UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-10385

Pacific Funds Series Trust

(Exact name of registrant as specified in charter)

700 Newport Center Drive, P.O. Box 7500

Newport Beach, CA 92660

(Address of principal executive offices) (Zip code)

Robin S. Yonis

Vice President, General Counsel and Assistant Secretary of Pacific Funds Series Trust

700 Newport Center Drive, P.O. Box 9000

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski, Esq.

Dechert LLP

90 State House Square

Hartford, CT 06103

Registrant’s telephone number, including area code:949-219-6767

Date of fiscal year end: March 31

Date of reporting period:March 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NW, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule30e-1 under the Act (17 CFR 27030e-1).

ANNUAL REPORT

PACIFIC FUNDS

ANNUAL REPORT

AS OF MARCH 31, 2019

Pacific Funds Series Trust, which is a Delaware statutory trust, may be referred to as “Pacific Funds” or the “Trust”.

Beginning January 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of Pacific Funds shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from Pacific Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Pacific Funds electronically by contacting Pacific Funds using one of the methods listed in the Where To Go For More Information section or by contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. You can inform Pacific Funds or your financial intermediary that you wish to continue receiving paper copies by contacting Pacific Funds using one of the methods listed in the Where To Go For More Information section or by contacting your financial intermediary directly. Your election to receive reports in paper will apply to all communications received for all Funds held with Pacific Funds.

PACIFIC FUNDS

Dear Shareholders:

We are pleased to share with you the Annual Report for the fiscal year ended March 31, 2019 for Pacific Funds Series Trust (“Pacific Funds” or the “Trust”). Pacific Funds is comprised of thirty-four Funds, seventeen of which are included in this report (each individually, a “Fund” and collectively, the “Funds”) and are available for direct investment. Pacific Life Fund Advisors LLC (PLFA), as Adviser to the Funds, manages Pacific FundsSM Portfolio Optimization Conservative, Pacific FundsSM Portfolio Optimization Moderate-Conservative, Pacific FundsSM Portfolio Optimization Moderate, Pacific FundsSM Portfolio Optimization Growth, Pacific FundsSM Portfolio Optimization Aggressive-Growth (together, the “Portfolio Optimization Funds”), and Pacific FundsSM Diversified Alternatives. PLFA also does business under the name “Pacific Asset Management” and manages Pacific FundsSM Short Duration Income, Pacific FundsSM Core Income, Pacific FundsSM Strategic Income, Pacific FundsSM Floating Rate Income, and Pacific FundsSM High Income under that name.

Each of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives is an asset allocation “Fund of Funds” that invests in Class P shares of certain other funds of the Trust (the “PF Underlying Funds”). PLFA supervises the management of those PF Underlying Funds which are only available for investment by the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives and are included in a separate PF Underlying Funds Annual Report. Please see “Where to Go for More Information” for instructions on how to obtain the PF Underlying Funds’ Annual Report. The Portfolio Optimization Funds and Pacific Funds Diversified Alternatives also invest in Class P shares of Pacific FundsSM Core Income, Pacific FundsSM High Income, Pacific FundsSM Floating Rate Income and Pacific FundsSMSmall-Cap Growth.

The Adviser, Pacific Asset Management and Rothschild & Co Asset Management US Inc. (together, the “Managers”) and their Funds as of March 31, 2019 are listed below:

| | | | |

| | | |

| Manager | | Fund | | Page

Number |

| | | |

| Pacific Life Fund Advisors LLC (PLFA) | | Pacific FundsSM Portfolio Optimization Conservative | | A-4 |

| | Pacific FundsSM Portfolio Optimization Moderate-Conservative | | A-5 |

| | Pacific FundsSM Portfolio Optimization Moderate | | A-7 |

| | Pacific FundsSM Portfolio Optimization Growth | | A-9 |

| | Pacific FundsSM Portfolio Optimization Aggressive-Growth | | A-10 |

| | Pacific FundsSM Diversified Alternatives | | A-11 |

| | | |

| Pacific Asset Management | | Pacific FundsSM Short Duration Income | | A-12 |

| | Pacific FundsSM Core Income | | A-13 |

| | Pacific FundsSM Strategic Income | | A-14 |

| | Pacific FundsSM Floating Rate Income | | A-15 |

| | Pacific FundsSM High Income | | A-16 |

| | | |

| Rothschild & Co Asset Management US Inc. (Rothschild & Co AMUS) | | Pacific FundsSM Large-Cap | | A-17 |

| | Pacific FundsSM Large-Cap Value | | A-18 |

| | Pacific FundsSM Small/Mid-Cap | | A-19 |

| | Pacific FundsSM Small-Cap | | A-20 |

| | Pacific FundsSM Small-Cap Value | | A-21 |

| | Pacific FundsSM Small-Cap Growth | | A-22 |

The Adviser and the Managers have prepared a discussion regarding the performance of the Funds of the Trust that they manage, including commentary discussing positive and negative factors affecting performance for the past twelve months.

We appreciate your confidence in Pacific Funds and look forward to serving your financial needs in the years to come.

Sincerely,

| | |

| |  |

| |

| James T. Morris | | Adrian Griggs |

| |

| Chairman of the Board | | Chief Executive Officer |

| |

| Pacific Funds Series Trust | | Pacific Funds Series Trust |

A-1

PACIFIC FUNDS PERFORMANCE DISCUSSION

This Annual Report is provided for the general information of investors with beneficial interests in the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus, as supplemented, which contains information about the Trust and each of its Funds, including their investment objectives, risks, charges and expenses. You should read the prospectus carefully before investing. There is no assurance that a Fund will achieve its investment objective. Each Fund is subject to market risk. The value of a Fund changes as its asset values go up or down. The value of a Fund’s shares will fluctuate, and when redeemed, may be worth more or less than their original cost. The total return for each Fund of the Trust is net of fees and includes reinvestment of all dividends and capital gain distributions, if any, and does not include deductions of any applicable share class sales charges. Past performance is not predictive of future performance. This report shows you the performance of the Funds compared to benchmark indices. Index performance is provided for illustrative and comparative purposes only and does not predict or depict the performance of the Funds. Indices are unmanaged, do not incur transaction costs, do not include fees and expenses, and cannot be purchased directly by investors. Index returns include reinvested dividends.

The composite benchmarks for the Portfolio Optimization Funds are composed of up to four broad-based indices. The percentage amounts of each broad-based index within each composite benchmark are based on each Fund’s target asset class allocations in effect during the reporting period. The percentages attributed to a broad-based index within a composite benchmark will change if a Fund’s target asset class allocations change.

PLFA supervises the management of the Funds contained in this report, subject to the oversight of the Trust’s Board of Trustees (Board). PLFA also does business under the name “Pacific Asset Management” and manages the Pacific Funds Short Duration Income, Pacific Funds Core Income, Pacific Funds Strategic Income, Pacific Funds Floating Rate Income, and Pacific Funds High Income under that name. PLFA has written the general market conditions commentary which expresses PLFA’s opinions and views on how the market generally performed for the fiscal year ended March 31, 2019 (the reporting period) as well as separate commentary specific to those Funds that it directly manages that is based on its opinion of how these Funds performed during the year.

All views and opinions expressed in the management discussion of fund performance are subject to change at any time based upon market, economic or other conditions, and the Trust, its Adviser, Pacific Asset Management and Rothschild & Co AMUS disclaim any responsibility to update such views. These views and options may not be relied upon as investment advice or recommendations, or as an offer for any particular security. Any references to “we”, “I”, or “ours” are references to the Managers. Any sectors referenced are provided by the applicable Manager and could be different from the sectors listed in the Schedules of Investments if obtained from another source. The Managers may include statements that constitute “forward-looking statements” under the United States (U.S.) securities laws. Forward-looking statements include information concerning possible or assumed future results of the Trust’s investment operations, asset levels, earnings, expenses, industry or market conditions, regulatory developments and other aspects of the Trust’s operations or general economic conditions. In addition, when used in this report, words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “projects” and future or conditional verbs such as “will”, “may”, “could”, “should”, and “would”, or any other statement that necessarily depends on future events, are intended to identify forward- looking statements. Forward-looking statements are not guarantees of performance or economic results. They involve risks, uncertainties and assumptions. Although such statements are based on expectations that the Managers believe to be reasonable, actual results may differ materially from expectations. Investors must not rely on any forward-looking statements. Statements of facts and performance data are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy.

In connection with any forward-looking statements and any investment in the Trust, investors should carefully consider the investment objectives, policies and risks described in the Trust’s current prospectus, as supplemented, and Statement of Additional Information, as supplemented, as filed with the U.S. Securities and Exchange Commission (SEC), which may be obtained from the SEC’s website atwww.sec.gov.

Market Conditions(for the year ended March 31, 2019)

Executive Summary

After a turbulent fourth quarter of 2018, global equity markets bounced higher in the last quarter of the reporting period. Concerns over Federal Reserve (Fed) rate hikes, trade and other geopolitical issues led to a global slowdown. While the Fed had been signaling additional rate hikes in 2019, the global slowdown convinced the central bank to hold off on further monetary tightening. Additionally, trade negotiations between the U.S. and China appeared to make progress. These conditions helped ease some concerns, which in turn boosted equities over the last quarter of the reporting period.

Fixed Income

The U.S.ten-year Treasury yield fluctuated over the reporting period, rising from approximately 2.70% at the start of the reporting period to 3.20% in the fourth quarter of 2018 before plunging back down to 2.40% by the end of the reporting period. The broad bond market (as defined by the Bloomberg Barclays U.S. Aggregate Bond Index) returned 4.48% for the reporting period. Spread sectors were mixed over the reporting period. Within the U.S., riskier credit tiers performed well over the last quarter of the reporting period as credit spreads tightened after they spiked in the fourth quarter of 2018. Emerging market bonds were challenged by the strengthening U.S. dollar, although they experienced some recovery over the last quarter of the reporting period.

Domestic Equity

Domestic equities rose over the reporting period and fared better than foreign markets. Over the reporting period, the S&P 500 Index returned 9.50%. Growth stocks finished higher than value stocks, as the financial sector (which represents a large part of value indices) struggled over the reporting period as interest margins were pressured by a flattening yield curve. On the other hand, technology stocks fared well over the reporting period. Bond proxy sectors such as real estate and utilities delivered gains as theten-year Treasury yield

A-2

See benchmark definitions on A-23 and A-24

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

had been sinking since November 2018, making the higher dividend sectors more attractive. Large corporations held up better than their smaller counterparts. Small-capitalization companies had lower credit ratings, and their debt levels as a percentage of total capital increased.

International Equity

Although international equities finished higher over the last quarter of the reporting period, they ended in negative territory over the reporting period as the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index returned-3.71% over this period. European stocks generally struggled. Geopolitical issues like Brexit (Britain’s exit from the European Union) and trade tensions caused headwinds that held back performance. Furthermore, the U.S. dollar rally was a headwind for unhedged international exposures. Emerging market equities also performed poorly over the reporting period as the MSCI Emerging Markets Index returned-7.41%. Emerging market equities became volatile, particularly for Chinese markets as trade tensions caused businesses to scramble and its consumers to become less optimistic. Chinese equities staged a significant recovery however, with the Shenzhen Composite up 33.70% for the last quarter of the reporting period.

Concluding Remarks

Going forward, we expect to see several themes impact the markets. The U.S. economy should continue to stay on course as business and consumer confidence remain supportive, especially if trade tensions begin to fade. However, we expect U.S.-China trade negotiations to remain an area of investor focus. As the effects of the tax cuts wind down, we anticipate U.S. earnings growth to decelerate and stock buybacks to ebb from very high levels seen throughout 2018.

Regarding central banks, the Fed is expected to take a pause. While markets had been anticipating additional interest rate hikes, they are now pricing in a rate cut by the end of 2019. The European Central Bank ended its bond purchasing program and will be going through a transition as it will need to find a successor for Mario Drahghi who is scheduled to step down in October 2019. Several emerging market central banks may find some relief from the Fed refraining from additional rate hikes.

In the U.S., investors may continue to focus on the yield curve, which has historically inverted prior to recessions, but it generally did not lead to equities falling immediately thereafter. Nonetheless, U.S. corporations will have to deal with rising wage growth caused by the tight labor market and increasing input costs resulting from the tariffs imposed on Chinese goods. Additionally, a steady stream of share buybacks has generally lifted prices and when this trend recedes, U.S. stocks may begin to trail.

Overseas, we believe foreign stocks are fairly attractive relative to U.S. equities based on price multiples although they also exhibit heightened geopolitical risks. Additionally, international industries tend to have a higher concentration in defensive sectors than those of the U.S., which tend to be more technology-related. Technology-related stocks are generally trading at a considerable premium compared to others, which may limit further upside. This is particularly true if market sentiment toward defensive sectors gains momentum. Emerging markets’price-to-book multiples compared to those of U.S. equities are near historic lows. Furthermore, the U.S. and China will likely be inclined to reach a trade deal sooner than later, as rising tensions are weighing down sentiment. Once a deal with China is reached, the Trump administration may extend the trade war to Europe and Japan with automobile tariffs. This would be particularly challenging for Germany, which is already flirting with a potential recession.

In fixed income, we anticipate the Fed may refrain from pursuing an aggressive monetary policy, as inflation risks remain somewhat subdued, although wage growth has been accelerating. Additionally, loose credit standards and heightened leverage have become more concerning, especially for leveraged loans. Although we do not anticipate a significant deterioration in credit fundamentals in the near term, we will closely monitor these conditions as challenges in credit markets have tended to precede equity markets in the lead up to a recession. While we do not see recession likely in the near term, we are watching this sector of the market for an early warning. We expect broad alternatives to provide continued diversification, especially for strategies that can successfully take advantage of rapidly changing developments in currency or commodity markets.

Performance of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives

The performance of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives are composites of the performance of each of the PF Underlying Funds in which each invests (which may include bonds, domestic and/or international equities). The Portfolio Optimization Funds are compared to two broad-based indices; however, to further assist in performance comparisons, composite benchmarks were constructed for the Portfolio Optimization Funds. Each composite benchmark is comprised of up to four broad-based indices shown below. The composite benchmarks were constructed with allocations to each asset class that correspond to the target allocations for Portfolio Optimization Funds. However, the actual allocations of any Portfolio Optimization Fund will naturally vary from these targets as a result of market performance over time. Pacific Funds Diversified Alternatives does not have a composite benchmark. Theone-year performance for these broad-based indices for the year ended March 31, 2019 is shown in the following table:

| | | | |

Broad-Based Indices | | | |

S&P 500 Index (representing U.S. Stocks) | | | 9.50% | |

Morgan Stanley Capital International (MSCI) EAFE Index (Net) (International Stocks) | | | (3.71% | ) |

Bloomberg Barclays U.S. Aggregate Bond Index (Fixed Income) | | | 4.48% | |

ICE BofA Merrill Lynch U.S.3-MonthT-Bill Index (Cash) | | | 2.12% | |

| | |

| | See benchmark definitions on A-23 and A-24 |

A-3

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

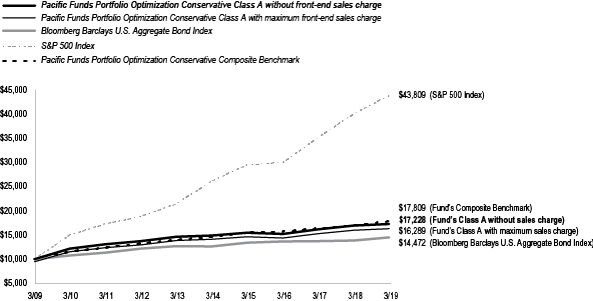

Pacific Funds Portfolio Optimization Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2019?

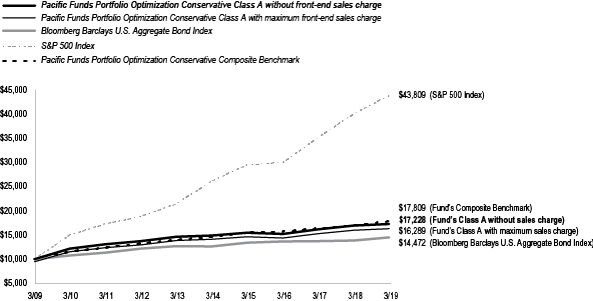

A. For the year ended March 31, 2019, Pacific Funds Portfolio Optimization Conservative’s Class A (without sales charge) returned 1.88%, compared to a 4.48% return for the Bloomberg Barclays U.S. Aggregate Bond Index, a 9.50% return for the S&P 500 Index, and a 4.94% return for the Pacific Funds Portfolio Optimization Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class B, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | 1.88% | | | | 2.97% | | | | 5.59% | |

Fund’s Class A with maximum sales charge | | | (3.69% | ) | | | 1.81% | | | | 5.00% | |

Fund’s Class B without sales charge | | | 1.15% | | | | 2.22% | | | | 5.01% | |

Fund’s Class B with maximum sales charge | | | (3.39% | ) | | | 1.89% | | | | 5.01% | |

Fund’s Class C without sales charge | | | 1.13% | | | | 2.24% | | | | 4.87% | |

Fund’s Class C with maximum sales charge | | | 0.22% | | | | 2.24% | | | | 4.87% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.77% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 15.92% | |

Pacific Funds Portfolio Optimization Conservative Composite Benchmark | | | 4.94% | | | | 4.05% | | | | 5.94% | |

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Advisor Class without sales charge | | | 2.26% | | | | 3.24% | | | | 3.22% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.15% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 13.96% | |

Pacific Funds Portfolio Optimization Conservative Composite Benchmark | | | 4.94% | | | | 4.05% | | | | 4.25% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Conservative Composite Benchmark. The Pacific Funds Portfolio Optimization Conservative Composite Benchmark is comprised of the Bloomberg Barclays U.S. Aggregate Bond, S&P 500, ICE BofA Merrill Lynch U.S.3-MonthT-Bill, and MSCI EAFE (Net) Indices in a weighting that is fixed and specific to the Fund. The Fund was primarily invested in various fixed income strategies, with a smaller allocation to equity and alternative strategies, during the reporting period. Fixed income investments included allocations to intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond, and floating rate strategies. The equity segment consisted mainly of allocations to domestic and foreign large-capitalization strategies. The Fund’s alternatives allocation consisted of investments in a currency strategy and an equity long/short strategy.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-4

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Among the fixed income lineup, high yield bonds contributed to performance over the reporting period as the asset class fared relatively well. However, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg Barclays U.S. Aggregate Bond Index and likewise detracted from performance over the reporting period. Additionally, exposure to short-term bonds also detracted from performance.

As for domestic equities, exposure to value stocks was a headwind over the reporting period as growth sectors such as information technology surged past value sectors. On the other hand, the exposure to real estate helped performance.

International equities held back performance over the reporting period. An overweight to emerging markets had a negative impact on performance, although the PF Emerging Markets Fund outpaced its benchmark, the MSCI Emerging Markets Index, which helped offset the drag from the exposure to the asset class.

Alternatives as a group also detracted from performance over the reporting period. The PF Equity Long/Short Fund primarily detracted from performance.

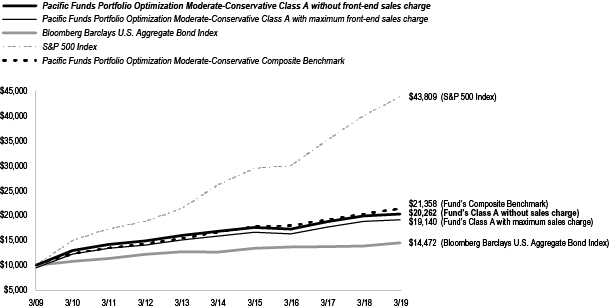

Pacific Funds Portfolio Optimization Moderate-Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2019?

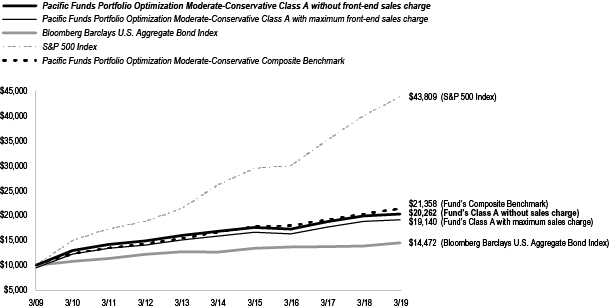

A. For the year ended March 31, 2019, Pacific Funds Portfolio Optimization Moderate-Conservative’s Class A (without sales charge) returned 1.91%, compared to a 4.48% return for the Bloomberg Barclays U.S. Aggregate Bond Index, a 9.50% return for the S&P 500 Index, and a 5.28% return for the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class B, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | 1.91% | | | | 3.85% | | | | 7.32% | |

Fund’s Class A with maximum sales charge | | | (3.68% | ) | | | 2.68% | | | | 6.71% | |

Fund’s Class B without sales charge | | | 1.07% | | | | 3.07% | | | | 6.73% | |

Fund’s Class B with maximum sales charge | | | (3.16% | ) | | | 2.77% | | | | 6.73% | |

Fund’s Class C without sales charge | | | 1.11% | | | | 3.09% | | | | 6.56% | |

Fund’s Class C with maximum sales charge | | | 0.26% | | | | 3.09% | | | | 6.56% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.77% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 15.92% | |

Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark | | | 5.28% | | | | 5.17% | | | | 7.88% | |

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Advisor Class without sales charge | | | 2.10% | | | | 4.09% | | | | 4.71% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.15% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 13.96% | |

Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark | | | 5.28% | | | | 5.17% | | | | 6.00% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| | |

| | See benchmark definitions on A-23 and A-24 |

A-5

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark. The Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark is comprised of the Bloomberg Barclays U.S. Aggregate Bond, S&P 500, MSCI EAFE (Net), and ICE BofA Merrill Lynch U.S.3-MonthT-Bill Indices in a weighting that is fixed and specific to the Fund. The Fund had a diversified allocation mix that was modestly tilted to fixed income during the reporting period. Fixed income investments included intermediate-term bond strategies as well as short duration bond, inflation-indexed bond, high yield bond, emerging markets bond, and floating rate strategies. The Fund’s equity exposure was diversified across style (growth/value), market capitalization and region (including an allocation to foreign small-capitalization and emerging markets strategies). The Fund’s alternatives allocation consisted of investments in a currency strategy and an equity long/short strategy.

Among the fixed income lineup, high yield bonds contributed to performance over the reporting period as the asset class fared relatively well. However, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg Barclays U.S. Aggregate Bond Index and likewise detracted from relative performance over the reporting period. Additionally, exposure to short-term bonds also detracted from performance.

As for domestic equities, exposure to value stocks was a headwind over the reporting period as growth sectors such as information technology surged past value sectors. The exposure to real estate also helped performance.

International equities held back performance over the reporting period. An overweight to emerging markets had a negative impact on performance, although the PF Emerging Markets Fund outpaced its benchmark, the MSCI Emerging Markets Index, which helped offset the drag from the exposure to the asset class.

Alternatives as a group also detracted from performance over the reporting period. The PF Equity Long/Short Fund primarily detracted from performance.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-6

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

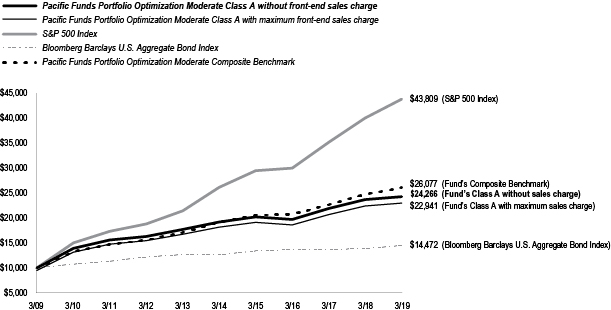

Pacific Funds Portfolio Optimization Moderate (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2019?

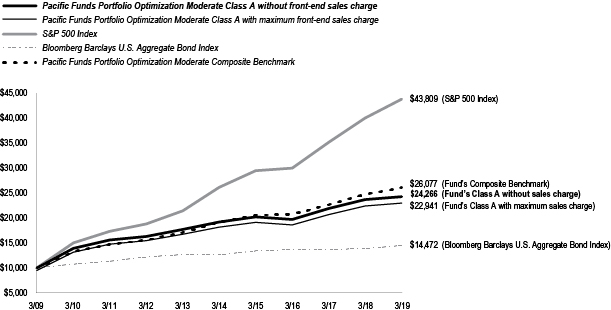

A. For the year ended March 31, 2019, Pacific Funds Portfolio Optimization Moderate’s Class A (without sales charge) returned 2.49%, compared to a 9.50% return for the S&P 500 Index, a 4.48% return for the Bloomberg Barclays U.S. Aggregate Bond Index, and a 5.68% return for the Pacific Funds Portfolio Optimization Moderate Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class B, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | 2.49% | | | | 4.81% | | | | 9.27% | |

Fund’s Class A with maximum sales charge | | | (3.15% | ) | | | 3.64% | | | | 8.66% | |

Fund’s Class B without sales charge | | | 1.75% | | | | 4.04% | | | | 8.68% | |

Fund’s Class B with maximum sales charge | | | (2.45% | ) | | | 3.75% | | | | 8.68% | |

Fund’s Class C without sales charge | | | 1.78% | | | | 4.04% | | | | 8.53% | |

Fund’s Class C with maximum sales charge | | | 0.94% | | | | 4.04% | | | | 8.53% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 15.92% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.77% | |

Pacific Funds Portfolio Optimization Moderate Composite Benchmark | | | 5.68% | | | | 6.43% | | | | 10.06% | |

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Advisor Class without sales charge | | | 2.75% | | | | 5.07% | | | | 6.31% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 13.96% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.15% | |

Pacific Funds Portfolio Optimization Moderate Composite Benchmark | | | 5.68% | | | | 6.43% | | | | 7.98% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate Composite Benchmark. The Pacific Funds Portfolio Optimization Moderate Composite Benchmark is comprised of the S&P 500, Bloomberg Barclays U.S. Aggregate Bond, MSCI EAFE (Net), and ICE BofA Merrill Lynch U.S.3-MonthT-Bill Indices in a weighting that is fixed and specific to the Fund. The Fund is allocated to a mix of equity and fixed income strategies over the reporting period, with a larger allocation toward equity investments. The equity exposure was diversified across style (growth/value), market capitalization and region (including allocations to foreign small-capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded real estate investment trusts (REITs). Fixed income investments included intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond, and floating rate loan strategies. The Fund’s alternatives allocation consisted of investments in a currency strategy and an equity long/short strategy.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-7

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Within domestic equities exposure to value stocks was a headwind over the reporting period as growth sectors such as information technology surged past value sectors like financials. The exposure to real estate also helped performance. Furthermore, the PF Growth and PF Developing Growth Funds outperformed their respective benchmarks, which contributed to performance.

International equities held back performance over the reporting period. An overweight to emerging markets had a negative impact on performance, although the PF Emerging Markets Fund outpaced its benchmark, the MSCI Emerging Markets Index, which helped offset the drag from the exposure to the asset class. Additionally, the PF International Value Fund underperformed its benchmark, which held back performance.

Among the fixed income lineup, high yield bonds contributed to performance over the reporting period as the asset class fared relatively well. However, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg Barclays U.S. Aggregate Bond Index and likewise detracted from relative performance over the reporting period. Additionally, exposure to short-term bonds also detracted from performance.

Alternatives as a group also detracted from performance over the reporting period. The PF Equity Long/Short Fund primarily detracted from performance.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-8

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

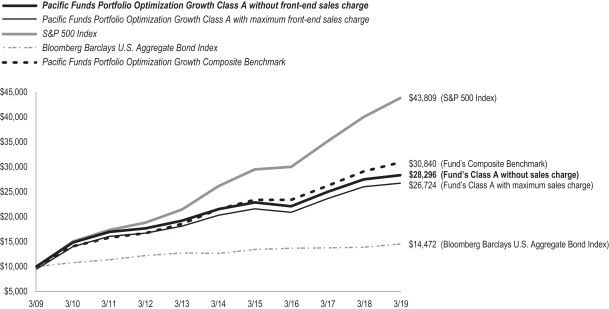

Pacific Funds Portfolio Optimization Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2019?

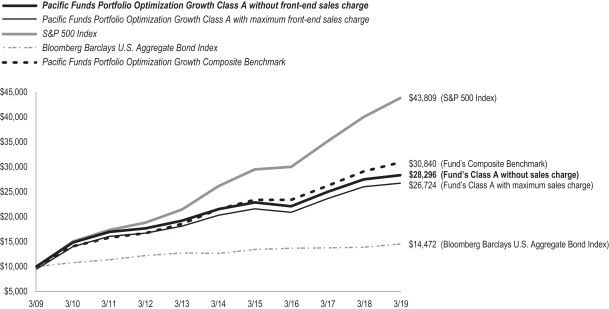

A. For the year ended March 31, 2019, Pacific Funds Portfolio Optimization Growth’s Class A (without sales charge) returned 2.92%, compared to a 9.50% return for the S&P 500 Index, a 4.48% return for the Bloomberg Barclays U.S. Aggregate Bond Index, and a 5.98% return for the Pacific Funds Portfolio Optimization Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class B, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | 2.92% | | | | 5.67% | | | | 10.96% | |

Fund’s Class A with maximum sales charge | | | (2.74% | ) | | | 4.47% | | | | 10.33% | |

Fund’s Class B without sales charge | | | 2.15% | | | | 4.89% | | | | 10.40% | |

Fund’s Class B with maximum sales charge | | | (1.96% | ) | | | 4.61% | | | | 10.40% | |

Fund’s Class C without sales charge | | | 2.12% | | | | 4.88% | | | | 10.26% | |

Fund’s Class C with maximum sales charge | | | 1.30% | | | | 4.88% | | | | 10.26% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 15.92% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.77% | |

Pacific Funds Portfolio Optimization Growth Composite Benchmark | | | 5.98% | | | | 7.49% | | | | 11.92% | |

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Advisor Class without sales charge | | | 3.12% | | | | 5.92% | | | | 7.77% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 13.96% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.15% | |

Pacific Funds Portfolio Optimization Growth Composite Benchmark | | | 5.98% | | | | 7.49% | | | | 9.66% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Growth Composite Benchmark. The Pacific Funds Portfolio Optimization Growth Composite Benchmark is comprised of the S&P 500, Bloomberg Barclays U.S. Aggregate Bond, and MSCI EAFE (Net) Indices in a weighting that is fixed and specific to the Fund. The Fund had a diversified allocation mix that was tilted to equity. The equity exposure was diversified across style (growth/value), market capitalization and region (including allocations to foreign small capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded REITs. Fixed income investments included intermediate-term bond strategies as well as specific strategies such as short duration bond, inflation-indexed bond and emerging markets bond strategies. The Fund’s alternatives allocation consisted of investments in a currency strategy and an equity long/short strategy.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-9

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Within domestic equities exposure to value stocks was a headwind over the reporting period as growth sectors such as information technology surged past value sectors like financials. The exposure to real estate also helped performance. Furthermore, the PF Growth and PF Developing Growth Funds outperformed their respective benchmarks, which contributed to performance.

International equities held back performance over the reporting period. An overweight to emerging markets had a negative impact on performance, although the PF Emerging Markets Fund outpaced its benchmark, the MSCI Emerging Markets Index, which helped offset the drag from the exposure to the asset class. Additionally, the PF International Value Fund underperformed its benchmark, which held back performance.

Among the fixed income lineup, high yield bonds contributed to performance over the reporting period as the asset class fared relatively well. However, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg Barclays U.S. Aggregate Bond Index and likewise detracted from relative performance over the reporting period. Additionally, exposure to short-term bonds also detracted from performance.

Alternatives as a group also detracted from performance over the reporting period. The PF Equity Long/Short Fund primarily detracted from performance.

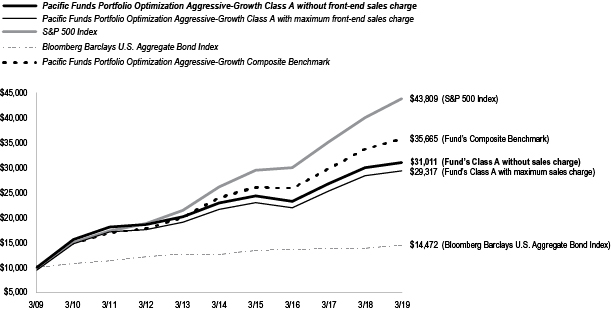

Pacific Funds Portfolio Optimization Aggressive-Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2019?

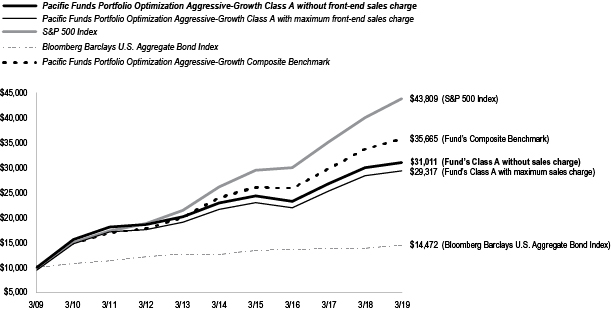

A. For the year ended March 31, 2019, Pacific Funds Portfolio Optimization Aggressive-Growth’s Class A (without sales charge) returned 3.39%, compared to a 9.50% return for the S&P 500 Index, a 4.48% return for the Bloomberg Barclays U.S. Aggregate Bond Index, and a 5.79% return for the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class B, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | 3.39% | | | | 6.26% | | | | 11.98% | |

Fund’s Class A with maximum sales charge | | | (2.29% | ) | | | 5.06% | | | | 11.36% | |

Fund’s Class B without sales charge | | | 2.59% | | | | 5.49% | | | | 11.53% | |

Fund’s Class B with maximum sales charge | | | (1.56% | ) | | | 5.19% | | | | 11.53% | |

Fund’s Class C without sales charge | | | 2.57% | | | | 5.49% | | | | 11.36% | |

Fund’s Class C with maximum sales charge | | | 1.74% | | | | 5.49% | | | | 11.36% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 15.92% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.77% | |

Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark | | | 5.79% | | | | 8.29% | | | | 13.56% | |

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Advisor Class without sales charge | | | 3.57% | | | | 6.53% | | | | 8.65% | |

S&P 500 Index | | | 9.50% | | | | 10.91% | | | | 13.96% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.15% | |

Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark | | | 5.79% | | | | 8.29% | | | | 11.15% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| | |

| | See benchmark definitions on A-23 and A-24 |

A-10

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark. The Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark is comprised of the S&P 500, MSCI EAFE (Net), and Bloomberg Barclays U.S. Aggregate Bond Indices in a weighting that is fixed and specific to the Fund. The Fund is primarily allocated to domestic and international equity funds that are diversified across style (growth/value), market capitalization and region (which included allocations to foreign small-capitalization and emerging markets stocks). The Fund also maintained exposure to select sectors, such as publicly-traded REITs, as well as a small allocation to intermediate-term fixed income securities. The Fund’s alternatives allocation consisted of investments in a currency strategy and an equity long/short strategy.

Within domestic equities exposure to value stocks was a headwind over the reporting period as growth sectors such as information technology surged past value sectors like financials. The exposure to real estate also helped performance. Furthermore, the PF Growth and PF Developing Growth Funds outperformed their respective benchmarks, which contributed to performance.

International equities held back performance over the reporting period. An overweight to emerging markets had a negative impact on performance, although the PF Emerging Markets Fund outpaced its benchmark, the MSCI Emerging Markets Index, which helped offset the drag from the exposure to the asset class. Additionally, the PF International Value underperformed its benchmark, which held back performance.

The Fund’s allocation to fixed income is relatively a minor position. Nonetheless, exposure to short-term bonds detracted from performance.

Alternatives as a group also detracted from performance over the reporting period. The PF Equity Long/Short Fund primarily detracted from performance.

Pacific Funds Diversified Alternatives (managed by Pacific Life Fund Advisors LLC)

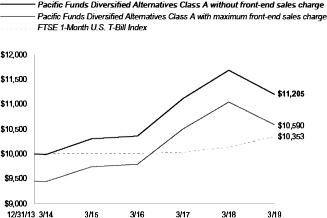

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds Diversified Alternatives’ Class A (without sales charge) returned-4.15%, compared to a 2.08% return for its benchmark, the FTSE1-Month U.S.T-Bill Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(12/31/13) | |

Fund’s Class A without sales charge | | | (4.15% | ) | | | 2.32% | | | | 2.19% | |

Fund’s Class A with maximum sales charge | | | (9.43% | ) | | | 1.17% | | | | 1.10% | |

Fund’s Class C without sales charge | | | (4.81% | ) | | | 1.56% | | | | 1.43% | |

Fund’s Class C with maximum sales charge | | | (5.76% | ) | | | 1.56% | | | | 1.43% | |

Fund’s Advisor Class without sales charge | | | (3.91% | ) | | | 2.56% | | | | 2.42% | |

FTSE1-Month U.S.T-Bill Index | | | 2.08% | | | | 0.69% | | | | 0.66% | (1) |

| | (1) | Due to data limitation, the benchmark since inception return reflects the commencement period from the first calendar day of the month the portfolio commenced its operations. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the benchmark. The Fund is a “fund of funds” that seeks to achieve its investment goal by investing in other funds, and seeks to maintain a low to moderate correlation of its returns with the returns of traditional equity and fixed income asset classes over long-term periods by gaining exposure to a number ofnon-traditional asset classes and alternative investment strategies. Over the reporting period, the Fund was primarily invested innon-traditional asset classes and alternative investment strategies. The Fund’s investments included currencies and long-short equity strategies. The Fund also invested in inflation-indexed debt, floating rate loans, real estate, internationalsmall-cap, and emerging markets equity and debt strategies.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-11

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

The Fund’s allocations to the PF Real Estate Fund, PF Currency Strategies Fund and Pacific Funds Floating Rate Income were the top contributors to performance. The PF Real Estate Fund benefited from an overweight position to residential REITs. The PF Currency Strategies Fund’s short position in the Korean won largely contributed to performance. Pacific Funds Floating Rate Income benefited from an overweight position to second lien bank loans.

The PF Equity Long/Short Fund was the weakest-performing fund over the reporting period. PF InternationalSmall-Cap Fund, PF Emerging Markets Fund and PF Emerging Markets Debt Fund also detracted from performance over the reporting period. These funds have exposure to foreign markets, which struggled over the reporting period, as trade tensions intensified.

Pacific Funds Short Duration Income (managed by Pacific Asset Management)

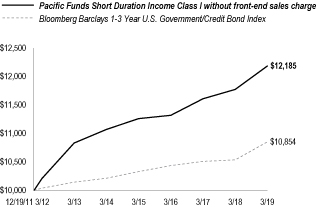

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds Short Duration Income’s Class I (without sales charge) returned 3.47%, compared to a 3.03% return for its benchmark, the Bloomberg Barclays1-3 Year U.S. Government/Credit Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(12/19/11) | |

Fund’s Class I without sales charge | | | 3.47% | | | | 1.94% | | | | 2.75% | |

Bloomberg Barclays1-3 Year U.S. Government/Credit Bond Index | | | 3.03% | | | | 1.22% | | | | 1.14% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/29/12) | |

Fund’s Class A without sales charge | | | 3.11% | | | | 1.66% | | | | 2.23% | |

Fund’s Class A with maximum sales charge | | | (0.01% | ) | | | 1.05% | | | | 1.76% | |

Fund’s Class C without sales charge | | | 2.35% | | | | 0.89% | | | | 1.47% | |

Fund’s Class C with maximum sales charge | | | 1.35% | | | | 0.89% | | | | 1.47% | |

Fund’s Advisor Class without sales charge | | | 3.46% | | | | 1.93% | | | | 2.48% | |

Bloomberg Barclays1-3 Year U.S. Government/Credit Bond Index | | | 3.03% | | | | 1.22% | | | | 1.14% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund uses a short term corporate debt focused strategy. Using a fundamental approach with atop-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund’s asset allocation and focus on short maturity BBB-rated securities were the primary contributors to performance. The Fund’s allocations tonon-investment grade debt securities, bank loans and high yield bonds, benefited performance during the reporting period. The Fund’s underweight to treasury and government related securities also benefited performance. The Fund’s underweight to duration detracted from performance given the flattening of the yield curve seen during the reporting period. Security selection in pharmaceuticals and chemicals benefited performance while overweights to banking and midstream hurt performance.

The significant spread widening seen in December 2018 and subsequent rally in the first quarter 2019 leave us with a neutral view of investment-grade corporate credit as we enter April 2019. We believe that stable monetary policy should help the technical picture for the asset class. From an asset allocation perspective, we like floating-rate loans andBBB-rated investment-grade names in preferred sectors. We hold limited exposure in high yield bonds favoring bank loans. We expect to maintain exposure to securitized assets and have looked to add to certain deal structures. Sector and credit selection remain vital as we focus on deleveraging stories and sectors, while staying cautious with sectors experiencing more deterioration in credit metrics. We are also mindful of sectors that can be meaningfully impacted by slowing global growth, evolution of trade-policy changes and rising cost inflation, such as technology, automotive and chemicals. We are underweight duration relative to the benchmark.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-12

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Core Income (managed by Pacific Asset Management)

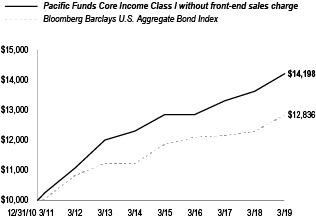

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds Core Income’s Class I (without sales charge) returned 4.30%, compared to a 4.48% return for its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(12/31/10) | |

Fund’s Class I without sales charge | | | 4.30% | | | | 2.92% | | | | 4.34% | |

Fund’s Class A without sales charge | | | 3.99% | | | | 2.62% | | | | 4.07% | |

Fund’s Class A with maximum sales charge | | | (0.40% | ) | | | 1.74% | | | | 3.53% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 3.08% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/30/11) | |

Fund’s Class C without sales charge | | | 3.11% | | | | 1.85% | | | | 2.94% | |

Fund’s Class C with maximum sales charge | | | 2.11% | | | | 1.85% | | | | 2.94% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.92% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/29/12) | |

Fund’s Advisor Class without sales charge | | | 4.19% | | | | 2.90% | | | | 3.40% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.26% | |

| | | |

| | | | | | 1 Year | | | Since Inception (04/27/15) | |

Fund’s Class P without sales charge | | | | | | | 4.29% | | | | 2.35% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | 4.48% | | | | 1.99% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I underperformed the benchmark. The Fund uses an intermediate term corporate debt focused strategy. Using a fundamental approach with atop-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund’s underweight to duration detracted from performance given the flattening of the yield curve seen during the reporting period. The Fund’s allocation tonon-investment grade securities, bank loans and high yield bonds, and to underweight treasury and government related securities benefited performance. Security selection in pharmaceuticals and chemicals benefited performance while overweight’s to banking and midstream hurt performance.

The significant spread widening seen in December 2018 and subsequent rally in the first quarter 2019 continues to leave us with a more neutral view of investment-grade corporate credit as we enter April 2019. Stable monetary policy should help the technical picture for the asset class. From an asset allocation perspective, we like the improved relative value in floating-rate loans andBBB-rated investment-grade names in preferred sectors. We expect to maintain exposure to securitized assets and have looked to add to certain deal structures as they became more attractive due to thesell-off in December 2018. Sector and credit selection remain vital as we focus on deleveraging stories and sectors, while staying cautious with sectors experiencing more deterioration in credit metrics. We are also mindful of sectors that can be meaningfully impacted by slowing global growth, evolution of trade-policy changes and rising cost inflation, such as technology, automotive and chemicals. We are underweight duration relative to the benchmark.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-13

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Strategic Income (managed by Pacific Asset Management)

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds Strategic Income’s Class I (without sales charge) returned 3.77%, compared to a 4.48% return for its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/19/11) | |

Fund’s Class I without sales charge | | | 3.77% | | | | 3.40% | | | | 6.21% | |

Bloomberg Barclays U.S Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.42% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/29/12) | |

Fund’s Class A without sales charge | | | 3.43% | | | | 3.10% | | | | 5.25% | |

Fund’s Class A with maximum sales charge | | | (1.00% | ) | | | 2.20% | | | | 4.58% | |

Fund’s Class C without sales charge | | | 2.73% | | | | 2.35% | | | | 4.50% | |

Fund’s Class C with maximum sales charge | | | 1.74% | | | | 2.35% | | | | 4.50% | |

Fund’s Advisor Class without sales charge | | | 3.70% | | | | 3.36% | | | | 5.50% | |

Bloomberg Barclays U.S Aggregate Bond Index | | | 4.48% | | | | 2.74% | | | | 2.26% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I underperformed the benchmark. The Fund uses anon-investment grade focused multi-sector credit strategy. Using a fundamental approach with atop-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund underperformed the benchmark for the reporting period primarily driven by asset allocation and duration. The Fund focuses on U.S. credit sectors including bank loans, high yield bonds, and corporate debt. The Fund’s overweight to bank loans detracted from performance. The Fund’s underweight to longer maturity government bonds detracted from performance. The Fund’s underweight in duration also detracted from performance given the flattening of the yield curve seen during the reporting period. Sector allocations in midstream, gaming, and cable & satellite benefited performance while building materials, packaging, and metals & mining detracted.

The significant spread widening seen in December 2018 and subsequent rally in the first quarter 2019 continues to leave us with a positive view of corporate credit as we enter the new fiscal year. We believe that improved relative value should help the technical picture for credit, specifically as monetary policy stabilizes. From an asset allocation perspective, we like the improved relative value in bank loans and investment-grade names in preferred sectors. After increasing our exposure in December 2018 to high yield bonds, we have reduced that exposure in favor of bank loan securities based on relative value. Sector and credit selection remain vital as we focus on deleveraging stories and sectors, while staying cautious with sectors experiencing more deterioration in credit metrics. We are also mindful of sectors that can be meaningfully impacted by slowing global growth, evolution of trade-policy changes and rising cost inflation, such as technology, automotive and chemicals. We are underweight duration relative to the benchmark.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-14

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Floating Rate Income (managed by Pacific Asset Management)

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds Floating Rate Income’s Class I (without sales charge) returned 2.88%, compared to a 3.33% return for its benchmark, the Credit Suisse Leveraged Loan Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(06/30/11) | |

Fund’s Class I without sales charge | | | 2.88% | | | | 3.43% | | | | 4.56% | |

Credit Suisse Leveraged Loan Index | | | 3.33% | | | | 3.83% | | | | 4.47% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/30/11) | |

Fund’s Class A without sales charge | | | 2.57% | | | | 3.12% | | | | 4.55% | |

Fund’s Class A with maximum sales charge | | | (0.48% | ) | | | 2.49% | | | | 4.11% | |

Fund’s Class C without sales charge | | | 1.86% | | | | 2.37% | | | | 3.80% | |

Fund’s Class C with maximum sales charge | | | 0.88% | | | | 2.37% | | | | 3.80% | |

Credit Suisse Leveraged Loan Index | | | 3.33% | | | | 3.83% | | | | 5.03% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/29/12) | |

Fund’s Advisor Class without sales charge | | | 2.83% | | | | 3.39% | | | | 4.38% | |

Credit Suisse Leveraged Loan Index | | | 3.33% | | | | 3.83% | | | | 4.76% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (12/31/12) | |

Fund’s Class P without sales charge | | | 2.87% | | | | 3.41% | | | | 3.90% | |

Credit Suisse Leveraged Loan Index | | | 3.33% | | | | 3.83% | | | | 4.26% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I underperformed the benchmark. Using a fundamental approach with a top down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look for investment opportunities in floating rate loans and floating rate debt securities.

The Fund’s underperformance to the benchmark was primarily attributable to the focus on larger bank loan issuers. During the reporting period, larger issuers underperformed. This was most pronounced during the year end 2018 volatility as more liquid, larger issuers underperformed. The Fund benefited from overweights to second lien bank loans, which outperformed during the reporting period. Given the liquidity driven selloff seen in December 2018 along with the broader outperformance of smaller facility sizes during the reporting period, second liens outperformed their first lien counterparts. The Fund’s overweight to B versus BB-rated issuers was a contributor to performance as B-rated issuers outperformed BB’s.

The Fund’s overweight to chemicals and underweight to media/telecommunications contributed to performance. The Fund’s overweight to forest products/containers and overweight to manufacturing detracted from performance.

We enter the new fiscal year underweight risk as measured to our benchmark by yield. While prices have recovered much of the liquidity driven selloff seen in December 2018, the asset class provides attractive yields and stable corporate health conditions. Our underweight in yield to our benchmark is primarily attributable to our limited exposure to distressed issuers (those below$90-dollar price). We are focused on the performing segment of the bank loan market. At the end of the reporting period, we are overweight to food/tobacco securities, forest products/containers securities, and manufacturing securities. We are underweight to technology, health care, and media/telecommunication securities.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-15

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds High Income (managed by Pacific Asset Management)

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific Funds High Income’s Class I (without sales charge) returned 4.27%, compared to a 5.93% return for its benchmark, the Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(12/19/11) | |

Fund’s Class I without sales charge | | | 4.27% | | | | 3.54% | | | | 6.43% | |

Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index | | | 5.93% | | | | 4.69% | | | | 6.92% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since Inception (06/29/12) | |

Fund’s Class A without sales charge | | | 3.97% | | | | 3.27% | | | | 5.35% | |

Fund’s Class A with maximum sales charge | | | (0.41% | ) | | | 2.38% | | | | 4.67% | |

Fund’s Class C without sales charge | | | 3.35% | | | | 2.53% | | | | 4.60% | |

Fund’s Class C with maximum sales charge | | | 2.37% | | | | 2.53% | | | | 4.60% | |

Fund’s Advisor Class without sales charge | | | 4.23% | | | | 3.53% | | | | 5.60% | |

Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index | | | 5.93% | | | | 4.69% | | | | 6.21% | |

| | | |

| | | | | | 1 Year | | | Since

Inception

(01/14/15) | |

Fund’s Class P without sales charge | | | | | | | 4.27% | | | | 4.99% | |

Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index | | | | | | | 5.93% | | | | 5.74% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I underperformed the benchmark. The Fund seeks a high level of current income by investing innon-investment grade, debt instruments or in instruments with characteristics ofnon-investment grade instruments. Using a fundamental approach with atop-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts.

During the reporting period, the Fund underperformed the benchmark primarily due to sector allocations and security selection. Sanchez Energy and Halcon Resources were notable detractors in the independent exploration& production sector. Ahern Rentals was a notable detractor in the construction machinery sector. On a sector basis, notable positive contributors include food and beverage and finance companies while underweight allocations to cable/satellite and health care sectors detracted. Duration was neutral to performance during the reporting period.

As we enter the new fiscal year, we believe it is especially important amid current market conditions to maintain our focus on credit selection as the key to our high-yield investment process. The Fund’s investments continue to be focused on U.S.-centric companies, targeting a relatively healthy U.S. consumer and companies with strong underlying fundamentals. We expect building materials, restaurant, and manufacturing sectors to continue to benefit from the relative strength of U.S. consumers and growing government spending. In the case of housing-related sectors, our focus on less cyclical roofing exposures provides both attractive yield and some downside protection. The Fund remains underweight exposure to industries in secular decline, which include phone companies in the wirelines sector and hardware companies susceptible to rapid change in the technology sector.

| | |

| | See benchmark definitions on A-23 and A-24 |

A-16

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Large-Cap (managed by Rothschild & Co Asset Management US Inc.)

Q. How did the Fund perform for the year ended March 31, 2019?

A. For the year ended March 31, 2019, Pacific FundsLarge-Cap’s Advisor Class (without sales charge) returned 6.97%, compared to a 9.50% return for its benchmark, the S&P 500 Index.

The following graph compares the performance of a hypothetical $10,000 investment in Advisor Class shares of the Fund to its benchmark for the period from inception through March 31, 2019. For comparison purposes, the performance of all classes for the periods ended March 31, 2019 are also shown in the table below. Performance data for Class A, C, and S shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2019

| | | | | | | | |

| | | 1 Year | | | Since

Inception

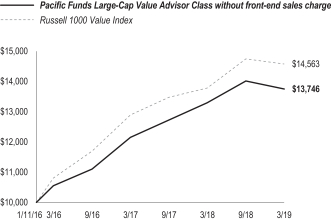

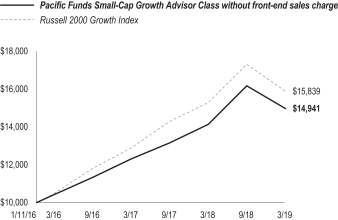

(1/11/16) | |