UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number: (811-10373)

Exact name of registrant as specified in charter: TH Lee, Putnam Investment Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Charles A. Ruys de Perez, Vice President and |

| | Chief Compliance Officer |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John E. Baumgardner, Esq. |

| | Sullivan & Cromwell LLP |

| | 125 Broad Street |

| | New York, New York 10004-2498 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

Date of fiscal year end: October 31, 2006

Date of reporting period: November 1, 2005— April 30, 2006

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Semiannual Report

For the period ended April 30, 2006

TH Lee, Putnam Emerging Opportunities Portfolio

About the fund and TH Lee, Putnam Capital LLC

TH Lee, Putnam Emerging Opportunities Portfolio (“the fund”) is a closed-end interval fund. This innovative fund pursues aggressive growth by combining investments in publicly traded stocks and privately held companies in a closed-end format. With this special structure, the fund seeks to tap into companies with the best growth potential while maintaining diversification across public and private markets.

The fund is sponsored by an affiliate of TH Lee, Putnam Capital LLC, which is a joint venture of Putnam Investments (“Putnam”) and Thomas H. Lee Partners LP (“TH Lee”). This venture was founded in 1999 to offer alternative investment products to individual investors who have historically lacked access to the private-equity marketplace. Thomas H. Lee Partners LP, founded in 1974, is one of the oldest and most successful private-equity investment firms in the United States. The firm’s investment strategy targets growth companies with competitive advantages in expanding or consolidating industries. Putnam Investments, founded in 1937, is one of the world’s largest mutual fund companies and a leader in investment research and portfolio management through disciplined teamwork.

The fund’s public-equity portfolio is managed by members of Putnam’s Small and Emerging Growth Team — Richard Weed, Managing Director, and Raymond Haddad, Senior Vice President. This team analyzes small- and mid-capitalization growth stocks. Frederick Wynn, Managing Director, is responsible for managing the fund’s private-equity investments.

The fund’s management structure also includes an Investment Committee consisting of senior Putnam and TH Lee investment professionals. The Investment Committee consults with the management team and gives final approval to the structure of all private-equity deals.

Report from Fund Management

Performance commentary

We are pleased to report that your fund returned 18.06% at net asset value (NAV, or without sales charges) during the six months that ended April 30, 2006, the first half of its current fiscal year. Our results benefited from the continuing advance of stocks of aggressive-growth mid- and small-cap companies. These types of stocks led all other areas of the market, as the economy continued to expand and corporate profits as a percentage of the overall economy rose to historic levels. The economic backdrop was also positive for private companies financed through the venture capital market, as IPO (initial public offering) issuance continued to be strong. The valuation of the fund’s private-equity portfolio appreciated by approximately 22% in the period. The results at NAV for the fund overall, including both public and private securities, slightly lagged behind those of the Russell 2500 Growth Index during the six-month period.

| RETURN FOR PERIODS ENDED APRIL 30, 2006 | | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | Growth Index |

|

| 6 months | 18.06% | 13.03% | 19.11% |

|

| 1 year | 24.31 | 19.05 | 34.07 |

|

| 3 years | 71.58 | 64.25 | 93.30 |

|

| Annual average | 19.72 | 17.99 | 24.57 |

|

| Life of fund (since inception 7/30/01) | 40.31 | 34.35 | 42.22 |

|

| Annual average | 7.38 | 6.40 | 7.68 |

|

| | |

| RETURN FOR PERIODS ENDED MARCH 31, 2006 (most recent quarter) | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | Growth Index |

|

| 6 months | 7.50% | 2.93% | 14.87% |

|

| 1 year | 10.93 | 6.23 | 26.44 |

|

| 3 years | 72.23 | 64.92 | 109.52 |

|

| Annual average | 19.87 | 18.15 | 27.96 |

|

| Life of fund (since inception 7/30/01) | 30.37 | 24.83 | 41.79 |

|

| Annual average | 5.83 | 4.86 | 7.75 |

|

Past performance does not indicate future results. Performance assumes reinvestment of distributions and does not account for taxes. More recent returns may be less or more than those shown. Investment returns will fluctuate, and you may have a gain or a loss when you sell your shares. Returns at public offering price (POP) reflect the highest applicable sales charge of 4.25% . Sales charges differ with the original purchase amount. The fund is currently closed to new investments. The Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation. Indexes are not available for direct investment. For a portion of the period this fund limited expenses, without which returns would have been lower.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 1

Market overview

Equity markets continued to move higher over the past six months. For the most part, investors appeared to focus on the period’s many favorable trends, which included robust corporate earnings and solid balance sheets, continued economic expansion, and improving job creation. High energy prices caused periodic concern, but there was no outbreak of inflation into other sectors of the economy. The U.S. Federal Reserve’s interest-rate increases, intended to prevent any such inflation, appeared to slow the housing market by raising financing costs, particularly for adjustable-rate mortgages and credit card debt. With consumers burdened by higher interest payments and financing costs, many market analysts are looking for greater business spending to maintain the economic expansion.

Investors have continued to embrace mid- and small-cap stocks. The market advanced across a variety of sectors, but was led by energy and basic materials, which have benefited from strong prices for oil, metals, and other commodities. Traditional growth sectors had mixed results. Technology stocks advanced, but did not lead the market, and stocks from the health-care sector were among the weakest performers. In spite of the interest-rate increases, which historically have had an adverse effect on small companies, the returns from small- and mid-cap stocks generally outpaced those of large-cap issues.

Strategy overview

The fund’s approach to selecting publicly traded stocks relies on a combination of fundamental and quantitative analytical tools to research U.S. mid- and small-cap companies. Our goal is to try to identify those companies likely to achieve consistently high rates of sales and earnings growth. We rigorously compare stocks to identify those with the most attractive capital appreciation potential relative to their risk, and we rely on our proprietary research to understand each company’s competitive advantages. We tend to take investment risk primarily with our stock selections because we have confidence that our research process can uncover securities with attractive appreciation potential. Typically, the portfolio team does not take major sector risks, and the public-equity portfolio’s sector weightings are generally similar to those of its benchmark.

2 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

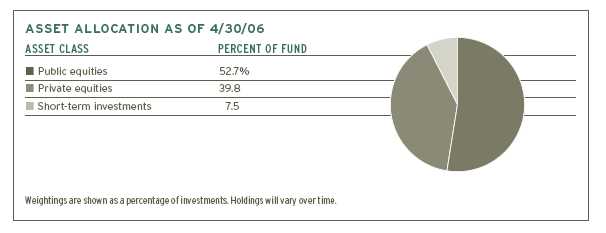

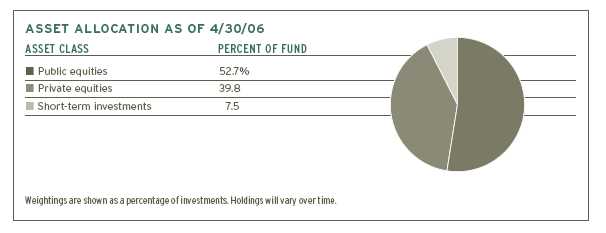

With regard to private equities, while we currently intend not to make private equity investments in companies not already in the portfolio, we may decide to make follow-on investments in a company already among the fund’s current private equity holdings if we believe this action would be in the best interest of shareholders. Both we and the Trustees want to maintain the fund’s diversification among various asset classes, which we consider to be a key risk management tool of the fund and one of its distinctive characteristics. Asset diversification also contributes to maintaining appropriate fund liquidity. As of April 30, 2006, the end of the fund’s semiannual period, the portfolio included four remaining private-equity holdings that represented approximately 41% of overall assets.

How fund holdings affected performance

Holdings in the fund’s private-equity portfolio reported new developments during the period. We can also note that two of the holdings, CommVault Systems and Restore Medical, filed registration statements with the Securities and Exchange Commission with the goal of completing their IPOs. CommVault is an enterprise-level software company that provides information and data management solutions to both large and small customers worldwide. Restore Medical is a medical device manufacturer offering FDA-approved products to treat problematic snoring and sleep disordered breathing, frequently referred to as obstructive sleep apnea (OSA). Restore Medical sells its products to physicians primarily in the United States, Europe, and Asia. During the period, the company announced that a clinical medical study had shown that 81% of patients who used its Pillar Procedure, which is designed to help alleviate sleep apnea, had found it effective. The Pillar Procedure also earned Restore Medical recognition as the 2005 Manufacturer of the Year by Medical Device & Diagnostic Industry. We would also like to note that in May 2006, after the close of the semiannual period, Restore Medical completed its IPO at a price of $8.00 per share, which was significantly higher than the fund’s per share cost basis in the investment when it was purchased in early 2004. Both CommVault and Restore Medical contributed to the fund’s results in the period by appreciating in value.

With regard to the two other private-equity holdings, Capella Education Company now has over 14,000 students enrolled in over 13 degree programs. Refractec, the company that developed the NearVision CK Treatment to correct farsightedness, has now certified more than 800 physicians to perform the therapy. In 2005, approximately 150,000 treatments were administered. On June 7, 2006, after the end of the semiannual period, Refractec announced that Thomas G. Frinzi, formerly

| TOP SECTOR WEIGHTINGS AS OF 4/30/06 (includes both public and private holdings) |

|

| Technology | 25.5% |

|

| Health care | 21.5 |

|

| Consumer staples | 17.2 |

|

| Consumer cyclicals | 8.6 |

|

| Capital goods | 5.5 |

|

| Weightings are shown as a percentage of net assets. Holdings will vary over time. |

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 3

| TOP 10 HOLDINGS (includes public and private companies) | INDUSTRY |

|

| CommVault Systems | Software |

|

| Capella Education Co. | Schools |

|

| Restore Medical | Medical technology |

|

| Refractec | Medical technology |

|

| Spirit Finance Corp. | Real estate |

|

| WESCO International, Inc. | Electrical equipment |

|

| Pediatrix Medical Group, Inc. | Health-care services |

|

| Manpower, Inc. | Commercial and consumer services |

|

| MedImmune, Inc. | Biotechnology |

|

| R.H. Donnelley Corp. | Publishing |

|

| These holdings represent 49.5% of the fund’s net assets as of 4/30/06. Portfolio holdings will vary over time. |

the company's chief operating officer, had been promoted to position of chief executive officer, following the departure of the previous CEO to pursue other ventures. We would like to be able to share more news about the private-equity holdings, but due to the sensitive nature of the information and confidentiality agreements we have signed with the companies, we are restricted regarding the information we can provide on a company-by-company basis.

Several of the fund’s top-performing public-equity holdings benefited from the increase in capital spending by corporations to tap into the U.S. and global economic expansion. An example is WESCO International, which makes electrical products used in industrial facilities. It has benefited from increased spending on upgrading existing plants and constructing new ones. Another holding, Steel Dynamics, makes steel products used in buildings and transportation infrastructure, and has developed a new, longer-lasting equipment for building railways. Both stocks nearly doubled in value during the period.

A stock we added during the period, Agnico-Eagle Mines, benefited as worries about inflation pushed the price of gold higher. This company, based in Canada, mines gold throughout North America and offers an attractive earnings growth rate.

Holdings in the technology sector had mixed results. Atmel Corporation, a company that designs and manufactures integrated circuits, contributed positively to the fund’s results, and we sold the stock to lock in profits after it reached what we considered its full valuation. However, Intergraph detracted from results. This company provides spatial information management systems that help businesses and governments manage their operations by creating intelligent maps. Its stock price fell when the company announced earnings and revenues would be below expectations, and we decided to sell the holding because of its less-attractive growth prospects.

4 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Holdings in the health-care sector had the most negative impact on performance. Biotechnology company MedImmune and medical service company Hospira lost ground because of disappointing quarterly earnings report. The fund continues to hold both stocks because of our confidence in their ability to return to a higher rate of growth.

Please note that all holdings discussed in this report may not have been held by the fund for the entire period discussed, are subject to review in accordance with the fund’s investment strategy, and may vary in the future.

Of special interest

Shortly after the end of the semiannual period, Thomas H. Lee resigned as a Trustee of the Fund. Earlier in 2006, Mr. Lee left Thomas H. Lee Partners, the firm he founded in 1974. We would like to thank Mr. Lee for his service to the Fund.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 5

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

We consider the current investment environment for emerging-growth companies to be favorable. Corporate profit margins remain quite robust by historical standards. Earnings quality is also high, in that companies have not relied on debt to improve their earnings growth. The strength of balance sheets is important because short-term rates have risen and long-term rates are at their highest levels since 2002. Stock market volatility has increased recently, as some investors apparently fear that growth will cause inflation, while others worry that a slowdown in the housing market could spread to the rest of the economy. To summarize, we think investors should be prepared for heightened volatility arising from market uncertainty, but our research is still uncovering a host of investment opportunities, as businesses remain fundamentally healthy and innovation continues in many industries.

We will continue to conduct research that helps us to manage risk, while also identifying opportunities that can result from market volatility. Regardless of the direction that markets take in the months ahead, we will retain our focus on disciplined, bottom-up stock selection and continue to believe that this approach best serves investors over the long term.

The views expressed here are exclusively those of TH Lee, Putnam Capital Management, LLC, the fund’s Manager. All such views are subject to change, including views regarding the fund’s private-equity holdings. Although holdings described favorably were viewed as such as of 4/30/06, there is no guarantee the fund will continue to hold these securities in the future or that they will not decline in value.

The fund is currently closed to new investors. If the fund is re-opened, shares of the fund may be offered only to investors who have a net worth of more than $1,500,000 or who otherwise meet the definition of a “qualified client,” as defined in and adopted under the Investment Advisers Act of 1940, as amended.

An investment in the fund involves a considerable amount of risk and should be considered speculative. Because it is possible that you may lose some or all of your investment, you should not invest in the fund unless you can afford a total loss of investment. An investment in the fund involves a high degree of risk, which includes the following specific types of risk: the risks associated with venture-capital companies and venture-capital funds; investing in securities that are illiquid and subject to substantial transfer restrictions; the risks of investing in smaller companies; the fund’s ability to focus holdings in a small number of industry sectors that may be relatively new or emerging industries; the risk of investing in a fund that will pay an incentive fee; investing in a fund, many of whose assets will be priced in the absence of a readily available market and may be priced based on estimates of fair value, which may prove inaccurate; and the risk involved in the fund Manager’s limited experience in venture-capital investing. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The fund invests some or all of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations.

6 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Trustee approval of management contract

General conclusions

The Board of Trustees of your fund oversees the management of the fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with TH Lee, Putnam Capital Management, LLC. In this regard, the Board of Trustees requests and evaluates all information it deems reasonably necessary under the circumstances. On June 13, 2005, the Board of Trustees met to consider the information provided by the Manager and other information developed with the assistance of the Board’s independent counsel. Upon completion of this review, the Board of Trustees, following a vote by the Independent Trustees (those Trustees who are not “interested persons,” as defined in the Investment Company Act, of your fund or the Manager), approved the continuance of your fund’s management contract, effective July 27, 2005.

This approval was based on the following conclusions:

| * | That the fee schedule is, and since the inception of the fund has been, unusual and seeks |

| appropriately to reflect fees charged by Putnam and competitive advisers in respect of the public |

| and private securities portions of the fund’s portfolio, and in particular to reward successful |

| investment decisions through the incentive fee applicable only to the private securities, and |

| |

| * | That the fee schedule currently in effect for your fund, including the base fee and incentive fee |

| components, represents reasonable compensation in light of the nature and quality of the services |

| being provided to the fund and the costs incurred by the Manager in providing such services. |

These conclusions were based on a careful consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund are the result of several years of review and discussion between the Trustees and the Manager, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Services provided; investment performance

The quality of the investment process provided by the Manager represented a major factor in the Trustees’ evaluation of the quality of services provided by the Manager under your fund’s management contract. The Trustees concluded that the Manager generally provides a high quality investment process but also recognize that this does not guarantee favorable investment results for the fund in every time period. The Trustees evaluated the experience and skills of the individuals assigned to the management of your fund’s public-equity and private-equity investments and the resources made available to such personnel. Recognizing that expertise of portfolio management personnel, particularly for private-equity investments, is highly prized among competitive investment

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 7

advisers, the Trustees have noted favorably the Manager’s commitment to retaining highly qualified personnel notwithstanding the relatively small size of the fund and the determination to suspend sales of fund shares.

The Trustees considered the investment performance of your fund over the 1-year and since-inception periods ended March 31, 2005, and considered information comparing the fund’s performance with its benchmark index and with the performance of competitive funds. The Trustees also reviewed an analysis from the Manager of the costs of the services provided and profits realized by the Manager from the relationship with the fund in 2004.

Competitiveness

The Trustees reviewed comparative fee and expense information for other closed-end funds investing both in public and private equities, and noted that your fund’s management fees were generally lower than those of these funds. The Trustees noted in addition that the Manager has agreed to reimburse the fund to the extent that total fund expenses (exclusive of incentive fees payable under the management contract) exceed 1.85% of average annual assets through October 31, 2006. They also reviewed analysis provided by the Manager regarding the performance of your fund’s current and former private-equity investments and noted the amounts your fund has accrued as incentive fees payable to the Manager under your fund’s management contract as a result of appreciation in the value of these investments.

The Trustees noted that your fund is the only client of the Manager, and that your fund is unique among all registered investment companies managed by affiliates of the Manager with respect to its investment objective and fee structure. The Trustees have been satisfied that the fund’s fee structure appropriately mediates the fees charged by Putnam Investments and competitors on portfolios of publicly-traded securities and those (including both asset-based fees and incentive fees) charged by managers of private securities. Accordingly, the Trustees did not attribute great weight to a comparative review of fees paid by other funds and institutional accounts whose assets are managed by the Manager’s affiliates.

Economies of scale

The Trustees noted that the fund’s fee structure does not have breakpoints (which lower the net effective fee rate as assets grow), that the Manager is compensated under the incentive fee only if the performance of the fund’s private assets is successful and that, since inception through October 31, 2006, the Manager has agreed to reimburse the fund to the extent its total expenses (exclusive of incentive fees) exceed 1.85% of average annual assets. The Trustees also noted that the fund’s assets as of May 31, 2005 were approximately $70 million and that, because your fund is presently not open to new investments, the fund’s assets have recently diminished through regular quarterly repurchases. The Trustees expressed their intent to consider whether the current fee arrangements remain appropriate if and when the fund is reopened to new investments and fund assets increase.

8 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that the Manager may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment adviser, subject to the obligation to seek best execution. This area has been marked by significant change in recent years. The Trustees noted that allocations of brokerage to reward firms that sell fund shares were discontinued on December 31, 2003. They also noted that, commencing in 2004, the allocation of brokerage commissions by the Manager to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract with Putnam Retail Management Limited Partnership (“PRM”) and a report from the Manager on the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”). PRM and PFTC are affiliates of the Manager. PFTC benefits from the fund’s custodian and investor servicing agreements, and PRM benefits from the fund’s distributor’s contract at times when the fund is open to new investments.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 9

| The fund’s portfolio | | | |

| |

| |

| April 30, 2006 (Unaudited) | | | |

|

| |

| Common stocks (54.9%)* | | | |

| | SHARES | | VALUE |

|

| Basic Materials (3.4%) | | | |

|

| Agnico-Eagle Mines, Ltd. (Canada) | 12,400 | $ | 457,064 |

| Cameco Corp. (Canada) | 11,200 | | 455,280 |

| Coeur d’Alene Mines Corp. † | 29,300 | | 204,514 |

| Crown Holdings, Inc. † | 3,610 | | 57,867 |

| Freeport-McMoRan Copper & Gold, Inc. Class B | 7,100 | | 458,518 |

| Goldcorp, Inc. (Canada) | 8,500 | | 298,520 |

| PAN American Silver Corp. (Canada) † | 8,000 | | 198,400 |

| Steel Dynamics, Inc. | 4,827 | | 301,398 |

|

|

| | | | 2,431,561 |

| |

| Capital Goods (5.5%) | | | |

|

| Aeroflex, Inc. † | 22,000 | | 277,420 |

| Alliant Techsystems, Inc. † | 3,700 | | 295,963 |

| Armor Holdings, Inc. † | 7,200 | | 439,704 |

| Cummins, Inc. | 2,100 | | 219,450 |

| Dover Corp. | 5,900 | | 293,525 |

| JLG Industries, Inc. | 9,200 | | 263,856 |

| Lincoln Electric Holdings, Inc. | 6,100 | | 334,341 |

| Parker-Hannifin Corp. | 4,700 | | 380,935 |

| Rofin-Sinar Technologies, Inc. † | 5,800 | | 325,438 |

| Timken Co. | 9,500 | | 331,550 |

| Wabtec Corp. | 8,800 | | 321,464 |

| WESCO International, Inc. † | 6,700 | | 502,500 |

|

|

| | | | 3,986,146 |

| |

| Communications Equipment (1.1%) | | | |

|

| Avaya, Inc. † | 33,700 | | 404,400 |

| Plantronics, Inc. | 10,500 | | 393,750 |

|

|

| | | | 798,150 |

| |

| Computers (2.1%) | | | |

|

| Mentor Graphics Corp. † | 16,700 | | 219,271 |

| NCR Corp. † | 5,700 | | 224,580 |

| Netgear, Inc. † | 14,800 | | 332,260 |

| Palm, Inc. † | 18,300 | | 413,580 |

| Seagate Technology (Cayman Islands) † | 11,300 | | 300,128 |

|

|

| | | | 1,489,819 |

| |

| Consumer Cyclicals (8.6%) | | | |

|

| Aeropostale, Inc. † | 11,300 | | 347,023 |

| American Eagle Outfitters, Inc. | 6,300 | | 204,120 |

| Ameristar Casinos, Inc. | 8,600 | | 211,646 |

| ARAMARK Corp. Class B | 8,100 | | 227,691 |

| Brunswick Corp. | 5,500 | | 215,710 |

| Consolidated Graphics, Inc. † | 4,600 | | 240,534 |

10 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

| The fund’s portfolio | | | |

| |

| |

| Common stocks | | | |

| | SHARES | | VALUE |

|

| Consumer Cyclicals (continued) | | | |

|

| Corporate Executive Board Co. (The) | 2,900 | $ | 310,677 |

| Desarrolladora Homex SA de CV ADR (Mexico) † | 6,700 | | 256,744 |

| Goodman Global, Inc. † | 3,730 | | 73,854 |

| Jakks Pacific, Inc. † | 13,200 | | 299,244 |

| John H. Harland Co. | 4,500 | | 186,525 |

| K2, Inc. † | 15,100 | | 178,029 |

| Manpower, Inc. | 7,200 | | 469,080 |

| New York & Company, Inc. † | 11,200 | | 174,384 |

| OfficeMax, Inc. | 8,487 | | 328,447 |

| Oshkosh Truck Corp. | 4,600 | | 281,520 |

| Pacific Sunwear of California, Inc. † | 8,300 | | 193,390 |

| Pantry, Inc. (The) † | 4,700 | | 311,093 |

| Phillips-Van Heusen Corp. | 9,200 | | 369,840 |

| R. H. Donnelley Corp. † | 8,196 | | 460,041 |

| Sherwin-Williams Co. (The) | 7,600 | | 387,144 |

| Stein Mart, Inc. | 8,800 | | 139,040 |

| West Corp. † | 6,418 | | 297,282 |

| World Wrestling Entertainment, Inc. | 6,042 | | 104,768 |

|

|

| | | | 6,267,826 |

| |

| Consumer Staples (3.4%) | | | |

|

| American Greetings Corp. Class A | 6,600 | | 148,632 |

| Blyth Industries, Inc. | 6,600 | | 135,630 |

| Career Education Corp. † | 8,700 | | 320,769 |

| Domino’s Pizza, Inc. | 12,600 | | 331,758 |

| Gevity HR, Inc. | 4,900 | | 125,881 |

| Interline Brands, Inc. † | 15,600 | | 418,080 |

| Jack in the Box, Inc. † | 6,700 | | 280,060 |

| Labor Ready, Inc. † | 13,800 | | 364,734 |

| Sealy Corp. † | 4,420 | | 70,499 |

| Stamps.com, Inc. † | 8,700 | | 245,340 |

|

|

| | | | 2,441,383 |

| |

| Electronics (3.3%) | | | |

|

| Agere Systems, Inc. † | 24,700 | | 388,284 |

| Amphenol Corp. Class A | 7,800 | | 450,840 |

| Bookham, Inc. † | 23,000 | | 140,070 |

| Freescale Semiconductor, Inc. Class A † | 6,900 | | 218,178 |

| General Cable Corp. † | 10,400 | | 328,328 |

| Microchip Technology, Inc. | 10,100 | | 376,326 |

| RF Micro Devices, Inc. † | 37,000 | | 344,100 |

| Sanmina Corp. † | 28,600 | | 148,434 |

|

|

| | | | 2,394,560 |

| |

| Energy (5.5%) | | | |

|

| Complete Production Services, Inc. † | 4,100 | | 108,363 |

| Cooper Cameron Corp. † | 6,700 | | 336,608 |

| Giant Industries, Inc. † | 4,170 | | 299,740 |

| Helix Energy Solutions Group, Inc. † | 6,400 | | 248,448 |

| Hercules Offshore, Inc. † | 4,600 | | 188,094 |

| Noble Energy, Inc. | 8,100 | | 364,338 |

| Patterson-UTI Energy, Inc. | 6,400 | | 207,104 |

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 11

| The fund’s portfolio | | | |

| |

| |

| Common stocks | | | |

| | SHARES | | VALUE |

|

| |

| Energy (continued) | | | |

|

| Peabody Energy Corp. | 5,000 | $ | 319,300 |

| Pride International, Inc. † | 9,500 | | 331,455 |

| Rowan Cos., Inc. | 6,500 | | 288,145 |

| Sunoco, Inc. | 4,900 | | 397,096 |

| Suntech Power Holdings Co., Ltd. ADR (China) † | 1,010 | | 34,633 |

| Unit Corp. † | 4,900 | | 282,975 |

| Universal Compression Holdings, Inc. † | 4,000 | | 223,600 |

| Veritas DGC, Inc. † | 7,300 | | 349,816 |

|

|

| | | | 3,979,715 |

| |

| Financial (3.5%) | | | |

|

| AmerUs Group Co. | 3,100 | | 181,815 |

| Calamos Asset Management, Inc. Class A | 5,700 | | 220,932 |

| CB Richard Ellis Group, Inc. Class A † | 4,300 | | 377,927 |

| Corus Bankshares, Inc. | 6,100 | | 408,334 |

| Cullen/Frost Bankers, Inc. | 800 | | 46,304 |

| Nuveen Investments, Inc. Class A | 4,480 | | 215,578 |

| Safety Insurance Group, Inc. | 4,400 | | 203,676 |

| UnionBanCal Corp. | 2,800 | | 196,252 |

| W.R. Berkley Corp. | 9,250 | | 346,135 |

| Zenith National Insurance Corp. | 7,200 | | 317,664 |

|

|

| | | | 2,514,617 |

| |

| Health Care (7.8%) | | | |

|

| Amylin Pharmaceuticals, Inc. † | 2,850 | | 124,117 |

| Barr Pharmaceuticals, Inc. † | 6,600 | | 399,630 |

| C.R. Bard, Inc. | 5,300 | | 394,638 |

| Cerner Corp. † | 3,700 | | 146,705 |

| Charles River Laboratories International, Inc. † | 6,400 | | 302,400 |

| Community Health Systems, Inc. † | 10,400 | | 376,896 |

| Dade Behring Holdings, Inc. | 10,300 | | 401,700 |

| Henry Schein, Inc. † | 3,900 | | 181,818 |

| Hospira, Inc. † | 10,775 | | 415,376 |

| Invitrogen Corp. † | 3,300 | | 217,833 |

| Kinetic Concepts, Inc. † | 4,600 | | 200,836 |

| Laboratory Corp. of America Holdings † | 3,700 | | 211,270 |

| LCA-Vision, Inc. | 4,700 | | 263,952 |

| MedImmune, Inc. † | 14,700 | | 462,609 |

| Mentor Corp. | 5,200 | | 225,316 |

| Pediatrix Medical Group, Inc. † | 9,600 | | 485,952 |

| Sierra Health Services, Inc. † | 10,100 | | 396,021 |

| Varian Medical Systems, Inc. † | 5,600 | | 293,328 |

| Watson Pharmaceuticals, Inc. † | 4,900 | | 139,356 |

|

|

| | | | 5,639,753 |

| |

| Real Estate (4.8%) | | | |

|

| Spirit Finance Corp. (R) | 300,000 | | 3,480,000 |

12 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

| The fund’s portfolio | | |

| |

| |

| Common stocks | | |

| | SHARES | VALUE |

|

| |

| Semiconductor (0.5%) | | |

|

| Lam Research Corp. † | 5,500 | $ 268,840 |

| Nextest Systems Corp. † | 5,690 | 88,366 |

| Sigmatel, Inc. † | 4,200 | 28,098 |

|

|

| | | 385,304 |

| |

| Software (2.4%) | | |

|

| Blackboard, Inc. † | 8,800 | 258,456 |

| Cadence Design Systems, Inc. † | 13,100 | 247,983 |

| Epicor Software Corp. † | 14,500 | 175,885 |

| FileNET Corp. † | 6,200 | 172,484 |

| Internet Security Systems, Inc. † | 11,800 | 264,792 |

| Parametric Technology Corp. † | 11,840 | 176,890 |

| Progress Software Corp. † | 9,800 | 270,382 |

| SSA Global Technologies, Inc. † | 11,900 | 184,450 |

|

|

| | | 1,751,322 |

| |

| Technology Services (2.2%) | | |

|

| Covansys Corp. † | 23,800 | 414,120 |

| CSG Systems International, Inc. † | 16,600 | 419,648 |

| Fair Isaac Corp. | 8,700 | 322,857 |

| Global Payments, Inc. | 3,900 | 184,977 |

| Transaction Systems Architects, Inc. † | 7,200 | 287,568 |

|

|

| | | 1,629,170 |

| |

| Transportation (0.8%) | | |

|

| Hornbeck Offshore Services, Inc. † | 5,200 | 186,732 |

| J. B. Hunt Transport Services, Inc. | 8,800 | 209,704 |

| Omega Navigation Enterprises, Inc. † | 10,900 | 174,945 |

|

|

| | | 571,381 |

|

|

| Total common stocks (cost $32,933,181) | | $39,760,707 |

| |

| Convertible preferred stocks (41.4%)* | | |

| | SHARES | VALUE |

|

| |

| Capella Education Co. Ser. G, zero % cv. pfd. (Private) | | |

| (acquired 2/14/02, cost $5,009,274) ‡ † (F) | 449,640 | $ 9,999,989 |

| CommVault Systems Ser. CC, zero % cv. pfd. (Private) | | |

| (acquired various dates from 1/30/02 through 9/4/03, | | |

| cost $7,011,032) ‡ † (F) | 2,235,708 | 10,060,686 |

| Refractec Ser. D, zero % cv. pfd. (Private) (acquired various | | |

| dates from 8/16/02 through 6/30/03, cost $4,999,998) ‡ † § (F) | 833,333 | 4,108,332 |

| Restore Medical Ser. C, zero % cv. pfd. (Private) (acquired 1/28/04, | | |

| cost $3,009,673) ‡ † § (F) | 1,145,039 | 5,816,798 |

|

|

| Total convertible preferred stocks (cost $20,029,977) | $29,985,805 |

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 13

The fund’s portfolio

| Short-term investments (7.8%)* (cost $5,635,000) | |

| | |

| | PRINCIPAL AMOUNT | VALUE |

|

| |

| Repurchase agreement dated April 28, 2006 with | | |

| Bank of America due May 1, 2006 with respect to | | |

| various U.S. Government obligations — maturity | | |

| value of $5,637,235 for an effective yield of 4.76% | | |

| (collateralized by Fannie Mae 5.25% due 10/30/07 | | |

| valued at $5,637,413) | $5,635,000 | $ 5,635,000 |

|

| |

| Total investments (cost $58,598,158) | | $75,381,512 |

|

* Percentages indicated are based on net assets of $72,486,452.

† Non-income-producing security.

‡ Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at April 30, 2006 was $29,985,805 or 41.4% of net assets.

§ Affiliated Companies (Note 4).

(R) Real Estate Investment Trust.

(F) Security is valued at fair value following procedures approved by the Trustees (Note 1).

At April 30, 2006, liquid assets totaling $98,488 have been designated as collateral for open written option contracts.

ADR after the name of a foreign holding stands for American Depository Receipts, representing ownership of foreign securities on deposit with a custodian bank.

The accompanying notes are an integral part of these financial statements.

| Written options outstanding at April 30, 2006 | | | |

| (premiums received $1,763) (Unaudited) | | | |

| | | |

| | CONTRACT | EXPIRATION DATE/ | |

| | AMOUNT | STRIKE PRICE | VALUE |

|

| Agnico-Eagle Mines, Ltd.(Canada) (Put) | 1,240 | May | 06/32.40 | $ 521 |

| Goldcorp, Inc. (Canada) (Put) | 850 | May | 06/30.98 | 358 |

| Steel Dynamics, Inc. (Call) | 482 | May | 06/66.34 | 507 |

|

|

| | | | | $1,386 |

14 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Statement of assets and liabilities

April 30, 2006 (Unaudited)

|

| Assets | |

|

| Investment in securities, at value (Note 1) | |

|

| Unaffiliated issuers (identified cost $50,588,487) | $65,456,382 |

|

| Affiliated issuers (identified cost $8,009,671) (Note 4) | 9,925,130 |

|

| Cash | 320 |

|

| Dividends receivable | 8,068 |

|

| Receivable for securities sold | 837,573 |

|

| Total assets | 76,227,473 |

|

| |

| Liabilities | |

|

| Payable for securities purchased | 1,428,814 |

|

| Payable for shareholder servicing fee (Note 2) | 14,202 |

|

| Payable for compensation of Manager (Note 2) | 123,071 |

|

| Payable for incentive fee (Note 2) | 2,087,166 |

|

| Payable for investor servicing and custodian fees (Note 2) | 27,475 |

|

| Payable for administrative services (Note 2) | 5,623 |

|

| Written options outstanding, at value (premiums received $1,763) (Note 1) | 1,386 |

|

| Other accrued expenses | 53,284 |

|

| Total liabilities | 3,741,021 |

|

| Net assets | $72,486,452 |

|

| |

| Represented by | |

|

| Paid-in capital (10,000,000 unlimited shares authorized) (Note 1) | $53,052,409 |

|

| Distributions in excess of net investment income (Note 1) | (1,428,090) |

|

| Accumulated net realized gain on investments (Note 1) | 4,078,402 |

|

| Net unrealized appreciation of investments | 16,783,731 |

|

| Total — Representing net assets applicable to capital shares outstanding | $72,486,452 |

|

| |

| Computation of net asset value | |

|

| Net asset value and redemption price per common share | |

| ($72,486,452 divided by 2,491,701 shares) | $29.09 |

|

| Offering price per common share (100/95.75 of $29.09)* | $30.38 |

|

| *On single retail shares of less than $500,000. On sales of $500,000 or more, the offering price is reduced. | |

| The accompanying notes are an integral part of these financial statements. | |

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 15

| Statement of operations | |

| |

| Six months ended April 30, 2006 (Unaudited) | |

|

| |

| Investment income: | |

|

| Dividends (net of foreign tax of $127) | $238,326 |

|

| Interest | 68,939 |

|

| Total investment income | 307,265 |

|

| |

| Expenses: | |

|

| Compensation of Manager (Note 2) | 401,044 |

|

| Incentive fee (Note 2) | 1,117,488 |

|

| Investor servicing fees (Note 2) | 11,731 |

|

| Custodian fees (Note 2) | 36,424 |

|

| Trustee compensation and expenses (Note 2) | 37,500 |

|

| Administrative services (Note 2) | 33,361 |

|

| Shareholder servicing fees (Note 2) | 74,975 |

|

| Other | 65,851 |

|

| Fees waived and reimbursed by Manager (Note 2) | (43,019) |

|

| Net expenses | 1,735,355 |

|

| Net investment loss | (1,428,090) |

|

| Net realized gain on investments (Notes 1 and 3) | 4,313,293 |

|

| Net realized gain on written options (Notes 1 and 3) | 4,531 |

|

| Net unrealized appreciation of investments | |

| and written options during the period | 8,455,236 |

|

| Net gain on investments | 12,773,060 |

|

| Net increase in net assets resulting from operations | $11,344,970 |

|

| The accompanying notes are an integral part of these financial statements. | |

16 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

| Statement of changes in net assets | |

| |

| | Six months ended | Year ended |

| | April 30 | October 31 |

| | 2006* | 2005 |

|

| |

| Increase (decrease) in net assets | | |

|

| Operations: | | |

|

| Net investment loss | $(1,428,090) | $(899,232) |

|

| Net realized gain on investments | 4,317,824 | 8,611,449 |

|

| Net unrealized appreciation (depreciation) of investments | 8,455,236 | (2,724,770) |

|

| Net increase in net assets resulting from operations | 11,344,970 | 4,987,447 |

|

| Distributions to shareholders: (Note 1) | | |

|

| From net realized long-term gain on investments | (4,811,953) | (1,368,623) |

|

| From net realized short-term gain on investments | (2,882,477) | — |

|

| |

| Capital share transactions: | | |

|

| Proceeds from shares issued | — | 1,200,930 |

|

| Reinvestments in connection with distributions | 6,976,410 | 995,905 |

|

| Cost of shares repurchased (Note 5) | (6,000,606) | (15,497,419) |

|

| Increase (decrease) from capital share transactions | 975,804 | (13,300,584) |

|

| Total increase (decrease) in net assets | 4,626,344 | (9,681,760) |

|

| |

| Net assets | | |

|

| Beginning of period | 67,860,108 | 77,541,868 |

|

| End of period | $72,486,452 | $67,860,108 |

|

| |

| Number of fund shares | | |

|

| Shares outstanding at beginning of period | 2,438,393 | 2,921,173 |

|

| Shares issued | — | 43,758 |

|

| Shares reinvested | 275,529 | 36,790 |

|

| Shares repurchased (Note 5) | (222,221) | (563,328) |

|

| Shares outstanding at end of period | 2,491,701 | 2,438,393 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 17

| Statement of cash flows | |

| |

| For the period ended April 30, 2006 (Unaudited) | |

|

| |

| Decrease in cash | |

|

| Cash flows from operating activities: | |

|

| Net increase in net assets from operations | $ 11,344,970 |

|

| Adjustments to reconcile net decrease in net assets | |

| from operations to net cash provided by operating activities: | |

|

| Purchase of investment securities | (20,217,639) |

|

| Proceeds from disposition of investment securities | 30,708,152 |

|

| Purchase of short-term investment securities, net | (3,297,000) |

|

| Increase in dividends receivable | (4,374) |

|

| Decrease in payable for shareholder servicing fees | (38,165) |

|

| Decrease in payable for compensation of Manager | (94,896) |

|

| Increase in payable for incentive fee | 1,117,488 |

|

| Increase in payable for investor servicing and custodian fees | 11,624 |

|

| Net premiums received on written options | 749 |

|

| Decrease in payable for administration services | (5,776) |

|

| Decrease in other accrued expenses | (38,200) |

|

| Net realized gain on investments | (4,313,293) |

|

| Net unrealized appreciation on investments during the period | (8,455,236) |

|

| Net cash provided by operating and investing activities | 6,718,404 |

|

| Cash flows from financing activities: | |

|

| Payment of shares redeemed | (6,000,606) |

|

| Cash distribution to shareholders paid | (718,020) |

|

| Net cash used in financing activities | (6,718,626) |

|

| Net decrease in cash | (222) |

|

| Cash balance, beginning of period | 542 |

|

| Cash balance, end of period | $320 |

|

| The accompanying notes are an integral part of these financial statements. | |

18 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

| Financial highlights | | | | | |

| |

| (For a common share outstanding throughout the period) | | | | |

| | Six months ended | | | | | For the period |

| | | April 30 | | | | | July 30, 2001† |

| Per-share | | (Unaudited) | | Year ended October 31 | | to October 31 |

| operating performance | | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|

| Net asset value, | | | | | | | |

| beginning of period | | $27.83 | $26.54 | $25.32 | $18.91 | $22.44 | $23.88 |

|

| Investment operations: | | | | | | | |

|

| Net investment income (loss) (a,b) | (.57) | (.34)(f) | (.59) | (.45) | (.38) | —(e) |

|

| Net realized and unrealized | | | | | | | |

| gain (loss) on investments | | 5.11 | 2.13 | 1.81 | 6.86 | (3.11) | (1.44) |

|

| Total from investment operations | 4.54 | 1.79 | 1.22 | 6.41 | (3.49) | (1.44) |

|

| Less distributions: | | | | | | | |

|

| From net investment income | | — | — | — | — | (.04) | — |

|

| From net realized gain | | | | | | | |

| on investments | | (3.28) | (.50) | — | — | — | — |

|

| From return of capital | | — | — | — | — | —(e) | — |

|

| Total distributions | | (3.28) | (.50) | — | — | (.04) | — |

|

| Net asset value, | | | | | | | |

| end of period | | $29.09 | $27.83 | $26.54 | $25.32 | $18.91 | $22.44 |

|

| Total return at net asset value | | | | | | |

| after incentive fee (%)(c) | | 18.06* | 6.78 | 4.82 | 33.90 | (15.61) | (6.03)* |

|

| Total return at net asset value | | | | | | |

| before incentive fee (%)(c) | | 19.59* | 7.07 | 5.53 | 34.43 | (15.61) | (6.03)* |

|

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in thousands) | | $72,486 | $67,860 | $77,542 | $90,020 | $73,682 | $85,908 |

|

| Ratio of expenses to average net | | | | | | |

| assets after incentive fee (%)(b,d) | 2.58* | 2.00 | 2.49 | 2.30 | 2.21 | .58* |

|

| Ratio of expenses to average net | | | | | | |

| assets before incentive fee (%)(b,d) | .92* | 1.85 | 1.85 | 1.85 | 2.21 | .58* |

|

| Ratio of net investment loss to average | | | | | |

| net assets after incentive fee (%)(b) | (2.12)* | (1.23)(f) | (2.30) | (2.17) | (1.76) | —* |

|

| Portfolio turnover rate (%) | | 32.31* | 103.14 | 100.29 | 93.90 | 102.88 | 11.20* |

|

† Commencement of operations.

* Not annualized.

(a) Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

(b) Reflects an expense limitation in effect during the period (Note 2). As a result of such limitation, expenses of the fund for the periods ended April 30, 2006, October 31, 2005, October 31, 2004, October 31, 2003, October 31, 2002 and October 31, 2001 reflect a reduction of 0.06%, 0.19%, 0.15%, 0.10%, 0.07%, and 0.04%, respectively, based on average net assets.

(c) Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

(d) Includes amounts paid through expense offset arrangements (Note 2).

(e) Amount represents less than $0.01 per share.

(f) Reflects a non-recurring accrual related to Putnam Investment Management, LLC’s settlement with the SEC regarding brokerage allocation practices, which amounted to less than $0.01 per share and 0.02% of average net assets.

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 19

Notes to financial statements

April 30, 2006 (Unaudited)

Note 1 Significant accounting policies

TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”), is a series of TH Lee, Putnam Investment Trust (the “trust”) which is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. The objective of the fund is to seek long-term capital appreciation by investing at least 80% of its total assets in publicly traded growth stocks and privately issued venture capital investments. The fund may invest up to 50% of its portfolio in private equity investments as well as up to 5% of its assets in private equity funds.

The fund offers its shares at net asset value plus a maximum front-end sales charge of 4.25% . The fund provides a limited degree of liquidity to its shareholders by conducting quarterly repurchase offers. In each repurchase offer, the fund intends to repurchase 5% of its outstanding shares at their net asset value. The fund may also, at any time, conduct additional sales of its shares to qualified clients, as defined in the Investment Advisers Act of 1940 as amended. On January 26, 2005 the Trustees closed the fund to any new sales (except through dividend reinvestments) of shares. The Trustees may consider reopening the fund to new sales of shares if current conditions change.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation

Investments for which market quotations are readily available are stated at the last reported sales price on their principal exchange, or official closing price for certain markets. If no sales are reported — as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price. Market quotations are not considered to be readily available for private equity securities: such investments are initially valued at cost and then stated at fair value following procedures approved by the Trustees. As part of those procedures, TH Lee, Putnam Capital Management, LLC (the “Manager “), a subsidiary of TH Lee, Putnam Capital, L.P. (a joint venture of Putnam Investment Holdings, LLC, which in turn is an indirect subsidiary of Putnam LLC (“Putnam”) and Thomas H. Lee Partners, LP) will monitor each fair valued security on a daily basis and will adjust its value, as

20 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

necessary, based on such factors as the financial and/or operating results, the general developments in the issuer’s business including products and services offered, management changes, changes in contracts with customers, issues relating to financing, the likelihood of a public offering, the liquidity of the security, any legal or contractual restrictions, the value of an unrestricted related public security and other analytical data. Restricted securities of the same class as publicly traded securities will be valued at a discount from the public market price reflecting the nature and extent of the restriction. Securities fair valued at April 30, 2006 represented 41.4% of the fund’s net assets. Fair value prices may differ materially from the value that would be realized if the fair-valued securities were sold. Securities quoted in foreign currencies are translated into U.S. dollars at the current exchange rate. For foreign investments, if trading or events occurring in other markets after the close of the principal exchange in which the securities are traded are expected to materially affect the value of the investments, then those investments are valued, taking into consideration these events, at their fair value. Short-term investments having remaining maturities of 60 days or less are stated at amortized cost, which approximates fair value.

B) Security transactions and related investment income

Security transactions are recorded on the trade date (date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis. Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital, if any, are reflected as a reduction of cost when the amount is conclusively determined.

C) Repurchase agreements

The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. The Manager is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest.

D) Futures and options contracts

The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase, or for other investment purposes. The fund may also write options on swaps or securities it owns or in which it may invest to increase its current returns.

The potential risk to the fund is that the change in value of futures and options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 21

changes in the value of the underlying instruments, if there is an illiquid secondary market for the contracts, or if the counterparty to the contract is unable to perform. Risks may exceed amounts recognized on the statement of assets and liabilities. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses on purchased options are included in realized gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a reduction to the cost of investments.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. The fund and the broker agree to exchange an amount of cash equal to the daily fluctuation in the value of the futures contract. Such receipts or payments are known as “variation margin.” Exchange traded options are valued at the last sale price, or if no sales are reported, the last bid price for purchased options and the last ask price for written options. Options traded over-the-counter are valued using prices supplied by dealers. Futures and written option contracts outstanding at period end, if any, are listed after the fund’s portfolio.

E) Federal taxes

It is the policy of the fund to distribute all of its taxable income within the prescribed time and otherwise comply with the provisions of the Internal Revenue Code of 1986 (the “Code”) applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code, as amended. Therefore, no provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains.

The aggregate identified cost on a tax basis is $58,622,302, resulting in gross unrealized appreciation and depreciation of $18,270,918 and $1,511,708, respectively, or net unrealized appreciation of $16,759,210.

F) Distributions to shareholders

Distributions to shareholders from net investment income are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

22 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

G) Deal related costs

Deal related costs are comprised primarily of legal and consulting costs incurred in connection with private equity investment transactions of the fund, whether or not consummated. Deal related costs that are attributable to existing private equity securities are added to the cost basis of the investments. All other deal related costs are expensed as incurred.

H) Statement of cash flows

The cash amount shown in the Statement of cash flows is the amount reported as cash in the fund’s Statement of assets and liabilities and represents cash on hand at its custodian and does not include any short-term investments at April 30, 2006.

Note 2 Management fee, administrative services and other transactions

The fund has entered into a Management Contract with the Manager. As compensation for the services rendered and expenses borne by the Manager, the fund pays the Manager a fee at an annual rate of 1.20% of the average daily net assets of the fund, computed daily and payable monthly.

In addition, the fund will accrue daily a liability for incentive fees payable equal to 20% of the realized and unrealized gains less realized and unrealized losses on investments that were originally purchased by the fund in private equity transactions. The fund will not accrue an incentive fee unless all realized and unrealized losses from prior periods have been offset by realized (and, where applicable unrealized) gains. The fund will pay annually, on December 31, to the Manager a fee equal to 20% of the aggregate incentive fee base, calculated from the commencement of the fund’s operations, less the cumulative amount of the incentive fee paid to the Manager in previous periods. The incentive fee base for a private equity security equals realized gains less realized and unrealized losses until the issuer of the security has completed an initial public offering and any applicable lockup period has expired and, thereafter, equals realized and unrealized gains less realized and unrealized losses. In the case of private equity funds, the incentive fee base equals the sum of all amounts that are actually distributed to the fund less realized and unrealized losses. The fund does not pay any incentive fee on a private equity holding until the fund sells the holding or the holding becomes freely sellable, although the fund will continue to accrue a liability with respect to additional unrealized gains for such security. At April 30, 2006, incentive fees totaling $2,087,166 have been accrued based on the aggregate incentive fee base, of which $1,117,488 was accrued for the six months ended April 30, 2006.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 23

The Manager has agreed to limit its compensation (and, to the extent necessary, bear other expenses) through October 31, 2006, to the extent that expenses of the fund (exclusive of the incentive fee, interest expense on any borrowings, offering costs and any extraordinary expenses) exceed an annual rate of 1.85% of its average daily net assets.

The fund has entered into an Administrative Services Contract with Putnam Fiduciary Trust Company (“PFTC”), an affiliate of the Manager, to provide administrative services, including fund accounting and the pricing of the fund shares. As compensation for the services, the fund pays PFTC a fee at an annual rate of 0.10% of the average daily net assets of the fund, computed daily and payable monthly.

Custodial functions for the fund’s assets are provided by PFTC, a subsidiary of Putnam, LLC. PFTC receives fees for custody services based on the fund’s asset level, the number of its security holdings and transaction volumes. Putnam Investor Services, a division of PFTC, provides investor servicing agent functions to the fund. Putnam Investor Services receives fees for investor servicing based on the number of shareholder accounts. For the six months ended April 30, 2006, the fund paid PFTC $48,155 for these services.

The fund has entered into an arrangement with PFTC whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the fund’s expenses. For the six months ended April 30, 2006, there was no reduction to the fund’s expenses under these arrangements.

Each independent Trustee of the trust receives an annual Trustee fee of $25,000. Trustees receive additional fees for attendance at certain committee meetings.

The fund intends to pay compensation to selected brokers and dealers that are not affiliated with the fund, the Manager or Putnam, that hold shares for their customers in accordance with the shareholder servicing agreements between the fund and the brokers and dealers. The shareholder servicing fee is accrued daily and payable quarterly at an annual rate of 0.25% of the average daily net assets attributable to outstanding shares beneficially owned by customers of the brokers and dealers.

For the six months ended April 30, 2006, Putnam Retail Management, acting as underwriter received no net commissions from the sale of common shares.

24 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Note 3 Purchases and sales of securities

During the six months ended April 30, 2006, cost of purchases and proceeds from sales of investment securities other than short-term investments aggregated $21,280,593 and $30,932,781, respectively. There were no purchases or sales of U.S. government securities.

| Written option transactions during the period are summarized as follows: | |

|

| | Contract | Premiums |

| | Amounts | Received |

|

| Written options outstanding at | | |

| beginning of period | 1,460 | $1,014 |

|

| Options opened | 9,228 | 5,280 |

| Options exercised | — | — |

| Options expired | (8,116) | (4,531) |

| Options closed | — | — |

|

| Written options outstanding | | |

| at end of period | 2,572 | $1,763 |

|

Note 4 Transactions with affiliated issuers

Transactions during the period with companies in which the fund owned at least 5% of the voting securities were as follows:

| Name of Affiliates | Purchase Cost | Sales Cost | Dividend Income | Fair Value |

|

| Refractec | $— | $— | $— | $4,108,332 |

| |

| Restore Medical | — | — | — | 5,816,798 |

|

| |

| Totals | $— | $— | $— | $9,925,130 |

|

Fair value amounts are shown for issues that are affiliated at period end.

Note 5 Share repurchase

To provide liquidity to the shareholders, the fund has a policy of making offers to repurchase a portion of its shares on a quarterly basis. Repurchases are made in February, May, August and November of each year. Repurchase offers are made for at least 5% (but not more than 25%) of fund shares in any quarter with the approval of the Trustees. If the number of shares tendered for repurchase exceeds the offering limit, or if the Manager in its discretion elects to limit repurchases to 5% of the fund’s

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 25

shares, the fund will repurchase shares on a pro-rata basis, and tendering shareholders will not have all of their tendered shares repurchased by the fund. During the six months ended April 30, 2006, the fund repurchased 222,221 shares valued at $6,000,606.

On February 10, 2006, the fund received actual redemption requests totaling $6,949,737 or 10.07% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 49.64% of the shares the shareholder requested be repurchased.

| | Shares | |

| Date | Repurchased | Amount |

|

| November 2005 | 91,098 | $2,550,756 |

| February 2006 | 131,123 | 3,449,850 |

|

At April 30, 2006, the Manager owned 241,164 shares of the fund (9.7% of shares outstanding) valued at $7,015,461.

Note 6 Regulatory matters and litigation

Putnam Management has entered into agreements with the Securities and Exchange Commission and the Massachusetts Securities Division settling charges connected with excessive short-term trading by Putnam employees and, in the case of the charges brought by the Massachusetts Securities Division, by participants in some Putnam-administered 401(k) plans. Pursuant to these settlement agreements, Putnam Management will pay a total of $193.5 million in penalties and restitution, with $153.5 million being paid to certain open-end funds and their shareholders. The amount will be allocated to shareholders and funds pursuant to a plan developed by an independent consultant, and will be paid following approval of the plan by the SEC and the Massachusetts Securities Division.

The Securities and Exchange Commission’s and Massachusetts Securities Division’s allegations and related matters also serve as the general basis for numerous lawsuits, including purported class action lawsuits filed against Putnam Management and certain related parties, including certain Putnam funds. Putnam Management will bear any costs incurred by Putnam funds in connection with these lawsuits. Putnam Management believes that the likelihood that the pending private lawsuits and purported class action lawsuits will have a material adverse financial impact on the fund is remote, and the pending actions are not likely to materially affect its ability to provide investment management services to its clients, including the Putnam funds.

26 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

IMPORTANT NOTICE REGARDING DELIVERY OF SHAREHOLDER DOCUMENTS

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

PROXY VOTING

TH Lee, Putnam Capital is committed to managing its mutual funds in the best interests of shareholders. The fund’s proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnaminvestments.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the fund’s proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

FUND PORTFOLIO HOLDINGS

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s public reference room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006 27

This page left blank intentionally.

28 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2006

Not FDIC Insured

May Lose Value

No Bank Guarantee

|

Fund information

INVESTMENT MANAGER

TH Lee, Putnam Capital Management, LLC

One Post Office Square

Boston, MA 02109

MARKETING SERVICES

Putnam Retail Management, L.P.

One Post Office Square

Boston, MA 02109

CUSTODIAN

Putnam Fiduciary Trust Company

LEGAL COUNSEL

Sullivan & Cromwell LLP

TRUSTEES

John A. Hill

Chairman

Joseph L. Bower

Stephen B. Kay

OFFICERS

Linwood E. Bradford

President and Principal Executive Officer

Steven D. Krichmar

Vice President and Principal Financial Officer

Michael T. Healy

Vice President and Principal Accounting Officer

James F. Clark

Vice President and Assistant Clerk

Amrit Kanwal

Vice President and Treasurer

Karen R. Kay

Vice President and Assistant Clerk

Francis J. McNamara, III

Vice President, Chief Legal Officer and Clerk

Robert R. Leveille

Vice President and Assistant Clerk

James P. Pappas

Vice President

Charles A. Ruys de Perez

Vice President and Chief Compliance Officer

|

TH Lee Putnam Capital

One Post Office Square

Boston, Massachusetts 02109

|

TH601 234361 6/06

Item 2. Code of Ethics:

Not Applicable

Item 3. Audit Committee Financial Expert:

Not Applicable

Item 4. Principal Accountant Fees and Services:

Not Applicable

Item 5. Audit Committee

Not Applicable

Item 6. Schedule of Investments:

The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above.

Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment

Companies:

|

Not Applicable

Item 8. Portfolio Managers of Closed-End Management Investment Companies

(a) Not Applicable

(b) Not Applicable

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated

Purchasers

|

| Registrant Purchase of Equity Securities | | | |

| | | | | Maximum |

| | | | Total Number | Number (or |

| | | | of Shares | Approximate |

| | | | Purchased | Dollar Value) of |

| | | | as Part of | Shares that |

| | | | Publicly | May Yet Be |

| | Total Number | Average | Announced | Purchased |

| | of Shares | Price Paid | Plans or | under the Plans |

| Period | Purchased | per Share | Programs | or Programs |

| |

| August 13, 2005 through | | | | |

| November 11, 2005 | 91,098 | $28.00 | 91,098 | -- |

| |

| November 12, 2005 through | | | | |

| February 10, 2006 | 131,123 | $26.31 | 131,123 | -- |

The fund has a policy of making offers to repurchase a portion of its shares on a quarterly basis. Repurchase offers are made for at least 5% (but not more than 25%) of its shares in any quarter with the approval of the Trustees. If the number of shares tendered for repurchase exceeds the offering limit, and if the Manager in its discretion elects to limit repurchases to 5% of the fund's shares, the fund will repurchase shares on a pro-rata basis, and tendering shareholders will not have all of their tendered shares repurchased by the fund.

On February 10, 2006, the fund received actual redemption requests totaling $6,949,737 or 10.07% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 49.6%, of the shares the shareholder requested be repurchased.

| | Date Plan | Expiration |

| | Announced | Date |

| August 13, 2005 through | | |

| November 11, 2005 | October 11, 2005 | November 11, 2005 |

| | |

| November 12, 2005 through | January 13, 2006 | February 10, 2006 |

| February 10, 2006 | | |

Item 10. Submission of Matters to a Vote of Security Holders:

Not applicable

Item 11. Controls and Procedures:

(a) The registrant's principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission's rules and forms. In reaching this conclusion, the registrant’s certifying officers took into account the procedural enhancements described in Item 11(b) below.

(b) Changes in internal control over financial reporting: During the registrant’s last fiscal quarter, as a result of a regular compliance review, the registrant enhanced the procedures by which the registrant documents the basis on which each purchaser of the registrant’s shares is determined to be an eligible purchaser and has conducted a review of the basis on which each past purchaser of the registrant’s shares has been determined to be an eligible purchaser. These enhanced procedures and this review are designed to support the continuing appropriateness of the registrant’s recorded liability in respect of incentive fees payable to the registrant’s investment adviser pursuant to the registrant’s management contract.

Item 12. Exhibits:

(a)(1) Not Applicable