UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10067

Eaton Vance Variable Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2014

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

VT Floating-Rate Income Fund

Annual Report

December 31, 2014

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of the Fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report December 31, 2014

Eaton Vance

VT Floating-Rate Income Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 31 | |

| |

Federal Tax Information | | | 32 | |

| |

Management and Organization | | | 33 | |

| |

Important Notices | | | 35 | |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Management’s Discussion of Fund Performance1

Economic and Market Conditions

The U.S. floating-rate loan market began the 12-month period ended December 31, 2014 on strong footing, as robust new issue supply was met by investor demand amid strong appetite for risk and a global search for yield. Aside from brief bouts of weakness in technical conditions in February and April, overall market tone was generally firm for the first seven months of the period, with total demand exceeding the supply of net new issuance by a meaningful margin.

Beginning in the second quarter, retail investor demand began to wane, turning net negative after nearly two straight years of positive demand. We believe this was in response to an unexpected declining interest rate outlook, as well an increasing number of negative headlines surrounding the asset class. Declining retail demand was more than offset by continued demand growth from institutional investors and investors in collateralized loan obligations. Sluggish technical conditions developed in the August/September timeframe, primarily due to substantial new loan supply, and deteriorated further by December due to the sharp decline in oil prices. These weaker technical conditions modestly weighed on loan prices in the final stretch of the period.

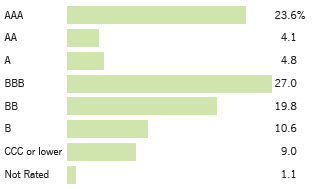

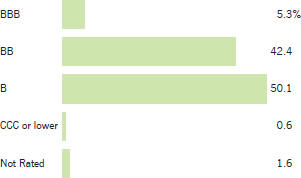

Overall, the S&P/LSTA Leveraged Loan Index2 (the Index) — a broad barometer of the loan market — returned 1.60% for the 12-month period. Returns were comprised mainly of interest income. Lower-quality loans generally outpaced their higher-quality counterparts; loans rated BB, B, CCC and D (defaulted)6 returned 1.52%, 1.43%, 6.09% and 2.30%, respectively, for the period.

On April 29, 2014, Energy Future Holdings (EFH, formerly TXU Corp.) filed for bankruptcy. The Fund did not hold a position in EFH at the time of default. EFH’s Chapter 11 bankruptcy filing caused the Index default rate to spike to 3.2% on a trailing 12-month basis as of December 31, 2014. Excluding EFH, however, the Index’s trailing 12-month default rate was a scant 0.34%, well below the market’s

10-year average of 2.6%, according to Standard & Poor’s Leveraged Commentary & Data (S&P/LCD).

Fund Performance

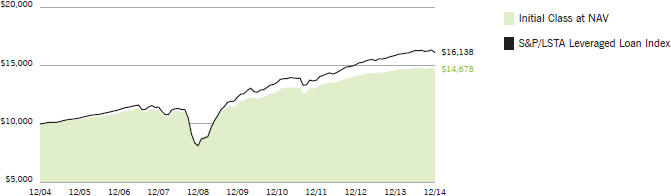

For the fiscal year ended December 31, 2014, Eaton Vance VT Floating-Rate Income Fund (the Fund) Initial Class shares at net asset value (NAV) had a total return of 0.57%.

By comparison, the Fund’s benchmark, the Index, returned 1.60% for the period.

During the period, the Fund maintained portfolio quality at a level consistent with management’s views on appropriate credit risk. In contrast, the Index descended in credit quality over the 12-month period, with lower-quality issuers awarded higher returns. As a result of the Fund’s historical positioning toward higher-quality credit tiers relative to the Index, the Fund’s underweighting to segments rated CCC and D (defaulted) and overweighting to loans rated BB detracted from performance relative to the Index for the year.

Among individual holdings, the Fund had underweight or no exposure to a number of high-beta7, lower-quality Index names that rallied significantly during the period, namely Cengage Learning and SuperMedia. This detracted from performance relative to the Index. Heavier-than-Index Fund holdings in Education Management, SeaDrill and Town Sports also detracted from performance relative to the Index, as these issuers underperformed the overall loan market.

On the positive side, underweight or no exposure in EFH, Ocean Rig, Templar Energy and Fieldwood Energy helped the Fund’s performance versus the Index, as these issuers trailed the overall loan market.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Performance2,3

Portfolio Managers Scott H. Page, CFA, Craig P. Russ and Andrew Sveen, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

Initial Class at NAV | | | 05/02/2001 | | | | 05/02/2001 | | | | 0.57 | % | | | 4.63 | % | | | 3.91 | % |

ADV Class at NAV | | | 04/15/2014 | | | | 05/02/2001 | | | | 0.62 | | | | 4.64 | | | | 3.91 | |

S&P/LSTA Leveraged Loan Index | | | — | | | | — | | | | 1.60 | % | | | 5.57 | % | | | 4.90 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | Initial

Class | | | ADV

Class | |

| | | | | | | | | | | | | | | 1.16 | % | | | 0.91 | % |

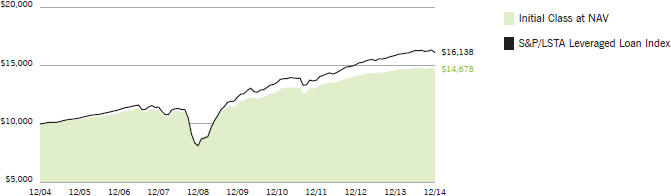

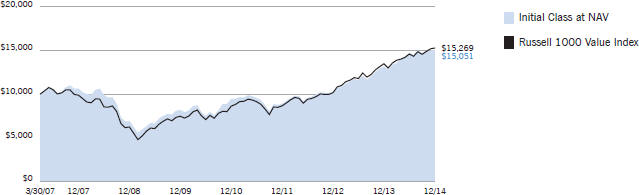

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Initial Class of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | | | | | | | | | |

| Growth of Investment | | Amount Invested | | | Period Beginning | | | At NAV | | | With Maximum Sales Charge | |

ADV Class | | $ | 10,000 | | | | 12/31/2004 | | | $ | 14,684 | | | | N.A. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

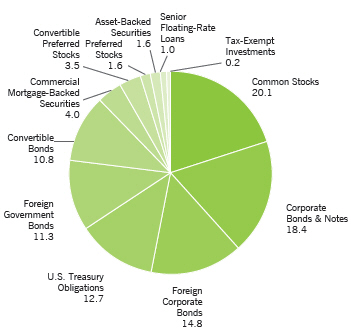

Fund Profile

Top 10 Issuers (% of total investments)5

| | | | |

Hilton Worldwide Finance, LLC | | | 1.2 | % |

Avago Technologies Cayman Ltd. | | | 1.1 | |

Transdigm, Inc. | | | 1.1 | |

Asurion, LLC | | | 1.1 | |

Chrysler Group, LLC | | | 1.0 | |

Michaels Stores, Inc. | | | 1.0 | |

Community Health Systems, Inc. | | | 0.9 | |

Dell, Inc. | | | 0.9 | |

Supervalu, Inc. | | | 0.9 | |

Infor (US), Inc. | | | 0.8 | |

Total | | | 10.0 | % |

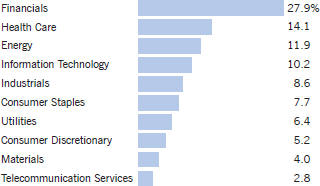

Top 10 Sectors (% of total investments)5

| | | | |

Health Care | | | 10.2 | % |

Electronics/Electrical | | | 9.7 | |

Business Equipment and Services | | | 7.6 | |

Retailers (Except Food and Drug) | | | 5.5 | |

Chemicals and Plastics | | | 5.1 | |

Automotive | | | 4.6 | |

Financial Intermediaries | | | 3.8 | |

Utilities | | | 3.8 | |

Food Products | | | 3.6 | |

Lodging and Casinos | | | 3.5 | |

Total | | | 57.4 | % |

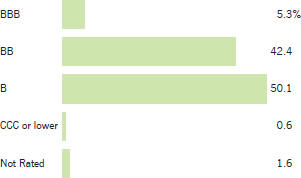

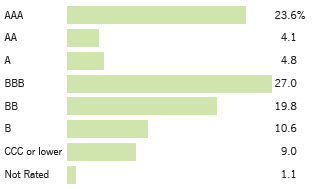

Credit Quality (% of bond and loan holdings)6

See Endnotes and Additional Disclosures in this report.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | S&P/LSTA Leveraged Loan Index is an unmanaged index of the institutional leveraged loan market. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | There is no sales charge. Insurance-related charges are not included in the calculation of returns. Such expenses would reduce the overall return shown. Please refer to the report for your insurance contract for performance data reflecting insurance-related charges. |

| | Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. Performance presented in the financial highlights included in the financial statements is not linked. In the performance table, the performance of ADV Class is linked to Initial Class. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 4 | Source: Fund prospectus. |

| 5 | Excludes cash and cash equivalents. |

| 6 | Ratings are based on Moody’s, S&P or Fitch, as applicable. If securities are rated differently by the ratings agencies, the higher rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” are not rated by the national ratings agencies stated above. |

| 7 | Beta is a measure of risk that shows a fund or strategies volatility relative to that fund’s stated benchmark. A fund or strategy with a beta of 1 performed exactly like the market index; a beta less than 1 means its performance was less volatile than the index, positive or negative. |

| | Fund profile subject to change due to active management. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Fund Expenses

Example: As a Fund shareholder, you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2014 – December 31, 2014).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect expenses and charges which are, or may be imposed under the variable annuity contract or variable life insurance policy (variable contracts) (if applicable) through which your investment in the Fund is made. Therefore, the second section of the table is useful in comparing ongoing costs associated with an investment in vehicles which fund benefits under variable contracts and to qualified pension and retirement plans, and will not help you determine the relative total costs of investing in the Fund through variable contracts. In addition, if these expenses and charges imposed under the variable contracts were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(7/1/14) | | | Ending

Account Value

(12/31/14) | | | Expenses Paid

During Period*

(7/1/14 – 12/31/14) | | | Annualized

Expense

Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | |

Initial Class | | $ | 1,000.00 | | | $ | 992.60 | | | $ | 5.78 | | | | 1.15 | % |

ADV Class | | $ | 1,000.00 | | | $ | 992.80 | | | $ | 4.52 | | | | 0.90 | % |

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Initial Class | | $ | 1,000.00 | | | $ | 1,019.40 | | | $ | 5.85 | | | | 1.15 | % |

ADV Class | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.58 | | | | 0.90 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2014. Expenses shown do not include any insurance-related charges. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments

| | | | | | | | |

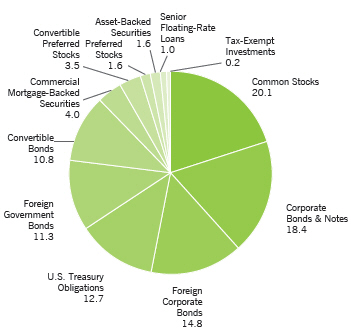

| Senior Floating-Rate Interests — 96.4%(1) | |

| | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Aerospace and Defense — 1.9% | |

Atlantic Aviation FBO, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing June 1, 2020 | | $ | 271 | | | $ | 264,808 | |

BE Aerospace, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 16, 2021 | | | 750 | | | | 750,000 | |

DAE Aviation Holdings, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing November 2, 2018 | | | 336 | | | | 335,460 | |

Ducommun Incorporated | | | | | | | | |

Term Loan, 4.75%, Maturing June 28, 2017 | | | 95 | | | | 94,974 | |

IAP Worldwide Services, Inc. | | | | | | | | |

Revolving Loan, Maturing July 18, 2018(2) | | | 133 | | | | 132,540 | |

Term Loan - Second Lien, 8.00%, Maturing July 18, 2019(3) | | | 182 | | | | 145,982 | |

Silver II US Holdings, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing December 13, 2019 | | | 3,207 | | | | 2,986,087 | |

Standard Aero Limited | | | | | | | | |

Term Loan, 5.00%, Maturing November 2, 2018 | | | 152 | | | | 152,073 | |

Transdigm, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing February 28, 2020 | | | 5,742 | | | | 5,653,269 | |

Term Loan, 3.75%, Maturing June 4, 2021 | | | 1,194 | | | | 1,174,299 | |

| | | | | | | | | |

| | | | | | $ | 11,689,492 | |

| | | | | | | | | |

|

Automotive — 4.5% | |

Affinia Group Intermediate Holdings, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing April 27, 2020 | | $ | 469 | | | $ | 465,706 | |

Allison Transmission, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing August 23, 2019 | | | 2,318 | | | | 2,295,136 | |

Chrysler Group, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing May 24, 2017 | | | 2,754 | | | | 2,750,879 | |

Term Loan, 3.25%, Maturing December 31, 2018 | | | 3,325 | | | | 3,303,057 | |

CS Intermediate Holdco 2, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing April 4, 2021 | | | 2,413 | | | | 2,387,238 | |

Dayco Products, LLC | | | | | | | | |

Term Loan, 5.25%, Maturing December 12, 2019 | | | 620 | | | | 616,823 | |

Federal-Mogul Holdings Corporation | | | | | | | | |

Term Loan, 4.75%, Maturing April 15, 2021 | | | 2,618 | | | | 2,602,892 | |

Goodyear Tire & Rubber Company (The) | | | | | | | | |

Term Loan - Second Lien, 4.75%, Maturing April 30, 2019 | | | 3,975 | | | | 3,966,056 | |

INA Beteiligungsgesellschaft GmbH | | | | | | | | |

Term Loan, 4.25%, Maturing May 15, 2020 | | | 725 | | | | 726,209 | |

MPG Holdco I, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing October 20, 2021 | | | 1,886 | | | | 1,879,325 | |

TI Group Automotive Systems, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing July 2, 2021 | | | 2,264 | | | | 2,235,330 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Automotive (continued) | |

Tower Automotive Holdings USA, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing April 23, 2020 | | $ | 2,650 | | | $ | 2,608,632 | |

Veyance Technologies, Inc. | | | | | | | | |

Term Loan, 5.25%, Maturing September 8, 2017 | | | 1,397 | | | | 1,395,773 | |

Visteon Corporation | | | | | | | | |

Term Loan, 3.50%, Maturing April 9, 2021 | | | 647 | | | | 639,878 | |

| | | | | | | | | |

| | | | | | $ | 27,872,934 | |

| | | | | | | | | |

|

Beverage and Tobacco — 0.2% | |

Flavors Holdings, Inc. | | | | | | | | |

Term Loan, 6.75%, Maturing October 3, 2020 | | $ | 568 | | | $ | 543,680 | |

Term Loan - Second Lien, 11.00%, Maturing October 3, 2021 | | | 1,000 | | | | 955,000 | |

| | | | | | | | | |

| | | | | | $ | 1,498,680 | |

| | | | | | | | | |

|

Brokerage / Securities Dealers / Investment Houses — 0.0%(4) | |

American Beacon Advisors, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing November 22, 2019 | | $ | 192 | | | $ | 189,819 | |

| | | | | | | | | |

| | | | | | $ | 189,819 | |

| | | | | | | | | |

|

Building and Development — 1.8% | |

ABC Supply Co., Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing April 16, 2020 | | $ | 667 | | | $ | 647,399 | |

CPG International, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing September 30, 2020 | | | 395 | | | | 392,037 | |

Gates Global, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 5, 2021 | | | 973 | | | | 948,423 | |

Ply Gem Industries, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing February 1, 2021 | | | 2,487 | | | | 2,440,829 | |

Quikrete Holdings, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing September 28, 2020 | | | 591 | | | | 584,194 | |

RE/MAX International, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing July 31, 2020 | | | 1,844 | | | | 1,821,276 | |

Realogy Corporation | | | | | | | | |

Term Loan, 3.75%, Maturing March 5, 2020 | | | 3,711 | | | | 3,658,075 | |

Summit Materials Companies I, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing January 30, 2019 | | | 707 | | | | 707,265 | |

WireCo WorldGroup, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing February 15, 2017 | | | 290 | | | | 291,018 | |

| | | | | | | | | |

| | | | | | $ | 11,490,516 | |

| | | | | | | | | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Business Equipment and Services — 7.5% | |

Acosta Holdco, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing September 26, 2021 | | $ | 2,500 | | | $ | 2,499,375 | |

Allied Security Holdings, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing February 12, 2021 | | | 420 | | | | 413,462 | |

Altisource Solutions S.a.r.l. | | | | | | | | |

Term Loan, 4.50%, Maturing December 9, 2020 | | | 2,026 | | | | 1,580,055 | |

AVSC Holding Corp. | | | | | | | | |

Term Loan, 4.50%, Maturing January 24, 2021 | | | 273 | | | | 271,914 | |

BakerCorp International, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing February 14, 2020 | | | 1,326 | | | | 1,223,674 | |

Brickman Group Ltd., LLC | | | | | | | | |

Term Loan, 4.00%, Maturing December 18, 2020 | | | 520 | | | | 507,250 | |

Brock Holdings III, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing March 16, 2017 | | | 477 | | | | 449,576 | |

CCC Information Services, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 20, 2019 | | | 221 | | | | 215,029 | |

Ceridian, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing September 15, 2020 | | | 2,413 | | | | 2,382,921 | |

ClientLogic Corporation | | | | | | | | |

Term Loan, 7.48%, Maturing January 30, 2017 | | | 1,132 | | | | 1,103,950 | |

Corporate Capital Trust, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing May 15, 2019 | | | 620 | | | | 612,931 | |

CPM Acquisition Corp. | | | | | | | | |

Term Loan, 6.25%, Maturing August 29, 2017 | | | 235 | | | | 235,120 | |

Crossmark Holdings, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing December 20, 2019 | | | 1,275 | | | | 1,251,030 | |

Education Management, LLC | | | | | | | | |

Term Loan, 9.25%, Maturing March 30, 2018(5) | | | 1,527 | | | | 691,005 | |

EIG Investors Corp. | | | | | | | | |

Term Loan, 5.00%, Maturing November 9, 2019 | | | 2,729 | | | | 2,718,950 | |

Emdeon Business Services, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing November 2, 2018 | | | 3,683 | | | | 3,626,529 | |

Expert Global Solutions, Inc. | | | | | | | | |

Term Loan, 8.52%, Maturing April 3, 2018 | | | 313 | | | | 312,037 | |

Extreme Reach, Inc. | | | | | | | | |

Term Loan, 6.75%, Maturing February 7, 2020 | | | 467 | | | | 465,332 | |

Garda World Security Corporation | | | | | | | | |

Term Loan, 4.00%, Maturing November 6, 2020 | | | 71 | | | | 69,083 | |

Term Loan, 4.00%, Maturing November 6, 2020 | | | 276 | | | | 270,053 | |

IG Investment Holdings, LLC | | | | | | | | |

Term Loan, 5.25%, Maturing October 31, 2019 | | | 689 | | | | 687,489 | |

IMS Health Incorporated | | | | | | | | |

Term Loan, 3.50%, Maturing March 17, 2021 | | | 512 | | | | 501,774 | |

Information Resources, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing September 30, 2020 | | | 765 | | | | 764,356 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Business Equipment and Services (continued) | |

ION Trading Technologies S.a.r.l. | | | | | | | | |

Term Loan, 4.25%, Maturing June 10, 2021 | | $ | 794 | | | $ | 786,176 | |

KAR Auction Services, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing March 11, 2021 | | | 1,353 | | | | 1,336,802 | |

Kronos Incorporated | | | | | | | | |

Term Loan, 4.50%, Maturing October 30, 2019 | | | 1,220 | | | | 1,213,754 | |

Language Line, LLC | | | | | | | | |

Term Loan, 6.25%, Maturing June 20, 2016 | | | 977 | | | | 969,520 | |

MCS AMS Sub-Holdings, LLC | | | | | | | | |

Term Loan, 7.00%, Maturing October 15, 2019 | | | 354 | | | | 316,746 | |

Monitronics International, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing March 23, 2018 | | | 610 | | | | 604,252 | |

National CineMedia, LLC | | | | | | | | |

Term Loan, 2.92%, Maturing November 26, 2019 | | | 250 | | | | 238,542 | |

PGX Holdings, Inc. | | | | | | | | |

Term Loan, 6.25%, Maturing September 29, 2020 | | | 398 | | | | 398,991 | |

Quintiles Transnational Corp. | | | | | | | | |

Term Loan, 3.75%, Maturing June 8, 2018 | | | 2,547 | | | | 2,521,089 | |

RCS Capital Corporation | | | | | | | | |

Term Loan, 6.50%, Maturing April 29, 2019 | | | 1,472 | | | | 1,376,669 | |

Sensus USA, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing May 9, 2017 | | | 337 | | | | 330,149 | |

ServiceMaster Company | | | | | | | | |

Term Loan, 4.25%, Maturing July 1, 2021 | | | 1,571 | | | | 1,545,328 | |

SunGard Data Systems, Inc. | | | | | | | | |

Term Loan, 3.91%, Maturing February 28, 2017 | | | 424 | | | | 422,531 | |

Term Loan, 4.00%, Maturing March 8, 2020 | | | 3,203 | | | | 3,179,438 | |

TNS, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing February 14, 2020 | | | 567 | | | | 567,299 | |

TransUnion, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing April 9, 2021 | | | 2,829 | | | | 2,795,035 | |

Travelport Finance (Luxembourg) S.a.r.l. | | | | | | | | |

Term Loan, 6.00%, Maturing September 2, 2021 | | | 875 | | | | 875,219 | |

U.S. Security Holdings, Inc. | | | | | | | | |

Term Loan, 6.25%, Maturing July 28, 2017 | | | 52 | | | | 51,261 | |

Term Loan, 6.25%, Maturing July 28, 2017 | | | 263 | | | | 261,871 | |

WASH Multifamily Laundry Systems, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing February 21, 2019 | | | 1,481 | | | | 1,464,493 | |

West Corporation | | | | | | | | |

Term Loan, 3.25%, Maturing June 30, 2018 | | | 2,677 | | | | 2,630,090 | |

| | | | | | | | | |

| | | | | | $ | 46,738,150 | |

| | | | | | | | | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Cable and Satellite Television — 2.7% | |

Atlantic Broadband Finance, LLC | | | | | | | | |

Term Loan, 3.25%, Maturing November 30, 2019 | | $ | 815 | | | $ | 799,312 | |

Cequel Communications, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing February 14, 2019 | | | 2,143 | | | | 2,115,966 | |

Charter Communications Operating, LLC | | | | | | | | |

Term Loan, 3.00%, Maturing July 1, 2020 | | | 714 | | | | 701,118 | |

Term Loan, 3.00%, Maturing January 3, 2021 | | | 1,305 | | | | 1,281,412 | |

Crown Media Holdings, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing July 14, 2018 | | | 142 | | | | 141,179 | |

CSC Holdings, Inc. | | | | | | | | |

Term Loan, 2.67%, Maturing April 17, 2020 | | | 1,065 | | | | 1,044,543 | |

MCC Iowa, LLC | | | | | | | | |

Term Loan, 3.25%, Maturing January 29, 2021 | | | 517 | | | | 499,026 | |

Term Loan, 3.75%, Maturing June 30, 2021 | | | 572 | | | | 561,159 | |

Mediacom Illinois, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing June 30, 2021 | | | 324 | | | | 318,244 | |

Numericable U.S., LLC | | | | | | | | |

Term Loan, 4.50%, Maturing May 21, 2020 | | | 684 | | | | 684,173 | |

Term Loan, 4.50%, Maturing May 21, 2020 | | | 791 | | | | 790,827 | |

Sterling Entertainment Enterprises, LLC | | | | | | | | |

Term Loan, 3.17%, Maturing December 28, 2017 | | | 384 | | | | 367,450 | |

UPC Financing Partnership | | | | | | | | |

Term Loan, 3.25%, Maturing June 30, 2021 | | | 1,753 | | | | 1,718,114 | |

Virgin Media Bristol, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing June 7, 2020 | | | 4,250 | | | | 4,186,250 | |

Ziggo B.V. | | | | | | | | |

Term Loan, 3.50%, Maturing January 15, 2022 | | | 363 | | | | 354,319 | |

Term Loan, 3.50%, Maturing January 15, 2022 | | | 564 | | | | 549,827 | |

Term Loan, 3.50%, Maturing January 15, 2022 | | | 598 | | | | 582,728 | |

| | | | | | | | | |

| | | | | | $ | 16,695,647 | |

| | | | | | | | | |

|

Chemicals and Plastics — 4.6% | |

Allnex (Luxembourg) & Cy S.C.A. | | | | | | | | |

Term Loan, 4.50%, Maturing October 3, 2019 | | $ | 146 | | | $ | 144,796 | |

Allnex USA, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing October 3, 2019 | | | 76 | | | | 75,128 | |

Arysta LifeScience SPC, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing May 29, 2020 | | | 1,379 | | | | 1,373,251 | |

Axalta Coating Systems US Holdings, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing February 1, 2020 | | | 2,730 | | | | 2,667,272 | |

AZ Chem US, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing June 12, 2021 | | | 444 | | | | 438,498 | |

ECO Services Operations, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing October 8, 2021 | | | 300 | | | | 297,000 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Chemicals and Plastics (continued) | |

Emerald Performance Materials, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing August 1, 2021 | | $ | 374 | | | $ | 366,425 | |

Flint Group GmbH | | | | | | | | |

Term Loan, 4.75%, Maturing September 7, 2021 | | | 255 | | | | 248,404 | |

Flint Group US, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing September 7, 2021 | | | 1,543 | | | | 1,502,642 | |

Gemini HDPE, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing August 7, 2021 | | | 823 | | | | 796,194 | |

Huntsman International, LLC | | | | | | | | |

Term Loan, 2.71%, Maturing April 19, 2017 | | | 1,168 | | | | 1,147,188 | |

Term Loan, 3.75%, Maturing August 12, 2021 | | | 1,250 | | | | 1,232,031 | |

Ineos US Finance, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing May 4, 2018 | | | 5,006 | | | | 4,872,576 | |

Kronos Worldwide, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing February 18, 2020 | | | 199 | | | | 198,252 | |

MacDermid, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing June 7, 2020 | | | 793 | | | | 779,358 | |

Minerals Technologies, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing May 9, 2021 | | | 1,224 | | | | 1,214,324 | |

Omnova Solutions, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing May 31, 2018 | | | 1,370 | | | | 1,355,987 | |

Orion Engineered Carbons GmbH | | | | | | | | |

Term Loan, 5.00%, Maturing July 25, 2021 | | | 424 | | | | 425,527 | |

OXEA Finance, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing January 15, 2020 | | | 347 | | | | 332,640 | |

Term Loan - Second Lien, 8.25%, Maturing July 15, 2020 | | | 500 | | | | 478,750 | |

Polarpak, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing June 5, 2020 | | | 955 | | | | 939,625 | |

PQ Corporation | | | | | | | | |

Term Loan, 4.00%, Maturing August 7, 2017 | | | 2,035 | | | | 1,998,103 | |

Solenis International, L.P. | | | | | | | | |

Term Loan, 4.25%, Maturing July 31, 2021 | | | 224 | | | | 220,089 | |

Sonneborn Refined Products B.V. | | | | | | | | |

Term Loan, 5.50%, Maturing December 10, 2020 | | | 49 | | | | 48,872 | |

Sonneborn, LLC | | | | | | | | |

Term Loan, 5.50%, Maturing December 10, 2020 | | | 276 | | | | 276,941 | |

Tata Chemicals North America, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing August 7, 2020 | | | 739 | | | | 726,745 | |

Tronox Pigments (Netherlands) B.V. | | | | | | | | |

Term Loan, 4.00%, Maturing March 19, 2020 | | | 2,016 | | | | 1,988,142 | |

Univar, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing June 30, 2017 | | | 2,158 | | | | 2,093,813 | |

WNA Holdings, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing June 7, 2020 | | | 732 | | | | 719,870 | |

| | | | | | | | | |

| | | | | | $ | 28,958,443 | |

| | | | | | | | | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Conglomerates — 0.4% | |

RGIS Services, LLC | | | | | | | | |

Term Loan, 5.50%, Maturing October 18, 2017 | | $ | 1,573 | | | $ | 1,439,169 | |

Spectrum Brands, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing September 4, 2019 | | | 815 | | | | 807,152 | |

| | | | | | | | | |

| | | | | | $ | 2,246,321 | |

| | | | | | | | | |

|

Containers and Glass Products — 2.1% | |

Berry Plastics Holding Corporation | | | | | | | | |

Term Loan, 3.50%, Maturing February 8, 2020 | | $ | 3,124 | | | $ | 3,038,442 | |

Term Loan, 3.75%, Maturing January 6, 2021 | | | 1,989 | | | | 1,943,314 | |

Crown Americas, LLC | | | | | | | | |

Term Loan, 1.625%, Maturing October 22, 2021(6) | | | 1,075 | | | | 1,077,956 | |

Hilex Poly Co., LLC | | | | | | | | |

Term Loan, 6.00%, Maturing December 5, 2021 | | | 1,075 | | | | 1,064,250 | |

Libbey Glass, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing April 9, 2021 | | | 274 | | | | 270,205 | |

Pelican Products, Inc. | | | | | | | | |

Term Loan, 5.25%, Maturing April 10, 2020 | | | 1,641 | | | | 1,633,238 | |

Reynolds Group Holdings, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 1, 2018 | | | 3,617 | | | | 3,559,859 | |

TricorBraun, Inc. | | | | | | | | |

Term Loan, 4.01%, Maturing May 3, 2018 | | | 278 | | | | 274,263 | |

| | | | | | | | | |

| | | | | | $ | 12,861,527 | |

| | | | | | | | | |

|

Cosmetics / Toiletries — 0.4% | |

Prestige Brands, Inc. | | | | | | | | |

Term Loan, 4.13%, Maturing January 31, 2019 | | $ | 272 | | | $ | 272,164 | |

Term Loan, 4.50%, Maturing September 3, 2021 | | | 459 | | | | 458,793 | |

Revlon Consumer Products Corporation | | | | | | | | |

Term Loan, 4.00%, Maturing October 8, 2019 | | | 718 | | | | 707,657 | |

Sun Products Corporation (The) | | | | | | | | |

Term Loan, 5.50%, Maturing March 23, 2020 | | | 1,124 | | | | 1,051,248 | |

| | | | | | | | | |

| | | | | | $ | 2,489,862 | |

| | | | | | | | | |

|

Drugs — 2.3% | |

Alkermes, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing September 18, 2019 | | $ | 196 | | | $ | 195,010 | |

AMAG Pharmaceuticals, Inc. | | | | | | | | |

Term Loan, 7.25%, Maturing November 12, 2020 | | | 425 | | | | 422,875 | |

Auxilium Pharmaceuticals, Inc. | | | | | | | | |

Term Loan, 6.25%, Maturing April 26, 2017 | | | 297 | | | | 296,371 | |

Endo Luxembourg Finance Company I S.a r.l. | | | | | | | | |

Term Loan, 3.25%, Maturing February 28, 2021 | | | 248 | | | | 240,991 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Drugs (continued) | |

Ikaria, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing February 12, 2021 | | $ | 1,432 | | | $ | 1,425,885 | |

Impax Laboratories, Inc. | | | | | | | | |

Term Loan, Maturing December 2, 2020(2) | | | 575 | | | | 575,000 | |

Par Pharmaceutical Companies, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing September 30, 2019 | | | 4,813 | | | | 4,706,536 | |

Valeant Pharmaceuticals International, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing February 13, 2019 | | | 2,487 | | | | 2,467,117 | |

Term Loan, 3.50%, Maturing December 11, 2019 | | | 853 | | | | 845,865 | |

Term Loan, 3.50%, Maturing August 5, 2020 | | | 1,190 | | | | 1,180,867 | |

VWR Funding, Inc. | | | | | | | | |

Term Loan, 3.42%, Maturing April 3, 2017 | | | 2,285 | | | | 2,269,105 | |

| | | | | | | | | |

| | | | | | $ | 14,625,622 | |

| | | | | | | | | |

|

Ecological Services and Equipment — 0.7% | |

ADS Waste Holdings, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing October 9, 2019 | | $ | 4,134 | | | $ | 4,022,492 | |

EnergySolutions, LLC | | | | | | | | |

Term Loan, 6.75%, Maturing May 29, 2020 | | | 547 | | | | 547,592 | |

| | | | | | | | | |

| | | | | | $ | 4,570,084 | |

| | | | | | | | | |

|

Electronics / Electrical — 9.6% | |

Allflex Holdings III, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 17, 2020 | | $ | 346 | | | $ | 338,713 | |

Answers Corporation | | | | | | | | |

Term Loan, 6.25%, Maturing October 3, 2021 | | | 800 | | | | 768,000 | |

Applied Systems, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing January 25, 2021 | | | 545 | | | | 536,196 | |

Avago Technologies Cayman Ltd. | | | | | | | | |

Term Loan, 3.75%, Maturing May 6, 2021 | | | 7,065 | | | | 7,046,839 | |

Blue Coat Systems, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing May 31, 2019 | | | 1,481 | | | | 1,446,074 | |

Term Loan - Second Lien, 9.50%, Maturing June 28, 2020 | | | 450 | | | | 443,250 | |

Campaign Monitor Finance Pty Limited | | | | | | | | |

Term Loan, 6.25%, Maturing March 18, 2021 | | | 471 | | | | 465,545 | |

Carros Finance Luxembourg S.a.r.l. | | | | | | | | |

Term Loan, 4.50%, Maturing September 30, 2021 | | | 1,222 | | | | 1,211,246 | |

CommScope, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing January 14, 2018 | | | 716 | | | | 711,164 | |

CompuCom Systems, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing May 11, 2020 | | | 405 | | | | 387,471 | |

Dealertrack Technologies, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing February 28, 2021 | | | 310 | | | | 304,724 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Electronics / Electrical (continued) | |

Dell, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing April 29, 2020 | | $ | 5,742 | | | $ | 5,734,311 | |

Eagle Parent, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing May 16, 2018 | | | 1,212 | | | | 1,198,004 | |

Entegris, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing April 30, 2021 | | | 289 | | | | 283,265 | |

Excelitas Technologies Corp. | | | | | | | | |

Term Loan, 6.00%, Maturing October 31, 2020 | | | 513 | | | | 510,374 | |

Eze Castle Software, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing April 6, 2020 | | | 321 | | | | 314,871 | |

FIDJI Luxembourg (BC4) S.a.r.l. | | | | | | | | |

Term Loan, 6.25%, Maturing December 24, 2020 | | | 481 | | | | 482,754 | |

Freescale Semiconductor, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing February 28, 2020 | | | 1,275 | | | | 1,246,430 | |

Go Daddy Operating Company, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing May 13, 2021 | | | 3,227 | | | | 3,209,995 | |

GXS Group, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing January 16, 2021 | | | 594 | | | | 590,473 | |

Hyland Software, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing February 19, 2021 | | | 963 | | | | 959,242 | |

Infor (US), Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing June 3, 2020 | | | 241 | | | | 233,773 | |

Term Loan, 3.75%, Maturing June 3, 2020 | | | 5,012 | | | | 4,869,720 | |

M/A-COM Technology Solutions Holdings, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing May 7, 2021 | | | 323 | | | | 323,375 | |

MA FinanceCo., LLC | | | | | | | | |

Term Loan, 4.50%, Maturing October 7, 2019 | | | 800 | | | | 767,334 | |

Term Loan, 5.25%, Maturing October 7, 2021 | | | 800 | | | | 771,334 | |

Magic Newco, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing December 12, 2018 | | | 1,746 | | | | 1,739,403 | |

MH Sub I, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing July 8, 2021(6) | | | 34 | | | | 33,920 | |

Term Loan, 5.00%, Maturing July 8, 2021 | | | 488 | | | | 484,750 | |

Microsemi Corporation | | | | | | | | |

Term Loan, 3.25%, Maturing February 19, 2020 | | | 577 | | | | 567,433 | |

NXP B.V. | | | | | | | | |

Term Loan, 3.25%, Maturing January 11, 2020 | | | 1,210 | | | | 1,195,071 | |

Orbotech, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing August 6, 2020 | | | 349 | | | | 346,507 | |

Renaissance Learning, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing April 9, 2021 | | | 471 | | | | 463,187 | |

Rocket Software, Inc. | | | | | | | | |

Term Loan, 5.75%, Maturing February 8, 2018 | | | 216 | | | | 214,952 | |

RP Crown Parent, LLC | | | | | | | | |

Term Loan, 6.00%, Maturing December 21, 2018 | | | 3,318 | | | | 3,087,409 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Electronics / Electrical (continued) | |

SGMS Escrow Corp. | | | | | | | | |

Term Loan, 6.00%, Maturing October 1, 2021 | | $ | 625 | | | $ | 617,188 | |

SGS Cayman, L.P. | | | | | | | | |

Term Loan, 6.00%, Maturing April 23, 2021 | | | 141 | | | | 140,557 | |

Shield Finance Co. S.a.r.l. | | | | | | | | |

Term Loan, 5.00%, Maturing January 29, 2021 | | | 447 | | | | 445,508 | |

Sirius Computer Solutions, Inc. | | | | | | | | |

Term Loan, 7.00%, Maturing November 30, 2018 | | | 214 | | | | 214,574 | |

SkillSoft Corporation | | | | | | | | |

Term Loan, 5.75%, Maturing April 28, 2021 | | | 1,496 | | | | 1,471,562 | |

Smart Technologies ULC | | | | | | | | |

Term Loan, 10.50%, Maturing January 31, 2018 | | | 363 | | | | 358,875 | |

Sophia, L.P. | | | | | | | | |

Term Loan, 4.00%, Maturing July 19, 2018 | | | 989 | | | | 977,687 | |

Southwire Company | | | | | | | | |

Term Loan, 3.25%, Maturing February 10, 2021 | | | 248 | | | | 239,647 | |

SunEdison Semiconductor B.V. | | | | | | | | |

Term Loan, 6.50%, Maturing May 27, 2019 | | | 547 | | | | 539,041 | |

SurveyMonkey.com, LLC | | | | | | | | |

Term Loan, 5.50%, Maturing February 5, 2019 | | | 1,260 | | | | 1,254,537 | |

Sutherland Global Services, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing April 23, 2021 | | | 607 | | | | 603,827 | |

Sybil Software, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing March 20, 2020 | | | 2,069 | | | | 2,053,855 | |

Vantiv, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing June 13, 2021 | | | 597 | | | | 592,985 | |

VeriFone, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing July 8, 2021 | | | 1,990 | | | | 1,966,369 | |

Vertafore, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing October 3, 2019 | | | 484 | | | | 480,018 | |

Wall Street Systems Delaware, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing April 30, 2021 | | | 2,617 | | | | 2,586,854 | |

Websense, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing June 25, 2020 | | | 443 | | | | 436,812 | |

Zebra Technologies Corporation | | | | | | | | |

Term Loan, 4.75%, Maturing October 27, 2021 | | | 1,525 | | | | 1,536,915 | |

| | | | | | | | | |

| | | | | | $ | 59,803,920 | |

| | | | | | | | | |

|

Equipment Leasing — 0.5% | |

Delos Finance S.a.r.l. | | | | | | | | |

Term Loan, 3.50%, Maturing March 6, 2021 | | $ | 1,625 | | | $ | 1,615,521 | |

Flying Fortress, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing June 30, 2017 | | | 1,458 | | | | 1,443,750 | |

| | | | | | | | | |

| | | | | | $ | 3,059,271 | |

| | | | | | | | | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Financial Intermediaries — 3.7% | |

American Capital, Ltd. | | | | | | | | |

Term Loan, 3.50%, Maturing August 22, 2017 | | $ | 297 | | | $ | 293,288 | |

Armor Holding II, LLC | | | | | | | | |

Term Loan, 5.75%, Maturing June 26, 2020 | | | 1,356 | | | | 1,349,149 | |

Citco Funding, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing June 29, 2018 | | | 1,017 | | | | 1,013,636 | |

Clipper Acquisitions Corp. | | | | | | | | |

Term Loan, 3.00%, Maturing February 6, 2020 | | | 270 | | | | 259,582 | |

First Data Corporation | | | | | | | | |

Term Loan, 3.67%, Maturing March 24, 2017 | | | 500 | | | | 492,250 | |

Term Loan, 3.67%, Maturing March 23, 2018 | | | 3,455 | | | | 3,389,747 | |

Term Loan, 3.67%, Maturing September 24, 2018 | | | 1,125 | | | | 1,104,258 | |

Grosvenor Capital Management Holdings, LLP | | | | | | | | |

Term Loan, 3.75%, Maturing January 4, 2021 | | | 2,757 | | | | 2,708,949 | |

Guggenheim Partners, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing July 22, 2020 | | | 867 | | | | 860,901 | |

Hamilton Lane Advisors, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing February 28, 2018 | | | 263 | | | | 259,227 | |

Harbourvest Partners, LLC | | | | | | | | |

Term Loan, 3.25%, Maturing February 4, 2021 | | | 1,142 | | | | 1,106,664 | |

Home Loan Servicing Solutions Ltd. | | | | | | | | |

Term Loan, 4.50%, Maturing June 26, 2020 | | | 591 | | | | 559,234 | |

LPL Holdings, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing March 29, 2019 | | | 1,901 | | | | 1,874,564 | |

Medley, LLC | | | | | | | | |

Term Loan, 6.50%, Maturing June 15, 2019 | | | 367 | | | | 365,210 | |

MIP Delaware, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing March 9, 2020 | | | 647 | | | | 642,051 | |

Moneygram International, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing March 27, 2020 | | | 221 | | | | 205,035 | |

NXT Capital, Inc. | | | | | | | | |

Term Loan, 6.25%, Maturing September 4, 2018 | | | 74 | | | | 74,807 | |

Term Loan, 6.25%, Maturing September 4, 2018 | | | 444 | | | | 446,597 | |

Ocwen Financial Corporation | | | | | | | | |

Term Loan, 5.00%, Maturing February 15, 2018 | | | 2,591 | | | | 2,440,329 | |

Starwood Property Trust, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing April 17, 2020 | | | 1,577 | | | | 1,547,779 | |

Walker & Dunlop, Inc. | | | | | | | | |

Term Loan, 5.25%, Maturing December 11, 2020 | | | 396 | | | | 395,010 | |

Walter Investment Management Corp. | | | | | | | | |

Term Loan, 4.75%, Maturing December 11, 2020 | | | 2,140 | | | | 1,936,752 | |

| | | | | | | | | |

| | | | | | $ | 23,325,019 | |

| | | | | | | | | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Food Products — 3.5% | |

AdvancePierre Foods, Inc. | | | | | | | | |

Term Loan, 5.75%, Maturing July 10, 2017 | | $ | 2,602 | | | $ | 2,589,336 | |

Big Heart Pet Brands | | | | | | | | |

Term Loan, 3.50%, Maturing March 8, 2020 | | | 1,973 | | | | 1,898,951 | |

Charger OpCo B.V. | | | | | | | | |

Term Loan, 3.50%, Maturing July 23, 2021 | | | 1,600 | | | | 1,564,000 | |

CSM Bakery Solutions, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing July 3, 2020 | | | 543 | | | | 533,623 | |

Del Monte Foods, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing February 18, 2021 | | | 945 | | | | 869,739 | |

Diamond Foods, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing August 20, 2018 | | | 1,117 | | | | 1,108,654 | |

Dole Food Company, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing November 1, 2018 | | | 703 | | | | 697,096 | |

H.J. Heinz Company | | | | | | | | |

Term Loan, 3.50%, Maturing June 5, 2020 | | | 4,746 | | | | 4,726,270 | |

High Liner Foods Incorporated | | | | | | | | |

Term Loan, 4.25%, Maturing April 24, 2021 | | | 546 | | | | 539,734 | |

JBS USA Holdings, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing May 25, 2018 | | | 2,593 | | | | 2,555,837 | |

Term Loan, 3.75%, Maturing September 18, 2020 | | | 963 | | | | 951,066 | |

NBTY, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing October 1, 2017 | | | 3,727 | | | | 3,628,895 | |

Pinnacle Foods Finance, LLC | | | | | | | | |

Term Loan, 3.00%, Maturing April 29, 2020 | | | 420 | | | | 407,936 | |

| | | | | | | | | |

| | | | | | $ | 22,071,137 | |

| | | | | | | | | |

|

Food Service — 2.3% | |

Aramark Services, Inc. | | | | | | | | |

Term Loan, 3.67%, Maturing July 26, 2016 | | $ | 48 | | | $ | 47,712 | |

Term Loan, 3.67%, Maturing July 26, 2016 | | | 216 | | | | 213,469 | |

ARG IH Corporation | | | | | | | | |

Term Loan, 4.75%, Maturing November 15, 2020 | | | 173 | | | | 172,709 | |

Buffets, Inc. | | | | | | | | |

Term Loan, 0.13%, Maturing April 22, 2015(3) | | | 83 | | | | 66,552 | |

CEC Entertainment, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing February 14, 2021 | | | 993 | | | | 969,342 | |

Darling International, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing January 6, 2021 | | | 447 | | | | 444,950 | |

Dunkin’ Brands, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing February 7, 2021 | | | 3,299 | | | | 3,228,301 | |

Landry’s, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing April 24, 2018 | | | 1,636 | | | | 1,628,312 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Food Service (continued) | |

NPC International, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 28, 2018 | | $ | 1,307 | | | $ | 1,274,057 | |

OSI Restaurant Partners, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing October 25, 2019 | | | 293 | | | | 289,758 | |

P.F. Chang’s China Bistro, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 2, 2019 | | | 191 | | | | 183,478 | |

Seminole Hard Rock Entertainment, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing May 14, 2020 | | | 148 | | | | 142,702 | |

US Foods, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing March 31, 2019 | | | 3,423 | | | | 3,407,900 | |

Weight Watchers International, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing April 2, 2020 | | | 3,242 | | | | 2,514,770 | |

| | | | | | | | | |

| | | | | | $ | 14,584,012 | |

| | | | | | | | | |

|

Food / Drug Retailers — 2.8% | |

Albertson’s Holdings, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing August 25, 2019 | | $ | 1,675 | | | $ | 1,669,975 | |

Term Loan, 4.50%, Maturing August 25, 2021 | | | 675 | | | | 676,266 | |

Albertson’s, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing March 21, 2019 | | | 620 | | | | 617,427 | |

General Nutrition Centers, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing March 4, 2019 | | | 2,909 | | | | 2,815,807 | |

New Albertson’s, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing June 27, 2021 | | | 4,663 | | | | 4,603,566 | |

Pantry, Inc. (The) | | | | | | | | |

Term Loan, 4.75%, Maturing August 2, 2019 | | | 220 | | | | 219,655 | |

Rite Aid Corporation | | | | | | | | |

Term Loan, 3.50%, Maturing February 21, 2020 | | | 1,256 | | | | 1,253,592 | |

Term Loan - Second Lien, 5.75%, Maturing August 21, 2020 | | | 250 | | | | 251,406 | |

Supervalu, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing March 21, 2019 | | | 5,371 | | | | 5,288,872 | |

| | | | | | | | | |

| | | | | | $ | 17,396,566 | |

| | | | | | | | | |

|

Health Care — 9.9% | |

Akorn, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing April 16, 2021 | | $ | 673 | | | $ | 669,104 | |

Alere, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing June 30, 2017 | | | 1,622 | | | | 1,612,851 | |

Alliance Healthcare Services, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing June 3, 2019 | | | 640 | | | | 633,850 | |

Amneal Pharmaceuticals, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing November 1, 2019 | | | 1,070 | | | | 1,069,340 | |

Amsurg Corp. | | | | | | | | |

Term Loan, 3.75%, Maturing July 16, 2021 | | | 473 | | | | 470,853 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Health Care (continued) | |

Ardent Medical Services, Inc. | | | | | | | | |

Term Loan, 6.75%, Maturing July 2, 2018 | | $ | 706 | | | $ | 707,597 | |

ATI Holdings, Inc. | | | | | | | | |

Term Loan, 5.25%, Maturing December 20, 2019 | | | 221 | | | | 220,541 | |

Auris Luxembourg II S.A. | | | | | | | | |

Term Loan, Maturing December 31, 2021(2) | | | 550 | | | | 549,312 | |

Biomet, Inc. | | | | | | | | |

Term Loan, 3.67%, Maturing July 25, 2017 | | | 4,187 | | | | 4,173,890 | |

CareCore National, LLC | | | | | | | | |

Term Loan, 5.50%, Maturing March 5, 2021 | | | 324 | | | | 320,536 | |

CeramTec Acquisition Corporation | | | | | | | | |

Term Loan, 4.25%, Maturing August 30, 2020 | | | 90 | | | | 89,445 | |

CHG Healthcare Services, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing November 19, 2019 | | | 1,054 | | | | 1,044,075 | |

Community Health Systems, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing January 27, 2021 | | | 5,867 | | | | 5,862,450 | |

Convatec, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 22, 2016 | | | 502 | | | | 497,730 | |

CPI Buyer, LLC | | | | | | | | |

Term Loan, 5.50%, Maturing August 18, 2021 | | | 748 | | | | 736,903 | |

DaVita HealthCare Partners, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing June 24, 2021 | | | 2,090 | | | | 2,072,709 | |

DJO Finance, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing September 15, 2017 | | | 1,367 | | | | 1,339,263 | |

Envision Healthcare Corporation | | | | | | | | |

Term Loan, 4.00%, Maturing May 25, 2018 | | | 2,369 | | | | 2,347,695 | |

Faenza Acquisition GmbH | | | | | | | | |

Term Loan, 4.25%, Maturing August 30, 2020 | | | 272 | | | | 269,523 | |

Term Loan, 4.25%, Maturing August 30, 2020 | | | 911 | | | | 901,648 | |

Gentiva Health Services, Inc. | | | | | | | | |

Term Loan, 6.50%, Maturing October 18, 2019 | | | 2,754 | | | | 2,757,658 | |

Grifols Worldwide Operations USA, Inc. | | | | | | | | |

Term Loan, 3.17%, Maturing February 27, 2021 | | | 3,176 | | | | 3,137,888 | |

Halyard Health, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing November 1, 2021 | | | 475 | | | | 476,113 | |

HCA, Inc. | | | | | | | | |

Term Loan, 3.01%, Maturing May 1, 2018 | | | 420 | | | | 416,999 | |

Iasis Healthcare, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing May 3, 2018 | | | 794 | | | | 788,394 | |

inVentiv Health, Inc. | | | | | | | | |

Term Loan, 7.75%, Maturing May 15, 2018 | | | 331 | | | | 329,901 | |

Term Loan, 7.75%, Maturing May 15, 2018 | | | 1,340 | | | | 1,336,074 | |

JLL/Delta Dutch Newco B.V. | | | | | | | | |

Term Loan, 4.25%, Maturing March 11, 2021 | | | 1,294 | | | | 1,259,142 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Health Care (continued) | |

Kindred Healthcare, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing April 9, 2021 | | $ | 995 | | | $ | 967,637 | |

Kinetic Concepts, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing May 4, 2018 | | | 1,323 | | | | 1,311,145 | |

LHP Hospital Group, Inc. | | | | | | | | |

Term Loan, 9.00%, Maturing July 3, 2018 | | | 398 | | | | 383,592 | |

Mallinckrodt International Finance S.A. | | | | | | | | |

Term Loan, 3.25%, Maturing March 19, 2021 | | | 2,010 | | | | 1,972,547 | |

Term Loan, 3.50%, Maturing March 19, 2021 | | | 873 | | | | 860,539 | |

MedAssets, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing December 13, 2019 | | | 179 | | | | 178,159 | |

Millennium Laboratories, Inc. | | | | | | | | |

Term Loan, 5.25%, Maturing April 16, 2021 | | | 1,368 | | | | 1,363,423 | |

MMM Holdings, Inc. | | | | | | | | |

Term Loan, 9.75%, Maturing December 12, 2017 | | | 274 | | | | 266,133 | |

MSO of Puerto Rico, Inc. | | | | | | | | |

Term Loan, 9.75%, Maturing December 12, 2017 | | | 199 | | | | 197,471 | |

National Mentor Holdings, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing January 31, 2021 | | | 347 | | | | 339,776 | |

Onex Carestream Finance L.P. | | | | | | | | |

Term Loan, 5.00%, Maturing June 7, 2019 | | | 1,391 | | | | 1,384,600 | |

Opal Acquisition, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing November 27, 2020 | | | 1,436 | | | | 1,423,389 | |

Ortho-Clinical Diagnostics, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing June 30, 2021 | | | 1,541 | | | | 1,518,851 | |

Pharmaceutical Product Development, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing December 5, 2018 | | | 2,818 | | | | 2,806,230 | |

PRA Holdings, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing September 23, 2020 | | | 2,306 | | | | 2,279,922 | |

Radnet Management, Inc. | | | | | | | | |

Term Loan, 4.27%, Maturing October 10, 2018 | | | 881 | | | | 875,889 | |

RegionalCare Hospital Partners, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing April 19, 2019 | | | 1,519 | | | | 1,514,828 | |

Sage Products Holdings III, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing December 13, 2019 | | | 981 | | | | 979,422 | |

Salix Pharmaceuticals Ltd. | | | | | | | | |

Term Loan, 4.25%, Maturing January 2, 2020 | | | 1,168 | | | | 1,157,177 | |

Select Medical Corporation | | | | | | | | |

Term Loan, 2.99%, Maturing December 20, 2016 | | | 175 | | | | 171,937 | |

Term Loan, 3.75%, Maturing June 1, 2018 | | | 900 | | | | 877,500 | |

Steward Health Care System, LLC | | | | | | | | |

Term Loan, 6.75%, Maturing April 12, 2020 | | | 1,457 | | | | 1,444,525 | |

Tecomet, Inc. | | | | | | | | |

Term Loan, 5.75%, Maturing December 5, 2021 | | | 825 | | | | 796,125 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Health Care (continued) | |

Truven Health Analytics, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing June 6, 2019 | | $ | 806 | | | $ | 785,329 | |

U.S. Renal Care, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 3, 2019 | | | 198 | | | | 194,906 | |

| | | | | | | | | |

| | | | | | $ | 62,142,536 | |

| | | | | | | | | |

|

Home Furnishings — 0.9% | |

Interline Brands, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing March 17, 2021 | | $ | 149 | | | $ | 143,850 | |

Serta Simmons Holdings, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing October 1, 2019 | | | 3,326 | | | | 3,290,268 | |

Tempur-Pedic International, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing March 18, 2020 | | | 2,282 | | | | 2,253,433 | |

| | | | | | | | | |

| | | | | | $ | 5,687,551 | |

| | | | | | | | | |

|

Industrial Equipment — 2.8% | |

Alliance Laundry Systems, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing December 10, 2018 | | $ | 151 | | | $ | 150,039 | |

Apex Tool Group, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing January 31, 2020 | | | 3,788 | | | | 3,683,392 | |

Delachaux S.A. | | | | | | | | |

Term Loan, 5.25%, Maturing September 25, 2021 | | | 400 | | | | 399,000 | |

Doosan Infracore International, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing May 28, 2021 | | | 2,502 | | | | 2,489,251 | |

Filtration Group Corporation | | | | | | | | |

Term Loan, 4.50%, Maturing November 21, 2020 | | | 173 | | | | 173,033 | |

Gardner Denver, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 30, 2020 | | | 1,086 | | | | 1,020,905 | |

Generac Power Systems, Inc. | | | | | | | | |

Term Loan, 3.25%, Maturing May 31, 2020 | | | 1,771 | | | | 1,717,870 | |

Husky Injection Molding Systems Ltd. | | | | | | | | |

Term Loan, 4.25%, Maturing June 30, 2021 | | | 1,818 | | | | 1,770,337 | |

Milacron, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing March 28, 2020 | | | 296 | | | | 288,129 | |

NN, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing August 27, 2021 | | | 493 | | | | 492,549 | |

Paladin Brands Holding, Inc. | | | | | | | | |

Term Loan, 6.75%, Maturing August 16, 2019 | | | 422 | | | | 421,258 | |

Rexnord, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing August 21, 2020 | | | 2,765 | | | | 2,711,774 | |

Signode Industrial Group US, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing May 1, 2021 | | | 729 | | | | 701,823 | |

Spansion, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing December 19, 2019 | | | 515 | | | | 511,423 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Industrial Equipment (continued) | |

STS Operating, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing February 12, 2021 | | $ | 199 | | | $ | 195,522 | |

Tank Holding Corp. | | | | | | | | |

Term Loan, 4.25%, Maturing July 9, 2019 | | | 797 | | | | 784,196 | |

Virtuoso US, LLC | | | | | | | | |

Term Loan, 4.75%, Maturing February 11, 2021 | | | 273 | | | | 271,232 | |

| | | | | | | | | |

| | | | | | $ | 17,781,733 | |

| | | | | | | | | |

|

Insurance — 2.6% | |

Alliant Holdings I, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing December 20, 2019 | | $ | 1,697 | | | $ | 1,675,390 | |

AmWINS Group, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing September 6, 2019 | | | 2,313 | | | | 2,307,609 | |

Asurion, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing May 24, 2019 | | | 5,589 | | | | 5,521,796 | |

Term Loan, 4.25%, Maturing July 8, 2020 | | | 542 | | | | 526,852 | |

Term Loan - Second Lien, 8.50%, Maturing March 3, 2021 | | | 675 | | | | 673,313 | |

CGSC of Delaware Holding Corporation | | | | | | | | |

Term Loan, 5.00%, Maturing April 16, 2020 | | | 271 | | | | 250,559 | |

CNO Financial Group, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing September 28, 2018 | | | 483 | | | | 471,978 | |

Cunningham Lindsey U.S., Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing December 10, 2019 | | | 466 | | | | 455,618 | |

Hub International Limited | | | | | | | | |

Term Loan, 4.25%, Maturing October 2, 2020 | | | 2,001 | | | | 1,948,978 | |

USI, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing December 27, 2019 | | | 2,287 | | | | 2,248,451 | |

| | | | | | | | | |

| | | | | | $ | 16,080,544 | |

| | | | | | | | | |

|

Leisure Goods / Activities / Movies — 3.1% | |

AMC Entertainment, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing April 30, 2020 | | $ | 1,277 | | | $ | 1,262,348 | |

Aufinco Pty Limited | | | | | | | | |

Term Loan, 4.00%, Maturing May 29, 2020 | | | 246 | | | | 240,709 | |

Bombardier Recreational Products, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing January 30, 2019 | | | 1,603 | | | | 1,574,807 | |

ClubCorp Club Operations, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing July 24, 2020 | | | 818 | | | | 807,043 | |

Dave & Buster’s, Inc. | | | | | | | | |

Term Loan, 4.25%, Maturing July 25, 2020 | | | 101 | | | | 101,035 | |

Emerald Expositions Holding, Inc. | | | | | | | | |

Term Loan, 4.75%, Maturing June 17, 2020 | | | 572 | | | | 563,407 | |

Equinox Holdings, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing January 31, 2020 | | | 988 | | | | 981,335 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Leisure Goods / Activities / Movies (continued) | |

Fender Musical Instruments Corporation | | | | | | | | |

Term Loan, 5.75%, Maturing April 3, 2019 | | $ | 185 | | | $ | 184,189 | |

Kasima, LLC | | | | | | | | |

Term Loan, 3.25%, Maturing May 17, 2021 | | | 479 | | | | 467,906 | |

Live Nation Entertainment, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing August 17, 2020 | | | 171 | | | | 169,125 | |

Nord Anglia Education Finance, LLC | | | | | | | | |

Term Loan, 4.50%, Maturing March 31, 2021 | | | 1,667 | | | | 1,641,626 | |

Regal Cinemas, Inc. | | | | | | | | |

Term Loan, 2.70%, Maturing August 23, 2017 | | | 2,496 | | | | 2,455,440 | |

Sabre, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing February 19, 2019 | | | 637 | | | | 628,640 | |

SeaWorld Parks & Entertainment, Inc. | | | | | | | | |

Term Loan, 3.00%, Maturing May 14, 2020 | | | 1,482 | | | | 1,407,926 | |

SRAM, LLC | | | | | | | | |

Term Loan, 4.01%, Maturing April 10, 2020 | | | 914 | | | | 886,248 | |

Town Sports International, Inc. | | | | | | | | |

Term Loan, 4.50%, Maturing November 16, 2020 | | | 735 | | | | 531,138 | |

WMG Acquisition Corp. | | | | | | | | |

Term Loan, 3.75%, Maturing July 1, 2020 | | | 2,026 | | | | 1,954,716 | |

Zuffa, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing February 25, 2020 | | | 3,445 | | | | 3,307,052 | |

| | | | | | | | | |

| | | | | | $ | 19,164,690 | |

| | | | | | | | | |

|

Lodging and Casinos — 2.9% | |

Amaya Holdings B.V. | | | | | | | | |

Term Loan, 5.00%, Maturing August 1, 2021 | | $ | 2,319 | | | $ | 2,305,852 | |

Boyd Gaming Corporation | | | | | | | | |

Term Loan, 4.00%, Maturing August 14, 2020 | | | 280 | | | | 276,046 | |

Caesars Entertainment Operating Company | | | | | | | | |

Term Loan, 6.99%, Maturing March 1, 2017(5) | | | 785 | | | | 693,670 | |

CityCenter Holdings, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing October 16, 2020 | | | 500 | | | | 497,127 | |

Four Seasons Holdings, Inc. | | | | | | | | |

Term Loan, 3.50%, Maturing June 27, 2020 | | | 395 | | | | 388,334 | |

Golden Nugget, Inc. | | | | | | | | |

Term Loan, 5.50%, Maturing November 21, 2019 | | | 89 | | | | 88,487 | |

Term Loan, 5.50%, Maturing November 21, 2019 | | | 208 | | | | 206,471 | |

Hilton Worldwide Finance, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing October 26, 2020 | | | 7,220 | | | | 7,146,327 | |

La Quinta Intermediate Holdings, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing April 14, 2021 | | | 699 | | | | 692,144 | |

MGM Resorts International | | | | | | | | |

Term Loan, 3.50%, Maturing December 20, 2019 | | | 1,911 | | | | 1,869,197 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Lodging and Casinos (continued) | |

Pinnacle Entertainment, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing August 13, 2020 | | $ | 444 | | | $ | 439,877 | |

Playa Resorts Holding B.V. | | | | | | | | |

Term Loan, 4.00%, Maturing August 6, 2019 | | | 1,286 | | | | 1,266,932 | |

RHP Hotel Properties L.P. | | | | | | | | |

Term Loan, 3.75%, Maturing January 15, 2021 | | | 423 | | | | 423,139 | |

Scientific Games International, Inc. | | | | | | | | |

Term Loan, 6.00%, Maturing October 18, 2020 | | | 1,881 | | | | 1,858,663 | |

Tropicana Entertainment, Inc. | | | | | | | | |

Term Loan, 4.00%, Maturing November 27, 2020 | | | 222 | | | | 218,716 | |

| | | | | | | | | |

| | | | | | $ | 18,370,982 | |

| | | | | | | | | |

|

Nonferrous Metals / Minerals — 1.9% | |

Alpha Natural Resources, LLC | | | | | | | | |

Term Loan, 3.50%, Maturing May 22, 2020 | | $ | 1,400 | | | $ | 1,135,801 | |

Arch Coal, Inc. | | | | | | | | |

Term Loan, 6.25%, Maturing May 16, 2018 | | | 2,419 | | | | 2,011,384 | |

Fairmount Minerals Ltd. | | | | | | | | |

Term Loan, 3.81%, Maturing March 15, 2017 | | | 247 | | | | 228,359 | |

Term Loan, 4.50%, Maturing September 5, 2019 | | | 2,224 | | | | 2,026,011 | |

Murray Energy Corporation | | | | | | | | |

Term Loan, 5.25%, Maturing December 5, 2019 | | | 844 | | | | 814,309 | |

Noranda Aluminum Acquisition Corporation | | | | | | | | |

Term Loan, 5.75%, Maturing February 28, 2019 | | | 486 | | | | 466,800 | |

Novelis, Inc. | | | | | | | | |

Term Loan, 3.75%, Maturing March 10, 2017 | | | 2,648 | | | | 2,626,885 | |

Oxbow Carbon, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing July 19, 2019 | | | 1,203 | | | | 1,109,853 | |

Walter Energy, Inc. | | | | | | | | |

Term Loan, 7.25%, Maturing April 2, 2018 | | | 1,603 | | | | 1,247,247 | |

| | | | | | | | | |

| | | | | | $ | 11,666,649 | |

| | | | | | | | | |

|

Oil and Gas — 3.3% | |

Ameriforge Group, Inc. | | | | | | | | |

Term Loan, 5.00%, Maturing December 19, 2019 | | $ | 2,192 | | | $ | 2,006,045 | |

Bronco Midstream Funding, LLC | | | | | | | | |

Term Loan, 5.00%, Maturing August 15, 2020 | | | 1,010 | | | | 954,423 | |

Citgo Petroleum Corporation | | | | | | | | |

Term Loan, 4.50%, Maturing July 29, 2021 | | | 723 | | | | 721,380 | |

Crestwood Holdings, LLC | | | | | | | | |

Term Loan, 7.00%, Maturing June 19, 2019 | | | 1,243 | | | | 1,174,358 | |

Drillships Ocean Ventures, Inc. | | | | | | | | |

Term Loan, 5.50%, Maturing July 25, 2021 | | | 798 | | | | 647,377 | |

| | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Oil and Gas (continued) | |

Energy Transfer Equity, L.P. | | | | | | | | |

Term Loan, 3.25%, Maturing December 2, 2019 | | $ | 1,025 | | | $ | 996,812 | |

Fieldwood Energy, LLC | | | | | | | | |

Term Loan, 3.88%, Maturing September 28, 2018 | | | 642 | | | | 610,539 | |

Term Loan - Second Lien, 8.38%, Maturing September 30, 2020 | | | 425 | | | | 313,013 | |

Floatel International, Ltd. | | | | | | | | |

Term Loan, 6.00%, Maturing June 27, 2020 | | | 1,690 | | | | 1,377,136 | |

MEG Energy Corp. | | | | | | | | |

Term Loan, 3.75%, Maturing March 31, 2020 | | | 3,209 | | | | 3,074,092 | |

Obsidian Natural Gas Trust | | | | | | | | |

Term Loan, 7.00%, Maturing November 2, 2015 | | | 341 | | | | 338,208 | |

Paragon Offshore Finance Company | | | | | | | | |

Term Loan, 3.75%, Maturing July 18, 2021 | | | 648 | | | | 538,151 | |

Samson Investment Company | | | | | | | | |

Term Loan - Second Lien, 5.00%, Maturing September 25, 2018 | | | 1,425 | | | | 1,126,937 | |

Seadrill Partners Finco, LLC | | | | | | | | |

Term Loan, 4.00%, Maturing February 21, 2021 | | | 2,452 | | | | 1,914,759 | |

Seventy Seven Operating, LLC | | | | | | | | |

Term Loan, 3.75%, Maturing June 25, 2021 | | | 348 | | | | 295,142 | |

Sheridan Investment Partners II, L.P. | | | | | | | | |

Term Loan, 4.25%, Maturing December 16, 2020 | | | 23 | | | | 18,339 | |

Term Loan, 4.25%, Maturing December 16, 2020 | | | 61 | | | | 49,173 | |

Term Loan, 4.25%, Maturing December 16, 2020 | | | 436 | | | | 353,486 | |

Sheridan Production Partners I, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing October 1, 2019 | | | 78 | | | | 68,459 | |

Term Loan, 4.25%, Maturing October 1, 2019 | | | 128 | | | | 112,080 | |

Term Loan, 4.25%, Maturing October 1, 2019 | | | 967 | | | | 845,836 | |

Tallgrass Operations, LLC | | | | | | | | |

Term Loan, 4.25%, Maturing November 13, 2018 | | | 1,471 | | | | 1,439,787 | |

Tervita Corporation | | | | | | | | |

Term Loan, 6.25%, Maturing May 15, 2018 | | | 1,874 | | | | 1,739,858 | |

| | | | | | | | | |