UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2011

Item 1. Report to Stockholders.

INFORMATION REGARDING CALVERT OPERATING COMPANY

NAME CHANGES

Effective on April 30, 2011, the following Calvert operating companies will be renamed as indicated:

| | |

| Current Company Name | Company Name on 4/30/11 | Company Description |

| |

| Calvert Group, Ltd. | Calvert Investments, Inc. | Corporate parent of each |

| | | operating company listed |

| | | below |

| |

| Calvert Asset Management | Calvert Investment | Investment advisor to the |

| Company, Inc. | Management, Inc. | Calvert Funds |

| |

| Calvert Distributors, Inc. | Calvert Investment Distributors, | Principal underwriter |

| | Inc. | and distributor for the |

| | | Calvert Funds |

| |

| Calvert Administrative | Calvert Investment | Administrative services |

| Services Company | Administrative Services, Inc. | provider for the Calvert |

| | | Funds |

| |

| Calvert Shareholder | Calvert Investment Services, | Shareholder servicing |

| Services, Inc. | Inc. | provider for the Calvert |

| | | Funds |

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

TABLE

OFCONTENTS

| 4 | President’s Letter |

| 7 | SRI Update |

| 10 | Portfolio Management Discussion |

| 15 | Shareholder Expense Example |

| 17 | Statement of Net Assets |

| 23 | Statement of Operations |

| 24 | Statements of Changes in Net Assets |

| 26 | Notes to Financial Statements |

| 34 | Financial Highlights |

| 39 | Explanation of Financial Tables |

| 41 | Proxy Voting and Availability of Quarterly Portfolio Holdings |

| 41 | Basis for Board’s Approval of Investment Advisory Contracts |

Dear Shareholders:

The financial markets ended the six-month reporting period on a high note. The Federal Reserve’s announcement in the fall of 2010 of a second round of quantitative easing (QE2) initially buoyed the markets, which were further bolstered by the extension in December of the Bush-era tax cuts for all income levels. The resulting increase in U.S. consumer spending and confidence helped drive a year-end rally.

This calm lasted until new storms arrived in the beginning of 2011. Civil and political unrest in the Middle East and North Africa sent the price of energy soaring and heightened energy security concerns in many countries around the world. In March, the tragic earthquake and tsunami struck Japan. Our sympathies go out to the people of Japan who lost loved ones in this disaster. The earthquake—and its impact on the country’s nuclear reactors—roiled global financial markets. The cumulative effect of these events sparked a stock market sell-off before equities rebounded strongly in the final two weeks of the reporting period.

Markets Continue to Pick Up Steam

The stock market generally continued its upward momentum throughout the six-month period—with help from a strong fourth-quarter earnings season. Both U.S. growth- and value-oriented stocks reported significant gains across all capitalizations. In fact, the large-cap Russell 1000 Index and Standard & Poor’s 500 Index rose 18.13% and 17.31%, respectively, for the six-month period. Small- and mid-cap indices posted even higher returns as investors’ appetite for risk continued to strengthen.

However, continued uncertainty about the sovereign debt situation in some European countries as well as a drag from emerging markets tempered returns abroad, with the MSCI EAFE Index of international stocks returning 10.33% for the six-month period. Also, corporate bonds edged down slightly for the period, with the Barclays Capital U.S. Credit Index returning -0.98%. Money market returns remained flat, reflecting the Fed’s efforts to keep its target interest rate low.

Board Diversity and Company Competitiveness

At Calvert, we believe that companies with high standards of corporate governance, including diverse boards, are better positioned to compete in the global marketplace and to potentially outperform their peers. As a result, we continue to use our role as sustainable and responsible investors to encourage companies to clearly define diversity as inclusive of gender, ethnic, and racial backgrounds and to publicly commit to increasing diversity—on their boards and throughout their organizations.

We celebrated the first anniversary of the publication of the Women’s Empowerment Principles (WEP) and the 100th anniversary of International Women’s Day in March with a two-day event sponsored by the United Nations

| www. | calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 4 |

Women and the United Nations Global Compact. The WEP were established through collaboration between the United Nations Women and the United Nations Global Compact in March 2010. Calvert continues to be an integral player in furthering the adoption of the WEP across the globe. In fact, more than 140 CEOs worldwide have signed a statement of support for the WEP, in part due to Calvert’s efforts.

Also, our October 2010 diversity report “Examining the Cracks in the Ceiling” has been making news by being cited in more than 40 articles from outlets such as The Washington Post, Forbes, and The New York Times. While we are pleased to see such strong media interest in this topic, we’re even more pleased that the report has led to Calvert having conversations with more than a dozen companies about their diversity scores and actions they can take to improve their overall diversity performance.

Opportunities and Challenges Ahead

Overall, we are encouraged by the market’s ability to move ahead despite the recent troubles in the Middle East and Japan, and we expect a slow, gradual economic recovery to continue throughout the remainder of the year. A low core inflation rate (which excludes food and energy prices) will likely facilitate economic growth, while continued debt reduction, lingering high unemployment, and a struggling housing market should limit gains. Energy prices will remain a challenge until we see more resolution of the issues in the Middle East and North Africa. Of course, more geopolitical crises, rising commodity prices, and inflation spikes could certainly dampen the markets.

In short, we are optimistic and believe the markets, the global economy, and your Calvert funds can successfully navigate through any temporary setbacks that may lie ahead.

Discuss Your Portfolio Allocations with Your Advisor

Given the market shifts we have experienced, your overall portfolio asset allocation and investment strategy may no longer match your needs. Therefore, we recommend reviewing these with your financial advisor to ensure that your target mix of U.S. and international stocks, bonds, and cash is well-diversified and appropriate given your financial goals, time horizon, and risk tolerance.

We encourage you to visit our website, www.calvert.com, for fund information and updates as well as market and economic commentary from Calvert professionals.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

As noted elsewhere in this report, the Calvert operating companies that provide services to the funds will change their names effective April 30, 2011. As part of the changes, Calvert Group, Ltd. will be known as Calvert Investments, Inc., and the funds’ advisor, Calvert Asset Management Company, Inc., will be known as Calvert Investment Management, Inc. As always, we appreciate your investing with Calvert.

Sincerely,

Barbara J. Krumsiek

President and CEO

Calvert Investments, Inc.

April 2011

| www. | calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 6 |

SRI Update

from the Calvert Sustainability Research Department

Responsible management of environmental, social, and governance (ESG) factors isn’t just “nice to do”—it’s essential to keeping our companies and our economy healthy and strong. Therefore, Calvert continues to work hard to ensure that you have a say in charting new paths to a more prosperous future.

Corporate & Board Diversity

The newly released version of the Calvert report, “Examining the Cracks in the Ceiling: A Survey of Corporate Diversity Practices of the S&P 100,” revealed that women are still significantly underrepresented on corporate boards (18%) and in C-level executive positions (8.4%)—despite comprising more than half the workforce.

Another disappointment was learning that 37% of the companies disclose no demographic data on employees—such as race, ethnicity and gender—which is necessary to evaluate a company’s progress. Only eight companies disclose full EEO-1 data, which is a full breakdown of the workforce by race and gender across employment categories.

As an investor, Calvert believes companies that combine competitive financial performance with fair and equitable working environments—where diversity is not only tolerated but embraced—are more likely to recognize gains in both the workplace and marketplace and be better positioned to generate long-term value for their shareholders.

Green Homebuilding

In October, Calvert released “A Green Recovery for America’s Homebuilders? A Survey of Sustainable Practices by the Homebuilding Industry.” This updated version of our 2008 report on America’s 10 largest publicly traded homebuilders shows they have started to improve their policies and practices related to the environment and resources, but much progress remains to be seen.

Out of 42 possible points, the average total sustainability score was just over six points, or 15%. All 10 homebuilders have made some effort to develop environmental policies or practices or offer environmental products. However, there is a big difference in the level of commitment to sustainability and the penetration of “green” homes in each company’s product mix.

In the homebuilder rankings, KB Home and Pulte remained in the top two spots, while Meritage Homes and Toll Brothers had the biggest improvements—each moving up five spots. DR Horton and Ryland Homes fell back four and three places, respectively.

Climate Change

Calvert has continued its corporate engagement and policy work in support of energy efficiency, alternative energy, and reductions in greenhouse gas emissions. We have also been ramping up our work on climate change adaptation. Leading scientists believe that

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

even if we stop producing greenhouse gasses tomorrow, a certain amount of climate change will still happen because of the carbon dioxide and other pollutants already in the atmosphere.

As a result, Calvert has been collaborating with Oxfam America to highlight the risks U.S. companies face from climate change as well as the opportunities for innovation and new business that corporate solutions could offer. In November 2010, we helped facilitate a high-level roundtable on Capitol Hill hosted by Oxfam for members of Congress, key congressional staff, and companies such as John Deere, Johnson Controls, and Starbucks to discuss these topics.

Calvert and Oxfam are now helping some of the attending companies form a business coalition to assist corporations and vulnerable communities in their adaptation to the effects of climate change. The new coalition would publish case studies and best practices as well as promote public policies related to climate change adaptation and resiliency.

On the shareholder advocacy front, Calvert has filed shareholder proposals with three companies asking them to clarify what they are doing to manage their risks related to climate change—two of these proposals have already been successfully withdrawn.

Overall Shareholder Advocacy Efforts

In all, Calvert has filed 35 resolutions to date in the 2011 proxy season and 22 have already been successfully withdrawn after the companies agreed to the terms of the resolution. In addition to the resolutions cited above, six focused on sustainability reporting, four on political contributions, and seven on climate principles.

Special Equities

A modest but important portion of certain funds is allocated to small private companies that are developing products or services that address important sustainability or environmental issues. For example, Calvert Equity Portfolio recently invested in the DBL Equity Fund-BAEF II, LP, which invests in private, mid- to late-stage growth companies—primarily in the clean tech, health care, information technology, and sustainability-oriented industries—oca-ted near low- and moderate-income communities in San Francisco and adjoining states. The Fund will assist its portfolio companies in creating and implementing their Second Bottom Line strategy in job creation, job quality, and environmental stewardship.

Calvert International Equity Fund invested in FINAE, S.A.P.I. de C.V. SOFOM ENR, a company that provides college loans to students from low- and middle-income families in Mexico. Students are selected by universities for their academic talent and financial need, and screened by FINAE for their repayment capacity.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 8

As of March 31, 2011, DBL Equity Fund –BAEF II, LP represented 0.02% of Calvert Equity Portfolio; FINAE represented 0.26% of Calvert International Equity Fund. All holdings are subject to change without notice.

As of March 31, 2011, the following companies represent the following percentages of net assets: KB Home represented 0.20% of Calvert Small Cap Fund; Pulte represented 0.03% of Calvert Social Index Fund; Meritage Homes represented 0% of all Calvert equity funds; DR Horton represented 0.04% of Calvert Social Index Fund; Ryland represented 0% of all Calvert equity funds; John Deere represented 1.53% of Calvert Balanced Portfolio and 0.52% of Calvert Social Index Fund; Johnson Controls represented 0.36% of Calvert Social Index Fund; Starbucks represented 0.35% of Calvert Social Index Fund, 2.01% of Calvert Equity Portfolio, and 1.65% of Calvert Enhanced Equity Portfolio; General Cable represented 1.74% of Calvert Capital Accumulation Fund and 0.03% of Calvert Social Index Fund; and WABCO Holdings represented 2.73% of Calvert Capital Accumulation Fund and 0.05% of Calvert Social Index Fund. All holdings are subject to change without notice.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

PORTFOLIO MANAGEMENT DISCUSSION

John Montgomery

of Bridgeway Capital Management

Performance

Calvert Large Cap Growth Fund Class A shares (at NAV) returned 17.36% for the six-month period ending March 31, 2011, beating the Standard & Poor’s (S&P) 500 Index’s return of 17.31%. The outperformance was primarily due to good stock selection in the Consumer Discretionary sector.

CALVERT LARGE CAP GROWTH FUND

MARCH 31, 2011

INVESTMENT PERFORMANCE

(TOTAL RETURN AT NAV*)

| | 6 Months | | 12 Months | |

| | ended | | ended | |

| | 3/31/11 | | 3/31/11 | |

| Class A | 17.36 | % | 12.45 | % |

| Class B | 16.84 | % | 11.36 | % |

| Class C | 16.91 | % | 11.54 | % |

| Class I | 17.70 | % | 13.10 | % |

| Class Y | 17.51 | % | 12.65 | % |

| S&P 500 Index | 17.31 | % | 15.65 | % |

| Lipper Large-Cap Growth Funds Average | 17.31 | % | 16.06 | % |

Investment Climate

Despite global calamities and geopolitical unrest, the market did surprisingly well for this six-month period. The bull market raged even though unemployment remained high, input prices – especially energy – were climbing, and inflation seemed unavoidable. Inflation risk alone should have been enough to threaten stock performance, yet the positive stock market momentum continued for the period. Investors continued to brush past the reality check in favor of the new iPad and another mega-sized SUV. Across the board, stocks in each sector of the market appreciated.

Our area of the market, large-cap growth-oriented stocks, appreciated nicely during the fourth quarter of 2010 (up 11.83% for the quarter), yet trailed both mid- and small-cap growth stocks. It then added another 6.03% in the first quarter of 2011, which trailed all the other areas. Still, this most recent positive performance represents a welcome and long awaited development—the potential early signs of positive momentum for large-cap growth stocks.

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charge.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 10

CALVERT LARGE CAP GROWTH FUND

MARCH 31, 2011

| | % of Total | |

| ECONOMIC SECTORS | InvestMents | |

| Consumer Discretionary | 20.8 | % |

| Consumer Staples | 10.2 | % |

| Energy | 8.9 | % |

| Financials | 6.0 | % |

| Health Care | 9.0 | % |

| Industrials | 8.2 | % |

| Information Technology | 29.6 | % |

| Limited Partnership Interest | 0.3 | % |

| Materials | 2.2 | % |

| Telecommunication Services | 3.9 | % |

| Venture Capital | 0.9 | % |

| Total | 100 | % |

| | | |

| | |

| TEN LARGEST | % of Net | |

| STOCK HOLDINGS | Assets | |

| priceline.com, Inc. | 2.7 | % |

| W.W. Grainger, Inc. | 2.6 | % |

| International Business Machines Corp. 2.6% | |

| Ross Stores, Inc. | 2.1 | % |

| Netflix, Inc. | 2.1 | % |

| AmerisourceBergen Corp. | 2.0 | % |

| MetroPCS Communications, Inc. | 1.8 | % |

| TJX Co.’s, Inc. | 1.8 | % |

| CBS Corp. | 1.7 | % |

| Southwestern Energy Co. | 1.7 | % |

| Total | 21.1 | % |

Portfolio Strategy

What worked well

For this six-month period, good stock selection and an overweight to the Consumer Discretionary sector contributed to our benchmark-beating performance. Our largest-weighted sector remains Information Technology, comprising 29.6% of holdings at the end of March. Our most significant industry weights within this sector are in semiconductors and computers. One of our top performing stocks was Micron Technology, up 59% for the period, while another strong stock selection was Estee Lauder, up 53.9%.1

As a whole, our strong performers in a variety of industries were Micron Technology (semiconductors), Estee Lauder (personal products), Whole Foods Market (food), Priceline.com (Internet), and Netflix (Internet).

What didn’t work well

A few poor selections in the Information Technology sector detracted from our overall performance. One of our worst-performing stocks was JDS Uniphase, a provider of communications test and measurement solutions to telecommunications service providers, which declined 21.3%. The stock price tumbled in March when one of its competitors released negative guidance, creating uncertainty about the near-term outlook for other telecommunications/optics equipment companies.

Our five worst-performing stocks represented a variety of different industries from four different sectors – indicating that the hardest hit stocks did not have a common theme. These poor performers included JDS Uniphase (telecommunications), Akamai Technologies (Internet), Cisco Systems (telecommunications), Delta Air Lines (airlines), and Lloyds Banking Group (banks).

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

CALVERT LARGE CAP GROWTH FUND

MARCH 31, 2011

AVERAGE ANNUAL TOTAL RETURNS

| Class A shares* | (with max. load) | |

| One year | 7.12 | % |

| Five year | -1.89 | % |

| Ten year | 3.53 | % |

| Class B shares | (with max. load) | |

| One year | 6.36 | % |

| Five year | -2.02 | % |

| Ten year | 3.07 | % |

| |

| Class C shares | (with max. load) | |

| One year | 10.54 | % |

| Five year | -1.70 | % |

| Ten year | 3.14 | % |

| |

| Class I shares | | |

| One year | 13.10 | % |

| Five year | -0.36 | % |

| Ten year | 4.65 | % |

| Class Y shares* | | |

| One year | 12.65 | % |

| Five year | -0.81 | % |

| Ten year | 4.10 | % |

*Calvert Large Cap Growth Fund first offered Class Y shares on October 31, 2008. Performance prior to that date reflects Class A shares at net asset value (NAV). The Actual Class Y performance would have been different.

Outlook

Three major factors hit our radar screen when looking to the future of the market environment and our Fund. First, only three of the last 11 calendar years have been favorable to the growth style of investing. We believe we are still overdue for some continued catch-up for growth, which would be favorable to our Fund relative to broader market benchmarks, such as the S&P 500 Index.

Second, higher quality companies have been notably out of favor over the last few years. We see some signs that this “junk rally” period may have ended; for example, higher debt companies are no longer leading the pack. If this trend strengthens, this should also be favorable to the Fund, since our stock picking models tend to favor higher quality stocks overall.

Finally, stock prices over the last few years have been driven more by broader economic news and world events than company-level economics, such as revenues, earnings, and cash flows. This has not been favorable to Bridgeway’s bottom-up stock picking process, which seeks to choose one good company at a time rather than making broad market bets. We do believe the market will eventually focus on company fundamentals, as it has historically done over broader time periods. We definitely saw some signs of this in the most recent quarter, when some of our top performing companies, on a fundamental basis, were also rewarded with market-beating returns.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 12

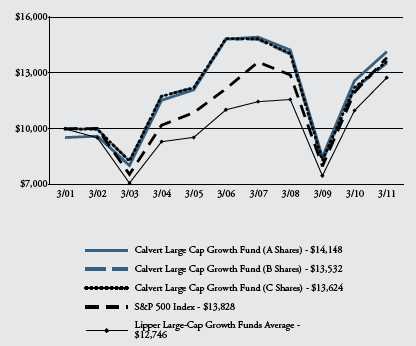

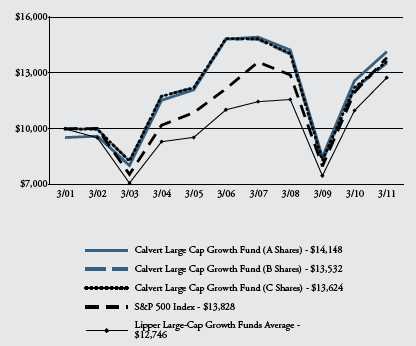

GROWTH OF $10,000

The graph below shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods. The results shown are for Classes A, B and C shares and reflect the deduction of the maximum front-end Class A sales charge of 4.75%, or deferred sales charge, as applicable and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s/Portfolio’s distributions or the redemption of the Fund/Portfolio shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.58%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s/Portfolio’s operating expenses.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

Bridgeway avoids specifically predicting or timing market factors. For example, we don’t hold cash with a view of trying to time a market downturn, which we believe is a losing proposition. Nevertheless, for the reasons above, we are optimistic that we could be entering a period much more favorable to our Fund than the last three years have been.

April 2011

In early May, the Directors of Calvert Impact Fund, Inc. approved a recommendation to merge Calvert Large Cap Growth Fund into Calvert Equity Portfolio of Calvert Social Investment Fund. Shareholders will be asked to vote on the proposed merger and must approve the transaction before it may take place. Effective May 2, Atlanta Capital Management Company, LLC, the portfolio manager of Calvert Equity Portfolio, took over management of Calvert Large Cap Growth Fund from Bridgeway Capital Management, Inc. The Fund’s investment objective will not change as a result of the portfolio manager change or the prospective merger with Calvert Equity Portfolio.

1 All returns shown for individual holdings reflect that part of the reporting period the holdings were held.

As of March 31, 2011, the following companies represented the following percentages of Fund net assets: Micron Technology 0.99%, Estee Lauder 1.11%, Whole Foods 1.70%, Priceline.com 2.72%, Netflix 2.09%, JDS Uniphase 1.68%, Akamai Technologies 1.11%, Cisco 0.88%, Delta Air Lines 0.80%, and Lloyds Banking Group 0.90%. All holdings are subject to change without notice.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 14

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2010 to March 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

The Fund charges an annual low balance account fee of $15 to those shareholders whose account balance is less than $1,000. If the low balance fee applies to your account, you should subtract the fee from the ending account value in the chart below.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

| | | | | | |

| | | BEGINNING | | ENDING ACCOUNT | | EXPENSES PAID |

| | | ACCOUNT VALUE | | VALUE | | DURING PERIOD* |

| | | 10/1/10 | | 3/31/11 | | 10/1/10 - 3/31/11 |

| class A | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,174.10 | $ | 7.65 |

| Hypothetical | $ | 1,000.00 | $ | 1,017.89 | $ | 7.10 |

| (5% return per | | | | | | |

| year before expenses) | | | | | | |

| class B | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,168.40 | $ | 12.72 |

| Hypothetical | $ | 1,000.00 | $ | 1,013.20 | $ | 11.81 |

| (5% return per | | | | | | |

| year before expenses) | | | | | | |

| class c | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,169.10 | $ | 11.85 |

| Hypothetical | $ | 1,000.00 | $ | 1,014.01 | $ | 11.00 |

| (5% return per | | | | | | |

| year before expenses) | | | | | | |

| class I | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,177.50 | $ | 4.39 |

| Hypothetical | $ | 1,000.00 | $ | 1,020.90 | $ | 4.07 |

| (5% return per | | | | | | |

| year before expenses) | | | | | | |

| class Y | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,175.10 | $ | 6.30 |

| Hypothetical | $ | 1,000.00 | $ | 1,019.14 | $ | 5.85 |

| (5% return per | | | | | | |

| year before expenses) | | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.41%, 2.35%, 2.19%, .81% and 1.16%, for Class A, Class B, Class C, Class I and Class Y respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 16

| | | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2011 |

| |

| EQUITY SECURITIES - 98.0% | shares | | value |

| Airlines - 0.8% | | | |

| Delta Air Lines, Inc.* | 539,500 | $ | 5,287,100 |

| |

| Auto Components - 3.4% | | | |

| BorgWarner, Inc.* | 96,000 | | 7,650,240 |

| Magna International, Inc. | 159,800 | | 7,656,018 |

| TRW Automotive Holdings Corp.* | 127,000 | | 6,995,160 |

| | | | 22,301,418 |

| |

| Beverages - 1.0% | | | |

| Dr Pepper Snapple Group, Inc. | 183,600 | | 6,822,576 |

| |

| Chemicals - 1.1% | | | |

| Praxair, Inc | 73,800 | | 7,498,080 |

| |

| Commercial Banks - 3.2% | | | |

| KeyCorp | 787,000 | | 6,988,560 |

| Lloyds Banking Group plc (ADR)* | 1,609,500 | | 5,955,150 |

| M&T Bank Corp | 92,000 | | 8,139,240 |

| | | | 21,082,950 |

| |

| Communications Equipment - 6.3% | | | |

| Cisco Systems, Inc. | 339,200 | | 5,817,280 |

| F5 Networks, Inc.* | 98,400 | | 10,092,888 |

| JDS Uniphase Corp.* | 534,000 | | 11,128,560 |

| Nokia Oyj (ADR) | 673,000 | | 5,727,230 |

| Research In Motion Ltd.* | 153,200 | | 8,666,524 |

| | | | 41,432,482 |

| |

| Computers & Peripherals - 4.0% | | | |

| Apple, Inc. (t)* | 28,100 | | 9,791,445 |

| Hewlett-Packard Co | 162,300 | | 6,649,431 |

| SanDisk Corp.* | 211,800 | | 9,761,862 |

| | | | 26,202,738 |

| |

| Containers & Packaging - 1.0% | | | |

| Ball Corp. | 187,700 | | 6,729,045 |

| |

| Diversified Telecommunication Services - 1.1% | | | |

| BCE, Inc. | 201,800 | | 7,333,412 |

| |

| Electrical Equipment - 1.0% | | | |

| Cooper Industries plc | 101,100 | | 6,561,390 |

| |

| Electronic Equipment & Instruments - 2.3% | | | |

| Dolby Laboratories, Inc.* | 148,500 | | 7,307,685 |

| TE Connectivity Ltd | 217,200 | | 7,562,904 |

| | | | 14,870,589 |

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

| | | |

| EQUITY SECURITIES - CONT’D | shares | | value |

| Energy Equipment & Services - 4.6% | | | |

| Cameron International Corp.* | 134,400 | $ | 7,674,240 |

| Core Laboratories NV | 64,000 | | 6,538,880 |

| FMC Technologies, Inc.* | 73,600 | | 6,953,728 |

| Noble Corp | 209,500 | | 9,557,390 |

| | | | 30,724,238 |

| |

| Food & Staples Retailing - 3.9% | | | |

| CVS Caremark Corp. | 220,000 | | 7,550,400 |

| Walgreen Co. | 169,200 | | 6,791,688 |

| Whole Foods Market, Inc. | 170,300 | | 11,222,770 |

| | | | 25,564,858 |

| |

| Food Products - 1.3% | | | |

| Campbell Soup Co | 250,000 | | 8,277,500 |

| |

| Health Care Equipment & Supplies - 0.5% | | | |

| Varian Medical Systems, Inc.* | 49,100 | | 3,321,124 |

| |

| Health Care Providers & Services - 6.5% | | | |

| AmerisourceBergen Corp. | 331,500 | | 13,114,140 |

| DaVita, Inc.* | 88,500 | | 7,567,635 |

| Laboratory Corp. of America Holdings* | 80,000 | | 7,370,400 |

| McKesson Corp. | 85,800 | | 6,782,490 |

| Quest Diagnostics, Inc. | 141,500 | | 8,167,380 |

| | | | 43,002,045 |

| |

| Household Products - 2.9% | | | |

| Colgate-Palmolive Co. | 128,700 | | 10,393,812 |

| Procter & Gamble Co | 140,100 | | 8,630,160 |

| | | | 19,023,972 |

| |

| Industrial Conglomerates - 1.3% | | | |

| 3M Co. | 88,000 | | 8,228,000 |

| |

| Insurance - 2.2% | | | |

| AXIS Capital Holdings Ltd | 192,000 | | 6,704,640 |

| Travelers Co.’s, Inc. | 131,800 | | 7,839,464 |

| | | | 14,544,104 |

| |

| Internet & Catalog Retail - 4.8% | | | |

| Netflix, Inc.* | 58,400 | | 13,860,072 |

| priceline.com, Inc.* | 35,600 | | 18,029,264 |

| | | | 31,889,336 |

| |

| Internet Software & Services - 1.1% | | | |

| Akamai Technologies, Inc.* | 193,300 | | 7,345,400 |

| |

| IT Services - 3.5% | | | |

| International Business Machines Corp. | 102,916 | | 16,782,512 |

| Western Union Co | 302,300 | | 6,278,771 |

| | | | 23,061,283 |

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 18

| | | |

| EQUITY SECURITIES - CONT’D | shares | | value |

| Life Sciences - Tools & Services - 1.0% | | | |

| Illumina, Inc.* | 97,200 | $ | 6,810,804 |

| |

| Machinery - 2.5% | | | |

| Cummins, Inc | 86,500 | | 9,482,130 |

| PACCAR, Inc. | 139,900 | | 7,323,765 |

| | | | 16,805,895 |

| |

| Media - 3.9% | | | |

| CBS Corp., Class B | 456,600 | | 11,433,264 |

| DIRECTV* | 159,100 | | 7,445,880 |

| McGraw-Hill Co.’s, Inc. | 178,000 | | 7,013,200 |

| | | | 25,892,344 |

| |

| Multiline Retail - 1.7% | | | |

| Dollar Tree, Inc.* | 125,800 | | 6,984,416 |

| Family Dollar Stores, Inc. | 88,000 | | 4,516,160 |

| | | | 11,500,576 |

| |

| Oil, Gas & Consumable Fuels - 3.2% | | | |

| Cimarex Energy Co | 87,600 | | 10,095,024 |

| Southwestern Energy Co.* | 264,600 | | 11,369,862 |

| | | | 21,464,886 |

| |

| Personal Products - 1.1% | | | |

| Estee Lauder Co.’s, Inc. | 76,300 | | 7,352,268 |

| |

| Pharmaceuticals - 0.9% | | | |

| Bristol-Myers Squibb Co. | 222,039 | | 5,868,491 |

| |

| Professional Services - 1.0% | | | |

| IHS, Inc.* | 74,100 | | 6,576,375 |

| |

| Semiconductors & Semiconductor Equipment - 10.0% | | | |

| Altera Corp. | 169,700 | | 7,470,194 |

| ARM Holdings plc (ADR) | 276,000 | | 7,774,920 |

| Atmel Corp.* | 640,000 | | 8,723,200 |

| Intel Corp. | 320,300 | | 6,460,451 |

| KLA-Tencor Corp. | 133,900 | | 6,342,843 |

| Lam Research Corp.* | 142,000 | | 8,045,720 |

| Linear Technology Corp. | 193,800 | | 6,517,494 |

| Micron Technology, Inc.* | 570,100 | | 6,533,346 |

| Texas Instruments, Inc | 238,700 | | 8,249,472 |

| | | | 66,117,640 |

| |

| Software - 2.4% | | | |

| Microsoft Corp. | 382,200 | | 9,692,592 |

| VMware, Inc.* | 76,600 | | 6,245,964 |

| | | | 15,938,556 |

| |

| Specialty Retail - 6.8% | | | |

| Advance Auto Parts, Inc | 109,000 | | 7,152,580 |

| Best Buy Co., Inc | 192,200 | | 5,519,984 |

| Limited Brands, Inc. | 209,300 | | 6,881,784 |

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 19

| | | | |

| EQUITY SECURITIES - CONT’D | | shares | | value |

| Specialty Retail - Cont’d | | | | |

| Ross Stores, Inc | | 195,200 | $ | 13,882,624 |

| TJX Co.’s, Inc | | 238,600 | | 11,865,578 |

| | | | | 45,302,550 |

| |

| Trading Companies & Distributors - 2.6% | | | | |

| W.W. Grainger, Inc | | 126,600 | | 17,430,288 |

| |

| Venture Capital - 0.3% | | | | |

| Better Energy Systems, Inc.: | | | | |

| Series B, Preferred (b)(i)* | | 992,555 | | 280,000 |

| Series B, Preferred Warrants (strike price $0.75/share, | | | | |

| expires 8/3/13) (b)(i)* | | 133,333 | | - |

| Napo Pharmaceuticals, Inc.: | | | | |

| Common Stock (b)(i)* | | 294,196 | | 882,588 |

| Common Warrants (strike price $0.55/share, | | | | |

| expires 9/15/14) (b)(i)* | | 54,061 | | 132,449 |

| Orteq Bioengineering Ltd., Series A, Preferred (b)(i)* | | 74,910 | | 781,426 |

| Village Laundry Services, Inc. (a)(b)(i)* | | 9,444 | | 174,525 |

| | | | | 2,250,988 |

| |

| Wireless Telecommunication Services - 2.8% | | | | |

| American Tower Corp.* | | 131,400 | | 6,809,148 |

| MetroPCS Communications, Inc.* | | 732,200 | | 11,890,928 |

| | | | | 18,700,076 |

| |

| Total Equity Securities (Cost $550,923,401) | | | | 649,115,377 |

| |

| | | PRINCIPAL | | |

| HIGH SOCIAL IMPACT INVESTMENTS - 0.6% | | AMOUNT | | |

| Calvert Social Investment Foundation Notes, 1.17%, 7/1/12 (b)(i)(r) | $ | 3,750,000 | | 3,719,775 |

| |

| Total High Social Impact Investments (Cost $3,750,000) | | | | 3,719,775 |

| |

| |

| |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.6% | | | | |

| SEAF Global SME Facility: | | | | |

| 9.00%, 12/16/14 (b)(i) | | 1,500,000 | | 1,500,000 |

| 9.00%, 4/20/15 (b)(i) | | 1,000,000 | | 1,000,000 |

| 9.00%, 11/5/15 (b)(i) | | 1,000,000 | | 1,000,000 |

| 9.00%, 3/31/16 (b)(i) | | 450,000 | | 450,000 |

| |

| Total Venture Capital Debt Obligations (Cost $3,950,000) | | | | 3,950,000 |

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 20

| | | | | |

| | | ADJUSTED | | | |

| VENTURE CAPITAL LIMITED PARTNERSHIP INTEREST - 0.3% | | BASIS | | VALUE | |

| Blackstone Cleantech Venture Partners (b)(i)* | $ | 98,791 | $ | 86,206 | |

| China Environment Fund III (b)(i)* | | 911,788 | | 1,538,690 | |

| Ignia Fund I (b)(i)* | | 501,806 | | 423,776 | |

| LeapFrog Financial Inclusion Fund (b)(i)* | | 104,574 | | 64,717 | |

| Renewable Energy Asia Fund (b)(i)* | | 183,676 | | 122,351 | |

| |

| Total Venture Capital Limited Partnership | | | | | |

| Interest (Cost $1,800,635) | | | | 2,235,740 | |

| |

| |

| TOTAL INVESTMENTS (Cost $560,424,036) - 99.5% | | | | 659,020,892 | |

| Other assets and liabilities, net - 0.5% | | | | 2,995,495 | |

| NET ASSETS - 100% | | | $ | 662,016,387 | |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares of common stock, | | | | | |

| with 250,000,000 shares of $0.01 per value shares authorized: | | | | | |

| Class A: 9,831,307 shares outstanding | | | $ | 349,531,363 | |

| Class B: 586,453 shares outstanding | | | | 14,703,261 | |

| Class C: 1,519,302 shares outstanding | | | | 50,421,875 | |

| Class I: 9,571,420 shares outstanding | | | | 354,887,041 | |

| Class Y: 133,349 shares outstanding | | | | 3,244,370 | |

| Undistributed net investment income (loss) | | | | (332,911 | ) |

| Accumulated net realized gain (loss) on investments | | | | | |

| and foreign currency transactions | | | | (209,035,606 | ) |

| Net unrealized appreciation (depreciation) on investments | | | | | |

| and assets and liabilities denominated in foreign currencies | | | | 98,596,994 | |

| |

| |

| NET ASSETS | | | $ | 662,016,387 | |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A (based on net assets of $295,726,035) | | | $ | 30.08 | |

| Class B (based on net assets of $16,033,043) | | | $ | 27.34 | |

| Class C (based on net assets of $42,010,715) | | | $ | 27.65 | |

| Class I (based on net assets of $304,209,572) | | | $ | 31.78 | |

| Class Y (based on net assets of $4,037,022) | | | $ | 30.27 | |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 21

| | | |

| RESTRICTED SECURITIES | ACQUISITION DATES | | COST |

| Better Energy Systems, Inc.: | | | |

| Series B, Preferred | 8/3/10 | $ | 400,000 |

| Series B, Preferred Warrants | | | |

| (strike price $0.75/share, expires 8/3/13) | 8/4/10 | | - |

| Blackstone Cleantech Venture Partners LP | 7/29/10 - 1/28/11 | | 98,791 |

| Calvert Social Investment Foundation Notes, 1.17%, 7/1/12 | 7/1/09 - 7/1/10 | | 3,750,000 |

| China Environment Fund III LP | 1/24/08 - 1/24/11 | | 911,788 |

| Ignia Fund I LP | 1/28/10 - 3/15/11 | | 501,806 |

| LeapFrog Financial Inclusion Fund LP | 1/20/10 - 12/16/10 | | 104,574 |

| Napo Pharmaceuticals, Inc.: | | | |

| Common Stock | 2/21/07 - 9/23/09 | | 419,720 |

| Common Warrants (strike price $0.55/share, expires 9/15/14) | 9/23/09 | | 16,908 |

| Orteq Bioengineering Ltd., Series A, Preferred | 7/19/07 | | 998,102 |

| Renewable Energy Asia Fund LP | 1/6/10 - 12/16/10 | | 183,676 |

| SEAF Global SME Facility: | | | |

| 9.00%, 12/16/14 | 12/16/09 | | 1,500,000 |

| 9.00%, 4/20/15 | 4/20/10 | | 1,000,000 |

| 9.00%, 11/5/15 | 11/4/10 | | 1,000,000 |

| 9.00%, 3/31/16 | 3/29/11 | | 450,000 |

| Village Laundry Services, Inc. | 7/22/09 | | 500,000 |

| (a) | Affiliated company. |

| (b) | This security was valued by the Board of Directors. See Note A. |

| (i) | Restricted securities represent 1.8% of the net assets of the Fund. |

| (r) | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| (t) | 28,100 shares of Apple, Inc. have been soft segregated in order to cover outstanding commitments to certain lim- ited partnership investments. There are no restrictions on the trading of this security. |

| * | Non-income producing security. |

Abbreviations:

ADR: American Depositary Receipts

LP: Limited Partnership

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 22

STATEMENT OF OPERATIONS

SIX MONTHS ENDED

MARCH 31, 2011

| | | |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Dividend income (net of foreign taxes withheld of $48,911) | $ | 3,508,064 | |

| Interest income | | 171,701 | |

| Total investment income | | 3,679,765 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 828,132 | |

| Investment subadvisory fee: | | | |

| Base fee | | 1,490,638 | |

| Performance adjustment | | (292,899 | ) |

| Transfer agency fees and expenses | | 575,744 | |

| Distribution Plan expenses: | | | |

| Class A | | 376,584 | |

| Class B | | 81,170 | |

| Class C | | 211,997 | |

| Directors’ fees and expenses | | 26,114 | |

| Administrative fees | | 513,337 | |

| Accounting fees | | 45,921 | |

| Custodian fees | | 37,729 | |

| Registration fees | | 32,503 | |

| Reports to shareholders | | 108,529 | |

| Professional fees | | 29,236 | |

| Miscellaneous | | 44,569 | |

| Total expenses | | 4,109,304 | |

| Reimbursement from Advisor: | | | |

| Class A | | (94,478 | ) |

| Class Y | | (1,526 | ) |

| Fees paid indirectly | | (624 | ) |

| Net expenses | | 4,012,676 | |

| |

| NET INVESTMENT INCOME (LOSS) | | (332,911 | ) |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | 98,615,892 | |

| Foreign currency transactions | | (1,446 | ) |

| | | 98,614,446 | |

| |

| Change in unrealized appreciation (depreciation) on: | | | |

| Investments | | 7,893,936 | |

| Assets and liabilities denominated in foreign currencies | | 138 | |

| | | 7,894,074 | |

| |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | 106,508,520 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 106,175,609 | |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 23

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, | | | September 30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2011 | | | 2010 | |

| Operations: | | | | | | |

| Net investment income (loss) | ($ | 332,911 | ) | ($ | 2,273,654 | ) |

| Net realized gain (loss) | | 98,614,446 | | | 4,170,780 | |

| Net increase from payment by affiliate | | — | | | 615,363 | |

| Change in unrealized appreciation (depreciation) | | 7,894,074 | | | 57,464,722 | |

| |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 106,175,609 | | | 59,977,211 | |

| |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | — | | | (741,648 | ) |

| Class I shares | | — | | | (1,709,150 | ) |

| Class Y shares | | — | | | (253 | ) |

| Total distributions | | — | | | (2,451,051 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 13,954,009 | | | 29,809,753 | |

| Class B shares | | 148,957 | | | 347,204 | |

| Class C shares | | 1,754,944 | | | 2,601,124 | |

| Class I shares | | 16,125,915 | | | 51,162,940 | |

| Class Y shares | | 1,300,801 | | | 3,356,473 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | — | | | 679,767 | |

| Class I shares | | — | | | 1,672,370 | |

| Class Y shares | | — | | | 246 | |

| Redemption fees: | | | | | | |

| Class A shares | | 1,919 | | | 11,106 | |

| Class B shares | | — | | | 438 | |

| Class C shares | | 10 | | | 261 | |

| Class I shares | | 4 | | | 1 | |

| Class Y shares | | 8 | | | — | |

| Shares redeemed: | | | | | | |

| Class A shares | | (63,765,805 | ) | | (162,383,965 | ) |

| Class B shares | | (2,275,295 | ) | | (5,695,822 | ) |

| Class C shares | | (7,346,736 | ) | | (15,178,358 | ) |

| Class I shares | | (47,883,793 | ) | | (127,394,379 | ) |

| Class Y shares | | (1,225,097 | ) | | (413,683 | ) |

| Total capital share transactions | | (89,210,159 | ) | | (221,424,524 | ) |

| |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | 16,965,450 | | | (163,898,364 | ) |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 24

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | |

| | | Six Months ended | | | Year ended | |

| | | March 31, | | | September 30, | |

| NET ASSETS | | 2011 | | | 2010 | |

| Beginning of period | $ | 645,050,937 | | $ | 808,949,301 | |

| End of period (including net investment loss | | | | | | |

| of $332,911 and $0, respectively) | $ | 662,016,387 | | $ | 645,050,937 | |

| |

| |

| |

| CAPITAL SHARE ACTIVITY | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 487,527 | | | 1,183,172 | |

| Class B shares | | 5,816 | | | 15,070 | |

| Class C shares | | 66,620 | | | 111,809 | |

| Class I shares | | 540,919 | | | 1,955,026 | |

| Class Y shares | | 48,303 | | | 131,881 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | — | | | 26,647 | |

| Class I shares | | — | | | 62,519 | |

| Class Y shares | | — | | | 9 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (2,250,901 | ) | | (6,487,656 | ) |

| Class B shares | | (87,912 | ) | | (246,935 | ) |

| Class C shares | | (279,871 | ) | | (653,163 | ) |

| Class I shares | | (1,638,898 | ) | | (4,914,001 | ) |

| Class Y shares | | (42,630 | ) | | (16,768 | ) |

| Total capital share activity | | (3,151,027 | ) | | (8,832,390 | ) |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 25

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: The Calvert Large Cap Growth Fund (the “Fund”), a series of Calvert Impact Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The operation of each series is accounted for separately. The Fund offers five classes of shares. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge at the time of redemption, depending on how long the shares have been owned by the investor. Effective March 1, 2010, Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum investment may be waived for certain institutional accounts, where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Effective October 31, 2008, the Fund began to offer Class Y shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges, and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Directors. In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At March 31, 2011, securities valued at $12,156,503 or 1.8% of net assets were fair valued in good faith under the direction of the Board of Directors.

The Fund utilizes various methods to measure the fair value of its investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 26

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows.

Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Foreign securities are valued based on quotations from the principle market in which such securities are normally traded. If events occur after the close of the principle market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are fair valued by the Fund’s Board of Directors and are categorized as Level 3 in the hierarchy. Venture capital equity securities are generally valued at enterprise value, determined by an industry multiple times revenue, with discounts as appropriate based on assumptions of liquidation or exit risk, or to a recent round of equity financing. Venture capital limited partnership securities are generally valued at the enterprise value of the underlying investments held by the partnership based on reports from the general partner or other available information; the resulting figure is then multiplied by the capital percentage owned in the limited partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 27

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2011:

| | | | | | | | |

| | | valuatIon InPuts |

| InvestMents In securItIes | | level 1 | level 2 | | level 3 | | | total |

| Equity securities* | $ | 646,864,389 | - | | - | | $ | 646,864,389 |

| Venture capital | | - | - | $ | 8,436,728 | | | 8,436,728 |

| Other debt obligations | | - | - | | 3,719,775 | | | 3,719,775 |

| TOTAL | $ | 646,864,389 | - | $ | 12,156,503 | ** | $ | 659,020,892 |

| * | For further breakout of equity securities by industry, please refer to the Statement of Net Assets. |

| ** | Level 3 securities represent 1.8% of net assets. |

Repurchase Agreements: The Fund may enter into repurchase agreements with recognized financial institutions or registered broker/dealers and, in all instances, holds underlying securities with a value exceeding the total repurchase price, including accrued interest. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date, or in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 28

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund (within seven days for Class I shares). The redemption fee is paid to the Class of the Fund from which the redemption is made, and is accounted for as an addition to paid-in capital. It is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund Expense Offset Arrangements: The Fund has an arrangement with its custodian bank whereby the custodian’s fees may be paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits are used to reduce the Fund’s expenses. Such a deposit arrangement may be an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Asset Management Company, Inc. (the “Advisor”) is wholly-owned by Calvert Group, Ltd. (“Calvert”) which is indirectly wholly-owned by UNIFI Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly based on the following annual rates: .25% on the first $1 billion, and .225% on assets in excess of $1 billion. Under the terms of the agreement, $139,514 was payable at period end. In addition, $137,022 was payable at period end for operating expenses paid by the Advisor during March 2011.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 29

Bridgeway Capital Management, Inc., (“BCM”) is the Fund’s Subadvisor. BCM receives a subadvisory fee, paid by the Fund. For its services, BCM receives an annual fee, payable monthly based on the following annual rates: .45% on the first $1 billion, and .425% on assets in excess of $1 billion. BCM may earn (or have its base fee reduced by) a performance fee adjustment of plus or minus .25%, based on the extent to which performance of the Fund’s Class I shares exceeds or trails the Standard & Poor’s 500 Index, the Fund’s benchmark. The performance rate adjustment is 5.00% times the difference between the performance of the Fund and that of the benchmark index, except that there is no performance adjustment if the difference between the Fund performance and the benchmark index performance is less than or equal to 2%. The performance period is the most recent one-year period ending on the last day of the previous month that the New York Stock Exchange was open for trading. For purposes of calculating the base fee, net assets are averaged over the most recent month of the rolling one-year period. For purposes of calculating the performance fee, net assets are averaged over the rolling one-year performance period. Under the terms of the agreement, $178,401 was payable at period end.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2012. The contractual expense cap is 1.50% for Class A, 2.50% for Class B, 2.50% for Class C , .90% for Class I and 1.25% for Class Y. For the purposes of this expense limit, operating expenses do not include interest expense, brokerage commissions, performance fee adjustments, taxes, and extraordinary expenses. This expense limitation does not limit any acquired fund fees and expenses. To the extent any expense offset credits are earned, the Advisor’s obligation under the contractual limitation may be reduced and the Advisor may benefit from the expense offset arrangement.

Calvert Administrative Services Company, an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .20% for Classes A, B, C, and Y, and .10% for Class I based on their average daily net assets. Under the terms of the agreement, $85,981 was payable at period end.

Calvert Distributors, Inc. (“CDI”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted Distribution Plans that permit the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .25%, 1.00% and 1.00% annually of average daily net assets of each Class A, Class B and Class C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly of .25%, 1.00% and 1.00% of the Fund’s average daily net assets of Class A, Class B and Class C, respectively. Class I and Class Y shares do not have Distribution Plan expenses. Under the terms of the agreement, $111,303 was payable at period end.

The Distributor received $20,560 as its portion of commissions charged on sales of the Fund’s Class A shares for the six months ended March 31, 2011.

Calvert Shareholder Services, Inc. (“CSSI”) is the shareholder servicing agent for the Fund. For its services, CSSI received a fee of $99,130 for the six months ended March 31, 2011. Under the terms of the agreement, $16,085 was payable at period end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 30

The Fund may invest in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from the Calvert Group, Ltd. and its subsidiaries. The Fund has received from the Securities and Exchange Commission an exemptive order permitting the Fund to make investments in these notes under certain conditions.

Each Director of the Fund who is not an employee of the Advisor or its affiliates receives an annual retainer of $44,000 plus a meeting fee of $2,000 for each Board meeting attended. Additional fees of up to $5,000 annually may be paid to the Board chair and Committee chairs ($10,000 for the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Director’s fees are allocated to each of the funds served.

NOTE C — INVESTMENT ACTIVITY

During the period, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $270,788,288 and $353,660,560, respectively.

| CAPITAL LOSS CARRYFORWARDS | | | |

| EXPIRATION DATE | | | |

| 30-Sep-17 | ($ | 89,270,429 | ) |

| 30-Sep-18 | | (218,448,578 | ) |

Capital losses may be utilized to offset future capital gains until expiration. Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Funds will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Losses incurred during those future years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may more likely expire unused. Also, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

As of March 31, 2011, the tax basis components of unrealized appreciation/(depreciation) and the federal tax cost were as follows:

| Unrealized appreciation | $ | 121,437,047 | |

| Unrealized (depreciation) | | (22,752,173 | ) |

| Net unrealized appreciation/(depreciation) | $ | 98,684,874 | |

| |

| Federal income tax cost of investments | $ | 560,336,018 | |

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 31

NOTE D — LINE OF CREDIT

A financing agreement is in place with all Calvert Group Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings under the committed facility bear interest at the higher of the London Interbank Offered Rate, (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .125% per annum is incurred on the unused portion of the committed facility, which is allocated to all participating funds. The Fund had no loans outstanding pursuant to this line of credit at March 31, 2011. For the six months ended March 31, 2011, borrowings by the Fund under the Agreement were as follows:

| | | WEIGHTED | | | MONTH OF |

| | AVERAGE | AVERAGE | | MAXIMUM | MAXIMUM |

| | DAILY | INTEREST | | AMOUNT | AMOUNT |

| | BALANCE | RATE | | BORROWED | BORROWED |

| $ | 181,262 | 1.51% | $ | 2,075,874 | November 2010 |

NOTE E — AFFILIATED COMPANIESAn affiliated company is a company in which the Fund has a direct or indirect ownership of, control of, or voting power over 5 percent or more of the outstanding voting shares. Affiliated companies of the Fund are as follows:

| AFFILIATES | | cost | | value |

| Village Laundry Services, Inc. | $ | 500,000 | $ | 174,525 |

NOTE F — OTHERIn connection with certain venture capital investments, the Fund is committed to future capital calls, which will increase the Fund’s investment in these securities. The aggregate amount of the future capital commitments totals $3,367,640 at March 31, 2011.

NOTE G — SUBSEQUENT EVENTS

In preparing the financial statements as of March 31, 2011, no subsequent events or transactions occurred that would have materially impacted the financial statements as presented.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 32

Effective April 30, 2011, the Calvert operating companies will be renamed as follows: Calvert Group, Ltd. will be renamed Calvert Investments, Inc., Calvert Asset Management Company, Inc. will be renamed Calvert Investment Management, Inc., Calvert Distributors, Inc. will be renamed Calvert Investment Distributors, Inc., Calvert Administrative Services Company will be renamed Calvert Investment Administrative Services, Inc., and Calvert Shareholder Services, Inc. will be renamed Calvert Investment Services, Inc.

On May 2, 2011, the Board of Directors approved a resolution to reorganize the Calvert Large Cap Growth Fund into the Calvert Social Investment Fund, Equity Portfolio. Shareholders of Calvert Large Cap Growth Fund will be asked to vote on the reorganization and must approve it before any change may take place.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 33

| | | | | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | | | | Periods ended | | | | |

| | | MARCH

31, | | | SEPTEMBER 30, | | | SEPTEMBER 30, | |

| class a shares | | 2011 | | | 2010 | | | 2009 | |

| Net asset value, beginning | $ | 25.63 | | $ | 23.74 | | $ | 25.72 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.05 | ) | | (.14 | ) | | .07 | |

| Net realized and unrealized gain (loss) | | 4.50 | | | 2.08 | | | (2.05 | ) |

| Total from investment operations | | 4.45 | | | 1.94 | | | (1.98 | ) |

| Distributions from: | | | | | | | | | |

| Net investment income | | — | | | (.05 | ) | | — | |

| Total distributions | | — | | | (.05 | ) | | — | |

| Total increase (decrease) in net asset value | | 4.45 | | | 1.89 | | | (1.98 | ) |

| Net asset value, ending | $ | 30.08 | | $ | 25.63 | | $ | 23.74 | |

| |

| Total return* | | 17.36 | % | | 8.16 | %** | | (7.70 | %) |

| Ratios to average net assets: A | | | | | | | | | |

| Net investment income (loss) | | (.30 | %) (a) | | (.49 | %) | | .28 | % |

| Total expenses | | 1.47 | % (a) | | 1.55 | % | | 1.38 | % |

| Expenses before offsets | | 1.41 | % (a) | | 1.50 | % | | 1.27 | % |

| Net expenses | | 1.41 | % (a) | | 1.50 | % | | 1.27 | % |

| Portfolio turnover | | 41 | % | | 53 | % | | 58 | % |

| Net assets, ending (in thousands) | $ | 295,726 | | $ | 297,120 | | $ | 400,598 | |

| |

| |

| |

| |

| | | | | | Years ended | | | | |

| | | SEPTEMBER 30, | | | SEPTEMBER 30, | | | SEPTEMBER 30, | |

| class a shares | | 2008 | | | 2007 | | | 2006 | |

| Net asset value, beginning | $ | 35.86 | | $ | 30.61 | | $ | 29.32 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.11 | ) | | (.01 | ) | | (.10 | ) |

| Net realized and unrealized gain (loss) | | (9.63 | ) | | 5.26 | | | 1.39 | |

| Total from investment operations | | (9.74 | ) | | 5.25 | | | 1.29 | |

| Distributions from: | | | | | | | | | |

| Net realized gain | | (.40 | ) | | — | | | — | |

| Total distributions | | (.40 | ) | | — | | | — | |

| Total increase (decrease) in net asset value | | (10.14 | ) | | 5.25 | | | 1.29 | |

| Net asset value, ending | $ | 25.72 | | $ | 35.86 | | $ | 30.61 | |

| |

| Total return* | | (27.49 | %) | | 17.15 | % | | 4.40 | % |

| Ratios to average net assets: A | | | | | | | | | |

| Net investment income (loss) | | (.31 | %) | | (.04 | %) | | (.43 | %) |

| Total expenses | | 1.50 | % | | 1.28 | % | | 1.52 | % |

| Expenses before offsets | | 1.50 | % | | 1.28 | % | | 1.52 | % |

| Net expenses | | 1.49 | % | | 1.27 | % | | 1.51 | % |

| Portfolio turnover | | 81 | % | | 49 | % | | 34 | % |

| Net assets, ending (in thousands) | $ | 632,988 | | $ | 1,026,289 | | $ | 842,433 | |

See notes to financial highlights.

www.calvert.com CALVERT LARGE CAP GROWTH FUND SEMI-ANNUAL REPORT (UNAUDITED) 34

| | | | | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | | | | Periods ended | | | | |

| | | MARCH

31, | | | SEPTEMBER 30, | | | SEPTEMBER 30, | |

| class B shares | | 2011 | | | 2010 | | | 2009 | |

| Net asset value, beginning | $ | 23.40 | | $ | 21.85 | | $ | 23.91 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.17 | ) | | (.45 | ) | | (.16 | ) |

| Net realized and unrealized gain (loss) | | 4.11 | | | 2.00 | | | (1.90 | ) |

| Total from investment operations | | 3.94 | | | 1.55 | | | (2.06 | ) |

| Total increase (decrease) in net asset value | | 3.94 | | | 1.55 | | | (2.06 | ) |

| Net asset value, ending | $ | 27.34 | | $ | 23.40 | | $ | 21.85 | |

| |

| Total return* | | 16.84 | % | | 7.09 | %** | | (8.62 | %) |

| Ratios to average net assets: A | | | | | | | | | |

| Net investment income (loss) | | (1.24 | %) (a) | | (1.46 | %) | | (.72 | %) |

| Total expenses | | 2.35 | % (a) | | 2.46 | % | | 2.33 | % |

| Expenses before offsets | | 2.35 | % (a) | | 2.46 | % | | 2.27 | % |

| Net expenses | | 2.35 | % (a) | | 2.46 | % | | 2.27 | % |

| Portfolio turnover | | 41 | % | | 53 | % | | 58 | % |

| Net assets, ending (in thousands) | $ | 16,033 | | $ | 15,644 | | $ | 19,676 | |

| |

| |

| |

| |

| | | | | | Years ended | | | | |

| | | SEPTEMBER 30, | | | SEPTEMBER 30, | | | SEPTEMBER 30, | |

| class B shares | | 2008 | | | 2007 | | | 2006 | |

| Net asset value, beginning | $ | 33.65 | | $ | 28.95 | | $ | 27.97 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.42 | ) | | (.27 | ) | | (.32 | ) |

| Net realized and unrealized gain (loss) | | (8.92 | ) | | 4.97 | | | 1.30 | |

| Total from investment operations | | (9.34 | ) | | 4.70 | | | .98 | |

| Distributions from: | | | | | | | | | |

| Net realized gain | | (.40 | ) | | — | | | — | |

| Total distributions | | (.40 | ) | | — | | | — | |

| Total increase (decrease) in net asset value | | (9.74 | ) | | 4.70 | | | .98 | |