UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10067

Eaton Vance Variable Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2021

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

VT Floating-Rate Income Fund

Annual Report

December 31, 2021

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report December 31, 2021

Eaton Vance

VT Floating-Rate Income Fund

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Management’s Discussion of Fund Performance1

Economic and Market Conditions

Amid a global recovery from the pandemic-induced sell-off that had engulfed equity and credit markets, senior loans displayed their value as a portfolio diversifier by outperforming most other U.S. fixed-income asset classes — including government debt and investment-grade corporate bonds — during the 12-month period ended December 31, 2021.

As the period opened on January 1, 2021, senior loans were in the midst of a rally that had begun the previous March when central banks around the world stepped in to support capital markets. At that time, the U.S. Federal Reserve had cut its benchmark federal funds rate to 0.00%-0.25%, initiated a significant bond-buying program, and announced other policy measures to help global credit markets.

Except for pauses in March and July 2021 when returns were flat — and in November 2021 when a new COVID-19 variant caused asset prices to plummet worldwide — the loan rally continued throughout the period. A massive fiscal stimulus package passed by the U.S. Congress, the rollout of vaccines, the reopening of U.S. businesses, and comparatively low yields in other fixed-income asset classes all provided tailwinds for senior loans during the period.

Technical factors also bolstered loan performance as demand outpaced supply for most of the period. Contributing factors included an increase in institutional demand for structured loan products and net monthly inflows for retail funds during every month of the period.

Issuer fundamentals improved as well, with rating upgrades outpacing rating downgrades. The trailing 12-month default rate plummeted from 3.83% at the beginning of the period to 0.29% at period-end, well below the market’s 3.20% long-term average. Reflecting the improved economic environment, the average loan price rose from $96.20 at the start of the period to $98.64 at period-end.

For the period as a whole, lower quality loans outperformed higher quality issues, with BBB, BB, B, CCC and D-rated (defaulted) loans in the S&P/LSTA Leveraged Loan Index (the Index), a broad measure of the asset class, returning 2.52%, 3.12%, 5.22%, 12.45%, and 7.31%, respectively. Overall, the Index returned 5.20% during the period.

Fund Performance

For the 12-month period ended December 31, 2021, Eaton Vance VT Floating-Rate Income Fund (the Fund) returned 3.63% for Initial Class shares at net asset value (NAV), underperforming its benchmark, the Index, which returned 5.20%.

The Index is unmanaged, and returns do not reflect any applicable sales charges, commissions, or expenses.

The Fund has historically tended to maintain underweight exposures relative to the Index to lower credit-quality segments of the market, namely the CCC and D (defaulted) rating tiers within the Index. This strategy may help the Fund experience limited credit losses over the long run, but may also detract from relative performance versus the Index in times when lower quality loans perform well. This underweight exposure to lower quality loans, which tend to have higher coupon yields, may also result in a lower average coupon yield for the Fund relative to the Index.

During the period, the Fund’s underweight exposure to CCC rated loans, which were the best-performing credit tier in the Index during the period,

detracted from performance versus the Index. Loan selections in the oil and gas, retailers (ex-food and drug), and aerospace and defense industries detracted from performance relative to the Index as well.

The Fund’s cash position also detracted from performance versus the Index as loan prices rose for much of the period. The Index does not include cash.

In contrast, loan selections in the containers and glass products, telecommunications, and nonferrous metals/minerals industries contributed to Fund performance versus the Index. The Fund’s underweight exposure to the utilities sector, which underperformed the Index as the market favored more cyclical sectors during the period, helped relative returns as well.

The Fund’s underweight exposure to BBB rated loans, the highest quality credit tier in the Index, also aided performance versus the Index. BBB loans were the weakest-performing credit tier in the Index during the period.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Performance2,3

Portfolio Manager(s) Craig P. Russ, Andrew N. Sveen, CFA, Jeffrey R. Hesselbein, CFA and Michael J. Turgel, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | | |

Initial Class at NAV | | | 05/02/2001 | | | | 05/02/2001 | | | | 3.63 | % | | | 3.19 | % | | | 3.53 | % |

ADV Class at NAV | | | 04/15/2014 | | | | 05/02/2001 | | | | 3.77 | | | | 3.42 | | | | 3.72 | |

Institutional Class at NAV | | | 05/02/2016 | | | | 05/02/2001 | | | | 4.07 | | | | 3.70 | | | | 3.89 | |

|

| |

| | | | | |

S&P/LSTA Leveraged Loan Index | | | — | | | | — | | | | 5.20 | % | | | 4.27 | % | | | 4.69 | % |

| | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | Initial

Class | | | ADV

Class | | | Institutional

Class | |

| | | | | |

| | | | | | | | | | | 1.20 | % | | | 0.95 | % | | | 0.67 | % |

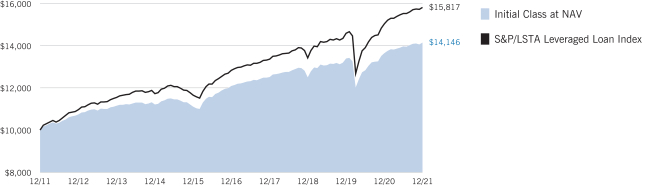

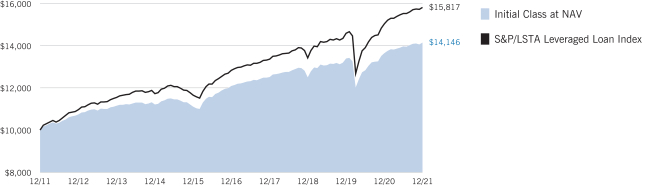

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Initial Class of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | | | | | | | | | |

| Growth of Investment3 | | Amount Invested | | | Period Beginning | | | At NAV | | | With Maximum Sales Charge | |

| | | | |

ADV Class | | | $10,000 | | | | 12/31/2011 | | | | $14,420 | | | | N.A. | |

Institutional Class | | | $10,000 | | | | 12/31/2011 | | | | $14,646 | | | | N.A. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Fund Profile

Top 10 Issuers (% of total investments)5

| | | | |

Numericable Group S.A. | | | 1.1 | % |

| |

TransDigm, Inc. | | | 1.0 | |

| |

Ziggo B.V. | | | 0.9 | |

| |

Epicor Software Corporation | | | 0.9 | |

| |

CommScope, Inc. | | | 0.8 | |

| |

AppLovin Corporation | | | 0.8 | |

| |

Asurion, LLC | | | 0.8 | |

| |

Carnival Corporation | | | 0.8 | |

| |

Virgin Media SFA Finance Limited | | | 0.7 | |

| |

Hyland Software, Inc. | | | 0.7 | |

| |

Total | | | 8.5 | % |

Credit Quality (% of bonds and loans)6

Top 10 Sectors (% of total investments)5

| | | | |

Electronics/Electrical | | | 19.4 | % |

| |

Business Equipment and Services | | | 8.7 | |

| |

Health Care | | | 8.0 | |

| |

Building and Development | | | 4.4 | |

| |

Chemicals and Plastics | | | 4.2 | |

| |

Industrial Equipment | | | 3.9 | |

| |

Leisure Goods/Activities/Movies | | | 3.6 | |

| |

Cable and Satellite Television | | | 3.5 | |

| |

Drugs | | | 3.1 | |

| |

Automotive | | | 2.8 | |

| |

Total | | | 61.6 | % |

See Endnotes and Additional Disclosures in this report.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | S&P/LSTA Leveraged Loan Index is an unmanaged index of the institutional leveraged loan market. S&P/LSTA Leveraged Loan indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® is a registered trademark of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); LSTA is a trademark of Loan Syndications and Trading Association, Inc. S&P DJI, Dow Jones, their respective affiliates and their third party licensors do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | There is no sales charge. Insurance-related charges are not included in the calculation of returns. If such charges were reflected, the returns would be lower. Please refer to the report for your insurance contract for performance data reflecting insurance-related charges. |

Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of ADV Class is linked to Initial Class and the performance of Institutional Class is linked to ADV Class. Performance presented in the Financial Highlights included in the financial statements is not linked.

| 4 | Source: Fund prospectus. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 5 | Excludes cash and cash equivalents. |

| 6 | Credit ratings are categorized using S&P Global Ratings (“S&P”). Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not |

| | necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by S&P. |

Fund profile subject to change due to active management.

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Fund Expenses

Example: As a Fund shareholder, you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2021 – December 31, 2021).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect expenses and charges which are, or may be imposed under the variable annuity contract or variable life insurance policy (variable contracts) (if applicable) or qualified pension or retirement plans (Qualified Plans) through which your investment in the Fund is made. Therefore, the second section of the table is useful in comparing ongoing costs associated with an investment in vehicles which fund benefits under variable contracts and Qualified Plans, and will not help you determine the relative total costs of investing in the Fund through variable contracts or Qualified Plans. In addition, if these expenses and charges imposed under the variable contracts or Qualified Plans were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(7/1/21) | | | Ending

Account Value

(12/31/21) | | | Expenses Paid

During Period*

(7/1/21 – 12/31/21) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Initial Class | | $ | 1,000.00 | | | $ | 1,012.40 | | | $ | 5.93 | | | | 1.17 | % |

ADV Class | | $ | 1,000.00 | | | $ | 1,013.70 | | | $ | 4.67 | | | | 0.92 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,014.10 | | | $ | 3.25 | | | | 0.64 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Initial Class | | $ | 1,000.00 | | | $ | 1,019.31 | | | $ | 5.96 | | | | 1.17 | % |

ADV Class | | $ | 1,000.00 | | | $ | 1,020.57 | | | $ | 4.69 | | | | 0.92 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,021.98 | | | $ | 3.26 | | | | 0.64 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2021. Expenses shown do not include insurance-related charges or direct expenses of Qualified Plans. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments

| | | | | | | | |

| Asset-Backed Securities — 1.6% | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | |

Benefit Street Partners CLO XXV, Ltd., Series 2021-25A, Class E, 7.093%, (3 mo. USD LIBOR + 6.85%), 1/15/35(1)(2) | | $ | 1,000 | | | $ | 986,379 | |

| | |

BlueMountain CLO XXIV, Ltd., Series 2019-24A, Class ER, 6.972%, (3 mo. USD LIBOR + 6.84%), 4/20/34(1)(2) | | | 1,000 | | | | 973,072 | |

| | |

Halseypoint CLO 5, Ltd., Series 2021-5A, Class E, 7.156%, (3 mo. USD LIBOR + 6.94%), 1/30/35(1)(2) | | | 1,000 | | | | 975,777 | |

| | |

Palmer Square CLO, Ltd., Series 2015-1A, Class DR4, 6.66%, (3 mo. USD LIBOR + 6.50%), 5/21/34(1)(2) | | | 1,000 | | | | 994,964 | |

| | |

Rad CLO 5, Ltd., Series 2019-5A, Class E, 6.824%, (3 mo. USD LIBOR + 6.70%), 7/24/32(1)(2) | | | 2,000 | | | | 2,000,001 | |

| | |

Rad CLO 11, Ltd., Series 2021-11A, Class E, 6.374%, (3 mo. USD LIBOR + 6.25%), 4/15/34(1)(2) | | | 2,000 | | | | 2,000,912 | |

| | |

Riserva CLO, Ltd., Series 2016-3A, Class ERR, 6.622%, (3 mo. USD LIBOR + 6.50%), 1/18/34(1)(2) | | | 2,250 | | | | 2,236,352 | |

| |

Total Asset-Backed Securities

(identified cost $10,222,920) | | | $ | 10,167,457 | |

|

| Common Stocks — 0.7% | |

| Security | | Shares | | | Value | |

|

| Aerospace and Defense — 0.0%(3) | |

| | |

IAP Global Services, LLC(4)(5)(6) | | | 24 | | | $ | 116,949 | |

| |

| | | | $ | 116,949 | |

|

| Automotive — 0.0%(3) | |

| | |

Dayco Products, LLC(5)(6) | | | 15,250 | | | $ | 114,375 | |

| |

| | | | $ | 114,375 | |

|

| Chemicals and Plastics — 0.1% | |

| | |

Hexion Holdings Corp., Class B(5)(6) | | | 30,229 | | | $ | 875,281 | |

| |

| | | | $ | 875,281 | |

|

| Containers and Glass Products — 0.1% | |

| | |

LG Newco Holdco, Inc., Class A(5)(6) | | | 33,758 | | | $ | 295,382 | |

| |

| | | | $ | 295,382 | |

|

| Electronics / Electrical — 0.1% | |

| | |

Skillsoft Corp.(5)(6) | | | 66,843 | | | $ | 611,613 | |

| |

| | | | $ | 611,613 | |

|

| Health Care — 0.1% | |

| | |

Akorn Holding Company, LLC, Class A(5)(6) | | | 58,449 | | | $ | 547,959 | |

| |

| | | | $ | 547,959 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Nonferrous Metals / Minerals — 0.0%(3) | |

| | |

ACNR Holdings, Inc., Class A(5)(6) | | | 2,056 | | | $ | 94,747 | |

| |

| | | | $ | 94,747 | |

|

| Oil and Gas — 0.1% | |

| | |

AFG Holdings, Inc.(4)(5)(6) | | | 17,136 | | | $ | 133,832 | |

| | |

McDermott International, Ltd.(5)(6) | | | 103,251 | | | | 47,754 | |

| | |

QuarterNorth Energy, Inc.(5)(6) | | | 5,908 | | | | 561,260 | |

| | |

RDV Resources, Inc., Class A(5)(6) | | | 10,680 | | | | 1,602 | |

| |

| | | | $ | 744,448 | |

|

| Radio and Television — 0.1% | |

| | |

Clear Channel Outdoor Holdings, Inc.(5)(6) | | | 19,512 | | | $ | 64,585 | |

| | |

Cumulus Media, Inc., Class A(5)(6) | | | 24,069 | | | | 270,776 | |

| | |

iHeartMedia, Inc., Class A(5)(6) | | | 8,298 | | | | 174,590 | |

| |

| | | | $ | 509,951 | |

|

| Retailers (Except Food and Drug) — 0.0%(3) | |

| | |

David’s Bridal, LLC(4)(5)(6) | | | 17,912 | | | $ | 0 | |

| | |

Phillips Pet Holding Corp.(4)(5)(6) | | | 285 | | | | 110,848 | |

| |

| | | | $ | 110,848 | |

|

| Telecommunications — 0.1% | |

| | |

GEE Acquisition Holdings Corp.(4)(5)(6) | | | 13,555 | | | $ | 293,195 | |

| |

| | | | $ | 293,195 | |

|

| Utilities — 0.0%(3) | |

| | |

Longview Intermediate Holdings, LLC, Class A(4)(5)(6) | | | 36,023 | | | $ | 286,743 | |

| |

| | | | $ | 286,743 | |

| |

Total Common Stocks

(identified cost $5,320,465) | | | $ | 4,601,491 | |

|

| Convertible Preferred Stocks — 0.1% | |

| Security | | Shares | | | Value | |

|

| Containers and Glass Products — 0.1% | |

| | |

LG Newco Holdco, Inc., Series A, 13.00%(5)(6) | | | 5,114 | | | $ | 593,216 | |

| |

Total Convertible Preferred Stocks

(identified cost $268,481) | | | $ | 593,216 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Corporate Bonds — 7.9% | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Aerospace and Defense — 0.0%(3) | |

| | |

Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) | | $ | 250 | | | $ | 259,314 | |

| |

| | | | $ | 259,314 | |

|

| Air Transport — 0.7% | |

| | |

Air Canada, 3.875%, 8/15/26(1) | | $ | 475 | | | $ | 485,125 | |

| | |

American Airlines, Inc./AAdvantage Loyalty IP, Ltd.: | | | | | | | | |

| | |

5.50%, 4/20/26(1) | | | 1,275 | | | | 1,327,824 | |

| | |

5.75%, 4/20/29(1) | | | 950 | | | | 1,017,217 | |

| | |

Delta Air Lines, Inc./SkyMiles IP, Ltd., 4.75%, 10/20/28(1) | | | 550 | | | | 601,030 | |

| | |

United Airlines, Inc.: | | | | | | | | |

| | |

4.375%, 4/15/26(1) | | | 325 | | | | 339,316 | |

| | |

4.625%, 4/15/29(1) | | | 325 | | | | 335,832 | |

| |

| | | | $ | 4,106,344 | |

|

| Automotive — 0.2% | |

| | |

Clarios Global, L.P.: | | | | | | | | |

| | |

6.25%, 5/15/26(1) | | $ | 293 | | | $ | 306,922 | |

| | |

6.75%, 5/15/25(1) | | | 180 | | | | 188,732 | |

| | |

Tenneco, Inc., 5.125%, 4/15/29(1) | | | 675 | | | | 660,788 | |

| |

| | | | $ | 1,156,442 | |

|

| Building and Development — 0.1% | |

| | |

American Builders & Contractors Supply Co., Inc., 4.00%, 1/15/28(1) | | $ | 250 | | | $ | 256,166 | |

| | |

Cushman & Wakefield U.S. Borrower, LLC, 6.75%, 5/15/28(1) | | | 300 | | | | 321,428 | |

| | |

SRS Distribution, Inc., 4.625%, 7/1/28(1) | | | 325 | | | | 326,716 | |

| |

| | | | $ | 904,310 | |

|

| Business Equipment and Services — 0.7% | |

| | |

Allied Universal Holdco, LLC: | | | | | | | | |

| | |

4.625%, 6/1/28(1) | | $ | 2,000 | | | $ | 1,987,750 | |

| | |

6.625%, 7/15/26(1) | | | 575 | | | | 604,023 | |

| | |

Garda World Security Corp., 4.625%, 2/15/27(1) | | | 700 | | | | 697,298 | |

| | |

Prime Security Services Borrower, LLC/Prime Finance, Inc., 5.25%, 4/15/24(1) | | | 575 | | | | 612,478 | |

| | |

Sabre GLBL, Inc.: | | | | | | | | |

| | |

7.375%, 9/1/25(1) | | | 175 | | | | 183,113 | |

| | |

9.25%, 4/15/25(1) | | | 225 | | | | 254,509 | |

| |

| | | | $ | 4,339,171 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Cable and Satellite Television — 1.1% | |

| | |

Altice France S.A.: | | | | | | | | |

| | |

5.125%, 1/15/29(1) | | $ | 100 | | | $ | 97,644 | |

| | |

5.125%, 7/15/29(1) | | | 4,175 | | | | 4,079,768 | |

| | |

5.50%, 1/15/28(1) | | | 400 | | | | 397,570 | |

| | |

Ziggo B.V., 5.50%, 1/15/27(1) | | | 1,997 | | | | 2,054,234 | |

| |

| | | | $ | 6,629,216 | |

|

| Chemicals and Plastics — 0.1% | |

| | |

INEOS Quattro Finance 2 PLC, 3.375%, 1/15/26(1) | | $ | 250 | | | $ | 251,206 | |

| | |

Olympus Water US Holding Corp., 4.25%, 10/1/28(1) | | | 475 | | | | 473,050 | |

| |

| | | | $ | 724,256 | |

|

| Commercial Services — 0.2% | |

| | |

WASH Multifamily Acquisition, Inc., 5.75%, 4/15/26(1) | | $ | 1,000 | | | $ | 1,052,195 | |

| |

| | | | $ | 1,052,195 | |

|

| Cosmetics / Toiletries — 0.0%(3) | |

| | |

Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc., 5.00%, 12/31/26(1) | | $ | 100 | | | $ | 98,892 | |

| |

| | | | $ | 98,892 | |

|

| Diversified Financial Services — 0.1% | |

| | |

AG Issuer, LLC, 6.25%, 3/1/28(1) | | $ | 350 | | | $ | 363,620 | |

| |

| | | | $ | 363,620 | |

|

| Drugs — 0.4% | |

| | |

Bausch Health Companies, Inc.: | | | | | | | | |

| | |

4.875%, 6/1/28(1) | | $ | 275 | | | $ | 280,998 | |

| | |

5.50%, 11/1/25(1) | | | 575 | | | | 585,071 | |

| | |

Endo Luxembourg Finance Co. I S.a.r.l./Endo US, Inc., 6.125%, 4/1/29(1) | | | 1,125 | | | | 1,104,722 | |

| | |

Jazz Securities DAC, 4.375%, 1/15/29(1) | | | 650 | | | | 674,160 | |

| |

| | | | $ | 2,644,951 | |

|

| Ecological Services and Equipment — 0.2% | |

| | |

GFL Environmental, Inc.: | | | | | | | | |

| | |

4.25%, 6/1/25(1) | | $ | 475 | | | $ | 489,250 | |

| | |

5.125%, 12/15/26(1) | | | 1,000 | | | | 1,041,225 | |

| |

| | | | $ | 1,530,475 | |

|

| Electronics / Electrical — 0.9% | |

| | |

CommScope, Inc.: | | | | | | | | |

| | |

4.75%, 9/1/29(1) | | $ | 1,000 | | | $ | 995,555 | |

| | |

6.00%, 3/1/26(1) | | | 2,000 | | | | 2,062,690 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| | |

Imola Merger Corp., 4.75%, 5/15/29(1) | | $ | 1,325 | | | $ | 1,361,921 | |

| | |

LogMeIn, Inc., 5.50%, 9/1/27(1) | | | 375 | | | | 379,890 | |

| | |

Veritas US, Inc./Veritas Bermuda, Ltd., 7.50%, 9/1/25(1) | | | 550 | | | | 569,968 | |

| |

| | | | $ | 5,370,024 | |

|

| Entertainment — 0.0%(3) | |

| | |

Six Flags Theme Parks, Inc., 7.00%, 7/1/25(1) | | $ | 200 | | | $ | 213,813 | |

| |

| | | | $ | 213,813 | |

|

| Financial Intermediaries — 0.1% | |

| | |

CoreLogic, Inc., 4.50%, 5/1/28(1) | | $ | 400 | | | $ | 399,086 | |

| |

| | | | $ | 399,086 | |

|

| Food Products — 0.1% | |

| | |

Del Monte Foods, Inc., 11.875%, 5/15/25(1) | | $ | 750 | | | $ | 836,584 | |

| |

| | | | $ | 836,584 | |

|

| Health Care — 0.6% | |

| | |

Mozart Debt Merger Sub, Inc., 3.875%, 4/1/29(1) | | $ | 1,725 | | | $ | 1,722,361 | |

| | |

RP Escrow Issuer, LLC, 5.25%, 12/15/25(1) | | | 175 | | | | 176,762 | |

| | |

Tenet Healthcare Corp., 4.25%, 6/1/29(1) | | | 1,675 | | | | 1,703,927 | |

| |

| | | | $ | 3,603,050 | |

|

| Industrial Equipment — 0.1% | |

| | |

Clark Equipment Company, 5.875%, 6/1/25(1) | | $ | 100 | | | $ | 104,168 | |

| | |

Madison IAQ, LLC, 4.125%, 6/30/28(1) | | | 650 | | | | 652,584 | |

| |

| | | | $ | 756,752 | |

|

| Internet Software & Services — 0.1% | |

| | |

Arches Buyer, Inc., 4.25%, 6/1/28(1) | | $ | 450 | | | $ | 450,581 | |

| |

| | | | $ | 450,581 | |

|

| Leisure Goods / Activities / Movies — 0.4% | |

| | |

Carnival Corp., 4.00%, 8/1/28(1) | | $ | 2,450 | | | $ | 2,436,611 | |

| | |

SeaWorld Parks & Entertainment, Inc., 8.75%, 5/1/25(1) | | | 200 | | | | 212,200 | |

| |

| | | | $ | 2,648,811 | |

|

| Machinery — 0.1% | |

| | |

TK Elevator U.S. Newco, Inc., 5.25%, 7/15/27(1) | | $ | 350 | | | $ | 368,386 | |

| |

| | | | $ | 368,386 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Oil and Gas — 0.2% | |

| | |

CITGO Petroleum Corporation: | | | | | | | | |

| | |

6.375%, 6/15/26(1) | | $ | 150 | | | $ | 152,404 | |

| | |

7.00%, 6/15/25(1) | | | 1,025 | | | | 1,055,950 | |

| |

| | | | $ | 1,208,354 | |

|

| Packaging & Containers — 0.2% | |

| | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group Issuer, LLC: | | | | | | | | |

| | |

4.00%, 10/15/27(1) | | $ | 450 | | | $ | 438,219 | |

| | |

4.375%, 10/15/28(1) | | | 625 | | | | 621,259 | |

| |

| | | | $ | 1,059,478 | |

|

| Radio and Television — 0.5% | |

| | |

Diamond Sports Group, LLC/Diamond Sports Finance Co., 5.375%, 8/15/26(1) | | $ | 875 | | | $ | 438,506 | |

| | |

iHeartCommunications, Inc.: | | | | | | | | |

| | |

4.75%, 1/15/28(1) | | | 200 | | | | 203,130 | |

| | |

5.25%, 8/15/27(1) | | | 150 | | | | 156,165 | |

| | |

6.375%, 5/1/26 | | | 47 | | | | 48,737 | |

| | |

8.375%, 5/1/27 | | | 85 | | | | 89,786 | |

| | |

Univision Communications, Inc.: | | | | | | | | |

| | |

4.50%, 5/1/29(1) | | | 650 | | | | 657,657 | |

| | |

5.125%, 2/15/25(1) | | | 1,500 | | | | 1,516,868 | |

| |

| | | | $ | 3,110,849 | |

|

| Real Estate Investment Trusts (REITs) — 0.1% | |

| | |

Park Intermediate Holdings, LLC/PK Domestic Property, LLC/PK Finance Co-Issuer, 5.875%, 10/1/28(1) | | $ | 550 | | | $ | 572,811 | |

| |

| | | | $ | 572,811 | |

|

| Retailers (Except Food and Drug) — 0.0%(3) | |

| | |

PetSmart, Inc./PetSmart Finance Corp., 4.75%, 2/15/28(1) | | $ | 100 | | | $ | 102,807 | |

| |

| | | | $ | 102,807 | |

|

| Software and Services — 0.1% | |

| | |

Boxer Parent Co., Inc., 7.125%, 10/2/25(1) | | $ | 375 | | | $ | 393,692 | |

| |

| | | | $ | 393,692 | |

|

| Technology — 0.1% | |

| | |

Clarivate Science Holdings Corp., 3.875%, 7/1/28(1) | | $ | 825 | | | $ | 830,787 | |

| |

| | | | $ | 830,787 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Telecommunications — 0.4% | |

| | |

LCPR Senior Secured Financing DAC, 5.125%, 7/15/29(1) | | $ | 500 | | | $ | 503,250 | |

| | |

Lumen Technologies, Inc., 4.00%, 2/15/27(1) | | | 1,225 | | | | 1,244,355 | |

| | |

VMED O2 UK Financing I PLC, 4.25%, 1/31/31(1) | | | 750 | | | | 736,215 | |

| |

| | | | $ | 2,483,820 | |

|

| Utilities — 0.1% | |

| | |

Calpine Corp.: | | | | | | | | |

| | |

4.50%, 2/15/28(1) | | $ | 250 | | | $ | 259,808 | |

| | |

5.25%, 6/1/26(1) | | | 346 | | | | 355,416 | |

| |

| | | | $ | 615,224 | |

| |

Total Corporate Bonds

(identified cost $48,371,288) | | | $ | 48,834,095 | |

|

| Exchange-Traded Funds — 0.6% | |

| Security | | Shares | | | Value | |

| | |

SPDR Blackstone Senior Loan ETF | | | 76,000 | | | $ | 3,467,880 | |

| |

Total Exchange-Traded Funds

(identified cost $3,501,320) | | | $ | 3,467,880 | |

|

| Preferred Stocks — 0.1% | |

| Security | | Shares | | | Value | |

|

| Financial Services — 0.0% | |

| | |

DBI Investors, Inc., Series A-1(4)(5)(6) | | | 839 | | | $ | 0 | |

| |

| | | | $ | 0 | |

|

| Nonferrous Metals / Minerals — 0.1% | |

| | |

ACNR Holdings, Inc., 15.00% (PIK)(5)(6) | | | 971 | | | $ | 302,628 | |

| |

| | | | $ | 302,628 | |

|

| Retailers (Except Food and Drug) — 0.0% | |

| | |

David’s Bridal, LLC, Series A,

8.00% (PIK)(4)(5)(6) | | | 494 | | | $ | 0 | |

| | |

David’s Bridal, LLC, Series B,

10.00% (PIK)(4)(5)(6) | | | 2,012 | | | | 0 | |

| |

| | | | $ | 0 | |

| |

Total Preferred Stocks

(identified cost $162,891) | | | $ | 302,628 | |

| | | | | | | | |

| Senior Floating-Rate Loans — 84.8%(7) | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Aerospace and Defense — 2.1% | |

| | |

AI Convoy (Luxembourg) S.a.r.l., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 1/18/27 | | $ | 490 | | | $ | 491,071 | |

| | |

Dynasty Acquisition Co., Inc.: | | | | | | | | |

| | |

Term Loan, 3.724%, (3 mo. USD LIBOR + 3.50%), 4/6/26 | | | 1,135 | | | | 1,107,715 | |

| | |

Term Loan, 3.724%, (3 mo. USD LIBOR + 3.50%), 4/6/26 | | | 2,110 | | | | 2,059,834 | |

| | |

IAP Worldwide Services, Inc.: | | | | | | | | |

| | |

Revolving Loan, 0.75%, 7/18/23(8) | | | 133 | | | | 132,792 | |

| | |

Term Loan - Second Lien, 8.00%, (3 mo. USD LIBOR + 6.50%, Floor 1.50%), 7/18/23(4) | | | 169 | | | | 137,817 | |

| | |

Spirit Aerosystems, Inc., Term Loan, 4.25%, (1 mo. USD LIBOR + 3.75%, Floor 0.50%), 1/15/25 | | | 372 | | | | 373,239 | |

| | |

TransDigm, Inc.: | | | | | | | | |

| | |

Term Loan, 2.354%, (1 mo. USD LIBOR + 2.25%), 8/22/24 | | | 3,001 | | | | 2,972,113 | |

| | |

Term Loan, 2.354%, (1 mo. USD LIBOR + 2.25%), 5/30/25 | | | 3,399 | | | | 3,354,696 | |

| | |

WP CPP Holdings, LLC, Term Loan, 4.75%, (3 mo. USD LIBOR + 3.75%, Floor 1.00%), 4/30/25 | | | 2,227 | | | | 2,140,779 | |

| |

| | | | $ | 12,770,056 | |

|

| Air Transport — 0.7% | |

| | |

AAdvantage Loyalty IP, Ltd., Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 4/20/28 | | $ | 650 | | | $ | 674,781 | |

| | |

Brown Group Holding, LLC, Term Loan, 3.00%, (3 mo. USD LIBOR + 2.50%, Floor 0.50%), 6/7/28 | | | 897 | | | | 896,180 | |

| | |

Mileage Plus Holdings, LLC, Term Loan, 6.25%, (3 mo. USD LIBOR + 5.25%, Floor 1.00%), 6/21/27 | | | 1,025 | | | | 1,084,578 | |

| | |

United Airlines, Inc., Term Loan, 4/21/28(9) | | | 500 | | | | 502,778 | |

| | |

Walker & Dunlop, Inc., Term Loan, 2.75%, (SOFR + 2.25%, Floor 0.50%), 12/16/28 | | | 900 | | | | 900,000 | |

| |

| | | | $ | 4,058,317 | |

|

| Automotive — 2.7% | |

| | |

Adient US, LLC, Term Loan, 3.604%, (1 mo. USD LIBOR + 3.50%), 4/8/28 | | $ | 572 | | | $ | 572,943 | |

| | |

American Axle and Manufacturing, Inc., Term Loan, 3.00%, (1 mo. USD LIBOR + 2.25%, Floor 0.75%), 4/6/24 | | | 1,213 | | | | 1,212,998 | |

| | |

Autokiniton US Holdings, Inc., Term Loan, 5.00%, (12 mo. USD LIBOR + 4.50%, Floor 0.50%), 4/6/28 | | | 1,144 | | | | 1,147,969 | |

| | |

Bright Bidco B.V., Term Loan, 4.50%, (6 mo. USD LIBOR + 3.50%, Floor 1.00%), 6/30/24 | | | 1,099 | | | | 850,376 | |

| | |

Chassix, Inc., Term Loan, 6.50%, (USD LIBOR + 5.50%, Floor 1.00%), 11/15/23(10) | | | 504 | | | | 453,600 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Automotive (continued) | |

| | |

Clarios Global, L.P., Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 4/30/26 | | $ | 2,451 | | | $ | 2,440,124 | |

| | |

CS Intermediate Holdco 2, LLC, Term Loan, 2.75%, (1 mo. USD LIBOR + 2.00%, Floor 0.75%), 11/2/23 | | | 1,584 | | | | 1,491,078 | |

| | |

Dayco Products, LLC, Term Loan, 4.425%, (3 mo. USD LIBOR + 4.25%), 5/19/23 | | | 740 | | | | 729,023 | |

| | |

Garrett LX I S.a.r.l., Term Loan, 3.75%, (3 mo. USD LIBOR + 3.25%, Floor 0.50%), 4/30/28 | | | 424 | | | | 422,878 | |

| | |

Gates Global, LLC, Term Loan, 3.25%, (1 mo. USD LIBOR + 2.50%, Floor 0.75%), 3/31/27 | | | 396 | | | | 395,678 | |

| | |

Les Schwab Tire Centers, Term Loan, 4.00%, (3 mo. USD LIBOR + 3.25%, Floor 0.75%), 11/2/27 | | | 3,299 | | | | 3,302,326 | |

| | |

MajorDrive Holdings IV, LLC, Term Loan, 4.50%, (3 mo. USD LIBOR + 4.00%, Floor 0.50%), 5/12/28 | | | 473 | | | | 473,216 | |

| | |

Tenneco, Inc., Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 10/1/25 | | | 813 | | | | 803,176 | |

| | |

TI Group Automotive Systems, LLC, Term Loan, 3.75%, (3 mo. USD LIBOR + 3.25%, Floor 0.50%), 12/16/26 | | | 422 | | | | 421,812 | |

| | |

Truck Hero, Inc., Term Loan, 4.00%, (1 mo. USD LIBOR + 3.25%, Floor 0.75%), 1/31/28 | | | 1,265 | | | | 1,263,065 | |

| | |

Wheel Pros, LLC, Term Loan, 5.25%, (1 mo. USD LIBOR + 4.50%, Floor 0.75%), 5/11/28 | | | 648 | | | | 648,020 | |

| |

| | | | $ | 16,628,282 | |

|

| Beverage and Tobacco — 0.3% | |

| | |

Arterra Wines Canada, Inc., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.50%, Floor 0.75%), 11/24/27 | | $ | 594 | | | $ | 595,578 | |

| | |

City Brewing Company, LLC, Term Loan, 4.25%, (3 mo. USD LIBOR + 3.50%, Floor 0.75%), 4/5/28 | | | 524 | | | | 497,830 | |

| | |

Triton Water Holdings, Inc., Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 3/31/28 | | | 821 | | | | 812,923 | |

| |

| | | | $ | 1,906,331 | |

|

| Brokerage / Securities Dealers / Investment Houses — 0.5% | |

| | |

Advisor Group, Inc., Term Loan, 4.604%, (1 mo. USD LIBOR + 4.50%), 7/31/26 | | $ | 2,012 | | | $ | 2,018,672 | |

| | |

Hudson River Trading, LLC, Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 3/20/28 | | | 1,290 | | | | 1,282,992 | |

| |

| | | | $ | 3,301,664 | |

|

| Building and Development — 4.4% | |

| | |

Aegion Corporation, Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 5/17/28 | | $ | 324 | | | $ | 327,125 | |

| | |

American Residential Services, LLC, Term Loan, 4.25%, (3 mo. USD LIBOR + 3.50%, Floor 0.75%), 10/15/27 | | | 347 | | | | 346,933 | |

| | |

APi Group DE, Inc.: | | | | | | | | |

| | |

Term Loan, 12/18/28(9) | | | 650 | | | | 650,244 | |

| | |

Term Loan, 2.601%, (1 mo. USD LIBOR + 2.50%), 10/1/26 | | | 1,045 | | | | 1,044,129 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Building and Development (continued) | |

| | |

Artera Services, LLC, Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 3/6/25 | | $ | 771 | | | $ | 748,634 | |

| | |

Beacon Roofing Supply, Inc., Term Loan, 2.354%, (1 mo. USD LIBOR + 2.25%), 5/19/28 | | | 672 | | | | 668,687 | |

| | |

Brookfield Property REIT, Inc., Term Loan, 2.604%, (1 mo. USD LIBOR + 2.50%), 8/27/25 | | | 697 | | | | 688,967 | |

| | |

Centuri Group, Inc., Term Loan, 3.00%, (3 mo. USD LIBOR + 2.50%, Floor 0.50%), 8/27/28 | | | 634 | | | | 633,721 | |

| | |

Core & Main L.P., Term Loan, 2.602%, (1 mo. USD LIBOR + 2.50%), 7/27/28 | | | 1,022 | | | | 1,017,644 | |

| | |

Cornerstone Building Brands, Inc., Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 4/12/28 | | | 2,814 | | | | 2,815,898 | |

| | |

Covanta Holding Corporation: | | | | | | | | |

| | |

Term Loan, 11/30/28(9) | | | 24 | | | | 24,444 | |

| | |

Term Loan, 11/30/28(9) | | | 326 | | | | 326,322 | |

| | |

CP Atlas Buyer, Inc., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 11/23/27 | | | 919 | | | | 916,143 | |

| | |

CPG International, Inc., Term Loan, 3.25%, (3 mo. USD LIBOR + 2.50%, Floor 0.75%), 5/5/24 | | | 2,772 | | | | 2,777,326 | |

| | |

Cushman & Wakefield U.S. Borrower, LLC, Term Loan, 2.852%, (1 mo. USD LIBOR + 2.75%), 8/21/25 | | | 521 | | | | 518,155 | |

| | |

Foundation Building Materials Holding Company, LLC, Term Loan, 3.75%, (3 mo. USD LIBOR + 3.25%, Floor 0.50%), 2/3/28 | | | 744 | | | | 739,955 | |

| | |

MI Windows and Doors, LLC, Term Loan, 4.50%, (1 mo. USD LIBOR + 3.75%, Floor 0.75%), 12/18/27 | | | 272 | | | | 273,645 | |

| | |

Northstar Group Services, Inc., Term Loan, 6.50%, (1 mo. USD LIBOR + 5.50%, Floor 1.00%), 11/12/26 | | | 929 | | | | 932,629 | |

| | |

Osmose Utilities Services, Inc., Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 6/23/28 | | | 499 | | | | 496,646 | |

| | |

Park River Holdings, Inc., Term Loan, 4.00%, (3 mo. USD LIBOR + 3.25%, Floor 0.75%), 12/28/27 | | | 398 | | | | 394,848 | |

| | |

Quikrete Holdings, Inc.: | | | | | | | | |

| | |

Term Loan, 6/11/28(9) | | | 1,600 | | | | 1,597,083 | |

| | |

Term Loan, 2.604%, (1 mo. USD LIBOR + 2.50%), 2/1/27 | | | 2,121 | | | | 2,100,117 | |

| | |

RE/MAX International, Inc., Term Loan, 3.00%, (3 mo. USD LIBOR + 2.50%, Floor 0.50%), 7/21/28 | | | 1,169 | | | | 1,165,471 | |

| | |

SRS Distribution, Inc., Term Loan, 4.25%, (6 mo. USD LIBOR + 3.75%, Floor 0.50%), 6/2/28 | | | 723 | | | | 722,962 | |

| | |

Standard Industries, Inc., Term Loan, 3.00%, (3 mo. USD LIBOR + 2.50%, Floor 0.50%), 9/22/28 | | | 2,864 | | | | 2,868,714 | |

| | |

White Cap Buyer, LLC, Term Loan, 4.50%, (1 mo. USD LIBOR + 4.00%, Floor 0.50%), 10/19/27 | | | 2,033 | | | | 2,038,032 | |

| | |

WireCo WorldGroup, Inc., Term Loan, 4.75%, (6 mo. USD LIBOR + 4.25%, Floor 0.50%), 10/27/28 | | | 425 | | | | 424,469 | |

| |

| | | | $ | 27,258,943 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Business Equipment and Services — 8.3% | |

| | |

AlixPartners, LLP, Term Loan, 3.25%, (1 mo. USD LIBOR + 2.75%, Floor 0.50%), 2/4/28 | | $ | 943 | | | $ | 939,560 | |

| | |

Allied Universal Holdco, LLC, Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 5/12/28 | | | 1,464 | | | | 1,460,399 | |

| | |

AppLovin Corporation: | | | | | | | | |

| | |

Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 8/15/25 | | | 3,743 | | | | 3,735,352 | |

| | |

Term Loan, 3.50%, (1 mo. USD LIBOR + 3.00%, Floor 0.50%), 10/25/28 | | | 1,222 | | | | 1,222,854 | |

| | |

Asplundh Tree Expert, LLC, Term Loan, 1.854%, (1 mo. USD LIBOR + 1.75%), 9/7/27 | | | 716 | | | | 713,636 | |

| | |

Bracket Intermediate Holding Corp., Term Loan, 4.377%, (3 mo. USD LIBOR + 4.25%), 9/5/25 | | | 726 | | | | 724,899 | |

| | |

Brand Energy & Infrastructure Services, Inc., Term Loan, 5.25%, (3 mo. USD LIBOR + 4.25%, Floor 1.00%), 6/21/24 | | | 1,650 | | | | 1,618,840 | |

| | |

Camelot U.S. Acquisition 1 Co., Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 10/30/26 | | | 1,323 | | | | 1,315,558 | |

| | |

Ceridian HCM Holding, Inc., Term Loan, 2.577%, (1 week USD LIBOR + 2.50%), 4/30/25 | | | 2,056 | | | | 2,035,378 | |

| | |

Deerfield Dakota Holding, LLC, Term Loan, 4.75%, (1 mo. USD LIBOR + 3.75%, Floor 1.00%), 4/9/27 | | | 1,478 | | | | 1,481,062 | |

| | |

EAB Global, Inc., Term Loan, 4.00%, (USD LIBOR + 3.50%, Floor 0.50%), 8/16/28(10) | | | 900 | | | | 896,531 | |

| | |

Employbridge, LLC, Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 7/14/28 | | | 1,147 | | | | 1,138,701 | |

| | |

Endure Digital, Inc., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.50%, Floor 0.75%), 2/10/28 | | | 2,438 | | | | 2,420,610 | |

| | |

First Advantage Holdings, LLC, Term Loan, 2.854%, (1 mo. USD LIBOR + 2.75%), 1/31/27 | | | 935 | | | | 932,574 | |

| | |

Foundational Education Group, Inc., Term Loan, 4.75%, (6 mo. USD LIBOR + 4.25%, Floor 0.50%), 8/31/28 | | | 1,425 | | | | 1,428,563 | |

| | |

Garda World Security Corporation, Term Loan, 4.36%, (1 mo. USD LIBOR + 4.25%), 10/30/26 | | | 1,727 | | | | 1,727,364 | |

| | |

Grab Holdings, Inc., Term Loan, 5.50%, (3 mo. USD LIBOR + 4.50%, Floor 1.00%), 1/29/26 | | | 1,390 | | | | 1,395,579 | |

| | |

Greeneden U.S. Holdings II, LLC, Term Loan, 4.75%, (1 mo. USD LIBOR + 4.00%, Floor 0.75%), 12/1/27 | | | 496 | | | | 498,628 | |

| | |

Hillman Group, Inc. (The): | | | | | | | | |

| | |

Term Loan, 2.785%, (1 mo. USD LIBOR + 2.75%, Floor 0.50%), 7/14/28(8) | | | 46 | | | | 45,861 | |

| | |

Term Loan, 3.25%, (1 mo. USD LIBOR + 2.75%, Floor 0.50%), 7/14/28 | | | 194 | | | | 193,480 | |

| | |

Indy US Bidco, LLC, Term Loan, 3.854%, (1 mo. USD LIBOR + 3.75%), 3/5/28 | | | 447 | | | | 447,375 | |

| | |

Intrado Corporation, Term Loan, 5.00%, (3 mo. USD LIBOR + 4.00%, Floor 1.00%), 10/10/24 | | | 943 | | | | 897,734 | |

| | |

IRI Holdings, Inc., Term Loan, 4.354%, (1 mo. USD LIBOR + 4.25%), 12/1/25 | | | 3,721 | | | | 3,720,152 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Business Equipment and Services (continued) | |

| | |

Iron Mountain, Inc., Term Loan, 1.851%, (1 mo. USD LIBOR + 1.75%), 1/2/26 | | $ | 626 | | | $ | 617,414 | |

| | |

Ivanti Software, Inc.: | | | | | | | | |

| | |

Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 12/1/27 | | | 447 | | | | 444,811 | |

| | |

Term Loan, 5.00%, (3 mo. USD LIBOR + 4.25%, Floor 0.75%), 12/1/27 | | | 1,567 | | | | 1,572,676 | |

| | |

KUEHG Corp., Term Loan, 4.75%, (3 mo. USD LIBOR + 3.75%, Floor 1.00%), 2/21/25 | | | 848 | | | | 831,677 | |

| | |

Loire Finco Luxembourg S.a.r.l., Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 4/21/27 | | | 246 | | | | 242,733 | |

| | |

Magnite, Inc., Term Loan, 5.75%, (6 mo. USD LIBOR + 5.00%, Floor 0.75%), 4/28/28 | | | 948 | | | | 945,381 | |

| | |

MedAssets Software Intermediate Holdings, Inc.: | | | | | | | | |

| | |

Term Loan, 4.50%, (6 mo. USD LIBOR + 4.00%, Floor 0.50%), 12/18/28 | | | 800 | | | | 800,500 | |

| | |

Term Loan - Second Lien, 11/18/29(9) | | | 575 | | | | 572,844 | |

| | |

Monitronics International, Inc., Term Loan, 7.75%, (3 mo. USD LIBOR + 6.50%, Floor 1.25%), 3/29/24 | | | 1,024 | | | | 960,553 | |

| | |

NAB Holdings, LLC, Term Loan, 3.50%, (SOFR + 3.00%, Floor 0.50%), 11/23/28 | | | 650 | | | | 647,969 | |

| | |

Packaging Coordinators Midco, Inc., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.75%, Floor 0.75%), 11/30/27 | | | 224 | | | | 224,715 | |

| | |

Pike Corporation, Term Loan, 3.11%, (1 mo. USD LIBOR + 3.00%), 1/21/28 | | | 288 | | | | 287,072 | |

| | |

Rockwood Service Corporation, Term Loan, 4.104%, (1 mo. USD LIBOR + 4.00%), 1/23/27 | | | 917 | | | | 919,957 | |

| | |

Sabre GLBL, Inc.: | | | | | | | | |

| | |

Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 12/17/27 | | | 211 | | | | 208,537 | |

| | |

Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 12/17/27 | | | 336 | | | | 332,420 | |

| | |

SITEL Worldwide Corporation, Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 8/28/28 | | | 1,921 | | | | 1,923,324 | |

| | |

Skopima Merger Sub, Inc., Term Loan, 4.50%, (1 mo. USD LIBOR + 4.00%, Floor 0.50%), 5/12/28 | | | 1,097 | | | | 1,091,861 | |

| | |

Sotheby’s, Term Loan, 5.00%, (3 mo. USD LIBOR + 4.50%, Floor 0.50%), 1/15/27 | | | 326 | | | | 327,194 | |

| | |

Spin Holdco, Inc., Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 3/4/28 | | | 2,556 | | | | 2,566,692 | |

| | |

Tempo Acquisition, LLC, Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 11/2/26 | | | 645 | | | | 646,802 | |

| | |

TPG VIII Elf Purchaser, LLC, Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 11/6/28 | | | 350 | | | | 350,569 | |

| | |

Trans Union, LLC: | | | | | | | | |

| | |

Term Loan, 1.854%, (1 mo. USD LIBOR + 1.75%), 11/16/26 | | | 1,094 | | | | 1,082,875 | |

| | |

Term Loan, 2.75%, (1 mo. USD LIBOR + 2.25%, Floor 0.50%), 12/1/28 | | | 1,700 | | | | 1,697,992 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Business Equipment and Services (continued) | |

| | |

TTF Holdings, LLC, Term Loan, 5.00%, (1 mo. USD LIBOR + 4.25%, Floor 0.75%), 3/31/28 | | $ | 404 | | | $ | 405,427 | |

| | |

West Corporation, Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 10/10/24 | | | 216 | | | | 204,382 | |

| | |

WEX, Inc., Term Loan, 2.354%, (1 mo. USD LIBOR + 2.25%), 3/31/28 | | | 298 | | | | 296,541 | |

| |

| | | | $ | 51,193,608 | |

|

| Cable and Satellite Television — 2.5% | |

| | |

Altice France S.A., Term Loan, 4.118%, (2 mo. USD LIBOR + 4.00%), 8/14/26 | | $ | 485 | | | $ | 483,383 | |

| | |

Charter Communications Operating, LLC, Term Loan, 1.86%, (1 mo. USD LIBOR + 1.75%), 2/1/27 | | | 2,053 | | | | 2,035,574 | |

| | |

CSC Holdings, LLC: | | | | | | | | |

| | |

Term Loan, 2.36%, (1 mo. USD LIBOR + 2.25%), 7/17/25 | | | 3,461 | | | | 3,412,673 | |

| | |

Term Loan, 2.61%, (1 mo. USD LIBOR + 2.50%), 4/15/27 | | | 922 | | | | 911,723 | |

| | |

Numericable Group S.A., Term Loan, 2.879%, (3 mo. USD LIBOR + 2.75%), 7/31/25 | | | 2,304 | | | | 2,265,783 | |

| | |

UPC Broadband Holding B.V., Term Loan, 2.36%, (1 mo. USD LIBOR + 2.25%), 4/30/28 | | | 625 | | | | 617,500 | |

| | |

UPC Financing Partnership, Term Loan, 3.11%, (1 mo. USD LIBOR + 3.00%), 1/31/29 | �� | | 2,050 | | | | 2,045,900 | |

| | |

Virgin Media Bristol, LLC: | | | | | | | | |

| | |

Term Loan, 2.61%, (1 mo. USD LIBOR + 2.50%), 1/31/28 | | | 3,225 | | | | 3,197,004 | |

| | |

Term Loan, 3.36%, (1 mo. USD LIBOR + 3.25%), 1/31/29 | | | 750 | | | | 750,469 | |

| |

| | | | $ | 15,720,009 | |

|

| Chemicals and Plastics — 4.1% | |

| | |

Aruba Investments, Inc., Term Loan, 4.75%, (6 mo. USD LIBOR + 4.00%, Floor 0.75%), 11/24/27 | | $ | 422 | | | $ | 422,872 | |

| | |

Atotech B.V., Term Loan, 3.00%, (1 mo. USD LIBOR + 2.50%, Floor 0.50%), 3/18/28 | | | 920 | | | | 919,758 | |

| | |

Axalta Coating Systems US Holdings, Inc., Term Loan, 1.974%, (3 mo. USD LIBOR + 1.75%), 6/1/24 | | | 705 | | | | 705,385 | |

| | |

Charter NEX US, Inc., Term Loan, 4.50%, (1 mo. USD LIBOR + 3.75%, Floor 0.75%), 12/1/27 | | | 272 | | | | 273,271 | |

| | |

CPC Acquisition Corp., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.75%, Floor 0.75%), 12/29/27 | | | 1,390 | | | | 1,379,079 | |

| | |

Diamond (BC) B.V., Term Loan, 9/29/28(9) | | | 1,000 | | | | 995,000 | |

| | |

Ferro Corporation: | | | | | | | | |

| | |

Term Loan, 2.47%, (3 mo. USD LIBOR + 2.25%), 2/14/24 | | | 77 | | | | 76,602 | |

| | |

Term Loan, 2.47%, (3 mo. USD LIBOR + 2.25%), 2/14/24 | | | 78 | | | | 78,267 | |

| | |

Term Loan, 2.47%, (3 mo. USD LIBOR + 2.25%), 2/14/24 | | | 92 | | | | 91,992 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Chemicals and Plastics (continued) | |

| | |

Gemini HDPE, LLC, Term Loan, 3.50%, (3 mo. USD LIBOR + 3.00%, Floor 0.50%), 12/31/27 | | $ | 435 | | | $ | 435,566 | |

| | |

Groupe Solmax, Inc., Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 5/29/28 | | | 772 | | | | 773,008 | |

| | |

Illuminate Buyer, LLC, Term Loan, 3.604%, (1 mo. USD LIBOR + 3.50%), 6/30/27 | | | 1,249 | | | | 1,242,696 | |

| | |

INEOS Enterprises Holdings US Finco, LLC, Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 8/28/26 | | | 161 | | | | 161,301 | |

| | |

INEOS Styrolution US Holding, LLC, Term Loan, 3.25%, (1 mo. USD LIBOR + 2.75%, Floor 0.50%), 1/29/26 | | | 1,517 | | | | 1,516,427 | |

| | |

INEOS US Finance, LLC, Term Loan, 11/8/28(9) | | | 500 | | | | 497,813 | |

| | |

Kraton Polymers, LLC, Term Loan, 11/18/28(9) | | | 375 | | | | 375,703 | |

| | |

Lonza Group AG, Term Loan, 4.75%, (6 mo. USD LIBOR + 4.00%, Floor 0.75%), 7/3/28 | | | 871 | | | | 870,972 | |

| | |

LSF11 Skyscraper Holdco S.a.r.l., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%), 9/29/27 | | | 1,241 | | | | 1,241,424 | |

| | |

Messer Industries GmbH, Term Loan, 2.724%, (3 mo. USD LIBOR + 2.50%), 3/2/26 | | | 838 | | | | 832,505 | |

| | |

Momentive Performance Materials, Inc., Term Loan, 3.36%, (1 mo. USD LIBOR + 3.25%), 5/15/24 | | | 2,803 | | | | 2,803,562 | |

| | |

Orion Engineered Carbons GmbH, Term Loan, 2.75%, (3 mo. USD LIBOR + 2.25%, Floor 0.50%), 9/24/28 | | | 299 | | | | 300,746 | |

| | |

PMHC II, Inc., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 3/31/25 | | | 987 | | | | 982,863 | |

| | |

PQ Corporation, Term Loan, 3.25%, (3 mo. USD LIBOR + 2.75%, Floor 0.50%), 6/9/28 | | | 1,244 | | | | 1,245,563 | |

| | |

Pretium PKG Holdings, Inc., Term Loan, 4.50%, (3 mo. USD LIBOR + 4.00%, Floor 0.50%), 10/2/28 | | | 500 | | | | 499,643 | |

| | |

Rohm Holding GmbH, Term Loan, 4.904%, (6 mo. USD LIBOR + 4.75%), 7/31/26 | | | 567 | | | | 567,911 | |

| | |

Starfruit Finco B.V., Term Loan, 3.102%, (1 mo. USD LIBOR + 3.00%), 10/1/25 | | | 1,174 | | | | 1,170,462 | |

| | |

Trinseo Materials Operating S.C.A.: | | | | | | | | |

| | |

Term Loan, 2.104%, (1 mo. USD LIBOR + 2.00%), 9/6/24 | | | 1,314 | | | | 1,308,903 | |

| | |

Term Loan, 2.604%, (1 mo. USD LIBOR + 2.50%), 5/3/28 | | | 572 | | | | 568,668 | |

| | |

Tronox Finance, LLC, Term Loan, 2.454%, (USD LIBOR + 2.25%), 3/13/28(10) | | | 867 | | | | 860,315 | |

| | |

W.R. Grace & Co.-Conn., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 9/22/28 | | | 1,875 | | | | 1,880,625 | |

| |

| | | | $ | 25,078,902 | |

|

| Conglomerates — 0.0%(3) | |

| | |

Penn Engineering & Manufacturing Corp., Term Loan, 3.50%, (3 mo. USD LIBOR + 2.50%, Floor 1.00%), 6/27/24 | | $ | 133 | | | $ | 132,996 | |

| | |

| | | | | | | $ | 132,996 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Containers and Glass Products — 1.7% | |

| | |

Berlin Packaging, LLC, Term Loan, 4.25%, (USD LIBOR + 3.75%, Floor 0.50%), 3/11/28(10) | | $ | 973 | | | $ | 971,853 | |

| | |

Berry Global, Inc., Term Loan, 1.864%, (2 mo. USD LIBOR + 1.75%), 7/1/26 | | | 682 | | | | 678,567 | |

| | |

BWAY Holding Company, Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 4/3/24 | | | 1,346 | | | | 1,329,985 | |

| | |

Flex Acquisition Company, Inc., Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 3/2/28 | | | 2,395 | | | | 2,393,592 | |

| | |

Libbey Glass, Inc., Term Loan, 11.00%, (1 mo. USD LIBOR + 10.00%, Floor 1.00%), 11/13/25 | | | 1,070 | | | | 1,112,291 | |

| | |

Proampac PG Borrower, LLC, Term Loan, 4.50%, (USD LIBOR + 3.75%, Floor 0.75%), 11/3/25(10) | | | 1,379 | | | | 1,381,542 | |

| | |

Reynolds Group Holdings, Inc.: | | | | | | | | |

| | |

Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 2/5/26 | | | 891 | | | | 887,023 | |

| | |

Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 9/20/28 | | | 773 | | | | 772,386 | |

| | |

TricorBraun Holdings, Inc., Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 3/3/28 | | | 373 | | | | 370,993 | |

| | |

Trident TPI Holdings, Inc.: | | | | | | | | |

| | |

Term Loan, 4.201%, (3 mo. USD LIBOR + 4.00%, Floor 0.50%), 9/15/28(8) | | | 74 | | | | 74,552 | |

| | |

Term Loan, 4.50%, (3 mo. USD LIBOR + 4.00%, Floor 0.50%), 9/15/28 | | | 524 | | | | 524,807 | |

| |

| | | | $ | 10,497,591 | |

|

| Cosmetics / Toiletries — 0.2% | |

| | |

Kronos Acquisition Holdings, Inc.: | | | | | | | | |

| | |

Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 12/22/26 | | $ | 743 | | | $ | 724,247 | |

| | |

Term Loan, 12/22/26(9) | | | 350 | | | | 346,500 | |

| |

| | | | $ | 1,070,747 | |

|

| Drugs — 2.8% | |

| | |

Akorn, Inc., Term Loan, 8.50%, (3 mo. USD LIBOR + 7.50%, Floor 1.00%), 10/1/25 | | $ | 496 | | | $ | 503,796 | |

| | |

Alkermes, Inc., Term Loan, 3.00%, (3 mo. USD LIBOR + 2.50%, Floor 0.50%), 3/12/26 | | | 183 | | | | 180,615 | |

| | |

Amneal Pharmaceuticals, LLC, Term Loan, 3.625%, (1 mo. USD LIBOR + 3.50%), 5/4/25 | | | 2,076 | | | | 2,056,498 | |

| | |

Bausch Health Companies, Inc., Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 6/2/25 | | | 2,436 | | | | 2,428,119 | |

| | |

Cambrex Corporation, Term Loan, 4.25%, (1 mo. USD LIBOR + 3.50%, Floor 0.75%), 12/4/26 | | | 173 | | | | 173,539 | |

| | |

Catalent Pharma Solutions, Inc., Term Loan, 2.50%, (1 mo. USD LIBOR + 2.00%, Floor 0.50%), 2/22/28 | | | 733 | | | | 734,559 | |

| | |

Curia Global, Inc., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.75%, Floor 0.75%), 8/30/26 | | | 149 | | | | 148,829 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Drugs (continued) | |

| | |

Grifols Worldwide Operations USA, Inc., Term Loan, 2.104%, (1 mo. USD LIBOR + 2.00%), 11/15/27 | | $ | 2,835 | | | $ | 2,797,588 | |

| | |

Horizon Therapeutics USA, Inc.: | | | | | | | | |

| | |

Term Loan, 2.125%, (1 mo. USD LIBOR + 2.00%), 5/22/26 | | | 668 | | | | 666,498 | |

| | |

Term Loan, 2.25%, (1 mo. USD LIBOR + 1.75%, Floor 0.50%), 3/15/28 | | | 1,290 | | | | 1,287,562 | |

| | |

Jazz Financing Lux S.a.r.l., Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 5/5/28 | | | 2,117 | | | | 2,128,020 | |

| | |

Mallinckrodt International Finance S.A.: | | | | | | | | |

| | |

Term Loan, 6.00%, (3 mo. USD LIBOR + 5.25%, Floor 0.75%), 9/24/24 | | | 4,088 | | | | 3,840,716 | |

| | |

Term Loan, 6.25%, (3 mo. USD LIBOR + 5.50%, Floor 0.75%), 2/24/25 | | | 386 | | | | 362,617 | |

| | |

Pearl Intermediate Parent, LLC, Term Loan - Second Lien, 6.354%, (1 mo. USD LIBOR + 6.25%), 2/13/26 | | | 150 | | | | 150,937 | |

| |

| | | | $ | 17,459,893 | |

|

| Ecological Services and Equipment — 0.7% | |

| | |

Clean Harbors, Inc., Term Loan, 2.104%, (1 mo. USD LIBOR + 2.00%), 10/8/28 | | $ | 375 | | | $ | 375,117 | |

| | |

EnergySolutions, LLC, Term Loan, 4.75%, (3 mo. USD LIBOR + 3.75%, Floor 1.00%), 5/9/25 | | | 1,335 | | | | 1,336,185 | |

| | |

GFL Environmental, Inc., Term Loan, 3.50%, (3 mo. USD LIBOR + 3.00%, Floor 0.50%), 5/30/25 | | | 2,253 | | | | 2,260,895 | |

| | |

TruGreen Limited Partnership, Term Loan, 4.75%, (1 mo. USD LIBOR + 4.00%, Floor 0.75%), 11/2/27 | | | 347 | | | | 347,529 | |

| |

| | | | $ | 4,319,726 | |

|

| Electronics / Electrical — 19.1% | |

| | |

Allegro Microsystems, Inc., Term Loan, 4.25%, (3 mo. USD LIBOR + 3.75%, Floor 0.50%), 9/30/27 | | $ | 27 | | | $ | 26,923 | |

| | |

Altar Bidco, Inc., Term Loan, 11/17/28(9) | | | 1,050 | | | | 1,047,375 | |

| | |

Applied Systems, Inc., Term Loan, 3.50%, (3 mo. USD LIBOR + 3.00%, Floor 0.50%), 9/19/24 | | | 3,850 | | | | 3,853,237 | |

| | |

Aptean, Inc., Term Loan, 4.354%, (1 mo. USD LIBOR + 4.25%), 4/23/26 | | | 2,174 | | | | 2,169,533 | |

| | |

AQA Acquisition Holding, Inc., Term Loan, 4.75%, (3 mo. USD LIBOR + 4.25%, Floor 0.50%), 3/3/28 | | | 522 | | | | 522,783 | |

| | |

Astra Acquisition Corp.: | | | | | | | | |

| | |

Term Loan, 5.75%, (1 mo. USD LIBOR + 5.25%, Floor 0.50%), 10/25/28 | | | 1,475 | | | | 1,450,416 | |

| | |

Term Loan - Second Lien, 9.625%, (1 mo. USD LIBOR + 8.875%, Floor 0.75%), 10/22/29 | | | 1,375 | | | | 1,361,250 | |

| | |

Banff Merger Sub, Inc., Term Loan, 3.974%, (3 mo. USD LIBOR + 3.75%), 10/2/25 | | | 4,062 | | | | 4,050,531 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| | |

Buzz Merger Sub, Ltd., Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 1/29/27 | | $ | 33 | | | $ | 33,508 | |

| | |

CentralSquare Technologies, LLC, Term Loan, 3.974%, (3 mo. USD LIBOR + 3.75%), 8/29/25 | | | 496 | | | | 469,247 | |

| | |

Chamberlain Group, Inc., Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 11/3/28 | | | 1,275 | | | | 1,275,398 | |

| | |

Cloudera, Inc.: | | | | | | | | |

| | |

Term Loan, 4.25%, (1 mo. USD LIBOR + 3.75%, Floor 0.50%), 10/8/28 | | | 2,650 | | | | 2,643,926 | |

| | |

Term Loan - Second Lien, 6.50%, (1 mo. USD LIBOR + 6.00%, Floor 0.50%), 10/8/29 | | | 600 | | | | 601,500 | |

| | |

Cohu, Inc., Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 10/1/25 | | | 376 | | | | 374,610 | |

| | |

CommScope, Inc., Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 4/6/26 | | | 2,114 | | | | 2,090,459 | |

| | |

Constant Contact, Inc., Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 2/10/28 | | | 1,145 | | | | 1,145,945 | |

| | |

Cornerstone OnDemand, Inc., Term Loan, 4.25%, (6 mo. USD LIBOR + 3.75%, Floor 0.50%), 10/16/28 | | | 1,075 | | | | 1,074,059 | |

| | |

Creation Technologies, Inc., Term Loan, 6.00%, (3 mo. USD LIBOR + 5.50%, Floor 0.50%), 10/5/28 | | | 800 | | | | 795,000 | |

| | |

Cvent, Inc., Term Loan, 3.854%, (1 mo. USD LIBOR + 3.75%), 11/29/24 | | | 258 | | | | 258,189 | |

| | |

Delta TopCo, Inc., Term Loan, 4.50%, (6 mo. USD LIBOR + 3.75%, Floor 0.75%), 12/1/27 | | | 871 | | | | 872,530 | |

| | |

DG Investment Intermediate Holdings 2, Inc., Term Loan, 4.25%, (1 mo. USD LIBOR + 3.50%, Floor 0.75%), 3/31/28 | | | 1,493 | | | | 1,494,260 | |

| | |

E2open, LLC, Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 2/4/28 | | | 1,070 | | | | 1,073,596 | |

| | |

ECI Macola Max Holding, LLC, Term Loan, 4.50%, (3 mo. USD LIBOR + 3.75%, Floor 0.75%), 11/9/27 | | | 867 | | | | 867,663 | |

| | |

Electro Rent Corporation, Term Loan, 6.00%, (3 mo. USD LIBOR + 5.00%, Floor 1.00%), 1/31/24 | | | 1,872 | | | | 1,874,894 | |

| | |

Energizer Holdings, Inc., Term Loan, 2.75%, (1 mo. USD LIBOR + 2.00%), 12/22/27 | | | 651 | | | | 650,506 | |

| | |

Epicor Software Corporation, Term Loan, 4.00%, (1 mo. USD LIBOR + 3.25%, Floor 0.75%), 7/30/27 | | | 5,225 | | | | 5,227,768 | |

| | |

EXC Holdings III Corp., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.50%, Floor 1.00%), 12/2/24 | | | 336 | | | | 337,680 | |

| | |

Finastra USA, Inc., Term Loan, 4.50%, (6 mo. USD LIBOR + 3.50%, Floor 1.00%), 6/13/24 | | | 4,106 | | | | 4,092,407 | |

| | |

Fiserv Investment Solutions, Inc., Term Loan, 4.16%, (3 mo. USD LIBOR + 4.00%), 2/18/27 | | | 394 | | | | 394,739 | |

| | |

Gainwell Acquisition Corp., Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 10/1/27 | | | 4,116 | | | | 4,132,233 | |

| | |

Go Daddy Operating Company, LLC: | | | | | | | | |

| | |

Term Loan, 1.854%, (1 mo. USD LIBOR + 1.75%), 2/15/24 | | | 994 | | | | 990,442 | |

| | |

Term Loan, 2.104%, (1 mo. USD LIBOR + 2.00%), 8/10/27 | | | 714 | | | | 709,265 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| | |

Hyland Software, Inc., Term Loan, 4.25%, (1 mo. USD LIBOR + 3.50%, Floor 0.75%), 7/1/24 | | $ | 4,490 | | | $ | 4,502,398 | |

| | |

IGT Holding IV AB, Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 3/31/28 | | | 1,092 | | | | 1,090,385 | |

| | |

II-VI Incorporated, Term Loan, 12/1/28(9) | | | 825 | | | | 825,172 | |

| | |

Imperva, Inc., Term Loan, 5.00%, (3 mo. USD LIBOR + 4.00%, Floor 1.00%), 1/12/26 | | | 370 | | | | 370,392 | |

| | |

Imprivata, Inc., Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 12/1/27 | | | 2,187 | | | | 2,190,306 | |

| | |

Informatica, LLC, Term Loan, 2.875%, (1 mo. USD LIBOR + 2.75%), 10/27/28 | | | 2,175 | | | | 2,169,834 | |

| | |

LogMeIn, Inc., Term Loan, 4.839%, (1 mo. USD LIBOR + 4.75%), 8/31/27 | | | 1,711 | | | | 1,703,117 | |

| | |

MA FinanceCo., LLC: | | | | | | | | |

| | |

Term Loan, 2.854%, (1 mo. USD LIBOR + 2.75%), 6/21/24 | | | 331 | | | | 329,509 | |

| | |

Term Loan, 5.25%, (3 mo. USD LIBOR + 4.25%, Floor 1.00%), 6/5/25 | | | 1,332 | | | | 1,355,342 | |

| | |

Magenta Buyer, LLC: | | | | | | | | |

| | |

Term Loan, 5.75%, (3 mo. USD LIBOR + 5.00%, Floor 0.75%), 7/27/28 | | | 2,718 | | | | 2,717,054 | |

| | |

Term Loan - Second Lien, 9.00%, (3 mo. USD LIBOR + 8.25%, Floor 0.75%), 7/27/29 | | | 1,475 | | | | 1,470,391 | |

| | |

Marcel LUX IV S.a.r.l.: | | | | | | | | |

| | |

Term Loan, 3.354%, (1 mo. USD LIBOR + 3.25%), 3/15/26 | | | 2,158 | | | | 2,154,803 | |

| | |

Term Loan, 4.75%, (1 mo. USD LIBOR + 4.00%, Floor 0.75%), 12/31/27 | | | 61 | | | | 61,486 | |

| | |

Mavenir Systems, Inc., Term Loan, 5.25%, (3 mo. USD LIBOR + 4.75%, Floor 0.50%), 8/18/28 | | | 300 | | | | 300,875 | |

| | |

Maverick Bidco, Inc., Term Loan, 4.50%, (3 mo. USD LIBOR + 3.75%, Floor 0.75%), 5/18/28 | | | 625 | | | | 626,172 | |

| | |

Mediaocean, LLC, Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 12/15/28 | | | 525 | | | | 523,359 | |

| | |

MH Sub I, LLC, Term Loan, 4.75%, (1 mo. USD LIBOR + 3.75%, Floor 1.00%), 9/13/24 | | | 324 | | | | 325,292 | |

| | |

Mirion Technologies, Inc., Term Loan, 3.25%, (6 mo. USD LIBOR + 2.75%, Floor 0.50%), 10/20/28 | | | 574 | | | | 573,432 | |

| | |

MKS Instruments, Inc., Term Loan, 10/21/28(9) | | | 3,325 | | | | 3,321,881 | |

| | |

N-Able International Holdings II, LLC, Term Loan, 3.50%, (3 mo. USD LIBOR + 3.00%, Floor 0.50%), 7/19/28 | | | 299 | | | | 298,502 | |

| | |

Panther Commercial Holdings L.P., Term Loan, 5.00%, (3 mo. USD LIBOR + 4.50%, Floor 0.50%), 1/7/28 | | | 1,617 | | | | 1,621,947 | |

| | |

PointClickCare Technologies, Inc., Term Loan, 3.75%, (6 mo. USD LIBOR + 3.00%, Floor 0.75%), 12/29/27 | | | 372 | | | | 372,420 | |

| | |

Polaris Newco, LLC, Term Loan, 4.50%, (3 mo. USD LIBOR + 4.00%, Floor 0.50%), 6/2/28 | | | 1,771 | | | | 1,772,445 | |

| | |

Proofpoint, Inc., Term Loan, 3.75%, (3 mo. USD LIBOR + 3.25%, Floor 0.50%), 8/31/28 | | | 1,850 | | | | 1,848,150 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

VT Floating-Rate Income Fund

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| | |

Rackspace Technology Global, Inc., Term Loan, 3.50%, (3 mo. USD LIBOR + 2.75%, Floor 0.75%), 2/15/28 | | $ | 893 | | | $ | 887,779 | |

| | |

RealPage, Inc., Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 4/24/28 | | | 2,295 | | | | 2,290,797 | |

| | |

Recorded Books, Inc., Term Loan, 4.105%, (1 mo. USD LIBOR + 4.00%), 8/29/25 | | | 1,188 | | | | 1,189,546 | |

| | |

Redstone Holdco 2 L.P., Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 4/27/28 | | | 2,095 | | | | 2,009,651 | |

| | |

Seattle Spinco, Inc., Term Loan, 2.854%, (1 mo. USD LIBOR + 2.75%), 6/21/24 | | | 2,236 | | | | 2,225,254 | |

| | |

SkillSoft Corporation, Term Loan, 5.50%, (3 mo. USD LIBOR + 4.75%, Floor 0.75%), 6/30/28 | | | 525 | | | | 527,625 | |

| | |

SolarWinds Holdings, Inc., Term Loan, 2.854%, (1 mo. USD LIBOR + 2.75%), 2/5/24 | | | 3,871 | | | | 3,819,847 | |

| | |

Sophia L.P., Term Loan, 4.00%, (3 mo. USD LIBOR + 3.50%, Floor 0.50%), 10/7/27 | | | 2,498 | | | | 2,499,957 | |

| | |

Sovos Compliance, LLC: | | | | | | | | |

| | |

Term Loan, 4.50%, 8/11/28(8) | | | 162 | | | | 162,695 | |

| | |

Term Loan, 5.00%, (1 mo. USD LIBOR + 4.50%, Floor 0.50%), 8/11/28 | | | 938 | | | | 942,117 | |

| | |

SurveyMonkey, Inc., Term Loan, 3.86%, (1 mo. USD LIBOR + 3.75%), 10/10/25 | | | 887 | | | | 882,441 | |

| | |

Symplr Software, Inc., Term Loan, 5.25%, (3 mo. USD LIBOR + 4.50%, Floor 0.75%), 12/22/27 | | | 1,067 | | | | 1,070,805 | |

| | |

Synaptics Incorporated, Term Loan, 2.75%, (6 mo. USD LIBOR + 2.25%, Floor 0.50%), 12/2/28 | | | 324 | | | | 324,187 | |

| | |

Tibco Software, Inc., Term Loan, 3.852%, (1 mo. USD LIBOR + 3.75%), 6/30/26 | | | 1,930 | | | | 1,919,501 | |

| | |

TTM Technologies, Inc., Term Loan, 2.599%, (1 mo. USD LIBOR + 2.50%), 9/28/24 | | | 428 | | | | 428,386 | |

| | |

Turing Midco, LLC, Term Loan, 3.50%, (1 mo. USD LIBOR + 3.00%, Floor 0.50%), 3/23/28 | | | 356 | | | | 356,390 | |

| | |

Uber Technologies, Inc., Term Loan, 3.604%, (1 mo. USD LIBOR + 3.50%), 4/4/25 | | | 3,370 | | | | 3,375,317 | |

| | |

Ultimate Software Group, Inc. (The): | | | | | | | | |

| | |

Term Loan, 3.75%, (1 mo. USD LIBOR + 3.25%, Floor 0.50%), 5/4/26 | | | 2,946 | | | | 2,934,755 | |

| | |

Term Loan, 3.854%, (1 mo. USD LIBOR + 3.75%), 5/4/26 | | | 1,320 | | | | 1,317,810 | |

| | |

Ultra Clean Holdings, Inc., Term Loan, 3.854%, (1 mo. USD LIBOR + 3.75%), 8/27/25 | | | 848 | | | | 850,551 | |

| | |

Valkyr Purchaser, LLC, Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 11/5/27 | | | 447 | | | | 447,742 | |

| | |

Verifone Systems, Inc., Term Loan, 4.178%, (3 mo. USD LIBOR + 4.00%), 8/20/25 | | | 1,688 | | | | 1,661,188 | |

| | |

Veritas US, Inc., Term Loan, 6.00%, (3 mo. USD LIBOR + 5.00%, Floor 1.00%), 9/1/25 | | | 1,605 | | | | 1,606,484 | |

| | |

Vision Solutions, Inc., Term Loan, 4.75%, (3 mo. USD LIBOR + 4.00%, Floor 0.75%), 4/24/28 | | | 623 | | | | 623,437 | |

| | | | | | | | |

| Borrower/Description | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| | |

VS Buyer, LLC, Term Loan, 3.104%, (1 mo. USD LIBOR + 3.00%), 2/28/27 | | $ | 3,296 | | | $ | 3,288,920 | |

| |

| | | | $ | 118,129,718 | |

|

| Equipment Leasing — 0.5% | |

| | |

Avolon TLB Borrower 1 (US), LLC: | | | | | | | | |

| | |

Term Loan, 2.50%, (1 mo. USD LIBOR + 1.75%, Floor 0.75%), 1/15/25 | | $ | 1,493 | | | $ | 1,495,671 | |

| | |

Term Loan, 2.75%, (1 mo. USD LIBOR + 2.25%, Floor 0.50%), 12/1/27 | | | 1,114 | | | | 1,116,689 | |

| | |

PECF USS Intermediate Holding III Corporation, Term Loan, 12/15/28(9) | | | 525 | | | | 526,181 | |

| |

| | | | $ | 3,138,541 | |

|

| Financial Intermediaries — 2.4% | |

| | |

Aretec Group, Inc., Term Loan, 4.354%, (1 mo. USD LIBOR + 4.25%), 10/1/25 | | $ | 1,798 | | | $ | 1,803,330 | |

| | |

CoreLogic, Inc., Term Loan, 4.00%, (1 mo. USD LIBOR + 3.50%, Floor 0.50%), 6/2/28 | | | 3,591 | | | | 3,593,693 | |

| | |

Ditech Holding Corporation, Term Loan, 0.00%, 6/30/22(11) | | | 1,375 | | | | 275,062 | |

| | |

Edelman Financial Center, LLC, Term Loan, 4.25%, (1 mo. USD LIBOR + 3.50%, Floor 0.75%), 4/7/28 | | | 1,294 | | | | 1,294,129 | |

| | |

EIG Management Company, LLC, Term Loan, 4.50%, (1 mo. USD LIBOR + 3.75%, Floor 0.75%), 2/22/25 | | | 193 | | | | 191,838 | |

| | |

FinCo I, LLC, Term Loan, 2.604%, (1 mo. USD LIBOR + 2.50%), 6/27/25 | | | 576 | | | | 574,825 | |

| | |

Focus Financial Partners, LLC: | | | | | | | | |

| | |

Term Loan, 2.104%, (1 mo. USD LIBOR + 2.00%), 7/3/24 | | | 594 | | | | 589,764 | |

| | |

Term Loan, 3.00%, (1 mo. USD LIBOR + 2.50%, Floor 0.50%), 7/1/28 | | | 586 | | | | 583,980 | |

| | |

Term Loan, 4.75%, (USD Prime + 1.50%), 6/24/28 | | | 136 | | | | 135,102 | |

| | |

GreenSky Holdings, LLC: | | | | | | | | |

| | |

Term Loan, 3.352%, (1 mo. USD LIBOR + 3.25%), 3/31/25 | | | 987 | | | | 987,179 | |

| | |

Term Loan, 5.50%, (1 mo. USD LIBOR + 4.50%, Floor 1.00%), 3/29/25 | | | 369 | | | | 370,068 | |

| | |

HighTower Holdings, LLC, Term Loan, 4/21/28(9) | | | 1,000 | | | | 1,002,344 | |

| | |

KKR Apple Bidco, LLC, Term Loan, 3.50%, (1 mo. USD LIBOR + 3.00%, Floor 0.50%), 9/23/28 | | | 150 | | | | 149,708 | |

| | |

LPL Holdings, Inc., Term Loan, 1.854%, (1 mo. USD LIBOR + 1.75%), 11/12/26 | | | 1,469 | | | | 1,463,722 | |

| | |

Mariner Wealth Advisors, LLC: | | | | | | | | |

| | |

Term Loan, 3.45%, (3 mo. USD LIBOR + 3.25%, Floor 0.50%), 8/18/28(8) | | | 47 | | | | 46,653 | |

| | |