UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2014

Item 1. Report to Stockholders.

[Calvert Small Cap Fund Semi-Annual Report to Shareholders]

[Calvert Global Alternative Energy Fund and Calvert Global Water Fund Semi-Annual Report to Shareholders]

[Calvert Green Bond Fund Semi-Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

After a “risk-on” year in 2013, the first quarter of 2014 proved to be a more challenging environment for equities. Concerns about economic growth in emerging markets, geopolitical turmoil in the Ukraine, and somewhat softer macroeconomic data in the United States injected more risk aversion into the markets. At the same time, profit-taking and tempered expectations for a repeat performance of stellar 2013 returns likely drove down investor risk tolerance in the first quarter.

Despite investors taking a more cautious approach toward equities at the start of 2014, the exceptionally strong performance of the equity markets, particularly U.S. equities, in the fourth quarter of 2013 allowed all major global equity indices to finish the six-month reporting period in positive territory. For the six months ended March 31, 2014, the Standard and Poor’s (S&P) 500, Russell 1000, Russell 2000, MSCI EAFE, and MSCI Emerging Markets Indices returned 12.51%, 12.48%, 9.94%, 6.56%, and 1.49%, respectively.

From an investment-style perspective, small-cap stocks underperformed their large-cap counterparts, while value stocks outperformed growth stocks. The rotation from expensive growth stocks to more bargain-priced value stocks, if it continues, could suggest a more favorable outlook for higher-quality stocks. Looking at sector

A Look at the Environmental, Social, and Governance Analytical Framework

In recent years, U.S. consumers, investors, and companies themselves have become increasingly aware of how environmental, social, and governance (ESG) matters impact the corporate bottom line, the economy, and quality of life. At Calvert, we continue to look for ways to add value to many of our equity portfolios by integrating critical ESG factors into our research process on a company-by-company basis. We work extensively with our in-house sustainability research department to develop quantitative ESG methods and measures, compiled from multiple externally- and internally-generated data sources. We use these inputs in conjunction with fundamental research on company valuations and investment theses.

This integrated approach has yielded multiple opportunities to add value to the investment process, either by identifying long-term investment potential or by uncovering hidden risks. Calvert also continues to advocate for improved corporate policies in the areas of climate change, financial market reform, corporate governance, revenue transparency, and sustainability reporting, among others. Taken together, these efforts are helping to enhance the market’s focus on and understanding of relevant ESG issues.

4 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| CALVERT |

| SMALL CAP FUND |

| MARCH 31, 2014 |

| |

| | % OF TOTAL |

| ECONOMIC SECTORS | INVESTMENTS |

| Consumer Discretionary | 12.2% |

| Consumer Staples | 4.3% |

| Energy | 3.8% |

| Financials | 19.3% |

| Health Care | 9.4% |

| Industrials | 17.8% |

| Information Technology | 21.3% |

| Materials | 5.4% |

| Short-Term Investments | 4.7% |

| Telecommunication Services | 1.8% |

| Total | 100% |

performance, Health Care, Information Technology, and Materials were the top-performing sectors within the Russell 1000 Index, while the Telecommunications, Consumer Discretionary, and Consumer Staples sectors lagged.

U.S. Economic Recovery Moves Forward, Despite Fed Tapering Talk

Positive fourth-quarter results in the equity markets were driven by several factors, centering on continued U.S. economic recovery and growing investor confidence, thus creating an environment conducive to earnings expansion. These factors explain, in part, why U.S. equities shone so strongly compared with foreign developed and emerging markets. Extreme weather likely held back economic growth in much of the U.S. during the period, but markets found support as investors gained comfort in the view that weaker economic data was more a byproduct of inclement weather, rather than reflecting a broader economic slowdown.

| CALVERT |

| SMALL CAP FUND |

| MARCH 31, 2014 |

| |

| INVESTMENT PERFORMANCE | |

| (TOTAL RETURN AT NAV*) | |

| | 6 MONTHS | 12 MONTHS |

| | ENDED | ENDED |

| | 3/31/14 | 3/31/14 |

| Class A | 8.11% | 24.70% |

| Class B | 7.23% | 22.78% |

| Class C | 7.64% | 23.74% |

| Class I | 8.45% | 25.66% |

| Class Y** | 8.37% | 25.00% |

| |

| Russell 2000 | | |

| Index | 9.94% | 24.90% |

| |

| Lipper Small | | |

| Cap Core | | |

| Funds Average | 10.54% | 23.71% |

| |

| TEN LARGEST | | % OF NET |

| STOCK HOLDINGS | | ASSETS |

| DST Systems, Inc. | | 3.6% |

| Becton Dickinson & Co. | 3.6% |

| Unifirst Corp. | | 3.3% |

| Benchmark Electronics, Inc. | 3.1% |

| Kemper Corp. | | 3.1% |

| Casey's General Stores, Inc. | 2.9% |

| Matson, Inc. | | 2.9% |

| TeleTech Holdings, Inc. | 2.8% |

| Brown Shoe Co., Inc. | 2.8% |

| Deluxe Corp. | | 2.6% |

| Total | | 30.7% |

* Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

** Calvert Small Cap Fund first offered Class Y shares on October 18, 2013.

Performance prior to that date reflects the performance of Class A shares at net asset value (NAV). Actual Class Y share performance would have been different.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

The Fed’s decision to begin tapering its quantitative easing (QE) programs in January divided analysts on whether rising interest rates would dampen the economic recovery and create downward pressure on stocks, or whether they would instill confidence that the Fed is being responsible and attract more investors. On the whole, the resiliency and low volatility of interest rates in the wake of Fed tapering was a positive sign, indicating that—at least for a while—tapering need not produce the kind of jump in interest rates many analysts had feared.

Consumers Play a Key Role in Recovery

Although market analysts have focused largely on what is happening at the Federal Reserve, we believe an important driver of economic activity in the United States, and of Fed policy by extension, is the continued improvement in the health of the consumer balance sheet. This gives consumers better access to consumer loans and mortgages, supporting the continued recovery of the housing and automotive industries, among others. At the same time, initial jobless claims maintained their downward trend throughout the period. Continued improvements in the labor market should support consumer spending and the U.S. housing sector—keys to the success of the U.S. economic recovery.

An Anemic Europe and Sluggish China Worry Investors

A global backdrop of lower-than-target inflation persisted throughout the period, despite continued aggressive easing actions by the world’s largest central banks. There are several drivers contributing to low inflation we believe are likely to persist in the near-term. For example, anemic economic activity in Europe continued to highlight the threat of deflation, as inflation in the eurozone dipped below 1% during the period. While European Central Bank (ECB) President Mario Draghi indicated a willingness to intervene if further downside risks to price stability materialize, there appear to be few catalysts capable of driving an increase in demand-side inflation since the euro area’s economic recovery has remained tepid.

| CALVERT |

| SMALL CAP FUND |

| MARCH 31, 2014 |

| |

| AVERAGE ANNUAL TOTAL RETURNS |

| |

| CLASS A SHARES | (WITH MAX. LOAD) |

| One year | 18.79% |

| Five year | 20.08% |

| Since inception (10/1/2004) | 6.16% |

| |

| CLASS B SHARES | (WITH MAX. LOAD) |

| One year | 17.78% |

| Since inception (11/29/2010) | 13.84% |

| |

| CLASS C SHARES | (WITH MAX. LOAD) |

| One year | 22.74% |

| Five year | 20.17% |

| Since inception (4/1/2005) | 5.57% |

| |

| CLASS I SHARES | |

| One year | 25.66% |

| Five year | 22.17% |

| Since inception (4/29/2005) | 8.24% |

| |

| CLASS Y SHARES* | |

| One year | 25.00% |

| Five year | 21.32% |

| Since inception (10/1/2004) | 6.74% |

* Calvert Small Cap Fund first offered Class Y shares on October 18, 2013. Performance prior to that date reflects the performance of Class A shares at net asset value (NAV). Actual Class Y share performance would have been different.

6 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

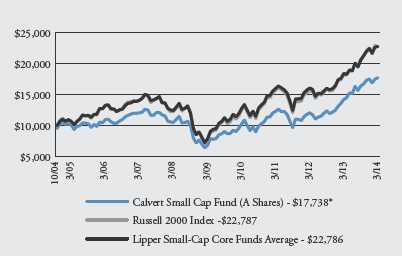

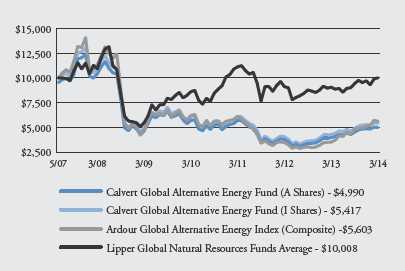

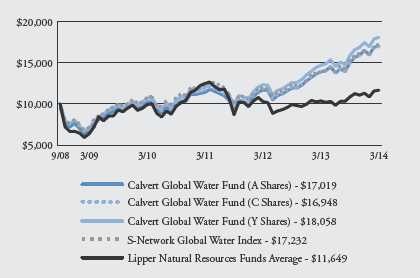

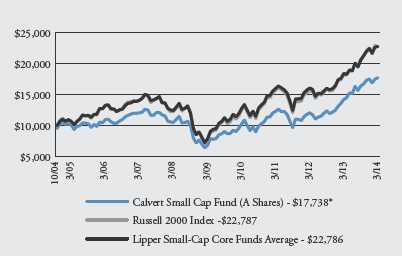

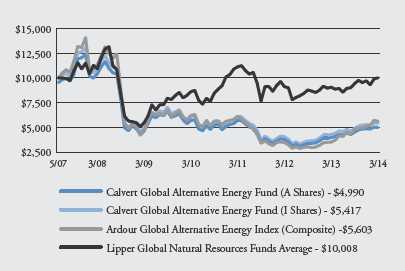

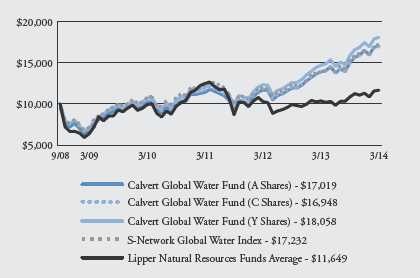

GROWTH OF $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods or since inception (for funds without 10-year records). The results shown are for Class A shares and reflect the deduction of the maximum front-end Class A sales charge of 4.75%, or deferred sales charge, as applicable and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

* The month-end date of 10/31/04 is used for comparison purposes only: actual fund inception is 10/1/04.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.78%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

Worries about a hard landing in China returned to the forefront of investor concerns as the China HSBC Manufacturing PMI (Purchasing Managers’ Index) steadily declined throughout the period into contraction territory. Meanwhile, political upheaval in the Ukraine, which culminated with Russian forces occupying the Crimea region, injected further risk aversion into investor sentiment. The situation continued to negatively impact emerging-market stocks and currencies, which were already under pressure due to the prospect of slower GDP growth in emerging markets. We expect the Ukraine situation to be a continued source of headline market risk in the near-term, until a final diplomatic solution is reached.

Outlook

The contrast in economic conditions between the United States and both Europe and China (and other emerging markets) should continue to draw more investment to the U.S. in the near-term. Fed tapering will most likely add to this effect in equities as well as other asset classes. We expect the dollar to continue strengthening slowly, which may provide another reason for foreign investors to favor U.S. securities over those in their domestic markets. This also supports our outlook for continued low inflation in the near-term.

The recovery may still feel “sluggish” because the current 6.7% unemployment rate—while down from a recession peak of 10%—is still running higher than in previous expansions. From the perspective of equity investors, however, higher unemployment is likely keep downward pressure on wages, which, in turn, could help strengthen profit margins.

We think the Fed will be particularly careful not to derail economic expansion, especially as long as inflation remains low, and will do so by carefully telegraphing its position and plans as they evolve. Moreover, the signal that the Fed is serious about normalizing interest rates should improve investor confidence about the condition of the economy and reassure those who have been worried about the inflationary risk of an eternal quantitative easing. However, sharp changes in interest-rate expectations remain a risk factor, as they can drive mortgage rates higher, negatively impacting housing activity and weakening this major component of the U.S. economic recovery.

We also believe the U.S. economy can still compensate for a dampened global growth outlook. And we expect economic growth to reaccelerate in the second-half of the year on the heels of continued improvement in the housing and labor markets. In addition, as consumer activity picks up in the spring and summer, there is potential for some lost consumer activity to be recovered later in the year. Overall, we believe these conditions continue to provide a favorable underpinning for the equities markets.

Calvert Investment Management, Inc.

May 2014

8 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

As always, Calvert continues to work hard to ensure you have a say in the responsible management of environmental, social, and governance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Shareholder Advocacy

Calvert filed more than 26 shareholder proposals over the reporting period on a variety of issues, including board diversity, reduction of greenhouse gas emissions, disclosure of country-level sourcing and human rights risk assessment processes for apparel companies, and sustainability reporting.

After commitments from Pioneer Natural Resources Company and QEP Resources, Calvert has withdrawn one shareholder proposal and decided not to file a second one for the 2014 proxy season. The two companies agreed to improve disclosure and continue engagement regarding key challenges related to hydraulic fracturing, such as water use and emissions reduction. The resulting disclosures will help Calvert and the companies better understand how they are managing these important opportunities and risks.

Also, an effort led by Calvert Investments and other institutional investors drove the World Federation of Exchanges (WFE) to announce the launch of a Sustainability Working Group in March to develop a consensus on sustainability reporting. Such a standard would promote greater transparency and fairness in the capital markets, improve cost-efficiencies, promote timeliness and consistency for reporting companies, and equip investors to value companies more accurately and make more informed investment decisions.

During the period, Calvert filed proxy resolutions with all the U.S. publicly traded financial exchanges—CBOE, CME, IntercontinentalExchange Group/NYSE and NASDAQ OMX (NDAQ)—on this issue. However, all resolutions were withdrawn after leadership agreed to join the Working Group. We congratulate these WFE member exchanges for their leadership on investor information transparency.

Calvert was a part of the working group that developed the Shareholder Director Exchange Protocol (SDX) released in February. The protocol addresses the increasing levels of direct engagement between institutional investors, such as activist investors, and public company boards, which can significantly change the dynamic between public companies and investors. Engagement is typically between investors and management, but there is a growing interest on the part of investors and directors for more dialogue, especially when fundamental corporate governance or sustainability issues emerge. The protocol helps lay the basis for productive engagement while addressing common concerns each side may have.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

Community Investments

Many of our Funds participate in Calvert’s High Social Impact Investing program, through the CI notes administered through the Calvert Foundation. This community investment program may allocate a small percentage of Fund assets at below-market interest rates to investments that provide economic opportunity for struggling populations.

Through the CI notes’ WIN-WIN portfolio (Women Investing in Women), we recently invested in the Opportunity Fund, the leading microfinance provider in California, which provides microloans for small businesses, microsavings accounts, and community real estate financing. Its innovative repayment system allows clients like Chef Tina Ferguson-Riffe to grow her business with a $20,000 loan for new restaurant equipment and repay the loan based on daily credit/debit card sales, instead of large monthly payments.

In December, the CI notes program invested $1.2 million in One Acre Fund, a nonprofit that provides smallholder farmers in Kenya, Rwanda, and Burundi a bundle of services including seed, training, and access to markets. One Acre Fund expects to reach 251,000 farm families in 2014.

Special Equities

A modest but important portion of certain funds is allocated to small private companies developing products or services that address important sustainability or environmental issues facing our society.

One such recent investment, acquired just after the reporting period, was Africa Renewable Energy Fund, which supports small- to medium-scale independent power producers in sub-Saharan Africa with grid-connected, development-stage renewable energy projects, including small hydro, wind, geothermal, solar, biomass and waste gas technologies. Electricity outages continue to be a major problem in many of these countries. This investment will help to address that supply gap in a sustainable manner.

As of March 31, 2014, Calvert Social Investment Foundation (“Calvert Foundation” or “Foundation”) Community Investment Notes represented the following percentages of Fund net assets: Calvert Balanced Portfolio 0.7%, Calvert Equity Portfolio 0.4%, Calvert Bond Portfolio 0.4%, Calvert International Equity Fund 1.2%, Calvert Capital Accumulation Fund 0.4%, and Calvert Small Cap Fund 0.3%. The Calvert Foundation is a 501(c)(3) nonprofit organization. The Foundation’s Community Investment Note Program is not a mutual fund and should not be confused with any Calvert Investments-sponsored investment product.

As of March 31, 2014, the following companies represented the following percentages of Portfolio net assets: Pioneer Natural Resources Company .22% of Calvert Social Index Fund, 1.14% of Calvert Bond Portfolio and .29% of Calvert Balanced Portfolio; QEP Resources .04% of Calvert Social Index Fund, CBOE 0.04% of Calvert Social Index Fund, CME 0.19% of Calvert Social Index Fund, IntercontinentalExchange Group/NYSE 0.18% of Calvert Social Index Fund and 2.46% of Calvert Equity Portfolio, and NASDAQ OMX (NDAQ) 0.03% of Calvert Social Index Fund. Africa Renewable Energy Fund represented 0% of each of Calvert Equity Portfolio and Calvert International Equity Fund. Holdings are subject to change.

10 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2013 to March 31, 2014).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

| | BEGINNING | ENDING ACCOUNT | EXPENSES PAID |

| | ACCOUNT VALUE | VALUE | DURING PERIOD* |

| | 10/1/13 | 3/31/14 | 10/1/13 - 3/31/14 |

| CLASS A | | | |

| Actual | $1,000.00 | $1,081.11 | $8.15 |

| Hypothetical | $1,000.00 | $1,017.10 | $7.90 |

| (5% return per year before expenses) | | | |

| |

| CLASS B | | | |

| Actual | $1,000.00 | $1,072.29 | $16.48 |

| Hypothetical | $1,000.00 | $1,009.03 | $15.98 |

| (5% return per year before expenses) | | | |

| |

| CLASS C | | | |

| Actual | $1,000.00 | $1,076.43 | $12.24 |

| Hypothetical | $1,000.00 | $1,013.14 | $11.87 |

| (5% return per year before expenses) | | | |

| |

| CLASS I | | | |

| Actual | $1,000.00 | $1,084.50 | $4.78 |

| Hypothetical | $1,000.00 | $1,020.35 | $4.63 |

| (5% return per year before expenses) | | | |

| |

| CLASS Y | | | |

| Actual | $1,000.00 | $1,083.69 | $6.77 |

| Hypothetical | $1,000.00 | $1,018.44 | $6.56 |

| (5% return per year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.57%, 3.19%, 2.36%, 0.92%, and 1.30% for Class A, Class B, Class C, and Class I, and Class Y, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

12 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2014 |

| |

| EQUITY SECURITIES - 95.0% | SHARES | VALUE |

| Aerospace & Defense - 0.9% | | |

| Ducommun, Inc.* | 71,989 | $1,804,044 |

| |

| Airlines - 2.0% | | |

| Skywest, Inc. | 339,398 | 4,330,718 |

| |

| Auto Components - 0.4% | | |

| Gentex Corp. | 26,229 | 827,000 |

| |

| Automobiles - 0.2% | | |

| Toyota Motor Corp. (ADR) | 3,205 | 361,844 |

| |

| Banks - 6.2% | | |

| East West Bancorp, Inc | 86,193 | 3,146,044 |

| PrivateBancorp, Inc | 140,535 | 4,287,723 |

| SVB Financial Group* | 15,560 | 2,003,817 |

| Umpqua Holdings Corp. | 207,258 | 3,863,289 |

| | | 13,300,873 |

| |

| Biotechnology - 1.9% | | |

| PDL BioPharma, Inc | 490,325 | 4,074,601 |

| |

| Capital Markets - 0.5% | | |

| E*Trade Financial Corp.* | 46,603 | 1,072,801 |

| |

| Chemicals - 2.0% | | |

| Minerals Technologies, Inc. | 65,664 | 4,239,268 |

| |

| Commercial Services & Supplies - 5.9% | | |

| Deluxe Corp. | 105,250 | 5,522,467 |

| Unifirst Corp. | 64,604 | 7,102,564 |

| | | 12,625,031 |

| |

| Communications Equipment - 3.3% | | |

| Comtech Telecommunications Corp. | 67,251 | 2,142,617 |

| Harris Corp | 65,776 | 4,812,172 |

| | | 6,954,789 |

| |

| Consumer Finance - 2.1% | | |

| Nelnet, Inc | 107,664 | 4,403,458 |

| |

| Diversified Consumer Services - 1.3% | | |

| Grand Canyon Education, Inc.* | 57,005 | 2,662,134 |

| |

| Diversified Telecommunication Services - 1.1% | | |

| Atlantic Tele-Network, Inc. | 35,326 | 2,328,690 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| Electronic Equipment & Instruments - 8.9% | | |

| Anixter International, Inc | 5,513 | $559,680 |

| Arrow Electronics, Inc.* | 41,532 | 2,465,340 |

| Benchmark Electronics, Inc.* | 293,607 | 6,650,199 |

| PC Connection, Inc. | 14,526 | 295,168 |

| Plexus Corp.* | 97,277 | 3,897,889 |

| Sanmina Corp.* | 296,272 | 5,169,946 |

| | | 19,038,222 |

| |

| Energy Equipment & Services - 2.4% | | |

| Dresser-Rand Group, Inc.* | 23,206 | 1,355,462 |

| Exterran Holdings, Inc | 87,700 | 3,848,276 |

| | | 5,203,738 |

| |

| Food & Staples Retailing - 3.1% | | |

| Casey’s General Stores, Inc | 91,260 | 6,168,264 |

| Spartan Stores, Inc. | 17,144 | 397,912 |

| | | 6,566,176 |

| |

| Health Care Equipment & Supplies - 5.2% | | |

| Becton Dickinson & Co | 65,491 | 7,667,686 |

| Medtronic, Inc | 297 | 18,278 |

| Mindray Medical International Ltd. (ADR) | 108,526 | 3,511,901 |

| | | 11,197,865 |

| |

| Health Care Providers & Services - 2.2% | | |

| Ensign Group, Inc | 33,565 | 1,464,777 |

| Magellan Health Services, Inc.* | 54,393 | 3,228,224 |

| | | 4,693,001 |

| |

| Hotels, Restaurants & Leisure - 2.2% | | |

| Texas Roadhouse, Inc | 179,148 | 4,672,180 |

| |

| Household Durables - 1.1% | | |

| Panasonic Corp. (ADR) | 205,425 | 2,350,062 |

| |

| Insurance - 10.2% | | |

| American Financial Group, Inc | 51,618 | 2,978,875 |

| FBL Financial Group, Inc. | 49,902 | 2,161,754 |

| Fidelity National Financial, Inc | 16,911 | 531,682 |

| Kemper Corp. | 166,677 | 6,528,738 |

| PartnerRe Ltd | 12,026 | 1,244,691 |

| Platinum Underwriters Holdings Ltd | 80,668 | 4,848,147 |

| Symetra Financial Corp | 103,302 | 2,047,446 |

| The Navigators Group, Inc.* | 23,523 | 1,444,077 |

| | | 21,785,410 |

| |

| IT Services - 9.2% | | |

| CSG Systems International, Inc. | 13,082 | 340,655 |

| DST Systems, Inc | 82,216 | 7,793,255 |

| TeleTech Holdings, Inc.* | 245,341 | 6,013,308 |

| Unisys Corp.* | 176,820 | 5,385,937 |

| | | 19,533,155 |

14 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| Machinery - 2.8% | | |

| AGCO Corp | 4,543 | $250,592 |

| Barnes Group, Inc | 140,048 | 5,387,647 |

| LB Foster Co | 6,809 | 319,002 |

| Twin Disc, Inc | 3,376 | 88,924 |

| | | 6,046,165 |

| |

| Marine - 2.9% | | |

| Matson, Inc | 247,638 | 6,114,182 |

| |

| Media - 2.9% | | |

| McClatchy Co.* | 265,980 | 1,707,592 |

| Regal Entertainment Group | 190,043 | 3,550,003 |

| Time Warner Cable, Inc. | 6,878 | 943,524 |

| Time Warner, Inc. | 680 | 44,424 |

| | | 6,245,543 |

| |

| Metals & Mining - 2.6% | | |

| Olympic Steel, Inc. | 44,387 | 1,273,907 |

| Worthington Industries, Inc | 112,138 | 4,289,278 |

| | | 5,563,185 |

| |

| Oil, Gas & Consumable Fuels - 1.4% | | |

| EPL Oil & Gas, Inc.* | 53,334 | 2,058,692 |

| Knightsbridge Tankers Ltd | 71,681 | 971,278 |

| | | 3,029,970 |

| |

| Paper & Forest Products - 0.8% | | |

| PH Glatfelter Co | 63,528 | 1,729,232 |

| |

| Personal Products - 1.2% | | |

| USANA Health Sciences, Inc.* | 35,102 | 2,644,585 |

| |

| Pharmaceuticals - 0.0% | | |

| Roche Holding AG (ADR) | 706 | 26,630 |

| |

| Professional Services - 3.3% | | |

| ICF International, Inc.* | 71,601 | 2,850,436 |

| Insperity, Inc | 60,834 | 1,884,637 |

| Navigant Consulting, Inc.* | 127,180 | 2,373,179 |

| | | 7,108,252 |

| |

| Specialty Retail - 4.1% | | |

| ANN, Inc.* | 68,441 | 2,838,933 |

| Brown Shoe Co., Inc | 226,467 | 6,010,434 |

| | | 8,849,367 |

| |

| Wireless Telecommunication Services - 0.7% | | |

| Shenandoah Telecommunications Co. | 45,309 | 1,463,028 |

| |

| |

| Total Equity Securities (Cost $166,325,748) | | 202,845,199 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

| | | |

| | | PRINCIPAL | |

| HIGH SOCIAL IMPACT INVESTMENTS - 0.3% | | AMOUNT | VALUE |

| Calvert Social Investment Foundation Notes, 0.50%, 7/1/14 (b)(i)(r) | $651,905 | $647,481 |

| |

| Total High Social Impact Investments (Cost $651,905) | | | 647,481 |

| |

| TIME DEPOSIT - 4.6% | | | |

| State Street Bank Time Deposit, 0.083%, 4/1/14 | | 9,958,354 | 9,958,354 |

| |

| Total Time Deposit (Cost $9,958,354) | | | 9,958,354 |

| |

| |

| TOTAL INVESTMENTS (Cost $176,936,007) - 99.9% | | 213,451,034 |

| Other assets and liabilities, net - 0.1% | | | 130,914 |

| NET ASSETS - 100% | | | $213,581,948 |

| |

| NET ASSETS CONSIST OF: | | | |

| Paid-in capital applicable to the following shares of common stock, | | |

| with 250,000,000 of $0.01 par value shares authorized: | | | |

| Class A: 6,052,661 shares outstanding | | | $112,784,761 |

| Class B: 50,776 shares outstanding | | | 317,883 |

| Class C: 678,745 shares outstanding | | | 12,119,793 |

| Class I: 2,150,273 shares outstanding | | | 46,466,569 |

| Class Y: 17,985 shares outstanding | | | 434,211 |

| Undistributed net investment income (loss) | | | (577,444) |

| Accumulated net realized gain (loss) | | | 5,521,148 |

| Net unrealized appreciation (depreciation) | | | 36,515,027 |

| |

| NET ASSETS | | | $213,581,948 |

| |

| |

| NET ASSET VALUE PER SHARE | | | |

| Class A (based on net assets of $143,648,878) | | | $23.73 |

| Class B (based on net assets of $1,158,932) | | | $22.82 |

| Class C (based on net assets of $14,867,200) | | | $21.90 |

| Class I (based on net assets of $53,479,113) | | | $24.87 |

| Class Y (based on net assets of $427,825) | | | $23.79 |

| |

| |

| RESTRICTED SECURITIES | ACQUISITION DATE | COST |

| Calvert Social Investment Foundation Notes, 0.50%, 7/1/14 | | 7/1/10 | $651,905 |

(b) This security was valued under the direction of the Board of Directors. See Note A.

(i) Restricted securities represent 0.3% of net assets.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

* Non-income producing security.

Abbreviations:

ADR: American Depositary Receipts

See notes to financial statements.

16 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| |

| STATEMENT OF OPERATIONS |

| SIX MONTHS ENDED MARCH 31, 2014 |

| |

| NET INVESTMENT INCOME | |

| Investment Income: | |

| Interest income | $6,766 |

| Dividend income (net of foreign taxes withheld of $116) | 1,314,782 |

| Total investment income | 1,321,548 |

| |

| Expenses: | |

| Investment advisory fee | 710,980 |

| Transfer agency fees and expenses | 207,922 |

| Administrative fees | 216,051 |

| Distribution Plan expenses: | |

| Class A | 171,263 |

| Class B | 6,115 |

| Class C | 71,374 |

| Directors’ fees and expenses | 7,936 |

| Custodian fees | 16,247 |

| Registration fees | 24,790 |

| Reports to shareholders | 33,692 |

| Professional fees | 14,771 |

| Accounting fees | 12,314 |

| Miscellaneous | 9,930 |

| Total expenses | 1,503,385 |

| Reimbursement from Advisor: | |

| Class B | (3,157) |

| Class I | (2,873) |

| Net expenses | 1,497,355 |

| |

| |

| NET INVESTMENT INCOME (LOSS) | (175,807) |

| |

| |

| REALIZED AND UNREALIZED | |

| GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain (loss) | 22,577,183 |

| Change in unrealized appreciation (depreciation) | (6,504,104) |

| |

| NET REALIZED AND UNREALIZED | |

| GAIN (LOSS) ON INVESTMENTS | 16,073,079 |

| |

| INCREASE (DECREASE) IN NET ASSETS | |

| RESULTING FROM OPERATIONS | $15,897,272 |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

| | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | SIX MONTHS ENDED | YEAR ENDED |

| | MARCH 31, | SEPTEMBER 30, |

| INCREASE (DECREASE) IN NET ASSETS | 2014 | 2013 |

| Operations: | | |

| Net investment income (loss) | ($175,807) | $59,127 |

| Net realized gain (loss) | 22,577,183 | 21,131,949 |

| Change in unrealized appreciation (depreciation) | (6,504,104) | 21,290,978 |

| |

| INCREASE (DECREASE) IN NET ASSETS | | |

| RESULTING FROM OPERATIONS | 15,897,272 | 42,482,054 |

| |

| Distributions to shareholders from: | | |

| Net investment income: | | |

| Class A shares | — | (1,239,153) |

| Class C shares | — | (21,918) |

| Class I shares | — | (484,645) |

| Net realized gain: | | |

| Class A shares | (14,647,076) | (2,586,265) |

| Class B shares | (138,533) | (38,354) |

| Class C shares | (1,638,395) | (288,508) |

| Class I shares | (5,147,885) | (707,515) |

| Class Y shares | (15,807) | — |

| Total distributions | (21,587,696) | (5,366,358) |

| |

| Capital share transactions: | | |

| Shares sold: | | |

| Class A shares | 18,166,349 | 24,588,981 |

| Class B shares | 47,074 | 13,124 |

| Class C shares | 1,347,429 | 2,375,780 |

| Class I shares | 6,271,803 | 18,224,871 |

| Class Y shares | 489,419 | — |

| Reinvestment of distributions: | | |

| Class A shares | 13,901,092 | 3,585,262 |

| Class B shares | 135,230 | 36,506 |

| Class C shares | 1,424,032 | 261,891 |

| Class I shares | 4,854,479 | 1,105,442 |

| Class Y shares | 15,806 | — |

| Redemption fees: | | |

| Class A shares | 691 | 376 |

| Shares redeemed: | | |

| Class A shares | (13,852,059) | (20,298,567) |

| Class B shares | (235,213) | (542,521) |

| Class C shares | (1,055,063) | (1,506,475) |

| Class I shares | (2,761,496) | (7,040,078) |

| Class Y shares | (71,014) | — |

| Total capital share transactions | 28,678,559 | 20,804,592 |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | 22,988,135 | 57,920,288 |

See notes to financial statements.

18 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| INCREASE (DECREASE) IN NET ASSETS - CONT’D | | |

| | SIX MONTHS ENDED | YEAR ENDED |

| | MARCH

31, | SEPTEMBER

30, |

| NET ASSETS | 2014 | 2013 |

| Beginning of period | $190,593,813 | $132,673,525 |

| End of period (including undistributed net investment loss | | |

| and distributions in excess of net investment income | | |

| of $577,444 and $401,637, respectively) | $213,581,948 | $190,593,813 |

| |

| CAPITAL SHARE ACTIVITY | | |

| Shares sold: | | |

| Class A shares | 763,470 | 1,106,630 |

| Class B shares | 2,108 | 604 |

| Class C shares | 61,169 | 110,481 |

| Class I shares | 250,790 | 770,556 |

| Class Y shares | 20,138 | — |

| Reinvestment of distributions: | | |

| Class A shares | 611,593 | 193,984 |

| Class B shares | 6,155 | 2,027 |

| Class C shares | 67,714 | 15,188 |

| Class I shares | 204,227 | 57,733 |

| Class Y shares | 694 | — |

| Shares redeemed: | | |

| Class A shares | (586,180) | (952,854) |

| Class B shares | (10,287) | (26,539) |

| Class C shares | (47,521) | (76,223) |

| Class I shares | (112,175) | (323,345) |

| Class Y shares | (2,847) | — |

| Total capital share activity | 1,229,048 | 878,242 |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 19

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert Small Cap Fund (the “Fund”), a series of Calvert Impact Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert Impact Fund, Inc. is comprised of four separate series. The operations of each series are accounted for separately. The Fund offers five classes of shares - Classes A, B, C, I, and Y. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived for certain other institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries, foundations, and endowments that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each Class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges, and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

20 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. There were no such transfers during the period. Valuation techniques used to value the Fund’s investments by major category are as follows: Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 21

materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At March 31, 2014, securities valued at $647,481, or 0.3% of net assets, were fair valued in good faith under the direction of the Board.

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2014:

| | | VALUATION INPUTS | |

| INVESTMENTS IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Equity securities* | $202,845,199 | — | — | $202,845,199 |

| Other debt obligations | — | $10,605,835 | — | 10,605,835 |

| TOTAL | $202,845,199 | $10,605,835 | — | $213,451,034 |

* For further breakdown of equity securities by industry, please refer to the Statement of Net Assets.

Restricted Securities: The Fund may invest in securities that are subject to legal or con tractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

22 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date, or in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase (within seven days for Class I shares). The redemption fee is accounted for as an addition to paid-in capital and is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affili-

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 23

ates. For its services, the Advisor receives an annual fee, payable monthly, of .70% of the average daily net assets. Under the terms of the agreement, $125,931 was payable at period end. In addition, $10,014 was payable at period end for operating expenses paid by the Advisor during March 2014.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2015. The contractual expense cap is 1.69%, 3.19%, 2.69%, .92%, and 1.42%. for Class A, B, C, I, and Y, respectively. For the purpose of these expense limits, operating expenses do not include interest expense, brokerage commissions, taxes, or extraordinary expenses. This expense limitation does not limit acquired fund fees and expenses, if any. At period end, $464 was recievable from the Advisor Calvert Investment Administrative Services, Inc., an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .25% for Classes A, B, C, and Y shares and .10% for Class I shares based on the average daily net assets. Under the terms of the agreement, $38,206 was payable at period end.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted a Distribution Plan that permits the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .35%, 1.00%, and 1.00% annually of average daily net assets of Class A, B, and C shares, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly, of .25%, 1.00%, and 1.00% of average daily net assets of Class A, B, and C, respectively. Class I and Y shares do not have Distribution Plan expenses. Under the terms of the agreement, $43,840 was payable at period end.

CID received $22,524 as its portion of the commissions charged on sales of Class A shares for the six months ended March 31, 2014.

Calvert Investment Services, Inc. (“CIS”), an affiliate of the Advisor, acts as shareholder servicing agent for the Fund. For its services, CIS received a fee of $34,021 for the six months ended March 31, 2014. Under the terms of the agreement, $5,691 was payable at period end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

The Fund invests in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) nonprofit organization that receives in-kind support from Calvert and its subsidiaries. The Fund has received an exemptive order from the Securities and Exchange Commission permitting the Fund to make investments in these notes under certain conditions.

Each Director of the Fund who is not an employee of the Advisor or its affiliates receives an annual retainer of $48,000 plus a meeting fee of up to $3,000 for each Board meeting attended. Additional fees of $5,000 annually may be paid to the Board chair and Committee chairs ($10,000 for the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Directors’ fees are allocated to each of the funds served.

24 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the period, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $102,650,590 and $80,893,858, respectively.

The Fund intends to elect to defer ordinary losses of $401,637 incurred from January 1, 2013 through September 30, 2013 and treat them as arising in the fiscal year ending September 30, 2014.

As of March 31, 2014, the tax basis components of unrealized appreciation/(depreciation) and the federal tax cost were as follows:

| Unrealized appreciation | $39,049,391 |

| Unrealized (depreciation) | (2,568,522) |

| Net unrealized appreciation/(depreciation) | $36,480,869 |

| |

| Federal income tax cost of investments | $176,970,165 |

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings under the committed facility bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .11% per annum is incurred on the unused portion of the committed facility, which is allocated to all participating funds. The Fund had no borrowings under the agreement during the six months ended March 31, 2014.

NOTE E — SUBSEQUENT EVENTS

In preparing the financial statements as of March 31, 2014, no subsequent events or transactions occurred that would have required recognition or disclosure in these financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 25

| | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | PERIODS ENDED | |

| | MARCH 31, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS A SHARES | 2014 (z) | 2013 (z) | 2012 (z) |

| Net asset value, beginning | $24.58 | $19.36 | $15.15 |

| Income from investment operations: | | | |

| Net investment income (loss) | (.03) | (.01) | .20 |

| Net realized and unrealized gain (loss) | 1.90 | 6.02 | 4.05 |

| Total from investment operations | 1.87 | 6.01 | 4.25 |

| Distributions from: | | | |

| Net investment income | — | (.25) | (.04) |

| Net realized gain | (2.72) | (.54) | — |

| Total distributions | (2.72) | (.79) | (.04) |

| Total increase (decrease) in net asset value | (.85) | 5.22 | 4.21 |

| Net asset value, ending | $23.73 | $24.58 | $19.36 |

| |

| Total return* | 8.11% | 32.42% | 28.12% |

| Ratios to average net assets:A | | | |

| Net investment income (loss) | (.27%) (a) | (.05%) | 1.13% |

| Total expenses | 1.57% (a) | 1.67% | 1.78% |

| Expenses before offsets | 1.57% (a) | 1.67% | 1.69% |

| Net expenses | 1.57% (a) | 1.67% | 1.69% |

| Portfolio turnover | 43% | 82% | 3% |

| Net assets, ending (in thousands) | $143,649 | $129,407 | $95,189 |

| |

| |

| | | YEARS ENDED | |

| | SEPTEMBER 30, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS A SHARES | 2011 (z) | 2010 | 2009 |

| Net asset value, beginning | $15.55 | $14.14 | $15.61 |

| Income from investment operations: | | | |

| Net investment income (loss) | .02 | (.06) | (.02) |

| Net realized and unrealized gain (loss) | (.42) | 1.47 | (1.45) |

| Total from investment operations | (.40) | 1.41 | (1.47) |

| Distributions from: | | | |

| Net investment income | — | — | — |

| Net realized gain | — | — | — |

| Total distributions | — | — | — |

| Total increase (decrease) in net asset value | (.40) | 1.41 | (1.47) |

| Net asset value, ending | $15.15 | $15.55 | $14.14 |

| |

| Total return* | (2.56%) | 9.97% | (9.42%) |

| Ratios to average net assets:A | | | |

| Net investment income (loss) | .13% | (.35%) | (.18%) |

| Total expenses | 1.81% | 1.94% | 2.09% |

| Expenses before offsets | 1.69% | 1.69% | 1.70% |

| Net expenses | 1.69% | 1.69% | 1.69% |

| Portfolio turnover | 9% | 174% | 61% |

| Net assets, ending (in thousands) | $81,374 | $34,763 | $34,051 |

See notes to financial highlights.

26 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | PERIODS ENDED | |

| | MARCH 31, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS B SHARES | 2014 (z) | 2013 (z) | 2012 (z) |

| Net asset value, beginning | $23.92 | $18.89 | $14.97 |

| Income from investment operations: | | | |

| Net investment income (loss) | (.22) | (.32) | (.05) |

| Net realized and unrealized gain (loss) | 1.84 | 5.89 | 3.97 |

| Total from investment operations | 1.62 | 5.57 | 3.92 |

| Distributions from: | | | |

| Net investment income | — | — | — |

| Net realized gain | (2.72) | (.54) | — |

| Total distributions | (2.72) | (.54) | — |

| Total increase (decrease) in net asset value | (1.10) | 5.03 | 3.92 |

| Net asset value, ending | $22.82 | $23.92 | $18.89 |

| |

| Total return* | 7.23% | 30.40% | 26.19% |

| Ratios to average net assets:A | | | |

| Net investment income (loss) | (1.90%) (a) | (1.53%) | (.31%) |

| Total expenses | 3.71% (a) | 3.64% | 3.50% |

| Expenses before offsets | 3.19% (a) | 3.19% | 3.19% |

| Net expenses | 3.19% (a) | 3.19% | 3.19% |

| Portfolio turnover | 43% | 82% | 3% |

| Net assets, ending (in thousands) | $1,159 | $1,263 | $1,449 |

| |

| |

| | | | PERIOD ENDED |

| | | | SEPTEMBER 30, |

| CLASS B SHARES | | | 2011 (z)# |

| Net asset value, beginning | | | $16.81 |

| Income from investment operations: | | | |

| Net investment income (loss) | | | (.21) |

| Net realized and unrealized gain (loss) | | | (1.63) |

| Total from investment operations | | | (1.84) |

| Distributions from: | | | |

| Net investment income | | | — |

| Net realized gain | | | — |

| Total distributions | | | — |

| Total increase (decrease) in net asset value | | | (1.84) |

| Net asset value, ending | | | $14.97 |

| |

| Total return* | | | (10.95%) |

| Ratios to average net assets: A | | | |

| Net investment income (loss) | | | (1.38%) (a) |

| Total expenses | | | 3.46% (a) |

| Expenses before offsets | | | 3.19% (a) |

| Net expenses | | | 3.19% (a) |

| Portfolio turnover | | | 9%** |

| Net assets, ending (in thousands) | | | $2,183 |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 27

| | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | PERIODS ENDED | |

| | MARCH 31, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS C SHARES | 2014 (z) | 2013 (z) | 2012 (z) |

| Net asset value, beginning | $22.98 | $18.08 | $14.25 |

| Income from investment operations: | | | |

| Net investment income (loss) | (.12) | (.17) | .03 |

| Net realized and unrealized gain (loss) | 1.76 | 5.65 | 3.80 |

| Total from investment operations | 1.64 | 5.48 | 3.83 |

| Distributions from: | | | |

| Net investment income | — | (.04) | — |

| Net realized gain | (2.72) | (.54) | — |

| Total distributions | (2.72) | (.58) | — |

| Total increase (decrease) in net asset value | (1.08) | 4.90 | 3.83 |

| Net asset value, ending | $21.90 | $22.98 | $18.08 |

| |

| Total return* | 7.64% | 31.35% | 26.88% |

| Ratios to average net assets: A | | | |

| Net investment income (loss) | (1.07%) (a) | (.86%) | .19% |

| Total expenses | 2.36% (a) | 2.49% | 2.64% |

| Expenses before offsets | 2.36% (a) | 2.49% | 2.64% |

| Net expenses | 2.36% (a) | 2.49% | 2.64% |

| Portfolio turnover | 43% | 82% | 3% |

| Net assets, ending (in thousands) | $14,867 | $13,726 | $9,907 |

| |

| |

| | | YEARS ENDED | |

| | SEPTEMBER 30, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS C SHARES | 2011 (z) | 2010 | 2009 |

| Net asset value, beginning | $14.77 | $13.55 | $15.08 |

| Income from investment operations: | | | |

| Net investment income (loss) | (.15) | (.15) | (.12) |

| Net realized and unrealized gain (loss) | (.37) | 1.37 | (1.41) |

| Total from investment operations | (.52) | 1.22 | (1.53) |

| Distributions from: | | | |

| Net investment income | — | — | — |

| Net realized gain | — | — | — |

| Total distributions | — | — | — |

| Total increase (decrease) in net asset value | (.52) | 1.22 | (1.53) |

| Net asset value, ending | $14.25 | $14.77 | $13.55 |

| |

| Total return* | (3.52%) | 9.00% | (10.15%) |

| Ratios to average net assets: A | | | |

| Net investment income (loss) | (.87%) | (1.28%) | (1.17%) |

| Total expenses | 2.74% | 3.17% | 3.64% |

| Expenses before offsets | 2.69% | 2.69% | 2.70% |

| Net expenses | 2.69% | 2.69% | 2.69% |

| Portfolio turnover | 9% | 174% | 61% |

| Net assets, ending (in thousands) | $8,618 | $2,583 | $1,889 |

See notes to financial highlights.

28 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

| | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | PERIODS ENDED | |

| | MARCH 31, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS I SHARES | 2014 (z) | 2013 (z) | 2012 (z) |

| Net asset value, beginning | $25.56 | $20.06 | $15.80 |

| Income from investment operations: | | | |

| Net investment income | .05 | .16 | .35 |

| Net realized and unrealized gain (loss) | 1.98 | 6.24 | 4.21 |

| Total from investment operations | 2.03 | 6.40 | 4.56 |

| Distributions from: | | | |

| Net investment income | — | (.36) | (.30) |

| Net realized gain | (2.72) | (.54) | — |

| Total distributions | (2.72) | (.90) | (.30) |

| Total increase (decrease) in net asset value | (.69) | 5.50 | 4.26 |

| Net asset value, ending | $24.87 | $25.56 | $20.06 |

| |

| Total return* | 8.45% | 33.43% | 29.11% |

| Ratios to average net assets:A | | | |

| Net investment income | .38% (a) | .71% | 1.88% |

| Total expenses | .93% (a) | .98% | 1.03% |

| Expenses before offsets | .92% (a) | .92% | .92% |

| Net expenses | .92% (a) | .92% | .92% |

| Portfolio turnover | 43% | 82% | 3% |

| Net assets, ending (in thousands) | $53,479 | $46,198 | $26,129 |

| |

| |

| | | YEARS ENDED | |

| | SEPTEMBER 30, | SEPTEMBER 30, | SEPTEMBER 30, |

| CLASS I SHARES | 2011 (z) | 2010 | 2009 |

| Net asset value, beginning | $16.14 | $14.56 | $15.94 |

| Income from investment operations: | | | |

| Net investment income | .17 | .08 | .08 |

| Net realized and unrealized gain (loss) | (.45) | 1.50 | (1.46) |

| Total from investment operations | (.28) | 1.58 | (1.38) |

| Distributions from: | | | |

| Net investment income | (.06) | — | — |

| Net realized gain | — | — | — |

| Total distributions | (.06) | — | — |

| Total increase (decrease) in net asset value | (.34) | 1.58 | (1.38) |

| Net asset value, ending | $15.80 | $16.14 | $14.56 |

| |

| Total return* | (1.81%) | 10.85% | (8.66%) |

| Ratios to average net assets:A | | | |

| Net investment income | .90% | .44% | .60% |

| Total expenses | 1.08% | 1.16% | 1.16% |

| Expenses before offsets | .92% | .92% | .93% |

| Net expenses | .92% | .92% | .92% |

| Portfolio turnover | 9% | 174% | 61% |

| Net assets, ending (in thousands) | $17,895 | $12,001 | $12,428 |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 29

| |

| FINANCIAL HIGHLIGHTS |

| |

| | PERIOD ENDED |

| | MARCH 31, |

| CLASS Y SHARES | 2014 (z)## |

| Net asset value, beginning | $25.36 |

| Income from investment operations: | |

| Net investment income | 0.02 |

| Net realized and unrealized gain (loss) | 1.13 |

| Total from investment operations | 1.15 |

| Distributions from: | |

| Net investment income | — |

| Net realized gain | (2.72) |

| Total distributions | (2.72) |

| Total increase (decrease) in net asset value | (1.57) |

| Net asset value, ending | $23.79 |

| |

| Total return* | 5.04% |

| Ratios to average net assets:A | |

| Net investment income | .23% (a) |

| Total expenses | 1.30% (a) |

| Expenses before offsets | 1.30% (a) |

| Net expenses | 1.30% (a) |

| Portfolio turnover | 43% |

| Net assets, ending (in thousands) | $428 |

A Total expenses do not reflect amounts reimbursed and/or waived by the Advisor or reductions from expense offset arrangements. Expenses before offsets reflect expenses after reimbursement and/or waiver by the Advisor but prior to reductions from expense offset arrangements. Net expenses are net of all reductions and represent the net expenses paid by the Fund.

* Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge.

** Portfolio turnover is not annualized for periods of less than one year.

# From November 29, 2010 inception.

## From October 18, 2013 inception. (a) Annualized.

(z) Per share figures are calculated using the Average Shares Method.

See notes to financial statements.

30 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

EXPLANATION OF FINANCIAL TABLES

SCHEDULE OF INVESTMENTS

The Schedule of Investments is a snapshot of all securities held in the fund at their market value, on the last day of the reporting period. Securities are listed by asset type (e.g., common stock, corporate bonds, U.S. government obligations) and may be further broken down into sub-groups and by industry classification.

STATEMENT OF ASSETS AND LIABILITIES

The Statement of Assets and Liabilities is often referred to as the fund’s balance sheet. It lists the value of what the fund owns, is due and owes on the last day of the reporting period. The fund’s assets include the market value of securities owned, cash, receivables for securities sold and shareholder subscriptions, and receivables for dividends and interest payments that have been earned, but not yet received. The fund’s liabilities include payables for securities purchased and shareholder redemptions, and expenses owed but not yet paid. The statement also reports the fund’s net asset value (NAV) per share on the last day of the reporting period. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. This statement is accompanied by a Schedule of Investments. Alternatively, if certain conditions are met, a Statement of Net Assets may be presented in lieu of this statement and the Schedule of Investments.

STATEMENT OF NET ASSETS

The Statement of Net Assets provides a detailed list of the fund’s holdings, including each security’s market value on the last day of the reporting period. The Statement of Net Assets includes a Schedule of Investments. Other assets are added and other liabilities subtracted from the investments total to calculate the fund’s net assets. Finally, net assets are divided by the outstanding shares of the fund to arrive at its share price, or Net Asset Value (NAV) per share.

At the end of the Statement of Net Assets is a table displaying the composition of the fund’s net assets. Paid in Capital is the money invested by shareholders and represents the bulk of net assets. Undistributed Net Investment Income and Accumulated Net Realized Gains usually approximate the amounts the fund had available to distribute to shareholders as of the statement date. Accumulated Realized Losses will appear as negative balances. Unrealized Appreciation (Depreciation) is the difference between the market value of the fund’s investments and their cost, and reflects the gains (losses) that would be realized if the fund were to sell all of its investments at their statement-date values.

STATEMENT OF OPERATIONS

The Statement of Operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. Investment income includes dividends earned from stocks and interest earned from interest-bearing securities in the fund. Expenses incurred in operating the fund include the advisory fee paid to the investment advisor, administrative services fees, distribution plan expenses (if applicable), transfer agent fees, shareholder servicing expenses, custodial, legal, and audit fees, and the printing and postage expenses related to shareholder reports. Expense offsets (fees paid indirectly) may also be shown. Credits earned from offset arrangements are used to reduce the fund’s expenses. This statement

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 31

also shows net gains (losses) realized on the sale of investments and the increase or decrease in the unrealized appreciation (depreciation) on investments held during the period.

STATEMENT OF CHANGES IN NET ASSETS

The Statement of Changes in Net Assets shows how the fund’s total net assets changed during the two most recent reporting periods. Changes in the fund’s net assets are attributable to investment operations, distributions and capital share transactions.

The Operations section of the report summarizes information detailed in the Statement of Operations. The Distribution section shows the dividend and capital gain distributions made to shareholders. The amounts shown as distributions in this section may not match the net investment income and realized gains amounts shown in the Operations section because distributions are determined on a tax basis and certain investments or transactions may be treated differently for financial statement and tax purposes. The Capital Share Transactions section shows the amount shareholders invested in the fund, either by purchasing shares or by reinvesting distributions, and the amounts redeemed. The corresponding numbers of shares issued, reinvested and redeemed are shown at the end of the report.

FINANCIAL HIGHLIGHTS

The Financial Highlights table provides a per-share breakdown per class of the components that affect the fund’s net asset value for current and past reporting periods. The table provides total return, total distributions, expense ratios, portfolio turnover and net assets for the applicable period. Total return is a measure of a fund’s performance that encompasses all elements of return: dividends, capital gain distributions and changes in net asset value. Total return is the change in value of an investment over a given period, assuming reinvestment of any dividends and capital gain distributions, expressed as a percentage of the initial investment. Total distributions include distributions from net investment income and net realized gains. Long-term gains are earned on securities held in the fund more than one year. Short-term gains, on the sale of securities held less than one year, are treated as ordinary dividend income for tax purposes. The expense ratio is a fund’s cost of doing business, expressed as a percentage of net assets. These expenses directly reduce returns to shareholders. Portfolio turnover measures the trading activity in a fund’s investment portfolio – how often securities are bought and sold by a fund. Portfolio turnover is affected by market conditions, changes in the size of the fund, the nature of the fund’s investments and the investment style of the portfolio manager.

PROXY VOTING

The Proxy Voting Guidelines of the Calvert Funds that the Fund uses to determine how to vote proxies relating to portfolio securities are provided as an Appendix to the Fund’s Statement of Additional Information. The Statement of Additional Information can be obtained free of charge by calling the Fund at 1-800-368-2745, by visiting the Calvert website at www.calvert.com; or by visiting the SEC’s website at www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at www.calvert.com and on the SEC’s website at www.sec.gov.

32 www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

AVAILABILITY OF QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

BASIS FOR BOARD’S APPROVAL OF INVESTMENT ADVISORY CONTRACT

At a meeting held on December 10, 2013, the Board of Directors, and by a separate vote, the disinterested Directors, approved the continuance of the Investment Advisory Agreement between Calvert Impact Fund, Inc. and the Advisor with respect to the Fund.