| 1

Semiannual Report

Franklin Large Cap Equity Fund

Your Fund’s Goal and Main Investments: Franklin Large Cap Equity Fund seeks long-term growth of principal and income through investing at least 80% of its net assets in equity securities of large capitalization companies with market capitalizations within the top 50% of companies in the Russell 1000® Index, or of more than $5 billion, at the time of purchase.1 The Fund attempts to keep taxable capital gains distributions relatively low.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

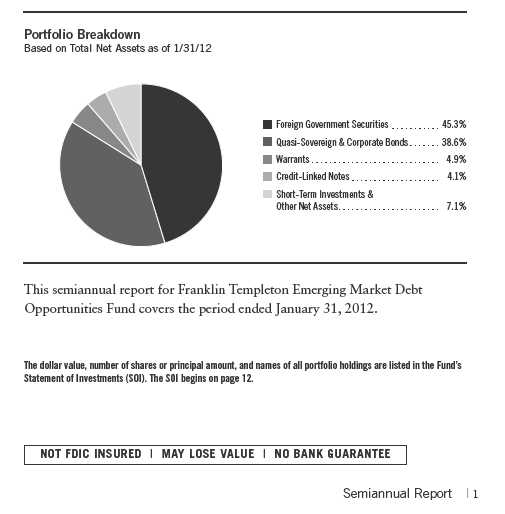

This semiannual report for Franklin Large Cap Equity Fund covers the period ended January 31, 2012.

Performance Overview

Franklin Large Cap Equity Fund – Class A had a -1.86% cumulative total return for the six months ended January 31, 2012. The Fund underperformed the +2.71% total return of its benchmark, the Standard & Poor’s 500® Index (S&P 500®), which is a broad measure of U.S. stock performance.2 You can find other Fund performance data in the Performance Summary beginning on page 7.

Economic and Market Overview

The U.S. economy improved during the six months ended January 31, 2012, despite geopolitical, fiscal, employment and housing pressures. In contrast, growth outside the U.S. generally slowed, which some attributed to the effects of Japan’s earthquake and Thailand’s flooding on the global supply chain, pop-ulist uprisings across the oil-and-gas-producing regions of the Middle East and North Africa, and the eurozone sovereign debt crisis. Although U.S. manufacturing growth slowed in the first half of the period as high commodity prices

1. The Russell 1000® Index is market capitalization weighted and measures performance of the largest companies in the Russell 3000® Index, which represent the majority of the U.S. market’s total capitalization. Russell 1000® and Russell 3000® are trademarks of the Frank Russell Company.

2. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product. The index is unmanaged and includes reinvested distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

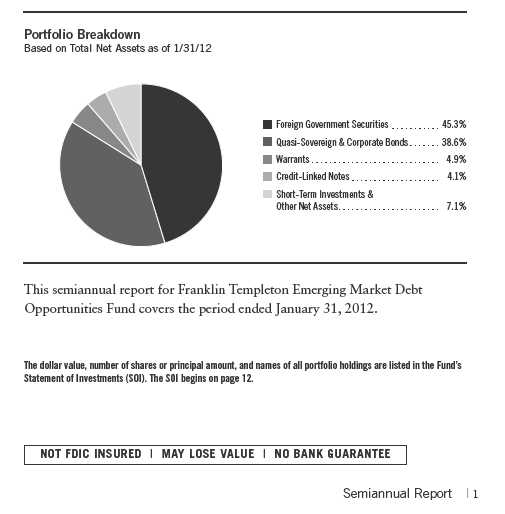

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 16.

Semiannual Report | 3

reduced purchasing power and demand ebbed, the trend began to reverse near period-end. The U.S. manufacturing sector helped power the domestic economy and, along with India, led global manufacturing growth at period-end. European and Asian manufacturing, however, generally weakened through most of the six-month reporting period before stabilizing at period-end.

The U.S. financial system and household balance sheets continued to improve, but the country still faced persistently high unemployment, a prolonged housing market slump and massive national debt. Inflation rose across much of the world but stayed relatively contained in the U.S. The Federal Reserve Board (Fed) sought to boost economic growth by implementing its new bond-buying program, dubbed “Operation Twist” by commentators, which is intended to further lower long-term bond yields. The Fed also anticipated it would keep the federal funds target rate at 0% to 0.25% at least through late 2014. Outside the U.S., European policymakers stepped up their response to their sovereign debt and banking crisis. The European Central Bank cut short-term interest rates and expanded bank lending facilities, and six key global central banks agreed to lower dollar funding costs for Europe’s distressed commercial banks. Chinese policymakers lowered commercial bank reserve requirements and the International Monetary Fund revamped its credit line and eased its lending terms.

Worrisome global events and slowing global growth dampened investor sentiment and market volatility surged. Through most of the period, risk-averse investors sought perceived safe havens and seemed to ignore that many companies generated record profits. As 2012 began, better-than-expected U.S. economic reports renewed many investors’ risk appetite. Despite large swings, U.S. stocks as measured by the S&P 500 Index gained 2.71% for the six months ended January 31, 2012.2 The Dow Jones Industrial Average rose 5.52%, reflecting investors’ general preference for large, established U.S. companies.2 In contrast, developed and emerging world stocks as measured by the MSCI All Country World Index fell 4.58%.2 Amid general global market declines, U.S. Treasuries and perceived safe-haven currencies such as the U.S. dollar and Japanese yen delivered solid returns.

Investment Strategy

We are research-driven, fundamental investors pursuing a blend of growth and value strategies. We use a top-down analysis of macroeconomic trends, market sectors (with some attention to the sector weightings in the Fund’s comparative index) and industries combined with a bottom-up analysis of individual securities. In selecting investments for the Fund, we look for companies we believe are positioned for growth in revenues, earnings or assets, and are selling at reasonable prices. We also consider the level of dividends a company has paid.

4 | Semiannual Report

We employ a thematic approach to identify sectors that may benefit from longer term dynamic growth. Within these sectors, we consider the basic financial and operating strength and quality of a company and company management. The Fund, from time to time, may have significant positions in particular sectors such as technology or industrials. We also seek to identify companies that we believe are temporarily out of favor with investors, but have a good intermediate-or long-term outlook.

Manager’s Discussion

During the six months under review, stock selection in the information technology sector contributed significantly to the Fund’s performance relative to the benchmark S&P 500.3 Strong performers within the sector included global positioning systems manufacturer Trimble Navigation,4 voice and language solutions provider Nuance Communications,4 integrated circuits and semiconductor devices company Taiwan Semiconductor Manufacturing,4 and global payments solution company MasterCard. Stock selection in the financials sector also boosted relative results, supported by commercial bank Wells Fargo and insurance company ACE.5 Other key contributors to relative performance included apparel and home fashions retailer TJX, footwear and apparel company NIKE, global alcoholic beverages company Diageo,4 and global bio-pharmaceutical companies Celgene and Gilead Sciences.

In contrast, stock selection in the industrials, consumer discretionary and materials sectors detracted considerably from the Fund’s performance relative to the S&P 500.6 In the industrials sector, German industrial conglomerate Siemens7 and Canadian transport solutions manufacturer Bombardier hurt relative results.4 Consumer discretionary holdings including South Korea’s largest automaker Hyundai Motor4 and global business efficiency and automotive components company Johnson Controls weighed on returns. In the materials sector, diversified metals and mining company Rio Tinto4 and agricultural chemicals manufacturer The Mosaic Co. were key detractors.7 Other

3. The information technology sector comprises communications equipment; computers and peripherals; electronic equipment, instruments and components; Internet software and services; IT services; semiconductors and semiconductor equipment; and software in the SOI.

4. Not a component of the S&P 500.

5. The financials sector comprises capital markets, commercial banks, consumer finance, diversified financial services and insurance in the SOI.

6. The industrials sector comprises aerospace and defense, air freight and logistics, electrical equipment, industrial conglomerates, and machinery in the SOI. The consumer discretionary sector comprises auto components; automobiles; Internet and catalog retail; specialty retail; and textiles, apparel and luxury goods in the SOI. The materials sector comprises chemicals in the SOI.

7. Sold by period-end.

Semiannual Report | 5

major detractors included financial advisory and asset management firm Lazard,7 energy equipment and services company Weatherford International, and Swiss food products manufacturer Nestle.4

Thank you for your continued participation in Franklin Large Cap Equity Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Large Cap Equity Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of January 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Semiannual Report

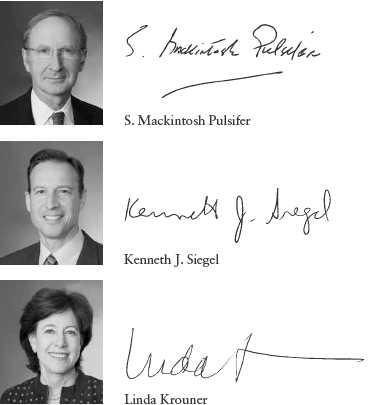

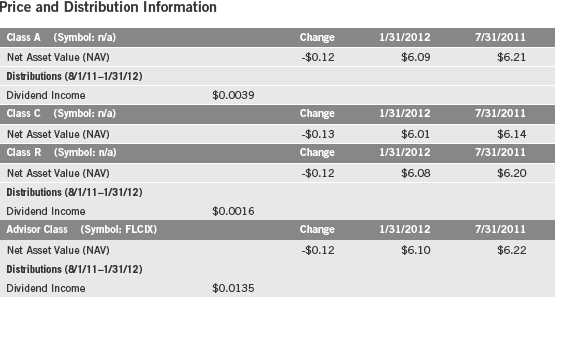

Performance Summary as of 1/31/12

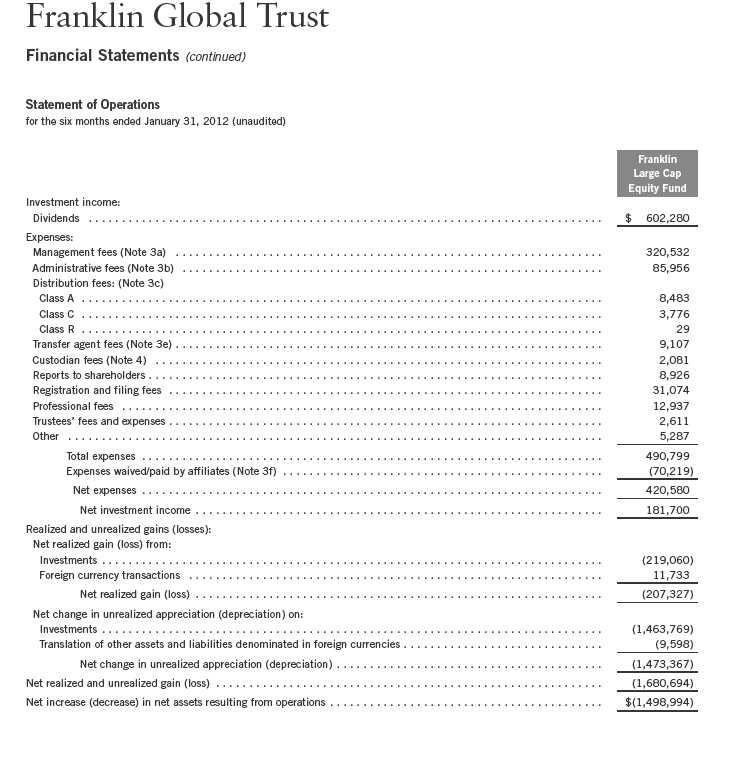

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 7

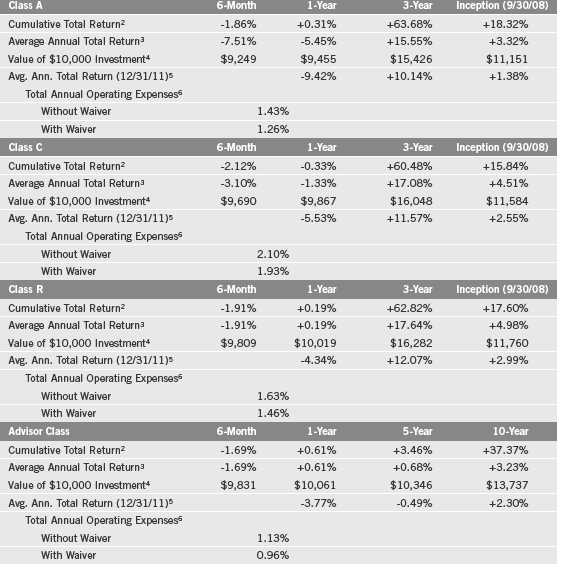

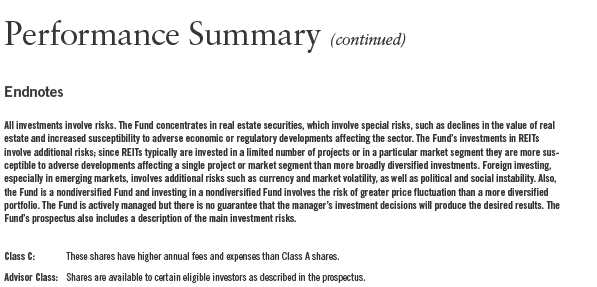

Performance Summary (continued)

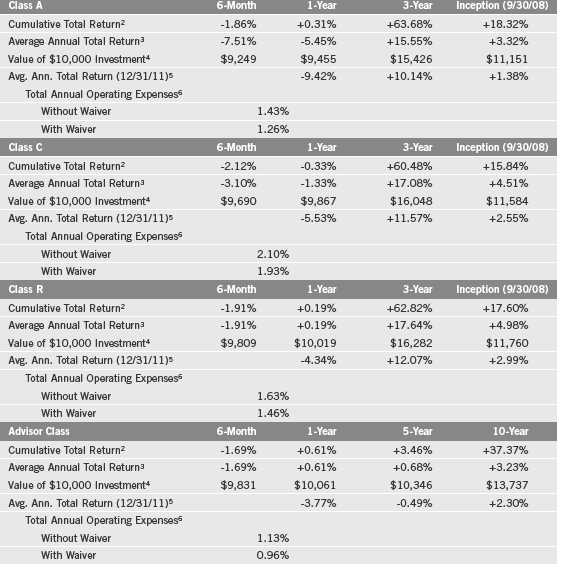

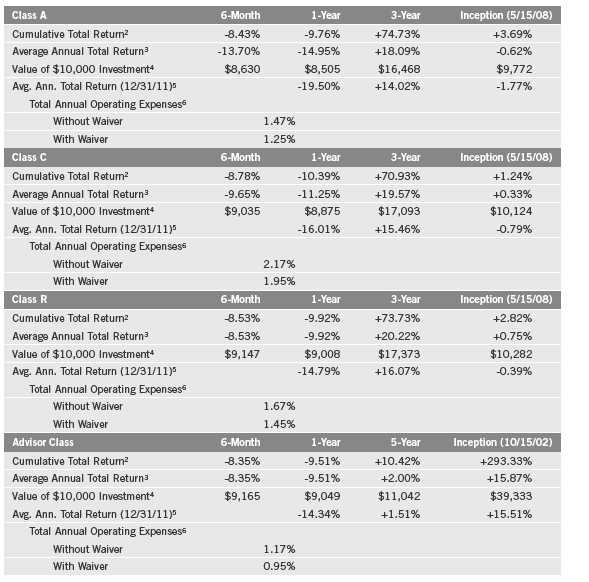

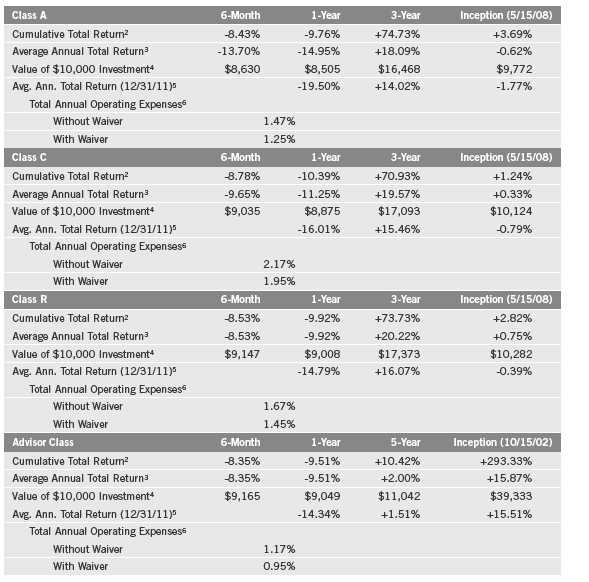

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or to assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.95% (other than certain nonroutine expenses) until 11/30/12.

8 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investments in foreign company stocks involve special risks including currency fluctuations and political uncertainty. There are special risks involved with significant exposure to a particular sector, including increased susceptibility related to economic, business or other developments affecting that sector, which may result in increased volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower. 2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 9

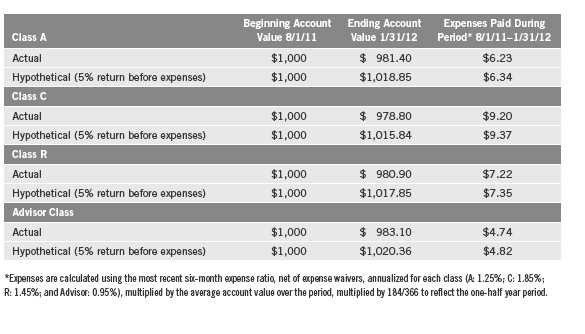

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if applicable; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if appli- cable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

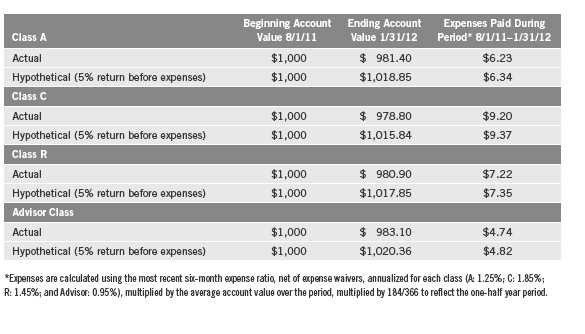

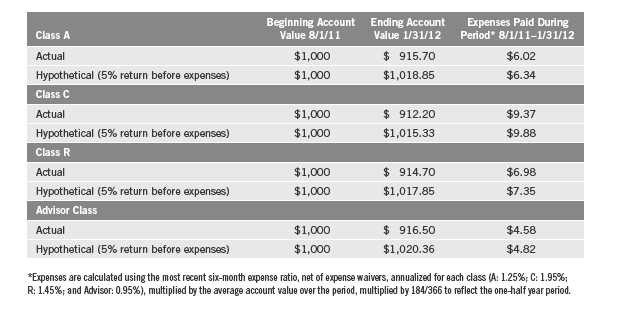

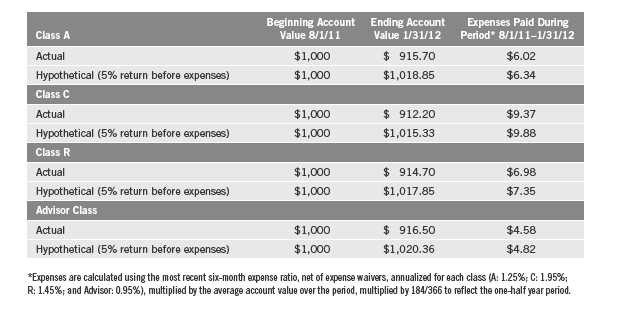

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

10 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

Semiannual Report | 11

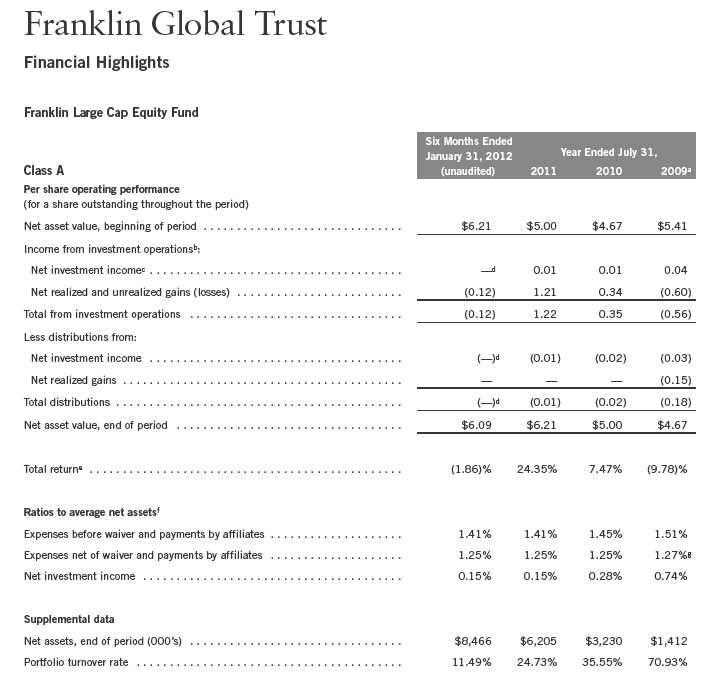

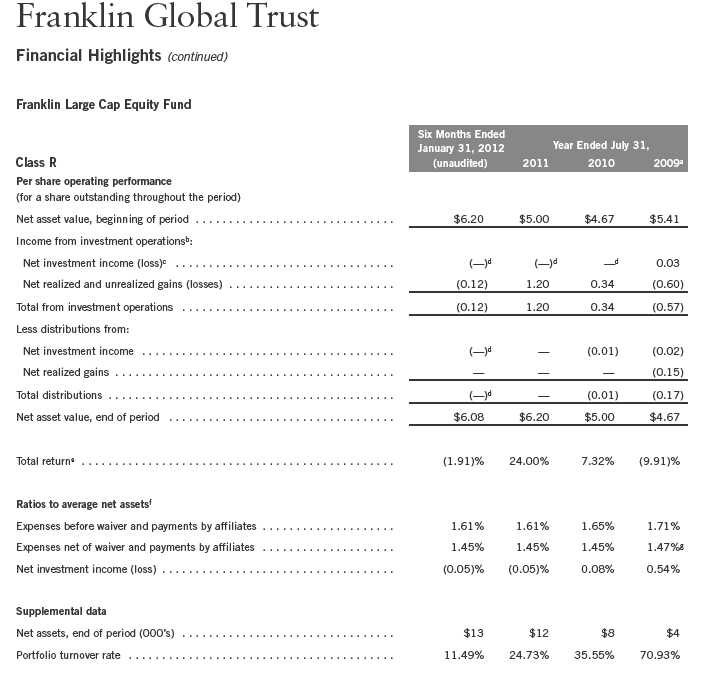

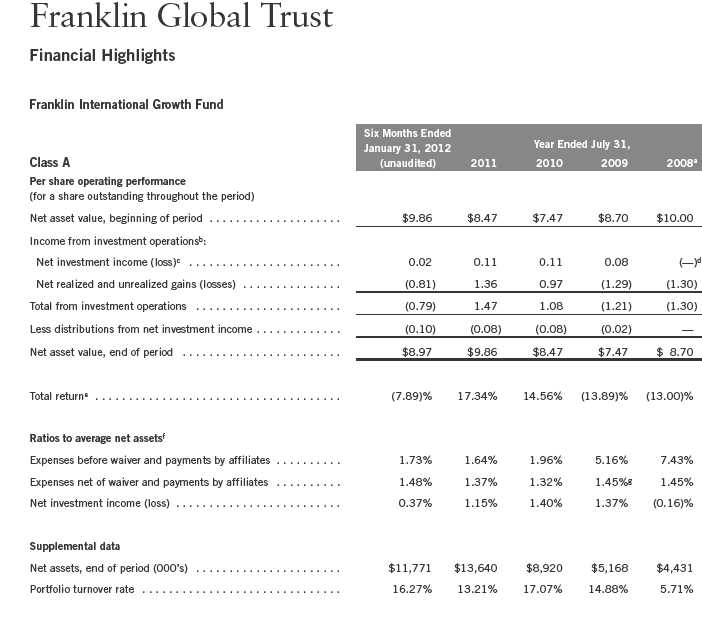

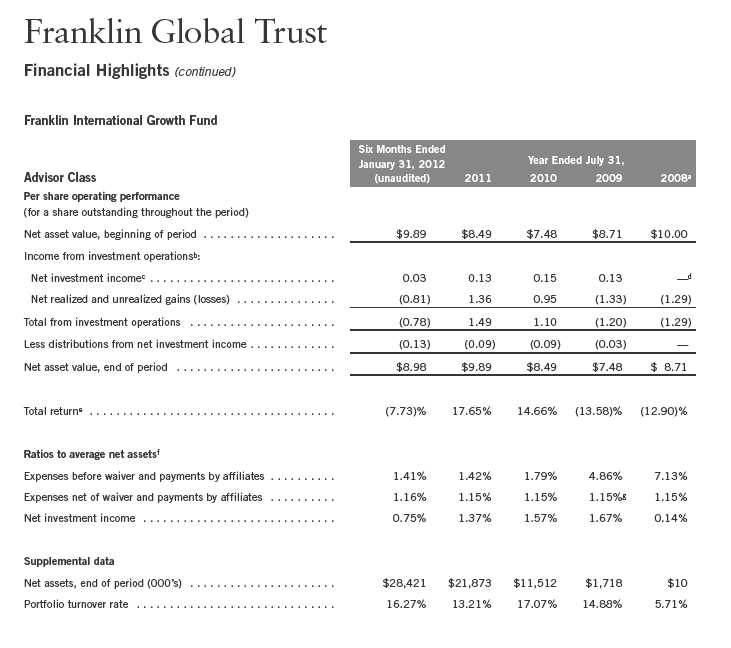

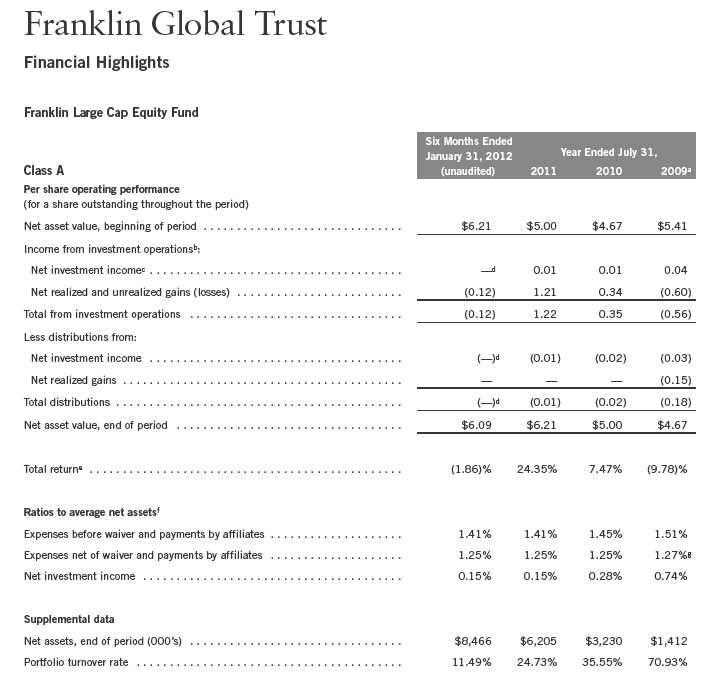

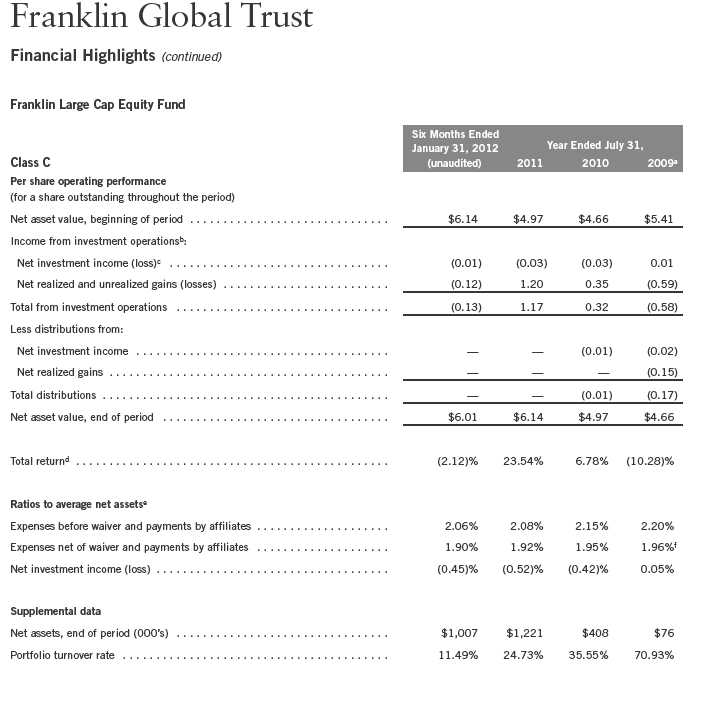

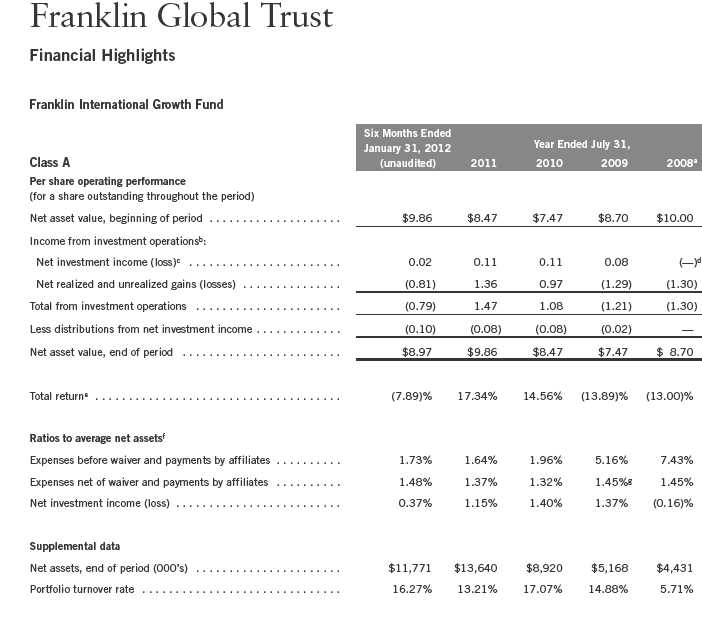

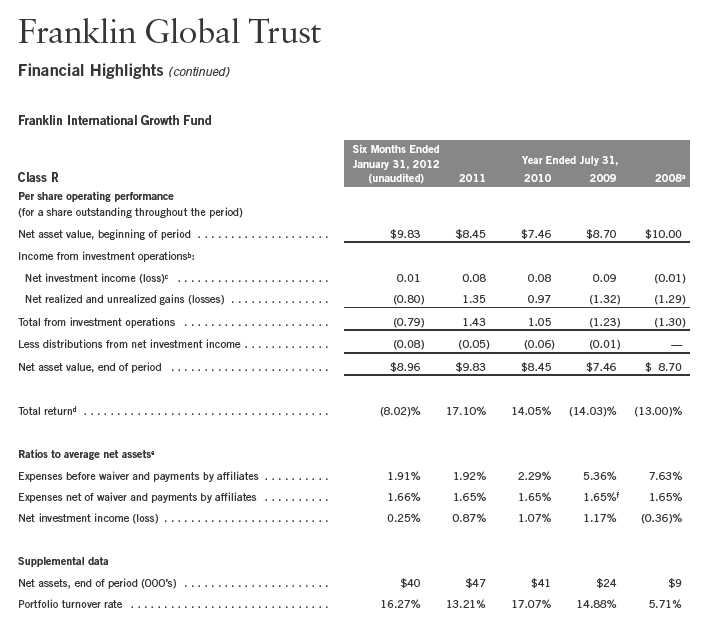

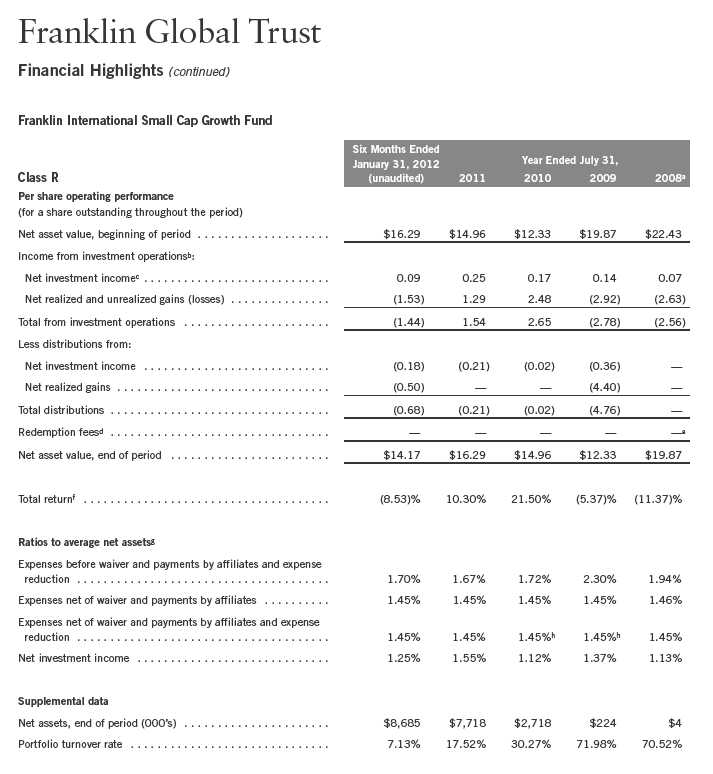

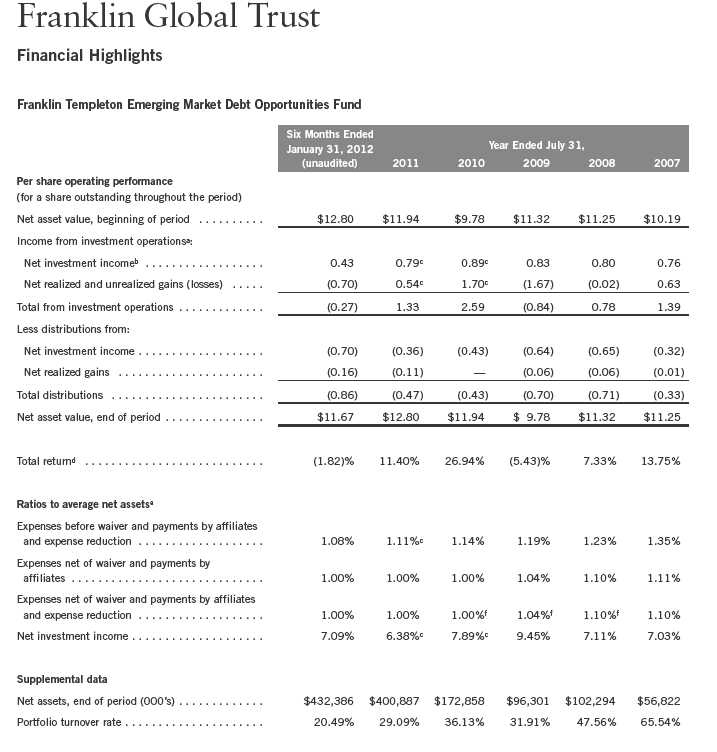

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

12 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

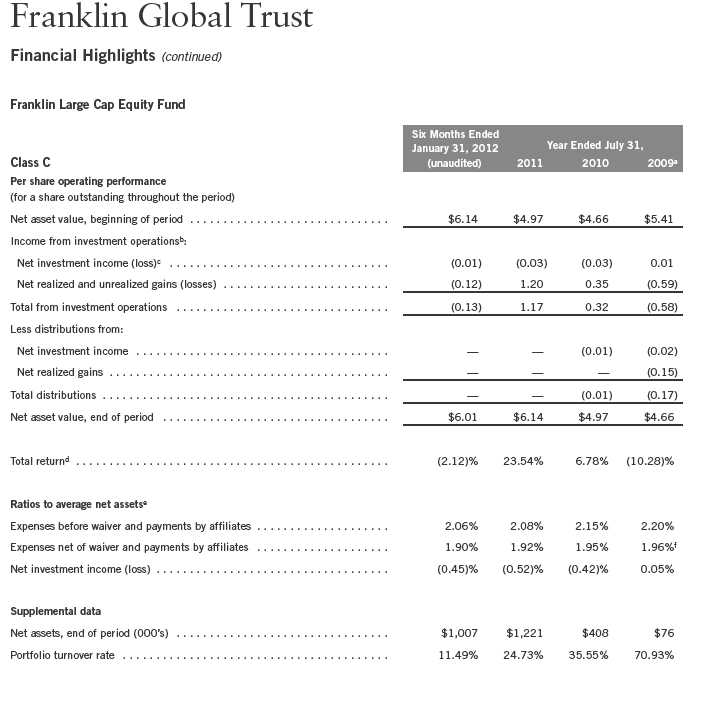

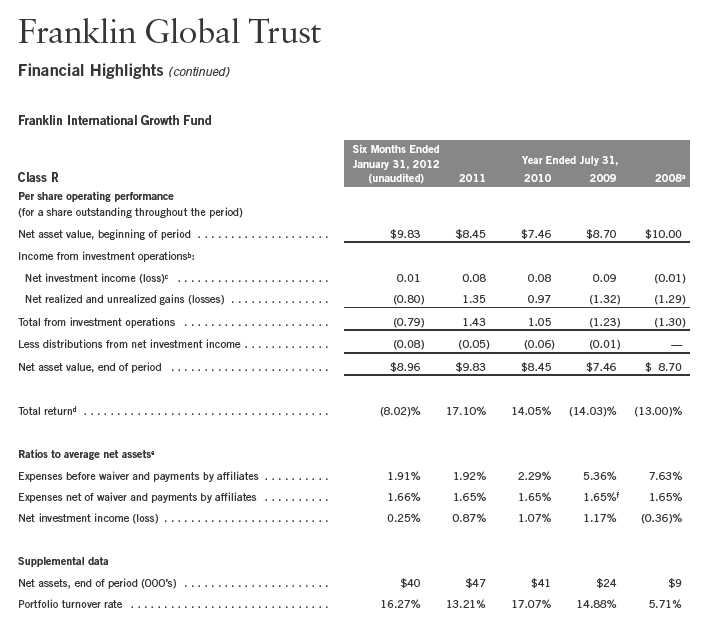

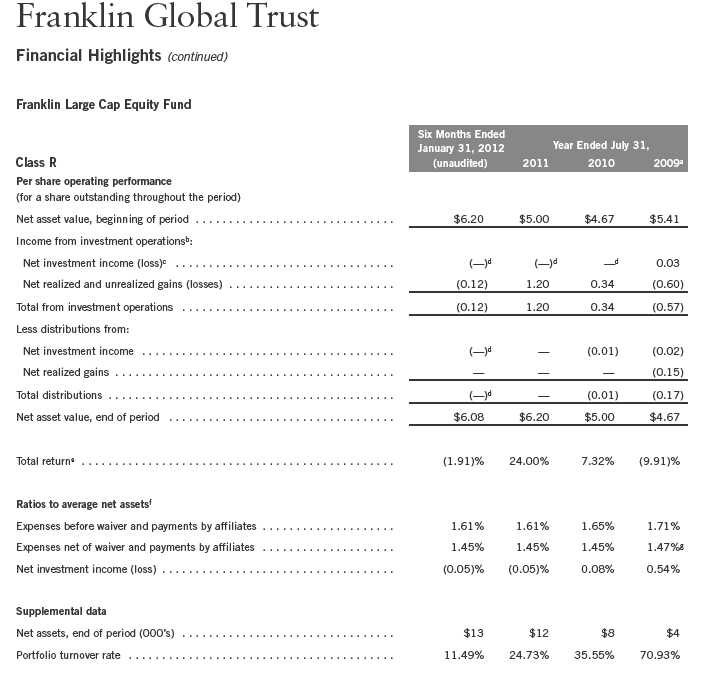

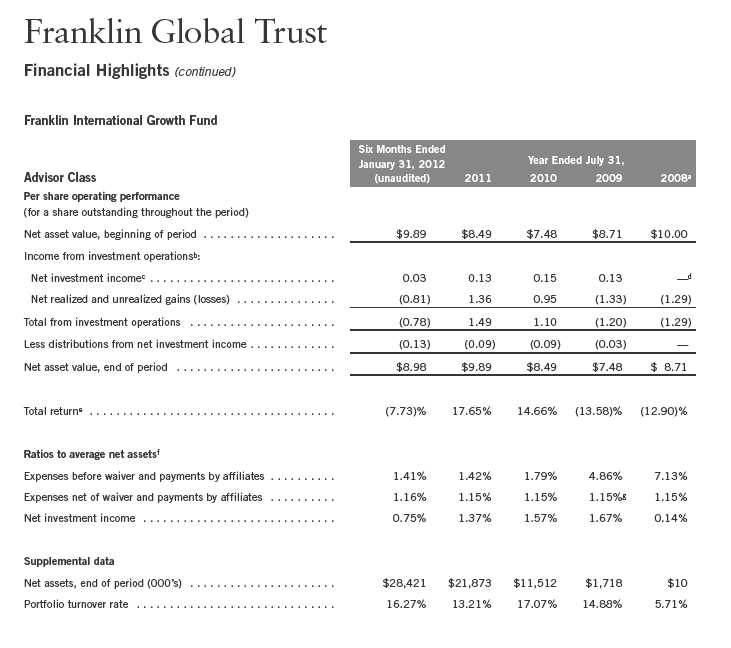

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 13

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

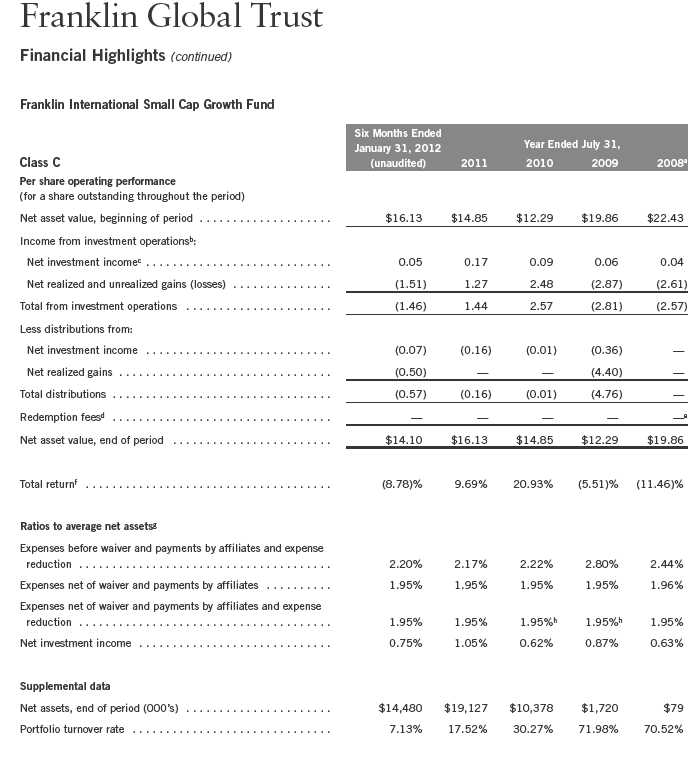

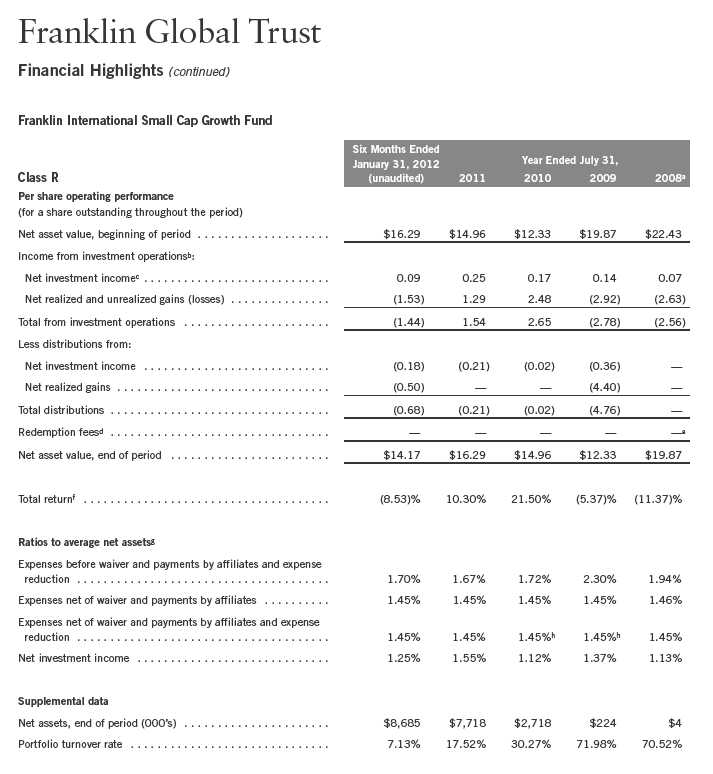

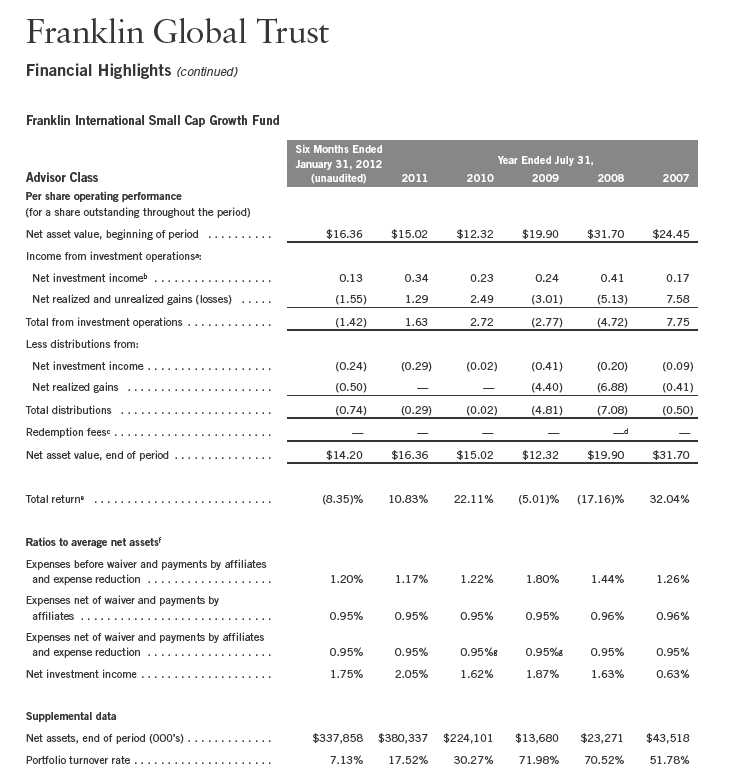

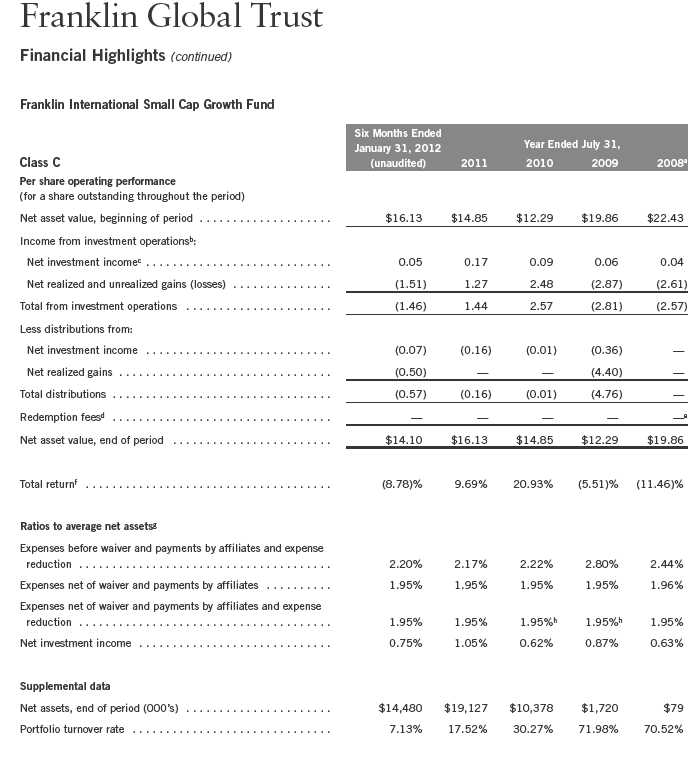

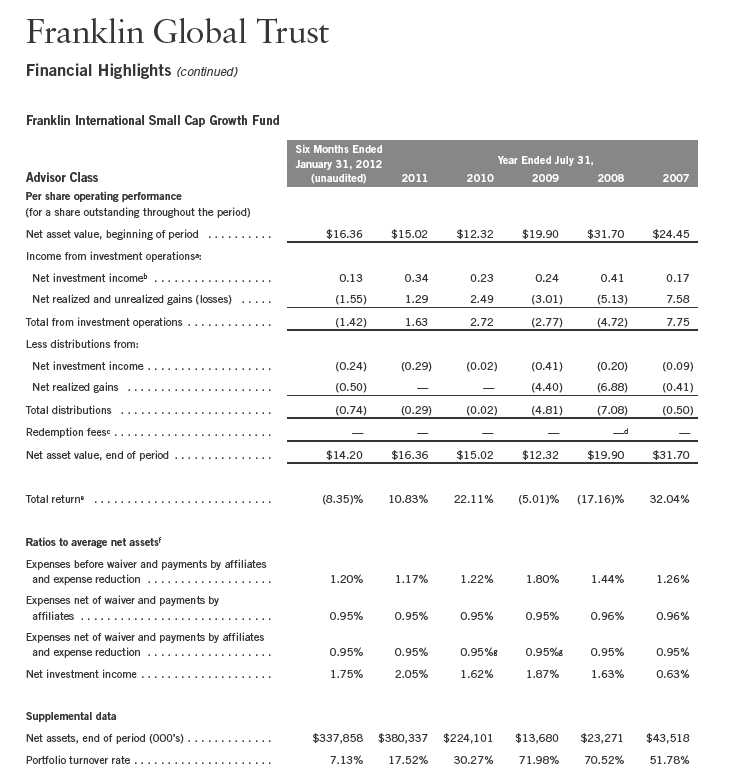

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 15

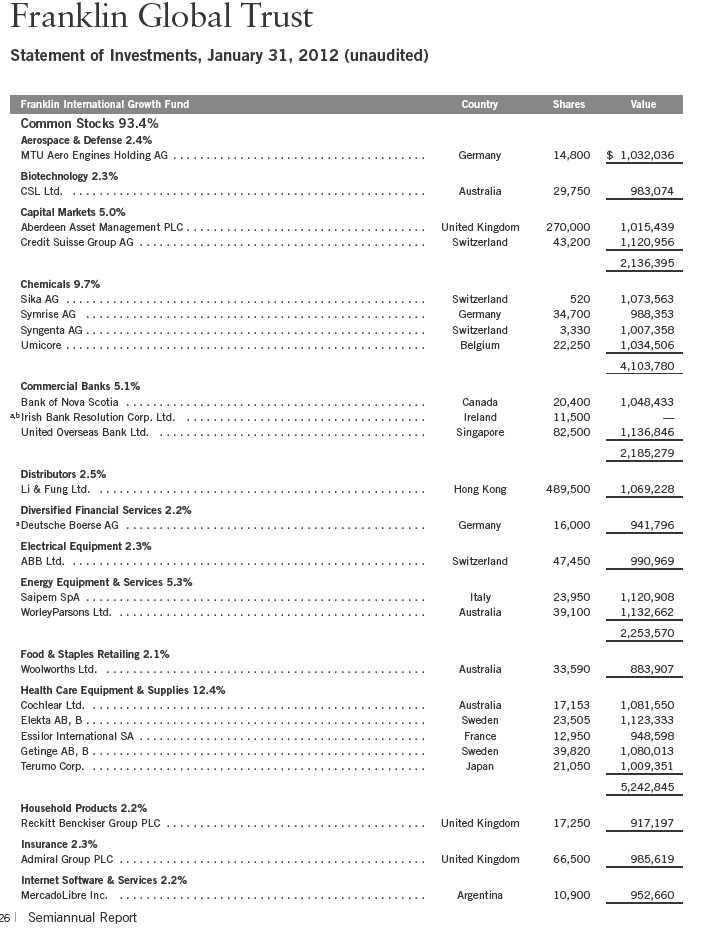

16 | Semiannual Report

Semiannual Report | 17

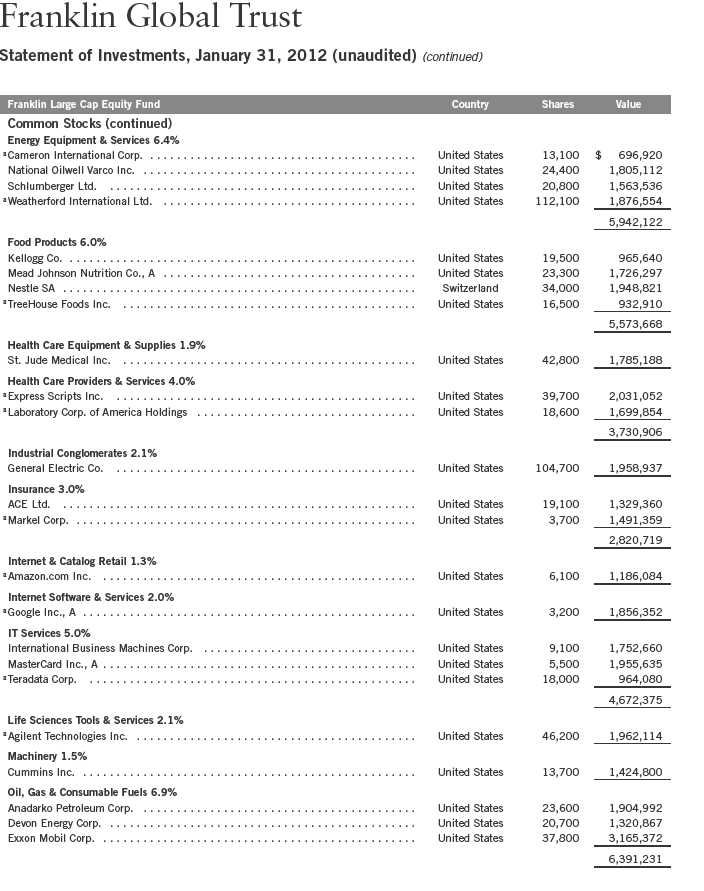

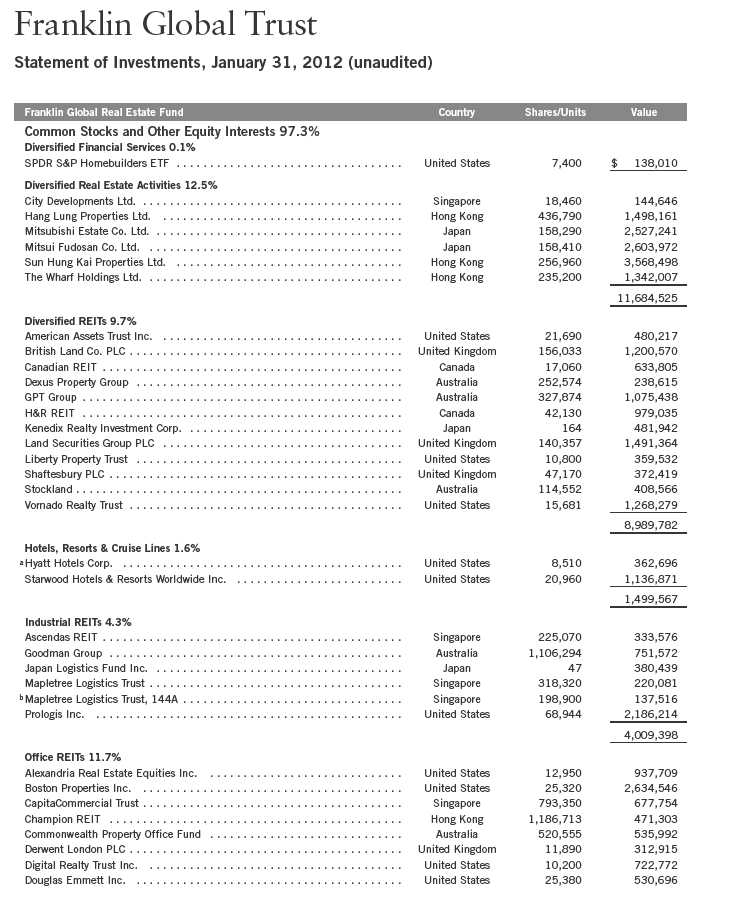

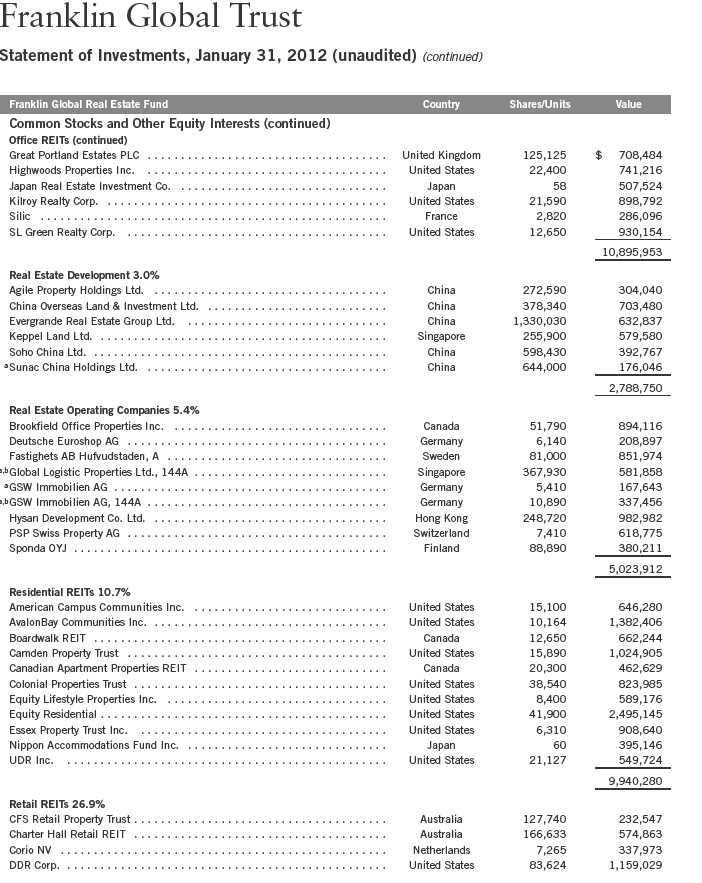

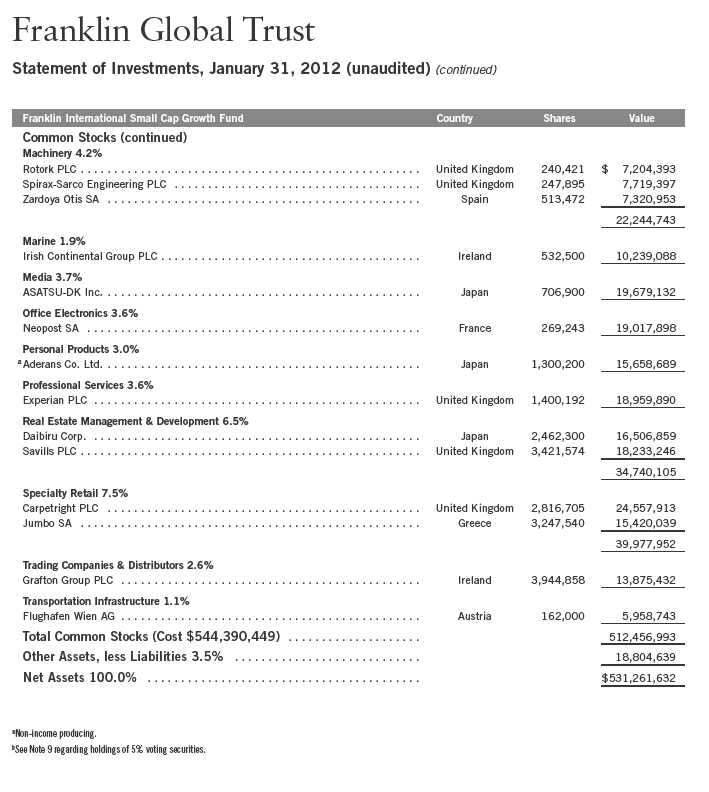

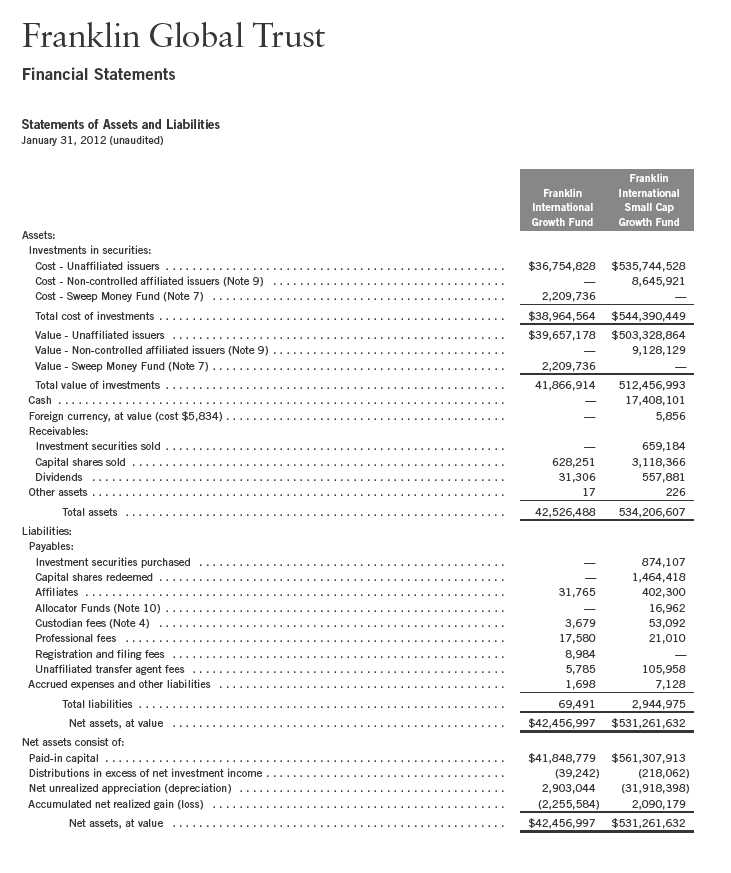

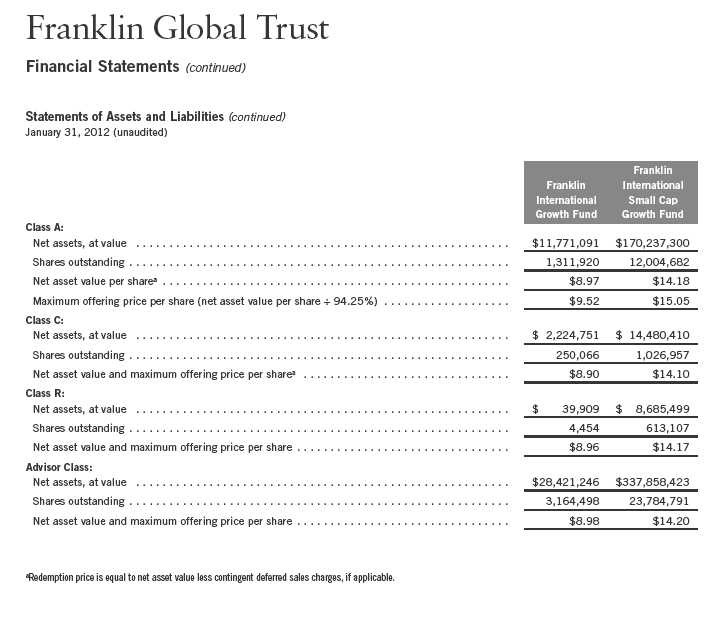

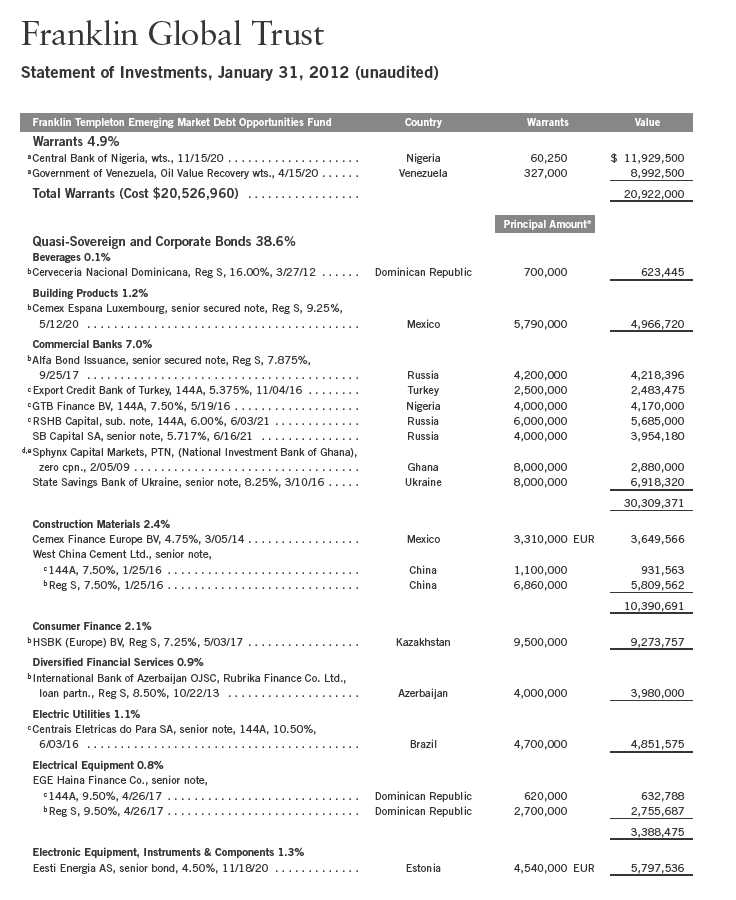

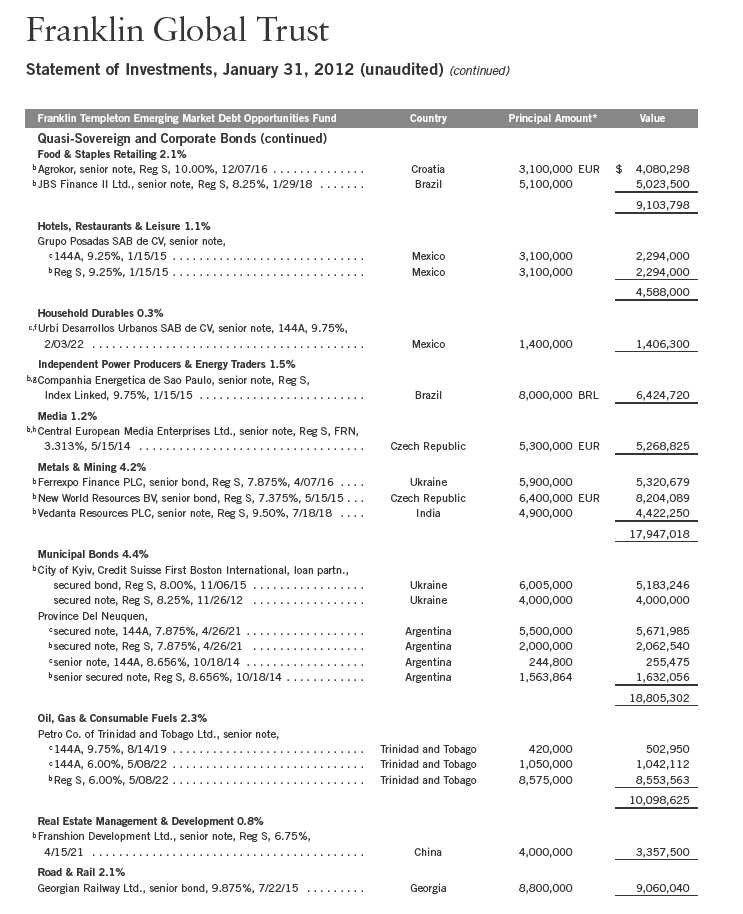

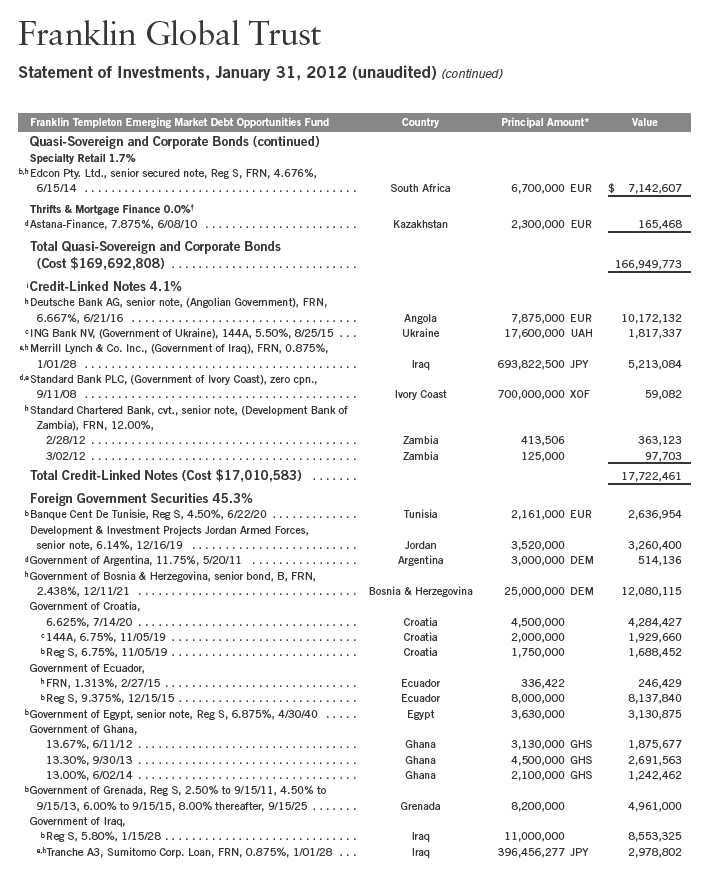

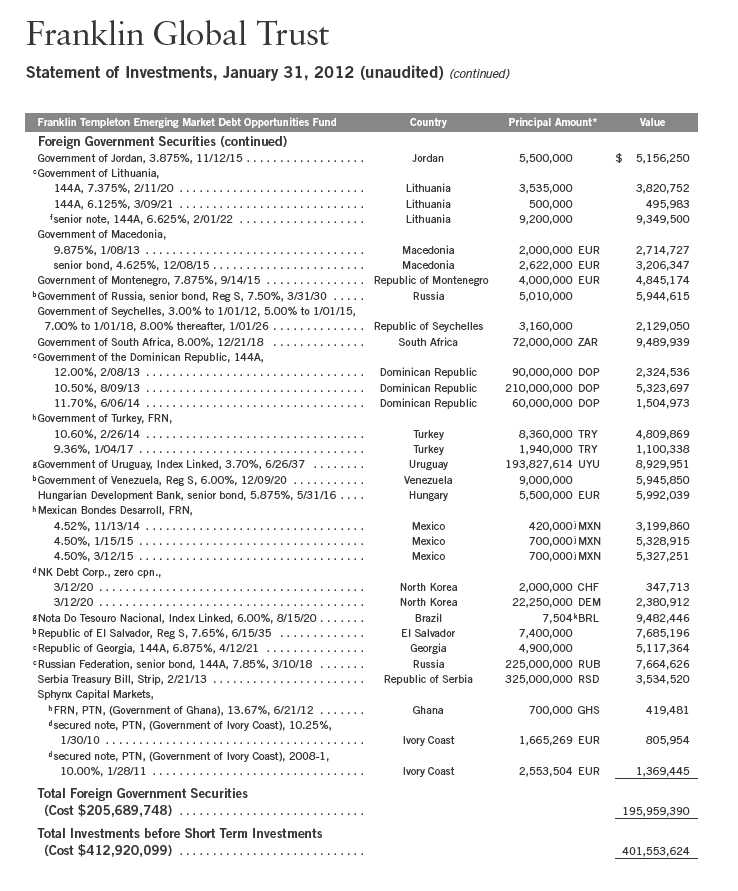

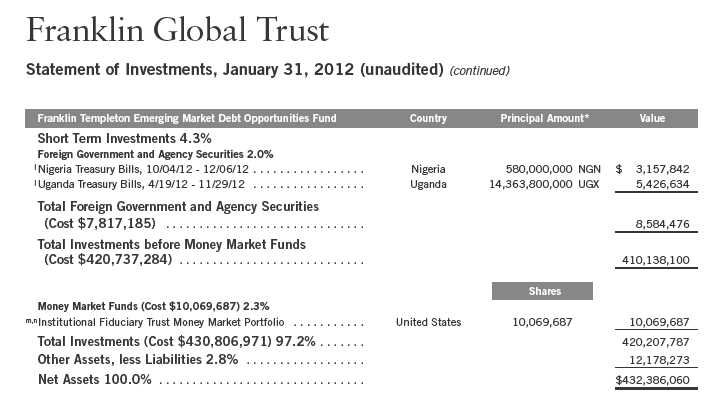

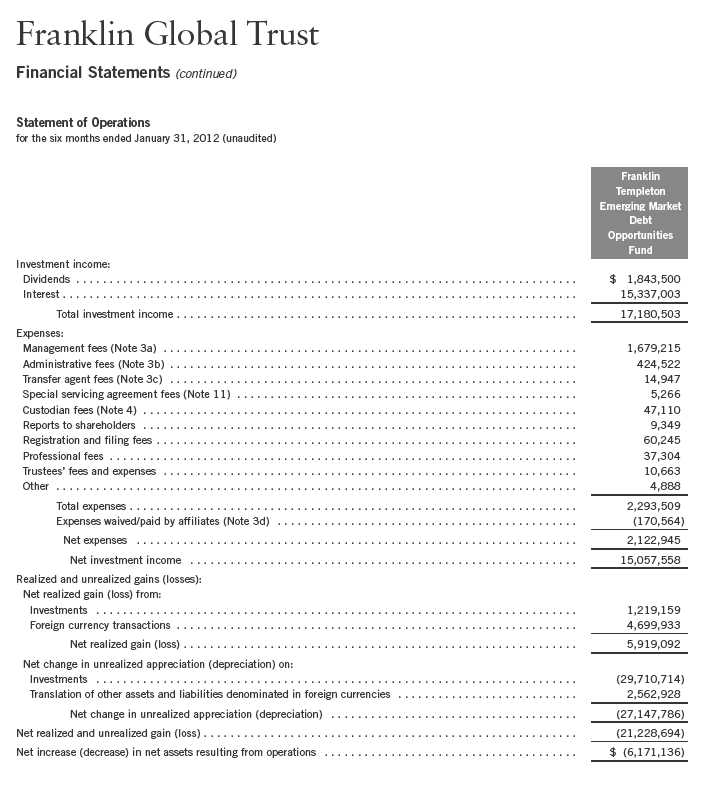

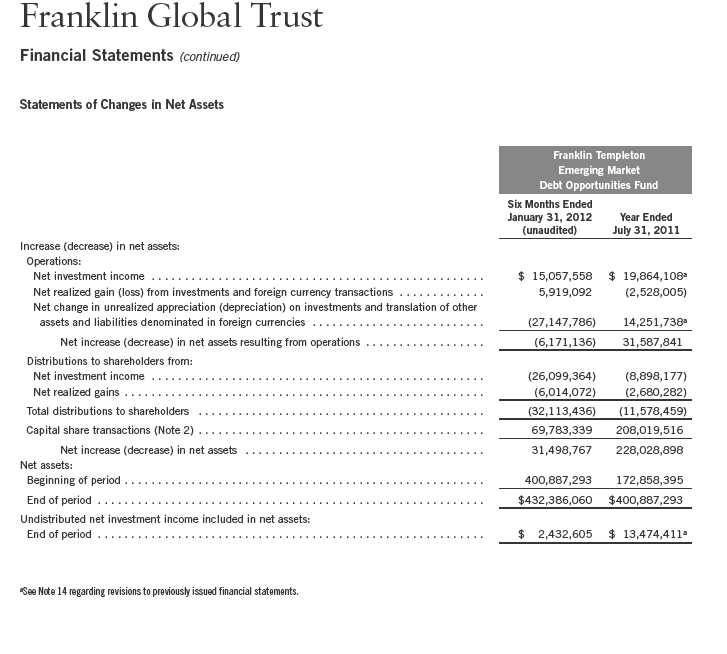

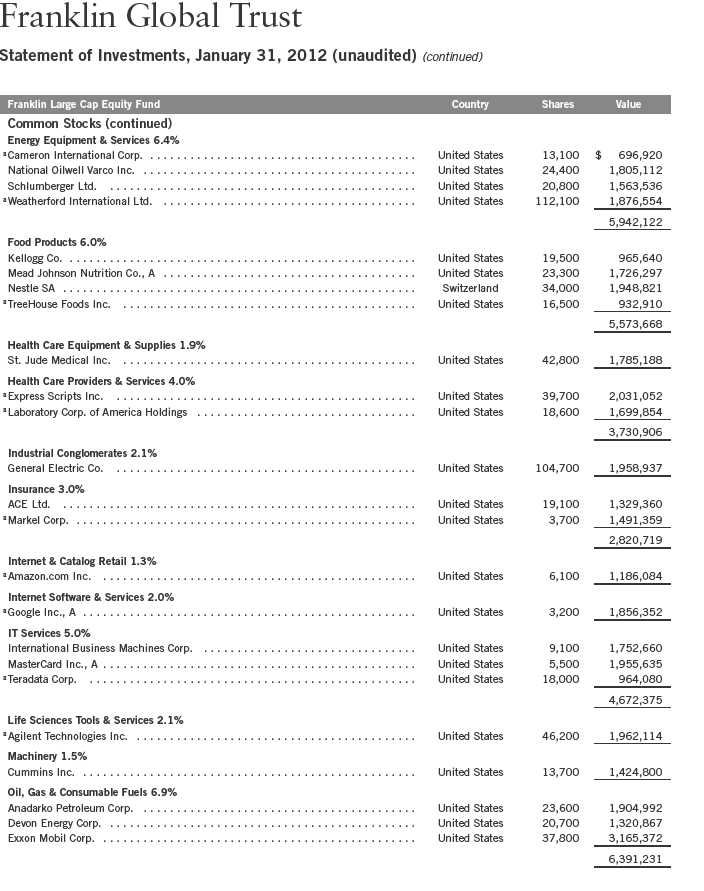

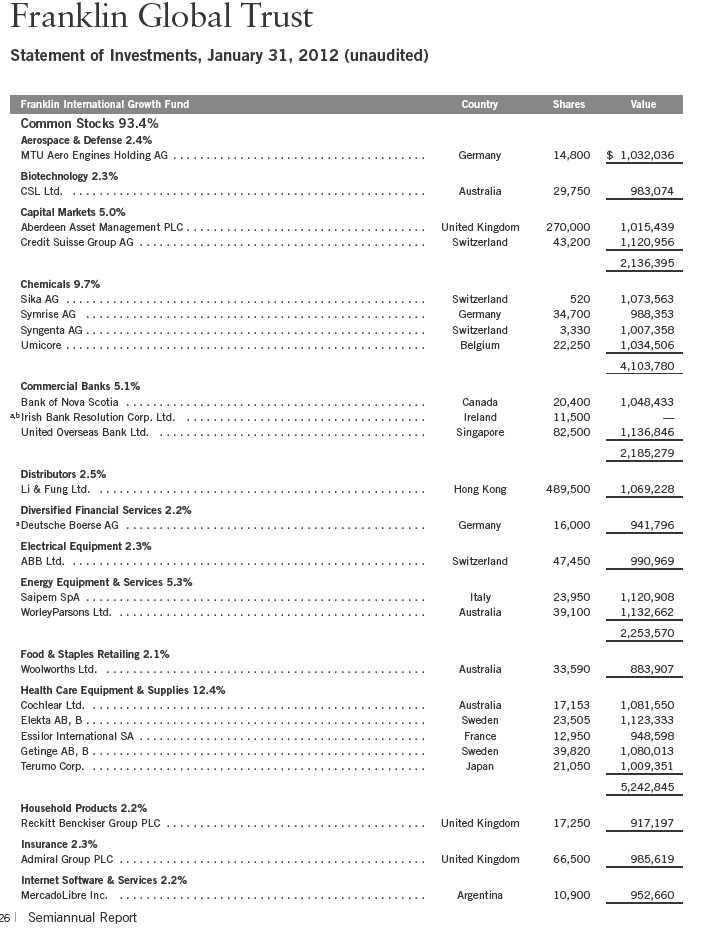

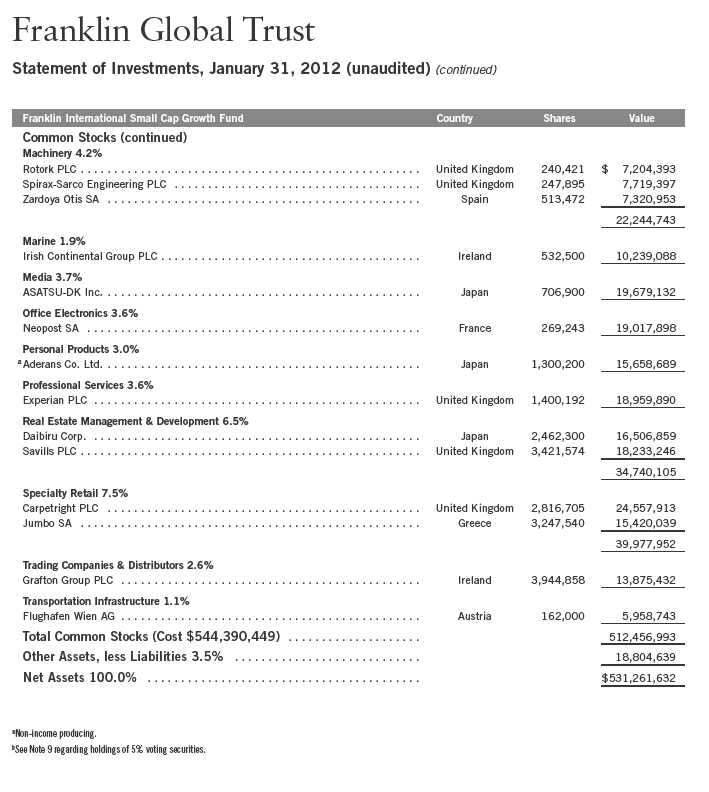

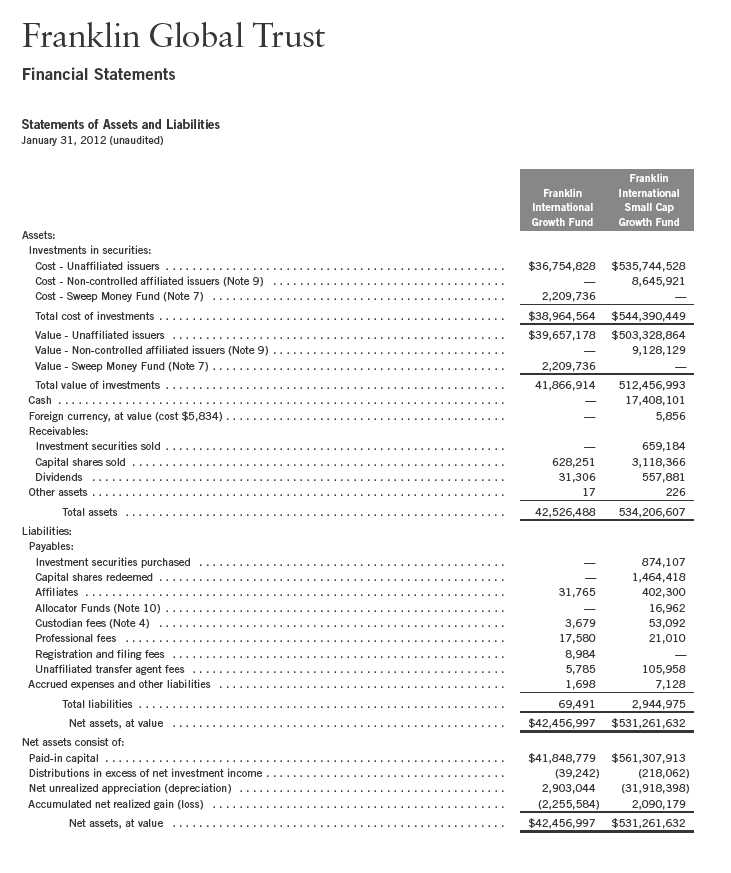

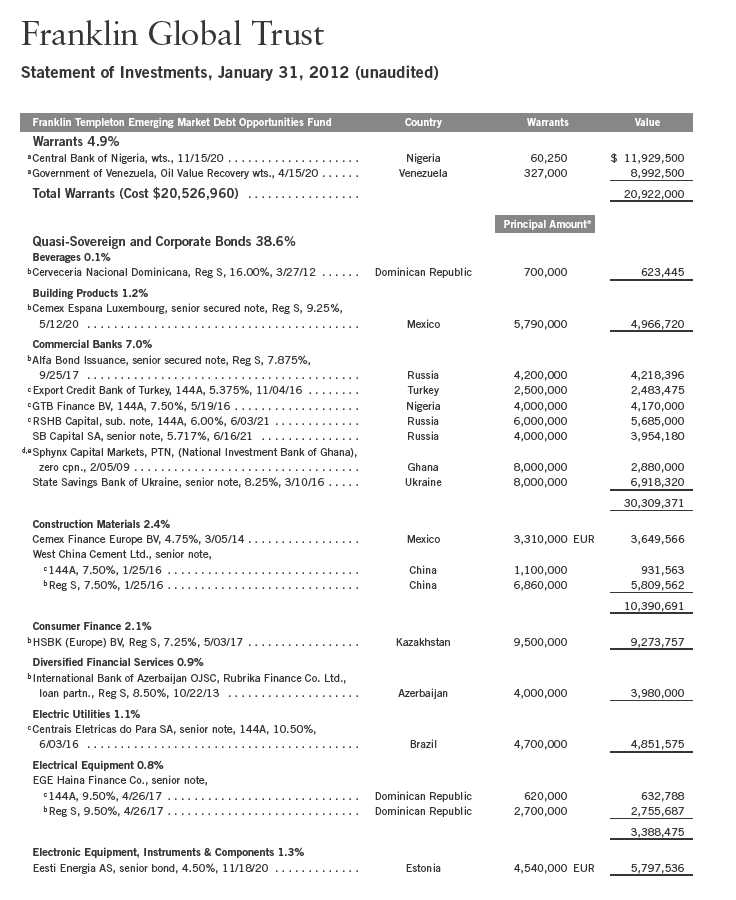

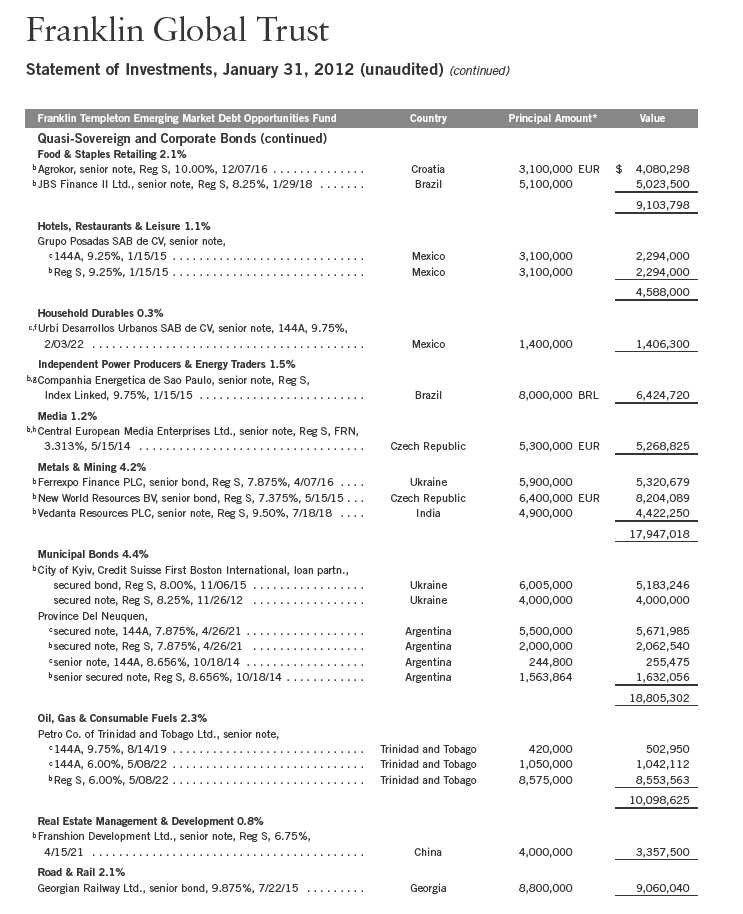

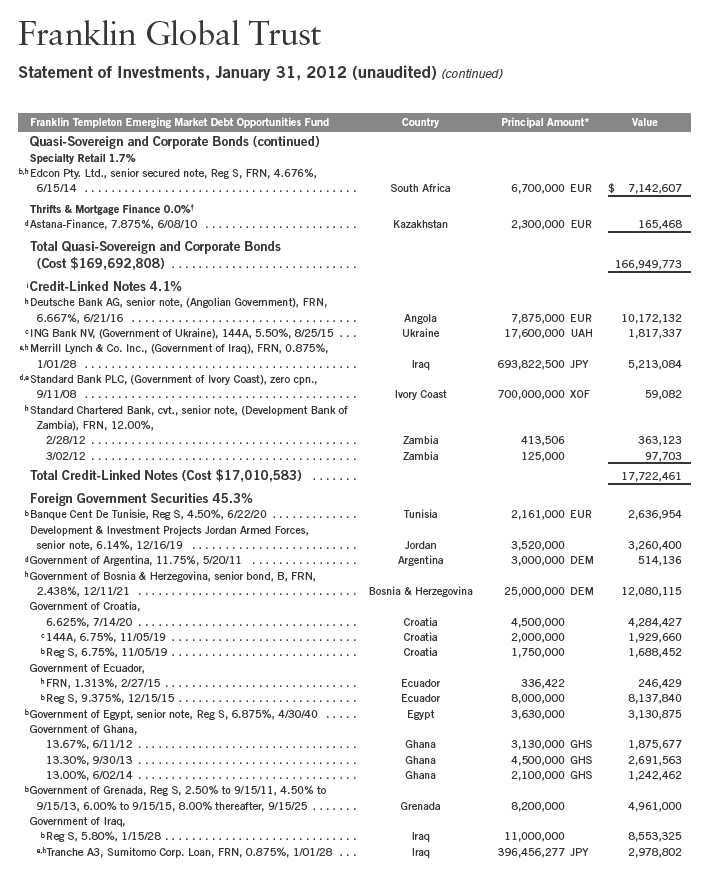

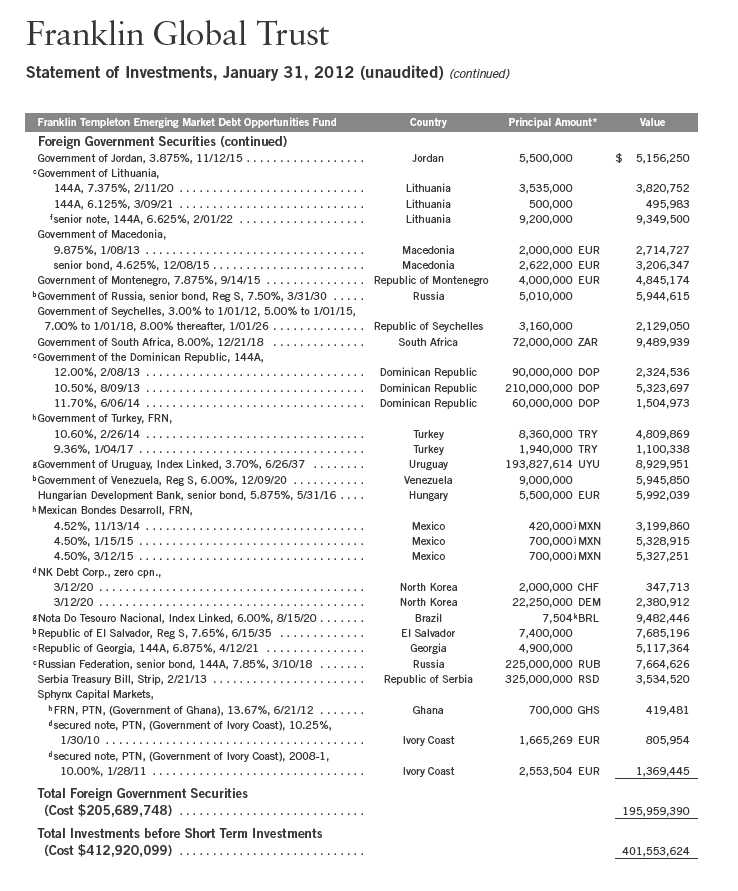

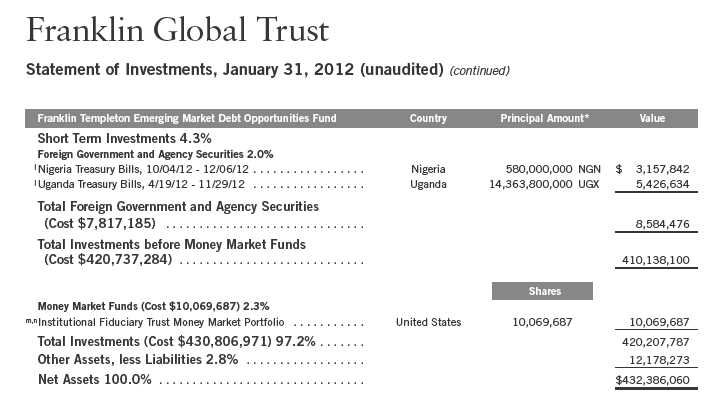

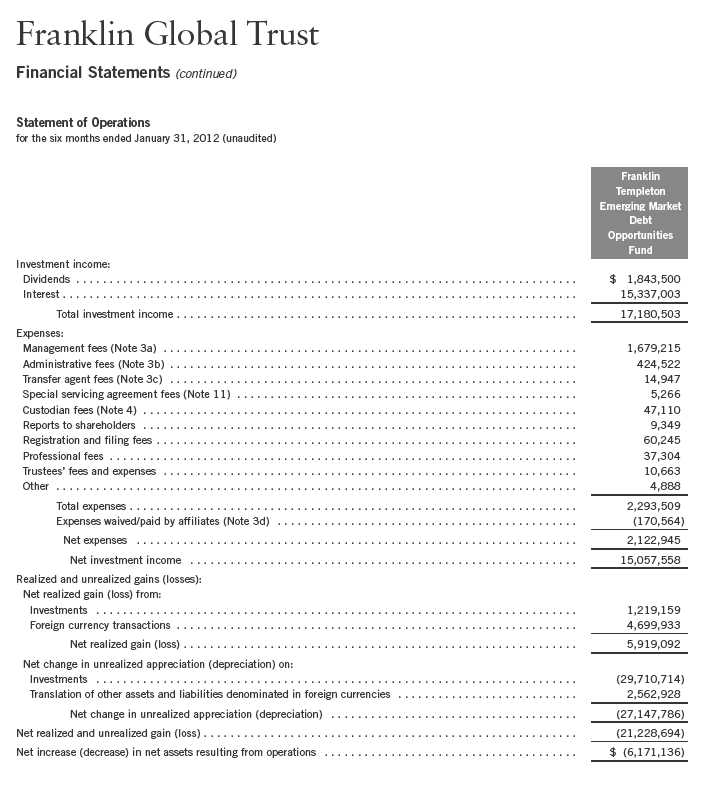

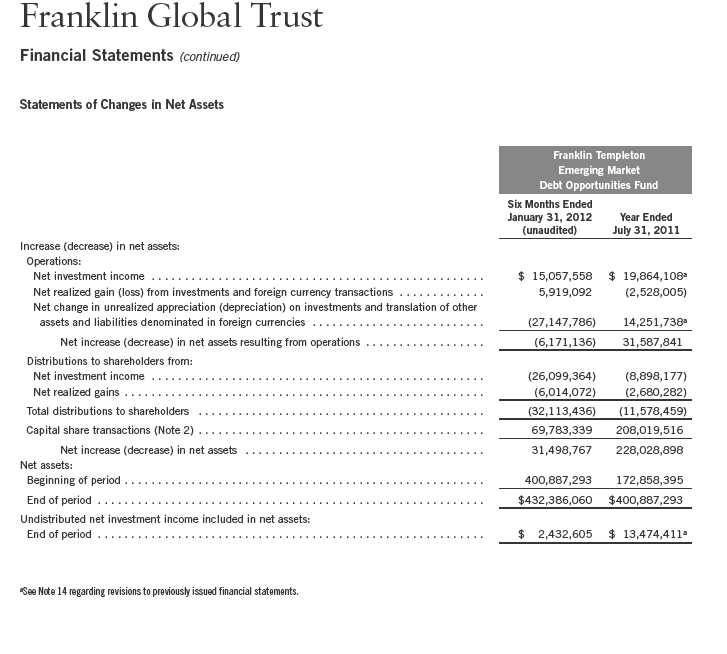

Franklin Global Trust

Statement of Investments, January 31, 2012 (unaudited) (continued)

See Abbreviations on page 32.

aNon-income producing.

bSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States.

Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption

from registration. This security has been deemed liquid under guidelines approved by the Trust’s Board of Trustees.

cSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio.

18 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 19

20 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited)

Franklin Large Cap Equity Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

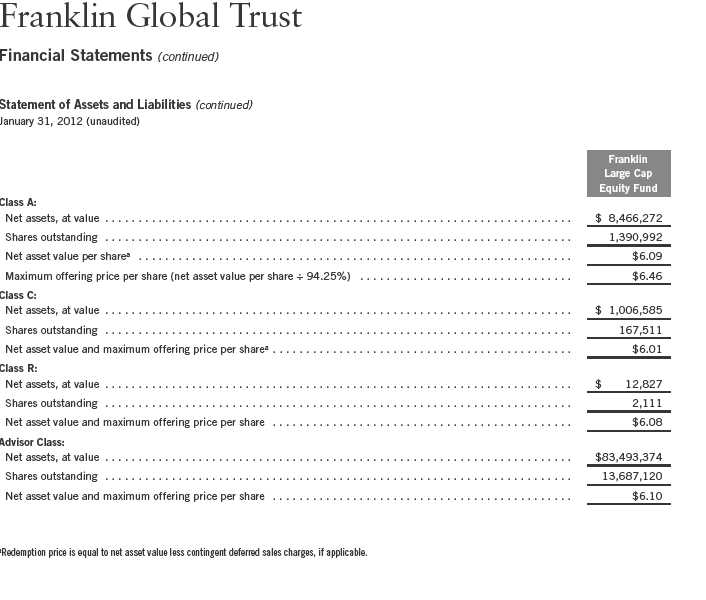

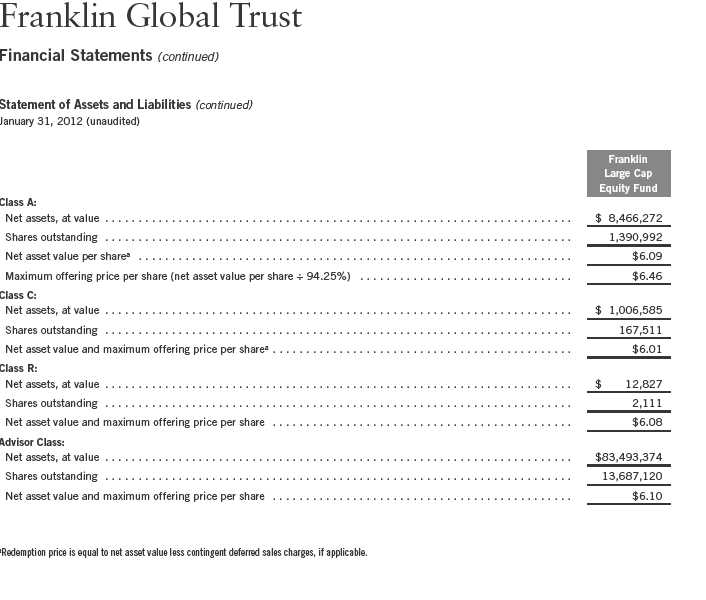

Franklin Global Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of five separate funds. The Franklin Large Cap Equity Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers four classes of shares: Class A, Class C, Class R, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

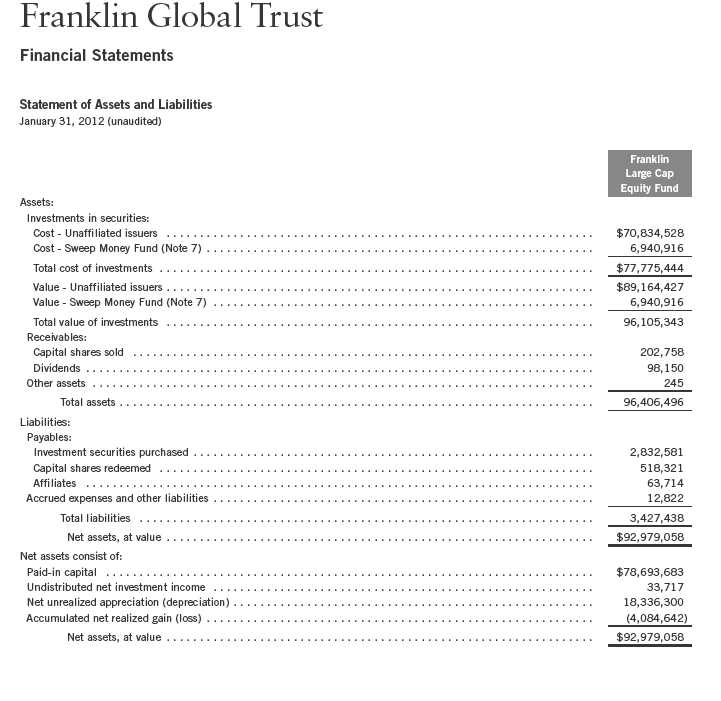

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Semiannual Report | 23

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

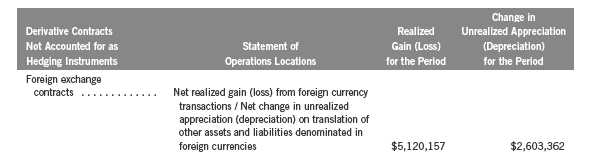

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

24 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Income Taxes |

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of January 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Semiannual Report | 25

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

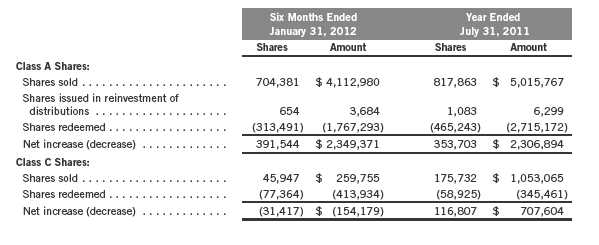

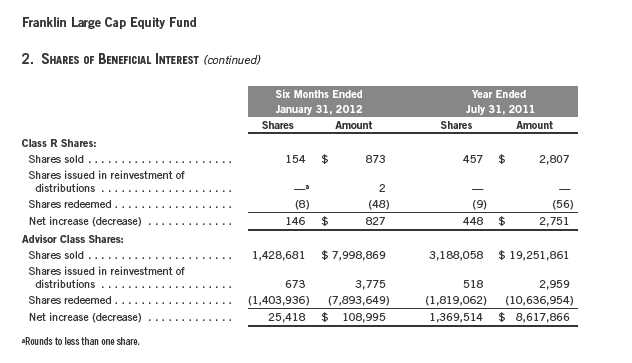

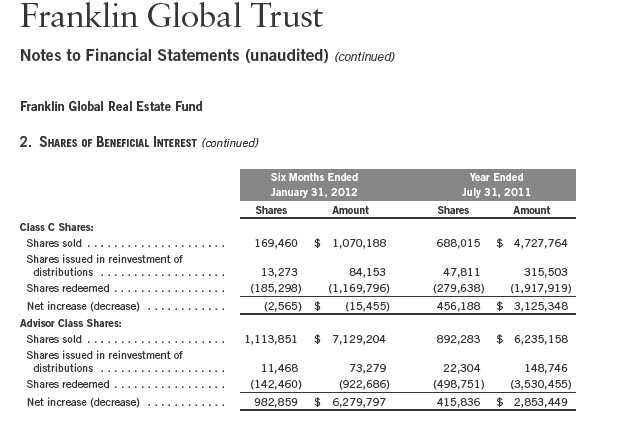

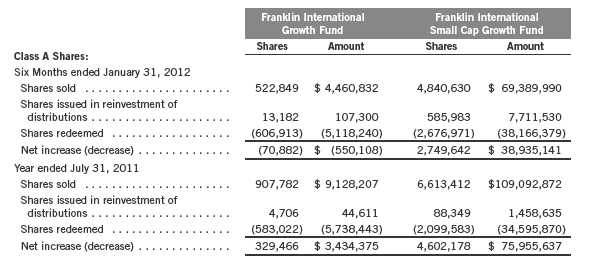

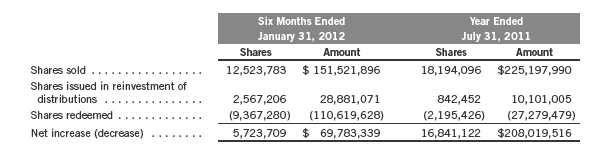

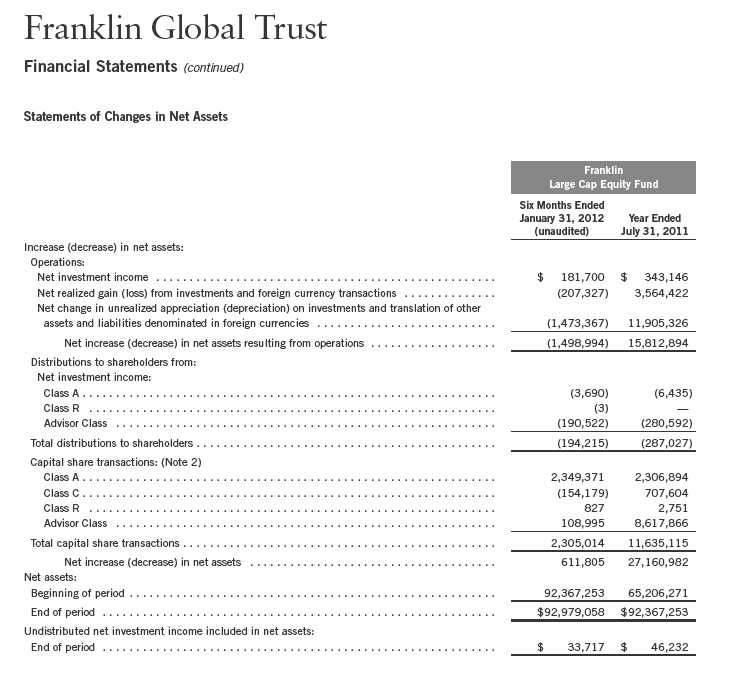

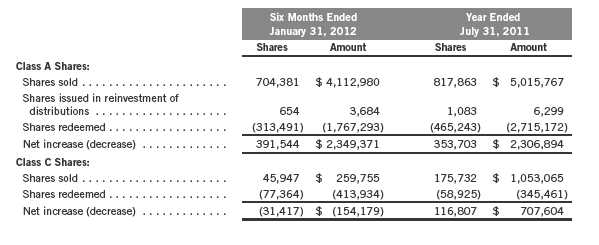

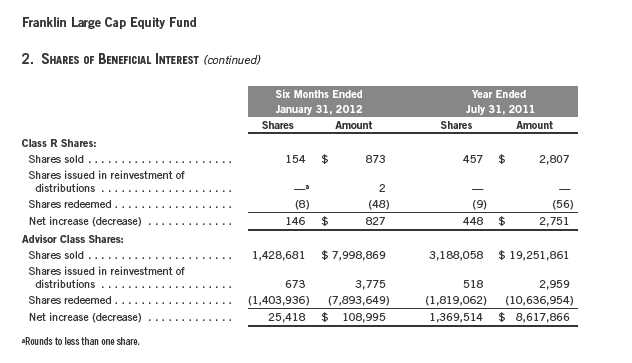

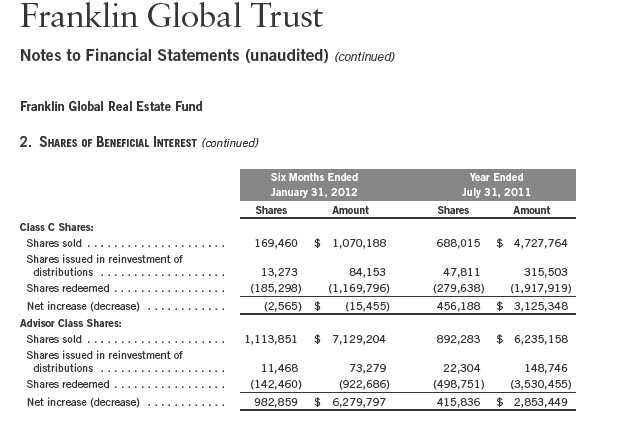

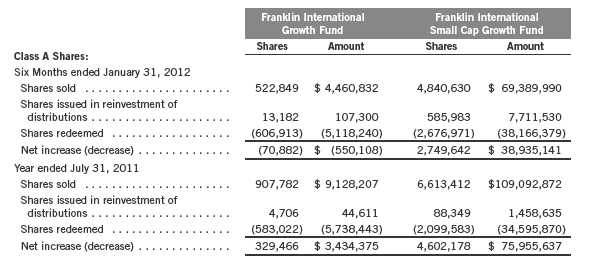

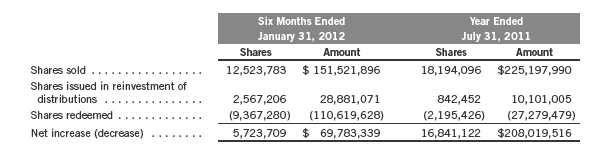

2. SHARES OF BENEFICIAL INTEREST

At January 31, 2012, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

26 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| |

| Subsidiary | Affiliation |

| Fiduciary International, Inc. (Fiduciary) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to Fiduciary based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.750 | % | Up to and including $500 million |

| 0.650 | % | Over $500 million, up to and including $1 billion |

| 0.600 | % | Over $1 billion, up to and including $1.5 billion |

| 0.550 | % | Over $1.5 billion, up to and including $6.5 billion |

| 0.530 | % | Over $6.5 billion, up to and including $11.5 billion |

| 0.500 | % | In excess of $11.5 billion |

Semiannual Report | 27

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| b. | Administrative Fees |

The Fund pays an administrative fee to FT Services of 0.20% per year of the average daily net assets of the Fund.

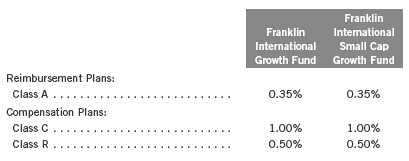

c. Distribution Fees

The Trust’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class C and R compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

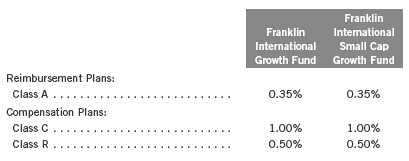

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

| | |

| Reimbursement Plan: | | |

| Class A | 0.35 | % |

| Compensation Plans: | | |

| Class C | 1.00 | % |

| Class R | 0.50 | % |

The Board of Trustees has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

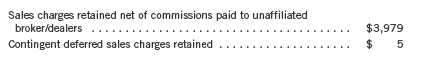

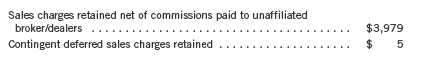

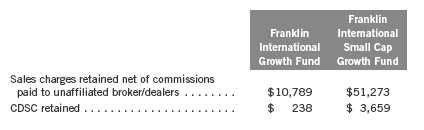

d. Sales Charges/Underwriting Agreements

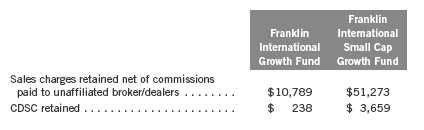

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

28 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| e. | Transfer Agent Fees |

For the period ended January 31, 2012, the Fund paid transfer agent fees of $9,107, of which $6,321 was retained by Investor Services.

f. Waiver and Expense Reimbursements

FT Services has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Fund so that the common expenses (i.e. a combination of management fees, administrative fees, and other expenses, but excluding distribution fees, and acquired fund fees and expenses) for each class of the Fund do not exceed 0.95% (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until November 30, 2012.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended January 31, 2012, there were no credits earned.

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At July 31, 2011, the Fund had capital loss carryforwards of $3,861,459 expiring in 2018.

Under the Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous law. Any post-enactment capital losses generated will be required to be utilized prior to the losses incurred in pre-enactment tax years.

For tax purposes, realized currency losses occurring subsequent to October 31 may be deferred and treated as occurring on the first day of the following fiscal year. At July 31, 2011, the Fund deferred realized currency losses of $15,856.

Semiannual Report | 29

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

5. INCOME TAXES (continued)

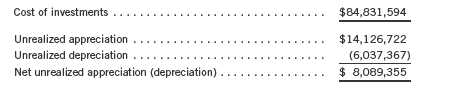

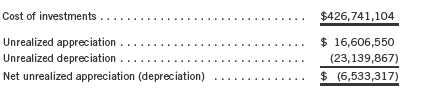

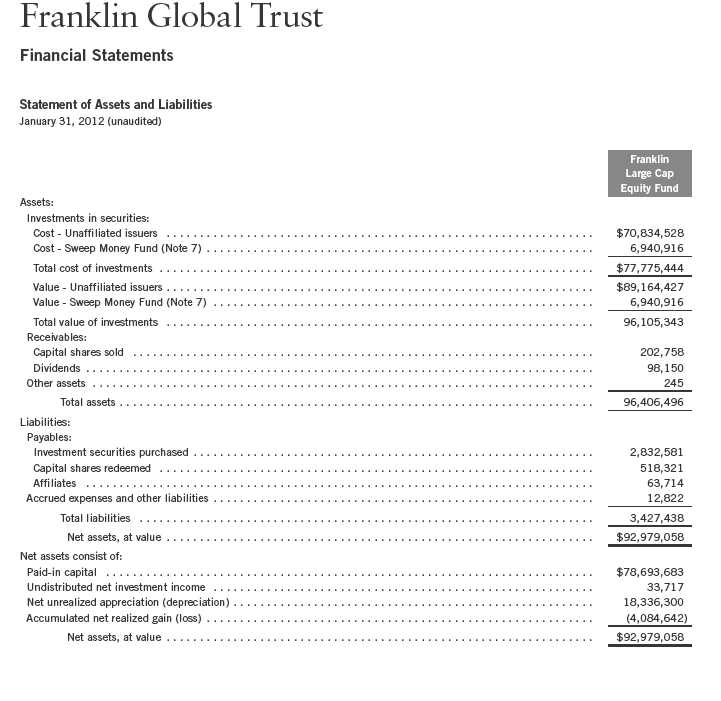

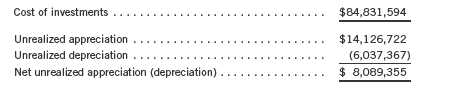

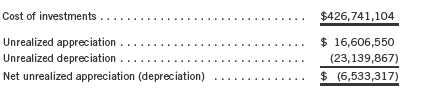

At January 31, 2012, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| | | |

| Cost of investments | $ | 77,775,444 | |

| |

| Unrealized appreciation | $ | 20,186,287 | |

| Unrealized depreciation | | (1,856,388 | ) |

| Net unrealized appreciation (depreciation) | $ | 18,329,899 | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of foreign currency transactions and pass-through entity income.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended January 31, 2012, aggregated $10,868,393 and $9,668,481, respectively.

7. INVESTMENTS IN INSTITUTIONAL FIDUCIARY TRUST MONEY MARKET PORTFOLIO

The Fund invests in the Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an open-end investment company managed by Franklin Advisers, Inc. (an affiliate of the investment manager). Management fees paid by the Fund are reduced on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid by the Sweep Money Fund.

8. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18, 2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit

30 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

8. CREDIT FACILITY (continued)

Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended January 31, 2012, the Fund did not use the Global Credit Facility.

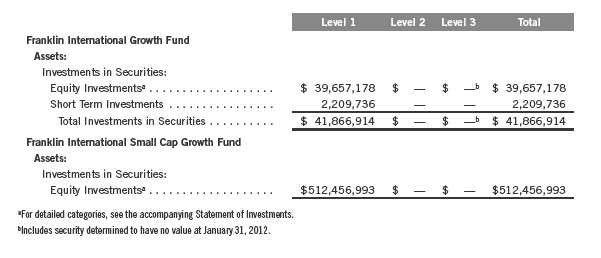

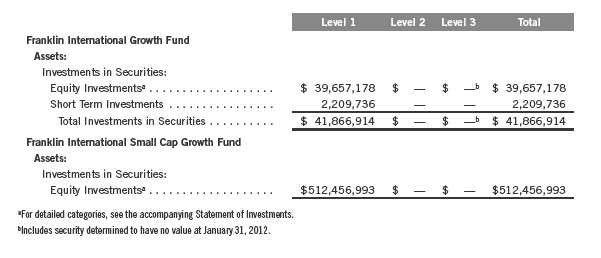

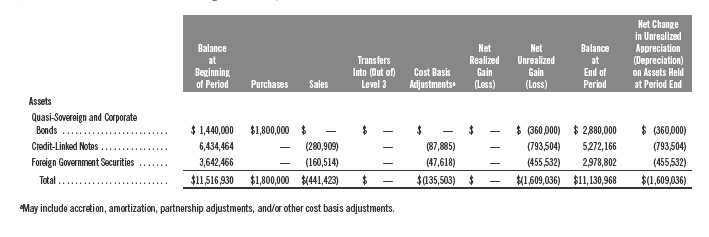

9. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At January 31, 2012, all of the Fund’s investments in securities carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

10. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Fund believes the adoption of this ASU will not have a material impact on its financial statements.

Semiannual Report | 31

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Large Cap Equity Fund

11. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

ADR - American Depositary Receipt

GDR - Global Depositary Receipt

32 | Semiannual Report

Franklin Global Trust

Shareholder Information

Franklin Large Cap Equity Fund

Proxy Voting Policies and Procedures

The Trust’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Trust’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Semiannual Report | 33

This page intentionally left blank.

1

Semiannual Report

Franklin Global Real Estate Fund

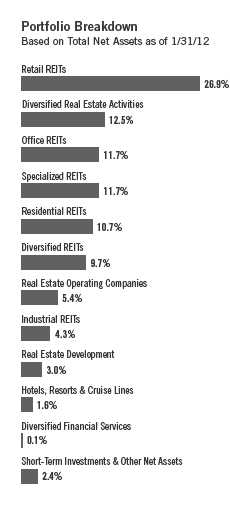

Your Fund’s Goal and Main Investments: Franklin Global Real Estate Fund seeks high total return. Under normal market conditions, the Fund invests at least 80% of its net assets in securities of companies located anywhere in the world that operate in the real estate sector, including mainly real estate investment trusts (REITs) and REIT-like entities.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Global Real Estate Fund covers the period ended January 31, 2012.

Performance Overview

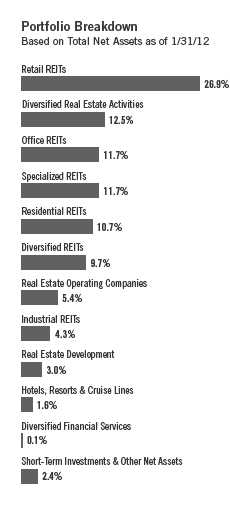

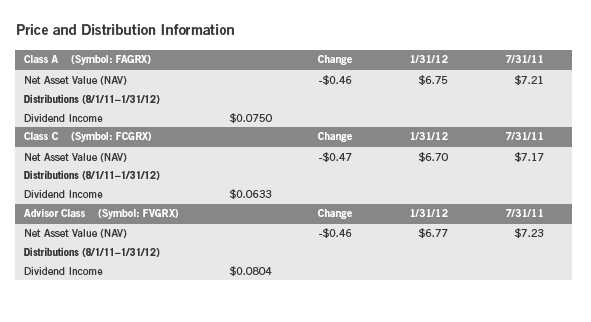

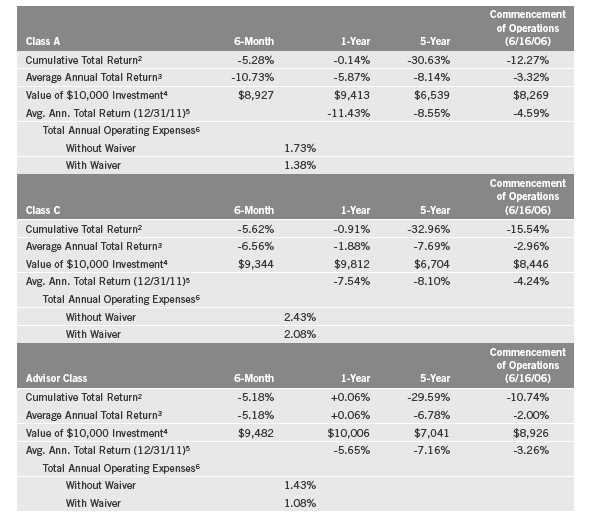

Franklin Global Real Estate Fund – Class A had a -5.28% cumulative total return for the six months under review. The Fund performed comparably to the -5.02% total return of its benchmark, the FTSE® EPRA/NAREIT Developed Index, which measures global real estate markets in North America, Europe and Asia.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 8.

Economic and Market Overview

The U.S. economy improved during the six months ended January 31, 2012, despite geopolitical, fiscal, employment and housing pressures. In contrast,

1. REITs are real estate investment trust companies, usually with publicly traded stock, that manage a portfolio of income-producing real estate properties such as apartments, hotels, industrial properties, office buildings or shopping centers. The Fund predominantly invests in “equity” REITs, which also take ownership positions in real estate. Shareholders of equity REITs generally receive income from rents received and receive capital gains when properties are sold at a profit. REITs are generally operated by experienced property management teams and typically concentrate on a specific geographic region or property type.

2. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. FTSE® is a trademark of London Stock Exchange Plc and the Financial Times Limited. The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 16.

Semiannual Report | 3

growth outside the U.S. generally slowed, which some attributed to the effects of Japan’s earthquake and Thailand’s flooding on the global supply chain, pop-ulist uprisings across the oil-and-gas-producing regions of the Middle East and North Africa, and the eurozone sovereign debt crisis. Although U.S. manufacturing growth slowed in the first half of the period as high commodity prices reduced purchasing power and demand ebbed, the trend began to reverse near period-end. The U.S. manufacturing sector helped power the domestic economy and, along with India, led global manufacturing growth at period-end. European and Asian manufacturing, however, generally weakened through most of the six-month reporting period before stabilizing at period-end.

The U.S. financial system and household balance sheets continued to improve, but the country still faced persistently high unemployment, a prolonged housing market slump and massive national debt. Inflation rose across much of the world but stayed relatively contained in the U.S. The Federal Reserve Board (Fed) sought to boost economic growth by implementing its new bond-buying program, dubbed “Operation Twist” by commentators, which is intended to further lower long-term bond yields. The Fed also anticipated it would keep the federal funds target rate at 0% to 0.25% at least through late 2014. Outside the U.S., European policymakers stepped up their response to their sovereign debt and banking crisis. The European Central Bank cut short-term interest rates and expanded bank lending facilities, and six key global central banks agreed to lower dollar funding costs for Europe’s distressed commercial banks. Chinese policymakers lowered commercial bank reserve requirements and the International Monetary Fund revamped its credit line and eased its lending terms.

Worrisome global events and slowing global growth dampened investor sentiment and market volatility surged. Through most of the period, risk-averse investors sought perceived safe havens and seemed to ignore that many companies generated record profits. As 2012 began, better-than-expected U.S. economic reports renewed many investors’ risk appetite. Despite large swings, U.S. stocks as measured by the Standard & Poor’s® 500 Index gained 2.71% for the six months ended January 31, 2012.3 The Dow Jones Industrial Average rose 5.52%, reflecting investors’ general preference for large, established U.S. companies.3 In contrast, developed and emerging world stocks as measured by the MSCI All Country World Index fell 4.58%.3 Amid general global market declines, U.S. Treasuries and perceived safe-haven currencies such as the U.S. dollar and Japanese yen delivered solid returns.

3. Source: © 2012 Morningstar. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product.

4 | Semiannual Report

Global Real Estate Market Overview

Most global real estate markets declined during the reporting period, especially across Europe due to concerns about the European sovereign debt crisis and fears of a Greek sovereign debt default. Real estate markets in Asia were hurt by concerns about rising inflation and a possible Chinese economic slowdown. According to the FTSE EPRA/NAREIT Developed Index, in U.S. dollar terms, Australia, the U.S., New Zealand and Canada posted modest gains, while all other countries had declines.

Investment Strategy

We are research-driven, fundamental investors. We seek to limit price volatility by investing across markets and property types. We also seek to provide a consistently high level of income. We center our active investment strategy on the belief that unsynchronized regional economic activity within the global economy can provide consistent, attractive return opportunities in the global real estate markets. We use a bottom-up, value-oriented stock selection process that incorporates macro-level views in the evaluation process. We use top-down macro overlays to provide country/regional, property type, and company size perspectives in identifying international/local cyclical and thematic trends that highlight investment opportunities. We may use currency forward contracts from time to time to help manage currency risk and the Fund’s exposure to various currencies.

Manager’s Discussion

During the six months under review, major contributors to Fund performance relative to the FTSE EPRA/NAREIT Developed Index included positions in U.S.-based shopping mall operators Taubman Centers and Simon Property Group, along with U.S.-based office space REIT Kilroy Realty. Shares of luxury mall owner Taubman Centers and the largest U.S. shopping mall owner, Simon Property Group, rose sharply during the period as sales for tenant stores at better quality shopping centers held up well despite slow U.S. economic growth earlier in the period. As a result of the strong performances, management at Taubman Centers and Simon Property Group raised their guidance in October for funds from operation (FFO) in 2011. FFO per share, calculated primarily by adding back depreciation and amortization expenses to earnings, is used as a barometer of performance by REITs instead of earnings per share, the measure used by publicly traded companies in other sectors. In the second half of the period, these REITs also benefited from robust holiday shopping revenues and signs of an improving U.S. economy.

What is a currency forward contract?

A currency forward contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency for a specific exchange rate on a future date.

Semiannual Report | 5

Kilroy Realty’s stock price surged late in the period after management reported strong third-quarter financial results in early November. Also favorable for the company were positive economic reports in the fourth quarter, such as a modest decline in the unemployment rate and a higher economic growth rate. Such improvements could indicate that demand for corporate office space would likely continue to rise, particularly due to technology sector strength in some of Kilroy’s west coast markets.

Significant detractors from relative Fund performance included Evergrande Real Estate Group, Keppel Land and CapitaCommercial Trust. Although its sales exceeded analysts’ expectations, Evergrande Real Estate Group, a diversified Chinese property company not held in the benchmark, hindered relative Fund performance largely due to investor concerns about China’s moderating economy and government limitations on real estate development and mortgage loans as well as property prices. Singapore-based Keppel Land is a diversified property company that owns many different real estate-related subsidiaries. Its share price was negatively affected by market uncertainty caused by the European sovereign debt crisis. Keppel suffered to a greater degree than more specialized real estate companies that derive most of their revenue from leases. Shares of Singapore-based office space REIT CapitaCommercial Trust fell during the period largely due to rising inflation in the region, negative news flow from western countries, especially those in Europe, concerns about slowing global economic growth and a potential oversupply in the Singapore office market.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended January 31, 2012, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s substantial investment in securities denominated in currencies with non-U.S. exposure.

6 | Semiannual Report

Thank you for your continued participation in Franklin Global Real Estate Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Global Real Estate Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of January 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | |

| Top 10 Holdings | | |

| 1/31/12 | | |

| |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Simon Property Group Inc. | 5.9 | % |

| Retail REITs, U.S. | | |

| Sun Hung Kai Properties Ltd. | 3.8 | % |

| Diversified Real Estate Activities, | | |

| Hong Kong | | |

| Unibail-Rodamco SE | 3.4 | % |

| Retail REITs, France | | |

| Westfield Group | 2.9 | % |

| Retail REITs, Australia | | |

| Boston Properties Inc. | 2.8 | % |

| Office REITs, U.S. | | |

| Mitsui Fudosan Co. Ltd. | 2.8 | % |

| | |

| Diversified Real Estate Activities, Japan | | |

| Public Storage | 2.8 | % |

| Specialized REITs, U.S. | | |

| Mitsubishi Estate Co. Ltd. | 2.7 | % |

| Diversified Real Estate Activities, Japan | | |

| Equity Residential | 2.7 | % |

| Residential REITs, U.S. | | |

| Prologis Inc. | 2.3 | % |

| Industrial REITs, U.S. | | |

Semiannual Report | 7

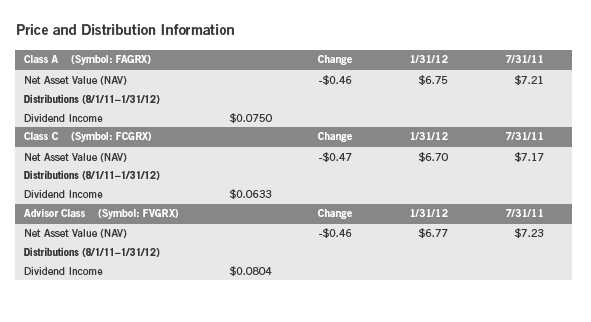

Performance Summary as of 1/31/12

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Semiannual Report

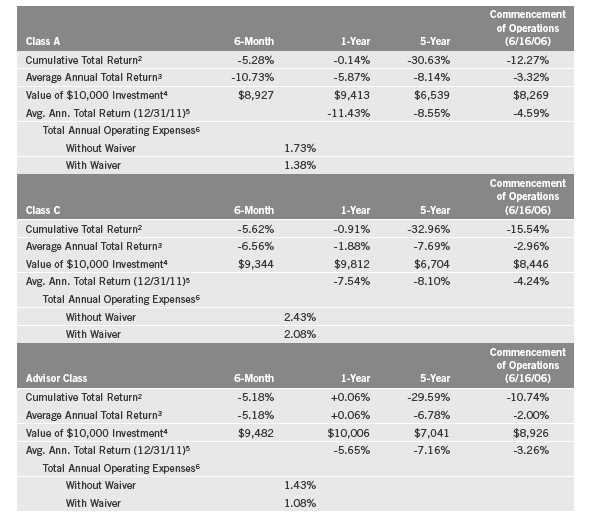

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees) for each class of the Fund do not exceed 1.08% (other than certain nonroutine expenses) until 11/30/12.

Semiannual Report | 9

1. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly,

causing total annual Fund operating expenses to become higher than the figures shown.

10 | Semiannual Report

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

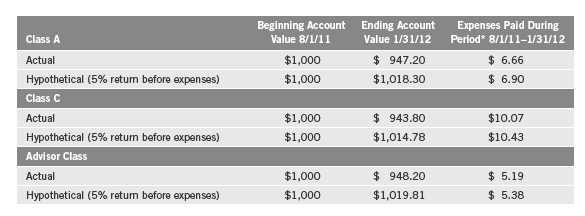

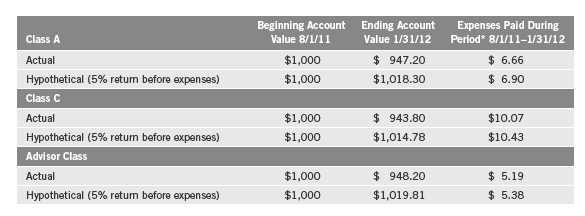

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,60 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.36%; C: 2.06%; and Advisor: 1.06%), multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

12 | Semiannual Report

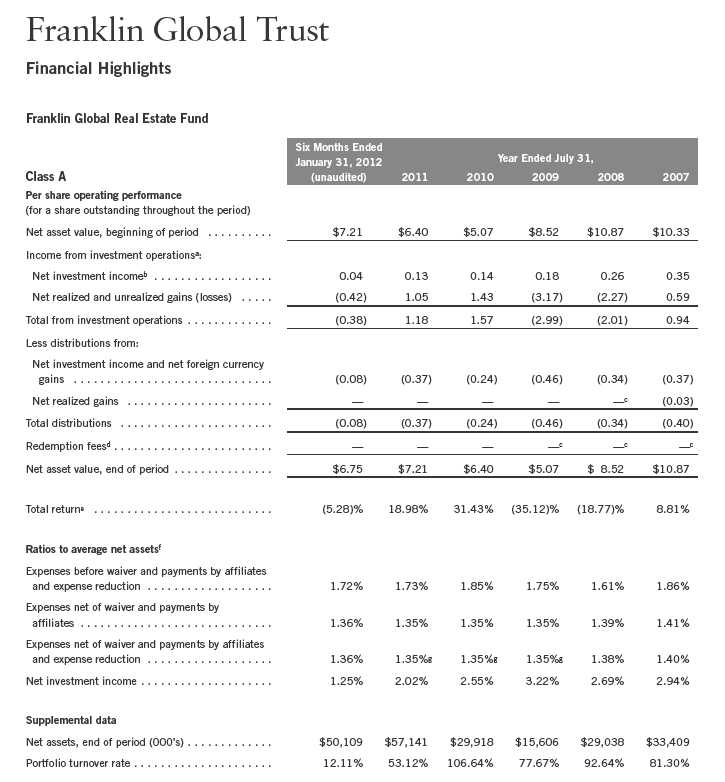

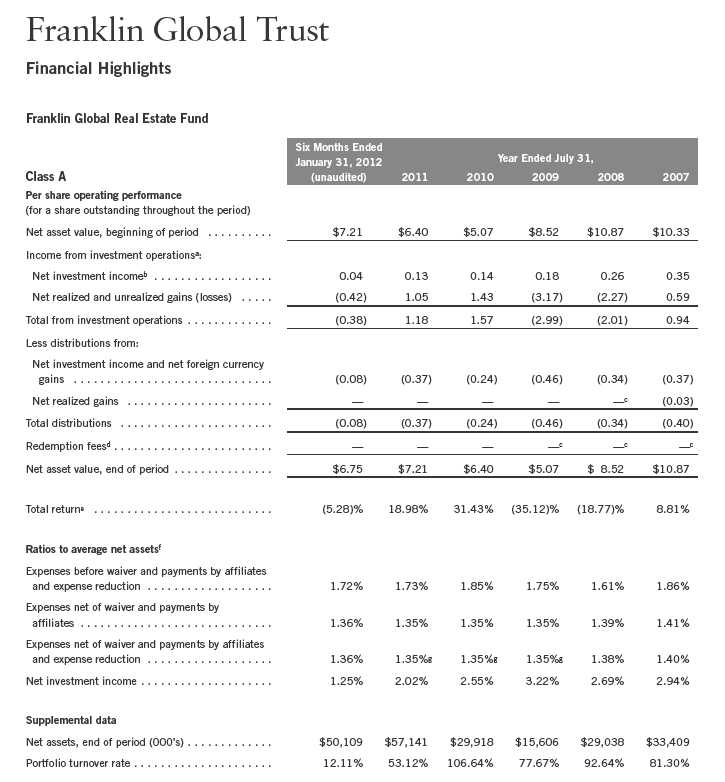

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 13

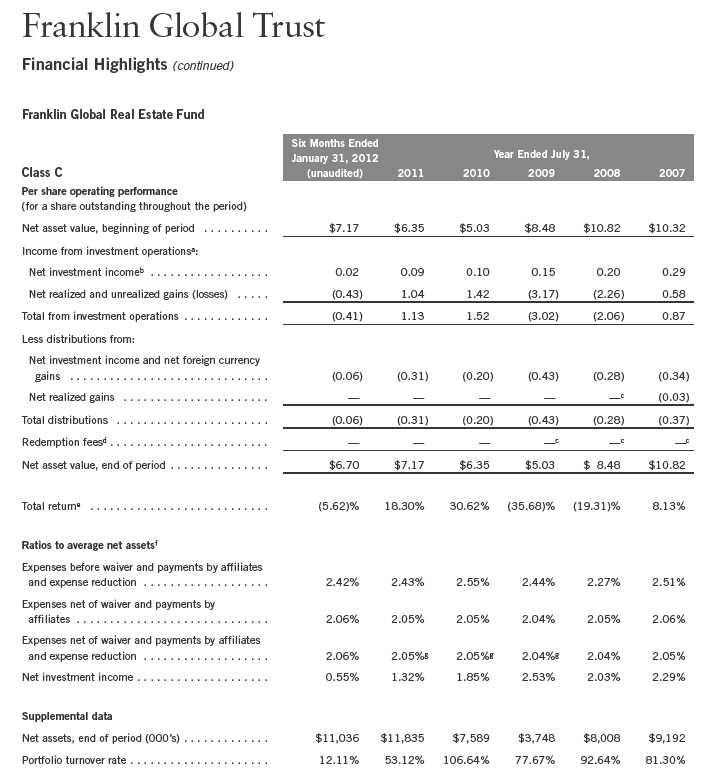

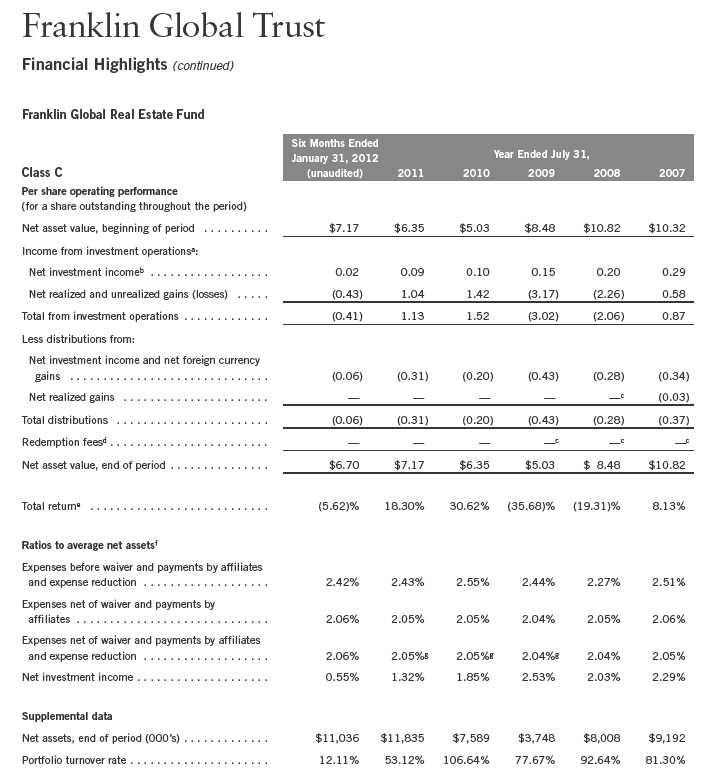

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 15

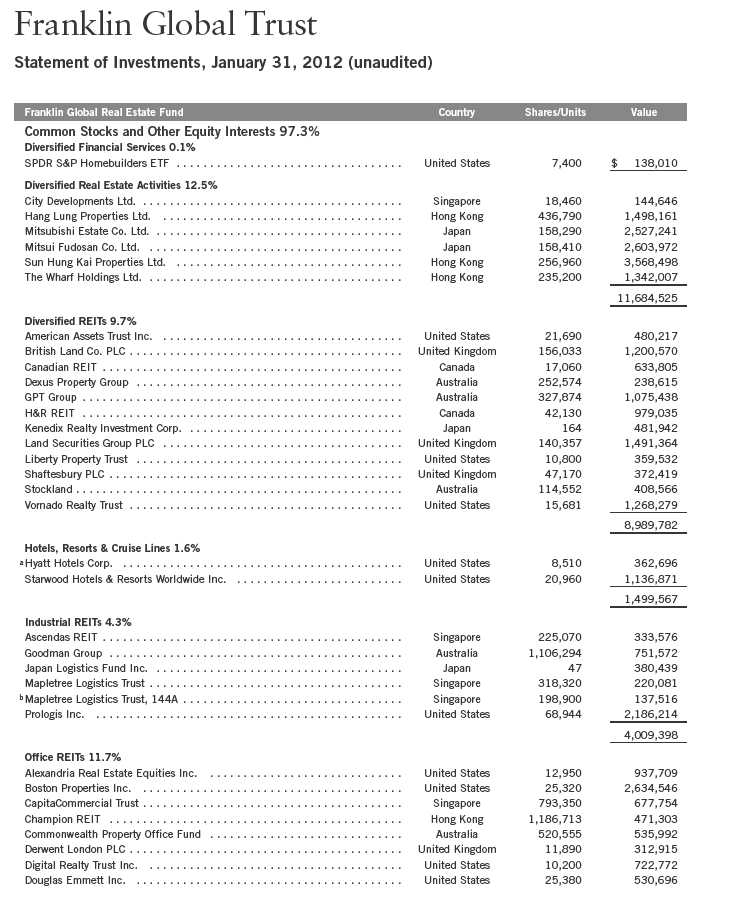

16 | Semiannual Report

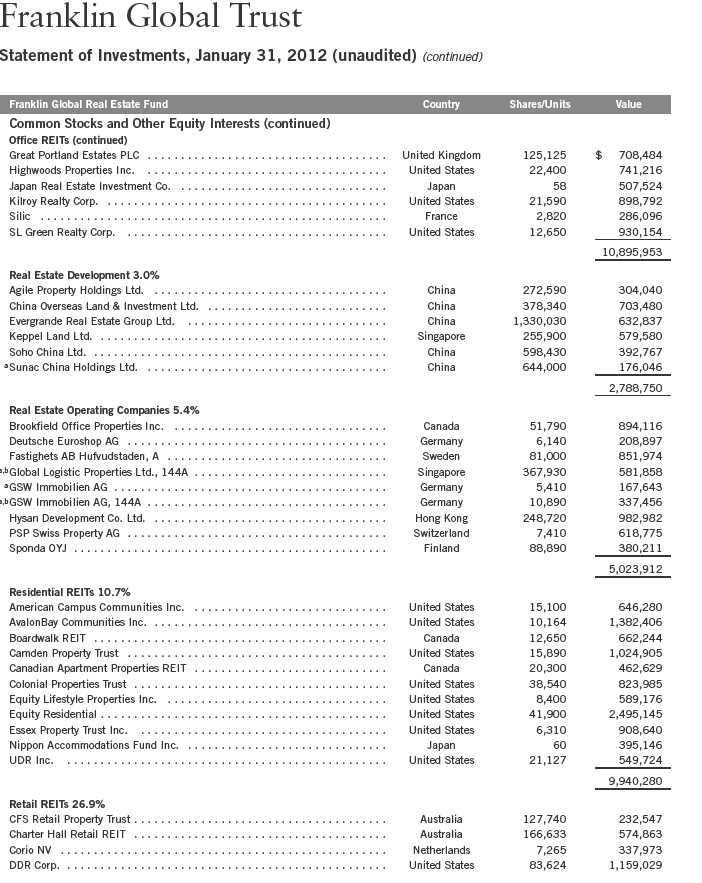

Semiannual Report | 17

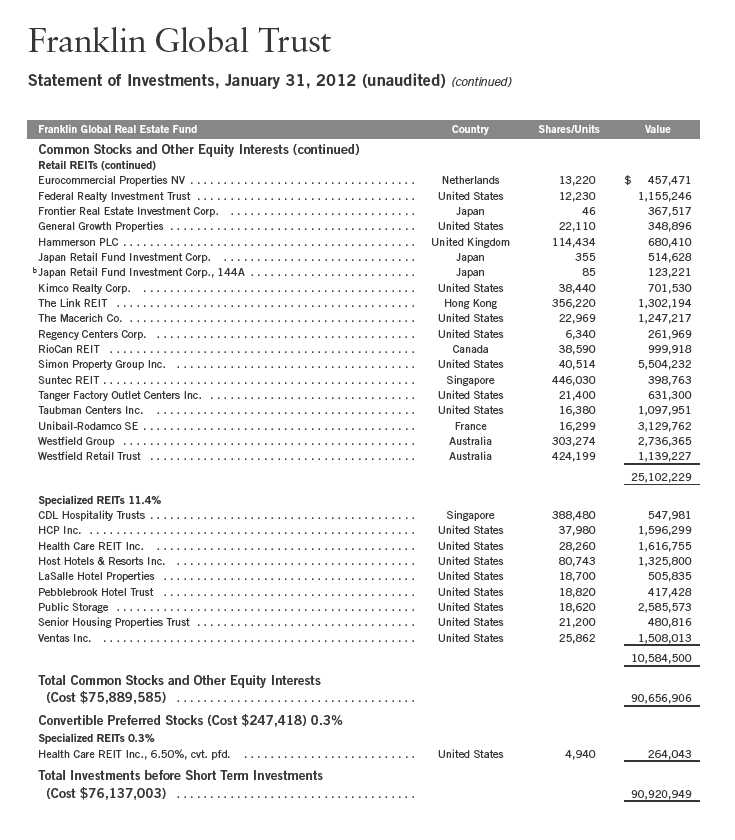

18 | Semiannual Report

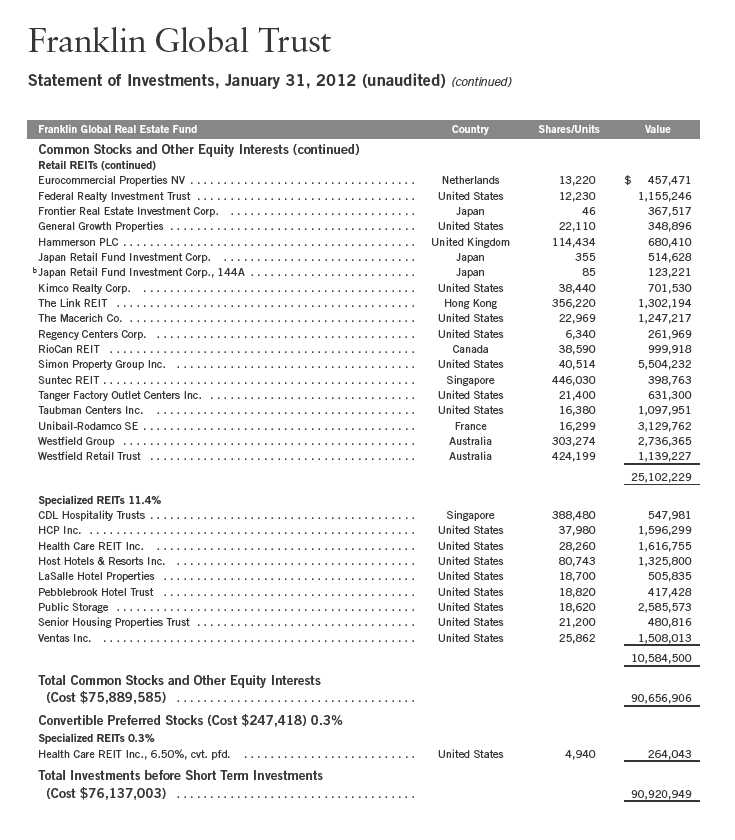

| | | | | |

| Franklin Global Trust | | | | | |

| |

| Statement of Investments, January 31, 2012 (unaudited) (continued) | | | | |

| |

| Franklin Global Real Estate Fund | Country | | Principal Amount | | Value |

| Short Term Investments (Cost $2,000,000) 2.2% | | | | | |

| Time Deposits 2.2% | | | | | |

| Royal Bank of Canada, 0.07%, 2/01/12 | United States | $ | 2,000,000 | $ | 2,000,000 |

| Total Investments (Cost $78,137,003) 99.8% | | | | | 92,920,949 |

| Other Assets, less Liabilities 0.2% | | | | | 231,424 |

| Net Assets 100.0% | | | | $ | 93,152,373 |

| |

| |

| See Abbreviations on page 33. | | | | | |

| |

| aNon-income producing. | | | | | |

| bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers or in |

| a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At January 31, |

| 2012, the aggregate value of these securities was $1,180,051, representing 1.27% of net assets. | | | | | |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 19

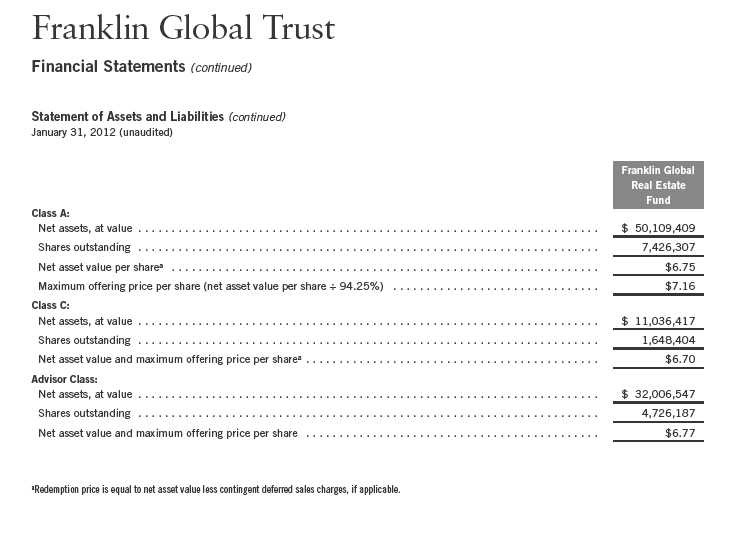

20 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

Franklin Global Trust

Notes to Financial Statements (unaudited)

Franklin Global Real Estate Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

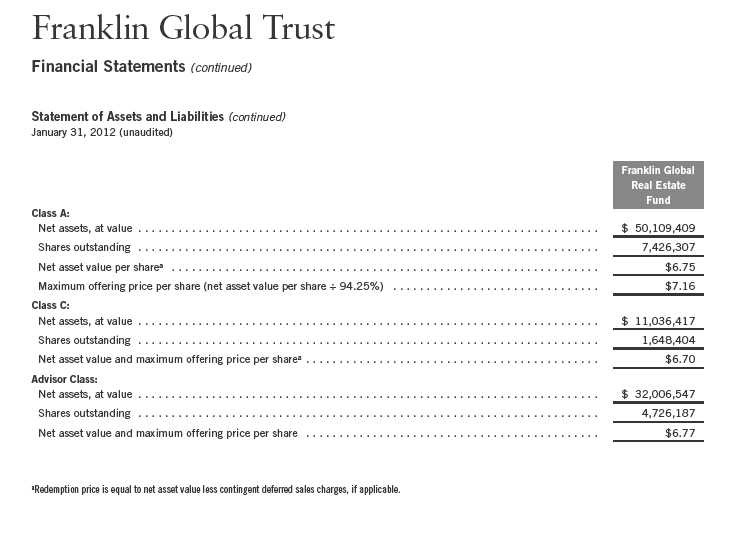

Franklin Global Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of five separate funds. The Franklin Global Real Estate Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers three classes of shares: Class A, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and exchange traded funds listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Time deposits are valued at cost, which approximates market value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

24 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

Semiannual Report | 25

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Income Taxes |

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of January 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

26 | Semiannual Report

Franklin Global Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.