UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2013

Item 1. Report to Stockholders.

[Calvert Small Cap Fund Semi-Annual Report to Shareholders]

[Calvert Global Alternative Energy Fund and Calvert Global Water Fund Semi-Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Investment Climate

The six-month period ended March 31, 2013 was marked by uncertainties surrounding the U.S. presidential election and impending fiscal cliff, with equity markets ultimately benefiting from a relief rally to start 2013 as market participants responded favorably to the last-minute, short-term fiscal cliff deal. Hurricane Sandy weighed on the manufacturing sector, especially in the northeast, but improving data in the U.S. labor and housing markets and accommodative monetary policy by the Federal Reserve (Fed) helped boost investor sentiment.

There was some progress on the European policy front, but recessionary pressures in the eurozone and concerns about slower growth in China were a drag on international equity markets as the period wore on. Despite the headwinds emanating from Europe, all major global equity indices finished the first half of the fiscal year in positive territory with the Standard and Poor’s (S&P) 500, Russell 1000, Russell 2000, MSCI EAFE, and MSCI Emerging Markets Indices returning 10.19%, 11.10%, 14.48%, 12.18%, and 3.95%, respectively.

In a reversal of a multi-year trend, value stocks significantly outperformed growth stocks, and within the Russell 1000 Index, Financials, Industrials, and Consumer

Extending the Environmental, Social, and Governance Analytical Framework

U.S. consumers and investors are becoming more educated about how environmental, social, and governance (ESG) matters impact themselves and the economy. In fact, the increasing availability of information about ESG practices and their impacts on company performance is forcing companies to upgrade their standards and practices. Rather than risking backlash from regulators, the public, or investors, companies are now trying to manage and mitigate these risks and the potential for events such as the BP oil spill to protect their brand value and support continued consumer demand.

While this is positive for the U.S. economy as a whole, and for the companies poised to benefit from the push toward improving ESG awareness, it presents an increasingly complex investment landscape. At the same time, it also presents investors with a unique opportunity to identify and benefit from these trends.

That is why at Calvert we have developed sophisticated analytical approaches that enable our investment analysts and portfolio managers to quantify ESG issues in our valuation calculations and the buy and sell decisions of certain of our equity portfolios. This process further merges values with valuations in a way that seeks to improve investment performance and mitigate risks. To this end, we believe the ability to leverage the proprietary expertise of our investment and sustainability research teams can set Calvert apart as we strive to integrate ESG more deeply into our active portfolio management, seeking to identify those companies that manage their ESG impacts sustainably and create the most shareholder value.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 4

Discretionary were the top-performing sectors, while the Information Technology, Telecommunication Services, and Energy sectors lagged.

Congress Avoids Fiscal Cliff but Political Dysfunction Continues

The fiscal cliff became a major source of concern for investors as the calendar-year-end deadline approached. Despite initial positive rhetoric from policymakers, negotiations were visibly contentious before Congress reached a last-minute deal that allowed the payroll tax cut to expire and postponed most spending cuts for two months, spurring a relief rally. However, political dysfunction quickly returned to the forefront as U.S. policymakers were unable to reach a deal to avoid sequestration, prompting $85 billion in automatic spending cuts to take effect. Despite renewed fiscal policy headwinds, investors looked past the federal budget sequester and focused on the gradually improving economic conditions in the United States.

Economic Recovery in the United States Continues Despite Hurricane Sandy

Despite the negative economic impact of Hurricane Sandy, other U.S. macro data were mostly positive. Vehicle sales remained strong, construction spending continued to increase, and exports from the United States reached a record high as manufacturing activity rebounded following the “superstorm.” Our contention in the second half of 2011 that the U.S. housing sector had started to recover is now supported by multiple data points, including sales of new and existing homes as well as building permits and housing starts, which all increased through the first half of the fiscal year. At the same time, the inventory of homes for sale

| CALVERT |

| SMALL CAP FUND |

| MARCH 31, 2013 |

| |

| INVESTMENT PERFORMANCE | | | |

| (total return at NAV*) | | | | |

| | 6 MONTHS | | 12 MONTHS | |

| | ENDED | | ENDED | |

| | 3/31/13 | | 3/31/13 | |

| Class A | 14.75 | % | 17.97 | % |

| Class B | 13.82 | % | 16.15 | % |

| Class C | 14.20 | % | 16.91 | % |

| Class I | 15.16 | % | 18.83 | % |

| |

| Russell 2000 Index | 14.48 | % | 16.30 | % |

| |

| Lipper Small-Cap Core | | | | |

| Funds Average | 14.91 | % | 14.80 | % |

| | % OF TOTAL | |

| ECONOMIC SECTORS | INVESTMENTS | |

| Consumer Discretionary | | 15.6 | % |

| Consumer Staples | | 6.0 | % |

| Energy | | 9.4 | % |

| Financials | | 19.5 | % |

| Health Care | | 13.0 | % |

| Industrials | | 14.6 | % |

| Information Technology | | 12.1 | % |

| Materials | | 5.4 | % |

| Short-Term Investments | | 1.0 | % |

| Telecommunication Services | | 1.0 | % |

| Utilities | | 2.4 | % |

| Total | | 100 | % |

| |

| TEN LARGEST | % OF NET | |

| STOCK HOLDINGS | | ASSETS | |

| Skywest, Inc. | | 3.3 | % |

| Worthington Industries, Inc. | | 3.0 | % |

| Sanmina Corp. | | 3.0 | % |

| Deluxe Corp. | | 3.0 | % |

| Platinum Underwriters Holdings Ltd. | 2.8 | % |

| Exterran Holdings, Inc. | | 2.8 | % |

| Madison Square Garden Co. | | 2.8 | % |

| Acorda Therapeutics, Inc. | | 2.8 | % |

| Molina Healthcare, Inc. | | 2.7 | % |

| Helix Energy Solutions Group, Inc. | 2.7 | % |

| Total | | 28.9 | % |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charge.www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

continued to tighten, helping push home prices higher. The decision by the U.S. Fed to purchase $40 billion of mortgage-backed securities each month in an effort to lower long-term interest rates seemed to be working as mortgage rates remained near historic lows.

The labor market continued to show signs of healing as unemployment claims maintained their downward trend and the unemployment rate fell to 7.6% as of March, although this was driven by a drop in labor force participation.

Real gross domestic product (GDP) increased at a 3.1% annualized rate in the third quarter of 2012, although this slowed to a 0.1% gain in the fourth quarter. The marginal advance in the fourth quarter was attributed to a significant decline in government spending, which offset strong gains in residential investment and capital expenditures and a 2.2% increase in consumer spending.

The third-quarter U.S. earnings season proved to be less than stellar, as reported earnings of S&P 500 companies declined 1% on a year-over-year basis. However, 67% of S&P 500 companies beat earn-

| CALVERT |

| SMALL CAP FUND |

| MARCH 31, 2013 |

| |

| AVERAGE ANNUAL TOTAL RETURNS | |

| |

| CLASS A SHARES | (with max. load) | |

| One year | | 12.36 | % |

| Five year | | 5.19 | % |

| Since inception (10/1/2004) | | 4.17 | % |

| |

| CLASS B SHARES | (with max. load) | |

| One year | | 11.15 | % |

| Since inception (11/29/2010) | 9.63 | % |

| |

| CLASS C SHARES | (with max. load) | |

| One year | | 15.91 | % |

| Five year | | 5.23 | % |

| Since inception (4/1/2005) | | 3.50 | % |

| |

| CLASS I SHARES | | | |

| One year | | 18.83 | % |

| Five year | | 7.04 | % |

| Since inception (4/29/2005) | | 6.22 | % |

ings expectations and 65% topped revenue forecasts for the fourth-quarter earnings season.

Overall, strong signs of recovery in the U.S. housing market, the slowly improving employment picture, a decent earnings season, and good year-to-date performance in the equity markets seemed to be having a positive impact on Americans. Consumer confidence reached its highest level in five years while consumer spending also improved, giving us confidence that U.S. equity markets can continue to perform well in the long run.

Fed Maintains Accommodative Monetary Policy as Global Monetary Easing Cycle Continues

Inflation remained tame, allowing the Fed to maintain its accommodative stance. With that said, debate appeared to be growing inside the Fed about the appropriate time to scale back the most recent round of quantitative easing. The eventuality of this scale-back triggered considerable discussion in the media around the impact of rising interest rates.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 6

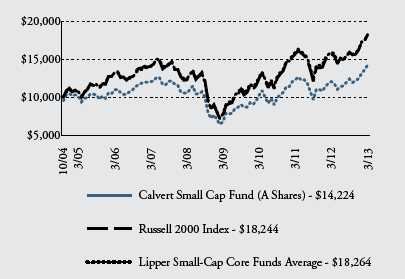

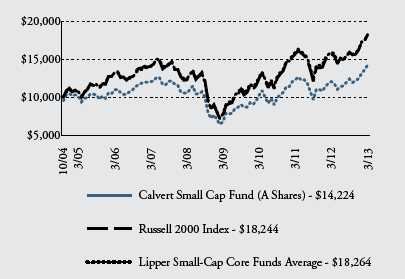

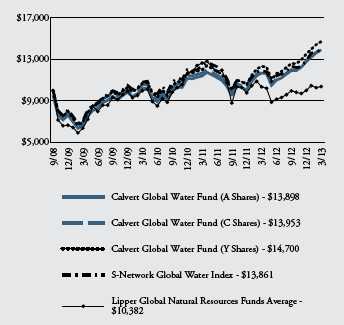

GROWTH OF $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods or since inception (for funds without 10-year records). The results shown are for Class A shares and reflect the deduction of the maximum front-end sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.78%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

* The month-end date of 10/31/04 is used for comparison purposes only; actual Fund inception is 10/1/04.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

Meanwhile, Japan launched a massive easing campaign aimed at fighting deflation, which helped produce a significant run in Japanese equities.

Progress on the Policy Front, but Eurozone in Double-Dip Recession

The eurozone officially entered into a recession in late 2012 for the second time in four years. With unemployment in the euro region hitting a record high 12%, and manufacturing PMI mired deep in contraction territory, the fiscal drag in the eurozone continued to be worse than anticipated. Even core European economies were not immune to the region’s recessionary pressures. The United Kingdom had its AAA credit rating cut by Moody’s, while the United Kingdom, Germany, Spain, and Belgium reported their economies shrank in the fourth quarter.

There were some notable improvements on the European sovereign debt side, however. The European Central Bank’s pledge to buy the sovereign debt of countries under severe fiscal stress helped restore some investor confidence in the eurozone bond market.

Economic and financial crisis was averted in Cyprus as the country’s policymakers reached a deal with eurozone finance ministers and international creditors for a 10 billion euro bailout. While the last-minute deal prevented imminent defaults of the country’s major banks, it also renewed concerns about the region’s ability to resolve its sovereign debt crisis.

Signs of China’s Economic Slowdown Stabilizing

Unfortunately, recessionary pressures in Europe are also likely to continue impacting emerging market economies. However, data released during the period suggested China’s economic slowdown was stabilizing and the Chinese government’s growth-boosting measures seemed to be having the desired effect without stoking inflation fears. China’s real GDP rose 7.9% in the fourth quarter and both measures of China’s Manufacturing PMI finished the period in expansion territory.

Despite these positive data points, the Chinese economy is not out of the woods yet. China’s transition from an export-driven economy to a more consumer-driven economy will likely face significant challenges. Having said that, continued economic growth in the United States could provide a significant positive boost for the Chinese economy.

Outlook

Equity markets started 2013 having gained a tremendous amount of ground since the depths of the financial crisis. A recovering U.S. housing market, a decline in unemployment, record-high exports, and encouraging year-end manufacturing data fueled by an attractive U.S. dollar exchange rate have all helped boost U.S. equity market sentiment. However, with the possibility of another less-than-stellar upcoming earnings season, and few positive catalysts on the near-term horizon, a short-term pull-back in equities remains a distinct possibility.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 8

We believe the U.S. economy will be able to maintain some expansion despite the sequester. Although having a short-term negative impact on economic growth, actions that reduce spending and improve budget strength for the United States over the long term are necessary. We expect housing to continue as a major driver of the recovery, having a positive impact on economic growth and consumer confidence as well as contributing to employment in housing-related sectors, as opposed to being a drag on the economy.

At the same time, we see the eurozone’s problems continuing to drag on and negatively impacting global economic growth. We believe the consensus forecast from the past several months for a European recovery was a bit premature. Because the economic recessionary pressures in the region are so pronounced and strong--especially in peripheral Europe, with Cyprus as one example, however small--the potential default issue may continue to resurface over time, reawakening markets to that reality.

Overall, we believe 2013 could be another good year for U.S. equities as investors look past the political dysfunction in Washington and move more money into stocks as they become more comfortable with risk. Value stocks generally performed better than growth companies in the second half of 2012 and we believe that this trend may persist in 2013, as risk aversion continues to subside. We also think small-cap equities are poised to post better returns than large-caps, driven by healthy earnings and top-line results as well as global M&A activity.

May 2013

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2012 to March 31, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 10

| | | |

| | BEGINNING | ENDING ACCOUNT | EXPENSES PAID |

| | ACCOUNT VALUE | VALUE | DURING PERIOD* |

| | 10/1/12 | 3/31/13 | 10/1/12 - 3/31/13 |

| CLASS A | | | |

| Actual | $1,000.00 | $1,148.00 | $9.05 |

| Hypothetical | $1,000.00 | $1,016.50 | $8.50 |

| (5% return per | | | |

| year before expenses) | | | |

| CLASS B | | | |

| Actual | $1,000.00 | $1,138.78 | $17.01 |

| Hypothetical | $1,000.00 | $1,009.03 | $15.98 |

| (5% return per | | | |

| year before expenses) | | | |

| CLASS C | | | |

| Actual | $1,000.00 | $1,142.61 | $13.64 |

| Hypothetical | $1,000.00 | $1,012.20 | $12.81 |

| (5% return per | | | |

| year before expenses) | | | |

| CLASS I | | | |

| Actual | $1,000.00 | $1,151.55 | $4.94 |

| Hypothetical | $1,000.00 | $1,020.34 | $4.63 |

| (5% return per | | | |

| year before expenses) | | | |

*Expenses are equal to the Fund’s annualized expense ratio of 1.69%, 3.19%, 2.55%, and 0.92% for Class A, Class B, Class C, and Class I, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

| | | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2013 |

| |

| EQUITY SECURITIES - 98.6% | SHARES | | VALUE |

| Aerospace & Defense - 0.6% | | | |

| Ducommun, Inc.* | 28,506 | $ | 564,134 |

| Sparton Corp.* | 24,296 | | 325,566 |

| | | | 889,700 |

| |

| Airlines - 3.3% | | | |

| Skywest, Inc. | 302,886 | | 4,861,320 |

| |

| Biotechnology - 4.7% | | | |

| Acorda Therapeutics, Inc.* | 126,691 | | 4,057,913 |

| PDL BioPharma, Inc. | 379,691 | | 2,775,541 |

| | | | 6,833,454 |

| |

| Chemicals - 1.4% | | | |

| American Pacific Corp.* | 6,004 | | 138,752 |

| Minerals Technologies, Inc. | 47,479 | | 1,970,853 |

| | | | 2,109,605 |

| |

| Commercial Banks - 8.6% | | | |

| Columbia Banking System, Inc | 87,832 | | 1,930,547 |

| East West Bancorp, Inc | 54,608 | | 1,401,787 |

| PrivateBancorp, Inc | 125,643 | | 2,375,909 |

| SVB Financial Group* | 49,506 | | 3,511,956 |

| Umpqua Holdings Corp. | 247,449 | | 3,281,174 |

| | | | 12,501,373 |

| |

| Commercial Services & Supplies - 5.4% | | | |

| Deluxe Corp. | 104,620 | | 4,331,268 |

| Steelcase, Inc. | 238,259 | | 3,509,555 |

| | | | 7,840,823 |

| |

| Computers & Peripherals - 1.9% | | | |

| Diebold, Inc | 89,612 | | 2,717,036 |

| |

| Consumer Finance - 1.9% | | | |

| Nelnet, Inc | 83,795 | | 2,832,271 |

| |

| Diversified Consumer Services - 2.2% | | | |

| Grand Canyon Education, Inc.* | 128,122 | | 3,253,018 |

| |

| Diversified Telecommunication Services - 0.8% | | | |

| Atlantic Tele-Network, Inc. | 22,372 | | 1,085,266 |

| PCCW Ltd. (ADR) | 6,073 | | 28,482 |

| | | | 1,113,748 |

| |

| Electric Utilities - 2.4% | | | |

| Portland General Electric Co. | 115,984 | | 3,517,795 |

| |

| Electrical Equipment - 2.5% | | | |

| Belden, Inc | 71,932 | | 3,715,288 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 12

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Electronic Equipment & Instruments - 5.0% | | | |

| Arrow Electronics, Inc.* | 20,672 | $ | 839,697 |

| PC Connection, Inc. | 20,759 | | 339,410 |

| Plexus Corp.* | 73,070 | | 1,776,332 |

| Sanmina Corp.* | 383,400 | | 4,355,424 |

| | | | 7,310,863 |

| |

| Energy Equipment & Services - 5.5% | | | |

| Exterran Holdings, Inc.* | 152,934 | | 4,129,218 |

| Helix Energy Solutions Group, Inc.* | 170,086 | | 3,891,568 |

| | | | 8,020,786 |

| |

| Food & Staples Retailing - 2.1% | | | |

| Harris Teeter Supermarkets, Inc. | 70,634 | | 3,016,778 |

| |

| Food Products - 1.9% | | | |

| Darling International, Inc.* | 157,222 | | 2,823,707 |

| |

| Health Care Equipment & Supplies - 2.4% | | | |

| Mindray Medical International Ltd. (ADR) | 89,367 | | 3,569,318 |

| |

| Health Care Providers & Services - 4.1% | | | |

| Magellan Health Services, Inc.* | 43,136 | | 2,051,980 |

| Molina Healthcare, Inc.* | 128,159 | | 3,956,268 |

| | | | 6,008,248 |

| |

| Hotels, Restaurants & Leisure - 2.5% | | | |

| Texas Roadhouse, Inc. | 181,717 | | 3,668,866 |

| |

| Insurance - 6.4% | | | |

| FBL Financial Group, Inc | 13,252 | | 514,973 |

| Platinum Underwriters Holdings Ltd | 74,441 | | 4,154,552 |

| ProAssurance Corp | 66,516 | | 3,148,202 |

| Symetra Financial Corp. | 66,067 | | 885,958 |

| The Navigators Group, Inc.* | 12,411 | | 729,146 |

| | | | 9,432,831 |

| |

| Internet Software & Services - 0.4% | | | |

| AOL, Inc.* | 14,777 | | 568,767 |

| |

| IT Services - 4.8% | | | |

| CSG Systems International, Inc.* | 59,183 | | 1,254,088 |

| Lender Processing Services, Inc. | 101,696 | | 2,589,180 |

| Unisys Corp.* | 141,744 | | 3,224,676 |

| | | | 7,067,944 |

| |

| Machinery - 2.8% | | | |

| Barnes Group, Inc | 114,232 | | 3,304,732 |

| LB Foster Co. | 7,168 | | 317,471 |

| Standex International Corp | 8,003 | | 441,926 |

| | | | 4,064,129 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

| | | | |

| EQUITY SECURITIES - CONT’D | | SHARES | | VALUE |

| Media - 2.9% | | | | |

| Madison Square Garden Co.* | | 71,082 | $ | 4,094,323 |

| McClatchy Co.* | | 72,161 | | 209,267 |

| | | | | 4,303,590 |

| |

| Metals & Mining - 3.0% | | | | |

| Worthington Industries, Inc. | | 143,845 | | 4,456,318 |

| |

| Oil, Gas & Consumable Fuels - 3.9% | | | | |

| EPL Oil & Gas, Inc.* | | 81,472 | | 2,184,264 |

| Ship Finance International Ltd. | | 200,162 | | 3,530,858 |

| | | | | 5,715,122 |

| |

| Paper & Forest Products - 0.9% | | | | |

| PH Glatfelter Co | | 56,393 | | 1,318,468 |

| |

| Personal Products - 2.1% | | | | |

| Revlon, Inc.* | | 15,729 | | 351,700 |

| USANA Health Sciences, Inc.* | | 54,843 | | 2,650,562 |

| | | | | 3,002,262 |

| |

| Pharmaceuticals - 1.8% | | | | |

| Viropharma, Inc.* | | 104,236 | | 2,622,578 |

| |

| Specialty Retail - 5.8% | | | | |

| ANN, Inc.* | | 87,337 | | 2,534,520 |

| Barnes & Noble, Inc.* | | 214,734 | | 3,532,374 |

| Brown Shoe Co., Inc. | | 154,728 | | 2,475,648 |

| | | | | 8,542,542 |

| |

| Textiles, Apparel & Luxury Goods - 2.2% | | | | |

| Jones Group, Inc | | 247,253 | | 3,145,058 |

| |

| Thrifts & Mortgage Finance - 2.2% | | | | |

| Northwest Bancshares, Inc. | | 252,094 | | 3,199,073 |

| |

| Wireless Telecommunication Services - 0.2% | | | | |

| Shenandoah Telecommunications Co. | | 17,569 | | 267,576 |

| |

| |

| Total Equity Securities (Cost $121,064,734) | | | | 144,310,255 |

| |

| | | PRINCIPAL | | |

| HIGH SOCIAL IMPACT INVESTMENTS - 0.4% | | AMOUNT | | |

| Calvert Social Investment Foundation Notes, 1.04%, 7/1/13 (b)(i)(r) | $ | 651,905 | | 646,653 |

| |

| Total High Social Impact Investments (Cost $651,905) | | | | 646,653 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 14

| | | | | |

| | | PRINCIPAL | | | |

| TIME DEPOSIT - 1.0% | | AMOUNT | | VALUE | |

| State Street Bank Time Deposit, 0.12%, 4/1/13 | $ | 1,518,655 | $ | 1,518,655 | |

| |

| Total Time Deposit (Cost $1,518,655) | | | | 1,518,655 | |

| |

| |

| |

| TOTAL INVESTMENTS (Cost $123,235,294) - 100.0% | | | | 146,475,563 | |

| Other assets and liabilities, net - 0.0% | | | | (45,500 | ) |

| NET ASSETS - 100% | | | $ | 146,430,063 | |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares of common stock, with | | | |

| 250,000,000 of $0.01 no par value shares authorized: | | | | | |

| Class A: 5,010,034 shares outstanding | | | $ | 88,427,497 | |

| Class B: 64,528 shares outstanding | | | | 628,801 | |

| Class C: 541,038 shares outstanding | | | | 9,132,386 | |

| Class I: 1,249,935 shares outstanding | | | | 24,485,501 | |

| Undistributed net investment income (loss) | | | | (435,751 | ) |

| Accumulated net realized gain (loss) | | | | 951,360 | |

| Net unrealized appreciation (depreciation) | | | | 23,240,269 | |

| |

| |

| NET ASSETS | | | $ | 146,430,063 | |

| |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A (based on net assets of $106,697,564) | | | $ | 21.30 | |

| Class B (based on net assets of $1,347,584) | | | $ | 20.88 | |

| Class C (based on net assets of $10,811,426) | | | $ | 19.98 | |

| Class I (based on net assets of $27,573,489) | | | $ | 22.06 | |

| |

| |

| | | ACQUISITION | | | |

| RESTRICTED SECURITIES | | DATE | | COST | |

| Calvert Social Investment Foundation Notes, 1.04%, 7/1/13 | | 7/1/10 | $ | 651,905 | |

(b) This security was valued by the Board of Directors. See Note A.

(i) Restricted securities represent 0.4% of net assets for the Small Cap Portfolio.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

* Non-income producing security.

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

| | | |

| STATEMENT OF OPERATIONS |

| SIX MONTHS ENDED MARCH 31, 2013 |

| |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Interest income | $ | 4,117 | |

| Dividend income | | 1,368,184 | |

| Total investment income | | 1,372,301 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 469,682 | |

| Transfer agency fees and expenses | | 200,219 | |

| Administrative fees | | 147,658 | |

| Distribution Plan expenses: | | | |

| Class A | | 120,192 | |

| Class B | | 6,730 | |

| Class C | | 49,572 | |

| Directors’ fees and expenses | | 7,791 | |

| Custodian fees | | 12,713 | |

| Registration fees | | 24,779 | |

| Reports to shareholders | | 37,512 | |

| Professional fees | | 14,119 | |

| Accounting fees | | 10,840 | |

| Miscellaneous | | 12,061 | |

| Total expenses | | 1,113,868 | |

| Reimbursement from Advisor: | | | |

| Class A | | (15,613 | ) |

| Class B | | (3,063 | ) |

| Class I | | (11,265 | ) |

| Fees paid indirectly | | (192 | ) |

| Net expenses | | 1,083,735 | |

| |

| |

| NET INVESTMENT INCOME | | 288,566 | |

| |

| REALIZED AND UNREALIZED | | | |

| GAIN (LOSS) ON INVESTMENTS | | | |

| Net realized gain (loss) | | 17,288,095 | |

| Change in unrealized appreciation (depreciation) | | 1,512,116 | |

| |

| |

| NET REALIZED AND UNREALIZED | | | |

| GAIN (LOSS) ON INVESTMENTS | | 18,800,211 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 19,088,777 | |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 16

| | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | SIX MONTHS ENDED | | | YEAR ENDED | |

| | | MARCH

31, | | | SEPTEMBER 30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2013 | | | 2012 | |

| Operations: | | | | | | |

| Net investment income | $ | 288,566 | | $ | 1,450,692 | |

| Net realized gain (loss) | | 17,288,095 | | | 2,290,129 | |

| Change in unrealized appreciation (depreciation) | | 1,512,116 | | | 26,719,904 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 19,088,777 | | | 30,460,725 | |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (1,239,153 | ) | | (231,181 | ) |

| Class C shares | | (21,918 | ) | | — | |

| Class I shares | | (484,645 | ) | | (317,661 | ) |

| Net realized gain: | | | | | | |

| Class A shares | | (2,586,265 | ) | | — | |

| Class B shares | | (38,354 | ) | | — | |

| Class C shares | | (288,508 | ) | | — | |

| Class I shares | | (707,515 | ) | | — | |

| Total distributions | | (5,366,358 | ) | | (548,842 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 6,819,223 | | | 10,573,719 | |

| Class B shares | | 4,949 | | | 27,875 | |

| Class C shares | | 361,571 | | | 756,259 | |

| Class I shares | | 3,129,150 | | | 6,361,024 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 3,585,262 | | | 212,545 | |

| Class B shares | | 36,506 | | | — | |

| Class C shares | | 261,891 | | | — | |

| Class I shares | | 1,105,442 | | | 317,661 | |

| Redemption fees: | | | | | | |

| Class A shares | | 72 | | | 92 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (8,669,696 | ) | | (18,929,423 | ) |

| Class B shares | | (276,337 | ) | | (1,235,717 | ) |

| Class C shares | | (763,275 | ) | | (1,696,666 | ) |

| Class I shares | | (5,560,639 | ) | | (3,695,176 | ) |

| Total capital share transactions | | 34,119 | | | (7,307,807 | ) |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | 13,756,538 | | | 22,604,076 | |

| |

| |

| NET ASSETS | | | | | | |

| Beginning of period | | 132,673,525 | | | 110,069,449 | |

| End of period (including distributions in excess of net | | | | | | |

| investment income and undistributed net investment income | | | | | | |

| of $435,751 and $1,021,399, respectively) | $ | 146,430,063 | | $ | 132,673,525 | |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

| | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | SIX MONTHS ENDED | | YEAR ENDED | |

| | MARCH 31, | | SEPTEMBER 30, | |

| CAPITAL SHARE ACTIVITY | 2013 | | 2012 | |

| Shares sold: | | | | |

| Class A shares | 347,248 | | 591,192 | |

| Class B shares | 249 | | 1,584 | |

| Class C shares | 19,666 | | 44,571 | |

| Class I shares | 152,196 | | 350,694 | |

| Reinvestment of distributions: | | | | |

| Class A shares | 193,984 | | 12,517 | |

| Class B shares | 2,027 | | — | |

| Class C shares | 15,188 | | — | |

| Class I shares | 57,733 | | 18,162 | |

| Shares redeemed: | | | | |

| Class A shares | (447,216 | ) | (1,057,872 | ) |

| Class B shares | (14,456 | ) | (70,728.00 | ) |

| Class C shares | (41,753 | ) | (101,484 | ) |

| Class I shares | (262,481 | ) | (198,820 | ) |

| Total capital share activity | 22,385 | | (410,184 | ) |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 18

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert Small Cap Fund (the “Fund”), a series of Calvert Impact Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert Impact Fund, Inc. is comprised of three separate series. The operations of each series are accounted for separately. The Fund offers four classes of shares - Classes A, B, C, and I. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived for certain other institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each Class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges, and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 19

measurement date. These inputs are summarized in the three broad levels listed below: Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows: Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 20

relevant information for the investment to determine the fair value of the investment. When more appropriate, the fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At March 31, 2013, securities valued at $646,653 or 0.4% of net assets, were fair valued in good faith under the direction of the Board.

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2013:

| | VALUATION INPUTS |

| INVESTMENTS IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Equity securities* | $144,310,255 | — | — | $144,310,255 |

| Other debt obligations | — | $2,165,308 | — | 2,165,308 |

| TOTAL | $144,310,255 | $2,165,308 | — | $146,475,563 |

*For further breakdown of equity securities by industry, please refer to the Statement of Net Assets.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 21

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase (within seven days for Class I shares). The redemption fee is accounted for as an addition to paid-in capital and is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Expense Offset Arrangement: The Fund had an arrangement with the custodian bank whereby the custodian’s fees may have been paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits were used to reduce the Fund’s expenses. This arrangement was suspended on January 1, 2013, until further notice, due to low interest rates. Such a deposit arrangement was an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly, of .70% of the average daily net assets. Under the terms of the agreement, $86,499 was payable at period end. In addition, $89,897 was payable at period end for operating expenses paid by the Advisor during March 2013.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 22

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2014. The contractual expense cap is 1.69%, 3.19%, 2.69%, and .92% for Class A, B, C, and I, respectively. For the purpose of these expense limits, operating expenses do not include interest expense, brokerage commissions, taxes, or extraordinary expenses. This expense limitation does not limit acquired fund fees and expenses, if any. To the extent that any expense offset credits were earned, the Advisor’s obligation under the contractual limitation may have been reduced and the Advisor may have benefited from the expense offset arrangement.

Calvert Investment Administrative Services, Inc., an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .25% for Classes A, B, and C shares and .10% for Class I shares based on the average daily net assets. Under the terms of the agreement, $27,335 was payable at period end.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted Distribution Plans that permit the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .35%, 1.00%, and 1.00% annually of average daily net assets of Class A, B, and C shares, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly, of .25%, 1.00%, and 1.00% of average daily net assets of Class A, B, and C, respectively. Class I shares do not have Distribution Plan expenses. Under the terms of the agreement, $32,668 was payable at period end.

CID received $9,999 as its portion of the commissions charged on sales of Class A shares for the six months ended March 31, 2013.

Calvert Investment Services, Inc. (“CIS”), an affiliate of the Advisor, acts as shareholder servicing agent for the Fund. For its services, CIS received a fee of $39,271 for the six months ended March 31, 2013. Under the terms of the agreement, $6,551 was payable at period end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

The Fund invests in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c) (3) non-profit organization that receives in-kind support from Calvert and its subsidiaries. The Fund has received an exemptive order from the Securities and Exchange Commission permitting the Fund to make investments in these notes under certain conditions.

Each Director of the Funds who is not an employee of the Advisor or its affiliates receives an annual retainer of $48,000 plus a meeting fee of $3,000 for each Board meeting attended. Additional fees of up to $5,000 annually may be paid to the Board chair and Committee chairs ($10,000 for the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Director’s fees are allocated to each of the funds served.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 23

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the period, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $104,074,928 and $102,837,220, respectively.

| CAPITAL LOSS CARRYFORWARDS | | |

| EXPIRATION DATE | | |

| 30-Sep-16 | ($9,134,808 | ) |

| 30-Sep-17 | (3,426,646 | ) |

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred in taxable years beginning after December 22, 2010 can be carried forward for an unlimited period. These losses are required to be utilized prior to the losses incurred in pre-enactment taxable years. Losses incurred in pre-enactment taxable years can be utilized until expiration.

As of March 31, 2013, the tax basis components of unrealized appreciation/(depreciation) and the federal tax cost were as follows:

| Unrealized appreciation | $25,005,036 | |

| Unrealized (depreciation) | (1,815,598 | ) |

| Net unrealized appreciation/(depreciation) | $23,189,438 | |

| Federal income tax cost of investments | $123,286,125 | |

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings under the committed facility bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .11% per annum is incurred on the unused portion of the committed facility, which is allocated to all participating funds. The Fund had no loans outstanding pursuant to this line of credit at March 31, 2013. For the six months ended March 31, 2013, borrowings by the Fund under the agreement were as follows:

| | WEIGHTED | | MONTH OF |

| AVERAGE | AVERAGE | MAXIMUM | MAXIMUM |

| DAILY | INTEREST | AMOUNT | AMOUNT |

| BALANCE | RATE | BORROWED | BORROWED |

| $34,027 | 1.45% | $2,356,583 | March 2013 |

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 24

NOTE E - SUBSEQUENT EVENTS

In preparing the financial statements as of March 31, 2013, no subsequent events or transactions occurred that would have required recognition or disclosure in these financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 25

| | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | PERIODS ENDED |

| MARCH 31, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS A SHARES | 2013 | (z) | 2012 | (z) | 2011 | (z) |

| Net asset value, beginning | $19.36 | | $15.15 | | $15.55 | |

| Income from investment operations: | | | | | | |

| Net investment income | .03 | | .20 | | .02 | |

| Net realized and unrealized gain (loss) | 2.70 | | 4.05 | | (.42 | ) |

| Total from investment operations | 2.73 | | 4.25 | | (.40 | ) |

| Distributions from: | | | | | | |

| Net investment income | (.25 | ) | (.04 | ) | — | |

| Net realized gain | (.54 | ) | — | | — | |

| Total distributions | (.79 | ) | (.04 | ) | — | |

| Total increase (decrease) in net asset value | 1.94 | | 4.21 | | (.40 | ) |

| Net asset value, ending | $21.30 | | $19.36 | | $15.15 | |

| |

| Total return* | 14.75 | % | 28.12 | % | (2.56 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income | .35 | % (a) | 1.13 | % | .13 | % |

| Total expenses | 1.72 | % (a) | 1.78 | % | 1.81 | % |

| Expenses before offsets | 1.69 | % (a) | 1.69 | % | 1.69 | % |

| Net expenses | 1.69 | % (a) | 1.69 | % | 1.69 | % |

| Portfolio turnover | 77 | % | 3 | % | 9 | % |

| Net assets, ending (in thousands) | $106,698 | | $95,189 | | $81,374 | |

| |

| |

| | | | YEARS ENDED | | | |

| | SEPTEMBER 30, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS A SHARES | 2010 | | 2009 | | 2008 | |

| Net asset value, beginning | $14.14 | | $15.61 | | $18.95 | |

| Income from investment operations: | | | | | | |

| Net investment income (loss) | (.06 | ) | (.02 | ) | (.04 | ) |

| Net realized and unrealized gain (loss) | 1.47 | | (1.45 | ) | (3.30 | ) |

| Total from investment operations | 1.41 | | (1.47 | ) | (3.34 | ) |

| Total increase (decrease) in net asset value | 1.41 | | (1.47 | ) | (3.34 | ) |

| Net asset value, ending | $15.55 | | $14.14 | | $15.61 | |

| |

| Total return* | 9.97 | % | (9.42 | %) | (17.63 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income (loss) | (.35 | %) | (.18 | %) | (.21 | %) |

| Total expenses | 1.94 | % | 2.09 | % | 1.88 | % |

| Expenses before offsets | 1.69 | % | 1.70 | % | 1.70 | % |

| Net expenses | 1.69 | % | 1.69 | % | 1.69 | % |

| Portfolio turnover | 174 | % | 61 | % | 62 | % |

| Net assets, ending (in thousands) | $34,763 | | $34,051 | | $31,035 | |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 26

| | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | PERIODS ENDED |

| MARCH 31, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS B SHARES | 2013 | (z) | 2012 | (z) | 2011 | (z)# |

| Net asset value, beginning | $18.89 | | $14.97 | | $16.81 | |

| Income from investment operations: | | | | | | |

| Net investment income (loss) | (.11 | ) | (0.05 | ) | (.21 | ) |

| Net realized and unrealized gain (loss) | 2.64 | | 3.97 | | (1.63 | ) |

| Total from investment operations | 2.53 | | 3.92 | | (1.84 | ) |

| Distributions from: | | | | | | |

| Net realized gain | (.54 | ) | — | | — | |

| Total distributions | (.54 | ) | — | | — | |

| Total increase (decrease) in net asset value | 1.99 | | 3.92 | | (1.84 | ) |

| Net asset value, ending | $20.88 | | $18.89 | | $14.97 | |

| |

| Total return* | 13.82 | % | 26.19 | % | (10.95 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income (loss) | (1.13 | %)(a) | (.31 | %) | (1.38 | %) (a) |

| Total expenses | 3.65 | % (a) | 3.50 | % | 3.46 | % (a) |

| Expenses before offsets | 3.19 | % (a) | 3.19 | % | 3.19 | % (a) |

| Net expenses | 3.19 | % (a) | 3.19 | % | 3.19 | % (a) |

| Portfolio turnover | 77 | % | 3 | % | 9 | %** |

| Net assets, ending (in thousands) | $1,348 | | $1,449 | | $2,183 | |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 27

| | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | PERIODS ENDED |

| MARCH 31, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS C SHARES | 2013 | (z) | 2012 | (z) | 2011 | (z) |

| Net asset value, beginning | $18.08 | | $14.25 | | $14.77 | |

| Income from investment operations: | | | | | | |

| Net investment income (loss) | (.04 | ) | .03 | | (.15 | ) |

| Net realized and unrealized gain (loss) | 2.52 | | 3.80 | | (.37 | ) |

| Total investment operations | 2.48 | | 3.83 | | (.52 | ) |

| Distributions from: | | | | | | |

| Net investment income | (.04 | ) | — | | — | |

| Net realized gain | (.54 | ) | — | | — | |

| Total distributions | (.58 | ) | — | | — | |

| Total increase (decrease) in net asset value | 1.90 | | 3.83 | | (.52 | ) |

| Net asset value, ending | $19.98 | | $18.08 | | $14.25 | |

| |

| Total return* | 14.20 | % | 26.88 | % | (3.52 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income (loss) | (.51 | %) (a) | .19 | % | (.87 | %) |

| Total expenses | 2.55 | % (a) | 2.64 | % | 2.74 | % |

| Expenses before offsets | 2.55 | % (a) | 2.64 | % | 2.69 | % |

| Net expenses | 2.55 | % (a) | 2.64 | % | 2.69 | % |

| Portfolio turnover | 77 | % | 3 | % | 9 | % |

| Net assets, ending (in thousands) | $10,811 | | $9,907 | | $8,618 | |

| |

| |

| | | | YEARS ENDED | | | |

| | SEPTEMBER 30, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS C SHARES | 2010 | | 2009 | | 2008 | |

| Net asset value, beginning | $13.55 | | $15.08 | | $18.50 | |

| Income from investment operations: | | | | | | |

| Net investment income (loss) | (.15 | ) | (.12 | ) | (.20 | ) |

| Net realized and unrealized gain (loss) | 1.37 | | (1.41 | ) | (3.22 | ) |

| Total from investment operations | 1.22 | | (1.53 | ) | (3.42 | ) |

| Total increase (decrease) in net asset value | 1.22 | | (1.53 | ) | (3.42 | ) |

| Net asset value, ending | $14.77 | | $13.55 | | $15.08 | |

| |

| Total return* | 9.00 | % | (10.15 | %) | (18.49 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income (loss) | (1.28 | %) | (1.17 | %) | (1.21 | %) |

| Total expenses | 3.17 | % | 3.64 | % | 3.22 | % |

| Expenses before offsets | 2.69 | % | 2.70 | % | 2.70 | % |

| Net expenses | 2.69 | % | 2.69 | % | 2.69 | % |

| Portfolio turnover | 174 | % | 61 | % | 62 | % |

| Net assets, ending (in thousands) | $2,583 | | $1,889 | | $1,735 | |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 28

| | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | PERIODS ENDED |

| MARCH 31, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS I SHARES | 2013 | (z) | 2012 | (z) | 2011 | (z) |

| Net asset value, beginning | $20.06 | | $15.80 | | $16.14 | |

| Income from investment operations: | | | | | | |

| Net investment income | .11 | | .35 | | .17 | |

| Net realized and unrealized gain (loss) | 2.79 | | 4.21 | | (.45 | ) |

| Total from investment operations | 2.90 | | 4.56 | | (.28 | ) |

| Distributions from: | | | | | | |

| Net investment income | (.36 | ) | (.30 | ) | (.06 | ) |

| Net realized gain | (.54 | ) | — | | — | |

| Total distributions | (.90 | ) | (.30 | ) | (.06 | ) |

| Total increase (decrease) in net asset value | 2.00 | | 4.26 | | (.34 | ) |

| Net asset value, ending | $22.06 | | $20.06 | | $15.80 | |

| |

| Total return* | 15.16 | % | 29.11 | % | (1.81 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income | 1.14 | % (a) | 1.88 | % | .90 | % |

| Total expenses | 1.00 | % (a) | 1.03 | % | 1.08 | % |

| Expenses before offsets | .92 | % (a) | .92 | % | .92 | % |

| Net expenses | .92 | % (a) | .92 | % | .92 | % |

| Portfolio turnover | 77 | % | 3 | % | 9 | % |

| Net assets, ending (in thousands) | $27,573 | | $26,129 | | $17,895 | |

| |

| |

| | | | YEARS ENDED | | | |

| | SEPTEMBER 30, | | SEPTEMBER 30, | | SEPTEMBER 30, | |

| CLASS I SHARES | 2010 | | 2009 | | 2008 | |

| Net asset value, beginning | $14.56 | | $15.94 | | $19.31 | |

| Income from investment operations: | | | | | | |

| Net investment income | .08 | | .08 | | .08 | |

| Net realized and unrealized gain (loss) | 1.50 | | (1.46 | ) | (3.35 | ) |

| Total from investment operations | 1.58 | | (1.38 | ) | (3.27 | ) |

| Distributions from: | | | | | | |

| Net investment income | — | | — | | (.10 | ) |

| Total distributions | — | | — | | (.10 | ) |

| Total increase (decrease) in net asset value | 1.58 | | (1.38 | ) | (3.37 | ) |

| Net asset value, ending | $16.14 | | $14.56 | | $15.94 | |

| |

| Total return* | 10.85 | % | (8.66 | %) | (17.01 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income | .44 | % | .60 | % | .58 | % |

| Total expenses | 1.16 | % | 1.16 | % | 1.11 | % |

| Expenses before offsets | .92 | % | .93 | % | .93 | % |

| Net expenses | .92 | % | .92 | % | .92 | % |

| Portfolio turnover | 174 | % | 61 | % | 62 | % |

| Net assets, ending (in thousands) | $12,001 | | $12,428 | | $14,450 | |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 29

A Total expenses do not reflect amounts reimbursed and/or waived by the Advisor or reductions from expense offset arrangements. Expenses before offsets reflect expenses after reimbursement and/or waiver by the Advisor but prior to reductions from expense offset arrangements. Net expenses are net of all reductions and represent the net expenses paid by the Fund.

* Total return is not annualized for periods of less than one year and does not reflect deduction of any front-end or deferred sales charge.

** Portfolio turnover is not annualized for periods of less than one year.

# From November 29, 2010 inception.

(a) Annualized.

(z) Per share figures are calculated using the Average Shares Method.

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 30

EXPLANATION OF FINANCIAL TABLES

SCHEDULE OF INVESTMENTS

The Schedule of Investments is a snapshot of all securities held in the fund at their market value, on the last day of the reporting period. Securities are listed by asset type (e.g., common stock, corporate bonds, U.S. government obligations) and may be further broken down into sub-groups and by industry classification.

STATEMENT OF ASSETS AND LIABILITIES

The Statement of Assets and Liabilities is often referred to as the fund’s balance sheet. It lists the value of what the fund owns, is due and owes on the last day of the reporting period. The fund’s assets include the market value of securities owned, cash, receivables for securities sold and shareholder subscriptions, and receivables for dividends and interest payments that have been earned, but not yet received. The fund’s liabilities include payables for securities purchased and shareholder redemptions, and expenses owed but not yet paid. The statement also reports the fund’s net asset value (NAV) per share on the last day of the reporting period. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. This statement is accompanied by a Schedule of Investments. Alternatively, if certain conditions are met, a Statement of Net Assets may be presented in lieu of this statement and the Schedule of Investments.

STATEMENT OF NET ASSETS

The Statement of Net Assets provides a detailed list of the fund’s holdings, including each security’s market value on the last day of the reporting period. The Statement of Net Assets includes a Schedule of Investments. Other assets are added and other liabilities subtracted from the investments total to calculate the fund’s net assets. Finally, net assets are divided by the outstanding shares of the fund to arrive at its share price, or Net Asset Value (NAV) per share.

At the end of the Statement of Net Assets is a table displaying the composition of the fund’s net assets. Paid in Capital is the money invested by shareholders and represents the bulk of net assets. Undistributed Net Investment Income and Accumulated Net Realized Gains usually approximate the amounts the fund had available to distribute to shareholders as of the statement date. Accumulated Realized Losses will appear as negative balances. Unrealized Appreciation (Depreciation) is the difference between the market value of the fund’s investments and their cost, and reflects the gains (losses) that would be realized if the fund were to sell all of its investments at their statement-date values.

STATEMENT OF OPERATIONS

The Statement of Operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. Investment income includes dividends earned from stocks and interest earned from interest-bearing securities in the fund. Expenses

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 31

incurred in operating the fund include the advisory fee paid to the investment advisor, administrative services fees, distribution plan expenses (if applicable), transfer agent fees, shareholder servicing expenses, custodial, legal, and audit fees, and the printing and postage expenses related to shareholder reports. Expense offsets (fees paid indirectly) are also shown. Credits earned from offset arrangements are used to reduce the fund’s expenses. This statement also shows net gains (losses) realized on the sale of investments and the increase or decrease in the unrealized appreciation (depreciation) on investments held during the period.

STATEMENT OF CHANGES IN NET ASSETS

The Statement of Changes in Net Assets shows how the fund’s total net assets changed during the two most recent reporting periods. Changes in the fund’s net assets are attributable to investment operations, distributions and capital share transactions.

The Operations section of the report summarizes information detailed in the Statement of Operations. The Distribution section shows the dividend and capital gain distributions made to shareholders. The amounts shown as distributions in this section may not match the net investment income and realized gains amounts shown in the Operations section because distributions are determined on a tax basis and certain investments or transactions may be treated differently for financial statement and tax purposes. The Capital Share Transactions section shows the amount shareholders invested in the fund, either by purchasing shares or by reinvesting distributions, and the amounts redeemed. The corresponding numbers of shares issued, reinvested and redeemed are shown at the end of the report.

FINANCIAL HIGHLIGHTS

The Financial Highlights table provides a per-share breakdown per class of the components that affect the fund’s net asset value for current and past reporting periods. The table provides total return, total distributions, expense ratios, portfolio turnover and net assets for the applicable period. Total return is a measure of a fund’s performance that encompasses all elements of return: dividends, capital gain distributions and changes in net asset value. Total return is the change in value of an investment over a given period, assuming reinvestment of any dividends and capital gain distributions, expressed as a percentage of the initial investment. Total distributions include distributions from net investment income and net realized gains. Long-term gains are earned on securities held in the fund more than one year. Short-term gains, on the sale of securities held less than one year, are treated as ordinary dividend income for tax purposes. The expense ratio is a fund’s cost of doing business, expressed as a percentage of net assets. These expenses directly reduce returns to shareholders. Portfolio turnover measures the trading activity in a fund’s investment portfolio –how often securities are bought and sold by a fund. Portfolio turnover is affected by market conditions, changes in the size of the fund, the nature of the fund’s investments and the investment style of the portfolio manager.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 32

PROXY VOTING

The Proxy Voting Guidelines of the Calvert Funds that the Fund uses to determine how to vote proxies relating to portfolio securities are provided as an Appendix to the Fund’s Statement of Additional Information. The Statement of Additional Information can be obtained free of charge by calling the Fund at 1-800-368-2745, by visiting the Calvert website at www.calvert.com; or by visiting the SEC’s website at www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at www.calvert.com and on the SEC’s website at www.sec.gov.

AVAILABILITY OF QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

BASIS FOR BOARD’S APPROVAL OF INVESTMENT ADVISORY CONTRACT

At a meeting held on December 11, 2012, the Board of Directors, and by a separate vote, the disinterested Directors, approved the continuance of the Investment Advisory Agreement between Calvert Impact Fund, Inc. and the Advisor with respect to the Fund.

In evaluating the Investment Advisory Agreement, the Board considered, a variety of information relating to the Fund and the Advisor. The disinterested Directors reviewed a report prepared by the Advisor regarding various services provided to the Fund by the Advisor and its affiliates. Such report included, among other data, information regarding the Advisor’s personnel and the Advisor’s revenue and cost of providing services to the Fund, and a separate report prepared by an independent third party, which provided a statistical analysis comparing the Fund’s investment performance, expenses, and fees to comparable mutual funds.

The disinterested Directors were separately represented by independent legal counsel with respect to their consideration of the reapproval of the Investment Advisory Agreement. Prior to voting, the disinterested Directors reviewed the proposed continuance of the Investment Advisory Agreement with management and also met in private sessions with their counsel at which no representatives of management were present.

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 33

In the course of its deliberations regarding the Investment Advisory Agreement, the Board considered the following factors, among others: the nature, extent and quality of the services provided by the Advisor, including the personnel providing such services; the Advisor’s financial condition; the level and method of computing the Fund’s advisory fee; comparative performance, fee and expense information for the Fund; the profitability of the Calvert Family of Funds to the Advisor and its affiliates; the allocation of the Fund’s brokerage, including the Advisor’s process for monitoring “best execution”; the direct and indirect benefits, if any, derived by the Advisor and its affiliates from their relationship with the Fund; the effect of the Fund’s growth and size on the Fund’s performance and expenses; the affiliated distributor’s process for monitoring sales load breakpoints; the Advisor’s compliance programs and policies; the Advisor’s performance of substantially similar duties for other funds; and any possible conflicts of interest.

In considering the nature, extent and quality of the services provided by the Advisor under the Investment Advisory Agreement, the Board reviewed information provided by the Advisor relating to its operations and personnel, including, among other information, biographical information on the Advisor’s investment, supervisory and professional staff and descriptions of its organizational and management structure. The Board also took into account similar information provided periodically throughout the previous year by the Advisor as well as the Board’s familiarity with the Advisor’s senior management through Board of Directors’ meetings, discussions and other reports. The Board considered the Advisor’s management style and its performance in employing its investment strategies as well as its current level of staffing and overall resources. The Board also noted that it reviewed on a quarterly basis information regarding the Advisor’s compliance with applicable policies and procedures, including those related to personal investing. The Advisor’s administrative capabilities, including its ability to supervise the other service providers for the Fund, were also considered. The Board observed that the scope of services provided by the Advisor generally had expanded over time as a result of regulatory, market and other changes. The Board also took into account the environmental, social, sustainability and governance research and analysis provided by the Advisor to the Fund. The Board concluded that it was satisfied with the nature, extent and quality of services provided to the Fund by the Advisor under the Investment Advisory Agreement.

In considering the Fund’s performance, the Board noted that it reviewed on a quarterly basis detailed information about the Fund’s performance results, portfolio composition and investment strategies. In addition, the Board took into account overall financial market conditions. The Board also reviewed various comparative data provided to it in connection with its consideration of the renewal of the Investment Advisory Agreement, including, among other information, a comparison of the Fund’s total return with its Lipper index and with that of other mutual funds deemed to be in its peer group by an independent third party in its report. This comparison indicated that the Fund performed below the median of its peer group for the one-, three- and five-year periods ended June 30, 2012. The data also indicated that the Fund underperformed its Lipper index for the one-, three- and five-year periods ended June 30, 2012. The Board took into account management’s discussion of the Fund’s management style and recent improved performance. Based upon its review, the Board concluded that appropriate

www.calvert.com CALVERT SMALL CAP FUND SEMI-ANNUAL REPORT (UNAUDITED) 34

action was being taken with respect to the Fund’s performance.