|

| PRINCIPAL FINANCIAL GROUP, INC. REPORTS FULL YEAR AND FOURTH QUARTER 2009 RESULTS |

|

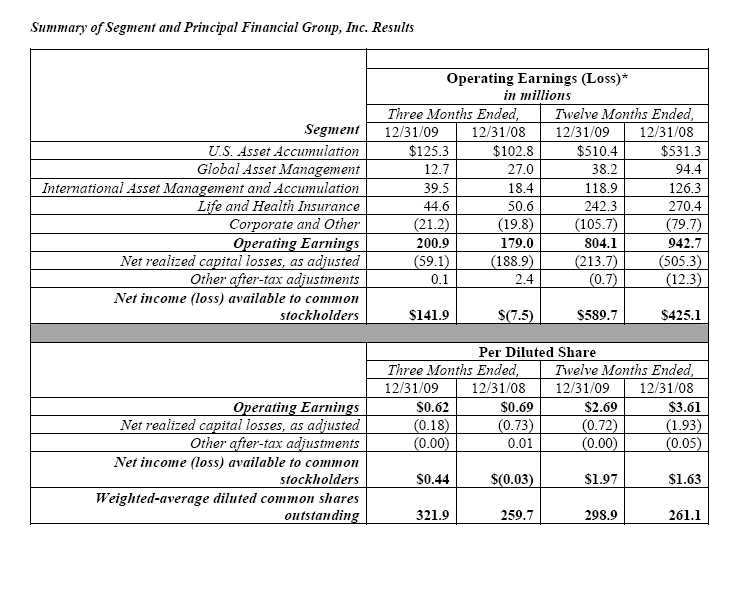

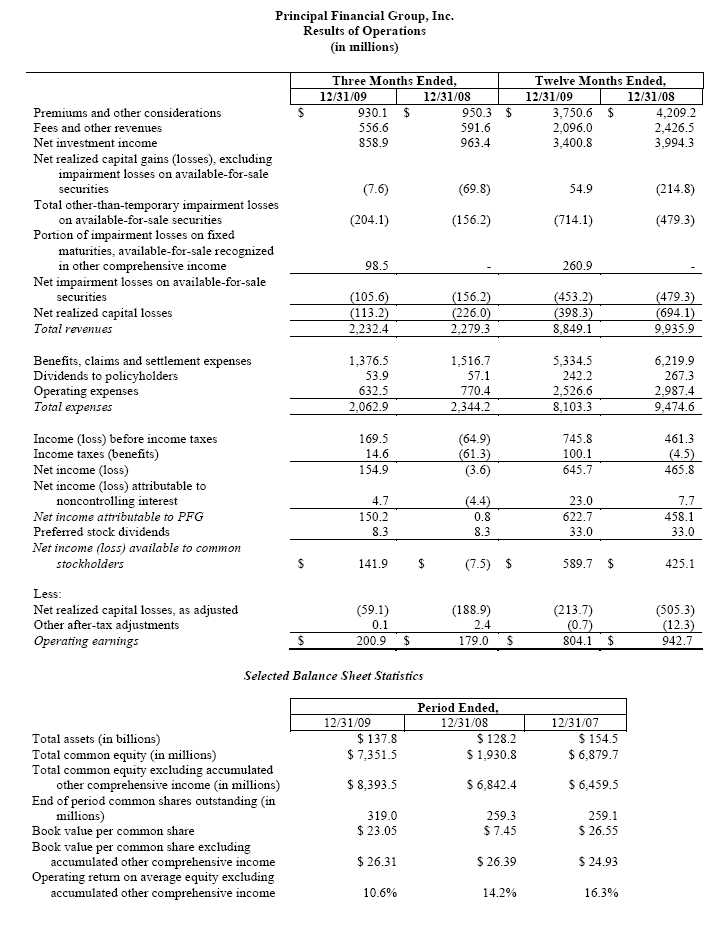

| Des Moines, IA (February 8, 2010) – Principal Financial Group, Inc. (NYSE: PFG) today announced |

| results for full year and fourth quarter 2009. The company reported net income available to common |

| stockholders of $589.7 million, or $1.97 per diluted share for the twelve months ended December 31, 2009, |

| compared to $425.1 million, or $1.63 per diluted share for the twelve months ended December 31, 2008. The |

| company reported operating earnings of $804.1 million for 2009, compared to $942.7 million for 2008. |

| Operating earnings per diluted share (EPS) for 2009 were $2.69 compared to $3.61 for 2008. Per share data is |

| based on weighted average common shares outstanding of 298.9 million and 261.1 million, for the twelve |

| month periods ending December 31, 2009, and December 31, 2008, respectively. Operating revenues for 2009 |

| were $9,322.8 million compared to $10,725.1 million for 2008.1 |

| For the three months ended December 31, 2009 the company reported net income available to |

| common stockholders of $141.9 million or $0.44 per diluted share compared to a net loss available to |

| common stockholders of $7.5 million, or $(0.03) per diluted share for the three months ended December 31, |

| 2008. The company reported operating earnings of $200.9 million for fourth quarter 2009, compared to |

| $179.0 million for fourth quarter 2008. EPS for fourth quarter 2009 was $0.62 compared to $0.69 for the |

| same period in 2008. Per share data is based on weighted average common shares outstanding of 321.9 million |

| and 259.7 million, for fourth quarter 2009 and fourth quarter 2008, respectively. Operating revenues for fourth |

| quarter 2009 were $2,368.7 million compared to $2,527.0 million for the same period last year. Assets under |

| management (AUM) were $284.7 billion as of December 31, 2009 compared to $247.0 billion as of |

| December 31, 2008. |

| “Fourth quarter was a solid finish to a very solid year for The Principal, demonstrating the |

| resiliency of our businesses,” said Larry D. Zimpleman, chairman, president and chief executive officer. |

| “With improved market conditions and business fundamentals, the fourth quarter was a continuation of |

| positive trends from the past two quarters.” |

| “2009 was a year of strong management action to address some of the most challenging economic |

| and market conditions in 75 years,” said Zimpleman. “We took the necessary actions to align expenses with |

| revenues; we enhanced liquidity through the crisis; and we strengthened our capital position with our equity |

| and debt capital raises. We also continued to implement our strategy to deliver sustainable, long-term growth |

| |

| |

| _________________________ |

| 1Use of non-GAAP financial measures is discussed in this release after Segment Highlights. |

| |

| Page 4 | |

| |

| by expanding our portfolio of employee benefit and investment offerings; adding new distribution alliances; |

| and extending our joint venture with Banco do Brasil for 23 years.2” |

| |

| Additional Highlights: |

| |

| • | Book value including accumulated other comprehensive income per share more than tripled from a year ago |

| | to $23.05 as of December 31, 2009, reflecting a $6.3 billion decrease in net unrealized losses.3 |

| • | Operating return on average equity excluding accumulated other comprehensive income improved 40 |

| | basis points in the fourth quarter to 10.6 percent for the trailing twelve months ended December 31, |

| | 2009. |

| • | Total company operating expenses down $375.6 million, or 12 percent compared to 2008, reflecting |

| | strong expense management. |

| • | Strong sales in 2009 of the company’s three key U.S. retirement and investment products, despite a |

| | difficult sales environment – $14.9 billion on a combined basis, including fourth quarter sales of $1.0 |

| | billion for Full Service Accumulation, $1.8 billion for Principal Funds and $0.4 billion for Individual |

| | Annuities. |

| • | Strong capital and liquidity, with: an estimated risk based capital ratio of 415 to 425 percent at year-end; |

| | approximately $1.5 billion of excess capital;4and approximately $6.4 billion of liquid assets. |

| • | Continued to scale back Investment Only (the company’s institutional GIC and funding agreement |

| | business), reducing the block by $4.3 billion in 2009, releasing approximately $165 million of capital. |

| • | Record operating earnings for the Individual Annuities business of $100.7 million in 2009. |

| • | Record assets under management for Principal International of $34.6 billion, including record net cash |

| | flows of $3.2 billion, or 14 percent of beginning of year assets under management. |

| |

| Added Terry Lillis, senior vice president and chief financial officer, “We’ve seen substantial recovery in |

| asset valuations, but with consumer confidence still fragile, the economic recovery remains tenuous. Businesses |

| and institutional investors continue to proceed with caution, which has impacted sales and net cash flows. We are |

| however, continuing to see signs of improvement. At a billion dollars in the fourth quarter, full service |

| accumulation sales more than doubled from third quarter, and quote activity has improved sequentially for three |

| consecutive quarters. In addition, increased search activity from institutional investors translated into a number of |

| key wins for Principal Global Investors in the fourth quarter.” |

| |

| Net Income |

| Net income available to common stockholders of $589.7 million for 2009 reflects net realized capital losses |

| of $213.7 million, which includes: |

| • | $279.4 million of losses related to sales and permanent impairments of fixed maturity securities, |

| | including $61.0 million of losses on commercial mortgage backed securities; partially offset by $71.7 |

| | million of gains related to sales of fixed maturity securities; |

| • | $78.1 million of losses on commercial mortgage loans; |

| • | $44.7 million of losses on derivatives and related hedge activities; |

| • | $99.0 million of gains related to deferred policy acquisition costs; and |

| • | $31.9 million of gains, primarily due to mark to market of fixed maturity securities held as trading. |

| |

| |

| _________________________ |

| 2Pending completion of necessary approvals and transactions associated with the Memorandum of Understanding announced on |

| October 27, 2009, to extend the pension and long-term asset accumulation joint venture in Brazil. |

| 3Net unrealized losses equal the excess of gross unrealized losses over gross unrealized gains. |

| 4Excess capital includes cash at the holding company and capital at the life company above that needed to maintain a 350 percent NAIC |

| risk based capital ratio for the life company. |

|

| U.S. Asset Accumulation |

| Segment operating earnings for fourth quarter 2009 were $125.3 million, compared to $102.8 million |

| for the same period in 2008. Individual annuities earnings were $24.2 million for fourth quarter 2009, compared |

| to a loss of $0.1 million in the year ago quarter. The increase from a year ago reflects 9 percent higher average |

| account values in fourth quarter 2009 than a year ago, and higher amortization expense from deferred policy |

| acquisition costs in fourth quarter 2008 due to equity market performance, which reduced earnings for that period |

| by $14.8 million after tax. Full service accumulation earnings increased $13.2 million or 24 percent from a year |

| ago to $67.5 million for fourth quarter 2009 primarily reflecting a 10 percent increase in average account values |

| and lower operating expenses. Principal Funds earnings increased $6.5 million from a year ago to $8.5 million |

| for fourth quarter 2009, primarily due to 7 percent higher average account values and lower operating expenses. |

| These increases were partially offset by a $24.8 million decline in Investment Only earnings, reflecting 23% lower |

| average account values in fourth quarter 2009 than a year ago, and higher fee income in fourth quarter 2008 |

| resulting from a high volume of medium term note early redemptions with no corresponding activity in fourth |

| quarter 2009. |

| Operating revenues for the fourth quarter were $1,017.1 million, compared to $1,100.5 million for |

| the same period in 2008. The decline primarily reflects lower net investment income in the Investment Only |

| business, which the company has been scaling back over the last several quarters. |

| Segment assets under management were $159.8 billion as of December 31, 2009, compared to |

| $139.1 billion as of December 31, 2008. |

| |

| Global Asset Management |

| Segment operating earnings for fourth quarter 2009 were $12.7 million. This compares to $27.0 |

| million in the prior year quarter, which included earnings of $15.6 million after-tax from a performance fee |

| (under the terms of the contract, this performance fee is determined every five years). |

| Operating revenues for fourth quarter were $120.4 million, compared to $173.5 million for the same |

| period in 2008 primarily due to the fourth quarter 2008 performance fee noted above. |

| Non-affiliated assets under management were $73.8 billion as of December 31, 2009, compared to |

| $70.3 billion as of December 31, 2008. |

|

| Page 6 |

| |

| International Asset Management and Accumulation |

| Segment operating earnings for fourth quarter 2009 were $39.5 million, compared to $18.4 million |

| in the prior year quarter, primarily due to higher fee revenues on higher assets under management and |

| improving macroeconomic conditions. The increase also reflects $3.4 million of after-tax gains on bonds in |

| Brazil in fourth quarter 2009, compared to $3.3 million of after-tax losses on bonds for the same period a year |

| ago, included in operating earnings under equity method accounting. |

| Operating revenues were $180.3 million for fourth quarter, compared to $148.6 million for the same |

| period last year, primarily the result of stronger earnings from Brazil and higher annuity sales in Chile. |

| Segment assets under management were a record $34.6 billion as of December 31, 2009, |

| compared to $23.1 billion as of December 31, 2008. The increase from a year ago includes record net cash |

| flows of $3.2 billion, or 14 percent of beginning of year assets under management. |

| |

| Life and Health Insurance |

| Segment operating earnings for fourth quarter 2009 were $44.6 million, compared to $50.6 million |

| for the same period in 2008. The decline primarily reflects higher claim costs in fourth quarter 2009 for the |

| Health division, which had an operating loss of $11.4 million, compared to an operating loss of $5.6 million |

| for fourth quarter 2008. Losses in both periods reflect claim seasonality in higher deductible plans. |

| Individual Life earnings were $30.5 million compared to $29.6 million in fourth quarter 2008. Specialty |

| Benefits earnings were $25.5 million compared to $26.6 million in fourth quarter 2008. |

| Operating revenues for fourth quarter were $1,095.8 million, compared to $1,154.9 million for the |

| same period a year ago. The decline was primarily due to a 10 percent decline in Health division premiums, |

| which primarily reflects a decline in group medical covered members. |

| |

| Corporate |

| Operating losses for fourth quarter 2009 were $21.2 million, compared to operating losses of $19.8 |

| million for the same period in 2008, primarily reflecting higher interest on corporate debt in fourth quarter |

| 2009. |

| |

| Other-than-temporary impairments for fourth quarter 2009 and year-ended December 31, 2009 |

| On April 9, 2009, the Financial Accounting Standards Board established new requirements for measuring and |

| presenting other-than-temporary impairment charges on available-for-sale securities, which the Company |

| adopted with first quarter 2009 reporting. |

| Based on the new requirements, on a pre-tax basis, total other than temporary impairment losses on available- |

| for-sale securities were $204.1 million for fourth quarter 2009 and the noncredit portion of loss recognized in |

| other comprehensive income was $98.5 million. Net impairment losses on available-for-sale securities of |

| $105.6 million for fourth quarter 2009 reflect: the company’s actions to reduce asset ratings drift risk by selling |

| or tendering certain securities, which resulted in a loss of $8.0 million; and deterioration in expected cash flows, |

| which resulted in a $19.0 million net impairment charge on non-agency residential mortgage backed securities |

| and residential collateralized debt obligations, and a $44.7 million net impairment of commercial mortgage |

| backed securities and commercial mortgage backed collateralized debt obligations. The remainder of the net |

| impairment losses for fourth quarter 2009 primarily relates to impairments of corporate credits. |

|

| Page 7 |

| |

| On a pre-tax basis, total other than temporary impairment losses on available-for-sale securities were $714.1 |

| million for year-ended December 31, 2009 and the noncredit portion of loss recognized in other |

| comprehensive income was $260.9 million. Net impairment losses on available-for-sale securities of $453.2 |

| million for the year-ended December 31, 2009 reflect: the company’s actions to reduce asset ratings drift risk |

| by selling or tendering certain securities, which resulted in a loss of $87.4 million; deterioration in expected |

| cash flows, which resulted in an $84.4 million net impairment charge on non-agency residential mortgage |

| backed securities and residential collateralized debt obligations, and a $93.9 million net impairment of |

| commercial mortgage backed securities and commercial mortgage backed collateralized debt obligations. |

| The remainder of the net impairment losses for the year-ended December 31, 2009 primarily relates to |

| impairments of corporate credits. |

| |

| Forward looking and cautionary statements |

| This press release contains forward-looking statements, including, without limitation, statements as to |

| operating earnings, net income available to common stockholders, net cash flows, realized and unrealized |

| losses, capital and liquidity positions, sales and earnings trends, and management's beliefs, expectations, |

| goals and opinions. The company does not undertake to update or revise these statements, which are based |

| on a number of assumptions concerning future conditions that may ultimately prove to be inaccurate. Future |

| events and their effects on the company may not be those anticipated, and actual results may differ materially |

| from the results anticipated in these forward-looking statements. The risks, uncertainties and factors that |

| could cause or contribute to such material differences are discussed in the company's annual report on Form |

| 10-K for the year ended December 31, 2008, and in company’s quarterly report on Form 10-Q for the quarter |

| ended September 30, 2009, filed by the company with the Securities and Exchange Commission, as updated |

| or supplemented from time to time in subsequent filings. These risks and uncertainties include, without |

| limitation: adverse capital and credit market conditions that may significantly affect the company’s ability to |

| meet liquidity needs, access to capital and cost of capital; a continuation of difficult conditions in the global |

| capital markets and the general economy that may materially adversely affect the company’s business and |

| results of operations; the actions of the U.S. government, Federal Reserve and other governmental and |

| regulatory bodies for purposes of stabilizing the financial markets might not achieve the intended effect; the |

| risk from acquiring new businesses, which could result in the impairment of goodwill and/or intangible assets |

| recognized at the time of acquisition; impairment of other financial institutions that could adversely affect the |

| company; investment risks which may diminish the value of the company’s invested assets and the |

| investment returns credited to customers, which could reduce sales, revenues, assets under management and |

| net income; requirements to post collateral or make payments related to declines in market value of specified |

| assets may adversely affect company liquidity and expose the company to counterparty credit risk; changes |

| in laws, regulations or accounting standards that may reduce company profitability; fluctuations in foreign |

| currency exchange rates that could reduce company profitability; Principal Financial Group, Inc.’s primary |

| reliance, as a holding company, on dividends from its subsidiaries to meet debt payment obligations and |

| regulatory restrictions on the ability of subsidiaries to pay such dividends; competitive factors; volatility of |

| financial markets; decrease in ratings; interest rate changes; inability to attract and retain sales |

| representatives; international business risks; a pandemic, terrorist attack or other catastrophic event; and |

| default of the company’s re-insurers. |

| |

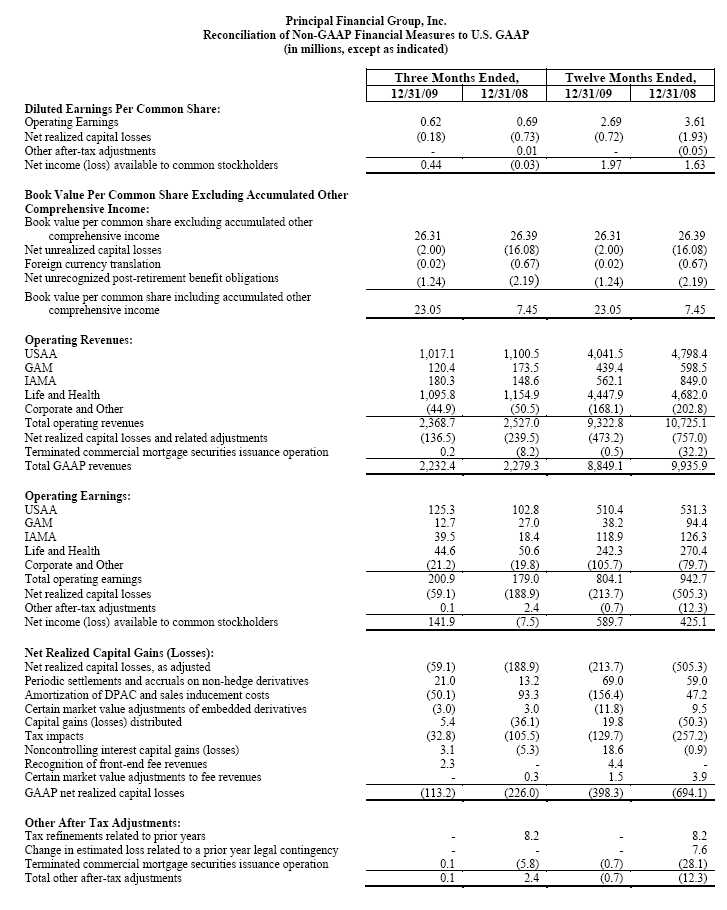

| Use of Non-GAAP Financial Measures |

| The company uses a number of non-GAAP financial measures that management believes are useful to investors |

| because they illustrate the performance of normal, ongoing operations, which is important in understanding and |

| evaluating the company’s financial condition and results of operations. They are not, however, a substitute for |

| U.S. GAAP financial measures. Therefore, the company has provided reconciliations of the non-GAAP |

| measures to the most directly comparable U.S. GAAP measure at the end of the release. The company adjusts |

| U.S. GAAP measures for items not directly related to ongoing operations. However, it is possible these |

| adjusting items have occurred in the past and could recur in the future reporting periods. Management also uses |

| non-GAAP measures for goal setting, as a basis for determining employee and senior management |

| awards and compensation, and evaluating performance on a basis comparable to that used by investors |

| and securities analysts. |

| |

| Page 8 | |

| |

| Earnings Conference Call |

| On Tuesday, February 9, 2010 at 10:00 A.M. (ET), Chairman, President and Chief Executive Officer Larry |

| Zimpleman and Senior Vice President and Chief Financial Officer Terry Lillis will lead a discussion of |

| results, asset quality and capital adequacy during a live conference call, which can be accessed as follows: |

| • | Via live Internet webcast. Please go towww.principal.com/investorat least 10-15 minutes prior to the |

| | start of the call to register, and to download and install any necessary audio software. |

| • | Via telephone by dialing 800-374-1609 (U.S. and Canadian callers) or 706-643-7701 (International |

| | callers) approximately 10 minutes prior to the start of the call. The call leader's name is Tom Graf. |

| • | Replays of the earnings call are available at:www.principal.com/investoror by dialing 800-642-1687 |

| | (U.S. and Canadian callers) or 706-645-9291 (International callers). The access code is 48727511. |

| | Replays will be available approximately two hours after the completion of the live earnings call through |

| | the end of day February 16, 2010. |

| The company's financial supplement and additional investment portfolio detail for fourth quarter 2009 is |

| currently available atwww.principal.com/investor, and may be referred to during the call. |

| |

| |

| |

| About the Principal Financial Group |

| The Principal Financial Group®(The Principal®)5is a leader in offering businesses, individuals and |

| institutional clients a wide range of financial products and services, including retirement and investment |

| services, life and health insurance, and banking through its diverse family of financial services companies. A |

| member of the Fortune 500, the Principal Financial Group has $284.7 billion in assets under management6 |

| and serves some 18.9 million customers worldwide from offices in Asia, Australia, Europe, Latin America |

| and the United States. Principal Financial Group, Inc. is traded on the New York Stock Exchange under the |

| ticker symbol PFG. For more information, visitwww.principal.com. |

| |

| |

| ### |

| |

| |

| |

| _________________________ |

| 5"The Principal Financial Group" and “The Principal” are registered service marks of Principal Financial Services, Inc., a member of the |

| Principal Financial Group. |

| 6As of December 31, 2009 |