UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant¨ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

FIRST SECURITY GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 30, 2007

TO THE SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.:

You are cordially invited to attend the 2007 Annual Meeting of Shareholders of First Security Group, Inc., which will be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee, on Thursday, June 14, 2007, at 3:00 pm local time.

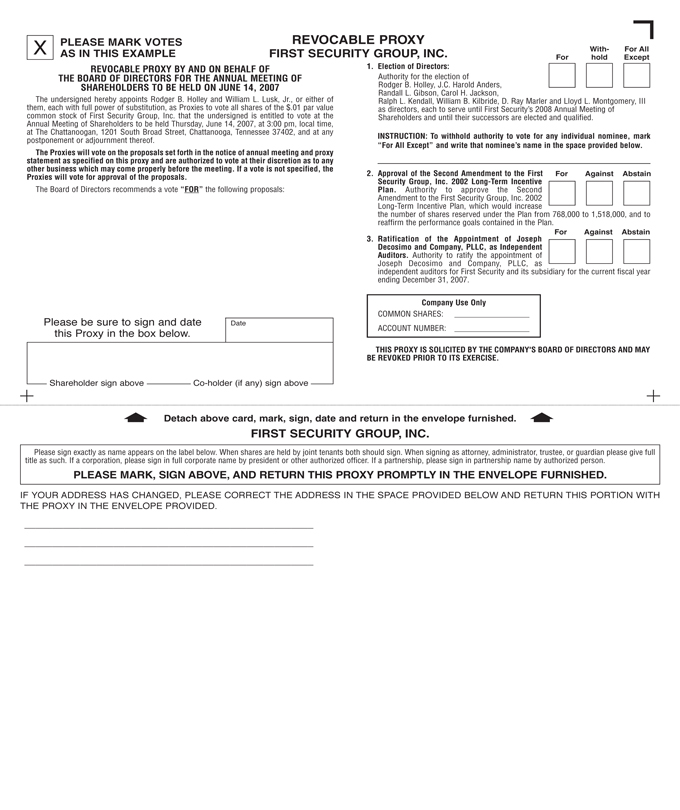

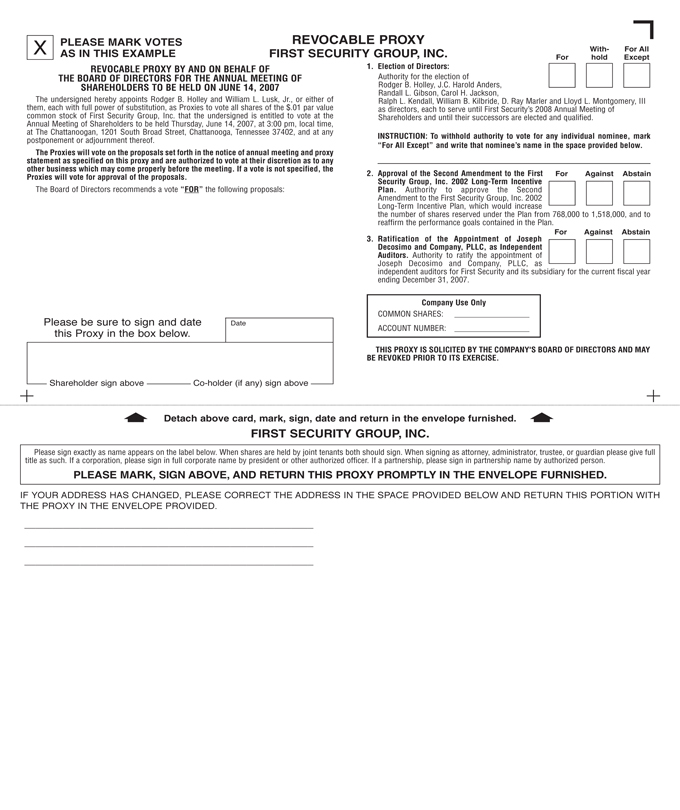

At the Meeting, you will be asked to consider and vote upon: (i) the election of eight (8) directors to serve until the 2008 Annual Meeting of Shareholders and until their successors have been elected and qualified; (ii) the approval of the Second Amendment to the First Security Group, Inc. 2002 Long-Term Incentive Plan, which would increase the number of shares reserved for issuance under the Plan from 768,000 to 1,518,000, and to reaffirm the performance goals contained in the Plan; and (iii) the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2007.

Enclosed are the Notice of Meeting, Proxy Statement and Proxy. We hope you can attend the Meeting and vote your shares in person. In any case, we would appreciate your completing the enclosed Proxy and returning it to us. This action will ensure that your preferences will be expressed on the matters that are being considered. If you are able to attend the Meeting, you may vote your shares in person even if you have previously returned your Proxy.

We want to thank you for your support this past year. We are proud of our progress as reflected in the results for 2006, and we encourage you to review carefully the 2006 Annual Report, which accompanies this proxy statement.

If you have any questions about the Proxy Statement or our Annual Report, please call or write us.

Sincerely,

Rodger B. Holley

Chairman of the Board, Chief Executive Officer & President

FIRST SECURITY GROUP, INC.

531 Broad Street

Chattanooga, Tennessee 37402

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 14, 2007

Notice is hereby given that the 2006 Annual Meeting of Shareholders of First Security Group, Inc. will be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee, on Thursday, June 14, 2007, at 3:00 pm local time for the following purposes:

| | 1. | Elect Directors. To consider and vote upon the election of eight (8) directors to serve until the 2008 Annual Meeting of Shareholders and until their successors have been elected and qualified. |

| | 2. | Amend the First Security Group, Inc. 2002 Long-Term Incentive Plan. To consider and vote upon the Second Amendment to the First Security Group, Inc. 2002 Long-Term Incentive Plan, which would increase the number of shares reserved under the Plan from 768,000 to 1,518,000, and to reaffirm the performance goals contained in the Plan. |

| | 3. | Ratify Auditors. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2007. |

| | 4. | Other Business. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

The enclosed Proxy Statement explains these proposals in greater detail. We urge you to review these materials carefully.

Only shareholders of record at the close of business on April 16, 2007 are entitled to notice of, and to vote at, the Meeting or any adjournments thereof. All shareholders, whether or not they expect to attend the Meeting in person, are requested to complete, date, sign and return the enclosed Proxy in the accompanying envelope.

|

By Order of the Board of Directors |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

April 30, 2007

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO FIRST SECURITY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.

JUNE 14, 2007

INTRODUCTION

General

This Proxy Statement is being furnished to our shareholders in connection with the solicitation of proxies by our Board of Directors from holders of our common stock, $0.01 par value, for use at the 2007 Annual Meeting of Shareholders of First Security to be held at The Chattanoogan, 1201 South Broad Street, Chattanooga, Tennessee, on Thursday, June 14, 2007, at 3:00 pm local time, and at any adjournments or postponements thereof. Unless otherwise clearly specified, all references to “First Security,” “we,” “us” and “our” refer to First Security Group, Inc. and our subsidiary, FSGBank, National Association.

The Meeting is being held to consider and vote upon the proposals summarized under “Summary of Proposals” below and described in greater detail in this Proxy Statement. Our Board of Directors knows of no other business that will be presented for consideration at the Meeting other than the matters described in this Proxy Statement.

The 2006 Annual Report to Shareholders, including financial statements for the fiscal year ended December 31, 2006, is included with this mailing. These proxy materials are first being mailed to our shareholders on or about April 30, 2007.

Our principal executive offices are located at 531 Broad Street, Chattanooga, Tennessee 37402 and our telephone number is (423) 266-2000.

Summary of Proposals

The proposals to be considered at the Meeting may be summarized as follows:

Proposal One. To consider and vote upon the election of eight (8) directors to serve until the 2008 Annual Meeting of Shareholders and until their successors have been elected and qualified;

Proposal Two. To consider and vote upon the Second Amendment to the First Security Group, Inc. 2002 Long-Term Incentive Plan, which would increase the number of shares reserved under the Plan from 768,000 to 1,518,000, and to reaffirm the Performance Goals contained in the Plan; and

Proposal Three. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as our independent auditors for the fiscal year ending December 31, 2007.

Quorum and Voting Requirements

Holders of record of common stock as of the Record Date defined below are entitled to one vote per share on each matter to be considered and voted upon at the Meeting. To hold a vote on any proposal, a quorum must be present with respect to that proposal. A quorum is a majority of the total votes entitled to be cast by the holders of the outstanding shares of common stock. In determining whether a quorum exists at the Meeting for purposes of all matters to be voted on, all votes “for” or “against,” as well as all abstentions and broker non-votes, will be counted as shares present. A “broker non-vote” occurs when a nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

1

Proposal One, relating to the election of the nominees for directors, requires approval by a plurality of the votes cast by the holders of shares of common stock entitled to vote with respect to that proposal. This means that those eight (8) nominees for directors receiving the greatest number of votes will be elected directors. Proposals Two and Three, and any other proposal that is properly brought before the Meeting, requires the affirmative vote of a majority of the votes cast at the Meeting in person or by proxy and entitled to vote with respect to the proposals.

Neither abstentions nor broker non-votes will be counted as votes cast for purposes of determining whether any proposal has received sufficient votes for approval, although abstentions and broker non-votes will be counted for purposes of determining whether a quorum exists. This means that abstentions and broker non-votes will not affect the outcome of the vote with respect to any proposal.

Record Date, Solicitation and Revocability of Proxies

Our Board of Directors has fixed the close of business on April 16, 2007 as the record date (“Record Date”) for determining the shareholders entitled to notice of, and to vote at, the Meeting. Accordingly, only holders of record of shares of common stock on the Record Date will be entitled to notice of, and to vote at, the Meeting. At the close of business on the Record Date, there were 17,653,482 shares of common stock issued and outstanding, which were held by approximately 1,294 holders of record.

Shares of common stock represented by properly executed Proxies, if such Proxies are received in time and not revoked, will be voted at the Meeting in accordance with the instructions indicated in such Proxies.If no instructions are indicated, such shares of common stock will be voted “FOR” all proposals and in the discretion of the proxy holder as to any other matter that may properly come before the Meeting. If necessary, the proxy holder may vote in favor of a proposal to adjourn the Meeting in order to permit further solicitation of proxies in the event there are not sufficient votes to approve the foregoing proposals at the time of the Meeting.

A shareholder who has given a Proxy may revoke it at any time prior to its exercise at the Meeting by: (i) giving written notice of revocation to our Secretary, (ii) properly submitting to us a duly executed Proxy bearing a later date, or (iii) appearing in person at the Meeting and voting in person. All written notices of revocation or other communications with respect to Proxies should be addressed as follows: First Security Group, Inc., 531 Broad Street, Chattanooga, Tennessee 37402, Attention: William L. (Chip) Lusk, Jr., Secretary of the Board.

The cost of soliciting proxies for the meeting will be paid by First Security. In addition to the solicitation of shareholders of record by mail, telephone, electronic mail, facsimile or personal contact, First Security will be contacting brokers, dealers, banks, or voting trustees or their nominees who can be identified as record holders of common stock; such holders, after inquiry by First Security, will provide information concerning quantities of proxy materials needed to supply such information to beneficial owners, and First Security will reimburse them for the reasonable expense of mailing proxy materials to such persons.

2

PROPOSAL ONE:

ELECTION OF DIRECTORS

General

The Meeting is being held to, among other things, elect eight (8) directors of First Security to serve a one-year term of office expiring at the 2008 Annual Meeting of Shareholders and until their successors have been elected and qualified. Although all nominees are expected to serve if elected, if any nominee is unable to serve, the persons voting the Proxies will vote for the remaining nominees and for such replacements, if any, as may be nominated by our Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees specified herein (8 persons). Cumulative voting is not permitted.

The following table shows for each nominee: (1) his or her name; (2) his or her age at December 31, 2006; (3) how long he or she has been one of our directors; (4) his or her position(s) with us, other than as a director; and (5) his or her principal occupation and business experience for the past five years. Except as otherwise indicated, each director has been engaged in his or her present principal occupation for more than five years. Each of the director nominees listed below is also a director of FSGBank.

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

Rodger B. Holley (59) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; and Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank. |

| | |

Lloyd L. Montgomery, III (53) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; and involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002. |

| | |

J.C. Harold Anders (63) | | 2003 | | Owner of Anders Rental (real estate rentals, Dalton, GA) since 1978; Co-Owner of Central Drive In (fast food company, Dalton, GA) since 1988; Co-Owner of Poag & Anders, Inc. (real estate development, Dalton, GA) since 1992; Co-Owner of Clayton & Anders, Inc. (real estate development, Dalton, GA) since 1992; and Director of Premier National Bank of Dalton (Dalton, GA) from 1996 until its acquisition by First Security in March 2003 (Chairman from 2001 to 2003). |

| | |

Randall L. Gibson (45) | | 2006 | | Chief Manager and General Counsel of Lawler-Wood, LLC (regional and international real estate services, Knoxville, TN) since 1995. |

| | |

Carol H. Jackson (67) | | 2002 | | Retired as Vice President of Baker Street Rentals (property management, Knoxville, TN) in 2006 after serving in this role since 1991. |

| | |

Ralph L. Kendall (78) | | 1999 | | Retired as a partner with Ernst & Young LLP (international CPA firm, Chattanooga, TN) in 1986. |

| | |

William B. Kilbride (56) | | 2003 | | President of Mohawk Home (a division of Mohawk Industries, Inc. NYSE:MHK) (floorcovering manufacturer, Calhoun, GA), since 1992. |

3

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

D. Ray Marler (62) | | 1999 | | President of Ray Marler Construction Company (general construction, Chattanooga, TN) since 1965; President and Chief Manager of Environmental Materials, LLC (environmental services, Chattanooga, TN) since 1998; President of Environmental Holdings, Inc. (environmental services, Chattanooga, TN) since 1998; President of Environmental Materials, Inc. (environmental services, Chattanooga, TN) since 1998; President and Chief Manager of Chattanooga Transfer LLC (waste management, Chattanooga, TN) since 2004; Partner of Canyons LLC (land development, Chattanooga, TN) since 2004; President and Chief Manager of City Disposal Services, LLC (waste management, Chattanooga, TN) since 2006; and Chief Manager of MWW, LLC (land management, Chattanooga, TN) from 2002 to 2006. |

FIRST SECURITY’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL EIGHT (8) NOMINEES LISTED ABOVE.

Director Independence

The Board of Directors has determined that the following directors are independent pursuant to the independence standards of the Nasdaq Stock Market:

The Board of Directors considered any transaction, relationship or arrangement between First Security and the directors named above (and his or her family) and concluded each of these directors could exercise independent judgment in carrying out his or her responsibilities.

Board Meetings and Committees

Our Board of Directors held twelve meetings in person during 2006. All incumbent directors attended at least 75% of the total number of meetings of the Board of Directors and the Board committees on which they served. Although we do not have a formal policy regarding our board members’ attendance at the Annual Meeting of Shareholders, board members are encouraged to attend the annual meeting. All of our directors, who were standing for reelection, attended the 2006 Annual Meeting of Shareholders (Mr. Gibson joined the Board of Directors subsequent to the 2006 Annual Meeting).

Our Board of Directors has eight standing committees: the Compensation Committee, the Audit/Corporate Governance Committee, the Executive Committee, the Asset/Liability Committee, the Property Committee, the Loan Committee, the Nominating Committee and the Trust Committee. Each committee also serves the same functions for FSGBank.

Nominating Committee. Our Nominating Committee is comprised of D. Ray Marler (Chairman), J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall and William B. Kilbride, each of whom are independent directors under the independence standards of the Nasdaq Stock Market. The Nominating Committee held one meeting in person during 2006, in addition to one meeting by unanimous written consent action. The Nominating Committee is responsible for the identification of individuals qualified to become members of the Board, and for either the selection of, or recommendation to our Board of Directors for, the director nominees for the next annual shareholders meeting. The Board of Directors has adopted a written charter for the Nominating Committee, a copy of which is available on our website, www.FSGBank.com.

4

The Nominating Committee has not adopted a formal policy or process for identifying or evaluating director nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, our customers and shareholders and professionals in the financial services and other industries. Similarly, the committee does not prescribe any specific qualifications or skills that a nominee must possess, although it considers the potential nominee’s business experience; knowledge of us and the financial services industry; experience in serving as one of our directors or as a director of another financial institution or public company generally; wisdom, integrity and analytical ability; familiarity with and participation in the communities served by us; commitment to and availability for service as a director; and any other factors the committee deems relevant.

In accordance with our bylaws, a shareholder may nominate persons for election as directors. If the officer presiding at meeting determines that a nomination was not made in accordance with the bylaws, the nomination may be disregarded. The bylaws require written notice to the Secretary of First Security of the nomination is received at our principal executive offices at least 60 days prior to the date of the annual meeting, assuming the meeting will be held the same date as the prior year’s annual meeting, or at least 60 days prior to the date of the annual meeting for that year provided that we have publicly announced the annual meeting date at least 75 days in advance. The notice must set forth:

| | (1) | the name, age, business address and residence address of all individuals nominated; |

| | (2) | the principal occupation or employment of all individuals nominated; |

| | (3) | the class and number of shares of First Security which are beneficially owned by all individuals nominated; |

| | (4) | any other information relating to all individuals nominated that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A of the Securities Exchange Act of 1934 and the SEC’s rules and regulations thereunder and any other applicable laws or rules or regulations of any governmental authority or of any national securities exchange or similar body overseeing any trading market on which shares of First Security are traded; |

| | (5) | the name and record address of the nominating shareholder; and |

| | (6) | the class and number of shares of First Security which are beneficially owned by the nominating shareholder. |

Audit/Corporate Governance Committee. Our Audit/Corporate Governance Committee is comprised of Ralph L. Kendall (Chairman), Carol H. Jackson and William B. Kilbride, each of whom are independent directors under the independence standards of the Nasdaq Stock Market. The Board of Directors has determined that Mr. Kendall and Mr. Kilbride meet the criteria specified under applicable SEC regulations for an “audit committee financial expert.” In addition, the Board believes that all of the Audit/Corporate Governance Committee members have the financial knowledge, business experience and independent judgment necessary for service on the Audit/Corporate Governance Committee. The Audit/Corporate Governance Committee held four meetings in person during 2006.

The Audit/Corporate Governance Committee has the responsibility of reviewing financial statements, evaluating internal accounting controls, reviewing reports of regulatory authorities, overseeing the audit of our fiduciary activities and determining that all audits and examinations required by law are performed. Our Board of Directors has adopted a written charter for the Audit/Corporate Governance Committee, a copy of which is available on our website, www.FSGBank.com. Our Board of Directors annually reviews and approves changes to the Audit/Corporate Governance Committee charter. Under the charter, the committee has the authority and is empowered to:

| | • | | appoint, approve compensation and oversee the work of the independent auditor; |

5

| | • | | resolve disagreements between management and the auditors regarding financial reporting; |

| | • | | pre-approve all auditing and appropriate non-auditing services performed by the independent auditor; |

| | • | | retain independent counsel and accountants to assist the committee; |

| | • | | seek information it requires from employees or external parties; and |

| | • | | meet with our officers, independent auditors or outside counsel as necessary. |

The Audit/Corporate Governance Committee Report is found in Proposal Three: Ratification of Appointment of Independent Registered Accounting Firm.

Compensation Committee. Our Compensation Committee is comprised of J.C. Harold Anders (Chairman), Ralph L. Kendall, and D. Ray Marler, each of whom are independent directors under the independence standards of the Nasdaq Stock Market. The Compensation Committee held four meetings in person during 2006. This committee has the authority to determine the compensation of our executive officers and employees and administers our benefit and incentive plans. This committee also has the power to interpret the provisions of our Long-Term Incentive Plans. Our Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is available on our website, www.FSGBank.com.

No member of the Compensation Committee is now or was during the last fiscal year an officer or employee of First Security or FSGBank. During 2006, none of our executive officers served as a director or member of the compensation committee (or group performing equivalent functions) of any other entity for which any of our Compensation Committee members served as an executive officer.

The Compensation Committee Report is found following the Compensation Discussion and Analysis in the “Executive Compensation” section of this Proxy Statement.

Director Compensation

2006 Director Compensation Table

The following table shows the total fees paid to, or earned by, each of our non-employee directors for their service on the Board of Directors during 2006.

| | | | | | | | | | | | | | | | |

| Name | | Fees

earned or

paid in cash | | Stock Awards | | | Option Awards (1) | | | Non-Equity

Incentive Plan

Compensation | | Change in Pension

Value and Non- Qualified Deferred

Comp Earnings | | All Other

Compensation | | Total |

(a)

| | ($) (b)

| | ($) (c)

| | | ($) (d)

| | | ($) (e)

| | ($) (f)

| | ($) (g)

| | ($) (h)

|

J.C. Harold Anders | | 37,500 | | — | | | 10,153 | (2) | | — | | — | | — | | 47,653 |

Randall L. Gibson | | 22,000 | | — | | | 1,756 | (3) | | — | | — | | — | | 23,756 |

Carol H. Jackson | | 34,000 | | — | | | 10,153 | (2) | | — | | — | | — | | 44,153 |

Ralph L. Kendall | | 34,500 | | — | | | 10,153 | (2) | | — | | — | | — | | 44,653 |

William B. Kilbride | | 32,000 | | — | | | 10,153 | (2) | | — | | — | | — | | 42,153 |

D. Ray Marler | | 37,000 | | — | | | 10,153 | (2) | | — | | — | | — | | 47,153 |

H. Patrick Wood(4) | | 3,500 | | — | | | 2,118 | (5) | | — | | — | | — | | 5,618 |

| (1) | The aggregate number of option awards outstanding as of December 31, 2006 for each director was as follows: J.C. Harold Anders held 17,200 options Randall L. Gibson held 4,584 options |

6

| | Carol H. Jackson held 17,200 options Ralph L. Kendall held 17,200 options William B. Kilbride held 17,200 options D. Ray Marler held 17,200 options H. Patrick Wood held no options |

| (2) | Under our 2002 Long-Term Incentive Plan, stock options were granted to Directors Anders, Jackson, Kendall, Kilbride and Marler on May 22, 2003, May 27, 2004, October 27, 2005 and June 23, 2006 and are subject to three-year service vesting. The values in the table represent the 2006 fiscal year expense computed in accordance with FAS 123(R), using the methods and assumptions described in the 2006 annual report. The May 22, 2003 options were granted at an exercise price of $6.94 per share, the May 27, 2004 options were granted at an exercise price of $8.33 per share, the October 27, 2005 options were granted at an exercise price of $9.78 per share, and the June 23, 2006 options were granted at an exercise price of $11.30 per share. The following assumptions were used in the Black-Scholes methodology for the 2003 award: expected volatility 14.0%, risk-free interest rate 3.34%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2004 award: expected volatility 13.0%, risk-free interest rate 4.22%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2005 award: expected volatility 13.0%, risk-free interest rate 4.49%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2006 award expected volatility 17.0%, risk-free interest rate 5.12%, expected life 6.5 years, expected divided yield 0.88%. The resulting Black-Scholes grant values for the 2003, 2004, 2005 and 2006 awards are $2.50, $1.92, $2.33 and $3.22 per share, respectively. The annual awards for each director listed was: 2003-3,600 options; 2004-3,600 options; 2005-5,000 options; and 2006-5,000 options. The fair value of each director award was: 2003-$9,014; 2004-$6,901; 2005-$11,633; and 2006-$16,106. |

| (3) | Under our 2002 Long-Term Incentive Plan, 4,584 stock options were granted to Director Gibson on August 21, 2006. This option grant coincided Mr. Gibson’s appointment to First Security’s Board of Directors and is subject to three-year service vesting. The values in the table represent the 2006 fiscal year expense computed in accordance with FAS 123(R), using the methods and assumptions described in the 2006 annual report. The options were granted at an exercise price of $11.14 per share. The following assumptions were used in the Black-Scholes methodology for the award: expected volatility 18.9%, risk-free interest rate 4.77%, expected life 6.5 years, expected divided yield 0.90%. The resulting Black-Scholes grant value for award was $3.16 per share. The fair value of the award was $14,476. |

| (4) | Mr. Wood’s term as First Security Director expired on June 23, 2006. |

| (5) | Under our 2002 Long-Term Incentive Plan, stock options were granted to Director Wood on May 22, 2003, May 27, 2004, and October 27, 2005 and were subject to three-year service vesting. The values in the table represent the 2006 fiscal year expense computed in accordance with FAS 123(R), using the methods and assumptions described in the 2006 annual report. The May 22, 2003 options were granted at an exercise price of $6.94 per share, the May 27, 2004 options were granted at an exercise price of $8.33 per share, and the October 27, 2005 options were granted at an exercise price of $9.78 per share. The following assumptions were used in the Black-Scholes methodology for the 2003 award: expected volatility 14.0%, risk-free interest rate 3.34%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2004 award: expected volatility 13.0%, risk-free interest rate 4.22%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2005 award: expected volatility 13.0%, risk-free interest rate 4.49%, expected life 7.0 years, expected divided yield 1.00%. The resulting Black-Scholes grant values for the 2003, 2004 and 2005 awards are $2.50, $1.92 and $2.33 per share, respectively. The annual awards for each director listed was: 2003-3,600 options; 2004-3,600 options; and 2005-5,000 options. The fair value of each director award was: 2003-$9,014; 2004-$6,901; and 2005-$11,633. With the expiration of his directorship term, Mr. Wood exercised his vested options and all unexercisable options lapsed as follows: For Mr. Wood’s 2003 award, he acquired all 3,600 shares which were fully vested. For his 2004 award, he acquired 2,376 vested shares and the remainder (1,224 option shares) lapsed as they were unexercisable at the end of this directorship term. Mr. Wood was unable to exercise any of his 2005 option award as they were not vested at the end of his directorship term. |

7

Cash Compensation

Annually, on or about the annual meeting date, each non-employee Director is paid a $12,000 retainer fee for the next year’s service up to the next annual meeting. The Audit/Corporate Governance, Compensation, Executive and Nominating Committees meet as needed and the Chairperson of each shall receive an additional annual retainer of $5,000, unless the Chairperson is an inside director. The Asset/Liability, Loan, Property, and Trust Committees will meet as needed and the Chairperson of each shall receive an additional annual retainer of $3,000, unless the Chairperson is an inside director. Fees are pro rated for Directors who are elected to the Board of Directors following the annual meeting of shareholders.

Each non-employee Director is paid a $500 fee for attending each Board meeting and a $500 fee for attending each Committee meeting. Non-employee Directors who attend Board meetings or Committee meetings are only eligible for the fees described above for meetings that are attended in person. Directors who participate in a Board or Committee meeting via teleconference will receive 50% of the standard meeting fee.

If the Company’s performance for the year merits a reward to the non-employee Directors, the Chief Executive Officer may declare a discretionary bonus fee payment to recognize their participation and role in the Company’s success and to facilitate the retention of the Board of Directors. For 2006, the payment was $7,500 per non-employee Director.

Equity Compensation

Non-employee Directors will receive an annual grant of 5,000 stock options. Non-employee Directors who commence service on the Board at any time other than immediately following the annual shareholder meeting will receive a Prorated Stock option grant based upon the number of months actually served. All stock options granted to non-employee Directors are subject to the terms of the company’s 2002 Long-Term Incentive Plan, and are granted within 30 days of the commencement or renewal (if reelected) of service as a Director.

8

Executive Officers

Executive officers are appointed annually at the meetings of the respective Boards of Directors of First Security and FSGBank following the annual meetings of shareholders, to serve until the next annual meeting and until their successors are chosen and qualified. The following table shows for each executive officer: (1) his name; (2) his age at December 31, 2006; (3) how long he has been an officer of First Security; (4) his position with First Security; and (5) his or her principal occupation and business experience for the past five years.

| | | | |

Name (Age)

| | Officer Since

| | Position with First Security and Business Experience

|

Rodger B. Holley (59) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; and Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank. |

| | |

Lloyd L. Montgomery, III (53) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; and involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002. |

| | |

William L. Lusk, Jr. (38) | | 1999 | | Secretary of the Board, Chief Financial Officer and Executive Vice President of First Security since April 1999; Secretary of the Board, Chief Financial Officer and Executive Vice President of FSGBank since June 2000; Secretary, Chief Financial Officer and Executive Vice President of Dalton Whitfield Bank (Dalton, GA) from September 1999 to September 2003 when it merged with FSGBank; and Chief Financial Officer and Executive Vice President of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank. |

9

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes First Security’s compensation philosophy and policies for 2006 that applied to the executives named below in the Summary Compensation Table (the “Named Executive Officers”). It explains the structure and rationale associated with each material element of each Named Executive Officer’s total compensation, and it provides important context for the more detailed disclosure tables and specific compensation amounts provided following this discussion and analysis.

The following discussion and analysis contains statements regarding future company performance targets and goals. These targets and goals are disclosed in the limited context of First Security’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. First Security specifically cautions investors not to apply these statements to other contexts.

Compensation Philosophy and Objectives

First Security’s Compensation Committee, composed entirely of independent directors, sets and administers the policies that govern First Security’s executive compensation programs, and various incentive and stock option programs. The outcomes of all decisions made by the Compensation Committee relating to the compensation of the Named Executive Officers are shared with the full Board.

First Security targets executive compensation at levels that believed to be consistent with others in the banking industry. The executive officers’ compensation is weighted toward programs contingent upon the First Security’s level of annual and long-term performance. In general, for senior management positions of First Security, including the Named Executive Officers, we will pay base salaries that target the market median and above of other banks of similar size and geographic location. The members of this peer group are specifically identified below under the heading “Pay Level and Benchmarking.” Goals for specific components of our compensation program include:

| | • | | Base salaries for executives generally targeted between the 50th and 75th percentiles of our peer group. |

| | • | | The Annual Incentive Plan is targeted to provide cash compensation at the 50th percentile of our peer group when target performance-based goals are achieved, with the potential for awards between the 60th and 75th percentiles of our peer group when annual goals are exceeded. |

| | • | | Long-Term Incentives are targeted to provide equity compensation at the 50th percentile of our peer group when target goals are met, with the potential for awards between the 60th and 75th percentiles of our peer group when target goals are exceeded. |

Compensation-Related Governance And Role Of The Compensation Committee

Committee Charter and Members. The Compensation Committee’s primary responsibilities are to: (1) determine the compensation payable to executive officers; (2) evaluate the performance of the Chief Executive Officer and the relationship between performance and First Security’s compensation policies for the Chief Executive Officer and other executive officers; (3) issue reports in accordance with SEC rules regarding compensation policies; and (4) approve and administer stock-based, profit-sharing and incentive compensation plans. The Charter of the Compensation Committee is available on our website, www.FSGBank.com, and in print upon request (submit request for copies of the Charter to First Security Group, Inc., Attn: Investor Relations, 531 Broad Street, Chattanooga, TN 37402). As of December 31, 2006, the members of the Company’s Compensation Committee are J.C. Harold Anders (Chairman), Ralph L. Kendall, and D. Ray Marler, each of whom is “independent” within the meaning of the listing standards of the NASDAQ, is a “nonemployee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, and is an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986.

10

Interaction with Consultants. The Compensation Committee has historically retained the services of nationally recognized consulting firms to assist First Security in benchmarking compensation for the Named Executive Officers. The most recent compensation study focusing on executive officers was conducted by Clark Consulting in February 2006. The consultant reported directly to the Compensation Committee.

Role of Executives in Compensation Committee Deliberations. The Compensation Committee frequently requests the Chief Executive Officer to be present at Committee meetings to discuss executive compensation and evaluate Company and individual performance. Occasionally other executives may attend a Committee meeting to provide pertinent financial or legal information. Executives in attendance may provide their insights and suggestions, but only independent Compensation Committee members may vote on decisions regarding changes in executive compensation.

The Chief Executive Officer does not provide the recommendations for changes in his own compensation. The Compensation Committee discusses the Chief Executive Officer’s compensation with him, but final deliberations and all votes regarding his compensation are made without the Chief Executive Officer present. The Committee initiates any changes in the Chief Executive Officer’s compensation based on periodic market reviews and recommendations from outside consultants. Relative to executives other than the Chief Executive Officer, the Committee uses the Chief Executive Officer’s proposals and input from Clark Consulting in making its decisions regarding compensation.

Compensation Committee Activity. In 2006, the Compensation Committee met four times. Activities included benchmarking each element of compensation for the Named Executive Officers, developing the 2006 equity plan, and determining recommended incentive awards and salary increases based on performance.

Compensation Framework

Summary of Pay Components. First Security uses the pay components identified below to balance the various objectives identified by the Compensation Committee. First Security’s compensation framework encourages the achievement of strategic objectives and creation of shareholder value, recognizes and rewards individual initiative and achievements, maintains an appropriate balance between base salary and annual and long-term incentive opportunity, and allows First Security to compete for, retain, and motivate talented executives that are important to our success.

Salaries. First Security pays its Named Executive Officers cash salaries intended to be competitive and takes into account the individual’s experience, perception of performance, responsibilities, and past and potential contribution to the Company. No specific weighting is applied to the factors considered, and the Committee uses its own judgment and expertise in determining appropriate salaries within the parameters of the compensation philosophy. Neither the profitability of First Security nor the market value of its stock are considered in setting the Named Executive Officers’ salary levels. First Security targets salaries between the 50th and 75th percentiles of our peer group.

In making salary decisions, the Committee also takes into account the positioning of projected total compensation with target-level performance incentives. Because incentive opportunities are defined as a percentage of base salary, each Named Executive Officer’s base salary also affects the amount of other components of compensation. The Committee reviews the projected total compensation based on the proposed salaries.

On February 28, 2007, the Committee approved the compensation for all Named Executive Officers for 2007, effective January 1, 2007. The Committee decided not to increase base salaries to the Named Executive Officers for 2007, preferring to place a greater portion of each Named Executive Officer’s total compensation at risk through additional opportunities with the annual cash incentive opportunity.

11

Annual Cash Incentives. First Security uses annual incentives to focus attention on current strategic priorities and drive achievement of short-term corporate objectives. Awards are provided under the terms of the First Security’s Annual Cash Incentive Plan. All employees are eligible to receive annual cash incentive compensation at the end of each year, if company-wide performance targets are achieved. In 2006, 100% of the Named Executive Officers’ incentive compensation was tied directly to the overall results of First Security.

In 2006, awards were made contingent on First Security’s diluted earnings per share relative to an established target of $0.60 per share. Payouts were capped at achievement of 125% of target performance and required a threshold of 75% of target performance before any incentive payout would have been made.

| | | | | | | | | |

| | | 2006 Annual Incentive Opportunity

|

Criteria

| | Threshold (75% of Target)

| | Target

| | Max (125% of

Target)

|

EPS | | $ | 0.45 | | $ | 0.60 | | $ | 0.75 |

The annual incentive objective for 2006 was achieved at just above the target level at $0.63 earnings per share. Payouts under the Annual Cash Incentive Plan are based on a percentage of salary that varies for each Named Executive Officer and for the level of performance achieved. In addition, the Committee retains subjective discretion to make award adjustments from the formula to recognize unique circumstances. The table below shows the award opportunities at threshold, target, and maximum levels, as well as each of the Named Executive Officer’s actual award in 2006 as a percentage of his salary.

| | | | | | | | | | | | |

| | | 2006 Annual Incentive Opportunity as Percent of Salary

| | | Actual Award

| |

Executive

| | Threshold

| | | Target

| | | Max

| | | | |

Mr. Holley | | 15 | % | | 30 | % | | 45 | % | | 33.8 | % |

Mr. Montgomery | | 10 | % | | 20 | % | | 30 | % | | 25.4 | % |

Mr. Lusk | | 10 | % | | 20 | % | | 30 | % | | 23.0 | % |

On February 28, 2007, the Committee approved modifications to the Annual Cash Incentive Plan to provide an increase in potential awards to the Named Executive Officers in 2007 as part of its desire to increase the at-risk portion of each Named Executive Officer’s total compensation. The table below indicates the new threshold, target, and maximum levels for 2007 earnings per share. In setting the 2007 diluted earnings per share range, the Committee determined that (1) the 2007 EPS Threshold would be 2006 EPS rather than 75% of the Target (which would have been $0.54), (2) the EPS Target would be 15% growth in EPS from 2006 level, and (3) the EPS Maximum would be 25% growth in EPS from the 2006 level, rather than 125% of the Target EPS (which would have been $0.90). The Committee believes that the new earnings per share range methodology establishes short term targets without sacrificing long term earnings continuity.

| | | | | | | | | |

| | | 2007 Annual Incentive Opportunity

|

Criteria

| | Threshold

| | Target

| | Max

|

EPS | | $ | 0.63 | | $ | 0.72 | | $ | 0.79 |

The table below shows the award opportunities at threshold, target, and maximum levels for each Named Executive Officer in 2007 as a percentage of his salary. The Committee retains subjective discretion to make award adjustments from the formula to recognize unique circumstances.

| | | | | | | | | |

| | | 2007 Annual Incentive Opportunity as Percent of Salary

| |

Executive

| | Threshold

| | | Target

| | | Max

| |

Mr. Holley | | 20 | % | | 35 | % | | 55 | % |

Mr. Montgomery | | 15 | % | | 25 | % | | 40 | % |

Mr. Lusk | | 15 | % | | 25 | % | | 40 | % |

12

Long-Term Incentives. First Security uses long-term incentives to encourage its Named Executive Officer’s to focus on critical long-range objectives, foster retention, and align the Named Executive Officers’ interests with the long-term interests of our other shareholders. In 2006, each Named Executive Officer received a grant of stock options and stock awards under the First Security 2002 Long-Term Incentive Plan. Based on the Compensation Committee’s analysis of First Security’s overall performance, each executive’s individual performance, and historical equity grant levels, the Committee decided to grant equity awards in 2006 at the same levels as were granted in 2005. All equity awarded to the Named Executive Officers during 2006 vest 33% at the end of the first year after grant, 33% at the end of the second year, and 34% at the end of the third year.

The 2002 Long-Term Incentive Plan authorizes the granting stock options (incentive stock options or non-qualified stock options), stock appreciation rights, and restricted stock.

401(k) and Employee Stock Ownership Plan. First Security sponsors the First Security Group 401(k) and Employee Stock Ownership Plan pursuant to which the Company makes matching contributions. The purpose of the plan is to provide participating employees with an opportunity to obtain beneficial interests in the stock of the Company and to accumulate capital for their future economic security. Our Plan owns shares of First Security common stock and allocates the shares for the company matching element of the 401(k). We may use the shares for ESOP profit sharing opportunities, but have not done so to date.

On December 27, 2006, First Security amended the Plan to make the 401(k) and matching contributions satisfy the safe harbor rules provided in Code Section 401(k)(12) and Code Section 401(m)(11). As a result, First Security will now make a matching contribution of at least 100% of each participant’s 401(k) contributions up to six percent (6%) of compensation. The amended plan also provides for 100% vesting of all accounts.

Executive Retirement Benefits. First Security has entered into salary continuation agreements with each of the Named Executive Officers. The salary continuation agreements are intended to provide the officers with a fixed annual benefit for 15 years subsequent to retirement on or after the normal retirement age of 65. The salary continuation agreements help support the objective of maintaining a stable, committed, and qualified team of key executives through the inclusion of retention and non-competition provisions.

First Security entered into a salary continuation agreement with Mr. Holley on December 21, 2005, pursuant to which Mr. Holley is entitled to certain nonqualified retirement benefits. Mr. Holley’s salary continuation agreement provides that Mr. Holley will be entitled to monthly benefits for 15 years upon his retirement after reaching normal retirement age (65). The amount of the monthly benefit will be based on a percentage of Mr. Holley’s final annual base salary or his average base salary for the three years prior to reaching normal retirement age, whichever is greater. The initial percentage of base salary payable to Mr. Holley is 60%, increasing 4% annually to a maximum of 80%. In the event Mr. Holley voluntarily resigns without good reason (as defined in the salary continuation agreement), he would be entitled to the vested percentage of the benefits actually accrued under his salary continuation agreement. The benefits vest in five equal annual increments beginning on June 1, 2006. In the event of a change in control, involuntary termination without cause, or resignation for good reason (each as defined in the salary continuation agreement), Mr. Holley would be entitled to the projected maximum benefit under his salary continuation agreement, based on his maximum percentage benefit and his expected annual salary upon reaching his normal retirement age. In the event of a termination due to disability, Mr. Holley would be entitled to 100% of the benefits accrued under the salary continuation agreement. Any such benefits are payable for 15 years, in twelve equal monthly installments, commencing on the first day of the month following his termination of employment or, if later, upon reaching normal retirement age. In the event Mr. Holley dies while benefits are still payable, his designated beneficiary would be entitled to all benefit payments at the same time and in the same manner as they would have been paid to Mr. Holley. In the event Mr. Holley is terminated for cause (as defined in the salary continuation agreement), Mr. Holley would not be entitled to any benefits under his salary continuation agreement. In the event Mr. Holley dies while in active service, his designated beneficiary would be entitled to the projected maximum benefit under the salary continuation agreement. Such benefit is payable for 15 years, in twelve equal monthly installments, commencing

13

on the first day of the month following Mr. Holley’s death. First Security purchased bank-owned life insurance policies, which may be used as a source for the payment of benefits.

First Security entered into a salary continuation agreement with Mr. Montgomery on December 21, 2005. The terms of Mr. Montgomery’s salary continuation agreement are generally the same as those in Mr. Holley’s agreement, except that percentage of base salary (or, if applicable, average base salary) payable to Mr. Montgomery is 30%, increasing 2% annually to a maximum of 50%.

First Security entered into a salary continuation agreement with Mr. Lusk on December 21, 2005. The terms of Mr. Lusk’s salary continuation agreement are generally the same as those in Mr. Holley’s agreement, except that percentage of base salary (or, if applicable, average base salary) payable to Mr. Lusk is 20%, increasing 1% annually to a maximum of 40%.

Other Compensation. The Named Executive Officers participate in First Security’s broad-based employee benefit plans, such as medical, dental, disability and term life insurance programs.

For each of the Named Executive Officers, First Security also provides the following perquisites: business and personal use of a Company car for transportation for the executive, his customers, employees and directors; social and civic club dues for networking and entertaining; and business and personal use of a cell phone for accessibility to the executive.

Pay Level And Benchmarking

As noted earlier, First Security’s compensation structure is designed to position an executive’s compensation between the 50th and 75th percentiles of a competitive practice. In 2006, the Compensation Committee worked with Clark Consulting to review total compensation levels for the Named Executive Officers. This review included base salary, annual cash incentives, all forms of equity compensation, and all other forms of compensation.

The primary data source used in setting competitive market levels for the executives is the information publicly disclosed by a “2006 Peer Group” of the 24 companies listed below. These companies include banks of similar size and geographic location.

2006 PEER GROUP

| | |

Company Name (Ticker)

|

Ameris Bancorp (ABCB) Banc Corporation (TBNC) BancTrust Financial Group, Inc. (BTFG) Bank of Granite Corporation (GRAN) Capital Bank Corporation (CBKN) Charter Financial Corp. (MHC) (CHFN) Colony Bankcorp, Inc. (CBAN) Fidelity Southern Corporation (LION) First M & F Corporation (FMFC) First South Bancorp, Inc. (FSBK) FLAG Financial Corporation (FLAG) FNB Corp. (FNBN) | | FNB Financial Services Corporation (FNBF) Greene County Bancshares, Inc. (GCBS) LSB Bancshares, Inc. (LXBK) NBC Capital Corporation (NBY) PAB Bankshares, Inc. (PABK) Peoples BancTrust Company, Inc. (PBTC) Pinnacle Financial Partners, Inc. (PNFP) Security Bank Corporation (SBKC) Southern Community Financial Corp. (SCMF) Summit Financial Group, Inc. (SMMF) TIB Financial Corp. (TIBB) Yadkin Valley Bank and Trust Company (YAVY) |

14

After consideration of the data collected on external competitive levels of compensation and internal relationships within the executive group, the Compensation Committee makes decisions regarding individual executives’ target total compensation opportunities based on the need to attract, motivate and retain an experienced and effective management team.

Review of Prior Amounts Granted and Realized

Our goal is to motivate and reward executives relative to driving superior future performance. The Compensation Committee does not currently consider prior stock compensation gains as a factor in determining future compensation levels.

Adjustment or Recovery of Awards

First Security has not adopted a formal policy or any employment agreement provisions that enable recovery, or “clawback”, of incentive awards in the event of misstated or restated financial results. However, Section 304 of the Sarbanes-Oxley Act does provide some ability to recover incentive awards in certain circumstances. If First Security is required to restate its financials due to noncompliance with any financial reporting requirements as a result of misconduct, our Chief Executive and Financial Officers must reimburse First Security for (1) any bonus or other incentive-or equity-based compensation received during the 12 months following the first public issuance of the non-complying document, and (2) any profits realized from the sale of First Security common stock during those 12 months.

Timing of Equity Grants

First Security does not have a formal written policy guiding the timing of equity grants. All equity grants were made after formal Compensation Committee approval. The Company has reviewed its equity grant practices and has confirmed that all past equity grants have been consistent with SEC guidelines.

Employment Agreements

First Security has entered into separate employment agreements with its Named Executive Officers.

First Security entered into a three-year employment agreement with Rodger B. Holley on May 16, 2003 regarding Mr. Holley’s employment as the Chairman, Chief Executive Officer and President. At the end of each year of the agreement, it renews for an additional year, unless either of the parties to the agreement gives notice of his or its intent not to renew the agreement at least 90 days prior to the renewal date. To date, neither First Security nor Mr. Holley have provided such notice; as a result, the term of Mr. Holley’s agreement will extend until at least May 16, 2010. Under the terms of the agreement, Company provides Mr. Holley with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. If First Security terminates Mr. Holley’s employment without cause or Mr. Holley terminates his employment for good reason, Mr. Holley will be entitled to a Lump Sum Payment, a Pro Rata Incentive Payment and continuation of medical benefits for twelve months. The Lump Sum Payment is an amount equal to the sum of his current base salary plus the greater of (1) the highest of his last three years’ incentive payments or (2) the target annual incentive set forth in the First Security’s Annual Incentive Compensation Plan. The Pro Rata Incentive Payment is an amount equal to the pro rata portion of the target annual incentive set forth in the Annual Incentive Compensation plan based on the number of days that have passed in the employment year before Mr. Holley’s termination. Upon a change of control of the Company, Mr. Holley will be entitled to three times the Lump Sum Payment, payment of a Pro Rata Incentive Payment, and continuation of medical benefits for twelve months. If the Company cannot continue the medical benefits to which Mr. Holley is entitled under the agreement because Mr. Holley is no longer employed, First Security will pay Mr. Holley the amount it would have paid for such benefits over the 12-month period. The agreement also generally provides that Mr. Holley will not compete with

15

the Company in the banking business nor solicit the Company’s customers or employees for a period of 12 months following termination of his employment. The noncompetition and nonsolicitation provisions of the agreement apply if Mr. Holley terminates his employment without cause, for good reason or in connection with a change of control, or if the First Security terminates his employment with or without cause.

First Security entered into a three-year employment agreement with Lloyd L. Montgomery, III on May 16, 2003 regarding Mr. Montgomery’s employment as the Chief Operating Officer and Executive Vice President. With the exception of the initial base salary, the terms of Mr. Montgomery’s employment agreement are the same as those in Mr. Holley’s agreement. Neither First Security nor Mr. Montgomery have provided notice of non-renewal of the agreement.

First Security entered into a three-year employment agreement with William L. Lusk, Jr. on May 16, 2003 regarding Mr. Lusk’s employment as the Secretary, Chief Financial Officer, and Executive Vice President. With the exception of the initial base salary, the terms of Mr. Lusk’s employment agreement are the same as those in Mr. Holley’s agreement. Neither First Security nor Mr. Lusk have provided notice of non-renewal of the agreement.

Tax and Accounting Considerations

First Security takes into account tax and accounting implications in the design of its compensation programs. For example, in the selection of long-term incentive instruments, the Compensation Committee reviews the projected expense amounts and expense timing associated with alternative types of awards. Under current accounting rules (i.e., Financial Accounting Standard 123, as revised 2004), First Security must expense the grant-date fair value of share-based grants such as restricted stock and stock options. The grant-date value is amortized and expensed over the service period or vesting period of the grant. In selecting appropriate incentive devices, the Compensation Committee reviews extensive modeling analyses and considers the related tax and accounting issues.

Section 162(m) of the Internal Revenue Code places a limit on the tax deduction for compensation in excess of $1 million paid to the chief executive officer and four most highly compensated executive officers of a corporation in a taxable year. The 2004 Annual Executive Incentive Plan and the 2004 Stock Compensation Plan are designed to constitute “performance-based compensation”. All of the compensation the Company paid in 2006 to the Named Executive Officers is expected to be deductible under Section 162(m).The Committee retains the flexibility, however, to pay non-deductible compensation if it believes doing so is in the best interests of First Security.

Section 4999 of the Internal Revenue Code imposes a 20% excise tax on an executive if the executive’s total benefit upon a change-in-control of First Security equals or exceeds three times the executive’s five-year average taxable compensation. If the 20% excise tax is triggered, it is imposed on all change-in-control benefits exceeding the executive’s five-year average taxable compensation. Additionally, under Section 280G of the Internal Revenue Code, the employer forfeits the compensation deduction related to such payments. Under the terms of the salary continuation agreements, each of the Named Executive Officers is entitled, if applicable, to a tax gross-up to cover estimated excess taxes and any additional income taxes attributable to the payment of the tax gross-up. The Committee believes that providing the tax gross-up benefit properly provides the executives the full benefit of the promises contained in the salary continuation agreements, so that the compensation received by the executives after their payment of taxes equals their benefits had no excise taxes been imposed. The Compensation Committee believes any increase in non-deductible compensation will not materially adversely affect First Security.

16

Conclusion

First Security believes its compensation program is reasonable and competitive with compensation paid by other financial institutions of similar size. The program is designed to reward managers for strong personal, company, and share-value performance. The Compensation Committee monitors the various guidelines that make up the program and reserves the right to adjust them as necessary to continue to meet First Security and shareholder objectives.

Compensation Committee Report

In performing its oversight role, the Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

Compensation Committee: | J.C. Harold Anders |

Ralph L. Kendall

D. Ray Marler

April 30, 2007

17

Summary Compensation Table

The following table provides certain summary information concerning the annual and long-term compensation paid or accrued by First Security and its subsidiaries to or on behalf of First Security’s Chief Executive Officer, Chief Financial Officer and the other most highly compensated executive officers of First Security.

| | | | | | | | | | | | | | | | | | |

Name and Principal

Position (a)

| | Year

(b)

| | Salary (1) ($) (c)

| | Bonus (2) ($) (d)

| | Stock

Awards (3) ($) (e)

| | Option

Awards (4) ($) (f)

| | Non-Equity

Incentive Plan

Compensation (5)

($) (g)

| | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings(6)

($) (h)

| | All Other

Compensation (7)

($) (i)

| | Total

($) (j)

|

Rodger B. Holley, | | 2006 | | 340,000 | | 250 | | 17,669 | | 38,974 | | 115,000 | | 256,360 | | 30,282 | | 798,535 |

Chairman, CEO & President | | | | | | | | | | | | | | | | | | |

Lloyd L. Montgomery, III, | | 2006 | | 216,300 | | 250 | | 9,640 | | 18,431 | | 55,000 | | 32,667 | | 26,206 | | 358,494 |

COO & EVP | | | | | | | | | | | | | | | | | | |

William L. Lusk, Jr., | | 2006 | | 183,750 | | 250 | | 8,029 | | 16,654 | | 42,500 | | 4,505 | | 28,023 | | 283,711 |

Secretary, CFO & EVP | | | | | | | | | | | | | | | | | | |

| (1) | Salary includes base salary only. |

| (2) | We paid each employee a $250 Christmas bonus in December. |

| (3) | Under our 2002 Long-Term Incentive Plan, stock awards were granted on December 21, 2005 and December 27, 2006 and are subject to three-year service vesting. The values in the table represent the 2006 fiscal year expense computed in accordance with FAS 123(R), using the methods and assumptions described in the 2006 annual report. The 2005 and 2006 share awards were granted at fair values of $9.50 per share and $11.35, respectively. Awards for the Named Executive Officers were: 2005: Mr. Holley-5,500 shares, Mr. Montgomery-3,000 shares, and Mr. Lusk-2,500 shares; 2006: Mr. Holley-5,500 shares, Mr. Montgomery-3,000 shares, and Mr. Lusk-2,500 shares. |

| (4) | Under our 1999 & 2002 Long-Term Incentive Plans, stock options were granted on April 22, 2003, January 28, 2004, December 21, 2005 and December 27, 2006 and are subject to three-year service vesting. The values in the table represent the 2006 fiscal year expense computed in accordance with FAS 123(R), using the methods and assumptions described in the 2006 annual report. The April 22, 2003 options were granted at an exercise price of $6.94 per share, the January 28, 2004 options were granted at an exercise price of $8.33 per share, the December 21, 2005 options were granted at an exercise price of $9.50 per share, and the December 27, 2006 options were granted at an exercise price of $11.35 per share. The following assumptions were used in the Black-Scholes methodology for the 2003 award: expected volatility 14.0%, risk-free interest rate 3.53%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2004 award: expected volatility 13.0%, risk-free interest rate 3.72%, expected life 7.0 years, expected divided yield 1.00%. The following assumptions were used in the Black-Scholes methodology for the 2005 award: expected volatility 13.0%, risk-free interest rate 4.44%, expected life 7.0 years, expected divided yield 1.05%. The following assumptions were used in the Black-Scholes methodology for the 2006 award: expected volatility 19.1%, risk-free interest rate 4.64%, expected life 6.5 years, expected divided yield 1.76%. The resulting Black-Scholes grant values for the 2003, 2004, 2005 and 2006 awards are $2.56, $1.78, $2.24 and $2.77 per share, respectively. Awards for the Named Executive Officers were: 2003: Mr. Holley-57,600 options, Mr. Montgomery-25,200 options, and Mr. Lusk-21,600 options; 2004: Mr. Holley-18,000 options, Mr. Montgomery-9,000 options, and Mr. Lusk-9,000 options; 2005: Mr. Holley-17,500 options, Mr. Montgomery-8,600 options, and Mr. Lusk-7,500 options; 2005: Mr. Holley-17,500 options, Mr. Montgomery-8,600 options, and Mr. Lusk-7,500 options. |

18

| (5) | The values provided in column (g) represent the annual incentive earned in fiscal year 2006 under our non-equity incentive compensation plan, which is explained in the Compensation Discussion and Analysis. |

| (6) | We have salary continuation agreements with the Named Executive Officers which are described in the Compensation Discussion and Analysis. The values in the table are attributable to the aggregate change in the actuarial present value of these defined benefit plans. We do not provide the Named Executive Officers with nonqualified deferred compensation opportunities. |

| (7) | For each Named Executive Officer, all other compensation includes $13,200 of 401(k) company match, as well as other expenses including personal usage of company car, parking, spouse travel to annual shareholders meeting, club dues, cell phone and remote computer network access. |

2006 Grants of Plan-Based Awards

The following table sets forth information for the fiscal year ended December 31, 2006 concerning plan-based awards granted to the Named Executive Officers.

| | | | | | | | | | | | | | | | | | | | | | |

Name (a)

| | Grant

Date (b)

| | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (1)

| | Estimated Future Payouts

Under Equity Incentive

Plan Awards(2)

| | All

Other

Stock

Awards:

Number

of

Shares

of Stock

or

Units (3) (#) (i)

| | All Other

Option

Awards:

Number of

Securities

Underlying

Options(4) (#) (j)

| | Exercise

of Base

Price of

Option

Awards (5) ($/Sh) (k)

| | Grant

Date Fair

Value of

Stock and

Option

Awards (6) ($) (l)

|

| | | Threshold

($) (c)

| | Target

($) (d)

| | Maximum

($) (e)

| | Threshold

(#) (f)

| | Target

(#) (g)

| | Maximum

(#) (h)

| | | | |

Rodger B. Holley | | 12/27/2006 | | 51,000 | | 102,000 | | 153,000 | | — | | — | | — | | 5,500 | | 17,500 | | 11.35 | | 110,935 |

Lloyd L. Montgomery, III | | 12/27/2006 | | 21,630 | | 43,260 | | 64,890 | | — | | — | | — | | 3,000 | | 8,600 | | 11.35 | | 57,889 |

William L. Lusk, Jr. | | 12/27/2006 | | 18,375 | | 36,750 | | 55,125 | | — | | — | | — | | 2,500 | | 7,500 | | 11.35 | | 49,165 |

| (1) | The estimated payouts are for fiscal year 2006. Additional details regarding the non-equity incentive compensation plan are available in the Compensation Discussion and Analysis. |

| (2) | None reported. 2006 equity grants were discretionary based on the Compensation Committee’s analysis of the Company’s overall performance, individual performance, and historical equity grant levels. Additional details regarding the non-equity incentive compensation plan are available in the Compensation Discussion and Analysis. |

| (3) | Restricted stock grants under the 2002 Long Term Incentive Plan. |

| (4) | Stock option grants under the 1999 Long Term Incentive Plan for Mr. Holley and under the 2002 Long Term Incentive Plan for Messrs Montgomery and Lusk. |

| (5) | Based on the closing price of FSGI on the grant date (i.e. $11.35 per share). |

| (6) | Additional details regarding the Black-Scholes methodology may be found in the Summary Compensation Table footnotes. |

19

Outstanding Equity Awards at 2006 Fiscal Year End

The following table sets forth information concerning outstanding awards previously granted to the Named Executive Officers that were held by the Named Executive Officers at December 31, 2006 .

| | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards

| | | Stock Awards

|

Name (a)

| | Number of

Securities

Underlying

Unexercised

Options

(#) Exercisable

(b)

| | | Number of

Securities

Underlying

Unexercised

Options (#) Unexercisable

(c)

| | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) (d)

| | Option

Exercise

Price

($) (e)

| | Option

Expiration

Date (f)

| | | Number

of

Shares

or Units

of Stock

that

have

not

Vested

(#) (g)

| | | Market

Value of

Shares

or Units

of Stock

that

have not

Vested (1)

($) (h)

| | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

that have

not

Vested

(#) (i)

| | Equity

Incentive

Plan

Awards:

Market

or Payout

Value of

Unearned

Shares,

Units or

Other

Rights

that have

not

Vested

($) (j)

|

Rodger B. Holley | | 116,064 | | | — | | | — | | 5.34 | | 02/01/2011 | | | — | | | — | | — | | — |

| | | 57,600 | | | — | | | — | | 6.94 | | 04/22/2013 | | | — | | | — | | — | | — |

| | | 11,880 | | | 6,120 | (2) | | — | | 8.33 | | 01/28/2014 | | | — | | | — | | — | | — |

| | | 5,775 | | | 11,725 | (3) | | — | | 9.50 | | 12/21/2015 | | | — | | | — | | — | | — |

| | | — | | | 17,500 | (4) | | — | | 11.35 | | 12/27/2016 | | | — | | | — | | — | | — |

| | | — | | | — | | | — | | — | | — | | | 9,185 | (5) | | 105,903 | | — | | — |

Lloyd L. Montgomery, III | | 83,520 | | | — | | | — | | 6.94 | | 04/24/2012 | | | — | | | — | | — | | — |

| | | 25,200 | | | — | | | — | | 6.94 | | 04/22/2013 | | | — | | | — | | — | | — |

| | | 5,940 | | | 3,060 | (6) | | — | | 8.33 | | 01/28/2014 | | | — | | | — | | — | | — |

| | | 2,838 | | | 5,762 | (7) | | — | | 9.50 | | 12/21/2015 | | | — | | | — | | — | | — |

| | | — | | | 8,600 | (8) | | — | | 11.35 | | 12/27/2016 | | | — | | | — | | — | | — |

| | | — | | | — | | | — | | — | | — | | | 5,010 | (9) | | 57,765 | | — | | — |

William L. Lusk, Jr. | | 59,904 | | | — | | | — | | 5.34 | | 02/01/2011 | | | — | | | — | | — | | — |

| | | 21,600 | | | — | | | — | | 6.94 | | 04/22/2013 | | | — | | | — | | — | | — |

| | | 5,940 | | | 3,060 | (10) | | — | | 8.33 | | 01/28/2014 | | | — | | | — | | — | | — |

| | | 2,475 | | | 5,025 | (11) | | — | | 9.50 | | 12/21/2015 | | | — | | | — | | — | | — |

| | | — | | | 7,500 | (12) | | — | | 11.35 | | 12/27/2016 | | | — | | | — | | — | | — |

| | | — | | | — | | | — | | — | | — | | | 4,175 | (13) | | 48,138 | | — | | — |

| (1) | Based on the closing price of FSGI on December 31, 2006 (i.e. $11.53 per share). |

| (2) | Vesting schedule for unexercisable options: 6,120 option shares on 1/28/2007. |

| (3) | Vesting schedule for unexercisable options: 5,775 option shares on 12/21/2007 and 5,950 option shares on 12/21/2008. |

| (4) | Vesting schedule for unexercisable options: 5,775 option shares on 12/27/2007, 5,775 option shares on 12/27/2008 and 5,950 option shares on 12/27/2009. |

| (5) | Vesting schedule for stock: 1,815 shares on 12/21/2007, 1,815 shares on 12/27/2007, 1,870 shares on 12/21/08, 1,815 shares on 12/27/08 and 1,870 shares on 12/27/09. |

| (6) | Vesting schedule for unexercisable options: 3,060 option shares on 1/28/2007. |

| (7) | Vesting schedule for unexercisable options: 2,838 option shares on 12/21/2007 and 2,924 option shares on 12/21/2008. |

| (8) | Vesting schedule for unexercisable options: 2,838 option shares on 12/27/2007, 2,838 option shares on 12/27/2008 and 2,924 option shares on 12/27/2009. |

| (9) | Vesting schedule for stock: 990 shares on 12/21/2007, 990 shares on 12/27/2007, 1,020 shares on 12/21/08, 990 shares on 12/27/08 and 1,020 shares on 12/27/09. |

20

| (10) | Vesting schedule for unexercisable options: 3,060 option shares on 1/28/2007. |

| (11) | Vesting schedule for unexercisable options: 2,475 option shares on 12/21/2007 and 2,550 option shares on 12/21/2008. |

| (12) | Vesting schedule for unexercisable options: 2,475 option shares on 12/27/2007, 2,475 option shares on 12/27/2008 and 2,550 option shares on 12/27/2009. |

| (13) | Vesting schedule for stock: 825 shares on 12/21/2007, 825 shares on 12/27/2007, 850 shares on 12/21/08, 825 shares on 12/27/08 and 850 shares on 12/27/09. |

2006 Option Exercises and Stock Vested

The following table sets forth information concerning the exercise of options and vesting of awards held by the Named Executive Officers during the fiscal year ended December 31, 2006 .

| | | | | | | | | | |

| | | Option Awards (1)

| | | Stock Awards

|

Name (a)

| | Number of

Shares

Acquired on

Exercise (#) (b)

| | Value Realized

on Exercise ($) (c)

| | | Number of

Shares Acquired

on Vesting (#) (d)

| | | Value

Realized on

Vesting (2) ($) (e)

|

Rodger B. Holley | | — | | — | | | 1,815 | (3) | | 21,217 |

Lloyd L. Montgomery, III | | — | | — | | | 990 | (4) | | 11,573 |

William L. Lusk, Jr. | | — | | — | | | 825 | (5) | | 9,644 |

| (1) | Messrs Holley, Montgomery and Lusk did not exercise any stock options during the fiscal year ended December 31, 2006. |

| (2) | Based on the closing price of FSGI on vesting date, December 21, 2006 (i.e. $11.69 per share). |

| (3) | 33% of 5,500 share stock award dated December 21, 2005 vested at end of one year. |

| (4) | 33% of 3,000 share stock award dated December 21, 2005 vested at end of one year. |