THE OFFERED NOTES

The issuing entity will offer the following notes if the aggregate initial note balance of the notes is $1,085,187,000:

| | | | | | | | |

| Class | | | | Offered

Amounts(1)(2) | | Interest

Rate | | Final Scheduled

Payment Date |

Class A-1 Notes | | | | $209,950,000 | | % | | February 16, 2021 |

Class A-2 Notes(3) | | | | $361,000,000 | | % | | June 15, 2023 |

Class A-3 Notes(3) | | | | $335,350,000 | | % | | November 15, 2024 |

Class A-4 Notes | | | | $93,700,000 | | % | | August 15, 2025 |

(1) If the aggregate initial note balance of the issued notes is $1,356,484,000, the aggregate initial note balance of the offered notes will be $1,250,000,000, consisting of the following offered notes: $263,150,000 of Class A-1 notes, $870,200,000 of Class A-2 notes and Class A-3 notes in the aggregate, and $116,650,000 of Class A-4 notes.

(2) Not less than 5% of each class of notes will be retained by CONA or one or more majority-owned affiliates of CONA (which for EU risk retention purposes will be a wholly-owned special purpose subsidiary of CONA) to satisfy the credit risk retention obligations of CONA described under “The Sponsor—Credit Risk Retention” and “—EU Risk Retention” in this prospectus. If the aggregate initial note balance of the notes is $1,085,187,000, $11,050,000 of the Class A-1 notes, $36,650,000 of the Class A-2 notes and the Class A-3 notes in the aggregate, and $4,932,000 of the Class A-4 notes are not being offered hereunder. If the aggregate initial note balance of the notes is $1,356,484,000, $13,850,000 of the Class A-1 notes, $45,800,000 of the Class A-2 notes and the Class A-3 notes in the aggregate, and $6,140,000 of the Class A-4 notes are not being offered hereunder.

(3) If the aggregate initial note balance of the issued notes is $1,085,187,000, the initial note balance of the issued Class A-2 notes is expected to be within the range of $330,000,000 - $430,000,000, and the initial note balance of the issued Class A-3 notes is expected to be within the range of $303,000,000 - $403,000,000. If the aggregate initial note balance of the issued notes is $1,356,484,000, the initial note balance of the issued Class A-2 notes is expected to be within the range of $413,000,000 - $538,000,000, and the initial note balance of the issued Class A-3 notes is expected to be within the range of $378,000,000 - $503,000,000. The offered amount of each of the Class A-2 notes and the Class A-3 notes will be 95% of the related initial note balance of such class. See “Risk Factors—There are risks associated with the unknown initial note balance of the notes”.

The issuing entity will also issue $10,852,000 of Class B % asset-backed notes, $10,852,000 of Class C % asset-backed notes and $10,851,000 of Class D % asset-backed notes, if the aggregate initial note balance of the notes is $1,085,187,000, or $13,565,000 of Class B % asset-backed notes, $13,565,000 of Class C % asset-backed notes and $13,564,000 of Class D % asset-backed notes, if the aggregate initial note balance of the notes is $1,356,484,000, which, in either case, are not being offered by this prospectus.

The final scheduled payment date for the Class B notes is September 15, 2025. The final scheduled payment date for the Class C notes is October 15, 2025. The final scheduled payment date for the Class D notes is July 15, 2026.

The Class B notes, Class C notes and the Class D notes are not being publicly registered and will be retained by the sponsor or another majority-owned affiliate of the sponsor. Information about the Class B notes, Class C notes and the Class D notes is set forth

herein solely to provide a better understanding of the Class A notes.

We refer to the Class A-1 notes, the Class A-2 notes, the Class A-3 notes and the Class A-4 notes as the “Class A notes.” We refer to the Class A notes, the Class B notes, the Class C notes and the Class D notes, collectively as the “notes.” The Class A notes, which we refer to as the “offered notes,” are the only securities that are being offered by this prospectus.

The notes are issuable in a minimum denomination of $1,000 and integral multiples of $1,000 in excess thereof.

So long as the Class A notes are outstanding, the Class A notes will be the “controlling class.” After the Class A notes have been paid in full, the Class B notes will be the controlling class; after the Class B notes have been paid in full, the Class C notes will be the controlling class; and after the Class C notes have been paid in full, the Class D notes will be the controlling class.

The issuing entity expects to issue the notes on or about February , 2020, which we refer to as the “closing date.”

THE CERTIFICATES

On the closing date, the issuing entity will issue subordinated and non-interest bearing “certificates” in a nominal aggregate principal amount of $100,000, which represent the equity interest in the issuing entity and are not offered hereby. The “certificateholders” will be entitled on each payment date only to amounts remaining after payments on the notes and payments of issuing entity expenses and other required amounts on such payment date. The certificates will initially be held by the depositor. The portion of the certificates retained by the depositor to satisfy U.S. and EU credit risk retention rules will not be sold or transferred except as permitted under those rules. See “The Sponsor—Credit Risk Retention” and “—EU Risk Retention.”

INTEREST AND PRINCIPAL

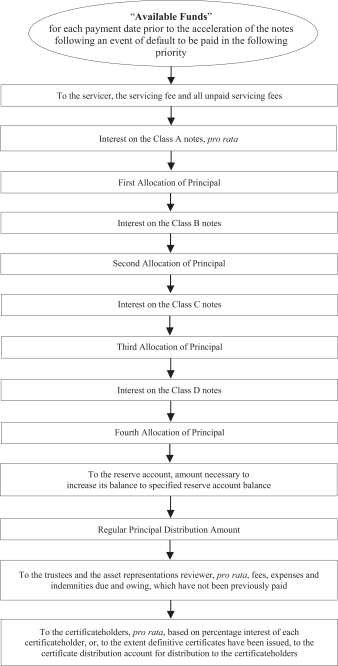

To the extent of funds available therefor and prior to an acceleration of the notes following an event of default, after payment of certain amounts to the servicer, the issuing entity will pay interest and principal on the notes monthly, on the 15th day of each month (or, if the 15th day is not a business day, on the next business day), which we refer to as the