United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-10625

(Investment Company Act File Number)

Federated Core Trust II, L.P.

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/13

Date of Reporting Period: 11/30/13

Item 1. Reports to Stockholders

Annual Shareholder Report

November 30, 2013

Emerging Markets Fixed Income Core Fund

A Portfolio of Federated Core Trust II, L.P.

Not FDIC Insured • May Lose Value • No Bank Guarantee

CONTENTS

| 1 |

| 4 |

| 6 |

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 22 |

| 23 |

| 24 |

| 25 |

| 28 |

| 30 |

| 30 |

Management's Discussion of Fund Performance (unaudited)

The total return of Emerging Markets Fixed Income Core Fund (the “Fund”), based on net asset value, for the 12-month reporting period ended November 30, 2013, was -4.42%. The total return for the Barclays Emerging Markets USD Aggregate Index (BEMAI) (formerly, Barclays Emerging Markets Bond Index),1 the Fund's broad based securities market index, was -3.46% for the same period. The Fund's total return for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses which were not reflected in the total return of the BEMAI.

During the reporting period, the most significant factors affecting the Fund's performance relative to the BEMAI were: (1) duration,2 which played a sizable role in the Fund's performance; (2) credit quality, including the allocation between securities that are rated investment-grade3 and high-yield4 securities; and (3) regional and country allocation.

During the reporting period, the Fund underperformed the BEMAI.

MARKET OVERVIEW

During the 12-month reporting period, risk premiums in the global emerging bond markets5 were governed by a myriad of risks, but one singular factor stood above all—the U.S. Federal Reserve's (the Fed) stance on quantitative easing was the reigning influence on emerging global bond markets. This topic shaped the course of practically all global financial markets. The moderation of quantitative easing in the United States resonated through currency, equity and bond markets. Intensified Japanese economic stimulus was a secondary market narrative that had emerging market implications, especially in emerging Asia. The reinvigoration of Chinese economic activity also left its mark on emerging bond markets. Apart from global macroeconomic developments, investor sentiment was also rattled by increases in political tensions in some emerging markets, primarily in emerging Europe, Latin America and Egypt.

U.S. economic statistics proved quintessential in the past 12-month reporting period. The Fed was very explicit in tying monetary guidance directly to future U.S. economic data. Specifically, they fashioned U.S. employment statistics as the main fulcrum behind their policy decisions. As the reporting year unfolded, benchmark global yields along with the U.S. dollar began to rise on the projection that the Fed would finally begin to taper (moderate) its quantitative easing. Then just as the reporting period was drawing to a close, the Fed surprised market participants and did not taper despite a healthy upturn in economic data.

This scrutiny over quantitative easing infused the most volatility into the emerging market economies. Mirroring this assertion, emerging bond markets experienced violent swings throughout the reporting period and endured negative impacts across the whole complex. Due to high reliance on exports of metals and mining goods to China, along with significant dependence of the local capital markets on U.S. investor inflows, bonds of Latin American issuers were hit particularly hard during the selloff.

Looking at the differences in the regional performance, Latin America generally underperformed while Russia and the Central and Eastern Europe region outperformed. In spite of the strong performance of the Europe, Middle East and Africa region (EMEA), in line with our expectations, there was a noticeable divergence in performance of various markets depending on the need to finance the current account deficit. Countries with significant current account deficits such as Turkey and South Africa have materially underperformed markets with current account surpluses (e.g. Russia and the Gulf Cooperation Council markets). This divergence was not unique to the EMEA region as we have seen underperformance of India and other markets with current account deficits in Asia as well.

DURATION

During the reporting period, duration detracted from Fund performance mainly as a consequence of the excessive volatility generated by the Fed's determination whether or not to taper its quantitative easing. This had significant effect on longer duration/maturity bonds. The Fund was positioned in longer-duration assets which tended to underperform.

Annual Shareholder Report

CREDIT QUALITY

Fund management allocated more of the portfolio to investment-grade sovereign bonds than high-yield bonds. Given their high-quality these bonds tend to be more sensitive to U.S. interest rates. As rates moved higher in the U.S., investment-grade bonds underperformed high-yield bonds.6

Regional and country allocation

The Fund had an overweight position relative to the BEMAI in Latin American countries, largely offset with an underweight allocation to Asia and countries in Eastern and Central Europe. The strategy was partially successful since Asia, as a region, tended to underperform relative to other regions. However, most Eastern and Central European countries performed well relative to other countries in the BEMAI. The Latin American region underperformed all other regions in BEMAI.

| 1 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the BEMAI. |

| 2 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations. |

| 3 | Investment-grade securities are securities that are rated at least “BBB- (minus)” or unrated securities of a comparable quality. Noninvestment-grade securities are securities that are not rated at least “BBB- (minus)” or unrated securities of a comparable quality. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower-rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower creditworthiness, greater price volatility, more risk to principal and income than with higher-rated securities and increased possibilities of default. |

| 4 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. |

| 5 | International investing involves special risks including currency risk, increased volatility of foreign securities, political risks and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries. |

| 6 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

Annual Shareholder Report

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

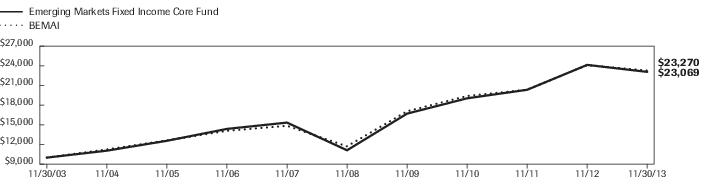

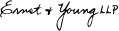

The Average Annual Total Return table below shows returns averaged over the stated periods. The graph below illustrates the hypothetical investment of $10,0001 in the Emerging Markets Fixed Income Core Fund from November 30, 2003 to November 30, 2013, compared to Barclays Emerging Markets USD Aggregate Index (BEMAI) (formerly, Barclays Emerging Markets Bond Index).2

| Average Annual Total Returns for the Period Ended 11/30/2013 | |

| 1 Year | -4.42% |

| 5 Years | 15.72% |

| 10 Years | 8.72% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Growth of a $10,000 Investment

Growth of $10,000 as of November 30, 2013

| Emerging Markets Fixed Income Core Fund | | BEMAI |

| 11/30/2003 | 10,000 | 10,000 |

| 11/30/2004 | 11,056 | 11,249 |

| 11/30/2005 | 12,564 | 12,628 |

| 11/30/2006 | 14,378 | 14,084 |

| 11/30/2007 | 15,337 | 14,850 |

| 11/30/2008 | 11,119 | 11,721 |

| 11/30/2009 | 16,706 | 17,066 |

| 11/30/2010 | 19,041 | 19,396 |

| 11/30/2011 | 20,341 | 20,348 |

| 11/30/2012 | 24,135 | 24,104 |

| 11/30/2013 | 23,069 | 23,270 |

41 graphic description end -->

| 1 | The Fund's performance assumes the reinvestment of all dividends and distributions. The BEMAI has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 2 | Barclays changed the name of the “Barclays Emerging Markets Bond Index” to “Barclays Emerging Market USD Aggregate Index.” The BEMAI tracks total returns for external-currency-denominated debt instruments of the emerging markets. The BEMAI is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At November 30, 2013, the Fund's issuer country exposure composition was as follows:

| Country | Exposure as a Percentage

of Total Net Assets1 |

| Brazil | 15.3% |

| Russia | 15.0% |

| Mexico | 12.0% |

| Turkey | 6.1% |

| Colombia | 3.9% |

| Venezuela | 3.2% |

| United Arab Emirates | 2.9% |

| Indonesia | 2.8% |

| Peru | 2.6% |

| Philippines | 2.6% |

| Qatar | 2.5% |

| Uruguay | 2.2% |

| Argentina | 1.9% |

| Thailand | 1.6% |

| Israel | 1.4% |

| Hungary | 1.3% |

| India | 1.2% |

| Kazakhstan | 1.2% |

| South Africa | 1.2% |

| China | 1.1% |

| Iceland | 1.1% |

| El Salvador | 1.0% |

| Egypt | 0.9% |

| Panama | 0.8% |

| Poland | 0.8% |

| Armenia | 0.7% |

| Jamaica | 0.7% |

| Nigeria | 0.7% |

| Chile | 0.6% |

| Bahrain | 0.5% |

| Dominican Republic | 0.5% |

| Lithuania | 0.5% |

| Morocco | 0.5% |

| Singapore | 0.5% |

| South Korea | 0.5% |

| Hong Kong | 0.4% |

| Bolivia | 0.3% |

| Costa Rica | 0.3% |

| Georgia | 0.3% |

| Sri Lanka | 0.3% |

| Trinidad and Tobago | 0.3% |

Annual Shareholder Report

| Country | Exposure as a Percentage

of Total Net Assets1 |

| Croatia | 0.2% |

| Serbia | 0.2% |

| Ghana | 0.1% |

| Guatemala | 0.1% |

| Zambia | 0.1% |

| Cash Equivalents2 | 4.5% |

| Other Assets and Liabilities—Net3 | 0.6% |

| TOTAL | 100% |

| 1 | This table depicts the Fund's exposure to various countries through its investment in foreign fixed-income securities along with the Fund's holdings of cash equivalents and other assets and liabilities. With respect to foreign fixed-income securities, country allocations are based primarily on the country in which the issuing company (the “Issuer”) has registered the security. However, the Fund's Adviser may allocate the Issuer to a country based on other factors such as the location of the Issuer's head office, the jurisdiction of the Issuer's incorporation, the location of the principal trading market for the Issuer's securities or the country from which a majority of the Issuer's revenue is derived. |

| 2 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. This does not include cash held in the Fund that is denominated in foreign currencies. See the Statement of Assets and Liabilities for information regarding the Fund's foreign cash position. |

| 3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

November 30, 2013

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | CORPORATE BONDS—56.1% | |

| | | Aerospace & Defense—0.3% | |

| 2,683,000 | 1,2 | Embraer Overseas Ltd., Sr. Unsecd. Note, Series 144A, 5.696%, 9/16/2023 | $2,696,415 |

| | | Automotive—1.1% | |

| 4,900,000 | 1,2 | Metalsa SA de CV, Series 144A, 4.90%, 4/24/2023 | 4,532,500 |

| 4,250,000 | 1,2 | Tenedora Nemak SA de CV, Series 144A, 5.50%, 2/28/2023 | 4,122,500 |

| | | TOTAL | 8,655,000 |

| | | Banking—5.8% | |

| 3,000,000 | | Banco Bradesco SA, Series REGS, 6.75%, 9/29/2019 | 3,315,000 |

| 1,500,000 | 1,2 | Banco Bradesco SA, Sub. Note, Series 144A, 5.90%, 1/16/2021 | 1,519,500 |

| 1,800,000 | 1,2 | Banco Davivienda SA, Series 144A, 2.95%, 1/29/2018 | 1,723,500 |

| 2,250,000 | | Banco Do Brasil SA, Jr. Sub. Note, Series REGS, 8.50%, 10/29/2049 | 2,463,750 |

| 2,000,000 | 1,2 | Banco Internacional del Peru, Jr. Sub. Note, Series 144A, 8.500%, 4/23/2070 | 2,179,633 |

| 3,000,000 | 1,2 | Banco Internacional del Peru, Sr. Unsecd. Note, Series 144A, 5.75%, 10/7/2020 | 3,067,500 |

| 1,600,000 | 1,2 | Banco Reservas Rep Domin, Series 144A, 7.00%, 2/1/2023 | 1,528,000 |

| 2,060,000 | 1,2 | Caixa Economica Federal, Series 144A, 3.50%, 11/7/2022 | 1,684,050 |

| 1,300,000 | | Caixa Economica Federal, Series REGS, 2.375%, 11/6/2017 | 1,209,000 |

| 800,000 | 1,2 | GTB Finance BV, Series 144A, 6.00%, 11/8/2018 | 792,000 |

| 2,000,000 | 1,2 | ICICI Bank Ltd., Sr. Unsecd. Note, Series 144A, 5.75%, 11/16/2020 | 2,047,002 |

| 4,000,000 | 1,2 | ICICI Bank Ltd./Dubai, Sr. Unsecd. Note, Series 144A, 4.75%, 11/25/2016 | 4,175,836 |

| 3,500,000 | | Korea Development Bank, Sr. Unsecd. Note, 3.50%, 8/22/2017 | 3,703,259 |

| 1,900,000 | 1,2 | Sberbank of Russia, Series 144A, 5.125%, 10/29/2022 | 1,809,750 |

| 2,000,000 | | Sberbank of Russia, Series REGS, 5.125%, 10/29/2022 | 1,905,000 |

| 1,350,000 | 1,2 | Turkiye Is Bankasi (Isbank), Series 144A, 5.50%, 4/21/2019 | 1,371,937 |

| 1,360,000 | 1,2 | Turkiye Vakiflar Bankasi T.A.O., Series 144A, 5.00%, 10/31/2018 | 1,356,736 |

| 3,500,000 | | VTB Bank OJSC, Series REGS, 6.315%, 2/22/2018 | 3,751,930 |

| 3,000,000 | 1,2 | Vnesheconombank, Series 144A, 4.224%, 11/21/2018 | 3,003,517 |

| 1,600,000 | 1,2 | Vnesheconombank, Sr. Unsecd. Note, Series 144A, 5.375%, 2/13/2017 | 1,703,360 |

| 1,650,000 | 1,2 | Yapi ve Kredi Bankasi A.S., Series 144A, 5.25%, 12/3/2018 | 1,640,901 |

| | | TOTAL | 45,951,161 |

| | | Beverage & Tobacco—0.7% | |

| 2,000,000 | | Ajecorp BV, Series REGS, 6.50%, 5/14/2022 | 2,000,000 |

| 4,000,000 | 1,2 | Corp Lindley SA, Series 144A, 4.625%, 4/12/2023 | 3,770,000 |

| | | TOTAL | 5,770,000 |

| | | Brewing—0.2% | |

| 2,000,000 | 1,2 | Anadolu Efes Biracilik ve Malt Sanayii A.S., Series 144A, 3.375%, 11/1/2022 | 1,645,000 |

| | | Broadcast Radio & TV—1.6% | |

| 4,150,000 | | Grupo Televisa SA, 6.625%, 3/18/2025 | 4,811,527 |

| 3,800,000 | | Grupo Televisa SA, Sr. Note, 8.50%, 3/11/2032 | 4,925,271 |

| 2,650,000 | | TV Azteca SA de CV, Series REGS, 7.50%, 5/25/2018 | 2,703,000 |

| | | TOTAL | 12,439,798 |

| | | Building & Development—1.4% | |

| 2,500,000 | | Odebrecht Finance Ltd., Series REGS, 7.125%, 6/26/2042 | 2,334,375 |

| 5,100,000 | 1,2 | Odebrecht SA, Company Guarantee, Series 144A, 7.50%, 9/29/2049 | 4,972,500 |

| 3,400,000 | 1,2 | Odebrecht SA, Series 144A, 4.375%, 4/25/2025 | 2,941,000 |

| 1,300,000 | 1,2 | Odebrecht SA, Series 144A, 5.125%, 6/26/2022 | 1,277,250 |

| | | TOTAL | 11,525,125 |

Annual Shareholder Report

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | CORPORATE BONDS—continued |

| | | Building Materials—0.4% | |

| 3,235,000 | 1,2 | Rearden G Holdings EINS GmbH, Company Guarantee, Series 144A, 7.875%, 3/30/2020 | $3,408,881 |

| | | Cable & Wireless Television—0.6% | |

| 4,250,000 | | Net Servicos de Comunicacao SA, Company Guarantee, 7.50%, 1/27/2020 | 4,632,500 |

| | | Chemicals & Plastics—1.5% | |

| 2,245,000 | 1,2 | ALPEK SA de CV, Series 144A, 4.50%, 11/20/2022 | 2,121,525 |

| 4,950,000 | | ALPEK SA de CV, Series REGS, 4.50%, 11/20/2022 | 4,677,750 |

| 3,700,000 | 1,2 | Braskem Finance Ltd., Company Guarantee, Series 144A, 5.75%, 4/15/2021 | 3,681,500 |

| 1,200,000 | 1,2 | PTT Global Chemical PCL, Sr. Unsecd. Note, Series 144A, 4.25%, 9/19/2022 | 1,148,580 |

| | | TOTAL | 11,629,355 |

| | | Conglomerates—1.3% | |

| 3,000,000 | | Hutch Whampoa Int. 12 Ltd., Series REGS, 6.00%, 5/29/2049 | 3,195,000 |

| 6,600,000 | | Voto-Votorantim O/S Trad, Series REGS, 6.625%, 9/25/2019 | 7,375,500 |

| | | TOTAL | 10,570,500 |

| | | Consumer Products—0.5% | |

| 1,500,000 | | Fomento Economico Mexicano, SA de C.V., 2.875%, 5/10/2023 | 1,343,547 |

| 3,250,000 | | Fomento Economico Mexicano, SA de C.V., 4.375%, 5/10/2043 | 2,741,928 |

| | | TOTAL | 4,085,475 |

| | | Farming & Agriculture—0.3% | |

| 2,340,000 | 1,2 | Kazagro Natl Mgmt Hldng., Series 144A, 4.625%, 5/24/2023 | 2,132,208 |

| | | Finance—0.3% | |

| 2,000,000 | 1,2 | Corp Financi De Desarrol, Sr. Unsecd. Note, Series 144A, 4.75%, 2/8/2022 | 1,990,000 |

| 500,000 | | Gruposura Finance, Company Guarantee, Series REGS, 5.70%, 5/18/2021 | 516,250 |

| | | TOTAL | 2,506,250 |

| | | Financial Intermediaries—1.0% | |

| 1,970,000 | | ADIB Capital Invest 1 Ltd., 6.375%, 10/29/2049 | 1,994,625 |

| 2,650,000 | 1,2 | Banco Santander, SA, Series 144A, 4.125%, 11/9/2022 | 2,530,750 |

| 3,300,000 | | SASOL Financing International PLC, 4.50%, 11/14/2022 | 3,114,375 |

| | | TOTAL | 7,639,750 |

| | | Food & Drug Retailers—0.1% | |

| 600,000 | | Cencosud SA, Series REGS, 4.875%, 1/20/2023 | 571,944 |

| | | Food Products—1.9% | |

| 6,320,000 | 1,2 | BRF-Brasil Foods SA, Series 144A, 3.95%, 5/22/2023 | 5,624,800 |

| 1,550,000 | | BRF-Brasil Foods SA, Series REGS, 3.95%, 5/22/2023 | 1,379,500 |

| 3,810,000 | 1,2 | Grupo Bimbo SAB de CV, Sr. Unsecd. Note, Series 144A, 4.50%, 1/25/2022 | 3,856,528 |

| 1,900,000 | 1,2 | JBS Investments GmbH, Series 144A, 7.75%, 10/28/2020 | 1,919,000 |

| 2,000,000 | 1,2 | Minerva Luxembourg SA, Series 144A, 7.75%, 1/31/2023 | 1,970,000 |

| | | TOTAL | 14,749,828 |

| | | Metals & Mining—3.5% | |

| 1,842,000 | | Alrosa Finance SA, Company Guarantee, Series REGS, 7.75%, 11/3/2020 | 2,051,527 |

| 2,058,000 | | Anglogold Ashanti Holdings PLC, Sr. Unsecd. Note, 5.125%, 8/1/2022 | 1,823,744 |

| 4,080,000 | | Anglogold Ashanti Holdings PLC, Sr. Unsecd. Note, 8.50%, 7/30/2020 | 4,294,200 |

| 2,600,000 | 1,2 | Codelco, Inc., Series 144A, 3.00%, 7/17/2022 | 2,370,774 |

| 500,000 | 1,2 | Fresnillo PLC, Series 144A, 5.50%, 11/13/2023 | 493,750 |

| 2,235,000 | | Nord Gold NV, Series REGS, 6.375%, 5/7/2018 | 2,134,872 |

| 3,200,000 | 1,2 | Polyus Gold International, Ltd., Series 144A, 5.625%, 4/29/2020 | 3,144,000 |

| 1,950,000 | 1,2 | Samarco Mineracao SA, Series 144A, 4.125%, 11/1/2022 | 1,750,125 |

| 1,500,000 | 1,2 | Samarco Mineracao SA, Series 144A, 5.75%, 10/24/2023 | 1,477,500 |

| 2,000,000 | | Vale Overseas Ltd., 4.375%, 1/11/2022 | 1,940,866 |

Annual Shareholder Report

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | CORPORATE BONDS—continued |

| | | Metals & Mining—continued |

| 4,790,000 | | Vale Overseas Ltd., 6.875%, 11/21/2036 | $4,925,140 |

| 1,500,000 | | Vale SA, 5.625%, 9/11/2042 | 1,334,703 |

| | | TOTAL | 27,741,201 |

| | | Oil & Gas—17.6% | |

| 1,200,000 | 1,2 | Afren PLC, Series 144A, 6.625%, 12/9/2020 | 1,199,732 |

| 1,750,000 | | Afren PLC, Series REGS, 10.25%, 4/8/2019 | 2,043,125 |

| 3,000,000 | 1,2 | Alliance Oil Co. Ltd., Series 144A, 7.00%, 5/4/2020 | 2,947,500 |

| 3,000,000 | 1,2 | CNOOC Finance 2012 Ltd., Series 144A, 3.875%, 5/2/2022 | 2,962,533 |

| 3,400,000 | | Ecopetrol SA, Note, 7.625%, 7/23/2019 | 4,029,000 |

| 1,370,000 | 1,2 | Gazprom Neft, Series 144A, 6.00%, 11/27/2023 | 1,392,262 |

| 10,850,000 | 1,2 | Gazprom, Note, Series 144A, 8.625%, 4/28/2034 | 12,843,688 |

| 4,600,000 | 1,2 | IPIC GMTN, Ltd., Company Guarantee, Series 144A, 5.00%, 11/15/2020 | 5,025,500 |

| 3,000,000 | | KazMunaiGaz Finance Sub BV, Series REGS, 6.375%, 4/9/2021 | 3,277,500 |

| 1,200,000 | 1,2 | Kazmunaygas National Co., Series 144A, 4.40%, 4/30/2023 | 1,115,400 |

| 2,900,000 | 1,2 | Kazmunaygas National Co., Series 144A, 5.75%, 4/30/2043 | 2,522,855 |

| 3,800,000 | 1,2 | Lukoil International Finance BV, Company Guarantee, Series 144A, 6.125%, 11/9/2020 | 4,142,000 |

| 2,000,000 | 1,2 | Lukoil International Finance BV, Series 144A, 3.416%, 4/24/2018 | 2,020,400 |

| 3,200,000 | 1,2 | Lukoil International Finance BV, Series 144A, 4.563%, 4/24/2023 | 2,984,000 |

| 4,000,000 | 1,2 | PTT Public Co. Ltd., Series 144A, 4.50%, 10/25/2042 | 3,207,612 |

| 1,000,000 | 1,2 | PTTEP Canada International, Series 144A, 6.35%, 6/12/2042 | 1,042,303 |

| 2,800,000 | | PTTEP Canada International, Series REGS, 5.692%, 4/5/2021 | 3,048,340 |

| 3,500,000 | 1,2 | Pacific Rubiales, Series 144A, 5.375%, 1/26/2019 | 3,508,750 |

| 5,627,000 | 1,2 | Pacific Rubiales, Sr. Unsecd. Note, Series 144A, 7.25%, 12/12/2021 | 5,950,552 |

| 1,150,000 | 1,2 | Pertamina PT, Note, Series 144A, 5.25%, 5/23/2021 | 1,102,562 |

| 4,400,000 | 1,2 | Pertamina PT, Series 144A, 4.30%, 5/20/2023 | 3,762,000 |

| 1,000,000 | 1,2 | Pertamina PT, Sr. Unsecd. Note, Series 144A, 6.50%, 5/27/2041 | 855,000 |

| 5,300,000 | | Petrobras International Finance Co., Company Guarantee, 7.875%, 3/15/2019 | 6,155,076 |

| 4,100,000 | | Petrobras International Finance Co., Sr. Unsecd. Note, 5.375%, 1/27/2021 | 4,131,939 |

| 31,475,000 | | Petroleos de Venezuela, SA, Company Guarantee, Series REGS, 8.50%, 11/2/2017 | 25,101,313 |

| 1,600,000 | | Petroleos Mexicanos, 3.50%, 1/30/2023 | 1,461,600 |

| 1,530,000 | | Petroleos Mexicanos, 3.50%, 7/18/2018 | 1,565,098 |

| 1,600,000 | | Petroleos Mexicanos, 6.50%, 6/2/2041 | 1,625,318 |

| 4,650,000 | | Petroleos Mexicanos, Company Guarantee, Series WI, 8.00%, 5/3/2019 | 5,638,125 |

| 2,050,000 | | Petroleos Mexicanos, Floating Rate Note—Sr. Note, 2.266%, 7/18/2018 | 2,121,750 |

| 1,983,333 | | Petroleum Co. of Trinidad and Tobago Ltd., Sr. Unsecd. Note, Series REGS, 6.00%, 5/8/2022 | 2,117,208 |

| 3,725,000 | 1,2 | Reliance Industries Ltd., Series 144A, 5.875%, 2/28/2049 | 3,166,250 |

| 800,000 | 1,2 | Sinopec Group Oversea 2012, Series 144A, 3.90%, 5/17/2022 | 792,550 |

| 800,000 | 1,2 | Sinopec Group Oversea 2012, Series 144A, 4.875%, 5/17/2042 | 766,938 |

| 1,800,000 | 1,2 | Sinopec Group Oversea 2013, Series 144A, 2.50%, 10/17/2018 | 1,814,989 |

| 2,565,000 | 1,2 | Sinopec Group Oversea 2013, Series 144A, 4.375%, 10/17/2023 | 2,567,278 |

| 2,500,000 | 1,2 | Thai Oil PCL, Series 144A, 3.625%, 1/23/2023 | 2,294,350 |

| 2,350,000 | 1,2 | Thai Oil PCL, Series 144A, 4.875%, 1/23/2043 | 1,956,641 |

| 2,500,000 | 1,2 | Transport De Gas Peru, Series 144A, 4.25%, 4/30/2028 | 2,200,000 |

| 1,200,000 | 1,2 | Transprtdra De Gas Intl, Series 144A, 5.70%, 3/20/2022 | 1,239,000 |

| 2,300,000 | | Transprtdra De Gas Intl, Series REGS, 5.70%, 3/20/2022 | 2,374,750 |

| | | TOTAL | 140,072,787 |

| | | Paper Products—1.2% | |

| 8,650,000 | | Fibria Overseas Finance, Company Guarantee, Series REGS, 6.75%, 3/3/2021 | 9,515,000 |

Annual Shareholder Report

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | CORPORATE BONDS—continued |

| | | Real Estate—0.8% | |

| 5,700,000 | 1,2 | Qatari Diar Finance QSC, Foreign Gov't. Guarantee, Series 144A, 5.00%, 7/21/2020 | $6,298,500 |

| | | Retailers—0.3% | |

| 2,340,000 | 1,2 | Saci Falabella, Series 144A, 3.75%, 4/30/2023 | 2,157,215 |

| | | Sovereign—0.8% | |

| 2,000,000 | 1,2 | Bank of Georgia JSC, Series 144A, 7.75%, 7/5/2017 | 2,098,453 |

| 3,800,000 | 1,2 | Qatar, Government of, Series 144A, 6.40%, 1/20/2040 | 4,351,000 |

| | | TOTAL | 6,449,453 |

| | | State/Provincial—0.6% | |

| 5,400,000 | 1,2 | Brazil Minas SPE, Series 144A, 5.333%, 2/15/2028 | 5,089,500 |

| | | Steel—0.4% | |

| 3,200,000 | | OJSC Novo (Steel Funding), Series REGS, 4.95%, 9/26/2019 | 3,172,000 |

| | | Technology Services—0.5% | |

| 4,200,000 | | STATS ChipPAC Ltd., Series REGS, 4.50%, 3/20/2018 | 4,200,000 |

| | | Telecommunications & Cellular—5.4% | |

| 1,800,000 | | America Movil SAB de CV, Company Guarantee, Series WI, 5.00%, 10/16/2019 | 1,986,817 |

| 2,425,000 | | America Movil SAB de CV, Floating Rate Note—Sr. Note, 1.256%, 9/12/2016 | 2,450,560 |

| 5,850,000 | 1,2 | Digicel Ltd., Series 144A, 6.00%, 4/15/2021 | 5,659,875 |

| 3,000,000 | | MTS International Funding Ltd., Series REGS, 8.625%, 6/22/2020 | 3,555,000 |

| 1,500,000 | 1,2 | MTS International Funding Ltd., Sr. Unsecd. Note, Series 144A, 8.625%, 6/22/2020 | 1,777,500 |

| 3,600,000 | 1,2 | Qtel International Finance Ltd., Bank Guarantee, Series 144A, 5.00%, 10/19/2025 | 3,654,000 |

| 2,800,000 | 1,2 | Qtel International Finance Ltd., Company Guarantee, Series 144A, 4.75%, 2/16/2021 | 2,964,500 |

| 1,400,000 | 1,2 | Qtel International Finance Ltd., Series 144A, 3.25%, 2/21/2023 | 1,274,280 |

| 1,000,000 | 1,2 | Qtel International Finance Ltd., Series 144A, 3.875%, 1/31/2028 | 870,200 |

| 2,600,000 | 1,2 | Telemovil Finance Co., Ltd., Company Guarantee, Series 144A, 8.00%, 10/1/2017 | 2,782,000 |

| 4,500,000 | | Telemovil Finance Co., Ltd., Company Guarantee, Series REGS, 8.00%, 10/1/2017 | 4,815,000 |

| 4,600,000 | 1,2 | Vimpelcom, Company Guarantee, Series 144A, 7.504%, 3/1/2022 | 4,815,740 |

| 6,900,000 | 1,2 | Vimpelcom, Series 144A, 5.95%, 2/13/2023 | 6,537,750 |

| | | TOTAL | 43,143,222 |

| | | Transportation—0.2% | |

| 1,600,000 | 1,2 | Topaz Marine SA, Series 144A, 8.625%, 11/1/2018 | 1,616,000 |

| | | Utilities—5.8% | |

| 3,500,000 | 1,2 | Abu Dhabi National Energy Co. PJSC, Series 144A, 3.625%, 1/12/2023 | 3,276,875 |

| 6,350,000 | | Cent Elet Brasil Elebra, Series REGS, 5.75%, 10/27/2021 | 6,223,000 |

| 1,000,000 | | Centrais Eletricas Brasileiras SA, Sr. Unsecd. Note, Series REGS, 6.875%, 7/30/2019 | 1,075,000 |

| 1,345,000 | 1,2 | Comision Fed De Electric, Series 144A, 4.875%, 1/15/2024 | 1,338,275 |

| 5,305,000 | 1,2 | Dubai Electricity & Water, Sr. Unsecd. Note, Series 144A, 7.375%, 10/21/2020 | 6,233,375 |

| 1,228,000 | | Hrvatska Electroprivreda, Series REGS, 6.00%, 11/9/2017 | 1,244,885 |

| 3,150,000 | | Israel Electric Corp. Ltd., Series REGS, 7.25%, 1/15/2019 | 3,507,402 |

| 6,950,000 | 1,2 | Israel Electric Corp. Ltd., Sr. Unsecd. Note, Series 144A, 6.70%, 2/10/2017 | 7,535,051 |

| 6,010,000 | | Majapahit Holding BV, Company Guarantee, Series REGS, 7.75%, 1/20/2020 | 6,641,050 |

| 4,750,000 | | Power Sector Assets & Liabilities Management Corp., Company Guarantee, Series REGS, 7.39%, 12/2/2024 | 5,842,500 |

| 2,800,000 | | Power Sector Assets & Liabilities Management Corp., Series REGS, 7.25%, 5/27/2019 | 3,356,500 |

| | | TOTAL | 46,273,913 |

| | | TOTAL CORPORATE BONDS

(IDENTIFIED COST $446,874,038) | 446,337,981 |

| | | FLOATING RATE LOAN—0.1% | |

| 1,472,352 | 3 | Carolbrl, 1.00%, 12/31/2017

(IDENTIFIED COST $1,449,409) | 589,677 |

Annual Shareholder Report

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | GOVERNMENTS/AGENCIES—38.5% | |

| | | Banking—0.9% | |

| 3,961,000 | | African Export-Import Bank, 5.75%, 7/27/2016 | $4,208,562 |

| 2,450,000 | | African Export-Import Bank, 8.75%, 11/13/2014 | 2,603,125 |

| | | TOTAL | 6,811,687 |

| | | Sovereign—37.6% | |

| 20,600,000 | | Argentina, Government of, Note, 0.00%, 12/15/2035 | 1,843,700 |

| 13,723,000 | | Argentina, Government of, Sr. Unsecd. Note, 7.00%, 10/3/2015 | 13,517,155 |

| 5,805,000 | 1,2 | Armenia, Government of, Sr. Unsecd. Note, Series 144A, 6.00%, 9/30/2020 | 5,709,218 |

| 4,200,000 | 1,2 | Bahrain, Government of, Series 144A, 6.125%, 8/1/2023 | 4,353,090 |

| 2,665,000 | 1,2 | Bolivia, Government of, Series 144A, 4.875%, 10/29/2022 | 2,531,750 |

| 15,769,000 | | Brazil, Government of, 4.25%, 1/7/2025 | 14,822,860 |

| 3,500,000 | | Brazil, Government of, Note, 8.00%, 1/15/2018 | 3,893,750 |

| 4,000,000 | | Brazil, Government of, Unsub., 11.00%, 8/17/2040 | 4,600,000 |

| 1,100,000 | 1,2 | Central Bank of Nigeria, Series 144A, 5.125%, 7/12/2018 | 1,127,500 |

| 5,000,000 | | Colombia, Government of, 7.375%, 9/18/2037 | 6,087,500 |

| 3,100,000 | | Colombia, Government of, Note, 7.375%, 1/27/2017 | 3,596,000 |

| 2,225,000 | | Colombia, Government of, Sr. Unsecd. Note, 4.375%, 7/12/2021 | 2,314,000 |

| 1,500,000 | 1,2 | Costa Rica, Government of, Series 144A, 4.25%, 1/26/2023 | 1,372,500 |

| 1,000,000 | 1,2 | Costa Rica, Government of, Series 144A, 4.375%, 4/30/2025 | 900,000 |

| 550,000 | | Croatia, Government of, Sr. Unsecd. Note, 6.25%, 4/27/2017 | 584,485 |

| 1,200,000 | 1,2 | Dominican Republic, Government of, Series 144A, 5.875%, 4/18/2024 | 1,125,600 |

| 1,500,000 | | Dominican Republic, Government of, Sr. Unsecd. Note, 7.50%, 5/6/2021 | 1,612,500 |

| 6,200,000 | | Dubai, Government of, 5.25%, 1/30/2043 | 5,285,500 |

| 800,000 | 1,2 | Ghana, Government of, Series 144A, 7.875%, 8/7/2023 | 780,000 |

| 1,010,000 | 1,2 | Guatemala, Government of, Series 144A, 4.875%, 2/13/2028 | 909,000 |

| 1,502,000 | | Hungary, Government of, 4.125%, 2/19/2018 | 1,505,004 |

| 1,970,000 | | Hungary, Government of, 5.75%, 11/22/2023 | 1,950,300 |

| 1,500,000 | | Hungary, Government of, 6.375%, 3/29/2021 | 1,610,625 |

| 4,700,000 | | Hungary, Government of, Unsecd. Note, 6.25%, 1/29/2020 | 5,046,625 |

| 7,820,000 | | Iceland, Government of, 4.875%, 6/16/2016 | 8,142,575 |

| 2,810,000 | | Indonesia, Government of, 6.875%, 1/17/2018 | 3,154,225 |

| 5,300,000 | 1,2 | Indonesia, Government of, Sr. Unsecd. Note, Series 144A, 11.625%, 3/4/2019 | 7,115,250 |

| 1,800,000 | | Kingdom of Morocco, 4.25%, 12/11/2022 | 1,656,000 |

| 2,200,000 | 1,2 | Kingdom of Morocco, Series 144A, 4.25%, 12/11/2022 | 2,024,000 |

| 3,200,000 | | Lithuania, Government of, Sr. Unsecd. Note, 6.125%, 3/9/2021 | 3,642,400 |

| 5,858,000 | | Panama, Government of, 6.70%, 1/26/2036 | 6,502,380 |

| 4,620,000 | | Peru, Government of, Bond, 7.35%, 7/21/2025 | 5,832,750 |

| 2,650,000 | | Philippines, Government of, Sr. Unsecd. Note, 5.50%, 3/30/2026 | 2,944,150 |

| 7,200,000 | | Philippines, Government of, Sr. Unsecd. Note, 6.375%, 10/23/2034 | 8,524,800 |

| 1,650,000 | | Poland, Government of, 3.00%, 3/17/2023 | 1,507,688 |

| 3,900,000 | | Poland, Government of, Sr. Unsecd. Note, 6.375%, 7/15/2019 | 4,572,750 |

| 10,730,000 | | Republica Oriental del Uruguay, 7.625%, 3/21/2036 | 13,063,775 |

| 3,800,000 | 1,2 | Russia, Government of, Series 144A, 3.50%, 1/16/2019 | 3,876,000 |

| 6,800,000 | 1,2 | Russia, Government of, Bond, Series 144A, 5.00%, 4/29/2020 | 7,318,500 |

| 35,978,800 | | Russia, Government of, Unsub., 7.50%, 3/31/2030 | 42,095,196 |

| 1,315,000 | 1,2 | Serbia, Government of, Series 144A, 5.875%, 12/3/2018 | 1,324,862 |

| 2,690,000 | 1,2 | Sri Lanka, Government of, Sr. Unsecd. Note, Series 144A, 6.25%, 10/4/2020 | 2,609,300 |

| 5,000,000 | | Turkey, Government of, 6.75%, 5/30/2040 | 5,143,750 |

| 6,770,000 | | Turkey, Government of, 6.875%, 3/17/2036 | 7,049,262 |

| 2,750,000 | | Turkey, Government of, 7.00%, 9/26/2016 | 3,038,750 |

Annual Shareholder Report

Shares or

Foreign

Currency

Par Amount | | | Value in

U.S. Dollars |

| | | GOVERNMENTS/AGENCIES—continued |

| | | Sovereign—continued |

| 16,320,000 | | Turkey, Government of, Bond, 5.625%, 3/30/2021 | $16,940,160 |

| 9,500,000 | | Turkey, Government of, Note, 7.375%, 2/5/2025 | 10,649,500 |

| 26,600,000 | | United Mexican States, Note, 5.125%, 1/15/2020 | 29,592,500 |

| 7,600,000 | | United Mexican States, Sr. Unsecd. Note, 5.95%, 3/19/2019 | 8,797,000 |

| 3,300,000 | | Uruguay, Government of, Note, 8.00%, 11/18/2022 | 4,059,000 |

| 1,200,000 | | Zambia, Government of, 5.375%, 9/20/2022 | 1,050,000 |

| | | TOTAL | 299,305,185 |

| | | TOTAL GOVERNMENTS/AGENCIES

(IDENTIFIED COST $291,821,236) | 306,116,872 |

| | | INVESTMENT COMPANy—4.7% | |

| 37,304,479 | 4,5 | Federated Prime Value Obligations Fund, Institutional Shares, 0.07%

(AT NET ASSET VALUE) | 37,304,479 |

| | | TOTAL INVESTMENTS—99.4%

(IDENTIFIED COST $777,381,182)6 | 790,349,009 |

| | | OTHER ASSETS AND LIABILITIES - NET—0.6%7 | 4,727,782 |

| | | TOTAL NET ASSETS—100% | $795,076,791 |

At November 30, 2013, the Fund had the following outstanding foreign exchange contracts:

| Settlement Date | Foreign

Currency

Units to

Deliver/Receive | In

Exchange

For | Unrealized

Appreciation |

| Contract Purchased: | | | |

| 2/5/2014 | 3,897,393 Euro | $5,287,593 | $7,268 |

| Contract Sold: | | | |

| 2/5/2014 | 3,897,393 Euro | $5,301,935 | $7,074 |

| UNREALIZED APPRECIATION ON FOREIGN EXCHANGE CONTRACTS | $14,342 |

Unrealized Appreciation on Foreign Exchange Contracts is included in “Other Assets and Liabilities—Net.”

| 1 | Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At November 30, 2013, these restricted securities amounted to $283,969,612, which represented 35.7% of total net assets. |

| 2 | Denotes a restricted security that may be resold without restriction to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933 and that the Fund has determined to be liquid under criteria established by the Fund's Board of Directors (the “Directors”). At November 30, 2013, these liquid restricted securities amounted to $283,969,612, which represented 35.7% of total net assets. |

| 3 | The rate shown represents a weighted average coupon rate on settled positions at year/period end. Remaining maturities of floating rate loans may be less than stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. Floating rate loans generally have rates of interest which are determined periodically by reference to a base lending rate plus a premium. |

| 4 | Affiliated holding. |

| 5 | 7-day net yield. |

| 6 | The cost of investments for federal tax purposes amounts to $778,387,939. |

| 7 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at November 30, 2013.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities, including investment companies with daily net asset values, if applicable.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of November 30, 2013, in valuing the Fund's assets carried at fair value:

| Valuation Inputs |

| | Level 1—

Quoted

Prices and

Investments

in Investment

Companies | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | Total |

| Debt Securities: | | | | |

| Corporate Bonds | $— | $446,337,981 | $— | $446,337,981 |

| Floating Rate Loan | — | — | 589,677 | 589,677 |

| Governments/Agencies | — | 306,116,872 | — | 306,116,872 |

| Investment Company | 37,304,479 | — | — | 37,304,479 |

| TOTAL SECURITIES | $37,304,479 | $752,454,853 | $589,677 | $790,349,009 |

| OTHER FINANCIAL INSTRUMENTS* | $— | $14,342 | $— | $14,342 |

| * | Other financial instruments include foreign exchange contracts. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $34.73 | $29.27 | $27.40 | $24.04 | $15.99 |

| Income From Investment Operations: | | | | | |

| Net investment income1 | 1.88 | 1.91 | 1.88 | 1.90 | 1.75 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (3.41) | 3.55 | (0.01) | 1.46 | 6.30 |

| TOTAL FROM INVESTMENT OPERATIONS | (1.53) | 5.46 | 1.87 | 3.36 | 8.05 |

| Net Asset Value, End of Period | $33.20 | $34.73 | $29.27 | $27.40 | $24.04 |

| Total Return2 | (4.42)% | 18.65% | 6.82% | 13.98% | 50.34% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 0.00%3 | 0.00%3 | 0.00%3 | 0.00%3 | 0.00%4 |

| Net investment income | 5.53% | 5.99% | 6.63% | 7.41% | 8.46% |

| Expense waiver/reimbursement5 | 0.06% | 0.06% | 0.06% | 0.06% | 0.17% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $795,077 | $764,886 | $687,883 | $698,514 | $461,477 |

| Portfolio turnover | 37% | 19% | 18% | 23% | 30% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | The Adviser has voluntarily agreed to reimburse all operating expenses incurred by the Fund. This arrangement has no fixed term. |

| 4 | Represents less than 0.01%. |

| 5 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

November 30, 2013

| Assets: | | |

Total investment in securities, at value including $37,304,479 of investment in an affiliated holding (Note 5)

(identified cost $777,381,182) | | $790,349,009 |

| Cash | | 210,459 |

| Income receivable | | 8,944,484 |

| Unrealized appreciation on foreign exchange contracts | | 14,342 |

| Bank loan receivable | | 9,979 |

| TOTAL ASSETS | | 799,528,273 |

| Liabilities: | | |

| Payable for investments purchased | $4,350,623 | |

| Payable to adviser (Note 5) | 1,633 | |

| Payable for Directors'/Trustees' fees (Note 5) | 1,045 | |

| Accrued expenses (Note 5) | 98,181 | |

| TOTAL LIABILITIES | | 4,451,482 |

| Net assets for 23,950,696 shares outstanding | | $795,076,791 |

| Net Assets Consist of: | | |

| Paid-in capital | | $782,094,622 |

| Net unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | 12,982,169 |

| TOTAL NET ASSETS | | $795,076,791 |

| Net Asset Value, Offering Price and Redemption Proceeds Per Share: | | |

| $795,076,791 ÷ 23,950,696 shares outstanding | | $33.20 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended November 30, 2013

| Investment Income: | | |

| Interest (net of foreign taxes withheld of $180) | | $45,840,667 |

| Dividends received from an affiliated holding (Note 5) | | 32,525 |

| TOTAL INCOME | | 45,873,192 |

| Expenses: | | |

| Custodian fees | $165,198 | |

| Transfer agent fee | 70,093 | |

| Directors'/Trustees' fees (Note 5) | 11,514 | |

| Auditing fees | 30,949 | |

| Legal fees | 7,408 | |

| Portfolio accounting fees | 151,445 | |

| Printing and postage | 11,133 | |

| Insurance premiums (Note 5) | 5,483 | |

| Taxes | 250 | |

| Miscellaneous (Note 5) | 7,860 | |

| TOTAL EXPENSES | 461,333 | |

| Reimbursement of other operating expenses (Note 5) | (461,333) | |

| Net expenses | | — |

| Net investment income | | 45,873,192 |

| Realized and Unrealized Loss on Investments and Foreign Currency Transactions: | | |

| Net realized loss on investments and foreign currency transactions | | (2,170,586) |

| Net change in unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | (87,153,380) |

| Net realized and unrealized loss on investments and foreign currency transactions | | (89,323,966) |

| Change in net assets resulting from operations | | $(43,450,774) |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended November 30 | 2013 | 2012 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $45,873,192 | $45,244,030 |

| Net realized gain (loss) on investments and foreign currency transactions | (2,170,586) | 16,916,868 |

| Net change in unrealized appreciation/depreciation of investments and translation of assets and liabilities in foreign currency | (87,153,380) | 65,895,799 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | (43,450,774) | 128,056,697 |

| Share Transactions: | | |

| Contributions | 320,028,385 | 79,248,500 |

| Withdrawals | (246,387,179) | (130,302,000) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 73,641,206 | (51,053,500) |

| Change in net assets | 30,190,432 | 77,003,197 |

| Net Assets: | | |

| Beginning of period | 764,886,359 | 687,883,162 |

| End of period | $795,076,791 | $764,886,359 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

November 30, 2013

1. ORGANIZATION

Emerging Markets Fixed Income Core Fund (the “Fund”) is a non-diversified portfolio of Federated Core Trust II, L.P. (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “Act”). The Trust is a limited partnership that was established under the laws of the State of Delaware on November 13, 2000 and offered only to registered investment companies and other accredited investors. The Trust consists of one portfolio. The Fund's primary investment objective is to achieve total return on its assets. Its secondary investment objective is to achieve a high level of income.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Directors. |

| ■ | Fixed-income securities and repurchase agreements acquired with remaining maturities of 60 days or less are valued at their amortized cost (adjusted for the accretion of any discount or amortization of any premium), unless the issuer's creditworthiness is impaired or other factors indicate that amortized cost is not an accurate estimate of the investment's fair value, in which case it would be valued in the same manner as a longer-term security. |

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Directors. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Directors, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, or if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Directors have appointed a Valuation Committee comprised of officers of the Fund, Federated Investment Counseling (“Adviser”) and certain of the Adviser's affiliated companies to determine fair value of securities and in overseeing the calculation of the NAV. The Directors have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Directors. The Directors periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities and mortgage-backed securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Directors.

Annual Shareholder Report

The Directors also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

The Directors have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Directors.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. All net income and gain/loss (realized and unrealized) will be allocated daily to the shareholders based on their capital contributions to the Fund. The Fund does not currently intend to declare and pay distributions.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted using the effective-interest-rate method.

Federal Taxes

As a partnership, the Fund is not subject to U.S. federal income tax. Instead, each investor reports separately on its own federal income tax return its allocated portion of the Fund's income, gain, losses, deductions and credits (including foreign tax credits for creditable foreign taxes imposed on the Fund). As of and during the year ended November 30, 2013, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of November 30, 2013, tax years 2010 through 2013 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Pennsylvania.

The Fund has reclassified $334,934,419 and $39,568,952 from undistributed net investment income and accumulated net realized gain on investments and foreign currency transactions, respectively, to paid-in capital during the year ended November 30, 2013. The reclassification was to reflect, as an adjustment to paid-in capital, the cumulative amount of net investment income and net realized gains that have been allocated to the Fund's shareholders as of November 30, 2013, and had no impact to shareholders' capital.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Annual Shareholder Report

Foreign Exchange Contracts

The Fund enters into foreign exchange contracts for the delayed-delivery of securities or foreign currency exchange transactions. The Fund enters into foreign exchange contracts to protect assets against adverse changes in foreign currency exchange rates or exchange control regulations. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund's securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

Foreign exchange contracts are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provides for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. Foreign exchange contracts outstanding at period end, including net unrealized appreciation/depreciation or net settlement amount, are listed after the Fund's Portfolio of Investments.

The average value at settlement date payable and receivable of foreign exchange contracts purchased and sold by the Fund throughout the period was $17,764 and $5,049, respectively. This is based on the contracts held as of each month-end throughout the fiscal period.

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies (FCs) are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales and maturities of short-term securities, sales of FCs, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate.

Restricted Securities

The Fund may purchase securities which are considered restricted. Restricted securities are securities that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) are subject to contractual restrictions on public sales. In some cases, when a security cannot be offered for public sale without first being registered, the issuer of the restricted security has agreed to register such securities for resale, at the issuer's expense, either upon demand by the Fund or in connection with another registered offering of the securities. Many such restricted securities may be resold in the secondary market in transactions exempt from registration. Restricted securities may be determined to be liquid under criteria established by the Directors. The Fund will not incur any registration costs upon such resales. The Fund's restricted securities, like other securities, are priced in accordance with procedures established by and under the general supervision of the Directors.

Additional Disclosure Related to Derivative Instruments

| Fair Value of Derivative Instruments |

| | Asset |

| | Statement of

Assets and

Liabilities

Location | Fair

Value |

Derivatives not accounted for as hedging instruments

under ASC Topic 815 | | |

| Foreign exchange contracts | Receivable for

foreign exchange

contracts | $14,342 |

Annual Shareholder Report

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended November 30, 2013

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| | Forward

Currency

Contracts |

| Foreign exchange contracts | $3,282 |

| Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income |

| | Forward

Currency

Contracts |

| Foreign exchange contracts | $14,342 |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated.

3. CONTRIBUTIONS/WITHDRAWALS

Transactions in shares were as follows:

| Year Ended November 30 | 2013 | 2012 |

| Contributions | 9,337,737 | 2,589,441 |

| Withdrawals | (7,411,217) | (4,067,972) |

| TOTAL CHANGE RESULTING FROM CONTRIBUTIONS/WITHDRAWALS | 1,926,520 | (1,478,531) |

4. FEDERAL TAX INFORMATION

At November 30, 2013, the cost of investments for federal tax purposes was $778,387,939. The net unrealized appreciation of investments for federal tax purposes excluding: a) any unrealized appreciation resulting from the translation of FCs to U.S. dollars of assets and liabilities other than investments in securities and b) outstanding foreign currency commitments was $11,961,070. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $30,518,486 and net unrealized depreciation from investments for those securities having an excess of cost over value of $18,557,416.

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The Adviser provides investment adviser services at no fee. The Adviser may voluntarily choose to reimburse certain operating expenses of the Fund. The Adviser can modify or terminate this voluntary reimbursement at any time at its sole discretion. For the year ended November 30, 2013, the Adviser voluntarily reimbursed $461,333 of other operating expenses.

Administrative Fee

Federated Administrative Services, Inc. (FASI), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. FASI provides administrative personnel and services at no fee.

Interfund Transactions

During the year ended November 30, 2013, the Fund engaged in purchase and sale transactions with funds that have a common investment adviser (or affiliated investment advisers), common Directors/Trustees, and/or common Officers. These purchase and sale transactions complied with Rule 17a-7 under the Act and amounted to $45,225,069 and $5,711,312, respectively.

General

Certain Officers and Directors of the Fund are Officers and Directors or Trustees of certain of the above companies. To efficiently facilitate payment, Directors'/Trustees' fees and certain expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses are paid by an affiliate of the Adviser which in due course are reimbursed by the Fund.

Annual Shareholder Report

Transactions Involving Affiliated Holdings

Affiliated holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions involving the affiliated holding during the year ended November 30, 2013, were as follows:

| | Federated

Prime Value

Obligations Fund,

Institutional Shares |

| Balance of Shares Held 11/30/2012 | 11,304,045 |

| Purchases/Additions | 459,431,065 |

| Sales/Reductions | (433,430,631) |

| Balance of Shares Held 11/30/2013 | 37,304,479 |

| Value | $37,304,479 |

| Dividend Income | $32,525 |

6. Investment TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended November 30, 2013, were as follows:

| Purchases | $391,763,510 |

| Sales | $293,023,343 |

7. CONCENTRATION OF RISK

Compared to diversified mutual funds, the Fund may invest a higher percentage of its assets among fewer issuers of portfolio securities. This increases the Fund's risk by magnifying the impact (positively or negatively) that any one issuer has on the Fund's share price and performance. The Fund invests in securities of non-U.S. issuers. Political or economic developments may have an effect on the liquidity and volatility of portfolio securities and currency holdings.

8. LINE OF CREDIT

The Fund participates in a $100,000,000 unsecured, uncommitted revolving line of credit (LOC) agreement with PNC Bank. The LOC was made available for extraordinary or emergency purposes, primarily for financing redemption payments. Borrowings are charged interest at a rate offered to the Fund by PNC Bank at the time of the borrowing. As of November 30, 2013, there were no outstanding loans. During the year ended November 30, 2013, the Fund did not utilize the LOC.

9. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other funds advised by subsidiaries of Federated Investors, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of November 30, 2013, there were no outstanding loans. During the year ended November 30, 2013, the program was not utilized.

Annual Shareholder Report

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF DIRECTORS OF Federated Core trust II, l.p. AND SHAREHOLDERS OF emerging markets fixed income core fund:

We have audited the accompanying statement of assets and liabilities of Emerging Markets Fixed Income Core Fund (the “Fund”) (one of the portfolios constituting Federated Core Trust II, L.P.), including the portfolio of investments, as of November 30, 2013, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2013, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Emerging Markets Fixed Income Core Fund, a portfolio of Federated Core Trust II, L.P., at November 30, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

January 24, 2014

Annual Shareholder Report

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur ongoing costs, including to the extent applicable, management fees, distribution (12b-1) fees and/or shareholder services fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2013 to November 30, 2013.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Beginning

Account Value

6/1/2013 | Ending

Account Value

11/30/2013 | Expenses Paid

During Period1 |

| Actual | $1,000 | $970.10 | $0.00 |

Hypothetical (assuming a 5% return

before expenses) | $1,000 | $1,025.07 | $0.00 |

| 1 | Expenses are equal to the Fund's annualized net expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half-year period). The Adviser has voluntarily agreed to reimburse all operating expenses incurred by the Fund. This arrangement has no fixed term. |

Annual Shareholder Report

Shareholder Meeting Results (unaudited)

A Special Meeting of Shareholders of Federated Core Trust II, L.P. (the “Trust”), of which the Fund is a portfolio, was held on October 28, 2013. On August 29, 2013, the record date for shareholders voting at the meeting, there were 24,389,155.837 total outstanding shares of the Trust.

The following item was considered by shareholders of the Trust and the results of their voting were as follows:

AGENDA ITEM

Proposal to elect certain Trustees of the Trust:1

| Name | For | Withheld |

| John T. Collins | 20,387,311.528 | 3,307,844.000 |

| Maureen Lally-Green | 20,387,311.528 | 3,307,844.000 |

| Thomas M. O'Neill | 20,387,311.528 | 3,307,844.000 |

| P. Jerome Richey | 20,387,311.528 | 3,307,844.000 |

| 1 | The following Trustees continued their terms:

John F. Donahue, J. Christopher Donahue, Maureen Lally-Green (having been previously appointed by the Board), Peter E. Madden, Charles F. Mansfield, Jr., Thomas M. O'Neill (having been previously appointed by the Board), and John S. Walsh. |

Board of Directors and Trust Officers

The Board of Directors is responsible for managing the Trust's business affairs and for exercising all the Trust's powers except those reserved for the shareholders. The following tables give information about each Director and the senior officers of the Fund. Where required, the tables separately list Directors who are “interested persons” of the Fund (i.e., “Interested” Directors) and those who are not (i.e., “Independent” Directors). Unless otherwise noted, the address of each person listed is Federated Investors Tower, 1001 Liberty Avenue, Pittsburgh, PA 15222. The address of all Independent Directors listed is 4000 Ericsson Drive, Warrendale, PA 15086-7561; Attention: Mutual Fund Board. As of December 31, 2013, the Trust comprised one portfolio(s), and the Federated Fund Family consisted of 42 investment companies (comprising 135 portfolios). Unless otherwise noted, each Officer is elected annually. Unless otherwise noted, each Director oversees all portfolios in the Federated Fund Family and serves for an indefinite term. The Fund's Statement of Additional Information includes additional information about Trust Directors and is available, without charge and upon request, by calling 1-800-341-7400.

In Memoriam - John F. Cunningham, Independent Director

With deep sadness, Federated announces the passing of John F. Cunningham, who served as an independent member of the Board of the Federated Fund Family since 1999. Mr. Cunningham's savvy business acumen and incisive intellect made him a powerful force on the Federated Fund Board. He was an advocate for shareholders and a respected colleague within the Federated family. Mr. Cunningham enjoyed an outstanding career in technology, having served as President and in other Senior Executive positions with leading companies in the industry. Federated expresses gratitude to Mr. Cunningham for his fine contributions as a Board member, colleague and friend. He will be greatly missed.

Interested Directors Background

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s) |

John F. Donahue*

Birth Date: July 28, 1924

Director

Began serving: November 2001 | Principal Occupations: Director or Trustee of the Federated Fund Family; Chairman and Director, Federated Investors, Inc.; Chairman of the Federated Fund Family's Executive Committee.

Previous Positions: Chairman of the Federated Fund Family; Trustee, Federated Investment Management Company; Chairman and Director, Federated Investment Counseling. |

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Director

Began serving: November 2000 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Fund Family; Director or Trustee of the Funds in the Federated Fund Family; President, Chief Executive Officer and Director, Federated Investors, Inc.; Chairman and Trustee, Federated Investment Management Company; Trustee, Federated Investment Counseling; Chairman and Director, Federated Global Investment Management Corp.; Chairman, Federated Equity Management Company of Pennsylvania and Passport Research, Ltd. (investment advisory subsidiary of Federated); Trustee, Federated Shareholder Services Company; Director, Federated Services Company.

Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer, Federated Investment Management Company, Federated Global Investment Management Corp. and Passport Research, Ltd. |