SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. N/A)

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary proxy statement | | ¨ | | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x | | Definitive proxy statement | | |

| | | |

¨ | | Definitive additional materials | | | | |

| |

¨ | | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

FIRST SECURITY GROUP, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transactions applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement no.: |

April 28, 2006

TO THE SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.:

You are cordially invited to attend the 2006 Annual Meeting of Shareholders of First Security Group, Inc., which will be held at the Four Seasons, 200 Boylston Street, Boston, Massachusetts, on Friday, June 23, 2006, at 3:00 p.m. local time.

At the Meeting, you will be asked to consider and vote upon: (i) the election of seven (7) directors to serve until the 2007 Annual Meeting of Shareholders and until their successors have been elected and qualified; and (ii) the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2006.

Enclosed are the Notice of Meeting, Proxy Statement and Proxy. We hope you can attend the Meeting and vote your shares in person. In any case, we would appreciate your completing the enclosed Proxy and returning it to us. This action will ensure that your preferences will be expressed on the matters that are being considered. If you are able to attend the Meeting, you may vote your shares in person even if you have previously returned your Proxy.

We want to thank you for your support this past year. We are proud of our progress as reflected in the results for 2005, and we encourage you to review carefully the 2005 Annual Report, which accompanies this proxy statement.

If you have any questions about the Proxy Statement or our Annual Report, please call or write us.

|

| Sincerely, |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

FIRST SECURITY GROUP, INC.

817 Broad Street

Chattanooga, Tennessee 37402

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 23, 2006

Notice is hereby given that the 2006 Annual Meeting of Shareholders of First Security Group, Inc. will be held at the Four Seasons, 200 Boylston Street, Boston, Massachusetts 02116, on Friday, June 23, 2006, at 3:00 p.m. local time for the following purposes:

| | 1. | Elect Directors. To consider and vote upon the election of seven (7) directors to serve until the 2007 Annual Meeting of Shareholders and until their successors have been elected and qualified. |

| | 2. | Ratify Auditors. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security for the fiscal year ending December 31, 2006. |

| | 3. | Other Business. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

The enclosed Proxy Statement explains these proposals in greater detail. We urge you to review these materials carefully.

Only shareholders of record at the close of business on April 14, 2006 are entitled to notice of, and to vote at, the Meeting or any adjournments thereof. All shareholders, whether or not they expect to attend the Meeting in person, are requested to complete, date, sign and return the enclosed Proxy in the accompanying envelope.

|

By Order of the Board of Directors |

|

|

Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

April 28, 2006

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO FIRST SECURITY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS OF

FIRST SECURITY GROUP, INC.

JUNE 23, 2006

INTRODUCTION

General

This Proxy Statement is being furnished to our shareholders in connection with the solicitation of proxies by our Board of Directors from holders of our common stock, $0.01 par value, for use at the 2006 Annual Meeting of Shareholders of First Security to be held at the Four Seasons, 200 Boylston Street, Boston, Massachusetts 02116, on Friday, June 23, 2006, at 3:00 p.m. local time, and at any adjournments or postponements thereof. Unless otherwise clearly specified, all references to “First Security,” “we,” “us” and “our” refer to First Security Group, Inc. and our subsidiary, FSGBank, National Association.

The Meeting is being held to consider and vote upon the proposals summarized under “Summary of Proposals” below and described in greater detail in this Proxy Statement. Our Board of Directors knows of no other business that will be presented for consideration at the Meeting other than the matters described in this Proxy Statement.

The 2005 Annual Report to Shareholders, including financial statements for the fiscal year ended December 31, 2005, is included with this mailing. These proxy materials are first being mailed to our shareholders on or about April 28, 2006.

Our principal executive offices are located at 817 Broad Street, Chattanooga, Tennessee 37402 and our telephone number is (423) 266-2000.

Summary of Proposals

The proposals to be considered at the Meeting may be summarized as follows:

Proposal One. To consider and vote upon the election of seven (7) directors to serve until the 2007 Annual Meeting of Shareholders and until their successors have been elected and qualified; and

Proposal Two. To consider and vote upon the ratification of the appointment of Joseph Decosimo and Company, PLLC, as our independent auditors for the fiscal year ending December 31, 2006.

Quorum and Voting Requirements

Holders of record of common stock as of the Record Date defined below are entitled to one vote per share on each matter to be considered and voted upon at the Meeting. To hold a vote on any proposal, a quorum must be present with respect to that proposal. A quorum is a majority of the total votes entitled to be cast by the holders of the outstanding shares of common stock. In determining whether a quorum exists at the Meeting for purposes of all matters to be voted on, all votes “for” or “against,” as well as all abstentions and broker non-votes, will be counted as shares present. A “broker non-vote” occurs when a nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

Proposal One, relating to the election of the nominees for directors, requires approval by a plurality of the votes cast by the holders of shares of common stock entitled to vote with respect to that proposal. This means that those seven (7) nominees for directors receiving the greatest number of votes will be elected directors. Proposal Two, and any other proposal that is properly brought before the Meeting, requires the affirmative vote of a majority of the votes cast at the Meeting in person or by proxy and entitled to vote with respect to the proposals.

1

Neither abstentions nor broker non-votes will be counted as votes cast for purposes of determining whether any proposal has received sufficient votes for approval, although abstentions and broker non-votes will be counted for purposes of determining whether a quorum exists. This means that abstentions and broker non-votes will not affect the outcome of the vote with respect to any proposal.

Record Date, Solicitation and Revocability of Proxies

Our Board of Directors has fixed the close of business on April 14, 2006 as the record date (“Record Date”) for determining the shareholders entitled to notice of, and to vote at, the Meeting. Accordingly, only holders of record of shares of common stock on the Record Date will be entitled to notice of, and to vote at, the Meeting. At the close of business on the Record Date, there were 17,573,707 shares of common stock issued and outstanding, which were held by approximately 1,363 holders of record.

Shares of common stock represented by properly executed Proxies, if such Proxies are received in time and not revoked, will be voted at the Meeting in accordance with the instructions indicated in such Proxies.If no instructions are indicated, such shares of common stock will be voted “FOR” all proposals and in the discretion of the proxy holder as to any other matter that may properly come before the Meeting. If necessary, the proxy holder may vote in favor of a proposal to adjourn the Meeting in order to permit further solicitation of proxies in the event there are not sufficient votes to approve the foregoing proposals at the time of the Meeting.

A shareholder who has given a Proxy may revoke it at any time prior to its exercise at the Meeting by: (i) giving written notice of revocation to our Secretary, (ii) properly submitting to us a duly executed Proxy bearing a later date, or (iii) appearing in person at the Meeting and voting in person. All written notices of revocation or other communications with respect to Proxies should be addressed as follows: First Security Group, Inc., 817 Broad Street, Chattanooga, Tennessee 37402, Attention: William L. (Chip) Lusk, Jr., Secretary of the Board.

2

PROPOSAL ONE:

ELECTION OF DIRECTORS

General

The Meeting is being held to, among other things, elect seven (7) directors of First Security to serve a one-year term of office expiring at the 2007 Annual Meeting of Shareholders and until their successors have been elected and qualified. Although all nominees are expected to serve if elected, if any nominee is unable to serve, the persons voting the Proxies will vote for the remaining nominees and for such replacements, if any, as may be nominated by our Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees specified herein (7 persons). Cumulative voting is not permitted.

The following table shows for each nominee: (1) his or her name; (2) his or her age at December 31, 2005; (3) how long he or she has been one of our directors; (4) his or her position(s) with us, other than as a director; and (5) his or her principal occupation and business experience for the past five years. Except as otherwise indicated, each director has been engaged in his or her present principal occupation for more than five years. Each of the director nominees listed below is also a director of FSGBank.

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

Rodger B. Holley (58) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; and Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank. |

| | |

Lloyd L. Montgomery, III (52) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; and involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002. |

| | |

J.C. Harold Anders (62) | | 2003 | | Owner of Anders Rental (real estate rentals, Dalton, GA) since 1978; Co-Owner of Central Drive In (fast food company, Dalton, GA) since 1988; Co-Owner of Poag & Anders, Inc. (real estate development, Dalton, GA) since 1992; Co-Owner of Clayton & Anders, Inc. (real estate development, Dalton, GA) since 1992; and Director of Premier National Bank of Dalton (Dalton, GA) from 1996 until its acquisition by First Security in March 2003 (Chairman from 2001 to 2003). |

| | |

Carol H. Jackson (66) | | 2002 | | Vice President of Baker Street Rentals (property management, Knoxville, TN) since 1991. |

| | |

Ralph L. Kendall (77) | | 1999 | | Retired as a partner with Ernst & Young LLP (international CPA firm, Chattanooga, TN) in 1986. |

| | |

William B. Kilbride (55) | | 2003 | | President of Mohawk Home, a division of Mohawk Industries (floorcovering manufacturer, Calhoun, GA), since 1992. |

3

| | | | |

Name (Age)

| | Director

Since

| | Position with the First Security and Business Experience

|

D. Ray Marler (61) | | 1999 | | President of Ray Marler Construction Company (general construction, Chattanooga, TN) since 1965; President and Chief Manager of Environmental Materials, LLC (environmental services, Chattanooga, TN) since 1998; President of Environmental Holdings, Inc. (environmental services, Chattanooga, TN) since 1998; President of Environmental Materials, Inc. (environmental services, Chattanooga, TN) since 1998; and Chief Manager of MWW, LLC (land management, Chattanooga, TN) since 2002. |

FIRST SECURITY’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL SEVEN (7) NOMINEES LISTED ABOVE.

Non-Continuing Director

On April 14, 2006, Mr. H. Patrick Wood notified us that he would not be standing for re-election to our Board of Directors and would be resigning his director position at the end of his term to spend more time with his family and on other business interests. We thank Mr. Wood for his service and wish him well in his continuing business activities.

Mr. Wood, who was 77 at December 31, 2005, has served as a director of First Security and FSGBank since 2002 and continues to serve as Chairman of the Lawler-Wood Group, a regional and international real estate service firm based in Knoxville, Tennessee, a position he has held since 1975.

No successor to Mr. Wood has been selected at this time, although we intend to fill the vacancy caused by Mr. Wood’s decision not to stand for re-election. Our Nominating Committee is conducting a search for a nominee to fill this Board seat, but was unable to identify a replacement in time for inclusion in this proxy statement. As a result, the seat will remain empty until following the 2006 Annual Meeting of Shareholders.

Information About the Board of Directors and Its Committees

Our Board of Directors held 15 meetings during 2005, which includes three meetings by unanimous written consent action. All incumbent directors attended at least 75% of the total number of meetings of the Board of Directors and the Board committees on which they served. Although we do not have a formal policy regarding our board members’ attendance at the Annual Meeting of Shareholders, board members are encouraged to attend the annual meeting. Seven of our eight directors attended the 2005 annual meeting.

Our Board of Directors has eight standing committees: the Compensation Committee, the Audit/Governance Committee, the Executive Committee, the Asset/Liability Committee, the Property Committee, the Loan Committee, the Nominating Committee and the Trust Committee. Each committee also serves the same functions for FSGBank.

Our Compensation Committee is comprised of four independent directors, J.C. Harold Anders (Chairman), Ralph L. Kendall, D. Ray Marler and H. Patrick Wood. This committee has the authority to determine the compensation of our executive officers and employees and administers our benefit and incentive plans. This committee also has the power to interpret the provisions of our Long-Term Incentive Plans. Our Compensation Committee held eight meetings during 2005, which includes three meetings by unanimous written consent action.

Our Audit/Corporate Governance Committee is comprised of Ralph L. Kendall (Chairman), Carol H. Jackson and William B. Kilbride, all of whom are “independent directors” as defined by the National Association of Securities Dealers, Inc. The Board of Directors has determined that Mr. Kendall and Mr. Kilbride meet the

4

criteria specified under applicable SEC regulations for an “audit committee financial expert.” In addition, the Board believes that all of the Audit/Corporate Governance Committee members have the financial knowledge, business experience and independent judgment necessary for service on the Audit/Corporate Governance Committee. The Audit/Corporate Governance Committee has the responsibility of reviewing financial statements, evaluating internal accounting controls, reviewing reports of regulatory authorities, overseeing the audit of our fiduciary activities and determining that all audits and examinations required by law are performed. Our Audit/Corporate Governance Committee held five meetings during 2005.

Our Board of Directors has adopted a written charter for the Audit/Corporate Governance Committee, a copy of which is available on our website. Our Board of Directors annually reviews and approves changes to the Audit/Corporate Governance Committee charter. Under the charter, the committee has the authority and is empowered to:

| | • | | appoint, approve compensation and oversee the work of the independent auditor; |

| | • | | resolve disagreements between management and the auditors regarding financial reporting; |

| | • | | pre-approve all auditing and appropriate non-auditing services performed by the independent auditor; |

| | • | | retain independent counsel and accountants to assist the committee; |

| | • | | seek information it requires from employees or external parties; and |

| | • | | meet with our officers, independent auditors or outside counsel as necessary. |

Our Nominating Committee is comprised of D. Ray Marler (Chairman), J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall and William B. Kilbride, all of whom are “independent directors” as defined by the National Association of Securities Dealers, Inc. The Board of Directors has adopted a written charter for the Nominating Committee, a copy of which is available on our website.

The Nominating Committee has not adopted a formal policy or process for identifying or evaluating director nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, our customers and shareholders and professionals in the financial services and other industries. Similarly, the committee does not prescribe any specific qualifications or skills that a nominee must possess, although it considers the potential nominee’s business experience; knowledge of us and the financial services industry; experience in serving as one of our directors or as a director of another financial institution or public company generally; wisdom, integrity and analytical ability; familiarity with and participation in the communities served by us; commitment to and availability for service as a director; and any other factors the committee deems relevant. Our Nominating Committee held one meeting during 2005.

Code of Business Conduct and Ethics. We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to all of our directors, officers and employees. We believe the Code is reasonably designed to deter wrongdoing and to promote honest and ethical conduct, including: the ethical handling of conflicts of interest; full, fair and accurate disclosure in filings and other public communications made by us; compliance with applicable laws; prompt internal reporting of violations of the Code; and accountability for adherence to the Code. A copy of the Code is available on our website.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee is now or was during the last fiscal year an officer or employee of First Security or FSGBank. During 2005, none of our executive officers served as a director or member of the compensation committee (or group performing equivalent functions) of any other entity for which any of our Compensation Committee members served as an executive officer.

5

Executive Officers

Executive officers are appointed annually at the meetings of the respective Boards of Directors of First Security and FSGBank following the annual meetings of shareholders, to serve until the next annual meeting and until their successors are chosen and qualified. The following table shows for each executive officer: (1) his name; (2) his age at December 31, 2005; (3) how long he has been an officer of First Security; (4) his position with First Security; and (5) his or her principal occupation and business experience for the past five years.

| | | | |

Name (Age)

| | Officer

Since

| | Position with First Security and Business Experience

|

Rodger B. Holley (58) | | 1999 | | Chairman of the Board, Chief Executive Officer and President of First Security since February 1999; Chairman of the Board, Chief Executive Officer and President of FSGBank since 2000; and Director of Dalton Whitfield Bank (Dalton, GA), from September 1999 to September 2003 when it merged with FSGBank. |

| | |

Lloyd L. Montgomery, III (52) | | 2002 | | Chief Operating Officer and Executive Vice President of First Security since March 2002; Chief Operating Officer and Executive Vice President of FSGBank since September 2003; Chairman of the Board of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank; and involved in business ventures and real estate development (Knoxville, TN) from January 2000 to March 2002. |

| | |

William L. Lusk, Jr. (37) | | 1999 | | Secretary of the Board, Chief Financial Officer and Executive Vice President of First Security since April 1999; Secretary of the Board, Chief Financial Officer and Executive Vice President of FSGBank since June 2000; Secretary, Chief Financial Officer and Executive Vice President of Dalton Whitfield Bank (Dalton, GA) from September 1999 to September 2003 when it merged with FSGBank; and Chief Financial Officer and Executive Vice President of First State Bank (Maynardville, TN) from July 2002 to September 2003 when it merged with FSGBank. |

6

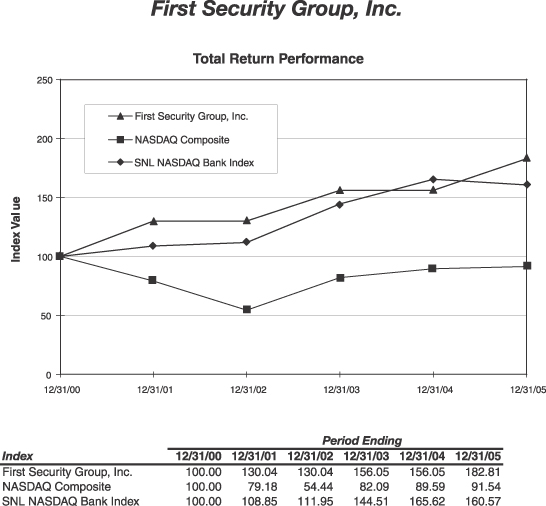

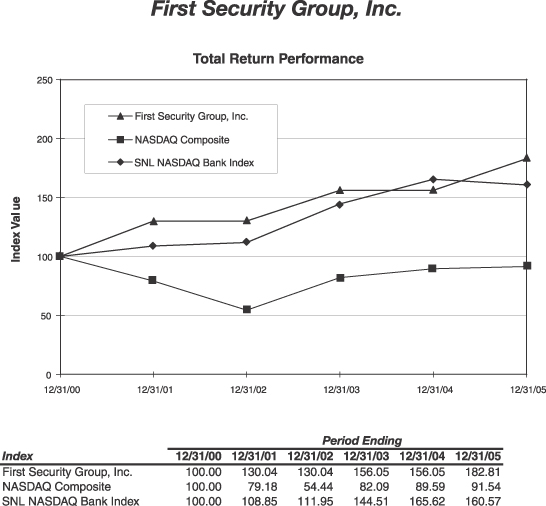

Performance Graph

The following Performance Graph compares the yearly percentage change in the cumulative total shareholder return on First Security’s common stock to the cumulative total return on the Nasdaq Stock Market (U.S.) Index and the SNL NASDAQ Bank Stock Index since December 31, 2000. The Performance Graph assumes that $100 was invested on December 31, 2000, with reinvestment of dividends, where applicable.

Source: SNL Financial LC, Charlottesville, VA (434) 977-1600 www.snl.com© 2006.

7

EXECUTIVE COMPENSATION AND OTHER BENEFITS

Under rules established by the SEC, we are required to provide information regarding the compensation and benefits provided to our Chief Executive Officer and our other executive officers (collectively, the “Named Executive Officers”). The disclosure requirements for the Named Executive Officers include the use of tables and a report explaining the rationale and considerations that led to fundamental executive compensation decisions affecting these individuals.

Summary Compensation Table

The following table sets forth various elements of compensation for our Named Executive Officers for each of the last three calendar years:

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation(1)

| | Long-Term Compensation

| | All Other

Compensation

($)(3)

|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Restricted

Stock

Awards

($)(2)(3)

| | Securities

Underlying

Options/SARs

(#)(2)

| |

| | | | | | |

Rodger B. Holley Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 315,000

291,667

265,417 | | $

$

$ | 43,680

250

250 | | $

$

$ | 52,250

0

0 | | 17,500

18,000

48,000 | | $

$

$ | 139,684

15,864

12,000 |

| | | | | | |

Lloyd L. Montgomery, III Chief Operating Officer | | 2005

2004

2003 | | $

$

$ | 206,000

192,708

179,167 | | $

$

$ | 28,860

250

250 | | $

$

$ | 28,500

0

0 | | 8,600

9,000

21,000 | | $

$

$ | 28,344

11,507

10,765 |

| | | | | | |

William L. Lusk, Jr. Chief Financial Officer | | 2005

2004

2003 | | $

$

$ | 175,000

161,458

150,625 | | $

$

$ | 24,180

5,300

250 | | $

$

$ | 23,750

0

0 | | 7,500

9,000

18,000 | | $

$

$ | 13,314

9,641

9,053 |

| (1) | We have omitted information on “perks” and other personal benefits with an aggregate value below the minimum amount required for disclosure under the Securities and Exchange Commission regulations. |

| (2) | This column shows the dollar value of restricted stock awards based on the closing price of our common stock on the date of grant. The number of shares of restricted stock awarded in 2005 is set forth below in the following table. The restricted stock awards in 2005 were granted on December 21, 2005 and vest over a three-year period, with the first 33% vesting on December 21, 2006. On December 21, 2005, the closing price of our stock was $9.50 per share. The following table also lists as of December 31, 2005 the number and value of unvested restricted stock awards based upon the $9.74 closing price of our common stock on the last trading day of the year, December 30, 2005. Dividends will be paid on the unvested shares of restricted stock to the same extent dividends are paid on our outstanding common stock generally. |

| | | | | | | |

Name

| | Number of Shares

of Restricted

Stock Granted in 2005

| | At December 31, 2005

|

| | | Number of Remaining

Unvested Shares of Restricted Stock

| | Value of Remaining

Unvested Shares of

Restricted Stock

|

Rodger B. Holley | | 5,500 | | 5,500 | | $ | 53,570 |

Lloyd L. Montgomery, III | | 3,000 | | 3,000 | | $ | 29,220 |

William L. Lusk, Jr. | | 2,500 | | 2,500 | | $ | 24,350 |

8

| (3) | Issued pursuant to our 1999 Long-Term Incentive Plan and 2002 Long-Term Incentive Plan. |

| (4) | Consists of our contributions to the indicated person’s 401(k) plan and accruals for the indicated person’s salary continuation agreement in the following amounts: |

| | | | | | | | |

Name

| | Year

| | 401(k) Matching Contributions

| | Accrual for Salary

Continuation Agreement

|

Rodger B. Holley | | 2005

2004

2003 | | $

$

$ | 17,982

15,864

12,000 | | $

$

$ | 121,702

0

0 |

| | | |

Lloyd L. Montgomery, III | | 2005

2004

2003 | | $

$

$ | 12,258

11,507

10,765 | | $

$

$ | 16,086

0

0 |

| | | |

William L. Lusk, Jr. | | 2005

2004

2003 | | $

$

$ | 10,500

9,641

9,053 | | $

$

$ | 2,814

0

0 |

Grants of Options/SARs in 2005. In 2005, we issued incentive stock options under the 2002 Long-Term Incentive Plan to various key executive officers and employees. No stock appreciation rights (SARs) were granted in 2005. The following table sets forth information referencing the award of such incentive stock options to our named executive officers:

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of Total

Options Granted to

Employees in 2005

| | | Exercise

Price ($)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Appreciation for Option Term

|

| | | | | | 5%

| | 10%

|

Rodger B. Holley | | 17,500 | | 8.0 | % | | $ | 9.50 | | 12/21/2015 | | $ | 104,554 | | $ | 264,960 |

Lloyd L. Montgomery, III | | 8,600 | | 3.9 | % | | $ | 9.50 | | 12/21/2015 | | $ | 51,381 | | $ | 130,209 |

William L. Lusk, Jr. | | 7,500 | | 3.4 | % | | $ | 9.50 | | 12/21/2015 | | $ | 44,809 | | $ | 113,554 |

Aggregated Option/SAR Exercises in 2005 and 2005 Year-End Option/SAR Values. No stock options were exercised by our named executive officers during 2005. Additionally, there were no stock appreciation rights outstanding during 2005.

The following table shows the number of shares of our common stock covered by both exercisable and non-exercisable options held by our named executive officers as of December 31, 2005. Also reported are the values for “in-the-money” options, which represent the positive spread between the exercise price of any such existing options and the closing price of our common stock on the last trading day of the year, December 30, 2005 ($9.74 per share).

| | | | | | | | | | |

Name

| | Number of Securities

Underlying Unexercised

Options at December 31, 2005 (#)

| | Value of Unexercised In-the-Money Options at December 31, 2005 ($)

|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Rodger B. Holley | | 160,020 | | 49,144 | | $ | 625,502 | | $ | 76,040 |

Lloyd L. Montgomery, III | | 103,122 | | 23,198 | | $ | 284,613 | | $ | 34,557 |

William L. Lusk, Jr. | | 77,130 | | 20,874 | | $ | 307,682 | | $ | 30,866 |

Director Compensation

Under our director compensation policy, we pay our non-employee directors for their service as our directors. Employee directors are not separately compensated for their service as our directors because their current compensation levels cover all of their expected duties including those related to the Board of Directors.

9

On or about the date of the annual shareholders meeting, each non-employee director is paid a $12,000 retainer for his or her next year’s service as a director. The retainer is prorated for new directors based upon the length of time between their appointment and the date of the next annual shareholders’ meeting. In addition, each non-employee director is paid $500 for each board and committee meeting he or she attends. A director who participates in a board or committee meeting via teleconference receives 50% of the normal meeting fee. Each non-employee Chairperson of the Executive, Audit/Corporate Governance, Compensation and Nominating Committees receives a $5,000 retainer. Each non-employee Chairperson of the Property, Loan, Asset/Liability and Trust Committees receives a $3,000 retainer. Non-employee directors are also reimbursed for their expenses incurred in the course of fulfilling their duties as our directors.

Under our director compensation policy, we also grant an annual option to purchase shares of our common stock to our non-employee directors at the end of the directors’ year of service. In the event a director joins the board during the year, the number of shares subject to the option is prorated based on the number of months actually served by the director. In 2005, each non-employee director received an option to purchase 5,000 shares under this policy. The options are subject to the terms of our 2002 Long-Term Incentive Plan.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our common stock as of December 31, 2005 by (1) each of our current directors and director nominees; (2) each of our named executive officers; (3) all of our present executive officers and directors as a group; and (4) each person or entity known to us to be the beneficial owner of more than five percent of our outstanding common stock, based on the most recent Schedules 13G and 13D Reports filed with the SEC and the information contained in those filings. Unless otherwise indicated, the address for each person included in the table is 817 Broad Street, Chattanooga, Tennessee 37402.

Information relating to beneficial ownership of our common stock is based upon “beneficial ownership” concepts described in the rules issued under the Securities Exchange Act of 1934, as amended. Under these rules a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of the security, or “investment power,” which includes the power to dispose or to direct the disposition of the security. Under the rules, more than one person may be deemed to be a beneficial owner of the same securities. A person is also deemed to be a beneficial owner of any security as to which that person has the right to acquire beneficial ownership within sixty (60) days from December 31, 2005.

| | | | | | |

Name of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | | Percent of Shares Beneficially Owned (1)

| |

Directors: | | | | | | |

Rodger B. Holley | | 283,767 | (2) | | 1.59 | % |

J.C. Harold Anders | | 104,047 | (3) | | * | |

Carol H. Jackson | | 59,291 | (4) | | * | |

Ralph L. Kendall | | 39,764 | (5) | | * | |

William B. Kilbride | | 15,564 | (6) | | * | |

D. Ray Marler | | 152,064 | (7) | | * | |

Lloyd L. Montgomery, III | | 145,092 | (8) | | * | |

H. Patrick Wood | | 316,044 | (9) | | 1.79 | % |

| | |

Executive Officers, who are not also a Director: | | | | | | |

William L. Lusk, Jr. | | 100,274 | (10) | | * | |

| | |

All Current Directors and Executive Officers, as a Group (9 persons): | | 1,215,907 | | | 6.74 | % |

Other 5% Shareholders: | | | | | | |

Wellington Management Company, LLP(11) | | 1,316,909 | | | 7.46 | % |

| * | Less than 1% of outstanding shares. |

10

| (1) | The percentage of our common stock beneficially owned was calculated based on 17,653,833 shares of common stock issued and outstanding as of December 31, 2005. The percentage assumes the exercise by the shareholder or group named in each row of all options for the purchase of our common stock held by such shareholder or group and exercisable within 60 days of December 31, 2005. |

| (2) | Includes 5,500 shares subject to a restricted stock award, 65,196 shares owned by an IRA for the benefit of Mr. Holley and 312 shares owned by Mr. Holley’s child; also includes 165,960 shares that Mr. Holley has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (3) | Includes 3,564 shares that Mr. Anders has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (4) | Includes 7,439 shares owned by Ms. Jackson’s spouse and 5,088 shares owned by an IRA for the benefit of Ms. Jackson; also includes 3,564 shares that Ms. Jackson has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (5) | Includes 3,600 shares owned by Mr. Kendall’s spouse; also includes 3,564 shares that Mr. Kendall has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (6) | Includes 3,564 shares that Mr. Kilbride has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (7) | Includes 3,564 shares that Mr. Marler has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (8) | Includes 3,000 shares subject to a restricted stock award and 106,092 shares that Mr. Montgomery has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (9) | Includes 43,200 shares owned by Mr. Wood’s spouse; also includes 3,564 shares that Mr. Wood has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (10) | Includes 2,500 shares subject to a restricted stock award, 10,997 shares owned by an IRA for the benefit for Mr. Lusk and 1,396 shares owned by Mr. Lusk’s wife and children; also includes 80,100 shares that Mr. Lusk has the right to acquire by exercising options that are exercisable within 60 days after December 31, 2005. |

| (11) | The address for Wellington Management Company, LLP is 75 State Street, Boston, Massachusetts 02109. |

Employment Agreements

We regularly evaluate the total compensation paid to our senior management to link their compensation to our operating performance in the short and long-term. Our current employment agreements with our senior management are described below.

Rodger B. Holley. We entered into a three-year employment agreement with Rodger B. Holley on May 16, 2003 regarding Mr. Holley’s employment as our Chairman, Chief Executive Officer and President. Under the terms of the agreement, Mr. Holley received an initial base salary of $280,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 21, 2005, the Compensation Committee recommended that Mr. Holley’s salary be increased to $340,000 per year. We also provide Mr. Holley with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. At the end of each year of the agreement, it renews for an additional year, unless either of the parties to the agreement gives notice of his or its intent not to renew the agreement at least 90 days prior to the renewal date. If we terminate Mr. Holley’s employment without cause or Mr. Holley terminates his employment for good reason, Mr. Holley will be entitled to a Lump Sum Payment, a Pro Rata Incentive Payment and continuation of medical benefits for twelve months. The Lump Sum Payment is an amount equal to the sum of his current base salary plus the greater of (1) the highest of his last three years’ incentive payments or (2) the target annual incentive set forth in our incentive compensation plan. The Pro Rata Incentive Payment is an amount equal to the pro rata portion of the target annual incentive set forth in our incentive compensation plan based on the number of days that have passed in the employment year before Mr. Holley’s termination. Upon a change of control of First Security, Mr. Holley will be entitled to three times the Lump Sum Payment, payment of a Pro Rata Incentive Payment, and continuation of medical benefits for twelve months. If we cannot continue

11

the medical benefits to which Mr. Holley is entitled under the agreement because Mr. Holley is no longer employed by us, we will pay Mr. Holley the amount we would have paid for such benefits over the 12-month period. The agreement also generally provides that he will not compete with us in the banking business nor solicit our customers or employees for a period of 12 months following termination of his employment. The noncompetition and nonsolicitation provisions of the agreement apply if Mr. Holley terminates his employment without cause, for good reason or in connection with a change of control, or if we terminate his employment with or without cause.

We entered into a salary continuation agreement with Mr. Holley on December 21, 2005, pursuant to which Mr. Holley is entitled to certain non-qualified retirement benefits. Mr. Holley’s salary continuation agreement provides that Mr. Holley will be entitled to monthly benefits for 15 years upon his retirement after reaching normal retirement age (65). The amount of the monthly benefit will be based on a percentage of Mr. Holley’s final annual base salary or his average base salary for the three years prior to reaching normal retirement age, whichever is greater. The initial percentage of base salary payable to Mr. Holley is 60%, increasing 4% annually to a maximum of 80%. In the event Mr. Holley voluntarily resigns without good reason (as defined in the salary continuation agreement), he would be entitled to the vested percentage of the benefits actually accrued under his salary continuation agreement. The benefits vest in five equal annual increments beginning on June 1, 2006. In the event of a change in control, involuntary termination without cause, or resignation for good reason (each as defined in the salary continuation agreement), Mr. Holley would be entitled to the projected maximum benefit under his salary continuation agreement, based on his maximum percentage benefit and his expected annual salary upon reaching his normal retirement age. In the event of a termination due to disability, Mr. Holley would be entitled to 100% of the benefits accrued under the salary continuation agreement. Any such benefits are payable for 15 years, in twelve equal monthly installments, commencing on the first day of the month following his termination of employment or, if later, upon reaching normal retirement age. In the event Mr. Holley dies while benefits are still payable, his designated beneficiary would be entitled to all benefit payments at the same time and in the same manner as they would have been paid to Mr. Holley. In the event Mr. Holley is terminated for cause (as defined in the salary continuation agreement), Mr. Holley would not be entitled to any benefits under his salary continuation agreement. In the event Mr. Holley dies while in active service to us, his designated beneficiary would be entitled to the projected maximum benefit under the salary continuation agreement. Such benefit is payable for 15 years, in twelve equal monthly installments, commencing on the first day of the month following Mr. Holley’s death. We have purchased bank-owned life insurance policies, which may be used as a source for the payment of benefits.

Lloyd L. Montgomery, III. We entered into a three-year employment agreement with Lloyd L. Montgomery, III on May 16, 2003 regarding Mr. Montgomery’s employment as our Chief Operating Officer and Executive Vice President. Under the terms of the agreement, Mr. Montgomery received an initial base salary of $185,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 21, 2005, the Compensation Committee recommended that Mr. Montgomery’s salary be increased to $216,300 per year. We also provide Mr. Montgomery with health and life insurance, membership fees to social and civic clubs and an automobile for business and personal use. The other terms of Mr. Montgomery’s employment agreement are the same as those in Mr. Holley’s agreement.

We entered into a salary continuation agreement with Mr. Montgomery on December 21, 2005. The terms of Mr. Montgomery’s salary continuation agreement are generally the same as those in Mr. Holley’s agreement, except that percentage of base salary (or, if applicable, average base salary) payable to Mr. Montgomery is 30%, increasing 2% annually to a maximum of 50%.

William L. Lusk, Jr. We entered into a three-year employment agreement with William L. Lusk, Jr. on May 16, 2003 regarding Mr. Lusk’s employment as our Secretary, Chief Financial Officer and Executive Vice President. Under the terms of the agreement, Mr. Lusk received an initial base salary of $155,000 per year, which is subject to adjustment at least annually by the Compensation Committee. On December 21, 2005, the Compensation Committee recommended that Mr. Lusk’s salary be increased to $183,750 per year. We also provide Mr. Lusk with health and life insurance, membership fees to social and civic clubs and an automobile for

12

business and personal use. The other terms of Mr. Lusk’s employment agreement are the same as those in Mr. Holley’s agreement.

We entered into a salary continuation agreement with Mr. Lusk on December 21, 2005. The terms of Mr. Lusk’s salary continuation agreement are generally the same as those in Mr. Holley’s agreement, except that percentage of base salary (or, if applicable, average base salary) payable to Mr. Lusk is 20%, increasing 1% annually to a maximum of 40%.

Compensation Committee Report

The following report reflects First Security’s compensation philosophy, as endorsed by the Board of Directors and the Compensation Committee, and resulting actions taken by First Security for the reporting periods shown in the various compensation tables supporting the report. The Compensation Committee either approves or recommends to the Board of Directors payment amounts and award levels for executive officers of First Security and FSGBank.

Compensation Policy

The policies that govern the Compensation Committee’s executive compensation decisions are designed to align changes in total compensation with changes in the value created for First Security’s shareholders. The Compensation Committee believes that compensation of executive officers and others should be directly linked to First Security’s operating performance and that achievement of performance objectives over time is the primary determinant of share price.

The underlying objectives of the Compensation Committee’s compensation strategy are to establish incentives for certain executives and others to achieve and maintain short-term and long-term operating performance goals for First Security, to link executive and shareholder interests through equity-based plans, and to provide a compensation package that recognizes individual contributions as well as overall business results. At First Security, performance-based executive officer compensation includes base salary and long-term stock incentives. To further these objectives, the Compensation Committee engaged Clark Consulting, an independent consultant with expertise in executive compensation, to assist in implementing its compensation strategy.

Base Salary and Increases

In establishing executive officer salaries and increases, the Compensation Committee considers individual annual performance and the relationship of total compensation to the defined salary market. The decision to increase base pay is recommended by the Chief Executive Officer and approved by the Compensation Committee. Information regarding salaries paid in the market is obtained through formal salary surveys and other means, and is used to evaluate competitiveness with First Security’s competitors. First Security’s general philosophy is to provide base pay that is competitive with the market and to reward individual performance while positioning salaries so that they are consistent with First Security performance.

Long-Term Incentives

Long-term incentive awards have been made under the Second Amended and Restated 1999 Long-Term Incentive Plan and the 2002 Long-Term Incentive Plan, as amended. The purpose of both plans is to promote First Security’s success and enhance its value by linking the personal interests of employees, officers, and directors to those of First Security’s shareholders and by providing such persons with an incentive for outstanding performance.

The 1999 Long-Term Incentive Plan authorizes the granting of awards to selected employees and officers of First Security or its subsidiaries in the following forms: (1) options to purchase shares of common stock, which may be incentive stock options or non-qualified stock options and (2) restricted stock. The 2002 Long-Term Incentive Plan authorizes the granting of awards to selected employees, officers, consultants and directors of First Security or its subsidiaries in the following forms: (1) options to purchase shares of common stock, which may be incentive stock options or non-qualified stock options, (2) restricted stock and (3) stock appreciation rights.

13

Both plans are administered by the Compensation Committee. The committee has the power, authority, and discretion, among other things, to: (1) designate participants; (2) determine the type or types of awards to be granted to each participant and the terms and conditions thereof; (3) establish, adopt, or revise any rules and regulations as it may deem necessary or advisable to administer both plans; and (4) make all other decisions and determinations that may be required under both plans or that the Compensation Committee deems necessary or advisable.

The following table sets forth information regarding our equity compensation plans under which shares of our common stock are authorized for issuance. The only equity compensation plans maintained by us are the First Security Group, Inc. Second Amended and Restated 1999 Long-Term Incentive Plan and the First Security Group, Inc. 2002 Long-Term Incentive Plan, as amended. All data is presented as of December 31, 2005.

| | | | | | | |

| | | Number of securities to be issued upon exercise of outstanding options

| | Weighted-average exercise price of outstanding options

| | Number of shares remaining available for future issuance under the Plans (excludes outstanding options)

|

Equity compensation plans approved by security holders | | 1,133,963 | | $ | 7.28 | | 268,280 |

| | | |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | | |

Total | | 1,133,963 | | $ | 7.28 | | 268,280 |

Deduction Limit

Pursuant to Section 162(m) of the Internal Revenue Code (the “Code”), First Security may not deduct compensation in excess of $1 million paid to the Chief Executive Officer or the four next most highly compensated executive officers of First Security. The 1999 Long-Term Incentive Plan and the 2002 Long-Term Incentive Plan were designed to comply with Code Section 162(m) so that the grant of options under both plans will be excluded from the calculation of annual compensation for purposes of Code Section 162(m) and will be fully deductible by us, although other awards under the plans that are not performance-based awards may not so qualify.

Chief Executive Officer Pay

Each year the Compensation Committee formally reviews the compensation paid to the Chief Executive Officer of the Company. Changes in base salary and the awarding of cash and stock incentives are based on overall financial performance and profitability related to objectives stated in the Company’s strategic performance plan and the initiatives taken to direct the Company. After careful consideration, the Compensation Committee recommended that the salary for Mr. Rodger B. Holley, President and Chief Executive Officer of the Company, be increased to $340,000.

Summary

The Compensation Committee believes that First Security’s compensation program is reasonable and competitive with compensation paid by other financial institutions of similar size. The program is designed to reward managers for strong personal, company, and share-value performance. The Compensation Committee monitors the various guidelines that make up the program and reserves the right to adjust them as necessary to continue to meet First Security and shareholder objectives.

| | |

| Compensation Committee: | | J.C. Harold Anders, Chairman |

| | | Ralph L. Kendall |

| | | D. Ray Marler |

| | | H. Patrick Wood |

| |

| | | April 28, 2006 |

14

Audit/Corporate Governance Committee Report

The Audit/Corporate Governance Committee monitors First Security’s financial reporting process on behalf of the Board of Directors. This report reviews the actions taken by the Audit/Corporate Governance Committee with regard to First Security’s financial reporting process during 2005 and particularly with regard to First Security’s audited consolidated financial statements as of December 31, 2005 and 2004 and for the three years ended December 31, 2005.

First Security’s management has the primary responsibility for First Security’s financial statements and reporting process, including the systems of internal controls. First Security’s independent auditors are responsible for performing an independent audit of First Security’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and issuing a report on First Security’s consolidated financial statements. The Audit/Corporate Governance Committee’s responsibility is to monitor the integrity of First Security’s financial reporting process and system of internal controls and to monitor the independence and performance of First Security’s independent auditors and internal auditors.

The Audit/Corporate Governance Committee believes that it has taken the actions it deems necessary or appropriate to fulfill its oversight responsibilities under the Audit/Corporate Governance Committee’s charter. To carry out its responsibilities, the Audit/Corporate Governance Committee met five times during 2005.

The Audit/Corporate Governance Committee reviewed and approved all of the related party transactions. In addition, the Audit/Corporate Governance Committee determined that the related party transactions were on substantially the same terms as those prevailing at the time for comparable transactions with unrelated parties, and were not expected to present unfavorable features to First Security.

In fulfilling its oversight responsibilities, the Audit/Corporate Governance Committee reviewed with management the audited financial statements included in First Security’s annual report on Form 10-K for the year ended December 31, 2005, including a discussion of the quality (rather than just the acceptability) of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit/Corporate Governance Committee also reviewed with First Security’s independent auditors, Joseph Decosimo and Company, PLLC, their judgments as to the quality (rather than just the acceptability) of the Company’s accounting principles, and such other matters as are required to be discussed with the Audit/Corporate Governance Committee under Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. In addition, the Audit/Corporate Governance Committee discussed with Joseph Decosimo and Company, PLLC its independence from management and First Security, including the written disclosures and other matters required of Joseph Decosimo and Company, PLLC by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. The Audit/Corporate Governance Committee also considered whether the provision of services during 2005 by Joseph Decosimo and Company, PLLC that were unrelated to its audit of the financial statements referred to above, and to their reviews of First Security’s interim financial statements during 2005, is compatible with maintaining Joseph Decosimo and Company, PLLC’s independence.

Additionally, the Audit/Corporate Governance Committee discussed with First Security’s internal and independent auditors the overall scope and plan for their respective audits. The Audit/Corporate Governance Committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of First Security’s internal controls, and the overall quality of First Security’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit/Corporate Governance Committee recommended to the Board of Directors that the audited financial statements be included in First Security’s annual report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange

15

Commission. The Audit/Corporate Governance Committee believes that, at this time, nothing has come to its attention that impairs Joseph Decosimo and Company, PLLC’s independence or their ability to provide quality professional audit services, and therefore recommends to the Board that First Security retain Joseph Decosimo and Company, PLLC as First Security’s independent auditors for 2006.

| | |

| Audit/Corporate Governance Committee: | | Ralph L. Kendall, Chairman |

| | | Carol H. Jackson |

| | | William B. Kilbride |

| |

| | | April 28, 2006 |

Certain Transactions and Business Relationships

Certain of our directors, officers and principal shareholders and their associates have had banking and business transactions with us in the ordinary course of business since the beginning of the last fiscal year. In the case of all such related party transactions, each transaction was either approved by the Audit/Corporate Governance Committee of the Board of Directors or by the Board of Directors. In addition, each transaction was on substantially the same terms, including price or interest rate and collateral, as those prevailing at the time for comparable transactions with unrelated parties, and were not expected to involve more than the normal risk of collectibility or present other unfavorable features to us. As of December 31, 2005, the aggregate amount of credit we extended to directors, executive officers and principal shareholders was $675 thousand, or less than 1% of our equity. We expect we will continue to engage in similar banking and business transactions in the ordinary course of business with our directors, executive officers, principal shareholders and their associates in the future.

16

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has appointed Joseph Decosimo and Company, PLLC, an independent registered public accounting firm, as independent auditors for First Security and FSGBank for the current fiscal year ending December 31, 2006, subject to ratification by the shareholders. Joseph Decosimo and Company, PLLC, has served as the independent auditors for First Security and FSGBank since February 17, 1999. Joseph Decosimo and Company, PLLC, has advised First Security that neither the firm nor any of its principals has any direct or material interest in First Security or FSGBank except as auditors and independent public accountants of First Security and FSGBank. Although shareholder ratification of our independent auditors is not required by our Bylaws or otherwise, we are submitting the selection of Joseph Decosimo and Company, PLLC to our shareholders for ratification to permit shareholders to participate in this important corporate decision.

The following table sets forth fees for professional audit and quarterly review services rendered by Joseph Decosimo and Company, PLLC, for the years ended December 31, 2005 and 2004, as well as fees billed for other services rendered by Joseph Decosimo and Company, PLLC, during those periods.

| | | | | | |

| | | 2005

| | 2004

|

Audit Fees | | $ | 217,500 | | $ | 167,500 |

Audit-Related Fees1 | | | 234,628 | | | 157,877 |

Tax Fees—Preparation and Compliance2 | | | 96,850 | | | 69,980 |

| | |

|

| |

|

|

Sub total | | | 548,978 | | | 395,357 |

| | |

|

| |

|

|

Tax Fees—Other3 | | | 22,300 | | | 55,025 |

All Other Fees4 | | | — | | | 20,000 |

| | |

|

| |

|

|

Sub total | | | 22,300 | | | 75,025 |

| | |

|

| |

|

|

Total Fees | | $ | 571,278 | | $ | 470,382 |

| | |

|

| |

|

|

| (1) | Audit-related fees consisted of assurance and other services that are related to the performance of the audit or quarterly review of First Security’s financial statements. Such fees include audits and due diligence procedures related to acquisitions, audit of First Security’s benefit plan, and accounting consultation related to the aforementioned items. Audit-related fees for 2005 include fees for services provided in connection with First Security’s initial public offering and filing of registration statement on Form S-1 with the Securities and Exchange Commission |

| (2) | Tax Fees—Preparation and Compliance consist of the aggregate fees billed for professional services rendered by Joseph Decosimo and Company, PLLC, for tax return preparation and compliance |

| (3) | Tax Fees—Other consist primarily of tax research and consultation related to acquisitions as well as tax planning and other tax advice. |

| (4) | Other fees consist primarily of fees billed for consultation with management regarding the appropriate accounting treatment of debt and equity financing. |

The Board of Directors of First Security has considered whether the provision of services during 2005 by Joseph Decosimo and Company, PLLC that were unrelated to its audit of First Security’s financial statements or its reviews of First Security’s interim financial statements during 2005 is compatible with maintaining Joseph Decosimo and Company, PLLC’s independence. The services provided by the independent auditors were pre-approved by the Audit Committee to the extent required under applicable law and in accordance with the provisions of the Committee’s charter. The Audit Committee requires pre-approval of all audit and allowable non-audit services.

A representative of Joseph Decosimo and Company, PLLC is expected to be present at the Meeting and will be given the opportunity to make a statement on behalf of the firm if he or she so desires. A representative of Joseph Decosimo and Company, PLLC is also expected to respond to appropriate questions from shareholders.

The appointment of Joseph Decosimo and Company, PLLC as independent auditors for First Security for fiscal year ending December 31, 2006 requires approval by the affirmative vote of the holders of shares of common stock representing a majority of the votes cast at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

APPROVAL OF THE APPOINTMENT OF JOSEPH DECOSIMO AND COMPANY, PLLC AS

INDEPENDENT AUDITORS FOR FISCAL YEAR ENDING DECEMBER 31, 2006.

17

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than 10% of the Company’s common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Directors, executive officers and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file. During 2005, all Form 4 reports were filed timely to the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required during the year ended December 31, 2005, for all of the Company’s directors, executive officers and beneficial owners of over 10% of the Company’s outstanding common stock.

DIRECTOR NOMINATIONS AND SHAREHOLDER COMMUNICATIONS

Director Nominations

The full Board of Directors of First Security has established the Nominating Committee to (1) identify individuals qualified to become members of the Board, and (2) select, or recommend to the Board, the director nominees for the next annual shareholders meeting. Our Nominating Committee is comprised of D. Ray Marler (Chairman), J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall and William B. Kilbride, all of whom are “independent directors” as defined by the National Association of Securities Dealers, Inc. The Nominating Committee has not adopted a formal policy or process for identifying or evaluating director nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, our customers and shareholders and professionals in the financial services and other industries. Similarly, the committee does not prescribe any specific qualifications or skills that a nominee must possess, although it considers the potential nominee’s business experience; knowledge of us and the financial services industry; experience in serving as one of our directors or as a director of another financial institution or public company generally; wisdom, integrity and analytical ability; familiarity with and participation in the communities served by us; commitment to and availability for service as a director; and any other factors the committee deems relevant.

In accordance with our bylaws, a shareholder may nominate persons for election as directors if written notice to the Secretary of First Security of the nomination is received at our principal executive offices at least 60 days prior to the date of the annual meeting, assuming the meeting will be held the same date as the prior year’s annual meeting, or at least 60 days prior to the date of the annual meeting for that year provided that we have publicly announced the annual meeting date at least 75 days in advance. The notice must set forth:

| | (1) | the name, age, business address and residence address of all individuals nominated; |

| | (2) | the principal occupation or employment of all individuals nominated; |

| | (3) | the class and number of shares of First Security which are beneficially owned by all individuals nominated; |

| | (4) | any other information relating to all individuals nominated that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A of the Securities Exchange Act of 1934 and the SEC’s rules and regulations thereunder and any other applicable laws or rules or regulations of any governmental authority or of any national securities exchange or similar body overseeing any trading market on which shares of First Security are traded; |

| | (5) | the name and record address of the nominating shareholder; and |

| | (6) | the class and number of shares of First Security which are beneficially owned by the nominating shareholder. |

18

The officer presiding at meeting may, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing requirements and therefore will be disregarded.

Shareholder Proposals

To be included in First Security’s annual proxy statement, shareholder proposals not relating to the election of directors must be received by First Security at least 120 days before the one-year anniversary of the mailing date for the prior year’s proxy statement, which in our case would require that proposals be submitted no later than December 29, 2006 for next year’s annual meeting. The persons named as proxies in First Security’s proxy statement for the meeting will, however, have discretionary authority to vote the proxies they have received as they see fit with respect to any proposals received less than 60 days prior to the meeting date. SEC Rule 14a-8 provides additional information regarding the content and procedure applicable to the submission of shareholder proposals.

Shareholder Communications

Shareholders wishing to communicate with the Board of Directors or with a particular director may do so in writing addressed to the Board, or to the particular director, by sending it to the William L. (Chip) Lusk, Jr., Secretary of the Board of First Security at First Security’s principal office at 817 Broad Street, Chattanooga, Tennessee 37402. The Secretary will promptly forward such communications to the applicable director or to the Chairman of the Board for consideration at the next scheduled meeting.

OTHER MATTERS

Management of First Security does not know of any matters to be brought before the Meeting other than those described above. If any other matters properly come before the Meeting, the persons designated as proxies will vote on such matters in accordance with their best judgment.

19

OTHER INFORMATION

Proxy Solicitation Costs

The cost of soliciting Proxies for the Meeting will be paid by First Security. In addition to the solicitation of shareholders of record by mail, telephone, electronic mail, facsimile or personal contact, we will be contacting brokers, dealers, banks, or voting trustees or their nominees who can be identified as record holders of common stock; such holders, after inquiry by us, will provide information concerning quantities of proxy materials needed to supply such information to beneficial owners, and we will reimburse them for the reasonable expense of mailing proxy materials to such persons.

Annual Report on Form 10-K

A copy of our annual report on Form 10-K for the fiscal year ended December 31, 2005 (including the financial schedules thereto but without the exhibits) is being mailed to shareholders of record along with this Proxy Statement.

We will furnish any exhibit to our annual report on Form 10-K to any person solicited hereby upon written request and payment of a reasonable fee as we may specify to cover our expenses in providing the exhibits.Requests may be addressed to First Security Group, Inc., 817 Broad Street, Chattanooga, Tennessee 37402, Attention: William L. (Chip) Lusk, Jr., Secretary of the Board.

Our annual report on Form 10-K, including exhibits, is also accessible from our corporate website, www.FSGBank.com. This website also contains our other filings with the Securities and Exchange Commission, including but not limited to our quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these or other reports. These reports are accessible soon after we file them with the Securities and Exchange Commission.

| | |

| | | By Order of the Board of Directors, |

| |

| | |  |

| | | Rodger B. Holley Chairman of the Board, Chief Executive Officer & President |

April 28, 2006

20

REVOCABLE PROXY

FIRST SECURITY GROUP, INC.

REVOCABLE PROXY BY AND ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 23, 2006

The undersigned hereby appoints Rodger B. Holley and William L. Lusk, Jr., or either of them, each with full power of substitution, as Proxies to vote all shares of the $.01 par value common stock of First Security Group, Inc. that the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held Friday, June 23, 2006, at 3:00 pm, local time, at the Four Seasons, 200 Boylston Street, Boston, Massachusetts 02116, and at any postponement or adjournment thereof.

The Proxies will vote on the proposals set forth in the notice of annual meeting and proxy statement as specified on this proxy and are authorized to vote at their discretion as to any other business which may come properly before the meeting. If a vote is not specified, the Proxies will vote for approval of the proposals.

The Board of Directors recommends a vote“FOR” the following proposals:

1. Election of Directors: Authority for the election of Rodger B. Holley, J.C. Harold Anders, Carol H. Jackson, Ralph L. Kendall, William B. Kilbride, D. Ray Marler and Lloyd L. Montgomery, III as directors, each to serve until First Security’s 2007 Annual Meeting of Shareholders and until their successors are elected and qualified.

| | | | |

For | | Withhold | | For All Except |

INSTRUCTION: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name in the space provided below.

2. Ratification of the Appointment of Joseph Decosimo and Company, PLLC, as Independent Auditors. Authority to ratify the appointment of Joseph Decosimo and Company, PLLC, as independent auditors for First Security and its subsidiary for the current fiscal year ending December 31, 2006.

COMMON SHARES:

ACCOUNT NUMBER:

THIS PROXY IS SOLICITED BY THE COMPANY’S BOARD OF DIRECTORS AND MAY BE REVOKED PRIOR TO ITS EXERCISE.

Please be sure to sign and date this Proxy in the box below.

Date

| | | | | | | | | | |

| | | | |

| | | | | | | | | |

| Shareholder sign above | | | | | | Co-holder (if any) sign above |

Detach above card, mark, sign, date and return in the envelope furnished.

FIRST SECURITY GROUP, INC.

Please sign exactly as name appears on the label below. When shares are held by joint tenants both should sign. When signing as attorney, administrator, trustee, or guardian please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

PLEASE MARK, SIGN ABOVE, AND RETURN THIS PROXY PROMPTLY IN THE ENVELOPE FURNISHED.

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.