UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2020

Date of Reporting Period

| Item 1. | Reports to Stockholders |

Calvert

Green Bond Fund

Annual Report

September 30, 2020

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (calvert.com/prospectus), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you are a direct investor, you may elect to receive shareholder reports and other communications from the Fund electronically by signing up for e-Delivery at calvert.com. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you are a direct investor, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-368-2745. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Calvert funds held directly or to all funds held through your financial intermediary, as applicable.

E-Delivery Sign-Up - Details Inside

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund and the other funds it manages. Accordingly, neither the Fund nor the adviser is subject to CFTC regulation.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-368-2745.

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account with the Calvert funds, click on Login to access your Account and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps.

Note: If your shares are not held directly with the Calvert funds but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Annual Report September 30, 2020

Calvert

Green Bond Fund

Calvert

Green Bond Fund

September 30, 2020

Management's Discussion of Fund Performance†

Economic and Market Conditions

As the 12-month period opened on October 1, 2019, interest rates were trending modestly upward amid better-than-expected U.S. employment reports and cautious optimism about a détente in U.S.-China trade relations. Interest rates continued to move upward through the end of 2019.

In January 2020, however, news of the novel coronavirus outbreak in China began to raise investor concerns and led to a “flight to quality” that sparked a brief fixed-income market rally. As the virus turned into a global pandemic in February and March, it ended the longest-ever period of U.S. economic expansion and brought about a global economic slowdown. Credit markets along with equity markets declined in value amid unprecedented volatility.

In response, the U.S. Federal Reserve (the Fed) announced two emergency rate cuts in March 2020 — lowering the federal funds rate to 0.00%-0.25% — along with other measures designed to shore up credit markets. At its July meeting, the Fed provided additional reassurances that it would maintain rates close to zero percent for the foreseeable future and use all tools at its disposal to support the U.S. economy. These moves helped calm the markets and initiated a new fixed-income rally that began in April and lasted through most of the summer.

Midway through August, however, the fixed-income rally stalled as investors grew concerned about a resurgence of the coronavirus and the consequences for the nascent economic recovery. For the rest of the period, fixed-income prices were flat to down, driven in part by Congress’ failure to pass another stimulus bill — following the expiration of support from the federal CARES Act passed in March 2020, which boosted unemployment benefits and helped businesses keep workers employed. As the period ended, the U.S. Senate and House were deadlocked on an additional stimulus bill, and coronavirus cases were rising.

For the period as a whole, most fixed-income asset classes delivered positive returns, with strong gains from April through mid-August 2020, which compensated for losses in March. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of the U.S. bond market, returned 6.98% for the period. As corporate bonds benefited from Fed policy — which included purchases of corporate investment-grade debt and high yield exchange-traded funds — the Bloomberg Barclays U.S. Corporate Bond Index returned 7.90% for the period.

High yield bonds, which had fared poorly early in the period, outperformed investment-grade bonds in the second half of the period as investors searched for yield in a low-rate environment. For the period as a whole, the Bloomberg Barclays U.S. Corporate High Yield Index returned 3.25%.

Fund Performance

For the 12-month period ended September 30, 2020, Calvert Green Bond Fund (the Fund) returned 5.27% for Class A shares at net asset value, outperforming its benchmark, the ICE BofA Green Bond Index - Hedged USD (the Index), which returned 3.80%.

The Fund's duration and yield-curve positioning were leading contributors to Index-relative performance during the period. The Fund's longer-than-Index USD (U.S. dollar) duration positioning was especially beneficial as the COVID-19 pandemic made riskier assets less favorable among investors and helped drive down U.S. interest rates to record lows during the first quarter of 2020. The use of derivatives (U.S. Treasury futures) detracted from the Fund's Index-relative performance. The Fund’s overweight exposure to investment-grade corporate bonds and its out-of-Index allocation to high yield securities were significant contributors during the full period. The Fund’s underweight exposure to government-related securities was also beneficial.

The Fund’s sector allocation positioning overall, however, detracted from Index-relative performance during the period. In particular, an underweight exposure to foreign government securities and an out-of-Index allocation to commercial mortgage-backed securities detracted from performance. Security selection within government-related issues also detracted from returns during the period.

In the first quarter of the period, green bond issuance approached record-breaking levels, and then fell off in the following two quarters in the midst of the COVID-19 pandemic. In the final quarter of the period, issuance began to recover.

With additional U.S. fiscal stimulus in doubt at the end of the period, the Fund exited or trimmed its positions in consumer-focused securitized credit as valuations rebounded. The Fund maintained an out-of-Index allocation to asset-backed securities, favoring areas that the Fund believed were more attractive in long-term fundamentals, such as renewable energy. At period-end, the Fund was underweight interest rate duration.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Green Bond Fund

September 30, 2020

Performance

Portfolio Managers Vishal Khanduja, CFA and Brian S. Ellis, CFA, each of Calvert Research and Management

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Since

Inception |

| Class A at NAV | 10/31/2013 | 10/31/2013 | 5.27% | 3.89% | 3.42% |

| Class A with 3.75% Maximum Sales Charge | — | — | 1.32 | 3.10 | 2.86 |

| Class I at NAV | 10/31/2013 | 10/31/2013 | 5.53 | 4.23 | 3.77 |

| Class R6 at NAV | 02/01/2019 | 10/31/2013 | 5.58 | 4.25 | 3.79 |

|

| ICE BofA Green Bond Index - Hedged USD | — | — | 3.80% | 4.85% | 4.47% |

| % Total Annual Operating Expense Ratios3 | Class A | Class I | Class R6 |

| Gross | 0.86% | 0.61% | 0.56% |

| Net | 0.73 | 0.48 | 0.43 |

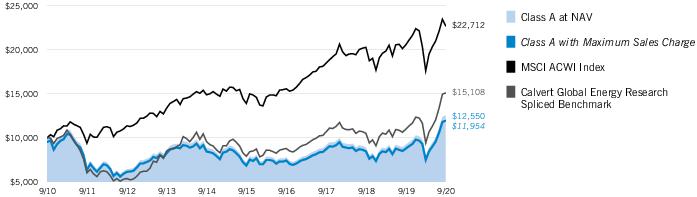

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class I | $250,000 | 10/31/2013 | $322,993 | N.A. |

| Class R6 | $1,000,000 | 10/31/2013 | $1,293,515 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Green Bond Fund

September 30, 2020

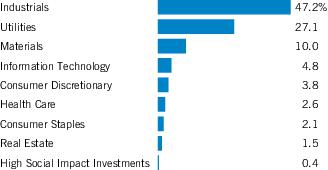

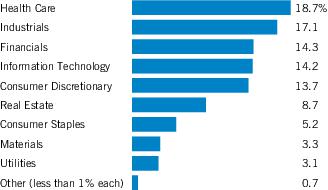

Asset Allocation (% of total investments)

| Country Allocation (% of total investments) | |

| United States | 73.3% |

| Canada | 5.1 |

| Netherlands | 4.6 |

| France | 4.6 |

| Luxembourg | 1.7 |

| Italy | 1.7 |

| Finland | 1.5 |

| South Korea | 1.2 |

| Sweden | 1.1 |

| Other (less than 1.0% each) | 5.2 |

| Total | 100.0% |

Credit Quality (% of bond holdings)*

* Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above.

See Endnotes and Additional Disclosures in this report.

Calvert

Green Bond Fund

September 30, 2020

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | ICE BofA Green Bond Index - Hedged USD tracks the performance of securities issued for qualified “green” purposes. Qualifying bonds must have a clearly designated use of proceeds that is solely applied toward projects or activities that promote climate change mitigation or adaptation or other environmental sustainability purposes. ICE® BofA® indices are not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofA® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R6 is linked to Class I. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. Performance presented in the Financial Highlights included in the financial statements is not linked. |

| | Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/21. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Fund profile subject to change due to active management. |

| | Additional Information |

| | Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. Bloomberg Barclays U.S. Corporate Bond Index measures the performance of investment-grade U.S. corporate securities with a maturity of one year or more. Bloomberg Barclays U.S. Corporate High Yield Index measures USD-denominated, non-investment grade corporate securities. |

| | Duration is a measure of the expected change in price of a bond — in percentage terms — given a one percent change in interest rates, all else being constant. Securities with lower durations tend to be less sensitive to interest rate changes. |

| | Yield curve is a graphical representation of the yields offered by bonds of various maturities. The yield curve flattens when long-term interest rates fall and/or short-term interest rates increase, and the yield curve steepens when long-term interest rates increase and/or short-term interest rates fall. |

Calvert

Green Bond Fund

September 30, 2020

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2020 to September 30, 2020).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(4/1/20) | Ending

Account Value

(9/30/20) | Expenses Paid

During Period*

(4/1/20 – 9/30/20) | Annualized

Expense

Ratio |

| Actual | | | | |

| Class A | $1,000.00 | $1,078.30 | $3.79 ** | 0.73% |

| Class I | $1,000.00 | $1,079.50 | $2.50 ** | 0.48% |

| Class R6 | $1,000.00 | $1,079.80 | $2.24 ** | 0.43% |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,021.35 | $3.69 ** | 0.73% |

| Class I | $1,000.00 | $1,022.60 | $2.43 ** | 0.48% |

| Class R6 | $1,000.00 | $1,022.85 | $2.17 ** | 0.43% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2020. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

Calvert

Green Bond Fund

September 30, 2020

| Asset-Backed Securities — 11.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| Helios Issuer, LLC: | | | |

| Series 2017-1A, Class C, 8.00%, 9/20/49(1) | $ | 5,443 | $ 5,389,138 |

| Series 2020-AA, Class A, 2.98%, 6/20/47(1) | | 6,051 | 6,311,028 |

| Mosaic Solar Loan Trust: | | | |

| Series 2018-1A, Class A, 4.01%, 6/22/43(1) | | 904 | 957,328 |

| Series 2019-1A, Class A, 4.37%, 12/21/43(1) | | 1,177 | 1,264,730 |

| Series 2019-2A, Class A, 2.88%, 9/20/40(1) | | 3,639 | 3,861,011 |

| Series 2019-2A, Class B, 3.28%, 9/20/40(1) | | 4,800 | 4,927,313 |

| Series 2019-2A, Class C, 4.35%, 9/20/40(1) | | 1,665 | 1,645,835 |

| Series 2020-1A, Class A, 2.10%, 4/20/46(1) | | 2,162 | 2,215,240 |

| Series 2020-1A, Class B, 3.10%, 4/20/46(1) | | 2,485 | 2,552,972 |

| Series 2020-2A, Class B, 2.21%, 8/20/46(1)(2) | | 1,350 | 1,330,631 |

| Mosaic Solar Loans LLC: | | | |

| Series 2017-1A, Class A, 4.45%, 6/20/42(1) | | 712 | 766,080 |

| Series 2017-2A, Class A, 3.82%, 6/22/43(1) | | 76 | 80,333 |

| RenewFund Receivables Trust, Series 2015-1, Class A, 3.51%, 4/15/25(1) | | 21 | 21,540 |

| SolarCity LMC Series I, LLC, Series 2013-1, Class A, 4.80%, 11/20/38(1) | | 165 | 161,564 |

| SolarCity LMC Series II, LLC, Series 2014-1, Class A, 4.59%, 4/20/44(1) | | 3,729 | 3,690,455 |

| SolarCity LMC Series III, LLC: | | | |

| Series 2014-2, Class A, 4.02%, 7/20/44(1) | | 2,992 | 3,023,140 |

| Series 2014-2, Class B, 5.44%, 7/20/44(1) | | 170 | 165,417 |

| Spruce ABS Trust, Series 2016-E1, Class A, 4.32%, 6/15/28(1) | | 191 | 196,445 |

| Sunnova Helios II Issuer, LLC, Series 2018-1A, Class B, 7.71%, 7/20/48(1) | | 868 | 837,008 |

| Sunnova Sol Issuer, LLC, Series 2020-1A, Class A, 3.35%, 2/1/55(1) | | 2,985 | 3,022,803 |

| Sunrun Atlas Issuer, LLC, Series 2019-2, Class A, 3.61%, 2/1/55(1) | | 1,798 | 1,891,723 |

| Sunrun Callisto Issuer, LLC, Series 2015-1A, Class B, 5.38%, 7/20/45(1) | | 802 | 790,835 |

| Sunrun Xanadu Issuer, LLC, Series 2019-1A, Class A, 3.98%, 6/30/54(1) | | 2,225 | 2,289,786 |

| TES, LLC, Series 2017-1A, Class A, 4.33%, 10/20/47(1) | | 2,515 | 2,568,116 |

| Tesla Auto Lease Trust: | | | |

| Series 2018-B, Class A, 3.71%, 8/20/21(1) | | 1,187 | 1,197,646 |

| Series 2018-B, Class C, 4.36%, 10/20/21(1) | | 1,875 | 1,923,857 |

| Series 2019-A, Class A2, 2.13%, 4/20/22(1) | | 1,706 | 1,725,219 |

| Series 2019-A, Class A4, 2.20%, 11/21/22(1) | | 1,535 | 1,578,556 |

| Series 2019-A, Class B, 2.41%, 12/20/22(1) | | 3,270 | 3,360,467 |

| Series 2019-A, Class E, 5.48%, 5/22/23(1) | | 1,545 | 1,619,308 |

| Series 2020-A, Class A3, 0.68%, 12/20/23(1) | | 1,000 | 1,005,244 |

| Series 2020-A, Class C, 1.68%, 2/20/24(1) | | 2,000 | 2,021,797 |

| Security | Principal

Amount

(000's omitted) | Value |

| Tesla Auto Lease Trust: (continued) | | | |

| Series 2020-A, Class D, 2.33%, 2/20/24(1) | $ | 1,695 | $ 1,721,779 |

| Series 2020-A, Class E, 4.64%, 8/20/24(1) | | 973 | 1,010,415 |

| Vivint Solar Financing V LLC, Series 2018-1A, Class A, 4.73%, 4/30/48(1) | | 1,452 | 1,501,881 |

| Vivint Solar Financing VII, LLC, Series 2020-1A, Class A, 2.21%, 7/31/51(1) | | 3,285 | 3,309,808 |

Total Asset-Backed Securities

(identified cost $70,441,374) | | | $ 71,936,448 |

| Collateralized Mortgage-Backed Obligations — 9.0% |

| Security | Principal

Amount

(000's omitted) | Value |

| Federal Home Loan Mortgage Corp. Multifamily Structured Pass Through Certificates: | | | |

| Series KG02, Class A2, 2.412%, 8/25/29 | $ | 4,050 | $ 4,446,453 |

| Series KG03, Class A2, 1.297%, 6/25/30(3) | | 1,360 | 1,384,276 |

| Federal National Mortgage Association: | | | |

| Series 2017-M2, Class A1, 2.801%, 2/25/27(3) | | 318 | 328,740 |

| Series 2017-M13, Class A2, 2.939%, 9/25/27(3) | | 4,150 | 4,708,296 |

| Series 2018-M4, Class A2, 3.045%, 3/25/28(3) | | 4,167 | 4,770,002 |

| Series 2018-M8, Class A2, 3.325%, 6/25/28(3) | | 923 | 1,073,663 |

| Series 2018-M13, Class A2, 3.697%, 9/25/30(3) | | 2,420 | 2,964,855 |

| Series 2019-M1, Class A2, 3.555%, 9/25/28(3) | | 5,005 | 5,958,675 |

| Series 2019-M9, Class A2, 2.937%, 4/25/29 | | 2,455 | 2,780,779 |

| Series 2019-M22, Class A2, 2.522%, 8/25/29 | | 12,800 | 14,143,748 |

| Series 2020-M1, Class A2, 2.444%, 10/25/29 | | 7,842 | 8,479,134 |

| Series 2020-M20, Class A2, 1.435%, 10/25/29 | | 4,250 | 4,372,833 |

Total Collateralized Mortgage-Backed Obligations

(identified cost $50,567,317) | | | $ 55,411,454 |

| Security | Principal

Amount

(000's omitted)* | Value |

| Basic Materials — 1.2% | |

| LG Chem, Ltd.: | | | |

| 3.25%, 10/15/24(1) | | 1,550 | $ 1,670,452 |

| 3.625%, 4/15/29(1) | | 5,125 | 5,688,815 |

| | | | $ 7,359,267 |

7

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Schedule of Investments — continued

| Security | Principal

Amount

(000's omitted)* | Value |

| Communications — 1.7% | |

| Verizon Communications, Inc.: | | | |

| 1.50%, 9/18/30 | | 8,484 | $ 8,468,004 |

| 3.875%, 2/8/29 | | 1,480 | 1,752,667 |

| | | | $ 10,220,671 |

| Consumer, Cyclical — 0.3% | |

| Toyota Motor Credit Corp., 2.15%, 2/13/30 | | 1,500 | $ 1,583,142 |

| | | | $ 1,583,142 |

| Consumer, Non-cyclical — 3.9% | |

| Coca-Cola Femsa SAB de CV, 1.85%, 9/1/32 | | 3,470 | $ 3,482,266 |

| Conservation Fund (The), Green Bonds, 3.474%, 12/15/29 | | 2,345 | 2,536,557 |

| Kaiser Foundation Hospitals, 3.15%, 5/1/27 | | 1,208 | 1,354,413 |

| Koninklijke Philips NV, 0.50%, 5/22/26(4) | EUR | 9,350 | 11,234,205 |

| PepsiCo, Inc., 2.875%, 10/15/49 | | 5,200 | 5,598,104 |

| | | | $ 24,205,545 |

| Energy — 2.6% | |

| Hanwha Energy USA Holdings Corp., 2.375%, 7/30/22(1) | | 2,500 | $ 2,571,300 |

| TerraForm Power Operating, LLC: | | | |

| 4.75%, 1/15/30(1) | | 11,700 | 12,457,107 |

| 5.00%, 1/31/28(1) | | 867 | 950,709 |

| | | | $ 15,979,116 |

| Financial — 26.8% | |

| Alexandria Real Estate Equities, Inc., 4.00%, 1/15/24 | | 2,364 | $ 2,602,190 |

| Bank of America Corp.: | | | |

| 2.456% to 10/22/24, 10/22/25(5) | | 5,888 | 6,214,987 |

| 3.499% to 5/17/21, 5/17/22(5) | | 7,282 | 7,418,838 |

| Bank of Nova Scotia (The), 2.375%, 1/18/23 | | 6,600 | 6,879,374 |

| Boston Properties, L.P., 3.40%, 6/21/29 | | 2,700 | 2,942,241 |

| Citigroup, Inc.: | | | |

| 0.50%, 1/29/22(4) | EUR | 14,064 | 16,636,666 |

| 1.678% to 5/15/23, 5/15/24(5) | | 7,075 | 7,253,782 |

| Commonwealth Bank of Australia, 3.25%, 3/31/22 | AUD | 2,020 | 1,510,258 |

| Credit Agricole Corporate & Investment Bank S.A., 0.924%, (3 mo. USD LIBOR + 0.625%), 10/3/21(6) | | 9,556 | 9,556,205 |

| DBS Group Holdings Ltd., 0.865%, (3 mo. USD LIBOR + 0.62%), 7/25/22(1)(6) | | 3,640 | 3,649,528 |

| Digital Dutch Finco BV, 1.50%, 3/15/30(4) | EUR | 1,500 | 1,840,312 |

| Digital Euro Finco LLC, 2.50%, 1/16/26(4) | EUR | 8,700 | 11,218,641 |

| HAT Holdings I, LLC/HAT Holdings II, LLC: | | | |

| 3.75%, 9/15/30(1) | | 3,562 | 3,588,715 |

| 5.25%, 7/15/24(1) | | 11,000 | 11,484,550 |

| Security | Principal

Amount

(000's omitted)* | Value |

| Financial (continued) | |

| HAT Holdings I, LLC/HAT Holdings II, LLC: (continued) | | | |

| 6.00%, 4/15/25(1) | | 76 | $ 81,058 |

| ING Groep NV: | | | |

| 1.40% to 7/1/25, 7/1/26(1)(5) | | 7,600 | 7,697,339 |

| 4.625%, 1/6/26(1) | | 2,175 | 2,554,058 |

| JPMorgan Chase & Co., 0.653% to 9/16/23, 9/16/24(5)(7) | | 12,500 | 12,509,264 |

| Kimco Realty Corp., 2.70%, 10/1/30 | | 2,500 | 2,543,820 |

| Metropolitan Life Global Funding I, 0.95%, 7/2/25(1) | | 5,200 | 5,252,311 |

| Mitsubishi UFJ Financial Group, Inc., 2.527%, 9/13/23 | | 1,100 | 1,164,345 |

| National Australia Bank, Ltd., 3.625%, 6/20/23 | | 1,867 | 2,026,037 |

| PNC Financial Services Group, Inc. (The), 2.20%, 11/1/24 | | 8,000 | 8,481,593 |

| Prologis Euro Finance, LLC, 0.375%, 2/6/28 | EUR | 6,700 | 7,908,461 |

| Prologis, L.P., 1.25%, 10/15/30 | | 3,614 | 3,532,616 |

| Prudential Financial, Inc., 1.50%, 3/10/26(7) | | 2,000 | 2,085,638 |

| Regency Centers, L.P., 3.75%, 6/15/24 | | 1,500 | 1,596,052 |

| Royal Bank of Canada, 0.25%, 5/2/24(4) | EUR | 8,600 | 10,188,809 |

| Welltower, Inc., 2.70%, 2/15/27 | | 4,000 | 4,224,953 |

| | | | $ 164,642,641 |

| Government - Multinational — 4.6% | |

| Asian Development Bank: | | | |

| 1.875%, 8/10/22 | | 1,500 | $ 1,546,360 |

| 2.125%, 3/19/25 | | 750 | 808,236 |

| 2.375%, 8/10/27 | | 750 | 839,292 |

| 3.125%, 9/26/28 | | 800 | 951,523 |

| European Bank for Reconstruction & Development, 1.625%, 9/27/24 | | 2,000 | 2,101,237 |

| European Investment Bank: | | | |

| 1.00%, 11/14/42(4) | EUR | 3,400 | 4,845,877 |

| 2.375%, 5/24/27 | | 3,965 | 4,424,915 |

| 2.50%, 10/15/24 | | 1,000 | 1,088,059 |

| International Bank for Reconstruction & Development: | | | |

| 0.625%, 11/22/27 | EUR | 3,550 | 4,448,181 |

| 3.125%, 11/20/25 | | 4,150 | 4,710,671 |

| International Finance Corp., 2.125%, 4/7/26 | | 1,500 | 1,635,985 |

| Nordic Investment Bank, 2.25%, 9/30/21 | | 950 | 969,506 |

| | | | $ 28,369,842 |

| Industrial — 3.4% | |

| Johnson Controls International plc/Tyco Fire & Security Finance SCA, 1.75%, 9/15/30(7) | | 4,000 | $ 4,039,016 |

| Owens Corning, 3.95%, 8/15/29 | | 10,632 | 12,056,574 |

8

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Schedule of Investments — continued

| Security | Principal

Amount

(000's omitted)* | Value |

| Industrial (continued) | |

| Xylem, Inc.: | | | |

| 1.95%, 1/30/28 | | 3,400 | $ 3,549,973 |

| 2.25%, 1/30/31 | | 1,071 | 1,137,770 |

| | | | $ 20,783,333 |

| Technology — 1.7% | |

| Apple, Inc., 0.50%, 11/15/31 | EUR | 7,238 | $ 8,804,862 |

| NXP B.V./NXP Funding, LLC NXP USA, Inc., 3.40%, 5/1/30(1) | | 1,411 | 1,547,878 |

| | | | $ 10,352,740 |

| Utilities — 13.8% | |

| Avangrid, Inc.: | | | |

| 3.15%, 12/1/24 | | 4,913 | $ 5,364,061 |

| 3.80%, 6/1/29 | | 7,600 | 8,786,170 |

| Brookfield Renewable Partners ULC, 3.33%, 8/13/50 | CAD | 4,000 | 2,979,866 |

| Clearway Energy Operating, LLC, 4.75%, 3/15/28(1) | | 2,047 | 2,125,687 |

| Consolidated Edison Co. of New York, Inc., 3.35%, 4/1/30 | | 1,333 | 1,538,921 |

| Enel Finance International NV: | | | |

| 1.00%, 9/16/24(4) | EUR | 4,250 | 5,183,175 |

| 1.125%, 9/16/26(4) | EUR | 4,100 | 5,103,581 |

| Liberty Utilities Finance GP 1, 2.05%, 9/15/30(1) | | 9,474 | 9,362,141 |

| MidAmerican Energy Co.: | | | |

| 3.15%, 4/15/50 | | 850 | 943,266 |

| 3.65%, 8/1/48 | | 3,570 | 4,221,650 |

| 4.25%, 7/15/49 | | 2,390 | 3,106,089 |

| NextEra Energy Operating Partners, L.P.: | | | |

| 4.25%, 9/15/24(1) | | 1,825 | 1,904,844 |

| 4.50%, 9/15/27(1)(7) | | 4,782 | 5,152,605 |

| Niagara Mohawk Power Corp., 1.96%, 6/27/30(1) | | 3,782 | 3,897,009 |

| Northern States Power Co., 2.60%, 6/1/51 | | 5,600 | 5,699,968 |

| NSTAR Electric Co., 3.25%, 5/15/29 | | 2,500 | 2,855,893 |

| Pattern Energy Operations, L.P./Pattern Energy Operations, Inc., 4.50%, 8/15/28(1) | | 5,914 | 6,146,579 |

| Public Service Co. of Colorado: | | | |

| 3.20%, 3/1/50 | | 4,500 | 5,116,737 |

| 4.10%, 6/15/48 | | 1,000 | 1,285,694 |

| Terraform Global Operating, LLC, 6.125%, 3/1/26(1) | | 1,595 | 1,628,591 |

| Tucson Electric Power Co., 1.50%, 8/1/30 | | 2,000 | 1,983,677 |

| | | | $ 84,386,204 |

Total Corporate Bonds

(identified cost $347,247,168) | | | $ 367,882,501 |

| High Social Impact Investments — 0.2% |

| Security | Principal

Amount

(000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(8)(9) | $ | 1,196 | $ 1,189,991 |

Total High Social Impact Investments

(identified cost $1,196,055) | | | $ 1,189,991 |

| Security | Shares | Value |

| Real Estate Management & Development — 0.8% | |

| Brookfield Property Partners, L.P.: | | | |

| Series A, 5.75% | | 92,000 | $ 1,644,040 |

| Series A2, 6.375%(7) | | 169,100 | 3,353,253 |

Total Preferred Stocks

(identified cost $6,575,394) | | | $ 4,997,293 |

| Sovereign Government Bonds — 9.3% |

| Security | Principal

Amount

(000's omitted)* | Value |

| Chile Government International Bond, 2.55%, 1/27/32 | | 1,500 | $ 1,586,250 |

| French Republic Government Bond OAT, 1.75%, 6/25/39(1)(4) | EUR | 12,090 | 18,525,214 |

| Kreditanstalt fuer Wiederaufbau: | | | |

| 0.75%, 9/30/30 | | 3,034 | 3,015,659 |

| 1.75%, 9/14/29(7) | | 2,200 | 2,387,847 |

| Municipality Finance PLC: | | | |

| 0.05%, 9/6/29(4) | EUR | 3,750 | 4,512,649 |

| 1.375%, 9/21/21(1) | | 3,500 | 3,537,940 |

| Nacional Financiera SNC, 3.375%, 11/5/20(1) | | 750 | 752,138 |

| Nederlandse Waterschapsbank NV: | | | |

| 1.00%, 5/28/30(1) | | 2,400 | 2,408,851 |

| 2.375%, 3/24/26(1) | | 1,700 | 1,862,770 |

| 3.125%, 12/5/22(1) | | 500 | 530,680 |

| Province of Ontario Canada: | | | |

| 1.95%, 1/27/23 | CAD | 3,200 | 2,489,346 |

| 2.65%, 2/5/25 | CAD | 5,000 | 4,076,377 |

| South Coast British Columbia Transportation Authority, 2.65%, 10/29/50 | CAD | 5,490 | 4,425,190 |

| Sweden Government International Bond, 0.125%, 9/9/30(1) | SEK | 61,500 | 7,006,455 |

Total Sovereign Government Bonds

(identified cost $53,017,876) | | | $ 57,117,366 |

9

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Schedule of Investments — continued

| Taxable Municipal Obligations — 4.6% |

| Security | Principal

Amount

(000's omitted) | Value |

| General Obligations — 1.5% | |

| Massachusetts, Green Bonds, 3.277%, 6/1/46 | $ | 8,240 | $ 9,308,151 |

| | | | $ 9,308,151 |

| Water and Sewer — 3.1% | |

| District of Columbia Water & Sewer Authority, Green Bonds, 4.814%, 10/1/2114 | $ | 1,665 | $ 2,499,681 |

| Massachusetts Water Pollution Abatement Trust, 5.192%, 8/1/40(10) | | 150 | 183,548 |

| Narragansett Bay Commission, RI, Wastewater System Revenue, Green Bonds: | | | |

| 2.094%, 9/1/30 | | 620 | 652,711 |

| 2.184%, 9/1/31 | | 500 | 516,765 |

| 2.264%, 9/1/32 | | 445 | 458,915 |

| 2.344%, 9/1/33 | | 1,445 | 1,491,139 |

| New York City Municipal Water Finance Authority, NY, (Water and Sewer System), 5.882%, 6/15/44(10) | | 605 | 969,192 |

| San Diego County Water Authority, CA, Green Bonds, 1.951%, 5/1/34 | | 635 | 642,442 |

| San Francisco City and County Public Utilities Commission, CA, Water Revenue, Green Bonds, 3.303%, 11/1/39 | | 10,705 | 11,571,142 |

| | | | $ 18,985,535 |

Total Taxable Municipal Obligations

(identified cost $25,553,348) | | | $ 28,293,686 |

| U.S. Government Agencies and Instrumentalities — 2.1% |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. International Development Finance Corp.: | | | |

| 1.79%, 10/15/29 | $ | 4,430 | $ 4,683,031 |

| 2.36%, 10/15/29 | | 2,870 | 3,134,738 |

| 3.16%, 6/1/33 | | 173 | 200,205 |

| 3.22%, 9/15/29 | | 701 | 794,008 |

| 3.52%, 9/20/32 | | 3,256 | 3,808,376 |

Total U.S. Government Agencies and Instrumentalities

(identified cost $11,429,525) | | | $ 12,620,358 |

| U.S. Government Agency Mortgage-Backed Securities — 0.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| Federal National Mortgage Association: | | | |

| Pool #AN1879, 2.65%, with maturity at 6/1/26 | $ | 1,853 | $ 2,028,859 |

| Pool #AN1909, 2.68%, with maturity at 7/1/26 | | 2,000 | 2,202,179 |

Total U.S. Government Agency Mortgage-Backed Securities

(identified cost $3,907,780) | | $ 4,231,038 |

| Short-Term Investments — 0.9% | | | |

| Other — 0.5% |

| Description | Units | Value |

| Calvert Cash Reserves Fund, LLC, 0.13%(11) | | 3,018,762 | $ 3,019,064 |

Total Other

(identified cost $3,019,064) | | | $ 3,019,064 |

| Securities Lending Collateral — 0.4% |

| Security | Shares | Value |

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.09%(12) | | 2,339,550 | $ 2,339,550 |

Total Securities Lending Collateral

(identified cost $2,339,550) | | | $ 2,339,550 |

Total Short-Term Investments

(identified cost $5,358,614) | | | $ 5,358,614 |

Total Investments — 99.3%

(identified cost $575,294,451) | | | $ 609,038,749 |

| Other Assets, Less Liabilities — 0.7% | | | $ 4,308,889 |

| Net Assets — 100.0% | | | $ 613,347,638 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. | |

| * | In U.S. dollars unless otherwise indicated. |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At September 30, 2020, the aggregate value of these securities is $195,971,772 or 32.0% of the Fund's net assets. |

| (2) | When-issued security. |

| (3) | Weighted average fixed-rate coupon that changes/updates monthly. Rate shown is the rate at September 30, 2020. |

10

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Schedule of Investments — continued

| (4) | Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At September 30, 2020, the aggregate value of these securities is $89,289,129 or 14.6% of the Fund's net assets. |

| (5) | Security converts to variable rate after the indicated fixed-rate coupon period. |

| (6) | Variable rate security. The stated interest rate represents the rate in effect at September 30, 2020. |

| (7) | All or a portion of this security was on loan at September 30, 2020. The aggregate market value of securities on loan at September 30, 2020 was $6,874,641. |

| (8) | Affiliated company (see Note 8). |

| (9) | Restricted security. Total market value of restricted securities amounts to $1,189,991, which represents 0.2% of the net assets of the Fund as of September 30, 2020. |

| (10) | Build America Bond. Represents taxable municipal obligation issued pursuant to the American Recovery and Reinvestment Act of 2009 or other legislation providing for the issuance of taxable municipal debt on which the issuer receives federal support. |

| (11) | Affiliated investment company, available to Calvert portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of September 30, 2020. |

| (12) | Represents investment of cash collateral received in connection with securities lending. |

| Country Allocation (% of Total Investments) | |

| United States | 73.3% |

| Canada | 5.1 |

| Netherlands | 4.6 |

| France | 4.6 |

| Other (less than 3.0% each) | 12.4 |

| Total | 100.0% |

Forward Foreign Currency Exchange Contracts

| Currency Purchased | Currency Sold | Counterparty | Settlement

Date | Unrealized

Appreciation | Unrealized

(Depreciation) |

| USD | 1,559,171 | AUD | 2,144,812 | State Street Bank and Trust Company | 11/30/20 | $ 22,723 | $ — |

| USD | 10,708,791 | CAD | 14,038,675 | State Street Bank and Trust Company | 11/30/20 | 163,813 | — |

| USD | 3,047,615 | CAD | 4,058,681 | State Street Bank and Trust Company | 11/30/20 | — | (1,013) |

| USD | 110,826,237 | EUR | 93,586,167 | State Street Bank and Trust Company | 11/30/20 | 967,205 | — |

| USD | 7,121,257 | SEK | 61,714,020 | State Street Bank and Trust Company | 11/30/20 | 226,150 | — |

| | | | | | | $1,379,891 | $(1,013) |

Futures Contracts

| Description | Number of

Contracts | Position | Expiration

Date | Notional

Amount | Value/

Unrealized

Appreciation

(Depreciation) |

| Interest Rate Futures | | | | | |

| U.S. 2-Year Treasury Note | 41 | Long | 12/31/20 | $ 9,059,398 | $ 3,455 |

| U.S. Ultra-Long Treasury Bond | 10 | Long | 12/21/20 | 2,218,125 | (16,191) |

| U.S. 5-Year Treasury Note | (40) | Short | 12/31/20 | (5,041,250) | (2,881) |

| U.S. Long Treasury Bond | (57) | Short | 12/21/20 | (10,048,031) | 33,292 |

| U.S. Ultra 10-Year Treasury Note | (208) | Short | 12/21/20 | (33,263,750) | (56,785) |

| | | | | | $(39,110) |

11

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Schedule of Investments — continued

Restricted Securities

| Description | Acquisition Date | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20 | 12/13/19 | $1,196,055 |

| Abbreviations: |

| LIBOR | – London Interbank Offered Rate |

| Currency Abbreviations: |

| AUD | – Australian Dollar |

| CAD | – Canadian Dollar |

| EUR | – Euro |

| SEK | – Swedish Krona |

| USD | – United States Dollar |

12

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Statement of Assets and Liabilities

| | September 30, 2020 |

| Assets | |

Investments in securities of unaffiliated issuers, at value (identified cost $571,079,332) - including

$6,874,641 of securities on loan | $ 604,829,694 |

| Investments in securities of affiliated issuers, at value (identified cost $4,215,119) | 4,209,055 |

| Receivable for variation margin on open futures contracts | 137,549 |

| Receivable for open forward foreign currency exchange contracts | 1,379,891 |

| Cash | 2,020,329 |

| Deposits at broker for futures contracts | 737,392 |

| Deposits for derivatives collateral - forward foreign currency exchange contracts | 1,340,000 |

| Cash denominated in foreign currency, at value (cost $23,506) | 23,511 |

| Receivable for investments sold | 5,394,105 |

| Receivable for capital shares sold | 4,161,682 |

| Interest receivable | 3,064,449 |

| Dividends and interest receivable - affiliated | 15,535 |

| Securities lending income receivable | 241 |

| Receivable from affiliate | 36,082 |

| Directors' deferred compensation plan | 80,217 |

| Total assets | $627,429,732 |

| Liabilities | |

| Cash collateral due to broker | $ 1,340,000 |

| Payable for open forward foreign currency exchange contracts | 1,013 |

| Payable for investments purchased | 8,305,749 |

| Payable for when-issued securities | 1,330,630 |

| Payable for capital shares redeemed | 276,343 |

| Distributions payable | 26,318 |

| Deposits for securities loaned | 2,339,550 |

| Payable to affiliates: | |

| Investment advisory fee | 122,313 |

| Administrative fee | 58,710 |

| Distribution and service fees | 15,851 |

| Sub-transfer agency fee | 6,896 |

| Directors' deferred compensation plan | 80,217 |

| Accrued expenses | 178,504 |

| Total liabilities | $ 14,082,094 |

| Net Assets | $613,347,638 |

| Sources of Net Assets | |

| Paid-in capital | $ 584,543,926 |

| Distributable earnings | 28,803,712 |

| Total | $613,347,638 |

| Class A Shares | |

| Net Assets | $ 77,990,912 |

| Shares Outstanding | 4,767,856 |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 16.36 |

Maximum Offering Price Per Share

(100 ÷ 96.25 of net asset value per share) | $ 17.00 |

13

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Statement of Assets and Liabilities — continued

| | September 30, 2020 |

| Class I Shares | |

| Net Assets | $532,148,520 |

| Shares Outstanding | 32,487,915 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 16.38 |

| Class R6 Shares | |

| Net Assets | $ 3,208,206 |

| Shares Outstanding | 195,751 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 16.39 |

On sales of $50,000 or more, the offering price of Class A shares is reduced.

14

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

| | Year Ended |

| | September 30, 2020 |

| Investment Income | |

| Dividend income | $ 350,595 |

| Dividend income - affiliated issuers | 6,827 |

| Interest and other income | 11,248,075 |

| Interest income - affiliated issuers | 14,641 |

| Securities lending income, net | 4,619 |

| Total investment income | $11,624,757 |

| Expenses | |

| Investment advisory fee | $ 1,169,611 |

| Administrative fee | 561,413 |

| Distribution and service fees: | |

| Class A | 169,309 |

| Directors' fees and expenses | 19,356 |

| Custodian fees | 19,560 |

| Transfer agency fees and expenses | 405,839 |

| Accounting fees | 109,055 |

| Professional fees | 46,644 |

| Registration fees | 107,139 |

| Reports to shareholders | 27,550 |

| Miscellaneous | 54,628 |

| Total expenses | $ 2,690,104 |

| Waiver and/or reimbursement of expenses by affiliate | $ (268,226) |

| Reimbursement of expenses - other | (5,648) |

| Net expenses | $ 2,416,230 |

| Net investment income | $ 9,208,527 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities | $ 3,254,226 |

| Investment securities - affiliated issuers | 3,481 |

| Futures contracts | (4,504,476) |

| Foreign currency transactions | (28,818) |

| Forward foreign currency exchange contracts | (4,896,490) |

| Net realized loss | $ (6,172,077) |

| Change in unrealized appreciation (depreciation): | |

| Investment securities | $ 21,883,045 |

| Investment securities - affiliated issuers | (5,270) |

| Futures contracts | (127,411) |

| Foreign currency | 19,432 |

| Forward foreign currency exchange contracts | 428,931 |

| Net change in unrealized appreciation (depreciation) | $22,198,727 |

| Net realized and unrealized gain | $16,026,650 |

| Net increase in net assets from operations | $25,235,177 |

15

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Statements of Changes in Net Assets

| | Year Ended September 30, |

| | 2020 | 2019 |

| Increase (Decrease) in Net Assets | | |

| From operations: | | |

| Net investment income | $ 9,208,527 | $ 5,638,916 |

| Net realized gain (loss) | (6,172,077) | 1,294,743 |

| Net change in unrealized appreciation (depreciation) | 22,198,727 | 15,872,750 |

| Net increase in net assets from operations | $ 25,235,177 | $ 22,806,409 |

| Distributions to shareholders: | | |

| Class A | $ (1,392,425) | $ (1,080,665) |

| Class I | (9,054,002) | (4,552,457) |

| Class R6 | (22,346) | (5,324) |

| Total distributions to shareholders | $ (10,468,773) | $ (5,638,446) |

| Capital share transactions: | | |

| Class A | $ 17,390,289 | $ 12,395,417 |

| Class I | 233,793,006 | 158,968,614 |

| Class R6 | 2,598,426 | 560,126 (1) |

| Net increase in net assets from capital share transactions | $253,781,721 | $171,924,157 |

| Net increase in net assets | $268,548,125 | $189,092,120 |

| Net Assets | | |

| At beginning of year | $ 344,799,513 | $ 155,707,393 |

| At end of year | $613,347,638 | $344,799,513 |

| (1) | For the period from the commencement of operations, February 1, 2019, to September 30, 2019. |

16

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

| | Class A |

| | Year Ended September 30, |

| | 2020 | 2019 | 2018 | 2017 | 2016 |

| Net asset value — Beginning of year | $ 15.87 | $ 14.82 | $ 15.32 | $ 15.64 | $ 15.14 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.28 | $ 0.34 | $ 0.27 | $ 0.26 | $ 0.25 |

| Net realized and unrealized gain (loss) | 0.55 | 1.05 | (0.39) | (0.16) | 0.53 |

| Total income (loss) from operations | $ 0.83 | $ 1.39 | $ (0.12) | $ 0.10 | $ 0.78 |

| Less Distributions | | | | | |

| From net investment income | $ (0.32) | $ (0.34) | $ (0.27) | $ (0.26) | $ (0.25) |

| From net realized gain | (0.02) | — | (0.11) | (0.16) | (0.03) |

| Total distributions | $ (0.34) | $ (0.34) | $ (0.38) | $ (0.42) | $ (0.28) |

| Net asset value — End of year | $ 16.36 | $ 15.87 | $ 14.82 | $ 15.32 | $ 15.64 |

| Total Return(2) | 5.27% | 9.53% | (0.80)% | 0.71% | 5.21% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $77,991 | $58,422 | $42,611 | $38,011 | $28,987 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 0.79% | 0.86% | 0.99% | 1.04% | 1.12% |

| Net expenses | 0.73% | 0.77% | 0.85% | 0.88% | 0.88% |

| Net investment income | 1.77% | 2.21% | 1.83% | 1.71% | 1.64% |

| Portfolio Turnover | 26% | 21% | 16% | 43% | 243% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

17

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Financial Highlights — continued

| | Class I |

| | Year Ended September 30, |

| | 2020 | 2019 | 2018 | 2017 | 2016 |

| Net asset value — Beginning of year | $ 15.89 | $ 14.83 | $ 15.32 | $ 15.63 | $ 15.13 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.32 | $ 0.38 | $ 0.33 | $ 0.32 | $ 0.31 |

| Net realized and unrealized gain (loss) | 0.55 | 1.06 | (0.40) | (0.15) | 0.53 |

| Total income (loss) from operations | $ 0.87 | $ 1.44 | $ (0.07) | $ 0.17 | $ 0.84 |

| Less Distributions | | | | | |

| From net investment income | $ (0.36) | $ (0.38) | $ (0.31) | $ (0.32) | $ (0.31) |

| From net realized gain | (0.02) | — | (0.11) | (0.16) | (0.03) |

| Total distributions | $ (0.38) | $ (0.38) | $ (0.42) | $ (0.48) | $ (0.34) |

| Net asset value — End of year | $ 16.38 | $ 15.89 | $ 14.83 | $ 15.32 | $ 15.63 |

| Total Return(2) | 5.53% | 9.84% | (0.48)% | 1.15% | 5.60% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $532,149 | $285,796 | $113,097 | $23,641 | $23,908 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 0.54% | 0.61% | 0.74% | 0.68% | 0.67% |

| Net expenses | 0.48% | 0.48% | 0.50% | 0.50% | 0.50% |

| Net investment income | 2.00% | 2.47% | 2.24% | 2.09% | 2.01% |

| Portfolio Turnover | 26% | 21% | 16% | 43% | 243% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

18

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Financial Highlights — continued

| | Class R6 |

| | Year Ended September 30, | Period Ended

September 30, |

| | 2020 | 2019 (1) |

| Net asset value — Beginning of period | $ 15.90 | $ 15.01 |

| Income (Loss) From Operations | | |

| Net investment income(2) | $ 0.32 | $ 0.26 |

| Net realized and unrealized gain | 0.55 | 0.89 |

| Total income from operations | $ 0.87 | $ 1.15 |

| Less Distributions | | |

| From net investment income | $ (0.36) | $ (0.26) |

| From net realized gain | (0.02) | — |

| Total distributions | $ (0.38) | $ (0.26) |

| Net asset value — End of period | $16.39 | $15.90 |

| Total Return(3) | 5.58% | 7.68% (4) |

| Ratios/Supplemental Data | | |

| Net assets, end of period (000’s omitted) | $ 3,208 | $ 581 |

| Ratios (as a percentage of average daily net assets):(5) | | |

| Total expenses | 0.49% | 0.54% (6) |

| Net expenses | 0.43% | 0.43% (6) |

| Net investment income | 1.99% | 2.49% (6) |

| Portfolio Turnover | 26% | 21% (7) |

| (1) | For the period from the commencement of operations, February 1, 2019, to September 30, 2019. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

| (7) | For the year ended September 30, 2019. |

19

See Notes to Financial Statements.

Calvert

Green Bond Fund

September 30, 2020

Notes to Financial Statements

1 Significant Accounting Policies

Calvert Green Bond Fund (the Fund) is a diversified series of Calvert Impact Fund, Inc. (the Corporation). The Corporation is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The investment objective of the Fund is to seek to maximize income, to the extent consistent with preservation of capital, primarily through investment in bonds. The Fund invests primarily in “green” investments which include those issued by companies that develop or provide products or services that seek to provide environmental solutions and/or that support environmental projects, among others.

The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. A contingent deferred sales charge of 0.80% may apply to certain redemptions of Class A shares for accounts for which no sales charge was paid, if redeemed within 12 months of purchase. Class I and Class R6 shares are sold at net asset value, are not subject to a sales charge and are sold only to certain eligible investors. Each class represents a pro rata interest in the Fund, but votes separately on class-specific matters and is subject to different expenses.

The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946). Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

A Investment Valuation— Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (the Board) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

U.S. generally accepted accounting principles (U.S. GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Valuation techniques used to value the Fund’s investments by major category are as follows:

Equity Securities. Equity securities (including warrants and rights) listed on a U.S. securities exchange generally are valued at the last sale or closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Equity securities listed on the NASDAQ Global or Global Select Market are valued at the NASDAQ official closing price and are categorized as Level 1 in the hierarchy. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and ask prices and are categorized as Level 2 in the hierarchy.

Debt Securities. Debt securities are generally valued based on valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. Accordingly, debt securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities with a remaining maturity at time of purchase of more than sixty days are valued based on valuations provided by a third party pricing service. Such securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities of sufficient credit quality purchased with remaining maturities of sixty days or less are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Affiliated Fund. The Fund may invest in Calvert Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Calvert Research and Management (CRM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day and are categorized as Level 2 in the hierarchy. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Other Securities. Investments in registered investment companies (including money market funds) that do not trade on an exchange are valued at the net asset value per share on the valuation day and are categorized as Level 1 in the hierarchy.

Derivatives. Futures contracts are valued at unrealized appreciation (depreciation) based on the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average ask prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund's forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service and are categorized as Level 2

Calvert

Green Bond Fund

September 30, 2020

Notes to Financial Statements — continued

in the hierarchy. U.S. exchange-traded options are valued at the mean between the bid and ask prices at valuation time as reported by the Options Price Reporting Authority and are categorized as Level 1 in the hierarchy.

Fair Valuation. If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Fund's adviser, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by or at the direction of the Board in a manner that most fairly reflects the security’s “fair value”, which is the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material.

The following table summarizes the market value of the Fund's holdings as of September 30, 2020, based on the inputs used to value them:

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Asset-Backed Securities | $ — | $ 71,936,448 | $ — | $ 71,936,448 |

| Collateralized Mortgage-Backed Obligations | — | 55,411,454 | — | 55,411,454 |

| Corporate Bonds | — | 367,882,501 | — | 367,882,501 |

| High Social Impact Investments | — | 1,189,991 | — | 1,189,991 |

| Preferred Stocks | 4,997,293 | — | — | 4,997,293 |

| Sovereign Government Bonds | — | 57,117,366 | — | 57,117,366 |

| Taxable Municipal Obligations | — | 28,293,686 | — | 28,293,686 |

| U.S. Government Agencies and Instrumentalities | — | 12,620,358 | — | 12,620,358 |

| U.S. Government Agency Mortgage-Backed Securities | — | 4,231,038 | — | 4,231,038 |

| Short-Term Investments: | | | | |

| Other | — | 3,019,064 | — | 3,019,064 |

| Securities Lending Collateral | 2,339,550 | — | — | 2,339,550 |

| Total Investments | $7,336,843 | $601,701,906 | $ — | $609,038,749 |

| Forward Foreign Currency Exchange Contracts | $ — | $ 1,379,891 | $ — | $ 1,379,891 |

| Futures Contracts | 36,747 | — | — | 36,747 |

| Total | $7,373,590 | $603,081,797 | $ — | $610,455,387 |

| Liability Description | | | | |

| Forward Foreign Currency Exchange Contracts | $ — | $ (1,013) | $ — | $ (1,013) |

| Futures Contracts | (75,857) | — | — | (75,857) |

| Total | $ (75,857) | $ (1,013) | $ — | $ (76,870) |

B Investment Transactions and Income— Investment transactions for financial statement purposes are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Non-cash dividends are recorded at the fair value of the securities received. Withholding taxes on foreign interest, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned.

C Share Class Accounting— Realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net assets of each class to the total net assets of the Fund. Net investment income, other than class-specific expenses, is allocated daily to each class of shares based upon the ratio of the value of each class’s paid shares to the total value of all paid shares. Expenses arising in connection with a specific class are charged

Calvert

Green Bond Fund

September 30, 2020

Notes to Financial Statements — continued

directly to that class. Sub-accounting, recordkeeping and similar administrative fees payable to financial intermediaries, which are a component of transfer agency fees and expenses on the Statement of Operations, are not allocated to Class R6 shares.

D Foreign Currency Transactions— The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

E Futures Contracts— The Fund may enter into futures contracts to buy or sell a financial instrument for a set price at a future date. Initial margin deposits of either cash or securities as required by the broker are made upon entering into the contract. While the contract is open, daily variation margin payments are made to or received from the broker reflecting the daily change in market value of the contract and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. When a futures contract is closed, a realized gain or loss is recorded equal to the difference between the opening and closing value of the contract. The risks associated with entering into futures contracts may include the possible illiquidity of the secondary market which would limit the Fund’s ability to close out a futures contract prior to the settlement date, an imperfect correlation between the value of the contracts and the underlying financial instruments, or that the counterparty will fail to perform its obligations under the contracts’ terms. Futures contracts are designed by boards of trade, which are designated “contracts markets” by the Commodities Futures Trading Commission. Futures contracts trade on the contracts markets in a manner that is similar to the way a stock trades on a stock exchange, and the boards of trade, through their clearing corporations, guarantee the futures contracts against default. As a result, there is minimal counterparty credit risk to the Fund.

F Forward Foreign Currency Exchange Contracts— The Fund may enter into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. The forward foreign currency exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded as unrealized until such time as the contracts have been closed. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from movements in the value of a foreign currency relative to the U.S. dollar.

G Options Contracts— Upon the purchase of a call or put option, the premium paid by the Fund is included in the Statement of Assets and Liabilities as an investment. The amount of the investment is subsequently marked-to-market to reflect the current market value of the option purchased, in accordance with the Fund’s policies on investment valuations discussed above. Premiums paid for purchasing options that expire are treated as realized losses. Premiums paid for purchasing options that are exercised or closed are added to the amounts paid or offset against the proceeds on the underlying investment transaction to determine the realized gain or loss. As the purchaser of an index option, the Fund has the right to receive a cash payment equal to any depreciation in the value of the index below the exercise price of the option (in the case of a put) or equal to any appreciation in the value of the index over the exercise price of the option (in the case of a call) as of the valuation date of the option. The risk associated with purchasing options is limited to the premium originally paid. Purchased options traded over-the-counter involve risk that the issuer or counterparty will fail to perform its contractual obligations.

H Restricted Securities— The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities (excluding Rule 144A securities) is included at the end of the Schedule of Investments.

I Distributions to Shareholders— Distributions to shareholders are recorded by the Fund on ex-dividend date. The Fund declares income distributions daily to shareholders of record at the time of declaration and generally pays them monthly. The Fund makes distributions of net realized capital gains, if any, at least annually. Distributions are declared separately for each class of shares. Distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

J Estimates— The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

K Indemnifications— The Corporation’s By-Laws provide for indemnification for Directors or officers of the Corporation and certain other parties, to the fullest extent permitted by Maryland law and the 1940 Act, provided certain conditions are met. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

L Federal Income Taxes— No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Calvert

Green Bond Fund

September 30, 2020

Notes to Financial Statements — continued

Management has analyzed the Fund's tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund's financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

M When-Issued Securities and Delayed Delivery Transactions— The Fund may purchase or sell securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. At the time the transaction is negotiated, the price of the security that will be delivered is fixed. The Fund maintains cash and/or security positions for these commitments such that sufficient liquid assets will be available to make payments upon settlement. Securities purchased on a delayed delivery or when-issued basis are marked-to-market daily and begin earning interest on settlement date. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

2 Related Party Transactions

The investment advisory fee is earned by CRM, a subsidiary of Eaton Vance Management (EVM), as compensation for investment advisory services rendered to the Fund. EVM is a wholly-owned subsidiary of Eaton Vance Corp. Pursuant to the investment advisory agreement dated December 31, 2016 and an amended fee schedule to such agreement effective February 1, 2019, CRM receives a fee, payable monthly, at the annual rate of 0.25% of the Fund’s average daily net assets. For the year ended September 30, 2020, the investment advisory fee amounted to $1,169,611. The Fund may invest its cash in Cash Reserves Fund. CRM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

CRM has agreed to reimburse the Fund's operating expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only and excluding expenses such as brokerage commissions, acquired fund fees and expenses of unaffiliated funds, borrowing costs, taxes or litigation expenses) exceed 0.73%, 0.48% and 0.43% for Class A, Class I and Class R6, respectively, of such class’s average daily net assets. The expense reimbursement agreement with CRM may be changed or terminated after January 31, 2021. For the year ended September 30, 2020, CRM waived or reimbursed expenses of $268,226.

The administrative fee is earned by CRM as compensation for administrative services rendered to the Fund. The fee is computed at an annual rate of 0.12% of the Fund’s average daily net assets attributable to Class A, Class I and Class R6 and is payable monthly. For the year ended September 30, 2020, CRM was paid administrative fees of $561,413.