| Writer's Direct Number | Writer's E-mail Address |

| 212.756.2208 | david.rosewater@srz.com |

April 11, 2014

VIA EDGAR AND ELECTRONIC MAIL

Mr. Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

Securities and Exchange Commission

Washington D.C. 20549 | |

| | Re: | XenoPort, Inc. (“XenoPort” or the "Company")

Preliminary Proxy Statement on Schedule 14A filed by Clinton Relational Opportunity Master Fund, L.P., Clinton Magnolia Master Fund, Ltd., GEH Capital, Inc., Clinton Relational Opportunity, LLC, Clinton Group, Inc., George E. Hall, Kevin J. Cameron, Rael Mazansky, M.D. and Charles A. Rowland, Jr. Filed March 28, 2014 File No. 001-51329 |

Dear Mr. Duchovny:

On behalf of Clinton Relational Opportunity Master Fund, L.P. and its affiliates (collectively, “Clinton”), Kevin J. Cameron, Rael Mazansky, M.D. and Charles A. Rowland, Jr. (each, a “Filing Person” and collectively with Clinton, the “Filing Persons”), we are responding to your letter dated April 4, 2014 (the “SEC Comment Letter”) in connection with the Preliminary Proxy Statement on Schedule 14A filed on March 28, 2014 (the "Preliminary Proxy Statement"). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the "Commission") and respond below. For your convenience, the comments are restated below in italics, with our responses following.

Concurrently with this letter, Clinton is filing a revised Preliminary Proxy Statement on Schedule 14A (the "Revised Proxy Statement"). The Revised Proxy Statement reflects revisions made to the Preliminary Proxy Statement in response to the comments of the Staff. Unless otherwise noted, the page numbers in the italicized headings below refer to pages in the Preliminary Proxy Statement, while the page numbers in the responses refer to pages in the Revised Proxy Statement. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Revised Proxy Statement.

For your convenience, we are emailing to your attention a copy of the Revised Proxy Statement, including a copy marked to show the changes from the Preliminary Proxy Statement.

Preliminary Schedule 14A

Reasons for Our Solicitation, page 6

- Please revise your disclosure to explain why you believe Mr. Barrett should be replaced.

In response to your comment, the Filing Persons have revised the disclosure on page 8 of the Revised Proxy Statement to include an explanation as to why they believe Mr. Barrett should be replaced.

- Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Please provide us the support for the following:

- Your belief that it is likely that “829 can be developed into an effective drug for the treatment of relapsing-remitting multiple sclerosis (“MS”) and/or psoriasis.”

In response to your comment, the Filing Persons note that early studies performed by the Company into the compound known as 829 show that it has a pharmacokinetic profile that nearly matches that of Biogen’s Tecfidera, which is another MMF pro-drug.[1]

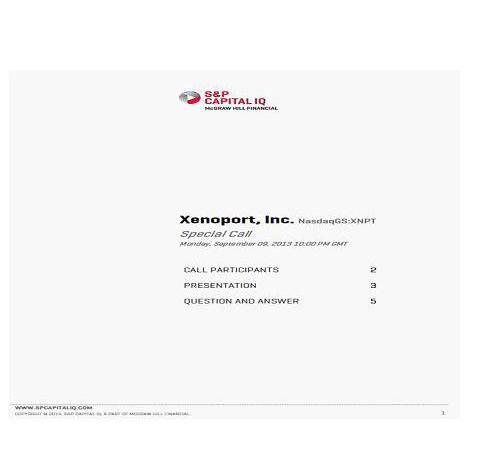

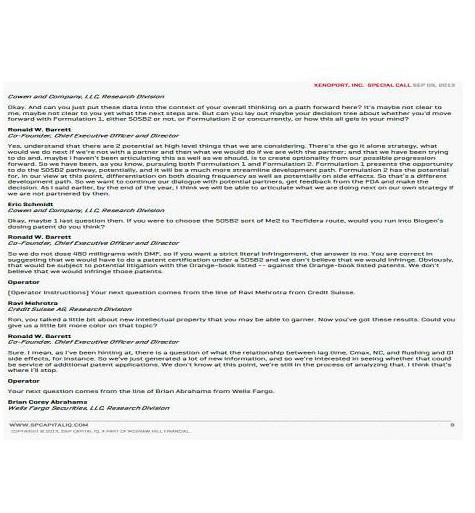

The Company’s CEO said on a September 9, 2013 conference call that 829 “could be bioequivalent to Tecfidera.” It is our belief that given this overlapping pharmacokinetic profile, 829 will exhibit effectiveness similar to that of Tecfidera, which been approved for the treatment of relapsing-remitting multiple sclerosis by the Food and Drug Administration. During the September 9, 2013 conference call, the Company’s CEO agreed, stating that “we believe the

[1]See XenoPort Form 8-K, filed with the Commission on September 9, 2013 (“The 400 mg BID XP23829 Formulation 1 dosed without food provided an MMF PK profile that was nearly identical to that of 240 mg BID TECFIDERA dosed without food”)

probability for success will be high based on these results. Therefore, we believe that [829] could be a candidate for a streamline development as a twice-a-day product for MS.”[2]

Biogen also performed extensive studies demonstrating the effectiveness of Tecfidera in treating psoriasis and we believe that the MMF generated by 829 (because of its overlapping pharmacokinetic profile with the MMF produced by Tecfidera) will be similarly effective in the treatment of psoriasis. The Company’s CEO commented on the September 9, 2013 conference call that 829 “with its similar [pharmacokinetic] profile would be anticipated to produce a similar effect in psoriasis” as Tecfidera.

- Your statement that the company’s early studies suggest that 829 “but may produce fewer side effects than Tecfidera.”

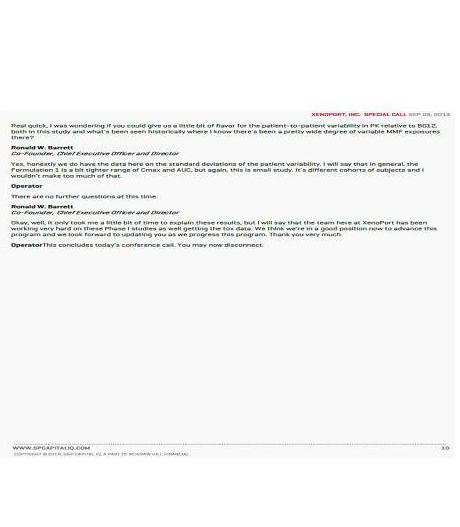

In response to your comment, the Filing Persons note that in the Company has reported that in its early studies of 829, the participants in the study experienced fewer side effects than those participants receiving Tecfidera.[3] There is also evidence from animal studies the Company performed that 829 was less irritating to the stomach lining of animals than Tecfidera.[4] On the September 9, 2013 conference call, the Company’s CEO said that, based on early results, he was “absolutely” hopeful that 829 would be superior to Tecfidera with respect to side effects and that 829 has the potential for “differentiation on both dosing frequency as well as potentially on side effects.”

- Your statement that the early studies also suggest that “it might be possible to create a time-release formulation of 829 that may have superior efficacy compared with Tecfidera as a result of providing more constant exposure to MMF and improving upon Tecfidera’s daily, dual-peak MMF exposure.”

In response to your comment, the Filing Persons note that the Company’s CEO has indicated that a particular longer-acting formulation of 829 that the Company tested “could potentially support once a day dosing in MS and/or Psoriasis” and might be “more effective, equally effective or less effective” than Tecfidera depending upon whether more prolonged exposure to the active ingredients (at a lower dosage) improves effectiveness.

- Your belief that 829 may become a “‘second generation’ biotechnology blockbuster[].”

[2] See transcript from XenoPort Special Call held Monday, September 9, 2013, attached hereto in Exhibit A.

[3] See transcript from XenoPort Special Call held Monday, September 9, 2013, attached hereto in Exhibit A.

[4] See transcript from XenoPort Special Call held Monday, September 9, 2013, attached hereto in Exhibit A.

In response to your comment, the Filing Persons note that there are many examples of follow-on biotechnology drugs that improve, even slightly, on the first generation drug’s efficacy, dosing or side effects and which have gone on to be large commercial and clinical successes. Like 829, these second-generation drugs – examples include Abraxane (which improved upon paclitaxel), Vyvanse (improving upon Adderall) and Eylea (improving upon Lucentis) – were built around the known efficacy of chemically related “first generation” drugs (or use the same mechanism as that parent). Building a product on established science in this way has proven to be relatively lower risk than the typical biotechnology endeavor and enormously profitable for investors as even small improvements can be clinically and commercially significant.

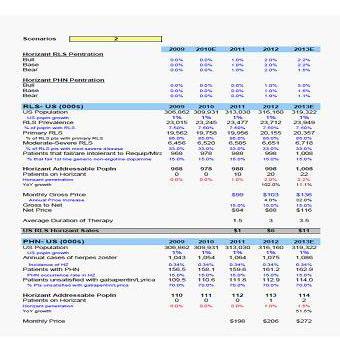

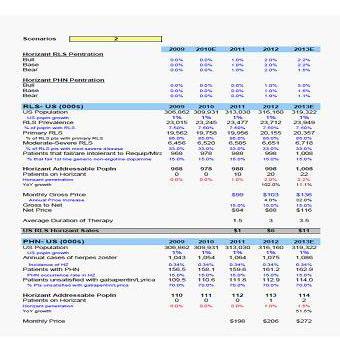

- Your disclosure that there are other, more established drugs that “(in many cases) [are] less expensive treatment options” than Horizant.

In response to your comment, the Filing Persons note that Horizant sells for $125 per month and that there are many other long-standing treatments for restless leg syndrome (“RLS”), which Horizant aims to treat. Examples include generic gabapentin (available for $11 per month) and two other generic RLS treatments (ropinirole and pramipexole, both also available for $11 per month), other extended-release versions of gabapentin, such as Gralise (which admittedly is not labeled for RLS), or other branded RLS treatments, such as Neupro, Requip XL and Mirapex ER.

- With respect to your belief that 829 may become a second generation biotechnology blockbuster drug, please revise your disclosure to describe any specific plans you have to effect the necessary changes for that potential outcome.

In response to your comment, the Filing Persons respectfully note that they do not have any specific plans with respect to effecting the changes necessary so that 829 may become a second generation biotechnology blockbuster drug, other than the reallocation of additional Company resources to 829, which is disclosed on page 8 of the Revised Proxy Statement. As such, the Filing Persons do not believe that any additional disclosure is required pursuant to the foregoing comment.

- Please provide us support for the information regarding Horizant attributed to Morgan Stanley Research.

In response to your comment, the Filing Persons are hereby providing as supplemental support in Exhibit A hereto a copy of the Morgan Stanley research report cited in the footnote on page 8 of the Revised Proxy Statement.

- Please provide us support for your disclosure that “the capital markets have assigned an enterprise value to XenoPort of just $180 million.”

In response to your comment, the Filing Persons note that they have revised the disclosure on page 8 of the Revised Proxy Statement to reflect that the Company now has an enterprise value of just $166 million. Enterprise value is determined as the sum of (i) the Company's market capitalization,plus (ii) net debt. The market capitalization of XenoPort as of April 9, 2014 was approximately $291.6 million, which reflects a closing price of $4.86 and 60.0 million shares outstanding (as disclosed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013, filed with the Commission on February 28, 2014 (the "2013 Form 10-K")). The Company has net debt of $(126.0) million, which is equal to the sum of (A) $(58.7) million of cash and cash equivalents as of December 31, 2013 (as disclosed in the 2013 Form 10-K),plus (B) $(67.3) million of net proceeds received from the Company's January 23, 2014 follow-on offering[5]. Based on the foregoing current capital market values, the enterprise value of the Company as of April 8, 2014 was approximately $165.6 million.

Background of the Proxy Solicitation, page 7

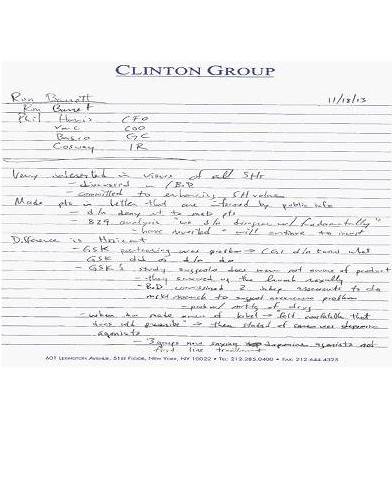

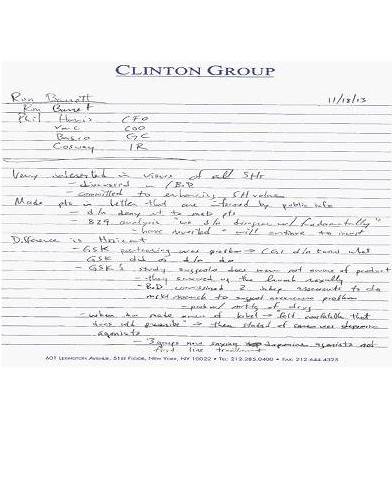

- Please provide support for your statement that on November 18, 2013 Mr. Barrett said he did not disagree with your analysis of the value of 829.

In response to your comment, the Filing Persons are hereby providing in Exhibit A supplemental support in the form of handwritten notes taken by Clinton during the November 18, 2013 call that reflects the foregoing statement.

- Please disclose the names of the two board members you met with on December 13, 2013 and those you met on February 18, 2014.

In response to your comment, the Filing Persons have revised the disclosure on page 9 of the Revised Proxy Statement to include the names of the board members that Clinton met with on December 13, 2013 and February 18, 2013.

- Please revise your disclosure to describe the two settlement proposals you received from the company and your counter-proposal.

In response to your comment, the Filing Persons respectfully note that, during the February 18, 2013 meeting among Clinton, John Freund and Catherine Friedman, the parties agreed to keep the terms of the various settlement proposals and counter-proposal confidential. As a result of such confidentiality obligations, the Filing Persons do not believe that the terms of such proposals should be publicly disclosed in the Revised Proxy Statement; however, the Filing Persons have revised the disclosure on page 9 of the Revised Proxy Statement to expressly state that the parties agreed to keep the terms of such settlement proposals and counter-proposal confidential.

[5]See XenoPort Form 8-K, filed with the Commission on January 24, 2014 (“net proceeds to us from this offering are expected to be approximately $67.3 million”).

Proposal No. 1. Election of Directors, page 8

- Please describe the business activities of Mr. Cameron from 2009 to 2011.

In response to your comment, the Filing Persons have revised the disclosure on page 10 of the Revised Proxy Statement to include a description of the business activities of Mr. Cameron from 2009 to 2011.

- We note your disclosure in the penultimate paragraph on page 10 that you may introduce substitute or additional nominees. Advise us, with a view towards revised disclosure, whether the participants are required to identify or nominate such substitute nominees in order to comply with any applicable company advance notice bylaw. In addition, please confirm for us that should the participants lawfully identify or nominate substitute nominees before the meeting, the participants will file an amended proxy statement that (1) identifies the substitute nominees, (2) discloses whether such nominees have consented to being named in the revised proxy statement and to serve if elected and (3) includes the disclosure required by Items 5(b) and 7 of Schedule 14A with respect to such nominees.

In response to your comment, the Filing Persons note that the Bylaws of the Company do not specify any requirements for the nomination of substitute or additional nominees. In Clinton's notice to the Company of its intent to nominate persons for election to the Board and present proposals at the Company's Annual Meeting, dated February 10, 2014 (the "Notice"), Clinton indicated that it retained the right to nominate additional nominees if more than three directors are to be elected at the Annual Meeting and alternate nominees as chosen by Clinton if, due to death or disability, any Nominee or additional nominee is unable to stand for election at the Annual Meeting or for good cause will not serve. The Company has not objected to our retention of such rights. The Filing Persons believe that they have satisfied any advance notice requirements of the Bylaws by timely reserving their rights to provide such additional or substitute nominees.

In addition, the Filing Persons confirm that, should the Filing Persons lawfully identify or nominate substitute nominees before the Annual Meeting, the Filing Persons will file an amended proxy statement that (1) identifies the substitute nominees, (2) discloses whether such nominees have consented to being named in the revised proxy statement and to serve if elected and (3) includes the disclosure required by Items 5(b) and 7 of Schedule 14A with respect to such nominees.

Proposal No. 2. Bylaw Repeal Proposal, page 11

- Please revise your disclosure for this proposal and proposals 3, 4, 5, and 13 to describe the advantages and disadvantages for each proposal.

In response to your comment, the Filing Persons respectfully note that, for matters not required to be submitted to a vote of security holders (which includes proposals 5 and 13 in the Preliminary Proxy Statement (i.e. Proposals 2 and 8 in the Revised Proxy

Statement)), Item 18 of Schedule 14A requires that the Filing Persons "state the nature of such matter, the reasons for submitting it to a vote of security holders and what action is intended to be taken by the registrant in the event of a negative vote on the matter by the security holders". In addition, if action is to be taken with respect to any amendment of the registrant's bylaws or charter (which includes proposals 3 and 4 in the Preliminary Proxy Statement (i.e. Proposals 6 and 7 in the Revised Proxy Statement)), Item 19 of Schedule 14A requires that the Filing Persons "state briefly the reasons for and the general effect of such amendment". The Filing Persons note that the disclosure set forth on pages 12 and 17-20 of the Revised Proxy Statement addresses each of the foregoing requirements for Proposals 2, 6, 7 and 8 therein and, therefore, the Filing Persons do not believe that any further disclosure is required pursuant to the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

- Please revise this proposal and proposal 5 to describe the reasons for the proposal.

In response to your comment, the Filing Persons have revised the disclosure on pages 16 and 20 of the Revised Proxy Statement to describe their reasons for the adoption of each of the foregoing proposals.

Proposal No. 4. Officer Disqualification Proposal, page 13

- Please revise your disclosure for this proposal to explain the meaning of the term officer as used in the proposal.

In response to your comment, the Filing Persons have revised the disclosure on page 19 of the Revised Proxy Statement to explain the intended meaning of the term officer as used with respect to the Officer Disqualification Proposal.

Proposal No. 6. Performance of Paul L. Berns since the 2013 Annual Meeting, page 15

- Please revise your disclosure to clarify whether this proposal is precatory and to describe any consequences arising from the approval or disapproval of this proposal by security holders. Please also apply this comment to proposals 7-11.

In response to your comment, the Filing Persons have revised pages 21 through 26 of the Revised Proxy Statement to clarify that the foregoing proposals are precatory and describe the consequences arising from the approval or disapproval of such proposals by stockholders.

Solicitation of Proxies, page 24

- We note that you intend to solicit proxies by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements. Please be advised that all written soliciting materials, including any scripts to be uses in soliciting proxies must be filed under the cover of Schedule 14A on the date of first use. Please confirm your understanding.

In response to your comment, the Filing Persons hereby confirm their understanding that all written soliciting materials, including any scripts to be used in soliciting proxies, must be filed under the cover of Schedule 14A on the date of first use.

Information Concerning XenoPort, page 25

- You are required to provide information that will be contained in the company’s proxy statement for the annual meeting unless it is your intent to rely on Exchange Act Rule 14a-5(c). If you intend to rely on Rule 14a-5(c), please disclose that fact. Also, please be advised that we believe reliance on Rule 14a-5(c) before the company distributes the information to security holders would be inappropriate. Alternatively, if you determine to disseminate your proxy statement prior to the distribution of the company’s proxy statement, you must undertake to provide the omitted information to security holders. Please advise as to your intent in this regard.

In response to your comment, the Filing Persons have revised the disclosure on page 29 of the Revised Proxy Statement to indicate their intention to rely on Rule 14a-5(c) with respect to the provision of information that will be contained in the Company's proxy statement for the Annual Meeting and to include an undertaking to distribute to the stockholders a supplement containing the required information if the Company does not distribute its proxy materials to the Company's stockholders at least ten days prior to the Annual Meeting and if any required information is omitted from the Company's definitive materials when filed (or if such materials are not filed).

***

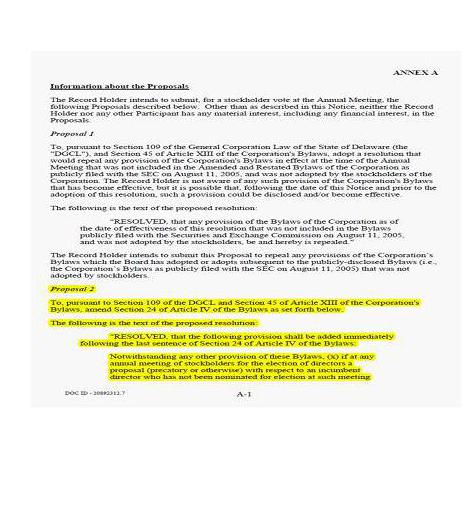

In addition, you may have noticed that the proposed stockholder resolution set forth in Proposal 3 (the Incumbent Director Performance Proposal) of the Preliminary Proxy Statement differed from the corresponding resolution set forth in "Proposal 6" of the Company's preliminary proxy statement, filed with the Commission on April 3, 2014, in connection with the Annual Meeting. The Filing Persons are hereby submitting as Exhibit B hereto a copy of the Proposals as set forth in the Notice delivered to the Company on February 10, 2014. We are also separately emailing to your attention a full copy of the Notice as delivered to the Company. The text of the Incumbent Director Performance Proposal (which has been highlighted for ease of reference) as set forth in the Notice was identical to the text of the proposed resolution set forth in Proposal 3 of the Preliminary Proxy Statement and Proposal 6 of the Revised Proxy Statement. As a result, the Filing Persons believe that the Company should be required to revise the disclosure in its proxy statement regarding the Incumbent Director Performance Proposal (including the text of such resolution to be presented to stockholders of the Company) to accurately reflect the proposal as it was set forth in the Notice.

Please do not hesitate to contact me at (212) 756-2208 or Marc Weingarten at (212) 756-2280 with any additional comments or questions.

Very truly yours,

/s/ David Rosewater

David Rosewater

Each of the undersigned (each a “participant”) hereby acknowledges that (i) the participant and/or filing person is responsible for the adequacy and accuracy of the disclosure in the filings on Schedule 14A; (ii) staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings and (iii) the participant and/or filing person may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Dated: April 11, 2014 | |

CLINTON RELATIONAL OPPORTUNITY MASTER FUND, L.P. By: Clinton Relational Opportunity, LLC, its investment manager By: /s/ John Hall Name: John Hall Title: Authorized Signatory | CLINTON MAGNOLIA MASTER FUND, LTD. By: Clinton Group, Inc., its investment manager By: /s/ Francis Ruchalski Name: Francis Ruchalski Title: Chief Financial Officer |

GEH CAPITAL, INC. By: /s/ Francis Ruchalski Name: Francis Ruchalski Title: Comptroller | CLINTON RELATIONAL OPPORTUNITY, LLC By: /s/ John Hall Name: John Hall Title: Authorized Signatory |

CLINTON GROUP, INC. By: /s/ Francis Ruchalski Name: Francis Ruchalski Title: Chief Financial Officer | /s/ George E. Hall George E. Hall |

/s/ Kevin J. Cameron Kevin J. Cameron | /s/ Rael Mazansky, M.D. Rael Mazansky, M.D. |

/s/ Charles A. Rowland, Jr. Charles A. Rowland, Jr. | |

EXHIBIT A

Supplemental Support

Transcript of XenoPort Special Call, September 9, 2013

Morgan Stanley Research Report

Notes from November 18, 2013 Conference Call

EXHIBIT B

Excerpt from the Notice Regarding Setting Forth the Proposals

[See attached]

B-1

B-2

B-7