UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

VANECK ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: DECEMBER 31, 2023

Item 1. Reports to Shareholders

| | |

| ANNUAL REPORT

December 31, 2023 |

| | |

| Agribusiness ETF | MOO |

| CMCI Commodity Strategy ETF | CMCI |

| Future of Food ETF | YUMY |

| Gold Miners ETF | GDX® |

| Green Metals ETF | GMET |

| Junior Gold Miners ETF | GDXJ® |

| Low Carbon Energy ETF | SMOG |

| Natural Resources ETF | HAP |

| Oil Refiners ETF | CRAK |

| Oil Services ETF | OIH |

| Rare Earth/Strategic Metals ETF | REMX |

| Steel ETF | SLX |

| Uranium+Nuclear Energy ETF | NLR |

Certain information contained in this report represents the opinion of the investment adviser which may change at any time. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings, the Funds’ performance, and the views of the investment adviser are as of December 31, 2023.

VANECK ETFs

PRESIDENT’S LETTER

December 31, 2023 (unaudited)

Dear Fellow Shareholders:

Our outlook for financial markets in 2023 was “sideways” and “40/60” or overweight bonds. This strategy worked well until November 2023, when the market suddenly rallied aggressively and priced in U.S. Federal Reserve (“Fed”) interest rate cuts which were to happen in 2024. It is one of the wonders of the market that it can price in its view of the future so quickly.

In this sense, it could be that 2024 has already happened. One could imagine that the three major factors—monetary policy, government spending and global economic growth—will not change much in 2024.

So, let’s review those three major forces on markets and some risks and trends worth noting.

Discussion

| 1. | Monetary Policy: Not Very Stimulative |

To recap this cycle: stocks and bonds historically do not perform well when the Fed tightens monetary conditions. And that’s just what the Fed announced it would be doing at the end of 2021. This would include raising rates and changing its balance sheet actions, which doesn’t create a great environment for financial assets.

A second, modern component to monetary policy is the Fed balance sheet. After buying bonds during the pandemic, the Fed has now started shrinking the balance sheet—from a high of almost $9 trillion in early 2022, assets dropped to just under $7.8 trillion toward the end of December 2023.1

Our favorite inflation is wage inflation, not food or gas prices. That is the kind of inflation which is endemic and hard to manage once it takes hold. And wage inflation is above 4%, not near the Fed’s 2% target, so we don’t see a big Fed stimulus. And the silent Fed action of reducing its bond holdings (“quantitative tightening”), continues.

| 2. | Government Spending: Also Muted |

A second bearish factor is that government spending is unlikely to increase next year. The Republicans, in control of the House of Representatives, continue to look to slow government spending. While we probably didn’t sufficiently appreciate the amount of some of the Biden Administration’s spending, like with the environmental Inflation Reduction Act (“IRA”), any such upside surprises are very unlikely in 2024.

| 3. | Global Growth is at Low Levels |

Over the last 20 years, the U.S. and China have been the two main pillars of global growth. But while there are bright spots, China is remarkable now for its economic weakness. The property market recession has helped pull Chinese prices lower year over year and that deflationary force affects the world economy. Other centers of growth like India, Indonesia and Africa are not big enough yet to drive global growth.

Notable

While interest rates whipsawed investors in 2023 with a net positive result, our outlook favoring bonds hasn’t changed, which is that they offer attractive risk-adjusted returns compared to equities, given the headwinds discussed above. Now, after the 2022 and 2023 losses, bond investments are offering attractive yields, this has been our favorite asset class to buy and remains our preference. (See What to Buy? Bonds. When? Now.2) As a reference, bonds offered attractive total returns in the 1970s even though that decade was the worst for interest rates in the last 100 years.

VANECK ETFs

PRESIDENT’S LETTER

(unaudited) (continued)

We like to look for market distortions and the most notable one is “yield curve inversion”—long-term interest rates lower than short-term rates. If, and it’s a big “if”, government entities like the Fed are stepping back from the bond markets, then it makes sense for long-term rates to be higher because with greater risk should come greater return. Yield curve inversion is present only about 10% of the time. It’s unusual.

With the new-found ubiquity and affordability of mobile phones in India, the Internet sector there is well primed to do as well as it has in the U.S., China and other major markets. Digital India seems like a good tactical play, despite higher price/earnings ratios. Emerging markets in general have lagged for so many years that most investors have given up. So many, that 2024 may be their year.

| 4. | Stores of Value/Real Assets |

In March 2023, I “pounded the table” on gold and Bitcoin in a CNBC interview. While those assets have rallied hard since then—again, the market likes to anticipate!—I don’t think this trend is over.

Growth stocks had a shockingly good 2023. Stocks in banks and financials have been beaten up. They are definitely worth a close look. This outlook is discussed in a recent podcast, The Compound & Friends,3 Episode 113, released on October 13, 2023.

We thank you for investing in VanEck’s investment strategies. On the following pages, you will find a performance discussion and financial statements for each of the funds for the 12 month period ended December 31, 2023. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

CEO and President

VanEck ETF Trust

January 18, 2024

PS The investing outlook can change suddenly. To get our quarterly investment outlooks, please subscribe to “VanEck News & Insights”.4 Should you have any questions regarding fund performance, please contact us at 800.826.2333 or visit our website.

| 1 | U.S. Federal Reserve: FEDERAL RESERVE Statistical Release, December 28, 2023, https://www.federalreserve.gov/releases/h41/20231228/ |

| | |

| 2 | VanEck: What to Buy? Bonds. When? Now., https://www.vaneck.com/us/en/blogs/investment-outlook/jan-van-eck-what-to-buy-bonds-when-now/ |

| | |

| 3 | The Compound & Friends, https://podcasts.apple.com/us/podcast/the-new-kings-of-wall-street/id1456467014?i=1000631190860 |

| | |

| 4 | VanEck: https://www.vaneck.com/us/en/subscribe/ |

VANECK ETFs

MANAGEMENT DISCUSSION

December 31, 2023 (unaudited)

Agribusiness

From its highest point towards the end of January 2023, the VanEck Agribusiness ETF fell for most of the rest of the year and the Fund lost 8.58% for the 12 month period ended December 31, 2023 (the “Period”). One sector contributed positively to the Fund’s performance—the healthcare sector, with companies in the pharmaceuticals segment of the contributing the most. The primary detractor from the Fund’s performance, however, was the materials sector. The greatest negative contribution to returns came from companies in the U.S. and Germany, while the greatest positive came from those in Japan and Norway.

The three top positive contributions to the Fund’s performance came from: Zoetis, Inc. (8.2% of Fund net assets†), Salmar ASA (1.3% of Fund net assets†), and Elanco Animal Health, Inc. (1.5% of Fund net assets†). The companies that detracted most from performance were: Bayer AG (7.0% of Fund net assets†), FMC Corp. (1.8% of Fund net assets†) and Nutrien Ltd. (6.4% of Fund net assets†).

Future of Food

With market sentiment continuing to show little favor to growth stocks, the VanEck Future of Food ETF had a disappointing year, losing 7.65% for the Period and underperforming its benchmark, the MSCI All Country World Index, by 29.85%. Only three sectors contributed positively to performance and then only minimally: utilities, healthcare and information technology. The greatest detractor from performance was the consumer staples sector. By far the greatest negative contribution to returns came from companies in the U.S., while the greatest positive contribution came from those in Switzerland.

The three top positive contributions to the Fund’s performance came from: Givaudan SA (5.1% of Fund net assets†), Ingredion, Inc. (6.8% of Fund net assets†) and Orbia Advance Corp. SAB de CV (4.4% of Fund net assets†). The companies that detracted most from performance were: FMC Corp. (2.8% of Fund net assets†), Vitasoy International Holdings Ltd. (1.5% of Fund net assets†) and Nutrien Ltd. (3.9% of Fund net assets†).

Gold Miners

The stocks of both major gold miners and their junior peers had a roller-coaster year. While persistent inflation might usually have been propitious, the U.S. Federal Reserve Bank’s raising of interest rates during the Period was not. Perhaps affected more than generally by the many uncertainties that abounded in the market and the rising cost of materials, the junior gold miners (VanEck Junior Gold Miners ETF) posted a gain of 7.78% and larger gold miners (VanEck Gold Miners ETF) posted a gain of 10.22% for the 12 month period.

Among the larger mining stocks, companies in South Africa and Australia contributed the most to performance. Companies in the U.S. and Burkina Faso detracted the most from performance. Among the juniors, Canada and Australia were the strongest contributors, while the U.S. detracted the most from performance.

The three top positive contributions to the VanEck Gold Miners ETF’s performance came from: Gold Fields Ltd. (4.3% of Fund net assets†), Wheaton Precious Metals Corp. (6.6% of Fund net assets†) and Kinross Gold Corp. (3.0% of Fund net assets†). The companies that detracted most from performance were: Franco-Nevada Corp. (6.3% of Fund net assets†), SSR Mining, Inc. (0.9% of Fund net assets†) and AngloGold Ashanti Ltd. (sold by Fund by period end).

The three top positive contributions to the VanEck Junior Gold Miners ETF’s performance came from: Kinross Gold Corp. (6.5% of Fund net assets†), Alamos Gold, Inc. (5.6% of Fund net assets†) and Cia de Minas Buenaventura SAA (3.3% of Fund net assets†). The companies that detracted most from performance were: SSR Mining, Inc. (1.9% of Fund net assets†), First Majestic Silver Corp. (1.7% of Fund net assets†) and Novagold Resources, Inc. (0.7% of Fund net assets†).

Green Metals

The VanEck Green Metals ETF had another disappointing year, losing 12.13% for the Period, not least reflecting the market’s supply and demand imbalance among green metals. The greatest positive returns

VANECK ETFs

MANAGEMENT DISCUSSION (unaudited) (continued)

came from companies in the Mexico. However, their contributions were significantly counterbalanced by losses from Chinese and South African companies operating across much of the spectrum of green metals.

The three top positive contributions to the Fund’s performance came from: Grupo Mexico SAB de CV (6.5% of Fund net assets†), Freeport-McMoRan, Inc. (8.4% of Fund net assets†) and Southern Copper Corp. (3.5% of Fund net assets†). The companies that detracted most from performance were: Anglo American Plc (5.6% of Fund net assets†), Albemarle Corp. (6.0% of Fund net assets†) and First Quantum Minerals Ltd. (1.5% of Fund net assets†).

Low Carbon Energy

While traditional energy stocks thrived in 2023, in contrast, reflecting amongst other things the market’s negative sentiment, despite the advantages conveyed by the Inflation Reduction Act, towards structural growth, the performance of low carbon energy stocks during the Period was both volatile and disappointing, with the VanEck Low Carbon Energy ETF recording only a small gain of 1.34%. While companies in the consumer discretionary sector contributed by far the most positively to performance, their contributions, together with those in the other sectors contributing positively, were barely able to counterbalance significant losses from companies in the information technology sector. Italy and Spain were the top contributing countries. Companies from South Korea and the U.S. detracted the most from performance.

The three top positive contributions to the Fund’s performance came from: Tesla, Inc. (7.7% of Fund net assets†), Enel SpA (6.4% of Fund net assets†) and Li Auto, Inc. (4.8% of Fund net assets†). The companies that detracted most from performance were: Enphase Energy, Inc. (3.1% of Fund net assets†), NextEra Energy, Inc. (7.5% of Fund net assets†) and SolarEdge Technologies, Inc. (1.1% of Fund net assets†).

Natural Resources

Natural resources stocks had a volatile, but ultimately successful, year with the VanEck Natural Resources ETF gaining 2.32% over the Period under review. During the year, stocks were helped by commodity prices remaining relatively resilient. The energy and materials sectors contributed the most to performance, while the healthcare sector was the greatest detractor. Australian companies contributed the most to performance, while U.S. companies detracted the most.

The three top positive contributions to the Fund’s performance came from: BHP Group Ltd. (2.8% of Fund net assets†), Shell Plc (2.8% of Fund net assets†) and Reliance Industries Ltd. (2.8% of Fund net assets†). The companies that detracted most from performance were: Chevron Corp. (3.8% of Fund net assets†), Bayer AG (1.6% of Fund net assets†) and Archer-Daniels-Midland Co. (1.7% of Fund net assets†).

Oil Refiners

Benefiting from high traditional energy prices, oil refining stocks had a good year with the VanEck Oil Refiners ETF recording a gain of 14.00% over the Period. Exposure to refiners in the U.S. contributed by far the most to the Fund’s total return. Finnish companies detracted the most from total return.

The three top positive contributions to the Fund’s performance came from: Marathon Petroleum Corp. (7.0% of Fund net assets†), Phillips 66 (8.2% of Fund net assets†) and Orlen SA (5.3% of Fund net assets†). The companies that detracted most from performance were: Neste Oyj (5.5% of Fund net assets†), S-Oil Corp. (1.6% of Fund net assets†) and SK Innovation Co., Ltd. (4.6% of Fund net assets†).

Oil Services

On the back of a strong traditional energy sector, but weaker crude oil prices than in 2022, oil services stocks performed positively in 2023 and the VanEck Oil Services ETF ended the Period up 3.21%. The oil service stocks in the UK contributed the most to performance and no countries detracted from performance.

The three top positive contributions to the Fund’s performance came from: TechnipFMC Plc (5.0% of Fund net assets†), Noble Corporation Plc (4.8% of Fund net assets†) and Transocean Ltd. (4.7% of Fund net assets†). The

companies that detracted most from performance were: Patterson-UTI Energy, Inc. (4.2% of Fund net assets†), Helmerich & Payne, Inc. (3.1% of Fund net assets†) and Nabors Industries Ltd. (0.8% of Fund net assets†).

Rare Earth and Strategic Metals

The VanEck Rare Earth/Strategic Metals ETF had disappointing year in 2023, losing 18.99%. In addition to falling lithium prices during the year, the Fund suffered from the continuing rotation in the market out of growth and into value stocks. The majority of the companies in the Fund’s portfolio contributed negatively to returns, and of those few companies contributing positively, those involved in the mining of lithium and/or production of lithium contributed the most. The greatest detractors from performance were three companies with mining operations and/or production involving cobalt, rare earths and lithium.

The three top positive contributions to the Fund’s performance came from: Liontown Resources Limited (5.0% of Fund net assets†), Arcadium Lithium Plc (7.6% of Fund net assets†) and Pilbara Minerals Ltd. (8.2% of Fund net assets†). The companies that detracted most from performance were: Zhejiang Huayou Cobalt Co., Ltd. (sold by the Fund by period end), China Northern Rare Earth Group High-Tech Co., Ltd. (5.0% of Fund net assets†) and Ganfeng Lithium Group Co., Ltd. (2.8% of Fund net assets†).

Steel

Despite a particularly volatile 2023, a strong middle and end to the year for steel stocks resulted in the VanEck Steel ETF recording a gain of 31.23% for the Period. The U.S., was by far the greatest contributor to performance, followed a ways behind by South Korea. No country detracted from performance.

The three top positive contributions to the Fund’s performance came from: United States Steel Corp. (5.3% of Fund net assets†), POSCO Holdings, Inc. (5.1% of Fund net assets†) and Nucor Corp. (6.7% of Fund net assets†). Only two companies detracted from performance: Worthington Steel, Inc. (sold by the Fund by period end) and Schnitzer Steel Industries, Inc. (0.7% of Fund net assets†).

Uranium+Nuclear Energy

Having displayed increasing strength throughout 2023, stocks in the VanEck Uranium+Nuclear Energy ETF recorded a gain of 36.02% for the Period. Energy companies were the greatest contributors to the Fund’s positive total return, with only the materials sector detracting from performance and then only minimally. Geographically, Canadian companies, followed closely by those in the U.S. contributed the most to performance, while those in Finland were the greatest detractors from performance.

The three top positive contributions to the Fund’s performance came from: Cameco Corp. (6.1% of Fund net assets†), Uranium Energy Corp. (4.4% of Fund net assets†) and Constellation Energy Corp. (7.1% of Fund net assets†). The companies that detracted most from performance were: Dominion Energy, Inc. (sold by Fund by period end), NuScale Power Corp. (sold by Fund by period end) and Global Atomic Corp. (1.1% of Fund net assets†).

| † | All Funds assets referenced are Total Net Assets as of December 31, 2023. |

The mention of a specific security is not a recommendation to buy, or solicitation to sell such security.

VANECK AGRIBUSINESS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVMOOTR1 | | | SPTR2 | |

| One Year | | | (8.62)% | | | | (8.58)% | | | | (8.66)% | | | | 26.29% | |

| Five Year | | | 7.85% | | | | 7.82% | | | | 8.01% | | | | 15.69% | |

| Ten Year | | | 5.50% | | | | 5.53% | | | | 5.58% | | | | 12.03% | |

| | 1 | MVIS® Global Agribusiness Index (MVMOOTR) is a rules based index intended to give investors a means of tracking the overall performance of the companies in the global agribusiness segment which includes: agri-chemicals, animal health and fertilizers, seeds and traits, from farm/irrigation equipment and farm machinery, aquaculture and fishing, livestock, cultivation and plantations (including grain, oil palms, sugar cane, tobacco leafs, grapevines etc.) and trading of agricultural products. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK FUTURE OF FOOD ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MSCI ACWI1 | |

| One Year | | (7.89)% | | (7.65)% | | 22.20% | |

| Life* | | (16.20)% | | (16.16)% | | 1.78% | |

| | * | Inception of Fund: 11/30/21; First Day of Secondary Market Trading: 11/31/21. | |

| | | | |

| | 1 | MSCI All Country World Index (MSCI ACWI), (NDUEACWF) represents large- and mid-cap companies across developed and emerging market countries. The index covers approximately 85% of the global investable equity opportunity set. | |

Hypothetical Growth of $10,000 (Since Inception)

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK GOLD MINERS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return | |

| | | Share Price | | NAV | | GDMNTR1 | | SPTR2 | |

| One Year | | 9.91% | | 10.22% | | 10.60% | | 26.29% | |

| Five Year | | 9.34% | | 9.44% | | 9.80% | | 15.69% | |

| Ten Year | | 4.86% | | 4.89% | | 5.25% | | 12.03% | |

| | 1 | NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization weighted index comprised of publicly traded companies involved in the mining for gold and silver. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK GREEN METALS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVGMETTR1 | | SPTR2 | |

| One Year | | (12.35)% | | (12.13)% | | (11.76)% | | 26.29% | |

| Life* | | (13.42)% | | (13.45)% | | (13.02)% | | 2.50% | |

| | * | Inception of Fund: 11/9/21; First Day of Secondary Market Trading: 11/10/21. | |

| | | | |

| | 1 | MVIS® Global Clean-Tech Metals Index is a global index (MVGMETTR) is a global index that tracks the performance of “Green Metals Companies” which are involved in the production, refining, processing and recycling of green metals. “Green metals” are metals used in the applications, products and processes that enable the energy transition from fossil fuels to cleaner energy sources and technologies. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000 (Since Inception)

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK JUNIOR GOLD MINERS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVGDXJTR1 | | SPTR2 | |

| One Year | | 7.09% | | 7.78% | | 8.59% | | 26.29% | |

| Five Year | | 5.68% | | 5.88% | | 6.48% | | 15.69% | |

| Ten Year | | 3.26% | | 3.37% | | 3.75% | | 12.03% | |

| | 1 | MVIS® Global Junior Gold Miners Index (MVGDXJTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK LOW CARBON ENERGY ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVSMOGTR1 | | SPTR2 | |

| One Year | | 1.41% | | 1.34% | | 1.42% | | 26.29% | |

| Five Year | | 15.96% | | 15.78% | | 16.34% | | 15.69% | |

| Ten Year | | 7.93% | | 7.96% | | 8.28% | | 12.03% | |

| | 1 | MVIS® Global Low Carbon Energy Index (MVSMOGTR) normally invests at least 80% of its total assets in stocks of low carbon energy companies.

Index data prior to April 26, 2021 reflects that of the Ardour Global IndexSM (Extra Liquid) (AGIXLT). From April 26, 2021 forward, the index data reflects that of MVSMOGTR. All Index history reflects a blend of the performance of the aforementioned Indexes. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK NATURAL RESOURCES ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return | |

| | | Share Price | | NAV | | RVEIT1 | | SPTR2 | |

| One Year | | 2.39% | | 2.32% | | 2.42% | | 26.29% | |

| Five Year | | 11.66% | | 11.66% | | 11.69% | | 15.69% | |

| Ten Year | | 5.38% | | 5.36% | | 5.49% | | 12.03% | |

| | 1 | VanEck® Natural Resources Index (RVEIT) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK OIL REFINERS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVCRAKTR1 | | SPTR2 | |

| One Year | | 13.68% | | 14.00% | | 13.57% | | 26.29% | |

| Five Year | | 7.76% | | 7.72% | | 7.69% | | 15.69% | |

| Life* | | 9.47% | | 9.50% | | 9.50% | | 12.38% | |

| | * | Inception of Fund: 8/18/15; First Day of Secondary Market Trading: 8/19/15. | |

| | | | |

| | 1 | MVIS® Global Oil Refiners Index (MVCRAKTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in crude oil refining which may include: gasoline, diesel, jet fuel, fuel oil, naphtha, and other petrochemicals. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000 (Since Inception)

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV since inception. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK OIL SERVICES ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVOIHTR1 | | SPTR2 | |

| One Year | | 3.18% | | 3.21% | | 3.39% | | 26.29% | |

| Five Year | | 3.34% | | 3.34% | | 3.32% | | 15.69% | |

| Ten Year | | (9.15)% | | (9.15)% | | (9.26)% | | 12.03% | |

| | 1 | MVIS® US Listed Oil Services 25 Index (MVOIHTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the largest and the most liquid common stocks and depositary receipts of U.S. exchange-listed companies involved in oil services to the upstream oil sector. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK RARE EARTH/STRATEGIC METALS ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVREMXTR1 | | SPTR2 | |

| One Year | | (19.18)% | | (18.99)% | | (18.42)% | | 26.29% | |

| Five Year | | 10.65% | | 10.75% | | 10.13% | | 15.69% | |

| Ten Year | | (2.29)% | | (2.30)% | | (2.73)% | | 12.03% | |

| | 1 | MVIS® Global Rare Earth/Strategic Metals Index (MVREMXTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in the rare earth and strategic metals segment. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

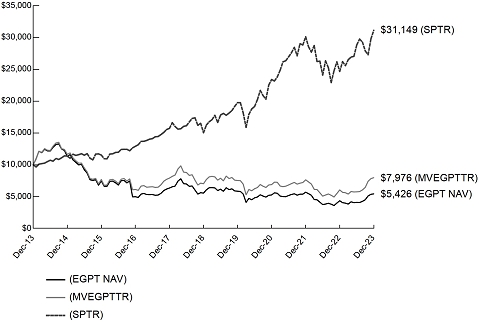

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK STEEL ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | STEEL1 | | SPTR2 | |

| One Year | | 31.07% | | 31.23% | | 32.56% | | 26.29% | |

| Five Year | | 20.68% | | 20.67% | | 21.53% | | 15.69% | |

| Ten Year | | 7.93% | | 7.93% | | 8.37% | | 12.03% | |

| | 1 | NYSE Arca Steel Index (STEEL) is a modified market capitalization weighted index comprised of common stocks and ADRs of selected companies that are primarily involved in a variety of activities that are related to steel production. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK URANIUM+NUCLEAR ENERGY ETF

PERFORMANCE COMPARISON

December 31, 2023 (unaudited)

| Average Annual Total Return |

| | | Share Price | | NAV | | MVNLRTR1 | | SPTR2 | |

| One Year | | 36.59% | | 36.02% | | 35.80% | | 26.29% | |

| Five Year | | 10.52% | | 10.40% | | 10.34% | | 15.69% | |

| Ten Year | | 7.33% | | 7.29% | | 7.02% | | 12.03% | |

| | 1 | MVIS® Global Uranium & Nuclear Energy Index (MVNLRTR) is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in uranium and nuclear energy. Index data prior to March 24, 2014 reflects that of the DAXglobal® Nuclear Energy Index (DXNE). From March 24, 2014, forward, the index data reflects that of MVNLRTR. All index history reflects a blend of the performance of the aforementioned Indexes. | |

| | | | |

| | 2 | The S&P 500 Index (SPTR) is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the index proportionate to its market value. | |

Hypothetical Growth of $10,000

This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV over the past 10 years. The result is compared with the Fund’s benchmark and a broad-based index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 18 for more information.

VANECK ETF TRUST

ABOUT FUND PERFORMANCE

(unaudited)

The price used to calculate market return (Share Price) is determined by using the closing price listed on its primary listing exchange. Since the shares of each Fund did not trade in the secondary market until after each Fund’s commencement, for the period from commencement to the first day of secondary market trading in shares of each Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for each Fund reflects, if applicable, temporary waivers of expenses and/or fees. Had each Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of each Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund returns reflect reinvestment of dividends and capital gains distributions. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

The Gold Miners Index and Steel Index are published by ICE Data Indices, LLC (ICE Data). The Agribusiness Index, Green Metal Index, Junior Gold Miners Index, Low Carbon Energy, Oil Refiners Index, Oil Services Index, Rare Earth/Strategic Metals Index and Uranium & Nuclear Energy Index are published by MarketVector Indexes GmbH (MarketVector), which is a wholly owned subsidiary of the Adviser, Van Eck Associates Corporation. The Natural Resources Index is published by S-Network Global Indexes, LLC (S-Network).

ICE Data, MarketVector and S-Network are referred to herein as the “Index Providers”. The Index Providers do not sponsor, endorse, or promote the Funds and bear no liability with respect to the Funds or any security.

VANECK ETF TRUST

EXPLANATION OF EXPENSES

(unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2023 to December 31, 2023.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense

Ratio

During Period | | Expenses Paid

During the Period

July 1, 2023 -

December 31, 2023(a) |

| Agribusiness ETF | | | | | | | | |

| Actual | | $1,000.00 | | $962.50 | | 0.53% | | $2.62 |

| Hypothetical (b) | | $1,000.00 | | $1,022.53 | | 0.53% | | $2.70 |

| CMCI Commodity Strategy ETF | | | | | | | | |

| Actual (c) | | $1,000.00 | | $976.80 | | 0.65% | | $2.32 |

| Hypothetical (b) | | $1,000.00 | | $1,021.93 | | 0.65% | | $3.31 |

| Future of Food ETF | | | | | | | | |

| Actual | | $1,000.00 | | $964.10 | | 0.69% | | $3.42 |

| Hypothetical (b) | | $1,000.00 | | $1,021.73 | | 0.69% | | $3.52 |

| Gold Miners ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,052.50 | | 0.51% | | $2.64 |

| Hypothetical (b) | | $1,000.00 | | $1,022.63 | | 0.51% | | $2.60 |

| Green Metals ETF | | | | | | | | |

| Actual | | $1,000.00 | | $916.70 | | 0.66% | | $3.19 |

| Hypothetical (b) | | $1,000.00 | | $1,021.88 | | 0.66% | | $3.36 |

| Junior Gold Miners ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,081.00 | | 0.51% | | $2.68 |

| Hypothetical (b) | | $1,000.00 | | $1,022.63 | | 0.51% | | $2.60 |

| Low Carbon Energy ETF | | | | | | | | |

| Actual | | $1,000.00 | | $915.50 | | 0.57% | | $2.75 |

| Hypothetical (b) | | $1,000.00 | | $1,022.33 | | 0.57% | | $2.91 |

VANECK ETF TRUST

EXPLANATION OF EXPENSES

(unaudited) (continued)

| | | Beginning

Account

Value

July 1, 2023 | | Ending

Account

Value

December 31, 2023 | | Annualized

Expense

Ratio

During Period | | Expenses Paid

During the Period

July 1, 2023 -

December 31, 2023(a) |

| Natural Resources ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,044.70 | | 0.52% | | $2.68 |

| Hypothetical (b) | | $1,000.00 | | $1,022.58 | | 0.52% | | $2.65 |

| Oil Refiners ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,174.50 | | 0.61% | | $3.34 |

| Hypothetical (b) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 |

| Oil Services ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,091.00 | | 0.35% | | $1.84 |

| Hypothetical (b) | | $1,000.00 | | $1,023.44 | | 0.35% | | $1.79 |

| Rare Earth/Strategic Metals ETF | | | | | | | | |

| Actual | | $1,000.00 | | $742.50 | | 0.54% | | $2.37 |

| Hypothetical (b) | | $1,000.00 | | $1,022.48 | | 0.54% | | $2.75 |

| Steel ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,185.10 | | 0.56% | | $3.08 |

| Hypothetical (b) | | $1,000.00 | | $1,022.38 | | 0.56% | | $2.85 |

| Uranium+Nuclear Energy ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,255.70 | | 0.61% | | $3.47 |

| Hypothetical (b) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 |

| (a) | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended December 31, 2023), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of the days in the fiscal year (to reflect the one-half year period). |

| (b) | Assumes annual return of 5% before expenses |

| (c) | Expenses are equal to the Fund’s annualized expense ratio (for the period from August 22, 2023 (commencement of operations) to December 31, 2023) multiplied by the average account value over the period, multiplied by the number of days since the commencement of operations divided by the number of days in the fiscal year. |

VANECK AGRIBUSINESS ETF

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 100.0% | | | | | | | | |

| Australia: 2.4% | | | | | | | | |

| Incitec Pivot Ltd. | | | 4,680,919 | | | $ | 9,078,247 | |

| Treasury Wine Estates Ltd. † | | | 1,757,647 | | | | 12,948,959 | |

| | | | | | | | 22,027,206 | |

| Brazil: 3.5% | | | | | | | | |

| Rumo SA | | | 3,421,900 | | | | 16,176,430 | |

| Yara International ASA (NOK) | | | 432,007 | | | | 15,354,091 | |

| | | | | | | | 31,530,521 | |

| Canada: 6.4% | | | | | | | | |

| Nutrien Ltd. (USD) | | | 1,042,864 | | | | 58,744,529 | |

| Chile: 1.0% | | | | | | | | |

| Sociedad Quimica y Minera de Chile SA (ADR) | | | 152,981 | | | | 9,212,516 | |

| China: 4.0% | | | | | | | | |

| China Mengniu Dairy Co. Ltd. (HKD) * | | | 4,212,000 | | | | 11,346,682 | |

| Wilmar International Ltd. (SGD) | | | 9,287,051 | | | | 25,100,179 | |

| | | | | | | | 36,446,861 | |

| Denmark: 1.1% | | | | | | | | |

| Bakkafrost P/F (NOK) | | | 133,935 | | | | 7,004,960 | |

| Schouw & Co. A/S | | | 37,175 | | | | 3,047,568 | |

| | | | | | | | 10,052,528 | |

| Germany: 8.0% | | | | | | | | |

| Bayer AG | | | 1,715,529 | | | | 63,693,180 | |

| K+S AG | | | 569,491 | | | | 8,996,312 | |

| | | | | | | | 72,689,492 | |

| Indonesia: 0.3% | | | | | | | | |

| Golden Agri-Resources Ltd. (SGD) | | | 13,584,145 | | | | 2,675,575 | |

| Israel: 0.9% | | | | | | | | |

| ICL Group Ltd. (USD) † | | | 1,534,632 | | | | 7,688,506 | |

| Japan: 5.3% | | | | | | | | |

| Kubota Corp. † | | | 2,213,630 | | | | 33,226,843 | |

| Maruha Nichiro Corp. | | | 125,100 | | | | 2,462,821 | |

| NH Foods Ltd. | | | 266,600 | | | | 9,040,522 | |

| Nissui Corp. | | | 687,800 | | | | 3,699,496 | |

| | | | | | | | 48,429,682 | |

| Malaysia: 2.6% | | | | | | | | |

| IOI Corp. Bhd | | | 5,722,455 | | | | 4,893,953 | |

| Kuala Lumpur Kepong Bhd | | | 1,347,970 | | | | 6,397,286 | |

| PPB Group Bhd | | | 1,650,880 | | | | 5,202,338 | |

| Sime Darby Plantation Bhd | | | 7,202,200 | | | | 6,982,008 | |

| | | | | | | | 23,475,585 | |

| Netherlands: 1.0% | | | | | | | | |

| OCI NV | | | 326,457 | | | | 9,467,174 | |

| Norway: 4.1% | | | | | | | | |

| Leroy Seafood Group ASA | | | 833,154 | | | | 3,428,917 | |

| Mowi ASA | | | 1,215,505 | | | | 21,775,972 | |

| Salmar ASA | | | 211,608 | | | | 11,855,962 | |

| | | | | | | | 37,060,851 | |

| Russia: 0.0% | | | | | | | | |

| PhosAgro PJSC ∞ | | | 97,916 | | | | 0 | |

| PhosAgro PJSC (USD) (GDR) ∞ | | | 1,892 | | | | 0 | |

| | | Number

of Shares | | | Value | |

| Russia (continued) | | | | | | | | |

| PhosAgro PJSC (USD) (GDR) ∞ | | | 1 | | | $ | 0 | |

| | | | | | | | 0 | |

| Singapore: 0.8% | | | | | | | | |

| Charoen Pokphand Indonesia Tbk PT (IDR) | | | 21,468,100 | | | | 7,004,115 | |

| Switzerland: 0.9% | | | | | | | | |

| Bucher Industries AG | | | 19,823 | | | | 8,326,870 | |

| Taiwan: 0.5% | | | | | | | | |

| Taiwan Fertilizer Co. Ltd. | | | 2,218,000 | | | | 4,880,698 | |

| Thailand: 0.8% | | | | | | | | |

| Charoen Pokphand Foods PCL (NVDR) | | | 12,998,936 | | | | 7,449,277 | |

| United Kingdom: 3.9% | | | | | | | | |

| CNH Industrial NV (USD) | | | 2,612,762 | | | | 31,823,441 | |

| Genus Plc | | | 123,774 | | | | 3,419,223 | |

| | | | | | | | 35,242,664 | |

| United States: 52.5% | | | | | | | | |

| AGCO Corp. | | | 147,049 | | | | 17,853,219 | |

| Archer-Daniels-Midland Co. | | | 702,220 | | | | 50,714,328 | |

| Balchem Corp. | | | 55,638 | | | | 8,276,152 | |

| Bunge Global SA | | | 326,614 | | | | 32,971,683 | |

| CF Industries Holdings, Inc. | | | 392,246 | | | | 31,183,557 | |

| Corteva, Inc. | | | 1,067,098 | | | | 51,135,336 | |

| Darling Ingredients, Inc. * | | | 370,246 | | | | 18,453,061 | |

| Deere & Co. | | | 187,471 | | | | 74,964,029 | |

| Elanco Animal Health, Inc. * | | | 923,754 | | | | 13,763,935 | |

| FMC Corp. | | | 267,272 | | | | 16,851,500 | |

| Mosaic Co. | | | 583,483 | | | | 20,847,847 | |

| Neogen Corp. * † | | | 418,351 | | | | 8,413,039 | |

| Pilgrim’s Pride Corp. * | | | 119,774 | | | | 3,312,949 | |

| Toro Co. † | | | 213,195 | | | | 20,464,588 | |

| Tyson Foods, Inc. | | | 661,967 | | | | 35,580,726 | |

| Zoetis, Inc. | | | 376,526 | | | | 74,314,937 | |

| | | | | | | | 479,100,886 | |

Total Common Stocks

(Cost: $1,099,062,640) | | | | | | | 911,505,536 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 3.0% | | | | | |

Money Market Fund: 3.0%

(Cost: $27,567,080) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 27,567,080 | | | | 27,567,080 | |

Total Investments: 103.0%

(Cost: $1,126,629,720) | | | | | | | 939,072,616 | |

| Liabilities in excess of other assets: (3.0)% | | | | (27,015,297) | |

| NET ASSETS: 100.0% | | | | | | $ | 912,057,319 | |

See Notes to Financial Statements

VANECK AGRIBUSINESS ETF

SCHEDULE OF INVESTMENTS

(continued)

| Definitions: |

| |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| HKD | Hong Kong Dollar |

| IDR | Indonesian Rupiah |

| NOK | Norwegian Krone |

| NVDR | Non-Voting Depositary Receipt |

| SGD | Singapore Dollar |

| USD | United States Dollar |

Footnotes:

| † | Security fully or partially on loan. Total market value of securities on loan is $41,077,399. |

| * | Non-income producing |

| ∞ | Security is valued using significant unobservable inputs that factor in discount for lack of marketability and is classified as Level 3 in the fair value hierarchy. |

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Consumer Staples | | | 32.2 | % | | $ | 293,349,338 | |

| Materials | | | 26.6 | | | | 242,503,950 | |

| Industrials | | | 23.3 | | | | 212,047,935 | |

| Health Care | | | 17.9 | | | | 163,604,313 | |

| | | | 100.0 | % | | $ | 911,505,536 | |

The summary of inputs used to value the Fund’s investments as of December 31, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | $ | — | | | $ | 22,027,206 | | | $ | — | | | $ | 22,027,206 | |

| Brazil | | | — | | | | 31,530,521 | | | �� | — | | | | 31,530,521 | |

| Canada | | | 58,744,529 | | | | — | | | | — | | | | 58,744,529 | |

| Chile | | | 9,212,516 | | | | — | | | | — | | | | 9,212,516 | |

| China | | | — | | | | 36,446,861 | | | | — | | | | 36,446,861 | |

| Denmark | | | — | | | | 10,052,528 | | | | — | | | | 10,052,528 | |

| Germany | | | — | | | | 72,689,492 | | | | — | | | | 72,689,492 | |

| Indonesia | | | — | | | | 2,675,575 | | | | — | | | | 2,675,575 | |

| Israel | | | 7,688,506 | | | | — | | | | — | | | | 7,688,506 | |

| Japan | | | — | | | | 48,429,682 | | | | — | | | | 48,429,682 | |

| Malaysia | | | 5,202,338 | | | | 18,273,247 | | | | — | | | | 23,475,585 | |

| Netherlands | | | — | | | | 9,467,174 | | | | — | | | | 9,467,174 | |

| Norway | | | — | | | | 37,060,851 | | | | — | | | | 37,060,851 | |

| Russia | | | — | | | | — | | | | 0 | | | | 0 | |

| Singapore | | | — | | | | 7,004,115 | | | | — | | | | 7,004,115 | |

| Switzerland | | | — | | | | 8,326,870 | | | | — | | | | 8,326,870 | |

| Taiwan | | | — | | | | 4,880,698 | | | | — | | | | 4,880,698 | |

| Thailand | | | — | | | | 7,449,277 | | | | — | | | | 7,449,277 | |

| United Kingdom | | | 31,823,441 | | | | 3,419,223 | | | | — | | | | 35,242,664 | |

| United States | | | 479,100,886 | | | | — | | | | — | | | | 479,100,886 | |

| Money Market Fund | | | 27,567,080 | | | | — | | | | — | | | | 27,567,080 | |

| Total Investments | | $ | 619,339,296 | | | $ | 319,733,320 | | | $ | 0 | | | $ | 939,072,616 | |

See Notes to Financial Statements

VANECK CMCI COMMODITY STRATEGY ETF

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31,2023

| | | Par

(000’s | ) | | Value | |

| Short-Term Investments: 103.9% | | | | | |

| United States Treasury Obligations: 102.8% | | | | | |

| United States Treasury Bills | | | | | | | | |

| 5.30%, 03/21/24 (a) | | $ | 1,150 | | | $ | 1,136,911 | |

| 5.30%, 04/02/24 (a) | | | 1,250 | | | | 1,233,557 | |

| 5.33%, 01/11/24 (a) | | | 50 | | | | 49,935 | |

| 5.40%, 01/16/24 | | | 50 | | | | 49,898 | |

| | | | | | | | 2,470,301 | |

| | | Number

of Shares | | | Value | |

| Money Market Fund: 1.1% | | | | | | | | |

| Invesco Treasury Portfolio - Institutional Class | | | 26,217 | | | $ | 26,217 | |

Total Short-Term Investments: 103.9%

(Cost: $2,495,974) | | | | 2,496,518 | |

| Liabilities in excess of other assets: (3.9)% | | | | (93,679) | |

| NET ASSETS: 100.0% | | | | | | $ | 2,402,839 | |

Total Return Swap Contracts

Long Exposure

| Counterparty | | Reference

Obligation | | Notional

Amount | | Rate paid by

the Fund (b) | | Payment

Frequency | | Termination

Date | | Unrealized

Appreciation/

(Depreciation) | | % of Net

Assets |

| UBS | | UBS Bloomberg

Constant

Maturity Index

Total Return | | $2,469,000 | | 5.75% | | Monthly | | 01/03/24 | | $(79,504) | | 3.3% |

Definitions:

Footnotes:

| (a) | All or a portion of these securities are segregated for swap collateral. Total value of securities segregated is $469,402. |

| (b) | The rate shown reflects the rate in effect at the end of the reporting period: Secured Overnight Financing Rate + 0.40%. |

| Summary of Investments by Sector | | % of

Investments | | Value | |

| Government | | | 98.9 | % | | $ | 2,470,301 | |

| Money Market Fund | | | 1.1 | | | | 26,217 | |

| | | | 100.0 | % | | $ | 2,496,518 | |

The summary of inputs used to value the Fund’s investments as of December 31, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| United States Treasury Obligations | | $ | — | | | $ | 2,470,301 | | | $ | — | | | $ | 2,470,301 | |

| Money Market Fund | | | 26,217 | | | | — | | | | — | | | | 26,217 | |

| Total Investments | | $ | 26,217 | | | $ | 2,470,301 | | | $ | — | | | $ | 2,496,518 | |

| Other Financial Instruments: | | | | | | | | | | | | | | | | |

| Total Return Swap Contracts | | $ | — | | | $ | (79,504) | | | $ | — | | | $ | (79,504) | |

See Notes to Financial Statements

VANECK FUTURE OF FOOD ETF

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 96.8% | | | | | | | | |

| Brazil: 2.0% | | | | | | | | |

| Yara International ASA (NOK) | | | 1,847 | | | $ | 65,645 | |

| Canada: 5.3% | | | | | | | | |

| Maple Leaf Foods, Inc. | | | 2,200 | | | | 42,111 | |

| Nutrien Ltd. (USD) | | | 2,280 | | | | 128,432 | |

| | | | | | | | 170,543 | |

| China: 1.5% | | | | | | | | |

| Vitasoy International Holdings Ltd. (HKD) | | | 48,000 | | | | 47,841 | |

| Denmark: 5.2% | | | | | | | | |

| Novozymes A/S | | | 3,091 | | | | 170,033 | |

| France: 3.3% | | | | | | | | |

| Danone SA | | | 1,628 | | | | 105,689 | |

| Germany: 3.6% | | | | | | | | |

| Symrise AG | | | 1,052 | | | | 115,683 | |

| Ireland: 3.3% | | | | | | | | |

| Kerry Group Plc | | | 1,228 | | | | 107,300 | |

| Isle of Man: 0.3% | | | | | | | | |

| Agronomics Ltd. * | | | 76,708 | | | | 9,290 | |

| Japan: 2.2% | | | | | | | | |

| Kubota Corp. | | | 4,800 | | | | 72,049 | |

| Mexico: 4.4% | | | | | | | | |

| Orbia Advance Corp. SAB de CV | | | 64,280 | | | | 142,798 | |

| Netherlands: 0.7% | | | | | | | | |

| Corbion NV | | | 1,060 | | | | 22,716 | |

| Philippines: 0.7% | | | | | | | | |

| Monde Nissin Corp. 144A | | | 147,600 | | | | 22,337 | |

| Sweden: 1.8% | | | | | | | | |

| Oatly Group AB (ADR) * † | | | 50,452 | | | | 59,533 | |

| Switzerland: 10.6% | | | | | | | | |

| Bucher Industries AG | | | 216 | | | | 90,733 | |

| Givaudan SA | | | 40 | | | | 165,750 | |

| Nestle SA | | | 768 | | | | 88,963 | |

| | | | | | | | 345,446 | |

| United States: 51.9% | | | | | | | | |

| AppHarvest, Inc. * | | | 39,524 | | | | 40 | |

| | | Number

of Shares | | | Value | |

| United States (continued) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 1,156 | | | $ | 83,486 | |

| Atlantic Sapphire ASA (NOK) * | | | 10,900 | | | | 1,728 | |

| Balchem Corp. | | | 308 | | | | 45,815 | |

| Ball Corp. | | | 1,844 | | | | 106,067 | |

| Berry Global Group, Inc. | | | 696 | | | | 46,903 | |

| Beyond Meat, Inc. * † | | | 1,589 | | | | 14,142 | |

| Bunge Global SA | | | 1,652 | | | | 166,770 | |

| Conagra Brands, Inc. | | | 1,584 | | | | 45,397 | |

| Corteva, Inc. | | | 3,295 | | | | 157,896 | |

| Deere & Co. | | | 500 | | | | 199,936 | |

| FMC Corp. | | | 1,457 | | | | 91,864 | |

| Ingredion, Inc. | | | 2,044 | | | | 221,836 | |

| International Flavors & Fragrances, Inc. | | | 1,016 | | | | 82,266 | |

| John Bean Technologies Corp. | | | 532 | | | | 52,907 | |

| Kellanova | | | 780 | | | | 43,610 | |

| Lindsay Corp. | | | 664 | | | | 85,762 | |

| Local Bounti Corp. * | | | 427 | | | | 884 | |

| Titan International, Inc. * | | | 3,380 | | | | 50,294 | |

| Trimble, Inc. * | | | 1,732 | | | | 92,142 | |

| Valmont Industries, Inc. | | | 408 | | | | 95,272 | |

| WK Kellogg Co. | | | 195 | | | | 2,562 | |

| | | | | | | | 1,687,579 | |

Total Common Stocks

(Cost: $4,049,891) | | | | | | | 3,144,482 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 2.6% | | | | | |

Money Market Fund: 2.6%

(Cost: $85,782) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 85,782 | | | | 85,782 | |

Total Investments: 99.4%

(Cost: $4,135,673) | | | | | | | 3,230,264 | |

| Other assets less liabilities: 0.6% | | | | | 19,834 | |

| NET ASSETS: 100.0% | | | | | | $ | 3,250,098 | |

Definitions:

| ADR | American Depositary Receipt |

| HKD | Hong Kong Dollar |

| NOK | Norwegian Krone |

| USD | United States Dollar |

Footnotes:

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $69,986. |

| | |

| 144A | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended, or otherwise restricted. These securities may be resold in transactions exempt from registration, unless otherwise noted. These securities have an aggregate value of $22,337, or 0.7% of net assets. |

See Notes to Financial Statements

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Materials | | | 42.7 | % | | $ | 1,341,869 | |

| Consumer Staples | | | 33.5 | | | | 1,054,228 | |

| Industrials | | | 20.6 | | | | 646,953 | |

| Information Technology | | | 2.9 | | | | 92,142 | |

| Financials | | | 0.3 | | | | 9,290 | |

| | | | 100.0 | % | | $ | 3,144,482 | |

The summary of inputs used to value the Fund’s investments as of December 31, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Brazil | | $ | — | | | $ | 65,645 | | | $ | — | | | $ | 65,645 | |

| Canada | | | 170,543 | | | | — | | | | — | | | | 170,543 | |

| China | | | — | | | | 47,841 | | | | — | | | | 47,841 | |

| Denmark | | | — | | | | 170,033 | | | | — | | | | 170,033 | |

| France | | | — | | | | 105,689 | | | | — | | | | 105,689 | |

| Germany | | | — | | | | 115,683 | | | | — | | | | 115,683 | |

| Ireland | | | 107,300 | | | | — | | | | — | | | | 107,300 | |

| Isle of Man | | | 9,290 | | | | — | | | | — | | | | 9,290 | |

| Japan | | | — | | | | 72,049 | | | | — | | | | 72,049 | |

| Mexico | | | 142,798 | | | | — | | | | — | | | | 142,798 | |

| Netherlands | | | — | | | | 22,716 | | | | — | | | | 22,716 | |

| Philippines | | | 22,337 | | | | — | | | | — | | | | 22,337 | |

| Sweden | | | 59,533 | | | | — | | | | — | | | | 59,533 | |

| Switzerland | | | — | | | | 345,446 | | | | — | | | | 345,446 | |

| United States | | | 1,687,539 | | | | 40 | | | | — | | | | 1,687,579 | |

| Money Market Fund | | | 85,782 | | | | — | | | | — | | | | 85,782 | |

| Total Investments | | $ | 2,285,122 | | | $ | 945,142 | | | $ | — | | | $ | 3,230,264 | |

See Notes to Financial Statements

VANECK GOLD MINERS ETF

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 99.8% | | | | | | | | |

| Australia: 11.3% | | | | | | | | |

| Capricorn Metals Ltd. * † ‡ | | | 20,050,051 | | | $ | 64,357,270 | |

| Emerald Resources NL * † ‡ | | | 33,158,599 | | | | 68,071,396 | |

| Evolution Mining Ltd. ‡ | | | 105,079,094 | | | | 283,073,281 | |

| Genesis Minerals Ltd. * † ‡ | | | 58,231,049 | | | | 71,007,737 | |

| Gold Road Resources Ltd. † ‡ | | | 57,529,786 | | | | 77,002,407 | |

| Northern Star Resources Ltd. ‡ | | | 61,150,496 | | | | 568,109,598 | |

| Perseus Mining Ltd. ‡ | | | 73,086,967 | | | | 92,052,113 | |

| Ramelius Resources Ltd. ‡ | | | 60,479,560 | | | | 69,387,841 | |

| Red 5 Ltd. * † ‡ | | | 183,287,984 | | | | 38,696,331 | |

| Regis Resources Ltd. * † ‡ | | | 40,191,502 | | | | 59,680,236 | |

| Silver Lake Resources Ltd. * † ‡ | | | 49,737,568 | | | | 40,301,500 | |

| West African Resources Ltd. * † ‡ | | | 54,599,293 | | | | 35,162,971 | |

| | | | | | | | 1,466,902,681 | |

| Brazil: 6.6% | | | | | | | | |

| Wheaton Precious Metals Corp. (USD) † | | | 17,503,906 | | | | 863,642,722 | |

| Burkina Faso: 0.5% | | | | | | | | |

| IAMGOLD Corp. (USD) * † ‡ | | | 25,609,846 | | | | 64,792,910 | |

| Canada: 41.5% | | | | | | | | |

| Agnico Eagle Mines Ltd. (USD) † | | | 19,102,999 | | | | 1,047,799,495 | |

| Alamos Gold, Inc. (USD) ‡ | | | 21,090,479 | | | | 284,088,752 | |

| Aya Gold & Silver, Inc. * † ‡ | | | 6,510,989 | | | | 47,946,082 | |

| B2Gold Corp. (USD) ‡ | | | 69,199,440 | | | | 218,670,230 | |

| Barrick Gold Corp. (USD) | | | 67,852,312 | | | | 1,227,448,324 | |

| Dundee Precious Metals, Inc. ‡ | | | 9,653,861 | | | | 62,084,591 | |

| Equinox Gold Corp. (USD) * † ‡ | | | 16,653,671 | | | | 81,436,451 | |

| First Majestic Silver Corp. (USD) † ‡ | | | 15,268,065 | | | | 93,898,600 | |

| Fortuna Silver Mines, Inc. (USD) * † ‡ | | | 16,302,465 | | | | 62,927,515 | |

| Franco-Nevada Corp. (USD) | | | 7,423,537 | | | | 822,602,135 | |

| K92 Mining, Inc. * † ‡ | | | 12,443,231 | | | | 61,432,909 | |

| Kinross Gold Corp. (USD) ‡ | | | 65,325,716 | | | | 395,220,582 | |

| MAG Silver Corp. (USD) * † ‡ | | | 5,477,884 | | | | 57,024,772 | |

| New Gold, Inc. (USD) * ‡ | | | 36,422,093 | | | | 53,176,256 | |

| OceanaGold Corp. ‡ | | | 37,639,378 | | | | 72,504,186 | |

| Osisko Gold Royalties Ltd. (USD) † ‡ | | | 9,852,651 | | | | 140,695,856 | |

| Pan American Silver Corp. (USD) ‡ | | | 19,391,732 | | | | 316,666,984 | |

| Sandstorm Gold Ltd. (USD) ‡ | | | 15,759,817 | | | | 79,271,880 | |

| SilverCrest Metals, Inc. (USD) * † ‡ | | | 7,758,829 | | | | 50,820,330 | |

| SSR Mining, Inc. (USD) ‡ | | | 10,849,041 | | | | 116,735,681 | |

| Torex Gold Resources, Inc. * ‡ | | | 4,569,959 | | | | 50,669,498 | |

| Wesdome Gold Mines Ltd. * † ‡ | | | 7,925,699 | | | | 46,342,438 | |

| | | | | | | | 5,389,463,547 | |

| | | Number

of Shares | | | Value | |

| China: 5.2% | | | | | | | | |

| Zhaojin Mining Industry Co. Ltd. (HKD) † ‡ | | | 138,861,000 | | | $ | 172,509,427 | |

| Zijin Mining Group Co. Ltd. (HKD) ‡ | | | 305,276,000 | | | | 497,648,143 | |

| | | | | | | | 670,157,570 | |

| Egypt: 0.6% | | | | | | | | |

| Centamin Plc (GBP) ‡ | | | 61,640,067 | | | | 78,287,286 | |

| Kyrgyzstan: 0.5% | | | | | | | | |

| Centerra Gold, Inc. (CAD) † ‡ | | | 11,483,423 | | | | 68,886,604 | |

| Peru: 1.6% | | | | | | | | |

| Cia de Minas Buenaventura SAA (ADR) ‡ | | | 13,500,186 | | | | 205,742,835 | |

| South Africa: 9.4% | | | | | | | | |

| Anglogold Ashanti Plc (USD) ‡ | | | 22,331,408 | | | | 417,374,016 | |

| DRDGOLD Ltd. (ADR) ‡ | | | 4,600,414 | | | | 36,573,291 | |

| Gold Fields Ltd. (ADR) † | | | 39,006,177 | | | | 564,029,319 | |

| Harmony Gold Mining Co. Ltd. (ADR) ‡ | | | 32,985,574 | | | | 202,861,280 | |

| | | | | | | | 1,220,837,906 | |

| Turkey: 1.1% | | | | | | | | |

| Eldorado Gold Corp. (USD) * † ‡ | | | 10,794,577 | | | | 140,005,664 | |

| United Kingdom: 2.3% | | | | | | | | |

| Endeavour Mining Plc (CAD) † ‡ | | | 13,073,337 | | | | 295,156,410 | |

| United States: 19.2% | | | | | | | | |

| Coeur Mining, Inc. * † ‡ | | | 20,350,645 | | | | 66,343,103 | |

| Hecla Mining Co. † ‡ | | | 32,895,820 | | | | 158,228,894 | |

| Newmont Corp. | | | 44,538,137 | | | | 1,843,433,490 | |

| Royal Gold, Inc. ‡ | | | 3,495,437 | | | | 422,808,060 | |

| | | | | | | | 2,490,813,547 | |

Total Common Stocks

(Cost: $12,586,545,705) | | | | | | | 12,954,689,682 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 0.7% | | | | | |

Money Market Fund: 0.7%

(Cost: $84,425,319) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio | | | 84,425,319 | | | | 84,425,319 | |

Total Investments: 100.5%

(Cost: $12,670,971,024) | | | | | | | 13,039,115,001 | |

| Liabilities in excess of other assets: (0.5)% | | | | (69,535,091) | |

| NET ASSETS: 100.0% | | | | | | $ | 12,969,579,910 | |

See Notes to Financial Statements

Definitions:

| ADR | American Depositary Receipt |

| CAD | Canadian Dollar |

| GBP | British Pound |

| HKD | Hong Kong Dollar |

| USD | United States Dollar |

Footnotes:

| † | Security fully or partially on loan. Total market value of securities on loan is $272,613,003. |

| ‡ | Affiliated issuer – as defined under the Investment Company Act of 1940. |

| * | Non-income producing |

Summary of Investments by Sector

Excluding Collateral for Securities Loaned | | % of

Investments | | Value | |

| Gold | | | 94.0 | % | | $ | 12,167,176,505 | |

| Silver | | | 5.6 | | | | 736,692,847 | |

| Precious Metals & Minerals | | | 0.4 | | | | 50,820,330 | |

| | | | 100.0 | % | | $ | 12,954,689,682 | |

See Notes to Financial Statements

VANECK GOLD MINERS ETF

SCHEDULE OF INVESTMENTS

(continued)

Transactions in securities of affiliates for the period ended December 31, 2023 were as follows:

| | | Value

12/31/2022 | | Purchases | | Sales

Proceeds | | Realized Gain

(Loss) | | Net Change in

Unrealized

Appreciation

(Depreciation) | | Value

12/31/2023 | | Dividend

Income |

| Alamos Gold, Inc. | | $205,708,403 | | $97,926,113 | | $(91,787,173) | | $33,411,396 | | $38,830,013 | | $284,088,752 | | $2,146,947 |

| AngloGold Ashanti Ltd. | | 421,250,192 | | 128,016,893 | | (561,889,059) | | 31,552,774 | | (18,930,800) | | – | | 4,654,974 |

| Anglogold Ashanti Plc | | – | | 486,741,198 | | (49,414,698) | | (3,622,646) | | (16,329,838) | | 417,374,016 | | – |

| Aya Gold & Silver, Inc. | | 36,219,878 | | 18,248,037 | | (11,816,801) | | 526,291 | | 4,768,677 | | 47,946,082 | | – |

| B2Gold Corp. | | 198,829,515 | | 119,981,082 | | (70,326,427) | | 482,828 | | (30,296,768) | | 218,670,230 | | 10,379,842 |

| Capricorn Metals Ltd. | | 60,639,778 | | 23,350,554 | | (21,097,899) | | 3,471,143 | | (2,006,306) | | 64,357,270 | | – |

| Centamin Plc | | 81,495,953 | | 28,656,248 | | (26,961,602) | | (2,301,373) | | (2,601,940) | | 78,287,286 | | 2,873,963 |

| Centerra Gold, Inc. | | 59,014,494 | | 27,024,446 | | (26,558,801) | | (244,363) | | 9,650,828 | | 68,886,604 | | 2,437,098 |

| Cia de Minas Buenaventura SAA | | 97,965,488 | | 44,409,346 | | (43,257,323) | | (3,652,217) | | 110,277,541 | | 205,742,835 | | 1,063,546 |

| Coeur Mining, Inc. | | 48,923,959 | | 30,342,505 | | (13,984,559) | | 1,131,689 | | (70,491) | | 66,343,103 | | – |

| DRDGOLD Ltd. | | 33,159,785 | | 15,773,278 | | (15,761,897) | | 1,202,596 | | 2,199,529 | | 36,573,291 | | 1,999,972 |

| Dundee Precious Metals, Inc. | | 47,434,105 | | 26,014,258 | | (27,289,178) | | 6,481,418 | | 9,443,988 | | 62,084,591 | | 1,624,035 |

| Eldorado Gold Corp. | | 80,041,390 | | 49,522,735 | | (39,175,181) | | 4,484,988 | | 45,131,732 | | 140,005,664 | | – |

| Emerald Resources NL | | – | | 55,364,751 | | (6,276,532) | | 658,280 | | 18,324,897 | | 68,071,396 | | – |

| Endeavour Mining Plc | | 272,623,252 | | 114,413,893 | | (111,896,252) | | 12,742,662 | | 7,272,855 | | 295,156,410 | | 10,683,088 |

| Endeavour Silver Corp. | | 31,843,407 | | 11,754,771 | | (31,369,309) | | (31,528,367) | | 19,299,498 | | – | | – |

| Equinox Gold Corp. | | 51,858,919 | | 30,388,224 | | (26,291,911) | | (3,695,026) | | 29,176,245 | | 81,436,451 | | – |

| Evolution Mining Ltd. | | 193,675,761 | | 84,944,044 | | (68,220,726) | | 9,159,005 | | 63,515,197 | | 283,073,281 | | 2,569,894 |

| First Majestic Silver Corp. | | 113,580,650 | | 41,521,793 | | (29,836,274) | | (8,163,584) | | (23,203,985) | | 93,898,600 | | 307,792 |

| Fortuna Silver Mines, Inc. | | 56,398,523 | | 20,513,609 | | (16,244,329) | | 544,115 | | 1,715,597 | | 62,927,515 | | – |

| Genesis Minerals Ltd. | | – | | 65,207,080 | | (4,169,949) | | 357,149 | | 9,613,457 | | 71,007,737 | | – |

| Gold Fields Ltd. | | 478,159,484 | | 276,955,320 | | (426,044,022) | | 138,905,861 | | 96,052,676 | | –(a) | | 17,340,162 |

| Gold Road Resources Ltd. | | 64,292,600 | | 24,682,733 | | (23,967,180) | | 3,752,802 | | 8,241,452 | | 77,002,407 | | 639,132 |

| Harmony Gold Mining Co. Ltd. | | 108,915,631 | | 53,575,115 | | (54,249,864) | | 8,894,320 | | 85,726,078 | | 202,861,280 | | 1,300,978 |

| Hecla Mining Co. | | 174,714,054 | | 66,870,522 | | (60,052,795) | | 6,538,068 | | (29,840,955) | | 158,228,894 | | 839,152 |

| IAMGOLD Corp. | | 64,050,910 | | 25,113,076 | | (23,948,361) | | (2,968,750) | | 2,546,035 | | 64,792,910 | | – |

| K92 Mining, Inc. | | 68,361,763 | | 24,588,986 | | (21,385,546) | | (3,322,673) | | (6,809,621) | | 61,432,909 | | – |

| Kinross Gold Corp. | | 266,228,145 | | 120,234,257 | | (126,991,039) | | 7,226,728 | | 128,522,491 | | 395,220,582 | | 8,122,774 |

| MAG Silver Corp. | | – | | 77,139,851 | | (9,596,876) | | (663,618) | | (9,854,585) | | 57,024,772 | | – |

| New Gold, Inc. | | 34,655,550 | | 15,033,856 | | (15,464,128) | | 247,909 | | 18,703,069 | | 53,176,256 | | – |

| Northern Star Resources Ltd. | | 447,846,466 | | 179,271,785 | | (187,034,662) | | 25,293,628 | | 102,732,381 | | 568,109,598 | | 10,561,194 |

| OceanaGold Corp. | | 69,497,545 | | 30,167,146 | | (27,165,338) | | (2,192,786) | | 2,197,619 | | 72,504,186 | | 747,748 |

| Osisko Gold Royalties Ltd. | | 115,363,105 | | 53,556,728 | | (50,746,044) | | 7,789,593 | | 14,732,474 | | 140,695,856 | | 1,768,652 |

| Pan American Silver Corp. | | 178,290,511 | | 257,877,807 | | (100,269,980) | | (20,927,228) | | 1,695,874 | | 316,666,984 | | 7,274,981 |

| Perseus Mining Ltd. | | 101,580,825 | | 37,644,927 | | (33,876,938) | | 10,204,377 | | (23,501,078) | | 92,052,113 | | 1,668,520 |

| Ramelius Resources Ltd. | | – | | 67,125,033 | | (7,787,713) | | 657,096 | | 9,393,425 | | 69,387,841 | | 678,566 |

See Notes to Financial Statements

Transactions in securities of affiliates for the period ended December 31, 2023 were as follows: (continued)

| | | Value

12/31/2022 | | Purchases | | Sales

Proceeds | | Realized Gain

(Loss) | | Net Change in

Unrealized

Appreciation

(Depreciation) | | Value

12/31/2023 | | Dividend

Income |

| Red 5 Ltd. | | – | | 41,841,327 | | (456,348) | | (14,900) | | (2,673,748) | | 38,696,331 | | – |

| Regis Resources Ltd. | | 54,855,943 | | 19,070,648 | | (18,871,317) | | (5,446,084) | | 10,071,046 | | 59,680,236 | | – |

| Royal Gold, Inc. | | 383,500,042 | | 163,145,167 | | (152,561,261) | | 19,639,847 | | 9,084,265 | | 422,808,060 | | 5,342,727 |

| Sandstorm Gold Ltd. | | 81,298,870 | | 32,289,919 | | (29,670,840) | | (4,502,598) | | (143,472) | | 79,271,879 | | 964,895 |

| Silver Lake Resources Ltd. | | 39,070,300 | | 14,164,299 | | (13,179,663) | | (3,408,546) | | 3,655,110 | | 40,301,500 | | – |

| SilverCrest Metals, Inc. | | 45,623,274 | | 18,136,876 | | (17,186,358) | | (250,076) | | 4,496,614 | | 50,820,330 | | – |

| SSR Mining, Inc. | | 167,794,658 | | 58,604,650 | | (54,962,167) | | (3,492,352) | | (51,209,108) | | 116,735,681 | | 3,113,773 |

| Torex Gold Resources, Inc. | | 51,060,705 | | 22,988,524 | | (21,484,811) | | 1,740,362 | | (3,635,282) | | 50,669,498 | | – |

| Wesdome Gold Mines Ltd. | | 40,768,741 | | 18,248,425 | | (15,552,316) | | (3,918,962) | | 6,796,550 | | 46,342,438 | | – |

| West African Resources Ltd. | | 42,653,378 | | 13,230,123 | | (12,023,851) | | (1,661,490) | | (7,035,189) | | 35,162,971 | | – |

| Yamana Gold, Inc. | | 276,431,736 | | 58,355,514 | | (351,105,117) | | 61,096,866 | | (44,778,999) | | – | | – |

| Zhaojin Mining Industry Co. Ltd. | | 149,510,918 | | 68,634,696 | | (67,178,503) | | 12,790,664 | | 8,751,652 | | 172,509,427 | | 827,660 |

| Zijin Mining Group Co. Ltd. | | 399,648,130 | | 184,635,144 | | (173,682,432) | | 95,514,237 | | (8,466,936) | | 497,648,143 | | 11,399,383 |

| | | $5,994,836,736 | | $3,543,297,312 | | $(3,390,121,350) | | $400,521,053 | | $601,229,764 | | $6,585,734,196 | | $113,331,448 |

| (a) | Security held by the Fund, however not classified as an affiliate at the end of the reporting period. |

The summary of inputs used to value the Fund’s investments as of December 31, 2023 is as follows:

| | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | $ | — | | | $ | 1,466,902,681 | | | $ | — | | | $ | 1,466,902,681 | |

| Brazil | | | 863,642,722 | | | | — | | | | — | | | | 863,642,722 | |

| Burkina Faso | | | 64,792,910 | | | | — | | | | — | | | | 64,792,910 | |

| Canada | | | 5,389,463,547 | | | | — | | | | — | | | | 5,389,463,547 | |

| China | | | — | | | | 670,157,570 | | | | — | | | | 670,157,570 | |

| Egypt | | | — | | | | 78,287,286 | | | | — | | | | 78,287,286 | |

| Kyrgyzstan | | | 68,886,604 | | | | — | | | | — | | | | 68,886,604 | |

| Peru | | | 205,742,835 | | | | — | | | | — | | | | 205,742,835 | |

| South Africa | | | 1,220,837,906 | | | | — | | | | — | | | | 1,220,837,906 | |

| Turkey | | | 140,005,664 | | | | — | | | | — | | | | 140,005,664 | |

| United Kingdom | | | 295,156,410 | | | | — | | | | — | | | | 295,156,410 | |

| United States | | | 2,490,813,547 | | | | — | | | | — | | | | 2,490,813,547 | |

| Money Market Fund | | | 84,425,319 | | | | — | | | | — | | | | 84,425,319 | |

| Total Investments | | $ | 10,823,767,464 | | | $ | 2,215,347,537 | | | $ | — | | | $ | 13,039,115,001 | |

See Notes to Financial Statements

VANECK GREEN METALS ETF

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | Number

of Shares | | | Value | |

| COMMON STOCKS: 100.0% | | | | | | | | |

| Australia: 14.9% | | | | | | | | |

| Glencore Plc (GBP) | | | 339,498 | | | $ | 2,040,978 | |