Exhibit 99.4

ALLSCRIPTS TM

Inform. Connect. Transform.

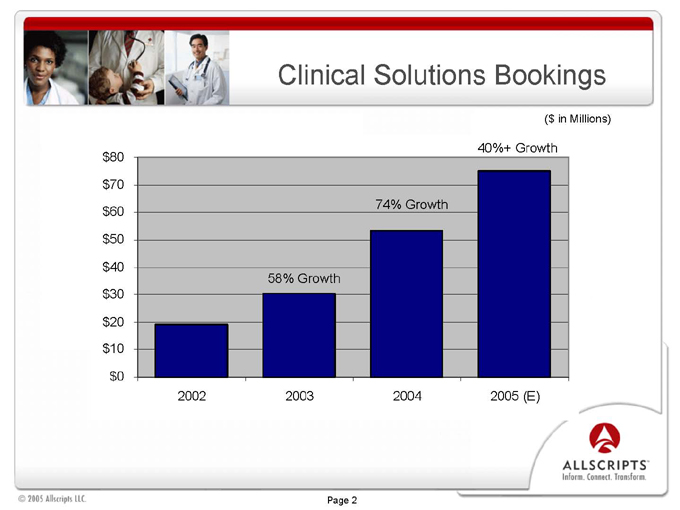

Clinical Solutions Bookings

($ in Millions) $80

$70 $60

$50

$40 $30

$20 $10

$0

40%+ Growth

74% Growth

58% Growth

2002

2003

2004

2005 (E)

Page 2

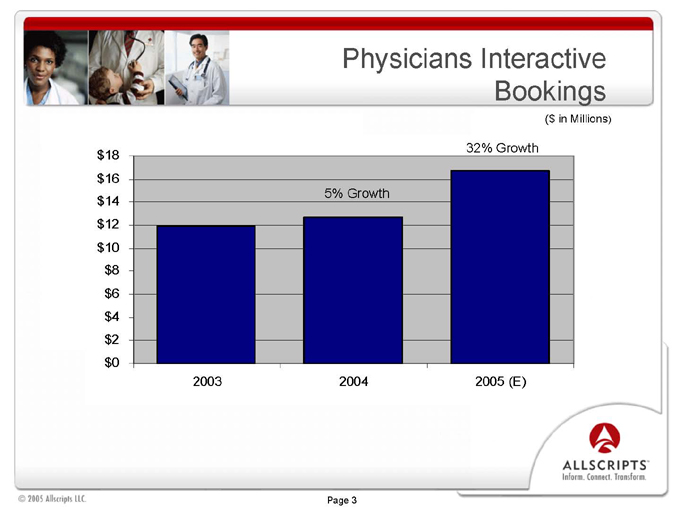

Physicians Interactive Bookings

($ in Millions) $18 $16 $14 $12 $10 $8 $6 $4 $2 $0

5% Growth

32% Growth

2003

2004

2005 (E)

Page 3

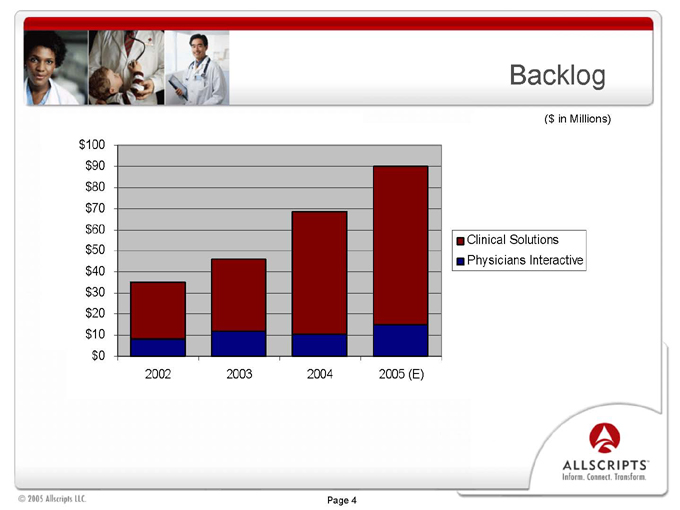

Backlog

($ in Millions) $100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0

2002 2003 2004 2005 (E)

Clinical Solutions

Physicians Interactive

Page 4

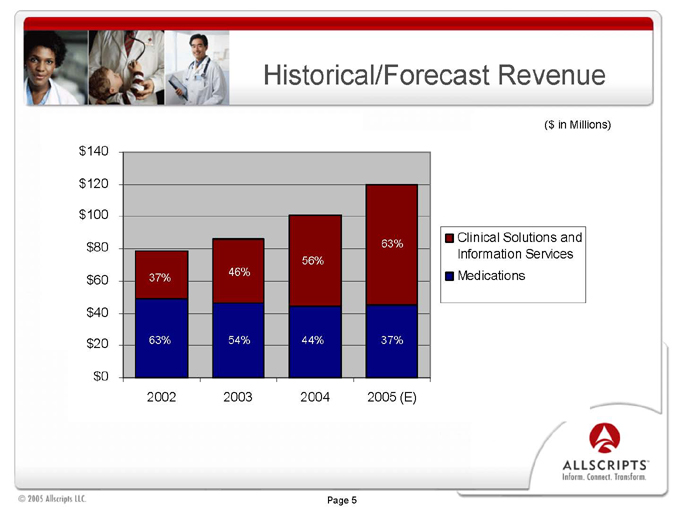

Historical/Forecast Revenue

($ in Millions) $140 $120 $100 $80 $60 $40 $20 $0

63% 56% 46% 37%

63% 54% 44% 37%

2002 2003 2004 2005 (E)

Clinical Solutions and Information Services

Medications

Page 5

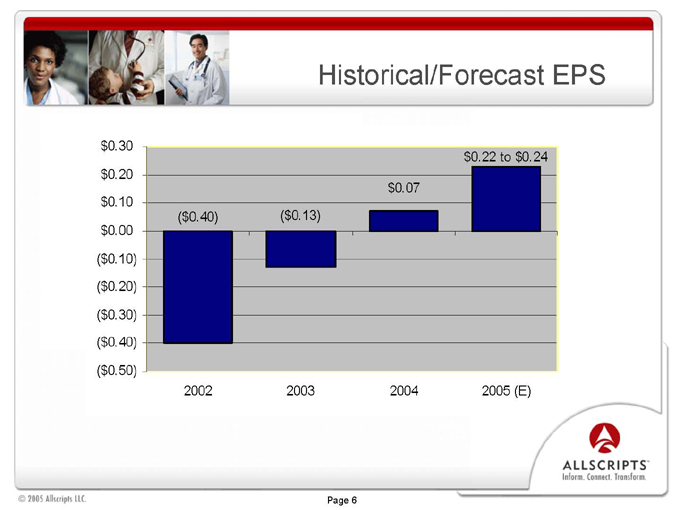

Historical/Forecast EPS

$0.30

$0.20 $0.10

$0.00

($ 0.10)

($ 0.20)

($ 0.30)

($ 0.40)

($ 0.50) $0.22 to $0.24

$0.07

($ 0.40) ($0.13)

2002 2003 2004 2005 (E)

Page 6

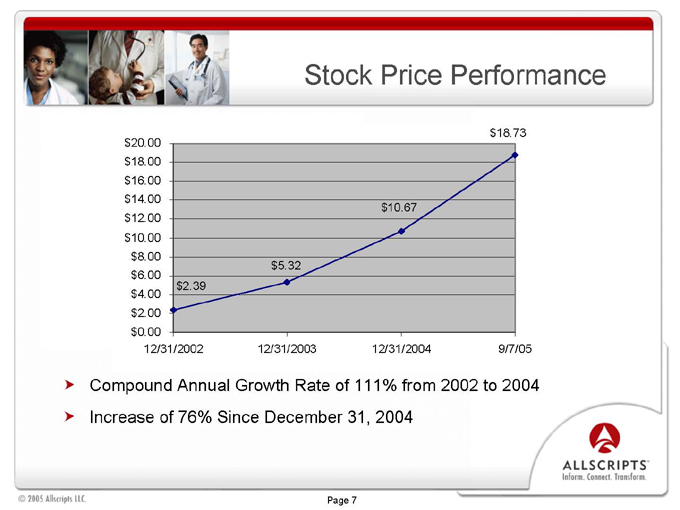

Stock Price Performance $20.00 $18.00 $16.00 $14.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 $18.73

$10.67

$5.32 $2.39

12/31/2002 12/31/2003 12/31/2004 9/7/05

Compound Annual Growth Rate of 111% from 2002 to 2004

Increase of 76% Since December 31, 2004

Page 7

Top 10 Questions…

Page 8

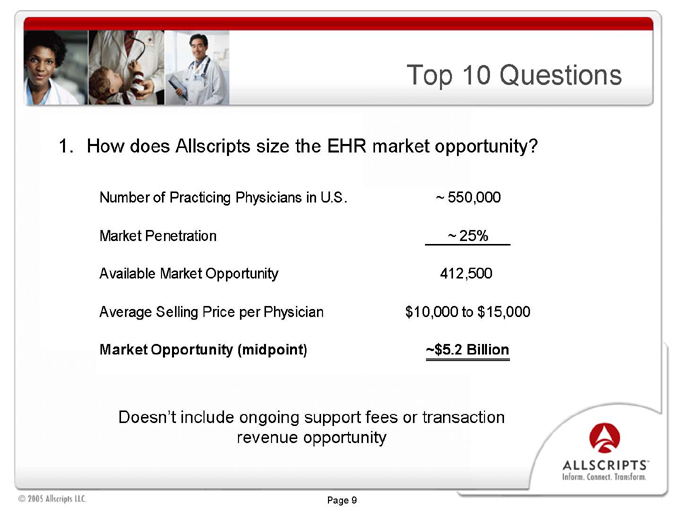

Top 10 Questions

1. How does Allscripts size the EHR market opportunity?

Number of Practicing Physicians in U.S. ~ 550,000 Market Penetration ~ 25% Available Market Opportunity 412,500 Average Selling Price per Physician $10,000 to $15,000

Market Opportunity (midpoint) ~$5.2 Billion

Doesn’t include ongoing support fees or transaction revenue opportunity

Page 9

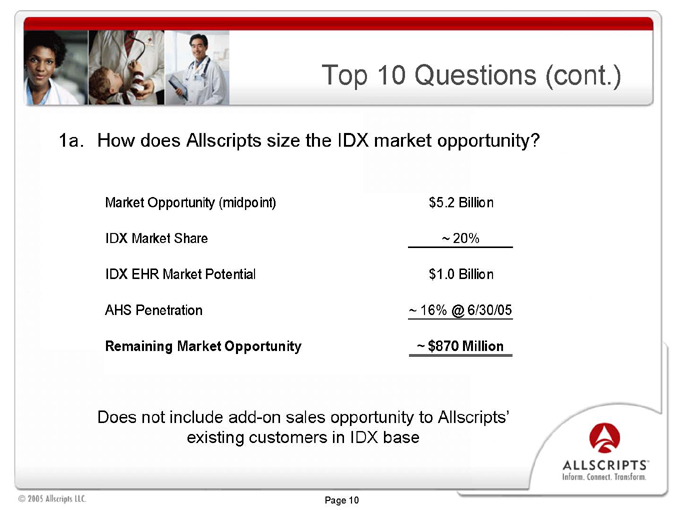

Top 10 Questions (cont.)

1a. How does Allscripts size the IDX market opportunity?

Market Opportunity (midpoint) $5.2 Billion IDX Market Share ~ 20% IDX EHR Market Potential $1.0 Billion AHS Penetration ~ 16% @ 6/30/05

Remaining Market Opportunity ~ $870 Million

Does not include add-on sales opportunity to Allscripts’ existing customers in IDX base

Page 10

Top 10 Questions (cont.)

2. Is there seasonality in your bookings? What about revenue?

Short answer is yes…

Clinical Software Business – ~35% of our bookings historically have occurred in Q4. Remaining 65% tends to be evenly distributed over first three quarters. Revenue largely insulated from seasonality due to revenue recognition policy Medication Distribution Business – Seasonality largely a function of when people are more likely to be sick (Winter months) and distribution of flu vaccine (Q3 and Q4) Physicians Interactive Business – Moderate amount of seasonality tied to large pharma budgeting process. Less prominent than in Clinical Software business

Page 11

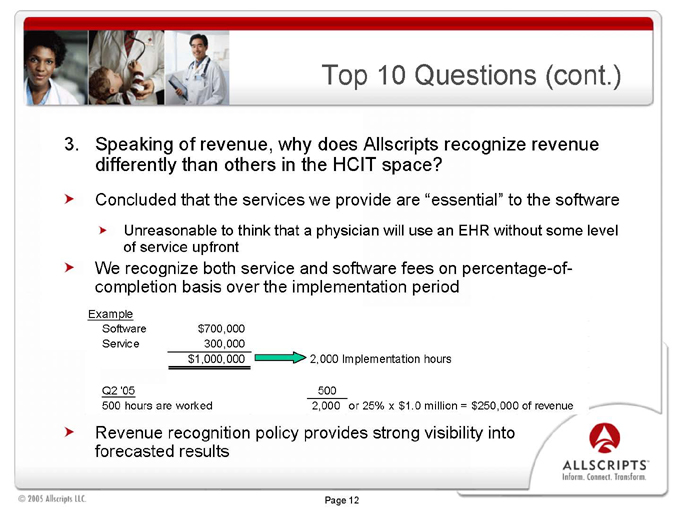

Top 10 Questions (cont.)

3. Speaking of revenue, why does Allscripts recognize revenue differently than others in the HCIT space?

Concluded that the services we provide are “essential” to the software

Unreasonable to think that a physician will use an EHR without some level of service upfront

We recognize both service and software fees on percentage-of-completion basis over the implementation period

Example

Software $700,000 Service 300,000 $1,000,000

2,000 Implementation hours

Q2 ‘05 500

500 hours are worked 2,000 or 25% x $1.0 million = $250,000 of revenue

Revenue recognition policy provides strong visibility into forecasted results

Page 12

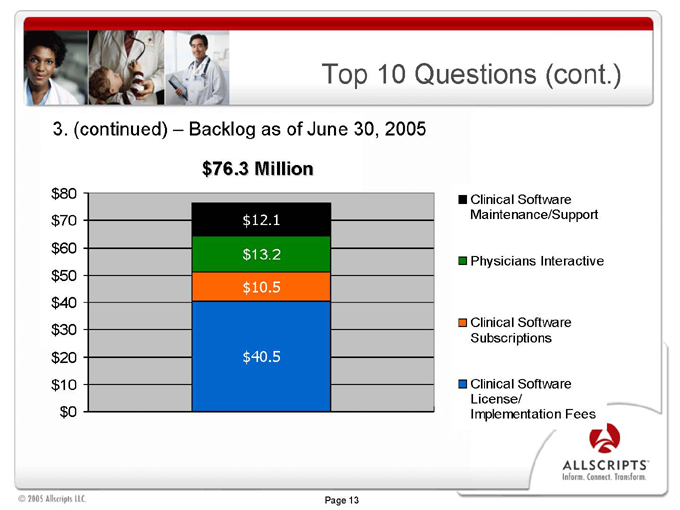

Top 10 Questions (cont.)

3. (continued) – Backlog as of June 30, 2005 $76.3 Million $80 $70 $60 $50 $40 $30 $20 $10 $0 $13.2 $10.5 $40.5

Clinical Software Maintenance/Support

Physicians Interactive

Clinical Software Subscriptions

Clinical Software License/ Implementation Fees

Page 13

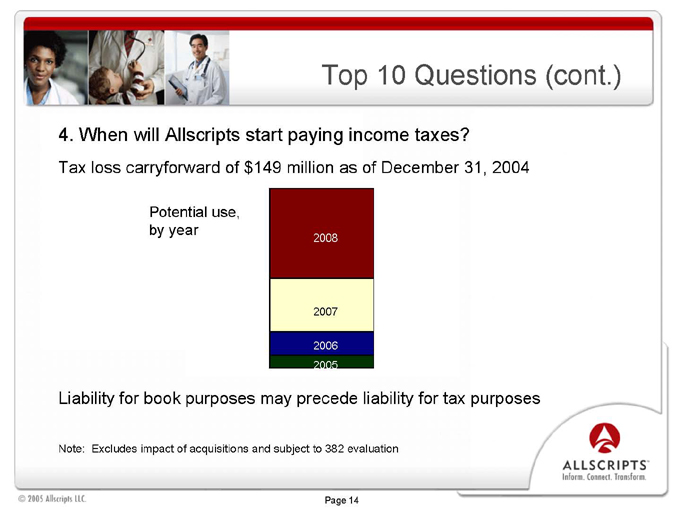

Top 10 Questions (cont.)

4. When will Allscripts start paying income taxes?

Tax loss carryforward of $149 million as of December 31, 2004

Potential use,

by year

2008

2007

2006

2005

Liability for book purposes may precede liability for tax purposes

Note: Excludes impact of acquisitions and subject to 382 evaluation

Page 14

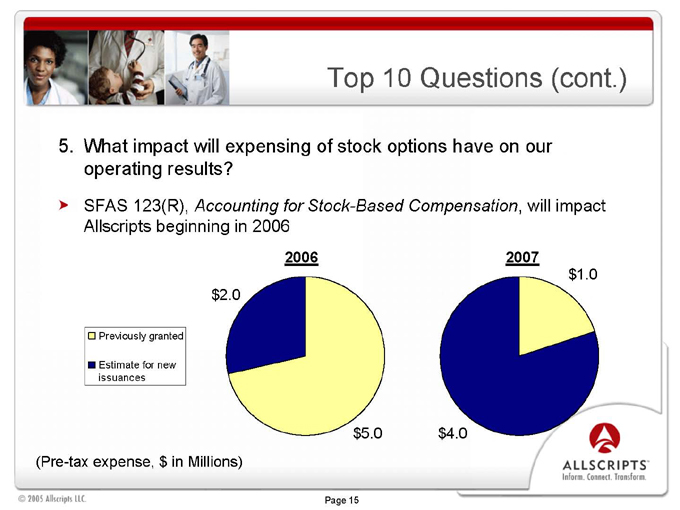

Top 10 Questions (cont.)

5. What impact will expensing of stock options have on our operating results?

SFAS 123(R), Accounting for Stock-Based Compensation, will impact Allscripts beginning in 2006

2006 $2.0 $5.0

2007 $1.0 $4.0

Previously granted

Estimate for new issuances

(Pre-tax expense, $ in Millions)

Page 15

Top 10 Questions (cont.)

6. When will Allscripts convertible debt be converted into common stock? When will it start impacting earnings per share?

Our Senior Convertible Debt ($82.5 million with a 3.5 percent coupon) became convertible into 7.3 million common shares as of July 1, 2005

Given market value of debentures (contemplates option to convert and future coupons), we do not expect any conversion prior to July 2009

Impact of conversion is currently anti-dilutive; therefore excluded from fully diluted EPS calculation

Conversion becomes dilutive at an after-tax quarterly earnings level of approximately $5.2 million or $0.12 per share

Page 16

Top 10 Questions (cont.)

7. By the way, what are you going to do with all of that cash?

Page 17

Top 10 Questions (cont.)

8. Do you intend to sell the Medication Distribution business?

Page 18

Top 10 Questions (cont.)

9. You and Glen talk a lot about transaction revenues. What is it, who pays for it, and when will it make a difference?

What is it? Will take on several different forms

“Per Click” Fees (i.e., formulary, transmit prescriptions to retail pharmacy or mail order) Referral Fees (i.e., clinical trial referrals) Software Subsidies (i.e., managed care willing to subsidize eRx)

Who will pay for it? Depends on the form. Will not be the physician. In fact, they may participate in the fees

“Per Click” Fees = PBMs, Payors, Retail Pharmacy, etc. Referral Fees = Pharma, CRO’s, etc.

Software Subsidies = Managed Care Organizations

When will it make a difference?

$1 million in 2004, driven by ~ 8 million transactions Estimate 2005 transactions > 20 million transactions

Page 19

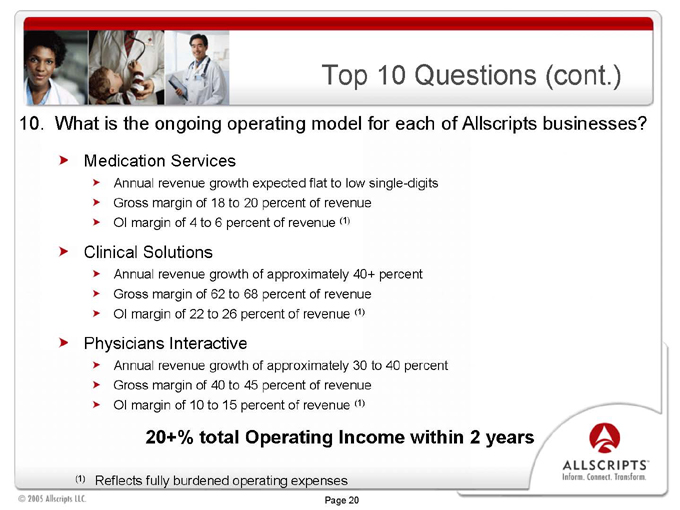

Top 10 Questions (cont.)

10. What is the ongoing operating model for each of Allscripts businesses?

Medication Services

Annual revenue growth expected flat to low single-digits Gross margin of 18 to 20 percent of revenue OI margin of 4 to 6 percent of revenue (1)

Clinical Solutions

Annual revenue growth of approximately 40+ percent Gross margin of 62 to 68 percent of revenue OI margin of 22 to 26 percent of revenue (1)

Physicians Interactive

Annual revenue growth of approximately 30 to 40 percent Gross margin of 40 to 45 percent of revenue OI margin of 10 to 15 percent of revenue (1)

20+% total Operating Income within 2 years

(1) Reflects fully burdened operating expenses

Page 20

ALLSCRIPTS TM

Inform. Connect. Transform.

Private and Confidential