UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-10371

LORD ABBETT TRUST I

(Exact name of Registrant as specified in charter)

30 Hudson Street, Jersey City, New Jersey 07302-4804

(Address of principal executive offices) (Zip code)

Randolph A. Stuzin, Esq.

Vice President and Assistant Secretary

30 Hudson Street, Jersey City, New Jersey 07302-4804

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 522-2388

Date of fiscal year end: 7/31

Date of reporting period: 7/31/2024

| Item 1: | Report(s) to Shareholders. |

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $67 | 0.65% |

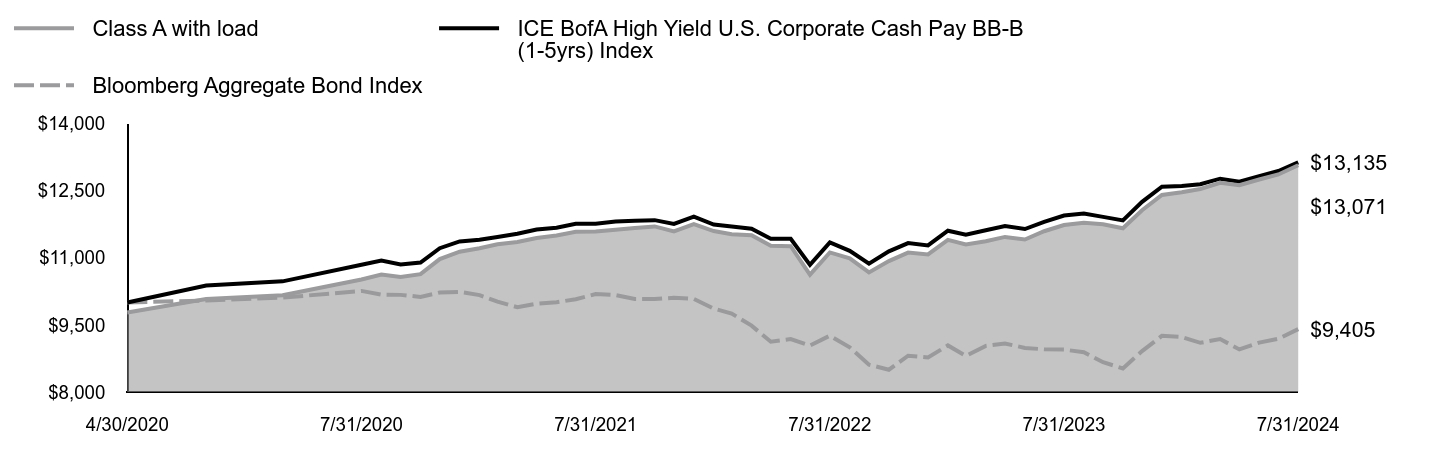

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 6.80%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class A with load | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $9,775 | $10,000 | $10,000 |

| 5/31/2020 | $9,795 | $10,021 | $10,032 |

| 6/30/2020 | $9,911 | $10,160 | $10,095 |

| 7/31/2020 | $10,115 | $10,313 | $10,246 |

| 8/31/2020 | $10,131 | $10,263 | $10,163 |

| 9/30/2020 | $10,137 | $10,340 | $10,157 |

| 10/31/2020 | $10,153 | $10,403 | $10,112 |

| 11/30/2020 | $10,288 | $10,481 | $10,211 |

| 12/31/2020 | $10,344 | $10,514 | $10,225 |

| 1/31/2021 | $10,340 | $10,466 | $10,152 |

| 2/28/2021 | $10,228 | $10,270 | $10,005 |

| 3/31/2021 | $10,173 | $10,254 | $9,880 |

| 4/30/2021 | $10,216 | $10,235 | $9,959 |

| 5/31/2021 | $10,220 | $10,238 | $9,991 |

| 6/30/2021 | $10,284 | $10,300 | $10,061 |

| 7/31/2021 | $10,378 | $10,478 | $10,174 |

| 8/31/2021 | $10,360 | $10,441 | $10,154 |

| 9/30/2021 | $10,294 | $10,313 | $10,066 |

| 10/31/2021 | $10,267 | $10,264 | $10,064 |

| 11/30/2021 | $10,291 | $10,371 | $10,093 |

| 12/31/2021 | $10,256 | $10,284 | $10,068 |

| 1/31/2022 | $10,086 | $10,100 | $9,851 |

| 2/28/2022 | $9,925 | $9,854 | $9,741 |

| 3/31/2022 | $9,765 | $9,609 | $9,470 |

| 4/30/2022 | $9,490 | $9,263 | $9,111 |

| 5/31/2022 | $9,422 | $9,137 | $9,170 |

| 6/30/2022 | $9,189 | $8,881 | $9,026 |

| 7/31/2022 | $9,472 | $9,279 | $9,246 |

| 8/31/2022 | $9,230 | $8,864 | $8,985 |

| 9/30/2022 | $8,914 | $8,482 | $8,597 |

| 10/31/2022 | $8,901 | $8,474 | $8,485 |

| 11/30/2022 | $9,138 | $8,783 | $8,798 |

| 12/31/2022 | $9,021 | $8,568 | $8,758 |

| 1/31/2023 | $9,230 | $8,801 | $9,027 |

| 2/28/2023 | $9,105 | $8,625 | $8,794 |

| 3/31/2023 | $9,238 | $8,799 | $9,017 |

| 4/30/2023 | $9,282 | $8,852 | $9,072 |

| 5/31/2023 | $9,270 | $8,844 | $8,973 |

| 6/30/2023 | $9,294 | $8,839 | $8,941 |

| 7/31/2023 | $9,340 | $8,881 | $8,935 |

| 8/31/2023 | $9,342 | $8,893 | $8,878 |

| 9/30/2023 | $9,208 | $8,738 | $8,652 |

| 10/31/2023 | $9,188 | $8,731 | $8,516 |

| 11/30/2023 | $9,452 | $9,034 | $8,901 |

| 12/31/2023 | $9,780 | $9,382 | $9,242 |

| 1/31/2024 | $9,749 | $9,353 | $9,217 |

| 2/29/2024 | $9,682 | $9,271 | $9,086 |

| 3/31/2024 | $9,791 | $9,391 | $9,170 |

| 4/30/2024 | $9,666 | $9,257 | $8,939 |

| 5/31/2024 | $9,706 | $9,306 | $9,090 |

| 6/30/2024 | $9,781 | $9,371 | $9,176 |

| 7/31/2024 | $9,975 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class A at NAV | 6.80% | 0.49% |

| Class A with sales charge | 4.40% | (0.06%) |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9060-A

09/24

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $130 | 1.26% |

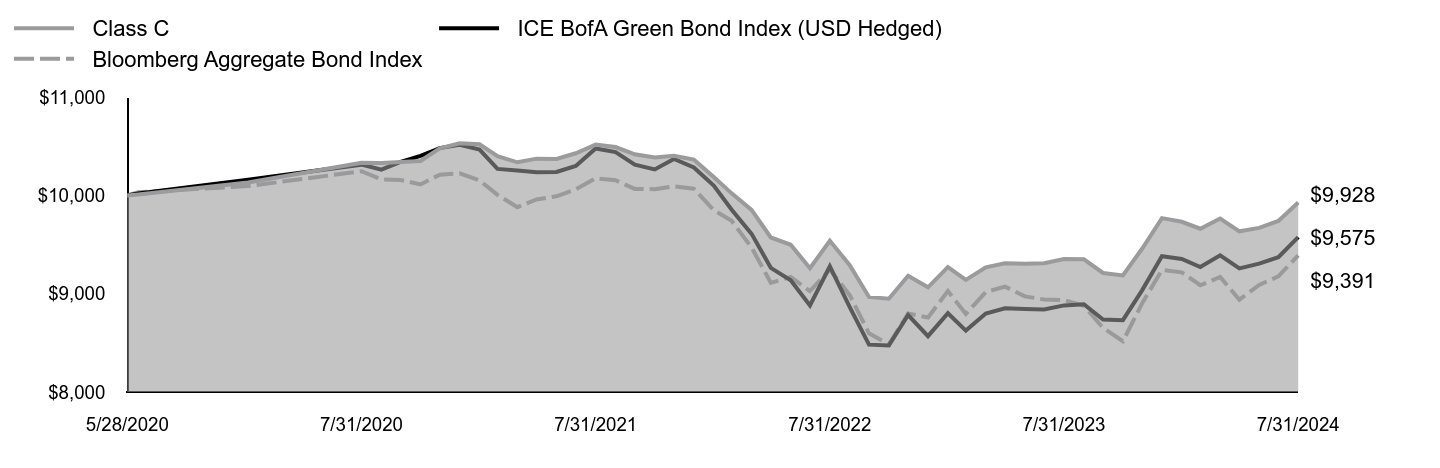

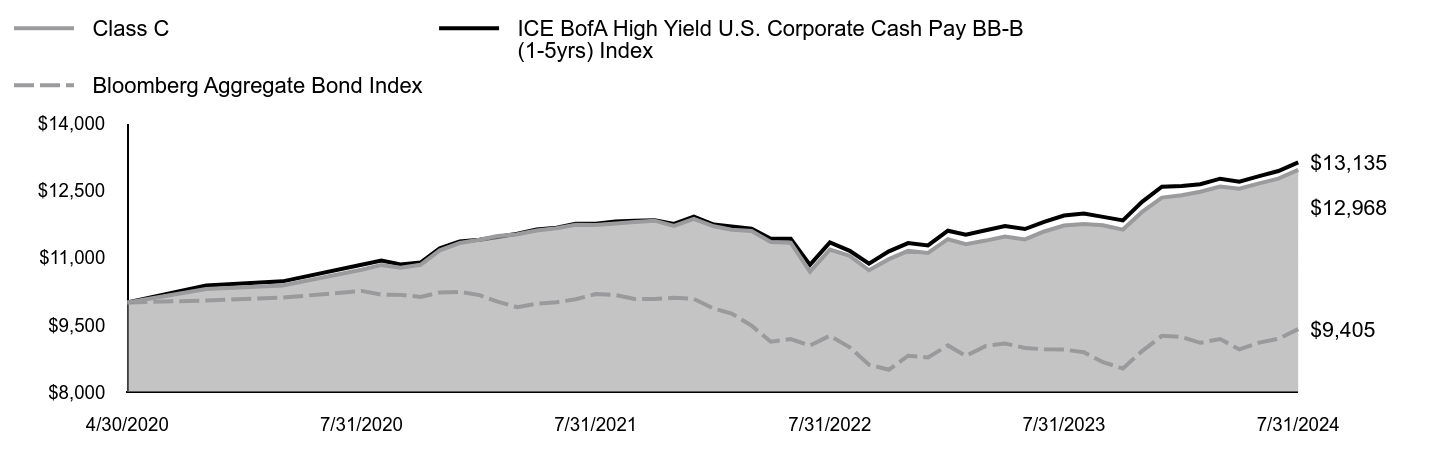

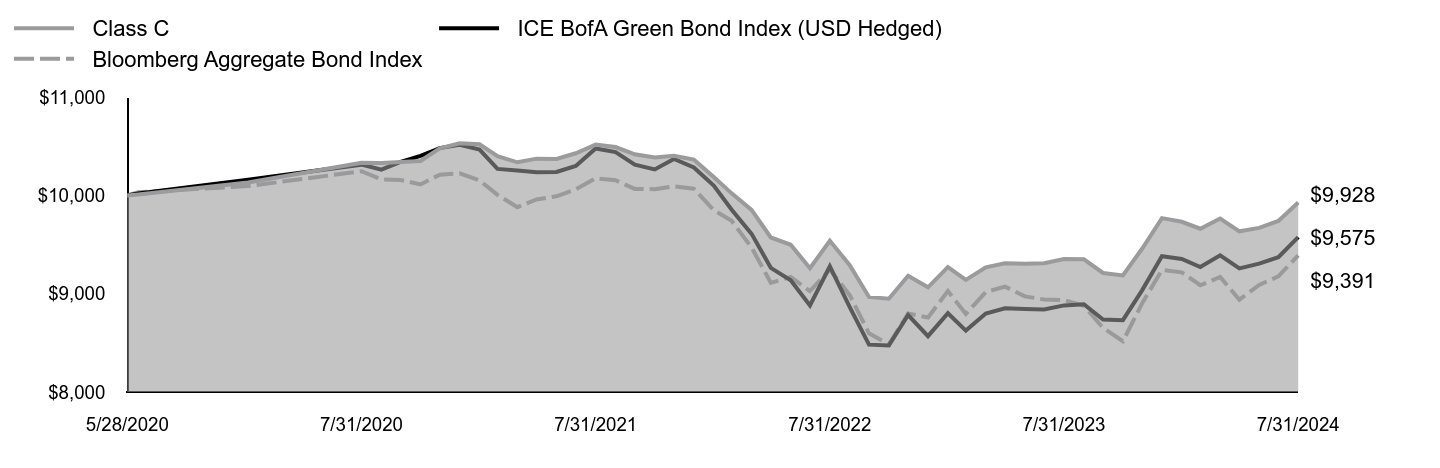

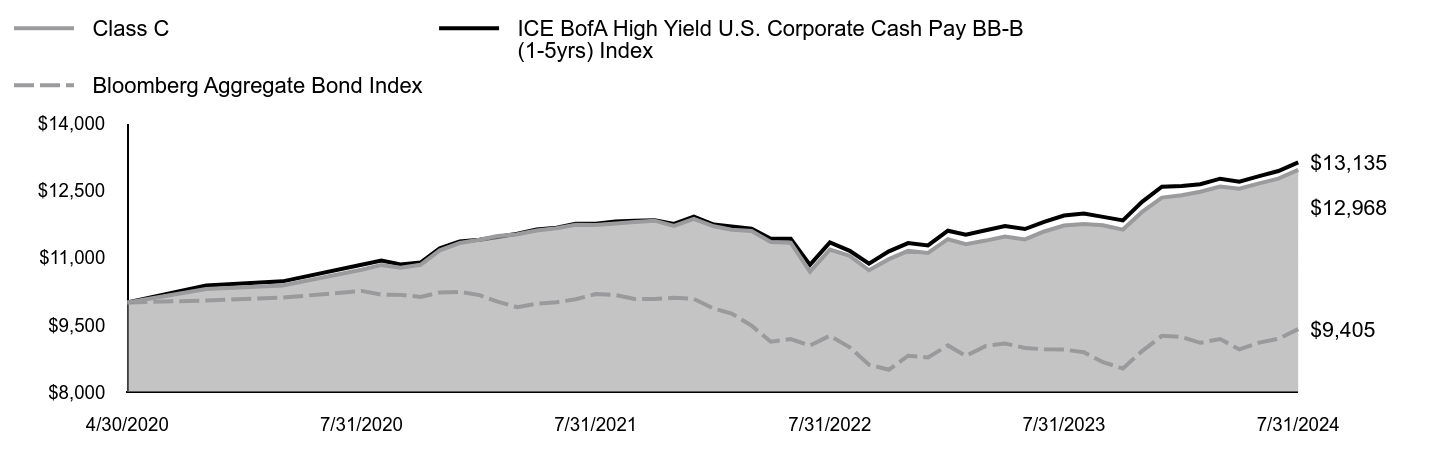

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 6.15%, reflecting performance at the net asset value (NAV) of Class C shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class C | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,010 | $10,021 | $10,032 |

| 6/30/2020 | $10,131 | $10,160 | $10,095 |

| 7/31/2020 | $10,332 | $10,313 | $10,246 |

| 8/31/2020 | $10,331 | $10,263 | $10,163 |

| 9/30/2020 | $10,341 | $10,340 | $10,157 |

| 10/31/2020 | $10,350 | $10,403 | $10,112 |

| 11/30/2020 | $10,480 | $10,481 | $10,211 |

| 12/31/2020 | $10,531 | $10,514 | $10,225 |

| 1/31/2021 | $10,520 | $10,466 | $10,152 |

| 2/28/2021 | $10,399 | $10,270 | $10,005 |

| 3/31/2021 | $10,337 | $10,254 | $9,880 |

| 4/30/2021 | $10,374 | $10,235 | $9,959 |

| 5/31/2021 | $10,371 | $10,238 | $9,991 |

| 6/30/2021 | $10,429 | $10,300 | $10,061 |

| 7/31/2021 | $10,517 | $10,478 | $10,174 |

| 8/31/2021 | $10,492 | $10,441 | $10,154 |

| 9/30/2021 | $10,418 | $10,313 | $10,066 |

| 10/31/2021 | $10,385 | $10,264 | $10,064 |

| 11/30/2021 | $10,404 | $10,371 | $10,093 |

| 12/31/2021 | $10,365 | $10,284 | $10,068 |

| 1/31/2022 | $10,188 | $10,100 | $9,851 |

| 2/28/2022 | $10,021 | $9,854 | $9,741 |

| 3/31/2022 | $9,853 | $9,609 | $9,470 |

| 4/30/2022 | $9,572 | $9,263 | $9,111 |

| 5/31/2022 | $9,498 | $9,137 | $9,170 |

| 6/30/2022 | $9,259 | $8,881 | $9,026 |

| 7/31/2022 | $9,539 | $9,279 | $9,246 |

| 8/31/2022 | $9,290 | $8,864 | $8,985 |

| 9/30/2022 | $8,967 | $8,482 | $8,597 |

| 10/31/2022 | $8,949 | $8,474 | $8,485 |

| 11/30/2022 | $9,183 | $8,783 | $8,798 |

| 12/31/2022 | $9,065 | $8,568 | $8,758 |

| 1/31/2023 | $9,271 | $8,801 | $9,027 |

| 2/28/2023 | $9,141 | $8,625 | $8,794 |

| 3/31/2023 | $9,269 | $8,799 | $9,017 |

| 4/30/2023 | $9,309 | $8,852 | $9,072 |

| 5/31/2023 | $9,304 | $8,844 | $8,973 |

| 6/30/2023 | $9,311 | $8,839 | $8,941 |

| 7/31/2023 | $9,353 | $8,881 | $8,935 |

| 8/31/2023 | $9,350 | $8,893 | $8,878 |

| 9/30/2023 | $9,211 | $8,738 | $8,652 |

| 10/31/2023 | $9,186 | $8,731 | $8,516 |

| 11/30/2023 | $9,457 | $9,034 | $8,901 |

| 12/31/2023 | $9,769 | $9,382 | $9,242 |

| 1/31/2024 | $9,732 | $9,353 | $9,217 |

| 2/29/2024 | $9,661 | $9,271 | $9,086 |

| 3/31/2024 | $9,765 | $9,391 | $9,170 |

| 4/30/2024 | $9,635 | $9,257 | $8,939 |

| 5/31/2024 | $9,670 | $9,306 | $9,090 |

| 6/30/2024 | $9,740 | $9,371 | $9,176 |

| 7/31/2024 | $9,928 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class C at NAV | 6.15% | (0.17%) |

| Class C with sales charge | 5.15% | (0.17%) |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9061-C

09/24

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F | $47 | 0.45% |

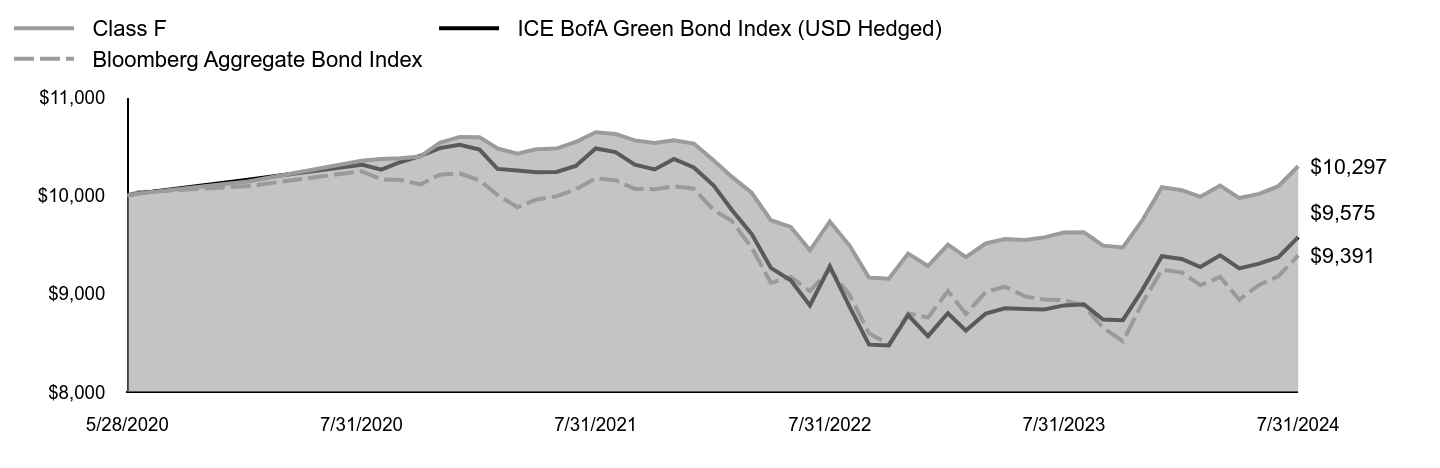

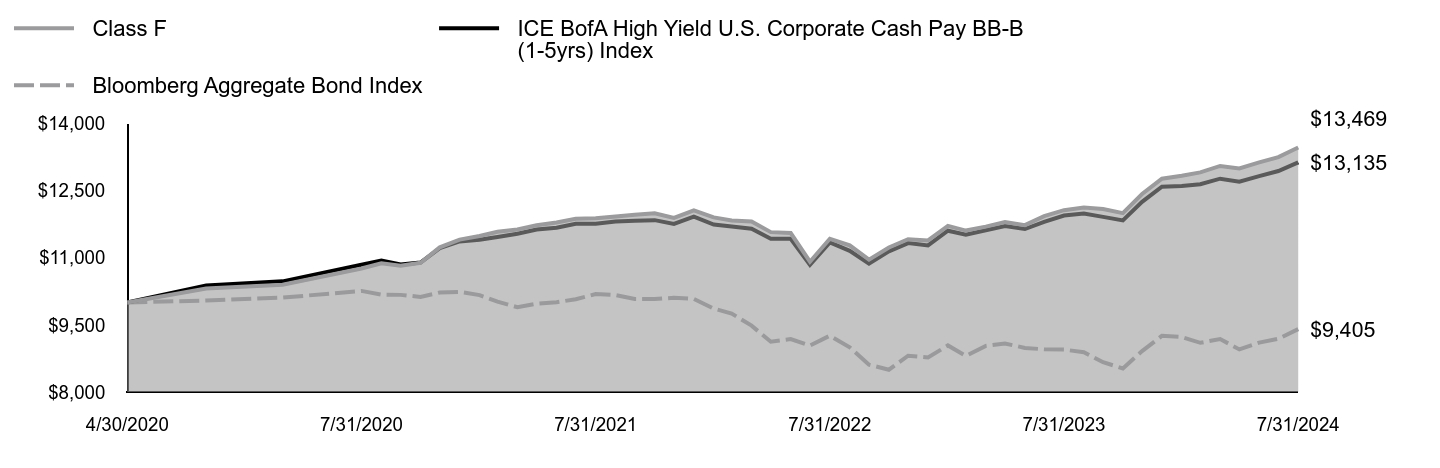

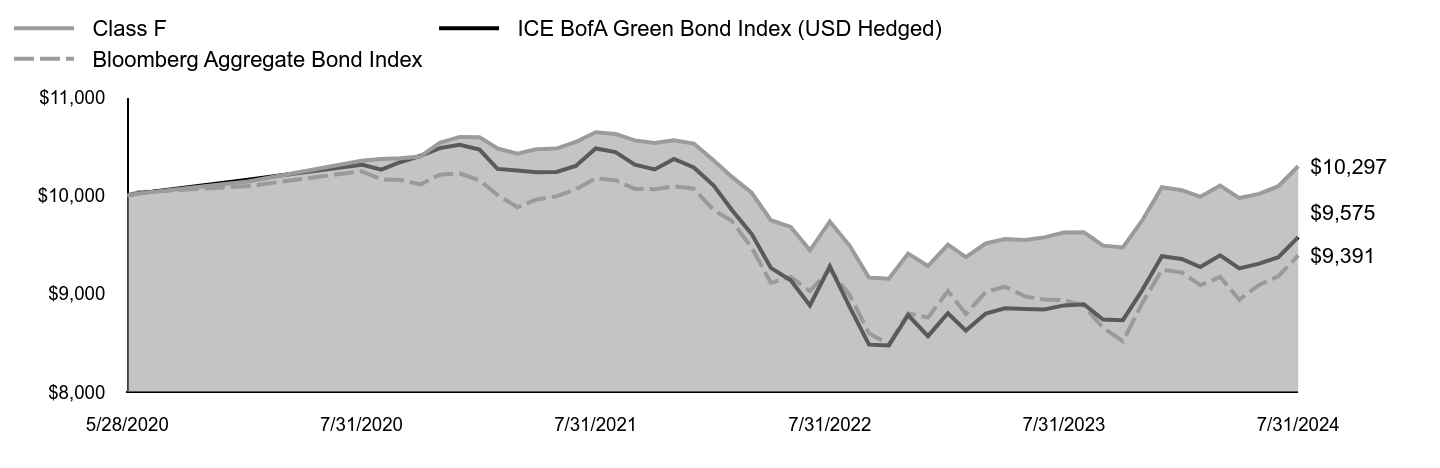

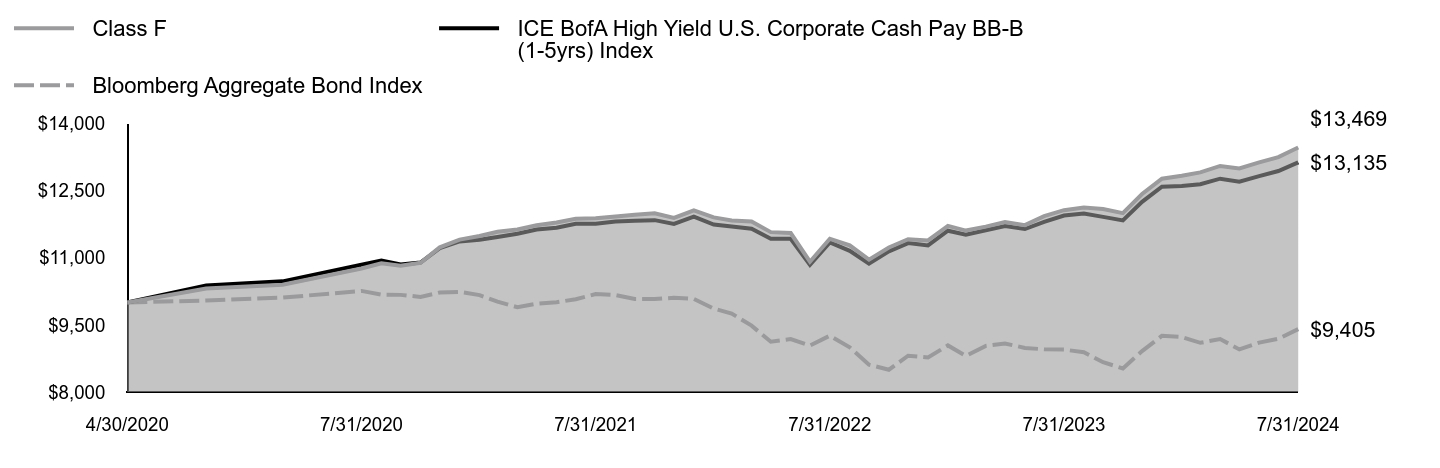

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 7.01%, reflecting performance at the net asset value (NAV) of Class F shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class F | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,142 | $10,160 | $10,095 |

| 7/31/2020 | $10,352 | $10,313 | $10,246 |

| 8/31/2020 | $10,370 | $10,263 | $10,163 |

| 9/30/2020 | $10,378 | $10,340 | $10,157 |

| 10/31/2020 | $10,396 | $10,403 | $10,112 |

| 11/30/2020 | $10,536 | $10,481 | $10,211 |

| 12/31/2020 | $10,595 | $10,514 | $10,225 |

| 1/31/2021 | $10,593 | $10,466 | $10,152 |

| 2/28/2021 | $10,479 | $10,270 | $10,005 |

| 3/31/2021 | $10,425 | $10,254 | $9,880 |

| 4/30/2021 | $10,471 | $10,235 | $9,959 |

| 5/31/2021 | $10,477 | $10,238 | $9,991 |

| 6/30/2021 | $10,544 | $10,300 | $10,061 |

| 7/31/2021 | $10,642 | $10,478 | $10,174 |

| 8/31/2021 | $10,626 | $10,441 | $10,154 |

| 9/30/2021 | $10,560 | $10,313 | $10,066 |

| 10/31/2021 | $10,534 | $10,264 | $10,064 |

| 11/30/2021 | $10,560 | $10,371 | $10,093 |

| 12/31/2021 | $10,528 | $10,284 | $10,068 |

| 1/31/2022 | $10,355 | $10,100 | $9,851 |

| 2/28/2022 | $10,191 | $9,854 | $9,741 |

| 3/31/2022 | $10,028 | $9,609 | $9,470 |

| 4/30/2022 | $9,748 | $9,263 | $9,111 |

| 5/31/2022 | $9,680 | $9,137 | $9,170 |

| 6/30/2022 | $9,442 | $8,881 | $9,026 |

| 7/31/2022 | $9,735 | $9,279 | $9,246 |

| 8/31/2022 | $9,487 | $8,864 | $8,985 |

| 9/30/2022 | $9,164 | $8,482 | $8,597 |

| 10/31/2022 | $9,152 | $8,474 | $8,485 |

| 11/30/2022 | $9,408 | $8,783 | $8,798 |

| 12/31/2022 | $9,282 | $8,568 | $8,758 |

| 1/31/2023 | $9,499 | $8,801 | $9,027 |

| 2/28/2023 | $9,372 | $8,625 | $8,794 |

| 3/31/2023 | $9,511 | $8,799 | $9,017 |

| 4/30/2023 | $9,557 | $8,852 | $9,072 |

| 5/31/2023 | $9,547 | $8,844 | $8,973 |

| 6/30/2023 | $9,573 | $8,839 | $8,941 |

| 7/31/2023 | $9,622 | $8,881 | $8,935 |

| 8/31/2023 | $9,626 | $8,893 | $8,878 |

| 9/30/2023 | $9,489 | $8,738 | $8,652 |

| 10/31/2023 | $9,470 | $8,731 | $8,516 |

| 11/30/2023 | $9,743 | $9,034 | $8,901 |

| 12/31/2023 | $10,084 | $9,382 | $9,242 |

| 1/31/2024 | $10,053 | $9,353 | $9,217 |

| 2/29/2024 | $9,986 | $9,271 | $9,086 |

| 3/31/2024 | $10,100 | $9,391 | $9,170 |

| 4/30/2024 | $9,973 | $9,257 | $8,939 |

| 5/31/2024 | $10,015 | $9,306 | $9,090 |

| 6/30/2024 | $10,094 | $9,371 | $9,176 |

| 7/31/2024 | $10,297 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class F at NAV | 7.01% | 0.70% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9062-F

09/24

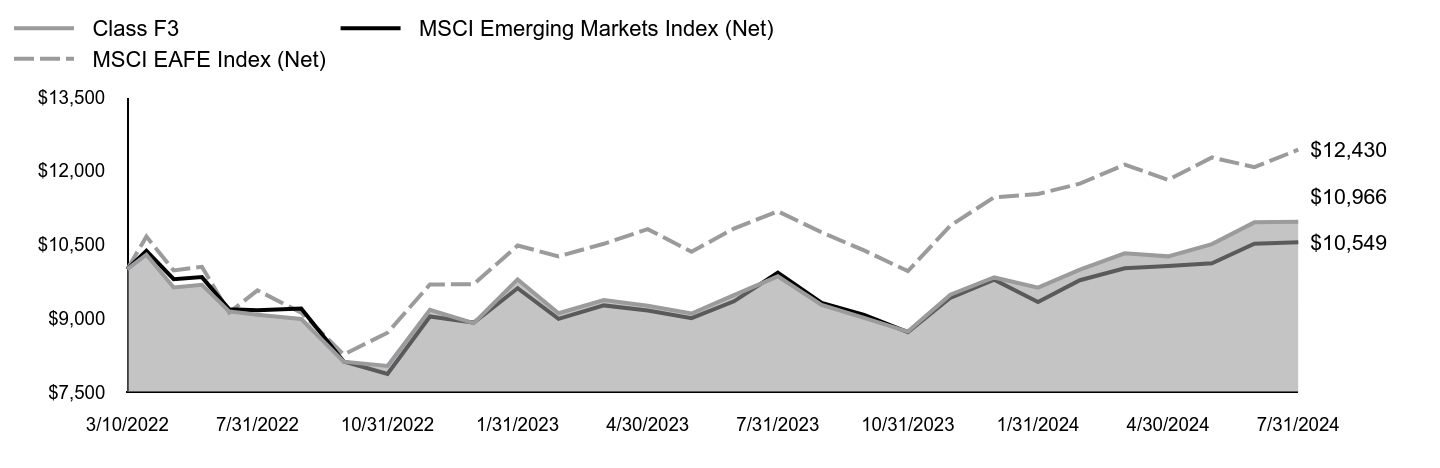

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F3 | $45 | 0.43% |

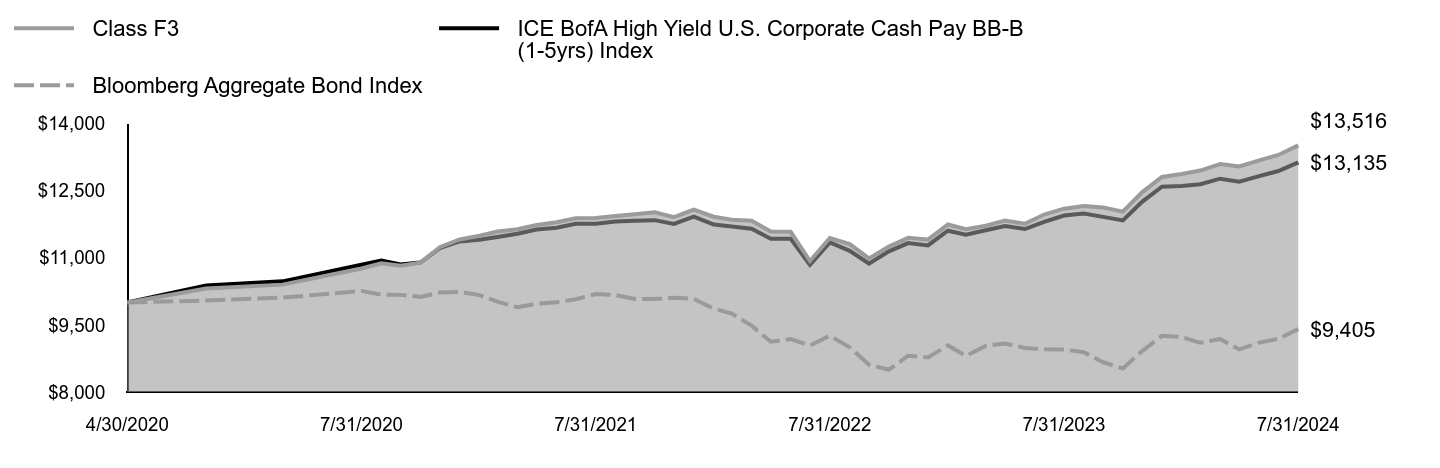

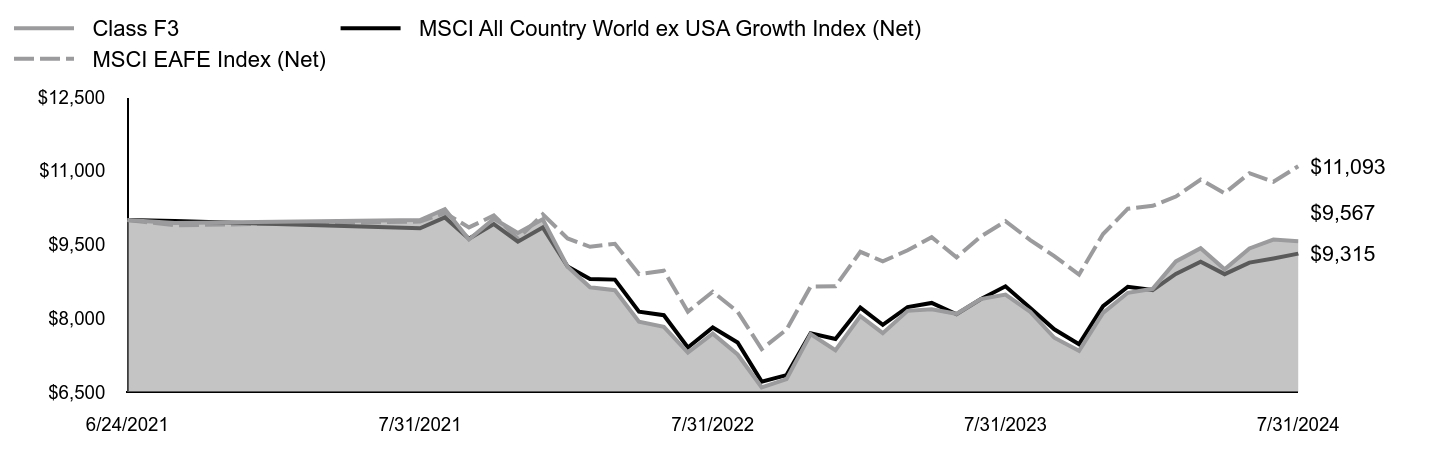

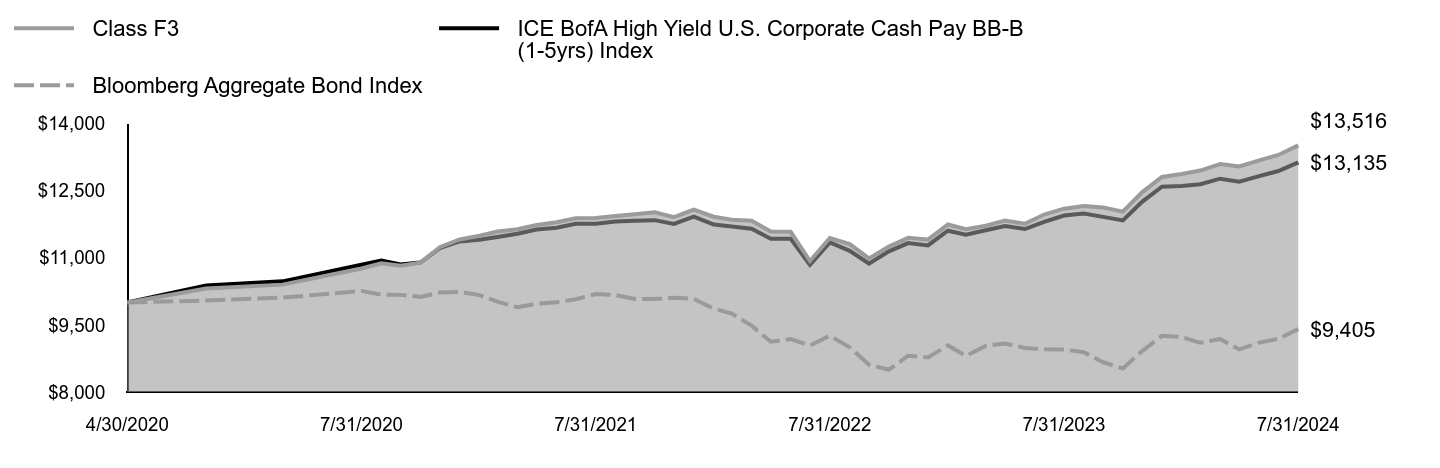

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 7.02%, reflecting performance at the net asset value (NAV) of Class F3 shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class F3 | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,142 | $10,160 | $10,095 |

| 7/31/2020 | $10,353 | $10,313 | $10,246 |

| 8/31/2020 | $10,362 | $10,263 | $10,163 |

| 9/30/2020 | $10,380 | $10,340 | $10,157 |

| 10/31/2020 | $10,400 | $10,403 | $10,112 |

| 11/30/2020 | $10,540 | $10,481 | $10,211 |

| 12/31/2020 | $10,600 | $10,514 | $10,225 |

| 1/31/2021 | $10,598 | $10,466 | $10,152 |

| 2/28/2021 | $10,485 | $10,270 | $10,005 |

| 3/31/2021 | $10,432 | $10,254 | $9,880 |

| 4/30/2021 | $10,478 | $10,235 | $9,959 |

| 5/31/2021 | $10,485 | $10,238 | $9,991 |

| 6/30/2021 | $10,552 | $10,300 | $10,061 |

| 7/31/2021 | $10,651 | $10,478 | $10,174 |

| 8/31/2021 | $10,635 | $10,441 | $10,154 |

| 9/30/2021 | $10,570 | $10,313 | $10,066 |

| 10/31/2021 | $10,545 | $10,264 | $10,064 |

| 11/30/2021 | $10,571 | $10,371 | $10,093 |

| 12/31/2021 | $10,540 | $10,284 | $10,068 |

| 1/31/2022 | $10,367 | $10,100 | $9,851 |

| 2/28/2022 | $10,204 | $9,854 | $9,741 |

| 3/31/2022 | $10,041 | $9,609 | $9,470 |

| 4/30/2022 | $9,761 | $9,263 | $9,111 |

| 5/31/2022 | $9,693 | $9,137 | $9,170 |

| 6/30/2022 | $9,455 | $8,881 | $9,026 |

| 7/31/2022 | $9,749 | $9,279 | $9,246 |

| 8/31/2022 | $9,501 | $8,864 | $8,985 |

| 9/30/2022 | $9,178 | $8,482 | $8,597 |

| 10/31/2022 | $9,166 | $8,474 | $8,485 |

| 11/30/2022 | $9,412 | $8,783 | $8,798 |

| 12/31/2022 | $9,297 | $8,568 | $8,758 |

| 1/31/2023 | $9,515 | $8,801 | $9,027 |

| 2/28/2023 | $9,388 | $8,625 | $8,794 |

| 3/31/2023 | $9,526 | $8,799 | $9,017 |

| 4/30/2023 | $9,573 | $8,852 | $9,072 |

| 5/31/2023 | $9,563 | $8,844 | $8,973 |

| 6/30/2023 | $9,589 | $8,839 | $8,941 |

| 7/31/2023 | $9,639 | $8,881 | $8,935 |

| 8/31/2023 | $9,642 | $8,893 | $8,878 |

| 9/30/2023 | $9,505 | $8,738 | $8,652 |

| 10/31/2023 | $9,486 | $8,731 | $8,516 |

| 11/30/2023 | $9,760 | $9,034 | $8,901 |

| 12/31/2023 | $10,101 | $9,382 | $9,242 |

| 1/31/2024 | $10,071 | $9,353 | $9,217 |

| 2/29/2024 | $10,004 | $9,271 | $9,086 |

| 3/31/2024 | $10,118 | $9,391 | $9,170 |

| 4/30/2024 | $9,991 | $9,257 | $8,939 |

| 5/31/2024 | $10,033 | $9,306 | $9,090 |

| 6/30/2024 | $10,113 | $9,371 | $9,176 |

| 7/31/2024 | $10,316 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class F3 at NAV | 7.02% | 0.75% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9064-F3

09/24

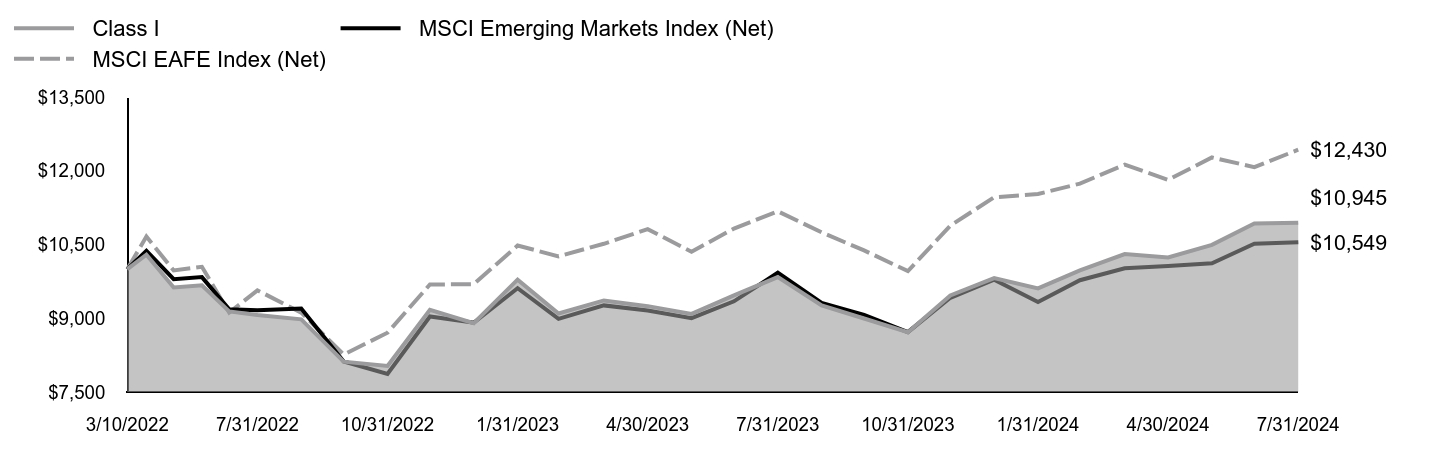

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $47 | 0.45% |

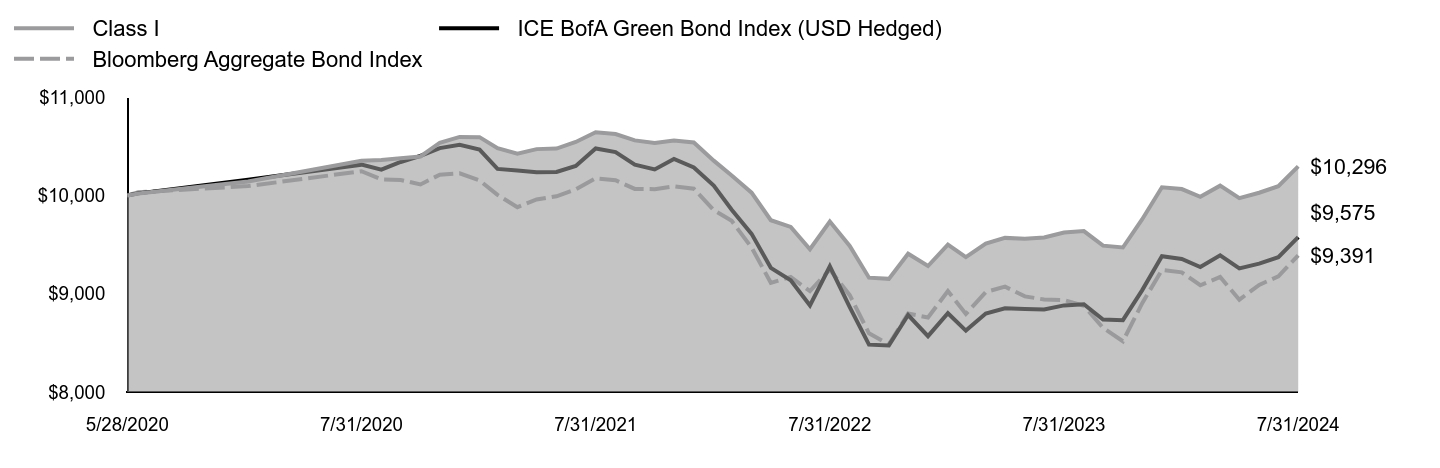

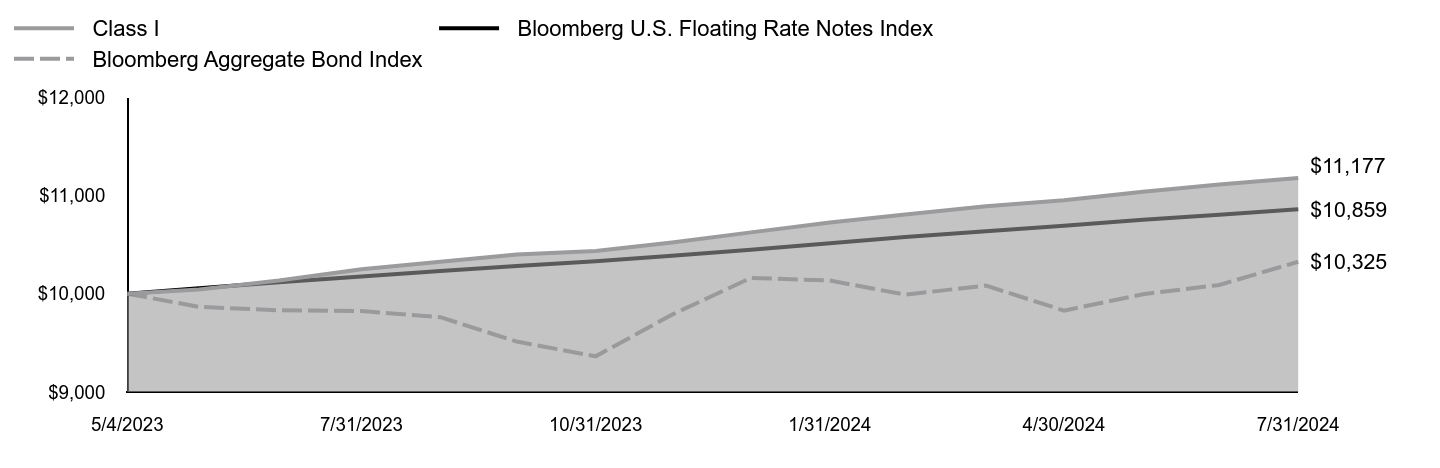

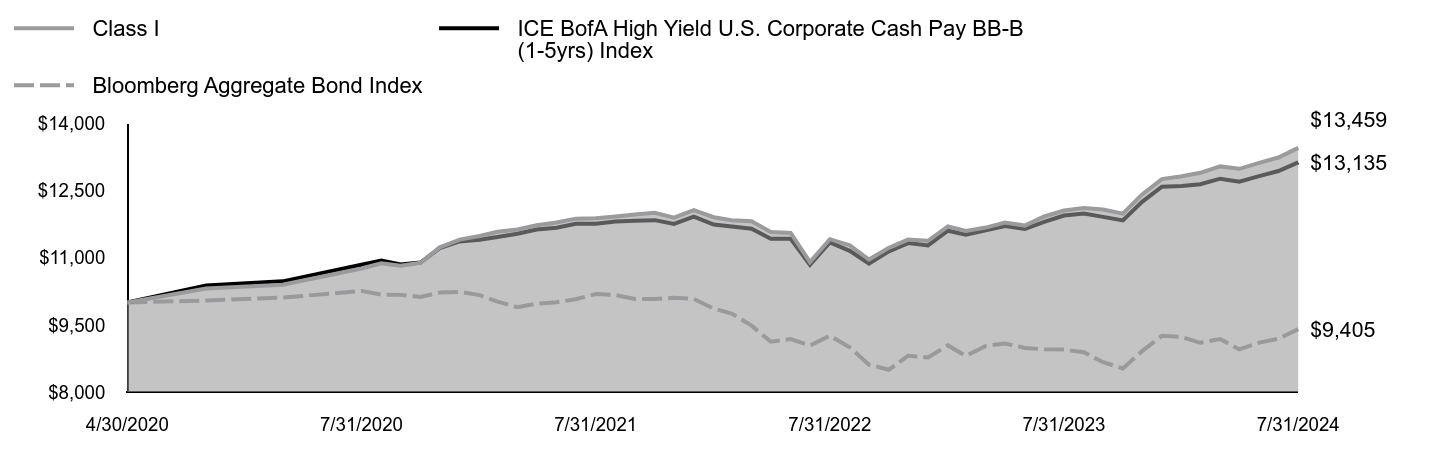

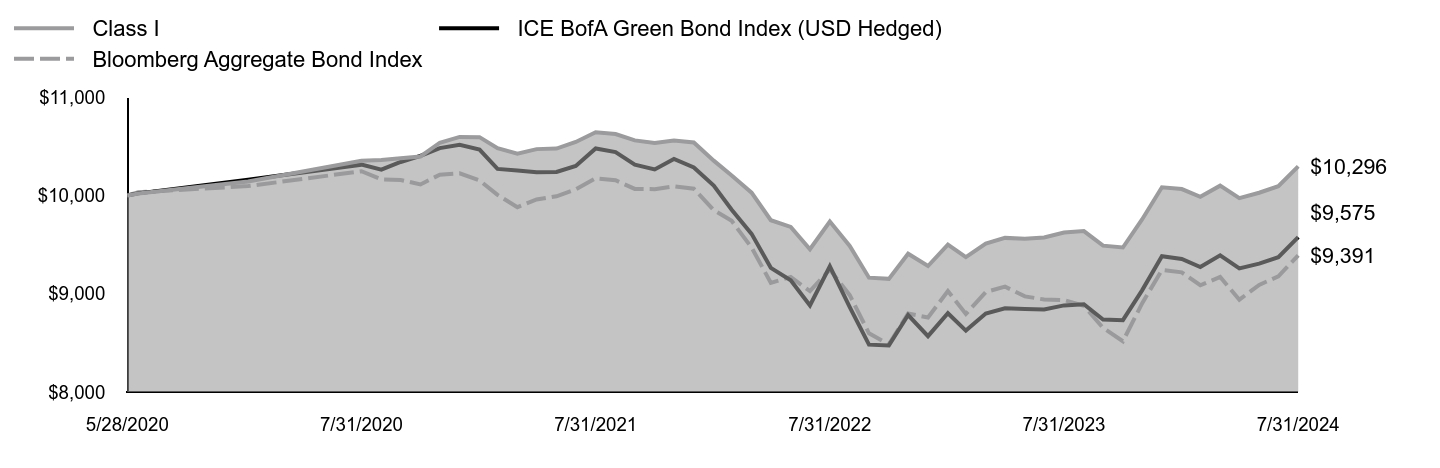

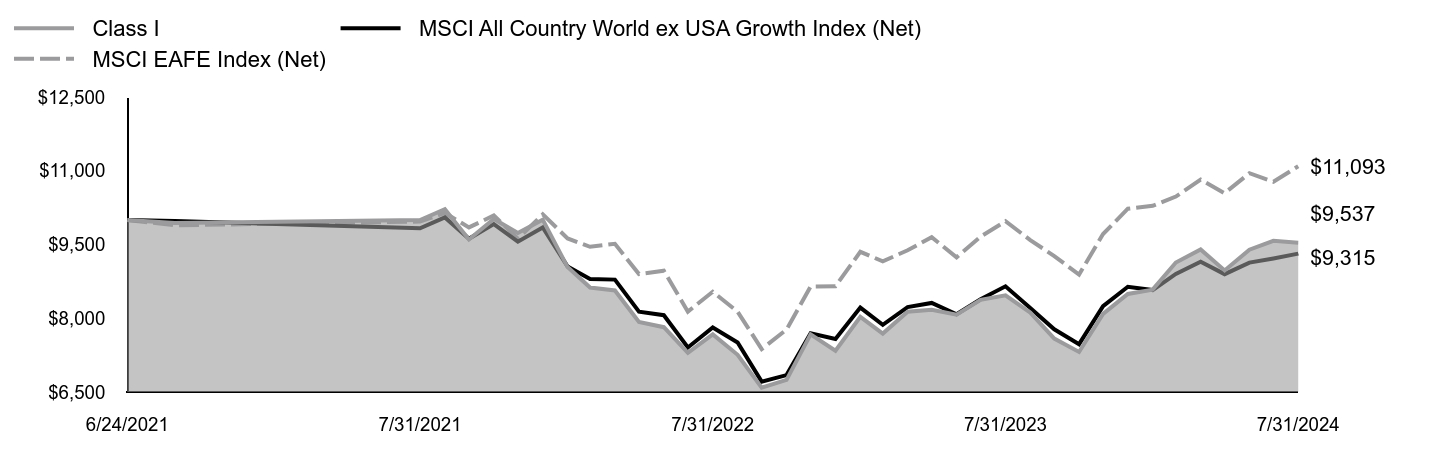

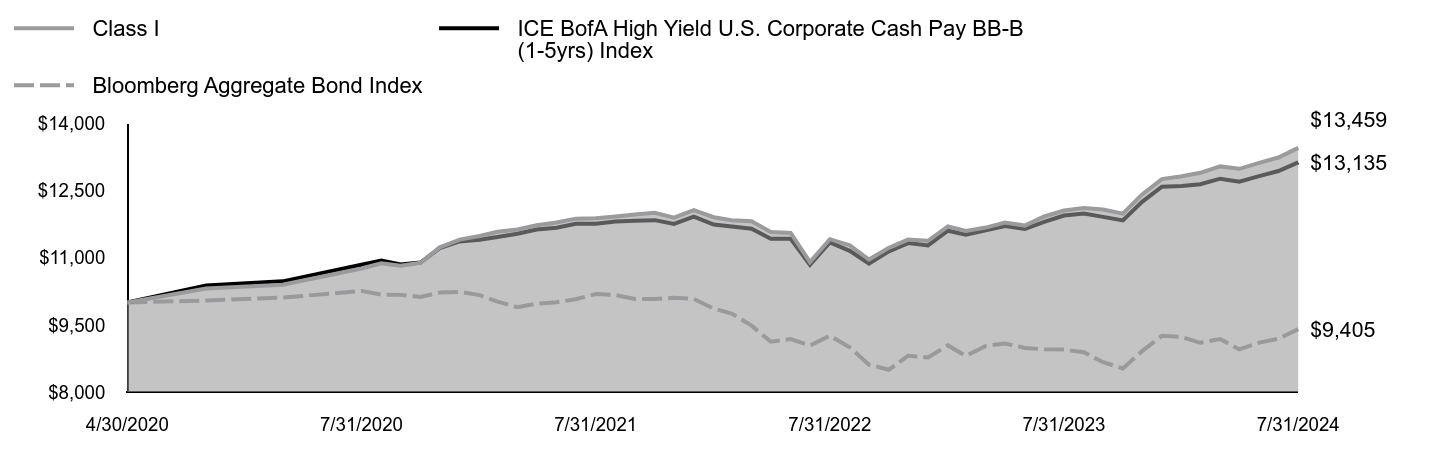

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 7.01%, reflecting performance at the net asset value (NAV) of Class I shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class I | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,142 | $10,160 | $10,095 |

| 7/31/2020 | $10,352 | $10,313 | $10,246 |

| 8/31/2020 | $10,360 | $10,263 | $10,163 |

| 9/30/2020 | $10,378 | $10,340 | $10,157 |

| 10/31/2020 | $10,396 | $10,403 | $10,112 |

| 11/30/2020 | $10,536 | $10,481 | $10,211 |

| 12/31/2020 | $10,595 | $10,514 | $10,225 |

| 1/31/2021 | $10,593 | $10,466 | $10,152 |

| 2/28/2021 | $10,480 | $10,270 | $10,005 |

| 3/31/2021 | $10,425 | $10,254 | $9,880 |

| 4/30/2021 | $10,471 | $10,235 | $9,959 |

| 5/31/2021 | $10,477 | $10,238 | $9,991 |

| 6/30/2021 | $10,544 | $10,300 | $10,061 |

| 7/31/2021 | $10,642 | $10,478 | $10,174 |

| 8/31/2021 | $10,625 | $10,441 | $10,154 |

| 9/30/2021 | $10,560 | $10,313 | $10,066 |

| 10/31/2021 | $10,534 | $10,264 | $10,064 |

| 11/30/2021 | $10,559 | $10,371 | $10,093 |

| 12/31/2021 | $10,538 | $10,284 | $10,068 |

| 1/31/2022 | $10,354 | $10,100 | $9,851 |

| 2/28/2022 | $10,202 | $9,854 | $9,741 |

| 3/31/2022 | $10,028 | $9,609 | $9,470 |

| 4/30/2022 | $9,748 | $9,263 | $9,111 |

| 5/31/2022 | $9,680 | $9,137 | $9,170 |

| 6/30/2022 | $9,452 | $8,881 | $9,026 |

| 7/31/2022 | $9,734 | $9,279 | $9,246 |

| 8/31/2022 | $9,486 | $8,864 | $8,985 |

| 9/30/2022 | $9,163 | $8,482 | $8,597 |

| 10/31/2022 | $9,151 | $8,474 | $8,485 |

| 11/30/2022 | $9,407 | $8,783 | $8,798 |

| 12/31/2022 | $9,282 | $8,568 | $8,758 |

| 1/31/2023 | $9,499 | $8,801 | $9,027 |

| 2/28/2023 | $9,372 | $8,625 | $8,794 |

| 3/31/2023 | $9,510 | $8,799 | $9,017 |

| 4/30/2023 | $9,568 | $8,852 | $9,072 |

| 5/31/2023 | $9,558 | $8,844 | $8,973 |

| 6/30/2023 | $9,572 | $8,839 | $8,941 |

| 7/31/2023 | $9,622 | $8,881 | $8,935 |

| 8/31/2023 | $9,637 | $8,893 | $8,878 |

| 9/30/2023 | $9,489 | $8,738 | $8,652 |

| 10/31/2023 | $9,470 | $8,731 | $8,516 |

| 11/30/2023 | $9,755 | $9,034 | $8,901 |

| 12/31/2023 | $10,083 | $9,382 | $9,242 |

| 1/31/2024 | $10,065 | $9,353 | $9,217 |

| 2/29/2024 | $9,986 | $9,271 | $9,086 |

| 3/31/2024 | $10,099 | $9,391 | $9,170 |

| 4/30/2024 | $9,972 | $9,257 | $8,939 |

| 5/31/2024 | $10,027 | $9,306 | $9,090 |

| 6/30/2024 | $10,094 | $9,371 | $9,176 |

| 7/31/2024 | $10,296 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class I at NAV | 7.01% | 0.70% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9063-I

09/24

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

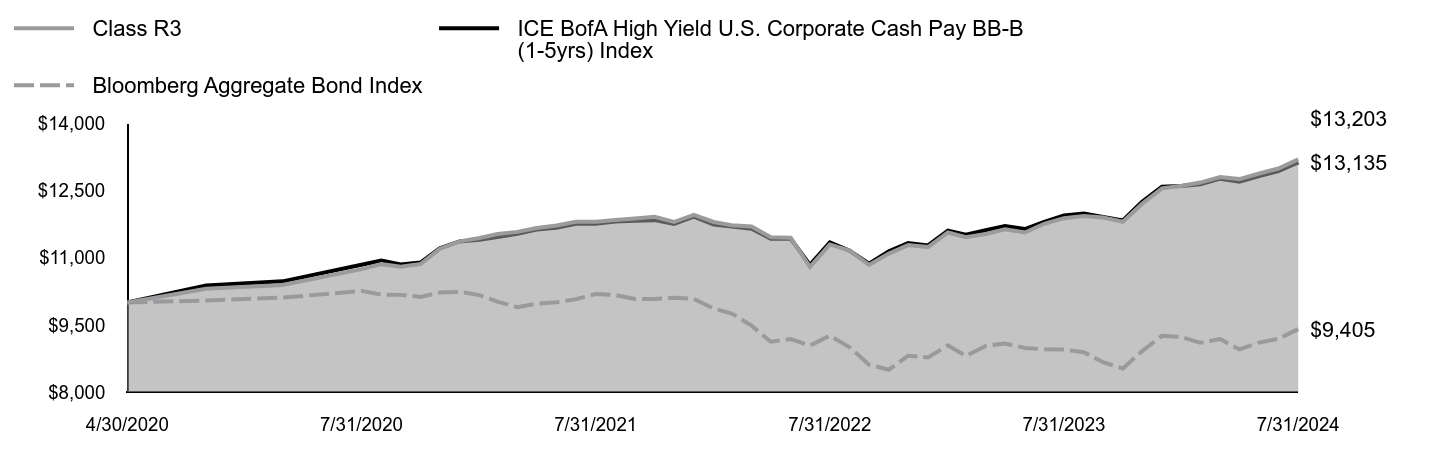

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R3 | $98 | 0.95% |

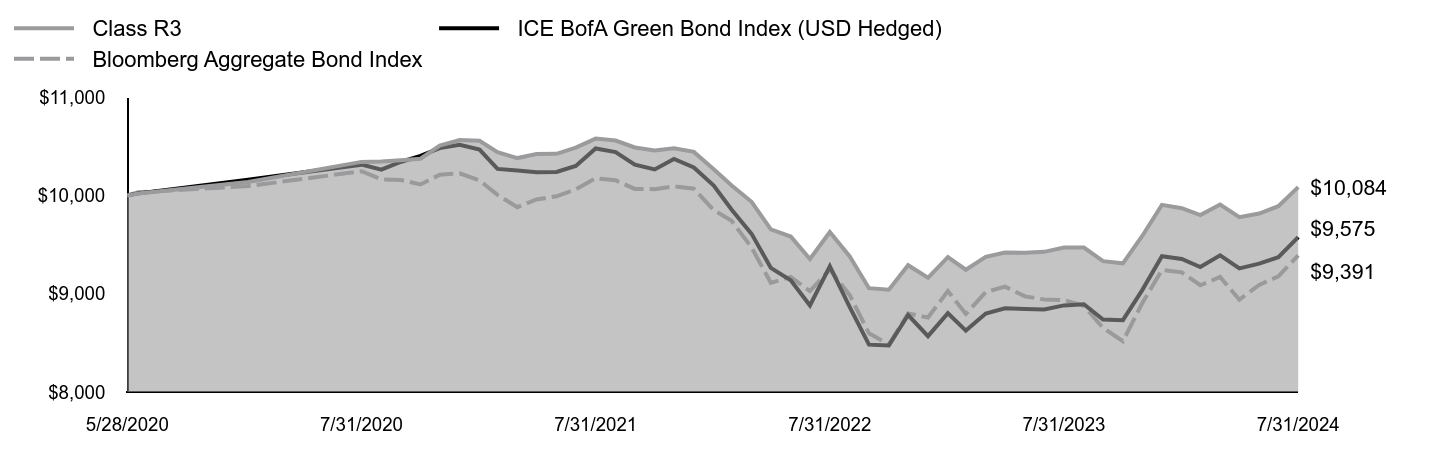

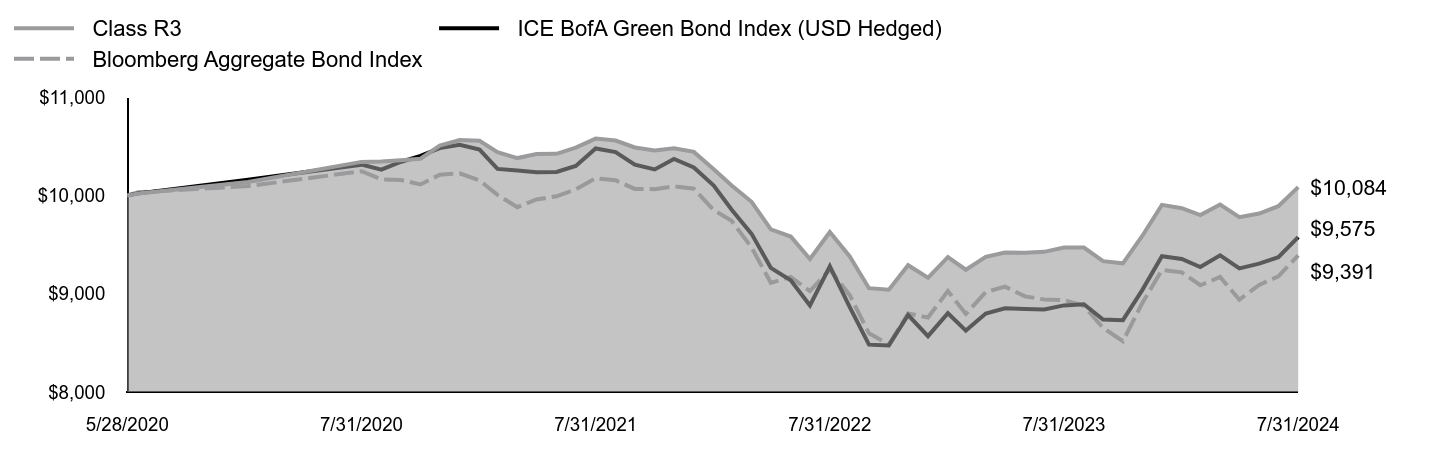

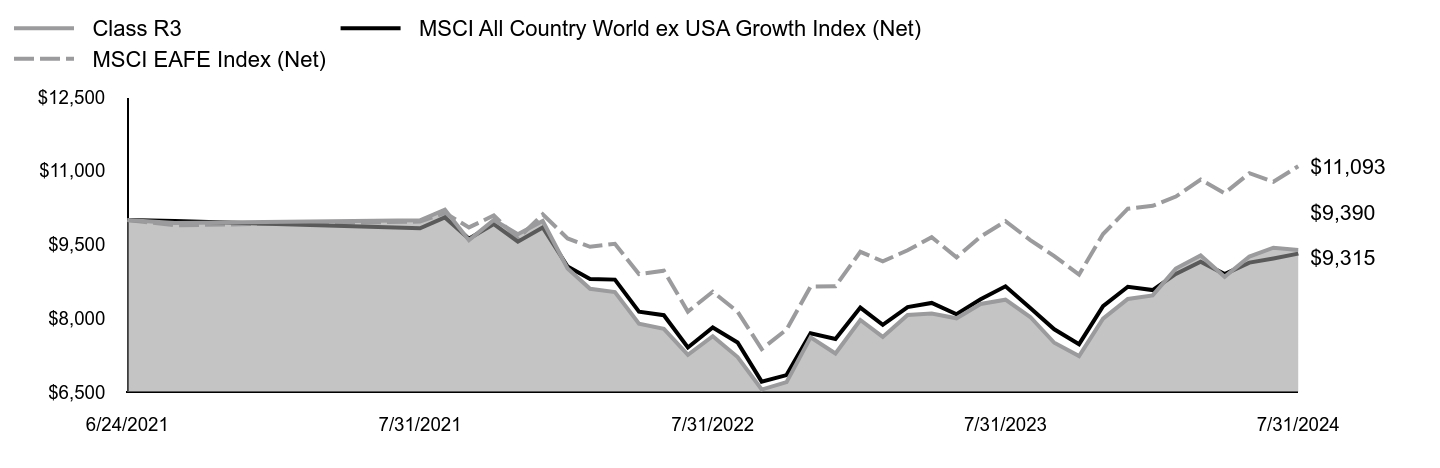

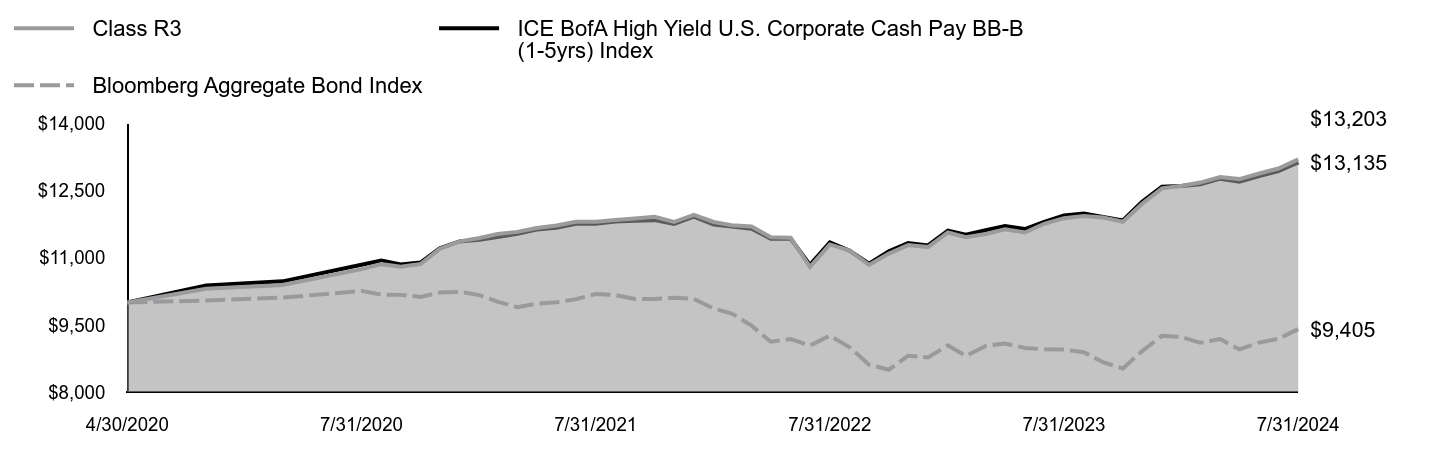

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 6.48%, reflecting performance at the net asset value (NAV) of Class R3 shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class R3 | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,136 | $10,160 | $10,095 |

| 7/31/2020 | $10,341 | $10,313 | $10,246 |

| 8/31/2020 | $10,345 | $10,263 | $10,163 |

| 9/30/2020 | $10,359 | $10,340 | $10,157 |

| 10/31/2020 | $10,373 | $10,403 | $10,112 |

| 11/30/2020 | $10,508 | $10,481 | $10,211 |

| 12/31/2020 | $10,563 | $10,514 | $10,225 |

| 1/31/2021 | $10,556 | $10,466 | $10,152 |

| 2/28/2021 | $10,439 | $10,270 | $10,005 |

| 3/31/2021 | $10,380 | $10,254 | $9,880 |

| 4/30/2021 | $10,422 | $10,235 | $9,959 |

| 5/31/2021 | $10,423 | $10,238 | $9,991 |

| 6/30/2021 | $10,486 | $10,300 | $10,061 |

| 7/31/2021 | $10,578 | $10,478 | $10,174 |

| 8/31/2021 | $10,558 | $10,441 | $10,154 |

| 9/30/2021 | $10,488 | $10,313 | $10,066 |

| 10/31/2021 | $10,458 | $10,264 | $10,064 |

| 11/30/2021 | $10,479 | $10,371 | $10,093 |

| 12/31/2021 | $10,443 | $10,284 | $10,068 |

| 1/31/2022 | $10,267 | $10,100 | $9,851 |

| 2/28/2022 | $10,101 | $9,854 | $9,741 |

| 3/31/2022 | $9,935 | $9,609 | $9,470 |

| 4/30/2022 | $9,654 | $9,263 | $9,111 |

| 5/31/2022 | $9,582 | $9,137 | $9,170 |

| 6/30/2022 | $9,353 | $8,881 | $9,026 |

| 7/31/2022 | $9,628 | $9,279 | $9,246 |

| 8/31/2022 | $9,379 | $8,864 | $8,985 |

| 9/30/2022 | $9,056 | $8,482 | $8,597 |

| 10/31/2022 | $9,040 | $8,474 | $8,485 |

| 11/30/2022 | $9,290 | $8,783 | $8,798 |

| 12/31/2022 | $9,162 | $8,568 | $8,758 |

| 1/31/2023 | $9,372 | $8,801 | $9,027 |

| 2/28/2023 | $9,244 | $8,625 | $8,794 |

| 3/31/2023 | $9,376 | $8,799 | $9,017 |

| 4/30/2023 | $9,418 | $8,852 | $9,072 |

| 5/31/2023 | $9,416 | $8,844 | $8,973 |

| 6/30/2023 | $9,426 | $8,839 | $8,941 |

| 7/31/2023 | $9,470 | $8,881 | $8,935 |

| 8/31/2023 | $9,470 | $8,893 | $8,878 |

| 9/30/2023 | $9,331 | $8,738 | $8,652 |

| 10/31/2023 | $9,309 | $8,731 | $8,516 |

| 11/30/2023 | $9,585 | $9,034 | $8,901 |

| 12/31/2023 | $9,904 | $9,382 | $9,242 |

| 1/31/2024 | $9,870 | $9,353 | $9,217 |

| 2/29/2024 | $9,800 | $9,271 | $9,086 |

| 3/31/2024 | $9,908 | $9,391 | $9,170 |

| 4/30/2024 | $9,779 | $9,257 | $8,939 |

| 5/31/2024 | $9,816 | $9,306 | $9,090 |

| 6/30/2024 | $9,890 | $9,371 | $9,176 |

| 7/31/2024 | $10,084 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class R3 at NAV | 6.48% | 0.20% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9065-R3

09/24

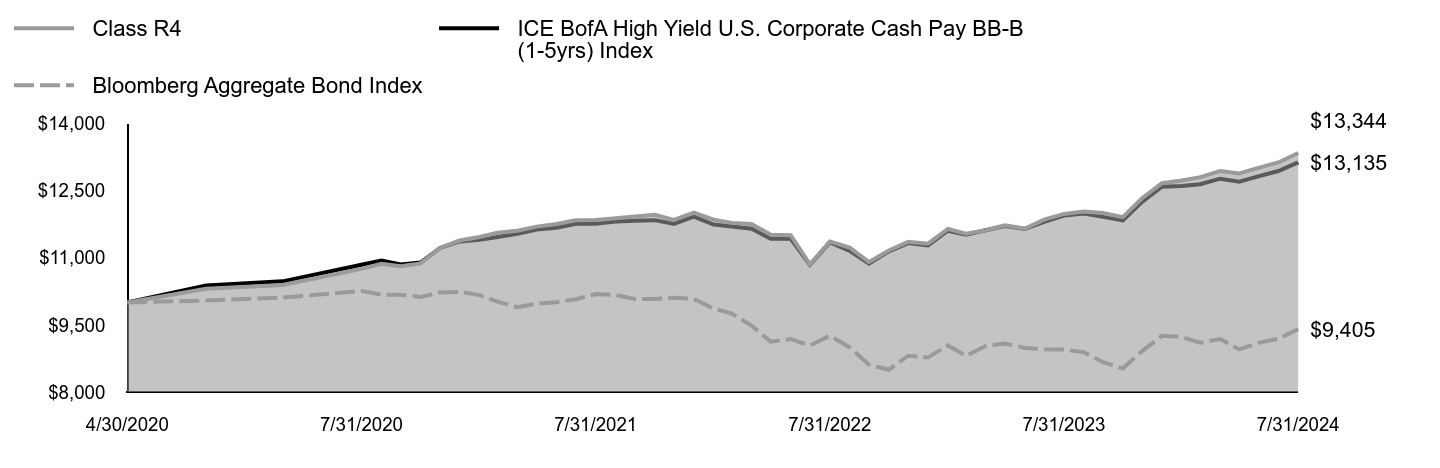

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R4 | $72 | 0.70% |

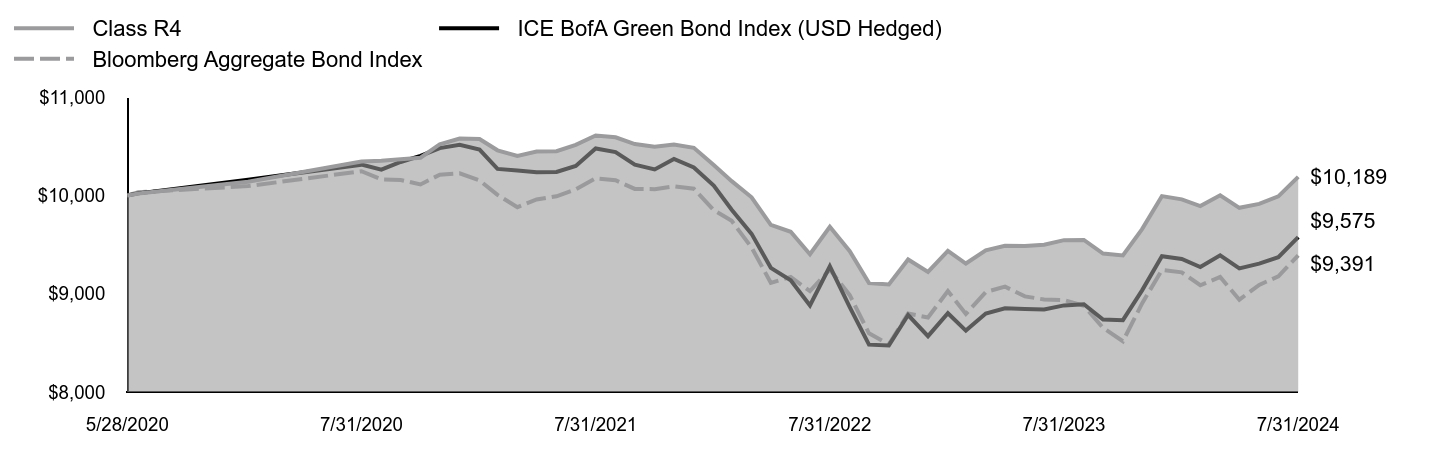

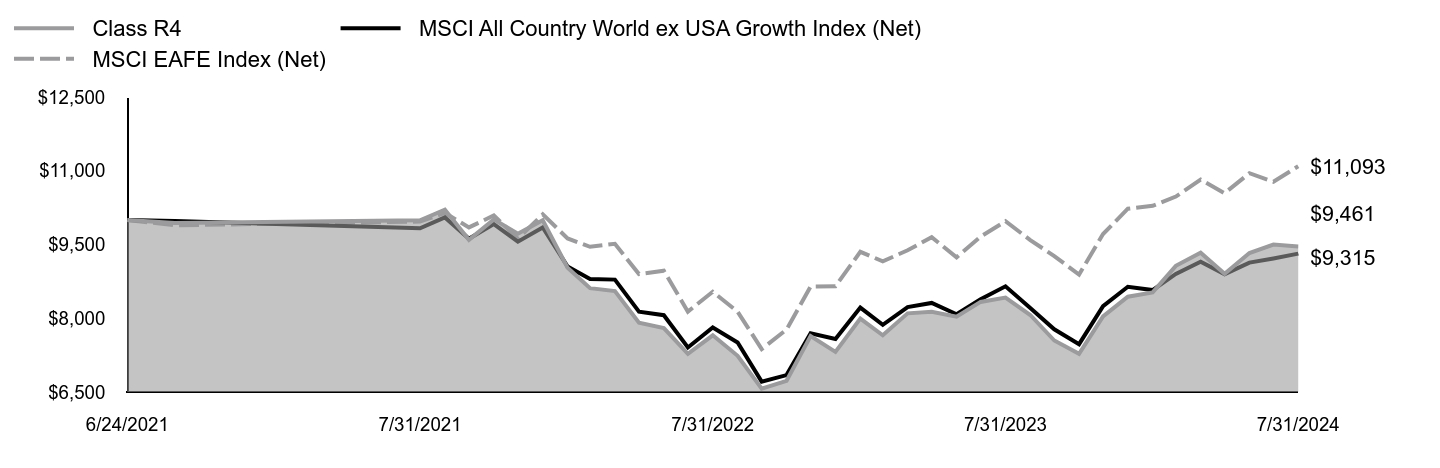

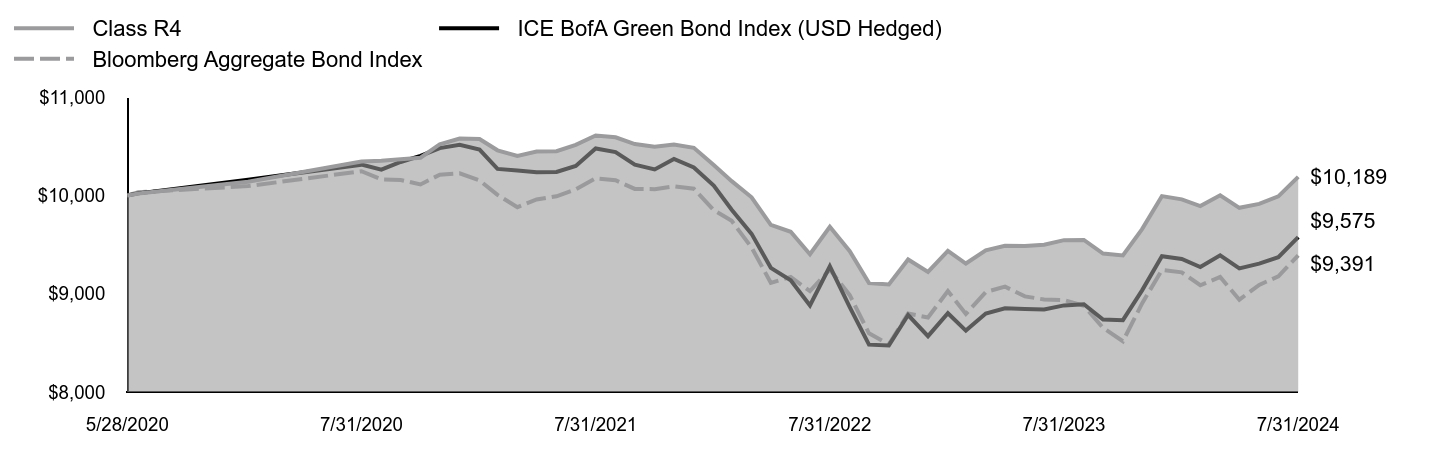

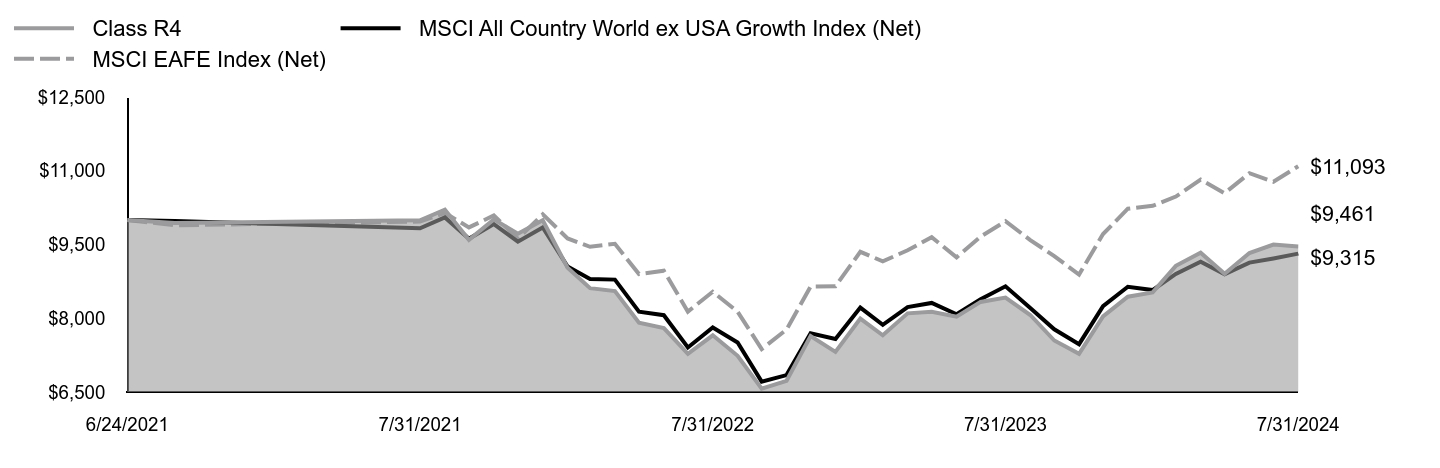

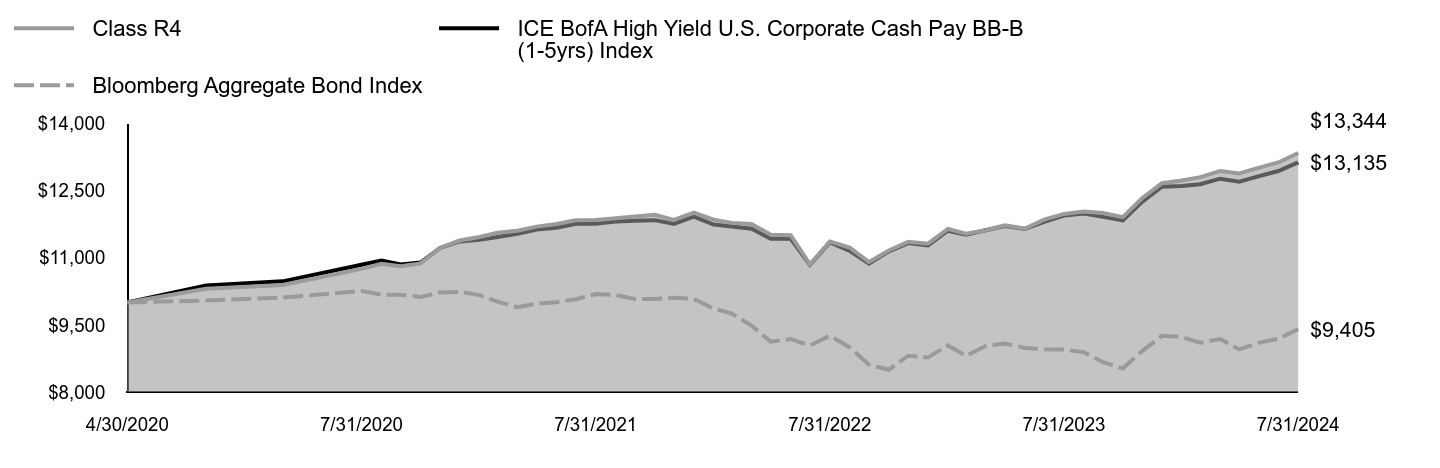

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 6.74%, reflecting performance at the net asset value (NAV) of Class R4 shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class R4 | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,139 | $10,160 | $10,095 |

| 7/31/2020 | $10,346 | $10,313 | $10,246 |

| 8/31/2020 | $10,352 | $10,263 | $10,163 |

| 9/30/2020 | $10,368 | $10,340 | $10,157 |

| 10/31/2020 | $10,384 | $10,403 | $10,112 |

| 11/30/2020 | $10,521 | $10,481 | $10,211 |

| 12/31/2020 | $10,579 | $10,514 | $10,225 |

| 1/31/2021 | $10,574 | $10,466 | $10,152 |

| 2/28/2021 | $10,459 | $10,270 | $10,005 |

| 3/31/2021 | $10,402 | $10,254 | $9,880 |

| 4/30/2021 | $10,446 | $10,235 | $9,959 |

| 5/31/2021 | $10,450 | $10,238 | $9,991 |

| 6/30/2021 | $10,514 | $10,300 | $10,061 |

| 7/31/2021 | $10,610 | $10,478 | $10,174 |

| 8/31/2021 | $10,591 | $10,441 | $10,154 |

| 9/30/2021 | $10,523 | $10,313 | $10,066 |

| 10/31/2021 | $10,495 | $10,264 | $10,064 |

| 11/30/2021 | $10,519 | $10,371 | $10,093 |

| 12/31/2021 | $10,484 | $10,284 | $10,068 |

| 1/31/2022 | $10,310 | $10,100 | $9,851 |

| 2/28/2022 | $10,145 | $9,854 | $9,741 |

| 3/31/2022 | $9,981 | $9,609 | $9,470 |

| 4/30/2022 | $9,700 | $9,263 | $9,111 |

| 5/31/2022 | $9,630 | $9,137 | $9,170 |

| 6/30/2022 | $9,402 | $8,881 | $9,026 |

| 7/31/2022 | $9,681 | $9,279 | $9,246 |

| 8/31/2022 | $9,432 | $8,864 | $8,985 |

| 9/30/2022 | $9,109 | $8,482 | $8,597 |

| 10/31/2022 | $9,095 | $8,474 | $8,485 |

| 11/30/2022 | $9,348 | $8,783 | $8,798 |

| 12/31/2022 | $9,222 | $8,568 | $8,758 |

| 1/31/2023 | $9,435 | $8,801 | $9,027 |

| 2/28/2023 | $9,307 | $8,625 | $8,794 |

| 3/31/2023 | $9,442 | $8,799 | $9,017 |

| 4/30/2023 | $9,487 | $8,852 | $9,072 |

| 5/31/2023 | $9,486 | $8,844 | $8,973 |

| 6/30/2023 | $9,498 | $8,839 | $8,941 |

| 7/31/2023 | $9,545 | $8,881 | $8,935 |

| 8/31/2023 | $9,547 | $8,893 | $8,878 |

| 9/30/2023 | $9,409 | $8,738 | $8,652 |

| 10/31/2023 | $9,389 | $8,731 | $8,516 |

| 11/30/2023 | $9,657 | $9,034 | $8,901 |

| 12/31/2023 | $9,993 | $9,382 | $9,242 |

| 1/31/2024 | $9,960 | $9,353 | $9,217 |

| 2/29/2024 | $9,892 | $9,271 | $9,086 |

| 3/31/2024 | $10,002 | $9,391 | $9,170 |

| 4/30/2024 | $9,874 | $9,257 | $8,939 |

| 5/31/2024 | $9,914 | $9,306 | $9,090 |

| 6/30/2024 | $9,991 | $9,371 | $9,176 |

| 7/31/2024 | $10,189 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class R4 at NAV | 6.74% | 0.45% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9066-R4

09/24

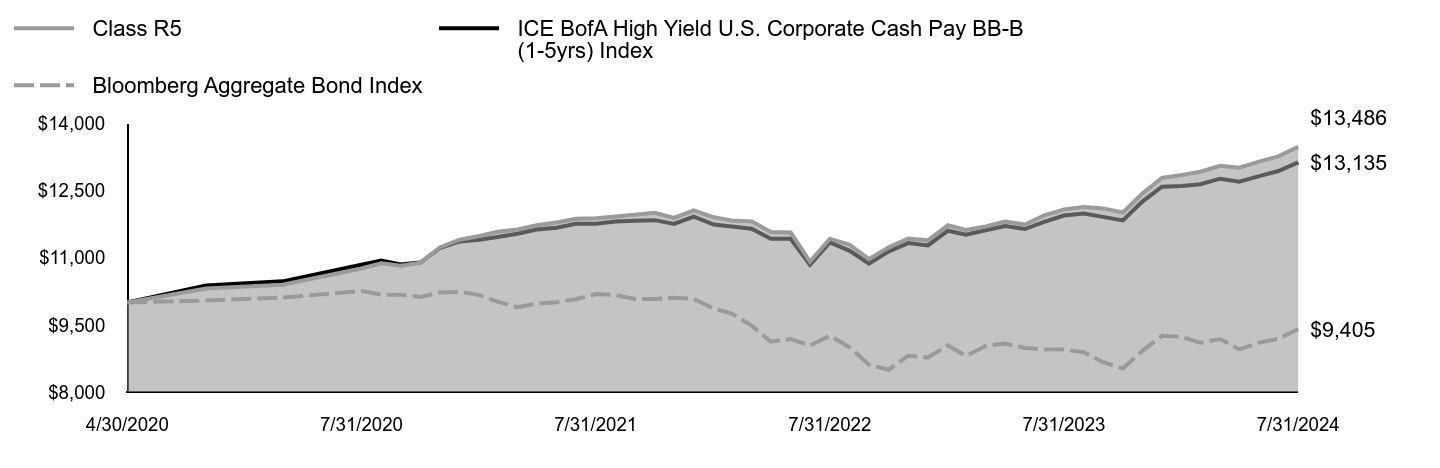

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R5 | $47 | 0.45% |

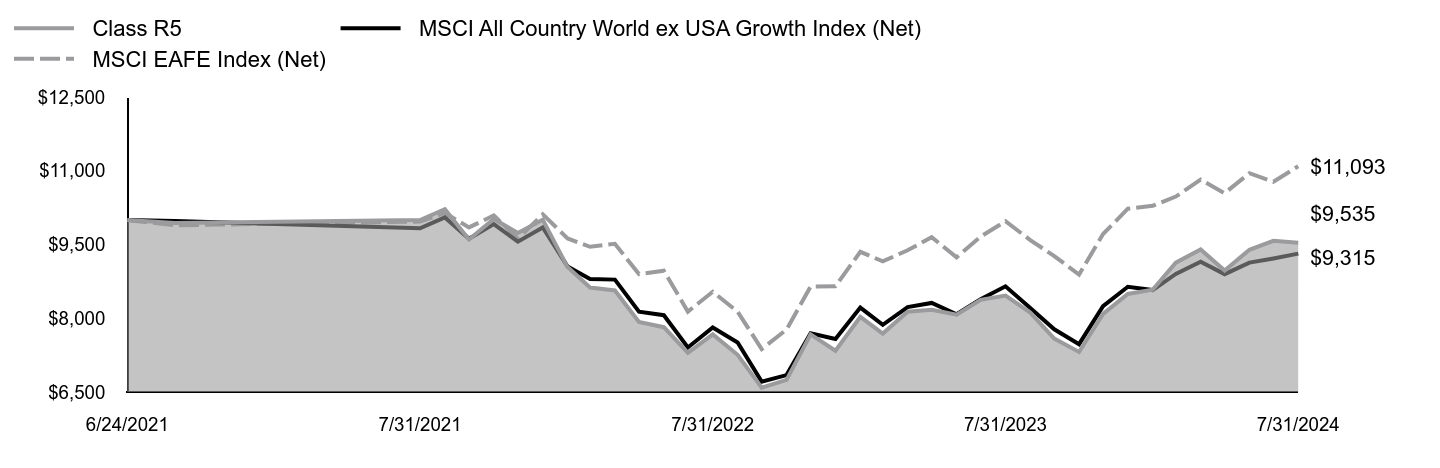

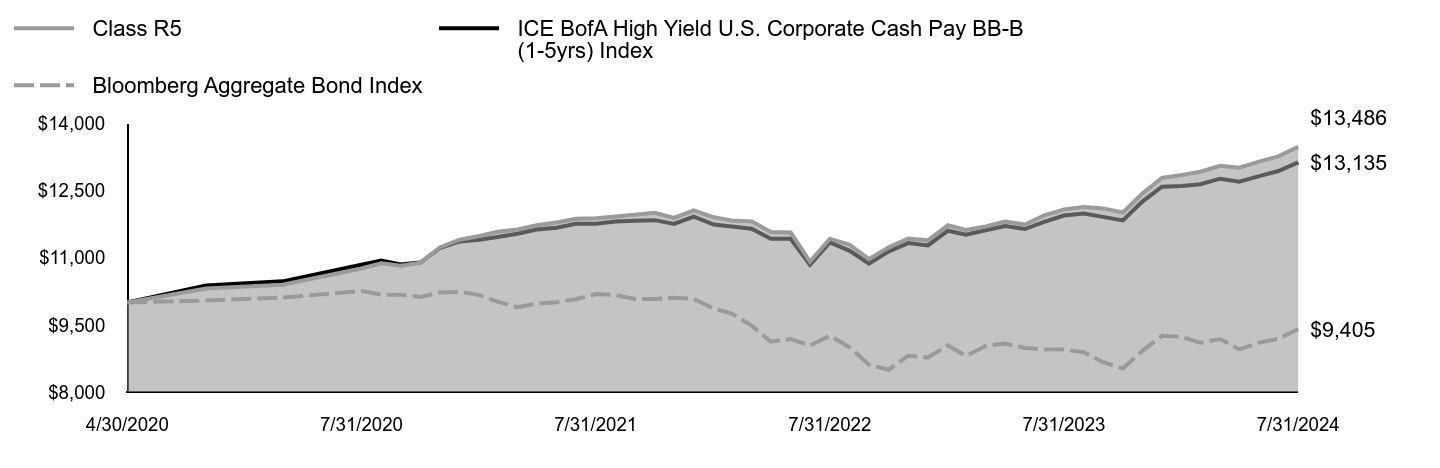

How did the Fund perform last year and what affected its performance?

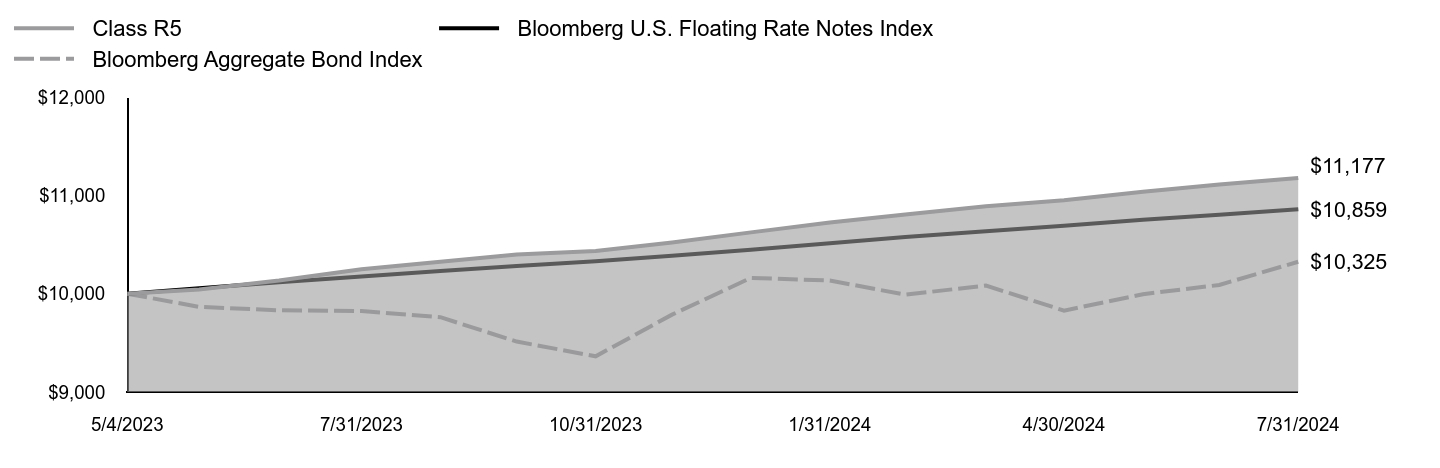

For the fiscal year ended July 31, 2024, the Fund returned 7.01%, reflecting performance at the net asset value (NAV) of Class R5 shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class R5 | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,142 | $10,160 | $10,095 |

| 7/31/2020 | $10,351 | $10,313 | $10,246 |

| 8/31/2020 | $10,359 | $10,263 | $10,163 |

| 9/30/2020 | $10,377 | $10,340 | $10,157 |

| 10/31/2020 | $10,396 | $10,403 | $10,112 |

| 11/30/2020 | $10,535 | $10,481 | $10,211 |

| 12/31/2020 | $10,595 | $10,514 | $10,225 |

| 1/31/2021 | $10,593 | $10,466 | $10,152 |

| 2/28/2021 | $10,479 | $10,270 | $10,005 |

| 3/31/2021 | $10,425 | $10,254 | $9,880 |

| 4/30/2021 | $10,471 | $10,235 | $9,959 |

| 5/31/2021 | $10,477 | $10,238 | $9,991 |

| 6/30/2021 | $10,544 | $10,300 | $10,061 |

| 7/31/2021 | $10,642 | $10,478 | $10,174 |

| 8/31/2021 | $10,625 | $10,441 | $10,154 |

| 9/30/2021 | $10,560 | $10,313 | $10,066 |

| 10/31/2021 | $10,534 | $10,264 | $10,064 |

| 11/30/2021 | $10,559 | $10,371 | $10,093 |

| 12/31/2021 | $10,527 | $10,284 | $10,068 |

| 1/31/2022 | $10,354 | $10,100 | $9,851 |

| 2/28/2022 | $10,191 | $9,854 | $9,741 |

| 3/31/2022 | $10,028 | $9,609 | $9,470 |

| 4/30/2022 | $9,748 | $9,263 | $9,111 |

| 5/31/2022 | $9,680 | $9,137 | $9,170 |

| 6/30/2022 | $9,453 | $8,881 | $9,026 |

| 7/31/2022 | $9,734 | $9,279 | $9,246 |

| 8/31/2022 | $9,487 | $8,864 | $8,985 |

| 9/30/2022 | $9,164 | $8,482 | $8,597 |

| 10/31/2022 | $9,152 | $8,474 | $8,485 |

| 11/30/2022 | $9,408 | $8,783 | $8,798 |

| 12/31/2022 | $9,282 | $8,568 | $8,758 |

| 1/31/2023 | $9,500 | $8,801 | $9,027 |

| 2/28/2023 | $9,372 | $8,625 | $8,794 |

| 3/31/2023 | $9,511 | $8,799 | $9,017 |

| 4/30/2023 | $9,557 | $8,852 | $9,072 |

| 5/31/2023 | $9,559 | $8,844 | $8,973 |

| 6/30/2023 | $9,573 | $8,839 | $8,941 |

| 7/31/2023 | $9,622 | $8,881 | $8,935 |

| 8/31/2023 | $9,626 | $8,893 | $8,878 |

| 9/30/2023 | $9,489 | $8,738 | $8,652 |

| 10/31/2023 | $9,470 | $8,731 | $8,516 |

| 11/30/2023 | $9,755 | $9,034 | $8,901 |

| 12/31/2023 | $10,084 | $9,382 | $9,242 |

| 1/31/2024 | $10,053 | $9,353 | $9,217 |

| 2/29/2024 | $9,986 | $9,271 | $9,086 |

| 3/31/2024 | $10,100 | $9,391 | $9,170 |

| 4/30/2024 | $9,973 | $9,257 | $8,939 |

| 5/31/2024 | $10,015 | $9,306 | $9,090 |

| 6/30/2024 | $10,095 | $9,371 | $9,176 |

| 7/31/2024 | $10,297 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class R5 at NAV | 7.01% | 0.70% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9067-R5

09/24

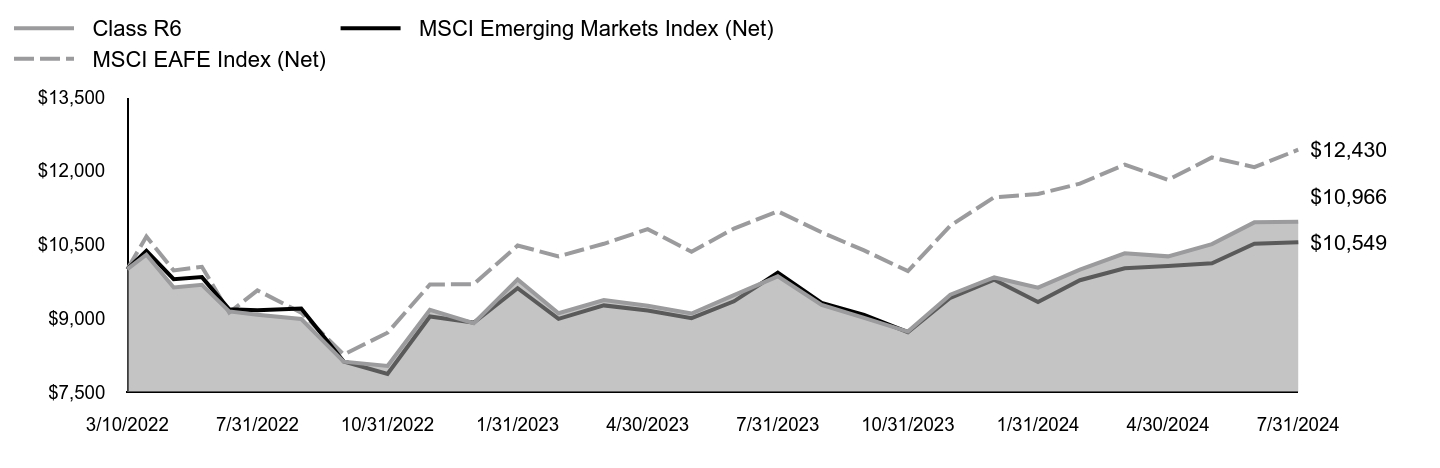

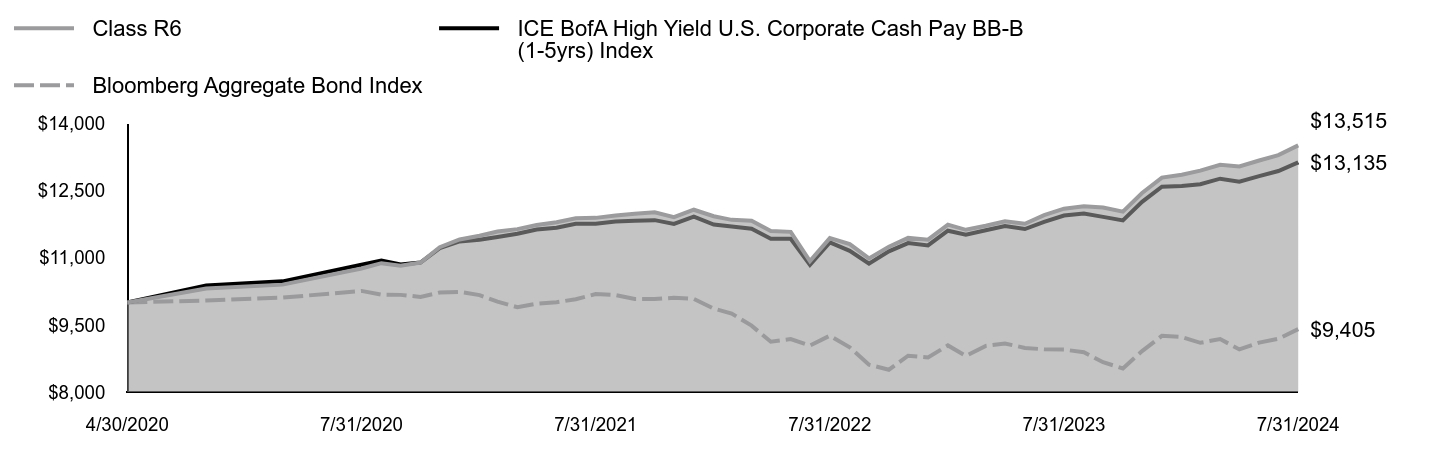

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Climate Focused Bond Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $45 | 0.43% |

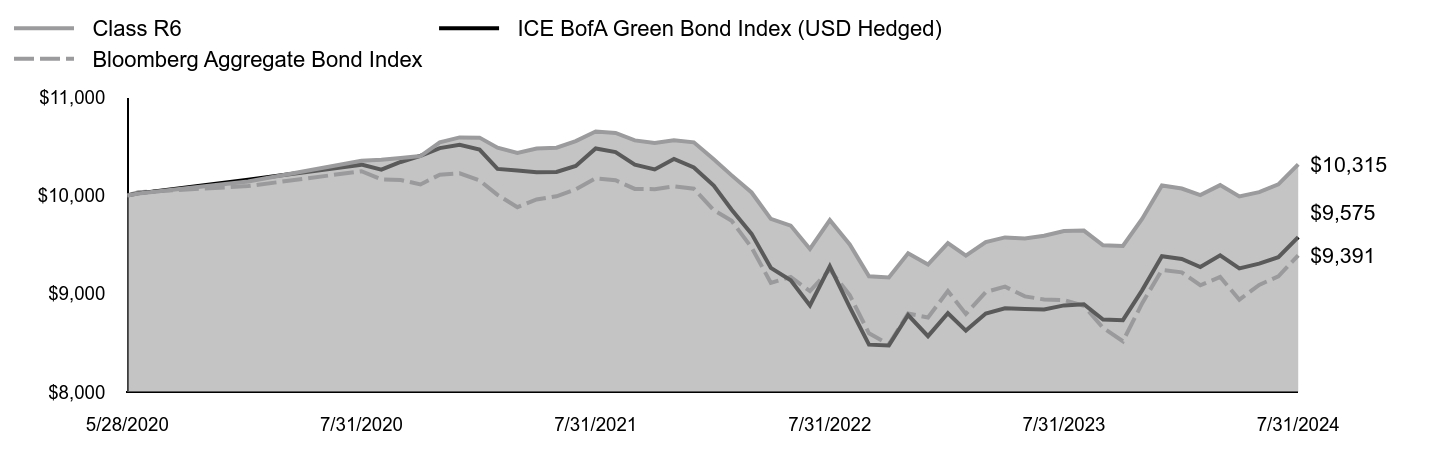

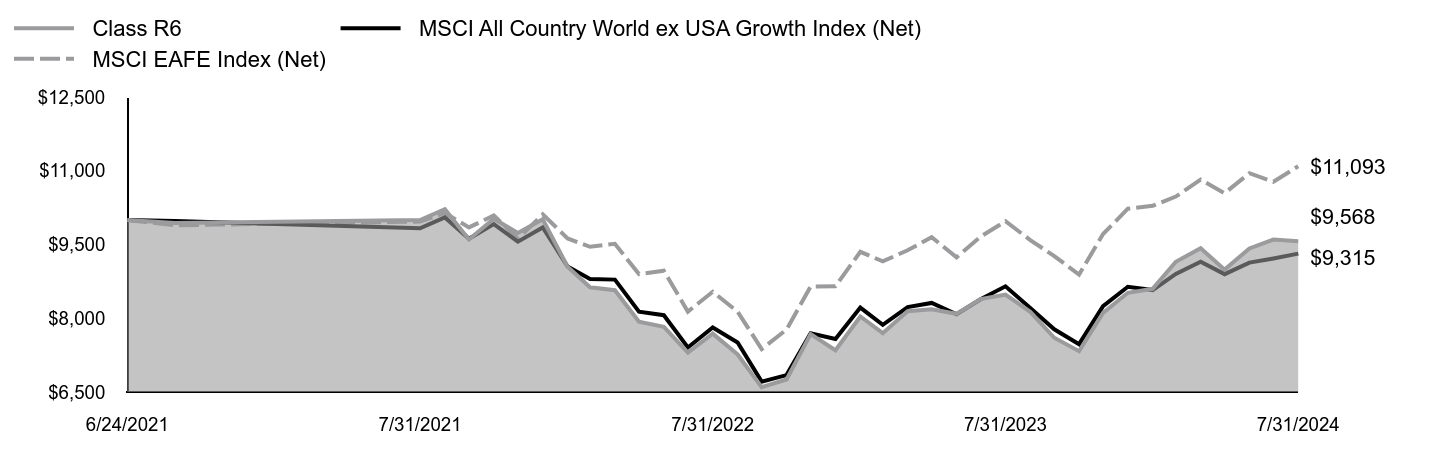

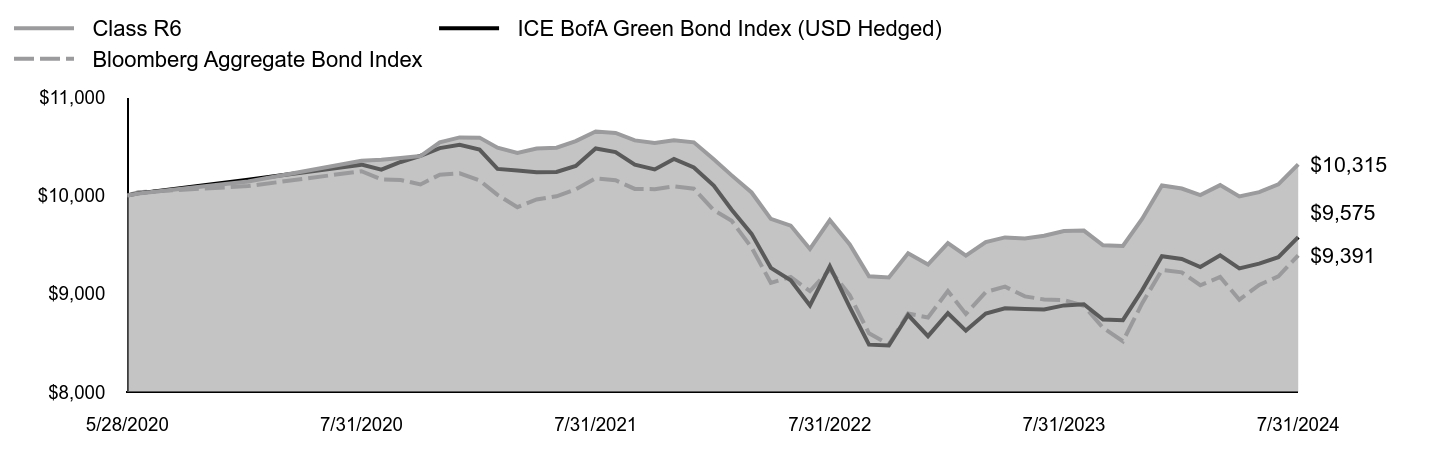

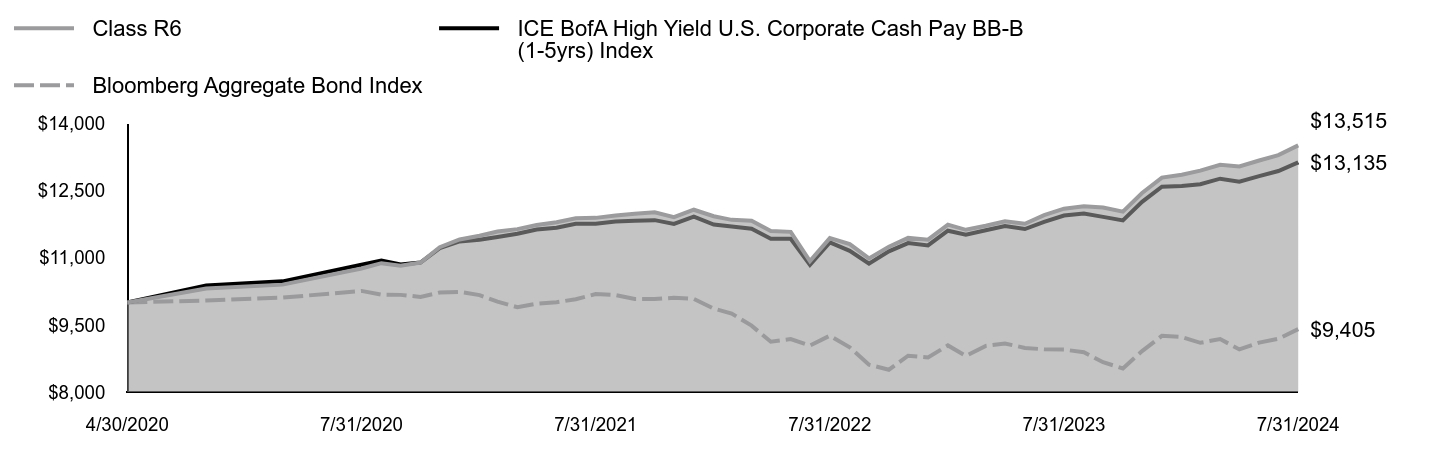

How did the Fund perform last year and what affected its performance?

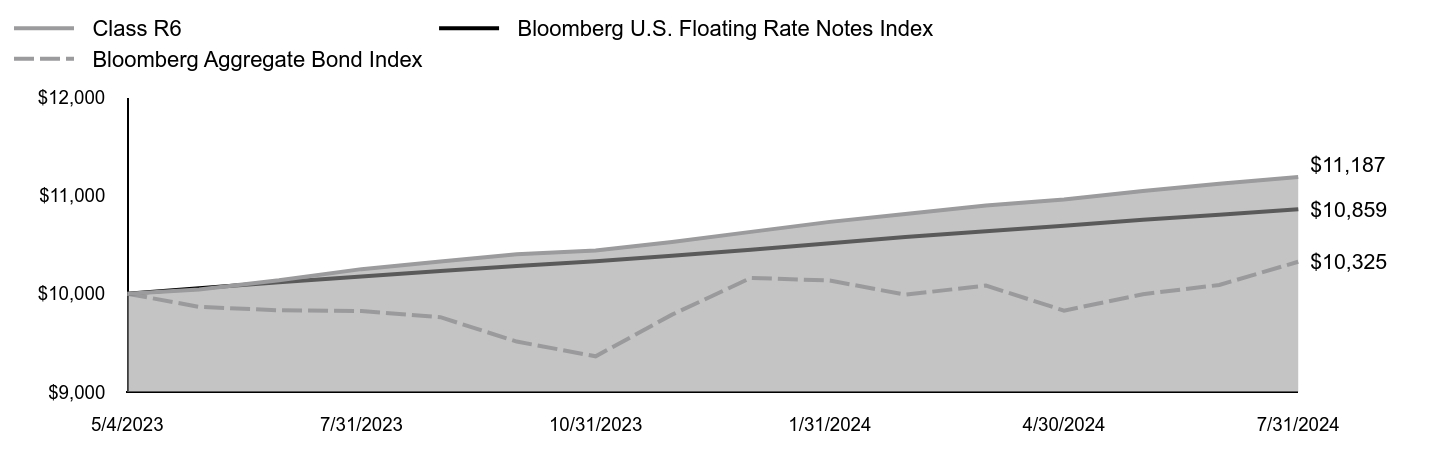

For the fiscal year ended July 31, 2024, the Fund returned 7.02%, reflecting performance at the net asset value (NAV) of Class R6 shares with all distributions reinvested, compared to a securities market index with investment characteristics similar to those of the Fund, the ICE BofA Green Bond Index (USD Hedged), which returned 7.81% over the same period. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 5.10% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment.

Top contributors to performance: The Fund’s allocation to high yield corporate bonds was one of the largest contributors to relative performance.

Top detractors from performance: The Fund’s overweight allocation to commercial mortgage-backed securities detracted from relative performance.

Total Return Based on $10,000 Investment

| Class R6 | ICE BofA Green Bond Index (USD Hedged) | Bloomberg Aggregate Bond Index |

|---|

| 5/28/2020 | $10,000 | $10,000 | $10,000 |

| 5/31/2020 | $10,020 | $10,021 | $10,032 |

| 6/30/2020 | $10,142 | $10,160 | $10,095 |

| 7/31/2020 | $10,353 | $10,313 | $10,246 |

| 8/31/2020 | $10,362 | $10,263 | $10,163 |

| 9/30/2020 | $10,380 | $10,340 | $10,157 |

| 10/31/2020 | $10,400 | $10,403 | $10,112 |

| 11/30/2020 | $10,540 | $10,481 | $10,211 |

| 12/31/2020 | $10,590 | $10,514 | $10,225 |

| 1/31/2021 | $10,588 | $10,466 | $10,152 |

| 2/28/2021 | $10,485 | $10,270 | $10,005 |

| 3/31/2021 | $10,432 | $10,254 | $9,880 |

| 4/30/2021 | $10,478 | $10,235 | $9,959 |

| 5/31/2021 | $10,485 | $10,238 | $9,991 |

| 6/30/2021 | $10,552 | $10,300 | $10,061 |

| 7/31/2021 | $10,651 | $10,478 | $10,174 |

| 8/31/2021 | $10,635 | $10,441 | $10,154 |

| 9/30/2021 | $10,560 | $10,313 | $10,066 |

| 10/31/2021 | $10,534 | $10,264 | $10,064 |

| 11/30/2021 | $10,561 | $10,371 | $10,093 |

| 12/31/2021 | $10,540 | $10,284 | $10,068 |

| 1/31/2022 | $10,367 | $10,100 | $9,851 |

| 2/28/2022 | $10,204 | $9,854 | $9,741 |

| 3/31/2022 | $10,030 | $9,609 | $9,470 |

| 4/30/2022 | $9,761 | $9,263 | $9,111 |

| 5/31/2022 | $9,693 | $9,137 | $9,170 |

| 6/30/2022 | $9,455 | $8,881 | $9,026 |

| 7/31/2022 | $9,748 | $9,279 | $9,246 |

| 8/31/2022 | $9,501 | $8,864 | $8,985 |

| 9/30/2022 | $9,178 | $8,482 | $8,597 |

| 10/31/2022 | $9,166 | $8,474 | $8,485 |

| 11/30/2022 | $9,412 | $8,783 | $8,798 |

| 12/31/2022 | $9,297 | $8,568 | $8,758 |

| 1/31/2023 | $9,515 | $8,801 | $9,027 |

| 2/28/2023 | $9,388 | $8,625 | $8,794 |

| 3/31/2023 | $9,526 | $8,799 | $9,017 |

| 4/30/2023 | $9,573 | $8,852 | $9,072 |

| 5/31/2023 | $9,563 | $8,844 | $8,973 |

| 6/30/2023 | $9,589 | $8,839 | $8,941 |

| 7/31/2023 | $9,638 | $8,881 | $8,935 |

| 8/31/2023 | $9,642 | $8,893 | $8,878 |

| 9/30/2023 | $9,493 | $8,738 | $8,652 |

| 10/31/2023 | $9,486 | $8,731 | $8,516 |

| 11/30/2023 | $9,760 | $9,034 | $8,901 |

| 12/31/2023 | $10,101 | $9,382 | $9,242 |

| 1/31/2024 | $10,070 | $9,353 | $9,217 |

| 2/29/2024 | $10,003 | $9,271 | $9,086 |

| 3/31/2024 | $10,105 | $9,391 | $9,170 |

| 4/30/2024 | $9,990 | $9,257 | $8,939 |

| 5/31/2024 | $10,033 | $9,306 | $9,090 |

| 6/30/2024 | $10,112 | $9,371 | $9,176 |

| 7/31/2024 | $10,315 | $9,575 | $9,391 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 5/28/20 |

|---|

| Class R6 at NAV | 7.02% | 0.75% |

| ICE BofA Green Bond Index (USD Hedged) | 7.81% | (1.04%) |

Bloomberg Aggregate Bond IndexFootnote Reference* | 5.10% | (1.49%) |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $21,162,971 |

| # of Portfolio Holdings | 190 |

| Portfolio Turnover Rate | 59% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

| Portfolio Holdings Presented by Portfolio Allocation | %Footnote Reference* |

| Asset-Backed Securities | 0.24% |

| Convertible Bonds | 0.42% |

| Corporate Bonds | 68.64% |

| Floating Rate Loans | 1.93% |

| Foreign Government Obligations | 18.16% |

| Government Sponsored Enterprises Collateralized Mortgage Obligations | 0.43% |

| Municipal Bonds | 1.98% |

| U.S. Treasury Obligations | 6.62% |

| Repurchase Agreements | 1.58% |

| Total | 100.00% |

| Footnote | Description |

Footnote* | Represents percent of total investments, which excludes derivatives |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Climate Focused Bond Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9068-R6

09/24

Lord Abbett Emerging Markets Equity Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett Emerging Markets Equity Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $121 | 1.15% |

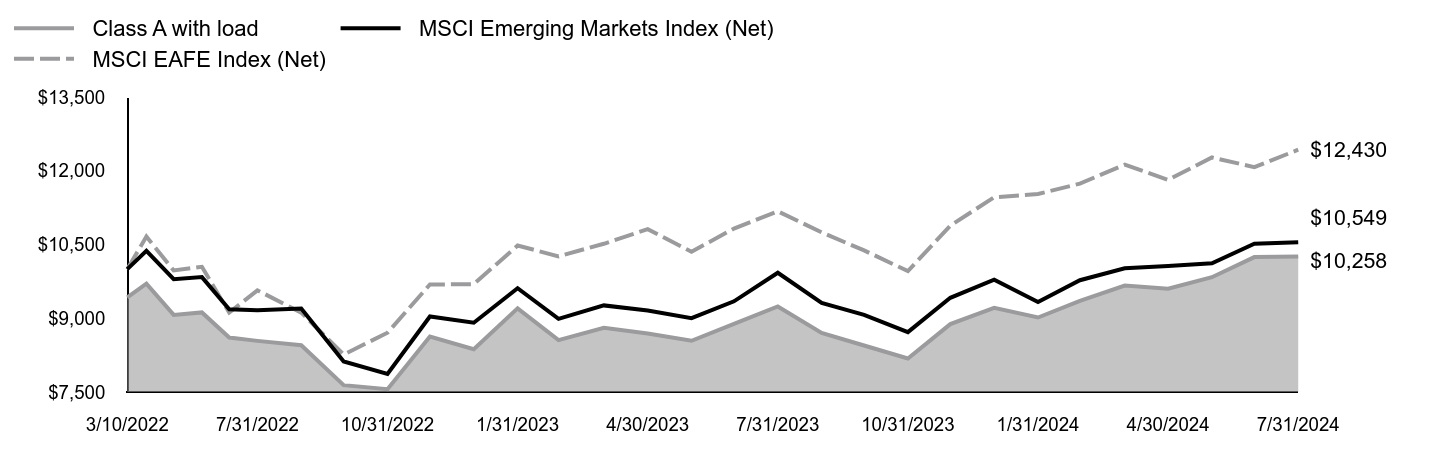

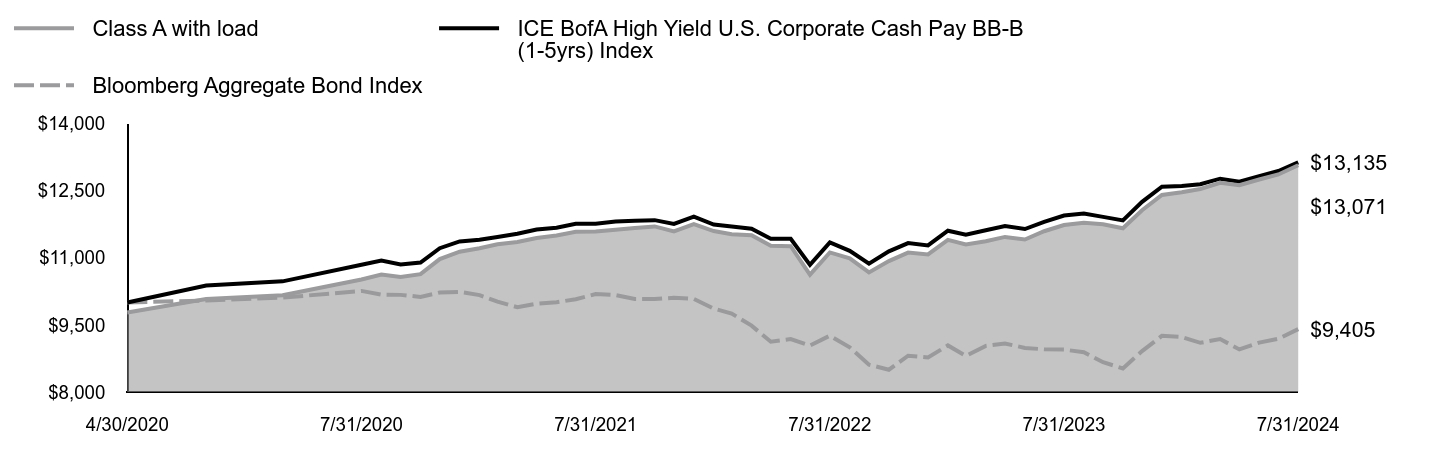

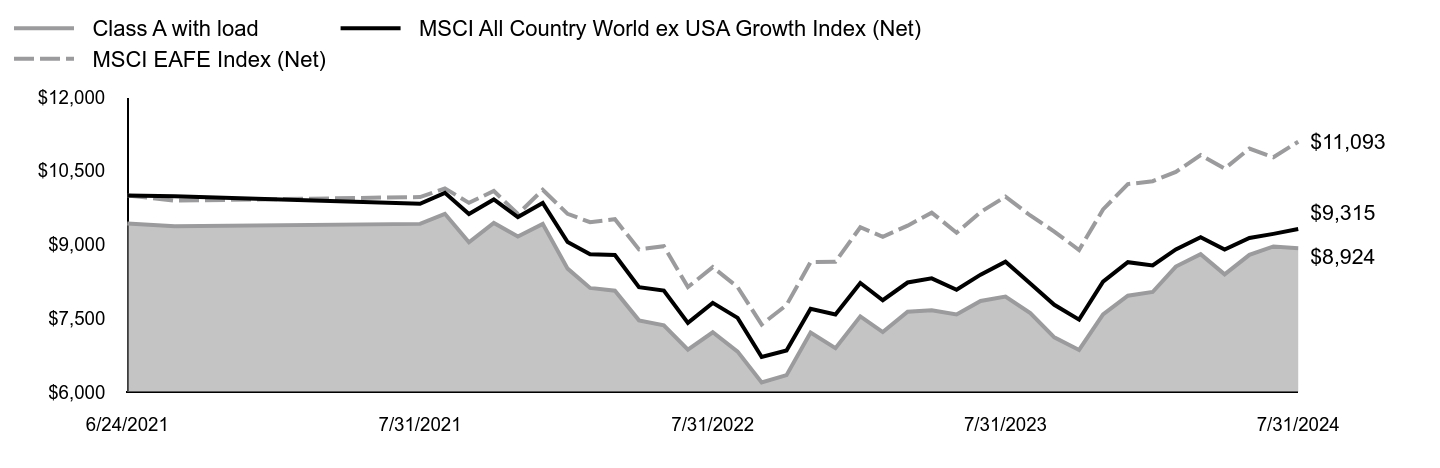

How did the Fund perform last year and what affected its performance?

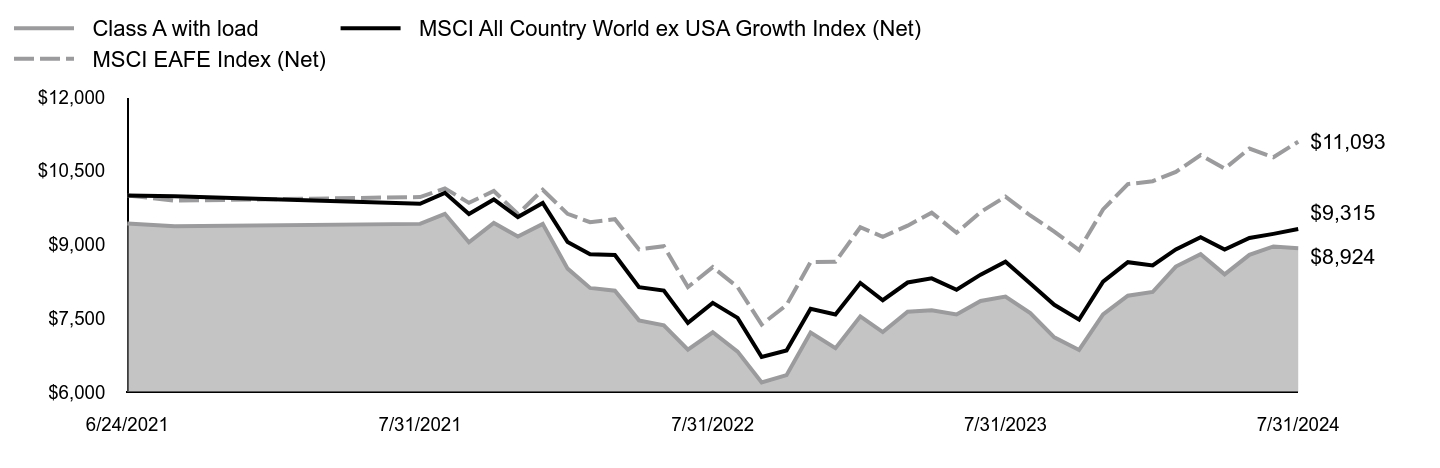

For the fiscal year ended July 31, 2024, the Fund returned 11.01%, reflecting performance at the net asset value (NAV) of Class A shares, compared to the 6.27% of a securities market index with investment characteristics similar to those of the Fund, the MSCI Emerging Markets Index (Net). The Fund's broad-based market index, the MSCI EAFE Index (Net), returned 11.21% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment. Against this backdrop, global equity markets delivered strong returns.

Top contributors to performance: Security selection within the Information Technology sector contributed to relative performance, led by an overweight allocation to Taiwan Semiconductor Manufacturing Co., Ltd. Security selection within the Industrials sector also contributed to relative performance, led by an overweight allocation to LIG Nex1 Co., Ltd.

Top detractors from performance: Security selection within the Financials sector detracted from relative performance, led by an overweight allocation to Ping An Insurance Group Company of China, Ltd. Also, within the Financials sector, an overweight allocation to Prudential PLC detracted from relative performance.

Total Return Based on $10,000 Investment

| Class A with load | MSCI Emerging Markets Index (Net) | MSCI EAFE Index (Net) |

|---|

| 3/10/2022 | $9,427 | $10,000 | $10,000 |

| 3/31/2022 | $9,704 | $10,372 | $10,663 |

| 4/30/2022 | $9,069 | $9,795 | $9,973 |

| 5/31/2022 | $9,119 | $9,838 | $10,047 |

| 6/30/2022 | $8,609 | $9,184 | $9,115 |

| 7/31/2022 | $8,540 | $9,162 | $9,569 |

| 8/31/2022 | $8,452 | $9,200 | $9,115 |

| 9/30/2022 | $7,640 | $8,121 | $8,262 |

| 10/31/2022 | $7,558 | $7,869 | $8,707 |

| 11/30/2022 | $8,628 | $9,036 | $9,687 |

| 12/31/2022 | $8,369 | $8,909 | $9,695 |

| 1/31/2023 | $9,202 | $9,613 | $10,480 |

| 2/28/2023 | $8,555 | $8,989 | $10,261 |

| 3/31/2023 | $8,805 | $9,262 | $10,516 |

| 4/30/2023 | $8,689 | $9,157 | $10,813 |

| 5/31/2023 | $8,542 | $9,003 | $10,355 |

| 6/30/2023 | $8,888 | $9,345 | $10,826 |

| 7/31/2023 | $9,241 | $9,926 | $11,177 |

| 8/31/2023 | $8,702 | $9,315 | $10,748 |

| 9/30/2023 | $8,446 | $9,071 | $10,381 |

| 10/31/2023 | $8,183 | $8,719 | $9,960 |

| 11/30/2023 | $8,882 | $9,417 | $10,885 |

| 12/31/2023 | $9,211 | $9,785 | $11,463 |

| 1/31/2024 | $9,016 | $9,331 | $11,529 |

| 2/29/2024 | $9,354 | $9,775 | $11,740 |

| 3/31/2024 | $9,666 | $10,017 | $12,126 |

| 4/30/2024 | $9,601 | $10,062 | $11,816 |

| 5/31/2024 | $9,836 | $10,118 | $12,273 |

| 6/30/2024 | $10,245 | $10,517 | $12,075 |

| 7/31/2024 | $10,258 | $10,549 | $12,430 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 3/10/22 |

|---|

| Class A at NAV | 11.01% | 3.60% |

| Class A with sales charge | 4.62% | 1.07% |

| MSCI Emerging Markets Index (Net) | 6.27% | 2.26% |

MSCI EAFE Index (Net)Footnote Reference* | 11.21% | 9.52% |

| Footnote | Description |

Footnote* | The Fund has adopted the MSCI EAFE Net Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $5,536,385 |

| # of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 79% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?

Portfolio Holdings Presented by SectorFootnote Reference* | % Footnote Reference** |

| Communication Services | 9.53% |

| Consumer Discretionary | 12.30% |

| Consumer Staples | 6.24% |

| Energy | 6.04% |

| Financials | 21.49% |

| Health Care | 4.16% |

| Industrials | 8.15% |

| Information Technology | 25.39% |

| Materials | 2.79% |

| Real Estate | 2.20% |

| Utilities | 1.71% |

| 100.00% |

| Footnote | Description |

Footnote* | A sector may comprise several industries |

Footnote** | Represents percent of total investments, which excludes derivatives. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett Emerging Markets Equity Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

TSR-A-9080-A

09/24

Lord Abbett Emerging Markets Equity Fund

Annual Shareholder Report

July 31, 2024

lordabbett.com/FundDocuments

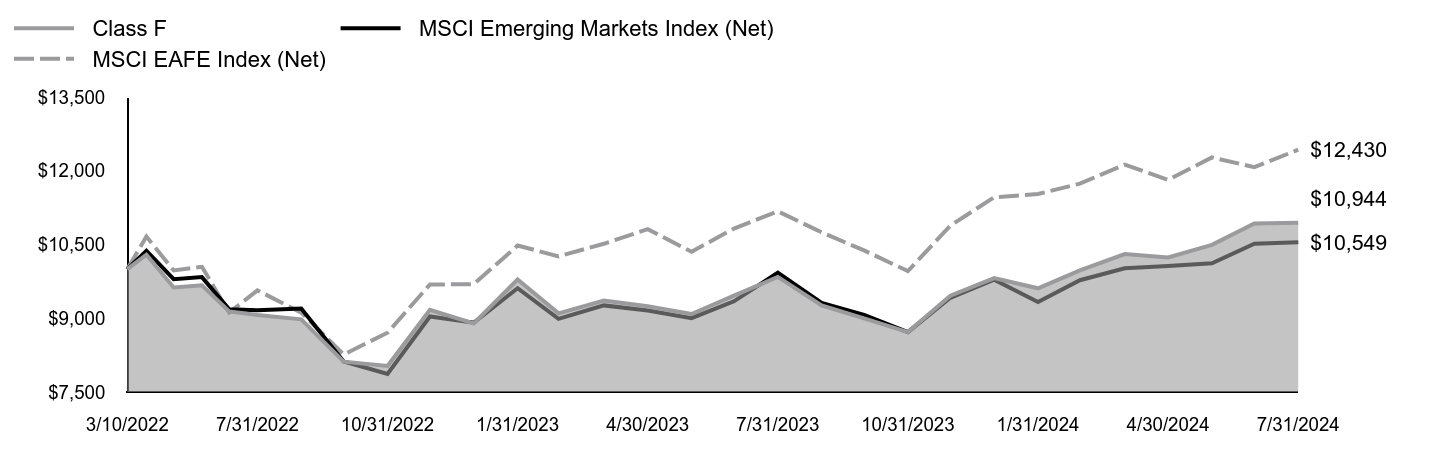

This annual shareholder report contains important information about the Lord Abbett Emerging Markets Equity Fund for the period of August 1, 2023 to July 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $200 | 1.90% |

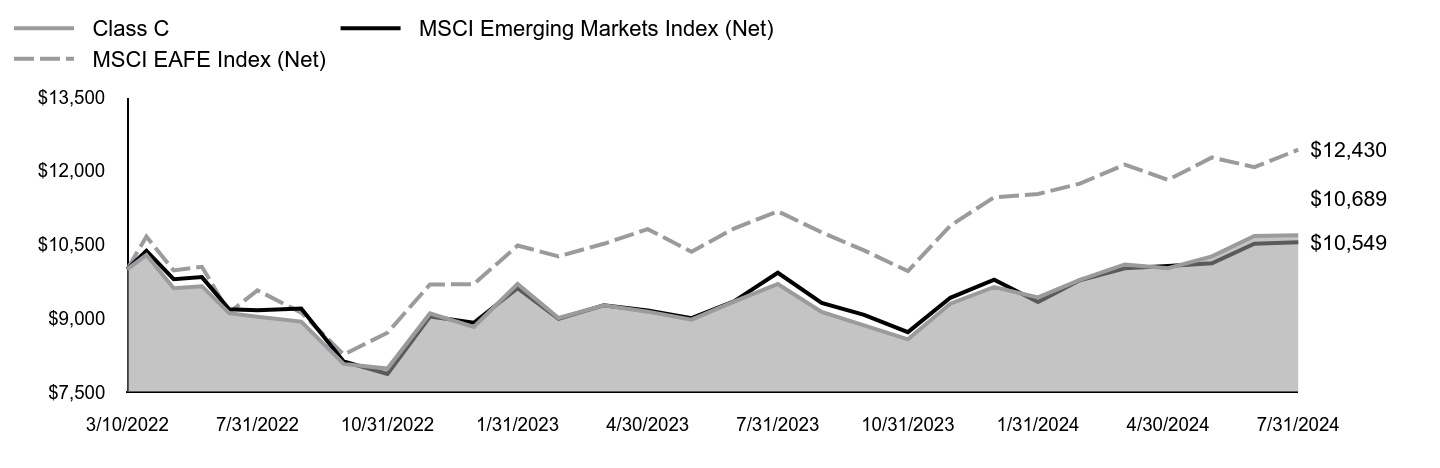

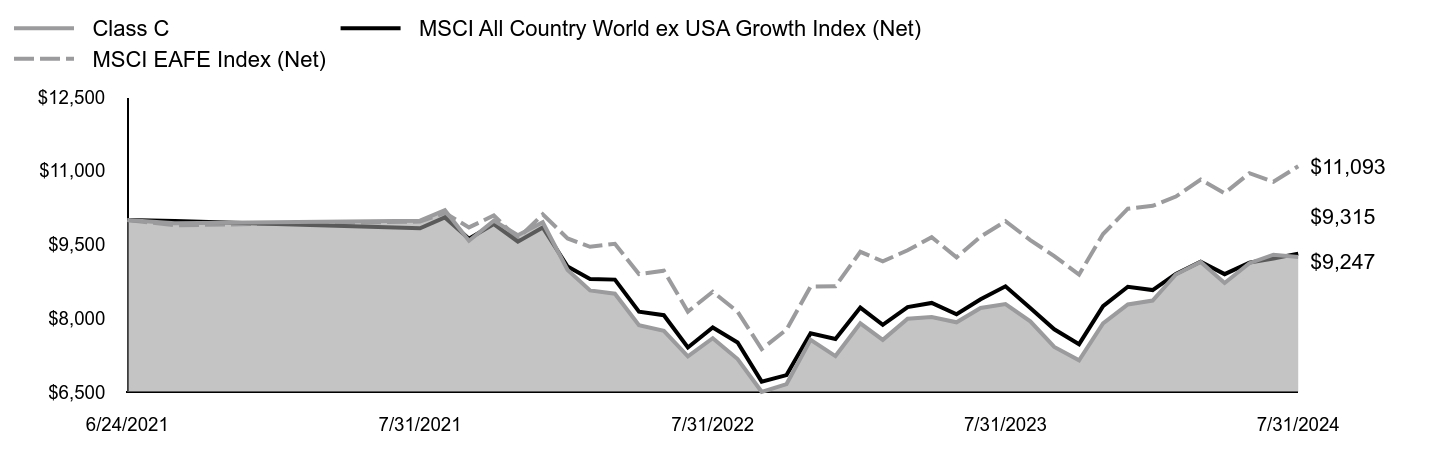

How did the Fund perform last year and what affected its performance?

For the fiscal year ended July 31, 2024, the Fund returned 10.22%, reflecting performance at the net asset value (NAV) of Class C shares, compared to the 6.27% of a securities market index with investment characteristics similar to those of the Fund, the MSCI Emerging Markets Index (Net). The Fund's broad-based market index, the MSCI EAFE Index (Net), returned 11.21% over the same period.

Positive factors for the markets included momentum around the soft-landing narrative, specifically in the second half of the period, which was supported by signs of a cooling labor market and a slowing economy, leading the market to adjust its expectations of future interest rate cuts by the U.S. Federal Reserve (the Fed). Negative factors, specifically in the beginning of the period, included stronger-than-expected GDP growth, resilient labor market data, and persistently high inflation readings that led to a more prolonged interest rate environment. Against this backdrop, global equity markets delivered strong returns.

Top contributors to performance: Security selection within the Information Technology sector contributed to relative performance, led by an overweight allocation to Taiwan Semiconductor Manufacturing Co., Ltd. Security selection within the Industrials sector also contributed to relative performance, led by an overweight allocation to LIG Nex1 Co., Ltd.

Top detractors from performance: Security selection within the Financials sector detracted from relative performance, led by an overweight allocation to Ping An Insurance Group Company of China, Ltd. Also, within the Financials sector, an overweight allocation to Prudential PLC detracted from relative performance.

Total Return Based on $10,000 Investment

| Class C | MSCI Emerging Markets Index (Net) | MSCI EAFE Index (Net) |

|---|

| 3/10/2022 | $10,000 | $10,000 | $10,000 |

| 3/31/2022 | $10,287 | $10,372 | $10,663 |

| 4/30/2022 | $9,613 | $9,795 | $9,973 |

| 5/31/2022 | $9,653 | $9,838 | $10,047 |

| 6/30/2022 | $9,105 | $9,184 | $9,115 |

| 7/31/2022 | $9,032 | $9,162 | $9,569 |

| 8/31/2022 | $8,932 | $9,200 | $9,115 |

| 9/30/2022 | $8,071 | $8,121 | $8,262 |

| 10/31/2022 | $7,977 | $7,869 | $8,707 |

| 11/30/2022 | $9,099 | $9,036 | $9,687 |

| 12/31/2022 | $8,823 | $8,909 | $9,695 |

| 1/31/2023 | $9,698 | $9,613 | $10,480 |

| 2/28/2023 | $9,006 | $8,989 | $10,261 |

| 3/31/2023 | $9,264 | $9,262 | $10,516 |

| 4/30/2023 | $9,135 | $9,157 | $10,813 |

| 5/31/2023 | $8,972 | $9,003 | $10,355 |

| 6/30/2023 | $9,339 | $9,345 | $10,826 |

| 7/31/2023 | $9,698 | $9,926 | $11,177 |

| 8/31/2023 | $9,128 | $9,315 | $10,748 |

| 9/30/2023 | $8,857 | $9,071 | $10,381 |

| 10/31/2023 | $8,572 | $8,719 | $9,960 |

| 11/30/2023 | $9,298 | $9,417 | $10,885 |

| 12/31/2023 | $9,637 | $9,785 | $11,463 |

| 1/31/2024 | $9,426 | $9,331 | $11,529 |

| 2/29/2024 | $9,781 | $9,775 | $11,740 |

| 3/31/2024 | $10,095 | $10,017 | $12,126 |

| 4/30/2024 | $10,020 | $10,062 | $11,816 |

| 5/31/2024 | $10,259 | $10,118 | $12,273 |

| 6/30/2024 | $10,676 | $10,517 | $12,075 |

| 7/31/2024 | $10,689 | $10,549 | $12,430 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | Since Inception 3/10/22 |

|---|

| Class C at NAV | 10.22% | 2.83% |

| Class C with sales charge | 9.22% | 2.83% |

| MSCI Emerging Markets Index (Net) | 6.27% | 2.26% |

MSCI EAFE Index (Net)Footnote Reference* | 11.21% | 9.52% |

| Footnote | Description |

Footnote* | The Fund has adopted the MSCI EAFE Net Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $5,536,385 |

| # of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 79% |

| Total Advisory Fees Paid | $0 |

What did the Fund invest in?