Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant

to Rule 30e-1 under the Investment Company Act of 1940:

Annual Report

For the year ended October 31, 2005

|

TH Lee, Putnam Emerging Opportunities Portfolio

|

About the fund and TH Lee, Putnam Capital LLC

TH Lee, Putnam Emerging Opportunities Portfolio (“the fund”) is a closed-end interval fund. This innovative fund pursues aggressive growth by combining investments in publicly traded stocks and privately held companies in a closed-end format. With this special structure, the fund can tap into companies with the best growth potential while maintaining diversification across public and private markets.

The fund is sponsored by an affiliate of TH Lee, Putnam Capital LLC, which is a joint venture of Putnam Investments (“Putnam”) and Thomas H. Lee Partners LP (“TH Lee”). This venture was founded in 1999 to offer alternative investment products to individual investors who have historically lacked access to the private-equity marketplace. Thomas H. Lee Partners LP, founded in 1974, is one of the oldest and most successful private-equity investment firms in the United States. The firm’s investment strategy targets growth companies with competitive advantages in expanding or consolidating industries. Putnam Investments, founded in 1937, is one of the world’s largest mutual fund companies and a leader in investment research and portfolio management through disciplined teamwork.

The fund is managed by members of Putnam’s Small and Emerging Growth Team -- Richard Weed, Managing Director, and Raymond Haddad, Senior Vice President. This team analyzes small- and mid-capitalization growth stocks. Frederick Wynn, Managing Director, is responsible for managing the fund’s private equity investments.

The fund’s management structure also includes an Investment Committee consisting of senior Putnam and TH Lee investment professionals. The Investment Committee consults with the management team and gives final approval to the structure of all private-equity deals.

Report from Fund Management

Your fund’s portfolio delivered a 6.78% return at net asset value for the fiscal year that ended October 31, 2005. We are also pleased to report that, in the later months of the period, aggressive growth stocks emerged as leading performers in the stock market. Additionally, our stock selection among private equities has proved rewarding as one private equity holding made a successful initial public offering in December 2004 and remains in the portfolio as a publicly traded stock. The valuations of the remaining four private equity holdings, which are in the venture capital stage of development and have limited liquidity, stayed approximately the same throughout the period. The portfolio’s publicly traded stocks participated in the stock market’s advance but the overall portfolio trailed the benchmark’s return of 13.83% .

| RETURN FOR PERIODS ENDED OCTOBER 31, 2005 | | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | Growth Index |

|

| 1 year | 6.78% | 2.23% | 13.83% |

|

| 3 years | 49.86 | 43.49 | 74.88 |

|

| Annual average | 14.44 | 12.79 | 20.48 |

|

| Life of fund (since inception 7/30/01) | 18.85 | 13.79 | 19.40 |

|

| Annual average | 4.14 | 3.08 | 4.25 |

|

| |

| RETURN FOR PERIODS ENDED SEPTEMBER 30, 2005 (most recent quarter) | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | Growth Index |

|

| 1 year | 12.83% | 8.03% | 21.01% |

|

| 3 years | 63.29 | 56.32 | 91.18 |

|

| Annual average | 17.76 | 16.06 | 24.11 |

|

| Life of fund (since inception 7/30/01) | 21.28 | 16.13 | 23.44 |

|

| Annual average | 4.73 | 3.65 | 5.17 |

|

Past performance does not indicate future results. Performance assumes reinvestment of distributions and does not account for taxes. More recent returns may be less or more than those shown. Investment returns will fluctuate and you may have a gain or a loss when you sell your shares. Returns at public offering price (POP) reflect the highest applicable sales charge of 4.25% . Sales charges differ with the original purchase amount. The fund currently is closed to new investments. The Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation. Indexes are not available for direct investment. For a portion of the period this fund limited expenses, without which returns would have been lower.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 1

Market overview

An expanding economy supported a generally stable stock market during the period. Gross domestic product grew at a fairly steady annual pace near 3.5% . However, there were episodes of volatility, particularly in March and October. The U.S. Federal Reserve Board’s (the Fed’s) continuing increases in interest rates, as well as a steady rise in energy prices, began to burden consumer spending. Rate increases also caused concern that corporate profit margins would come under pressure, though earnings generally remained high relative to long-term average levels.

The challenges facing businesses in the later months of the period created more favorable conditions for aggressive growth stocks. Many growth companies have superior business models, products, and services, which can provide a greater advantage in a more competitive environment. In the second half of the fiscal period, growth stocks began to outperform value stocks, and small- and mid-capitalization stocks continued to outperform large caps. Activity in the market for initial public offerings also accelerated during the summer months, though it dropped off again in September, when the hurricane season created new uncertainties about the pace of economic activity.

With regard to sectors, high oil and gas prices helped boost the earnings of energy and utilities companies. Communications services stocks also did well. The technology and health-care sectors, the largest areas of the growth universe, performed more in line with the broad market. Reflecting the rising burdens on consumer spending, consumer cyclical stocks underperformed in the period and lagged behind consumer staples.

Strategy overview

The fund’s approach to selecting stocks remains unchanged. Using a combination of fundamental and quantitative analytical tools, we research U.S. midsize and small companies to try to identify those likely to achieve top rates of sales and earnings growth. We believe that most of the stocks we choose will outperform the market over time, so this is where we tend to take investment risk. Typically, the portfolio’s sector weightings are similar to those of its benchmark. During the period, the portfolio had only modestly overweight positions in two sectors, energy and health care, and it was underweight in consumer cyclicals and technology. We also favored mid-cap stocks over small-cap stocks during the period.

2 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

As mentioned in the semiannual report, in light of the closing of the fund to new investors in January 2005, we have implemented a policy to stop making new investments in private equities of venture capital companies for the time being. In our view, devoting any more assets to additional venture capital companies could upset the diversification that we consider one of the fund’s attractive characteristics. The fund currently has four private equity holdings that together represent a significant portion of the portfolio and these could appreciate and represent a larger proportion of assets in the future.

How fund holdings affected performance

The health-care sector was the largest portion of the portfolio on an absolute basis and represented the biggest overweight position. Several holdings in the sector outperformed the benchmark index by a wide margin, including Coventry Health Care, Barr Pharmaceuticals, and Medimmune. Coventry is a managed health-care company operating health plans and insurance companies. Barr Pharmaceuticals develops, manufactures, and markets generic and proprietary prescription pharmaceuticals. Medimmune develops and markets products to treat infectious diseases, transplantation medicine, autoimmune diseases and cancer. There were some disappointing health-care holdings as well, including Invitrogen, a biotechnology company, and Atherogenics, a medical technology company, but we continue to have confidence in the growth potential of these companies and they remain holdings.

The portfolio’s technology position was slightly underweight relative to the benchmark, but still represented the second-largest weighting on an absolute basis. The results of our stock selections were mixed. There were very strong performers, such as MEMC Electronic Materials, which produces silicon wafers used in computers, telecommunications equipment, consumer electronics, industrial automation systems, and automobiles. Among the top detractors in the sector was Catapult Communications, which develops software-based test systems supporting customers with digital telecommunications equipment. This micro-cap stock plunged in May and we sold it after determining the company had poor business prospects relative to the stock’s valuation.

The consumer cyclicals sector faced many challenges during the period, given the increasing pressures on consumer spending. Our stock selections overall did not fare well, but one of the better performers was Skywest Airlines, an overweight position. In spite of higher fuel costs, Skywest’s profits rose compared with last year, and it added capacity by acquiring Atlantic Southeast Airlines during the period. Among our disappointments in the sector were Petsmart, the retail chain of pet-related goods, and Ameristar Casinos, a gaming company. Both were hurt because consumers, burdened with higher gas prices and interest payments, had less money to spend on their pets and on gaming. They were also both

TOP SECTOR WEIGHTINGS AS OF 10/31/05 (includes both public and private holdings)

| Health care | 24.8% |

|

| Technology | 22.9 |

|

| Consumer staples | 17.0 |

|

| Consumer cyclicals | 10.1 |

|

| Energy | 6.9 |

|

Weightings are shown as a percentage of net assets. Holdings will vary over time.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 3

| TOP 10 HOLDINGS (includes public and private companies) | INDUSTRY |

|

| Capella Education Co. | Schools |

|

| CommVault Systems | Software |

|

| Refractec | Medical Technology |

|

| Spirit Finance Corp. | Real Estate |

|

| Restore Medical | Medical Technology |

|

| MedImmune, Inc. | Biotechnology |

|

| Varian Medical Systems, Inc. | Medical Technology |

|

| WESCO International, Corp. | Electrical Equipment |

|

| R. H. Donnelley Corp. | Publishing |

|

| Lam Research Corp. | Semiconductor |

|

These holdings represent 45.3% of the fund's net assets as of 10/31/05. Portfolio holdings will vary over time.

hurt by the hurricane season. Numerous Petsmart stores were forced to close for many weeks. Ameristar operates casinos in the state of Mississippi, where Hurricane Katrina caused extensive damage. Our view is that both stocks will recover from this temporary downturn, and they remain in the portfolio.

Spirit Finance, a commercial real estate finance and service company, which was initially purchased as a private security, completed its initial public offering in December 2004, and has remained among the portfolio’s holdings. We continue to support the company’s long-term strategy and we are impressed with the company’s recent business execution. The stock also continues to pay an attractive 6.7% dividend yield.

We continue to be pleased with the overall performance of the fund’s private equity portfolio and want to highlight some recent developments with these companies. In June, the team at Restore Medical that designed the firm’s innovative Pillar Procedure for treating sleep disordered breathing was named the “Outstanding Design Team” by Medical Device & Diagnostic Industry magazine. In July, CommVault, a company that serves businesses by protecting data on computer networks, won the Best Solution Award for its QiNetix product site at the Midsize Enterprise Summit 2005, produced by Gartner Vision Events. In October, Refractec, which develops minimally invasive procedures for ophthalmologists to treat patients, reported that the Federal Aviation Administration approved a protocol for airplane pilots to treat far-sightedness with the company’s NearVision CK procedure. Capella Education Company, as we mentioned in the fund’s semiannual report, filed an initial registration statement with the Securities and Exchange Commission in April. In July, Capella University, a wholly owned subsidiary of Capella Education Co. and an online, accredited, degree-granting university, held its largest graduation in its history, awarding 918 graduate and undergraduate degrees. We would like to be able to share more news about the private equity holdings, but due to the sensitive nature of the information and confidentiality agreements we have signed with the companies, we are restricted regarding the information we can provide on a company-by-company basis.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period discussed, are subject to review in accordance with the fund’s investment strategy, and may vary in the future.

4 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

Aggressive growth stocks are performing well relative to other investment styles at this time. We believe our research capabilities and disciplined investment process can position the portfolio to benefit from this trend, which, in our opinion, enhances the prospects of both publicly traded stocks and venture capital companies.

The outlook for growth stocks is attractive as the economic expansion continues under tighter financing conditions. The economy already has weathered more than 10 interest-rate increases and a doubling in energy prices over the past year, yet growth continues. Companies that rely on consumer spending fueled by low interest rates and high rates of disposable income face significant challenges. But in our view, well-managed growth companies with solid balance sheets and business models, as well as strong products and services, are beginning the fund’s new fiscal year in a favorable position.

The views expressed here are exclusively those of TH Lee, Putnam Capital Management, LLC, the fund’s Manager. All such views are subject to change, including views regarding the fund’s private equity holdings. Although holdings described favorably were viewed as such as of 10/31/05, there is no guarantee the fund will continue to hold these securities in the future or that they will not decline in value.

The fund is currently closed to new investments. If the fund is re-opened, shares of the fund may be offered only to investors who have a net worth of more than $1,500,000 or who otherwise meet the definition of a “qualified client,” as defined in and adopted under the Investment Advisers Act of 1940, as amended.

An investment in the fund involves a considerable amount of risk and should be considered speculative. Because it is possible that you may lose some or all of your investment, you should not invest in the fund unless you can afford a total loss of investment. An investment in the fund involves a high degree of risk, which includes the following specific types of risk: the risks associated with venture-capital companies and venture-capital funds; investing in securities that are illiquid and subject to substantial transfer restrictions; the risks of investing in smaller companies; the fund’s ability to focus holdings in a small number of industry sectors which may be relatively new or emerging industries; the risk of investing in a fund that will pay an incentive fee; investing in a fund, many of whose assets will be priced in the absence of a readily available market and may be priced based on estimates of fair value, which may prove inaccurate; and the risk involved in the fund Manager’s limited experience in venture-capital investing. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 5

Trustee approval of management contract

The Board of Trustees of your fund oversees the management of the fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with TH Lee, Putnam Capital Management, LLC. In this regard, the Board of Trustees requests and evaluates all information it deems reasonably necessary under the circumstances. On June 13, 2005, the Board of Trustees met to consider the information provided by the Manager and other information developed with the assistance of the Board’s independent counsel. Upon completion of this review, the Board of Trustees, following a vote by the Independent Trustees (those Trustees who are not “interested persons,” as defined in the Investment Company Act, of your fund or the Manager), approved the continuance of your fund’s management contract, effective July 27, 2005.

This approval was based on the following conclusions:

- That the fee schedule is, and since the inception of the fund has been, unusual and seeks appropriately to reflect fees charged by Putnam and competitive advisers in respect of the public and private securities portions of the fund’s portfolio, and in particular to reward successful investment decisions through the incentive fee applicable only to the private securities, and

- That the fee schedule currently in effect for your fund, including the base fee and incentive fee components, represents reasonable compensation in light of the nature and quality of the services being provided to the fund and the costs incurred by the Manager in providing such services.

These conclusions were based on a careful consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund are the result of several years of review and discussion between the Trustees and the Manager, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Services provided; investment performance

The quality of the investment process provided by the Manager represented a major factor in the Trustees’ evaluation of the quality of services provided by the Manager under your fund’s management contract. The Trustees concluded that the Manager generally provides a high quality investment process but also recognize that this does not guarantee favorable investment results for the fund in every time period. The Trustees evaluated the experience and skills of the individuals assigned to the management of your fund’s public equity and private equity investments and the resources made available to such personnel. Recognizing that expertise of portfolio management personnel, particularly for private equity investments, is highly prized among competitive investment

6 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

advisers, the Trustees have noted favorably the Manager’s commitment to retaining highly qualified personnel notwithstanding the relatively small size of the fund and the determination to suspend sales of fund shares.

The Trustees considered the investment performance of your fund over the 1-year and since-inception periods ended March 31, 2005, and considered information comparing the fund’s performance with its benchmark index and with the performance of competitive funds. The Trustees also reviewed an analysis from the Manager of the costs of the services provided and profits realized by the Manager from the relationship with the fund in 2004.

The Trustees reviewed comparative fee and expense information for other closed-end funds investing both in public and private equities, and noted that your fund’s management fees were generally lower than those of these funds. The Trustees noted in addition that the Manager has agreed to reimburse the fund to the extent that total fund expenses (exclusive of incentive fees payable under the management contract) exceed 1.85% of average annual assets through October 31, 2006. They also reviewed analysis provided by the Manager regarding the performance of your fund’s current and former private equity investments and noted the amounts your fund has accrued as incentive fees payable to the Manager under your fund’s management contract as a result of appreciation in the value of these investments.

The Trustees noted that your fund is the only client of the Manager, and that your fund is unique among all registered investment companies managed by affiliates of the Manager with respect to its investment objective and fee structure. The Trustees have been satisfied that the fund’s fee structure appropriately mediates the fees charged by Putnam Investments and competitors on portfolios of publicly-traded securities and those (including both asset-based fees and incentive fees) charged by managers of private securities. Accordingly, the Trustees did not attribute great weight to a comparative review of fees paid by other funds and institutional accounts whose assets are managed by the Manager’s affiliates.

The Trustees noted that the fund’s fee structure does not have breakpoints (which lower the net effective fee rate as assets grow), that the Manager is compensated under the incentive fee only if the performance of the fund’s private assets is successful and that, since inception through October 31, 2006, the Manager has agreed to reimburse the fund to the extent its total expenses (exclusive of incentive fees) exceed 1.85% of average annual assets. The Trustees also noted that the fund’s assets as of May 31, 2005 were approximately $70 million and that, because your fund is presently not open to new investments, the fund’s assets have recently diminished through regular quarterly repurchases. The Trustees expressed their intent to consider whether the current fee arrangements remain appropriate if and when the fund is reopened to new investments and fund assets increase.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 7

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that the Manager may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment adviser, subject to the obligation to seek best execution. This area has been marked by significant change in recent years. The Trustees noted that allocations of brokerage to reward firms that sell fund shares were discontinued on December 31, 2003. They also noted that, commencing in 2004, the allocation of brokerage commissions by the Manager to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract with Putnam Retail Management Limited Partnership (“PRM”) and a report from the Manager on the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”). PRM and PFTC are affiliates of the Manager. PFTC benefits from the fund’s custodian and investor servicing agreements, and PRM benefits from the fund’s distributor’s contract at times when the fund is open to new investments.

8 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

Report of independent registered

public accounting firm

|

To the Trustees of TH Lee, Putnam Investment Trust and Shareholders of

TH Lee, Putnam Emerging Opportunities Portfolio

|

In our opinion, the accompanying statement of assets and liabilities, including the fund’s portfolio, and the related statements of operations, of changes in net assets and of cash flows and the financial highlights present fairly, in all material respects, the financial position of TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”) at October 31, 2005, and the results of its operations, the changes in its net assets, its cash flows and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at October 31, 2005, by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 15, 2005

|

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 9

| The fund’s portfolio | | |

| |

| |

| October 31, 2005 | | |

|

| |

| |

| |

| |

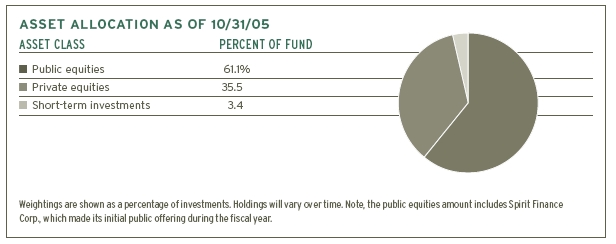

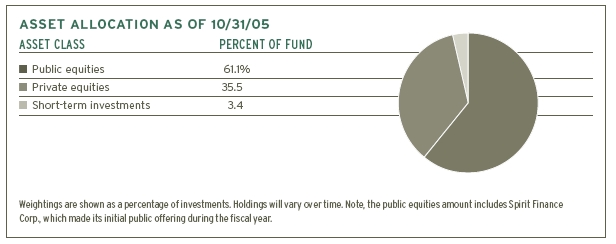

| Common stocks (62.1%)* | | |

| NUMBER OF SHARES | | | VALUE |

|

| |

| |

| Basic Materials (1.6%) | | |

|

| |

| 21,200 | Crown Holdings, Inc. † | $ | 343,864 |

| 9,600 | Freeport-McMoRan Copper & Gold, Inc. Class B | | 474,432 |

| 9,127 | Steel Dynamics, Inc. | | 282,663 |

|

|

| | | | 1,100,959 |

| |

| Biotechnology (2.1%) | | |

|

| |

| 9,900 | Amylin Pharmaceuticals, Inc. † | | 332,640 |

| 10,800 | Cubist Pharmaceuticals, Inc. † | | 218,268 |

| 4,000 | Invitrogen Corp. † | | 254,360 |

| 17,200 | MedImmune, Inc. † | | 601,656 |

|

|

| | | | 1,406,924 |

| |

| Capital Goods (4.5%) | | |

|

| |

| 3,600 | Cummins, Inc. | | 307,332 |

| 8,700 | DRS Technologies, Inc. | | 428,562 |

| 10,800 | JLG Industries, Inc. | | 414,288 |

| 4,800 | L-3 Communications Holdings, Inc. | | 373,536 |

| 11,900 | Mueller Industries, Inc. | | 327,726 |

| 8,400 | Reynolds and Reynolds Co. (The) Class A | | 222,936 |

| 13,300 | Timken Co. | | 377,188 |

| 14,400 | WESCO International, Inc. † | | 572,400 |

|

|

| | | | 3,023,968 |

| |

| Communications Equipment (0.2%) | | |

|

| |

| 3,152 | Comtech Telecommunications Corp. † | | 120,911 |

| |

| Computers (2.1%) | | | |

|

| |

| 19,900 | Emulex Corp. † | | 368,349 |

| 7,800 | Intergraph Corp. † | | 377,364 |

| 7,200 | Logitech International SA ADR (Switzerland) † | | 276,192 |

| 7,100 | NCR Corp. † | | 214,562 |

| 8,210 | VeriFone Holdings, Inc. † | | 190,472 |

|

|

| | | | 1,426,939 |

| |

| Consumer Cyclicals (10.1%) | | |

|

| |

| 10,950 | Advance Auto Parts, Inc. † | | 410,625 |

| 13,200 | Aeropostale, Inc. † | | 257,928 |

| 6,900 | American Eagle Outfitters, Inc. | | 162,495 |

| 10,000 | Ameristar Casinos, Inc. | | 213,300 |

| 8,800 | ARAMARK Corp. Class B | | 223,696 |

| 6,400 | Brunswick Corp. | | 244,032 |

| 4,200 | Building Material Holding Corp. | | 357,042 |

| 8,600 | Choice Hotels International, Inc. | | 284,574 |

| 8,600 | Conn’s, Inc. † | | 251,722 |

| 4,400 | Consolidated Graphics, Inc. † | | 171,556 |

| 6,900 | Desarrolladora Homex SA de CV ADR (Mexico) † | | 206,241 |

| |

| 10 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 | | |

| Common stocks | | | |

| NUMBER OF SHARES | | | VALUE |

|

| |

| |

| Consumer Cyclicals (continued) | | |

|

| |

| 2,410 | Global Cash Access, Inc. † | $ | 33,788 |

| 14,300 | GTECH Holdings Corp. | | 455,312 |

| 5,100 | John H. Harland Co. | | 212,109 |

| 10,600 | K-Swiss, Inc. Class A | | 322,770 |

| 4,500 | Michaels Stores, Inc. | | 148,860 |

| 12,900 | New York & Company, Inc. † | | 174,150 |

| 7,300 | Oshkosh Truck Corp. | | 317,988 |

| 9,800 | Pacific Sunwear of California, Inc. † | | 245,196 |

| 13,300 | PETsMART, Inc. | | 312,550 |

| 9,800 | Phillips-Van Heusen Corp. | | 278,810 |

| 9,200 | R. H. Donnelley Corp. † | | 567,916 |

| 12,900 | Stein Mart, Inc. | | 236,715 |

| 4,800 | VistaPrint, Ltd. (Bermuda) † | | 81,264 |

| 8,700 | Walter Industries, Inc. | | 397,329 |

| 7,400 | West Corp. † | | 291,930 |

|

|

| | | | 6,859,898 |

| |

| Consumer Staples (4.3%) | | |

|

| |

| 8,700 | Career Education Corp. † | | 309,633 |

| 6,200 | Chattem, Inc. † | | 204,600 |

| 13,300 | Domino’s Pizza, Inc. | | 318,136 |

| 12,100 | Great Atlantic & Pacific Tea Co. † | | 339,889 |

| 10,800 | Interline Brands, Inc. † | | 210,924 |

| 21,400 | Labor Ready, Inc. † | | 499,690 |

| 8,300 | Red Robin Gourmet Burgers, Inc. † | | 400,309 |

| 6,800 | Talx Corp. | | 268,804 |

| 16,300 | Tupperware Corp. | | 373,759 |

|

|

| | | | 2,925,744 |

| |

| Electronics (1.5%) | | | |

|

| |

| 5,600 | Amphenol Corp. Class A | | 223,832 |

| 86,300 | Atmel Corp. † | | 212,298 |

| 16,400 | Freescale Semiconductor, Inc. Class A † | | 388,516 |

| 11,700 | MEMC Electronic Materials, Inc. † | | 209,898 |

|

|

| | | | 1,034,544 |

| |

| Energy (6.9%) | | | |

|

| |

| 3,270 | Bronco Drilling Co., Inc. † | | 79,265 |

| 4,900 | CAL Dive International, Inc. † | | 301,546 |

| 5,800 | CONSOL Energy, Inc. | | 353,220 |

| 6,100 | Cooper Cameron Corp. † | | 449,753 |

| 5,170 | Giant Industries, Inc. † | | 295,672 |

| 3,100 | Hercules Offshore, Inc. † | | 67,487 |

| 6,800 | Newfield Exploration Co. † | | 308,244 |

| 10,000 | Noble Energy, Inc. | | 400,500 |

| 8,600 | Patterson-UTI Energy, Inc. | | 293,518 |

| 6,100 | Peabody Energy Corp. | | 476,776 |

| 18,400 | Pride International, Inc. † | | 516,488 |

| 9,200 | Rowan Cos., Inc. | | 303,508 |

| 6,800 | Unit Corp. † | | 356,320 |

| 5,200 | Universal Compression Holdings, Inc. † | | 185,380 |

| 10,300 | Veritas DGC, Inc. † | | 331,763 |

|

|

| | | | 4,719,440 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 11

| The fund’s portfolio | | |

| |

| |

| Common stocks | | | |

| NUMBER OF SHARES | | | VALUE |

|

| |

| |

| Financial (4.4%) | | | |

|

| |

| 3,600 | AmerUs Group Co. | $ | 212,832 |

| 11,200 | Asset Acceptance Capital Corp. † | | 296,688 |

| 9,900 | Calamos Asset Management, Inc. Class A | | 240,471 |

| 4,400 | CB Richard Ellis Group, Inc. Class A † | | 214,940 |

| 11,955 | Commerce Bancorp, Inc. | | 364,269 |

| 5,000 | Corus Bankshares, Inc. | | 274,500 |

| 7,280 | Nuveen Investments, Inc. Class A | | 294,622 |

| 4,900 | Safety Insurance Group, Inc. | | 184,289 |

| 6,700 | Texas Regional Bancshares, Inc. | | 196,511 |

| 9,700 | W.R. Berkley Corp. | | 423,890 |

| 4,100 | Westcorp | | 258,341 |

|

|

| | | | 2,961,353 |

| |

| Health Care Services (4.3%) | | |

|

| |

| 4,800 | Cerner Corp. † | | 405,360 |

| 3,150 | Coventry Health Care, Inc. † | | 170,069 |

| 12,300 | Henry Schein, Inc. † | | 487,572 |

| 7,000 | LifePoint Hospitals, Inc. † | | 273,700 |

| 10,000 | Lincare Holdings, Inc. † | | 408,500 |

| 5,700 | Pediatrix Medical Group, Inc. † | | 439,242 |

| 6,000 | Sierra Health Services, Inc. † | | 450,000 |

| 7,600 | United Surgical Partners International, Inc. † | | 272,460 |

|

|

| | | | 2,906,903 |

| |

| Medical Technology (5.3%) | | |

|

| |

| 12,400 | American Medical Systems Holdings, Inc. † | | 202,740 |

| 7,900 | Atherogenics, Inc. † | | 118,500 |

| 5,100 | Bausch & Lomb, Inc. | | 378,369 |

| 6,900 | Charles River Laboratories International, Inc. † | | 301,944 |

| 11,400 | Dade Behring Holdings, Inc. | | 410,514 |

| 4,000 | Diagnostic Products Corp. | | 168,400 |

| 6,700 | DJ Orthopedics, Inc. † | | 194,836 |

| 6,500 | Kinetic Concepts, Inc. † | | 233,350 |

| 5,700 | Mentor Corp. | | 256,500 |

| 5,400 | Respironics, Inc. † | | 193,698 |

| 9,400 | Sybron Dental Specialties, Inc. † | | 403,260 |

| 8,200 | Symmetry Medical, Inc. † | | 181,548 |

| 12,900 | Varian Medical Systems, Inc. † | | 587,724 |

|

|

| | | | 3,631,383 |

| |

| Pharmaceuticals (2.1%) | | |

|

| |

| 7,200 | Barr Pharmaceuticals, Inc. † | | 413,640 |

| 9,400 | Endo Pharmaceuticals Holdings, Inc. † | | 253,048 |

| 11,600 | Hospira, Inc. † | | 462,260 |

| 5,300 | Salix Pharmaceuticals, Ltd. † | | 95,082 |

| 5,500 | Watson Pharmaceuticals, Inc. † | | 190,080 |

|

|

| | | | 1,414,110 |

| |

| Real Estate (5.0%) | | | |

|

| |

| 300,000 | Spirit Finance Corp. (R) | | 3,366,000 |

12 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

| The fund’s portfolio | | |

| |

| |

| Common stocks | | |

| NUMBER OF SHARES | | | VALUE |

|

| |

| |

| Semiconductor (1.1%) | | |

|

| |

| 17,000 | Brooks Automation, Inc. † | $ | 199,070 |

| 15,500 | Lam Research Corp. † | | 522,970 |

|

|

| | | | 722,040 |

| |

| Software (2.3%) | | | |

|

| |

| 14,100 | Blackboard, Inc. † | | 396,210 |

| 16,200 | Cadence Design Systems, Inc. † | | 258,876 |

| 15,900 | Epicor Software Corp. † | | 195,252 |

| 6,700 | FileNET Corp. † | | 188,605 |

| 29,600 | Parametric Technology Corp. † | | 192,696 |

| 10,500 | Progress Software Corp. † | | 326,970 |

|

|

| | | | 1,558,609 |

| |

| Technology Services (3.3%) | | |

|

| |

| 7,100 | Anteon International Corp. † | | 320,920 |

| 16,500 | CSG Systems International, Inc. † | | 387,915 |

| 5,800 | Digital River, Inc. † | | 162,458 |

| 9,400 | Fair Isaac Corp. | | 392,544 |

| 7,400 | Fiserv, Inc. † | | 323,232 |

| 10,600 | Global Payments, Inc. | | 454,210 |

| 8,600 | Transaction Systems Architects, Inc. † | | 232,286 |

|

|

| | | | 2,273,565 |

| |

| Transportation (1.0%) | | |

|

| |

| 310 | American Commercial Lines, Inc. † | | 8,717 |

| 5,500 | Hornbeck Offshore Services, Inc. † | | 177,155 |

| 8,800 | J. B. Hunt Transport Services, Inc. | | 170,808 |

| 10,500 | SkyWest, Inc. | | 307,755 |

|

|

| | | | 664,435 |

|

|

| | Total Common stocks (cost $38,272,076) | $ | 42,117,725 |

| |

| Convertible preferred stocks (36.1%)* | | |

| NUMBER OF SHARES | | | VALUE |

|

| |

| 449,640 | Capella Education Co. Ser. G, zero % cv. pfd. | | |

| | (Private) (acquired 2/14/02, cost $5,009,274) ‡ † (F) | $ | 8,606,105 |

| 2,235,708 | CommVault Systems Ser. CC, zero % cv. pfd. (Private) | | |

| | (acquired various dates from 1/30/02 through 9/4/03, | | |

| | cost $7,011,032) ‡ † (F) | | 8,406,262 |

| 833,333 | Refractec Ser. D, zero % cv. pfd. (Private) (acquired | | |

| | various dates from 8/16/02 through 6/30/03, | | |

| | cost $4,999,998) ‡ † § (F) | | 4,499,998 |

| 1,145,039 | Restore Medical Ser. C, zero % (Private) | | |

| | (acquired 1/28/04, cost $3,009,673) ‡ † § (F) | | 3,000,002 |

|

|

| | Total Convertible preferred stocks (cost $20,029,977) | $ 24,512,367 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 13

| Short-term investments (3.4%)* (cost $2,338,000) | |

| PRINCIPAL AMOUNT | | VALUE |

|

| |

| $2,338,000 | Repurchase agreement dated October 31, 2005 with | |

| | Bank of America due November 1, 2005 with respect | |

| | to various U.S. Government obligations -- maturity | |

| | value of $2,338,259 for an effective yield of 3.99% | |

| | (collateralized by Freddie Mac zero % due 4/4/2006 | |

| | valued at $2,386,371) | $ 2,338,000 |

|

| |

| | Total Investments (cost $60,640,053) | $68,968,092 |

|

| * Percentages indicated are based on net assets of $67,860,108. |

| † Non-income-producing security. |

| ‡ Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at October 31, 2005 was $24,512,367 |

| or 36.1% of net assets. |

| § Affiliated Companies (Note 4). |

| (R) Real Estate Investment Trust. |

| (F) Security is valued at fair value following procedures approved by the Trustees (Note 1). |

| At October 31, 2005, liquid assets totaling $51,822 have been designated as collateral for open written option contracts. |

| ADR after the name of a foreign holding stands for American Depository Receipts, representing ownership of foreign securities on deposit with a |

| custodian bank. |

| The accompanying notes are an integral part of these financial statements. |

| Written options outstanding at October 31, 2005 | | |

| (premiums received $1,014) | | |

| CONTRACT | | EXPIRATION DATE/ | |

| AMOUNT | | STRIKE PRICE | VALUE |

|

| 601 | Medimmune, Inc. (Put) | Nov 05/29.07 | $ 124 |

| 859 | Walter Industries, Inc. (Put) | Nov 05/39.99 | 434 |

|

|

| | | | $558 |

14 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

| Statement of assets and liabilities | |

| |

| October 31, 2005 | |

|

| |

| Assets | |

|

| Investments in securities, at value (Note 1) | |

|

| Unaffiliated issuers (identified cost $52,630,382) | $61,468,092 |

|

| Affiliated issuers (identified cost $8,009,671) (Note 4) | 7,500,000 |

|

| Cash | 542 |

|

| Dividends receivable | 3,694 |

|

| Receivable for securities sold | 612,944 |

|

| Total assets | $69,585,272 |

|

| |

| Liabilities | |

|

| Payable for securities purchased | 365,860 |

|

| Payable for shareholder servicing fee (Note 2) | 52,367 |

|

| Payable for compensation of Manager (Note 2) | 217,967 |

|

| Payable for incentive fee (Note 2) | 969,678 |

|

| Payable for investor servicing and custodian fees (Note 2) | 15,851 |

|

| Payable for administrative services (Note 2) | 11,399 |

|

| Written options outstanding, at value (premiums received $1,014) (Note 1) | 558 |

|

| Other accrued expenses | 91,484 |

|

| Total liabilities | 1,725,164 |

|

| Net assets | $67,860,108 |

|

| |

| Represented by | |

|

| Paid-in capital (10,000,000 unlimited shares authorized) (Note 1) | $52,076,605 |

|

| Accumulated net realized gain on investments (Note 1) | 7,455,008 |

|

| Net unrealized appreciation of investments | 8,328,495 |

|

| Total -- Representing net assets applicable to capital shares outstanding | $67,860,108 |

|

| |

| Computation of net asset value | |

|

| Net asset value and redemption price per common share | |

| ($67,860,108 divided by 2,438,393 shares) | $27.83 |

|

| Offering price per class common share (100/95.75 of $27.83)* | $29.07 |

|

| * | On single retail shares of less than $500,000. On sales of $500,000 or more and on group sales, the offering price is reduced.

The accompanying notes are an integral part of these financial statements. |

| |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 15

| Statement of operations | |

| |

| Year ended October 31, 2005 | |

|

| |

| Investment income: | |

|

| Dividends (net of foreign tax of $354) | $473,773 |

|

| Interest | 74,166 |

|

| Other income (Note 6) | 11,313 |

|

| Total investment income | 559,252 |

|

| |

| Expenses: | |

|

| Compensation of Manager (Note 2) | 876,189 |

|

| Incentive fee (Note 2) | 107,692 |

|

| Investor servicing fees (Note 2) | 39,424 |

|

| Custodian fees (Note 2) | 84,802 |

|

| Trustee compensation and expenses (Note 2) | 75,764 |

|

| Administrative services (Note 2) | 73,042 |

|

| Shareholder servicing fees (Note 2) | 164,406 |

|

| Legal | 96,227 |

|

| Other | 79,574 |

|

| Fees waived and reimbursed by Manager (Note 2) | (138,636) |

|

| Net expenses | 1,458,484 |

|

| Net investment loss | (899,232) |

|

| Net realized gain on investments (Notes 1 and 3) | 8,591,408 |

|

| Net realized gain on written options (Notes 1 and 3) | 20,041 |

|

| Net unrealized depreciation of investments and written | |

| options during the year | (2,724,770) |

|

| Net gain on investments | 5,886,679 |

|

| Net increase in net assets resulting from operations | $4,987,447 |

|

| The accompanying notes are an integral part of these financial statements. | |

16 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

| Statement of changes in net assets | |

| |

| | Year ended | Year ended |

| | October 31 | October 31 |

| | 2005 | 2004 |

|

| |

| Decrease in net assets | | |

|

| Operations: | | |

|

| Net investment loss | $ (899,232) | $ (1,857,057) |

|

| Net realized gain on investments | 8,611,449 | 11,775,704 |

|

| Net unrealized depreciation of investments | (2,724,770) | (6,255,100) |

|

| Net increase in net assets resulting from operations | 4,987,447 | 3,663,547 |

|

| Distributions to shareholders: (Note 1) | | |

|

| From net realized long-term gain on investments | (1,368,623) | -- |

|

| |

| Capital share transactions: | | |

|

| Proceeds from shares issued | 1,200,930 | 2,119,730 |

|

| Reinvestments in connection with distributions | 995,905 | -- |

|

| Cost of shares repurchased (Note 5) | (15,497,419) | (18,261,812) |

|

| Decrease from capital share transactions | (13,300,584) | (16,142,082) |

|

| Total decrease in net assets | (9,681,760) | (12,478,535) |

|

| |

| Net assets | | |

|

| Beginning of year | 77,541,868 | 90,020,403 |

|

| End of year | $67,860,108 | $ 77,541,868 |

|

| |

| Number of fund shares | | |

|

| Shares outstanding at beginning of year | 2,921,173 | 3,554,909 |

|

| Shares issued | 43,758 | 81,188 |

|

| Shares reinvested | 36,790 | -- |

|

| Shares repurchased (Note 5) | (563,328) | (714,924) |

|

| Shares outstanding at end of year | 2,438,393 | 2,921,173 |

|

| The accompanying notes are an integral part of these financial statements. | | |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 17

| Statement of cash flows | | |

| |

| For the year ended October 31, 2005 | | |

|

| |

| Increase in cash | | |

|

| Cash flows from operating activities: | | |

|

| Net increase in net assets from operations | | $ 4,987,447 |

|

| Adjustments to reconcile net increase in net assets from | | |

| operations to net cash provided by operating activities: | | |

|

| Purchase of investment securities | | (74,507,373) |

|

| Proceeds from disposition of investment securities | | 93,103,464 |

|

| Purchase of short-term investment securities, net | | (2,338,000) |

|

| Decrease in dividends receivable | | 8,925 |

|

| Decrease in payable for shareholder servicing fees | | (3,870) |

|

| Increase in payable for compensation of Manager | | 45,163 |

|

| Increase in payable for incentive fee | | 107,692 |

|

| Decrease in payable for investor servicing and custodian fees | | (22,735) |

|

| Decrease in payable for administrative services | | (1,081) |

|

| Net premiums received on written options | | 1,014 |

|

| Decrease in other accrued expenses | | (13,436) |

|

| Net realized gain on investments | | (8,591,408) |

|

| Net unrealized depreciation on investments during the year | | 2,724,770 |

|

| Net cash provided by operating and investing activities | | $ 15,500,572 |

|

| Cash flows from financing activities: | | |

|

| Proceeds from shares sold | | 1,200,930 |

|

| Payment of shares redeemed | | (15,497,419) |

|

| Cash distribution paid to shareholders | | (372,718) |

|

| Net cash used in financing activities | | (14,669,207) |

|

| Net increase in cash | | 831,365 |

|

| Cash balance, beginning of year | | (830,823) |

|

| Cash balance, end of year | | $ 542 |

|

| The accompanying notes are an integral part of these financial statements. | | |

18 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

| Financial highlights | | | | | |

| |

| (For a common share outstanding throughout the period) | | | | |

| | | | | | For the period |

| | | | | | July 30, 2001† |

| Per-share | | Year ended October 31 | | to October 31 |

| operating performance | 2005 | 2004 | 2003 | 2002 | 2001 |

|

| Net asset value, | | | | | |

| beginning of period | $26.54 | $25.32 | $18.91 | $22.44 | $23.88 |

|

| Investment operations: | | | | | |

|

| Net investment income (loss) (a,b) | (.34)(f) | (.59) | (.45) | (.38) | --(e) |

|

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.13 | 1.81 | 6.86 | (3.11) | (1.44) |

|

| Total from investment operations | 1.79 | 1.22 | 6.41 | (3.49) | (1.44) |

|

| Less distributions: | | | | | |

|

| From net investment income | -- | -- | -- | (.04) | -- |

|

| From net realized gain | | | | | |

| on investments | (.50) | -- | -- | -- | -- |

|

| From return of capital | -- | -- | -- | --(e) | -- |

|

| Total distributions | (.50) | -- | -- | (.04) | -- |

|

| Net asset value, | | | | | |

| end of period | $27.83 | $26.54 | $25.32 | $18.91 | $22.44 |

|

| Total return at net asset value | | | | | |

| after incentive fee (%)(c) | 6.78 | 4.82 | 33.90 | (15.61) | (6.03)* |

|

| Total return at net asset value | | | | | |

| before incentive fee (%)(c) | 7.07 | 5.53 | 34.43 | (15.61) | (6.03)* |

|

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period | | | | | |

| (in thousands) | $67,860 | $77,542 | $90,020 | $73,682 | $85,908 |

|

| Ratio of expenses to average net | | | | | |

| assets after incentive fee (%)(b,d) | 2.00 | 2.49 | 2.30 | 2.21 | .58* |

|

| Ratio of expenses to average net | | | | | |

| assets before incentive fee (%)(b,d) | 1.85 | 1.85 | 1.85 | 2.21 | .58* |

|

| Ratio of net investment loss to average | | | | | |

| net assets after incentive fee (%)(b) | (1.23)(f) | (2.30) | (2.17) | (1.76) | --* |

|

| Portfolio turnover rate (%) | 103.14 | 100.29 | 93.90 | 102.88 | 11.20* |

|

† Commencement of operations.

* Not annualized.

| (a) | Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period. |

| |

| (b) | Reflects an expense limitation in effect during the period (Note 2). As a result of such limitation, expenses of the fund for the periods ended October 31, 2005, October 31, 2004, October 31, 2003, October 31, 2002 and October 31, 2001 reflect a reduction of 0.19%, 0.15%, 0.10%, 0.07%, and 0.04%, respectively, based on average net assets. |

| |

| (c) | Total return assumes dividend reinvestment and does not reflect the effect of sales charges. |

| |

| (d) | Includes amounts paid through expense offset arrangements (Note 2). |

| |

| (e) | Amount represents less than $0.01 per share. |

| |

| (f) | Reflects a non-recurring accrual related to Putnam Investment Management, LLC’s settlement with the SEC regarding brokerage allocation practices, which amounted to less than $0.01 per share and 0.02% of average net assets (Note 6). |

| |

| | The accompanying notes are an integral part of these financial statements. |

| |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 19

Notes to financial statements

October 31, 2005

|

Note 1 Significant accounting policies

|

TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”), is a series of TH Lee, Putnam Investment Trust (the “trust”), which is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. The objective of the fund is to seek long-term capital appreciation by investing at least 80% of its total assets in publicly traded growth stocks and privately issued venture capital investments. The fund may invest up to 50% of its portfolio in private equity investments as well as up to 5% of its assets in private equity funds.

The fund offers its shares at net asset value plus a maximum front-end sales charge of 4.25% . The fund provides a limited degree of liquidity to its shareholders by conducting quarterly repurchase offers. In each repurchase offer, the fund intends to repurchase 5% of its outstanding shares at their net asset value. The fund may also, at any time, conduct additional sales of its shares to qualified clients, as defined in the Investment Advisers Act of 1940, as amended. On January 26, 2005 the Trustees closed the fund to any new sales (except through dividend reinvestments) of shares. The Trustees may consider reopening the fund to new sales of shares again if current conditions change.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation

Investments for which market quotations are readily available are stated at the last reported sales price on their principal exchange, or official closing price for certain markets. If no sales are reported -- as in the case of some securities traded over-the-counter -- a security is valued at its last reported bid price. Market quotations are not considered to be readily available for private equity securities: such investments are initially valued at cost and then stated at fair value following procedures approved by the Trustees. As part of those procedures, TH Lee, Putnam Capital Management, LLC (the “Manager “), a subsidiary of TH Lee, Putnam Capital, L.P. (a joint venture of Putnam Investment Holdings, LLC, which in turn is an indirect subsidiary of Putnam LLC (“Putnam”) and Thomas H. Lee Partners, LP) will monitor each fair valued security on a daily basis and will adjust its value, as necessary, based on such factors as the financial and/or

20 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

operating results, the general developments in the issuer’s business including products and services offered, management changes, changes in contracts with customers, issues relating to financing, the likelihood of a public offering, the liquidity of the security, any legal or contractual restrictions, the value of an unrestricted related public security and other analytical data. Restricted securities of the same class as publicly traded securities will be valued at a discount from the public market price reflecting the nature and extent of the restriction. Securities fair valued at October 31, 2005 represented 36.1% of the fund’s net assets. Fair value prices may differ materially from the value that would be realized if the fair-valued securities were sold. Securities quoted in foreign currencies are translated into U.S. dollars at the current exchange rate. For foreign investments, if trading or events occurring in other markets after the close of the principal exchange in which the securities are traded are expected to materially affect the value of the investments, then those investments are valued, taking into consideration these events, at their fair value. Short-term investments having remaining maturities of 60 days or less are stated at amortized cost, which approximates fair value.

On November 11, 2005, the fund’s positions in Capella Education Co. and CommVault Systems were revalued at $8,992,000 and $6,997,766, respectively, pursuant to the fund’s fair value procedures.

B) Security transactions and related investment income

Security transactions are recorded on the trade date (date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis. Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital, if any, are reflected as a reduction of cost when the amount is conclusively determined.

The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. The Manager is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest.

D) Futures and options contracts

|

The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase. The fund may also write options on securities it owns or in which it may invest to increase its current returns.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 21

The potential risk to the fund is that the change in value of futures and options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments, if there is an illiquid secondary market for the contracts, or if the counterparty to the contract is unable to perform. Risks may exceed amounts recognized on the statement of assets and liabilities. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses on purchased options are included in realized gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a reduction to the cost of investments.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. The fund and the broker agree to exchange an amount of cash equal to the daily fluctuation in the value of the futures contract. Such receipts or payments are known as “variation margin.” Exchange traded options are valued at the last sale price, or if no sales are reported, the last bid price for purchased options and the last ask price for written options. Options traded over-the-counter are valued using prices supplied by dealers. Futures and written option contracts outstanding at period end, if any, are listed after the fund’s portfolio.

It is the policy of the fund to distribute all of its taxable income within the prescribed time and otherwise comply with the provisions of the Internal Revenue Code of 1986 (the “Code”) applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code, as amended. Therefore, no provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains.

F) Distributions to shareholders

|

Distributions to shareholders from net investment income are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences include temporary and permanent differences of losses on wash sale transactions, organization costs and net operating loss. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. For the year ended October 31, 2005, the fund reclassified $899,232 to decrease net investment loss and $11,243 to increase paid-in-capital, with a decrease to accumulated net realized gains of $910,475.

22 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

The tax basis components of distributable earnings and the federal tax cost as of period end were as follows:

| Unrealized appreciation | $ 10,207,075 |

| Unrealized depreciation | (1,903,180) |

| | ------------------- |

| Net unrealized appreciation | 8,303,895 |

| Undistributed short-term gain | 2,669,564 |

| Undistributed long-term gain | 4,809,588 |

| |

| Cost for federal income tax purposes | $60,664,197 |

Deal related costs are comprised primarily of legal and consulting costs incurred in connection with private equity investment transactions of the fund, whether or not consummated. Deal related costs that are attributable to existing private equity securities are added to the cost basis of the investments. All other deal related costs are expensed as incurred.

H) Statement of cash flows

|

The cash amount shown in the Statement of cash flows is the amount reported as cash in the fund’s Statement of assets and liabilities and represents cash on hand at its custodian and does not include any short-term investments at October 31, 2005.

Note 2 Management fee, administrative services and other transactions

____________________________________________________________________________________________________________________________________________________________________

The fund has entered into a Management Contract with the Manager. As compensation for the services rendered and expenses borne by the Manager, the fund pays the Manager a fee at an annual rate of 1.20% of the average daily net assets of the fund, computed daily and payable monthly.

In addition, the fund will accrue daily a liability for incentive fees payable equal to 20% of the realized and unrealized gains less realized and unrealized losses on investments that were originally purchased by the fund in private equity transactions. The fund will not accrue an incentive fee unless all realized and unrealized losses from prior periods have been offset by realized (and, where applicable, unrealized gains). The fund will pay annually, on December 31, to the Manager a fee equal to 20% of the aggregate incentive fee base, calculated from the commencement of the fund’s operations, less the cumulative amount of the incentive fee paid to the Manager in previous periods. The incentive fee base for a private equity security equals realized gains less realized and unrealized losses until the issuer of the security has completed an initial public offering and any applicable lock-up period has expired and, thereafter, equals realized and unrealized gains less realized and unrealized losses. In the case of private equity funds, the incentive fee base equals the sum of all amounts that are actually distributed to the fund less

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 23

realized and unrealized losses. The fund does not pay any incentive fee on a private equity holding until the fund sells the holding or the holding becomes freely sellable, although the fund will continue to accrue a liability with respect to additional unrealized gains for such security. At October 31, 2005, incentive fees totaling $969,678 have been accrued based on the aggregate incentive fee base, of which $107,692 was accrued for the year ended October 31, 2005.

The Manager has agreed to limit its compensation (and, to the extent necessary, bear other expenses) through October 31, 2006, to the extent that expenses of the fund (exclusive of the incentive fee, interest expense on any borrowings, offering costs and any extraordinary expenses) exceed an annual rate of 1.85% of its average daily net assets.

The fund has entered into an Administrative Services Contract with Putnam Fiduciary Trust Company (“PFTC”), an affiliate of the Manager, to provide administrative services, including fund accounting and the pricing of the fund shares. As compensation for the services, the fund pays PFTC a fee at an annual rate of 0.10% of the average daily net assets of the fund, computed daily and payable monthly.

Custodial functions for the fund’s assets are provided by PFTC, a subsidiary of Putnam, LLC. PFTC receives fees for custody services based on the fund’s asset level, the number of its security holdings and transaction volumes. Putnam Investor Services, a division of PFTC, provides investor servicing agent functions to the fund. Putnam Investor Services receives fees for investor servicing based on the number of shareholder accounts. During the year ended October 31, 2005, the fund paid PFTC $121,396 for these services.

The fund has entered into an arrangement with PFTC whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the fund’s expenses. For the year ended October 31, 2005, there was no reduction to the fund’s expenses under these arrangements.

Each independent Trustee of the trust receives an annual Trustee fee of $25,000. Trustees receive additional fees for attendance at certain committee meetings.

The fund intends to pay compensation to selected brokers and dealers that are not affiliated with the fund, the Manager or Putnam, that hold shares for their customers in accordance with the shareholder servicing agreements between the fund and the brokers and dealers. The shareholder servicing fee is accrued daily and payable quarterly at an annual rate of 0.25% of the average daily net assets attributable to outstanding shares beneficially owned by customers of the brokers and dealers.

For the year ended October 31, 2005, Putnam Retail Management, acting as underwriter received net commissions of $1,645 from the sale of common shares.

24 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

Note 3 Purchases and sales of securities

____________________________________________________________________________________________________ |

During the year ended October 31, 2005, cost of purchases and proceeds from sales of investment securities other than short-term investments aggregated $74,267,926 and $91,311,443, respectively. There were no purchases or sales of U.S. government securities.

| Written option transactions during the period are summarized as follows: | |

|

| | | | Contract | Premiums |

| | | | Amounts | Received |

| Written options outstanding | | | |

| at beginning of year | | | -- | $ -- |

|

| Options opened | | | 63,757 | 40,006 |

| Options exercised | | | (19,359) | (15,118) |

| Options expired | | | (32,785) | (18,045) |

| Options closed | | | (10,153) | (5,829) |

|

| Written options outstanding | | | |

| at end of year | | | 1,460 | $ 1,014 |

|

| |

| Note 4 Transactions with affiliated issuers | | |

|

| |

| Transactions during the year with companies in which the fund owned at least 5% of the voting |

| securities were as follows: | | | |

| |

| Name of Affiliates | Purchase Cost | Sales Cost | Dividend Income | Fair Value |

|

| Refractec | $-- | $-- | $-- | $ 4,499,998 |

| Restore Medical | -- | -- | -- | 3,000,002 |

|

| Totals | $-- | $-- | $-- | $7,500,000 |

|

| Fair value amounts are shown for issues that are affiliated at period end. | |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 25

Note 5 Share repurchases

To provide liquidity to the shareholders, the fund has a policy of making offers to repurchase a portion of its shares on a quarterly basis. Repurchases are made in February, May, August and November of each year. Repurchase offers are made for at least 5% (but not more than 25%) of fund shares in any quarter with the approval of the Trustees. If the number of shares tendered for repurchase exceeds the offering limit, or if the Manager in its discretion elects to limit repurchases to 5% of the fund’s shares, the fund will repurchase shares on a pro-rata basis, and tendering shareholders will not have all of their tendered shares repurchased by the fund. For the year ended October 31, 2005, the fund repurchased 563,328 shares valued at $15,497,419.

On February 11, 2005 and May 13, 2005, the fund received actual redemption requests totaling $5,060,332 or 6.409% and $4,108,344 or 5.761% of total fund assets, respectively. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 77% and 86.7% respectively, of the shares the shareholder requested be repurchased.

| | Shares | |

| Date | Repurchased | Amount |

|

| November 2004 | 156,492 | $4,312,929 |

| February 2005 | 141,039 | 3,929,357 |

| May 2005 | 144,712 | 3,840,536 |

| August 2005 | 121,085 | 3,414,597 |

|

| At October 31, 2005, the Manager owned 213,521 shares of the fund (8.6% of shares outstanding) |

| valued at $5,942,289. | | |

| |

| Note 6 Regulatory matters and litigation | | |

|

Putnam Management has entered into agreements with the Securities and Exchange Commission and the Massachusetts Securities Division settling charges connected with excessive short-term trading by Putnam employees and, in the case of the charges brought by the Massachusetts Securities Division, by participants in some Putnam-administered 401(k) plans. Pursuant to these settlement agreements, Putnam Management will pay a total of $193.5 million in penalties and restitution, with $153.5 million being paid to shareholders and the Putnam funds. The restitution amount will be allocated to shareholders and Putnam funds pursuant to a plan developed by an independent consultant, with payments to shareholders following approval of the plan by the SEC and the Massachusetts Securities Division.

26 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

The Securities and Exchange Commission’s and Massachusetts Securities Division’s allegations and related matters also serve as the general basis for numerous lawsuits, including purported class action lawsuits filed against Putnam Management and certain related parties, including certain Putnam funds. Putnam Management will bear any costs incurred by Putnam funds in connection with these lawsuits. Putnam Management believes that the likelihood that the pending private lawsuits and purported class action lawsuits will have a material adverse financial impact on the fund is remote, and the pending actions are not likely to materially affect its ability to provide investment management services to its clients, including the Putnam funds.

On March 23, 2005, Putnam Management entered into a settlement with the Securities and Exchange Commission resolving its inquiry into Putnam Management’s alleged failure to fully and effectively disclose a former brokerage allocation practice to the Board of Trustees and shareholders of the Putnam funds. This practice, which Putnam Management ceased as of January 1, 2004, involved allocating a portion of the brokerage on mutual fund portfolio transactions to certain broker-dealers who sold shares of Putnam mutual funds. Under the settlement order, Putnam Management has paid a civil penalty of $40 million and disgorgement of $1 to the Securities and Exchange Commission for distribution to certain Putnam funds pursuant to a plan approved by the Securities and Exchange Commission. As part of the settlement, Putnam Management neither admitted nor denied any wrongdoing. Although TH Lee, Putnam Emerging Opportunities Portfolio will not receive any portion of those amounts, the Manager elected to make a voluntary additional payment of $11,313 to the fund in connection with the settlement order. This amount, which is reflected in Other income on the Statement of operations, was calculated on the same basis, and paid at the same time, as amounts distributed to other Putnam funds pursuant to the distribution plan.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 27

Pursuant to Section 852 of the Internal Revenue Code, as amended, the fund hereby designates $4,860,283 as long term capital gain, for its taxable year ended October 31, 2005.

The fund designated 17.36% of ordinary income distributions as qualifying for the dividends received deduction for corporations.

For its tax year ended October 31, 2005, the fund designated 17.57% of its taxable ordinary income distributions as qualified dividends taxed at the individual net capital gain rates.

The Form 1099 you receive in January 2006 will show the tax status of all distributions paid to your account in calendar 2005.

28 TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005

A listing of the trustees of TH Lee, Putnam Investments Trust (the “Trust”) and the officers of the Fund and their business experience for the past five years follows. An asterisk(*) indicates trustees who are interested persons of the Fund (as defined by the 1940 Act). Unless otherwise noted, the address of each trustee and officer is one Post Office Square, Boston, Massachusetts 02109.

| | Position(s) Held | | |

| | with Fund During | | |

| Name | the Past 5 Years | | Principal Occupation(s) |

|

| John A. Hill | Chairman and Trustee | Born 1942 | Chairman and Trustee, Putnam |

| | | | Funds (108 funds as of October 31, |

| | | | 2005), Vice-Chairman, First |

| | | | Reserve Corporation (a private |

| | | | equity buyout firm that specializes |

| | | | in energy investments in the diver- |

| | | | sified world-wide energy industry). |

| | | | Director of Devon Energy |

| | | | Corporation, TransMontaigne Oil |

| | | | Company, Sarah Lawrence College |

| | | | and various private companies |

| | | | controlled by First Reserve |

| | | | Corporation. Formerly a Director of |

| | | | Continuum Health Partners of New |

| | | | York and St. Luke’s-Roosevelt (a |

| | | | New York City Hospital). |

Thomas H. Lee* | Trustee | Born 1944 | Chairman and CEO of Thomas H. Lee |

| | | | Partners, L.P. Currently serves or has |

| | | | served as Director of General |

| | | | Nutrition Companies, Metris |

| | | | Companies, Inc., Playtex Products, |

| | | | Inc., Refco Group Ltd., LLC, Snapple |

| | | | Beverage Corp., Vertis Holdings, Inc., |

| | | | Warner Music Group, and Wyndham |

| | | | International, Inc. Member of The JP |

| | | | Morgan National Advisory Board. Mr. |

| | | | Lee is currently a trustee of The |

| | | | Intrepid Museum Foundation, Lincoln |

| | | | Center for the Performing Arts, The |

| | | | Museum of Modern Art, NYU Medical |

| | | | Center, The Rockefeller University, |

| | | | and Whitney Museum of American |

| | | | Art. He also serves on the Executive |

| | | | Committee for Harvard University’s |

| | | | Committee on University Resources. |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2005 29

| | Position(s) Held | | |

| | with Fund During | | |

| Name | the Past 5 Years | | Principal Occupation(s) |

|

| Joseph L. Bower | Trustee | Born 1938 | Donald K. David Professor of |

| | | | Business Administration, Harvard |

| | | | Business School, and Chair of The |

| | | | General Manager Program. Director, |

| | | | Anika Therapeutics, Inc., Brown |

| | | | Shoe, Inc., Loews Corporation, New |

| | | | America High Income Fund and |

| | | | Sonesta International Hotels |

| | | | Corporation. Trustee of the New |

| | | | England Conservatory of Music and |

| | | | of the DeCordova Museum and |

| | | | Sculpture Park. Prior to 2005, |

| | | | Director, ML-Lee/Acquisition Funds. |

Stephen B. Kay | Trustee | Born 1934 | Senior Director of Goldman, Sachs |

| | | | & Co. Director of CareGroup |

| | | | (consortium of hospitals). Trustee, |

| | | | Chairman of the Investment |

| | | | Committee and Member of the |

| | | | Executive & Finance Committees of |

| | | | the Board of the Dana-Farber |

| | | | Cancer Institute. Member of the |

| | | | Dean’s Advisory Council, Harvard |

| | | | School of Public Health. Member of |

| | | | the Board of Overseers of Harvard |

| | | | University from 1994-1999. Chair of |

| | | | the Board of Trustees and Member |

| | | | of the Investment Committee, |

| | | | Brandeis University. Prior to 2004, |

| | | | a Director of Control Risk Insurance |

| | | | Company. Former director of the |

| | | | Harvard Alumni Association and |

| | | | past President of the Harvard |