united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-10123

The North Country Funds

(Exact name of Registrant as specified in charter)

250 Glen Street, Glens Falls, NY 12801

(Address of principal executive offices) (Zip code)

Richard Malinowski

c/o Ultimus Fund Solutions, LLC., 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 11/30

Date of reporting period: 11/30/21

Item 1. Reports to Stockholders.

| | | The North Country Funds |

| | | |

| | | Large Cap Equity Fund

(formerly, the Equity Growth Fund)

Intermediate Bond Fund |

| | | |

| | |  |

| | | |

| | | |

| | | |

| | | |

| | | Annual Report

November 30, 2021 |

| | | |

| Investment Adviser | | |

| North Country Investment Advisers, Inc. | | |

| 250 Glen Street | | |

| Glens Falls, NY 12801 | | |

| | | |

Administrator and

Fund Accountant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

Investor Information: (888) 350-2990 | |

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the North Country Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

The North Country Funds

ANNUAL REPORT

November 30, 2021

ECONOMIC SUMMARY

As we entered 2021, there was a fairly positive consensus view on the economy and potential returns in equity markets, while fixed income returns were predicted to be muted. The initiation of COVID-19 vaccinations, global re-openings, unprecedented economic stimulus and strong consumer demand were the driving factors behind this view. Most of the first half of the year went according to plan. GDP growth averaged a strong annualized 6.5 percent during the first half of the year, and major equity indexes were up across the board.

During summer, the Delta variant, inflation, global supply chain issues and labor shortages led to slowing GDP growth and higher volatility in financial markets. With wide spread vaccines and last winter’s COVID-19 spike behind us, it was generally thought that the pandemic was mostly behind us. The emergence of the Delta variant overturned these thoughts. Supply chain issues and labor shortages neutralized strong consumer demand in many circumstances. Annualized GDP growth in the third quarter fell to a disappointing 2 percent.

As we ended November, economic growth appeared to be rebounding in the fourth quarter and the labor market continued to gain strength. However, inflation and the new Omicron variant again led to volatile markets. Inflation continued to swell throughout the year, hitting 40-year highs in November. Due to the strong labor market and inflation concerns, the Federal Reserve announced that they were beginning to taper their asset purchase program. The Omicron variant further extends the pandemic as we head into the third calendar year of the crisis.

The Large Cap Equity Fund

While the economic recovery was under way throughout 2021, we remained balanced with a tilt toward growth and continued to monitor incremental risks that represented headwinds for U.S. stocks, including elevated inflation, microchip shortages, surging imports and clogged U.S. distribution channels. Yet while risks remained, as they always do, the market prospects appeared encouraging: consumer balance sheets were in good shape, housing starts were only at average levels with lots of demand in the pipeline, the banking system was sound, and there was demand for hiring and business investment. Through the year’s volatility, we maintained exposure to quality, focused on high-conviction stocks, and continued to take advantage of market dislocations for compelling stock-selection opportunities.

For the one-year period ending November 30, 2021, the North Country Large Cap Equity Fund returned 22.73% while the S&P 500 returned 27.92%. On an annualized basis, the three, five and 10-year total returns for the North Country Large Cap Equity Fund were 20.57%, 18.49%, and 15.46% versus the S&P 500 at 20.38%, 17.90% and 16.16%, respectively.

The Equity Fund’s underperformance over the one-year time period can be attributed to stock selection – outsized positions in companies primarily in the Communications Services and Information Technology sectors. Other select names across the portfolio still generated strong returns this year, as these companies with unique products and services have been widely viewed as beneficiaries of this new global economic environment. The greater focus on quality factors throughout the year has benefited the relative performance of the portfolio in times of stress, and we will continue to implement an investment process that focuses on sustainable free cash flow from operations, profit margins, capital discipline and strong balance sheets.

The Intermediate Bond Fund

It was a volatile year for interest rates in 2021. Intermediate and long-term rates rose as the economy improved and the year ended with a much steeper yield curve.

The emergency policies that have been in place for the past 20 months are in the early stages of being slowly removed. The pace of the Fed’s bond tapering effort is expected to be faster than initially announced and one or more rate hikes is potentially expected in the second half of 2022.

The North Country Intermediate Bond Fund returned -1.89% for the 12-month period ending November 30, 2021 while the ICE Bank of America Merrill Lynch Corporate/Government “A” rated or better 1-10 year index1 returned -0.96% and the Bloomberg Barclays U.S. Aggregate Bond Index2 returned -1.15%.

The North Country Intermediate Bond Fund had annualized total returns for the three-year, five-year and 10-year periods ending November 30, 2021 of 4.64%, 2.73% and 2.23% while the ICE Bank of America Merrill Lynch Corporate/Government “A” rated or better 1-10 year index returned 4.40%, 2.99% and 2.54% for the respective time periods.

The North Country Intermediate Bond Fund underperformed its benchmark for the one-year, five-year and 10-year periods and outperformed its benchmark for the three-year period, ending November 30, 2021. This was due to an average maturity and duration longer than the benchmark in a time when intermediate term interest rates increased, in general, and as credit spreads widened, both contributing to underperformance of longer duration and longer maturity fixed income investments.

In 2022, the Fed is expected to be faced with keeping the economic recovery going, tackling any uncertainties new coronavirus variants could pose to the labor market, and dealing with an economy that has been running hot with inflation for several months. The Fed’s proactive stance while the economy slows may put some additional upward pressure on short-, intermediate-, and long-term U.S. interest rates.

| 1 | The ICE Bank of America Merrill Lynch Corporate/Government “A” rated or better 1-10 year index is based upon publicly issued intermediate corporate and government debt securities with maturities ranging between 1 and 10 years. |

| 2 | The Barclays US Aggregate Bond Index measures a broad spectrum of U.S. investment grade taxable fixed income securities including treasury, agency, corporate, mortgage-backed, asset backed and international dollar denominated issues with maturities of 1 year or more. |

Large Cap Equity Fund:

| Annual Fund Operating Expenses: | | (As a Percentage of Net Assets) |

| Total Annual Operating Expenses: | | 0.99% |

| | | |

| Intermediate Bond Fund: | | |

| | | |

| Annual Fund Operating Expenses: | | (As a Percentage of Net Assets) |

| Total Annual Operating Expenses: | | 0.82% |

Average Annual Total Returns as of September 30, 2021 (Latest Calendar Quarter)

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | 22.17% | | 17.49% | | 15.90% | |

| North Country Intermediate Bond Fund | -0.70% | | 2.22% | | 2.31% | |

Average Annual Total Returns as of November 30, 2021 (Fiscal Year-End)

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | 22.73% | | 18.49% | | 15.46% | |

| North Country Intermediate Bond Fund | -1.89% | | 2.73% | | 2.23% | |

Performance data quoted above is historical and is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end by calling 1-888-350-2990. Information provided is unaudited.

The views expressed are as November 30, 2021 and are those of the adviser, North Country Investment Advisers, Inc. The views are subject to change at any time in response to changing circumstances in the markets and are not intended to predict or guarantee the future performance of any individual security market sector or the markets generally, or the North Country Funds.

Not FDIC insured. Not obligations of or guaranteed by the bank. May involve investment risks, including possible loss of the principal invested.

6002-NLD-01/03/2022

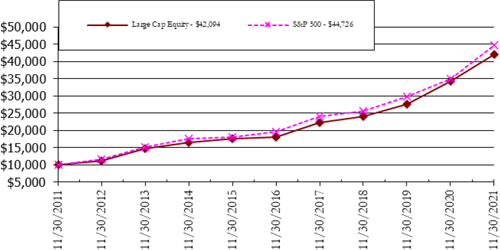

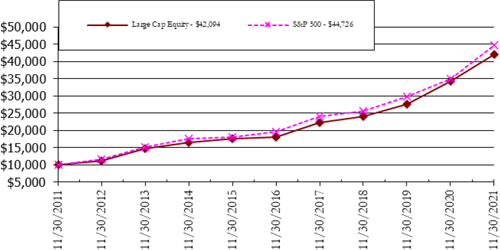

| North Country Large Cap Equity Fund |

| Growth of $10,000 Investment (Unaudited) |

This chart illustrates the comparison of a hypothetical investment of $10,000 in the North Country Large Cap Equity Fund (assuming reinvestment of all dividends and distributions) versus the Fund’s benchmark index.

Average Annual Total Returns as of November 30, 2021

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | 22.73% | | 18.49% | | 15.46% | |

| S&P 500 | 27.92% | | 17.90% | | 16.16% | |

The S&P 500 is a market capitalization-weighted index of 500 widely held common stocks. Indexes and benchmarks are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index or benchmark, although they can invest in its underlying securities or funds.

Past performance is not indicative of future results. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions.

| The returns do not reflect a reduction for taxes a shareholder would pay on the redemption of fund shares or fund distributions. |

| |

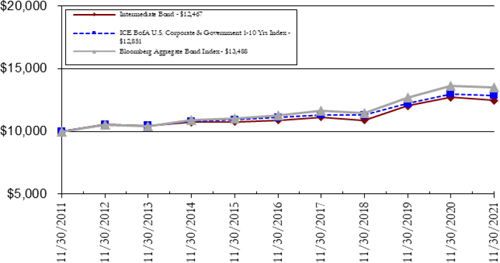

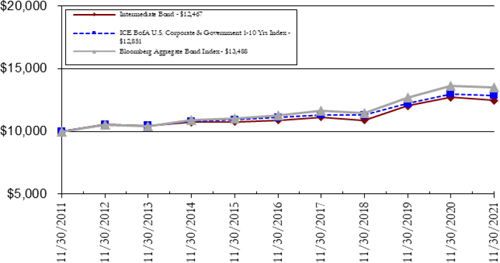

| North Country Intermediate Bond Fund |

| Growth of $10,000 Investment (Unaudited) |

This chart illustrates the comparison of a hypothetical investment of $10,000 in the North Country Intermediate Bond Fund (assuming reinvestment of all dividends and distributions) versus the Fund’s benchmark indexes.

Average Annual Total Returns as of November 30, 2021

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Intermediate Bond Fund | -1.89% | | 2.73% | | 2.23% | |

| ICE BofA U.S. Corporate & Government 1-10 Yrs Index | -0.96% | | 2.99% | | 2.54% | |

| Bloomberg Aggregate Bond Index | -1.15% | | 3.65% | | 3.04% | |

The ICE BofA U.S. Corporate & Government 1-10 Yrs Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities with a remaining term to final maturity less than 10 years. The Bloomberg Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark. The indexes are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Past performance is not indicative of future results. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions.

| The returns do not reflect a reduction for taxes a shareholder would pay on the redemption of fund shares or fund distributions. |

| |

| North Country Large Cap Equity Fund |

| Portfolio Summary (Unaudited) |

| November 30, 2021 |

| Industries | % of Net Assets | | Industries | % of Net Assets |

| Common Stock | 97.9% | | Apparel & Textile Products | 1.7% |

| Software | 14.9% | | Insurance | 1.5% |

| Internet Media & Services | 8.2% | | Household Products | 1.4% |

| Technology Hardware | 7.6% | | Beverages | 1.3% |

| Medical Equipment & Devices | 6.8% | | Electric Utilities | 1.3% |

| E-Commerce Discretionary | 5.1% | | Commercial Support Services | 1.3% |

| Biotech & Pharma | 4.8% | | Diversified Industrials | 1.2% |

| Technology Services | 4.4% | | Entertainment Content | 1.1% |

| Banking | 4.3% | | Wholesale - Consumer Staples | 0.7% |

| Retail - Discretionary | 3.5% | | Specialty Finance | 0.6% |

| Institutional Financial Services | 3.4% | | Machinery | 0.5% |

| Retail - Consumer Staples | 3.4% | | Telecommunications | 0.4% |

| Chemicals | 2.7% | | Infrastructure REIT | 0.4% |

| Healthcare Facilities & Services | 2.6% | | Construction Materials | 0.3% |

| Transportation & Logistics | 2.3% | | Self-Storage REIT | 0.3% |

| Leisure Facilities & Services | 2.1% | | Office REIT | 0.3% |

| Oil & Gas Producers | 1.9% | | Money Market Fund | 2.1% |

| Home Construction | 1.9% | | Liabilities in excess of other assets | (0.0)% |

| Semiconductors | 1.9% | | Total Net Assets | 100.0% |

| Asset Management | 1.8% | | | |

| | | | | |

| Top Ten Holdings | % of Net Assets | | Top Ten Holdings | % of Net Assets |

| Apple, Inc. | 6.6% | | Alphabet, Inc. | 3.7% |

| Microsoft Corporation | 6.6% | | salesforce.com, Inc. | 3.2% |

| Amazon.com, Inc. | 5.1% | | UnitedHealth Group, Inc. | 2.6% |

| Adobe, Inc. | 3.9% | | Home Depot, Inc. (The) | 2.6% |

| Visa, Inc. | 3.8% | | Intercontinental Exchange, Inc. | 2.2% |

| | | | | |

| North Country Intermediate Bond Fund |

| Portfolio Summary (Unaudited) |

| November 30, 2021 |

| Industries | % of Net Assets | | Industries | % of Net Assets |

| Corporate Bonds | 72.2% | | Aerospace & Defense | 2.1% |

| Banking | 15.0% | | Software | 1.8% |

| Institutional Financial Services | 5.1% | | Biotech & Pharma | 1.5% |

| Technology Hardware | 4.8% | | Machinery | 1.5% |

| Semiconductors | 4.5% | | Health Care Facilities & Services | 1.3% |

| Oil & Gas Producers | 4.2% | | Apparel & Textile Products | 1.3% |

| Retail - Discretionary | 3.5% | | Medical Equipment & Devices | 1.2% |

| Transportation & Logistics | 2.9% | | Cable & Satellite | 1.1% |

| Telecommunications | 2.7% | | Household Products | 0.6% |

| Beverages | 2.6% | | Retail - Consumer Staples | 0.3% |

| Insurance | 2.5% | | U.S. Government & Agencies | 23.4% |

| Real Estate Investment Trusts | 2.5% | | Government Sponsored | 20.7% |

| Electric Utilities | 2.5% | | Agency Fixed Rate | 2.7% |

| Food | 2.3% | | Money Market Fund | 3.9% |

| Entertainment Content | 2.2% | | Other assets less liabilities | 0.5% |

| Chemicals | 2.2% | | Total Net Assets | 100.0% |

| Top Ten Holdings | % of Net Assets |

| Federal Home Loan Banks 3.4%, Due 03/14/2029 | 3.5% |

| AT&T, Inc. 4.35%, Due 03/01/2029 | 2.6% |

| Anheuser-Busch InBev Worldwide, Inc. 4%, Due 04/13/2028 | 2.6% |

| Federal Farm Credit Banks Funding Corporation 3.15%, Due 04/03/2028 | 2.6% |

| Georgia Power Company 3.25%, Due 03/30/2027 | 2.5% |

| Federal Home Loan Banks 2.75%, Due 12/13/2024 | 2.5% |

| Federal Farm Credit Banks Funding Corporation 2.35%, Due 08/14/2024 | 2.4% |

| Wells Fargo & Company 3.45%, Due 02/13/2023 | 2.4% |

| Federal Farm Credit Banks Funding Corporation 3.27%, Due 03/22/2029 | 2.4% |

| Southwest Airlines Company 5.125%, Due 06/15/2027 | 2.3% |

| | |

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| November 30, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 1.7% | | | | |

| | 12,000 | | | NIKE, Inc., Class B | | $ | 2,030,880 | |

| | 12,500 | | | VF Corporation | | | 896,625 | |

| | | | | | | | 2,927,505 | |

| | | | | ASSET MANAGEMENT - 1.8% | | | | |

| | 3,350 | | | BlackRock, Inc. | | | 3,030,443 | |

| | | | | | | | | |

| | | | | BANKING - 4.3% | | | | |

| | 83,000 | | | Bank of America Corporation | | | 3,691,010 | |

| | 23,000 | | | JPMorgan Chase & Company | | | 3,653,090 | |

| | | | | | | | 7,344,100 | |

| | | | | BEVERAGES - 1.3% | | | | |

| | 14,200 | | | PepsiCo, Inc. | | | 2,268,876 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 4.8% | | | | |

| | 11,900 | | | Amgen, Inc. | | | 2,366,672 | |

| | 18,500 | | | Johnson & Johnson | | | 2,884,705 | |

| | 54,500 | | | Pfizer, Inc. | | | 2,928,285 | |

| | | | | | | | 8,179,662 | |

| | | | | CHEMICALS - 2.7% | | | | |

| | 2,700 | | | Air Products and Chemicals, Inc. | | | 776,088 | |

| | 3,900 | | | Ecolab, Inc. | | | 863,733 | |

| | 8,500 | | | LyondellBasell Industries N.V., Class A | | | 740,605 | |

| | 6,300 | | | Sherwin-Williams Company (The) | | | 2,086,812 | |

| | | | | | | | 4,467,238 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 1.3% | | | | |

| | 13,500 | | | Waste Management, Inc. | | | 2,169,045 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 0.3% | | | | |

| | 3,000 | | | Vulcan Materials Company | | | 574,920 | |

| | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS - 1.2% | | | | |

| | 10,000 | | | Honeywell International, Inc. | | | 2,022,400 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 5.1% | | | | |

| | 2,475 | | | Amazon.com, Inc.(a) | | $ | 8,679,998 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.3% | | | | |

| | 8,000 | | | Dominion Energy, Inc. | | | 569,600 | |

| | 9,500 | | | NextEra Energy, Inc. | | | 824,410 | |

| | 13,750 | | | Southern Company (The) | | | 840,125 | |

| | | | | | | | 2,234,135 | |

| | | | | ENTERTAINMENT CONTENT - 1.1% | | | | |

| | 17,500 | | | Activision Blizzard, Inc. | | | 1,025,500 | |

| | 6,350 | | | Walt Disney Company (The)(a) | | | 920,115 | |

| | | | | | | | 1,945,615 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.6% | | | | |

| | 10,075 | | | UnitedHealth Group, Inc. | | | 4,475,517 | |

| | | | | | | | | |

| | | | | HOME CONSTRUCTION - 1.9% | | | | |

| | 50,000 | | | Masco Corporation | | | 3,295,000 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 1.4% | | | | |

| | 16,500 | | | Procter & Gamble Company (The) | | | 2,385,570 | |

| | | | | | | | | |

| | | | | INFRASTRUCTURE REIT - 0.4% | | | | |

| | 2,350 | | | American Tower Corporation | | | 616,828 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 3.4% | | | | |

| | 2,600 | | | Goldman Sachs Group, Inc. (The) | | | 990,574 | |

| | 29,150 | | | Intercontinental Exchange, Inc. | | | 3,810,488 | |

| | 11,300 | | | Morgan Stanley | | | 1,071,466 | |

| | | | | | | | 5,872,528 | |

| | | | | INSURANCE - 1.5% | | | | |

| | 9,550 | | | Berkshire Hathaway, Inc., Class B(a) | | | 2,642,390 | |

| | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES - 8.2% | | | | |

| | 2,200 | | | Alphabet, Inc., Class A(a) | | | 6,243,490 | |

| | 9,500 | | | Meta Platforms, Inc.(a) | | | 3,082,370 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | INTERNET MEDIA & SERVICES - 8.2% (Continued) | | | | |

| | 5,700 | | | Netflix, Inc.(a) | | $ | 3,658,830 | |

| | 20,000 | | | Twitter, Inc.(a) | | | 878,800 | |

| | | | | | | | 13,863,490 | |

| | | | | LEISURE FACILITIES & SERVICES - 2.1% | | | | |

| | 5,600 | | | Domino’s Pizza, Inc. | | | 2,935,184 | |

| | 2,600 | | | McDonald’s Corporation | | | 635,960 | |

| | | | | | | | 3,571,144 | |

| | | | | MACHINERY - 0.5% | | | | |

| | 4,000 | | | Caterpillar, Inc. | | | 773,400 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 6.8% | | | | |

| | 20,000 | | | Abbott Laboratories | | | 2,515,400 | |

| | 5,000 | | | Danaher Corporation | | | 1,608,200 | |

| | 19,000 | | | Medtronic PLC | | | 2,027,300 | |

| | 9,000 | | | Stryker Corporation | | | 2,129,670 | |

| | 5,245 | | | Thermo Fisher Scientific, Inc. | | | 3,319,193 | |

| | | | | | | | 11,599,763 | |

| | | | | OFFICE REIT - 0.3% | | | | |

| | 2,500 | | | Alexandria Real Estate Equities, Inc. | | | 500,175 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 1.9% | | | | |

| | 10,200 | | | Chevron Corporation | | | 1,151,274 | |

| | 18,100 | | | Exxon Mobil Corporation | | | 1,083,104 | |

| | 40,000 | | | Williams Companies, Inc. (The) | | | 1,071,600 | |

| | | | | | | | 3,305,978 | |

| | | | | RETAIL - CONSUMER STAPLES - 3.4% | | | | |

| | 5,075 | | | Costco Wholesale Corporation | | | 2,737,354 | |

| | 6,100 | | | Dollar Tree, Inc.(a) | | | 816,363 | |

| | 15,500 | | | Walmart, Inc. | | | 2,179,765 | |

| | | | | | | | 5,733,482 | |

| | | | | RETAIL - DISCRETIONARY - 3.5% | | | | |

| | 10,900 | | | Home Depot, Inc. (The) | | | 4,366,649 | |

| | 23,050 | | | TJX Companies, Inc. (The) | | | 1,599,670 | |

| | | | | | | | 5,966,319 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | SELF-STORAGE REIT - 0.3% | | | | |

| | 1,750 | | | Public Storage | | $ | 572,915 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 1.9% | | | | |

| | 24,100 | | | Intel Corporation | | | 1,185,720 | |

| | 11,250 | | | QUALCOMM, Inc. | | | 2,031,300 | |

| | | | | | | | 3,217,020 | |

| | | | | SOFTWARE - 14.9% | | | | |

| | 10,000 | | | Adobe, Inc.(a) | | | 6,698,500 | |

| | 34,200 | | | Microsoft Corporation | | | 11,306,177 | |

| | 19,000 | | | Oracle Corporation | | | 1,724,060 | |

| | 19,400 | | | salesforce.com, Inc.(a) | | | 5,528,224 | |

| | | | | | | | 25,256,961 | |

| | | | | SPECIALTY FINANCE - 0.6% | | | | |

| | 6,800 | | | Capital One Financial Corporation | | | 955,604 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 7.6% | | | | |

| | 68,500 | | | Apple, Inc. | | | 11,323,050 | |

| | 30,750 | | | Cisco Systems, Inc. | | | 1,686,330 | |

| | | | | | | | 13,009,380 | |

| | | | | TECHNOLOGY SERVICES - 4.4% | | | | |

| | 6,000 | | | PayPal Holdings, Inc.(a) | | | 1,109,340 | |

| | 33,125 | | | Visa, Inc., Class A | | | 6,418,631 | |

| | | | | | | | 7,527,971 | |

| | | | | TELECOMMUNICATIONS - 0.4% | | | | |

| | 15,000 | | | Verizon Communications, Inc. | | | 754,050 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.3% | | | | |

| | 5,700 | | | FedEx Corporation | | | 1,313,109 | |

| | 4,500 | | | Union Pacific Corporation | | | 1,060,380 | |

| | 9,000 | | | United Parcel Service, Inc., Class B | | | 1,785,330 | |

| | | | | | | | 4,158,819 | |

| | | | | WHOLESALE - CONSUMER STAPLES - 0.7% | | | | |

| | 17,500 | | | Sysco Corporation | | | 1,225,700 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Shares | | | | | Fair Value | |

| | | | | TOTAL COMMON STOCKS (Cost $57,686,698) | | $ | 167,123,941 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 2.1% | | | | |

| | | | | MONEY MARKET FUNDS - 2.1% | | | | |

| | 3,565,852 | | | BlackRock Liquidity Funds Treasury Trust Fund, Institutional Class, 0.02% (Cost $3,565,852)(b) | | | 3,565,852 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $61,252,550) | | $ | 170,689,793 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - 0.0% | | | (64,184 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 170,625,609 | |

N.V. - Naamioze Vennootschap

PLC - Public Limited Company

REIT - Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2021. |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS |

| November 30, 2021 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 72.2% | | | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 2.1% | | | | | | | | | | |

| | 250,000 | | | Boeing Company (The) | | | | 2.2500 | | 06/15/26 | | $ | 251,002 | |

| | 1,000,000 | | | Boeing Company (The) | | | | 3.2500 | | 03/01/28 | | | 1,036,223 | |

| | 500,000 | | | General Dynamics Corporation | | | | 2.2500 | | 11/15/22 | | | 506,503 | |

| | | | | | | | | | | | | | 1,793,728 | |

| | | | | APPAREL & TEXTILE PRODUCTS — 1.3% | | | | | | | | | | |

| | 1,000,000 | | | Ralph Lauren Corporation | | | | 3.7500 | | 09/15/25 | | | 1,083,117 | |

| | | | | | | | | | | | | | | |

| | | | | BANKING — 15.0% | | | | | | | | | | |

| | 500,000 | | | Bank of America Corporation | | | | 4.1830 | | 11/25/27 | | | 547,562 | |

| | 1,250,000 | | | Bank of America Corporation(a) | | USD LIBOR 3M + 1.190% | | 2.8840 | | 10/22/30 | | | 1,296,655 | |

| | 500,000 | | | Citigroup, Inc. | | | | 4.4500 | | 09/29/27 | | | 556,611 | |

| | 1,000,000 | | | JPMorgan Chase & Company | | | | 3.8750 | | 09/10/24 | | | 1,069,088 | |

| | 1,000,000 | | | JPMorgan Chase & Company | | | | 3.1250 | | 01/23/25 | | | 1,052,070 | |

| | 500,000 | | | JPMorgan Chase & Company | | | | 3.3000 | | 04/01/26 | | | 533,707 | |

| | 1,500,000 | | | Mitsubishi UFJ Financial Group, Inc. | | | | 3.1950 | | 07/18/29 | | | 1,594,575 | |

| | 500,000 | | | PNC Financial Services Group, Inc. (The) | | | | 3.4500 | | 04/23/29 | | | 546,268 | |

| | 1,500,000 | | | Sumitomo Mitsui Financial Group, Inc. | | | | 2.1300 | | 07/08/30 | | | 1,475,705 | |

| | 500,000 | | | US Bancorp | | | | 3.6000 | | 09/11/24 | | | 534,749 | |

| | 500,000 | | | US Bancorp Series MTN | | | | 3.1000 | | 04/27/26 | | | 531,377 | |

| | 2,000,000 | | | Wells Fargo & Company | | | | 3.4500 | | 02/13/23 | | | 2,063,402 | |

| | 1,000,000 | | | Wells Fargo & Company | | | | 3.0000 | | 02/19/25 | | | 1,044,185 | |

| | | | | | | | | | | | | | 12,845,954 | |

| | | | | BEVERAGES — 2.6% | | | | | | | | | | |

| | 2,000,000 | | | Anheuser-Busch InBev Worldwide, Inc. | | | | 4.0000 | | 04/13/28 | | | 2,240,880 | |

| | | | | | | | | | | | | | | |

| | | | | BIOTECH & PHARMA — 1.5% | | | | | | | | | | |

| | 1,000,000 | | | Merck & Company, Inc. | | | | 2.8000 | | 05/18/23 | | | 1,032,685 | |

| | 250,000 | | | Pfizer, Inc. | | | | 2.7500 | | 06/03/26 | | | 265,538 | |

| | | | | | | | | | | | | | 1,298,223 | |

| | | | | CABLE & SATELLITE — 1.1% | | | | | | | | | | |

| | 750,000 | | | TCI Communications, Inc. | | | | 7.8750 | | 02/15/26 | | | 944,800 | |

| | | | | | | | | | | | | | | |

| | | | | CHEMICALS — 2.2% | | | | | | | | | | |

| | 500,000 | | | Air Products and Chemicals, Inc. | | | | 2.7500 | | 02/03/23 | | | 513,067 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 72.2% (Continued) | | | | | | | | | | |

| | | | | CHEMICALS — 2.2% (Continued) | | | | | | | | | | |

| | 1,250,000 | | | DuPont de Nemours, Inc. | | | | 4.2050 | | 11/15/23 | | $ | 1,322,988 | |

| | | | | | | | | | | | | | 1,836,055 | |

| | | | | ELECTRIC UTILITIES — 2.5% | | | | | | | | | | |

| | 2,000,000 | | | Georgia Power Company | | | | 3.2500 | | 03/30/27 | | | 2,121,065 | |

| | | | | | | | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT — 2.2% | | | | | | | | | | |

| | 300,000 | | | TWDC Enterprises 18 Corporation | | | | 3.1500 | | 09/17/25 | | | 318,937 | |

| | 1,500,000 | | | Walt Disney Company (The) | | | | 2.6500 | | 01/13/31 | | | 1,558,754 | |

| | | | | | | | | | | | | | 1,877,691 | |

| | | | | FOOD — 2.3% | | | | | | | | | | |

| | 1,000,000 | | | Hershey Company (The) | | | | 1.7000 | | 06/01/30 | | | 989,064 | |

| | 1,000,000 | | | Hormel Foods Corporation | | | | 1.8000 | | 06/11/30 | | | 981,726 | |

| | | | | | | | | | | | | | 1,970,790 | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 1.3% | | | | | | | | | | |

| | 1,000,000 | | | CVS Health Corporation | | | | 4.3000 | | 03/25/28 | | | 1,127,104 | |

| | | | | | | | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS — 0.6% | | | | | | | | | | |

| | 500,000 | | | Kimberly-Clark Corporation | | | | 2.4000 | | 03/01/22 | | | 502,535 | |

| | | | | | | | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 5.1% | | | | | | | | | | |

| | 1,000,000 | | | Bank of New York Mellon Corporation (The) | | | | 3.2500 | | 05/16/27 | | | 1,080,219 | |

| | 500,000 | | | Goldman Sachs Group, Inc. (The) | | | | 3.6250 | | 01/22/23 | | | 516,602 | |

| | 500,000 | | | Goldman Sachs Group, Inc. (The) | | | | 3.8500 | | 01/26/27 | | | 537,196 | |

| | 1,000,000 | | | Morgan Stanley | | | | 3.6250 | | 01/20/27 | | | 1,083,719 | |

| | 1,000,000 | | | Morgan Stanley | | | | 3.9500 | | 04/23/27 | | | 1,094,470 | |

| | | | | | | | | | | | | | 4,312,206 | |

| | | | | INSURANCE — 2.5% | | | | | | | | | | |

| | 1,000,000 | | | American International Group, Inc. | | | | 3.9000 | | 04/01/26 | | | 1,091,385 | |

| | 550,000 | | | Berkshire Hathaway Finance Corporation | | | | 1.8500 | | 03/12/30 | | | 547,240 | |

| | 500,000 | | | MetLife, Inc. | | | | 3.0000 | | 03/01/25 | | | 529,543 | |

| | | | | | | | | | | | | | 2,168,168 | |

| | | | | MACHINERY — 1.5% | | | | | | | | | | |

| | 1,000,000 | | | Deere & Company | | | | 5.3750 | | 10/16/29 | | | 1,251,162 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 72.2% (Continued) | | | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES — 1.2% | | | | | | | | | | |

| | 1,000,000 | | | Stryker Corporation | | | | 1.9500 | | 06/15/30 | | $ | 984,060 | |

| | | | | | | | | | | | | | | |

| | | | | OIL & GAS PRODUCERS — 4.2% | | | | | | | | | | |

| | 1,000,000 | | | BP Capital Markets PLC | | | | 2.7500 | | 05/10/23 | | | 1,026,445 | |

| | 1,000,000 | | | BP Capital Markets PLC | | | | 3.5350 | | 11/04/24 | | | 1,064,086 | |

| | 500,000 | | | BP Capital Markets PLC | | | | 3.0170 | | 01/16/27 | | | 522,879 | |

| | 1,000,000 | | | Occidental Petroleum Corporation | | | | 3.4000 | | 04/15/26 | | | 992,500 | |

| | | | | | | | | | | | | | 3,605,910 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 2.5% | | | | | | | | | | |

| | 1,000,000 | | | Simon Property Group, L.P. | | | | 3.5000 | | 09/01/25 | | | 1,071,161 | |

| | 1,000,000 | | | Simon Property Group, L.P. | | | | 3.3750 | | 06/15/27 | | | 1,078,464 | |

| | | | | | | | | | | | | | 2,149,625 | |

| | | | | RETAIL - CONSUMER STAPLES — 0.3% | | | | | | | | | | |

| | 250,000 | | | Target Corporation | | | | 2.5000 | | 04/15/26 | | | 262,456 | |

| | | | | | | | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY — 3.5% | | | | | | | | | | |

| | 750,000 | | | Home Depot, Inc. (The) | | | | 2.9500 | | 06/15/29 | | | 802,633 | |

| | 1,000,000 | | | Lowe’s Companies, Inc. | | | | 3.1000 | | 05/03/27 | | | 1,066,607 | |

| | 1,000,000 | | | TJX Companies, Inc. (The) | | | | 3.8750 | | 04/15/30 | | | 1,129,942 | |

| | | | | | | | | | | | | | 2,999,182 | |

| | | | | SEMICONDUCTORS — 4.5% | | | | | | | | | | |

| | 500,000 | | | Intel Corporation | | | | 2.4500 | | 11/15/29 | | | 514,704 | |

| | 1,000,000 | | | Intel Corporation | | | | 3.9000 | | 03/25/30 | | | 1,136,031 | |

| | 1,250,000 | | | NVIDIA Corporation | | | | 2.8500 | | 04/01/30 | | | 1,329,718 | |

| | 800,000 | | | Texas Instruments, Inc. | | | | 2.2500 | | 09/04/29 | | | 828,297 | |

| | | | | | | | | | | | | | 3,808,750 | |

| | | | | SOFTWARE — 1.8% | | | | | | | | | | |

| | 500,000 | | | Oracle Corporation | | | | 3.4000 | | 07/08/24 | | | 526,482 | |

| | 500,000 | | | Oracle Corporation | | | | 2.9500 | | 04/01/30 | | | 516,773 | |

| | 500,000 | | | Oracle Corporation | | | | 3.2500 | | 05/15/30 | | | 528,307 | |

| | | | | | | | | | | | | | 1,571,562 | |

| | | | | TECHNOLOGY HARDWARE — 4.8% | | | | | | | | | | |

| | 1,000,000 | | | Apple, Inc. | | | | 2.9000 | | 09/12/27 | | | 1,064,151 | |

| | 500,000 | | | Apple, Inc. | | | | 1.4000 | | 08/05/28 | | | 488,769 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 72.2% (Continued) | | | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE — 4.8% (Continued) | | | | | | | | | | |

| | 1,500,000 | | | Apple, Inc. | | | | 1.6500 | | 05/11/30 | | $ | 1,461,311 | |

| | 1,000,000 | | | Cisco Systems, Inc. | | | | 3.5000 | | 06/15/25 | | | 1,081,366 | |

| | | | | | | | | | | | | | 4,095,597 | |

| | | | | TELECOMMUNICATIONS — 2.7% | | | | | | | | | | |

| | 2,000,000 | | | AT&T, Inc. | | | | 4.3500 | | 03/01/29 | | | 2,255,630 | |

| | | | | | | | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS — 2.9% | | | | | | | | | | |

| | 1,750,000 | | | Southwest Airlines Company | | | | 5.1250 | | 06/15/27 | | | 1,996,433 | |

| | 500,000 | | | Union Pacific Corporation | | | | 2.7500 | | 04/15/23 | | | 511,719 | |

| | | | | | | | | | | | | | 2,508,152 | |

| | | | | TOTAL CORPORATE BONDS (Cost $60,425,175) | | | | | | | | | 61,614,402 | |

| | | | | | | | | | | | | | | |

| | | | | U.S. GOVERNMENT & AGENCIES — 23.4% | | | | | | | | | | |

| | | | | AGENCY FIXED RATE — 2.7% | | | | | | | | | | |

| | 687,274 | | | Fannie Mae Pool MA3735 | | | | 3.0000 | | 08/01/29 | | | 720,730 | |

| | 509,617 | | | Fannie Mae Pool MA3862 | | | | 3.0000 | | 12/01/29 | | | 535,056 | |

| | 1,004,180 | | | Fannie Mae Pool MA3929 | | | | 3.0000 | | 02/01/30 | | | 1,055,111 | |

| | | | | | | | | | | | | | 2,310,897 | |

| | | | | GOVERNMENT SPONSORED — 20.7% | | | | | | | | | | |

| | 2,000,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 2.3500 | | 08/14/24 | | | 2,085,275 | |

| | 500,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 3.1000 | | 12/06/24 | | | 533,011 | |

| | 750,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 2.6200 | | 11/17/25 | | | 793,281 | |

| | 1,000,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 2.8750 | | 01/18/28 | | | 1,086,535 | |

| | 2,000,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 3.1500 | | 04/03/28 | | | 2,211,447 | |

| | 2,000,000 | | | Federal Farm Credit Banks Funding Corporation | | | | 3.2700 | | 03/22/29 | | | 2,019,586 | |

| | 2,000,000 | | | Federal Home Loan Banks | | | | 2.7500 | | 12/13/24 | | | 2,113,772 | |

| | 1,000,000 | | | Federal Home Loan Banks | | | | 2.6250 | | 09/12/25 | | | 1,057,443 | |

| | 1,000,000 | | | Federal Home Loan Banks | | | | 2.6000 | | 12/04/25 | | | 1,060,322 | |

| | 500,000 | | | Federal Home Loan Banks | | | | 2.7000 | | 12/29/25 | | | 532,554 | |

| | 1,000,000 | | | Federal Home Loan Banks | | | | 3.2500 | | 09/08/28 | | | 1,117,759 | |

| | 3,000,000 | | | Federal Home Loan Banks | | | | 3.4000 | | 03/14/29 | | | 3,023,512 | |

| | | | | | | | | | | | | | 17,634,497 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

| NORTH COUNTRY INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| | | | | | Fair Value | |

| | | | | | | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $19,021,899) | | $ | 19,945,394 | |

| | | | | | | | | |

| Shares | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 3.9% | | | | |

| | | | | MONEY MARKET FUNDS - 3.9% | | | | |

| | 3,288,033 | | | BlackRock Liquidity Funds Treasury Trust Fund, Institutional Class, 0.02% (Cost $3,288,033)(b) | | | 3,288,033 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.5% (Cost $82,735,107) | | $ | 84,847,829 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 0.5% | | | 464,952 | |

| | | | | NET ASSETS - 100.0% | | $ | 85,312,781 | |

LP - Limited Partnership

PLC - Public Limited Company

REIT - Real Estate Investment Trust

| (a) | Variable rate security; the rate shown represents the rate on November 30, 2021. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2021. |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| |

| STATEMENTS OF ASSETS AND LIABILITIES |

| November 30, 2021 |

| | | Large Cap | | | Intermediate | |

| | | Equity Fund | | | Bond Fund | |

| ASSETS: | | | | | | |

| Investments in securities, at fair value (Cost $61,252,550 and $82,735,107 respectively) | | $ | 170,689,793 | | | $ | 84,847,829 | |

| Dividends and interest receivable | | | 188,912 | | | | 590,017 | |

| Receivable for fund shares sold | | | 10,328 | | | | 386 | |

| Prepaid expenses and other assets | | | 6,429 | | | | 6,349 | |

| Total Assets | | | 170,895,462 | | | | 85,444,581 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Accrued advisory fees | | | 107,808 | | | | 31,605 | |

| Payable for fund shares redeemed | | | 74,682 | | | | 27,765 | |

| Accrued administrative fees | | | 28,710 | | | | 19,351 | |

| Accrued audit fees | | | 17,773 | | | | 17,774 | |

| Accrued legal fees | | | 15,877 | | | | 16,245 | |

| Payable to related parties | | | 18,007 | | | | 12,158 | |

| Accrued expenses and other liabilities | | | 6,996 | | | | 6,902 | |

| Total Liabilities | | | 269,853 | | | | 131,800 | |

| Net Assets | | $ | 170,625,609 | | | $ | 85,312,781 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid in capital | | $ | 47,486,384 | | | $ | 83,032,024 | |

| Accumulated earnings | | | 123,139,225 | | | | 2,280,757 | |

| Net Assets | | $ | 170,625,609 | | | $ | 85,312,781 | |

| | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized; no par value) | | | 6,596,891 | | | | 8,059,454 | |

| | | | | | | | | |

| Net asset value, offering and redemption price per share($170,625,609/6,596,891 and $85,312,781/8,059,454, respectively) | | $ | 25.86 | | | $ | 10.59 | |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| |

| STATEMENTS OF OPERATIONS |

| For the Year Ended November 30, 2021 |

| | | Large Cap | | | Intermediate | |

| | | Equity Fund | | | Bond Fund | |

| INVESTMENT INCOME: | | | | | | | | |

| Dividends | | $ | 2,143,259 | | | $ | — | |

| Interest | | | 336 | | | | 2,096,027 | |

| Total investment income | | | 2,143,595 | | | | 2,096,027 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 1,230,738 | | | | 444,290 | |

| Administration and fund accounting fees | | | 213,475 | | | | 157,414 | |

| Legal fees | | | 40,001 | | | | 40,001 | |

| Transfer agency fees | | | 35,905 | | | | 31,305 | |

| Trustees’ fees | | | 27,798 | | | | 16,701 | |

| Audit fees | | | 17,801 | | | | 17,802 | |

| Printing expense | | | 13,507 | | | | 7,007 | |

| Chief Compliance Officer fees | | | 14,001 | | | | 8,001 | |

| Registration and filing fees | | | 13,501 | | | | 14,501 | |

| Custody fees | | | 12,409 | | | | 8,904 | |

| Insurance expense | | | 6,801 | | | | 4,100 | |

| Miscellaneous expenses | | | 3,896 | | | | 3,696 | |

| Total expenses | | | 1,629,833 | | | | 753,722 | |

| | | | | | | | | |

| Less: Advisory fee waiver | | | — | | | | (29,377 | ) |

| Net expenses | | | 1,629,833 | | | | 724,345 | |

| | | | | | | | | |

| Net investment income | | | 513,762 | | | | 1,371,682 | |

| | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain from investment transactions | | | 13,246,537 | | | | 135,416 | |

| Net change in unrealized appreciation/(depreciation) of investments | | | 19,569,412 | | | | (3,234,237 | ) |

| Net realized and unrealized gain /(loss) on investments | | | 32,815,949 | | | | (3,098,821 | ) |

| | | | | | | | | |

| Net increase/(decrease) in net assets resulting from operations | | $ | 33,329,711 | | | $ | (1,727,139 | ) |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| |

| LARGE CAP EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2021 | | | November 30, 2020 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 513,762 | | | $ | 556,375 | |

| Net realized gain from investment transactions | | | 13,246,537 | | | | 15,038,533 | |

| Net change in unrealized appreciation | | | 19,569,412 | | | | 14,539,350 | |

| Net increase in net assets resulting from operations | | | 33,329,711 | | | | 30,134,258 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Total distributions to shareholders | | | (15,652,516 | ) | | | (9,144,023 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 4) | | | 1,605,134 | | | | (6,012,715 | ) |

| | | | | | | | | |

| Net increase in net assets | | | 19,282,329 | | | | 14,977,520 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 151,343,280 | | | | 136,365,760 | |

| | | | | | | | | |

| End of year | | $ | 170,625,609 | | | $ | 151,343,280 | |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| |

| INTERMEDIATE BOND FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2021 | | | November 30, 2020 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 1,371,682 | | | $ | 1,431,392 | |

| Net realized gain from investment transactions | | | 135,416 | | | | 640,978 | |

| Net change in unrealized appreciation/(depreciation) | | | (3,234,237 | ) | | | 2,535,305 | |

| Net increase/(decrease) in net assets resulting from operations | | | (1,727,139 | ) | | | 4,607,675 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Total distributions to shareholders | | | (1,602,758 | ) | | | (1,450,252 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 4) | | | (3,711,506 | ) | | | 9,893,163 | |

| | | | | | | | | |

| Net increase/(decrease) in net assets | | | (7,041,403 | ) | | | 13,050,586 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 92,354,184 | | | | 79,303,598 | |

| | | | | | | | | |

| End of year | | $ | 85,312,781 | | | $ | 92,354,184 | |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| |

| LARGE CAP EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

| |

| (For a fund share outstanding throughout each year) |

| | | For the Year Ended November 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Net asset value, beginning of year | | $ | 23.48 | | | $ | 20.32 | | | $ | 18.99 | | | $ | 18.87 | | | $ | 15.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.07 | | | | 0.08 | | | | 0.08 | | | | 0.05 | | | | 0.07 | |

| Net realized and unrealized gain on investments | | | 4.74 | | | | 4.44 | | | | 2.55 | | | | 1.28 | | | | 3.59 | |

| Total from investment operations | | | 4.81 | | | | 4.52 | | | | 2.63 | | | | 1.33 | | | | 3.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.10 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.07 | ) |

| Distribution from net realized gains from security transactions | | | (2.33 | ) | | | (1.28 | ) | | | (1.25 | ) | | | (1.14 | ) | | | (0.26 | ) |

| Total distributions | | | (2.43 | ) | | | (1.36 | ) | | | (1.30 | ) | | | (1.21 | ) | | | (0.33 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 25.86 | | | $ | 23.48 | | | $ | 20.32 | | | $ | 18.99 | | | $ | 18.87 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (2) | | | 22.73 | % | | | 23.90 | % | | | 15.25 | % | | | 7.52 | % | | | 23.96 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 170,626 | | | $ | 151,343 | | | $ | 136,366 | | | $ | 127,978 | | | $ | 127,703 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 0.99 | % | | | 1.02 | % | | | 1.04 | % | | | 1.03 | % | | | 1.03 | % |

| Net investment income | | | 0.31 | % | | | 0.40 | % | | | 0.41 | % | | | 0.29 | % | | | 0.39 | % |

| Portfolio turnover rate | | | 7 | % | | | 5 | % | | | 15 | % | | | 22 | % | | | 12 | % |

| (1) | Net investment income per share is based on average shares outstanding during the year. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and capital gain distributions, if any. Total return does not reflect the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| |

| INTERMEDIATE BOND FUND |

| FINANCIAL HIGHLIGHTS |

| |

| (For a fund share outstanding throughout each year) |

| | | For the Year Ended November 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Net asset value, beginning of year | | $ | 10.99 | | | $ | 10.58 | | | $ | 9.76 | | | $ | 10.17 | | | $ | 10.14 | |

| | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.17 | | | | 0.18 | | | | 0.21 | | | | 0.19 | | | | 0.17 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.38 | ) | | | 0.41 | | | | 0.81 | | | | (0.41 | ) | | | 0.04 | |

| Total from investment operations | | | (0.21 | ) | | | 0.59 | | | | 1.02 | | | | (0.22 | ) | | | 0.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.17 | ) | | | (0.18 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.18 | ) |

| Distribution from net realized gains from security transactions | | | (0.02 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.19 | ) | | | (0.18 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.18 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 10.59 | | | $ | 10.99 | | | $ | 10.58 | | | $ | 9.76 | | | $ | 10.17 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (2) | | | (1.89 | )% | | | 5.66 | % | | | 10.53 | % | | | (2.17 | )% | | | 2.08 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 85,313 | | | $ | 92,354 | | | $ | 79,304 | | | $ | 71,188 | | | $ | 73,902 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses, before waiver | | | 0.85 | % | | | 0.86 | % | | | 0.88 | % | | | 0.89 | % | | | 0.88 | % |

| Expenses, after waiver | | | 0.82 | % | | | 0.86 | % | | | 0.88 | % | | | 0.89 | % | | | 0.88 | % |

| Net investment income | | | 1.54 | % | | | 1.68 | % | | | 2.00 | % | | | 1.93 | % | | | 1.67 | % |

| Portfolio turnover rate | | | 7 | % | | | 25 | % | | | 22 | % | | | 23 | % | | | 18 | % |

| (1) | Net investment income per share is based on average shares outstanding during the year. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and capital gain distributions, if any. Total return does not reflect the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

| The accompanying notes are an integral part of these financial statements |

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS | |

| | November 30, 2021 | |

| | | |

NOTE 1. ORGANIZATION

The North Country Funds (the “Trust”) was organized as a Massachusetts business trust on June 1, 2000, and registered under the Investment Company Act of 1940 as an open-end, diversified, management investment company on September 11, 2000. The Trust currently offers two series: the North Country Large Cap Equity Fund formerly known as the North Country Equity Growth Fund (the “Equity Fund”) and the North Country Intermediate Bond Fund (the “Bond Fund”, and together with the Equity Fund, the “Funds”). The Equity Fund’s principal investment objective is to provide investors with long-term capital appreciation while the Bond Fund seeks to provide investors with current income and total return with minimum fluctuations of principal value. Both Funds commenced operations on March 1, 2001.

The Bond Fund and the Equity Fund were initially organized on March 26, 1984 under New York law as Collective Investment Trusts sponsored by Glens Falls National Bank & Trust Company. Prior to their conversion to regulated investment companies (mutual funds) investor participation was limited to qualified employee benefit plans.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Trust in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with these generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Actual results could differ from these estimates. The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services - Investment Companies.

Security Valuation – Securities which are traded on a national securities exchange are valued at the last quoted sale price. NASDAQ traded securities are valued using the NASDAQ official closing price (“NOCP”). Investments for which no sales are reported are valued at the mean between the current bid and ask prices on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy described below. When an equity security is valued by the independent pricing service using factors other than market quotations or the market is considered inactive, they will be categorized in level 2.

Fixed income securities such as corporate bonds, municipal bonds, and U.S. government and agency obligations, when valued using market quotations in an active market, are categorized as level 1 securities. However, fair value may be determined using an independent pricing service that considers market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and other reference data. These securities would be categorized as level 2 securities.

The fair value of mortgage-backed securities is estimated by an independent pricing service which uses models that consider interest rate movements, new issue information and other security pertinent data. Evaluations of tranches

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

(non-volatile, volatile, or credit sensitive) are based on interpretations of accepted Wall Street modeling and pricing conventions. Mortgage-backed securities are categorized in level 2 of the fair value hierarchy described below to the extent the inputs are observable and timely.

Any securities or other assets for which market quotations are not readily available, or securities for which the last bid price does not accurately reflect the current value, are valued at fair value as determined by the Trust’s Fair Value Committee (the “Committee”) in accordance with the Trust’s Portfolio Securities Valuation Procedures (the “Procedures”). Pursuant to the Procedures, the Committee will consider, among others, the following factors to determine a security’s fair value: (i) the nature and pricing history (if any) of the security; (ii) whether any dealer quotations for the security are available; and (iii) possible valuation methodologies that could be used to determine the fair value of the security. In the absence of readily available market quotations, or other observable inputs, securities valued at fair value pursuant to the Procedures would be categorized as level 3.

Money market funds are valued at their net asset value of $1.00 per share and are categorized as level 1. Securities with maturities of 60 days or less may be valued at amortized cost, which approximates fair value and would be categorized as level 2. The ability of issuers of debt securities held by the Funds to meet their obligations may be affected by economic or political developments in a specific country or region.

The Funds utilize various methods to measure the fair value of most of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Funds have the ability to access.

Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of inputs used as of November 30, 2021, in valuing the Funds’ assets carried at fair value.

North Country Large Cap Equity Fund:

| Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

| Common Stock ** | | $ | 167,123,941 | | | $ | — | | | $ | — | | | $ | 167,123,941 | |

| Money Market Fund | | | 3,565,852 | | | | — | | | | — | | | | 3,565,852 | |

| Total | | $ | 170,689,793 | | | $ | — | | | $ | — | | | $ | 170,689,793 | |

North Country Intermediate Bond Fund:

| Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

| Corporate Bonds** | | $ | — | | | $ | 61,614,402 | | | $ | — | | | $ | 61,614,402 | |

| U.S. Government Agency Obligations | | | — | | | | 19,945,394 | | | | — | | | | 19,945,394 | |

| Money Market Fund | | | 3,288,033 | | | | — | | | | — | | | | 3,288,033 | |

| Total | | $ | 3,288,033 | | | $ | 81,559,796 | | | $ | — | | | $ | 84,847,829 | |

| * | The Funds did not hold any Level 3 investments during the period. |

| ** | See Schedule of Investments for industry classifications. |

Federal Income Taxes – The Funds make no provision for federal income or excise tax. The Funds intend to qualify each year as regulated investment companies (“RICs”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of their taxable income. The Funds also intend to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years November 30, 2018 to November 30, 2020 or expected to be taken in the Fund’s November 30, 2021 year-end tax returns. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. The Funds identify their major tax jurisdictions as U.S. Federal and New York State.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

Dividends and Distributions – The Bond Fund pays dividends from net investment income on a monthly basis. The Equity Fund will pay dividends from net investment income, if any, on an annual basis. Both Funds will declare and pay distributions from net realized capital gains, if any, annually. Income and capital gain distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Security Transactions – Securities transactions are recorded no later than the first business day after the trade date, except for reporting purposes when trade date is used. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities using the effective yield method. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Expenses – Most expenses of the Trust can be directly attributed to a Fund. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the Funds.

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, each Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. A Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Funds expect the risk of loss due to these warranties and indemnities to be remote.

Cash and cash equivalents – Cash and cash equivalents are held with a financial institution. The assets of the Funds may be placed in deposit accounts at U.S. banks and such deposits generally exceed Federal Deposit Insurance Corporation (“FDIC”) insurance limits. The FDIC insures deposit accounts up to $250,000 for each accountholder. The counterparty is generally a single bank rather than a group of financial institutions; thus there may be a greater counterparty credit risk. The Funds place deposits only with those counterparties which are believed to be creditworthy and there has been no history of loss.

NOTE 3. INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES

The Trust has entered into an investment advisory agreement (the “Advisory Agreement”) with North Country Investment Advisers, Inc. (the “Adviser”). Pursuant to the Advisory Agreement, the Adviser is responsible for formulating the Trust’s investment programs, making day-to-day investment decisions and engaging in portfolio transactions, subject to the authority of the Board of Trustees. Under the terms of the agreement, each Fund pays a fee, calculated daily and paid monthly, at an annual rate of 0.75% and 0.50% of the average daily net assets of the Equity Fund and Bond Fund, respectively. For the year ended November 30, 2021, the Adviser received advisory fees of $1,230,738 from the Equity Fund and $444,290 from the Bond Fund.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

Effective April 1, 2021, North Country Investment Advisers, Inc. (the “Adviser”) agreed to waive, through March 31, 2022, a portion of its advisory fees for the Bond Fund, which reduces the 0.50% contractual fee rate by 0.05% to 0.45%. This waiver may not be terminated prior to that date without the approval of the Trustees of The North Country Funds. For the year ended November 30, 2021, the Advisor waived $29,377 of its advisory fee. This amount waived is not subject to recoupment.

The Trust has entered into an Underwriting Agreement with Northern Lights Distributors, LLC (“the Distributor”) to serve as the principal underwriter for each Fund and distributor for each Fund’s shares.

In addition, certain affiliates of the Distributor provide services to the Funds as follows:

Ultimus Fund Solutions, LLC (“UFS”) – UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Fund pays UFS customary fees for providing administration, fund accounting, and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Funds for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Funds.

BluGiant, LLC (“BluGiant”), an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Funds on an ad-hoc basis. For the provision of these services, BluGiant receives customary fees from the Funds.

Certain officers and/or trustees of the Adviser are also officers/trustees of the Trust.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

NOTE 4. CAPITAL SHARE TRANSACTIONS

At November 30, 2021, there were an unlimited number of shares authorized with no par value. Paid in capital for the Equity Fund and Bond Fund amounted to $47,486,384 and $83,032,024, respectively.

Transactions in capital shares were as follows:

Equity Fund:

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2021 | | | November 30, 2020 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 388,578 | | | $ | 9,092,502 | | | | 895,280 | | | $ | 17,523,730 | |

| Shares issued for reinvestment of dividends | | | 701,718 | | | | 14,897,468 | | | | 89,207 | | | | 1,682,446 | |

| Shares redeemed | | | (940,379 | ) | | | (22,384,836 | ) | | | (1,248,045 | ) | | | (25,218,891 | ) |

| Net increase (decrease) | | | 149,917 | | | $ | 1,605,134 | | | | (263,558 | ) | | $ | (6,012,715 | ) |

Bond Fund:

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2021 | | | November 30, 2020 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 1,077,999 | | | $ | 11,621,164 | | | | 1,628,904 | | | $ | 17,607,247 | |

| Shares issued for reinvestment of dividends | | | 5,141 | | | | 55,306 | | | | 5,630 | | | | 60,781 | |

| Shares redeemed | | | (1,429,368 | ) | | | (15,387,976 | ) | | | (725,357 | ) | | | (7,774,865 | ) |

| Net increase (decrease) | | | (346,228 | ) | | $ | (3,711,506 | ) | | | 909,177 | | | $ | 9,893,163 | |

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

NOTE 5. INVESTMENTS

Investment transactions, excluding short-term securities, for the year ended November 30, 2021 were as follows:

| | | | | | Bond Fund | |

| | | | | | Excluding U.S. | | | U.S. | |

| | | | | | Government | | | Government | |

| | | Equity Fund | | | Securities | | | Securities | |

| Purchases | | $ | 10,500,966 | | | $ | 5,869,200 | | | $ | 0 | |

| Sales | | $ | 23,727,749 | | | $ | 7,167,955 | | | $ | 3,046,544 | |

| | | | | | | | | | | | | |

NOTE 6. AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS

The identified cost of investments in securities owned by each Fund for federal income tax purposes, and its respective gross unrealized appreciation and depreciation at November 30, 2021, were as follows:

| | | | | | Gross | | | Gross | | | Net Unrealized | |

| | | Tax | | | Unrealized | | | Unrealized | | | Appreciation | |

| Fund | | Cost | | | Appreciation | | | Depreciation | | | (Depreciation) | |

| Equity | | $ | 61,228,841 | | | $ | 110,083,664 | | | $ | (622,712 | ) | | $ | 109,460,952 | |

| Intermediate Bond | | $ | 82,735,107 | | | $ | 2,818,941 | | | $ | (706,219 | ) | | $ | 2,112,722 | |

NOTE 7. TAX INFORMATION

The tax character of distributions paid during the fiscal year ended November 30, 2021 and fiscal year ended November 30, 2020 was as follows:

For the year ended November 30, 2021:

| | | Ordinary | | | Long-Term | | | Return of | | | | |

| | | Income | | | Capital Gains | | | Capital | | | Total | |

| North Country Large Cap Equity Fund | | $ | 611,331 | | | $ | 15,041,185 | | | $ | — | | | $ | 15,652,516 | |

| North Country Intermediate Bond Fund | | | 1,440,392 | | | | 162,366 | | | | — | | | | 1,602,758 | |

For the year ended November 30, 2020:

| | | Ordinary | | | Long-Term | | | Return of | | | | |

| | | Income | | | Capital Gains | | | Capital | | | Total | |

| North Country Large Cap Equity Fund | | $ | 522,754 | | | $ | 8,621,269 | | | $ | — | | | $ | 9,144,023 | |

| North Country Intermediate Bond Fund | | | 1,450,252 | | | | — | | | | — | | | | 1,450,252 | |

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | NOTES TO FINANCIAL STATEMENTS (Continued) | |

| | November 30, 2021 | |

| | | |

As of November 30, 2021, the components of distributable earnings/ (deficit) on a tax basis were as follows:

| | | Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| | | Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation | | | Accumulated | |

| | | Income | | | Capital Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | Earnings/(Deficits) | |

| North Country Large Cap Equity Fund | | $ | 594,682 | | | $ | 13,083,591 | | | $ | — | | | $ | — | | | $ | — | | | $ | 109,460,952 | | | $ | 123,139,225 | |

| North Country Intermediate Bond Fund | | | 80,685 | | | | 87,350 | | | | — | | | | — | | | | — | | | | 2,112,722 | | | | 2,280,757 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOTE 8. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a) 9 of the Act. As of November 30, 2021, SEI Private Trust Company, an account holding shares for the benefit of others in nominee name, held approximately 87% of the voting securities of the Equity Fund and approximately 97% of the Bond Fund.

NOTE 9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statements of Assets and Liabilities have been evaluated through the date the financial statements were issued. Except as noted below, management has concluded that there is no impact requiring additional adjustment or disclosure in the financial statements. On December 8, 2021, the Bond Fund paid an ordinary income dividend of $0.0243 and a long-term capital gain dividend of $0.0109 per share to shareholders of record on December 7, 2021. On December 8, 2021, the Equity Fund paid an ordinary income dividend of $0.0661 per share, a short-term capital gain dividend of $ 0.0244 per share and a long-term capital gain dividend of $1.9901 per share to shareholders of record on December 7, 2021.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

The North Country Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of The North Country Funds comprising North Country Large Cap Equity Fund and North Country Intermediate Bond Fund (the “Funds”) as of November 30, 2021, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of November 30, 2021, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2004.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 24, 2022

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

| | THE NORTH COUNTRY FUNDS | |

| | | |

| | ADDITIONAL INFORMATION (Unaudited) | |

| | | |

FACTORS CONSIDERED BY THE INDEPENDENT TRUSTEES IN APPROVING THE INVESTMENT ADVISORY AGREEMENT