SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. N/A)

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary proxy statement | | ¨ | | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x | | Definitive proxy statement | | |

| | | |

¨ | | Definitive additional materials | | | | |

| |

¨ | | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

FIRST SECURITY GROUP, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transactions applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement no.: |

September 26, 2005

TO THE SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.:

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of First Security Group, Inc., which will be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee 37402, on Thursday, October 27, 2005, at 3:00 p.m. local time.

At the Meeting, you will be asked to consider and vote upon: (i) the election of nine (9) directors to serve until the 2006 Annual Meeting of Shareholders and until their successors have been elected and qualified; (ii) the approval of an increase in the number of authorized shares of common stock from 20 million to 50 million; and (iii) the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2005.

Enclosed are the Notice of Meeting, Proxy Statement and Proxy. We hope you can attend the Meeting and vote your shares in person. In any case, we would appreciate your completing the enclosed Proxy and returning it to us. This action will ensure that your preferences will be expressed on the matters that are being considered. If you are able to attend the Meeting, you may vote your shares in person even if you have previously returned your Proxy.

We want to thank you for your support this past year. We are proud of our progress as reflected in the results for 2004, and we encourage you to review carefully the 2004 Annual Report, which accompanies this proxy statement.

If you have any questions about the Proxy Statement or our Annual Report, please call or write us.

|

| Sincerely, |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

FIRST SECURITY GROUP, INC.

817 Broad Street

Chattanooga, Tennessee 37402

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD OCTOBER 27, 2005

Notice is hereby given that the 2005 Annual Meeting of Shareholders of First Security Group, Inc. will be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee 37402, on Thursday, October 27, 2005, at 3:00 p.m. local time for the following purposes:

| | 1. | Elect Directors. To consider and vote upon the election of nine (9) directors to serve until the 2006 Annual Meeting of Shareholders and until their successors have been elected and qualified. |

| | 2. | Increase Number of Authorized Shares. To consider and vote upon a proposed amendment to First Security’s Articles of Incorporation which would increase the number of authorized shares of common stock from 20 million to 50 million. |

| | 3. | Ratify Auditors. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2005. |

| | 4. | Other Business. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

The enclosed Proxy Statement explains these proposals in greater detail. We urge you to review these materials carefully.

Only shareholders of record at the close of business on September 16, 2005 are entitled to notice of, and to vote at, the Meeting or any adjournments thereof. All shareholders, whether or not they expect to attend the Meeting in person, are requested to complete, date, sign and return the enclosed Proxy in the accompanying envelope.

|

By Order of the Board of Directors |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

September 26, 2005

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO FIRST SECURITY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.

OCTOBER 27, 2005

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of First Security Group, Inc., a Tennessee corporation, in connection with the solicitation of proxies by First Security’s Board of Directors from holders of First Security’s common stock, $0.01 par value, for use at the 2005 Annual Meeting of Shareholders of First Security to be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee 37402, on Thursday, October 27, 2005, at 3:00 p.m. local time, and at any adjournments or postponements thereof. Unless otherwise clearly specified, the term “First Security” includes First Security Group, Inc. and its subsidiary, FSGBank, National Association, and any report of the number of shares outstanding or issued reflects adjustments due to the 12-for-10 stock split in the form of a stock dividend effected on December 22, 2004, the 12-for-10 stock split in the form of a stock dividend effected on June 16, 2003 and the 13-for-10 stock split in the form of a stock dividend effected on April 15, 2001.

The Meeting is being held to consider and vote upon the proposals summarized under “Summary of Proposals” below and described in greater detail in this Proxy Statement. First Security’s Board of Directors knows of no other business that will be presented for consideration at the Meeting other than the matters described in this Proxy Statement.

The 2004 Annual Report to Shareholders, including financial statements for the fiscal year ended December 31, 2004, is included with this mailing. These proxy materials are first being mailed to the shareholders of First Security on or about September 26, 2005.

The principal executive offices of First Security are located at 817 Broad Street, Chattanooga, Tennessee 37402, and its telephone number is (423) 266-2000.

Summary of Proposals

The proposals to be considered at the Meeting may be summarized as follows:

Proposal One. To consider and vote upon the election of nine (9) directors to serve until the 2006 Annual Meeting of Shareholders and until their successors have been elected and qualified;

Proposal Two. To consider and vote upon a proposed amendment to First Security’s Articles of Incorporation which would increase the number of authorized shares of common stock from 20 million to 50 million.

Proposal Three. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2005.

Quorum and Voting Requirements

Holders of record of common stock as of the Record Date defined below are entitled to one vote per share on each matter to be considered and voted upon at the Meeting. To hold a vote on any proposal, a quorum must be present with respect to that proposal. A quorum is a majority of the total votes entitled to be cast by the holders of the outstanding shares of common stock. In determining whether a quorum exists at the Meeting for purposes of all matters to be voted on, all votes “for” or “against,” as well as all abstentions and broker

1

non-votes, will be counted as shares present. A “broker non-vote” occurs when a nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

Proposal One, relating to the election of the nominees for directors, requires approval by a plurality of the votes cast by the holders of shares of common stock entitled to vote with respect to that proposal. This means that those nine (9) nominees for directors receiving the greatest number of votes will be elected directors. Proposals Two and Three, and any other proposal that is properly brought before the Meeting, require the affirmative vote of a majority of the votes cast at the Meeting in person or by proxy and entitled to vote with respect to the proposals.

Neither abstentions nor broker non-votes will be counted as votes cast for purposes of determining whether any proposal has received sufficient votes for approval, although abstentions and broker non-votes will be counted for purposes of determining whether a quorum exists. This means that abstentions and broker non-votes will not affect the outcome of the vote with respect to any proposal.

Record Date, Solicitation and Revocability of Proxies

The Board of Directors of First Security has fixed the close of business on September 16, 2005 as the record date (“Record Date”) for determining the shareholders entitled to notice of, and to vote at, the Meeting. Accordingly, only holders of record of shares of common stock on the Record Date will be entitled to notice of, and to vote at, the Meeting. At the close of business on the Record Date, there were 17,600,960 shares of common stock issued and outstanding, which were held by approximately 3,032 shareholders, which included 1,518 registered holders and 1,514 beneficial holders.

Shares of common stock represented by properly executed Proxies, if such Proxies are received in time and not revoked, will be voted at the Meeting in accordance with the instructions indicated in such Proxies.If no instructions are indicated, such shares of common stock will be voted “FOR” all proposals and in the discretion of the proxy holder as to any other matter that may properly come before the Meeting. If necessary, the proxy holder may vote in favor of a proposal to adjourn the Meeting in order to permit further solicitation of proxies in the event there are not sufficient votes to approve the foregoing proposals at the time of the Meeting.

A shareholder who has given a Proxy may revoke it at any time prior to its exercise at the Meeting by: (i) giving written notice of revocation to the Secretary of First Security, (ii) properly submitting to First Security a duly executed Proxy bearing a later date, or (iii) appearing in person at the Meeting and voting in person. All written notices of revocation or other communications with respect to Proxies should be addressed as follows: First Security Group, Inc., 817 Broad Street, Chattanooga, Tennessee 37402, Attention: William L. (Chip) Lusk, Jr., Secretary of the Board.

2

PROPOSAL ONE:

ELECTION OF DIRECTORS

General

The Meeting is being held to, among other things, elect nine (9) directors of First Security to serve a one-year term of office expiring at the 2006 Annual Meeting of Shareholders and until their successors have been elected and qualified. Although all nominees are expected to serve if elected, if any nominee is unable to serve, the persons voting the Proxies will vote for the remaining nominees and for such replacements, if any, as may be nominated by First Security’s Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees specified herein (9 persons). Cumulative voting is not permitted.

The following table shows for each nominee: (1) his or her name; (2) his or her age at September 16, 2005; (3) how long he or she has been a director of First Security; (4) his or her position(s) with First Security, other than as a director; and (5) his or her principal occupation and business experience for the past five years. Except as otherwise indicated, each director has been engaged in his or her present principal occupation for more than five years. Each of the director nominees listed below is also a director of FSGBank.

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

| Rodger B. Holley (58) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank; and Chairman, Chief Executive Officer and President of Pioneer Bancshares, Inc. (Chattanooga, TN) from 1992 to November 1998 including service to First American National Bank (Chattanooga, TN) following its acquisition of Pioneer Bancshares. |

| | |

| Lloyd L. Montgomery, III (52) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002; Knoxville City President and East Region President for the Retail Banking Group of First American National Bank (Knoxville, TN) from 1996 to November 1999; and assisted with the First American/AmSouth merger (Knoxville, TN) from November 1999 to January 2000. |

| | |

| J.C. Harold Anders (62) | | 2003 | | Owner of Anders Rental (real estate rentals, Dalton, GA) since 1978; Co-Owner of Central Drive In (fast food company, Dalton, GA) since 1988; Co-Owner of Poag & Anders, Inc. (real estate development, Dalton, GA) since 1992; Co-Owner of Clayton & Anders, Inc. (real estate development, Dalton, GA) since 1992; and Director of Premier National Bank of Dalton (Dalton, GA) from 1996 until its acquisition by First Security in March 2003 (Chairman from 2001 to 2003). |

| | |

| Carol H. Jackson (65) | | 2002 | | Vice President of Baker Street Rentals (property management, Knoxville, TN) since 1991. |

3

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

| Ralph L. Kendall (77) | | 1999 | | Retired as a partner with Ernst & Young LLP (international CPA firm, Chattanooga, TN) in 1986. |

| | |

| William B. Kilbride (54) | | 2003 | | President of Mohawk Home, a division of Mohawk Industries (rug and textile manufacturer, Calhoun, GA), since 1992. |

| | |

| D. Ray Marler (61) | | 1999 | | President of Ray Marler Construction Company (general construction, Chattanooga, TN) since 1965; President and Chief Manager of Environmental Materials, LLC (environmental services, Chattanooga, TN) since 1998; President of Environmental Holdings, Inc. (environmental services, Chattanooga, TN) since 1998; President of Environmental Materials, Inc. (environmental services, Chattanooga, TN) since 1998; Chief Manager of MWW, LLC (land management, Chattanooga, TN) since 2002; and Chief Manager of American Technologies, LLC (environmental services, Chattanooga, TN) from 1999 to 2001. |

| | |

| Hugh J. Moser, III (58) | | 2003 | | President of Tennessee Valley Resources, Inc. (agricultural distributor, Jefferson City, TN) since 1983. |

| | |

| H. Patrick Wood (77) | | 2002 | | Chairman of Lawler-Wood Group (regional and international real estate services, Knoxville, TN) since 1975. |

FIRST SECURITY’S BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” THE ELECTION OF ALL NINE (9) NOMINEES LISTED ABOVE.

Information About the Board of Directors and Its Committees

The Board of Directors of First Security held eleven meetings during 2004, which includes two meetings by unanimous written consent action. All incumbent directors attended at least 75% of the total number of meetings of the Board of Directors and the Board committees on which they served. Although First Security does not have a formal policy regarding its board members’ attendance at the Annual Meeting of Shareholders, board members are expected to attend the annual meeting. All of First Security’s directors attended the 2004 annual meeting.

On April 5, 2005, Clayton Causby resigned from our Board of Directors, citing a belief that he would not be able to devote the time necessary to continue to properly serve as a Board Member. Mr. Causby has agreed to serve as a consultant to us and as Chairperson of the Dalton Whifield Bank Advisory Board. Mr. Causby has not expressed any disagreement respect to our operations, policies or procedures.

First Security’s Board of Directors has eight standing committees: the Compensation Committee, the Audit/Governance Committee, the Executive Committee, the Asset/Liability Committee, the Property Committee, the Loan Committee, the Nominating Committee and the Trust Committee. Each committee also serves the same functions for FSGBank.

Our Compensation Committee is comprised of four independent directors, J.C. Harold Anders (Chairman), Ralph L. Kendall, D. Ray Marler and H. Patrick Wood. This committee has the authority to determine the compensation of our executive officers and employees and administers our benefit and incentive plans. This committee also has the power to interpret the provisions of our Long-Term Incentive Plans. Our Compensation Committee held ten meetings during 2004, which includes two meetings by unanimous written consent action.

Our Audit/Corporate Governance Committee is comprised of Ralph L. Kendall (Chairman), Carol H. Jackson and William B. Kilbride, all of whom are “independent directors” as defined by the National Association

4

of Securities Dealers, Inc. The Board of Directors has determined that Mr. Kendall and Mr. Kilbride meet the criteria specified under applicable SEC regulations for an “audit committee financial expert.” In addition, the Board believes that all of the Audit/Corporate Governance Committee members have the financial knowledge, business experience and independent judgment necessary for service on the Audit/Corporate Governance Committee. The Audit/Corporate Governance Committee has the responsibility of reviewing financial statements, evaluating internal accounting controls, reviewing reports of regulatory authorities, overseeing the audit of our fiduciary activities and determining that all audits and examinations required by law are performed. Our Audit/Corporate Governance Committee held seven meetings during 2004.

The Board of Directors has adopted a written charter for the Audit/Corporate Governance Committee, a copy of which is included asAppendix A to this proxy statement. The Board of Directors annually reviews and approves changes to the Audit/Corporate Governance Committee charter. Under the charter, the committee has the authority and is empowered to:

| | • | | appoint, approve compensation and oversee the work of the independent auditor; |

| | • | | resolve disagreements between management and the auditors regarding financial reporting; |

| | • | | pre-approve all auditing and appropriate non-auditing services performed by the independent auditor; |

| | • | | retain independent counsel and accountants to assist the committee; |

| | • | | seek information it requires from employees or external parties; and |

| | • | | meet with our officers, independent auditors or outside counsel as necessary. |

Our Nominating Committee is comprised of D. Ray Marler (Chairman), J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall and William B. Kilbride, all of whom are “independent directors” as defined by the National Association of Securities Dealers, Inc. The Board of Directors has adopted a written charter for the Nominating Committee, a copy of which is included asAppendix B to this proxy statement.

The Nominating Committee has not adopted a formal policy or process for identifying or evaluating director nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, our customers and shareholders and professionals in the financial services and other industries. Similarly, the committee does not prescribe any specific qualifications or skills that a nominee must possess, although it considers the potential nominee’s business experience; knowledge of us and the financial services industry; experience in serving as one of our directors or as a director of another financial institution or public company generally; wisdom, integrity and analytical ability; familiarity with and participation in the communities served by us; commitment to and availability for service as a director; and any other factors the committee deems relevant. Our Nominating Committee held one meeting during 2004.

Code of Business Conduct and Ethics. We have adopted a Code of Business Conduct and Ethics, referred to as the Code, that applies to all of our directors, officers and employees. We believe the Code is reasonably designed to deter wrongdoing and to promote honest and ethical conduct, including: the ethical handling of conflicts of interest; full, fair and accurate disclosure in filings and other public communications made by us; compliance with applicable laws; prompt internal reporting of violations of the Code; and accountability for adherence to the Code.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee is now or was during the last fiscal year an officer or employee of First Security or FSGBank. During 2004, none of our executive officers served as a director or member of the compensation committee (or group performing equivalent functions) of any other entity for which any of our Compensation Committee members served as an executive officer.

5

Executive Officers

Executive officers are appointed annually at the meetings of the respective Boards of Directors of First Security and FSGBank following the annual meetings of shareholders, to serve until the next annual meeting and until their successors are chosen and qualified. The following table shows for each executive officer: (1) his name; (2) his age at September 16, 2005; (3) how long he has been an officer of First Security; (4) his position(s) with First Security; and (5) his principal occupation and business experience for the past five years, if he has been employed by First Security for less than five years.

| | | | |

Name (Age)

| | Officer

Since

| | Position with First Security and Business Experience

|

| Rodger B. Holley (58) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank; and Chairman, Chief Executive Officer and President of Pioneer Bancshares, Inc. (Chattanooga, TN) from 1992 to November 1998 including service to First American National Bank (Chattanooga, TN) following its acquisition of Pioneer Bancshares. |

| | |

| Lloyd L. Montgomery, III (52) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002; Knoxville City President and East Region President for the Retail Banking Group of First American National Bank (Knoxville, TN) from 1996 to November 1999; and assisted with the First American/AmSouth merger (Knoxville, TN) from November 1999 to January 2000. |

| | |

| William L. Lusk, Jr. (37) | | 1999 | | Secretary of the Board, Chief Financial Officer and Executive Vice President of First Security since April 1999; Secretary of the Board, Chief Financial Officer and Executive Vice President of FSGBank since June 2000; Secretary, Chief Financial Officer and Executive Vice President of Dalton Whitfield Bank (Dalton, GA) from September 1999 to September 2003 when it merged with FSGBank; Chief Financial Officer and Executive Vice President of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; Director of Strategic Planning and Vice President of Pioneer Bancshares, Inc. (Chattanooga, TN) from December 1997 to March 1999 including service to First American National Bank (Chattanooga, TN) following its acquisition of Premier Bancshares; and Controller and Vice President of Pioneer Bancshares (Chattanooga, TN) from 1993 to December 1997. |

6

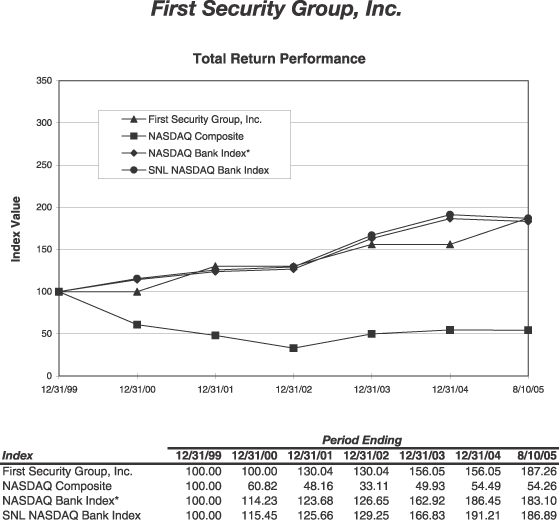

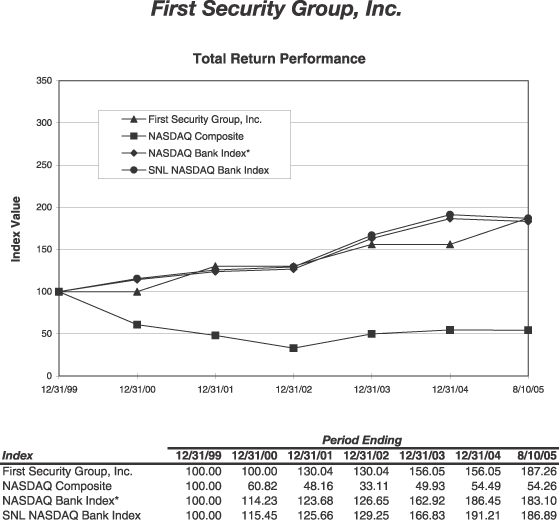

Performance Graph

The following Performance Graph compares the yearly percentage change in the cumulative total shareholder return on First Security’s common stock to the cumulative total return on the Nasdaq Stock Market (U.S.) Index and the Nasdaq Bank Stock Index since December 31, 1999. The Performance Graph assumes that $100 was invested on December 31, 1999, with reinvestment of dividends, where applicable. We have also included the relative values as of August 10, 2005, the date of our initial public offering and NASDAQ listing.

The disclosure in this year’s graph reflects a change made by the Company in the choice of the NASDAQ comparison index from the NASDAQ Bank Index provided by the Center for Research in Security Prices to the SNL NASDAQ Bank Index provided by SNL Financial LC. The SNL NASDAQ Bank Index is based on the same securities as the NASDAQ Bank Index but excludes savings banks. This change reflects what the Company believes is a more representative comparison for the Company’s industry. As required by regulations of the Securities and Exchange Commission applicable to such changes, the stock performance graph below contains both the NASDAQ Bank Index and the SNL NASDAQ Bank Index.

* Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago 2005. Used with permission. All rights reserved. crsp.com

Source: SNL Financial LC, Charlottesville, VA (434) 977-1600© 2005.

7

EXECUTIVE COMPENSATION AND OTHER BENEFITS

Under rules established by the SEC, First Security is required to provide information regarding the compensation and benefits provided to its Chief Executive Officer and each of its other executive officers whose total annual salary and bonus is at least $100,000 (collectively, the “Named Executive Officers”) and who performs a policy making function for First Security. The disclosure requirements for the Named Executive Officers include the use of tables and a report explaining the rationale and considerations that led to fundamental executive compensation decisions affecting these individuals.

The following table sets forth various elements of compensation for our Named Executive Officers for each of the last three calendar years:

Summary Compensation Table

| | | | | | | | | | | | | |

| | | Annual Compensation(1)

| | Long-Term

Compensation

| | All Other

Compensation

($)(3)

|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options/SARs

(#)(2)

| |

| | | | | |

Rodger B. Holley Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 291,667

265,417

200,208 | | $

$

$ | 250

250

50,250 | | 18,000

48,000

0 | | $

$

$ | 15,864

12,000

6,727 |

| | | | | |

Lloyd L. Montgomery, III Chief Operating Officer | | 2004

2003

2002 | | $

$

$ | 192,708

179,167

130,625 | | $

$

$ | 250

250

50,250 | | 9,000

21,000

69,600 | | $

$

$ | 11,507

10,765

3,713 |

| | | | | |

William L. Lusk, Jr. Chief Financial Officer | | 2004

2003

2002 | | $

$

$ | 161,458

150,625

129,167 | | $

$

$ | 5,300

250

25,250 | | 9,000

18,000

0 | | $

$

$ | 9,641

9,053

5,456 |

| (1) | We have omitted information on “perks” and other personal benefits with an aggregate value below the minimum amount required for disclosure under the Securities and Exchange Commission Regulations. |

| (2) | Issued pursuant to our 1999 Long-Term Incentive Plan. |

| (3) | Consists of our contributions to the indicated person’s 401(k) plan for the year indicated. |

Grants of Options/SARs in 2004. In 2004, we issued incentive stock options under the 1999 Long-Term Incentive Plan and the 2002 Long-Term Incentive Plan to various key executive officers and employees. No stock appreciation rights (SARs) were granted in 2004. The following table sets forth information referencing the award of such incentive stock options to our named executive officers:

| | | | | | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of Total

Options Granted

to Employees During 2004

| | | Exercise

Price ($)

| | Expiration Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term

|

Name

| | | | | | 5%

| | 10%

|

Rodger B. Holley | | 18,000 | | 11.05 | % | | $ | 8.33 | | 1/28/2014 | | $ | 94,296 | | $ | 238,966 |

Lloyd L. Montgomery, III | | 9,000 | | 5.52 | % | | $ | 8.33 | | 1/28/2014 | | $ | 47,148 | | $ | 119,483 |

William L. Lusk, Jr. | | 9,000 | | 5.52 | % | | $ | 8.33 | | 1/28/2014 | | $ | 47,148 | | $ | 119,483 |

Aggregated Option/SAR Exercises in 2004 and 2004 Year-End Option/SAR Values. No stock options were exercised by the named executive officers during 2004. Additionally, there were no stock appreciation rights outstanding during 2004.

8

The following table shows the number of shares of our common stock covered by both exercisable and non-exercisable options held by the our named executive officers as of December 31, 2004. Also reported are the values for “in-the-money” options, which represent the positive spread between the exercise price of any such existing options and the year-end price ($8.33 per share) of our common stock.

| | | | |

| | | Number of

Securities Underlying

Unexercised Options

At December 31, 2004 (#)

| | Value of Unexercised

In-the-Money Options

At December 31, 2004 ($)

|

Name

| | Exercisable (E)/

Unexercisable (U)

| | Exercisable (E)/

Unexercisable (U)

|

Rodger B. Holley | | 135,072 (E) / 56,592 (U) | | $373,219 (E) / $53,519 (U) |

Lloyd L. Montgomery, III | | 63,439 (E) / 54,281 (U) | | $88,066 (E) / $62,835 (U) |

William L. Lusk, Jr. | | 67,032 (E) / 23,472 (U) | | $188,901 (E) / $20,062 (U) |

Director Compensation

Under our director compensation policy, we pay our non-employee directors for their service as our directors. Employee directors are not separately compensated for their service as our directors because their current compensation levels cover all of their expected duties including those related to the Board of Directors. On or about the date of the annual shareholders meeting, each non-employee director is paid a $12,000 retainer for his or her next year’s service as a director. The retainer is prorated for new directors based upon the length of time between their appointment and the date of the next annual shareholders’ meeting. In addition, each non-employee director is paid $500 for each board and committee meeting he or she attends. A director who participates in a board or committee meeting via teleconference receives 50% of the normal meeting fee. Each non-employee Chairperson of the Executive, Audit/Corporate Governance, Compensation and Nominating Committees receives a $5,000 retainer. Each non-employee Chairperson of the Property, Loan, Asset/Liability and Trust Committees receives a $3,000 retainer. Non-employee directors are also reimbursed for their expenses incurred in the course of fulfilling their duties as our directors.

Under our director compensation policy, we also grant an annual option to purchase shares of our common stock to our non-employee directors at the end of the directors’ year of service. In the event a director joins the board during the year, the number of shares subject to the option is prorated based on the number of months actually served by the director. In 2004, each non-employee director received an option to purchase 3,600 shares under this policy. The options are subject to the terms of our 2002 Long-Term Incentive Plan. In 2005, we anticipate granting each non-employee director an option to purchase 5,000 shares under the policy.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our common stock as of September 16, 2005 by (1) each of our current directors; (2) each of our named executive officers and (3) all of our present executive officers and directors as a group. As of September 16, 2005, we did not know of any person who beneficially owned more than 5% of the presently outstanding shares of common stock. Unless otherwise indicated, the address for each person included in the table is 817 Broad Street, Chattanooga, Tennessee 37402.

Information relating to beneficial ownership of our common stock is based upon “beneficial ownership” concepts described in the rules issued under the Securities Exchange Act of 1934, as amended. Under these rules a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of the security, or “investment power,” which includes the power to dispose or to direct the disposition of the security. Under the rules, more than one person may be deemed to be a beneficial owner of the same securities. A person is also deemed to be a beneficial owner of any security as to which that person has the right to acquire beneficial ownership within sixty (60) days from

9

September 16, 2005. Unless otherwise indicated under “Nature of Beneficial Ownership,” each person is the record owner of and has sole voting and investment power with respect to his or her shares.

| | | | | | |

Name of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | | Percent of Shares

Beneficially Owned

After Offering(1)

| |

Directors: | | | | | | |

Rodger B. Holley | | 272,327 | (2) | | 1.53 | % |

J.C. Harold Anders | | 104,047 | (3) | | * | |

Carol H. Jackson | | 59,291 | (4) | | * | |

Ralph L. Kendall | | 39,764 | (5) | | * | |

William B. Kilbride | | 15,564 | (6) | | * | |

D. Ray Marler | | 152,064 | (7) | | * | |

Lloyd L. Montgomery, III | | 139,122 | (8) | | * | |

Hugh. J. Moser, III | | 116,028 | (9) | | * | |

H. Patrick Wood | | 316,044 | (10) | | 1.80 | % |

| | |

Executive Officers, who are not also a Director: | | | | | | |

William L. Lusk, Jr. | | 92,804 | (11) | | * | |

| | |

All Current Directors and Executive Officers, as a Group (10 persons): | | 1,307,055 | | | 7.28 | % |

| * | Less than 1% of outstanding shares. |

| (1) | The percentage of our common stock beneficially owned was calculated based on 17,600,960 shares of common stock issued and outstanding as of September 16, 2005. The percentage assumes the exercise by the shareholder or group named in each row of all options for the purchase of our common stock held by such shareholder or group and exercisable within 60 days of September 16, 2005. |

| (2) | Includes 65,196 shares owned by an IRA for the benefit of Mr. Holley and 312 shares owned by Mr. Holley’s child; also includes 160,020 shares that Mr. Holley has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (3) | Includes 3,564 shares that Mr. Anders has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (4) | Includes 7,439 shares owned by Ms. Jackson’s spouse and 5,088 shares owned by an IRA for the benefit of Ms. Jackson; also includes 3,564 shares that Ms. Jackson has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (5) | Includes 3,600 shares owned by Mr. Kendall’s spouse; also includes 3,564 shares that Mr. Kendall has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (6) | Includes 3,564 shares that Mr. Kilbride has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (7) | Includes 3,564 shares that Mr. Marler has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (8) | Includes 103,122 shares that Mr. Montgomery has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (9) | Includes 37,362 shares owned by a profit sharing plan for the benefit of Mr. Moser and 3,600 shares owned by Mr. Moser’s spouse; also includes 3,564 shares that Mr. Moser has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (10) | Includes 43,200 shares owned by Mr. Wood’s spouse; also includes 3,564 shares that Mr. Wood has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

| (11) | Includes 8,997 shares owned by an IRA for the benefit for Mr. Lusk and 1,396 shares owned by Mr. Lusk’s wife and children; also includes 77,130 shares that Mr. Lusk has the right to acquire by exercising options that are exercisable within 60 days after September 16, 2005. |

10

Employment Agreements

We regularly evaluate the total compensation paid to our senior management to link their compensation to our operating performance in the short and long-term. To that end, we are analyzing implementing bonus structures, supplemental retirement plans and equity-based and other long-term incentive programs that are consistent with those found in our industry. Our current employment agreements with our senior management are described below.

Rodger B. Holley. We entered into a three-year employment agreement with Rodger B. Holley on May 16, 2003 regarding Mr. Holley’s employment as our Chairman, Chief Executive Officer and President. Under the terms of the agreement, Mr. Holley received an initial base salary of $280,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 15, 2004, the Compensation Committee recommended that Mr. Holley’s salary be increased to $315,000 per year. We also provide Mr. Holley with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. At the end of each year of the agreement, it renews for an additional year, unless either of the parties to the agreement gives notice of his or its intent not to renew the agreement at least 90 days prior to the renewal date. If we terminate Mr. Holley’s employment without cause or Mr. Holley terminates his employment for good reason, Mr. Holley will be entitled to a Lump Sum Payment, a Pro Rata Incentive Payment and continuation of medical benefits for twelve months. The Lump Sum Payment is an amount equal to the sum of his current base salary plus the greater of (1) the highest of his last three years’ incentive payments or (2) the target annual incentive set forth in our incentive compensation plan. The Pro Rata Incentive Payment is an amount equal to the pro rata portion of the target annual incentive set forth in our incentive compensation plan based on the number of days that have passed in the employment year before Mr. Holley’s termination. Upon a change of control of First Security, Mr. Holley will be entitled to three times the Lump Sum Payment, payment of a Pro Rata Incentive Payment, and continuation of medical benefits for twelve months. If we cannot continue the medical benefits to which Mr. Holley is entitled under the agreement because Mr. Holley is no longer employed by us, we will pay Mr. Holley the amount we would have paid for such benefits over the 12-month period. The agreement also generally provides that he will not compete with us in the banking business nor solicit our customers or employees for a period of 12 months following termination of his employment. The noncompetition and nonsolicitation provisions of the agreement apply if Mr. Holley terminates his employment without cause, for good reason or in connection with a change of control, or if we terminate his employment with or without cause.

Lloyd L. Montgomery, III. We entered into a three-year employment agreement with Lloyd L. Montgomery, III on May 16, 2003 regarding Mr. Montgomery’s employment as our Chief Operating Officer and Executive Vice President. Under the terms of the agreement, Mr. Montgomery received an initial base salary of $185,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 15, 2004, the Compensation Committee recommended that Mr. Montgomery’s salary be increased to $206,000 per year. We also provide Mr. Montgomery with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. The other terms of Mr. Montgomery’s employment agreement are the same as those in Mr. Holley’s agreement.

William L. Lusk, Jr. We entered into a three-year employment agreement with William L. Lusk, Jr. on May 16, 2003 regarding Mr. Lusk’s employment as our Secretary, Chief Financial Officer and Executive Vice President. Under the terms of the agreement, Mr. Lusk received an initial base salary of $155,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 15, 2004, the Compensation Committee recommended that Mr. Lusk’s salary be increased to $175,000 per year. We also provide Mr. Lusk with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. The other terms of Mr. Lusk’s employment agreement are the same as those in Mr. Holley’s agreement.

11

Compensation Committee Report

The following report reflects First Security’s compensation philosophy, as endorsed by the Board of Directors and the Compensation Committee, and resulting actions taken by First Security for the reporting periods shown in the various compensation tables supporting the report. The Compensation Committee either approves or recommends to the Board of Directors payment amounts and award levels for executive officers of First Security and FSGBank.

Compensation Policy

The policies that govern the Compensation Committee’s executive compensation decisions are designed to align changes in total compensation with changes in the value created for First Security’s shareholders. The Compensation Committee believes that compensation of executive officers and others should be directly linked to First Security’s operating performance and that achievement of performance objectives over time is the primary determinant of share price.

The underlying objectives of the Compensation Committee’s compensation strategy are to establish incentives for certain executives and others to achieve and maintain short-term and long-term operating performance goals for First Security, to link executive and shareholder interests through equity-based plans, and to provide a compensation package that recognizes individual contributions as well as overall business results. At First Security, performance-based executive officer compensation includes base salary and long-term stock incentives. To further these objectives, the Compensation Committee engaged Ernst & Young LLP (Global Employment Solutions/Human Resource Services Division in Atlanta, Georgia), an independent consultant with expertise in executive compensation, to assist in implementing its compensation strategy.

Base Salary and Increases

In establishing executive officer salaries and increases, the Compensation Committee considers individual annual performance and the relationship of total compensation to the defined salary market. The decision to increase base pay is recommended by the Chief Executive Officer and approved by the Compensation Committee. Information regarding salaries paid in the market is obtained through formal salary surveys and other means, and is used to evaluate competitiveness with First Security’s competitors. First Security’s general philosophy is to provide base pay that is competitive with the market and to reward individual performance while positioning salaries so that they are consistent with First Security performance.

Long-Term Incentives

Long-term incentive awards have been made under the Second Amended and Restated 1999 Long-Term Incentive Plan and the 2002 Long-Term Incentive Plan, as amended. The purpose of both plans is to promote First Security’s success and enhance its value by linking the personal interests of employees, officers, and directors to those of First Security’s shareholders and by providing such persons with an incentive for outstanding performance.

The 1999 Long-Term Incentive Plan authorizes the granting of awards to selected employees and officers of First Security or its subsidiaries in the following forms: (1) options to purchase shares of common stock, which may be incentive stock options or non-qualified stock options and (2) restricted stock. The 2002 Long-Term Incentive Plan authorizes the granting of awards to selected employees, officers, consultants and directors of First Security or its subsidiaries in the following forms: (1) options to purchase shares of common stock, which may be incentive stock options or non-qualified stock options, (2) restricted stock and (3) stock appreciation rights.

Both plans are administered by the Compensation Committee. The committee has the power, authority, and discretion, among other things, to: (1) designate participants; (2) determine the type or types of awards to be

12

granted to each participant and the terms and conditions thereof; (3) establish, adopt, or revise any rules and regulations as it may deem necessary or advisable to administer both plans; and (4) make all other decisions and determinations that may be required under both plans or that the Compensation Committee deems necessary or advisable.

The following table sets forth information regarding our equity compensation plans under which shares of our common stock are authorized for issuance. The only equity compensation plans maintained by us are the First Security Group, Inc. Second Amended and Restated 1999 Long-Term Incentive Plan and the First Security Group, Inc. 2002 Long-Term Incentive Plan, as amended. All data is presented as of June 30, 2005.

| | | | | | | |

| | | Number of securities to be

issued upon exercise of

outstanding options

| | Weighted-average

exercise price of outstanding options

| | Number of shares

remaining available for

future issuance under

the Plans (excludes outstanding options)

|

Equity compensation plans approved by security holders | | 1,007,194 | | $ | 6.67 | | 530,649 |

| | | |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | | |

Total | | 1,007,194 | | $ | 6.67 | | 530,649 |

Deduction Limit

Pursuant to Section 162(m) of the Internal Revenue Code (the “Code”), First Security may not deduct compensation in excess of $1 million paid to the Chief Executive Officer or the four next most highly compensated executive officers of First Security. The 1999 Long-Term Incentive Plan and the 2002 Long-Term Incentive Plan were designed to comply with Code Section 162(m) so that the grant of options under both plans will be excluded from the calculation of annual compensation for purposes of Code Section 162(m) and will be fully deductible by us, although other awards under the plans that are not performance-based awards may not so qualify.

Chief Executive Officer Pay

Each year the Compensation Committee formally reviews the compensation paid to the Chief Executive Officer of the Company. Changes in base salary and the awarding of cash and stock incentives are based on overall financial performance and profitability related to objectives stated in the Company’s strategic performance plan and the initiatives taken to direct the Company. After careful consideration, the Compensation Committee recommended that the salary for Mr. Rodger B. Holley, President and Chief Executive Officer of the Company, be increased to $315,000.

Summary

The Compensation Committee believes that First Security’s compensation program is reasonable and competitive with compensation paid by other financial institutions of similar size. The program is designed to reward managers for strong personal, company, and share-value performance. The Compensation Committee monitors the various guidelines that make up the program and reserves the right to adjust them as necessary to continue to meet First Security and shareholder objectives.

| | |

| Compensation Committee: | | J.C. Harold Anders, Chairman |

| | | Ralph L. Kendall |

| | | D. Ray Marler |

| | | H. Patrick Wood |

| |

| | | September 26, 2005 |

13

Audit/Corporate Governance Committee Report

The Audit/Corporate Governance Committee monitors First Security’s financial reporting process on behalf of the Board of Directors. This report reviews the actions taken by the Audit/Corporate Governance Committee with regard to First Security’s financial reporting process during 2004 and particularly with regard to First Security’s audited consolidated financial statements as of December 31, 2004 and 2003 and for the three years ended December 31, 2004.

First Security’s management has the primary responsibility for First Security’s financial statements and reporting process, including the systems of internal controls. First Security’s independent auditors are responsible for performing an independent audit of First Security’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and issuing a report on First Security’s consolidated financial statements. The Audit/Corporate Governance Committee’s responsibility is to monitor the integrity of First Security’s financial reporting process and system of internal controls and to monitor the independence and performance of First Security’s independent auditors and internal auditors.

The Audit/Corporate Governance Committee believes that it has taken the actions it deems necessary or appropriate to fulfill its oversight responsibilities under the Audit/Corporate Governance Committee’s charter. To carry out its responsibilities, the Audit/Corporate Governance Committee met seven times during 2004.

The Audit/Corporate Governance Committee reviewed and approved all of the related party transactions. In addition, the Audit/Corporate Governance Committee determined that the related party transactions were on substantially the same terms as those prevailing at the time for comparable transactions with unrelated parties, and were not expected to present unfavorable features to First Security.

In fulfilling its oversight responsibilities, the Audit/Corporate Governance Committee reviewed with management the audited financial statements included in First Security’s annual report on Form 10-K for 2004, including a discussion of the quality (rather than just the acceptability) of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit/Corporate Governance Committee also reviewed with First Security’s independent auditors, Joseph Decosimo and Company, PLLC, their judgments as to the quality (rather than just the acceptability) of the Company’s accounting principles, and such other matters as are required to be discussed with the Audit/Corporate Governance Committee under Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. In addition, the Audit/Corporate Governance Committee discussed with Joseph Decosimo and Company, PLLC its independence from management and First Security, including the written disclosures and other matters required of Joseph Decosimo and Company, PLLC by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. The Audit/Corporate Governance Committee also considered whether the provision of services during 2004 by Joseph Decosimo and Company, PLLC that were unrelated to its audit of the financial statements referred to above, and to their reviews of First Security’s interim financial statements during 2004, is compatible with maintaining Joseph Decosimo and Company, PLLC’s independence.

Additionally, the Audit/Corporate Governance Committee discussed with First Security’s internal and independent auditors the overall scope and plan for their respective audits. The Audit/Corporate Governance Committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of First Security’s internal controls, and the overall quality of First Security’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit/Corporate Governance Committee recommended to the Board of Directors that the audited financial statements be included in First Security’s

14

annual report on Form 10-K for 2004 for filing with the Securities and Exchange Commission. The Audit/Corporate Governance Committee believes that, at this time, nothing has come to its attention that impairs Joseph Decosimo and Company, PLLC’s independence or their ability to provide quality professional audit services, and therefore recommends to the Board that First Security retain Joseph Decosimo and Company, PLLC as First Security’s independent auditors for 2005.

| | |

| Audit/Corporate Governance Committee: | | Ralph L. Kendall, Chairman |

| | | Carol H. Jackson |

| | | William B. Kilbride |

| |

| | | September 26, 2005 |

Certain Transactions and Business Relationships

Certain of our directors, officers and principal shareholders and their associates have had banking and business transactions with us in the ordinary course of business since the beginning of the last fiscal year. In the case of all such related party transactions, each transaction was either approved by the Audit/Corporate Governance Committee of the Board of Directors or by the Board of Directors. In addition, each transaction was on substantially the same terms, including price or interest rate and collateral, as those prevailing at the time for comparable transactions with unrelated parties, and were not expected to involve more than the normal risk of collectibility or present other unfavorable features to us. As of June 30, 2005, the aggregate amount of credit we extended to directors, executive officers and principal shareholders was $296 thousand, or less than 1% of our equity. We expect we will continue to engage in similar banking and business transactions in the ordinary course of business with our directors, executive officers, principal shareholders and their associates in the future.

15

PROPOSAL TWO:

APPROVAL TO INCREASE AUTHORIZED NUMBER OF SHARES

General

Our Articles of Incorporation currently authorize the issuance of up to 20,000,000 shares of common stock, $0.01 par value. As of the Record Date, 17,600,960 shares were issued and outstanding, 1,537,843 shares were subject to currently outstanding stock options or were reserved in connection with future options or awards under the First Security Group, Inc. Second Amended and Restated 1999 Long-Term Incentive Plan or the First Security Group, Inc. 2002 Long-Term Incentive Plan, as amended. After giving effect to such reserved shares, approximately 861,197 shares were available for issuance on the Record Date. Stock dividends completed in 2001, 2003 and 2004 were responsible for the issuance of 4,814,563 shares.

Our Board of Directors is proposing an amendment to our Articles of Incorporation to increase the number of authorized shares of common stock of First Security from 20 million to 50 million. If the shareholders approve this proposal, Section 2.1 of Article II of First Security’s Articles of Incorporation will be amended to read as follows:

SECTION 2.1. The Corporation shall have the authority to issue not more than 50,000,000 shares of common voting stock (“Common Stock” or “Shares”), par value $0.01 per share.

At this time, approximately 88% of our authorized shares is outstanding. Assuming shareholder approval of the amendment, approximately 35% of our authorized shares will be outstanding.

Purpose and Effect of the Proposed Amendment

Our Board of Directors believes that an increase in the number of shares of authorized stock as contemplated by the amendment is in the best short and long-term interest of First Security and our shareholders. The Board believes that the current number of authorized shares does not give First Security flexibility to issue stock for acquisitions or for general corporate purposes to the degree that the Company had previously. In particular, if the Board determines that it would be appropriate to effect a significant acquisition through the exchange of common stock, conduct a stock offering or declare a dividend or split, the current number of unissued authorized shares might not be enough to complete such transaction. Although we cannot guarantee that any future acquisitions, stock offerings, dividends or splits will occur, the Board believes that the proposed increase in the number of authorized shares will provide First Security with the flexibility necessary to maintain a reasonable stock price through future stock dividends or splits, or to issue shares in connection with an acquisition or other corporate purpose, without incurring the expense of convening a special shareholders’ meeting or the delay of waiting until the next annual meeting.

If this proposal is approved, all authorized but unissued shares of common stock will be available for issuance from time to time for any proper purpose approved by the Board, including issuances in connection with stock-based benefit plans, future stock splits or dividends and issuances to raise capital or effect acquisitions. Neither First Security nor the Board currently has any arrangements, agreements or understandings with respect to the issuance or use of the additional shares of authorized common stock sought to be approved (other than issuances permitted or required under the First Security Group, Inc. Second Amended and Restated 1999 Long-Term Incentive Plan or the First Security Group, Inc. 2002 Long-Term Incentive Plan, as amended, or awards made pursuant to those plans). If this proposal is approved, all or any of the shares may be issued without further shareholder action, unless required by law or the rules of the Nasdaq National Market.

The newly authorized shares of common stock will, upon issuance, have all of the rights and privileges of common stock presently authorized. Existing shareholders do not have preemptive or similar rights to subscribe for or purchase any additional shares of common stock that we may issue in the future. Therefore, future

16

issuances of common stock other than issuances on a pro rata basis to all shareholders would reduce each shareholder’s proportionate interest in First Security.

An increase in the authorized number of shares of common stock could have an anti-takeover effect. If we issue additional shares in the future, such an issuance could dilute the voting power of a person seeking control of First Security, thereby making an attempt to acquire control of First Security more difficult or expensive. Neither the Board nor management is currently aware of any attempt, or contemplated attempt, to acquire control of First Security, and we are not presenting this proposal with the intent that it be used as an anti-takeover device.

Vote Required to Approval Proposal

The approval of the amendment to the Articles of Incorporation to increase the number of authorized shares requires approval by the affirmative vote of the holders of shares of common stock representing a majority of the votes cast at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE APPROVAL OF THE AMENDMENT TO INCREASE THE

AUTHORIZED NUMBER OF SHARES

17

PROPOSAL THREE:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has appointed Joseph Decosimo and Company, PLLC, an independent registered public accounting firm, as independent auditors for First Security and FSGBank for the current fiscal year ending December 31, 2005, subject to ratification by the shareholders. Joseph Decosimo and Company, PLLC, has served as the independent auditors for First Security and FSGBank since February 17, 1999. Joseph Decosimo and Company, PLLC, has advised First Security that neither the firm nor any of its principals has any direct or material interest in First Security or FSGBank except as auditors and independent public accountants of First Security and FSGBank. Although shareholder ratification of our independent auditors is not required by our Bylaws or otherwise, we are submitting the selection of Joseph Decosimo and Company, PLLC to our shareholders for ratification to permit shareholders to participate in this important corporate decision.

The following table sets forth fees for professional audit and quarterly review services rendered by Joseph Decosimo and Company, PLLC, for the years ended December 31, 2004 and 2003, as well as fees billed for other services rendered by Joseph Decosimo and Company, PLLC, during those periods. Certain changes have been made to amounts for 2003 to conform to the 2004 presentation.

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 167,500 | | $ | 120,000 |

Audit-Related Fees1 | | | 157,877 | | | 104,575 |

Tax Fees—Preparation and Compliance2 | | | 69,980 | | | 60,965 |

| | |

|

| |

|

|

Sub total | | | 395,357 | | | 285,540 |

| | |

|

| |

|

|

Tax Fees—Other3 | | | 55,025 | | | 30,635 |

All Other Fees4 | | | 20,000 | | | 13,525 |

| | |

|

| |

|

|

Sub total | | | 75,025 | | | 44,160 |

| | |

|

| |

|

|

Total Fees | | $ | 470,382 | | $ | 329,700 |

| | |

|

| |

|

|

| (1) | Audit-related fees consisted of assurance and other services that are related to the performance of the audit or quarterly review of First Security’s financial statements. Such fees include audits and due diligence procedures related to acquisitions, audit of First Security’s benefit plan, and accounting consultation related to the aforementioned items. |

| (2) | Tax Fees—Preparation and Compliance consist of the aggregate fees billed for professional services rendered by Joseph Decosimo and Company, PLLC, for tax return preparation and compliance |

| (3) | Tax Fees—Other consist primarily of tax research and consultation related to acquisitions as well as tax planning and other tax advice. |

| (4) | Other fees consist primarily of fees billed for consultation with management regarding the appropriate accounting treatment of debt and equity financing. |

The Board of Directors of First Security has considered whether the provision of services during 2004 by Joseph Decosimo and Company, PLLC that were unrelated to its audit of First Security’s financial statements or its reviews of First Security’s interim financial statements during 2004 is compatible with maintaining Joseph Decosimo and Company, PLLC’s independence. The services provided by the independent auditors were pre-approved by the Audit Committee to the extent required under applicable law and in accordance with the provisions of the Committee’s charter. The Audit Committee requires pre-approval of all audit and allowable non-audit services.

A representative of Joseph Decosimo and Company, PLLC will be present at the Meeting and will be given the opportunity to make a statement on behalf of the firm if he or she so desires. A representative of Joseph Decosimo and Company, PLLC is also expected to respond to appropriate questions from shareholders.

The appointment of Joseph Decosimo and Company, PLLC as independent auditors for First Security for fiscal year ending December 31, 2005 requires approval by the affirmative vote of the holders of shares of common stock representing a majority of the votes cast at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

APPROVAL OF THE APPOINTMENT OF JOSEPH DECOSIMO AND COMPANY, PLLC AS INDEPENDENT AUDITORS FOR FISCAL YEAR ENDING DECEMBER 31, 2005.

18

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act (“Section 16”) requires the directors and certain officers of First Security, and persons who beneficially own more than 10% of First Security’s common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and any other equity securities of First Security. First Security is required to identify each director, officer or beneficial owner of more than 10% of First Security’s common stock who failed to timely file any such report with the SEC. First Security is not aware that any person beneficially owns more than 10% of First Security’s common stock. To our knowledge, based solely on a review of the copies of these reports furnished to First Security during the fiscal year ended December 31, 2004, each of our outside directors filed one late Form 4 reporting a stock option award. Additionally, Clayton Causby, a former director, filed an additional late Form 4 during 2004 to report an acquisition of stock in 2003.

DIRECTOR NOMINATIONS AND SHAREHOLDER COMMUNICATIONS

Director Nominations

The full Board of Directors of First Security has established the Nominating Committee to (1) identify individuals qualified to become members of the Board, and (2) select, or recommend to the Board, the director nominees for the next annual shareholders meeting. Our Nominating Committee is comprised of D. Ray Marler (Chairman), J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall and William B. Kilbride, all of whom are “independent directors” as defined by the National Association of Securities Dealers, Inc. The Nominating Committee has not adopted a formal policy or process for identifying or evaluating director nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, our customers and shareholders and professionals in the financial services and other industries. Similarly, the committee does not prescribe any specific qualifications or skills that a nominee must possess, although it considers the potential nominee’s business experience; knowledge of us and the financial services industry; experience in serving as one of our directors or as a director of another financial institution or public company generally; wisdom, integrity and analytical ability; familiarity with and participation in the communities served by us; commitment to and availability for service as a director; and any other factors the committee deems relevant.

In accordance with the First Security’s bylaws, a shareholder may nominate persons for election as directors if written notice to the Secretary of First Security of the nomination is received at the principal executive offices of First Security at least 60 days prior to the date of the annual meeting, assuming the meeting will be held the same date as the prior year’s annual meeting, or at least 60 days prior to the date of the annual meeting for that year provided that First Security has publicly announced the annual meeting date at least 75 days in advance. The notice must set forth:

| | (1) | the name, age, business address and residence address of all individuals nominated; |

| | (2) | the principal occupation or employment of all individuals nominated; |

| | (3) | the class and number of shares of First Security which are beneficially owned by all individuals nominated; |

| | (4) | any other information relating to all individuals nominated that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A of the Securities Exchange Act of 1934 and the SEC’s rules and regulations thereunder and any other applicable laws or rules or regulations of any governmental authority or of any national securities exchange or similar body overseeing any trading market on which shares of First Security are traded; |

| | (5) | the name and record address of the nominating shareholder; and |

| | (6) | the class and number of shares of First Security which are beneficially owned by the nominating shareholder. |

The officer presiding at meeting may, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing requirements and therefore will be disregarded.

19

Shareholder Proposals

To be included in First Security’s annual proxy statement, shareholder proposals not relating to the election of directors must be received by First Security at least 120 days before the one-year anniversary of the mailing date for the prior year’s proxy statement, which in our case would require that proposals be submitted no later than May 28, 2006 for next year’s annual meeting. However, we currently intend to hold our 2006 annual meeting of shareholders in the spring of 2006. Therefore, we request any proposals be submitted no later than January 15, 2006. The persons named as proxies in First Security’s proxy statement for the meeting will, however, have discretionary authority to vote the proxies they have received as they see fit with respect to any proposals received less than 60 days prior to the meeting date. SEC Rule 14a-8 provides additional information regarding the content and procedure applicable to the submission of shareholder proposals.

Shareholder Communications

Shareholders wishing to communicate with the Board of Directors or with a particular director may do so in writing addressed to the Board, or to the particular director, by sending it to the William L. (Chip) Lusk, Jr., Secretary of the Board of First Security at First Security’s principal office at 817 Broad Street, Chattanooga, Tennessee 37402. The Secretary will promptly forward such communications to the applicable director or to the Chairman of the Board for consideration at the next scheduled meeting.

OTHER MATTERS

Management of First Security does not know of any matters to be brought before the Meeting other than those described above. If any other matters properly come before the Meeting, the persons designated as proxies will vote on such matters in accordance with their best judgment.

20

OTHER INFORMATION

Proxy Solicitation Costs

The cost of soliciting Proxies for the Meeting will be paid by First Security. In addition to the solicitation of shareholders of record by mail, telephone, electronic mail, facsimile or personal contact, First Security will be contacting brokers, dealers, banks, or voting trustees or their nominees who can be identified as record holders of common stock; such holders, after inquiry by First Security, will provide information concerning quantities of proxy materials needed to supply such information to beneficial owners, and First Security will reimburse them for the reasonable expense of mailing proxy materials to such persons.

Annual Report on Form 10-K

First Security’s annual report on Form 10-K is accessible from our corporate website, www.FSGBank.com. This website also contains First Security’s other filings with the Securities and Exchange Commission, including but not limited to our quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these or other reports. These reports are accessible soon after we file them with the Securities and Exchange Commission.

In addition, upon the written request of any person whose Proxy is solicited by this Proxy Statement, First Security will furnish to such person without charge (other than for exhibits) a copy of First Security’s annual report on Form 10-K for the fiscal year ended December 31, 2004, including financial statements and schedules, as filed with the Securities and Exchange Commission. Requests may be addressed to First Security Group, Inc., 817 Broad Street, Chattanooga, Tennessee 37402, Attention: William L. (Chip) Lusk, Jr., Secretary of the Board.

|

By Order of the Board of Directors |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

September 26, 2005

21

Appendix A

FIRST SECURITY GROUP, INC. AND SUBSIDIARIES

AUDIT AND CORPORATE GOVERNANCE COMMITTEE

CHARTER

The Board of Directors (the “Board”) of First Security Group, Inc. (the “Company”) establishes an Audit and Corporate Governance Committee (the “Committee”) with authority, responsibility and specific duties as described below.

PURPOSE

The Committee’s purpose is to assist the Board of Directors in fulfilling its responsibility to provide oversight to:

| | • | | The integrity of the Company’s financial statements; |

| | • | | The Company’s compliance with legal and regulatory requirements; |

| | • | | The independent auditor’s qualifications and independence; |

| | • | | The performance of the Company’s internal audit function and independent auditors; and |

| | • | | The implementation of sound principles and practices of corporate governance that promote the best interest of the Company and its stockholders. |

The Committee will also prepare the report required by the Securities and Exchange Commission (“SEC”) to be included in the annual proxy statement.

AUTHORITY

The Committee may be requested by the Board to investigate any activity of the Company or any matter within the scope of their responsibilities. The Committee has the authority and is empowered to:

| | • | | Select and approve for Board of Directors and Stockholder approval the independent audit firm. Pre-approve the audit and all permitted, appropriate non-audit engagements and fees. The Committee Chairman may grant pre-approvals, when required between regular meetings, subject to a maximum $25,000 fee, provided the Chairman’s decision to grant pre-approval is presented to the full Audit Committee at its next meeting. |

| | • | | Oversee the work of the independent auditor, the internal auditor, information systems audit, or loan review entities retained to conduct audits and/or reviews at the organization. These persons will report directly to the Committee. |

| | • | | Establish Corporate Governance Guidelines and a Code of Ethics for Employees, including Senior Financial Employees, and Directors. |

| | • | | Resolve disagreements between management and the auditors regarding financial reporting. |

A-1

| | • | | Retain persons having special competence as necessary to assist the Committee in fulfilling its responsibilities (e.g., independent counsel, accountants, credit administration, etc.). |

| | • | | Seek information it requires from employees (all of whom are directed to cooperate with the Committee’s requests) or any external parties. |

| | • | | Meet with Company officers, independent auditors, or outside counsel as necessary. |

| | • | | Form and delegate authority to subcommittees, providing such decisions are presented to the full Committee at the next scheduled meeting. As such, subcommittees shall consist of one or more members of the Committee. |

MEMBERSHIP

The Committee Chair and Committee members shall be appointed annually by the Board Chair, subject to Board ratification, and may be replaced or removed by the Board.

The Committee members shall be financially literate and meet the independence requirements of the Securities and Exchange Commission and the NASDAQ. At least one member of the Committee shall be designated as the “financial expert”, as defined by applicable legislation and regulation. No committee member shall simultaneously serve on the audit committees of more than two public companies.