UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

VANECK ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 293-2000

Date of fiscal year end: SEPTEMBER 30

Date of reporting period: SEPTEMBER 30, 2023

Item 1. Report to Shareholders

| ANNUAL REPORT September 30, 2023 |

| Biotech ETF | BBH |

| Digital Transformation ETF | DAPP |

| Energy Income ETF | EINC |

| Environmental Services ETF | EVX |

| Gaming ETF | BJK |

| Green Infrastructure ETF | RNEW |

| Pharmaceutical ETF | PPH |

| Retail ETF | RTH |

| Robotics ETF | IBOT |

| Semiconductor ETF | SMH |

| Video Gaming and eSports ETF | ESPO |

Certain information contained in this report represents the opinion of the investment adviser which may change at any time. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings, the Funds’ performance, and the views of the investment adviser are as of September 30, 2023.

VANECK ETFs

PRESIDENT’S LETTER

September 30, 2023 (unaudited)

Dear Fellow Shareholders:

Our outlook for financial markets in 2023 was “sideways.” The three major forces—monetary policy, government spending and economic growth—were negative or muted. This remains my view despite events in the last few months, discussed at the end of this letter.

Discussion

To recap this cycle: stocks and bonds historically do not perform well when the Fed tightens monetary conditions, and that’s just what the Fed announced it would be doing at the end of 2021. This would include raising rates and changing its balance sheet actions, which doesn’t create a great environment for financial assets.

There are three things investors continue to face, none of which is particularly positive for financial assets.

| 1. | Monetary Policy: Tightening |

Money supply exploded during the COVID–19 pandemic, but it started shrinking in late 2022. This withdrawal of money supply is bad for stock and bond returns.

A second, modern component to monetary policy is the Fed balance sheet. After buying bonds during the pandemic, the Fed has now started shrinking the balance sheet—from a high of almost $9 trillion in early 2022, assets dropped to just short of $8.1 trillion toward the end of September 2023.1

As we’ve been saying since the summer of 2022, when wage inflation was confirmed, what should drive the Fed is fighting wage inflation. That is the kind of inflation that is endemic and hard to manage once it takes hold, not least because it creates a spiraling effect. And this is the battle that is at full pitch—the labor market has remained strong.

While headline inflation is falling, we are still in the “higher for longer” camp. The Fed seems likely to continue holding, or even raising, interest rates and will probably continue to shrink its balance sheet. This is not supportive of stock or bond markets.

A second bearish factor is that government spending is unlikely to increase next year. The Republicans, in control of the House of Representatives, continue to look to slow government spending. And even Democrats like Larry Summers believe that stimulus spending during the pandemic led to inflation. The debt ceiling compromise and the Supreme Court rejection of student debt relief continue this trend. But it is worth noting that environmental subsidies from the IRA bill are larger than expected.

| 3. | Global Growth is at Low Levels |

Both Chinese and European growth, for different reasons, were slow in 2022. Over the last 20 years, the U.S. and China have been the two main pillars of global growth. In China, the post-COVID-19 growth has been more domestic and consumer-led and still not enough to overcome the property sector malaise. In coming years, we will likely have to look to India, Indonesia and Africa to drive global growth.

I don’t believe that we will escape these three dampeners on stock and bond returns in what is left of 2023—higher interest rates, no government spending growth and tepid global growth. We will need upside corporate profitability surprises or high Chinese growth to substantially boost markets this year, in our view.

However, after the 2022 losses, bond investments are now offering attractive yields, so this has been our favorite asset class to buy and remains our preference. (See What to Buy? Bonds. When? Now.2) Because of higher interest rates, bonds can offer adequate returns, as they did in the 1970s even though that decade was the worst for interest rates in the last 100 years.

VANECK ETFs

PRESIDENT’S LETTER

(unaudited) (continued)

Outlook

My basic outlook favoring bonds hasn’t changed, which is that they offer attractive risk-adjusted returns compared to equities given the headwinds discussed above. This has obviously not been true for long-term bonds, which have lost money as their interest rates increased almost to short-term rates.

This waning period of “yield curve inversion”—long-term interest rates lower than short-term rates—is unusual and, I think, about to end. If, and it’s a big “if”, government entities like the Fed are stepping back from the bond markets, then it makes sense for long-term rates to be higher because with greater risk should come greater return.

Further, yield curve inversion is present only about 10% of the time. It’s unusual. This is a good time to think about what investments might benefit from the end of this era. Perhaps some bank stocks? This outlook is discussed in a recent podcast, The Compound and Friends, Episode 113, released on October 13, 2023.

My final thought is that, while I think the Fed won’t lower short-term interest rates for a while, this is a good time to get positioned in assets that would benefit from that stimulus, namely gold and BTC (bitcoin).

We thank you for investing with VanEck. On the following pages, you will find a performance discussion and financial statements for each of the funds for the 12 month period ended September 30, 2023. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

CEO and President

VanEck ETF Trust

October 16, 2023

PS The investing outlook can change suddenly. To get our quarterly investment outlooks, please subscribe to “VanEck News & Insights”.3 Should you have any questions regarding fund performance, please contact us at 800.826.2333 or visit our website.

1 U.S. Federal Reserve: FEDERAL RESERVE Statistical Release, September 28, 2023, https://www.federalreserve.gov/releases/h41/20230928/

2 What to Buy? Bonds. When? Now, https://www.vaneck.com/us/en/blogs/investment-outlook/jan-van-eck-what-to-buy-bonds-when-now/

3 https://www.vaneck.com/us/en/subscribe/

VANECK ETFs

MANAGEMENT DISCUSSION

September 30, 2023 (unaudited)

Biotech

Biotech stocks performed positively overall in the 12 months period, with the VanEck Biotech ETF gaining 11.24%. Having hit a high in early-December 2022, biotech stocks essentially oscillated and moved sideways for the rest of the period, but ended the year up on its start. Larger companies were able to maintain the financial impetus they had achieved during COVID-19 and continued to grow. However, such growth proved more difficult for medium-size and small biotech companies.

By end-September 2022, the FDA had approved 26 “novel drugs”, 1 over the next three months a further 11 were added and the total tally for the year was 37. 2 By end-September 2023, up on the previous year at the same time, some 40 novel drugs had already been approved. 3

The three top positive contributions to the Fund’s performance came from: Amgen, Inc. (14.4% of Fund net assets†), Gilead Sciences, Inc. (8.5% of Fund net assets†) and Seagen, Inc. (4.9% of Fund net assets†). The companies that detracted most from performance were: Illumina, Inc. (4.1% of Fund net assets†), BioNTech SE (2.8% of Fund net assets†) and Alnylam Pharmaceuticals, Inc. (2.7% of Fund net assets†).

Digital Transformation

The VanEck Digital Transformation ETF registered a gain of 10.29% over the 12 month period. The somewhat lack luster, albeit positive, performance of broadly-based digital transformation stocks can be ascribed to both a lack of enthusiasm—crypto “fatigue”—and continuing negative sentiment in the underlying digital asset space. In addition, neither was helped by continuing scandals in the space, for example, starting in November 2022, that around FTX.

Rising interest rates also squeezed stocks, not least by raising the cost of capital and reducing the value of future earnings: a challenge for companies that might be both “early stage” and still unprofitable.

The three companies that contributed most to the Fund’s performance were: Applied Digital Corp. (5.6% of Fund net assets†), Bit Digital, Inc. (4.9% of Fund net assets†) and Riot Platforms, Inc. (5.6% of Fund net assets†). The three companies that detracted most from performance were: Silvergate Capital Corp. (sold during the period), Argo Blockchain Plc (sold during the period) and Canaan, Inc. (4.9% of Fund net assets†).

Energy Income

Robust energy commodity prices during the period under review benefited midstream energy companies, including MLPs (master limited partnerships). Despite volatility during the period, both crude oil and natural gas prices remained firm, as did demand. For example, having started the 12 month period at $75.88 a barrel, after a few hiccups on the way, West Texas Intermediate (WTI) ended the period just 19.65% higher at $90.79 a barrel.

For the 12 months ended September 30, 2023, the VanEck Energy Income ETF gained 18.70%. The three greatest contributors to performance were: Magellan Midstream Partners LP (acquired by another compay during the period), Targa Resources Corp. (4.6% of Fund net assets†) and Energy Transfer LP (4.7% of Fund net assets†). TC Energy Corp. (6.3% of Fund net assets†), Enbridge, Inc. (8.1% of Fund net assets†) and NextDecade Corp. (0.6% of Fund net assets†) detracted the most from overall performance.

Environmental Services

The VanEck Environmental Services ETF had a roller coaster of a financial year, but ended the 12 month period under review with a gain of 10.24%. Having slowly, if erratically, made their way to a high toward the end of July, environmental stocks then fell through the end of September 2023, but remained in positive territory.

Themes in the sector during the 12 month period included the plastic debate and legislation, the demand for skilled labor (and the dearth of such workers) and the beneficial reuse of waste. In addition to corporations’ continuing commitment to ESG and sustainability, consolidation and M&A activity, together with funding

VANECK ETFs

MANAGEMENT DISCUSSION (unaudited) (continued)

from infrastructure investment legislation passed in 2021 and 2022’s Inflation Reduction Act were beneficial for environmental services companies.

The three top positive contributions to the Fund’s performance came from: Ecolab, Inc. (10.3% of Fund net assets†), Evoqua Water Technologies Corp. (acquired by another company during the period) and Clean Harbors, Inc. (3.5% of Fund net assets†). The three companies that detracted most from performance were: Li-Cycle Holdings Corp. (1.7% of Fund net assets†), Ambipar Emergency Response (sold during the period) and Darling Ingredients Inc. (3.3% of Fund net assets†).

Gaming

The VanEck Gaming ETF posted a gain of 22.55% for the 12 month period. Having risen through to highs in the middle of July 2023, gaming stocks declined through the end of September 2023, but remained in positive territory.

In Macau, China, the world’s biggest gaming hub, in 2023, gross gaming revenue (“GGR”) recovery was “so sturdy that the metric could approach 90% of pre-coronavirus levels.” 4 In Nevada, during the 11 month period through the end of July 2023, the “gaming win” 5 for the majority of months were up year-on-year—ranging from 17.99% in January 2023 and 0.07% in August 2023. The most it was down was 7.62% in November 2022.6

The three top positive contributions to the Fund’s performance came from: Flutter Entertainment Plc (8.1% of Fund net assets†), DraftKings, Inc. (5.7% of Fund net assets†) and Evolution AB (6.6% of Fund net assets†). The three companies that detracted most from performance were: Star Entertainment Group Ltd. (0.6% of Fund net assets†), Kangwon Land, Inc. (0.8% of Fund net assets†) and Galaxy Entertainment Group Ltd. (5.0% of Fund net assets†).

Green Infrastructure

Over the period from inception (October 18, 2022) to September 30, 2023, the VanEck Green Infrastructure ETF lost 5.62%. While, as with environmental services stocks, green infrastructure stocks were helped both by funding from infrastructure investment legislation passed in 2021 and 2022’s Inflation Reduction Act, they faced a number of headwinds, not least high interest rates and, in particular, a tight labor market.

The three top positive contributions to the Fund’s performance came from: Tesla, Inc. (5.6% of Fund net assets†), Quanta Services, Inc. (5.4% of Fund net assets†) and First Solar, Inc. (4.5% of Fund net assets†). The three companies that detracted most from performance were: Plug Power, Inc. (2.1% of Fund net assets†), Enphase Energy, Inc. (3.5% of Fund net assets†) and Lucid Group, Inc. (4.6% of Fund net assets†).

Pharmaceutical

Despite a “tough year in the stock market” 7 in 2023, pharmaceutical stocks in the VanEck Pharmaceutical ETF had a positive 12 month period gaining 21.14% by September 30, 2023. Also as noted by The Wall Street Journal, while, on the one hand, “[s]urging demand for medications that treat Type 2 diabetes and help patients lose weight has driven a major rally on Wall Street,” 8 on the other “[d]rugmakers who sell Covid-19 vaccines and treatments have fared especially poorly.” 9

In addition, toward the end of the financial year, the prospect of forthcoming negotiations around drug pricing had started to cast a pall over the space.

The three top positive contributions to the Fund’s performance came from: Novo Nordisk A/S (5.8% of Fund net assets†), Eli Lilly & Co. (7.5% of Fund net assets†) and Sanofi (5.1% of Fund net assets†). The three companies that detracted most from performance were: Catalent, Inc. (1.8% of Fund net assets†), Pfizer, Inc. (4.8% of Fund net assets†) and Bristol-Myers Squibb Co. (4.4% of Fund net assets†).

Retail

After a slow first six months, and despite rising inflation, higher interest rates (which reduce the value of future earnings), retail losses worldwide and the fears of recession, in the second six months of the 12 month period retail stocks in the VanEck Retail ETF rose steadily and had gained 9.58% by September 30, 2023.

The three top positive contributions to the Fund’s performance came from: Amazon.com, Inc. (19.5% of Fund net assets†), Walmart, Inc. (8.7% of Fund net assets†) and The TJX Companies, Inc. (4.6% of Fund net assets†). The three companies that detracted most from performance were: JD.com, Inc. (3.7% of Fund net assets†), Dollar General Corp. (1.5% of Fund net assets†) and CVS Health Corp. (5.0% of Fund net assets†).

Robotics

Over the period from inception (April 5, 2023) to September 30, 2023, the VanEck Robotics ETF gained 2.18%. In general, in the robotics space, technology continued to be the main driver of advancements, making robots both more capable and more efficient.

Offering safe, versatile automation in manufacturing and with unique features and minimal programming, cobots (collaborative robots) showed themselves to be an area of particular interest and research. And, indeed, one championed by industry leaders. As costs continued to come down and labor became both more expensive and less available, adoption (and replacement with robots) continued to become more widespread.

The three top positive contributions to the Fund’s performance came from: NVIDIA Corp. (6.2% of Fund net assets†), Denso Corp. (4.4% of Fund net assets†) and Emerson Electric Co. (6.1% of Fund net assets†). The three companies that detracted most from performance were: Keyence Corp. (4.2% of Fund net assets†), Hexagon AB (2.3% of Fund net assets†) and Fanuc Corp. (2.6% of Fund net assets†)

Semiconductor

In stark contrast to its performance over the previous financial year, by September 30, 2023, the VanEck Semiconductor ETF had gained 58.49%.

Despite the semiconductor market continuing to suffer from the fallout resulting from the trade restrictions between the U.S. and China, the excitement and optimism around artificial intelligence (“AI”) was a significant tailwind and driver of performance.

The three top positive contributions to the Fund’s performance came from: NVIDIA Corp. (19.7% of Fund net assets†), Broadcom, Inc. (6.5% of Fund net assets†) and Taiwan Semiconductor Manufacturing Co., Ltd. (12.6% of Fund net assets†). The only company that detracted from performance was: Qualcomm, Inc. (4.7% of Fund net assets†). Qorvo, Inc. (0.4% of Fund net assets†) and Universal Display Corp. (0.3% of Fund net assets†) contributed the least.

Video Games and eSports

Video gaming and esports stocks performed positively over the 12 months period, with the VanEck Video Gaming and eSports ETF up 28.11%. In addition to a more encouraging macro-economic environment, the specifically semiconductor-related Fund companies faced fewer difficulties than they had been, for example, declining demand following a period of chip shortages. The market’s more benign attitude to tech stocks also helped. Two further drivers were the growth in AI and an increase in gaming revenues.

The three top positive contributions to the Fund’s performance came from: NVIDIA Corp. (7.8% of Fund net assets†), Advanced Micro Devices, Inc. (6.9% of Fund net assets†) and Tencent Holdings Ltd. (7.8% of Fund net assets†). The three companies that detracted most from performance were: Embracer Group AB (sold during the period), Krafton, Inc. (1.9% of Fund net assets†) and Sea Ltd. (5.3% of Fund net assets†).

VANECK ETFs

MANAGEMENT DISCUSSION (unaudited) (continued)

† All Fund assets referenced are Total Net Assets as of September 30, 2023.

Returns based on NAV.

1 Food & Drug Administration: New Drug Therapy Approvals 2022, October 2, 2023, https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2022 (Accessed October 2, 2023)

2 Ibid.

3 Food & Drug Administration: New Drug Therapy Approvals 2023, https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2023 (Accessed October 2, 2023)

4 Casino.org: Macau GGR Could Hit 90% of Pre-COVID Levels in 2023, Fully Recover Next Year, August 8, 2023, https://www.casino.org/news/macau-ggr-could-reach-90-of-pre-covid-levels-this-year/

5 Or “gross revenue,” defined (in short) as: the total of all:

(a) Cash received as winnings;

(b) Cash received in payment for credit extended by a licensee to a patron for purposes of gaming; and

(c) Compensation received for conducting any game, or any contest or tournament in conjunction with interactive gaming, in which the licensee is not party to a wager, less the total of all cash paid out as losses to patrons, those amounts paid to fund periodic payments and any other items made deductible as losses by NRS 463.3715. For the purposes of this section, cash or the value of noncash prizes awarded to patrons in a contest or tournament are not losses, except that losses in a contest or tournament conducted in conjunction with an inter-casino linked system may be deducted to the extent of the compensation received for the right to participate in that contest or tournament. For a full definition see Nevada Gaming Control Act, https://www.leg.state.nv.us/NRS/NRS-463.html#NRS463Sec0161

6 Nevada Gaming Control Board/Gaming Commission: Abbreviated Revenue Release, https://gaming.nv.gov/index.aspx?page=172

7 The Wall Street Journal: The Big Pharma Stock Trade: Weight Loss Is In, Covid-19 Is Out, September 26, 2023, https://www.wsj.com/finance/stocks/the-big-pharma-stock-trade-weight-loss-is-in-covid-19-is-out-88ef314f

8 Ibid.

9 Ibid.

VANECK BIOTECH ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVBBHTR1 | | SPTR2 |

| One Year | | 11.13% | | 11.24% | | 11.37% | | 21.62% |

| Five Year | | 3.13% | | 3.11% | | 3.25% | | 9.92% |

| Ten Year | | 6.85% | | 6.84% | | 7.01% | | 11.91% |

| | |

| 1 | MVIS® US Listed Biotech 25 Index (MVBBHTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the biotech industry. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

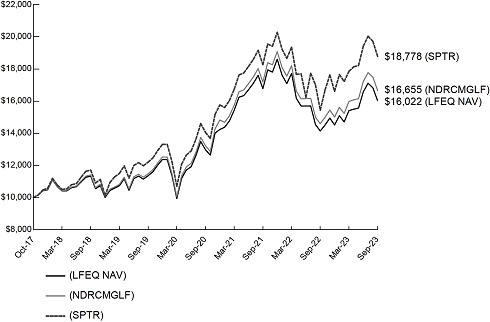

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

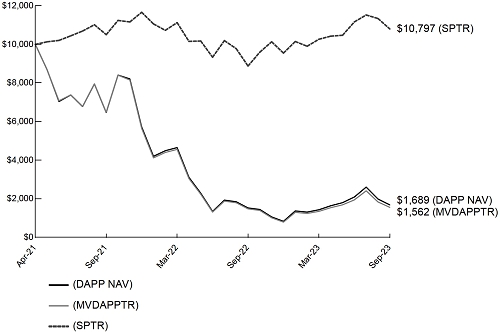

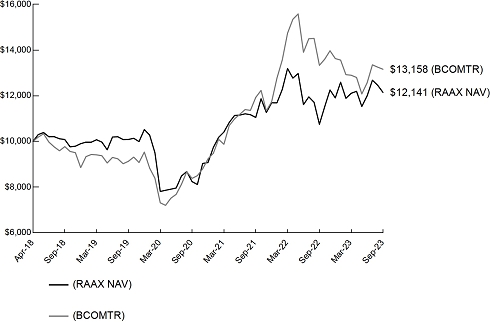

VANECK DIGITAL TRANSFORMATION ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVDAPPTR1 | | SPTR2 |

| One Year | | 10.93% | | 10.29% | | 5.25% | | 21.62% |

| Life* | | (51.27)% | | (51.35)% | | (52.87)% | | 3.16% |

| | |

| * | Inception of Fund: 4/12/21; First Day of Secondary Market Trading: 4/13/21. |

| | |

| 1 | MVIS® Global Digital Assets Equity Index (MVDAPPTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the global digital asset segment. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

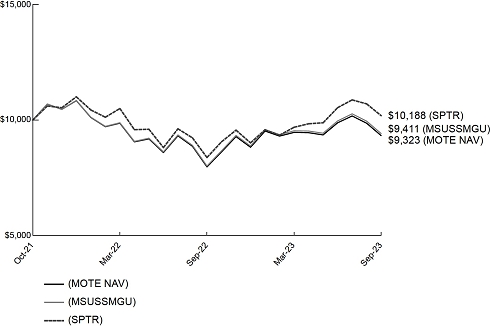

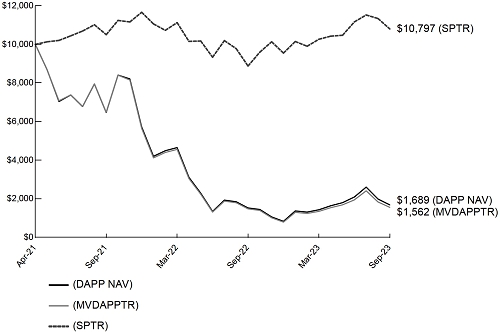

Hypothetical Growth of $10,000 (Since Inception)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on 17 for more information.

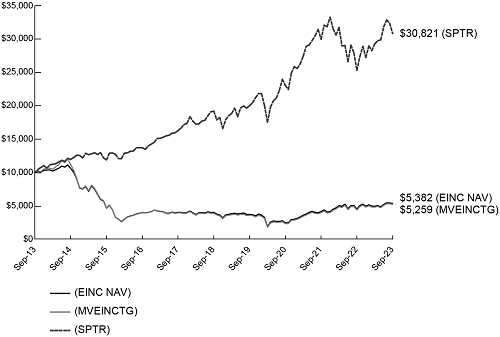

VANECK ENERGY INCOME ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVEINCTG1 | | SPTR2 |

| One Year | | 19.15% | | 18.70% | | 19.61% | | 21.62% |

| Five Year | | 6.01% | | 5.90% | | 6.06% | | 9.92% |

| Ten Year | | (5.99)% | | (6.01)% | | (6.22)% | | 11.91% |

| | |

| 1 | MVIS® North America Energy Infrastructure Index (MVEINCTG) is a rules-based, modified capitalization weighted, float adjusted index intended to give investors a means to track the overall performance of North American companies involved in the midstream energy segment, which includes MLPs and corporations involved in oil and gas storage and transportation. |

| | |

| | Index data prior to December 2, 2019 reflects that of the Solactive High Income MLP Index (the “MLP Index” or “YMLPTR”), a rules-based index designed to provide investors a means of tracking the performance of selected MLPs which are publicly traded on a U.S. securities exchange. All Index history reflects a blend of the performance of the aforementioned Indexes. |

| | |

| | VanEck Energy Income ETF (the “Fund”) is the successor to the Yorkville High Income MLP ETF pursuant to a reorganization that took place on February 22, 2016. Prior to that date, the Fund had no investment operations. Accordingly, for periods prior to that date, the Fund performance information is that of the Yorkville High Income MLP ETF. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

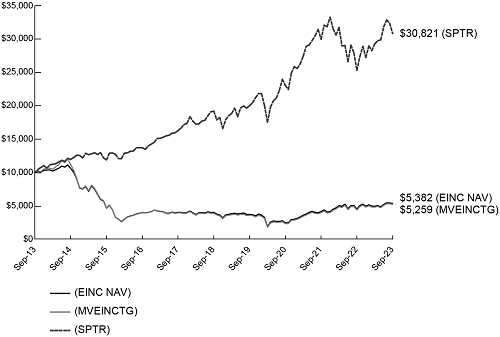

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

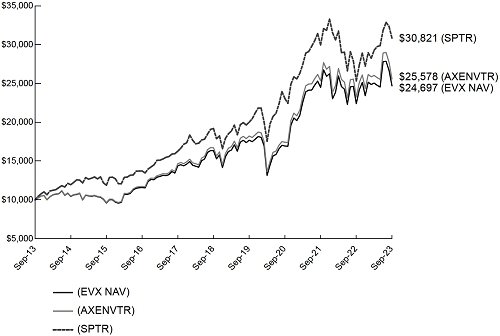

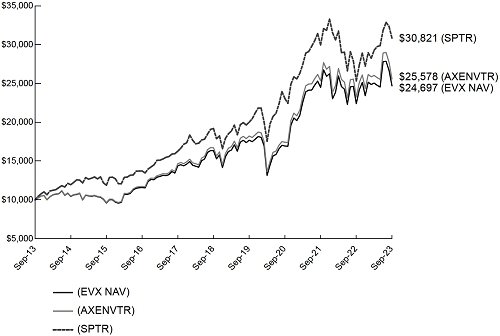

VANECK ENVIRONMENTAL SERVICES ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | AXENVTR1 | | SPTR2 |

| One Year | | 10.08% | | 10.24% | | 9.92% | | 21.62% |

| Five Year | | 8.60% | | 8.60% | | 8.86% | | 9.92% |

| Ten Year | | 9.47% | | 9.46% | | 9.85% | | 11.91% |

| | |

| 1 | NYSE Arca Environmental Services Index (AXENVTR) is a rules based, modified equal dollar weighted index intended to give investors a means of tracking the overall performance of the common stocks and depositary receipts of U.S. exchange-listed companies involved in environmental services. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

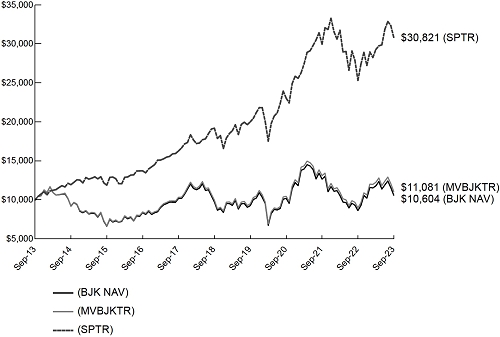

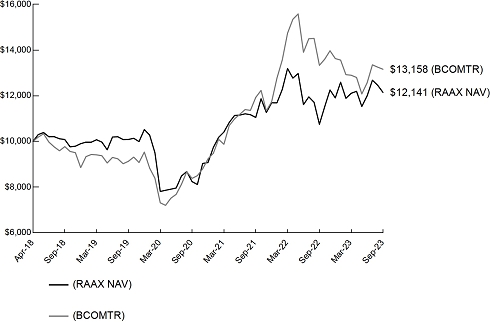

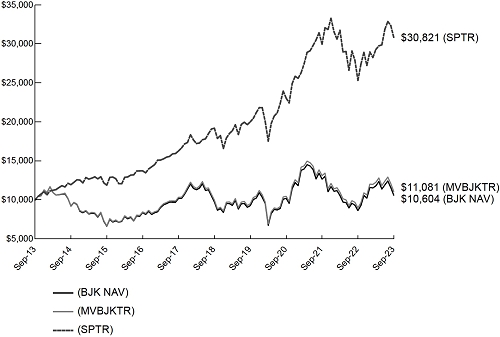

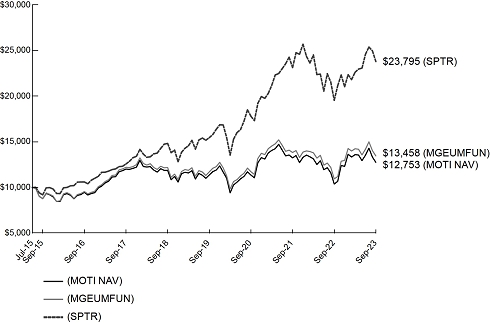

VANECK GAMING ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVBJKTR1 | | SPTR2 |

| One Year | | 22.52% | | 22.55% | | 23.03% | | 21.62% |

| Five Year | | 1.63% | | 1.70% | | 2.13% | | 9.92% |

| Ten Year | | 0.56% | | 0.59% | | 1.03% | | 11.91% |

| | |

| 1 | MVIS® Global Gaming Index (MVBJKTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the casino and gaming industry. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

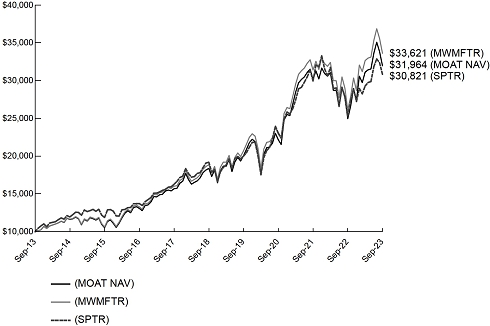

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

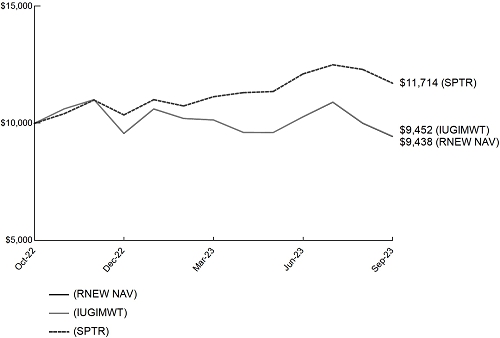

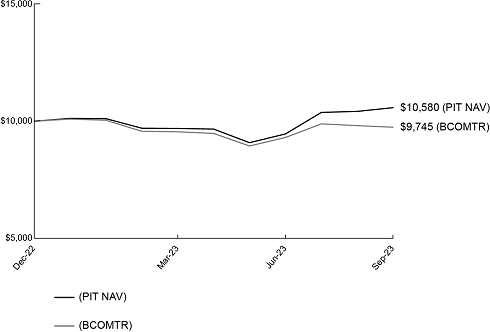

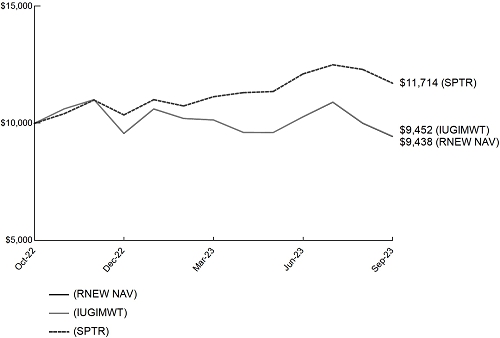

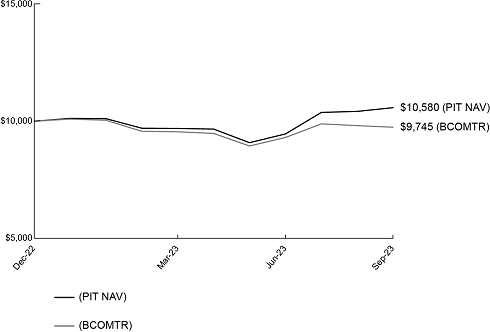

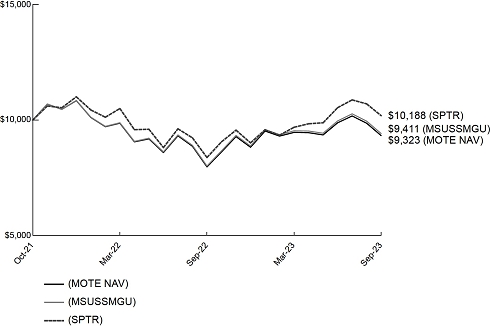

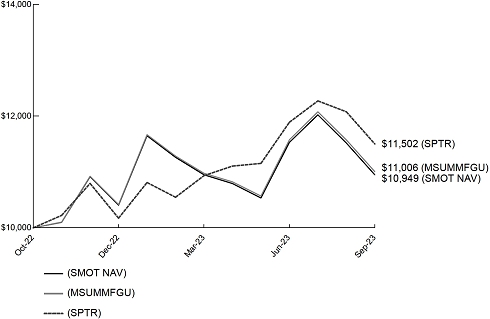

VANECK GREEN INFRASTRUCTURE ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | IUGIMWT1 | | SPTR2 |

| Life* | | (5.59)% | | (5.62)% | | (5.48)% | | 17.14% |

| | |

| * | Inception of Fund: 10/18/22; First Day of Secondary Market Trading: 10/19/22. |

| | |

| 1 | The Indxx US Green Infrastructure - MCAP Weighted Index (IUGIMWT) is a rules based, modified market capitalization weighted index intended to give investors a means of tracking the overall performance of companies engaged in business activities that seek to establish a sustainable infrastructure to facilitate the holistic use of green energy and positively impact the environment. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

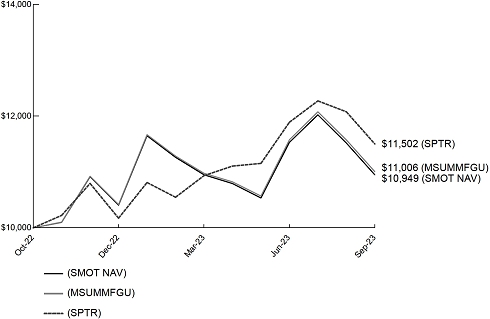

Hypothetical Growth of $10,000 (Since Inception)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

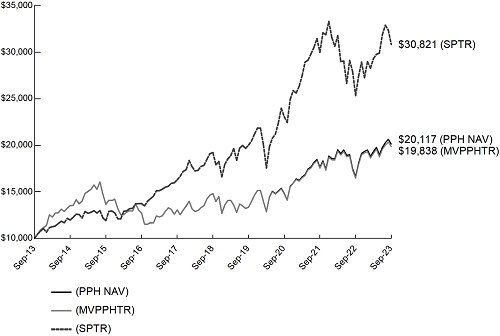

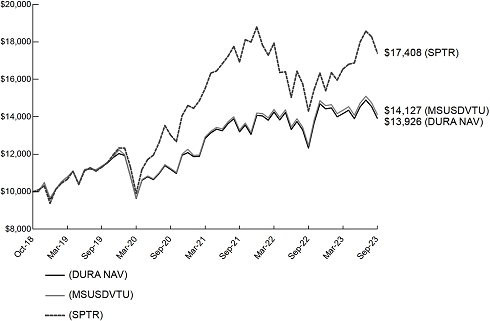

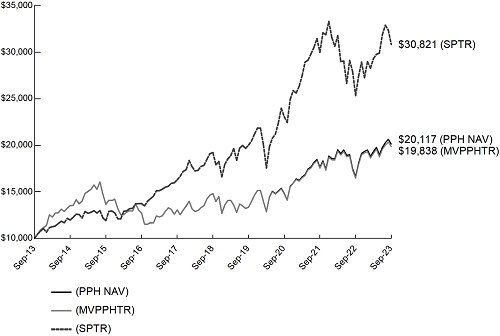

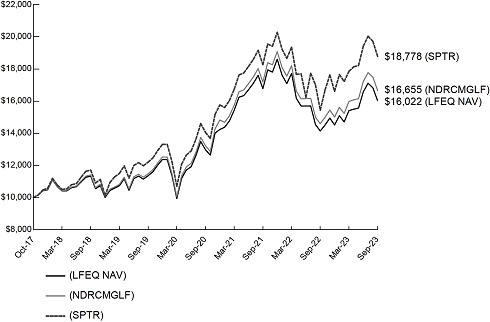

VANECK PHARMACEUTICAL ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVPPHTR1 | | SPTR2 |

| One Year | | 21.22% | | 21.14% | | 20.49% | | 21.62% |

| Five Year | | 6.33% | | 6.31% | | 6.00% | | 9.92% |

| Ten Year | | 7.26% | | 7.24% | | 7.09% | | 11.91% |

| | |

| 1 | MVIS® US Listed Pharmaceutical 25 Index (MVPPHTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the pharmaceutical industry. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

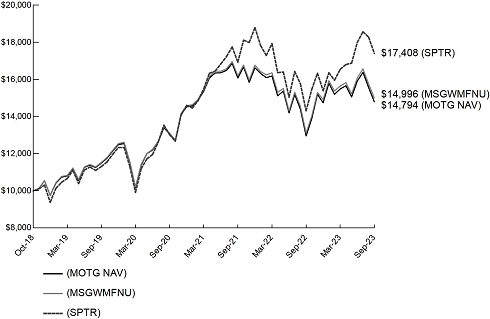

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

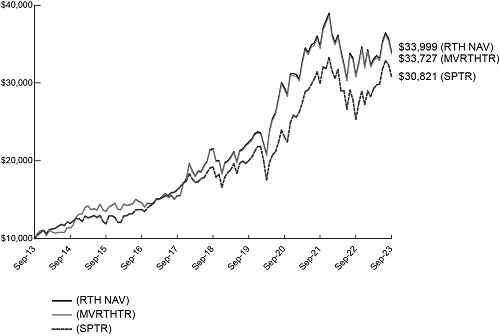

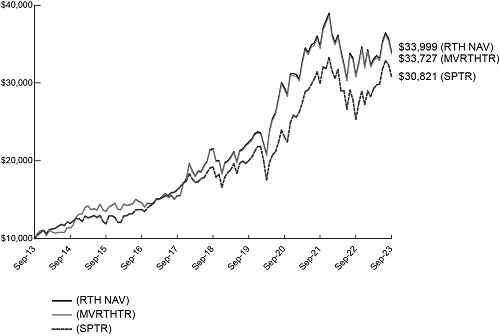

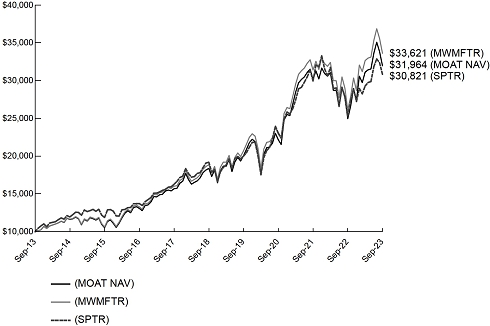

VANECK RETAIL ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVRTHTR1 | | SPTR2 |

| One Year | | 9.47% | | 9.58% | | 9.57% | | 21.62% |

| Five Year | | 9.52% | | 9.51% | | 9.47% | | 9.92% |

| Ten Year | | 13.02% | | 13.02% | | 12.93% | | 11.91% |

| | |

| 1 | MVIS® US Listed Retail 25 Index (MVRTHTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the retail industry. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

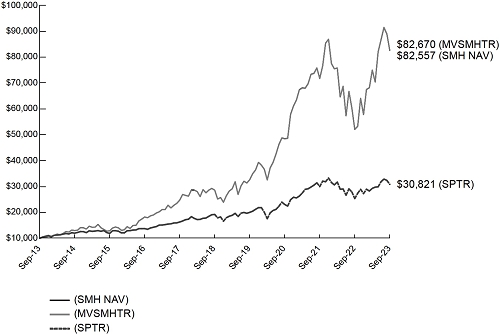

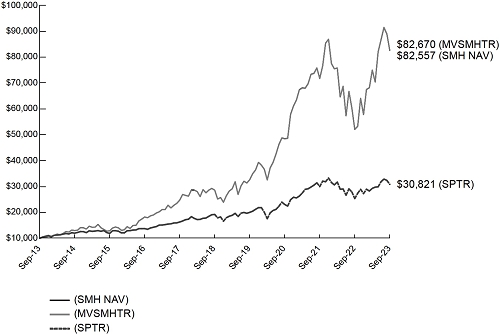

VANECK SEMICONDUCTOR ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVSMHTR1 | | SPTR2 |

| One Year | | 58.48% | | 58.49% | | 58.56% | | 21.62% |

| Five Year | | 23.60% | | 23.61% | | 23.67% | | 9.92% |

| Ten Year | | 23.50% | | 23.50% | | 23.52% | | 11.91% |

| | |

| 1 | MVIS® US Listed Semiconductor 25 Index (MVSMHTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the semiconductor industry. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

Hypothetical Growth of $10,000 (Ten Year)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

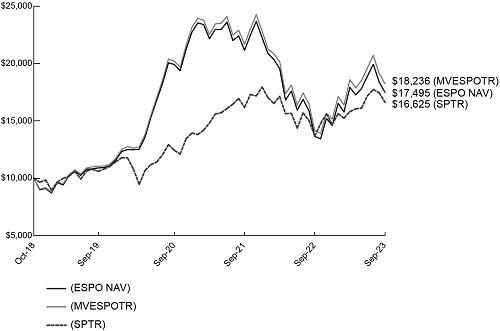

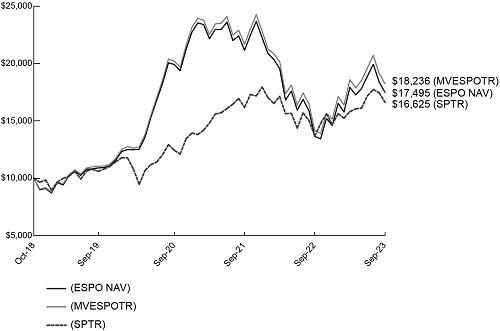

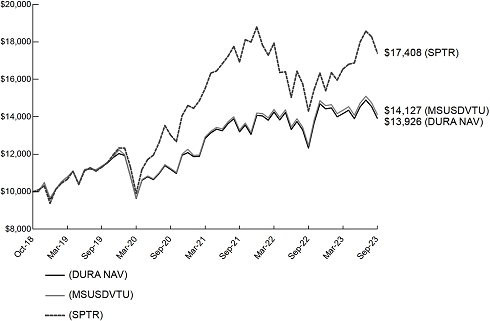

VANECK VIDEO GAMING AND ESPORTS ETF

PERFORMANCE COMPARISON

September 30, 2023 (unaudited)

| Average Annual Total Return |

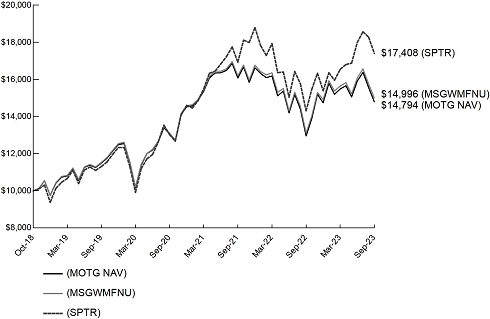

| | | Share Price | | NAV | | MVESPOTR1 | | SPTR2 |

| One Year | | 28.17% | | 28.11% | | 28.83% | | 21.62% |

| Life* | | 11.92% | | 11.95% | | 12.89% | | 10.80% |

| | |

| * | Inception of Fund: 10/16/18; First Day of Secondary Market Trading: 10/17/18. |

| | |

| 1 | MVIS® Global Video Gaming and eSports Index (MVESPOTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in video gaming and eSports. |

| | |

| 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. |

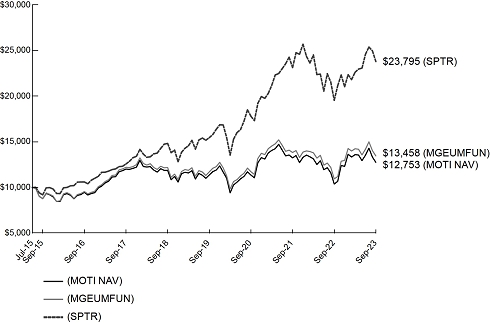

Hypothetical Growth of $10,000 (Since Inception)

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark broad-based index. | |  |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 17 for more information.

VANECK ETFs

ABOUT FUND PERFORMANCE

(unaudited)

The price used to calculate market return (Share Price) is determined by using the closing price listed on its primary listing exchange. Since the shares of each Fund did not trade in the secondary market until after each Fund’s commencement, for the period from commencement to the first day of secondary market trading in shares of each Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for each Fund reflects, if applicable, temporary waivers of expenses and/or fees. Had each Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of each Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund returns reflect reinvestment of dividends and capital gains distributions. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Certain indices may take into account withholding taxes. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

MVBBHTR, MCDAPPTR, MVEINCTG, MVBJKTR, MVPPHTR, MVRTHTR, MVSMHTR and MVESPOTR are published by MarketVector Indexes GmbH (MarketVector), a wholly owned subsidiary of the Adviser, Van Eck Associates Corporation. AXENVTR is published by ICE Data Indices, LLC (ICE Data). IUGIMWT is published by Indxx.

MarketVector, ICE Data, Indxx and Solactive are referred to herein as the “Index Providers”. The Index Providers do not sponsor, endorse, or promote the Funds and bear no liability with respect to the Funds or any security.

VANECK ETF TRUST

EXPLANATION OF EXPENSES

(unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, April 1, 2023 to September 30, 2023.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Annualized | | Expenses Paid |

| | | Account | | Account | | Expense | | During the Period |

| | | Value | | Value | | Ratio | | April 1, 2023 - |

| | | April 1, 2023 | | September 30, 2023 | | During Period | | September 30, 2023(a) |

| Biotech ETF | | | | | | | | |

| Actual | | $1,000.00 | | $961.30 | | 0.35% | | $1.72 |

| Hypothetical (b) | | $1,000.00 | | $1,023.31 | | 0.35% | | $1.78 |

| Digital Transformation ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,174.10 | | 0.51% | | $2.78 |

| Hypothetical (b) | | $1,000.00 | | $1,022.51 | | 0.51% | | $2.59 |

| Energy Income ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,086.70 | | 0.46% | | $2.41 |

| Hypothetical (b) | | $1,000.00 | | $1,022.76 | | 0.46% | | $2.33 |

| Environmental Services ETF | | | | | | | | |

| Actual | | $1,000.00 | | $985.60 | | 0.55% | | $2.74 |

| Hypothetical (b) | | $1,000.00 | | $1,022.31 | | 0.55% | | $2.79 |

| Gaming ETF | | | | | | | | |

| Actual | | $1,000.00 | | $897.80 | | 0.77% | | $3.66 |

| Hypothetical (b) | | $1,000.00 | | $1,021.21 | | 0.77% | | $3.90 |

| Green Infrastructure ETF | | | | | | | | |

| Actual | | $1,000.00 | | $930.40 | | 0.46% | | $2.23 |

| Hypothetical (b) | | $1,000.00 | | $1,022.76 | | 0.46% | | $2.33 |

| Pharmaceutical ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,041.90 | | 0.36% | | $1.84 |

| Hypothetical (b) | | $1,000.00 | | $1,023.26 | | 0.36% | | $1.83 |

| | | Beginning | | Ending | | Annualized | | Expenses Paid |

| | | Account | | Account | | Expense | | During the Period |

| | | Value | | Value | | Ratio | | April 1, 2023 - |

| | | April 1, 2023 | | September 30, 2023 | | During Period | | September 30, 2023(a) |

| Retail ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,026.80 | | 0.35% | | $1.78 |

| Hypothetical (b) | | $1,000.00 | | $1,023.31 | | 0.35% | | $1.78 |

| Robotics ETF | | | | | | | | |

| Actual (c) | | $1,000.00 | | $1,021.80 | | 0.47% | | $2.32 |

| Hypothetical (b) | | $1,000.00 | | $1,022.71 | | 0.47% | | $2.38 |

| Semiconductor ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,101.20 | | 0.35% | | $1.84 |

| Hypothetical (b) | | $1,000.00 | | $1,023.31 | | 0.35% | | $1.78 |

| Video Gaming and eSports ETF | | | | | | | | |

| Actual | | $1,000.00 | | $976.10 | | 0.57% | | $2.82 |

| Hypothetical (b) | | $1,000.00 | | $1,022.21 | | 0.57% | | $2.89 |

| | |

| (a) | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended September 30, 2023), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of the days in the fiscal year (to reflect the one-half year period). |

| (b) | Assumes annual return of 5% before expenses |

| (c) | Expenses are equal to the Fund’s annualized expense ratio (for the period from April 6, 2023 (commencement of operations) to September 30, 2023) multiplied by the average account value over the period, multiplied by the number of days since the commencement of operations divided by the number of days in the fiscal year. |

VANECK BIOTECH ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 99.9% | | | | | | |

| China: 3.9% | | | | | | |

| BeiGene Ltd. (ADR) * | | | 98,066 | | | $ | 17,639,131 | |

| Germany: 2.8% | | | | | | | | |

| BioNTech SE (ADR) * | | | 116,759 | | | | 12,684,698 | |

| Ireland: 4.5% | | | | | | | | |

| ICON Plc (USD) * | | | 81,772 | | | | 20,136,355 | |

| Switzerland: 0.7% | | | | | | | | |

| CRISPR Therapeutics AG (USD) * † | | | 71,392 | | | | 3,240,483 | |

| United States: 88.0% | | | | | | | | |

| Alnylam Pharmaceuticals, Inc. * | | | 69,704 | | | | 12,344,578 | |

| Amgen, Inc. | | | 240,831 | | | | 64,725,740 | |

| Argenx SE (ADR) * | | | 41,173 | | | | 20,241,882 | |

| Biogen, Inc. * | | | 89,764 | | | | 23,070,246 | |

| BioMarin Pharmaceutical, Inc. * | | | 155,071 | | | | 13,720,682 | |

| Bio-Techne Corp. | | | 154,049 | | | | 10,486,115 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | |

| Charles River Laboratories International, Inc. * | | | 50,573 | | | $ | 9,911,297 | |

| Exact Sciences Corp. * | | | 146,538 | | | | 9,996,822 | |

| Gilead Sciences, Inc. | | | 509,072 | | | | 38,149,856 | |

| Illumina, Inc. * | | | 133,164 | | | | 18,280,754 | |

| Incyte Corp. * | | | 153,888 | | | | 8,890,110 | |

| IQVIA Holdings, Inc. * | | | 108,181 | | | | 21,284,612 | |

| Moderna, Inc. * | | | 218,701 | | | | 22,589,626 | |

| Natera, Inc. * | | | 111,612 | | | | 4,938,831 | |

| QIAGEN NV * | | | 219,044 | | | | 8,871,282 | |

| Regeneron Pharmaceuticals, Inc. * | | | 37,940 | | | | 31,223,102 | |

| Repligen Corp. * † | | | 49,428 | | | | 7,859,546 | |

| Sarepta Therapeutics, Inc. * | | | 94,574 | | | | 11,464,260 | |

| Seagen, Inc. * | | | 103,373 | | | | 21,930,582 | |

| Vertex Pharmaceuticals, Inc. * | | | 105,501 | | | | 36,686,918 | |

| | | | | | | | 396,666,841 | |

Total Common Stocks

(Cost: $469,325,734) | | | | | | | 450,367,508 | |

Total Investments: 99.9%

(Cost: $469,325,734) | | | | | | | 450,367,508 | |

| Other assets less liabilities: 0.1% | | | | | | 611,872 | |

| NET ASSETS: 100.0% | | | | | | $ | 450,979,380 | |

Definitions:

| ADR | American Depositary Receipt |

| USD | United States Dollar |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $7,078,655. |

| Summary of Investments by Sector | | % of

Investments | | Value | |

| Biotechnology | | | 78.5 | % | | $ | 353,537,547 | |

| Life Sciences Tools & Services | | | 21.5 | | | | 96,829,961 | |

| | | | 100.0 | % | | $ | 450,367,508 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks * | | $ | 450,367,508 | | | $ | — | | | $ | — | | | $ | 450,367,508 | |

| * | See Schedule of Investments for geographic sector breakouts. |

See Notes to Financial Statements

VANECK DIGITAL TRANSFORMATION ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 100.2% | | | | | | |

| Australia: 4.6% | | | | | | |

| Iris Energy Ltd. (USD) * | | | 537,173 | | | $ | 1,992,912 | |

| Canada: 13.7% | | | | | | | | |

| Bitfarms Ltd. (USD) * | | | 1,740,050 | | | | 1,861,854 | |

| Hive Digital Technologies Ltd. (USD) * | | | 641,077 | | | | 1,974,517 | |

| Hut 8 Mining Corp. (USD) * | | | 1,068,451 | | | | 2,083,479 | |

| | | | | | | | 5,919,850 | |

| China: 4.9% | | | | | | | | |

| Canaan, Inc. (ADR) * † | | | 1,153,932 | | | | 2,100,156 | |

| | | | | | | | | |

| Germany: 8.8% | | | | | | | | |

| Bitcoin Group SE | | | 53,643 | | | | 1,140,566 | |

| Northern Data AG * † | | | 110,076 | | | | 2,686,860 | |

| | | | | | | | 3,827,426 | |

| Singapore: 4.0% | | | | | | | | |

| Bitdeer Technologies Group (USD) * † | | | 179,896 | | | | 1,734,197 | |

| United States: 64.2% | | | | | | | | |

| Applied Digital Corp. * | | | 388,727 | | | | 2,425,657 | |

| Bakkt Holdings, Inc. * † | | | 953,948 | | | | 1,116,119 | |

| Bit Digital, Inc. * † | | | 992,064 | | | | 2,123,017 | |

| Block, Inc. * | | | 67,616 | | | | 2,992,684 | |

| Cipher Mining, Inc. * † | | | 682,120 | | | | 1,589,340 | |

| Cleanspark, Inc. * | | | 581,379 | | | | 2,215,054 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | | | |

| Coinbase Global, Inc. * | | | 49,635 | | | $ | 3,726,596 | |

| Galaxy Digital Holdings Ltd. (CAD) * † | | | 612,678 | | | | 2,261,289 | |

| Marathon Digital Holdings, Inc. * † | | | 262,587 | | | | 2,231,990 | |

| MicroStrategy, Inc. * | | | 9,668 | | | | 3,173,811 | |

| Riot Platforms, Inc. * | | | 260,085 | | | | 2,426,593 | |

| Terawulf, Inc. * † | | | 1,177,611 | | | | 1,483,790 | |

| | | | | | | | 27,765,940 | |

Total Common Stocks

(Cost: $47,361,507) | | | | | | | 43,340,481 | |

| | | | | | | | | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 21.6% | | | | | |

Money Market Fund: 21.6%

(Cost: $9,346,580) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 9,346,580 | | | | 9,346,580 | |

Total Investments: 121.8%

(Cost: $56,708,087) | | | | | | | 52,687,061 | |

| Liabilities in excess of other assets: (21.8)% | | | | (9,437,063) | |

| NET ASSETS: 100.0% | | | | | | $ | 43,249,998 | |

Definitions:

| ADR | American Depositary Receipt |

| CAD | Canadian Dollar |

| USD | United States Dollar |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $9,129,530. |

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Information Technology | | | 74.1 | % | | $ | 32,103,227 | |

| Financials | | | 25.9 | | | | 11,237,254 | |

| | | | 100.0 | % | | $ | 43,340,481 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | $ | 1,992,912 | | | $ | — | | | $ | — | | | $ | 1,992,912 | |

| Canada | | | 5,919,850 | | | | — | | | | — | | | | 5,919,850 | |

| China | | | 2,100,156 | | | | — | | | | — | | | | 2,100,156 | |

| Germany | | | — | | | | 3,827,426 | | | | — | | | | 3,827,426 | |

| Singapore | | | 1,734,197 | | | | — | | | | — | | | | 1,734,197 | |

| United States | | | 27,765,940 | | | | — | | | | — | | | | 27,765,940 | |

| Money Market Fund | | | 9,346,580 | | | | — | | | | — | | | | 9,346,580 | |

| Total Investments | | $ | 48,859,635 | | | $ | 3,827,426 | | | $ | — | | | $ | 52,687,061 | |

See Notes to Financial Statements

VANECK ENERGY INCOME ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 79.5% | | | | | | |

| Energy: 79.5% | | | | | | |

| Antero Midstream Corp. | | | 94,722 | | | $ | 1,134,770 | |

| Archrock, Inc. | | | 26,489 | | | | 333,761 | |

| Cheniere Energy, Inc. | | | 18,286 | | | | 3,034,744 | |

| DT Midstream, Inc. | | | 30,460 | | | | 1,611,943 | |

| Enbridge, Inc. | | | 89,067 | | | | 2,956,134 | |

| EnLink Midstream LLC | | | 70,674 | | | | 863,636 | |

| Equitrans Midstream Corp. | | | 104,763 | | | | 981,629 | |

| Gibson Energy, Inc. | | | 53,420 | | | | 764,183 | |

| Hess Midstream LP | | | 15,352 | | | | 447,204 | |

| Keyera Corp. | | | 69,466 | | | | 1,630,974 | |

| Kinder Morgan, Inc. | | | 133,399 | | | | 2,211,755 | |

| Kinetik Holdings, Inc. | | | 7,121 | | | | 240,334 | |

| NextDecade Corp. * | | | 43,783 | | | | 224,169 | |

| ONEOK, Inc. | | | 48,842 | | | | 3,098,048 | |

| Pembina Pipeline Corp. | | | 60,633 | | | | 1,822,628 | |

| Plains GP Holdings LP | | | 59,230 | | | | 954,788 | |

| Shawcor Ltd. * | | | 20,426 | | | | 238,961 | |

| Targa Resources Corp. | | | 19,567 | | | | 1,677,283 | |

| TC Energy Corp. | | | 67,603 | | | | 2,326,219 | |

| | | Number

of Shares | | | Value | |

| Energy (continued) | | | | | | |

| The Williams Companies, Inc. | | | 76,482 | | | $ | 2,576,679 | |

Total Common Stocks

(Cost: $29,221,539) | | | | | | | 29,129,842 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS: 20.3% | | | | | | | | |

| Energy: 20.3% | | | | | | | | |

| Crestwood Equity Partners LP | | | 12,119 | | | | 354,481 | |

| Energy Transfer LP | | | 123,246 | | | | 1,729,141 | |

| Enterprise Products Partners LP | | | 62,762 | | | | 1,717,796 | |

| Genesis Energy LP | | | 12,491 | | | | 128,907 | |

| Holly Energy Partners LP | | | 5,292 | | | | 116,212 | |

| MPLX LP | | | 45,026 | | | | 1,601,575 | |

| NuStar Energy LP | | | 11,702 | | | | 204,083 | |

| Plains All American Pipeline LP | | | 59,674 | | | | 914,206 | |

| Western Midstream Partners LP | | | 24,792 | | | | 675,086 | |

Total Master Limited Partnerships

(Cost: $6,009,629) | | | | | | | 7,441,487 | |

Total Investments: 99.8%

(Cost: $35,231,168) | | | | | | | 36,571,329 | |

| Other assets less liabilities: 0.2% | | | | | | | 63,175 | |

| NET ASSETS: 100.0% | | | | | | $ | 36,634,504 | |

Footnotes:

| Summary of Investments by Sector | | % of

Investments | | Value | |

| Energy | | | 100.0 | % | | $ | 36,571,329 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks * | | $ | 29,129,842 | | | $ | — | | | $ | — | | | $ | 29,129,842 | |

| Master Limited Partnerships * | | | 7,441,487 | | | | — | | | | — | | | | 7,441,487 | |

| Total Investments | | $ | 36,571,329 | | | $ | — | | | $ | — | | | $ | 36,571,329 | |

| * | See Schedule of Investments for industry sector breakouts. |

See Notes to Financial Statements

VANECK ENVIRONMENTAL SERVICES ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 99.9% | | | | | | |

| Canada: 5.0% | | | | | | | | |

| GFL Environmental, Inc. (USD) | | | 80,557 | | | $ | 2,558,490 | |

| Li-Cycle Holdings Corp. (USD) * † | | | 378,834 | | | | 1,344,861 | |

| | | | | | | | 3,903,351 | |

| United States: 94.9% | | | | | | | | |

| ABM Industries, Inc. | | | 67,585 | | | | 2,704,076 | |

| Aris Water Solutions, Inc. † | | | 151,604 | | | | 1,513,008 | |

| Casella Waste Systems, Inc. * | | | 33,074 | | | | 2,523,546 | |

| CECO Environmental Corp. * | | | 101,599 | | | | 1,622,536 | |

| Clean Harbors, Inc. * | | | 16,326 | | | | 2,732,319 | |

| Darling Ingredients, Inc. * | | | 48,467 | | | | 2,529,977 | |

| Donaldson Co., Inc. | | | 44,576 | | | | 2,658,513 | |

| Ecolab, Inc. | | | 46,875 | | | | 7,940,625 | |

| Energy Recovery, Inc. * | | | 120,237 | | | | 2,550,227 | |

| Heritage-Crystal Clean, Inc. * | | | 60,670 | | | | 2,751,385 | |

| LanzaTech Global, Inc. * | | | 334,967 | | | | 1,564,296 | |

| Montrose Environmental Group, Inc. * | | | 85,803 | | | | 2,510,596 | |

| PureCycle Technologies, Inc. * † | | | 465,106 | | | | 2,609,245 | |

| Republic Services, Inc. | | | 55,314 | | | | 7,882,798 | |

| Schnitzer Steel Industries, Inc. | | | 57,439 | | | | 1,599,676 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | |

| Stericycle, Inc. * | | | 61,133 | | | $ | 2,733,256 | |

| STERIS Plc | | | 12,042 | | | | 2,642,256 | |

| Tennant Co. | | | 35,889 | | | | 2,661,169 | |

| Tetra Tech, Inc. | | | 17,137 | | | | 2,605,338 | |

| Vertex Energy, Inc. * † | | | 323,299 | | | | 1,438,681 | |

| Waste Connections, Inc. | | | 58,239 | | | | 7,821,498 | |

| Waste Management, Inc. | | | 51,553 | | | | 7,858,739 | |

| | | | | | | | 73,453,760 | |

Total Common Stocks

(Cost: $79,727,163) | | | | | | | 77,357,111 | |

| | | | | | | | | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 2.5% | | | |

Money Market Fund: 2.5%

(Cost: $1,973,216) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 1,973,216 | | | | 1,973,216 | |

Total Investments: 102.4%

(Cost: $81,700,379) | | | | | | | 79,330,327 | |

| Liabilities in excess of other assets: (2.4)% | | | | | | | (1,891,231) | |

| NET ASSETS: 100.0% | | | | | | $ | 77,439,096 | |

Definitions:

Footnotes:

| † | Security fully or partially on loan. Total market value of securities on loan is $2,842,105. |

| * | Non-income producing |

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Industrials | | | 75.8 | % | | $ | 58,596,651 | |

| Materials | | | 15.7 | | | | 12,149,546 | |

| Health Care | | | 3.4 | | | | 2,642,256 | |

| Consumer Staples | | | 3.3 | | | | 2,529,977 | |

| Energy | | | 1.8 | | | | 1,438,681 | |

| | | | 100.0 | % | | $ | 77,357,111 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks * | | $ | 77,357,111 | | | $ | — | | | $ | — | | | $ | 77,357,111 | |

| Money Market Fund | | | 1,973,216 | | | | — | | | | — | | | | 1,973,216 | |

| Total Investments | | $ | 79,330,327 | | | $ | — | | | $ | — | | | $ | 79,330,327 | |

| * | See Schedule of Investments for geographic sector breakouts. |

See Notes to Financial Statements

VANECK GAMING ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 100.1% | | | | | | |

| Australia: 10.8% | | | | | | |

| Aristocrat Leisure Ltd. | | | 122,567 | | | $ | 3,214,440 | |

| Lottery Corp. Ltd. | | | 509,098 | | | | 1,544,361 | |

| Star Entertainment Group Ltd. * | | | 267,420 | | | | 104,500 | |

| Star Entertainment Group Ltd. * † | | | 441,243 | | | | 172,426 | |

| Tabcorp Holdings Ltd. † | | | 607,647 | | | | 367,549 | |

| | | | | | | | 5,403,276 | |

| China: 6.7% | | | | | | | | |

| Galaxy Entertainment Group Ltd. (HKD) | | | 418,240 | | | | 2,502,302 | |

| Melco Resorts & Entertainment Ltd. (ADR) * | | | 50,674 | | | | 501,166 | |

| SJM Holdings Ltd. (HKD) * † | | | 825,500 | | | | 323,505 | |

| | | | | | | | 3,326,973 | |

| France: 2.3% | | | | | | | | |

| La Francaise des Jeux SAEM 144A | | | 35,308 | | | | 1,148,418 | |

| Greece: 1.9% | | | | | | | | |

| OPAP SA | | | 58,150 | | | | 974,910 | |

| Ireland: 8.1% | | | | | | | | |

| Flutter Entertainment Plc * | | | 24,683 | | | | 4,032,258 | |

| Japan: 1.6% | | | | | | | | |

| Heiwa Corp. † | | | 18,000 | | | | 258,704 | |

| Sankyo Co. Ltd. | | | 12,179 | | | | 558,955 | |

| | | | | | | | 817,659 | |

| Malaysia: 4.4% | | | | | | | | |

| Genting Bhd | | | 689,700 | | | | 611,893 | |

| Genting Malaysia Bhd | | | 908,598 | | | | 483,096 | |

| Genting Singapore Ltd. (SGD) | | | 1,777,700 | | | | 1,099,130 | |

| | | | | | | | 2,194,119 | |

| Malta: 0.9% | | | | | | | | |

| Kindred Group Plc (SEK) (SDR) | | | 47,588 | | | | 436,551 | |

| | | | | | | | | |

| South Korea: 0.8% | | | | | | | | |

| Kangwon Land, Inc. | | | 34,963 | | | | 391,224 | |

| | | Number

of Shares | | | Value | |

| Sweden: 6.6% | | | | | | | | |

| Evolution AB 144A | | | 32,495 | | | $ | 3,297,562 | |

| United Kingdom: 4.0% | | | | | | | | |

| Entain Plc | | | 130,096 | | | | 1,476,069 | |

| Playtech Plc * | | | 92,065 | | | | 507,912 | |

| | | | | | | | 1,983,981 | |

| United States: 52.0% | | | | | | | | |

| Boyd Gaming Corp. | | | 18,489 | | | | 1,124,686 | |

| Caesars Entertainment, Inc. * | | | 35,750 | | | | 1,657,013 | |

| Churchill Downs, Inc. | | | 12,199 | | | | 1,415,572 | |

| DraftKings, Inc. * | | | 97,195 | | | | 2,861,421 | |

| Gaming and Leisure Properties, Inc. | | | 49,973 | | | | 2,276,270 | |

| International Game Technology Plc † | | | 31,379 | | | | 951,411 | |

| Las Vegas Sands Corp. * | | | 71,657 | | | | 3,284,757 | |

| Light & Wonder, Inc. * | | | 16,889 | | | | 1,204,692 | |

| MGM Resorts International | | | 55,560 | | | | 2,042,386 | |

| Penn Entertainment, Inc. * | | | 25,459 | | | | 584,284 | |

| Sands China Ltd. (HKD) * | | | 716,000 | | | | 2,177,091 | |

| VICI Properties, Inc. | | | 138,457 | | | | 4,029,099 | |

| Wynn Macau Ltd. (HKD) * † | | | 246,800 | | | | 234,683 | |

| Wynn Resorts Ltd. | | | 23,203 | | | | 2,144,189 | |

| | | | | | | | 25,987,554 | |

Total Common Stocks

(Cost: $64,453,731) | | | | | | | 49,994,485 | |

| | | | | | | | | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 0.0% | | | | | |

Money Market Fund: 0.0%

(Cost: $193) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 193 | | | | 193 | |

Total Investments: 100.1%

(Cost: $64,453,924) | | | | | | | 49,994,678 | |

| Liabilities in excess of other assets: (0.1)% | | (65,475) | |

| NET ASSETS: 100.0% | | | | | | $ | 49,929,203 | |

Definitions:

| ADR | American Depositary Receipt |

| HKD | Hong Kong Dollar |

| SDR | Swedish Depositary Receipt |

| SEK | Swedish Krona |

| SGD | Singapore Dollar |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $1,644,613. |

| 144A | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended, or otherwise restricted. These securities may be resold in transactions exempt from registration, unless otherwise noted, and the value amounted $4,445,980, or 8.9% of net assets. |

See Notes to Financial Statements

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Consumer Discretionary | | | 87.4 | % | | $ | 43,689,116 | |

| Real Estate | | | 12.6 | | | | 6,305,369 | |

| | | | 100.0 | % | | $ | 49,994,485 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | $ | — | | | $ | 5,403,276 | | | $ | — | | | $ | 5,403,276 | |

| China | | | 501,166 | | | | 2,825,807 | | | | — | | | | 3,326,973 | |

| France | | | — | | | | 1,148,418 | | | | — | | | | 1,148,418 | |

| Greece | | | — | | | | 974,910 | | | | — | | | | 974,910 | |

| Ireland | | | — | | | | 4,032,258 | | | | — | | | | 4,032,258 | |

| Japan | | | — | | | | 817,659 | | | | — | | | | 817,659 | |

| Malaysia | | | — | | | | 2,194,119 | | | | — | | | | 2,194,119 | |

| Malta | | | — | | | | 436,551 | | | | — | | | | 436,551 | |

| South Korea | | | — | | | | 391,224 | | | | — | | | | 391,224 | |

| Sweden | | | — | | | | 3,297,562 | | | | — | | | | 3,297,562 | |

| United Kingdom | | | 507,912 | | | | 1,476,069 | | | | — | | | | 1,983,981 | |

| United States | | | 23,575,780 | | | | 2,411,774 | | | | — | | | | 25,987,554 | |

| Money Market Fund | | | 193 | | | | — | | | | — | | | | 193 | |

| Total Investments | | $ | 24,585,051 | | | $ | 25,409,627 | | | $ | — | | | $ | 49,994,678 | |

See Notes to Financial Statements

VANECK GREEN INFRASTRUCTURE ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 99.4% | | | | | | | | |

| Automobiles & Components: 24.2% | | | |

| BorgWarner, Inc. | | | 1,902 | | | $ | 76,784 | |

| Lucid Group, Inc. * † | | | 14,884 | | | | 83,202 | |

| Phinia, Inc. | | | 380 | | | | 10,180 | |

| Rivian Automotive, Inc. * † | | | 6,790 | | | | 164,860 | |

| Tesla, Inc. * | | | 406 | | | | 101,589 | |

| | | | | | | | 436,615 | |

| Capital Goods: 18.4% | | | | | | | | |

| Ameresco, Inc. * | | | 277 | | | | 10,681 | |

| Array Technologies, Inc. * | | | 1,224 | | | | 27,161 | |

| Bloom Energy Corp. * † | | | 1,565 | | | | 20,752 | |

| Donaldson Co., Inc. | | | 984 | | | | 58,686 | |

| Energy Recovery, Inc. * | | | 457 | | | | 9,693 | |

| FuelCell Energy, Inc. * † | | | 3,292 | | | | 4,214 | |

| Hyzon Motors, Inc. * | | | 1,985 | | | | 2,481 | |

| Plug Power, Inc. * † | | | 4,873 | | | | 37,035 | |

| Quanta Services, Inc. | | | 520 | | | | 97,276 | |

| SES AI Corp. * | | | 2,484 | | | | 5,639 | |

| Shoals Technologies Group, Inc. * | | | 1,378 | | | | 25,149 | |

| SunPower Corp. * † | | | 1,420 | | | | 8,761 | |

| Sunrun, Inc. * | | | 1,750 | | | | 21,980 | |

| TPI Composites, Inc. * † | | | 345 | | | | 914 | |

| | | | | | | | 330,422 | |

| Commercial & Professional Services: 18.9% | |

| Casella Waste Systems, Inc. * | | | 413 | | | | 31,512 | |

| Clean Harbors, Inc. * | | | 439 | | | | 73,471 | |

| Heritage-Crystal Clean, Inc. * | | | 198 | | | | 8,979 | |

| Montrose Environmental Group, Inc. * | | | 244 | | | | 7,139 | |

| Republic Services, Inc. | | | 665 | | | | 94,769 | |

| Stericycle, Inc. * | | | 750 | | | | 33,533 | |

| Waste Management, Inc. | | | 587 | | | | 89,482 | |

| | | | | | | | 338,885 | |

| Energy: 11.0% | | | | | | | | |

| Cheniere Energy, Inc. | | | 648 | | | | 107,541 | |

| Clean Energy Fuels Corp. * | | | 1,809 | | | | 6,928 | |

| Enviva, Inc. | | | 550 | | | | 4,109 | |

| Gevo, Inc. * † | | | 1,925 | | | | 2,291 | |

| Green Plains, Inc. * | | | 483 | | | | 14,538 | |

| New Fortress Energy, Inc. † | | | 1,664 | | | | 54,546 | |

| REX American Resources Corp. * | | | 141 | | | | 5,742 | |

| Tellurian, Inc. * † | | | 4,567 | | | | 5,298 | |

| | | | | | | | 200,993 | |

| | | Number

of Shares | | | Value | |

| Materials: 5.1% | | | | | | | | |

| Ecolab, Inc. | | | 539 | | | $ | 91,307 | |

| Semiconductors & Semiconductor Equipment: 8.0% | |

| Enphase Energy, Inc. * | | | 526 | | | | 63,199 | |

| First Solar, Inc. * | | | 496 | | | | 80,149 | |

| | | | | | | | 143,348 | |

| Technology Hardware & Equipment: 1.2% | |

| Itron, Inc. * | | | 369 | | | | 22,354 | |

| Utilities: 12.6% | | | | | | | | |

| Altus Power, Inc. * | | | 1,290 | | | | 6,773 | |

| Brookfield Renewable Corp. | | | 1,398 | | | | 33,468 | |

| Clearway Energy, Inc. | | | 669 | | | | 14,156 | |

| IDACORP, Inc. | | | 411 | | | | 38,490 | |

| Montauk Renewables, Inc. * | | | 1,166 | | | | 10,622 | |

| NextEra Energy Partners LP | | | 721 | | | | 21,414 | |

| Northwestern Energy Group, Inc. | | | 485 | | | | 23,309 | |

| Ormat Technologies, Inc. | | | 484 | | | | 33,841 | |

| Southwest Gas Holdings, Inc. | | | 579 | | | | 34,977 | |

| Sunnova Energy International, Inc. * † | | | 944 | | | | 9,884 | |

| | | | | | | | 226,934 | |

Total Common Stocks

(Cost: $1,919,472) | | | | | | | 1,790,858 | |

| | | | | | | | | |

MASTER LIMITED PARTNERSHIP: 0.5%

(Cost: $7,927) | | | | | | | | |

| Utilities: 0.5% | | | | | | | | |

| Suburban Propane Partners LP | | | 515 | | | | 8,266 | |

| | | | | | | | | |

Total Investments Before Collateral for Securities Loaned: 99.9%

(Cost: $1,927,399) | | | | 1,799,124 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 7.6% | | | |

Money Market Fund: 7.6%

(Cost: $136,137) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 136,137 | | | | 136,137 | |

Total Investments: 107.5%

(Cost: $2,063,536) | | | | | | | 1,935,261 | |

| Liabilities in excess of other assets: (7.5)% | | | | (134,258) | |

| NET ASSETS: 100.0% | | | | | | $ | 1,801,003 | |

Footnotes:

| † | Security fully or partially on loan. Total market value of securities on loan is $371,984. |

| * | Non-income producing |

See Notes to Financial Statements

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Industrials | | | 37.1 | % | | $ | 669,307 | |

| Consumer Discretionary | | | 24.3 | | | | 436,616 | |

| Utilities | | | 13.1 | | | | 235,200 | |

| Energy | | | 11.2 | | | | 200,993 | |

| Information Technology | | | 9.2 | | | | 165,701 | |

| Materials | | | 5.1 | | | | 91,307 | |

| | | | 100.0 | % | | $ | 1,799,124 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks * | | $ | 1,790,858 | | | $ | — | | | $ | — | | | $ | 1,790,858 | |

| Master Limited Partnership * | | | 8,266 | | | | — | | | | — | | | | 8,266 | |

| Money Market Fund | | | 136,137 | | | | — | | | | — | | | | 136,137 | |

| Total Investments | | $ | 1,935,261 | | | $ | — | | | $ | — | | | $ | 1,935,261 | |

| * | See Schedule of Investments for industry sector breakouts. |

See Notes to Financial Statements

VANECK PHARMACEUTICAL ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 99.8% | | | | | | | | |

| Denmark: 5.8% | | | | | | | | |

| Novo Nordisk A/S (ADR) | | | 273,286 | | | $ | 24,852,629 | |

| France: 5.1% | | | | | | | | |

| Sanofi (ADR) | | | 409,007 | | | | 21,939,135 | |

| Israel: 4.5% | | | | | | | | |

| Teva Pharmaceutical Industries Ltd. (ADR) * | | | 1,872,015 | | | | 19,094,553 | |

| Japan: 4.6% | | | | | | | | |

| Takeda Pharmaceutical Co. Ltd. (ADR) † | | | 1,278,300 | | | | 19,775,301 | |

| Switzerland: 5.2% | | | | | | | | |

| Novartis AG (ADR) † | | | 220,109 | | | | 22,420,303 | |

| United Kingdom: 14.6% | | | | | | | | |

| AstraZeneca Plc (ADR) | | | 321,589 | | | | 21,778,007 | |

| GSK Plc (ADR) | | | 563,552 | | | | 20,428,760 | |

| Haleon Plc (ADR) † | | | 2,470,295 | | | | 20,577,557 | |

| | | | | | | | 62,784,324 | |

| United States: 60.0% | | | | | | | | |

| AbbVie, Inc. | | | 147,973 | | | | 22,056,855 | |

| Bausch Health Cos, Inc. * | | | 505,257 | | | | 4,153,213 | |

| Bristol-Myers Squibb Co. | | | 324,985 | | | | 18,862,129 | |

| Catalent, Inc. * | | | 174,699 | | | | 7,954,046 | |

| Cencora, Inc. | | | 111,020 | | | | 19,980,269 | |

| Elanco Animal Health, Inc. * | | | 526,836 | | | | 5,921,637 | |

| Eli Lilly & Co. | | | 60,074 | | | | 32,267,548 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | | | |

| Jazz Pharmaceuticals Plc * | | | 84,390 | | | $ | 10,923,442 | |

| Johnson & Johnson | | | 167,169 | | | | 26,036,572 | |

| McKesson Corp. | | | 47,153 | | | | 20,504,482 | |

| Merck & Co., Inc. | | | 202,334 | | | | 20,830,285 | |

| Organon & Co. | | | 303,179 | | | | 5,263,187 | |

| Patterson Companies, Inc. | | | 112,105 | | | | 3,322,792 | |

| Perrigo Co. Plc | | | 165,145 | | | | 5,276,383 | |

| Pfizer, Inc. | | | 626,898 | | | | 20,794,207 | |

| Viatris, Inc. | | | 1,603,379 | | | | 15,809,317 | |

| Zoetis, Inc. | | | 103,778 | | | | 18,055,296 | |

| | | | | | | | 258,011,660 | |

Total Common Stocks

(Cost: $461,858,668) | | | | | | | 428,877,905 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 4.2% | | | |

Money Market Fund: 4.2%

(Cost: $18,206,223) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 18,206,223 | | | | 18,206,223 | |

Total Investments: 104.0%

(Cost: $480,064,891) | | | | | | | 447,084,128 | |

| Liabilities in excess of other assets: (4.0)% | | | | (17,037,832) | |

| NET ASSETS: 100.0% | | | | | | $ | 430,046,296 | |

Definitions:

| ADR | American Depositary Receipt |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $44,033,459. |

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Pharmaceuticals | | | 79.9 | % | | $ | 342,435,949 | |

| Health Care Distributors | | | 10.2 | | | | 43,807,544 | |

| Biotechnology | | | 5.1 | | | | 22,056,855 | |

| Personal Care Products | | | 4.8 | | | | 20,577,557 | |

| | | | 100.0 | % | | $ | 428,877,905 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks * | | $ | 428,877,905 | | | $ | — | | | $ | — | | | $ | 428,877,905 | |

| Money Market Fund | | | 18,206,223 | | | | — | | | | — | | | | 18,206,223 | |

| Total Investments | | $ | 447,084,128 | | | $ | — | | | $ | — | | | $ | 447,084,128 | |

| * | See Schedule of Investments for geographic sector breakouts. |

See Notes to Financial Statements

VANECK RETAIL ETF

SCHEDULE OF INVESTMENTS

September 30, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 100.2% | | | | | | | | |

| China: 3.7% | | | | | | | | |

| JD.com, Inc. (ADR) | | | 197,662 | | | $ | 5,757,894 | |

| United States: 96.5% | | | | | | | | |

| Amazon.com, Inc. * | | | 237,624 | | | | 30,206,763 | |

| AutoZone, Inc. * | | | 1,834 | | | | 4,658,342 | |

| Bath & Body Works, Inc. | | | 20,011 | | | | 676,372 | |

| Best Buy Co., Inc. | | | 21,779 | | | | 1,512,987 | |

| Cardinal Health, Inc. | | | 24,955 | | | | 2,166,593 | |

| Cencora, Inc. | | | 18,959 | | | | 3,412,051 | |

| Costco Wholesale Corp. | | | 21,613 | | | | 12,210,480 | |

| CVS Health Corp. | | | 110,473 | | | | 7,713,225 | |

| Dollar General Corp. | | | 22,281 | | | | 2,357,330 | |

| Dollar Tree, Inc. * | | | 19,997 | | | | 2,128,681 | |

| Lowe’s Companies, Inc. | | | 35,021 | | | | 7,278,765 | |

| Lululemon Athletica, Inc. * | | | 11,212 | | | | 4,323,459 | |

| McKesson Corp. | | | 15,959 | | | | 6,939,771 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | | | |

| O’Reilly Automotive, Inc. * | | | 7,303 | | | $ | 6,637,405 | |

| Ross Stores, Inc. | | | 35,077 | | | | 3,961,947 | |

| Sysco Corp. | | | 56,820 | | | | 3,752,961 | |

| Target Corp. | | | 45,286 | | | | 5,007,273 | |

| The Home Depot, Inc. | | | 45,290 | | | | 13,684,826 | |

| The Kroger Co. | | | 75,989 | | | | 3,400,508 | |

| The TJX Companies, Inc. | | | 79,738 | | | | 7,087,113 | |

| Tractor Supply Co. † | | | 12,401 | | | | 2,518,023 | |

| Ulta Beauty, Inc. * | | | 5,682 | | | | 2,269,675 | |

| Walgreens Boots Alliance, Inc. | | | 77,218 | | | | 1,717,328 | |

| Walmart, Inc. | | | 84,388 | | | | 13,496,173 | |

| | | | | | | | 149,118,051 | |

Total Common Stocks

(Cost: $167,279,707) | | | | | | | 154,875,945 | |

Total Investments: 100.2%

(Cost: $167,279,707) | | | | | | | 154,875,945 | |

| Liabilities in excess of other assets: (0.2)% | | | | (306,633) | |

| NET ASSETS: 100.0% | | | | | | $ | 154,569,312 | |

Definitions:

| ADR | American Depositary Receipt |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $2,404,518. |

| Summary of Investments by Sector | | % of

Investments | | Value | |

| Consumer Discretionary | | | 58.5 | % | | $ | 90,573,571 | |

| Consumer Staples | | | 28.4 | | | | 44,070,734 | |

| Health Care | | | 13.1 | | | | 20,231,640 | |

| | | | 100.0 | % | | $ | 154,875,945 | |

The summary of inputs used to value the Fund’s investments as of September 30, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |