THE OFFERED NOTES

The issuing entity will issue and offer the following notes if the aggregate initial note balance of the notes is $1,085,188,000:

| | | | | | | | |

| Class | | Offered

Amounts(1)(2) | | | Interest Rate | | Final Scheduled

Payment Date |

| | | |

Class A-1 Notes | | $ | 212,800,000 | | | % | | September 15, 2020 |

Class A-2 Notes | | $ | 361,000,000 | | | % | | September 15, 2022 |

Class A-3 Notes | | $ | 335,350,000 | | | % | | May 15, 2024 |

Class A-4 Notes | | $ | 90,850,000 | | | % | | February 18, 2025 |

(1) If the aggregate initial note balance of the notes is $1,410,746,000, the following notes will be offered: $276,450,000 of Class A-1 notes, $469,300,000 of Class A-2 notes, $436,050,000 of Class A-3 notes and $118,200,000 of Class A-4 notes.

(2) Not less than 5% of each class of notes will be retained by CONA or one or more majority-owned affiliates of CONA (which for EU risk retention purposes will be a wholly-owned special purpose subsidiary of CONA) to satisfy the credit risk retention obligations of CONA described under “Credit Risk Retention” and “EU Risk Retention” in this prospectus. If the aggregate initial note balance of the notes is $1,085,188,000, $11,200,000 of the Class A-1 notes, $19,000,000 of the Class A-2 notes, $17,650,000 of the Class A-3 notes and $4,782,000 of the Class A-4 notes are not being offered hereunder. If the aggregate initial note balance of the notes is $1,410,746,000, $14,550,000 of the Class A-1 notes, $24,700,000 of the Class A-2 notes, $22,950,000 of the Class A-3 notes and $6,222,000 of the Class A-4 notes are not being offered hereunder.

The issuing entity will also issue $10,852,000 of Class B % asset-backed notes, $10,852,000 of Class C % asset-backed notes and $10,852,000 of Class D % asset-backed notes, if the aggregate initial note balance of the notes is $1,085,188,000, or $14,108,000 of Class B % asset-backed notes, $14,108,000 of Class C % asset-backed notes and $14,108,000 of Class D % asset-backed notes, if the aggregate initial note balance of the notes is $1,410,746,000, which, in either case, are not being offered by this prospectus.

The final scheduled payment date for the Class B notes is March 17, 2025. The final scheduled payment date for the Class C notes is April 15, 2025. The final scheduled payment date for the Class D notes is January 15, 2026.

The Class B notes, Class C notes and the Class D notes are not being publicly registered and will be retained by the sponsor or another majority-owned affiliate of the sponsor. Information about the Class B notes, Class C notes and the Class D notes is set forth herein solely to provide a better understanding of the Class A notes.

We refer to the Class A-1 notes, the Class A-2 notes, the Class A-3 notes and the Class A-4 notes as the “Class A notes.” We refer to the Class A notes, the Class B notes, the Class C notes and the Class D notes, collectively as the “notes.” The Class A notes, which we refer to as the “offered notes,” are the only securities that are being offered by this prospectus.

The notes are issuable in a minimum denomination of $1,000 and integral multiples of $1,000 in excess thereof.

So long as the Class A notes are outstanding, the Class A notes will be the “controlling class.” After the Class A notes have been paid in full, the Class B notes will be the controlling class; after the Class B notes have been paid in full, the Class C notes will be the controlling class; and after the Class C notes have been paid in full, the Class D notes will be the controlling class.

The issuing entity expects to issue the notes on or about September [●], 2019, which we refer to as the “closing date.”

THE CERTIFICATES

On the closing date, the issuing entity will issue subordinated and non-interest bearing “certificates” in a nominal aggregate principal amount of $100,000, which represent the equity interest in the issuing entity and are not offered hereby. The “certificateholders” will be entitled on each payment date only to amounts remaining after payments on the notes and payments of issuing entity expenses and other required amounts on such payment date. The certificates will initially be held by the depositor. The portion of the certificates retained by the depositor to satisfy U.S. and EU credit risk retention rules will not be sold or transferred except as permitted under those rules. See “—Credit Risk Retention” and “—EU Risk Retention.”

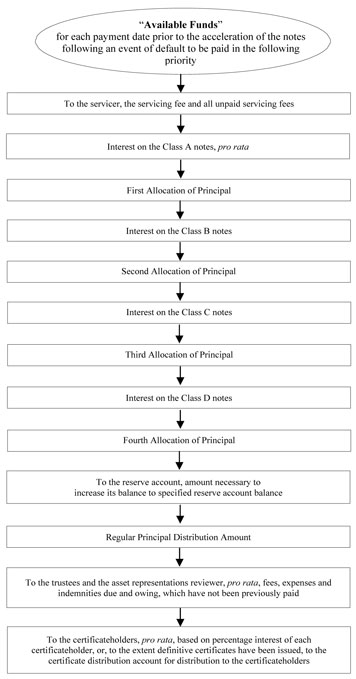

INTEREST AND PRINCIPAL

To the extent of funds available therefor and prior to an acceleration of the notes following an event of default, after payment of certain amounts to the servicer, the issuing entity will pay interest and principal on the notes monthly, on the 15th day of each month (or, if the 15th day is not a business day, on the next business day), which we refer to as the “payment date.” The first payment date is October 15, 2019. On each payment date, payments on the notes will be made to holders of record as of the close of business on the business day immediately preceding that payment date (except in limited circumstances where definitive notes are issued), which we refer to as the “record date.”