| Writer's Direct Number | Writer's E-mail Address |

| 212.756.2208 | david.rosewater@srz.com |

April 23, 2014

VIA EDGAR AND ELECTRONIC MAIL

Mr. Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

Securities and Exchange Commission

Washington D.C. 20549-3628 | |

| | Re: | XenoPort, Inc. (“XenoPort” or the "Company")

Revised Preliminary Proxy Statement on Schedule 14A filed by Clinton Relational Opportunity Master Fund, L.P., et al. Filed April 16, 2014 File No. 001-51329 |

Dear Mr. Duchovny:

On behalf of Clinton Relational Opportunity Master Fund, L.P. and its affiliates (collectively, “Clinton”), Kevin J. Cameron, Rael Mazansky, M.D. and Charles A. Rowland, Jr. (each, a “Filing Person” and collectively with Clinton, the “Filing Persons”), we are responding to your letter dated April 22, 2014 (the “SEC Comment Letter”) in connection with the revised preliminary proxy statement on Schedule 14A filed on April 16, 2014 (the "Second Revised Proxy Statement"). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the "Commission") and respond below. For your convenience, the comments are restated below in italics, with our responses following.

Concurrently with this letter, Clinton is filing a further revised preliminary proxy statement on Schedule 14A (the "Third Revised Proxy Statement"). The Third Revised Proxy Statement reflects revisions made to the Second Revised Proxy Statement in response to the comments of the Staff. Unless otherwise noted, the page numbers in the italicized headings below refer to pages in the Second Revised Proxy Statement, while the page numbers in the responses refer to pages in the Third Revised Proxy Statement. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Third Revised Proxy Statement.

For your convenience, we are emailing to your attention a copy of the Third Revised Proxy Statement, including a copy marked to show the changes from the Second Revised Proxy Statement.

Revised Preliminary Schedule 14A

Reasons for the Solicitation, page 8

| 1. | We note your response to prior comment 3 from our April 15, 2014 comment letter. It is unclear how the difference between figures for net income (loss) and revenues represents the cash expenditures for the company. We note that these are accounting terms that are likely to include non-cash items. Please advise or revise. |

| | |

| | In response to your comment, the Filing Persons respectfully note that the foregoing statement refers to aggregate expenditures (as such term is defined under GAAP), which is not limited to cash expenses. The Filing Persons are concurrently emailing to your attention additional supplemental support in the form of an Excel spreadsheet that sets forth all items of "expense" that the Company has included in its GAAP financial statements filed with the Commission since 2001. The sum of all such expense items is $830 million, which represents "more than $750 million" spent by the Company since its inception. As a result of the foregoing, the Filing Persons do not believe that any revisions are required in response to this comment. |

Proposal No. 3. Advisory Vote on Executive Compensation, page 13

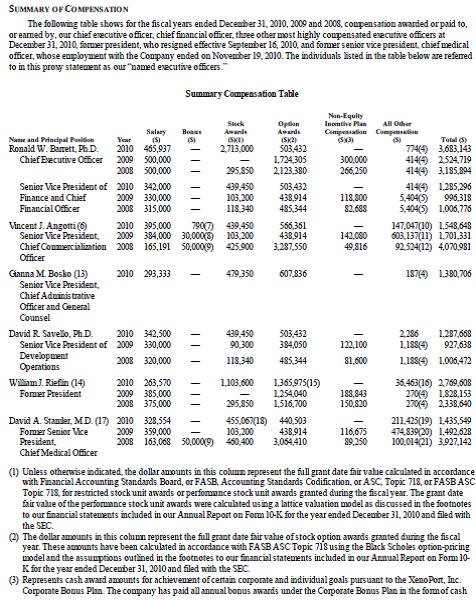

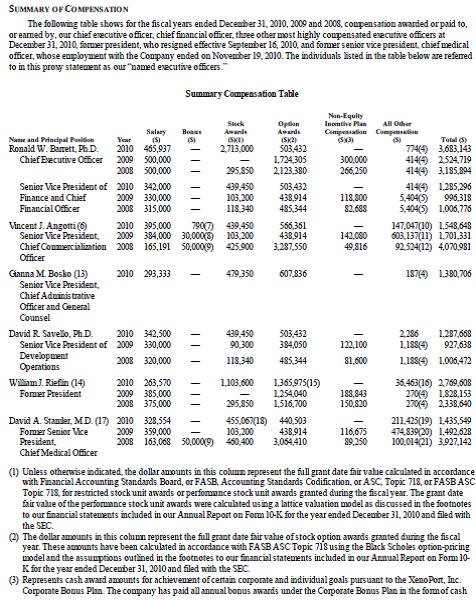

| 2. | We reissue prior comment 8 from our April 15, 2014 comment letter. We are unable to find support for the data included the supporting exhibit to your response. For example, while your supporting exhibit shows that Dr. Barrett received compensation of $3,185,894 in 2008, a review of the company’s proxy statement filed on April 9, 2009 indicates that Dr. Barrett received compensation of $1,971,250 for fiscal year 2008. Please advise or revise. |

| | |

| | In response to your comment, the Filing Persons respectfully note that the Company changed its methodology in 2009 with respect to the calculation of the aggregate value of stock awards in determining compensation. As a result, the aggregate amounts of compensation disclosed in the Company's proxy statements filed in connection with annual meetings held in 2006, 2007, 2008 and 2009 were calculated using a different methodology than the aggregate amounts of compensation disclosed in each proxy statement filed since, beginning with the proxy statement filed in connection with the 2010 annual meeting. For consistency purposes, each of the stock award and compensation values contained in the supporting materials previously emailed to your attention, and disclosed in the Second Revised Proxy Statement, was calculated using the current, revised methodology established in 2010, as reported by the Company in its proxy statements. In addition, attached as Exhibit A hereto is an excerpt from the Company's proxy statement filed in connection with the 2010 annual meeting in which the Company discloses compensation for years 2008 through 2010 using the current methodology. Based on the foregoing, the Filing Persons do not believe that any revisions are required in response to this comment. |

| 3. | On a related note, the support you're provided relating to the compensation received by certain directors appears to include certain compensation more than once. We note, for example, that the compensation received by Mr. Berns in 2006 includes $215,131 in compensation relating to option awards that appears to include option awards in 2006 and prior to 2006. Please revise your disclosure for Mr. Berns and every director referenced in our prior comment to clarify the foregoing orrevise the amount of compensation to include only the compensation received during the specific period your disclosure references. |

| | |

| | In response to your comment, the Filing Persons acknowledge that the supporting materials previously submitted did not correctly take into account the shift in methodology for calculating compensation that occurred in 2010 (described above in response to comment #3). As a result, the compensation data from fiscal years 2006 through 2009 was incorrect in the earlier supporting materials. The Filing Persons are concurrently emailing to your attention a revised version of the supplemental support which reflects consistent use of the current methodology across all time periods. In addition, the Filing Persons have revised pages 23 and 26 to reflect the revised aggregate compensation amounts for Mr. Berns and Ms. Friedman, the only two incumbent directors whose aggregate compensation changed as a result of consistently applying the current methodology across all applicable years. |

Proposal No. 5. Bylaw Repeal Proposal, page 16

| 4. | Please revise your disclosure for this proposal to describe any disadvantages that could arise from its approval. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure set forth on page 18 of the Third Revised Proxy Statement to describe any disadvantages that could arise from approval of the Bylaw Repeal Proposal. |

Proposal No. 13. Performance of Ernest Mario since the 2013 Annual Meeting, page 25

| 5. | It appears that Mr. Mario no longer serves as chief executive officer of Capnia, Inc. Please revise. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on page 27 of the Third Revised Proxy Statement to clarify that Mr. Mario no longer serves as chief executive officer of Capnia, Inc. |

***

Please do not hesitate to contact me at (212) 756-2208 or Marc Weingarten at (212) 756-2280 with any additional comments or questions.

| | Very truly yours, |

| | |

| | |

| | |

| | /s/ David Rosewater |

| | David Rosewater |

| | |

EXHIBIT A

Excerpt from XenoPort's 2010 Proxy Statement