UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10371

LORD ABBETT EQUITY TRUST

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Brooke A. Fapohunda, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 7/31

Date of reporting period: 7/31/2015

| Item 1: | Report(s) to Shareholders. |

2015 LORD ABBETT

ANNUAL REPORT

Lord Abbett

Calibrated Large Cap Value Fund

Calibrated Mid Cap Value Fund

For the fiscal year ended July 31, 2015

Lord Abbett Equity Trust

Lord Abbett Calibrated Large Cap Value Fund and

Lord Abbett Calibrated Mid Cap Value Fund

Annual Report

For the fiscal year ended July 31, 2015

Daria L. Foster, Trustee, President and Chief Executive Officer of the Lord Abbett Funds, and E. Thayer Bigelow, Independent Chairman of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Lord Abbett Equity Trust Funds for the fiscal year ended July 31, 2015. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Funds, please visit our website at www.lordabbett.com, where you also can access quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Daria L. Foster

Trustee, President and Chief Executive Officer

Calibrated Large Cap Value Fund

For the fiscal year ended July 31, 2015, the Fund returned 6.71%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 1000 Value® Index,1 which returned 6.40% over the same period.

Domestic equity markets saw solid gains over the past year, with the S&P 500® Index2 rising more than 11% during

the trailing 12-month period. Despite this general trend upward, there were a few periods of short-term volatility, most notably in October 2014, when the market almost entered correction territory, before rebounding to end the month at a new high, and in January 2015 when the S&P 500 declined 3.1%. One of the prevailing market themes during the trailing 12-month period was the decline in energy prices, with oil notably plunging 60% from a high in June 2014 to a six-year low in

1

March 2015. Finally, the U.S. economy initially was reported to have contracted by 0.2% in the first quarter of 2015; however, that figure was later revised up to a modest 0.6% expansion.

Consistent with our Calibrated investment approach that seeks to achieve excess returns through a focus on security selection, individual stock positions drove relative performance during the period. Strong stock selection within the energy and health care sectors contributed to relative performance over the trailing 12-month period. Within the energy sector, the share price of Valero Energy Corp., an international manufacturer and marketer of transportation fuels, advanced after the company reported strong earnings for the fourth quarter of 2014. Management remained focused on returning capital to shareholders, in the form of an increased dividend. The portfolio’s underweight position in Exxon Mobil Corp., an oil and natural gas exploration and production company, contributed to relative performance. The share price of Exxon fell during the period amid challenging market conditions.

Within the health care sector, the share price of Aetna Inc., a diversified health care benefits company, rose after the company reported well-managed medical expenses and membership growth during the first quarter of calendar year 2015. Pfizer, Inc., a global biopharmaceutical company, benefited from the acquisition of Hospira, Inc., a

world leader in injectable drugs and infusion technologies.

Stock selection within the information technology and utilities sectors detracted from relative performance during the period. Semiconductor provider Micron Technology, Inc. detracted from performance after missing on both the top and bottom line on second quarter 2015 results. Despite reporting an impressive second quarter, Intel Corp., a designer and manufacturer of digital technology platforms, faced headwinds surrounding the PC market.

Within the utilities sector, AES Corporation, a diversified power generation and utility company, detracted from relative performance. A diminished Brazilian economic outlook presented headwinds for the company. Edison International, a public utility company, also detracted from performance following a request to reopen a legal settlement for the permanent retirement of SONGS nuclear plant.

Calibrated Mid Cap Value Fund

For the fiscal year ended July 31, 2015, the Fund returned 10.15%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell Midcap Value® Index,3 which returned 6.64% over the same period.

Domestic equity markets saw solid gains over the past year, with the S&P 500® Index2 rising more than 11% during

2

the trailing 12-month period. Despite this general trend upward, there were a few periods of short-term volatility, most notably in October 2014, when the market almost entered correction territory, before rebounding to end the month at a new high, and in January 2015 when the S&P 500 declined 3.1%. One of the prevailing market themes during the trailing 12-month period was the decline in energy prices, with oil notably plunging 60% from a high in June 2014 to a six-year low in March 2015. Finally, the U.S. economy initially was reported to have contracted by 0.2% in the first quarter of 2015; however, that figure was later revised up to a modest 0.6% expansion.

Consistent with our Calibrated investment approach that seeks to achieve excess returns through a focus on security selection, individual stock positions drove relative performance during the period. Stock selection within the consumer discretionary and energy sectors contributed to relative performance. Within the consumer discretionary sector, the share price of Whirlpool Corp., a home appliances manufacturer, advanced amid new product launches and improving demand in North and Latin America. Cruise company Royal Caribbean Cruises Ltd. benefited during the period from lower fuel costs and an increase in booking volumes.

Within the energy sector, an overweight of strong-performing PBF Energy Inc., a petroleum refiner, resulted in

a positive contribution to performance. Lower oil prices resulted in stronger than expected East Coast refining margins, pushing earnings ahead of estimates at the end of 2014. An underweight position in natural gas producer Chesapeake Energy Corp. contributed to relative performance. Although Chesapeake saw an improvement in its operations and finances, legacy commitments continue to drag on the company’s share price.

Stock selection within the health care and industrials sectors detracted from relative performance during the period. Within the health care sector, the portfolio’s underweight in Humana Inc., a health and well-being company, detracted from performance. Humana benefited from speculation that Aetna Inc. would acquire the company. Aetna announced the acquisition on July 6, 2015. An underweight position in HCA Holdings Inc., a health care services company, also detracted from relative performance. HCA continued to see strong volumes and improving margins in its core business.

Within the industrials sector, Timken Company, an engineering and manufacturing company, detracted from relative performance after management announced currency headwinds adversely affected revenues. Terex Corp., a diversified global manufacturer, detracted from performance after the company reported operating margins were weighed down by labor issues at West Coast ports, poor weather, and oil/gas weakness.

3

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

2 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

3 The Russell Midcap® Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value index.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost.

You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense reimbursements, the Funds’ returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio holdings of the Funds as of July 31, 2015. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Funds’ portfolio is actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’ portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

4

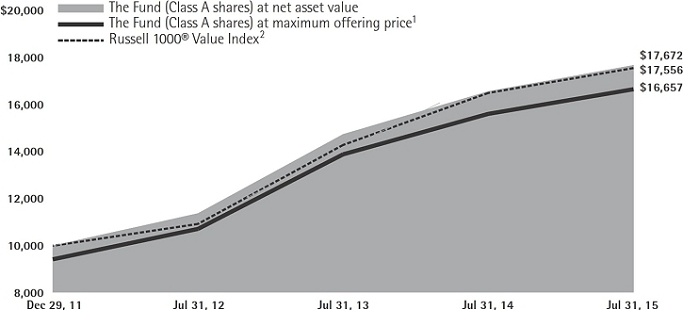

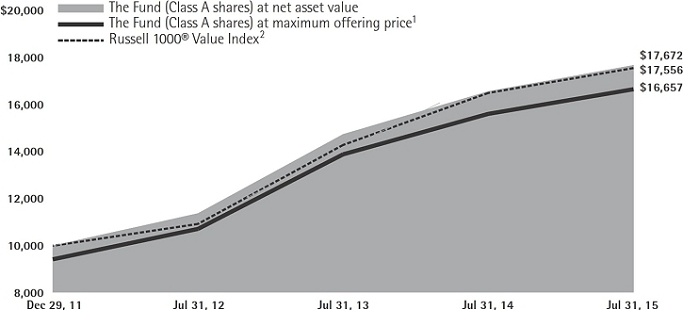

Calibrated Large Cap Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Value Index, assuming reinvestment of all distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the period, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended July 31, 2015

| | | | 1 Year | | Life of Class |

| Class A3 | | | 0.58 | % | | | 15.28 | % |

| Class C4 | | | 5.00 | % | | | 16.34 | % |

| Class F5 | | | 6.90 | % | | | 17.37 | % |

| Class I5 | | | 6.99 | % | | | 17.49 | % |

| Class R25 | | | 6.35 | % | | | 17.00 | % |

| Class R35 | | | 6.47 | % | | | 16.96 | % |

| Class R46 | | | – | | | | 0.38 | %* |

| Class R56 | | | – | | | | 0.38 | %* |

| Class R66 | | | – | | | | 0.38 | %* |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of the index begins on December 29, 2011.

3 Class A shares commenced operations on December 21, 2011 and performance for the Class began on December 29, 2011. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the period ended July 31, 2015, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on December 21, 2011 and performance for the Class began on December 29, 2011. Reflects the deduction of the 1% CDSC for Class C shares, which normally applies before the first anniversary of the purchase date.

5 Class F, I, R2 and R3 commenced operations on December 21, 2011 and performance for the Classes began on December 29, 2011. Performance is at net asset value.

6 Class R4, R5 and R6 commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

* Because Class R4, R5 and R6 shares have existed for less than one year, average annual returns are not provided.

5

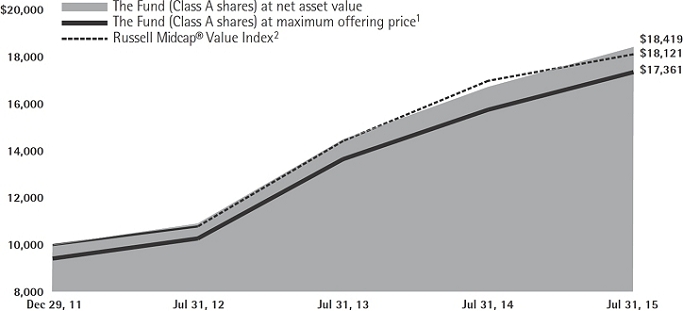

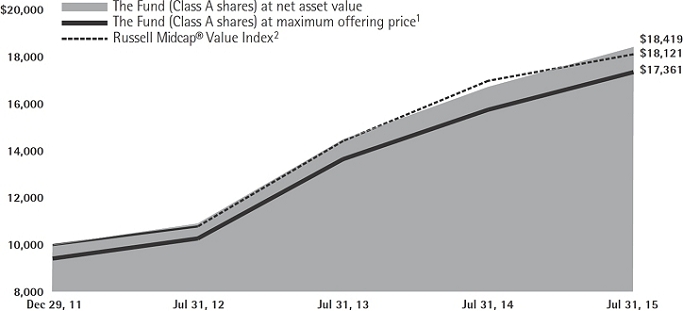

Calibrated Mid Cap Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell Midcap® Value Index, assuming reinvestment of all distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the period, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended July 31, 2015

| | | 1 Year | | Life of Class |

| Class A3 | | | 3.83 | % | | | 16.61 | % |

| Class C4 | | | 8.35 | % | | | 17.68 | % |

| Class F5 | | | 10.31 | % | | | 18.74 | % |

| Class I5 | | | 10.41 | % | | | 18.86 | % |

| Class R25 | | | 9.72 | % | | | 18.36 | % |

| Class R35 | | | 9.84 | % | | | 18.45 | % |

| Class R46 | | | – | | | | 0.46 | %* |

| Class R56 | | | – | | | | 0.46 | %* |

| Class R66 | | | – | | | | 0.46 | %* |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of the index begins on December 29, 2011.

3 Class A shares commenced operations on December 21, 2011 and performance for the Class began on December 29, 2011. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the period ended July 31, 2015, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on December 21, 2011 and performance for the Class began on December 29, 2011. Reflects the deduction of the 1% CDSC for Class C shares, which normally applies before the first anniversary of the purchase date.

5 Class F, I, R2 and R3 commenced operations on December 21, 2011 and performance for the Classes began on December 29, 2011. Performance is at net asset value.

6 Class R4, R5 and R6 commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

* Because Class R4, R5 and R6 shares have existed for less than one year, average annual returns are not provided.

6

Expense Example

As a shareholder of each Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2015 through July 31, 2015).

Actual Expenses

For each class of each Fund, the first line of the applicable table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 2/1/15 - 7/31/15” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the applicable table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

7

Calibrated Large Cap Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period† |

| | | | | | | |

| | | | | | | 2/1/15 – |

| | | 2/1/15 | | 7/31/15 | | 7/31/15 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,039.30 | | $3.79 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.08 | | $3.76 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,035.80 | | $7.52 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.41 | | $7.45 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,040.30 | | $3.04 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.82 | | $3.01 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,040.80 | | $2.53 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.32 | | $2.51 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,037.60 | | $5.56 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.34 | | $5.51 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,038.50 | | $5.05 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.84 | | $5.01 |

| Class R4 | | | | | | |

| Actual | | $1,000.00 | | $1,003.80 | | $0.64 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.61 | | $0.64 |

| Class R5 | | | | | | |

| Actual | | $1,000.00 | | $1,003.80 | | $0.43 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.82 | | $0.43 |

| Class R6 | | | | | | |

| Actual | | $1,000.00 | | $1,003.80 | | $0.40 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.85 | | $0.40 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.75% for Class A, 1.49% for Class C, 0.60% for Class F, 0.50% for Class I, 1.10% for Class R2, 1.00% for Class R3, 0.75% for Class R4, 0.50% for Class R5 and 0.47% for Class R6) multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period for Classes A, C, F, I, R2 and R3) and multiplied by 31/365 (to reflect the period from June 30, 2015, commencement of operations, to July 31, 2015, for Classes R4, R5 and R6). |

8

Portfolio Holdings Presented by Sector

July 31, 2015

| Sector* | %** |

| Consumer Discretionary | 5.33% |

| Consumer Staples | 6.25% |

| Energy | 12.60% |

| Financials | 30.76% |

| Health Care | 11.73% |

| Industrials | 10.55% |

| Information Technology | 11.69% |

| Materials | 2.46% |

| Telecommunication Services | 2.76% |

| Utilities | 5.32% |

| Repurchase Agreement | 0.55% |

| Total | 100.00% |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments. |

9

Calibrated Mid Cap Value Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period† |

| | | | | | | |

| | | | | | | 2/1/15 ��� |

| | | 2/1/15 | | 7/31/15 | | 7/31/15 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,029.40 | | $4.28 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.58 | | $4.26 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,025.50 | | $8.04 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.86 | | $8.00 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,030.40 | | $3.52 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.32 | | $3.51 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,030.30 | | $3.02 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.82 | | $3.01 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,027.30 | | $6.03 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.84 | | $6.01 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,027.80 | | $5.53 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.34 | | $5.51 |

| Class R4 | | | | | | |

| Actual | | $1,000.00 | | $1,000.00 | | $0.72 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.52 | | $0.72 |

| Class R5 | | | | | | |

| Actual | | $1,000.00 | | $1,000.00 | | $0.51 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.74 | | $0.51 |

| Class R6 | | | | | | |

| Actual | | $1,000.00 | | $1,000.00 | | $0.50 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,003.75 | | $0.50 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.85% for Class A, 1.60% for Class C, 0.70% for Class F, 0.60% for Class I, 1.20% for Class R2,1.10% for Class R3, 0.85% for Class R4, 0.60% for Class R5 and 0.59% for R6) multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period for Classes A, B, C, F, I, P, R2 and R3) and multiplied by 31/365 (to reflect the period from June 30, 2015, commencement of operations, to July 31, 2015, for Classes R4, R5 and R6). |

10

Portfolio Holdings Presented by Sector

July 31, 2015

| Sector* | %** |

| Consumer Discretionary | 9.04% |

| Consumer Staples | 3.23% |

| Energy | 9.00% |

| Financial | 33.19% |

| Health Care | 6.89% |

| Industrials | 9.92% |

| Information Technology | 9.71% |

| Materials | 6.32% |

| Telecommunication Services | 0.99% |

| Utilities | 11.09% |

| Repurchase Agreement | 0.62% |

| Total | 100.00% |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments. |

11

Schedule of Investments

CALIBRATED LARGE CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| COMMON STOCKS 99.42% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense 3.78% | | | | | | | | |

| General Dynamics Corp. | | | 25,100 | | | $ | 3,743 | |

| Orbital ATK, Inc. | | | 82,700 | | | | 5,868 | |

| Raytheon Co. | | | 35,900 | | | | 3,916 | |

| Spirit AeroSystems Holdings, Inc. Class A* | | | 27,100 | | | | 1,526 | |

| United Technologies Corp. | | | 39,900 | | | | 4,002 | |

| Total | | | | | | | 19,055 | |

| | | | | | | | | |

| Air Freight & Logistics 0.34% | | | | | | | | |

| FedEx Corp. | | | 10,000 | | | | 1,714 | |

| | | | | | | | | |

| Airlines 1.37% | | | | | | | | |

| Delta Air Lines, Inc. | | | 156,000 | | | | 6,917 | |

| | | | | | | | | |

| Automobiles 2.12% | | | | | | | | |

| Ford Motor Co. | | | 219,800 | | | | 3,259 | |

| General Motors Co. | | | 235,000 | | | | 7,405 | |

| Total | | | | | | | 10,664 | |

| | | | | | | | | |

| Banks 11.00% | | | | | | | | |

| BB&T Corp. | | | 144,100 | | | | 5,803 | |

| Citigroup, Inc. | | | 302,900 | | | | 17,707 | |

| Fifth Third Bancorp | | | 274,700 | | | | 5,788 | |

| JPMorgan Chase & Co. | | | 287,900 | | | | 19,730 | |

| Wells Fargo & Co. | | | 110,000 | | | | 6,366 | |

| Total | | | | | | | 55,394 | |

| | | | | | | | | |

| Biotechnology 0.78% | | | | | | | | |

| Alkermes plc (Ireland)*(a) | | | 23,800 | | | | 1,667 | |

| Amgen, Inc. | | | 12,900 | | | | 2,278 | |

| Total | | | | | | | 3,945 | |

| | | | | | | | | |

| Capital Markets 3.87% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 48,700 | | | | 6,120 | |

| Invesco Ltd. | | | 210,500 | | | | 8,125 | |

| Morgan Stanley | | | 135,700 | | | | 5,271 | |

| Total | | | | | | | 19,516 | |

| | | | | | | | | |

| Chemicals 0.89% | | | | | | | | |

| Huntsman Corp. | | | 236,000 | | | | 4,484 | |

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Communications Equipment 2.66% | | | | | | | | |

| Cisco Systems, Inc. | | | 287,200 | | | $ | 8,162 | |

| CommScope Holding Co., Inc.* | | | 166,400 | | | | 5,220 | |

| Total | | | | | | | 13,382 | |

| | | | | | | | | |

| Consumer Finance 2.66% | | | | | | | | |

| Capital One Financial Corp. | | | 126,400 | | | | 10,276 | |

| Santander Consumer USA Holdings, Inc.* | | | 128,500 | | | | 3,107 | |

| Total | | | | | | | 13,383 | |

| | | | | | | | | |

| Diversified Financial Services 1.80% | | | | | | | | |

| Intercontinental Exchange, Inc. | | | 9,150 | | | | 2,087 | |

| Voya Financial, Inc. | | | 148,200 | | | | 6,958 | |

| Total | | | | | | | 9,045 | |

| | | | | | | | | |

| Diversified Telecommunication Services 2.76% | | | | | | | | |

| AT&T, Inc. | | | 325,200 | | | | 11,297 | |

| Verizon Communications, Inc. | | | 55,300 | | | | 2,588 | |

| Total | | | | | | | 13,885 | |

| | | | | | | | | |

| Electric: Utilities 2.37% | | | | | | | | |

| Duke Energy Corp. | | | 44,900 | | | | 3,333 | |

| Edison International | | | 28,700 | | | | 1,722 | |

| PPL Corp. | | | 181,500 | | | | 5,774 | |

| Westar Energy, Inc. | | | 28,800 | | | | 1,084 | |

| Total | | | | | | | 11,913 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components 1.92% | |

| Avnet, Inc. | | | 163,500 | | | | 6,823 | |

| Ingram Micro, Inc. Class A* | | | 104,300 | | | | 2,840 | |

| Total | | | | | | | 9,663 | |

| | | | | | | | | |

| Energy Equipment & Services 2.28% | | | | | | | | |

| Atwood Oceanics, Inc. | | | 105,900 | | | | 2,203 | |

| National Oilwell Varco, Inc. | | | 20,700 | | | | 872 | |

| Rowan Cos., plc Class A | | | 100,700 | | | | 1,735 | |

| Schlumberger Ltd. | | | 72,200 | | | | 5,979 | |

| Tidewater, Inc. | | | 34,500 | | | | 674 | |

| Total | | | | | | | 11,463 | |

| 12 | See Notes to Financial Statements. |

Schedule of Investments (continued)

CALIBRATED LARGE CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Food & Staples Retailing 2.23% | | | | | | | | |

| CVS Health Corp. | | | 38,200 | | | $ | 4,296 | |

| Sysco Corp. | | | 27,900 | | | | 1,013 | |

| Wal-Mart Stores, Inc. | | | 82,600 | | | | 5,946 | |

| Total | | | | | | | 11,255 | |

| | | | | | | | | |

| Food Products 1.45% | | | | | | | | |

| Bunge Ltd. | | | 45,600 | | | | 3,641 | |

| ConAgra Foods, Inc. | | | 83,600 | | | | 3,684 | |

| Total | | | | | | | 7,325 | |

| | | | | | | | | |

| Health Care Equipment & Supplies 1.04% | | | | | | | | |

| Medtronic plc (Ireland)(a) | | | 66,500 | | | | 5,213 | |

| | | | | | | | | |

| Health Care Providers & Services 2.46% | | | | | | | | |

| Cardinal Health, Inc. | | | 67,000 | | | | 5,694 | |

| UnitedHealth Group, Inc. | | | 55,000 | | | | 6,677 | |

| Total | | | | | | | 12,371 | |

| | | | | | | | | |

| Household Durables 1.45% | | | | | | | | |

| Whirlpool Corp. | | | 41,000 | | | | 7,287 | |

| | | | | | | | | |

| Household Products 1.52% | | | | | | | | |

| Procter & Gamble Co. (The) | | | 100,000 | | | | 7,670 | |

| | | | | | | | | |

Independent Power and Renewable Electricity

Producer 1.23% | |

| AES Corp. (The) | | | 484,400 | | | | 6,200 | |

| | | | | | | | | |

| Information Technology Services 2.71% | | | | | | | | |

| Booz Allen Hamilton Holding Corp. | | | 96,900 | | | | 2,687 | |

| Fidelity National Information Services, Inc. | | | 84,800 | | | | 5,548 | |

| International Business Machines Corp. | | | 33,450 | | | | 5,419 | |

| Total | | | | | | | 13,654 | |

| | | | | | | | | |

| Insurance 6.81% | | | | | | | | |

| ACE Ltd. (Switzerland)(a) | | | 93,900 | | | | 10,213 | |

| Allstate Corp. (The) | | | 167,100 | | | | 11,522 | |

| Everest Re Group Ltd. | | | 39,200 | | | | 7,178 | |

| Hartford Financial Services Group, Inc. (The) | | | 36,300 | | | | 1,726 | |

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Prudential Financial, Inc. | | | 41,500 | | | $ | 3,667 | |

| Total | | | | | | | 34,306 | |

| | | | | | | | | |

| Machinery 2.14% | | | | | | | | |

| Cummins, Inc. | | | 56,600 | | | | 7,332 | |

| Timken Co. (The) | | | 103,600 | | | | 3,458 | |

| Total | | | | | | | 10,790 | |

| | | | | | | | | |

| Media 1.40% | | | | | | | | |

| Comcast Corp. Class A | | | 113,100 | | | | 7,059 | |

| | | | | | | | | |

| Multi-Line Retail 0.36% | | | | | | | | |

| Target Corp. | | | 22,300 | | | | 1,825 | |

| | | | | | | | | |

| Multi-Utilities 1.72% | | | | | | | | |

| PG&E Corp. | | | 124,100 | | | | 6,516 | |

| Sempra Energy | | | 21,200 | | | | 2,158 | |

| Total | | | | | | | 8,674 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels 10.32% | | | | | | | | |

| Anadarko Petroleum Corp. | | | 39,800 | | | | 2,959 | |

| Chevron Corp. | | | 187,500 | | | | 16,590 | |

| ConocoPhillips | | | 155,500 | | | | 7,828 | |

| Devon Energy Corp. | | | 62,300 | | | | 3,079 | |

| Exxon Mobil Corp. | | | 108,000 | | | | 8,555 | |

| Kinder Morgan, Inc. | | | 79,500 | | | | 2,754 | |

| Occidental Petroleum Corp. | | | 25,000 | | | | 1,755 | |

| Valero Energy Corp. | | | 129,200 | | | | 8,475 | |

| Total | | | | | | | 51,995 | |

| | | | | | | | | |

| Paper & Forest Products 1.57% | | | | | | | | |

| International Paper Co. | | | 165,000 | | | | 7,899 | |

| | | | | | | | | |

| Pharmaceuticals 7.45% | | | | | | | | |

| Allergan plc* | | | 6,500 | | | | 2,153 | |

| Eli Lilly & Co. | | | 30,700 | | | | 2,594 | |

| Johnson & Johnson | | | 91,600 | | | | 9,179 | |

| Mylan NV* | | | 52,500 | | | | 2,940 | |

| Pfizer, Inc. | | | 573,300 | | | | 20,673 | |

| Total | | | | | | | 37,539 | |

| | | | | | | | | |

| Professional Services 1.40% | | | | | | | | |

| Nielsen NV | | | 145,700 | | | | 7,061 | |

| | See Notes to Financial Statements. | 13 |

Schedule of Investments (continued)

CALIBRATED LARGE CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Real Estate Investment Trusts 4.61% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 29,800 | | | $ | 2,763 | |

| AvalonBay Communities, Inc. | | | 36,300 | | | | 6,256 | |

| General Growth Properties, Inc. | | | 209,700 | | | | 5,691 | |

| Health Care REIT, Inc. | | | 21,600 | | | | 1,498 | |

| Liberty Property Trust | | | 30,200 | | | | 1,028 | |

| SL Green Realty Corp. | | | 15,300 | | | | 1,762 | |

| Starwood Property Trust, Inc. | | | 99,700 | | | | 2,169 | |

| Vornado Realty Trust | | | 10,600 | | | | 1,034 | |

| Weyerhaeuser Co. | | | 33,500 | | | | 1,028 | |

| Total | | | | | | | 23,229 | |

| | | | | | | | | |

| Road & Rail 0.20% | | | | | | | | |

| Norfolk Southern Corp. | | | 12,100 | | | | 1,020 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment 3.36% | |

| Applied Materials, Inc. | | | 57,900 | | | | 1,005 | |

| Intel Corp. | | | 389,300 | | | | 11,270 | |

| Micron Technology, Inc.* | | | 53,800 | | | | 996 | |

| ON Semiconductor Corp.* | | | 341,700 | | | | 3,629 | |

| Total | | | | | | | 16,900 | |

| | | | | | | | | |

| Software 0.55% | | | | | | | | |

| Oracle Corp. | | | 44,800 | | | | 1,789 | |

| Symantec Corp. | | | 44,100 | | | | 1,003 | |

| Total | | | | | | | 2,792 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals 0.49% | |

| Hewlett-Packard Co. | | | 81,000 | | | | 2,472 | |

| | | | | | | | | |

| Tobacco 1.04% | | | | | | | | |

| Altria Group, Inc. | | | 96,400 | | | | 5,242 | |

| | | | | | | | | |

| Trading Companies & Distributors 1.31% | | | | | | | | |

| Air Lease Corp. | | | 186,200 | | | | 6,582 | |

Total Common Stocks

(cost $492,034,901) | | | | | | | 500,783 | |

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| Investments | | (000) | | | (000) | |

| SHORT-TERM INVESTMENT 0.55% | | | | | | | | |

| | | | | | | | | |

| Repurchase Agreement | | | | | | | | |

Repurchase Agreement dated 7/31/2015, Zero Coupon due 8/3/2015 with Fixed Income Clearing Corp. collateralized by $2,830,000 of U.S. Treasury Note at 1.50% due 5/31/2020; value: $2,819,388; proceeds: $2,759,315

(cost $2,759,315) | | $ | 2,759 | | | $ | 2,759 | |

Total Investments in Securities 99.97%

(cost $494,794,216) | | | | | | | 503,542 | |

| Cash and Other Assets in Excess of Liabilities(b) 0.03% | | | | | | | 142 | |

| Net Assets 100.00% | | | | | | $ | 503,684 | |

| * | Non-income producing security. |

| (a) | Foreign security traded in U.S. dollars. |

| (b) | Cash and Other Assets in Excess of Liabilities include net unrealized appreciation on futures contracts as follows: |

| 14 | See Notes to Financial Statements. |

Schedule of Investments (concluded)

CALIBRATED LARGE CAP VALUE FUND July 31, 2015

| Open Futures Contracts at July 31, 2015: | | | | | | | | | | | |

| | | | | | | | | | | | | Unrealized | |

| Type | | Expiration | | Contracts | | | Position | | Fair Value | | | Appreciation | |

| E-Mini S&P 500 Index | | September 2015 | | | 19 | | | Long | | | $1,993,480 | | | | $841 | |

| | | | | | | | | | | | | | | | | |

The following is a summary of the inputs used as of July 31, 2015 in valuing the Fund’s investments carried at fair value(1):

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Investment Type(2)(3) | | (000) | | | (000) | | | (000) | | | (000) |

| Common Stocks | | $ | 500,783 | | | $ | – | | | $ | – | | | $ | 500,783 |

| Repurchase Agreement | | | – | | | | 2,759 | | | | – | | | | 2,759 |

| Total | | $ | 500,783 | | | $ | 2,759 | | | $ | – | | | $ | 503,542 |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | | |

| Assets | | $ | 1 | | | $ | – | | | $ | – | | | $ | 1 |

| Liabilities | | | – | | | | – | | | | – | | | | – |

| Total | | $ | 1 | | | $ | – | | | $ | – | | | $ | 1 |

| (1) | Refer to Note 2(h) for a description of fair value measurements and the three-tier hierarchy of inputs. |

| (2) | See Schedule of Investments for fair values in each industry and identification of foreign issuers and/or geography. |

| (3) | There were no level transfers during the fiscal year ended July 31, 2015. |

| | See Notes to Financial Statements. | 15 |

Schedule of Investments

CALIBRATED MID CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| COMMON STOCKS 99.41% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense 1.52% | | | | | | | | |

| Orbital ATK, Inc. | | | 171,500 | | | $ | 12,168 | |

| Triumph Group, Inc. | | | 78,000 | | | | 4,200 | |

| Total | | | | | | | 16,368 | |

| | | | | | | | | |

| Airlines 0.41% | | | | | | | | |

| Alaska Air Group, Inc. | | | 32,100 | | | | 2,432 | |

| Southwest Airlines Co. | | | 54,400 | | | | 1,969 | |

| Total | | | | | | | 4,401 | |

| | | | | | | | | |

| Auto Components 0.21% | | | | | | | | |

| Lear Corp. | | | 21,600 | | | | 2,248 | |

| | | | | | | | | |

| Banks 5.50% | | | | | | | | |

| CIT Group, Inc. | | | 152,300 | | | | 7,164 | |

| Comerica, Inc. | | | 94,900 | | | | 4,501 | |

| Fifth Third Bancorp | | | 1,269,100 | | | | 26,740 | |

| Fulton Financial Corp. | | | 178,200 | | | | 2,309 | |

| M&T Bank Corp. | | | 140,500 | | | | 18,427 | |

| Total | | | | | | | 59,141 | |

| | | | | | | | | |

| Biotechnology 1.13% | | | | | | | | |

| Alkermes plc (Ireland)*(a) | | | 173,700 | | | | 12,163 | |

| | | | | | | | | |

| Capital Markets 3.48% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 90,500 | | | | 11,373 | |

| Invesco Ltd. | | | 675,300 | | | | 26,067 | |

| Total | | | | | | | 37,440 | |

| | | | | | | | | |

| Chemicals 3.48% | | | | | | | | |

| Celanese Corp. Series A | | | 64,000 | | | | 4,219 | |

| CF Industries Holdings, Inc. | | | 153,350 | | | | 9,079 | |

| Eastman Chemical Co. | | | 69,800 | | | | 5,472 | |

| FMC Corp. | | | 43,700 | | | | 2,121 | |

| Huntsman Corp. | | | 871,800 | | | | 16,564 | |

| Total | | | | | | | 37,455 | |

| | | | | | | | | |

| Commercial Services & Supplies 0.90% | | | | | | | | |

| R.R. Donnelley & Sons Co. | | | 550,600 | | | | 9,663 | |

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Communications Equipment 0.46% | | | | | | | | |

| CommScope Holding Co., Inc.* | | | 158,000 | | | $ | 4,956 | |

| | | | | | | | | |

| Consumer Finance 1.43% | | | | | | | | |

| Navient Corp. | | | 183,100 | | | | 2,875 | |

| Santander Consumer USA Holdings, Inc.* | | | 517,200 | | | | 12,506 | |

| Total | | | | | | | 15,381 | |

| | | | | | | | | |

| Diversified Consumer Services 0.24% | | | | | | | | |

| H&R Block, Inc. | | | 78,700 | | | | 2,620 | |

| | | | | | | | | |

| Diversified Telecommunication Services 0.99% | | | | | | | | |

| Frontier Communications Corp. | | | 442,200 | | | | 2,087 | |

| Level 3 Communications, Inc.* | | | 170,600 | | | | 8,616 | |

| Total | | | | | | | 10,703 | |

| | | | | | | | | |

| Electric: Utilities 5.72% | | | | | | | | |

| Edison International | | | 190,200 | | | | 11,414 | |

| Entergy Corp. | | | 93,500 | | | | 6,640 | |

| Great Plains Energy, Inc. | | | 305,200 | | | | 7,969 | |

| ITC Holdings Corp. | | | 280,000 | | | | 9,459 | |

| PPL Corp. | | | 255,050 | | | | 8,113 | |

| Westar Energy, Inc. | | | 476,500 | | | | 17,940 | |

| Total | | | | | | | 61,535 | |

| | | | | | | | | |

| Electrical Equipment 0.22% | | | | | | | | |

| Eaton Corp. plc | | | 39,894 | | | | 2,417 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components 3.46% | |

| Avnet, Inc. | | | 413,700 | | | | 17,264 | |

| Ingram Micro, Inc. Class A* | | | 456,800 | | | | 12,439 | |

| Jabil Circuit, Inc. | | | 370,300 | | | | 7,498 | |

| Total | | | | | | | 37,201 | |

| | | | | | | | | |

| Energy Equipment & Services 2.23% | | | | | | | | |

| Cameron International Corp.* | | | 94,100 | | | | 4,748 | |

| National Oilwell Varco, Inc. | | | 152,000 | | | | 6,404 | |

| Rowan Cos., plc Class A | | | 746,100 | | | | 12,855 | |

| Total | | | | | | | 24,007 | |

| 16 | See Notes to Financial Statements. |

Schedule of Investments (continued)

CALIBRATED MID CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Food Products 3.23% | | | | | | | | |

| Bunge Ltd. | | | 207,000 | | | $ | 16,529 | |

| ConAgra Foods, Inc. | | | 88,100 | | | | 3,882 | |

| Ingredion, Inc. | | | 163,000 | | | | 14,376 | |

| Total | | | | | | | 34,787 | |

| | | | | | | | | |

| Health Care Providers & Services 3.45% | | | | | | | | |

| Cardinal Health, Inc. | | | 60,500 | | | | 5,141 | |

| Cigna Corp. | | | 48,300 | | | | 6,958 | |

| Community Health Systems, Inc.* | | | 91,700 | | | | 5,365 | |

| Laboratory Corp. of America Holdings* | | | 66,500 | | | | 8,465 | |

| Quest Diagnostics, Inc. | | | 151,900 | | | | 11,212 | |

| Total | | | | | | | 37,141 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure 2.13% | | | | | | | | |

| Norwegian Cruise Line Holdings Ltd.* | | | 243,000 | | | | 15,168 | |

| Royal Caribbean Cruises Ltd. | | | 85,700 | | | | 7,700 | |

| Total | | | | | | | 22,868 | |

| | | | | | | | | |

| Household Durables 2.75% | | | | | | | | |

| Lennar Corp. | | | 55,300 | | | | 2,933 | |

| Tupperware Brands Corp. | | | 33,500 | | | | 1,959 | |

| Whirlpool Corp. | | | 138,900 | | | | 24,687 | |

| Total | | | | | | | 29,579 | |

| | | | | | | | | |

Independent Power and Renewable Electricity

Producer 1.42% | |

| AES Corp. (The) | | | 1,196,100 | | | | 15,310 | |

| | | | | | | | | |

| Information Technology Services 1.35% | | | | | | | | |

| Total System Services, Inc. | | | 106,500 | | | | 4,922 | |

| Xerox Corp. | | | 874,100 | | | | 9,633 | |

| Total | | | | | | | 14,555 | |

| | | | | | | | | |

| Insurance 9.14% | | | | | | | | |

| Arthur J Gallagher & Co. | | | 72,300 | | | | 3,429 | |

| Endurance Specialty Holdings Ltd. | | | 37,000 | | | | 2,571 | |

| Everest Re Group Ltd. | | | 106,800 | | | | 19,557 | |

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Hanover Insurance Group, Inc. (The) | | | 61,900 | | | $ | 5,005 | |

| Hartford Financial Services Group, Inc. (The) | | | 452,408 | | | | 21,512 | |

| Lincoln National Corp. | | | 177,500 | | | | 9,997 | |

| Reinsurance Group of America, Inc. | | | 65,198 | | | | 6,293 | |

| Validus Holdings Ltd. | | | 97,800 | | | | 4,533 | |

| XL Group plc (Ireland)(a) | | | 671,100 | | | | 25,515 | |

| Total | | | | | | | 98,412 | |

| | | | | | | | | |

| Machinery 3.96% | | | | | | | | |

| PACCAR, Inc. | | | 112,600 | | | | 7,301 | |

| Parker-Hannifin Corp. | | | 19,000 | | | | 2,142 | |

| SPX Corp. | | | 52,900 | | | | 3,460 | |

| Stanley Black & Decker, Inc. | | | 89,200 | | | | 9,410 | |

| Timken Co. (The) | | | 382,200 | | | | 12,758 | |

| Trinity Industries, Inc. | | | 256,100 | | | | 7,493 | |

| Total | | | | | | | 42,564 | |

| | | | | | | | | |

| Media 0.39% | | | | | | | | |

| Starz Class A* | | | 102,400 | | | | 4,142 | |

| | | | | | | | | |

| Metals & Mining 1.32% | | | | | | | | |

| Steel Dynamics, Inc. | | | 710,000 | | | | 14,221 | |

| | | | | | | | | |

| Multi-Line Retail 2.31% | | | | | | | | |

| Kohl’s Corp. | | | 303,400 | | | | 18,605 | |

| Macy’s, Inc. | | | 91,100 | | | | 6,291 | |

| Total | | | | | | | 24,896 | |

| | | | | | | | | |

| Multi-Utilities 3.95% | | | | | | | | |

| Consolidated Edison, Inc. | | | 129,300 | | | | 8,222 | |

| Public Service Enterprise Group, Inc. | | | 175,000 | | | | 7,292 | |

| SCANA Corp. | | | 392,746 | | | | 21,523 | |

| Sempra Energy | | | 54,200 | | | | 5,516 | |

| Total | | | | | | | 42,553 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels 6.78% | | | | | | | | |

| Cheniere Energy, Inc.* | | | 104,000 | | | | 7,173 | |

| Cimarex Energy Co. | | | 40,100 | | | | 4,175 | |

| Denbury Resources, Inc. | | | 313,100 | | | | 1,234 | |

| | See Notes to Financial Statements. | 17 |

Schedule of Investments (continued)

CALIBRATED MID CAP VALUE FUND July 31, 2015

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Oil, Gas & Consumable Fuels (continued) | | | | | | | | |

| EQT Corp. | | | 106,200 | | | $ | 8,162 | |

| Hess Corp. | | | 176,500 | | | | 10,415 | |

| Marathon Oil Corp. | | | 428,900 | | | | 9,011 | |

| Murphy Oil Corp. | | | 137,300 | | | | 4,502 | |

| PBF Energy, Inc. Class A | | | 314,200 | | | | 9,919 | |

| Pioneer Natural Resources Co. | | | 86,000 | | | | 10,902 | |

| Tesoro Corp. | | | 51,300 | | | | 4,994 | |

| Ultra Petroleum Corp.* | | | 312,200 | | | | 2,429 | |

| Total | | | | | | | 72,916 | |

| | | | | | | | | |

| Paper & Forest Products 1.52% | | | | | | | | |

| International Paper Co. | | | 341,500 | | | | 16,348 | |

| | | | | | | | | |

| Pharmaceuticals 2.31% | | | | | | | | |

| Mallinckrodt plc* | | | 182,900 | | | | 22,672 | |

| Mylan NV* | | | 38,200 | | | | 2,139 | |

| Total | | | | | | | 24,811 | |

| | | | | | | | | |

| Professional Services 1.98% | | | | | | | | |

| Nielsen NV | | | 440,000 | | | | 21,322 | |

| | | | | | | | | |

| Real Estate Investment Trusts 13.45% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 135,500 | | | | 12,562 | |

| Annaly Capital Management, Inc. | | | 599,500 | | | | 5,965 | |

| AvalonBay Communities, Inc. | | | 45,350 | | | | 7,815 | |

| Boston Properties, Inc. | | | 17,000 | | | | 2,096 | |

| Camden Property Trust | | | 158,500 | | | | 12,621 | |

| DDR Corp. | | | 307,000 | | | | 5,004 | |

| Duke Realty Corp. | | | 343,500 | | | | 6,928 | |

| Essex Property Trust, Inc. | | | 27,300 | | | | 6,140 | |

| General Growth Properties, Inc. | | | 596,600 | | | | 16,192 | |

| HCP, Inc. | | | 184,100 | | | | 7,114 | |

| Health Care REIT, Inc. | | | 113,100 | | | | 7,846 | |

| Healthcare Trust of America, Inc. Class A | | | 194,100 | | | | 4,878 | |

| Host Hotels & Resorts, Inc. | | | 339,900 | | | | 6,587 | |

| Kimco Realty Corp. | | | 269,600 | | | | 6,662 | |

| | | | | | Fair | |

| | | | | | Value | |

| Investments | | Shares | | | (000) | |

| Liberty Property Trust | | | 143,600 | | | $ | 4,887 | |

| Prologis, Inc. | | | 174,900 | | | | 7,103 | |

| Retail Properties of America, Inc. Class A | | | 177,800 | | | | 2,589 | |

| SL Green Realty Corp. | | | 29,400 | | | | 3,385 | |

| Starwood Property Trust, Inc. | | | 300,900 | | | | 6,547 | |

| Vornado Realty Trust | | | 83,800 | | | | 8,175 | |

| Weyerhaeuser Co. | | | 121,000 | | | | 3,713 | |

| Total | | | | | | | 144,809 | |

| | | | | | | | | |

| Real Estate Management & Development 0.20% | |

| Realogy Holdings Corp.* | | | 47,300 | | | | 2,153 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment 2.70% | |

| Cypress Semiconductor Corp.* | | | 453,900 | | | | 5,211 | |

| KLA-Tencor Corp. | | | 151,200 | | | | 8,021 | |

| ON Semiconductor Corp.* | | | 1,494,400 | | | | 15,871 | |

| Total | | | | | | | 29,103 | |

| | | | | | | | | |

| Software 1.22% | | | | | | | | |

| CA, Inc. | | | 211,600 | | | | 6,165 | |

| Rovi Corp.* | | | 232,200 | | | | 2,552 | |

| Symantec Corp. | | | 191,900 | | | | 4,364 | |

| Total | | | | | | | 13,081 | |

| | | | | | | | | |

| Specialty Retail 1.02% | | | | | | | | |

| GameStop Corp. Class A | | | 238,700 | | | | 10,944 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripheral 0.52% | |

| NCR Corp.* | | | 204,700 | | | | 5,637 | |

| | | | | | | | | |

| Trading Companies & Distributors 0.93% | | | | | | | | |

| Air Lease Corp. | | | 284,600 | | | | 10,061 | |

Total Common Stocks

(cost $1,067,672,728) | | | | | | | 1,069,912 | |

| 18 | See Notes to Financial Statements. |

Schedule of Investments (concluded)

CALIBRATED MID CAP VALUE FUND July 31, 2015

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| Investments | | (000) | | | (000) | |

| SHORT-TERM INVESTMENT 0.61% | | | | | | | | |

| | | | | | | | | |

| Repurchase Agreement | | | | | | | | |

Repurchase Agreement dated 7/31/2015, Zero Coupon due 8/3/2015 with Fixed Income Clearing Corp. collateralized by $6,795,000 of U.S. Treasury Note at 1.50% due 5/31/2020 value: $6,769,519; proceeds: $6,633,944

(cost $6,633,944) | | $ | 6,634 | | | $ | 6,634 | |

Total Investments in Securities 100.02%

(cost $1,074,306,672) | | | | | | | 1,076,546 | |

| Liabilities in Excess of Other Assets(b) (0.02)% | | | | | | | (255 | ) |

| Net Assets 100.00% | | | | | | $ | 1,076,291 | |

| * | Non-income producing security. |

| (a) | Foreign security traded in U.S. dollars. |

| (b) | Liabilities in Excess of Other Assets include net unrealized appreciation on futures contracts as follows: |

Open Futures Contracts at July 31, 2015:

| | | | | | | | | | | | | Unrealized | |

| Type | | Expiration | | Contracts | | | Position | | Fair Value | | | Appreciation | |

| E-Mini S&P 500 Index | | September 2015 | | | 49 | | | Long | | $ | 5,141,080 | | | | $ 16,916 | |

| | | | | | | | | | | | | | | | | |

The following is a summary of the inputs used as of July 31, 2015 in valuing the Fund’s investments carried at fair value(1):

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Investment Type(2)(3) | | (000) | | | (000) | | | (000) | | | (000) |

| Common Stocks | | $ | 1,069,912 | | | $ | – | | | $ | – | | | $ | 1,069,912 |

| Repurchase Agreement | | | – | | | | 6,634 | | | | – | | | | 6,634 |

| Total | | $ | 1,069,912 | | | $ | 6,634 | | | $ | – | | | $ | 1,076,546 |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | | |

| Assets | | $ | 17 | | | $ | – | | | $ | – | | | $ | 17 |

| Liabilities | | | – | | | | – | | | | – | | | | – |

| Total | | $ | 17 | | | $ | – | | | $ | – | | | $ | 17 |

| (1) | Refer to Note 2(h) for a description of fair value measurements and the three-tier hierarchy of inputs. |

| (2) | See Schedule of Investments for fair values in each industry and identification of foreign issuers and/or geography. |

| (3) | There were no level transfers during the fiscal year ended July 31, 2015. |

| | See Notes to Financial Statements. | 19 |

Statements of Assets and Liabilities

July 31, 2015

| | | Calibrated Large | | | Calibrated Mid | |

| | | Cap Value Fund | | | Cap Value Fund | |

| ASSETS: | | | | | | | | |

| Investments in securities, at cost | | $ | 494,794,216 | | | $ | 1,074,306,672 | |

| Investments in securities, at fair value | | $ | 503,541,814 | | | $ | 1,076,546,105 | |

| Cash | | | 132 | | | | – | |

| Deposits with brokers for futures collateral | | | 96,600 | | | | 220,800 | |

| Receivables: | | | | | | | | |

| Capital shares sold | | | 278,465 | | | | 3,811,958 | |

| Dividends | | | 720,060 | | | | 277,478 | |

| From advisor (See Note 3) | | | 151,537 | | | | 240,418 | |

| Prepaid expenses and other assets | | | 63,950 | | | | 92,494 | |

| Total assets | | | 504,852,558 | | | | 1,081,189,253 | |

| LIABILITIES: | | | | | | | | |

| Payables: | | | | | | | | |

| Investment securities purchased | | | 447,676 | | | | 3,572,457 | |

| Capital shares reacquired | | | 221,964 | | | | 381,998 | |

| 12b-1 distribution plan | | | 38,205 | | | | 100,822 | |

| Management fee | | | 255,737 | | | | 538,749 | |

| Trustees’ fees | | | 29,700 | | | | 38,378 | |

| Fund administration | | | 17,049 | | | | 35,917 | |

| To affiliate (See Note 3) | | | 81,320 | | | | 149,664 | |

| Variation margin | | | 5,350 | | | | 11,227 | |

| Accrued expenses | | | 71,607 | | | | 69,128 | |

| Total liabilities | | | 1,168,608 | | | | 4,898,340 | |

| NET ASSETS | | $ | 503,683,950 | | | $ | 1,076,290,913 | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Paid-in capital | | $ | 462,652,809 | | | $ | 1,005,769,395 | |

| Undistributed net investment income | | | 4,677,980 | | | | 6,284,831 | |

| Accumulated net realized gain on investments and futures contracts | | | 27,604,722 | | | | 61,980,338 | |

| Net unrealized appreciation on investments and futures contracts | | | 8,748,439 | | | | 2,256,349 | |

| Net Assets | | $ | 503,683,950 | | | $ | 1,076,290,913 | |

| 20 | See Notes to Financial Statements. |

Statements of Assets and Liabilities (concluded)

July 31, 2015

| | | Calibrated Large | | | Calibrated Mid | |

| | | Cap Value Fund | | | Cap Value Fund | |

| | | | | | | |

| Net assets by class: | | | | | | | | |

| Class A Shares | | $ | 75,083,493 | | | $ | 132,998,160 | |

| Class C Shares | | $ | 18,361,444 | | | $ | 48,851,289 | |

| Class F Shares | | $ | 26,401,223 | | | $ | 194,111,045 | |

| Class I Shares | | $ | 383,100,657 | | | $ | 699,681,164 | |

| Class R2 Shares | | $ | 370,687 | | | $ | 234,192 | |

| Class R3 Shares | | $ | 336,330 | | | $ | 384,924 | |

| Class R4 Shares | | $ | 10,037 | | | $ | 10,045 | |

| Class R5 Shares | | $ | 10,039 | | | $ | 10,047 | |

| Class R6 Shares | | $ | 10,040 | | | $ | 10,047 | |

| Outstanding shares by class (unlimited number of authorized shares of beneficial interest): | | | | | | | | |

| Class A Shares | | | 3,595,560 | | | | 6,128,846 | |

| Class C Shares | | | 894,256 | | | | 2,290,265 | |

| Class F Shares | | | 1,263,185 | | | | 8,937,684 | |

| Class I Shares | | | 18,297,668 | | | | 32,134,358 | |

| Class R2 Shares | | | 17,674 | | | | 10,746 | |

| Class R3 Shares | | | 16,194 | | | | 17,673 | |

| Class R4 Shares | | | 480.77 | | | | 463 | |

| Class R5 Shares | | | 479.62 | | | | 461.47 | |

| Class R6 Shares | | | 479.62 | | | | 461.47 | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | | | | | |

| Class A Shares-Net asset value | | | $20.88 | | | | $21.70 | |

Class A Shares-Maximum offering price

(Net asset value plus sales charge of 5.75%) | | | $22.15 | | | | $23.02 | |

| Class C Shares-Net asset value | | | $20.53 | | | | $21.33 | |

| Class F Shares-Net asset value | | | $20.90 | | | | $21.72 | |

| Class I Shares-Net asset value | | | $20.94 | | | | $21.77 | |

| Class R2 Shares-Net asset value | | | $20.97 | | | | $21.79 | |

| Class R3 Shares-Net asset value | | | $20.77 | | | | $21.78 | |

| Class R4 Shares-Net asset value | | | $20.88 | | | | $21.70 | |

| Class R5 Shares-Net asset value | | | $20.93 | | | | $21.77 | |

| Class R6 Shares-Net asset value | | | $20.93 | | | | $21.77 | |

| | See Notes to Financial Statements. | 21 |

Statements of Operations

For the Year Ended July 31, 2015

| | | Calibrated Large | | | Calibrated Mid | |

| | | Cap Value Fund | | | Cap Value Fund | |

| Investment income: | | | | | | | | |

| Dividends (net of foreign withholding taxes of $15,598 and $45,076, respectively) | | $ | 10,954,382 | | | $ | 16,425,933 | |

| Interest and other | | | 20 | | | | – | |

| Total investment income | | | 10,954,402 | | | | 16,425,933 | |

| Expenses: | | | | | | | | |

| Management fee | | | 2,858,288 | | | | 4,784,525 | |

| 12b-1 distribution plan-Class A | | | 189,004 | | | | 168,046 | |

| 12b-1 distribution plan-Class C | | | 143,721 | | | | 183,039 | |

| 12b-1 distribution plan-Class F | | | 21,835 | | | | 66,768 | |

| 12b-1 distribution plan-Class R2 | | | 1,654 | | | | 458 | |

| 12b-1 distribution plan-Class R3 | | | 1,258 | | | | 791 | |

| 12b-1 distribution plan-Class R4 | | | 2 | | | | 2 | |

| Shareholder servicing | | | 151,026 | | | | 204,792 | |

| Fund administration | | | 190,552 | | | | 318,968 | |

| Subsidy (See Note 3) | | | 498,857 | | | | 911,848 | |

| Reports to shareholders | | | 22,032 | | | | 36,779 | |

| Registration | | | 71,829 | | | | 80,164 | |

| Trustees’ fees | | | 18,813 | | | | 30,080 | |

| Custody | | | 57,897 | | | | 98,790 | |

| Professional | | | 57,010 | | | | 61,963 | |

| Other | | | 27,965 | | | | 30,179 | |

| Gross expenses | | | 4,311,743 | | | | 6,977,192 | |

| Expense reductions (See Note 9) | | | (124 | ) | | | (157 | ) |

| Management fee waived (See Note 3) | | | (1,572,239 | ) | | | (1,773,407 | ) |

| Net expenses | | | 2,739,380 | | | | 5,203,628 | |

| Net investment income | | | 8,215,022 | | | | 11,222,305 | |

| Net realized and unrealized gain (loss): | | | | | | | | |

| Net realized gain on investments | | | 36,136,543 | | | | 77,235,702 | |

| Net realized gain on futures contracts | | | 117,005 | | | | 277,321 | |

| Net change in unrealized appreciation/depreciation on investments | | | (14,273,972 | ) | | | (25,877,298 | ) |

| Net change in unrealized appreciation/depreciation on futures contracts | | | 14,688 | | | | 34,574 | |

| Net realized and unrealized gain | | | 21,994,264 | | | | 51,670,299 | |

| Net Increase in Net Assets Resulting From Operations | | $ | 30,209,286 | | | $ | 62,892,604 | |

| 22 | See Notes to Financial Statements. |

Statements of Changes in Net Assets

| | | Calibrated Large Cap Value Fund | |

| | | For the Year Ended | | | For the Year Ended | |

| INCREASE IN NET ASSETS | | July 31, 2015 | | | July 31, 2014 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 8,215,022 | | | $ | 7,795,574 | |

| Net realized gain on investments and futures contracts | | | 36,253,548 | | | | 52,694,291 | |

| Net change in unrealized appreciation/depreciation on investments and futures contracts | | | (14,259,284 | ) | | | (10,085,670 | ) |

| Net increase in net assets resulting from operations | | | 30,209,286 | | | | 50,404,195 | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | | | | | | |

| Class A | | | (1,204,218 | ) | | | (1,045,611 | ) |

| Class C | | | (102,230 | ) | | | (76,854 | ) |

| Class F | | | (304,560 | ) | | | (194,362 | ) |

| Class I | | | (6,351,681 | ) | | | (4,691,550 | ) |

| Class R2 | | | (2,399 | ) | | | (2,270 | ) |

| Class R3 | | | (2,316 | ) | | | (1,329 | ) |

| Net realized gain | | | | | | | | |

| Class A | | | (8,726,127 | ) | | | (5,297,306 | ) |

| Class C | | | (1,271,990 | ) | | | (567,582 | ) |

| Class F | | | (1,982,750 | ) | | | (894,441 | ) |

| Class I | | | (39,332,925 | ) | | | (20,521,883 | ) |

| Class R2 | | | (22,392 | ) | | | (13,679 | ) |

| Class R3 | | | (18,667 | ) | | | (7,550 | ) |

| Total distributions to shareholders | | | (59,322,255 | ) | | | (33,314,417 | ) |

| Capital share transactions (See Note 13): | | | | | | | | |

| Net proceeds from sales of shares | | | 102,023,014 | | | | 54,278,817 | |

| Reinvestment of distributions | | | 54,453,620 | | | | 30,660,755 | |

| Cost of shares reacquired | | | (76,282,834 | ) | | | (44,156,441 | ) |

| Net increase in net assets resulting from capital share transactions | | | 80,193,800 | | | | 40,783,131 | |

| Net increase in net assets | | | 51,080,831 | | | | 57,872,909 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | $ | 452,603,119 | | | $ | 394,730,210 | |

| End of year | | $ | 503,683,950 | | | $ | 452,603,119 | |

| Undistributed net investment income | | $ | 4,677,980 | | | $ | 4,437,656 | |

| | See Notes to Financial Statements. | 23 |

Statements of Changes in Net Assets (concluded)

| | | Calibrated Mid Cap Value Fund | |

| | | For the Year Ended | | | For the Year Ended | |

| INCREASE IN NET ASSETS | | July 31, 2015 | | | July 31, 2014 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 11,222,305 | | | $ | 7,268,966 | |

| Net realized gain on investments and futures contracts | | | 77,513,023 | | | | 62,191,475 | |

| Net change in unrealized appreciation/depreciation on investments and futures contracts | | | (25,842,724 | ) | | | (4,406,302 | ) |

| Net increase in net assets resulting from operations | | | 62,892,604 | | | | 65,054,139 | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | | | | | | |

| Class A | | | (343,526 | ) | | | (293,397 | ) |

| Class C | | | (22,152 | ) | | | (24,892 | ) |

| Class F | | | (85,392 | ) | | | (82,472 | ) |

| Class I | | | (8,637,527 | ) | | | (4,558,009 | ) |

| Class R2 | | | (375 | ) | | | (121 | ) |

| Class R3 | | | (841 | ) | | | (155 | ) |

| Net realized gain | | | | | | | | |

| Class A | | | (2,934,370 | ) | | | (2,474,174 | ) |

| Class C | | | (457,201 | ) | | | (317,466 | ) |

| Class F | | | (645,519 | ) | | | (626,065 | ) |

| Class I | | | (60,424,949 | ) | | | (32,739,473 | ) |

| Class R2 | | | (3,861 | ) | | | (1,518 | ) |

| Class R3 | | | (7,872 | ) | | | (1,714 | ) |

| Total distributions to shareholders | | | (73,563,585 | ) | | | (41,119,456 | ) |

| Capital share transactions (See Note 13): | | | | | | | | |

| Net proceeds from sales of shares | | | 476,119,680 | | | | 216,544,820 | |

| Reinvestment of distributions | | | 72,567,576 | | | | 40,540,557 | |

| Cost of shares reacquired | | | (80,310,064 | ) | | | (21,953,455 | ) |

| Net increase in net assets resulting from capital share transactions | | | 468,377,192 | | | | 235,131,922 | |

| Net increase in net assets | | | 457,706,211 | | | | 259,066,605 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | $ | 618,584,702 | | | $ | 359,518,097 | |

| End of year | | $ | 1,076,290,913 | | | $ | 618,584,702 | |

| Undistributed net investment income | | $ | 6,284,831 | | | $ | 4,171,295 | |

| 24 | See Notes to Financial Statements. |

This page is intentionally left blank.

25

Financial Highlights

CALIBRATED LARGE CAP VALUE FUND

| | | | | Per Share Operating Performance: |

| |

| | | | | | | | | | | Distributions to |

| | | | | Investment operations: | | shareholders from: |

| | | | | | | Net | | | | | | | | |

| | | Net asset | | | | realized | | Total | | | | | | |

| | | value, | | Net | | and | | from | | Net | | Net | | |

| | | beginning | | investment | | unrealized | | investment | | investment | | realized | | Total |

| | | of period | | income(a) | | gain | | operations | | income | | gain | | distributions |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | $22.30 | | | | $0.33 | | | | $1.15 | | | | $1.48 | | | | $(0.35 | ) | | | $(2.55 | ) | | | $(2.90 | ) |

| 7/31/2014 | | | 21.52 | | | | 0.36 | | | | 2.19 | | | | 2.55 | | | | (0.29 | ) | | | (1.48 | ) | | | (1.77 | ) |

| 7/31/2013 | | | 17.18 | | | | 0.35 | | | | 4.59 | | | | 4.94 | | | | (0.20 | ) | | | (0.40 | ) | | | (0.60 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.19 | | | | 1.99 | | | | 2.18 | | | | – | | | | – | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 21.98 | | | | 0.17 | | | | 1.14 | | | | 1.31 | | | | (0.21 | ) | | | (2.55 | ) | | | (2.76 | ) |

| 7/31/2014 | | | 21.30 | | | | 0.19 | | | | 2.17 | | | | 2.36 | | | | (0.20 | ) | | | (1.48 | ) | | | (1.68 | ) |

| 7/31/2013 | | | 17.10 | | | | 0.18 | | | | 4.59 | | | | 4.77 | | | | (0.17 | ) | | | (0.40 | ) | | | (0.57 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.15 | | | | 1.95 | | | | 2.10 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class F | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 22.32 | | | | 0.36 | | | | 1.16 | | | | 1.52 | | | | (0.39 | ) | | | (2.55 | ) | | | (2.94 | ) |

| 7/31/2014 | | | 21.54 | | | | 0.39 | | | | 2.19 | | | | 2.58 | | | | (0.32 | ) | | | (1.48 | ) | | | (1.80 | ) |

| 7/31/2013 | | | 17.19 | | | | 0.38 | | | | 4.59 | | | | 4.97 | | | | (0.22 | ) | | | (0.40 | ) | | | (0.62 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.20 | | | | 1.99 | | | | 2.19 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 22.36 | | | | 0.39 | | | | 1.15 | | | | 1.54 | | | | (0.41 | ) | | | (2.55 | ) | | | (2.96 | ) |

| 7/31/2014 | | | 21.56 | | | | 0.41 | | | | 2.21 | | | | 2.62 | | | | (0.34 | ) | | | (1.48 | ) | | | (1.82 | ) |

| 7/31/2013 | | | 17.20 | | | | 0.39 | | | | 4.60 | | | | 4.99 | | | | (0.23 | ) | | | (0.40 | ) | | | (0.63 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.19 | | | | 2.01 | | | | 2.20 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 22.38 | | | | 0.26 | | | | 1.15 | | | | 1.41 | | | | (0.27 | ) | | | (2.55 | ) | | | (2.82 | ) |

| 7/31/2014 | | | 21.61 | | | | 0.31 | | | | 2.19 | | | | 2.50 | | | | (0.25 | ) | | | (1.48 | ) | | | (1.73 | ) |

| 7/31/2013 | | | 17.14 | | | | 0.41 | | | | 4.59 | | | | 5.00 | | | | (0.13 | ) | | | (0.40 | ) | | | (0.53 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.16 | | | | 1.98 | | | | 2.14 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 22.21 | | | | 0.28 | | | | 1.15 | | | | 1.43 | | | | (0.32 | ) | | | (2.55 | ) | | | (2.87 | ) |

| 7/31/2014 | | | 21.46 | | | | 0.30 | | | | 2.19 | | | | 2.49 | | | | (0.26 | ) | | | (1.48 | ) | | | (1.74 | ) |

| 7/31/2013 | | | 17.15 | | | | 0.33 | | | | 4.58 | | | | 4.91 | | | | (0.20 | ) | | | (0.40 | ) | | | (0.60 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.17 | | | | 1.98 | | | | 2.15 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 6/30/2015 to 7/31/2015(f) | | | 20.80 | | | | 0.02 | | | | 0.06 | | | | 0.08 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 6/30/2015 to 7/31/2015(f) | | | 20.85 | | | | 0.03 | | | | 0.05 | | | | 0.08 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 6/30/2015 to 7/31/2015(f) | | | 20.85 | | | | 0.03 | | | | 0.05 | | | | 0.08 | | | | – | | | | – | | | | – | |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total return for classes A and C does not consider the effects of sales loads and assumes the reinvestments of all distributions. Total return for all other classes assumes the reinvestment of all distributions. |

| (c) | Commencement of operations was 12/21/2011, SEC effective date was 12/15/2011 and date shares first became available to the public was 1/3/2012. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Commencement of operations was at the close of business on June 30, 2015. |

| 26 | See Notes to Financial Statements. |

| | | | | Ratios to average net assets: | | | | Supplemental Data: |

| | | | | Expenses, | | | | | | | | | | |

| | | | | excluding | | Expenses, | | Expenses, | | | | | | |

| | | | | expense | | including | | excluding | | | | | | |

| | | | | reductions | | expense | | expense | | | | | | |

| | | | | and including | | reductions, | | reductions, | | | | | | |

| Net | | | | management | | management | | management | | | | Net | | |

| asset | | | | fee waived | | fee waived | | fee waived | | Net | | assets | | Portfolio |

| value, | | Total | | and expenses | | and expenses | | and expenses | | investment | | end of | | turnover |

| end of | | return | | reimbursed | | reimbursed | | reimbursed | | income | | period | | rate |

| period | | (%)(b) | | (%) | | (%) | | (%) | | (%) | | (000) | | (%) |

| | | | | | | | | | | | | | | |

| $ | 20.88 | | | | 6.71 | | | | 0.75 | | | | 0.75 | | | | 1.08 | | | | 1.54 | | | $ | 75,083 | | | | 80.48 | |

| | 22.30 | | | | 12.38 | | | | 0.75 | | | | 0.75 | | | | 1.08 | | | | 1.66 | | | | 81,218 | | | | 103.92 | |

| | 21.52 | | | | 29.60 | | | | 0.75 | | | | 0.75 | | | | 1.12 | | | | 1.83 | | | | 74,466 | | | | 90.00 | |

| | 17.18 | | | | 14.53 | (d) | | | 0.73 | (e) | | | 0.73 | (e) | | | 1.41 | (e) | | | 1.89 | (e) | | | 35,932 | | | | 62.31 | |

| |

| | 20.53 | | | | 5.93 | | | | 1.49 | | | | 1.49 | | | | 1.82 | | | | 0.82 | | | | 18,361 | | | | 80.48 | |

| | 21.98 | | | | 11.54 | | | | 1.49 | | | | 1.49 | | | | 1.82 | | | | 0.91 | | | | 10,456 | | | | 103.92 | |

| | 21.30 | | | | 28.71 | | | | 1.48 | | | | 1.48 | | | | 1.85 | | | | 0.91 | | | | 7,057 | | | | 90.00 | |

| | 17.10 | | | | 14.00 | (d) | | | 1.47 | (e) | | | 1.47 | (e) | | | 2.15 | (e) | | | 1.44 | (e) | | | 61 | | | | 62.31 | |

| |

| | 20.90 | | | | 6.90 | | | | 0.60 | | | | 0.60 | | | | 0.93 | | | | 1.70 | | | | 26,401 | | | | 80.48 | |

| | 22.32 | | | | 12.53 | | | | 0.60 | | | | 0.60 | | | | 0.93 | | | | 1.81 | | | | 17,316 | | | | 103.92 | |

| | 21.54 | | | | 29.82 | | | | 0.60 | | | | 0.60 | | | | 0.97 | | | | 1.94 | | | | 13,153 | | | | 90.00 | |

| | 17.19 | | | | 14.60 | (d) | | | 0.58 | (e) | | | 0.58 | (e) | | | 1.33 | (e) | | | 2.03 | (e) | | | 35 | | | | 62.31 | |

| |

| | 20.94 | | | | 6.99 | | | | 0.50 | | | | 0.50 | | | | 0.83 | | | | 1.80 | | | | 383,101 | | | | 80.48 | |

| | 22.36 | | | | 12.70 | | | | 0.50 | | | | 0.50 | | | | 0.83 | | | | 1.91 | | | | 343,275 | | | | 103.92 | |

| | 21.56 | | | | 29.91 | | | | 0.50 | | | | 0.50 | | | | 0.87 | | | | 2.01 | | | | 299,673 | | | | 90.00 | |

| | 17.20 | | | | 14.67 | (d) | | | 0.49 | (e) | | | 0.49 | (e) | | | 0.94 | (e) | | | 1.89 | (e) | | | 34,155 | | | | 62.31 | |

| |

| | 20.97 | | | | 6.35 | | | | 1.10 | | | | 1.10 | | | | 1.43 | | | | 1.21 | | | | 371 | | | | 80.48 | |

| | 22.38 | | | | 12.04 | | | | 1.01 | | | | 1.01 | | | | 1.44 | | | | 1.43 | | | | 198 | | | | 103.92 | |

| | 21.61 | | | | 29.97 | | | | 0.49 | | | | 0.49 | | | | 1.37 | | | | 2.01 | | | | 303 | | | | 90.00 | |

| | 17.14 | | | | 14.27 | (d) | | | 1.06 | (e) | | | 1.06 | (e) | | | 1.81 | (e) | | | 1.55 | (e) | | | 11 | | | | 62.31 | |

| |

| | 20.77 | | | | 6.47 | | | | 1.00 | | | | 1.00 | | | | 1.33 | | | | 1.31 | | | | 336 | | | | 80.48 | |

| | 22.21 | | | | 12.11 | | | | 1.00 | | | | 1.00 | | | | 1.33 | | | | 1.38 | | | | 141 | | | | 103.92 | |

| | 21.46 | | | | 29.51 | | | | 0.95 | | | | 0.95 | | | | 1.35 | | | | 1.70 | | | | 79 | | | | 90.00 | |

| | 17.15 | | | | 14.33 | (d) | | | 0.96 | (e) | | | 0.96 | (e) | | | 1.71 | (e) | | | 1.65 | (e) | | | 11 | | | | 62.31 | |

| |

| | 20.88 | | | | 0.38 | (d) | | | 0.75 | (e) | | | 0.75 | (e) | | | 1.06 | (e) | | | 1.41 | (e) | | | 10 | | | | 80.48 | |

| |

| | 20.93 | | | | 0.38 | (d) | | | 0.50 | (e) | | | 0.50 | (e) | | | 0.82 | (e) | | | 1.64 | (e) | | | 10 | | | | 80.48 | |

| |

| | 20.93 | | | | 0.38 | (d) | | | 0.47 | (e) | | | 0.47 | (e) | | | 0.70 | (e) | | | 1.64 | (e) | | | 10 | | | | 80.48 | |

| | See Notes to Financial Statements. | 27 |

Financial Highlights (concluded)

CALIBRATED MID CAP VALUE FUND

| | | | | Per Share Operating Performance: |

| |

| | | | | | | | | | | Distributions to |

| | | | | Investment operations: | | shareholders from: |

| | | | | | | Net | | | | | | | | |

| | | Net asset | | Net | | realized | | Total | | | | | | |

| | | value, | | investment | | and | | from | | Net | | Net | | |

| | | beginning | | income | | unrealized | | investment | | investment | | realized | | Total |

| | | of period | | (loss)(a) | | gain | | operations | | income | | gain | | distributions |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | $22.04 | | | | $0.24 | | | | $1.92 | | | | $2.16 | | | | $(0.26 | ) | | | $(2.24 | ) | | | $(2.50 | ) |

| 7/31/2014 | | | 21.11 | | | | 0.29 | | | | 2.78 | | | | 3.07 | | | | (0.23 | ) | | | (1.91 | ) | | | (2.14 | ) |

| 7/31/2013 | | | 16.47 | | | | 0.31 | | | | 4.93 | | | | 5.24 | | | | (0.22 | ) | | | (0.38 | ) | | | (0.60 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.15 | | | | 1.32 | | | | 1.47 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 21.71 | | | | 0.07 | | | | 1.90 | | | | 1.97 | | | | (0.11 | ) | | | (2.24 | ) | | | (2.35 | ) |

| 7/31/2014 | | | 20.89 | | | | 0.13 | | | | 2.75 | | | | 2.88 | | | | (0.15 | ) | | | (1.91 | ) | | | (2.06 | ) |

| 7/31/2013 | | | 16.39 | | | | 0.08 | | | | 4.99 | | | | 5.07 | | | | (0.19 | ) | | | (0.38 | ) | | | (0.57 | ) |

| 12/21/2011 to 7/31/2012(c) | | | 15.00 | | | | 0.08 | | | | 1.31 | | | | 1.39 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class F | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 7/31/2015 | | | 22.06 | | | | 0.27 | | | | 1.93 | | | | 2.20 | | | | (0.30 | ) | | | (2.24 | ) | | | (2.54 | ) |