UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

John H. Streur

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2016

Item 1. Report to Stockholders.

|

| |

Semi-Annual Report March 31, 2016 E-Delivery Sign-Up — Details Inside | |

|

|

| |

Choose Planet-friendly E-delivery! Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs. Just go to calvert.com. If you already have an online account at Calvert, click on Login, to access your Account, and select the documents you would like to receive via e-mail. If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm. |

|

| | | |

| | | TABLE OF CONTENTS |

| | | | |

| | | | President's Letter |

| | | | Portfolio Management Discussion |

| | | | Understanding Your Fund's Expenses |

| | | | Schedule of Investments |

| | | | Statement of Assets and Liabilities |

| | | | Statement of Operations |

| | | | Statements of Changes in Net Assets |

| | | | Notes to Financial Statements |

| | | | Financial Highlights |

| | | | Proxy Voting |

| | | | Availability of Quarterly Portfolio Holdings |

| | | | Basis for Board's Approval of Investment Advisory Contract |

|

| | |

| John Streur President and Chief Executive Officer, Calvert Investments, Inc. | |

Dear Shareholders,

Historically, environmental and social initiatives have been accomplished through the singular passage of legislation designed to remediate the impact of one significant influence on a singular populace. Commencing with the anti-deforestation efforts in 1842, followed by environmental legislation in industrialized nations to regulate smoke pollution in 1863, arguably, a predecessor to the ubiquitous stop smoking campaigns of today; the previous approach, put forth largely by developed nations, served to the benefit of their citizens and not the rest of the Earth's populace - the majority.

However, the year of 2015 marked a dynamic and exciting shift in the resolution of contemporary environmental and social causes - global leaders from all facets of society, collectively, took action to create global policy platforms with far reaching agendas designed to accelerate our global society's evolution towards a more sustainable and inclusive state. The Pope's Encyclical, issued June 18, 2015, called for the establishment of a new partnership between science and religion to combat human-driven climate change. The United Nations formalized the United Nations Sustainable Development Goals, which included seventeen Sustainable Development Goals (SDGs) geared towards dramatically reducing poverty, fighting inequality and injustice, and tackling climate change by 2030. The COP 21 (Conference of Parties to the 21 session of the United Nations Framework Convention on Climate Change) introduced a historic agreement to combat climate change and accelerate both the action and investment needed for a sustainable low carbon future. Indeed, these are a mere few examples of the broad reaching directives recently initiated in order to encourage action and stress accountability.

Additionally, and importantly, resolution has not only been limited to direct impact policy changes, but also by investors’ behavior and preference. Recognizing the demand by investors to be influencers of change through their capital allocations, the United States Department of Labor (“DOL”) issued Interpretive Bulletin (“IB”) 2015-01 in October of 2015. This bulletin updated and clarified the DOL’s position on how fiduciary investors may best utilize knowledge of a prospective investment’s key environmental, social and governance indicators when making investment decisions for retirement plans. Essentially, the DOL has created a platform that allows fiduciaries to utilize ESG information in their investment decisions regarding a variety of retirement assets, including, but not limited to, IRA accounts; 401(K) accounts; and retirement accounts monitored by a company or union. This legislation is a powerful and fundamental change, especially given- retirement assets represent over $24 trillion and, thus if purposefully directed, may effect meaningful impact. IB 2015-01 is an exciting development in the world of socially responsible investing as it will provide access to vast amounts of capital that can be used to encourage and facilitate better corporate practices.

Change is here. Our challenge, collectively as socially conscious investors, will be to maintain its momentum and focus. Through your investment in the Calvert Funds you are engaged and influential in this movement. By allocating capital only to the best environmentally and socially governed corporations, we-alongside you, encourage good corporate citizenry. Our shareholder advocacy efforts, which fundamentally represent you as a shareholder, consistently monitor and challenge poor corporate policy, thus effecting positive outcomes. Through your support, we are able to partner with academics and industry renowned technicians to produce innovative research that will help to provide both better ESG investment solutions and a more lasting impact.

This is an exciting time and we at Calvert appreciate servicing you, as fund shareholders, and look forward to the future together as we navigate the waters of progress.

Respectfully,

John Streur

May 2016

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 1

|

| |

| PORTFOLIO MANAGEMENT DISCUSSION |

|

| | | |

| Joshua Linder, CFA Portfolio Manager | | Christopher Madden, CFA Portfolio Manager |

| Kurt Moeller, CFA Portfolio Manager | | Jade Huang Portfolio Manager |

Market Review

Equity markets generally performed well over the trailing six months. However, positive returns from most major global equity indices masked the market volatility that played out during the period as concerns about global economic weakness and the implications of plunging oil prices weighed on investor sentiment. U.S. stocks benefited from solid macroeconomic data and an improving labor market. On the other hand, additional monetary easing by the European Central Bank (ECB) and Bank of Japan (BOJ) was met by investor skepticism as European and Japanese equities continued to struggle.

For the six-month period ended March 31, 2016, the Russell 2000 Index returned 2.02%. Domestic small cap stocks underperformed their large cap counterparts, due in part to investors’ preference for larger companies amidst a more volatile backdrop and the prospect of rising rates. The Federal Reserve (the Fed) elected to raise interest rates in December for the first time in nine years. However, by mid-February investor fears of a global recession began to subside, prompting a rally in equities that was led by small-cap stocks. The Fed’s incrementally cautious outlook later in the period also lowered market expectations for further rate hikes.

Dovish comments from the Fed similarly triggered a decline in the U.S. dollar, which provided a lift to commodity prices, including oil. The price of oil dropped below $30/barrel at one point before ending the period just shy of $40/barrel. Emerging markets (EM) benefited from the weaker dollar and higher commodity prices, and with economic data out of China showing signs of stabilization, EM stocks also participated in the market recovery.

Investment Strategy and Technique

The Fund normally invests at least 80% of its assets in small-cap stocks, using fundamental, quantitative, and macro-economic research and analyses, while integrating Calvert’s proprietary views on environmental, social and governance (ESG) information as part of its risk and opportunity assessment.

| |

| • | Our U.S. stock selection model seeks to identify high quality companies trading at attractive valuations. While the core of our model embeds a value and quality bias, it also focuses on companies operating efficiently and demonstrating strong capital stewardship. |

| |

| • | We review companies from a fundamental perspective to validate the stock selection model’s output, understand business drivers, determine whether ESG performance offers a competitive advantage, and avoid value traps. |

Fund Performance Relative to the Benchmark

For the six month period ending March 31, 2016, Calvert Small Cap Fund Class A shares returned 1.18%, underperforming its benchmark, the Russell 2000 Index, which returned 2.02%. Sector allocation was the primary source of underperformance, partially offset by a positive contribution from stock selection.

| |

| • | The Fund’s overweight allocation to the Consumer Discretionary sector negatively impacted performance as the performance of Consumer Discretionary stocks lagged. An underweight to Real Estate Investment Trusts (REITs) also detracted from performance, while the Fund benefited from an underweight to Biotechnology stocks, which underperformed significantly during the period. |

2 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

|

| | | | |

| | | | |

| | CALVERT SMALL CAP FUND |

| | MARCH 31, 2016 |

| | | | |

| | ECONOMIC SECTORS | % OF TOTAL INVESTMENTS | |

| | Financials | 19.3 | % | |

| | Information Technology | 18.3 | % | |

| | Industrials | 14.0 | % | |

| | Health Care | 13.8 | % | |

| | Consumer Discretionary | 10.6 | % | |

| | Exchange-Traded Products | 7.4 | % | |

| | Utilities | 3.7 | % | |

| | Materials | 3.1 | % | |

| | Energy | 2.4 | % | |

| | Short-Term Investments | 2.3 | % | |

| | Consumer Staples | 2.3 | % | |

| | Telecommunication Services | 2.2 | % | |

| | High Social Impact Investments | 0.6 | % | |

| | Total | 100 | % | |

| | | | |

| |

| • | Merger and acquisition (M&A) activity benefited performance with three of the Fund’s holdings acquired during the period for significant premiums - Affymetrix, Cascade Microtech, and FirstMerit Corp. |

| |

| • | Stock selection within the Information Technology sector was another top contributor, led by Super Microcomputer, which rapidly grew fourth quarter sales and profits due to strong placement within a niche segment of the market, and positively surprised investors with better than expected earnings. |

| |

| • | Stock selection in the Industrials sector detracted from performance with leisure airline Allegiant Travel a negative contributor during the period due to declining operating margins expected for 2016. Within Consumer Discretionary, department store Dillard’s underperformed, driven by weak same store sales, further exacerbated by unusually warm weather. We exited both positions during the period. |

Positioning and Market Outlook

We maintain our favorable view on the U.S. economy and believe U.S. stocks can continue to post decent performance, although probably not as good as what we’ve experienced over the past couple of years. While valuations of U.S. equities appear stretched based on historical standards, the positive economic climate in the U.S. relative to the rest of the world should provide some support for elevated valuation levels, allowing U.S. stocks to potentially commanding a premium. That said, the sharp decline by equities at the start of the year revealed how sensitive market sentiment is right

|

| | | | | | |

| | | | | |

| | CALVERT SMALL CAP FUND | |

| | MARCH 31, 2016 | |

| | | | | |

| | INVESTMENT PERFORMANCE | |

| | (TOTAL RETURN AT NAV) | |

| | | 6 MONTHS ENDED 3/31/16 | 12 MONTHS ENDED 3/31/16 | |

| | Class A | 1.18 | % | -4.29 | % | |

| | Class C | 0.80 | % | -5.03 | % | |

| | Class I | 1.39 | % | -3.88 | % | |

| | Class Y | 1.35 | % | -4.06 | % | |

| | Russell 2000 Index | 2.02 | % | -9.76 | % | |

| | Lipper Small-Cap Core Funds Average | 3.17 | % | -7.90 | % | |

| | | | | |

| | Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges. | |

| | | | |

| | TEN LARGEST STOCK HOLDINGS | % OF NET ASSETS | |

| | Grand Canyon Education, Inc. | | 1.9 | % | |

| | Texas Roadhouse, Inc. | | 1.9 | % | |

| | East West Bancorp, Inc. | | 1.8 | % | |

| | American Financial Group, Inc. | | 1.6 | % | |

| | Navigant Consulting, Inc. | | 1.6 | % | |

| | II-VI, Inc. | | 1.6 | % | |

| | La-Z-Boy, Inc. | | 1.5 | % | |

| | Deluxe Corp. | | 1.5 | % | |

| | SVB Financial Group | | 1.5 | % | |

| | Great Western Bancorp, Inc. | | 1.5 | % | |

| | Total | 16.4 | % | |

| | | | | |

now. With equity valuations above historical averages, markets are more vulnerable to shocks from some of the negative catalysts currently in the global economy, such as slowing growth in China and increased geopolitical risk.

An improving U.S. economy, albeit with sluggish growth, should allow the Fed to continue on its tightening path, though this process will likely be slow and policy will remain accommodative. This contrasts with other global central banks, such as the ECB and BOJ, which remain committed to further easing. However, market enthusiasm for global quantitative easing might continue to wane if robust economic recovery doesn’t follow.

We expect volatility in equity markets to continue, especially relative to the historically low levels of volatility experienced during the last few years, but this should also provide greater opportunities for stock picking. We also increased the number of Fund holdings during the period in order to better manage risk in this higher volatility environment. We are confident that our strategy can continue to succeed in the long-run as

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 3

investors re-focus on stock specific issues including valuation and earnings quality metrics.

|

| |

| |

| Joshua Linder, CFA | Christopher Madden, CFA |

| |

| Kurt Moeller, CFA | Jade Huang |

Calvert Investment Management, Inc.

May 2016

4 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

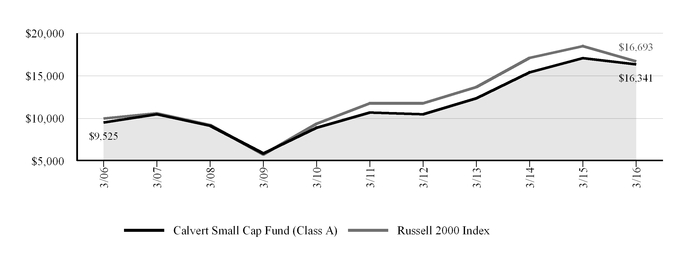

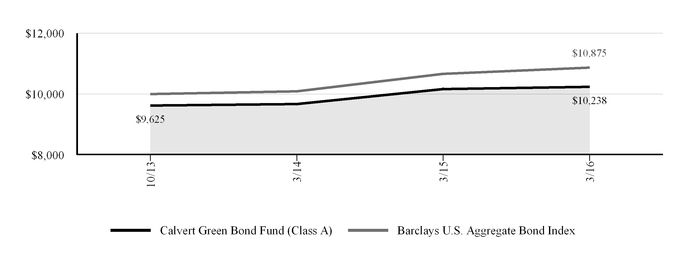

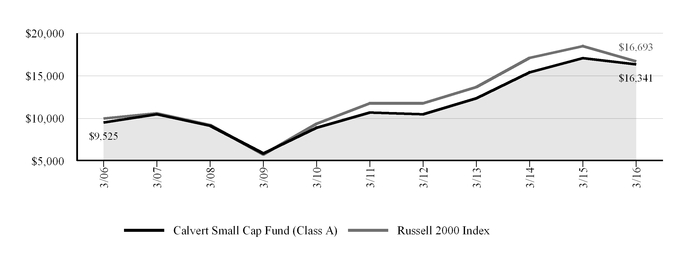

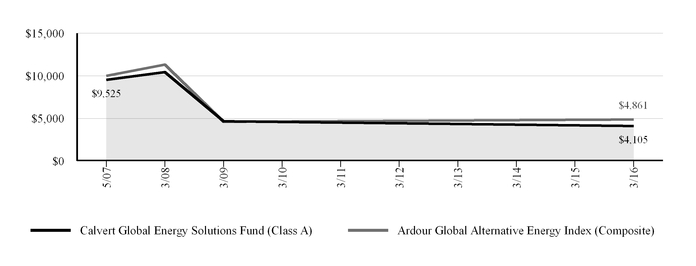

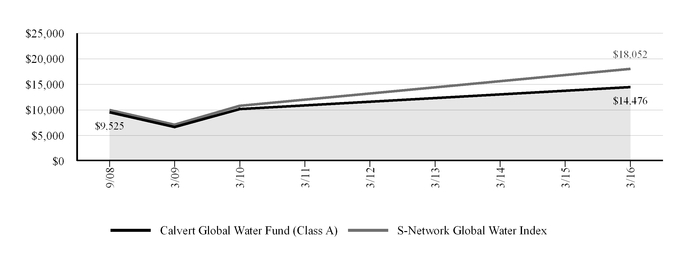

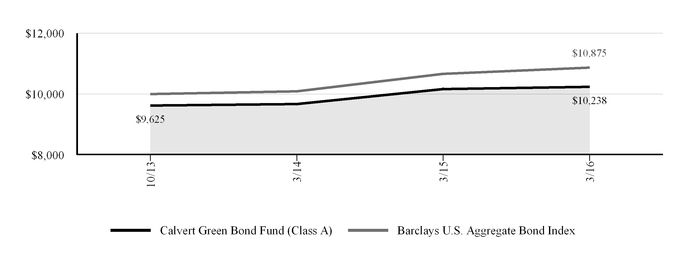

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Class A shares, reflect the deduction of the maximum front-end Class A sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with a broad based market index. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The value of an investment in a different share class would be different.

|

| | | | | | | |

| CALVERT SMALL CAP FUND |

| MARCH 31, 2016 |

| AVERAGE ANNUAL TOTAL RETURNS | Ticker Symbol | 1 Year | 5 Year | 10 Year |

| Class A (with max. load) | CCVAX | -8.83 | % | 7.81 | % | 5.03 | % |

| Class C (with max. load) | CSCCX | 5.98 | % | 7.95 | % | 4.61 | % |

| Class I | CSVIX | -3.88 | % | 9.56 | % | 6.30 | % |

| Class Y | CSCYX | -4.06 | % | 9.03 | % | 5.62 | % |

| Russell 2000 Index | | -9.76 | % | 7.20 | % | 5.26 | % |

| Lipper Small-Cap Core Funds Average | | -7.90 | % | 6.86 | % | 5.26 | % |

| | | | | |

| Calvert Small Cap Fund first offered Class C shares on April 1, 2005 and Class Y shares on October 18, 2013. Performance prior to those dates reflects the performance of Class A shares at net asset value (NAV). Actual Class C share performance would have been lower, and actual Class Y share performance would have been higher than Class A share performance because Class C has higher, and Class Y has lower, class-specific expenses than Class A. |

| | | | | |

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions, and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data, including most recent month-end, visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.39%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

UNDERSTANDING YOUR FUND'S EXPENSES

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in this mutual fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by the fund's investors during the period. The actual and hypothetical information presented in the examples is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2015 to March 31, 2016).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

The fund may charge an annual low balance account fee of $15 to those shareholders whose regular account balance is less than $5,000 ($1,000 for IRA accounts). If the low balance fee applies to your account, you should subtract the fee from the ending account value in the chart below.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | ANNUALIZED

EXPENSE RATIO | BEGINNING

ACCOUNT VALUE

10/1/15 | ENDING

ACCOUNT VALUE

3/31/16 | EXPENSES PAID

DURING PERIOD*

10/1/15 - 3/31/16 |

| Class A | | | | |

| Actual | 1.37% | $1,000.00 | $1,011.80 | $6.89 |

| Hypothetical (5% return per year before expenses) | 1.37% | $1,000.00 | $1,018.15 | $6.91 |

| Class C | | | | |

| Actual | 2.12% | $1,000.00 | $1,008.00 | $10.64 |

| Hypothetical (5% return per year before expenses) | 2.12% | $1,000.00 | $1,014.40 | $10.68 |

| Class I | | | | |

| Actual | 0.91% | $1,000.00 | $1,013.90 | $4.58 |

| Hypothetical (5% return per year before expenses) | 0.91% | $1,000.00 | $1,020.45 | $4.60 |

| Class Y | | | | |

| Actual | 1.09% | $1,000.00 | $1,013.50 | $5.49 |

| Hypothetical (5% return per year before expenses) | 1.09% | $1,000.00 | $1,019.55 | $5.50 |

| |

| * Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). Expense ratios shown in the Financial Highlights represent the actual expenses incurred for the period. |

6 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

CALVERT SMALL CAP FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2016 (Unaudited)

|

| | | | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - 89.8% | | |

| Air Freight & Logistics - 0.8% | | |

| Hub Group, Inc., Class A * | 51,293 | 2,092,241 |

|

| | | |

| Auto Components - 1.1% | | |

| Tenneco, Inc. * | 55,359 | 2,851,542 |

|

| | | |

| Banks - 9.5% | | |

| East West Bancorp, Inc. | 150,640 | 4,892,787 |

|

| Financial Institutions, Inc. | 113,044 | 3,286,189 |

|

| First Interstate BancSystem, Inc., Class A | 70,205 | 1,974,867 |

|

| FNB Corp. | 277,932 | 3,615,895 |

|

| Great Western Bancorp, Inc. | 144,948 | 3,952,732 |

|

| PrivateBancorp, Inc. | 99,867 | 3,854,866 |

|

| SVB Financial Group * | 39,991 | 4,081,082 |

|

| | | 25,658,418 |

|

| | | |

| Capital Markets - 3.5% | | |

| BGC Partners, Inc., Class A | 282,388 | 2,555,611 |

|

| Evercore Partners, Inc., Class A | 47,611 | 2,463,869 |

|

| Janus Capital Group, Inc. | 120,542 | 1,763,530 |

|

| OM Asset Management plc | 206,726 | 2,759,792 |

|

| | | 9,542,802 |

|

| | | |

| Chemicals - 0.9% | | |

| Minerals Technologies, Inc. | 43,883 | 2,494,749 |

|

| | | |

| Commercial Services & Supplies - 2.5% | | |

| Deluxe Corp. | 65,674 | 4,103,968 |

|

| Pitney Bowes, Inc. | 129,653 | 2,792,726 |

|

| | | 6,896,694 |

|

| | | |

| Communications Equipment - 1.2% | | |

| Brocade Communications Systems, Inc. | 188,775 | 1,997,239 |

|

| Plantronics, Inc. | 30,036 | 1,177,111 |

|

| | | 3,174,350 |

|

| | | |

| Construction & Engineering - 3.6% | | |

| Aegion Corp. * | 126,393 | 2,665,628 |

|

| Argan, Inc. | 95,749 | 3,366,535 |

|

| EMCOR Group, Inc. | 75,577 | 3,673,042 |

|

| | | 9,705,205 |

|

| | | |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

|

| | | | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - CONT’D | | |

| Diversified Consumer Services - 1.9% | | |

| Grand Canyon Education, Inc. * | 122,019 | 5,215,092 |

|

| | | |

| Diversified Telecommunication Services - 1.1% | | |

| Atlantic Tele-Network, Inc. | 38,327 | 2,906,336 |

|

| | | |

| Electric Utilities - 1.2% | | |

| Portland General Electric Co. | 84,680 | 3,344,013 |

|

| | | |

| Electronic Equipment & Instruments - 7.2% | | |

| Anixter International, Inc. * | 45,425 | 2,367,097 |

|

| Fabrinet * | 102,856 | 3,327,392 |

|

| II-VI, Inc. * | 198,436 | 4,308,046 |

|

| Plexus Corp. * | 79,770 | 3,152,510 |

|

| Sanmina Corp. * | 87,750 | 2,051,595 |

|

| SYNNEX Corp. | 33,024 | 3,057,692 |

|

| Vishay Intertechnology, Inc. | 107,372 | 1,311,012 |

|

| | | 19,575,344 |

|

| | | |

| Energy Equipment & Services - 2.4% | | |

| Bristow Group, Inc. | 99,252 | 1,877,848 |

|

| Frank's International NV | 84,551 | 1,393,400 |

|

| Newpark Resources, Inc. * | 403,977 | 1,745,181 |

|

| US Silica Holdings, Inc. | 67,971 | 1,544,301 |

|

| | | 6,560,730 |

|

| | | |

| Food Products - 1.3% | | |

| John B Sanfilippo & Son, Inc. | 48,982 | 3,384,166 |

|

| | | |

| Gas Utilities - 1.2% | | |

| ONE Gas, Inc. | 51,039 | 3,118,483 |

|

| | | |

| Health Care Equipment & Supplies - 7.1% | | |

| Analogic Corp. | 34,603 | 2,733,983 |

|

| Anika Therapeutics, Inc. * | 37,795 | 1,690,192 |

|

| Glaukos Corp. * | 113,289 | 1,910,053 |

|

| Globus Medical, Inc., Class A * | 69,290 | 1,645,638 |

|

| LDR Holding Corp. * | 74,922 | 1,909,762 |

|

| LivaNova plc * | 67,789 | 3,659,250 |

|

| STERIS plc | 43,487 | 3,089,751 |

|

| SurModics, Inc. * | 148,787 | 2,739,169 |

|

| | | 19,377,798 |

|

| | | |

| Health Care Providers & Services - 3.0% | | |

| Centene Corp. * | 52,202 | 3,214,077 |

|

| Envision Healthcare Holdings, Inc. * | 61,660 | 1,257,864 |

|

| | | |

8 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

|

| | | | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - CONT’D | | |

| Molina Healthcare, Inc. * | 58,358 | 3,763,508 |

|

| | | 8,235,449 |

|

| | | |

| Health Care Technology - 1.2% | | |

| Omnicell, Inc. * | 121,372 | 3,382,638 |

|

| | | |

| Hotels, Restaurants & Leisure - 1.9% | | |

| Texas Roadhouse, Inc. | 115,297 | 5,024,643 |

|

| | | |

| Household Durables - 1.5% | | |

| La-Z-Boy, Inc. | 155,562 | 4,159,728 |

|

| | | |

| Household Products - 1.0% | | |

| Central Garden & Pet Co., Class A * | 169,277 | 2,757,522 |

|

| | | |

| Insurance - 6.4% | | |

| American Equity Investment Life Holding Co. | 169,050 | 2,840,040 |

|

| American Financial Group, Inc. | 61,901 | 4,355,973 |

|

| FBL Financial Group, Inc., Class A | 54,647 | 3,361,884 |

|

| National General Holdings Corp. | 146,857 | 3,170,643 |

|

| Navigators Group, Inc. (The) * | 41,914 | 3,515,327 |

|

| | | 17,243,867 |

|

| | | |

| Internet Software & Services - 0.8% | | |

| Xactly Corp. * | 327,501 | 2,243,382 |

|

| | | |

| IT Services - 4.5% | | |

| Convergys Corp. | 124,126 | 3,446,979 |

|

| DST Systems, Inc. | 26,472 | 2,985,247 |

|

| Syntel, Inc. * | 60,736 | 3,032,549 |

|

| TeleTech Holdings, Inc. | 97,283 | 2,700,576 |

|

| | | 12,165,351 |

|

| | | |

| Leisure Products - 1.0% | | |

| Brunswick Corp. | 53,629 | 2,573,119 |

|

| | | |

| Life Sciences - Tools & Services - 2.4% | | |

| Cambrex Corp. * | 70,330 | 3,094,520 |

|

| Luminex Corp. * | 181,932 | 3,529,481 |

|

| | | 6,624,001 |

|

| | | |

| Machinery - 2.1% | | |

| Hillenbrand, Inc. | 115,589 | 3,461,890 |

|

| Wabash National Corp. * | 166,364 | 2,196,005 |

|

| | | 5,657,895 |

|

| | | |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

|

| | | | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - CONT’D | | |

| Marine - 1.0% | | |

| Matson, Inc. | 70,275 | 2,822,947 |

|

| | | |

| Metals & Mining - 1.1% | | |

| Reliance Steel & Aluminum Co. | 43,908 | 3,037,995 |

|

| | | |

| Multi-Utilities - 1.4% | | |

| Avista Corp. | 89,846 | 3,663,920 |

|

| | | |

| Paper & Forest Products - 1.0% | | |

| PH Glatfelter Co. | 136,533 | 2,830,329 |

|

| | | |

| Professional Services - 2.8% | | |

| Korn/Ferry International | 119,119 | 3,369,876 |

|

| Navigant Consulting, Inc. * | 273,116 | 4,317,964 |

|

| | | 7,687,840 |

|

| | | |

| Semiconductors & Semiconductor Equipment - 1.9% | | |

| Cabot Microelectronics Corp. | 63,470 | 2,596,557 |

|

| Integrated Device Technology, Inc. * | 119,488 | 2,442,335 |

|

| | | 5,038,892 |

|

| | | |

| Software - 1.4% | | |

| Sapiens International Corp. NV | 234,035 | 2,803,740 |

|

| VASCO Data Security International, Inc. * | 72,923 | 1,123,014 |

|

| | | 3,926,754 |

|

| | | |

| Specialty Retail - 3.3% | | |

| American Eagle Outfitters, Inc. | 144,573 | 2,410,032 |

|

| Chico's FAS, Inc. | 98,041 | 1,301,004 |

|

| Lithia Motors, Inc., Class A | 22,160 | 1,935,233 |

|

| Michaels Cos., Inc. (The) * | 115,198 | 3,222,088 |

|

| | | 8,868,357 |

|

| | | |

| Technology Hardware, Storage & Peripherals - 1.3% | | |

| Super Micro Computer, Inc. * | 104,150 | 3,549,432 |

|

| | | |

| Trading Companies & Distributors - 1.2% | | |

| Applied Industrial Technologies, Inc. | 75,548 | 3,278,783 |

|

| | | |

| Wireless Telecommunication Services - 1.1% | | |

| Shenandoah Telecommunications Co. | 112,960 | 3,021,680 |

|

| | | |

| Total Common Stocks (Cost $246,006,717) | | 243,692,487 |

|

| | | |

10 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

|

| | | | |

| | SHARES | VALUE ($) |

| EXCHANGE-TRADED PRODUCTS - 7.4% | | |

| iShares Russell 2000 ETF | 12,215 | 1,351,223 |

|

| SPDR S&P Biotech ETF | 61,168 | 3,159,939 |

|

| Vanguard REIT ETF | 185,117 | 15,512,805 |

|

| | | |

| Total Exchange-Traded Products (Cost $19,124,149) | | 20,023,967 |

|

| | | |

| | PRINCIPAL

AMOUNT ($) | VALUE ($) |

|

| HIGH SOCIAL IMPACT INVESTMENTS - 0.6% | | |

| Calvert Social Investment Foundation Notes: | | |

| 0.50%, 3/18/17 (a)(b) | 750,000 | 720,540 |

|

| 0.25%, 7/1/17 (a)(b) | 651,905 | 641,598 |

|

| ImpactAssets Global Sustainable Agriculture Notes, 0.00%, 11/3/20 (a)(b)(c) | 152,000 | 140,600 |

|

| ImpactAssets Microfinance Plus Notes, 0.00%, 11/3/20 (a)(b)(c) | 195,000 | 178,425 |

|

| | | |

| Total High Social Impact Investments (Cost $1,748,905) | | 1,681,163 |

|

| | | |

| TIME DEPOSIT - 2.3% | | |

| State Street Bank Time Deposit, 0.278%, 4/1/16 | 6,351,734 | 6,351,734 |

|

| | | |

| Total Time Deposit (Cost $6,351,734) | | 6,351,734 |

|

| | | |

| TOTAL INVESTMENTS (Cost $273,231,505) - 100.1% | | 271,749,351 |

|

| Other assets and liabilities, net - (0.1)% | | (299,155) |

|

NET ASSETS - 100.0% | |

| $271,450,196 |

|

|

| |

| NOTES TO SCHEDULE OF INVESTMENTS |

| * Non-income producing security. |

| (a) This security was valued under the direction of the Board of Directors. See Note A. |

| (b) Restricted securities represent 0.6% of the net assets of the Fund. |

| (c) The coupon rate shown on floating or adjustable rate securities represents the rate in effect on March 31, 2016. |

| |

| Abbreviations: |

| ETF: | Exchange-Traded Fund |

| plc: | Public Limited Company |

| REIT: | Real Estate Investment Trust |

|

| | |

| RESTRICTED SECURITIES | ACQUISITION DATES | COST ($) |

| Calvert Social Investment Foundation Notes, 0.50%, 3/18/17 | 3/18/16 | 750,000 |

| Calvert Social Investment Foundation Notes, 0.25%, 7/1/17 | 7/1/14 | 651,905 |

| ImpactAssets Global Sustainable Agriculture Notes, 0.00%, 11/3/20 | 11/13/15 | 152,000 |

| ImpactAssets Microfinance Plus Notes, 0.00%, 11/3/20 | 11/13/15 | 195,000 |

| See notes to financial statements. |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

CALVERT SMALL CAP FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2016 (Unaudited)

|

| | | |

| ASSETS | |

| Investments in securities, at value (Cost $273,231,505) - see accompanying schedule |

| $271,749,351 |

|

| Receivable for securities sold | 1,447,761 |

|

| Receivable for shares sold | 872,338 |

|

| Dividends and interest receivable | 160,608 |

|

| Directors' deferred compensation plan | 146,598 |

|

| Total assets | 274,376,656 |

|

| | |

| LIABILITIES | |

| Payable for securities purchased | 2,165,821 |

|

| Payable for shares redeemed | 333,240 |

|

| Payable to Calvert Investment Management, Inc. | 150,820 |

|

| Payable to Calvert Investment Distributors, Inc. | 47,474 |

|

| Payable to Calvert Investment Administrative Services, Inc. | 25,242 |

|

| Payable to Calvert Investment Services, Inc. | 4,562 |

|

| Directors' deferred compensation plan | 146,598 |

|

| Accrued expenses and other liabilities | 52,703 |

|

| Total liabilities | 2,926,460 |

|

| NET ASSETS |

| $271,450,196 |

|

| | |

| NET ASSETS CONSIST OF: | |

| Paid-in capital applicable to the following shares of common stock, | |

| with 250,000,000 shares of $0.01 par value shares authorized: | |

| Class A: 7,995,126 shares outstanding |

| $153,690,387 |

|

| Class C: 946,895 shares outstanding | 17,311,556 |

|

| Class I: 3,477,512 shares outstanding | 74,934,666 |

|

| Class Y: 738,600 shares outstanding | 16,339,669 |

|

| Undistributed net investment income | 297,018 |

|

| Accumulated net realized gain (loss) | 10,359,054 |

|

| Net unrealized appreciation (depreciation) | (1,482,154) |

|

| NET ASSETS |

| $271,450,196 |

|

| | |

| NET ASSET VALUE PER SHARE | |

| Class A (based on net assets of $163,461,869) |

| $20.45 |

|

| Class C (based on net assets of $17,234,272) |

| $18.20 |

|

| Class I (based on net assets of $75,571,649) |

| $21.73 |

|

| Class Y (based on net assets of $15,182,406) |

| $20.56 |

|

| | |

| See notes to financial statements. | |

12 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

CALVERT SMALL CAP FUND

STATEMENT OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2016 (Unaudited)

|

| | | |

| NET INVESTMENT INCOME | |

| Investment Income: | |

| Dividend income (net of foreign taxes withheld of $976) |

| $1,985,993 |

|

| Interest income | 10,686 |

|

| Total investment income | 1,996,679 |

|

| | |

| Expenses: | |

| Investment advisory fee | 882,517 |

|

| Administrative fees | 228,705 |

|

| Transfer agency fees and expenses | 183,721 |

|

| Distribution Plan expenses: | |

| Class A | 196,416 |

|

| Class C | 82,353 |

|

| Directors' fees and expenses | 12,651 |

|

| Accounting fees | 29,055 |

|

| Custodian fees | 15,539 |

|

| Professional fees | 16,483 |

|

| Registration fees | 30,268 |

|

| Reports to shareholders | 19,206 |

|

| Miscellaneous | 5,702 |

|

| Total expenses | 1,702,616 |

|

| Reimbursement from Advisor: | |

| Class A | (27,074) |

|

| Class C | (12,802) |

|

| Administrative fees waived | (42,525) |

|

| Net expenses | 1,620,215 |

|

| NET INVESTMENT INCOME | 376,464 |

|

| | |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain (loss) | 10,926,677 |

|

| | |

| Change in unrealized appreciation (depreciation) | (7,984,840) |

|

| | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | 2,941,837 |

|

| | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

| $3,318,301 |

|

| | |

| See notes to financial statements. | |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

CALVERT SMALL CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | SIX MONTHS ENDED

MARCH 31, 2016 (Unaudited) | | YEAR ENDED

SEPTEMBER 30, 2015 |

| Operations: | | | |

| Net investment income |

| $376,464 |

| |

| $675,481 |

|

| Net realized gain (loss) | 10,926,677 |

| | 20,293,614 |

|

| Change in unrealized appreciation (depreciation) | (7,984,840) |

| | (2,063,669) |

|

| | | | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | 3,318,301 |

| | 18,905,426 |

|

| | | | |

| Distributions to shareholders from: | | | |

| Net investment income: | | | |

| Class A shares | (57,580) |

| | (20,872) |

|

| Class I shares | (281,509) |

| | (248,707) |

|

| Class Y shares | (40,922) |

| | (1,492) |

|

| Net realized gain: | | | |

| Class A shares | (13,282,800) |

| | (16,247,126) |

|

| Class B shares (a) | — |

| | (103,427) |

|

| Class C shares | (1,547,908) |

| | (1,823,563) |

|

| Class I shares | (5,124,419) |

| | (7,539,487) |

|

| Class Y shares | (981,947) |

| | (556,157) |

|

| Total distributions | (21,317,085) |

| | (26,540,831) |

|

| | | | |

| Capital share transactions: | | | |

| Shares sold: | | | |

| Class A shares (b) | 24,040,716 |

| | 32,375,922 |

|

| Class B shares (a) | — |

| | 12,071 |

|

| Class C shares | 3,108,127 |

| | 3,181,023 |

|

| Class I shares | 17,721,373 |

| | 27,750,171 |

|

| Class Y shares | 7,415,026 |

| | 7,010,873 |

|

| Reinvestment of distributions: | | | |

| Class A shares | 12,670,273 |

| | 15,410,910 |

|

| Class B shares (a) | — |

| | 97,987 |

|

| Class C shares | 1,349,156 |

| | 1,588,359 |

|

| Class I shares | 4,766,952 |

| | 7,262,349 |

|

| Class Y shares | 770,692 |

| | 499,379 |

|

| Redemption fees: | | | |

| Class A shares | — |

| | 30 |

|

| Class C shares | — |

| | 1 |

|

| Shares redeemed: | | | |

| Class A shares | (16,248,535) |

| | (21,337,967) |

|

| Class B shares (a)(b) | — |

| | (990,170) |

|

| Class C shares | (1,662,454) |

| | (2,181,949) |

|

| Class I shares | (4,415,539) |

| | (27,279,543) |

|

| Class Y shares | (2,435,169) |

| | (1,507,266) |

|

| Total capital share transactions | 47,080,618 |

| | 41,892,180 |

|

| | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | 29,081,834 |

| | 34,256,775 |

|

See notes to financial statements.

|

14 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

CALVERT SMALL CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS - CONT’D

|

| | | | | | | |

| NET ASSETS | SIX MONTHS ENDED

MARCH 31, 2016 (Unaudited) | | YEAR ENDED

SEPTEMBER 30, 2015 |

| Beginning of period |

| $242,368,362 |

| |

| $208,111,587 |

|

End of period (including undistributed net investment income of $297,018 and $300,565, respectively) |

| $271,450,196 |

| |

| $242,368,362 |

|

| | | | |

| CAPITAL SHARE ACTIVITY | | | |

| Shares sold: | | | |

| Class A shares (c) | 1,155,458 |

| | 1,402,421 |

|

| Class B shares (a) | — |

| | 596 |

|

| Class C shares | 166,512 |

| | 152,248 |

|

| Class I shares | 819,115 |

| | 1,162,886 |

|

| Class Y shares | 363,134 |

| | 306,085 |

|

| Reinvestment of distributions: | | | |

| Class A shares | 622,282 |

| | 707,867 |

|

| Class B shares (a) | — |

| | 4,768 |

|

| Class C shares | 74,293 |

| | 80,382 |

|

| Class I shares | 219,590 |

| | 314,893 |

|

| Class Y shares | 37,546 |

| | 22,821 |

|

| Shares redeemed: | | | |

| Class A shares | (803,930) |

| | (926,943) |

|

| Class B shares (a)(c) | — |

| | (44,551) |

|

| Class C shares | (92,986) |

| | (103,746) |

|

| Class I shares | (203,577) |

| | (1,095,239) |

|

| Class Y shares | (116,664) |

| | (65,394) |

|

| Total capital share activity | 2,240,773 |

| | 1,919,094 |

|

| | | | |

| (a) Class B Shares were converted into Class A Shares at the close of business on April 20, 2015. |

| (b) Amounts include $819,610 of share transactions that were redeemed from Class B shares and converted into Class A shares at the close of business on April 20, 2015. |

| (c) Amount includes 36,721 shares redeemed from Class B shares and 34,437 shares purchased into Class A shares at the close of business on April 20,2015. |

| See notes to financial statements. |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert Small Cap Fund (the “Fund”), a series of Calvert Impact Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert Impact Fund, Inc. is comprised of four separate series. The operations of each series are accounted for separately. The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946).

The Fund offers four classes of shares - Classes A, C, I, and Y. The Fund also offered Class B shares; however, all Class B shares were converted to Class A shares effective April 20, 2015 and are no longer available. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived in certain other instances where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries, foundations, and endowments that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each Class has different: (a) dividend rates due to differences in Distribution Plan expenses and other class specific expenses, (b) exchange privileges and (c) class specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. U.S. generally accepted accounting principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Transfers in and/or out of levels are determined based on the fair value of such securities at the end of the period. Valuation techniques used to value the Fund’s investments by major category are as follows:

Common stock securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are

16 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account and are categorized as Level 2 in the hierarchy. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the Fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At March 31, 2016, securities valued at $1,681,163 or 0.6% of net assets, were fair valued in good faith under the direction of the Board.

The following table summarizes the market value of the Fund's holdings as of March 31, 2016, based on the inputs used to value them: |

| | | | | | | | | | | |

| | VALUATION INPUTS |

| INVESTMENTS IN SECURITIES* | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Common Stocks** |

| $243,692,487 |

| $— |

| $— |

|

| $243,692,487 |

|

| Exchange-Traded Products | 20,023,967 |

| — |

| — |

| 20,023,967 |

|

| High Social Impact Investments | — |

| 1,362,138 |

| 319,025 |

| 1,681,163 |

|

| Time Deposit | — |

| 6,351,734 |

| — |

| 6,351,734 |

|

| |

| TOTAL |

| $263,716,454 |

|

| $7,713,872 |

| $319,025^ |

| $271,749,351 |

|

| |

| * For a complete listing of investments, please refer to the Schedule of Investments. |

| ** For further breakdown of equity securities by industry, please refer to the Schedule of Investments. |

| ^ Level 3 securities represent 0.1% of net assets. |

There were no transfers between levels during the period.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Schedule of Investments.

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

The Fund may invest in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from Calvert and its subsidiaries. The Fund has received an exemptive order from the Securities and Exchange Commission permitting the Fund to make investments in these notes under certain conditions.

Security Transactions and Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital are recorded as a reduction of cost of investments. Distributions received on securities that represent a capital gain are recorded as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from U.S. generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Redemption Fees: The Fund charged a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase (within seven days for Class I shares). The redemption fee was accounted for as an addition to paid-in capital. This fee was eliminated effective February 2, 2015.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund's tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund's financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly, of 0.70% of the Fund’s average daily net assets.

The Advisor has contractually agreed to limit net annual Fund operating expenses through January 31, 2017. The contractual expense caps are 1.37%, 2.12%, 0.92%, and 1.12% for Class A, C, I, and Y, respectively. For the purpose of this expense limit, operating expenses do not include interest expense, brokerage commissions, taxes or extraordinary expenses. This expense limitation does not limit acquired fund fees and expenses, if any.

Calvert Investment Administrative Services, Inc. ("CIAS"), an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, based on the Fund’s average daily net assets.

For the period October 1, 2015 to January 31, 2016, the administrative fee was 0.25% for Class A, C and Y and 0.10% for Class I. CIAS and the Fund entered into an Amended and Restated Administrative Services Agreement that established a 0.12% administrative fee for all classes of the Fund commencing on February 1, 2016. CIAS voluntarily waived 0.13% (the amount of the administrative fee above 0.12%) for Class A, C and Y shares of the Fund for the period from December 1, 2015 through January 31, 2016. CIAS has also contractually agreed to waive 0.02% for Class I shares of the Fund (the difference between the previous administrative fee and the new 0.12% fee) from February 1, 2016 through January 31, 2018. During the six-month period ended March 31, 2016, CIAS voluntarily waived $40,257.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted a Distribution Plan that permits the

18 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed 0.35% and 1.00% annually of the average daily net assets of Class A and C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly, of 0.25% and 1.00% of the Fund’s average daily net assets of Class A and C shares, respectively. Class I and Class Y shares do not have Distribution Plan expenses.

CID received $23,691 as its portion of commissions charged on sales of the Fund’s Class A shares for the period ended March 31, 2016.

Calvert Investment Services, Inc. (“CIS”), an affiliate of the Advisor, acts as shareholder servicing agent for the Fund. For its services, CIS received a fee of $32,133 for the period ended March 31, 2016. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

Each Director of the Fund who is not an employee of the Advisor or its affiliates receives an annual retainer of $52,000 plus a meeting fee of up to $3,000 for each Board meeting attended. Additional fees of $6,000 annually may be paid to the Committee chairs ($10,000 for the Board Chair and the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Eligible Directors may participate in a Deferred Compensation Plan (the “Plan”). Obligations of the Plan will be paid solely out of the Fund’s assets. Directors’ fees are allocated to each of the funds served.

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the period, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $229,505,382 and $189,459,998, respectively.

As of March 31, 2016, the tax basis components of unrealized appreciation/(depreciation) and the federal tax cost were as follows:

|

| | | |

| Unrealized appreciation |

| $15,250,034 |

|

| Unrealized (depreciation) | (17,732,876) |

|

| Net unrealized appreciation (depreciation) |

| ($2,482,842 | ) |

| Federal income tax cost of investments |

| $274,232,193 |

|

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Calvert Funds for temporary or emergency purposes only. Borrowings bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of 0.20% per annum is incurred on the unused portion of the committed facility. An administrative fee of $25,000 was paid in connection with the uncommitted facility. These fees are allocated to all participating funds. The Fund had no borrowings under the agreement during the period ended March 31, 2016.

NOTE E — SUBSEQUENT EVENTS

In preparing the financial statements as of March 31, 2016, no subsequent events or transactions occurred that would have required recognition or disclosure in these financial statements.

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 19

CALVERT SMALL CAP FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | PERIODS ENDED |

| CLASS A SHARES | March 31, 2016 (a) (Unaudited) | | September 30, 2015 (a) | | September 30, 2014 (a) | | September 30, 2013 (a) | | September 30, 2012 (a) | | September 30, 2011 (a) |

| Net asset value, beginning |

| $22.04 |

| |

| $22.98 |

| |

| $24.58 |

| |

| $19.36 |

| |

| $15.15 |

| |

| $15.55 |

|

| Income from investment operations: | | | | | | | | | | | |

| Net investment income (loss) | 0.02 |

| | 0.04 |

| | (0.07) |

| | (0.01) |

| | 0.20 |

| | 0.02 |

|

| Net realized and unrealized gain (loss) | 0.23 |

| | 1.80 |

| | 1.19 |

| | 6.02 |

| | 4.05 |

| | (0.42) |

|

| Total from investment operations | 0.25 |

| | 1.84 |

| | 1.12 |

| | 6.01 |

| | 4.25 |

| | (0.40) |

|

| Distributions from: | | | | | | | | | | | |

| Net investment income | (0.01) |

| | —(b) |

| | — |

| | (0.25) |

| | (0.04) |

| | — |

|

| Net realized gain | (1.83) |

| | (2.78) |

| | (2.72) |

| | (0.54) |

| | — |

| | — |

|

| Total distributions | (1.84) |

| | (2.78) |

| | (2.72) |

| | (0.79) |

| | (0.04) |

| | — |

|

| Total increase (decrease) in net asset value | (1.59) |

| | (0.94) |

| | (1.60) |

| | 5.22 |

| | 4.21 |

| | (0.40) |

|

| Net asset value, ending |

| $20.45 |

| |

| $22.04 |

| |

| $22.98 |

| |

| $24.58 |

| |

| $19.36 |

| |

| $15.15 |

|

| Total return (c) | 1.18 | % | | 8.18 | % | | 4.69 | % | | 32.42 | % | | 28.12 | % | | (2.56 | %) |

| Ratios to average net assets: (d) | | | | | | | | | | | |

| Net investment income (loss) | 0.20%(e) |

| | 0.19 | % | | (0.28 | %) | | (0.05 | %) | | 1.13 | % | | 0.13 | % |

| Total expenses | 1.45%(e) |

| | 1.52 | % | | 1.61 | % | | 1.67 | % | | 1.78 | % | | 1.81 | % |

| Net expenses | 1.37%(e) |

| | 1.37 | % | | 1.53 | % | | 1.67 | % | | 1.69 | % | | 1.69 | % |

| Portfolio turnover | 78 | % | | 59 | % | | 103 | % | | 82 | % | | 3 | % | | 9 | % |

| Net assets, ending (in thousands) |

| $163,462 |

| |

| $154,728 |

| |

| $134,128 |

| |

| $129,407 |

| |

| $95,189 |

| |

| $81,374 |

|

| |

| (a) Per share figures are calculated using the Average Shares Method. |

| (b) Amount is less than $0.005 per share. |

| (c) Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge. |

| (d) Total expenses do not reflect amounts reimbursed and/or waived by the Advisor and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (e) Annualized. |

| See notes to financial statements. |

20 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

CALVERT SMALL CAP FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | PERIODS ENDED |

| CLASS C SHARES | March 31, 2016 (a) (Unaudited) | | September 30, 2015 (a) | | September 30, 2014 (a) | | September 30, 2013 (a) | | September 30, 2012 (a) | | September 30, 2011 (a) |

| Net asset value, beginning |

| $19.88 |

| |

| $21.12 |

| |

| $22.98 |

| |

| $18.08 |

| |

| $14.25 |

| |

| $14.77 |

|

| Income from investment operations: | | | | | | | | | | | |

| Net investment income (loss) | (0.05) |

| | (0.12) |

| | (0.23) |

| | (0.17) |

| | 0.03 |

| | (0.15) |

|

| Net realized and unrealized gain (loss) | 0.20 |

| | 1.66 |

| | 1.09 |

| | 5.65 |

| | 3.80 |

| | (0.37) |

|

| Total from investment operations | 0.15 |

| | 1.54 |

| | 0.86 |

| | 5.48 |

| | 3.83 |

| | (0.52) |

|

| Distributions from: | | | | | | | | | | | |

| Net investment income | — |

| | — |

| | — |

| | (0.04) |

| | — |

| | — |

|

| Net realized gain | (1.83) |

| | (2.78) |

| | (2.72) |

| | (0.54) |

| | — |

| | — |

|

| Total distributions | (1.83) |

| | (2.78) |

| | (2.72) |

| | (0.58) |

| | — |

| | — |

|

| Total increase (decrease) in net asset value | (1.68) |

| | (1.24) |

| | (1.86) |

| | 4.90 |

| | 3.83 |

| | (0.52) |

|

| Net asset value, ending |

| $18.20 |

| |

| $19.88 |

| |

| $21.12 |

| |

| $22.98 |

| |

| $18.08 |

| |

| $14.25 |

|

| Total return (b) | 0.80 | % | | 7.38 | % | | 3.81 | % | | 31.35 | % | | 26.88 | % | | (3.52 | %) |

| Ratios to average net assets: (c) | | | | | | | | | | | |

| Net investment income (loss) | (0.54%)(d) |

| | (0.56 | %) | | (1.06 | %) | | (0.86 | %) | | 0.19 | % | | (0.87 | %) |

| Total expenses | 2.32%(d) |

| | 2.36 | % | | 2.38 | % | | 2.49 | % | | 2.64 | % | | 2.74 | % |

| Net expenses | 2.12%(d) |

| | 2.12 | % | | 2.31 | % | | 2.49 | % | | 2.64 | % | | 2.69 | % |

| Portfolio turnover | 78 | % | | 59 | % | | 103 | % | | 82 | % | | 3 | % | | 9 | % |

| Net assets, ending (in thousands) |

| $17,234 |

| |

| $15,887 |

| |

| $14,156 |

| |

| $13,726 |

| |

| $9,907 |

| |

| $8,618 |

|

| | |

| (a) Per share figures are calculated using the Average Shares Method. | |

| (b) Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge. |

| (c) Total expenses do not reflect amounts reimbursed and/or waived by the Advisor and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (d) Annualized. | |

| See notes to financial statements. | |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 21

CALVERT SMALL CAP FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | PERIODS ENDED |

| CLASS I SHARES | March 31, 2016 (a) (Unaudited) | | September 30, 2015 (a) | | September 30, 2014 (a) | | September 30, 2013 (a) | | September 30, 2012 (a) | | September 30, 2011 (a) |

| Net asset value, beginning |

| $23.34 |

| |

| $24.14 |

| |

| $25.56 |

| |

| $20.06 |

| |

| $15.80 |

| |

| $16.14 |

|

| Income from investment operations: | | | | | | | | | | | |

| Net investment income | 0.07 |

| | 0.16 |

| | 0.08 |

| | 0.16 |

| | 0.35 |

| | 0.17 |

|

| Net realized and unrealized gain (loss) | 0.24 |

| | 1.90 |

| | 1.22 |

| | 6.24 |

| | 4.21 |

| | (0.45) |

|

| Total from investment operations | 0.31 |

| | 2.06 |

| | 1.30 |

| | 6.40 |

| | 4.56 |

| | (0.28) |

|

| Distributions from: | | | | | | | | | | | |

| Net investment income | (0.09) |

| | (0.08) |

| | — |

| | (0.36) |

| | (0.30) |

| | (0.06) |

|

| Net realized gain | (1.83) |

| | (2.78) |

| | (2.72) |

| | (0.54) |

| | — |

| | — |

|

| Total distributions | (1.92) |

| | (2.86) |

| | (2.72) |

| | (0.90) |

| | (0.30) |

| | (0.06) |

|

| Total increase (decrease) in net asset value | (1.61) |

| | (0.80) |

| | (1.42) |

| | 5.50 |

| | 4.26 |

| | (0.34) |

|

| Net asset value, ending |

| $21.73 |

| |

| $23.34 |

| |

| $24.14 |

| |

| $25.56 |

| |

| $20.06 |

| |

| $15.80 |

|

| Total return (b) | 1.39 | % | | 8.72 | % | | 5.27 | % | | 33.43 | % | | 29.11 | % | | (1.81 | %) |

| Ratios to average net assets: (c) | | | | | | | | | | | |

| Net investment income | 0.68%(d) |

| | 0.64 | % | | 0.33 | % | | 0.71 | % | | 1.88 | % | | 0.90 | % |

| Total expenses | 0.92%(d) |

| | 0.91 | % | | 0.95 | % | | 0.98 | % | | 1.03 | % | | 1.08 | % |

| Net expenses | 0.91%(d) |

| | 0.91 | % | | 0.92 | % | | 0.92 | % | | 0.92 | % | | 0.92 | % |

| Portfolio turnover | 78 | % | | 59 | % | | 103 | % | | 82 | % | | 3 | % | | 9 | % |

| Net assets, ending (in thousands) |

| $75,572 |

| |

| $61,669 |

| |

| $54,563 |

| |

| $46,198 |

| |

| $26,129 |

| |

| $17,895 |

|

| | |

| (a) Per share figures are calculated using the Average Shares Method. | |

| (b) Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge. |

| (c) Total expenses do not reflect amounts reimbursed and/or waived by the Advisor and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (d) Annualized. | |

| See notes to financial statements. | |

22 calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED)

CALVERT SMALL CAP FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | |

| | PERIODS ENDED | |

| CLASS Y SHARES | March 31, 2016 (a) (Unaudited) | | September 30, 2015 (a) | | September 30, 2014 (a)(b) | |

| Net asset value, beginning |

| $22.18 |

| |

| $23.06 |

| |

| $25.36 |

| |

| Income from investment operations: | | | | | | |

| Net investment income | 0.06 |

| | 0.09 |

| | 0.03 |

| |

| Net realized and unrealized gain (loss) | 0.23 |

| | 1.82 |

| | 0.39 |

| |

| Total from investment operations | 0.29 |

| | 1.91 |

| | 0.42 |

| |

| Distributions from: | | | | | | |

| Net investment income | (0.08) |

| | (0.01) |

| | — |

| |

| Net realized gain | (1.83) |

| | (2.78) |

| | (2.72) |

| |

| Total distributions | (1.91) |

| | (2.79) |

| | (2.72) |

| |

| Total increase (decrease) in net asset value | (1.62) |

| | (0.88) |

| | (2.30) |

| |

| Net asset value, ending |

| $20.56 |

| |

| $22.18 |

| |

| $23.06 |

| |

| Total return (c) | 1.35 | % | | 8.45 | % | | 1.81 | % | |

| Ratios to average net assets: (d) | | | | | | |

| Net investment income | 0.55%(e) |

| | 0.39 | % | | 0.14%(e) |

| |

| Total expenses | 1.13%(e) |

| | 1.31 | % | | 2.20%(e) |

| |

| Net expenses | 1.09%(e) |

| | 1.12 | % | | 1.16%(e) |

| |

| Portfolio turnover | 78 | % | | 59 | % | | 103 | % | |

| Net assets, ending (in thousands) |

| $15,182 |

| |

| $10,084 |

| |

| $4,406 |

| |

| |

| (a) Per share figures are calculated using the Average Shares Method. |

| (b) From October 18, 2013 inception. |

| (c) Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge. |

| (d) Total expenses do not reflect amounts reimbursed and/or waived by the Advisor and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (e) Annualized. |

| See notes to financial statements. |

calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 23

PROXY VOTING

The Proxy Voting Guidelines of the Calvert Funds that the Fund uses to determine how to vote proxies relating to portfolio securities are provided as an Appendix to the Fund’s Statement of Additional Information. The Statement of Additional Information can be obtained free of charge by calling the Fund at 1-800-368-2745, by visiting the Calvert website at www.calvert.com; or by visiting the SEC’s website at www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at www.calvert.com and on the SEC’s website at www.sec.gov.

AVAILABILITY OF QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

BASIS FOR BOARD'S APPROVAL OF INVESTMENT ADVISORY CONTRACT

At a meeting held on December 8, 2015, the Board of Directors, and by a separate vote, the disinterested Directors, approved the continuance of the Investment Advisory Agreement between Calvert Impact Fund, Inc. and the Advisor with respect to the Fund.

In evaluating the Investment Advisory Agreement, the Board considered a variety of information relating to the Fund and the Advisor. The disinterested Directors reviewed a report prepared by the Advisor regarding various services provided to the Fund by the Advisor and its affiliates. Such report included, among other data, information regarding the Advisor’s personnel and the Advisor’s revenue and cost of providing services to the Fund, and a separate report prepared by an independent third party, which provided a statistical analysis comparing the Fund’s investment performance, expenses and fees to comparable mutual funds.

The disinterested Directors were separately represented by independent legal counsel with respect to their consideration of the reapproval of the Investment Advisory Agreement. Prior to voting, the disinterested Directors reviewed the proposed continuance of the Investment Advisory Agreement with management and also met in private sessions with their counsel at which no representatives of management were present.