UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811-10373)

Exact name of registrant as specified in charter: TH Lee, Putnam Investment Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Charles A. Ruys de Perez, Vice President and |

| | Chief Compliance Officer |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John E. Baumgardner, Esq. |

| | Sullivan & Cromwell LLP |

| | 125 Broad Street |

| | New York, New York 10004-2498 |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: October 31, 2006

Date of reporting period: November 1, 2005— October 31, 2006

Annual Report

For the year ended October 31, 2006

TH Lee, Putnam Emerging Opportunities Portfolio

About the fund and TH Lee, Putnam Capital LLC

TH Lee, Putnam Emerging Opportunities Portfolio (“the fund”) is a closed-end interval fund. This innovative fund pursues aggressive growth by combining investments in publicly traded stocks and privately held companies in a closed-end format. With this special structure, the fund can tap into companies with the best growth potential while maintaining diversification across public and private markets.

The fund is sponsored by an affiliate of TH Lee, Putnam Capital LLC, which is a joint venture of Putnam Investments (“Putnam”) and Thomas H. Lee Partners LP (“TH Lee”). This venture was founded in 1999 to offer alternative investment products to individual investors who have historically lacked access to the private-equity marketplace. Thomas H. Lee Partners LP, founded in 1974, is one of the oldest and most successful private-equity investment firms in the United States. The firm’s investment strategy targets growth companies with competitive advantages in expanding or consolidating industries. Putnam Investments, founded in 1937, is one of the world’s largest mutual fund companies and a leader in investment research and portfolio management through disciplined teamwork.

The fund’s public-equity portfolio is managed by members of Putnam’s Small and Emerging Growth Team — Richard Weed, Managing Director, and Raymond Haddad, Senior Vice President. This team analyzes small- and mid-capitalization growth stocks. Frederick Wynn, Managing Director, is responsible for managing the fund’s private-equity investments.

The fund’s management structure also includes an Investment Committee consisting of senior Putnam and TH Lee investment professionals. The Investment Committee consults with the management team and gives final approval to the structure of all private-equity deals.

Report from Fund Management

Performance commentary

We are pleased to report that TH Lee, Putnam Emerging Opportunities Portfolio delivered a positive return at net asset value during its fiscal year ended October 31, 2006. The portfolio valuation rose based on appreciation of both public equities and venture capital investments. Two of the venture capital investments held in the portfolio made initial public offerings (IPOs) during the period: Restore Medical completed its IPO in May and CommVault Systems completed its IPO in September. Also, shortly after the end of the fiscal period, during November, another venture capital holding, Capella Education, completed its IPO. With regard to the fund’s public securities portfolio, stock selection contributed positively to performance. Strong contributors to performance included stocks in the technology and consumer cyclicals sectors. For the one-year period, the fund underperformed its benchmark, the Russell 2500 Growth Index, primarily due to poor performance of ce rtain health-care stocks. Since its inception in 2001, the portfolio has returned 34.14% at net asset value (NAV, or without sales charges).

| RETURN FOR PERIODS ENDED OCTOBER 31, 2006 | | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP* | Growth Index |

|

| 1 year | 12.86% | 8.05% | 15.56% |

|

| 3 years | 26.32 | 20.97 | 39.61 |

|

| Annual average | 8.10 | 6.55 | 11.76 |

|

| 5 years | 42.74 | 36.65 | 60.38 |

|

| Annual average | 7.38 | 6.44 | 9.91 |

|

| Life of fund (since inception 7/30/01) | 34.14 | 28.44 | 37.98 |

|

| Annual average | 5.74 | 4.87 | 6.31 |

|

| |

| |

| RETURN FOR PERIODS ENDED SEPTEMBER 30, 2006 (most recent quarter) | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP* | Growth Index |

|

| 1 year | 14.94% | 10.05% | 6.53% |

|

| 3 years | 39.95 | 34.03 | 43.99 |

|

| Annual average | 11.86 | 10.26 | 12.92 |

|

| 5 years | 51.93 | 45.48 | 67.92 |

|

| Annual average | 8.72 | 7.79 | 10.92 |

|

| Life of fund (since inception 7/30/01) | 39.39 | 33.47 | 31.50 |

|

| Annual average | 6.63 | 5.74 | 5.43 |

|

Past performance does not indicate future results. Performance assumes reinvestment of distributions and does not account for taxes. More recent returns may be less or more than those shown. Investment returns will fluctuate, and you may have a gain or a loss when you sell your shares. The Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation. Indexes are not available for direct investment. For a portion of the period, this fund limited expenses, without which returns would have been lower.

*Returns at public offering price (POP) reflect the highest applicable sales charge of 4.25% assessed at the beginning of the relevant period. Sales charges differ with the original purchase amount. The fund is currently closed to new investments.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

1

Market overview

Overall, equity markets advanced during the past year, propelled by a growing economy and high levels of corporate profits. Beginning in May, investor concerns about rising inflation, sustained high energy prices, and signs of a weakening housing market sparked a setback in the stock market, and the summer’s military conflict in Lebanon also had a negative impact on equity prices. However, starting in August, energy prices began to fall and in subsequent months, the equity markets recovered.

The United States economy experienced a transition to a somewhat slower rate of growth during the fiscal year. The Federal Reserve’s series of 17 interest-rate increases since 2004 slowed the U.S. housing market as sales of new and existing homes fell from the record levels reached during calendar year 2005. The home construction industry is now contracting. However, the rate increases had a positive impact as well; the drop in the rate of economic growth undercut inflationary pressures, and in recent months the Fed refrained from additional interest-rate increases. Equity markets have responded positively to economic conditions at the close of the period, as corporate profit margins remain strong.

Strategy overview

The fund’s approach to selecting publicly traded stocks relies on a combination of fundamental and quantitative analytical tools to research U.S. mid- and small-cap companies. Our goal is to try to identify those companies likely to achieve consistently high rates of sales and earnings growth. We rigorously evaluate the entire universe of stocks to identify those with the most attractive capital appreciation potential relative to their risk, and we rely on our proprietary research to understand each company’s competitive advantages. We try to generate superior performance through stock selection because we believe that our research process can uncover securities with significant appreciation potential. Typically, the portfolio team does not take major sector risks, and the public-equity portfolio’s sector weightings are generally in line with those of its benchmark.

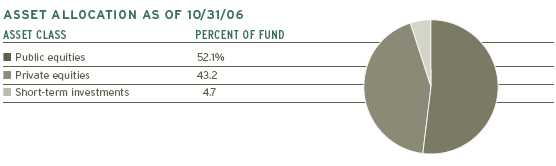

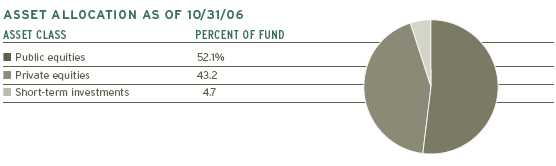

Weightings are shown as a percentage of investments. Holdings will vary over time. The private-equities weighting represents positions in companies that were originally private-equity investments and are still considered such because of trading restrictions, though several have made public offerings of stock.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

2

With regard to private equities, we currently do not intend to add new private-equity investments to the portfolio. However, we may decide to make additional investments in a company that is already among the fund’s private-equity holdings if we believe this action would be in the best interest of shareholders. Your fund’s management team and Trustees want to maintain the fund’s diversification among various asset classes, which we consider to be a key risk management tool and one of the fund’s distinctive characteristics. Asset diversification also contributes to maintaining appropriate fund liquidity. With the completion of an IPO by portfolio holding Capella Education in November, the portfolio had only one remaining pure private-equity holding, which represented approximately 1.9% of overall assets. (Two of the fund’s formerly private positions are still subject to lock-up agreements resulting from the companies’ initial public offerings, and are restricted from sale as a result.)

How fund holdings affected performance

As mentioned earlier, Restore Medical and CommVault Systems had an impact on the fund’s results during the past year. Restore Medical’s IPO priced at $8.00 per share, which was significantly higher than the fund’s adjusted per-share cost basis in the investment when it was purchased in early 2004. CommVault’s IPO priced at $14.50 per share, which was at the high end of its filed IPO price range. CommVault rose higher in subsequent market trading and had a positive effect on results in the period, though Restore’s price declined late in the period when the company reduced its sales outlook for 2007.

As you may recall, Restore is a medical device manufacturer offering FDA-approved products to treat problematic snoring and sleep disordered breathing, frequently referred to as obstructive sleep apnea (OSA). During the period, the company announced that a clinical medical study had shown that 81% of patients who used its Pillar Procedure, designed to help alleviate sleep apnea, had found it effective. The Pillar Procedure also earned Restore Medical recognition as the 2005 Manufacturer of the Year by Medical Device & Diagnostic Industry, a monthly magazine that covers the medical device manufacturing industry.

During the period, CommVault received the highest possible rating, “Strong Positive,” with regard to its technical leadership in data management software, in Gartner’s MarketScope for Enterprise Backup/Recovery Software, 2006 report. The stock finished the fiscal year at a price of approximately $18 per share, significantly higher than the fund’s adjusted purchase prices in 2002 and 2003.

| TOP SECTOR WEIGHTINGS AS OF 10/31/06 (includes both public and private equity) |

|

| Technology | 35.3% |

|

| Health care | 16.7 |

|

| Consumer staples | 15.8 |

|

| Consumer cyclicals | 9.5 |

|

| Finance | 9.4 |

|

| Weightings are shown as a percentage of net assets. Holdings will vary over time. |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

3

| TOP 10 HOLDINGS (includes public and private companies) | INDUSTRY |

|

| CommVault Systems, Inc. | Software |

|

| Capella Education Co. | Schools |

|

| Spirit Finance Corp. | Real estate |

|

| Restore Medical, Inc. | Medical technology |

|

| Refractec | Medical technology |

|

| OfficeMax, Inc. | Retail |

|

| Domino’s Pizza, Inc. | Restaurants |

|

| CB Richard Ellis Group, Inc. | Real estate |

|

| C.R. Bard, Inc. | Medical technology |

|

| Amphenol Corp. | Electronics |

|

These holdings represent 53.8% of the fund's net assets as of 10/31/06. Portfolio holdings will vary over time.

As of October 31, 2006, Refractec and Capella Education remained venture capital investments, but Capella completed a successful IPO in November, after the period ended. The offering was priced at $20 per share, above the IPO price range of $17.50 to $19.50. The stock subsequently appreciated in market trading. The offering also triggered a special dividend from Capella to the fund in which the fund realized a cash distribution of $6.19 per share, or approximately $2,800,000. (This distribution represents a capital return of greater than 50% of our original investment in Capella.) Capella is an online university that offers undergraduate and graduate degree programs, and currently has more than 13,000 enrolled students.

Refractec is a medical device company that develops and provides solutions for correcting nearsighted vision problems, such as reading glasses, typically associated with age. During the period, the company experienced a key managerial change, as the Chief Operating Officer was named to the position of Chief Executive Officer (CEO), upon the retirement of the former CEO. We have reduced the carrying value on this position during the period, which had an adverse impact on results.

A number of the portfolio’s public-equity holdings also contributed to performance. Several top contributors were clustered in industrial supply industries and benefited from an increase in corporate spending. General Cable Corporation more than doubled in value over the past year, and was one of the fund’s top-performing holdings. It makes wires and cables for electrical power transmission, industrial manufacturing, and voice and data applications. Amphenol, which makes electrical, electronic, and fiber optic connectors, as well as coaxial and flat-ribbon cable, was another overweight position relative to the benchmark and a major contributor to the fund’s results. The company recently announced that it has raised its revenue expectations for the coming year and is extending its share repurchase program.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

4

Weak performance of certain securities in the health-care sector had an adverse impact on performance. Barr Pharmaceuticals’ recent earnings were depressed because of the expenses associated with its acquisition of a European drug company, Pliva, after a costly bidding war. Sierra Health Services, an HMO operating in Western states, reported higher earnings recently but lowered its earnings growth outlook, causing the stock price to decline. We continue to own both stocks because we favor their prospects for capital appreciation given their current valuations.

Please note that all holdings discussed in this report may not have been held by the fund for the entire period discussed, are subject to review in accordance with the fund’s investment strategy, and may vary in the future.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

5

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

The portfolio remains positioned in what we consider to be a diverse array of attractive aggressive growth opportunities. We continue to actively manage the public-equity holdings with an investment process that selects stocks with a combination of fundamental and quantitative methods. Four companies — Spirit Finance, Restore Medical, CommVault Systems, and Capella Education — that have made the transition from the venture-capital stage to being publicly held entities remain in the portfolio. We believe that these companies continue to offer attractive investment potential to the fund. In our view, the portfolio is well positioned to pursue capital appreciation from aggressive growth investments.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

6

Trustee approval of management contract

General conclusions

The Board of Trustees of your fund oversees the management of the fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with TH Lee, Putnam Capital Management, LLC. In this regard, the Board of Trustees requests and evaluates all information it deems reasonably necessary under the circumstances. On June 12, 2006, the Board of Trustees met to consider the information provided by the Manager and other information developed with the assistance of the Board’s independent counsel. Upon completion of this review, the Board of Trustees, following a vote by the Independent Trustees (those Trustees who are not “interested persons,” as defined in the Investment Company Act, of your fund or the Manager), approved the continuance of your fund’s management contract, effective July 27, 2006.

This approval was based on the following conclusions:

• That the fee schedule is, and since the inception of the fund has been, unusual and seeks appropriately to reflect fees charged by Putnam and competitive advisers in respect of the public and private securities portions of the fund’s portfolio, and in particular to reward successful investment decisions through the incentive fee applicable only to the private securities, and

• That the fee schedule currently in effect for your fund, including the base fee and incentive fee components, represents reasonable compensation in light of the nature and quality of the services being provided to the fund and the costs incurred by the Manager in providing such services.

These conclusions were based on a careful consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund are the result of several years of review and discussion between the Trustees and the Manager, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Services provided; investment performance

The quality of the investment process provided by the Manager represented a major factor in the Trustees’ evaluation of the quality of services provided by the Manager under your fund’s management contract. The Trustees concluded that the Manager generally provides a high-quality investment process but also recognize that this does not guarantee favorable investment results for the fund in every time period. The Trustees evaluated the experience and skills of the individuals assigned to the management of your fund’s public equity and private equity investments and the resources made available to such personnel. Recognizing that expertise of portfolio management personnel, particularly for private equity investments, is highly prized among competitive investment advisers, the Trustees have noted favorably the Manager’s commitment to retaining highly qualified

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

7

personnel notwithstanding the relatively small size of the fund and the determination in early 2005 to suspend sales of fund shares.

The Trustees considered the investment performance of your fund over the 1-year and since-inception periods ended March 31, 2006, and considered information comparing the fund’s performance with its benchmark index and with the performance of competitive funds. They also reviewed analysis provided by the Manager regarding the performance of your fund’s current and former private equity investments. Recognizing that the incentive fee component of the fund’s management fee is tied to the performance of these investments, the Trustees noted the amounts your fund has accrued as incentive fees payable to the Manager under your fund’s management contract as a result of appreciation in the value of these investments. They also noted that the Manager had not actually received any incentive fees from the fund to date. The Trustees also reviewed an analysis from the Manager of the costs of the services provided and profits realized by the Manager from the relationship with the fund in 2005.

Competitiveness

The Trustees reviewed comparative fee and expense information for other closed-end funds investing both in public and private equities, and noted that your fund’s management fees were generally lower than those of these funds. The Trustees noted in addition that the Manager has agreed to reimburse the fund to the extent that total fund expenses (exclusive of incentive fees payable under the management contract) exceed 1.85% of average annual assets through October 31, 2007.

The Trustees noted that your fund is the only client of the Manager, and that your fund is unique among all registered investment companies managed by affiliates of the Manager with respect to its investment objective and fee structure. The Trustees also noted generally that in providing services to the fund under the management contract, the Manager is able to a large degree to utilize the resources of Putnam Investments, and that the fund would probably not be able to obtain these services for the same or lower costs if the Manager were not able to leverage its association with a large mutual fund manager.

The Trustees have been satisfied that the fund’s fee structure appropriately mediates the fees charged by Putnam Investments and competitors on portfolios of publicly traded securities and those (including both asset-based fees and incentive fees) charged by managers of private securities. Accordingly, the Trustees did not attribute great weight to a comparative review of fees paid by other funds and institutional accounts whose assets are managed by the Manager’s affiliates.

Economies of scale

The Trustees noted that the fund’s fee structure does not have breakpoints (which lower the net effective fee rate as assets grow), that the Manager is compensated under the incentive fee only if the performance of the fund’s private assets is successful and that, since inception, the fund’s expenses have been limited by the Manager. The Trustees also noted that the fund’s assets as of May 31, 2006, were approximately $65 million and that, because your fund is presently not open to new

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

8

investments, regular quarterly repurchases of five percent of the fund’s shares have diminished the fund’s assets (to the extent they have not been offset by appreciation of the fund’s portfolio holdings). The Trustees expressed their intent to consider whether the current fee arrangements remain appropriate if and when the fund is reopened to new investments and fund assets increase.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that the Manager may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment adviser. This area has been marked by significant change in recent years. The Trustees noted that Putnam has revised its soft-dollar policies to significantly reduce the allocation of client brokerage commissions to purchase third-party research services, and that such allocation continues at a modest level only to acquire research that is not customarily available for cash.

The Trustees’ annual review of your fund’s management contract also included the review of its administrative services contract with the Manager and its distributor’s contract with Putnam Retail Management Limited Partnership (“PRM”) and a report from the Manager on the custodian agreement and investor servicing agreements between the fund and Putnam Fiduciary Trust Company (“PFTC”). PRM and PFTC are affiliates of the Manager. PFTC benefits from the fund’s custodian and investor servicing agreements, and PRM benefits from the fund’s distributor’s contract at times when the fund is open to new investments.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

9

Report of independent registered public accounting firm

To the Trustees of the TH Lee, Putnam Investment Trust and Shareholders of TH Lee, Putnam Emerging Opportunities Portfolio

In our opinion, the accompanying statement of assets and liabilities, including the fund’s portfolio, and the related statements of operations, of changes in net assets and of cash flows and the financial highlights present fairly, in all material respects, the financial position of TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”) at October 31, 2006, and the results of its operations, the changes in its net assets, its cash flows and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at October 31, 2006, by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 18, 2006

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

10

The fund’s portfolio

October 31, 2006

Common stocks (83.1%)*

| | SHARES | | VALUE |

|

| |

| |

| Basic Materials (2.5%) | | | |

|

| |

| Agnico-Eagle Mines, Ltd. (Canada) | 9,700 | $ | 358,609 |

| Cameco Corp. (Canada) | 8,700 | | 305,631 |

| Coeur d’Alene Mines Corp. † | 28,900 | | 141,610 |

| Freeport-McMoRan Copper & Gold, Inc. Class B | 5,200 | | 314,496 |

| Goldcorp, Inc. (Canada) | 6,350 | | 166,878 |

| PAN American Silver Corp. (Canada) † | 6,600 | | 146,256 |

| Steel Dynamics, Inc. | 2,427 | | 145,887 |

|

|

| | | | 1,579,367 |

| |

| Capital Goods (5.3%) | | | |

|

| |

| Alliant Techsystems, Inc. † | 3,300 | | 254,793 |

| Cummins, Inc. | 1,900 | | 241,262 |

| Dover Corp. | 5,300 | | 251,750 |

| Global Imaging Systems, Inc. † | 10,900 | | 237,293 |

| John H. Harland Co. | 6,700 | | 273,963 |

| Lincoln Electric Holdings, Inc. | 5,300 | | 325,897 |

| Mettler-Toledo International, Inc. (Switzerland) † | 3,200 | | 219,680 |

| Parker-Hannifin Corp. | 2,400 | | 200,712 |

| Rofin-Sinar Technologies, Inc. † | 3,700 | | 227,846 |

| Superior Essex, Inc. † | 4,500 | | 168,705 |

| Timken Co. | 9,600 | | 288,480 |

| Wabtec Corp. | 8,800 | | 276,232 |

| WESCO International, Inc. † | 5,000 | | 326,350 |

|

|

| | | | 3,292,963 |

| |

| Consumer Cyclicals (9.5%) | | | |

|

| |

| Advance Auto Parts, Inc. | 6,400 | | 224,128 |

| Barnes & Noble, Inc. | 4,600 | | 190,026 |

| Big Lots, Inc. † | 7,300 | | 153,884 |

| Circuit City Stores-Circuit City Group | 10,300 | | 277,894 |

| Dollar Tree Stores, Inc. † | 6,900 | | 214,521 |

| GateHouse Media, Inc. | 4,350 | | 93,308 |

| Genlyte Group, Inc. (The) † | 3,300 | | 254,958 |

| Golf Galaxy, Inc. † | 1,900 | | 29,488 |

| Harte-Hanks, Inc. | 8,400 | | 212,100 |

| Hearst-Argyle Television, Inc. | 6,400 | | 161,280 |

| infoUSA, Inc. | 2,625 | | 28,849 |

| Jakks Pacific, Inc. † | 10,700 | | 232,083 |

| K2, Inc. † | 13,300 | | 181,678 |

| Maidenform Brands, Inc. † | 10,300 | | 228,145 |

| Manpower, Inc. | 2,800 | | 189,756 |

| Navigant Consulting, Inc. † | 11,000 | | 195,910 |

| OfficeMax, Inc. | 11,300 | | 537,654 |

| Pacific Sunwear of California, Inc. † | 17,900 | | 315,398 |

| Pantry, Inc. (The) † | 3,600 | | 196,488 |

| RadioShack Corp. | 19,000 | | 338,960 |

| Ross Stores, Inc. | 7,600 | | 223,668 |

| Sherwin-Williams Co. (The) | 5,400 | | 319,842 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

11

The fund’s portfolio

Common stocks

| | SHARES | | VALUE |

|

| |

| |

| Consumer Cyclicals (continued) | | | |

|

| |

| Timberland Co. (The) Class A † | 8,100 | $ | 233,685 |

| Tupperware Corp. | 7,600 | | 161,348 |

| Vail Resorts, Inc. † | 5,500 | | 212,575 |

| Whirlpool Corp. | 4,300 | | 373,799 |

| World Wrestling Entertainment, Inc. | 9,324 | | 155,431 |

|

|

| | | | 5,936,856 |

| |

| Consumer Staples (2.6%) | | | |

|

| |

| American Greetings Corp. Class A | 4,423 | | 105,754 |

| Blyth Industries, Inc. | 5,900 | | 141,128 |

| Domino’s Pizza, Inc. | 16,500 | | 448,470 |

| Interline Brands, Inc. † | 8,900 | | 213,066 |

| Jack in the Box, Inc. † | 4,300 | | 241,273 |

| Papa John’s International, Inc. † | 6,500 | | 238,550 |

| Sonic Corp. † | 9,800 | | 222,950 |

|

|

| | | | 1,611,191 |

| |

| Energy (3.1%) | | | |

|

| |

| Cameron International Corp. † | 6,000 | | 300,600 |

| Helix Energy Solutions Group, Inc. † | 6,100 | | 197,030 |

| Hercules Offshore, Inc. † | 4,600 | | 163,852 |

| Noble Energy, Inc. | 4,300 | | 209,109 |

| Patterson-UTI Energy, Inc. | 7,200 | | 167,040 |

| Peabody Energy Corp. | 5,400 | | 226,638 |

| Pride International, Inc. † | 7,200 | | 198,792 |

| Rowan Cos., Inc. | 5,000 | | 166,900 |

| Unit Corp. † | 3,600 | | 167,004 |

| Universal Compression Holdings, Inc. † | 2,700 | | 162,702 |

|

|

| | | | 1,959,667 |

| |

| Financial (3.7%) | | | |

|

| |

| A.G. Edwards, Inc. | 4,300 | | 245,315 |

| Advanta Corp. Class B | 2,100 | | 82,404 |

| Affiliated Managers Group † | 2,500 | | 250,350 |

| American Financial Group, Inc. | 3,200 | | 153,152 |

| Calamos Asset Management, Inc. Class A | 5,000 | | 146,100 |

| CB Richard Ellis Group, Inc. Class A † | 14,100 | | 423,421 |

| Corus Bankshares, Inc. | 9,100 | | 186,823 |

| Cullen/Frost Bankers, Inc. | 3,200 | | 173,312 |

| IntercontinentalExchange, Inc. † | 2,940 | | 248,195 |

| Nuveen Investments, Inc. Class A | 3,880 | | 191,284 |

| Safety Insurance Group, Inc. | 3,800 | | 190,038 |

|

|

| | | | 2,290,394 |

| |

| Health Care (14.9%) | | | |

|

| |

| American Medical Systems Holdings, Inc. † | 10,900 | | 194,129 |

| AmSurg Corp. † | 6,100 | | 128,222 |

| Barr Pharmaceuticals, Inc. † | 6,100 | | 319,457 |

| C.R. Bard, Inc. | 5,100 | | 417,996 |

| Cephalon, Inc. † | 5,500 | | 385,990 |

| Charles River Laboratories International, Inc. † | 5,000 | | 214,600 |

| Community Health Systems, Inc. † | 8,200 | | 266,090 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

12

The fund’s portfolio

Common stocks

| | SHARES | | VALUE |

|

| |

| |

| Health Care (continued) | | | |

|

| |

| Dade Behring Holdings, Inc. | 8,400 | $ | 306,012 |

| DENTSPLY International, Inc. | 9,700 | | 303,416 |

| Edwards Lifesciences Corp. † | 6,300 | | 270,459 |

| Henry Schein, Inc. † | 2,600 | | 129,194 |

| Hologic, Inc. † | 4,000 | | 192,600 |

| Hospira, Inc. † | 8,775 | | 318,971 |

| Immucor, Inc. † | 11,700 | | 322,101 |

| Invitrogen Corp. † | 3,300 | | 191,433 |

| Kinetic Concepts, Inc. † | 9,200 | | 319,792 |

| Laboratory Corp. of America Holdings † | 4,700 | | 321,903 |

| MedImmune, Inc. † | 10,200 | | 326,808 |

| Millipore Corp. † | 3,000 | | 193,590 |

| Mylan Laboratories, Inc. | 9,500 | | 194,750 |

| Pediatrix Medical Group, Inc. † | 5,000 | | 224,650 |

| Restore Medical, Inc. (acquired 1/28/04, | | | |

| cost $3,009,669) ‡ † § (F) (e) | 862,069 | | 2,790,948 |

| Salix Pharmaceuticals, Ltd. † | 16,296 | | 217,226 |

| Sierra Health Services, Inc. † | 8,100 | | 277,344 |

| Waters Corp. † | 7,000 | | 348,600 |

| Watson Pharmaceuticals, Inc. † | 4,900 | | 131,859 |

|

|

| | | | 9,308,140 |

| |

| Real Estate (5.7%) | | | |

|

| |

| Spirit Finance Corp. (R) | 300,000 | | 3,573,000 |

| |

| Technology (35.3%) | | | |

|

| |

| Acme Packet, Inc. † | 4,034 | | 69,385 |

| Aeroflex, Inc. † | 16,700 | | 180,360 |

| Agere Systems, Inc. † | 16,700 | | 283,566 |

| Amphenol Corp. Class A | 6,000 | | 407,400 |

| Autodesk, Inc. † | 4,400 | | 161,700 |

| Avaya, Inc. † | 22,000 | | 281,820 |

| Avnet, Inc. † | 14,000 | | 331,520 |

| Avocent Corp. † | 4,900 | | 179,879 |

| Cadence Design Systems, Inc. † | 15,100 | | 269,686 |

| CommVault Systems, Inc. (acquired various dates from | | | |

| 1/30/02 through 6/20/06, cost $7,011,032) ‡ † (F) | 1,127,926 | | 15,621,775 |

| Covansys Corp. † | 10,095 | | 236,223 |

| CSG Systems International, Inc. † | 13,800 | | 372,324 |

| Electronics for Imaging, Inc. † | 6,800 | | 160,752 |

| Epicor Software Corp. † | 12,700 | | 178,181 |

| Fiserv, Inc. † | 4,700 | | 232,180 |

| General Cable Corp. † | 6,700 | | 251,920 |

| Jack Henry & Associates, Inc. | 10,500 | | 228,795 |

| Jupitermedia Corp. † | 10,900 | | 95,811 |

| Knot, Inc. (The) † | 7,450 | | 178,577 |

| Komag, Inc. † | 3,800 | | 145,350 |

| Lam Research Corp. † | 4,600 | | 227,470 |

| Manhattan Associates, Inc. † | 6,100 | | 180,133 |

| Mentor Graphics Corp. † | 19,900 | | 335,713 |

| ON Semiconductor Corp. † | 34,000 | | 211,480 |

| Rackable Systems, Inc. † | 2,900 | | 89,929 |

| Redback Networks, Inc. † | 10,200 | | 161,364 |

| RF Micro Devices, Inc. † | 41,900 | | 305,870 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

13

The fund’s portfolio

Common stocks

| | | | SHARES | | VALUE |

|

| |

| Technology (continued) | | | | | |

|

| Sybase, Inc. † | | | 12,400 | $ | 301,940 |

| Transaction Systems Architects, Inc. † | | 6,500 | | 219,115 |

| TTM Technologies, Inc. † | | | 6,400 | | 77,760 |

| Tyler Technologies, Inc. † | | | 7,000 | | 99,330 |

|

|

| | | | | | 22,077,308 |

| |

| Transportation (0.5%) | | | | | |

|

| Hornbeck Offshore Services, Inc. † | | 4,600 | | 166,014 |

| Omega Navigation Enterprises, Inc. | | 9,600 | | 152,640 |

|

|

| | | | | | 318,654 |

|

|

| Total common stocks (cost $38,960,256) | | | $ | 51,947,540 |

| |

| |

| Convertible Preferred Stocks (15.1%)* | | | | |

| | | | SHARES | | VALUE |

|

| Capella Education Co. Ser. G, zero % cv. pfd. | | | | |

| (acquired 2/14/02, cost $5,009,274) (Private) ‡ † (F) (c) (d) | 449,640 | $ | 8,282,365 |

| Refractec Ser. D, zero % cv. pfd. (acquired various dates from | | | |

| 8/16/02 through 6/30/03, cost $4,999,998) (Private) ‡ † § (F) | 833,333 | | 1,166,666 |

|

|

| Total convertible preferred stocks (cost $10,009,272) | | | $ | 9,449,031 |

| |

| |

| Purchased Options Outstanding (—%)* (cost $14,279) | | | |

| | EXPIRATION DATE/ | | | | |

| | STRIKE PRICE | CONTRACT AMOUNT | | VALUE |

|

| WESCO International, Inc. | Jan 07/65.00 | | $ | 1,980 | | $ | 10,544 |

| |

| |

| Short-term Investments (4.8%)* (cost $2,999,000) | | | |

| | | PRINCIPAL AMOUNT/SHARES | | VALUE |

|

| Repurchase agreement dated October 31, 2006 with Bank | | | |

| of America due November 1, 2006 with respect | | | | |

| to various U.S. Government obligations — maturity | | | | |

| value of $2,999,439 for an effective yield of 5.27% | | | | |

| (collateralized by Fannie Mae 7.00% due 3/15/2010 | | | | |

| valued at $3,084,516) | | | $ | 2,999,000 | | $ | 2,999,000 |

|

| Total investments (cost $51,982,807) | | | $ | 64,406,115 |

|

* Percentages indicated are based on net assets of $62,548,890.

† Non-income-producing security.

‡ Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at October 31, 2006 was $27,861,754 or 44.5% of net assets.

§ Affiliated Companies (Note 4).

(R) Real Estate Investment Trust.

(F) Security was valued at fair value following procedures approved by the Trustees (Note 1).

At October 31, 2006, liquid assets totaling $495,184 have been designated as collateral for open written options.

(c) Effective November 9, 2006 this position was converted into shares of common stock of the issuer traded on the NASDAQ quotation system. This conversion is not reflected in the value of the position recorded in this report as of October 31, 2006.

(d) Security valuation as of October 31, 2006 includes an estimated special dividend that was paid to the fund in November 2006.

(e) Effective November 14, 2006, the contractual restrictions as to resale of the fund’s position in Restore Medical expired.

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

14

| Written options outstanding at 10/31/06 | | |

| (premiums received $23,775) | | | |

| | CONTRACT | EXPIRATION DATE/ | |

| | AMOUNT | STRIKE PRICE | VALUE |

|

| WESCO International, Inc. | $3,960 | Jan 07/70.00 | $ 11,948 |

| Rackable Systems, Inc. | 2,900 | Nov 06/31.79 | 3,945 |

| Redback Networks, Inc. | 5,100 | Dec 06/17.34 | 2,652 |

| Lam Research Corp. | 460 | Nov 06/55.90 | 276 |

| Komag, Inc. | 380 | Nov 06/30.65 | 22 |

|

|

| | | | $18,843 |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

15

Statement of assets and liabilities

October 31, 2006

| Assets | |

|

| Investment in securities, at value (Note 1): | |

|

| Unaffiliated issuers (identified cost $43,973,140) | $60,448,501 |

|

| Affiliated issuers (identified cost $8,009,667) (Note 4) | 3,957,614 |

|

| Cash | 4,227 |

|

| Dividends receivable | 4,381 |

|

| Receivable for securities sold | 268,322 |

|

| Total assets | 64,683,045 |

|

| |

| Liabilities | |

|

| Payable for securities purchased | 223,188 |

|

| Payable for shareholder servicing fee (Note 2) | 11,496 |

|

| Payable for compensation of Manager (Note 2) | 100,714 |

|

| Accrual for incentive fee (Note 2) | 1,680,956 |

|

| Payable for investor servicing and custodian fees (Note 2) | 19,047 |

|

| Payable for administrative services (Note 2) | 5,099 |

|

| Written options outstanding, at value (premiums received $23,775) (Notes 1 and 3) | 18,843 |

|

| Other accrued expenses | 74,812 |

|

| Total liabilities | 2,134,155 |

|

| Net assets | $62,548,890 |

|

| |

| Represented by | |

|

| Paid-in capital (10,000,000 unlimited shares authorized) (Note 1) | $46,412,957 |

|

| Accumulated net realized gain on investments (Note 1) | 3,707,693 |

|

| Net unrealized appreciation of investments | 12,428,240 |

|

| Total — Representing net assets applicable to capital shares outstanding | $62,548,890 |

|

| |

| Computation of net asset value | |

|

| Net asset value and redemption price per common share | |

| ($62,548,890 divided by 2,248,878 shares) | $27.81 |

|

| Offering price class common share (100/95.75 of $27.81) * | $29.04 |

|

* On single retail shares of less than $500,000. On sales of $500,000 or more, the offering price is reduced.

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

16

Statement of operations

Year ended October 31, 2006

| Investment income: | |

|

| Dividends (net of foreign tax $342) | $ 252,959 |

|

| Interest | 154,705 |

|

| Total investment income | 407,664 |

|

| |

| Expenses: | |

|

| Compensation of Manager (Note 2) | 787,740 |

|

| Incentive fee (Note 2) | 711,278 |

|

| Investor servicing fees (Note 2) | 40,979 |

|

| Custodian fees (Note 2) | 63,292 |

|

| Trustee compensation and expenses (Note 2) | 75,000 |

|

| Administrative services (Note 2) | 65,304 |

|

| Shareholder servicing fees (Note 2) | 142,574 |

|

| Legal | 109,693 |

|

| Other | 78,084 |

|

| Fees waived and reimbursed by Manager (Note 2) | (149,120) |

|

| Net expenses | 1,924,824 |

|

| Net investment loss | (1,517,160) |

|

| Net realized gain on investments (Notes 1 and 3) | 5,459,648 |

|

| Net increase from payments by affiliates (Note 2) | 3,135 |

|

| Net realized gain on written options (Notes 1 and 3) | 9,750 |

|

| Net unrealized appreciation of investments | |

| and written options during the year | 4,099,745 |

|

| Net gain on investments | 9,572,278 |

|

| Net increase in net assets resulting from operations | $8,055,118 |

|

| The accompanying notes are an integral part of these financial statements. | |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

17

Statement of changes in net assets

| | Year ended | Year ended |

| | October 31 | October 31 |

| | 2006 | 2005 |

|

| |

| Decrease in net assets | | |

|

| Operations: | | |

|

| Net investment loss | $ (1,517,160) | $ (899,232) |

|

| Net realized gain on investments | 5,472,533 | 8,611,449 |

|

| Net unrealized appreciation (depreciation) of investments | 4,099,745 | (2,724,770) |

|

| Net increase in net assets resulting from operations | 8,055,118 | 4,987,447 |

|

| Distributions to shareholders: (Note 1) | | |

|

| From ordinary income: | | |

|

| Net realized short-term gain on investments | (2,882,477) | — |

|

| From net realized long-term gain on investments | (4,811,953) | (1,368,623) |

|

| |

| Capital share transactions: | | |

|

| Proceeds from shares issued | — | 1,200,930 |

|

| Reinvestments in connection with distributions | 6,992,072 | 995,905 |

|

| Cost of shares repurchased (Note 5) | (12,663,978) | (15,497,419) |

|

| Decrease from capital share transactions | (5,671,906) | (13,300,584) |

|

| Total decrease in net assets | (5,311,218) | (9,681,760) |

|

| |

| Net assets | | |

|

| Beginning of year | 67,860,108 | 77,541,868 |

|

| End of year | $62,548,890 | $67,860,108 |

|

| |

| Number of fund shares | | |

|

| Shares outstanding at beginning of year | 2,438,393 | 2,921,173 |

|

| Shares issued | — | 43,758 |

|

| Shares reinvested | 276,125 | 36,790 |

|

| Shares repurchased (Note 5) | (465,640) | (563,328) |

|

| Shares outstanding at end of year | 2,248,878 | 2,438,393 |

|

| The accompanying notes are an integral part of these financial statements. | | |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

18

Statement of cash flows

For the year ended October 31, 2006

| Increase in cash | |

|

| Cash flows from operating activities: | |

|

| Net increase in net assets from operations | $8,055,118 |

|

| Adjustments to reconcile net decrease in net assets | |

| from operations to net cash used in operating activities: | |

|

| Purchase of investment securities | (36,879,427) |

|

| Proceeds from disposition of investment securities | 51,862,406 |

|

| Purchase of short-term investment securities, net | (661,000) |

|

| Increase in dividends receivable | (687) |

|

| Decrease in payable for shareholder servicing fees | (40,871) |

|

| Decrease in payable for compensation of Manager | (117,253) |

|

| Increase in payable for incentive fee | 711,278 |

|

| Increase in payable for investor servicing and custodian fees | 3,196 |

|

| Net increase in premiums received on written options | 22,761 |

|

| Decrease in payable for administration services | (6,300) |

|

| Decrease in other accrued expenses | (16,672) |

|

| Net realized gain on investments | (5,462,783) |

|

| Net unrealized appreciation on investments during the year | (4,099,745) |

|

| Net cash provided by operating and investing activities | 13,370,021 |

|

| Cash flows from financing activities: | |

|

| Payment of shares redeemed | (12,663,978) |

|

| Cash distribution to shareholders paid | (702,358) |

|

| Net cash used in financing activities | (13,366,336) |

|

| Net increase in cash | 3,685 |

|

| Cash balance, beginning of year | 542 |

|

| Cash balance, end of year | $4,227 |

|

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

19

Financial highlights

(For a common share outstanding throughout the period)

| Per-share | | Year ended October 31 | |

| operating performance | 2006 | 2005 | 2004 | 2003 | 2002 |

|

| Net asset value, | | | | | |

| beginning of period | $27.83 | $26.54 | $25.32 | $18.91 | $22.44 |

|

| Investment operations: | | | | | |

|

| Net investment income (loss)(a,b) | (.63) | (.34)(f) | (.59) | (.45) | (.38) |

|

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 3.89 | 2.13 | 1.81 | 6.86 | (3.11) |

|

| Total from investment operations | 3.26 | 1.79 | 1.22 | 6.41 | (3.49) |

|

| Less distributions: | | | | | |

|

| From net investment income | — | — | — | — | (.04) |

|

| From net realized gain | | | | | |

| on investments | (3.28) | (.50) | — | — | — |

|

| From return of capital | — | — | — | — | —(e) |

|

| Total distributions | (3.28) | (.50) | — | — | (.04) |

|

| Net asset value, | | | | | |

| end of period | $27.81 | $27.83 | $26.54 | $25.32 | $18.91 |

|

| Total return at net asset value | | | | | |

| after incentive fee (%)(c) | 12.86 | 6.78 | 4.82 | 33.90 | (15.61) |

|

| Total return at net asset value | | | | | |

| before incentive fee (%)(c) | 14.13 | 7.07 | 5.53 | 34.43 | (15.61) |

|

| |

| Ratios And Supplemental Data | | | | | |

|

| Net assets, end of period | | | | | |

| (in thousands) | $62,549 | $67,860 | $77,542 | $90,020 | $73,682 |

|

| Ratio of expenses to average net | | | | | |

| assets after incentive fee (%)(b,d) | 2.93 | 2.00 | 2.49 | 2.30 | 2.21 |

|

| Ratio of expenses to average net | | | | | |

| assets before incentive fee (%)(b,d) | 1.85 | 1.85 | 1.85 | 1.85 | 2.21 |

|

| Ratio of net investment loss to average | | | | | |

| net assets after incentive fee (%)(b) | (2.31) | (1.23)(f) | (2.30) | (2.17) | (1.76) |

|

| Portfolio turnover rate (%) | 57.01 | 103.14 | 100.29 | 93.90 | 102.88 |

|

(a) Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

(b) Reflects an expense limitation in effect during the period (Note 2). As a result of such limitation, expenses of the fund for the periods ended October 31, 2006, October 31, 2005, October 31, 2004, October 31, 2003 and October 31, 2002 reflect a reduction of 0.23%, 0.19%, 0.15%, 0.10% and 0.07%, respectively, based on average net assets.

(c) Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

(d) Includes amounts paid through expense offset arrangements (Note 2).

(e) Amount represents less than $0.01 per share.

(f) Reflects a non-recurring accrual related to Putnam Management’s settlement with the SEC regarding brokerage allocation practices, which amounted to less than $0.01 per share and 0.02% of average net assets.

The accompanying notes are an integral part of these financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

20

Notes to financial statements

October 31, 2006

Note 1 Significant accounting policies

TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”), is a series of TH Lee, Putnam Investment Trust (the “trust”) which is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. The objective of the fund is to seek long-term capital appreciation by investing at least 80% of its total assets in publicly traded growth stocks and privately issued venture capital investments. The fund may invest up to 50% of its portfolio in private equity investments as well as up to 5% of its assets in private equity funds.

The fund offers its shares at net asset value plus a maximum front-end sales charge of 4.25% . The fund provides a limited degree of liquidity to its shareholders by conducting quarterly repurchase offers. In each repurchase offer, the fund intends to repurchase 5% of its outstanding shares at their net asset value. The fund may also, at any time, conduct additional sales of its shares to qualified clients, as defined in the Investment Advisers Act of 1940 as amended. Effective January 26, 2005, the Trustees closed the fund to any new sales (except through dividend reinvestments) of shares. The Trustees may consider reopening the fund to new sales of shares again if current conditions change.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets. If no sales are reported — as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price. Market quotations are not considered to be readily available for private equity securities: such investments are initially valued at cost and then stated at fair value following procedures approved by the Trustees. As part of those procedures, TH Lee, Putnam Capital Management, LLC (the “Manager“), a subsidiary of TH Lee, Putnam Capital, L.P. (a joint venture of Putnam Investment Holdings, LLC, which in turn is an indirect subsidiary of Putnam LLC (“Putnam”) and Thomas H. Lee Partners, LP) will monitor each fair valued security on a daily basis and will adjust its value, as

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

21

necessary, based on such factors as the financial and/or operating results, the general developments in the issuer’s business including products and services offered, management changes, changes in contracts with customers, issues relating to financing, the likelihood of a public offering, the liquidity of the security, any legal or contractual restrictions, the value of an unrestricted related public security and other analytical data. Restricted securities of the same class as publicly traded securities will be valued at a discount from the public market price reflecting the nature and extent of the restriction. The discount applied to securities subject to resale restrictions with known expirations will be reduced according to a specified timetable as the applicable expiration approaches. Securities fair valued at October 31, 2006 represented 44.5% of the fund’s net assets. Fair value prices may differ materially from the value that would be realized if the fair-valued securities were sold. Securities quoted in foreign currencies are translated into U.S. dollars at the current exchange rate. For foreign investments, if trading or events occurring in other markets after the close of the principal exchange in which the securities are traded are expected to materially affect the value of the investments, then those investments are valued, taking into consideration these events, at their fair value. Short-term investments having remaining maturities of 60 days or less are stated at amortized cost, which approximates fair value.

B) Security transactions and related investment income

Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis. Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital, if any, are reflected as a reduction of cost.

C) Repurchase agreements

The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. The Manager is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest.

D) Futures and options contracts

The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase, or for other investment purposes. The fund may also write options on swaps or securities it owns or in which it may invest to increase its current returns.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

22

The potential risk to the fund is that the change in value of futures and options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments, if there is an illiquid secondary market for the contracts, or if the counterparty to the contract is unable to perform. Risks may exceed amounts recognized on the statement of assets and liabilities. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses on purchased options are included in realized gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a reduction to the cost of investments.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. The fund and the broker agree to exchange an amount of cash equal to the daily fluctuation in the value of the futures contract. Such receipts or payments are known as “variation margin.” Exchange traded options are valued at the last sale price or, if no sales are reported, the last bid price for purchased options and the last ask price for written options. Options traded over-the-counter are valued using prices supplied by dealers. Futures and written option contracts outstanding at period end, if any, are listed after the fund’s portfolio.

E) Federal taxes

It is the policy of the fund to distribute all of its taxable income within the prescribed time and otherwise comply with the provisions of the Internal Revenue Code of 1986 (the “Code”) applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code, as amended. Therefore, no provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains.

F) Distributions to shareholders

Distributions to shareholders from net investment income are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences include temporary and permanent differences of losses on wash sale transactions, nontaxable dividends and net operating loss. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. For the year ended October 31, 2006, the fund reclassified $1,517,160 to decrease undistributed net investment loss and $8,258 to increase paid-in-capital, with a decrease to accumulated net realized gains of $1,525,418.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

23

The tax basis components of distributable earnings and the federal tax cost as of October 31, 2006 were as follows:

| Unrealized appreciation | $16,918,681 |

| Unrealized depreciation | (4,549,265) |

| | ———————————————————— |

| Net unrealized appreciation | 12,369,416 |

| Undistributed short-term gain | 545,438 |

| Undistributed long-term gain | 3,216,147 |

| |

| Cost for federal income tax purposes | $52,036,699 |

G) Deal related costs

Deal related costs are comprised primarily of legal and consulting costs incurred in connection with private equity investment transactions of the fund, whether or not consummated. Deal related costs that are attributable to existing private equity securities are added to the cost basis of the investments. All other deal related costs are expensed as incurred.

H) Statement of cash flows

The cash amount shown in the Statement of cash flows is the amount reported as cash in the fund’s Statement of assets and liabilities and represents cash on hand at its custodian and does not include any short-term investments at October 31, 2006.

Note 2 Management fee, administrative services and other transactions

The fund has entered into a Management Contract with the Manager. As compensation for the services rendered and expenses borne by the Manager, the fund pays the Manager a fee at an annual rate of 1.20% of the average daily net assets of the fund, computed daily and payable monthly.

In addition, the fund will accrue daily a liability for incentive fees payable equal to 20% of the realized and unrealized gains less realized and unrealized losses on investments that were originally purchased by the fund in private equity transactions. The fund will not accrue an incentive fee unless all realized and unrealized losses from prior periods have been offset by realized (and, where applicable unrealized) gains. The fund will pay annually, on December 31, to the Manager a fee equal to 20% of the aggregate incentive fee base, calculated from the commencement of the fund’s operations, less the cumulative amount of the incentive fee paid to the Manager in previous periods. The incentive fee base for a private equity security equals realized gains less realized and unrealized losses until the issuer of the security has completed an initial public offering and any applicable lockup period has expired and, thereafter, equals realized and unrealized gains less realized and unrealized losses. In the case of private equity funds, the incentive fee base equals the sum of all

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

24

amounts that are actually distributed to the fund less realized and unrealized losses. The fund does not pay any incentive fee on a private equity holding until the fund sells the holding or the holding becomes freely sellable, although the fund will continue to accrue a liability with respect to additional unrealized gains for such security. At October 31, 2006, incentive fees totaling $1,680,956 have been accrued based on the aggregate incentive fee base, of which $711,278 was accrued for the year ended October 31, 2006.

The Manager has agreed to limit its compensation (and, to the extent necessary, bear other expenses) through October 31, 2007, to the extent that expenses of the fund (exclusive of the incentive fee, interest expense on any borrowings, offering costs and any extraordinary expenses) exceed an annual rate of 1.85% of its average daily net assets.

The fund has entered into an Administrative Services Contract with Putnam Fiduciary Trust Company (“PFTC”), an affiliate of the Manager, to provide administrative services, including fund accounting and the pricing of the fund shares. As compensation for the services, the fund pays PFTC a fee at an annual rate of 0.10% of the average daily net assets of the fund, computed daily and payable monthly.

Custodial functions for the fund’s assets are provided by PFTC, a subsidiary of Putnam, LLC. PFTC receives fees for custody services based on the fund’s asset level, the number of its security holdings and transaction volumes. Putnam Investor Services, a division of PFTC, provides investor servicing agent functions to the fund. Putnam Investor Services receives fees for investor servicing based on the number of shareholder accounts. For the year ended October 31, 2006, the fund paid PFTC $104,271 for these services.

During the year ended October 31, 2006, Putnam voluntarily reimbursed the fund $3,135 for net realized losses incurred from a trading error during the sale of investment securities. The effect of the losses incurred and the reimbursal by Putnam of such losses had no impact on total return.

The fund has entered into an arrangement with PFTC whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the fund’s expenses. For the year ended October 31, 2006, there was no reduction to the fund’s expenses under these arrangements.

Each independent Trustee of the trust receives an annual Trustee fee of $25,000. Trustees receive additional fees for attendance at certain committee meetings.

The fund intends to pay compensation to selected brokers and dealers that are not affiliated with the fund, the Manager or Putnam, that hold shares for their customers in accordance with the shareholder servicing agreements between the fund and the brokers and dealers. The shareholder servicing fee is

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

25

accrued daily and payable quarterly at an annual rate of 0.25% of the average daily net assets attributable to outstanding shares beneficially owned by customers of the brokers and dealers.

For the year ended October 31, 2006, Putnam Retail Management, acting as underwriter, received no net commissions from the sale of common shares.

Note 3 Purchases and sales of securities

During the year ended October 31, 2006, cost of purchases and proceeds from sales of investment securities other than short-term investments aggregated $36,736,755 and $51,490,706, respectively. There were no purchases or sales of U.S. government securities.

| Written option transactions during the period are summarized as follows: | |

|

| | Contract | Premiums |

| | Amounts | Received |

|

| Written options outstanding at | | |

| beginning of year | 1,460 | $ 1,014 |

|

| Options opened | 28,533 | 33,482 |

| Options exercised | (1,250) | (971) |

| Options expired | (15,943) | (9,750) |

| Options closed | — | — |

|

| Written options outstanding | | |

| at end of year | 12,800 | $23,775 |

|

Note 4 Transactions with affiliated issuers

Transactions during the year with companies in which the fund owned at least 5% of the voting securities were as follows:

| Name of Affiliates | Purchase Cost | Sales Cost | Dividend Income | Fair Value |

|

| Refractec | $— | $— | $— | $1,166,666 |

| Restore Medical | — | — | — | 2,790,948 |

|

| Totals | $— | $— | $— | $3,957,614 |

|

Fair value amounts are shown for issues that are affiliated at period end.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

26

Note 5 Share repurchase

To provide liquidity to the shareholders, the fund has a policy of making offers to repurchase a portion of its shares on a quarterly basis. Repurchases are made in February, May, August and November of each year. Repurchase offers are made for at least 5% (but not more than 25%) of fund shares in any quarter with the approval of the Trustees. If the number of shares tendered for repurchase exceeds the offering limit, or if the Manager in its discretion elects to limit repurchases to 5% of the fund’s shares, the fund will repurchase shares on a pro-rata basis, and tendering shareholders will not have all of their tendered shares repurchased by the fund. During the year ended October 31, 2006, the fund repurchased 465,640 shares valued at $12,663,978.

On February 10, 2006, the fund received actual redemption requests totaling $6,949,737 or 10.07% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 49.64% of the shares the shareholder requested be repurchased.

On May 12, 2006, the fund received actual redemption requests totaling $6,574,735 or 9.27% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 53.95% of the shares the shareholder requested be repurchased.

On August 11, 2006, the fund received actual redemption requests totaling $5,244,519 or 8.4% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 58.98% of the shares the shareholder requested be repurchased.

| | Shares | |

| Date | Repurchased | Amount |

|

| November 2005 | 91,098 | $2,550,756 |

| February 2006 | 131,719 | 3,465,512 |

| May 2006 | 124,538 | 3,545,582 |

| August 2006 | 118,285 | 3,102,128 |

|

At October 31, 2006, the Manager owned 241,164 shares of the fund (10.7% of shares outstanding) valued at $6,716,418.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

27

Note 6 Regulatory matters and litigation

Putnam Management has entered into agreements with the Securities and Exchange Commission and the Massachusetts Securities Division settling charges connected with excessive short-term trading by Putnam employees and, in the case of the charges brought by the Massachusetts Securities Division, by participants in some Putnam-administered 401(k) plans. Pursuant to these settlement agreements, Putnam Management will pay a total of $193.5 million in penalties and restitution, with $153.5 million being paid to certain open-end funds and their shareholders. The amount will be allocated to shareholders and funds pursuant to a plan developed by an independent consultant, and will be paid following approval of the plan by the SEC and the Massachusetts Securities Division.

The Securities and Exchange Commission’s and Massachusetts Securities Division’s allegations and related matters also serve as the general basis for numerous lawsuits, including purported class action lawsuits filed against Putnam Management and certain related parties, including certain Putnam funds. Putnam Management will bear any costs incurred by Putnam funds in connection with these lawsuits. Putnam Management believes that the likelihood that the pending private lawsuits and purported class action lawsuits will have a material adverse financial impact on the fund is remote, and the pending actions are not likely to materially affect its ability to provide investment management services to its clients, including the Putnam funds.

Note 7 New accounting pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”). The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken by a filer in the filer’s tax return. The Interpretation will become effective for fiscal years beginning after December 15, 2006 but will also apply to tax positions reflected in the fund’s financial statements as of that date. No determination has been made whether the adoption of the Interpretation will require the fund to make any adjustments to its net assets or have any other effect on the fund’s financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, Fair Value Measurements (the “Standard”). The Standard defines fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. The Standard applies to fair value measurements already required or permitted by existing standards. The Standard is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The Manager is currently evaluating what impact the adoption of the Standard will have on the fund’s financial statements.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

28

Federal tax information

(Unaudited)

Pursuant to Section 852 of the Internal Revenue Code, as amended, the fund hereby designates $3,218,512 as long term capital gain, for its taxable year ended October 31, 2006.

The fund designated 28.71% of ordinary income distributions as qualifying for the dividends received deduction for corporations.

For its tax year ended October 31, 2006, the fund designated 29.45% of its taxable ordinary income distributions as qualified dividends taxed at the individual net capital gain rates.

The Form 1099 you receive in January 2007 will show the tax status of all distributions paid to your account in calendar 2006.

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

29

Trustees and officers

A listing of the trustees of TH Lee, Putnam Investments Trust (the “Trust”) and the officers of the Fund and their business experience for the past five years follows. An asterisk(*) indicates trustees who are interested persons of the Fund (as defined by the 1940 Act). Unless otherwise noted, the address of each trustee and officer is one Post Office Square, Boston, Massachusetts 02109.

| | Position(s) Held | | |

| | with Fund During | | |

| Name | the Past 5 Years | | Principal Occupation(s) |

|

| John A. Hill | Chairman and Trustee | Born 1942 | Chairman and Trustee, Putnam |

| | | | Funds (108 funds as of October 31, |

| | | | 2005), Vice-Chairman, First |

| | | | Reserve Corporation (a private |

| | | | equity buyout firm that specializes |

| | | | in energy investments in the diver- |

| | | | sified world-wide energy industry). |

| | | | Director of Devon Energy |

| | | | Corporation, Sarah Lawrence |

| | | | College and various private compa- |

| | | | nies controlled by First Reserve |

| | | | Corporation. Formerly a Director of |

| | | | Continuum Health Partners of |

| | | | New York, St. Luke’s-Roosevelt |

| | | | (a New York City Hospital) and |

| | | | TransMontaigne Oil Company. |

| | | | |

| Joseph L. Bower | Trustee | Born 1938 | Donald K. David Professor of |

| | | | Business Administration, Harvard |

| | | | Business School, and Chair of The |

| | | | General Manager Program. Director, |

| | | | Anika Therapeutics, Inc., Brown |

| | | | Shoe, Inc., Loews Corporation, New |

| | | | America High Income Fund and |

| | | | Sonesta International Hotels |

| | | | Corporation. Life trustee of the |

| | | | New England Conservatory of |

| | | | Music and trustee of the DeCordova |

| | | | Museum and Sculpture Park. |

| | | | Prior to 2005, Director, ML-Lee/ |

| | | | Acquisition Funds. |

TH Lee, Putnam Emerging Opportunities Portfolio Annual Report October 31, 2006

30

Trustees and officers

| | Position(s) Held | | |

| | with Fund During | | |

| Name | the Past 5 Years | | Principal Occupation(s) |

|

| Stephen B. Kay | Trustee | Born 1934 | Senior Director of Goldman, Sachs |

| | | | & Co. Trustee, Chairman of the |

| | | | Investment Committee and Member |

| | | | of the Executive Committee of the |

| | | | Board of the Dana-Farber Cancer |

| | | | Institute. Member of the Dean’s |

| | | | Advisory Council, Harvard School of |

| | | | Public Health. Trustee, Boston |

| | | | Symphony Orchestra. Chair of the |

| | | | Board of Trustees, Brandeis |

| | | | University. Former Director of |

| | | | Control Risk Insurance Company. |

| | | | Former Director of the Harvard |

| | | | Alumni Association and former |

| | | | President of the Harvard Business |

| | | | School Association of Boston. |

| | | | Former Chairman of the Board of |

| | | | Directors of Beth Israel Hospital |

| | | | and former Chairman of the Board |

| | | | of CareGroup (consortium of |

| | | | hospitals). Former member of |

| | | | Board of Overseers, Harvard |

| | | | University 1994-1999. |

| | | | |

| Linwood E. Bradford | President and | Born 1968 | Managing Director, |

| | Principal Executive | | Putnam Investments |

| | Officer | | |

| | | | |

| Steven D. Krichmar | Vice President and | Born 1958 | Senior Managing Director, Putnam |

| | Principal Financial | | Investments. Prior to 2001, Partner, |

| | Officer | | PricewaterhouseCoopers LLP |

| | | | |

| Michael T. Healy | Vice President, | Born 1958 | Managing Director, |

| | Principal Accounting | | Putnam Investments |

| | Officer, and Assistant | | |

| | Treasurer | | |