united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-10123

The North Country Funds

(Exact name of Registrant as specified in charter)

250 Glen Street, Glens Falls, NY 12801

(Address of principal executive offices) (Zip code)

James Colantino

c/o Ultimus Fund Solutions, LLC., 4221 North 203rd Street, Suite 100 Elkhorn, Nebraska 68022-3474

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 11/30

Date of reporting period: 11/30/22

Item 1. Reports to Stockholders.

(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

| | | The North Country Funds |

| | | |

| | | Large Cap Equity Fund |

| | | |

| | |  |

| | | |

| | | |

| | | |

| | | |

| | | Annual Report

November 30, 2022 |

| | |

| | | |

| | | |

Investment Adviser

North Country Investment Advisers, Inc.250 Glen Street

Glens Falls, NY 12801

Administrator and

Fund Accountant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

Investor Information: (888) 350-2990 | |

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of The North Country Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. Investors should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before investing. |

The North Country Funds

ANNUAL REPORT

November 30, 2022

ECONOMIC SUMMARY

As we entered 2022, the consensus was that the economy was slowing with an elevated, albeit relatively low, chance of recession later in the year. Inflation was hitting 40-year high. The Federal Reserve started to taper asset purchases and indicated they would likely begin to raise interest rates early in the new year.

An extremely tight labor market, U.S. consumers’ excess savings, the Russian war on Ukraine and other factors all combined to push inflation higher and extend the peak further out than expected. The Consumer Price Index (CPI) finally peaked in June at 9.06% and had only declined to 7.75% as of October. The Federal Reserve, in order to combat the high level of inflation, initiated an extremely aggressive series of interest rate hikes. The Fed Funds rate increased 3.75% from March through early November, with further hikes likely.

While most financial markets had a decidedly negative year, the overall economy held up reasonably well. GDP was slightly negative for the first two quarters. However, it rebounded to 2.9% in the third quarter and estimates are trending up for the fourth quarter. The labor market, while moderating, remains relatively strong with continued positive employment growth and a historically low 3.7% unemployment rate through November.

The Large Cap Equity Fund

Global economies faced multiple headwinds throughout 2022 led by a combination of stubbornly high inflation, rising geopolitical uncertainty and lingering supply chain and policy impacts from the COVID-19 pandemic. In the U.S., the Fed’s attempt to constrain inflation led to multiple rate hikes in the year, with an indication that more hikes are likely in coming quarters. At the same time, Russia’s invasion of Ukraine helped create a spiraling energy crisis in Europe as some of its natural gas supplies have been cut off heading into the winter. Finally, China has experienced slowing growth as the country continued to enact strict measures to reduce the spread of COVID-19 among the country’s older, more immunocompromised communities. Consequently, markets began pricing in a reasonable chance of recession, both domestically and abroad.

The market’s selloff had its greatest impact within the highest growth companies and long-duration growth assets. Value’s year-to-date and one-year edge on growth stocks remains substantial. Throughout the period, investors navigated earnings seasons, which for our investments were largely in line with their share of positives, but also some disappointments. In general, companies that beat expectations and issued strong guidance were met with a sigh of relief, which was a stark contrast to the pullback firms encountered when coming up short - especially in terms of outlooks. While earnings seasons were volatile, many of the market’s gyrations continued to be driven by top-down macro concerns on uncertainty around Fed policy and the geopolitical crisis in Ukraine. During this time, we maintained exposure to high-conviction stocks, and continued to take advantage of market dislocations for compelling stock-selection opportunities.

For the one-year period ended November 30, 2022, the Large Cap Equity Fund returned -13.02% while the S&P 500 returned -9.21%. On an annualized basis, the three, five and 10-year total returns for the Large Cap Equity Fund were 9.77%, 10.39%, and 12.48% versus the S&P 500 at 10.91%, 10.98% and 13.34%, respectively.

The Large Cap Equity Fund’s underperformance over the one-year period can be attributed to stock selection - outsized positions in companies primarily in the Communications Services and Information Technology sectors. Other select names across the portfolio still generated strong relative returns during the year, as these companies with unique products and services have been widely viewed as beneficiaries of this new global economic environment. The greater focus on quality factors throughout the year has benefited the relative performance of the portfolio in times of stress, and we will continue to implement an investment process that focuses on sustainable free cash flow from operations, profit margins, capital discipline and strong balance sheets.

Large Cap Equity Fund:

| Annual Fund Operating Expenses: | | (As a Percentage of Net Assets) |

| Total Annual Operating Expenses: | | 1.02% |

Average Annual Total Returns as of September 30, 2022 (Latest Calendar Quarter)

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | -19.56% | | 8.68% | | 10.78% | |

Average Annual Total Returns as of November 30, 2022 (Fiscal Year-End)

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | -13.02% | | 10.39% | | 12.48% | |

Performance data quoted above is historical and is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end by calling 1-888-350-2990. Information provided is unaudited.

The views expressed are as November 30, 2022 and are those of the adviser, North Country Investment Advisers, Inc. The views are subject to change at any time in response to changing circumstances in the markets and are not intended to predict or guarantee the future performance of any individual security market sector or the markets generally, or The North Country Funds.

Not FDIC insured. Not obligations of or guaranteed by the bank. May involve investment risks, including possible loss of the principal invested.

4250-NLD-12/21/2022

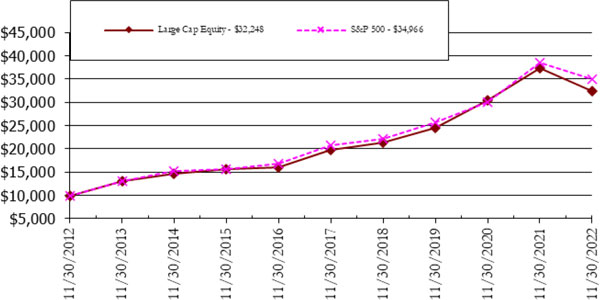

| North Country Large Cap Equity Fund |

| Growth of $10,000 Investment (Unaudited) |

This chart illustrates the comparison of a hypothetical investment of $10,000 in the North Country Large Cap Equity Fund (assuming reinvestment of all dividends and distributions) versus the Fund’s benchmark index.

Average Annual Total Returns as of November 30, 2022

| | 1 Year | | 5 Years | | 10 Years | |

| North Country Large Cap Equity Fund | (13.02)% | | 10.39% | | 12.48% | |

| S&P 500 | (9.21)% | | 10.98% | | 13.34% | |

The S&P 500 is a market capitalization-weighted index of 500 widely held common stocks. Indexes and benchmarks are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index or benchmark, although they can invest in its underlying securities or funds.

Past performance is not indicative of future results. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions.

The returns do not reflect a reduction for taxes a shareholder would pay on the redemption of fund shares or fund distributions.

| North Country Large Cap Equity Fund |

| Portfolio Summary (Unaudited) |

| November 30, 2022 |

| Industries | % of Net Assets | | Industries | % of Net Assets |

| Common Stock | 97.8% | | Entertainment Content | 2.0% |

| Software | 12.0% | | Beverages | 1.9% |

| Technology Hardware | 7.6% | | Asset Management | 1.8% |

| Biotech & Pharma | 7.2% | | Household Products | 1.7% |

| Medical Equipment & Devices | 6.8% | | Diversified Industrials | 1.7% |

| Retail - Discretionary | 4.4% | | Leisure Facilities & Services | 1.7% |

| Banking | 4.3% | | Home Construction | 1.3% |

| Internet Media & Services | 4.2% | | Electric Utilities | 1.2% |

| Retail - Consumer Staples | 4.1% | | Wholesale- Consumer Staples | 1.2% |

| Institutional Financial Services | 3.7% | | Data Center REIT | 0.8% |

| Technology Services | 3.0% | | Machinery | 0.7% |

| Oil & Gas Producers | 2.9% | | Specialty Finance | 0.5% |

| Chemicals | 2.8% | | Telecommunications | 0.4% |

| E-Commerce Discretionary | 2.6% | | Self-Storage REIT | 0.4% |

| Health Care Facilities & Services | 2.5% | | Construction Materials | 0.4% |

| Transportation & Logistics | 2.5% | | Infastructure REIT | 0.4% |

| Commercial Support Services | 2.3% | | Office REIT | 0.2% |

| Insurance | 2.3% | | Money Market Funds | 2.2% |

| Semiconductors | 2.2% | | Other assets in excess of liabilities | 0.0% |

| Electrical Equipment | 2.1% | | Total Net Assets | 100.0% |

| Top Ten Holdings | % of Net Assets | | Top Ten Holdings | % of Net Assets |

| Apple, Inc. | 6.5% | | Adobe, Inc. | 2.6% |

| Microsoft Corporation | 5.8% | | Amgen, Inc. | 2.6% |

| Home Depot, Inc. (The) | 3.0% | | Amazon.com, Inc. | 2.6% |

| Alphabet, Inc. | 3.0% | | UnitedHealth Group, Inc. | 2.5% |

| Visa, Inc | 3.0% | | Johnson & Johnson | 2.5% |

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.8% | | | | |

| | | | | ASSET MANAGEMENT - 1.8% | | | | |

| | 3,350 | | | BlackRock, Inc. | | $ | 2,398,600 | |

| | | | | | | | | |

| | | | | BANKING - 4.3% | | | | |

| | 69,500 | | | Bank of America Corporation | | | 2,630,575 | |

| | 21,700 | | | JPMorgan Chase & Company | | | 2,998,505 | |

| | | | | | | | 5,629,080 | |

| | | | | BEVERAGES - 1.9% | | | | |

| | 13,200 | | | PepsiCo, Inc. | | | 2,448,732 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 7.2% | | | | |

| | 11,900 | | | Amgen, Inc. | | | 3,408,159 | |

| | 18,500 | | | Johnson & Johnson | | | 3,293,000 | |

| | 54,500 | | | Pfizer, Inc. | | | 2,732,085 | |

| | | | | | | | 9,433,244 | |

| | | | | CHEMICALS - 2.8% | | | | |

| | 2,700 | | | Air Products and Chemicals, Inc. | | | 837,432 | |

| | 3,900 | | | Ecolab, Inc. | | | 584,337 | |

| | 8,500 | | | LyondellBasell Industries N.V., Class A | | | 722,585 | |

| | 6,250 | | | Sherwin-Williams Company (The) | | | 1,557,375 | |

| | | | | | | | 3,701,729 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.3% | | | | |

| | 18,000 | | | Waste Management, Inc. | | | 3,018,960 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 0.4% | | | | |

| | 3,000 | | | Vulcan Materials Company | | | 549,990 | |

| | | | | | | | | |

| | | | | DATA CENTER REIT - 0.8% | | | | |

| | 9,000 | | | Digital Realty Trust, Inc. | | | 1,012,140 | |

| | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS - 1.7% | | | | |

| | 10,000 | | | Honeywell International, Inc. | | | 2,195,500 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.8% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 2.6% | | | | |

| | 35,000 | | | Amazon.com, Inc.(a) | | $ | 3,378,900 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.2% | | | | |

| | 8,000 | | | Dominion Energy, Inc. | | | 488,880 | |

| | 5,500 | | | NextEra Energy, Inc. | | | 465,850 | |

| | 9,150 | | | Southern Company (The) | | | 618,906 | |

| | | | | | | | 1,573,636 | |

| | | | | ELECTRICAL EQUIPMENT - 2.1% | | | | |

| | 35,000 | | | Amphenol Corporation, Class A | | | 2,815,050 | |

| | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT – 2.0% | | | | |

| | 17,500 | | | Activision Blizzard, Inc. | | | 1,294,125 | |

| | 12,950 | | | Walt Disney Company (The)(a) | | | 1,267,417 | |

| | | | | | | | 2,561,542 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.5% | | | | |

| | 6,100 | | | UnitedHealth Group, Inc. | | | 3,341,336 | |

| | | | | | | | | |

| | | | | HOME CONSTRUCTION - 1.3% | | | | |

| | 33,000 | | | Masco Corporation | | | 1,675,740 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 1.7% | | | | |

| | 15,400 | | | Procter & Gamble Company (The) | | | 2,297,064 | |

| | | | | | | | | |

| | | | | INFRASTRUCTURE REIT - 0.4% | | | | |

| | 2,350 | | | American Tower Corporation | | | 519,938 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 3.7% | | | | |

| | 2,600 | | | Goldman Sachs Group, Inc. (The) | | | 1,003,990 | |

| | 26,350 | | | Intercontinental Exchange, Inc. | | | 2,853,969 | |

| | 11,300 | | | Morgan Stanley | | | 1,051,691 | |

| | | | | | | | 4,909,650 | |

| | | | | INSURANCE - 2.3% | | | | |

| | 9,550 | | | Berkshire Hathaway, Inc., Class B(a) | | | 3,042,630 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.8% (Continued) | | | | |

| | | | | INTERNET MEDIA & SERVICES - 4.2% | | | | |

| | 39,000 | | | Alphabet, Inc., Class A(a) | | $ | 3,938,610 | |

| | 5,500 | | | Meta Platforms, Inc., Class A(a) | | | 649,550 | |

| | 3,000 | | | Netflix, Inc.(a) | | | 916,590 | |

| | | | | | | | 5,504,750 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.7% | | | | |

| | 3,800 | | | Domino’s Pizza, Inc. | | | 1,477,174 | |

| | 2,600 | | | McDonald’s Corporation | | | 709,254 | |

| | | | | | | | 2,186,428 | |

| | | | | MACHINERY - 0.7% | | | | |

| | 4,000 | | | Caterpillar, Inc. | | | 945,640 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 6.8% | | | | |

| | 20,000 | | | Abbott Laboratories | | | 2,151,600 | |

| | 5,000 | | | Danaher Corporation | | | 1,367,050 | |

| | 9,000 | | | Stryker Corporation | | | 2,105,010 | |

| | 5,825 | | | Thermo Fisher Scientific, Inc. | | | 3,263,282 | |

| | | | | | | | 8,886,942 | |

| | | | | OFFICE REIT - 0.2% | | | | |

| | 1,500 | | | Alexandria Real Estate Equities, Inc. | | | 233,415 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 2.9% | | | | |

| | 8,400 | | | Chevron Corporation | | | 1,539,804 | |

| | 10,100 | | | Exxon Mobil Corporation | | | 1,124,534 | |

| | 34,400 | | | Williams Companies, Inc. (The) | | | 1,193,680 | |

| | | | | | | | 3,858,018 | |

| | | | | RETAIL - CONSUMER STAPLES - 4.1% | | | | |

| | 3,175 | | | Costco Wholesale Corporation | | | 1,712,119 | |

| | 8,400 | | | Dollar Tree, Inc.(a) | | | 1,262,436 | |

| | 15,500 | | | Walmart, Inc. | | | 2,362,510 | |

| | | | | | | | 5,337,065 | |

| | | | | RETAIL - DISCRETIONARY - 4.4% | | | | |

| | 12,200 | | | Home Depot, Inc. (The) | | | 3,952,678 | |

| | 23,050 | | | TJX Companies, Inc. (The) | | | 1,845,153 | |

| | | | | | | | 5,797,831 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.8% (Continued) | | | | |

| | | | | SELF-STORAGE REIT - 0.4% | | | | |

| | 1,900 | | | Public Storage | | $ | 566,124 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 2.2% | | | | |

| | 6,500 | | | NVIDIA Corporation | | | 1,099,995 | |

| | 13,750 | | | QUALCOMM, Inc. | | | 1,739,238 | |

| | | | | | | | 2,839,233 | |

| | | | | SOFTWARE - 12.0% | | | | |

| | 10,000 | | | Adobe, Inc.(a) | | | 3,449,300 | |

| | 30,000 | | | Microsoft Corporation | | | 7,654,199 | |

| | 19,000 | | | Oracle Corporation | | | 1,577,570 | |

| | 19,400 | | | Salesforce, Inc.(a) | | | 3,108,850 | |

| | | | | | | | 15,789,919 | |

| | | | | SPECIALTY FINANCE - 0.5% | | | | |

| | 6,800 | | | Capital One Financial Corporation | | | 702,032 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 7.6% | | | | |

| | 57,500 | | | Apple, Inc. | | | 8,511,725 | |

| | 30,750 | | | Cisco Systems, Inc. | | | 1,528,890 | |

| | | | | | | | 10,040,615 | |

| | | | | TECHNOLOGY SERVICES - 3.0% | | | | |

| | 18,125 | | | Visa, Inc., Class A | | | 3,933,125 | |

| | | | | | | | | |

| | | | | TELECOMMUNICATIONS - 0.4% | | | | |

| | 15,000 | | | Verizon Communications, Inc. | | | 584,700 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.5% | | | | |

| | 5,300 | | | Union Pacific Corporation | | | 1,152,379 | |

| | 11,400 | | | United Parcel Service, Inc., Class B | | | 2,162,922 | |

| | | | | | | | 3,315,301 | |

| | | | | WHOLESALE - CONSUMER STAPLES - 1.2% | | | | |

| | 17,500 | | | Sysco Corporation | | | 1,513,925 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NORTH COUNTRY LARGE CAP EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | TOTAL COMMON STOCKS (Cost $55,189,427) | | $ | 128,538,524 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 2.2% | | | | |

| | | | | MONEY MARKET FUNDS - 2.2% | | | | |

| | 2,986,737 | | | BlackRock Liquidity Funds Treasury Trust Fund, Institutional Class, 3.55% (Cost $2,986,737)(b) | | | 2,986,737 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 100.0% (Cost $58,176,164) | | $ | 131,525,261 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.0% | | | 45,998 | |

| | | | | NET ASSETS - 100.0% | | $ | 131,571,259 | |

N.V. - Naamioze Vennootschap

REIT - Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2022. |

The accompanying notes are an integral part of these financial statements.

| | THE NORTH COUNTRY FUNDS | |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| November 30, 2022 |

| | | Large Cap | |

| | | Equity Fund | |

| ASSETS: | | | | |

| Investments in securities, at fair value (Cost $58,176,164) | | $ | 131,525,261 | |

| Dividends and interest receivable | | | 226,192 | |

| Prepaid expenses and other assets | | | 9,780 | |

| Total Assets | | | 131,761,233 | |

| | | | | |

| LIABILITIES: | | | | |

| Due to Custodian | | | 35,130 | |

| Accrued advisory fees | | | 78,134 | |

| Payable to related parties | | | 12,054 | |

| Payable for fund shares redeemed | | | 14,939 | |

| Accrued audit fees | | | 17,749 | |

| Accrued administrative fees | | | 22,839 | |

| Accrued expenses and other liabilities | | | 9,129 | |

| Total Liabilities | | | 189,974 | |

| Net Assets | | $ | 131,571,259 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid in capital | | $ | 43,894,963 | |

| Accumulated earnings | | | 87,676,296 | |

| Net Assets | | $ | 131,571,259 | |

| | | | | |

| Shares outstanding (unlimited number of shares authorized; no par value) | | | 6,347,230 | |

| | | | | |

| Net asset value, offering and redemption price per share ($131,571,259/6,347,230) | | $ | 20.73 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| |

| STATEMENT OF OPERATIONS |

| For the Year Ended November 30, 2022 |

| | | Large Cap | |

| | | Equity Fund | |

| INVESTMENT INCOME: | | | | |

| Dividends | | $ | 2,114,505 | |

| Interest | | | 38,418 | |

| Total investment income | | | 2,152,923 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 1,055,929 | |

| Administration and fund accounting fees | | | 193,362 | |

| Legal fees | | | 40,987 | |

| Transfer agency fees | | | 37,566 | |

| Trustees’ fees | | | 22,199 | |

| Audit fees | | | 17,725 | |

| Printing expense | | | 14,600 | |

| Chief Compliance Officer fees | | | 11,001 | |

| Registration and filing fees | | | 13,403 | |

| Custody fees | | | 11,252 | |

| Insurance expense | | | 7,902 | |

| Shareholder Service fees | | | 30 | |

| Miscellaneous expenses | | | 6,096 | |

| Total expenses | | | 1,432,052 | |

| | | | | |

| Net investment income | | | 720,871 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain from investment transactions | | | 14,498,058 | |

| Net change in unrealized depreciation of investments | | | (36,088,146 | ) |

| Net realized and unrealized loss on investments | | | (21,590,088 | ) |

| | | | | |

| Net decrease in net assets resulting from operations | | $ | (20,869,217 | ) |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| |

| LARGE CAP EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2022 | | | November 30, 2021 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 720,871 | | | $ | 513,762 | |

| Net realized gain from investment transactions | | | 14,498,058 | | | | 13,246,537 | |

| Net change in unrealized appreciation/(deprecation) | | | (36,088,146 | ) | | | 19,569,412 | |

| Net increase (decrease) in net assets resulting from operations | | | (20,869,217 | ) | | | 33,329,711 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Total distributions to shareholders | | | (13,679,110 | ) | | | (15,652,516 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 4) | | | (4,506,023 | ) | | | 1,605,134 | |

| | | | | | | | | |

| Net increase (decrease) in net assets | | | (39,054,350 | ) | | | 19,282,329 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 170,625,609 | | | | 151,343,280 | |

| | | | | | | | | |

| End of year | | $ | 131,571,259 | | | $ | 170,625,609 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| |

| LARGE CAP EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

(For a fund share outstanding throughout each year)

| | | For the Year Ended November 30, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value, beginning of year | | $ | 25.86 | | | $ | 23.48 | | | $ | 20.32 | | | $ | 18.99 | | | $ | 18.87 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.11 | | | | 0.07 | | | | 0.08 | | | | 0.08 | | | | 0.05 | |

| Net realized and unrealized gain (loss) on investments | | | (3.16 | ) | | | 4.74 | | | | 4.44 | | | | 2.55 | | | | 1.28 | |

| Total from investment operations | | | (3.05 | ) | | | 4.81 | | | | 4.52 | | | | 2.63 | | | | 1.33 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.07 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.07 | ) |

| Distribution from net realized gains from security transactions | | | (2.01 | ) | | | (2.33 | ) | | | (1.28 | ) | | | (1.25 | ) | | | (1.14 | ) |

| Total distributions | | | (2.08 | ) | | | (2.43 | ) | | | (1.36 | ) | | | (1.30 | ) | | | (1.21 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 20.73 | | | $ | 25.86 | | | $ | 23.48 | | | $ | 20.32 | | | $ | 18.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (2) | | | (13.02 | )% | | | 22.73 | % | | | 23.90 | % | | | 15.25 | % | | | 7.52 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 131,571 | | | $ | 170,626 | | | $ | 151,343 | | | $ | 136,366 | | | $ | 127,978 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 1.02 | % | | | 0.99 | % | | | 1.02 | % | | | 1.04 | % | | | 1.03 | % |

| Net investment income | | | 0.51 | % | | | 0.31 | % | | | 0.40 | % | | | 0.41 | % | | | 0.29 | % |

| Portfolio turnover rate | | | 7 | % | | | 7 | % | | | 5 | % | | | 15 | % | | | 22 | % |

| (1) | Net investment income per share is based on average shares outstanding during the year or period. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and capital gain distributions, if any. Total return does not reflect the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| |

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2022 |

NOTE 1. ORGANIZATION

The North Country Funds (the “Trust”) was organized as a Massachusetts business trust on June 1, 2000, and registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end, diversified, management investment company on September 11, 2000. The Trust currently offers one series: the North Country Large Cap Equity Fund (the “Fund”). The Fund’s principal investment objective is to provide investors with long-term capital appreciation. The Fund commenced operations on March 1, 2001.

The Fund was initially organized on March 26, 1984 under New York law as a Collective Investment Trust sponsored by Glens Falls National Bank & Trust Company. Prior to its conversion to a regulated investment company (mutual fund), investor participation was limited to qualified employee benefit plans.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Trust in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with these generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Actual results could differ from these estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services - Investment Companies.

Security Valuation – Securities which are traded on a national securities exchange are valued at the last quoted sale price. NASDAQ traded securities are valued using the NASDAQ official closing price (“NOCP”). Investments for which no sales are reported are valued at the mean between the current bid and ask prices on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy described below. When an equity security is valued by the independent pricing service using factors other than market quotations or the market is considered inactive, they will be categorized in level 2.

Any securities or other assets for which market quotations are not readily available, or securities for which the last bid price does not accurately reflect the current value, are valued at fair value pursuant to the Fund’s fair value pricing policies and procedures, as approved by the Board (the “Valuation Policy”). The Board has designated North Country Investment Advisers, Inc., the Fund’s investment adviser (the “Adviser”), as the “Valuation Designee” pursuant to Rule 2a-5 under the 1940 Act to make fair value determinations for all of the Fund’s investments for which market quotations are not readily available (or are deemed unreliable). The Board will oversee the Adviser’s fair value determinations and the Adviser’s performance as Valuation Designee. Pursuant to the Valuation Policy, the Valuation Designee will take into account all relevant factors and circumstances in determining the fair value of a security, which may include: (i) the nature and pricing history (if any) of the security; (ii) whether any dealer quotations for the security are available; (iii) possible valuation methodologies that could be used to determine the fair value of the security; (iv) the recommendation of the portfolio manager of the Fund with respect to the valuation of the security; (v) whether the same or similar securities are held by other funds managed

| | THE NORTH COUNTRY FUNDS | |

| | | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2022 |

by the Adviser or other funds and the method used to price the security in those funds; (vi) the extent to which the fair value to be determined for the security will result from the availability and use of data, reports or formulae produced by third parties independent of the Adviser; (vii) the liquidity or illiquidity of the market for the security; (viii) the size of the Fund’s holdings; (ix) the existence of any extraordinary event relating to the security; (x) changes in the market environment; and (xi) any other matters considered relevant by the Valuation Designee. In the absence of readily available market quotations, or other observable inputs, securities valued at fair value pursuant to the Procedures would be categorized as level 3.

Money market funds are valued at their net asset value of $1.00 per share and are categorized as level 1. Securities with maturities of 60 days or less may be valued at amortized cost, which approximates fair value and would be categorized as level 2. The ability of issuers of debt securities held by the Fund to meet its obligations may be affected by economic or political developments in a specific country or region.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, including the Valuation Designee’s assumptions used in determining the fair value of priced instruments.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of inputs used as of November 30, 2022, in valuing the Fund’s assets carried at fair value.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2022 |

| North Country Large Cap Equity Fund: | |

| | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

| Common Stock ** | | $ | 128,538,524 | | | $ | — | | | $ | — | | | $ | 128,538,524 | |

| Money Market Fund | | | 2,986,737 | | | | — | | | | — | | | | 2,986,737 | |

| Total | | $ | 131,525,261 | | | $ | — | | | $ | — | | | $ | 131,525,261 | |

| * | The Fund did not hold any Level 3 investments during the period. |

| ** | See Schedule of Investments for industry classifications. |

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as regulated investment companies (“RICs”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years November 30, 2019, to November 30, 2021, or expected to be taken in the Fund’s November 30, 2022, year-end tax returns. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. The Fund identifies its major tax jurisdictions as U.S. Federal and New York State.

During the fiscal year ended November 30, 2022, the Fund utilized tax equalization which is the use of earnings and profits distributions to shareholders on redemption of shares as part of the dividends paid deduction for income tax purposes. Permanent book and tax differences, primarily attributable to the use of tax equalization credits, resulted in reclassifications for the Fund for the fiscal year ended November 30, 2022, as follows:

| Paid | | | | |

| In | | | Distributable | |

| Capital | | | Earnings | |

| $ | 914,602 | | | $ | (914,602 | ) |

Dividends and Distributions – The Fund will pay dividends from net investment income, if any, on an annual basis. The Fund will declare and pay distributions from net realized capital gains, if any, annually. Income and capital gain distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Security Transactions – Securities transactions are recorded no later than the first business day after the trade date, except for reporting purposes when trade date is used. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities using the effective yield method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2022 |

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

Cash and cash equivalents – Cash and cash equivalents are held with a financial institution. The assets of the Fund may be placed in deposit accounts at U.S. banks and such deposits generally exceed Federal Deposit Insurance Corporation (“FDIC”) insurance limits. The FDIC insures deposit accounts up to $250,000 for each accountholder. The counterparty is generally a single bank rather than a group of financial institutions; thus there may be a greater counterparty credit risk. The Fund places deposits only with those counterparties which are believed to be creditworthy and there has been no history of loss.

NOTE 3. INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES

The Trust has entered into an investment advisory agreement (the “Advisory Agreement”) with North Country Investment Advisers, Inc. (the “Adviser”). Pursuant to the Advisory Agreement, the Adviser is responsible for formulating the Trust’s investment programs, making day-to-day investment decisions and engaging in portfolio transactions, subject to the authority of the Board of Trustees. Under the terms of the agreement, the Fund pays a fee, calculated daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund. For the year ended November 30, 2022, the Adviser received advisory fees of $1,055,929.

The Trust has entered into an Underwriting Agreement with Northern Lights Distributors, LLC (“the Distributor”) to serve as the principal underwriter for the Fund and distributor for the Fund’s shares.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”) – UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Fund pays UFS customary fees for providing administration, fund accounting, and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

BluGiant, LLC (“BluGiant”), an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, BluGiant receives customary fees from the Fund.

Certain officers and/or trustees of the Adviser are also officers/trustees of the Trust.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2022 |

NOTE 4. CAPITAL SHARE TRANSACTIONS

At November 30, 2022, there were an unlimited number of shares authorized with no par value.

Transactions in capital shares were as follows:

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2022 | | | November 30, 2021 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 338,914 | | | $ | 7,300,809 | | | | 388,578 | | | $ | 9,092,502 | |

| Shares issued for reinvestment of dividends | | | 521,834 | | | | 12,764,060 | | | | 701,718 | | | | 14,897,468 | |

| Shares redeemed | | | (1,110,409 | ) | | | (24,570,892 | ) | | | (940,379 | ) | | | (22,384,836 | ) |

| Net increase (decrease) | | | (249,661 | ) | | $ | (4,506,023 | ) | | | 149,917 | | | $ | 1,605,134 | |

NOTE 5. INVESTMENTS

The cost of purchases and proceeds from the sales of securities, other than short-term investments, for the year ended November 30, 2022, amounted to $10,370,245 and $27,354,669, respectively.

NOTE 6. AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS

The identified cost of investments in securities owned by the Fund for federal income tax purposes, and its gross unrealized appreciation and depreciation at November 30, 2022, were as follows:

| | | | Gross | | | Gross | | | Net Unrealized | |

| Tax | | | Unrealized | | | Unrealized | | | Appreciation | |

| Cost | | | Appreciation | | | Depreciation | | | (Depreciation) | |

| $ | 58,138,892 | | | $ | 74,313,538 | | | $ | (927,169 | ) | | $ | 73,386,369 | |

| | THE NORTH COUNTRY FUNDS | |

| | | |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2022 |

NOTE 7. TAX INFORMATION

The tax character of distributions paid during the fiscal year ended November 30, 2022, and fiscal year ended November 30, 2021, was as follows:

| | | Fiscal Year Ended | | | Fiscal Year Ended | |

| | | November 30, 2022 | | | November 30, 2021 | |

| Ordinary Income | | $ | 594,998 | | | $ | 611,331 | |

| Long-Term Capital Gain | | | 13,084,112 | | | | 15,041,185 | |

| Return of Capital | | | — | | | | — | |

| | | $ | 13,679,110 | | | $ | 15,652,516 | |

As of November 30, 2022, the components of distributable earnings/ (deficit) on a tax basis were as follows:

| Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation/ | | | Distributable Earnings | |

| Income | | | Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | /(Accumulated Deficit) | |

| $ | 700,353 | | | $ | 13,589,574 | | | $ | — | | | $ | — | | | $ | — | | | $ | 73,386,369 | | | $ | 87,676,296 | |

The difference between book basis and tax basis unrealized appreciation/(depreciation) from investments is primarily attributable to the adjustments for C-Corporation return of capital distributions.

NOTE 8. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a) 9 of the 1940 Act. As of November 30, 2022, SEI Private Trust Company, an account holding shares for the benefit of others in nominee name, held approximately 87% of the voting securities of the Fund.

NOTE 9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Except as noted below, management has concluded that there are no events requiring additional adjustment or disclosure in the financial statements. On December 7, 2022, the Fund paid an ordinary income dividend of $0.1154 per share and a long-term capital gain dividend of $2.1411 per share to shareholders of record on December 6, 2022.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

The North Country Funds

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The North Country Funds comprising North Country Large Cap Equity Fund (the “Fund”) as of November 30, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2022, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2004.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

January 23, 2023

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

| | THE NORTH COUNTRY FUNDS | |

| |

| ADDITIONAL INFORMATION (Unaudited) |

FACTORS CONSIDERED BY THE INDEPENDENT TRUSTEES IN APPROVING THE INVESTMENT ADVISORY AGREEMENT

At a meeting (the “Meeting”) of the Board of Trustees (the “Board” or the “Trustees”) held on July 19, 2022, a majority of the Board, including a majority of trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (hereafter, the “Independent Trustees”), unanimously approved the continuance of the investment advisory agreement (the “Advisory Agreement”) between North Country Investment Advisers, Inc. (“NCIA” or the “Adviser”) and the North Country Large Cap Equity Fund (the “Large Cap Fund” or “Fund”). Fund counsel discussed with the Board its fiduciary responsibility to shareholders and the importance of assessing certain specific factors in its deliberations. Prior to the Meeting, the Adviser provided the Board with a number of written materials, including information relating to: a) the terms of the Advisory Agreement and fee arrangements with the Fund; b) the Adviser’s management and investment personnel; c) the financial condition and stability of the Adviser; d) data comparing the Fund’s fees, operating expenses and performance with that of a group of mutual funds in the same category, as determined by Access Data Corp., that the Adviser determined were similar in size to the Fund (the “Peer Group”); and e) past performance of the Fund as compared to its benchmark. In addition, the Board engaged in in-person discussions with representatives of the Adviser. The Board also met outside the presence of the Adviser to consider this matter and consulted with independent counsel and the Fund’s Chief Compliance Officer.

The Board, including the Independent Trustees, unanimously approved continuance of the Advisory Agreement based upon its review of the written materials provided at the Meeting, the reports provided at each quarterly meeting of the Board, the Board’s discussions with key personnel of the Adviser, and the Board’s deliberations. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling, and individual Trustees may have attributed different weights to the various factors. Below is a summary of the Board’s conclusions regarding various factors relevant to approval of continuance of the Advisory Agreement:

Nature, Extent and Quality of Services. The Board examined the nature, extent and quality of the services provided by the Adviser to the Fund. The Board, including the Independent Trustees, reviewed the qualifications of the Adviser’s key personnel, including the experience of the Fund’s portfolio managers, and agreed that sharing resources with its parent bank is a positive aspect of the Adviser’s services to the Fund. The Trustees discussed their satisfaction with the Adviser’s compliance program and noted the financial strength and stability of the Adviser. Based on these considerations, the Trustees determined that the Adviser has the capabilities, resources and personnel necessary to manage the Fund and concluded that they were satisfied with the nature, extent and quality of the services provided to the Fund under the Advisory Agreement.

Performance of the Adviser. The Independent Trustees discussed in detail the information provided to them regarding the Fund’s performance over multiple time periods ended May 31, 2022 as compared to the average of the total return of the Peer Group. The Independent Trustees also discussed in detail the information provided to them regarding the Fund’s performance over multiple time periods ended June 30, 2022 as compared to its benchmarks, the S&P 500 Index and the Lipper Large Cap Core Funds Index. The Trustees noted that the Fund outperformed 3 out of 12 funds in the Peer Group for the 1-year period, 4 out of 12 funds for the 3-year period, 5 out of 11 funds for the 5-year period, and 5 out of 6 funds for the 10-year period. The Trustees then noted that the Fund underperformed its benchmarks for the 1-year, 3-year, 5-year, and 10-year periods ended June 30, 2022. The Trustees considered that the Fund’s performance reflects, in part, the conservative manner in which it is managed and concluded that the investment performance of the Fund was sufficient to warrant continuation of the Advisory Agreement.

Cost of Services. With regard to cost of services and fees and expenses, the Trustees reviewed comparative fees charged by advisers to the Peer Group. The Trustees noted that as of November 30, 2021, the Fund’s effective management fee was between the median and the high for the Peer Group. The Trustees also noted that the Fund’s net expenses, when compared to the Peer Group, were between the median and the high for the Peer Group. The Trustees concluded that the cost of the services provided by the Adviser is within a reasonable range and warranted continuation of the Advisory Agreement.

Profitability. Trustees considered the Adviser’s profits realized in connection with the operation of the Fund. The Trustees noted that the Adviser was not receiving 12b-1 fees, soft dollars or affiliated brokerage fees in connection with

| | THE NORTH COUNTRY FUNDS | |

| |

| ADDITIONAL INFORMATION (Unaudited)(Continued) |

its services to the Fund. The Independent Trustees considered that NCIA had voluntarily limited the overall expense ratio of the Fund from its inception through the fiscal year ended November 30, 2009 and noted that the Fund is continuing to operate within those limitations. The Trustees concluded that, based on the quality of services provided, the profitability of the Adviser’s relationship with the Fund was not unreasonable and warranted continuation of the Advisory Agreement.

Economies of Scale. The Trustees noted that the Adviser represented that certain efficiencies may be realized when the level of assets under management in the Fund nears $500 million. The Trustees concluded that they would re-visit the issue of certain benefits to the Fund’s shareholders that might ensue from economies of scale following any significant growth in Fund assets or other change in circumstances.

Conclusion. Having requested and received such information from the Adviser as the Board believed to be reasonably necessary to evaluate the terms of the Advisory Agreement, and with the assistance of independent legal counsel, the Board concluded that the overall arrangements provided under the terms of the Advisory Agreement were reasonable, and that continuance of the Advisory Agreement was in the best interests of the Fund’s shareholders.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| INFORMATION REGARDING |

| TRUSTEES AND OFFICERS (Unaudited) |

The following table provides information regarding each Independent Trustee:

Name, Address(1)

and Year of Birth | Position(s)

Held with the

Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee | Other

Directorships

Held by

Trustees |

John C. Olsen

Born in 1955 | Chairman of the Board and Trustee | Indefinite Since 2004 (Chairman since 2021) | Retired (2019–Present); Firm Ambassador, Bonadio & Co., LLP (2018–2020). | 1 | None |

James E. Amell

Born in 1959 | Trustee | Indefinite Since 2017 | Director and Shareholder of Marvin and Co. PC (CPA Firm) (1981–Present). | 1 | None |

Keith P. McAfee

Born in 1963 | Trustee | Indefinite Since 2017 | Retired (2020–Present); Vice President of Electric Operations for New York, National Grid (2011–2020); Employee, National Grid (1992–2020). | 1 | None |

Amie Gonzales

Born in 1980 | Trustee | Indefinite Since 2021 | President, Hunt Companies Inc. (2019– Present); Project Manager, Hunt Companies Inc. (2012–2019) | 1 | None |

The following table provides information regarding each Trustee who is an “interested person” of the Trust, as defined in the 1940 Act:

Name, Address(1)

and Age | Position(s)

Held with the

Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee | Other

Directorships

Held by

Trustees |

Thomas L. Hoy*

Born in 1948 | Trustee | Indefinite Since 2015 | Consultant and Chairman of the Board, Arrow Financial Corp. and Glen Falls National Bank (2005–Present); Chairman of the Board, AAA Northway (travel insurance and auto services) (1990–Present). Director, New York Business Development Corp. (2012–2020). | 1 | Director, Federal Home Loan Bank of New York (2012–Present) |

Thomas Murphy*

Born in 1958 | Trustee | Indefinite Since 2022 | President and Chief Executive Officer of Arrow Financial Corporation (2013 – Present). | 1 | None |

| * | Messrs. Hoy and Murphy are an “interested person” because of their position with Arrow Financial Corporation, the parent holding company of the Adviser and GFNB. |

| (1) | The business address for each Trustee is 4221 North 203rd Street, Elkhorn, Nebraska 68022 |

Name, Address

and Age | Position(s)

Held with the

Fund | Term of Office *

and Length of

Time

Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee | Other

Directorships

Held by

Trustees |

James Colantino(1)

Born in 1969 | President | Since 2012 | Senior Vice President of Fund Administration (2012– Present), Ultimus Fund Solutions, LLC. | N/A | None |

James Ash(1)

Born in 1976 | Chief Compliance Officer | Since 2019 | Senior Compliance Officer, Northern Lights Compliance, LLC (2019–Present); Senior Vice President, National Sales Gemini Fund Services, LLC (2017–2019). | N/A | None |

Richard Gleason(1)

Born in 1977 | Treasurer | Since 2017 | Assistant Vice President of Fund Administration (2012-Present), Ultimus Fund Solutions, LLC. | N/A | None |

Jared Lahman(1)

Born in 1986 | AML Compliance Officer | Since 2022 | Compliance Analyst II, Northern Lights Compliance Services, LLC (2019 – Present). | N/A | None |

Sean Lawler(1)

Born in 1987 | Secretary | Since 2020 | Senior Legal Administrator (2020 – Present), Ultimus Fund Solutions, LLC; Legal Administrator (2014–2020), Gemini Fund Services, LLC. | N/A | None |

| * | Officers of the Trust are elected annually. |

| (1) | The business address of this officer is 4221 North 203rd Street, Elkhorn, Nebraska 68022 |

The Trust’s Statement of Additional Information includes additional information about the Trustees of the Trust and is available, without charge, upon request by calling 1-888-350-2990.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| ADDITIONAL INFORMATION (Unaudited) |

LIQUIDITY RISK MANAGEMENT PROGRAM

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources.

During the year ended November 30, 2022, the Trust’s Liquidity Risk Management Program Committee (the “Committee”) reviewed the Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. Accordingly, the Committee concluded that (i) the Fund’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program has been effectively implemented.

| | THE NORTH COUNTRY FUNDS | |

| | | |

| DISCLOSURE OF FUND EXPENSES (Unaudited) |

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note, the expenses shown in the tables are meant to highlight ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges (CDSCs) on redemptions.

This example is based on an investment of $1,000 invested at June 1, 2022 and held until November 30, 2022.

Actual Expenses: The “Actual” section of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Examples for Comparison Purposes: The “Hypothetical” section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs which may be applicable to your account. Therefore, the “Hypothetical” example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expense | | Expenses Paid During |

| | | Account Value | | Account Value | | Ratio | | the Period* |

| | | (6/1/22) | | (11/30/22) | | (Annualized) | | (6/1/22-11/30/22) |

| Large Cap Equity Fund | | | | | | | | |

| Actual | | $1,000.00 | | $999.00 | | 1.04% | | $5.21 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.85 | | 1.04% | | $5.27 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183 days divided by 365 days. |

Rev July 2011

| FACTS | WHAT DO THE NORTH COUNTRY FUNDS DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social Security number and wire transfer instructions ● account transactions and transaction history ● investment experience and purchase history When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons The North Country Funds (“The Funds”) choose to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | | Do The Funds share? | | Can you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | | Yes | | No |

| For our marketing purposes — to offer our products and services to you | | Yes | | No |

| For joint marketing with other financial companies | | Yes | | No |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | | Yes | | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | | No | | We don’t share |

| For our affiliates to market to you | | No | | We don’t share |

| For nonaffiliates to market to you | | No | | We don’t share |

| Questions? | Call 1-888-350-2990 |

| Who we are |

Who is providing this notice? | The North Country Funds |

| What we do |

How do The Funds protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We restrict access to nonpublic personal information about you to those employees who need to know that information to provide products or services to you. |

How do The Funds collect my personal information? | We collect your personal information, for example, when you ● open an account or deposit money ● direct us to buy securities or direct us to sell your securities ● seek advice about your investments We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes — information about your creditworthiness ● affiliates from using your information to market to you ● sharing for non-affiliates to market to you ● State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● Our affiliates include financial companies such as Glens Falls National Bank and Trust Company and North Country Investment Advisers. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● The Funds do not share with nonaffiliates so they can market you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ● The Funds do not jointly market. |

How to Obtain Proxy Voting Information

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30, as well as a description of the policies and procedures that the Fund uses to determine how to vote proxies is available without charge, upon request, by calling toll-free 1-888-350-2990 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain 1st and 3rd Fiscal Quarter Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit on Form N-PORT, within sixty days of the end of the period. Form N-PORT is available on the SEC’s website at http://www.sec.gov. The information on Form N-PORT is available without charge, upon request, by calling 1-888-350-2990.

NC-AR22

(b) Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. Not applicable.

Item 2. Code of Ethics.

As of the end of the period covered by this report, the Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer and principal financial officer.

Item 3. Audit Committee Financial Expert.

The Registrant’s board of trustees has determined that John C. Olsen is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Olsen is independent for purposes of this Item 3.

Item 4. Principal Accountant Fees and Services.

For the fiscal year ended November 30, 2022, the aggregate audit, audit-related and tax fees billed by Cohen Fund Audit Services, Ltd. for professional services rendered for the audits of the financial statement, or services that are normally provided in connection with statutory and regulatory filings or engagements for that fiscal year, for The North Country Funds are shown below. The aggregate tax fees billed by Cohen Fund Audit Services, Ltd. were rendered for tax compliance, tax advice and tax planning for each fund.

FY 2022 $ 14,000

FY 2021 $ 14,000

FY 2022 $ 0

FY 2021 $ 0

FY 2022 $ 3,000

FY 2021 $ 3,000

FY 2022 $ 0

FY 2021 $ 0

| (e) | (1) Audit Committee’s Pre-Approval Policies |

The Registrant’s Audit Committee is required to pre-approve all audit services and, when appropriate, any non-audit services (including audit-related, tax and all other services) to the Registrant. The Registrant’s Audit Committee also is required to pre-approve, when appropriate, any non-audit services (including audit-related, tax and all other services) to its adviser, or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the Registrant, to the extent that the services may be determined to have an impact on the operations or financial reporting of the Registrant. Services are reviewed on an engagement by engagement basis by the Audit Committee.

| (2) | There were no amounts that were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(c) of Rule 2-01 of Regulation S-X for the fiscal year ended November 30, 2022. |

(f) During the audit of Registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g) The aggregate non-audit fees billed by the Registrant's accountant for services rendered to the Registrant, and rendered to the Registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant:

Registrant Adviser

FY 2022 $ 3,000 $ 0

FY 2021 $ 3,000 $ 0

(h) Not applicable. All non-audit services to the Registrant were pre-approved by the Audit Committee for FY 2022.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants. Not applicable to open-end investment companies.

Item 6. Schedule of Investments. Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies. Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchases . Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders. None

Item 11. Controls and Procedures.

(a) Based on an evaluation of the Registrant’s disclosure controls and procedures as of a date within 90 days of filing date of this Form N-CSR, the principal executive officer and principal financial officer of the Registrant have concluded that the disclosure controls and procedures of the Registrant are reasonably designed to ensure that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported by the filing date, including that information required to be disclosed is accumulated and communicated to the Registrant’s management, including the Registrant’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no significant changes in the Registrant’s internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Item 12. Disclosure of securities lending activities for closed-end management investment companies.

Not applicable to open-end investment companies.

Item 13. Exhibits.

(a)(1) Code of Ethics filed herewith.

(a)(2) Certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 (and Item 11(a)(2) of Form N-CSR) are filed herewith.

(a)(3) Not applicable for open-end investment companies.

(b) Certifications required by Section 906 of the Sarbanes-Oxley Act of 2002 (and Item 11(b) of Form N-CSR) are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The North Country Funds

By (Signature and Title)

/s/ James Colantino

James Colantino, Principal Executive Officer

Date 2/3/23

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By (Signature and Title)

/s/ James Colantino

James Colantino, Principal Executive Officer

Date 2/3/23

By (Signature and Title)

/s/ Rich Gleason

Rich Gleason, Principal Financial Officer

Date 2/3/23