMIC, 5.49%, 10/10/17 | | 2,547,120 | | 2,638,068 | |

Bank of America Auto Trust, 2.99%, 03/15/19 | | 2,340,000 | | 2,344,472 | |

Bank of the West Auto Trust, 0.87%, 04/16/18 (b) | | 4,867,818 | | 4,860,062 | |

Bank of The West Auto Trust, 1.31%, 10/15/19 (b) | | 478,000 | | 475,046 | |

Bear Stearns Commercial Mortgage Securities Trust REMIC | | | | | |

5.74%, 09/11/17 (a) | | 575,656 | | 604,651 | |

5.20%, 12/11/38 | | 1,913,934 | | 1,950,837 | |

5.47%, 01/12/45 (a) | | 1,044,139 | | 1,074,646 | |

5.69%, 06/11/50 (a) | | 2,655,451 | | 2,769,443 | |

California Republic Auto Receivables Trust | | | | | |

0.63%, 02/15/16 | | 78,946 | | 78,915 | |

3.00%, 10/15/16 (b) | | 750,000 | | 756,843 | |

1.62%, 05/15/18 | | 3,000,000 | | 2,976,341 | |

1.57%, 08/15/18 | | 3,000,000 | | 2,976,473 | |

1.79%, 10/15/18 | | 1,458,000 | | 1,450,792 | |

REMIC, 0.77%, 09/15/17 | | 153,564 | | 153,396 | |

Capital One Multi-Asset Execution Trust, 0.61%, 03/15/16 (a) | | 5,557,000 | | 5,553,567 | |

CarMax Auto Owner Trust | | | | | |

2.08%, 03/15/18 | | 585,000 | | 587,710 | |

0.97%, 04/16/18 | | 1,642,283 | | 1,639,408 | |

1.91%, 03/15/19 | | 705,000 | | 706,312 | |

1.16%, 06/17/19 | | 1,826,000 | | 1,819,143 | |

Centerpoint Energy Transition Bond Co. III LLC, 4.19%, 02/01/17 | | 281,526 | | 284,334 | |

CenterPoint Energy Transition Bond Co. IV LLC, 0.90%, 04/15/17 | | 3,921,736 | | 3,910,894 | |

Chase Issuance Trust | | | | | |

0.58%, 02/15/17 (a) | | 5,952,000 | | 5,921,563 | |

0.79%, 02/15/17 (a) | | 3,523,000 | | 3,508,275 | |

Chrysler Capital Auto Receivables Trust | | | | | |

1.91%, 08/15/18 (b) | | 2,169,000 | | 2,162,113 | |

0.83%, 09/17/18 (b) | | 2,027,269 | | 2,023,385 | |

1.22%, 07/15/19 (b) | | 3,600,000 | | 3,581,070 | |

Citigroup Commercial Mortgage Trust REMIC | | | | | |

3.55%, 11/10/23 | | 1,000,000 | | 1,028,889 | |

5.43%, 10/15/49 | | 3,960,307 | | 4,013,249 | |

Citigroup/Deutsche Bank Commercial Mortgage Trust REMIC, 5.65%, 10/15/48 | | 3,000,000 | | 3,041,048 | |

CNH Equipment Trust | | | | | |

1.01%, 02/15/17 | | 6,750,000 | | 6,716,801 | |

0.99%, 11/15/18 | | 1,960,000 | | 1,944,723 | |

1.50%, 05/15/20 | | 325,000 | | 322,872 | |

COMM Mortgage Trust REMIC | | | | | |

5.80%, 07/10/17 (a) | | 2,547,654 | | 2,642,508 | |

0.72%, 09/10/17 | | 582,256 | | 578,167 | |

Commercial Mortgage Pass-Through Certificates REMIC, 5.31%, 12/10/16 | | 924,376 | | 940,816 | |

Commercial Mortgage Trust REMIC | | | | | |

3.45%, 05/15/23 | | 1,165,000 | | 1,194,892 | |

3.53%, 07/10/23 | | 517,000 | | 531,584 | |

3.65%, 11/10/23 | | 1,849,000 | | 1,900,776 | |

Credit Suisse First Boston Mortgage Securities Corp. REMIC, 5.57%, 05/15/36 (a) (b) | | 147,469 | | 147,980 | |

Dell Equipment Finance Trust | | | | | |

1.31%, 12/22/17 (a) (b) | | 3,000,000 | | 3,000,233 | |

1.30%, 03/23/20 (b) | | 842,000 | | 835,470 | |

1.81%, 03/23/20 (b) | | 481,000 | | 477,253 | |

0.94%, 06/22/20 (b) | | 1,290,000 | | 1,289,015 | |

1.36%, 06/22/20 (b) | | 100,000 | | 99,669 | |

Ford Credit Auto Owner Trust | | | | | |

1.11%, 05/15/17 | | 500,000 | | 499,001 | |

1.32%, 05/15/17 | | 440,000 | | 437,438 | |

1.95%, 04/15/18 | | 1,549,000 | | 1,549,483 | |

1.54%, 03/15/19 | | 2,500,000 | | 2,490,278 | |

1.71%, 05/15/19 | | 415,000 | | 413,648 | |

1.90%, 09/15/19 | | 185,000 | | 185,208 | |

1.97%, 04/15/20 | | 553,000 | | 553,615 | |

2.20%, 11/15/20 | | 3,000,000 | | 2,991,344 | |

Ford Credit Floorplan Master Owner Trust | | | | | |

1.50%, 09/15/16 | | 1,000,000 | | 1,001,609 | |

1.20%, 02/15/17 | | 3,111,000 | | 3,099,440 | |

1.42%, 01/15/18 | | 2,422,000 | | 2,403,169 | |

FREMF Mortgage Trust REMIC, 3.40%, 11/25/16 (a) (b) | | 229,000 | | 230,524 | |

GE Equipment Midticket LLC | | | | | |

0.95%, 04/22/16 | | 665,800 | | 665,224 | |

1.14%, 05/22/18 | | 3,000,000 | | 2,986,119 | |

GMF Floorplan Owner Revolving Trust, 0.83%, 05/15/18 (a) (b) | | 3,000,000 | | 2,989,464 | |

Golden Credit Card Trust | | | | | |

0.75%, 07/17/17 (a) (b) | | 3,000,000 | | 2,991,727 | |

2.02%, 04/15/20 (b) | | 2,922,000 | | 2,875,698 | |

GreatAmerica Leasing Receivables Funding LLC | | | | | |

1.16%, 12/15/16 (b) | | 1,365,378 | | 1,362,396 | |

0.89%, 01/15/17 (b) | | 3,702,101 | | 3,690,283 | |

1.47%, 01/15/18 (b) | | 545,000 | | 541,473 | |

1.54%, 07/20/18 (b) | | 5,180,000 | | 5,152,984 | |

2.02%, 06/21/21 (b) | | 620,000 | | 616,637 | |

Greenwich Capital Commercial Funding Corp. REMIC, 5.44%, 01/10/17 | | 593,299 | | 606,500 | |

GS Mortgage Securities Trust REMIC, 4.75%, 01/10/21 (b) | | 1,400,000 | | 1,519,132 | |

Harley-Davidson Motorcycle Trust, 1.41%, 06/15/20 | | 3,000,000 | | 2,988,570 | |

Huntington Auto Trust | | | | | |

1.07%, 06/15/16 | | 275,000 | | 274,445 | |

1.71%, 08/15/17 | | 200,000 | | 200,034 | |

Hyundai Auto Receivables Trust | | | | | |

1.42%, 12/15/16 | | 315,000 | | 314,836 | |

1.13%, 04/15/17 | | 590,000 | | 587,241 | |

1.35%, 04/15/17 | | 300,000 | | 299,266 | |

2.10%, 06/15/17 | | 2,248,000 | | 2,251,457 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

1.39%, 03/15/18 | | 395,000 | | 396,089 | |

0.90%, 12/17/18 | | 2,901,510 | | 2,895,226 | |

2.02%, 08/15/19 | | 560,000 | | 561,418 | |

JPMBB Commercial Mortgage Securities Trust REMIC, 3.71%, 09/15/23 | | 1,100,000 | | 1,142,177 | |

JPMorgan Chase Commercial Mortgage Securities Trust REMIC, 3.46%, 04/15/24 | | 3,430,000 | | 3,502,089 | |

JPMorgan Mortgage Trust REMIC | | | | | |

3.00%, 04/25/22 (a) (b) | | 2,632,250 | | 2,629,825 | |

3.50%, 08/25/22 (a) (b) | | 2,922,273 | | 2,948,264 | |

3.00%, 10/25/26 (a) (b) | | 2,053,167 | | 2,080,035 | |

Kubota Credit Owner Trust REMIC | | | | | |

0.94%, 12/15/17 (b) | | 449,081 | | 448,221 | |

1.54%, 03/15/19 (b) | | 7,000,000 | | 6,955,434 | |

Merrill Lynch Mortgage Investors Trust REMIC, 1.04%, 10/25/28 (a) | | 1,011,236 | | 966,417 | |

MMCA Auto Owner Trust, 1.21%, 12/16/19 (b) | | 6,631,989 | | 6,606,560 | |

Morgan Stanley Bank of America Merrill Lynch Trust REMIC, 3.65%, 12/15/23 | | 360,000 | | 373,542 | |

Morgan Stanley Capital I Trust REMIC | | | | | |

5.92%, 07/11/17 (a) | | 2,087,853 | | 2,168,926 | |

5.33%, 11/12/41 | | 2,402,701 | | 2,421,598 | |

5.64%, 06/11/42 (a) | | 3,934,564 | | 4,110,592 | |

4.98%, 06/12/47 (a) | | 40,290 | | 40,271 | |

Sierra Receivables Funding Co. LLC | | | | | |

2.84%, 05/20/19 (b) | | 2,374,975 | | 2,385,422 | |

2.38%, 03/20/29 (b) | | 856,601 | | 856,734 | |

Sierra Timeshare Receivables Funding LLC | | | | | |

3.26%, 02/20/19 (c) (d) | | 448,716 | | 450,800 | |

3.37%, 02/20/21 (b) | | 1,843,995 | | 1,858,027 | |

2.20%, 05/20/21 (b) | | 689,837 | | 685,681 | |

2.28%, 11/20/25 (b) | | 497,818 | | 496,729 | |

3.51%, 11/20/25 (b) | | 420,233 | | 420,640 | |

3.35%, 04/20/26 (b) | | 83,241 | | 83,303 | |

2.30%, 10/20/31 (b) | | 344,216 | | 343,349 | |

Springleaf Mortgage Loan Trust REMIC, 1.87%, 09/25/57 (a) (b) | | 1,591,629 | | 1,586,903 | |

SunTrust Auto Receivables Trust, 1.42%, 04/16/18 (b) | | 3,000,000 | | 2,969,504 | |

UBS-Barclays Commercial Mortgage Trust REMIC, 2.69%, 11/10/22 | | 900,000 | | 899,993 | |

USAA Auto Owner Trust, 1.34%, 08/17/20 | | 1,000,000 | | 996,054 | |

Volvo Financial Equipment LLC | | | | | |

0.74%, 01/15/16 (b) | | 77,959 | | 77,958 | |

0.95%, 11/15/17 (b) | | 951,933 | | 950,970 | |

0.82%, 04/16/18 (b) | | 2,311,031 | | 2,304,304 | |

1.51%, 06/17/19 (b) | | 3,275,000 | | 3,270,083 | |

Wells Fargo Mortgage-Backed Securities Trust REMIC | | | | | |

2.85%, 12/25/34 (a) | | 577,190 | | 567,634 | |

2.74%, 06/25/35 (a) | | 501,188 | | 504,296 | |

World Omni Auto Receivables Trust, 1.49%, 04/15/16 | | 565,000 | | 565,603 | |

World Omni Automobile Lease Securitization Trust, 1.54%, 02/15/18 | | 3,000,000 | | 2,978,921 | |

Total Non-U.S. Government Agency Asset- Backed Securities (cost $217,949,118) | | | | 215,861,013 | |

CORPORATE BONDS AND NOTES - 52.4% | | | | | |

CONSUMER DISCRETIONARY - 1.4% | | | | | |

CCO Safari II LLC, 3.58%, 07/23/20 (b) | | 3,000,000 | | 2,982,816 | |

Dollar General Corp., 1.88%, 04/15/18 | | 1,484,000 | | 1,469,725 | |

Mattel Inc., 2.50%, 11/01/16 | | 1,000,000 | | 1,009,779 | |

MGM Resorts International, 7.50%, 06/01/16 (e) | | 2,000,000 | | 2,036,880 | |

Time Warner Cable Inc., 6.75%, 07/01/18 | | 2,500,000 | | 2,728,183 | |

| | | | 10,227,383 | |

CONSUMER STAPLES - 3.4% | | | | | |

Altria Group Inc., 2.63%, 01/14/20 | | 5,000,000 | | 5,009,115 | |

Bunge Ltd. Finance Corp., 3.20%, 06/15/17 | | 3,000,000 | | 3,029,520 | |

HJ Heinz Co., 2.80%, 07/02/20 (b) | | 5,500,000 | | 5,487,108 | |

JM Smucker Co., 2.50%, 03/15/20 (e) | | 902,000 | | 895,662 | |

Kroger Co. | | | | | |

0.85%, 10/17/16 (a) | | 1,000,000 | | 999,362 | |

1.20%, 10/17/16 | | 2,844,000 | | 2,838,414 | |

Reynolds American Inc., 3.25%, 06/12/20 | | 3,500,000 | | 3,557,417 | |

WM Wrigley Jr. Co. | | | | | |

1.40%, 10/21/16 (b) | | 1,909,000 | | 1,907,017 | |

2.00%, 10/20/17 (b) | | 468,000 | | 468,782 | |

| | | | 24,192,397 | |

ENERGY - 2.5% | | | | | |

Anadarko Petroleum Corp., 6.38%, 09/15/17 | | 3,000,000 | | 3,145,803 | |

Canadian Natural Resources Ltd., 5.70%, 05/15/17 | | 1,000,000 | | 1,021,342 | |

Chevron Phillips Chemical Co. LLC, 1.70%, 05/01/18 (b) | | 3,000,000 | | 2,962,773 | |

Energy Transfer Partners LP, 4.15%, 10/01/20 | | 3,000,000 | | 2,768,640 | |

EnLink Midstream Partners LP, 2.70%, 04/01/19 | | 2,000,000 | | 1,824,780 | |

Enterprise Products Operating LLC, 1.65%, 05/07/18 | | 3,500,000 | | 3,414,323 | |

Shell International Finance BV, 1.25%, 11/10/17 (e) | | 3,000,000 | | 2,984,400 | |

| | | | 18,122,061 | |

FINANCIALS - 31.9% | | | | | |

Abbey National Treasury Services Plc, 2.35%, 09/10/19 | | 2,308,000 | | 2,310,460 | |

ABN AMRO Bank NV, 4.25%, 02/02/17 (b) | | 5,550,000 | | 5,699,245 | |

AerCap Ireland Capital Ltd., 2.75%, 05/15/17 (e) | | 2,698,000 | | 2,681,137 | |

Ally Financial Inc. | | | | | |

2.75%, 01/30/17 | | 3,000,000 | | 2,992,500 | |

3.25%, 11/05/18 (e) | | 2,000,000 | | 1,962,500 | |

American Express Credit Corp., 2.38%, 05/26/20 | | 3,390,000 | | 3,365,331 | |

Bank of America Corp. | | | | | |

3.63%, 03/17/16 | | 655,000 | | 658,367 | |

6.50%, 08/01/16 | | 1,500,000 | | 1,543,713 | |

6.00%, 09/01/17 | | 5,000,000 | | 5,320,940 | |

Bank of America NA | | | | | |

5.30%, 03/15/17 | | 1,500,000 | | 1,560,390 | |

1.65%, 03/26/18 | | 436,000 | | 433,032 | |

1.75%, 06/05/18 | | 527,000 | | 524,037 | |

Bank of Montreal, 1.80%, 07/31/18 | | 3,000,000 | | 2,993,721 | |

Barclays Plc, 2.75%, 11/08/19 | | 3,000,000 | | 2,989,041 | |

BioMed Realty LP, 3.85%, 04/15/16 | | 300,000 | | 300,917 | |

Brandywine Operating Partnership LP, 5.70%, 05/01/17 | | 850,000 | | 886,594 | |

Caisse Centrale Desjardins, 1.55%, 09/12/17 (b) | | 3,000,000 | | 2,980,365 | |

Camden Property Trust, 5.70%, 05/15/17 (f) | | 825,000 | | 861,441 | |

Capital One Bank USA NA | | | | | |

1.20%, 02/13/17 | | 2,000,000 | | 1,990,120 | |

2.25%, 02/13/19 | | 4,500,000 | | 4,481,212 | |

2.40%, 09/05/19 | | 2,627,000 | | 2,599,348 | |

Caterpillar Financial Services Corp., 2.25%, 12/01/19 | | 3,000,000 | | 3,008,067 | |

Citigroup Inc. | | | | | |

0.75%, 06/09/16 (a) | | 4,000,000 | | 3,988,216 | |

1.35%, 03/10/17 | | 2,000,000 | | 1,992,450 | |

1.80%, 02/05/18 | | 1,525,000 | | 1,519,695 | |

2.50%, 09/26/18 | | 627,000 | | 632,456 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

CNH Capital LLC, 6.25%, 11/01/16 | | 2,000,000 | | 2,037,500 | |

CNH Industrial America LLC, 7.25%, 01/15/16 | | 3,000,000 | | 3,004,611 | |

CommonWealth REIT, 6.25%, 08/15/16 | | 430,000 | | 431,830 | |

Compass Bank, 1.85%, 09/29/17 | | 2,000,000 | | 1,982,858 | |

Corp. Andina de Fomento, 1.50%, 08/08/17 | | 2,250,000 | | 2,238,401 | |

Countrywide Financial Corp., 6.25%, 05/15/16 | | 1,560,000 | | 1,586,278 | |

Daimler Finance North America LLC | | | | | |

0.84%, 03/02/18 (a) (b) (e) | | 2,500,000 | | 2,471,653 | |

2.00%, 08/03/18 (b) | | 3,000,000 | | 2,980,242 | |

Discover Bank | | | | | |

2.00%, 02/21/18 | | 6,500,000 | | 6,457,041 | |

2.60%, 11/13/18 (e) | | 1,277,000 | | 1,276,238 | |

Equity Commonwealth, 6.25%, 06/15/17 | | 1,800,000 | | 1,859,105 | |

Equity One Inc., 6.25%, 01/15/17 | | 3,053,000 | | 3,179,281 | |

ERP Operating LP, 2.38%, 07/01/19 | | 2,000,000 | | 2,005,554 | |

Fifth Third Bank, 2.38%, 04/25/19 | | 2,000,000 | | 2,006,820 | |

First Horizon National Corp., 3.50%, 12/15/20 | | 3,500,000 | | 3,470,120 | |

Ford Motor Credit Co. LLC | | | | | |

1.50%, 01/17/17 | | 6,000,000 | | 5,957,760 | |

2.55%, 10/05/18 | | 2,000,000 | | 1,985,758 | |

1.26%, 11/04/19 (a) | | 2,000,000 | | 1,942,548 | |

General Motors Financial Co. Inc. | | | | | |

2.40%, 04/10/18 (e) | | 3,540,000 | | 3,522,562 | |

3.20%, 07/13/20 | | 2,000,000 | | 1,969,202 | |

Glencore Funding LLC, 1.57%, 05/27/16 (a) (b) | | 1,470,000 | | 1,446,155 | |

Goldman Sachs Group Inc. | | | | | |

5.38% (callable at 100 beginning 05/10/20) (g) | | 1,675,000 | | 1,664,531 | |

2.38%, 01/22/18 | | 2,500,000 | | 2,521,768 | |

2.75%, 09/15/20 (e) | | 2,000,000 | | 1,999,120 | |

HBOS Plc, 6.75%, 05/21/18 (b) | | 3,000,000 | | 3,272,301 | |

HCP Inc., 6.30%, 09/15/16 | | 1,500,000 | | 1,550,750 | |

Highwoods Realty LP, 5.85%, 03/15/17 | | 1,000,000 | | 1,042,497 | |

Hospitality Properties Trust | | | | | |

6.30%, 06/15/16 | | 1,500,000 | | 1,505,127 | |

5.63%, 03/15/17 | | 3,352,000 | | 3,466,910 | |

6.70%, 01/15/18 | | 1,978,000 | | 2,092,655 | |

HSBC USA Inc. | | | | | |

0.87%, 03/03/17 (a) | | 2,045,000 | | 2,041,002 | |

2.63%, 09/24/18 | | 3,000,000 | | 3,043,647 | |

Huntington Bancshares Inc., 2.88%, 08/20/20 | | 3,166,000 | | 3,143,103 | |

International Lease Finance Corp., 5.75%, 05/15/16 | | 1,000,000 | | 1,013,750 | |

Intesa Sanpaolo SpA | | | | | |

3.13%, 01/15/16 | | 3,640,000 | | 3,643,079 | |

2.38%, 01/13/17 | | 2,650,000 | | 2,658,536 | |

JPMorgan Chase & Co. | | | | | |

5.30% (callable at 100 beginning 05/01/20) (g) | | 3,000,000 | | 2,988,750 | |

0.87%, 04/25/18 (a) | | 3,000,000 | | 2,979,051 | |

2.55%, 10/29/20 | | 3,000,000 | | 2,973,291 | |

Liberty Property LP, 5.50%, 12/15/16 | | 3,405,000 | | 3,516,899 | |

Lloyds Bank Plc, 4.20%, 03/28/17 | | 2,000,000 | | 2,061,530 | |

Mid-America Apartments LP, 6.05%, 09/01/16 | | 800,000 | | 820,658 | |

Mizuho Bank Ltd., 1.70%, 09/25/17 (b) | | 3,000,000 | | 2,985,459 | |

Morgan Stanley | | | | | |

4.75%, 03/22/17 | | 3,054,000 | | 3,163,342 | |

5.55%, 04/27/17 | | 4,000,000 | | 4,197,120 | |

2.65%, 01/27/20 | | 1,562,000 | | 1,558,298 | |

2.80%, 06/16/20 | | 2,000,000 | | 2,007,124 | |

PPF Funding Inc., 5.70%, 04/15/17 (b) | | 1,273,000 | | 1,316,125 | |

Pricoa Global Funding I, 1.90%, 09/21/18 (b) | | 3,000,000 | | 2,989,482 | |

Prologis International Funding II, 4.88%, 02/15/20 (b) | | 2,400,000 | | 2,532,060 | |

Reliance Standard Life Global Funding II, 2.15%, 10/15/18 (b) | | 2,500,000 | | 2,485,273 | |

Royal Bank of Scotland Plc | | | | | |

4.38%, 03/16/16 | | 260,000 | | 261,696 | |

1.88%, 03/31/17 (e) | | 7,000,000 | | 6,970,943 | |

Santander Holdings USA Inc., 4.63%, 04/19/16 | | 2,000,000 | | 2,017,546 | |

Skandinaviska Enskilda Banken AB, 2.63%, 11/17/20 (b) | | 3,000,000 | | 2,990,523 | |

SLM Corp., 6.25%, 01/25/16 (e) | | 1,000,000 | | 1,001,537 | |

SunTrust Bank, 1.35%, 02/15/17 | | 4,000,000 | | 3,991,648 | |

Toronto-Dominion Bank | | | | | |

1.75%, 07/23/18 | | 3,000,000 | | 2,996,127 | |

2.50%, 12/14/20 | | 2,000,000 | | 1,999,104 | |

UBS AG | | | | | |

1.38%, 06/01/17 | | 3,604,000 | | 3,587,072 | |

1.80%, 03/26/18 | | 1,250,000 | | 1,247,985 | |

UBS Group AG, 2.95%, 09/24/20 (b) | | 1,852,000 | | 1,834,908 | |

Union Bank NA, 2.63%, 09/26/18 | | 3,000,000 | | 3,029,469 | |

Wells Fargo & Co. | | | | | |

0.57%, 05/16/16 (a) | | 1,500,000 | | 1,499,031 | |

2.15%, 01/30/20 (e) | | 3,000,000 | | 2,974,770 | |

2.55%, 12/07/20 | | 2,000,000 | | 1,989,970 | |

Westpac Banking Corp., 0.82%, 05/25/18 (a) | | 3,000,000 | | 2,981,022 | |

| | | | 228,693,401 | |

HEALTH CARE - 3.8% | | | | | |

AbbVie Inc. | | | | | |

1.80%, 05/14/18 | | 2,273,000 | | 2,262,683 | |

2.50%, 05/14/20 | | 3,500,000 | | 3,465,399 | |

Actavis Funding SCS | | | | | |

1.30%, 06/15/17 | | 3,500,000 | | 3,466,865 | |

2.45%, 06/15/19 | | 1,000,000 | | 989,340 | |

Gilead Sciences Inc., 2.55%, 09/01/20 (e) | | 3,500,000 | | 3,500,322 | |

Mylan Inc., 1.35%, 11/29/16 | | 5,000,000 | | 4,958,200 | |

Perrigo Co. Plc, 1.30%, 11/08/16 | | 2,523,000 | | 2,505,261 | |

Thermo Fisher Scientific Inc., 2.40%, 02/01/19 | | 1,307,000 | | 1,306,778 | |

UnitedHealth Group Inc., 0.77%, 01/17/17 (a) | | 3,000,000 | | 3,002,001 | |

Ventas Realty LP, 1.55%, 09/26/16 | | 1,895,000 | | 1,896,345 | |

| | | | 27,353,194 | |

INDUSTRIALS - 2.4% | | | | | |

BAE Systems Holdings Inc., 2.85%, 12/15/20 (b) (e) | | 2,644,000 | | 2,638,368 | |

Cobham Plc, 2.68%, 10/28/17 (d) (h) | | 2,500,000 | | 2,484,450 | |

Eaton Corp., 1.50%, 11/02/17 | | 3,000,000 | | 2,981,214 | |

Lockheed Martin Corp., 2.50%, 11/23/20 | | 3,500,000 | | 3,487,684 | |

Penske Truck Leasing Co. LP | | | | | |

3.75%, 05/11/17 (b) | | 2,000,000 | | 2,040,334 | |

3.05%, 01/09/20 (b) | | 2,000,000 | | 1,984,184 | |

Union Pacific Corp., 1.80%, 02/01/20 | | 1,304,000 | | 1,283,882 | |

| | | | 16,900,116 | |

INFORMATION TECHNOLOGY - 1.2% | | | | | |

Hewlett Packard Enterprise Co., 2.45%, 10/05/17 (b) | | 3,500,000 | | 3,497,204 | |

Visa Inc., 2.20%, 12/14/20 | | 5,000,000 | | 4,996,200 | |

| | | | 8,493,404 | |

MATERIALS - 2.4% | | | | | |

Anglo American Capital Plc, 1.27%, 04/15/16 (a) (b) | | 1,216,000 | | 1,204,103 | |

Freeport-McMoRan Inc., 2.15%, 03/01/17 | | 2,000,000 | | 1,830,000 | |

LyondellBasell Industries NV, 5.00%, 04/15/19 | | 6,000,000 | | 6,382,632 | |

Martin Marietta Materials Inc., 1.70%, 06/30/17 (a) | | 3,468,000 | | 3,443,873 | |

Monsanto Co., 2.13%, 07/15/19 | | 2,500,000 | | 2,497,025 | |

Xstrata Finance Canada Ltd., 2.70%, 10/25/17 (b) (e) (i) | | 2,000,000 | | 1,830,000 | |

| | | | 17,187,633 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

TELECOMMUNICATION SERVICES - 0.8% | | | | | |

AT&T Inc., 2.45%, 06/30/20 | | 3,000,000 | | 2,955,609 | |

Verizon Communications Inc., 2.63%, 02/21/20 | | 3,000,000 | | 3,011,010 | |

| | | | 5,966,619 | |

UTILITIES - 2.6% | | | | | |

Berkshire Hathaway Energy Co., 2.40%, 02/01/20 | | 3,000,000 | | 2,972,103 | |

Dominion Gas Holdings LLC, 2.50%, 12/15/19 | | 2,000,000 | | 1,998,088 | |

Exelon Corp. | | | | | |

1.55%, 06/09/17 | | 3,000,000 | | 2,987,469 | |

2.85%, 06/15/20 | | 1,395,000 | | 1,387,756 | |

Exelon Generation Co. LLC, 2.95%, 01/15/20 (e) | | 767,000 | | 764,481 | |

NextEra Energy Capital Holdings Inc., 1.59%, 06/01/17 | | 3,000,000 | | 2,989,206 | |

Northeast Utilities, 1.60%, 01/15/18 | | 2,000,000 | | 1,979,066 | |

Southern California Edison Co. | | | | | |

1.13%, 05/01/17 | | 1,517,000 | | 1,507,167 | |

1.85%, 02/01/22 | | 1,954,643 | | 1,936,597 | |

| | | | 18,521,933 | |

Total Corporate Bonds and Notes (cost $378,042,486) | | | | 375,658,141 | |

GOVERNMENT AND AGENCY OBLIGATIONS - 16.2% | | | | | |

GOVERNMENT SECURITIES - 13.2% | | | | | |

Federal Home Loan Bank - 1.2% (j) | | | | | |

Federal Home Loan Bank | | | | | |

2.00%, 09/09/16 | | 3,835,000 | | 3,867,367 | |

1.13%, 12/08/17 | | 1,000,000 | | 999,601 | |

2.63%, 12/08/17 | | 2,000,000 | | 2,053,986 | |

3.13%, 12/08/17 | | 1,315,000 | | 1,361,434 | |

| | | | 8,282,388 | |

Federal Home Loan Mortgage Corp. - 2.2% (j) | | | | | |

Federal Home Loan Mortgage Corp. | | | | | |

1.00%, 03/08/17 - 12/15/17 | | 6,000,000 | | 5,987,905 | |

0.88%, 03/07/18 | | 7,000,000 | | 6,951,441 | |

1.75%, 05/30/19 | | 1,000,000 | | 1,007,652 | |

1.25%, 10/02/19 | | 2,000,000 | | 1,973,174 | |

| | | | 15,920,172 | |

Federal National Mortgage Association - 1.5% (j) | | | | | |

Federal National Mortgage Association | | | | | |

1.13%, 04/27/17 - 12/14/18 | | 6,200,000 | | 6,164,211 | |

0.88%, 10/26/17 | | 4,930,000 | | 4,908,619 | |

| | | | 11,072,830 | |

Sovereign - 0.6% | | | | | |

Korea Land & Housing Corp., 1.88%, 08/02/17 (b) | | 1,905,000 | | 1,900,613 | |

Kreditanstalt fur Wiederaufbau, 0.50%, 07/15/16 | | 2,193,000 | | 2,189,318 | |

| | | | 4,089,931 | |

U.S. Treasury Securities - 7.7% | | | | | |

U.S. Treasury Note | | | | | |

0.63%, 12/31/16 - 09/30/17 | | 25,577,000 | | 25,417,783 | |

0.88%, 11/30/17 (e) | | 6,250,000 | | 6,232,513 | |

1.00%, 12/31/17 | | 3,250,000 | | 3,246,305 | |

0.75%, 04/15/18 | | 13,100,000 | | 12,974,174 | |

0.88%, 10/15/18 | | 7,500,000 | | 7,418,108 | |

| | | | 55,288,883 | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 3.0% | | | | | |

Federal Home Loan Mortgage Corp. - 0.9% | | | | | |

Federal Home Loan Mortgage Corp. | | | | | |

4.00%, 02/01/26 | | 214,608 | | 226,463 | |

2.50%, 02/15/31, TBA (k) | | 4,000,000 | | 4,026,908 | |

REMIC, 4.00%, 12/15/38 | | 100,000 | | 105,970 | |

REMIC, 3.00%, 02/15/39 | | 1,188,596 | | 1,208,843 | |

REMIC, 2.00%, 03/15/41 | | 925,123 | | 904,037 | |

| | | | 6,472,221 | |

Federal National Mortgage Association - 1.9% | | | | | |

Federal National Mortgage Association | | | | | |

4.00%, 04/01/26 - 01/01/31 | | 2,290,986 | | 2,429,610 | |

4.50%, 05/01/26 | | 180,955 | | 194,928 | |

3.50%, 03/01/27 - 03/01/30 | | 4,119,832 | | 4,327,182 | |

3.00%, 05/01/30 | | 1,839,757 | | 1,896,504 | |

2.73%, 02/01/44 (a) | | 1,592,199 | | 1,636,062 | |

3.08%, 04/01/45 (a) | | 1,803,130 | | 1,851,272 | |

REMIC, 4.00%, 09/25/29 | | 173,000 | | 177,751 | |

REMIC, 2.50%, 01/25/41 | | 451,686 | | 455,475 | |

REMIC, 2.00%, 03/25/42 | | 683,046 | | 679,470 | |

| | | | 13,648,254 | |

Government National Mortgage Association - 0.2% | | | | | |

Government National Mortgage Association | | | | | |

2.50%, 11/20/42 (a) | | 512,335 | | 524,925 | |

REMIC, 4.50%, 11/20/39 | | 994,138 | | 1,053,801 | |

| | | | 1,578,726 | |

Total Government and Agency Obligations (cost $116,786,967) | | | | 116,353,405 | |

SHORT TERM INVESTMENTS - 5.2% | | | | | |

Investment Company - 2.7% | | | | | |

JNL Money Market Fund, 0.19% (l) (m) | | 19,694,333 | | 19,694,333 | |

Securities Lending Collateral - 2.5% | | | | | |

State Street Navigator Securities Lending Prime Portfolio, 0.29% (l) | | 18,228,193 | | 18,228,193 | |

Total Short Term Investments (cost $37,922,526) | | | | 37,922,526 | |

Total Investments - 103.9% (cost $750,701,097) | | | | 745,795,085 | |

Other Assets and Liabilities, Net - (3.9%) | | | | (28,229,234 | ) |

Total Net Assets - 100.0% | | | | $ | 717,565,851 | |

| | | | | | |

(a) | Variable rate security. Rate stated was in effect as of December 31, 2015. |

(b) | The Sub-Adviser has deemed this security which is exempt from registration under the Securities Act of 1933 (“1933 Act”), as amended, to be liquid based on procedures approved by the Board. As of December 31, 2015, the aggregate value of these liquid securities was $150,798,960 which represented 21.0% of net assets. |

(c) | Security is restricted to resale to institutional investors. See Restricted Securities in the Notes to Schedules of Investments. |

(d) | The Sub-Adviser has deemed this security to be illiquid based on procedures approved by the Trust’s Board of Trustees. |

(e) | All or a portion of the security was on loan. |

(f) | The interest rate for this security is inversely affected by upgrades or downgrades to the credit rating of the issuer. |

(g) | Perpetual security. |

(h) | Security fair valued in good faith in accordance with the procedures approved by the Trust’s Board of Trustees. Good faith fair valued securities may be classified as Level 2 or Level 3 for Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820 “Fair Value Measurement,” based on applicable valuation inputs. See FASB Topic 820 in the Notes to Financial Statements. |

(i) | Security is a “step-up” bond where the coupon may increase or step up at a future date or as the result of an upgrade or downgrade to the credit rating of the issuer. Rate stated was the coupon as of December 31, 2015. |

(j) | Securities in this category are direct debt of the agency and not collateralized by mortgages. |

See accompanying Notes to Financial Statements.

(k) | All or a portion of the investment was purchased on a delayed delivery basis. As of December 31, 2015, the total payable of investments purchased on a delayed delivery basis was $4,027,500. |

(l) | Yield changes daily to reflect current market conditions. Rate was the quoted yield as of December 31, 2015. |

(m) | Investment in affiliate. |

| | Shares/Par † | | Value | |

JNL/PPM America Total Return Fund | | | | | |

NON-U.S. GOVERNMENT AGENCY ASSET-BACKED SECURITIES - 5.3% | | | | | |

American Airlines Pass-Through Trust | | | | | |

5.60%, 07/15/20 (a) | | $ | 2,879,857 | | $ | 2,937,454 | |

4.95%, 01/15/23 | | 1,457,086 | | 1,537,226 | |

American Tower Trust I, 3.07%, 03/15/23 (a) | | 6,596,000 | | 6,458,752 | |

AmeriCredit Automobile Receivables Trust | | | | | |

1.31%, 11/08/17 | | 238,227 | | 238,234 | |

1.07%, 03/08/18 | | 778,973 | | 778,338 | |

Banc of America Commercial Mortgage Trust REMIC, 5.74%, 07/10/17 (b) | | 549,678 | | 571,877 | |

Banc of America Re-REMIC Trust REMIC, 3.49%, 04/16/25 (a) | | 1,985,000 | | 1,944,503 | |

Bear Stearns Commercial Mortgage Securities Trust REMIC | | | | | |

5.74%, 09/11/17 (b) | | 488,672 | | 513,286 | |

5.69%, 06/11/50 (b) | | 1,419,410 | | 1,480,342 | |

Citigroup Mortgage Loan Trust REMIC, 3.50%, 08/25/23 (a) | | 2,756,668 | | 2,747,967 | |

CNH Equipment Trust, 1.05%, 05/15/18 | | 3,000,000 | | 2,980,945 | |

Continental Airlines Inc. Pass-Through Trust | | | | | |

6.25%, 04/11/20 | | 565,937 | | 594,233 | |

4.15%, 04/11/24 | | 1,810,908 | | 1,857,992 | |

4.00%, 10/29/24 | | 1,593,918 | | 1,633,765 | |

Crown Castle Towers LLC, 4.88%, 08/15/20 (a) | | 1,450,000 | | 1,550,153 | |

DBUBS Mortgage Trust REMIC, 3.74%, 06/01/17 (a) | | 768,978 | | 770,357 | |

Dell Equipment Finance Trust | | | | | |

1.30%, 03/23/20 (a) | | 1,177,000 | | 1,167,872 | |

1.81%, 03/23/20 (a) | | 867,000 | | 860,247 | |

0.94%, 06/22/20 (a) | | 565,000 | | 564,569 | |

1.36%, 06/22/20 (a) | | 166,000 | | 165,451 | |

Delta Air Lines Inc. Pass-Through Trust | | | | | |

6.20%, 07/02/18 | | 678 | | 726 | |

4.95%, 05/23/19 | | 145,585 | | 152,864 | |

Ford Credit Auto Owner Trust | | | | | |

1.97%, 04/15/20 | | 1,256,000 | | 1,257,397 | |

2.21%, 01/15/21 | | 1,009,000 | | 1,001,500 | |

Ford Credit Floorplan Master Owner Trust, 1.40%, 08/15/17 | | 5,420,000 | | 5,395,253 | |

Greenwich Capital Commercial Funding Corp. REMIC, 5.44%, 01/10/17 | | 117,310 | | 119,920 | |

JPMorgan Chase Commercial Mortgage Securities Trust REMIC, 5.69%, 04/12/17 (b) | | 1,791,308 | | 1,847,534 | |

JPMorgan Mortgage Trust REMIC, 3.00%, 10/25/26 (a) (b) | | 2,463,801 | | 2,496,042 | |

Morgan Stanley Capital I Trust REMIC, 5.92%, 07/11/17 (b) | | 3,966,922 | | 4,120,960 | |

Morgan Stanley Re-REMIC Trust REMIC, 5.99%, 04/12/17 (a) (b) | | 1,281,489 | | 1,316,445 | |

MVW Owner Trust, 2.15%, 04/22/30 (a) | | 736,232 | | 723,906 | |

SBA Tower Trust, 2.90%, 10/15/44 (a) | | 5,000,000 | | 4,886,948 | |

Sierra Receivables Funding Co. LLC | | | | | |

2.84%, 05/20/19 (a) | | 292,122 | | 293,407 | |

2.38%, 03/20/29 (a) | | 155,730 | | 155,754 | |

United Air Lines Pass-Through Trust, 9.75%, 01/15/17 | | 39,437 | | 41,606 | |

Total Non-U.S. Government Agency Asset- Backed Securities (cost $55,262,485) | | | | 55,163,825 | |

CORPORATE BONDS AND NOTES - 56.4% | | | | | |

CONSUMER DISCRETIONARY - 4.7% | | | | | |

A&E Television Networks LLC | | | | | |

3.11%, 08/22/19 (c) (d) | | 1,000,000 | | 966,944 | |

3.63%, 08/22/22 (c) (d) | | 1,000,000 | | 950,294 | |

3.78%, 08/22/24 (c) (d) | | 1,000,000 | | 937,541 | |

ARAMARK Services Inc., 5.13%, 01/15/24 (a) | | 374,000 | | 381,013 | |

British Sky Broadcasting Group Plc | | | | | |

2.63%, 09/16/19 (a) | | 1,435,000 | | 1,428,911 | |

3.75%, 09/16/24 (a) | | 1,970,000 | | 1,925,161 | |

CCO Holdings LLC, 5.88%, 05/01/27 (a) | | 1,500,000 | | 1,492,500 | |

CCO Safari II LLC | | | | | |

6.38%, 10/23/35 (a) | | 3,335,000 | | 3,365,799 | |

6.83%, 10/23/55 (a) | | 3,550,000 | | 3,492,962 | |

Comcast Corp., 3.38%, 08/15/25 | | 1,270,000 | | 1,286,476 | |

Delphi Automotive Plc, 3.15%, 11/19/20 | | 675,000 | | 674,201 | |

Delphi Corp., 5.00%, 02/15/23 | | 1,867,000 | | 1,975,286 | |

Dollar General Corp., 3.25%, 04/15/23 | | 915,000 | | 871,450 | |

General Motors Co. | | | | | |

5.00%, 04/01/35 | | 3,500,000 | | 3,262,438 | |

6.25%, 10/02/43 | | 1,285,000 | | 1,355,852 | |

Grupo Televisa SAB, 6.13%, 01/31/46 | | 1,709,000 | | 1,698,917 | |

KB Home | | | | | |

4.75%, 05/15/19 | | 2,316,000 | | 2,246,520 | |

7.50%, 09/15/22 (e) | | 409,000 | | 406,955 | |

Levi Strauss & Co., 5.00%, 05/01/25 (e) | | 726,000 | | 722,370 | |

NAI Entertainment Holdings, 5.00%, 08/01/18 (a) | | 228,000 | | 231,420 | |

NBCUniversal Enterprise Inc., 5.25%, (callable at 100 beginning 03/19/21) (a) (f) | | 1,589,000 | | 1,684,340 | |

Numericable Group SA | | | | | |

4.88%, 05/15/19 (a) | | 1,247,000 | | 1,236,089 | |

5.38%, 05/15/22 (a), EUR | | 1,000,000 | | 1,108,491 | |

NVR Inc., 3.95%, 09/15/22 | | 4,573,000 | | 4,613,009 | |

Sally Holdings LLC, 5.63%, 12/01/25 | | 498,000 | | 502,980 | |

Schaeffler Finance BV | | | | | |

3.25%, 05/15/19 (a), EUR | | 1,296,000 | | 1,424,280 | |

3.50%, 05/15/22 (a), EUR | | 570,000 | | 632,645 | |

Schaeffler Holding Finance BV, 5.75%, 11/15/21 (a), EUR | | 1,007,000 | | 1,172,336 | |

Scientific Games International Inc., 7.00%, 01/01/22 (a) | | 1,022,000 | | 976,010 | |

Seminole Indian Tribe of Florida, 6.54%, 10/01/20 (a) | | 720,000 | | 748,800 | |

SES SA | | | | | |

3.60%, 04/04/23 (a) | | 652,000 | | 635,126 | |

5.30%, 04/04/43 (a) | | 464,000 | | 445,713 | |

Sirius XM Radio Inc., 6.00%, 07/15/24 (a) | | 2,926,000 | | 3,057,670 | |

Tenneco Inc., 5.38%, 12/15/24 | | 1,065,000 | | 1,080,975 | |

Time Warner Cable Inc., 6.75%, 06/15/39 | | 371,000 | | 372,319 | |

| | | | 49,363,793 | |

CONSUMER STAPLES - 2.3% | | | | | |

Bunge Ltd. Finance Co., 8.50%, 06/15/19 (g) | | 100,000 | | 115,755 | |

CVS Health Corp. | | | | | |

4.75%, 12/01/22 (a) | | 266,000 | | 285,054 | |

5.00%, 12/01/24 (a) | | 174,000 | | 188,341 | |

HJ Heinz Co. | | | | | |

3.95%, 07/15/25 (a) (e) | | 1,981,000 | | 2,000,178 | |

5.00%, 07/15/35 (a) | | 1,605,000 | | 1,644,478 | |

5.20%, 07/15/45 (a) | | 1,941,000 | | 2,026,779 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

JBS Investments GmbH, 7.25%, 04/03/24 (a) (e) | | 1,276,000 | | 1,157,970 | |

JM Smucker Co. | | | | | |

2.50%, 03/15/20 | | 631,000 | | 626,566 | |

3.50%, 03/15/25 | | 868,000 | | 864,040 | |

4.38%, 03/15/45 (e) | | 816,000 | | 793,899 | |

Mars Inc. | | | | | |

2.19%, 10/11/17 (c) (d) | | 2,850,000 | | 2,855,657 | |

3.74%, 10/11/27 (c) (d) | | 1,200,000 | | 1,214,576 | |

Post Holdings Inc., 8.00%, 07/15/25 (a) | | 2,222,000 | | 2,355,320 | |

Reynolds American Inc. | | | | | |

3.25%, 06/12/20 | | 1,000,000 | | 1,016,405 | |

4.45%, 06/12/25 | | 2,316,000 | | 2,423,502 | |

5.70%, 08/15/35 | | 975,000 | | 1,068,214 | |

7.00%, 08/04/41 | | 812,000 | | 912,622 | |

Tyson Foods Inc. | | | | | |

3.95%, 08/15/24 | | 679,000 | | 697,195 | |

4.88%, 08/15/34 | | 1,010,000 | | 1,030,140 | |

5.15%, 08/15/44 | | 549,000 | | 573,320 | |

| | | | 23,850,011 | |

ENERGY - 5.7% | | | | | |

Access Midstream Partners LP, 4.88%, 05/15/23 | | 133,000 | | 107,829 | |

California Resources Corp. | | | | | |

5.00%, 01/15/20 (e) | | 437,000 | | 155,681 | |

5.50%, 09/15/21 (e) | | 512,000 | | 161,280 | |

8.00%, 12/15/22 (a) (e) | | 3,661,000 | | 1,926,601 | |

6.00%, 11/15/24 (e) | | 418,000 | | 127,490 | |

Calumet Specialty Products Partners LP, 6.50%, 04/15/21 | | 2,025,000 | | 1,761,750 | |

Chesapeake Energy Corp., 8.00%, 12/15/22 (a) | | 1,750,000 | | 857,500 | |

CITGO Holding Inc., 10.75%, 02/15/20 (a) | | 2,694,000 | | 2,613,180 | |

Columbia Pipeline Group Inc. | | | | | |

3.30%, 06/01/20 (a) | | 743,000 | | 723,757 | |

4.50%, 06/01/25 (a) | | 746,000 | | 676,161 | |

5.80%, 06/01/45 (a) | | 933,000 | | 818,976 | |

Concho Resources Inc., 5.50%, 04/01/23 | | 1,664,000 | | 1,539,200 | |

Continental Resources Inc., 4.50%, 04/15/23 | | 876,000 | | 629,737 | |

DCP Midstream LLC, 5.85%, 05/21/43 (a) (b) | | 2,485,000 | | 1,901,025 | |

Devon Energy Corp., 5.85%, 12/15/25 (e) | | 2,293,000 | | 2,230,243 | |

Energy Transfer Partners LP | | | | | |

4.75%, 01/15/26 | | 1,379,000 | | 1,186,915 | |

4.90%, 03/15/35 | | 1,950,000 | | 1,417,133 | |

5.15%, 03/15/45 | | 1,189,000 | | 840,493 | |

6.13%, 12/15/45 | | 2,600,000 | | 2,115,482 | |

Energy XXI Gulf Coast Inc., 6.88%, 03/15/24 | | 959,000 | | 105,490 | |

EnLink Midstream Partners LP, 4.15%, 06/01/25 | | 1,666,000 | | 1,282,337 | |

Enterprise Products Operating LLC | | | | | |

3.75%, 02/15/25 (e) | | 1,837,000 | | 1,681,259 | |

3.70%, 02/15/26 | | 1,738,000 | | 1,560,284 | |

4.95%, 10/15/54 | | 937,000 | | 732,980 | |

EP Energy LLC, 6.38%, 06/15/23 | | 2,246,000 | | 1,123,000 | |

Halliburton Co. | | | | | |

3.38%, 11/15/22 | | 2,600,000 | | 2,558,964 | |

3.80%, 11/15/25 | | 1,304,000 | | 1,270,546 | |

5.00%, 11/15/45 | | 920,000 | | 908,804 | |

Jupiter Resources Inc., 8.50%, 10/01/22 (a) (e) | | 1,500,000 | | 600,000 | |

Memorial Production Partners LP, 6.88%, 08/01/22 | | 2,017,000 | | 605,100 | |

Oneok Inc., 7.50%, 09/01/23 (e) | | 4,690,000 | | 3,904,425 | |

Petrobras Global Finance BV, 4.38%, 05/20/23 (e) | | 2,381,000 | | 1,571,460 | |

Petroleos Mexicanos, 2.29%, 02/15/24 | | 2,771,850 | | 2,776,069 | |

Plains Exploration & Production Co., 6.75%, 02/01/22 | | 5,119,000 | | 3,148,185 | |

Regency Energy Partners LP | | | | | |

5.88%, 03/01/22 | | 3,534,000 | | 3,331,286 | |

5.00%, 10/01/22 | | 1,080,000 | | 957,164 | |

Sanchez Energy Corp., 7.75%, 06/15/21 (e) | | 412,000 | | 251,320 | |

Seadrill Ltd., 6.13%, 09/15/17 (a) (h) | | 1,250,000 | | 631,250 | |

SM Energy Co., 6.13%, 11/15/22 | | 1,856,000 | | 1,364,160 | |

Spectra Energy Partners LP | | | | | |

3.50%, 03/15/25 | | 2,332,000 | | 2,041,148 | |

4.50%, 03/15/45 | | 2,542,000 | | 1,952,950 | |

Transocean Inc. | | | | | |

3.00%, 10/15/17 (e) (g) | | 500,000 | | 443,438 | |

7.13%, 12/15/21 (e) (g) | | 1,824,000 | | 1,178,760 | |

4.30%, 10/15/22 (g) | | 2,015,000 | | 1,067,950 | |

Ultra Petroleum Corp., 6.13%, 10/01/24 (a) | | 2,451,000 | | 557,603 | |

| | | | 59,396,365 | |

FINANCIALS - 25.8% | | | | | |

Abbey National Treasury Services Plc, 4.00%, 03/13/24 (e) | | 3,354,000 | | 3,500,291 | |

ABN AMRO Bank NV, 2.45%, 06/04/20 (a) | | 5,622,000 | | 5,573,718 | |

AerCap Ireland Capital Ltd. | | | | | |

2.75%, 05/15/17 | | 152,000 | | 151,050 | |

4.63%, 10/30/20 | | 1,750,000 | | 1,791,563 | |

4.50%, 05/15/21 | | 288,000 | | 292,680 | |

AIG SunAmerica Global Financing X, 6.90%, 03/15/32 (a) | | 1,696,000 | | 2,176,796 | |

Ally Financial Inc., 5.75%, 11/20/25 | | 5,500,000 | | 5,568,750 | |

Altice Financing SA, 7.88%, 12/15/19 (a) | | 324,000 | | 336,960 | |

Bank of America Corp. | | | | | |

6.25% (callable at 100 beginning 09/05/24) (f) | | 1,683,000 | | 1,687,208 | |

6.50% (callable at 100 beginning 10/23/24) (f) | | 1,567,000 | | 1,651,226 | |

3.30%, 01/11/23 | | 3,428,000 | | 3,379,891 | |

4.20%, 08/26/24 | | 4,077,000 | | 4,082,920 | |

3.95%, 04/21/25 | | 2,317,000 | | 2,256,431 | |

Barclays Bank Plc | | | | | |

7.63%, 11/21/22 | | 679,000 | | 773,211 | |

7.75%, 04/10/23 (b) (i) | | 1,009,000 | | 1,077,108 | |

3.75%, 05/15/24 | | 4,150,000 | | 4,232,228 | |

Barclays Plc | | | | | |

8.25% (callable at 100 beginning 12/15/18) (f) (i) | | 5,300,000 | | 5,642,915 | |

3.65%, 03/16/25 | | 1,450,000 | | 1,393,486 | |

BlackRock Inc., 3.38%, 06/01/22 | | 1,062,000 | | 1,098,687 | |

BNP Paribas SA, 7.37%, (callable at 100 beginning 08/19/25) (a) (e) (f) | | 1,344,000 | | 1,379,280 | |

Capital One Bank USA NA, 2.40%, 09/05/19 | | 6,268,000 | | 6,202,023 | |

Cemex Finance LLC | | | | | |

9.38%, 10/12/22 (a) (e) | | 355,000 | | 373,638 | |

6.00%, 04/01/24 (a) (e) | | 1,171,000 | | 1,004,133 | |

Citigroup Inc. | | | | | |

5.90% (callable at 100 beginning 02/15/23) (e) (f) | | 1,375,000 | | 1,350,938 | |

6.13% (callable at 100 beginning 11/15/20) (f) | | 5,500,000 | | 5,610,000 | |

4.05%, 07/30/22 | | 1,325,000 | | 1,353,616 | |

CME Group Inc., 3.00%, 03/15/25 | | 2,750,000 | | 2,699,686 | |

Credit Suisse, 3.63%, 09/09/24 | | 1,000,000 | | 1,008,219 | |

Credit Suisse AG | | | | | |

7.50% (callable at 100 beginning 12/11/23) (a) (f) | | 4,248,000 | | 4,459,686 | |

6.50%, 08/08/23 (a) | | 7,411,000 | | 7,985,352 | |

Daimler Finance North America LLC | | | | | |

2.00%, 08/03/18 (a) | | 4,800,000 | | 4,768,387 | |

2.25%, 03/02/20 (a) (e) | | 7,000,000 | | 6,843,445 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

Discover Financial Services, 3.95%, 11/06/24 | | 1,460,000 | | 1,439,808 | |

Five Corners Funding Trust, 4.42%, 11/15/23 (a) | | 5,695,000 | | 5,946,132 | |

Ford Motor Credit Co. LLC | | | | | |

5.00%, 05/15/18 | | 5,898,000 | | 6,181,682 | |

2.24%, 06/15/18 | | 2,750,000 | | 2,725,181 | |

2.38%, 03/12/19 | | 1,600,000 | | 1,577,709 | |

GE Capital International Funding Co., 3.37%, 11/15/25 (a) | | 2,060,000 | | 2,097,622 | |

General Electric Capital Corp., 3.10%, 01/09/23 | | 792,000 | | 803,888 | |

General Motors Financial Co. Inc., 4.38%, 09/25/21 | | 2,419,000 | | 2,454,225 | |

GFI Group Inc., 8.63%, 07/19/18 (g) | | 2,250,000 | | 2,435,625 | |

Goldman Sachs Group Inc. | | | | | |

5.38% (callable at 100 beginning 05/10/20) (f) | | 3,786,000 | | 3,762,338 | |

2.38%, 01/22/18 | | 4,608,000 | | 4,648,122 | |

4.00%, 03/03/24 | | 2,064,000 | | 2,119,540 | |

4.25%, 10/21/25 | | 2,741,000 | | 2,721,753 | |

6.75%, 10/01/37 | | 1,500,000 | | 1,752,230 | |

5.15%, 05/22/45 | | 4,331,000 | | 4,204,132 | |

Hospitality Properties Trust, 4.50%, 03/15/25 | | 3,338,000 | | 3,205,184 | |

HSBC Holdings Plc | | | | | |

5.63% (callable at 100 beginning 01/17/20) (e) (f) (i) | | 2,037,000 | | 2,039,546 | |

6.37% (callable at 100 beginning 03/30/25) (e) (f) | | 4,499,000 | | 4,493,376 | |

Icahn Enterprises LP, 4.88%, 03/15/19 | | 2,518,000 | | 2,495,338 | |

International Lease Finance Corp. | | | | | |

6.75%, 09/01/16 (a) | | 1,100,000 | | 1,130,250 | |

7.13%, 09/01/18 (a) | | 1,000,000 | | 1,096,250 | |

4.63%, 04/15/21 | | 2,237,000 | | 2,292,925 | |

8.63%, 01/15/22 | | 750,000 | | 907,500 | |

Intesa Sanpaolo SpA, 5.02%, 06/26/24 (a) | | 6,500,000 | | 6,398,255 | |

Invesco Finance Plc, 3.13%, 11/30/22 | | 1,778,000 | | 1,754,036 | |

Janus Capital Group Inc., 4.88%, 08/01/25 | | 2,027,000 | | 2,080,440 | |

JPMorgan Chase & Co. | | | | | |

5.30% (callable at 100 beginning 05/01/20) (f) | | 5,250,000 | | 5,230,313 | |

7.90% (callable at 100 beginning 04/30/18) (f) | | 1,757,000 | | 1,788,626 | |

3.20%, 01/25/23 | | 3,609,000 | | 3,599,194 | |

Legg Mason Inc., 2.70%, 07/15/19 | | 1,883,000 | | 1,878,411 | |

Liberty Mutual Group Inc. | | | | | |

4.25%, 06/15/23 (a) | | 204,000 | | 207,428 | |

4.85%, 08/01/44 (a) | | 664,000 | | 615,055 | |

Mid-America Apartments LP, 4.00%, 11/15/25 | | 2,178,000 | | 2,163,813 | |

Mizuho Bank Ltd., 1.70%, 09/25/17 (a) | | 1,300,000 | | 1,293,699 | |

Mizuho Financial Group Cayman 3 Ltd., 4.60%, 03/27/24 (a) (e) | | 1,850,000 | | 1,905,411 | |

Morgan Stanley | | | | | |

2.38%, 07/23/19 | | 6,946,000 | | 6,924,280 | |

4.88%, 11/01/22 | | 4,381,000 | | 4,652,201 | |

4.10%, 05/22/23 | | 3,860,000 | | 3,902,198 | |

3.88%, 04/29/24 | | 6,271,000 | | 6,393,065 | |

Murray Street Investment Trust I, 4.65%, 03/09/17 (h) | | 3,500,000 | | 3,606,159 | |

National Rural Utilities Cooperative Finance Corp., 4.75%, 04/30/43 (b) | | 3,146,000 | | 3,103,214 | |

PNC Financial Services Group Inc., 4.85%, (callable at 100 beginning 06/01/23) (f) | | 581,000 | | 544,763 | |

Prologis International Funding II, 4.88%, 02/15/20 (a) | | 2,222,000 | | 2,344,266 | |

Prudential Financial Inc., 5.87%, 09/15/42 (b) | | 1,252,000 | | 1,301,454 | |

Royal Bank of Scotland Group Plc | | | | | |

7.50% (callable at 100 beginning 08/10/20) (f) (i) | | 3,520,000 | | 3,665,200 | |

8.00% (callable at 100 beginning 08/10/25) (e) (f) (i) | | 2,259,000 | | 2,388,893 | |

6.13%, 12/15/22 | | 1,880,000 | | 2,046,773 | |

6.10%, 06/10/23 | | 1,669,000 | | 1,794,046 | |

6.00%, 12/19/23 | | 737,000 | | 793,753 | |

5.13%, 05/28/24 | | 2,884,000 | | 2,923,058 | |

Santander UK Plc, 5.00%, 11/07/23 (a) | | 1,152,000 | | 1,199,176 | |

SAP Ireland US-Financial Services Ltd. | | | | | |

2.82%, 11/15/20 (c) (d) | | 2,485,000 | | 2,495,007 | |

3.18%, 11/15/22 (c) (d) | | 2,485,000 | | 2,462,218 | |

Shell International Finance BV, 3.25%, 05/11/25 | | 2,285,000 | | 2,231,108 | |

Stena AB, 7.00%, 02/01/24 (a) | | 1,332,000 | | 1,132,200 | |

Swedbank AB, 2.20%, 03/04/20 (a) (e) | | 2,600,000 | | 2,569,588 | |

UBS Group AG, 4.13%, 09/24/25 (a) | | 2,463,000 | | 2,461,985 | |

USAA Capital Corp., 2.13%, 06/03/19 (a) | | 500,000 | | 499,706 | |

WEA Finance LLC, 3.25%, 10/05/20 (a) | | 7,818,000 | | 7,851,054 | |

Wells Fargo & Co. | | | | | |

5.87% (callable at 100 beginning 06/15/25) (f) | | 3,161,000 | | 3,326,953 | |

4.48%, 01/16/24 | | 355,000 | | 373,553 | |

4.30%, 07/22/27 | | 3,396,000 | | 3,469,506 | |

4.90%, 11/17/45 | | 1,626,000 | | 1,641,135 | |

Westpac Banking Corp., 2.60%, 11/23/20 | | 8,000,000 | | 7,996,928 | |

ZF North America Capital Inc., 4.50%, 04/29/22 (a) | | 537,000 | | 524,918 | |

| | | | 269,768,917 | |

HEALTH CARE - 3.6% | | | | | |

AbbVie Inc. | | | | | |

2.90%, 11/06/22 | | 1,631,000 | | 1,579,035 | |

3.60%, 05/14/25 | | 3,530,000 | | 3,484,329 | |

4.70%, 05/14/45 (e) | | 1,415,000 | | 1,383,782 | |

Actavis Funding SCS | | | | | |

3.85%, 06/15/24 | | 1,319,000 | | 1,321,911 | |

4.75%, 03/15/45 | | 2,557,000 | | 2,492,714 | |

Becton Dickinson and Co. | | | | | |

3.73%, 12/15/24 | | 633,000 | | 638,810 | |

4.69%, 12/15/44 | | 1,109,000 | | 1,118,811 | |

Endo Finance LLC, 6.00%, 07/15/23 (a) | | 1,209,000 | | 1,202,955 | |

Forest Laboratories Inc., 5.00%, 12/15/21 (a) | | 1,268,000 | | 1,378,442 | |

Gilead Sciences Inc. | | | | | |

4.80%, 04/01/44 | | 1,302,000 | | 1,306,107 | |

4.50%, 02/01/45 | | 1,194,000 | | 1,168,426 | |

HCA Inc. | | | | | |

3.75%, 03/15/19 | | 3,369,000 | | 3,394,267 | |

4.25%, 10/15/19 | | 2,464,000 | | 2,513,280 | |

Howard Hughes Medical Institute, 3.50%, 09/01/23 | | 2,046,000 | | 2,125,254 | |

Mayo Clinic Rochester, 3.77%, 11/15/43 | | 600,000 | | 557,471 | |

MEDNAX Inc., 5.25%, 12/01/23 (a) | | 551,000 | | 553,755 | |

Memorial Sloan-Kettering Cancer Center, 5.00%, 07/01/42 | | 997,000 | | 1,066,996 | |

Merck & Co. Inc., 4.15%, 05/18/43 | | 1,520,000 | | 1,526,021 | |

Perrigo Finance Plc, 4.90%, 12/15/44 | | 1,143,000 | | 1,031,504 | |

Quest Diagnostics Inc., 4.70%, 03/30/45 | | 439,000 | | 395,322 | |

Tenet Healthcare Corp. | | | | | |

4.01%, 06/15/20 (a) (b) | | 653,000 | | 636,675 | |

6.75%, 06/15/23 (e) | | 1,283,000 | | 1,189,982 | |

VRX Escrow Corp. | | | | | |

5.88%, 05/15/23 (a) | | 2,649,000 | | 2,364,232 | |

6.13%, 04/15/25 (a) | | 914,000 | | 815,745 | |

WellCare Health Plans Inc., 5.75%, 11/15/20 | | 1,853,000 | | 1,908,590 | |

| | | | 37,154,416 | |

INDUSTRIALS - 3.8% | | | | | |

AECOM, 5.88%, 10/15/24 | | 1,203,000 | | 1,227,060 | |

Aircastle Ltd., 4.63%, 12/15/18 | | 1,270,000 | | 1,298,575 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

BAE Systems Holdings Inc., 2.85%, 12/15/20 (a) | | 1,322,000 | | 1,319,184 | |

Bombardier Inc. | | | | | |

5.50%, 09/15/18 (a) (e) | | 829,000 | | 760,690 | |

4.75%, 04/15/19 (a) (e) | | 4,607,000 | | 3,789,258 | |

6.13%, 01/15/23 (a) | | 759,000 | | 523,710 | |

7.50%, 03/15/25 (a) | | 1,370,000 | | 959,000 | |

CNH Industrial Capital LLC, 3.88%, 07/16/18 | | 2,366,000 | | 2,289,105 | |

Florida East Coast Holdings Corp., 6.75%, 05/01/19 (a) | | 1,583,000 | | 1,448,445 | |

General Electric Co. | | | | | |

4.00% (callable at 100 beginning 06/15/22) (f) | | 4,721,000 | | 4,721,000 | |

4.10% (callable at 100 beginning 12/15/22) (e) (f) | | 9,171,000 | | 9,148,073 | |

3.50%, 10/02/18 | | 4,600,000 | | 4,646,184 | |

Lockheed Martin Corp. | | | | | |

3.10%, 01/15/23 | | 3,750,000 | | 3,747,911 | |

4.50%, 05/15/36 | | 1,934,000 | | 1,956,558 | |

4.70%, 05/15/46 | | 1,642,000 | | 1,689,646 | |

| | | | 39,524,399 | |

INFORMATION TECHNOLOGY - 2.0% | | | | | |

CDK Global Inc., 3.30%, 10/15/19 | | 1,382,000 | | 1,371,719 | |

Hewlett Packard Enterprise Co. | | | | | |

6.20%, 10/15/35 (a) | | 1,400,000 | | 1,348,364 | |

6.35%, 10/15/45 (a) | | 2,890,000 | | 2,743,454 | |

Microsoft Corp., 3.13%, 11/03/25 | | 2,597,000 | | 2,612,086 | |

ViaSat Inc., 6.88%, 06/15/20 | | 2,692,000 | | 2,792,950 | |

Visa Inc. | | | | | |

2.80%, 12/14/22 | | 3,600,000 | | 3,606,473 | |

3.15%, 12/14/25 | | 2,200,000 | | 2,204,649 | |

4.15%, 12/14/35 | | 1,864,000 | | 1,881,700 | |

4.30%, 12/14/45 | | 2,761,000 | | 2,798,516 | |

| | | | 21,359,911 | |

MATERIALS - 2.3% | | | | | |

Anglo American Capital Plc, 2.63%, 09/27/17 (a) | | 2,750,000 | | 2,406,250 | |

Anglo American Plc, 3.63%, 05/14/20 (a) (e) | | 1,695,000 | | 1,203,450 | |

Ardagh Packaging Finance Plc, 3.51%, 12/15/19 (a) (b) (e) | | 2,850,000 | | 2,785,875 | |

Ball Corp., 4.38%, 12/15/20 | | 2,885,000 | | 2,930,078 | |

Barrick Gold Corp., 4.10%, 05/01/23 (e) | | 449,000 | | 385,207 | |

Cemex SAB de CV, 6.50%, 12/10/19 (a) | | 2,815,000 | | 2,716,475 | |

FMG Resources August 2006 Pty Ltd. | | | | | |

8.25%, 11/01/19 (a) (e) | | 1,450,000 | | 1,150,938 | |

9.75%, 03/01/22 (a) (e) | | 548,000 | | 501,420 | |

Freeport-McMoRan Copper & Gold Inc., 3.88%, 03/15/23 | | 484,000 | | 275,880 | |

Freeport-McMoRan Inc. | | | | | |

4.55%, 11/14/24 | | 1,070,000 | | 612,575 | |

5.40%, 11/14/34 | | 7,478,000 | | 3,963,340 | |

Methanex Corp., 5.65%, 12/01/44 (e) | | 1,569,000 | | 1,269,608 | |

Rain CII Carbon LLC, 8.25%, 01/15/21 (a) | | 3,508,000 | | 2,736,240 | |

Samarco Mineracao SA | | | | | |

4.13%, 11/01/22 (a) | | 345,000 | | 110,400 | |

5.38%, 09/26/24 (a) | | 340,000 | | 112,200 | |

Trinseo Materials Operating SCA, 6.75%, 05/01/22 (a) | | 778,000 | | 766,330 | |

| | | | 23,926,266 | |

TELECOMMUNICATION SERVICES - 2.1% | | | | | |

AT&T Inc. | | | | | |

4.50%, 05/15/35 (e) | | 1,965,000 | | 1,817,539 | |

4.75%, 05/15/46 | | 650,000 | | 595,026 | |

Frontier Communications Corp. | | | | | |

10.50%, 09/15/22 (a) | | 1,007,000 | | 1,000,706 | |

11.00%, 09/15/25 (a) | | 1,007,000 | | 996,930 | |

SES Global Americas Holdings GP, 5.30%, 03/25/44 (a) | | 1,524,000 | | 1,452,652 | |

T-Mobile USA Inc., 6.50%, 01/15/26 | | 1,299,000 | | 1,311,327 | |

Verizon Communications Inc. | | | | | |

6.40%, 09/15/33 | | 171,000 | | 194,825 | |

4.27%, 01/15/36 | | 2,592,000 | | 2,339,555 | |

6.55%, 09/15/43 | | 164,000 | | 194,697 | |

4.86%, 08/21/46 | | 5,948,000 | | 5,627,212 | |

5.01%, 08/21/54 | | 2,973,000 | | 2,721,514 | |

4.67%, 03/15/55 | | 3,995,000 | | 3,465,539 | |

| | | | 21,717,522 | |

UTILITIES - 4.1% | | | | | |

Abengoa Yield Plc, 7.00%, 11/15/19 (a) (e) | | 2,315,000 | | 2,037,200 | |

Atlantic City Electric Co., 3.38%, 09/01/24 | | 3,386,000 | | 3,327,822 | |

Dynegy Inc., 6.75%, 11/01/19 | | 1,010,000 | | 949,400 | |

Electricite de France SA, 5.25%, (callable at 100 beginning 01/29/23) (a) (f) | | 7,570,000 | | 7,115,800 | |

Enel SpA, 8.75%, 09/24/73 (d) (j) | | 1,872,000 | | 2,131,740 | |

Exelon Corp. | | | | | |

3.95%, 06/15/25 (d) (j) | | 2,209,000 | | 2,207,345 | |

5.10%, 06/15/45 (a) | | 1,831,000 | | 1,826,818 | |

FirstEnergy Corp. | | | | | |

4.25%, 03/15/23 (g) | | 883,000 | | 898,828 | |

7.38%, 11/15/31 | | 1,575,000 | | 1,918,245 | |

FirstEnergy Transmission LLC, 5.45%, 07/15/44 (a) | | 1,680,000 | | 1,691,416 | |

NextEra Energy Capital Holdings Inc., 1.59%, 06/01/17 | | 2,000,000 | | 1,992,804 | |

Oglethorpe Power Corp., 4.55%, 06/01/44 | | 2,344,000 | | 2,221,371 | |

Oncor Electric Delivery Co. LLC | | | | | |

6.80%, 09/01/18 | | 2,250,000 | | 2,501,046 | |

4.10%, 06/01/22 | | 1,679,000 | | 1,744,921 | |

2.95%, 04/01/25 | | 4,900,000 | | 4,604,128 | |

Pacific Gas & Electric Co., 4.30%, 03/15/45 | | 2,007,000 | | 1,980,897 | |

PPL Energy Supply LLC, 6.50%, 06/01/25 (a) (e) | | 940,000 | | 620,400 | |

PPL WEM Holdings Plc, 3.90%, 05/01/16 (a) | | 200,000 | | 200,800 | |

RJS Power Holdings LLC, 4.63%, 07/15/19 (a) (e) | | 2,850,000 | | 2,137,500 | |

Wisconsin Energy Corp., 3.55%, 06/15/25 | | 920,000 | | 925,326 | |

| | | | 43,033,807 | |

Total Corporate Bonds and Notes (cost $620,760,126) | | | | 589,095,407 | |

GOVERNMENT AND AGENCY OBLIGATIONS - 33.2% | | | | | |

GOVERNMENT SECURITIES - 15.1% | | | | | |

Municipals - 0.1% | | | | | |

Port Authority of New York & New Jersey, 4.46%, 10/01/62 | | 1,490,000 | | 1,431,994 | |

U.S. Treasury Securities - 15.0% | | | | | |

U.S. Treasury Bond | | | | | |

3.75%, 08/15/41 | | 10,048,000 | | 11,519,560 | |

3.13%, 11/15/41 | | 8,720,000 | | 8,990,259 | |

2.50%, 02/15/45 | | 2,350,000 | | 2,104,176 | |

U.S. Treasury Note | | | | | |

1.63%, 03/31/19 - 06/30/19 | | 41,144,000 | | 41,390,269 | |

1.50%, 05/31/19 - 05/31/20 | | 11,668,000 | | 11,665,728 | |

1.38%, 02/29/20 - 04/30/20 | | 17,710,000 | | 17,487,633 | |

2.00%, 11/15/21 - 02/15/22 | | 14,392,000 | | 14,421,604 | |

1.75%, 05/15/22 | | 16,835,000 | | 16,561,179 | |

2.75%, 02/15/24 | | 23,754,000 | | 24,741,074 | |

2.50%, 05/15/24 | | 7,250,000 | | 7,407,840 | |

| | | | 156,289,322 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 18.1% | | | | | |

Federal Home Loan Mortgage Corp. - 3.8% | | | | | |

Federal Home Loan Mortgage Corp. | | | | | |

3.00%, 04/01/30 - 07/01/45 | | 14,406,067 | | 14,539,031 | |

3.00%, 01/15/31, TBA (k) | | 244,000 | | 251,391 | |

6.00%, 07/01/37 - 09/01/37 | | 154,868 | | 174,383 | |

5.00%, 02/01/38 - 11/01/41 | | 3,726,278 | | 4,089,582 | |

4.50%, 03/01/42 - 10/01/43 | | 5,778,918 | | 6,234,709 | |

3.50%, 04/01/42 - 06/01/42 | | 5,088,605 | | 5,246,148 | |

4.00%, 03/01/43 - 02/01/45 | | 8,156,741 | | 8,634,641 | |

| | | | 39,169,885 | |

Federal National Mortgage Association - 10.0% | | | | | |

Federal National Mortgage Association | | | | | |

4.00%, 04/01/26 - 06/01/45 | | 20,216,757 | | 21,407,365 | |

2.50%, 01/01/28 - 05/01/28 | | 1,791,021 | | 1,816,251 | |

3.50%, 03/01/30 - 12/01/45 | | 24,473,756 | | 25,305,102 | |

3.00%, 05/01/30 - 05/01/43 | | 18,261,060 | | 18,432,536 | |

2.50%, 01/15/31, TBA (k) | | 6,126,000 | | 6,173,114 | |

5.50%, 12/01/33 - 08/01/38 | | 2,621,954 | | 2,938,808 | |

5.00%, 06/01/35 - 05/01/42 | | 4,544,330 | | 5,019,230 | |

6.00%, 08/01/37 - 01/01/38 | | 307,971 | | 347,964 | |

4.50%, 08/01/40 - 08/01/44 | | 14,071,637 | | 15,219,999 | |

4.00%, 04/01/44, TBA (k) | | 3,863,108 | | 4,089,556 | |

3.08%, 04/01/45 (b) | | 2,877,391 | | 2,954,215 | |

4.50%, 01/15/46, TBA (k) | | 347,000 | | 374,653 | |

| | | | 104,078,793 | |

Government National Mortgage Association - 4.3% | | | | | |

Government National Mortgage Association | | | | | |

5.00%, 08/20/41 - 01/20/43 | | 1,754,532 | | 1,938,387 | |

3.50%, 08/20/42 - 06/20/43 | | 10,952,572 | | 11,447,923 | |

2.50%, 05/20/43 (b) | | 1,595,305 | | 1,629,004 | |

3.00%, 05/20/43 - 07/20/45 | | 15,004,026 | | 15,226,247 | |

4.00%, 05/20/44 | | 4,057,566 | | 4,361,991 | |

4.00%, 08/20/45 | | 1,831,886 | | 1,946,025 | |

4.50%, 08/20/45 | | 3,290,500 | | 3,540,087 | |

3.50%, 01/15/46, TBA (k) | | 4,925,000 | | 5,132,414 | |

| | | | 45,222,078 | |

Total Government and Agency Obligations (cost $345,036,189) | | | | 346,192,072 | |

PREFERRED STOCKS - 0.2% | | | | | |

ENERGY - 0.1% | | | | | |

NuStar Logistics LP, 7.63%, (callable at 25 beginning 01/15/18) | | 48,000 | | 994,560 | |

FINANCIALS - 0.1% | | | | | |

Goldman Sachs Group Inc., 5.50%, (callable at 25 beginning 05/10/23) (e) (f) | | 10,000 | | 258,900 | |

U.S. Bancorp - Series G, 6.00%, (callable at 25 beginning 04/15/17) (e) (f) | | 44,500 | | 1,193,490 | |

| | | | 1,452,390 | |

Total Preferred Stocks (cost $2,623,000) | | | | 2,446,950 | |

VARIABLE RATE SENIOR LOAN INTERESTS - 2.1% (b) | | | | | |

CONSUMER DISCRETIONARY - 0.6% | | | | | |

Charter Communications Operating LLC Term Loan H, 3.25%, 07/23/23 | | $ | 963,000 | | 953,543 | |

Charter Communications Operating LLC Term Loan I, 3.50%, 01/23/23 | | 578,000 | | 576,798 | |

Four Seasons Hotels Ltd. New Term Loan, 3.50%, 06/27/20 | | 1,137,418 | | 1,114,670 | |

JC Penney Corp. Inc. Term Loan, 6.00%, 05/22/18 | | 867,750 | | 851,046 | |

PetSmart Inc. Term Loan B-1, 4.25%, 03/10/22 | | 839,780 | | 816,476 | |

Schaeffler AG New Term Loan B, 4.25%, 05/15/20 | | 406,154 | | 406,357 | |

Univision Communications Inc. Incremental Term Loan, 4.00%, 03/01/20 | | 1,040,074 | | 1,015,934 | |

| | | | 5,734,824 | |

ENERGY - 0.3% | | | | | |

CITGO Holding Inc. Term Loan B, 9.50%, 05/09/18 | | 2,178,000 | | 2,158,028 | |

Fieldwood Energy LLC 1st Lien Term Loan, 3.88%, 09/28/18 | | 1,568,998 | | 1,019,848 | |

Linden Term Loan B, 3.75%, 12/01/20 | | 425,056 | | 410,179 | |

| | | | 3,588,055 | |

FINANCIALS - 0.0% | | | | | |

Guggenheim Partners LLC Initial Term Loan, 4.25%, 07/17/20 | | 489,998 | | 485,711 | |

INDUSTRIALS - 0.3% | | | | | |

Gol LuxCo SA Fixed Rate Term Loan, 6.00%, 08/18/20 (c) | | 3,100,000 | | 3,007,000 | |

MATERIALS - 0.4% | | | | | |

Arch Coal Inc. Term Loan B, 6.25%, 05/14/18 | | 967,473 | | 425,959 | |

FMG Resources (August 2006) Pty Ltd. New Term Loan B, 4.25%, 06/30/19 | | 5,314,273 | | 3,926,450 | |

| | | | 4,352,409 | |

TELECOMMUNICATION SERVICES - 0.4% | | | | | |

Neptune Finco Corp. Term Loan B, 4.75%, 09/16/22 | | 2,750,000 | | 2,742,273 | |

T-Mobile USA Inc. Term Loan B, 3.50%, 11/03/22 | | 937,500 | | 936,478 | |

| | | | 3,678,751 | |

UTILITIES - 0.1% | | | | | |

Texas Competitive Electric Holdings Co. LLC Term Loan, 3.75%, 05/05/16 | | 1,269,802 | | 1,257,104 | |

Total Variable Rate Senior Loan Interests (cost $24,300,494) | | | | 22,103,854 | |

SHORT TERM INVESTMENTS - 5.9% | | | | | |

Investment Company - 3.3% | | | | | |

JNL Money Market Fund, 0.19% (l) (m) | | 34,606,249 | | 34,606,249 | |

Securities Lending Collateral - 2.6% | | | | | |

State Street Navigator Securities Lending Prime Portfolio, 0.29% (m) | | 27,187,615 | | 27,187,615 | |

Total Short Term Investments (cost $61,793,864) | | | | 61,793,864 | |

Total Investments - 103.1% (cost $1,109,776,158) | | | | 1,076,795,972 | |

Other Assets and Liabilities, Net - (3.1%) | | | | (32,489,354 | ) |

Total Net Assets - 100.0% | | | | $ | 1,044,306,618 | |

| | | | | | | |

(a) | The Sub-Adviser has deemed this security which is exempt from registration under the 1933 Act to be liquid based on procedures approved by the Board. As of December 31, 2015, the aggregate value of these liquid securities was $203,031,365 which represented 19.4% of net assets. |

(b) | Variable rate security. Rate stated was in effect as of December 31, 2015. |

(c) | Security fair valued in good faith in accordance with the procedures approved by the Trust’s Board of Trustees. Good faith fair valued securities may be classified as Level 2 or Level 3 for FASB ASC Topic 820 “Fair Value Measurement,” based on applicable valuation inputs. See FASB Topic 820 in the Notes to Financial Statements. |

(d) | The Sub-Adviser has deemed this security to be illiquid based on procedures approved by the Board. |

(e) | All or a portion of the security was on loan. |

See accompanying Notes to Financial Statements.

(f) | Perpetual security. |

(g) | The interest rate for this security is inversely affected by upgrades or downgrades to the credit rating of the issuer. |

(h) | Security is a “step-up” bond where the coupon may increase or step up at a future date or as the result of an upgrade or downgrade to the credit rating of the issuer. Rate stated was the coupon as of December 31, 2015. |

(i) | Convertible security. |

(j) | Security is restricted to resale to institutional investors. See Restricted Securities in the Notes to Schedules of Investments. |

(k) | All or a portion of the investment was purchased on a delayed delivery basis. As of December 31, 2015, the total payable of investments purchased on a delayed delivery basis was $16,030,131. |

(l) | Investment in affiliate. |

(m) | Yield changes daily to reflect current market conditions. Rate was the quoted yield as of December 31, 2015. |

| | Shares/Par † | | Value | |

JNL Money Market Fund | | | | | |

CORPORATE BONDS AND NOTES - 11.2% | | | | | |

CONSUMER STAPLES - 1.1% | | | | | |

PepsiCo Inc., 0.62%, 02/26/16 (a) | | $ | 32,000,000 | | $ | 32,009,007 | |