| Writer's Direct Number | Writer's E-mail Address |

| 212.756.2208 | david.rosewater@srz.com |

April 16, 2014

VIA EDGAR AND ELECTRONIC MAIL

Mr. Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

Securities and Exchange Commission

Washington D.C. 20549-3628 | |

| | Re: | XenoPort, Inc. (“XenoPort” or the "Company")

Revised Preliminary Proxy Statement on Schedule 14A filed by Clinton Relational Opportunity Master Fund, L.P., et al. Filed April 11, 2014 File No. 001-51329 |

Dear Mr. Duchovny:

On behalf of Clinton Relational Opportunity Master Fund, L.P. and its affiliates (collectively, “Clinton”), Kevin J. Cameron, Rael Mazansky, M.D. and Charles A. Rowland, Jr. (each, a “Filing Person” and collectively with Clinton, the “Filing Persons”), we are responding to your letter dated April 15, 2014 (the “SEC Comment Letter”) in connection with the revised preliminary proxy statement on Schedule 14A filed on April 11, 2014 (the "Revised Proxy Statement"). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the "Commission") and respond below. For your convenience, the comments are restated below in italics, with our responses following.

Concurrently with this letter, Clinton is filing a further revised preliminary proxy statement on Schedule 14A (the "Second Revised Proxy Statement"). The Second Revised Proxy Statement reflects revisions made to the Revised Proxy Statement in response to the comments of the Staff. Unless otherwise noted, the page numbers in the italicized headings below refer to pages in the Revised Proxy Statement, while the page numbers in the responses refer to pages in the Second Revised Proxy Statement. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Second Revised Proxy Statement.

For your convenience, we are emailing to your attention a copy of the Second Revised Proxy Statement, including a copy marked to show the changes from the Revised Proxy Statement.

Revised Preliminary Schedule 14A

Reasons for Our Solicitation, page 8

| 1. | We note your response to prior comment 2. Please revise the disclosure referenced in our first, second and third bullet points to indicate that your beliefs are based solely on the company’s public statements about 829 in September 2013 and not on any independent review you have conducted. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on page 7 of the Second Revised Proxy Statement to indicate that Clinton's beliefs are based solely on the Company's public statements about 829 made during its September 2013 investor call and not on any independent review conducted by Clinton. |

| | |

| 2. | Revise the disclosure referenced in the third bullet point in prior comment 2 to state, as you state in your response, that once a day dosing might be “more effective, equally effective or less effective” than Tecdifera. Note that when you are summarizing statements from a third party you should provide sufficient context so security holders are able to evaluate all of the underlying information, not solely selected excerpts. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on page 7 of the Second Revised Proxy Statement to state that once a day dosing of 829 may have superior, equal or lesser efficacy than Tecfidera. |

| | |

| 3. | Please provide us the support for your assertion that “since inception, the Company has spent approximately $750 million . . .” |

| | |

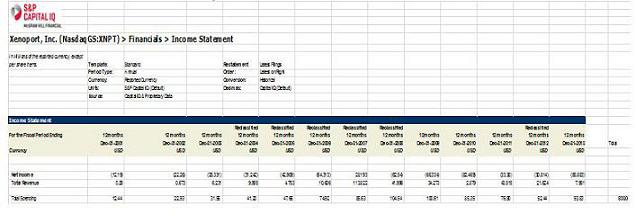

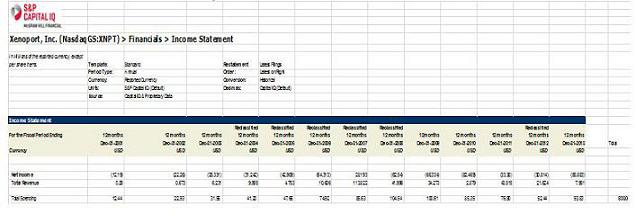

| | In response to your comment, the Filing Persons are hereby providing as supplemental support in Exhibit A hereto a chart compiled by S&P Capital IQ, based on information publicly disclosed by the Company in its annual reports on Form 10-K filed with the Commission during the relevant time period, that sets forth the total expenses of the Company (calculated as the sum of (i) net income (loss) plus (ii) total revenue) for each fiscal year since the Company's inception. As noted on the Capital IQ chart, the aggregate of such expenses is $830 million, in excess of the $750 million approximation in the Revised Proxy Statement. For ease of reference, a copy of the chart in the form of an Excel spreadsheet is also being e-mailed to your attention. |

| | |

| 4. | Please disclose the substance of your response to prior comment 3. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on page 7 of the Second Revised Proxy Statement to disclose the substance of the response to the Commission's prior comment 3. |

| | |

| 5. | We note your response to prior comment 4. Please confirm that you have provided us with the entire document or report referenced in your disclosure. If not, please do so. |

| | |

| | In response to your comment, the Filing Persons acknowledge that they previously provided the Commission with an excerpt of a very large and detailed spreadsheet published by Morgan Stanley, which they considered to be the only relevant portion of such data for purposes of responding to the Commission's prior comment 4. As requested, a copy of the entire financial model, in its original form as an Excel spreadsheet, published by Morgan Stanley will be separately emailed to your attention. |

| | |

| 6. | We disagree with your response to prior comment 11 and we reissue it. We believe that the requested disclosure is material to security holders in making an informed voting decision. See Rule 14a-9. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on pages 12 and 18-20 of the Second Revised Proxy Statement to describe the advantages and disadvantages of adopting each of Proposals 2, 6, 7 and 8. |

| | |

| Background of the Proxy Solicitation, page 7 |

| | |

| 7 | We note your response to prior comment 6. Please confirm supplementally, with a view toward revised disclosure, that you had previously provided or did contemporaneously provide your analysis to Mr. Barrett, such that he would be in a position to “not disagree” with it. |

| | |

| | In response to your comment, the Filing Persons confirm that the Filing Persons' analysis was previously provided to Dr. Barrett. Such analysis was set forth in a letter from Clinton to Dr. Barrett, dated October 15, 2013, which was also issued publicly via press release on the same date. The Filing Persons have revised the disclosure on page 8 of the Second Revised Proxy Statement to clarify that the analysis Dr. Barrett did "not disagree" with was the analysis set forth in Clinton's October 15, 2013 letter. |

| | |

| Proposal No. 3. Advisory Vote on Executive Compensation, page 13 |

| | |

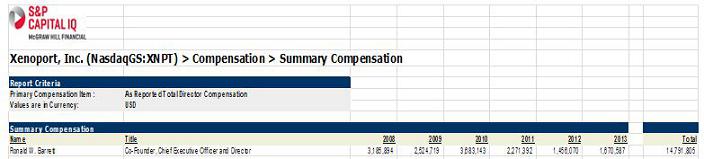

| 8. | Please provide us the support for your assertion that “From 2008 to 2013, Dr. Barrett …collected nearly $15 million in pay…” Also apply this comment to the compensation received by the directors subject to proposals 9 to 12. |

| | |

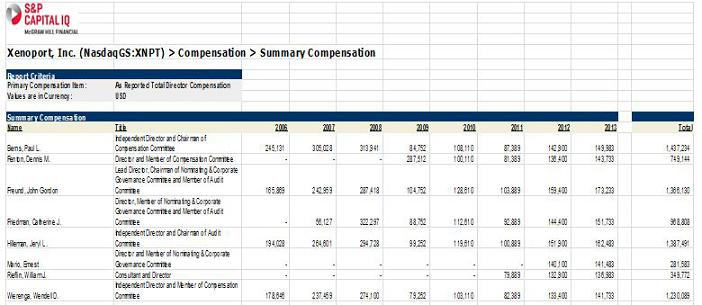

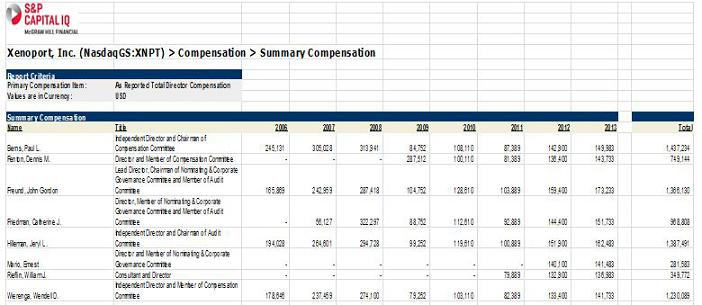

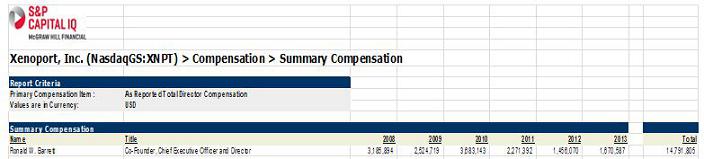

| | In response to your comment, the Filing Persons are providing supplementally in Exhibit B hereto the compensation data supporting the assertions regarding aggregate pay for Dr. Barrett and the Company's directors as set forth in Proposals 3 and 9-12. Such data was compiled by S&P Capital IQ based on information publicly disclosed by the Company in its proxy statements on Schedule 14A filed with the Commission during the relevant time periods. |

| | |

| Proposal No. 13. Performance of Ernest Mario since the 2013 Annual Meeting, page 25 |

| | |

| 9. | Please revise your disclosure to clarify whether Mr. Mario was a nominee at the annual meeting of VIVUS and was not elected or whether he resigned his position as part of a settlement with the dissident. |

| | |

| | In response to your comment, the Filing Persons have revised the disclosure on page 25 of the Second Revised Proxy Statement to clarify that Mr. Mario was initially renominated by VIVUS for election as director at its 2013 annual meeting, but Mr. Mario resigned as a director of VIVUS immediately prior to the annual meeting in connection with the company's settlement of a contested proxy solicitation with certain of its stockholders. |

***

Please do not hesitate to contact me at (212) 756-2208 or Marc Weingarten at (212) 756-2280 with any additional comments or questions.

Very truly yours,

/s/ David Rosewater

David Rosewater

EXHIBIT A

Supplemental Support in Response to Comment #3

EXHIBIT B

Supplemental Support in Response to Comment #8