UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10395

Pioneer Series Trust VII

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: October 31, 2024

Date of reporting period: November 1, 2023 through April 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Pioneer CAT Bond Fund

Semiannual Report | April 30, 2024

IMPORTANT NOTICE – UPCOMING CHANGES TO PIONEER FUNDS ANNUAL & SEMI-ANNUAL REPORTS

The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments that will result in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Beginning in July 2024, Reports will be streamlined to highlight key information (“Redesigned Reports”). Certain information currently included in the Reports, including financial statements, will no longer appear in the Reports but will be available online, delivered free of charge to shareholders upon request, and filed with the SEC.

If you previously elected to receive the Fund's Reports electronically, you will continue to receive the Redesigned Reports electronically. Otherwise, you will receive paper copies of the Fund's Redesigned Reports via USPS mail starting in July 2024. If you would like to receive the Fund's Redesigned Reports (and/or other communications) electronically instead of by mail, please contact your financial advisor or, if you are a direct investor, please log into your mutual fund account at amundi.com/usinvestors and select “E-Delivery” under the Profile page. You must be registered for online account access before you can enroll in E-Delivery.

visit us: www.amundi.com/us

Pioneer CAT Bond Fund | Semiannual Report | 4/30/241

Portfolio Summary | 4/30/24

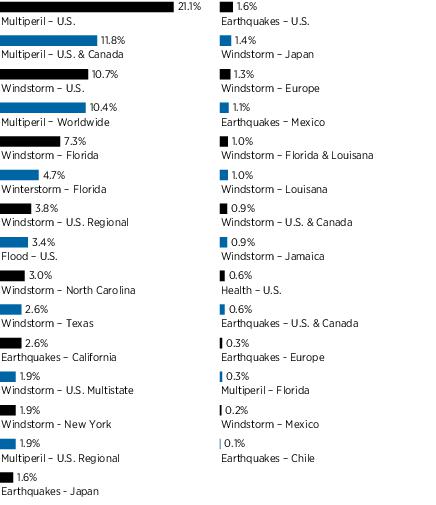

Portfolio Diversification

(As a percentage of total investments)*

Sector Diversification by Risk

(As a percentage of total investments)*

2Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

10 Largest Holdings

| (As a percentage of total investments)* |

| 1. | Mystic Re, 17.372% (3 Month U.S. Treasury Bill + 1,200 bps), 1/8/27 (144A) | 3.55% |

| 2. | Kendall Re, 13.127% (3 Month U.S. Treasury Bill + 775 bps), 4/30/27 (144A) | 3.11 |

| 3. | Palm Re, 14.879% (1 Month U.S. Treasury Bill + 950 bps), 6/7/27 (144A) | 3.10 |

| 4. | Lightning Re, 16.379% (3 Month U.S. Treasury Bill + 1,100 bps), 3/31/26 (144A) | 2.90 |

| 5. | Cape Lookout Re, 13.377% (1 Month U.S. Treasury Bill + 800 bps), 4/5/27 (144A) | 2.87 |

| 6. | Oakmont Re 2023, 4/1/29 | 2.80 |

| 7. | FloodSmart Re, 19.38% (3 Month U.S. Treasury Bill + 1,400 bps), 3/12/27 (144A) | 2.41 |

| 8. | Purple Re, 7.38% (1 Month U.S. Treasury Bill + 200 bps), 6/7/27 (144A) | 2.36 |

| 9. | Matterhorn Re, Series 2022, 10.604% (SOFR + 525 bps), 3/24/25 (144A) | 2.28 |

| 10. | MetroCat Re, 5.75% (3 Month U.S. Treasury Bill + 575 bps), 5/8/26 (144A) | 1.87 |

* Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/243

Prices and Distributions | 4/30/24

Net Asset Value per Share

| Class | 4/30/24 | 10/31/23 |

| A | $10.89 | $11.12 |

| K | $10.80 | $11.15 |

| Y | $10.80 | $11.14 |

| | | |

Distributions per Share: 11/1/23 - 4/30/24

| Class | Net

Investment

Income | Short-Term

Capital Gains | Long-Term

Capital Gains |

| A | $0.8440 | $— | $— |

| K | $0.9770 | $— | $— |

| Y | $0.9698 | $— | $— |

Index Definitions

The ICE Bank of America (ICE BofA) U.S. 3-Month Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days, that assumes reinvestment of all income. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 5 - 7.

4Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| Performance Update | 4/30/24 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer CAT Bond Fund at public offering price during the periods shown, compared to that of the ICE Bank of America (ICE BofA) U.S. 3-Month Treasury Bill Index.*

Average Annual Total Returns

(As of April 30, 2024) |

| Period | Net

Asset

Value

(NAV) | Public

Offering

Price

(POP) | ICE BofA U.S.

3-Month

Treasury Bill

Index |

Since Inception

(1/27/23) | 13.92% | 9.83% | 5.15% |

| 1 Year | 14.01 | 8.85 | 5.36 |

Expense Ratio

(Per prospectus dated March 1, 2024) |

| Gross | Net |

| 2.27% | 1.76% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. POP returns reflect deduction of maximum 4.50% sales charge. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2025 for Class A shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

* Performance of Class A shares of the Fund shown in the graph above is from the inception of Class A shares on 1/27/23 through 04/30/24. Index information shown in the graph above is from 1/31/23 through 04/30/24.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/245

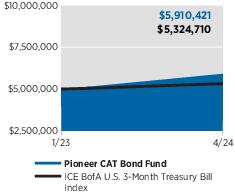

| Performance Update | 4/30/24 | Class K Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer CAT Bond Fund during the periods shown, compared to that of the ICE Bank of America (ICE BofA) U.S. 3-Month Treasury Bill Index.*

Average Annual Total Returns

(As of April 30, 2024) |

| Period | Net

Asset

Value

(NAV) | ICE BofA U.S.

3-Month

Treasury Bill

Index |

Since Inception

(1/27/23) | 14.32% | 5.15% |

| 1 Year | 14.51 | 5.36 |

Expense Ratio

(Per prospectus dated March 1, 2024) |

| Gross | Net |

| 1.97% | 1.51% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2025 for Class K shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

* Performance of Class K shares of the Fund shown in the graph above is from the inception of Class K shares on 1/27/23 through 04/30/24. Index information shown in the graph above is from 1/31/23 through 04/30/24.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

6Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| Performance Update | 4/30/24 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer CAT Bond Fund during the periods shown, compared to that of the ICE Bank of America (ICE BofA) U.S. 3-Month Treasury Bill Index.*

Average Annual Total Returns

(As of April 30, 2024) |

| Period | Net

Asset

Value

(NAV) | ICE BofA U.S.

3-Month

Treasury Bill

Index |

Since Inception

(1/27/23) | 14.26% | 5.15% |

| 1 Year | 14.32 | 5.36 |

Expense Ratio

(Per prospectus dated March 1, 2024) |

| Gross | Net |

| 2.12% | 1.51% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2025 for Class Y shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

* Performance of Class Y shares of the Fund shown in the graph above is from the inception of Class Y shares on 1/27/23 through 04/30/24. Index information shown in the graph above is from 1/31/23 through 04/30/24.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/247

Comparing Ongoing Fund Expenses

As a shareholder in the Fund, you incur two types of costs:

| (1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

| (2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| (1) | Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6 |

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer CAT Bond Fund

Based on actual returns from November 1, 2023 through April 30, 2024.

| Share Class | A | K | Y |

Beginning Account

Value on 11/1/23 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 4/30/24 | $1,000.00 | $1,000.00 | $1,000.00 |

Expenses Paid

During Period* | $8.06 | $6.76 | $7.31 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.62%, 1.36%, and 1.47% for Class A, Class K, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

8Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer CAT Bond Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from November 1, 2023 through April 30, 2024.

| Share Class | A | K | Y |

Beginning Account

Value on 11/1/23 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 4/30/24 | $1,016.81 | $1,018.10 | $1,017.55 |

Expenses Paid

During Period* | $8.12 | $6.82 | $7.37 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.62%, 1.36%, and 1.47% for Class A, Class K, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

Pioneer CAT Bond Fund | Semiannual Report | 4/30/249

Schedule of Investments | 4/30/24

(unaudited)

Principal

Amount

USD ($) | | | | | | Value |

| | Insurance-Linked Securities — 97.6% of

Net Assets# | |

| | Event Linked Bonds — 94.8% | |

| | Earthquakes – California — 2.5% | |

| 1,000,000(a) | Sutter Re, 12.13%, (3 Month U.S. Treasury Bill + 675 bps), 6/19/26 (144A) | $ 1,017,400 |

| 2,000,000(a) | Sutter Re, 15.13%, (3 Month U.S. Treasury Bill + 975 bps), 6/19/26 (144A) | 2,033,000 |

| 2,100,000(a) | Torrey Pines Re, 10.38%, (3 Month U.S. Treasury Bill + 500 bps), 6/5/26 (144A) | 2,129,820 |

| 1,750,000(a) | Ursa Re, 10.877%, (3 Month U.S. Treasury Bill + 550 bps), 12/7/26 (144A) | 1,780,625 |

| 1,250,000(a) | Ursa Re, 14.627%, (3 Month U.S. Treasury Bill + 925 bps), 12/7/26 (144A) | 1,262,875 |

| | | | | | | $ 8,223,720 |

|

|

| | Earthquakes – Chile — 0.1% | |

| 250,000(a) | International Bank for Reconstruction & Development, 10.121%, (SOFR + 479 bps), 3/31/26 (144A) | $ 253,325 |

| | Earthquakes - Europe — 0.3% | |

| EUR 1,000,000(a) | Azzurro Re II, 10.307%, (3 Month EURIBOR + 650 bps), 4/20/28 (144A) | $ 1,067,200 |

| | Earthquakes - Japan — 1.6% | |

| 250,000(a) | Nakama Re, 7.612%, (3 Month Term SOFR + 250 bps), 5/9/28 (144A) | $ 247,475 |

| 5,000,000(a) | Nakama Re, 7.729%, (3 Month U.S. Treasury Bill + 235 bps), 4/4/29 (144A) | 4,999,461 |

| | | | | | | $ 5,246,936 |

|

|

| | Earthquakes – Mexico — 1.1% | |

| 1,500,000(a) | International Bank for Reconstruction & Development, 9.551%, (SOFR + 422 bps), 4/24/28 (144A) | $ 1,498,500 |

| 2,000,000(a) | International Bank for Reconstruction & Development, 18.831%, (SOFR + 1,350 bps), 4/28/28 (144A) | 1,998,000 |

| | | | | | | $ 3,496,500 |

|

|

| | Earthquakes – U.S. — 1.5% | |

| 500,000(a) | Torrey Pines Re, 9.559%, (3 Month U.S. Treasury Bill + 418 bps), 6/7/24 (144A) | $ 498,500 |

The accompanying notes are an integral part of these financial statements.

10Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Principal

Amount

USD ($) | | | | | | Value |

| | Earthquakes – U.S. — (continued) | |

| 1,000,000(a) | Ursa Re, 10.88%, (3 Month U.S. Treasury Bill + 550 bps), 12/6/25 (144A) | $ 1,015,900 |

| 1,500,000(a) | Ursa Re II, 10.38%, (3 Month U.S. Treasury Bill + 500 bps), 6/16/25 (144A) | 1,501,500 |

| 2,000,000(b) | Veraison Re, 10.13%, (3 Month U.S. Treasury Bill + 475 bps), 3/8/27 (144A) | 2,013,000 |

| | | | | | | $ 5,028,900 |

|

|

| | Earthquakes – U.S. & Canada — 0.6% | |

| 2,000,000(a) | Acorn Re, 7.879%, (3 Month U.S. Treasury Bill + 250 bps), 11/7/24 (144A) | $ 1,980,000 |

| | Flood – U.S. — 3.3% | |

| 7,750,000(a) | FloodSmart Re, 19.38%, (3 Month U.S. Treasury Bill + 1,400 bps), 3/12/27 (144A) | $ 7,746,125 |

| 1,000,000(a) | FloodSmart Re, 21.629%, (1 Month U.S. Treasury Bill + 1,625 bps), 3/11/26 (144A) | 1,001,600 |

| 2,000,000(a) | FloodSmart Re, 22.63%, (3 Month U.S. Treasury Bill + 1,725 bps), 3/12/27 (144A) | 1,954,800 |

| 250,000(a) | FloodSmart Re, 26.88%, (1 Month U.S. Treasury Bill + 2,150 bps), 3/11/26 (144A) | 251,025 |

| | | | | | | $ 10,953,550 |

|

|

| | Health – U.S. — 0.6% | |

| 500,000(a) | Vitality Re XIII, 7.372%, (3 Month U.S. Treasury Bill + 200 bps), 1/6/26 (144A) | $ 496,200 |

| 1,000,000(a) | Vitality Re XV, 7.881%, (3 Month U.S. Treasury Bill + 250 bps), 1/7/28 (144A) | 998,600 |

| 500,000(a) | Vitality Re XV, 8.881%, (3 Month U.S. Treasury Bill + 350 bps), 1/7/28 (144A) | 503,850 |

| | | | | | | $ 1,998,650 |

|

|

| | Multiperil – Florida — 0.3% | |

| 1,000,000(a) | Sanders Re, 13.382%, (3 Month U.S. Treasury Bill + 800 bps), 6/5/26 (144A) | $ 1,016,900 |

| | Multiperil – U.S. — 20.6% | |

| 250,000(a) | Aquila Re, 10.632%, (3 Month U.S. Treasury Bill + 525 bps), 6/8/26 (144A) | $ 251,875 |

| 3,000,000(a)(c) | Atela Re, Ltd., 19.582%, (3 Month U.S. Treasury Bill + 1,425 bps), 5/9/27 (144A) | 3,000,000 |

| 750,000(a) | Baldwin Re, 9.88%, (3 Month U.S. Treasury Bill + 450 bps), 7/7/27 (144A) | 757,425 |

| 1,000,000(a) | Blue Halo Re, 20.629%, (3 Month U.S. Treasury Bill + 1,525 bps), 2/24/25 (144A) | 965,400 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2411

Schedule of Investments | 4/30/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. — (continued) | |

| 500,000(a) | Caelus Re VI, 10.474%, (3 Month U.S. Treasury Bill + 510 bps), 6/7/24 (144A) | $ 499,000 |

| 5,250,000(a) | Foundation Re, 11.63%, (3 Month U.S. Treasury Bill + 625 bps), 1/8/27 (144A) | 5,246,325 |

| 1,000,000(a) | Four Lakes Re, 11.13%, (3 Month U.S. Treasury Bill + 575 bps), 1/7/27 (144A) | 1,014,200 |

| 250,000(a) | Four Lakes Re, 11.88%, (3 Month U.S. Treasury Bill + 650 bps), 1/7/26 (144A) | 254,525 |

| 2,750,000(a) | Four Lakes Re, 14.88%, (3 Month U.S. Treasury Bill + 950 bps), 1/7/27 (144A) | 2,735,700 |

| 6,000,000(a) | Herbie Re, 11.38%, (3 Month U.S. Treasury Bill + 600 bps), 1/7/28 (144A) | 5,910,000 |

| 1,500,000(a) | Herbie Re, 14.379%, (3 Month U.S. Treasury Bill + 900 bps), 1/7/28 (144A) | 1,480,500 |

| 1,500,000(a) | High Point Re, 11.124%, (3 Month U.S. Treasury Bill + 575 bps), 1/6/27 (144A) | 1,506,000 |

| 3,850,000(a) | Hypatia Re, 15.879%, (3 Month U.S. Treasury Bill + 1,050 bps), 4/8/26 (144A) | 4,044,425 |

| 7,500,000(a) | Matterhorn Re, 10.604%, (SOFR + 525 bps), 3/24/25 (144A) | 7,336,500 |

| 5,625,000(a) | Merna Re II, 12.91%, (3 Month U.S. Treasury Bill + 753 bps), 7/7/25 (144A) | 5,690,812 |

| 350,000(a) | Merna Re II, 13.132%, (3 Month U.S. Treasury Bill + 775 bps), 7/7/26 (144A) | 362,670 |

| 11,250,000(a) | Mystic Re, 17.372%, (3 Month U.S. Treasury Bill + 1,200 bps), 1/8/27 (144A) | 11,432,250 |

| 500,000(a) | Residential Re, 5.377%, (3 Month U.S. Treasury Bill + 0 bps), 12/6/24 (144A) | 447,600 |

| 500,000(a) | Residential Re, 10.652%, (3 Month U.S. Treasury Bill + 528 bps), 12/6/25 (144A) | 470,250 |

| 500,000(a) | Residential Re, 11.39%, (3 Month U.S. Treasury Bill + 601 bps), 12/6/24 (144A) | 485,650 |

| 3,250,000(a) | Sanders Re, 11.129%, (3 Month U.S. Treasury Bill + 575 bps), 4/7/28 (144A) | 3,258,125 |

| 250,000(a) | Sanders Re II, 8.429%, (3 Month U.S. Treasury Bill + 305 bps), 4/7/25 (144A) | 243,750 |

| 1,500,000(a) | Sanders Re III, 8.99%, (3 Month U.S. Treasury Bill + 361 bps), 4/7/26 (144A) | 1,450,800 |

| 700,000(a) | Sanders Re III, 11.13%, (3 Month U.S. Treasury Bill + 575 bps), 4/7/27 (144A) | 701,470 |

| 1,550,000(a) | Solomon Re, 10.632%, (3 Month U.S. Treasury Bill + 525 bps), 6/8/26 (144A) | 1,588,905 |

| 3,900,000(a) | Stabilitas Re, 13.897%, (3 Month U.S. Treasury Bill + 850 bps), 6/5/26 (144A) | 4,052,880 |

The accompanying notes are an integral part of these financial statements.

12Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. — (continued) | |

| 1,250,000(a) | Sussex Re, 13.734%, (3 Month U.S. Treasury Bill + 836 bps), 1/8/25 (144A) | $ 1,218,750 |

| 1,650,000(a) | Topanga Re, 5.05%, (3 Month U.S. Treasury Bill + 505 bps), 1/8/26 (144A) | 1,588,455 |

| | | | | | | $ 67,994,242 |

|

|

| | Multiperil – U.S. & Canada — 11.5% | |

| 5,750,000(a) | Ashera Re, 10.377%, (3 Month U.S. Treasury Bill + 500 bps), 4/7/27 (144A) | $ 5,691,350 |

| 3,200,000(a) | Galileo Re, 12.374%, (3 Month U.S. Treasury Bill + 700 bps), 1/8/26 (144A) | 3,265,600 |

| 3,050,000(a) | Galileo Re, 12.374%, (3 Month U.S. Treasury Bill + 700 bps), 1/7/28 (144A) | 3,170,170 |

| 1,625,000(a) | Kilimanjaro III Re, 17.741%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/21/25 (144A) | 1,595,750 |

| 3,000,000(a) | Kilimanjaro III Re, 17.742%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/20/26 (144A) | 2,934,300 |

| 3,250,000(a) | Mona Lisa Re, 12.38%, (3 Month U.S. Treasury Bill + 700 bps), 7/8/25 (144A) | 3,220,100 |

| 2,250,000(a) | Montoya Re, 16.88%, (1 Month U.S. Treasury Bill + 1,150 bps), 4/7/27 (144A) | 2,306,925 |

| 3,350,000(a) | Mystic Re IV, 11.472%, (3 Month U.S. Treasury Bill + 610 bps), 1/8/25 (144A) | 3,284,005 |

| 250,000(a) | Mystic Re IV, 17.069%, (3 Month U.S. Treasury Bill + 1,169 bps), 1/8/25 (144A) | 243,425 |

| 3,000,000(a) | Northshore Re II, 13.379%, (3 Month U.S. Treasury Bill + 800 bps), 7/8/25 (144A) | 3,108,300 |

| 6,000,000(a) | Ramble Re, 11.629%, (3 Month U.S. Treasury Bill + 625 bps), 3/5/27 (144A) | 5,930,400 |

| 1,000,000(a) | Titania Re, 17.63%, (1 Month U.S. Treasury Bill + 1,225 bps), 2/27/26 (144A) | 1,080,900 |

| 2,000,000(a) | Vista Re, 12.131%, (3 Month U.S. Treasury Bill + 675 bps), 5/21/24 (144A) | 1,999,000 |

| | | | | | | $ 37,830,225 |

|

|

| | Multiperil – U.S. Regional — 1.8% | |

| 400,000(a) | Aquila Re, 12.877%, (3 Month U.S. Treasury Bill + 750 bps), 6/8/26 (144A) | $ 407,600 |

| 1,400,000(a) | Aquila Re, 14.632%, (3 Month U.S. Treasury Bill + 925 bps), 6/8/26 (144A) | 1,437,800 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2413

Schedule of Investments | 4/30/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Multiperil – U.S. Regional — (continued) | |

| 1,150,000(a) | Locke Tavern Re, 10.156%, (3 Month U.S. Treasury Bill + 478 bps), 4/9/26 (144A) | $ 1,155,175 |

| 3,000,000(a) | Long Point Re IV, 9.624%, (3 Month U.S. Treasury Bill + 425 bps), 6/1/26 (144A) | 3,010,500 |

| | | | | | | $ 6,011,075 |

|

|

| | Multiperil – Worldwide — 7.5% | |

| 2,150,000(a) | Atlas Capital, 12.603%, (SOFR + 725 bps), 6/5/26 (144A) | $ 2,232,345 |

| 250,000(a) | Atlas Capital Re, 13.668%, (3 Month U.S. Treasury Bill + 829 bps), 6/10/24 (144A) | 250,100 |

| 2,000,000(a) | Cat Re 2001, 17.872%, (3 Month U.S. Treasury Bill + 1,250 bps), 1/8/27 (144A) | 2,072,000 |

| 5,000,000(a) | Kendall Re, 11.63%, (3 Month U.S. Treasury Bill + 625 bps), 4/30/27 (144A) | 5,000,174 |

| 10,000,000(a) | Kendall Re, 13.127%, (3 Month U.S. Treasury Bill + 775 bps), 4/30/27 (144A) | 9,999,563 |

| 5,000,000(a) | Montoya Re, 12.489%, (1 Month U.S. Treasury Bill + 711 bps), 4/7/25 (144A) | 5,020,500 |

| | | | | | | $ 24,574,682 |

|

|

| | Windstorm – Europe — 1.3% | |

| EUR 2,000,000(a) | Blue Sky Re, 9.629%, (3 Month EURIBOR + 575 bps), 1/26/27 (144A) | $ 2,208,890 |

| EUR 2,000,000(a) | Windmill II Re, 7.355%, (3 Month EURIBOR + 347 bps), 7/5/24 (144A) | 2,132,266 |

| | | | | | | $ 4,341,156 |

|

|

| | Windstorm – Florida — 7.0% | |

| 2,000,000(a) | Armor Re, 15.63%, (3 Month U.S. Treasury Bill + 1,025 bps), 5/7/27 (144A) | $ 1,998,000 |

| 600,000(a) | First Coast Re, 9.00%, (3 Month U.S. Treasury Bill + 900 bps), 4/7/26 (144A) | 612,660 |

| 3,000,000(a) | Integrity Re, 18.63%, (1 Month U.S. Treasury Bill + 1,325 bps), 6/6/26 (144A) | 2,970,600 |

| 1,500,000(a) | Integrity Re, 28.374%, (1 Month U.S. Treasury Bill + 2,300 bps), 6/6/26 (144A) | 1,477,500 |

| 10,000,000(a) | Palm Re, 14.879%, (1 Month U.S. Treasury Bill + 950 bps), 6/7/27 (144A) | 9,990,000 |

The accompanying notes are an integral part of these financial statements.

14Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Principal

Amount

USD ($) | | | | | | Value |

| | Windstorm – Florida — (continued) | |

| 4,000,000(a) | Winston Re, 15.63%, (3 Month U.S. Treasury Bill + 1,025 bps), 2/26/27 (144A) | $ 3,940,400 |

| 2,250,000(a) | Winston Re, 17.13%, (3 Month U.S. Treasury Bill + 1,175 bps), 2/26/27 (144A) | 2,212,650 |

| | | | | | | $ 23,201,810 |

|

|

| | Windstorm – Florida & Louisana — 1.0% | |

| 3,250,000(a) | Nature Coast Re, 15.377%, (3 Month U.S. Treasury Bill + 1,000 bps), 12/7/26 (144A) | $ 3,297,775 |

| | Windstorm – Jamaica — 0.8% | |

| 2,750,000(a)(c) | International Bank for Reconstruction & Development, 12.51%, (SOFR + 719 bps), 12/29/27 (144A) | $ 2,750,000 |

| | Windstorm – Japan — 1.4% | |

| 1,300,000(a) | Black Kite Re, 12.231%, (3 Month U.S. Treasury Bill + 685 bps), 6/9/25 (144A) | $ 1,311,570 |

| 1,000,000(a) | Sakura Re, 7.784%, (3 Month U.S. Treasury Bill + 241 bps), 4/7/25 (144A) | 989,000 |

| 1,500,000(a) | Tomoni Re, 8.13%, (3 Month U.S. Treasury Bill + 275 bps), 4/7/26 (144A) | 1,467,900 |

| 750,000(a) | Tomoni Re, 8.647%, (3 Month U.S. Treasury Bill + 325 bps), 4/5/28 (144A) | 748,050 |

| | | | | | | $ 4,516,520 |

|

|

| | Windstorm – Louisana — 0.9% | |

| 3,000,000(a) | Bayou Re, 24.881%, (1 Month U.S. Treasury Bill + 1,950 bps), 5/26/26 (144A) | $ 3,117,300 |

| | Windstorm – Mexico — 0.2% | |

| 500,000(a) | International Bank for Reconstruction & Development, 16.331%, (SOFR + 1,100 bps), 4/24/28 (144A) | $ 499,500 |

| | Windstorm - New York — 1.8% | |

| 6,000,000(a) | MetroCat Re, 5.75%, (3 Month U.S. Treasury Bill + 575 bps), 5/8/26 (144A) | $ 6,017,400 |

| | Windstorm – North Carolina — 3.0% | |

| 500,000(a) | Blue Ridge Re, 13.372%, (1 Month U.S. Treasury Bill + 800 bps), 1/8/27 (144A) | $ 509,050 |

| 9,250,000(a) | Cape Lookout Re, 13.377%, (1 Month U.S. Treasury Bill + 800 bps), 4/5/27 (144A) | 9,240,750 |

| | | | | | | $ 9,749,800 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2415

Schedule of Investments | 4/30/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Windstorm – Texas — 2.6% | |

| 3,000,000(a) | Alamo Re, 11.379%, (1 Month U.S. Treasury Bill + 600 bps), 6/7/27 (144A) | $ 2,997,000 |

| 550,000(a) | Alamo Re, 12.56%, (3 Month U.S. Treasury Bill + 718 bps), 6/7/24 (144A) | 552,200 |

| 500,000(a) | Alamo Re, 12.87%, (1 Month U.S. Treasury Bill + 749 bps), 6/7/25 (144A) | 496,150 |

| 1,500,000(a) | Alamo Re, 13.13%, (1 Month U.S. Treasury Bill + 775 bps), 6/7/27 (144A) | 1,497,750 |

| 3,000,000(a) | Alamo Re, 16.627%, (1 Month U.S. Treasury Bill + 1,125 bps), 6/7/26 (144A) | 2,995,500 |

| | | | | | | $ 8,538,600 |

|

|

| | Windstorm – U.S. — 10.4% | |

| 5,000,000(a) | Alamo Re, 13.88%, (1 Month U.S. Treasury Bill + 850 bps), 6/7/26 (144A) | $ 5,120,500 |

| 750,000(a) | Bonanza Re, 11.16%, (3 Month U.S. Treasury Bill + 578 bps), 3/16/25 (144A) | 704,025 |

| 1,250,000(a) | Cape Lookout Re, 13.799%, (1 Month U.S. Treasury Bill + 842 bps), 4/28/26 (144A) | 1,280,000 |

| 5,250,000(a) | Gateway Re, 15.38%, (1 Month U.S. Treasury Bill + 1,000 bps), 7/8/26 (144A) | 5,417,475 |

| 500,000(a) | Gateway Re, 18.38%, (1 Month U.S. Treasury Bill + 1,300 bps), 2/24/26 (144A) | 531,500 |

| 250,000(a) | Gateway Re II, 14.88%, (3 Month U.S. Treasury Bill + 950 bps), 4/27/26 (144A) | 256,825 |

| 2,250,000(a) | Lower Ferry Re, 9.63%, (1 Month U.S. Treasury Bill + 425 bps), 7/8/26 (144A) | 2,275,875 |

| 900,000(a) | Lower Ferry Re, 10.38%, (1 Month U.S. Treasury Bill + 500 bps), 7/8/26 (144A) | 914,580 |

| 1,750,000(a) | Mayflower Re, 4.50%, (1 Month U.S. Treasury Bill + 450 bps), 7/8/26 (144A) | 1,778,875 |

| 700,000(a) | Merna Re II, 15.632%, (3 Month U.S. Treasury Bill + 1,025 bps), 7/7/26 (144A) | 741,300 |

| 7,600,000(a) | Purple Re, 7.38%, (1 Month U.S. Treasury Bill + 200 bps), 6/7/27 (144A) | 7,592,400 |

| 1,500,000(a) | Purple Re, 15.397%, (1 Month U.S. Treasury Bill + 1,000 bps), 6/5/26 (144A) | 1,513,800 |

| 4,250,000(a) | Purple Re, 17.632%, (1 Month U.S. Treasury Bill + 1,225 bps), 4/24/26 (144A) | 4,377,500 |

| 1,800,000(a) | Queen Street Re, 12.879%, (3 Month U.S. Treasury Bill + 750 bps), 12/8/25 (144A) | 1,856,880 |

| | | | | | | $ 34,361,535 |

|

|

The accompanying notes are an integral part of these financial statements.

16Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Principal

Amount

USD ($) | | | | | | Value | |

| | Windstorm – U.S. & Canada — 0.9% | | |

| 2,750,000(a) | Titania Re, 18.13%, (1 Month U.S. Treasury Bill + 1,275 bps), 2/27/26 (144A) | $ 2,921,875 | |

| | Windstorm – U.S. Multistate — 1.9% | | |

| 1,000,000(a) | Charles River Re, 5.877%, (1 Month U.S. Treasury Bill + 50 bps), 5/10/27 (144A) | $ 1,000,000 | |

| 4,250,000(a) | Gateway Re, 5.377%, (1 Month U.S. Treasury Bill + 0 bps), 12/23/24 (144A) | 3,970,775 | |

| 1,250,000(a) | Gateway Re, 6.877%, (1 Month U.S. Treasury Bill + 150 bps), 7/8/27 (144A) | 1,247,000 | |

| | | | | | | $ 6,217,775 | |

| |

| |

| | Windstorm – U.S. Regional — 3.7% | | |

| 2,450,000(a) | Citrus Re, 12.13%, (3 Month U.S. Treasury Bill + 675 bps), 6/7/26 (144A) | $ 2,514,435 | |

| 750,000(a) | Citrus Re, 14.379%, (3 Month U.S. Treasury Bill + 900 bps), 6/7/26 (144A) | 774,525 | |

| 4,500,000(a) | Citrus Re, 14.627%, (3 Month U.S. Treasury Bill + 925 bps), 6/7/27 (144A) | 4,477,050 | |

| 4,500,000(a) | Citrus Re, 15.877%, (3 Month U.S. Treasury Bill + 1,050 bps), 6/7/27 (144A) | 4,475,250 | |

| | | | | | | $ 12,241,260 | |

| |

| |

| | Winterstorm – Florida — 4.6% | | |

| 5,700,000(a) | Integrity Re, 17.38%, (1 Month U.S. Treasury Bill + 1,200 bps), 6/6/25 (144A) | $ 5,839,080 | |

| 8,900,000(a) | Lightning Re, 16.379%, (3 Month U.S. Treasury Bill + 1,100 bps), 3/31/26 (144A) | 9,341,440 | |

| | | | | | | $ 15,180,520 | |

| |

| |

| | Total Event Linked Bonds | $312,628,731 | |

| |

| |

Face

Amount

USD ($) | | | | | | |

| | Collateralized Reinsurance — 2.8% | |

| | Multiperil – Worldwide — 2.7% | |

| 9,000,000(d)(e) + | Oakmont Re 2023, 4/1/29 | $ 9,000,747 |

| | Windstorm – Florida — 0.1% | |

| 2,250,000(d)(e) + | Isosceles Re, 5/31/29 | $ 238,050 |

| | Windstorm – North Carolina — 0.0%† | |

| 250,000(e) + | Isosceles Re, 4/30/29 | $ 200 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2417

Schedule of Investments | 4/30/24

(unaudited) (continued)

Face

Amount

USD ($) | | | | | | Value |

| | Windstorm – U.S. Multistate — 0.0%† | |

| 250,000(e) + | White Heron Re, 5/31/29 | $ 6,507 |

| | Total Collateralized Reinsurance | $9,245,504 |

|

|

| | Total Insurance-Linked Securities

(Cost $319,740,589) | $321,874,235 |

|

|

| | TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 97.6%

(Cost $319,740,589) | $321,874,235 |

| | OTHER ASSETS AND LIABILITIES — 2.4% | $ 7,942,731 |

| | net assets — 100.0% | $329,816,966 |

| | | | | | | |

| bps | Basis Points. |

| EURIBOR | Euro Interbank Offered Rate. |

| SOFR | Secured Overnight Financing Rate. |

| (144A) | The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At April 30, 2024, the value of these securities amounted to $312,628,731, or 94.8% of net assets. |

| (a) | Floating rate note. Coupon rate, reference index and spread shown at April 30, 2024. |

| (b) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at April 30, 2024. |

| (c) | Securities purchased on a when-issued basis. Rates do not take effect until settlement date. |

| (d) | Non-income producing security. |

| (e) | Issued as participation notes. |

| + | Security is valued using significant unobservable inputs (Level 3). |

| † | Amount rounds to less than 0.1%. |

| # | Securities are restricted as to resale. |

| Restricted Securities | Acquisition date | Cost | Value |

| Acorn Re | 1/10/2024 | $ 1,984,051 | $ 1,980,000 |

| Alamo Re | 2/8/2023 | 548,629 | 552,200 |

| Alamo Re | 4/12/2023 | 5,100,819 | 5,120,500 |

| Alamo Re | 9/25/2023 | 502,152 | 496,150 |

| Alamo Re | 4/4/2024 | 3,000,000 | 2,997,000 |

| Alamo Re | 4/4/2024 | 1,500,000 | 1,497,750 |

| Alamo Re | 4/4/2024 | 3,000,000 | 2,995,500 |

| Aquila Re | 5/10/2023 | 400,000 | 407,600 |

| Aquila Re | 5/10/2023 | 250,000 | 251,875 |

| Aquila Re | 5/10/2023 | 1,400,000 | 1,437,800 |

The accompanying notes are an integral part of these financial statements.

18Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| Restricted Securities | Acquisition date | Cost | Value |

| Armor Re | 4/11/2024 | $ 2,000,000 | $ 1,998,000 |

| Ashera Re | 3/21/2024 | 5,750,000 | 5,691,350 |

| Atela Re, Ltd. | | 3,000,000 | 3,000,000 |

| Atlas Capital | 5/17/2023 | 2,150,000 | 2,232,345 |

| Atlas Capital Re | 1/31/2023 | 248,937 | 250,100 |

| Azzurro Re II | 3/21/2024 | 1,085,650 | 1,067,200 |

| Baldwin Re | 6/21/2023 | 750,000 | 757,425 |

| Bayou Re | 2/5/2024 | 3,134,551 | 3,117,300 |

| Black Kite Re | 6/6/2023 | 1,295,751 | 1,311,570 |

| Blue Halo Re | 2/14/2024 | 1,012,951 | 965,400 |

| Blue Ridge Re | 11/14/2023 | 500,000 | 509,050 |

| Blue Sky Re | 12/11/2023 | 2,152,900 | 2,208,890 |

| Bonanza Re | 1/27/2023 | 676,554 | 704,025 |

| Caelus Re VI | 1/30/2023 | 498,222 | 499,000 |

| Cape Lookout Re | 4/14/2023 | 1,256,314 | 1,280,000 |

| Cape Lookout Re | 3/12/2024 | 9,250,000 | 9,240,750 |

| Cat Re 2001 | 11/14/2023 | 2,000,000 | 2,072,000 |

| Charles River Re | 4/5/2024 | 1,000,000 | 1,000,000 |

| Citrus Re | 4/27/2023 | 750,000 | 774,525 |

| Citrus Re | 4/27/2023 | 2,486,644 | 2,514,435 |

| Citrus Re | 3/19/2024 | 4,500,000 | 4,477,050 |

| Citrus Re | 3/19/2024 | 4,500,000 | 4,475,250 |

| First Coast Re | 3/24/2023 | 600,000 | 612,660 |

| FloodSmart Re | 2/23/2023 | 1,000,000 | 1,001,600 |

| FloodSmart Re | 2/23/2023 | 250,000 | 251,025 |

| FloodSmart Re | 2/29/2024 | 7,750,000 | 7,746,125 |

| FloodSmart Re | 2/29/2024 | 2,000,000 | 1,954,800 |

| Foundation Re | 12/19/2023 | 5,250,000 | 5,246,325 |

| Four Lakes Re | 3/3/2023 | 250,000 | 254,525 |

| Four Lakes Re | 12/8/2023 | 1,007,375 | 1,014,200 |

| Four Lakes Re | 12/8/2023 | 2,750,467 | 2,735,700 |

| Galileo Re | 12/4/2023 | 3,050,000 | 3,170,170 |

| Galileo Re | 12/4/2023 | 3,245,158 | 3,265,600 |

| Gateway Re | 2/3/2023 | 500,000 | 531,500 |

| Gateway Re | 7/14/2023 | 5,360,632 | 5,417,475 |

| Gateway Re | 3/11/2024 | 1,250,000 | 1,247,000 |

| Gateway Re | 3/11/2024 | 3,992,429 | 3,970,775 |

| Gateway Re II | 4/13/2023 | 250,000 | 256,825 |

| Herbie Re | 2/15/2024 | 6,000,000 | 5,910,000 |

| Herbie Re | 2/15/2024 | 1,500,000 | 1,480,500 |

| High Point Re | 12/1/2023 | 1,500,000 | 1,506,000 |

| Hypatia Re | 3/27/2023 | 3,990,474 | 4,044,425 |

| Integrity Re | 3/23/2023 | 5,848,661 | 5,839,080 |

| Integrity Re | 3/1/2024 | 3,000,000 | 2,970,600 |

| Integrity Re | 3/1/2024 | 1,500,000 | 1,477,500 |

| International Bank for Reconstruction & Development | | 1,500,000 | 1,498,500 |

| International Bank for Reconstruction & Development | | 2,000,000 | 1,998,000 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2419

Schedule of Investments | 4/30/24

(unaudited) (continued)

| Restricted Securities | Acquisition date | Cost | Value |

| International Bank for Reconstruction & Development | | $ 500,000 | $ 499,500 |

| International Bank for Reconstruction & Development | 3/17/2023 | 250,000 | 253,325 |

| International Bank for Reconstruction & Development | 4/25/2024 | 2,750,000 | 2,750,000 |

| Isosceles Re | 8/7/2023 | — | 200 |

| Isosceles Re | 9/7/2023 | 3,945 | 238,050 |

| Kendall Re | 4/22/2024 | 5,000,000 | 5,000,174 |

| Kendall Re | 4/22/2024 | 10,000,000 | 9,999,563 |

| Kilimanjaro III Re | 1/8/2024 | 1,612,264 | 1,595,750 |

| Kilimanjaro III Re | 1/12/2024 | 2,932,952 | 2,934,300 |

| Lightning Re | 3/20/2023 | 9,364,738 | 9,341,440 |

| Locke Tavern Re | 3/23/2023 | 1,150,000 | 1,155,175 |

| Long Point Re IV | 2/23/2023 | 2,965,633 | 3,010,500 |

| Lower Ferry Re | 6/23/2023 | 2,250,000 | 2,275,875 |

| Lower Ferry Re | 3/11/2024 | 919,982 | 914,580 |

| Matterhorn Re | 1/26/2024 | 7,519,836 | 7,336,500 |

| Mayflower Re | 6/26/2023 | 1,750,000 | 1,778,875 |

| Merna Re II | 4/5/2023 | 350,000 | 362,670 |

| Merna Re II | 4/5/2023 | 700,000 | 741,300 |

| Merna Re II | 1/12/2024 | 5,740,642 | 5,690,812 |

| MetroCat Re | 5/12/2023 | 6,108,171 | 6,017,400 |

| Mona Lisa Re | 1/27/2023 | 3,217,678 | 3,220,100 |

| Montoya Re | 2/28/2023 | 5,014,776 | 5,020,500 |

| Montoya Re | 12/28/2023 | 2,250,000 | 2,306,925 |

| Mystic Re | 12/12/2023 | 11,373,681 | 11,432,250 |

| Mystic Re IV | 1/31/2023 | 227,511 | 243,425 |

| Mystic Re IV | 9/19/2023 | 3,308,370 | 3,284,005 |

| Nakama Re | 4/14/2023 | 250,000 | 247,475 |

| Nakama Re | 4/16/2024 | 5,000,000 | 4,999,461 |

| Nature Coast Re | 11/16/2023 | 3,269,004 | 3,297,775 |

| Northshore Re II | 10/5/2023 | 3,090,366 | 3,108,300 |

| Oakmont Re 2023 | 2/15/2024 | 7,815,573 | 9,000,747 |

| Palm Re | 4/4/2024 | 10,000,000 | 9,990,000 |

| Purple Re | 4/6/2023 | 4,321,495 | 4,377,500 |

| Purple Re | 6/27/2023 | 1,500,000 | 1,513,800 |

| Purple Re | 4/2/2024 | 7,600,000 | 7,592,400 |

| Queen Street Re | 5/12/2023 | 1,800,000 | 1,856,880 |

| Ramble Re | 2/26/2024 | 6,000,000 | 5,930,400 |

| Residential Re | 1/30/2023 | 494,904 | 485,650 |

| Residential Re | 9/19/2023 | 487,263 | 470,250 |

| Residential Re | 11/7/2023 | 459,623 | 447,600 |

| Sakura Re | 5/24/2023 | 990,046 | 989,000 |

| Sanders Re | 5/24/2023 | 1,000,000 | 1,016,900 |

| Sanders Re | 1/16/2024 | 3,250,000 | 3,258,125 |

| Sanders Re II | 1/30/2023 | 241,944 | 243,750 |

| Sanders Re III | 2/14/2023 | 1,434,635 | 1,450,800 |

| Sanders Re III | 3/24/2023 | 700,000 | 701,470 |

The accompanying notes are an integral part of these financial statements.

20Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| Restricted Securities | Acquisition date | Cost | Value |

| Solomon Re | 6/12/2023 | $ 1,550,000 | $ 1,588,905 |

| Stabilitas Re | 6/7/2023 | 3,917,107 | 4,052,880 |

| Sussex Re | 1/27/2023 | 1,247,621 | 1,218,750 |

| Sutter Re | 6/6/2023 | 1,000,000 | 1,017,400 |

| Sutter Re | 6/6/2023 | 2,000,000 | 2,033,000 |

| Titania Re | 2/16/2023 | 1,000,000 | 1,080,900 |

| Titania Re | 2/16/2023 | 2,750,000 | 2,921,875 |

| Tomoni Re | 5/31/2023 | 1,484,861 | 1,467,900 |

| Tomoni Re | 3/25/2024 | 750,000 | 748,050 |

| Topanga Re | 10/5/2023 | 1,525,697 | 1,588,455 |

| Torrey Pines Re | 5/18/2023 | 2,100,000 | 2,129,820 |

| Torrey Pines Re | 9/19/2023 | 497,988 | 498,500 |

| Ursa Re | 10/10/2023 | 1,250,000 | 1,262,875 |

| Ursa Re | 12/22/2023 | 1,001,674 | 1,015,900 |

| Ursa Re | 1/8/2024 | 1,759,466 | 1,780,625 |

| Ursa Re II | 1/10/2024 | 1,501,192 | 1,501,500 |

| Veraison Re | 1/30/2024 | 2,000,000 | 2,013,000 |

| Vista Re | 1/30/2023 | 2,002,157 | 1,999,000 |

| Vitality Re XIII | 3/6/2023 | 486,104 | 496,200 |

| Vitality Re XV | 1/22/2024 | 1,000,000 | 998,600 |

| Vitality Re XV | 1/22/2024 | 500,000 | 503,850 |

| White Heron Re | 8/30/2023 | — | 6,507 |

| Windmill II Re | 3/18/2024 | 2,172,369 | 2,132,266 |

| Winston Re | 2/14/2024 | 4,000,000 | 3,940,400 |

| Winston Re | 2/14/2024 | 2,250,000 | 2,212,650 |

| Total Restricted Securities | | | $321,874,235 |

| % of Net assets | | | 97.6% |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | In

Exchange for | Currency

Sold | Deliver | Counterparty | Settlement

Date | Unrealized

Appreciation |

| USD | 5,441,318 | EUR | 5,000,000 | Goldman Sachs & Co. | 6/28/24 | $92,079 |

| TOTAL FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS | $ 92,079 |

| USD | United States Dollar |

| EUR | Euro |

Principal amounts are denominated in U.S. dollars (“USD”) unless otherwise noted.

Purchases and sales of securities (excluding short-term investments) for the six months ended April 30, 2024, aggregated $245,848,648 and $9,820,477, respectively.

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2421

Schedule of Investments | 4/30/24

(unaudited) (continued)

At April 30, 2024, the net unrealized appreciation on investments based on cost for federal tax purposes of $321,378,109 was as follows:

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ 3,426,477 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (2,838,272) |

| Net unrealized appreciation | $ 588,205 |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| Level 1 | – | unadjusted quoted prices in active markets for identical securities. |

| Level 2 | – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| Level 3 | – | significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

The accompanying notes are an integral part of these financial statements.

22Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

The following is a summary of the inputs used as of April 30, 2024 in valuing the Fund’s investments:

| | Level 1 | Level 2 | Level 3 | Total |

| Insurance-Linked Securities | | | | |

| Collateralized Reinsurance | | | | |

| Multiperil – Worldwide | $— | $ — | $9,000,747 | $ 9,000,747 |

| Windstorm – Florida | — | — | 238,050 | 238,050 |

| Windstorm – North Carolina | — | — | 200 | 200 |

| Windstorm – U.S. Multistate | — | — | 6,507 | 6,507 |

| All Other Insurance-Linked Securities | — | 312,628,731 | — | 312,628,731 |

| Total Investments in Securities | $ — | $ 312,628,731 | $ 9,245,504 | $ 321,874,235 |

| Other Financial Instruments | | | | |

| Net unrealized appreciation on forward foreign currency exchange contracts | $— | $ 92,079 | $ — | $ 92,079 |

| Total Other Financial Instruments | $ — | $ 92,079 | $ — | $ 92,079 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2423

Schedule of Investments | 4/30/24

(unaudited) (continued)

The following is a reconciliation of assets valued using significant unobservable inputs (Level 3):

| | Insurance-

Linked

Securities |

| Balance as of 10/31/23 | $ 2,742,800 |

| Realized gain (loss)(1) | — |

| Changed in unrealized appreciation (depreciation)(2) | 1,163,663 |

| Return of capital | (2,476,532 ) |

| Purchases | 7,815,573 |

| Sales | — |

| Transfers in to Level 3* | — |

| Transfers out of Level 3* | — |

| Balance as of 4/30/24 | $ 9,245,504 |

| (1) | Realized gain (loss) on these securities is included in the realized gain (loss) from investments on the Statement of Operations. |

| (2) | Unrealized appreciation (depreciation) on these securities is included in the change in unrealized appreciation (depreciation) from investments on the Statement of Operations. |

| * | Transfers are calculated on the beginning of period values. During the six months ended April 30, 2024, there were no transfers in or out of Level 3. |

| Net change in unrealized appreciation (depreciation) of Level 3 investments still held and considered Level 3 at April 30, 2024: | $1,163,663 |

The accompanying notes are an integral part of these financial statements.

24Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Statement of Assets and Liabilities | 4/30/24

(unaudited)

| ASSETS: | |

| Investments in unaffiliated issuers, at value (cost $319,740,589) | $321,874,235 |

| Cash | 10,395,734 |

| Foreign currencies, at value (cost $108,037) | 107,332 |

| Unrealized appreciation on forward foreign currency exchange contracts | 92,079 |

| Receivables — | |

| Fund shares sold | 1,890,161 |

| Interest | 3,025,367 |

| Other assets | 73,546 |

| Total assets | $337,458,454 |

| LIABILITIES: | |

| Payables — | |

| Investment securities purchased | $ 5,750,000 |

| Fund shares repurchased | 1,712,882 |

| Trustees’ fees | 731 |

| Due to Adviser | 4,285 |

| Management fees | 53,860 |

| Administrative expenses | 4,391 |

| Distribution fees | 10 |

| Accrued expenses | 115,329 |

| Total liabilities | $ 7,641,488 |

| NET ASSETS: | |

| Paid-in capital | $321,829,559 |

| Distributable earnings | 7,987,407 |

| Net assets | $329,816,966 |

| NET ASSET VALUE PER SHARE: | |

| No par value (unlimited number of shares authorized) | |

| Class A (based on $301,654/27,693 shares) | $ 10.89 |

| Class K (based on $35,909,530/3,323,838 shares) | $ 10.80 |

| Class Y (based on $293,605,782/27,191,839 shares) | $ 10.80 |

| MAXIMUM OFFERING PRICE PER SHARE: | |

| Class A (based on $10.89 net asset value per share/100%-4.50% maximum sales charge) | $ 11.40 |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2425

Statement of Operations (unaudited)

FOR THE SIX MONTHS ENDED 4/30/24

| INVESTMENT INCOME: | | |

| Interest from unaffiliated issuers | $9,999,046 | |

| Dividends from unaffiliated issuers | 421,107 | |

| Total Investment Income | | $10,420,153 |

| EXPENSES: | | |

| Management fees | $1,034,095 | |

| Administrative expenses | 27,811 | |

| Transfer agent fees | | |

| Class A | 14 | |

| Class K | 2 | |

| Class Y | 89,790 | |

| Distribution fees | | |

| Class A | 250 | |

| Shareholder communications expense | 1,101 | |

| Custodian fees | 665 | |

| Registration fees | 45,448 | |

| Professional fees | 38,656 | |

| Printing expense | 7,028 | |

| Officers’ and Trustees’ fees | 4,428 | |

| Miscellaneous | 11,348 | |

| Total expenses | | $ 1,260,636 |

| Net investment income | | $ 9,159,517 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | |

| Net realized gain (loss) on: | | |

| Investments in unaffiliated issuers | $ (8,774) | |

| Forward foreign currency exchange contracts | (46,374) | |

| Other assets and liabilities denominated in foreign currencies | (41,305) | $ (96,453) |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investments in unaffiliated issuers | $ 621,037 | |

| Forward foreign currency exchange contracts | 106,769 | |

| Other assets and liabilities denominated in foreign currencies | (1,113) | $ 726,693 |

| Net realized and unrealized gain (loss) on investments | | $ 630,240 |

| Net increase in net assets resulting from operations | | $ 9,789,757 |

The accompanying notes are an integral part of these financial statements.

26Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

Statement of Changes in Net Assets

| | Six Months

Ended

4/30/24

(unaudited) | Period From

1/27/23* to

10/31/23 |

| FROM OPERATIONS: | | |

| Net investment income (loss) | $ 9,159,517 | $ 4,147,865 |

| Net realized gain (loss) on investments | (96,453) | 356,343 |

| Change in net unrealized appreciation (depreciation) on investments | 726,693 | 1,498,088 |

| Net increase in net assets resulting from operations | $ 9,789,757 | $ 6,002,296 |

| Class A ($0.84 and $— per share, respectively) | (11,981) | — |

| Class K ($0.98 and $— per share, respectively) | (809,165) | — |

| Class Y ($0.97 and $— per share, respectively) | (6,984,130) | — |

| Total distributions to shareholders | $ (7,805,276) | $ — |

| FROM FUND SHARE TRANSACTIONS: | | |

| Net proceeds from sales of shares | $271,485,609 | $102,533,307 |

| Reinvestment of distributions | 7,799,624 | — |

| Cost of shares repurchased | (35,652,091) | (24,336,260) |

| Net increase in net assets resulting from Fund share transactions | $243,633,142 | $ 78,197,047 |

| Net increase in net assets | $245,617,623 | $ 84,199,343 |

| NET ASSETS: | | |

| Beginning of period | $ 84,199,343 | $ — |

| End of period | $329,816,966 | $ 84,199,343 |

| * | The Fund commenced operations on January 27, 2023. |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2427

Statement of Changes in Net Assets

(continued)

| | Six Months

Ended

4/30/24

Shares

(unaudited) | Six Months

Ended

4/30/24

Amount

(unaudited) | Period From

1/27/23* to

10/31/23

Shares | Period From

1/27/23* to

10/31/23

Amount |

| Class A | | | | |

| Shares sold | 16,299 | $ 177,899 | 100,460 | $ 1,004,972 |

| Reinvestment of distributions | 1,034 | 10,716 | — | — |

| Less shares repurchased | (43,660) | (486,809) | (46,440) | (501,545) |

| Net increase | (26,327) | $ (298,194) | 54,020 | $ 503,427 |

| Class K | | | | |

| Shares sold | 2,427,699 | $ 25,893,156 | 928,213 | $ 9,553,900 |

| Reinvestment of distributions | 78,866 | 809,165 | — | — |

| Less shares repurchased | (57,656) | (639,870) | (53,284) | (577,599) |

| Net increase | 2,448,909 | $ 26,062,451 | 874,929 | $ 8,976,301 |

| Class Y | | | | |

| Shares sold | 23,147,794 | $245,414,554 | 8,787,638 | $ 91,974,435 |

| Reinvestment of distributions | 680,287 | 6,979,743 | — | — |

| Less shares repurchased | (3,262,695) | (34,525,412) | (2,161,185) | (23,257,116) |

| Net increase | 20,565,386 | $217,868,885 | 6,626,453 | $ 68,717,319 |

| * | The Fund commenced operations on January 27, 2023. |

The accompanying notes are an integral part of these financial statements.

28Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| | Six Months

Ended

4/30/24

(unaudited) | 1/27/23* to

10/31/23 |

| Class A | | |

| Net asset value, beginning of period | $11.12 | $10.00 |

| Increase (decrease) from investment operations: | | |

| Net investment income (loss) (a) | $ 0.56 | $ 0.77 |

| Net realized and unrealized gain (loss) on investments | 0.05 | 0.35 |

| Net increase (decrease) from investment operations | $ 0.61 | $ 1.12 |

| Distributions to shareholders: | | |

| Net investment income | $ (0.84) | $ — |

| Total distributions | $ (0.84) | $ — |

| Net increase (decrease) in net asset value | $ (0.23) | $ 1.12 |

| Net asset value, end of period | $10.89 | $11.12 |

| Total return (b) | 5.91%(c) | 11.20%(c) |

| Ratio of net expenses to average net assets | 1.62%(d) | 1.68%(d) |

| Ratio of net investment income (loss) to average net assets | 10.30%(d) | 9.65%(d) |

| Portfolio turnover rate | 6%(c) | 77%(c) |

| Net assets, end of period (in thousands) | $ 302 | $ 601 |

| Ratios with no waiver of fees and assumption of expenses by the Adviser and no reduction for fees paid indirectly: | | |

| Total expenses to average net assets | 1.62%(d) | 2.26%(d) |

| Net investment income (loss) to average net assets | 10.30%(d) | 9.07%(d) |

| * | Class A commenced operations on January 27, 2023. |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2429

Financial Highlights (continued)

| | Six Months

Ended

4/30/24

(unaudited) | 1/27/23* to

10/31/23 |

| Class K | | |

| Net asset value, beginning of period | $ 11.15 | $10.00 |

| Increase (decrease) from investment operations: | | |

| Net investment income (loss) (a) | $ 0.57 | $ 0.86 |

| Net realized and unrealized gain (loss) on investments | 0.06 | 0.29 |

| Net increase (decrease) from investment operations | $ 0.63 | $ 1.15 |

| Net investment income | (0.98) | — |

| Total distributions | $ (0.98) | $ — |

| Net increase (decrease) in net asset value | $ (0.35) | $ 1.15 |

| Net asset value, end of period | $ 10.80 | $11.15 |

| Total return (b) | 6.08%(c) | 11.50%(c) |

| Ratio of net expenses to average net assets | 1.36%(d) | 1.39%(d) |

| Ratio of net investment income (loss) to average net assets | 10.86%(d) | 10.70%(d) |

| Portfolio turnover rate | 6%(c) | 77%(c) |

| Net assets, end of period (in thousands) | $35,910 | $9,755 |

| Ratios with no waiver of fees and assumption of expenses by the Adviser and no reduction for fees paid indirectly: | | |

| Total expenses to average net assets | 1.36%(d) | 1.96%(d) |

| Net investment income (loss) to average net assets | 10.86%(d) | 10.13%(d) |

| * | Class K commenced operations on January 27, 2023. |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

30Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| | Six Months

Ended

4/30/24

(unaudited) | 1/27/23* to

10/31/23 |

| Class Y | | |

| Net asset value, beginning of period | $ 11.14 | $ 10.00 |

| Increase (decrease) from investment operations: | | |

| Net investment income (loss) (a) | $ 0.56 | $ 0.85 |

| Net realized and unrealized gain (loss) on investments | 0.07 | 0.29 |

| Net increase (decrease) from investment operations | $ 0.63 | $ 1.14 |

| Net investment income | (0.97) | — |

| Total distributions | $ (0.97) | $ — |

| Net increase (decrease) in net asset value | $ (0.34) | $ 1.14 |

| Net asset value, end of period | $ 10.80 | $ 11.14 |

| Total return (b) | 6.11%(c) | 11.40%(c) |

| Ratio of net expenses to average net assets | 1.47%(d) | 1.50%(d) |

| Ratio of net investment income (loss) to average net assets | 10.61%(d) | 10.55%(d) |

| Portfolio turnover rate | 6%(c) | 77%(c) |

| Net assets, end of period (in thousands) | $293,606 | $73,843 |

| Ratios with no waiver of fees and assumption of expenses by the Adviser and no reduction for fees paid indirectly: | | |

| Total expenses to average net assets | 1.47%(d) | 2.11%(d) |

| Net investment income (loss) to average net assets | 10.61%(d) | 9.94%(d) |

| * | Class Y commenced operations on January 27, 2023. |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2431

Notes to Financial Statements | 4/30/24

(unaudited)

1. Organization and Significant Accounting Policies

Pioneer CAT Bond Fund (the “Fund”) is one of two portfolios comprising Pioneer Series Trust VII (the “Trust”), a Delaware statutory trust. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, open-end management investment company. The investment objective of the Fund is to seek total return.

The Fund offers four classes of shares designated as Class A, Class C, Class K and Class Y shares. Class C shares had not commenced operations as of April 30, 2024. Class A, Class K and Class Y commenced operations on January 27, 2023. Each class of shares represents an interest in the same portfolio of investments of the Fund and has identical rights (based on relative net asset values) to assets and liquidation proceeds. Share classes can bear different rates of class-specific fees and expenses, such as transfer agent and distribution fees. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different dividends from net investment income earned by each class. The Amended and Restated Declaration of Trust of the Trust gives the Board of Trustees the flexibility to specify either per-share voting or dollar-weighted voting when submitting matters for shareowner approval. Under per-share voting, each share of a class of the Fund is entitled to one vote. Under dollar-weighted voting, a shareowner’s voting power is determined not by the number of shares owned, but by the dollar value of the shares on the record date. Each share class has exclusive voting rights with respect to matters affecting only that class, including with respect to the distribution plan for that class. There is no distribution plan for Class K or Class Y shares.

Amundi Asset Management US, Inc., an indirect wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”). Amundi Distributor US, Inc., an affiliate of the Adviser, serves as the Fund’s distributor (the “Distributor”).

The Fund is required to comply with Rule 18f-4 under the 1940 Act, which governs the use of derivatives by registered investment companies. Rule 18f-4 permits funds to enter into derivatives transactions (as defined in Rule 18f-4) and certain other transactions notwithstanding the restrictions on the issuance of “senior securities” under Section 18 of the 1940 Act. Rule 18f-4 requires a fund to establish and maintain a comprehensive derivatives risk management program, appoint a derivatives

32Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

risk manager and comply with a relative or absolute limit on fund leverage risk calculated based on value-at-risk (“VaR”), unless the fund uses derivatives in only a limited manner (a "limited derivatives user"). The Fund is currently a limited derivatives user for purposes of Rule 18f-4.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| A. | Security Valuation |

| | The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. |

| | Event-linked bonds are valued at the bid price obtained from an independent third party pricing service. Other insurance-linked securities (including reinsurance sidecars, collateralized reinsurance and industry loss warranties) may be valued at the bid price obtained from an independent pricing service, or through a third party using a pricing matrix, insurance valuation models, or other fair value methods or techniques to provide an estimated value of the instrument. |

| | Fixed income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers. |

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2433

| | The value of foreign securities is translated into U.S. dollars based on foreign currency exchange rate quotations supplied by a third party pricing source. Trading in non-U.S. equity securities is substantially completed each day at various times prior to the close of the NYSE. The values of such securities used in computing the net asset value of the Fund's shares are determined as of such times. The Adviser may use a fair value model developed by an independent pricing service to value non-U.S. equity securities. |

| | Shares of open-end registered investment companies (including money market mutual funds) are valued at such funds’ net asset value. |

| | Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities. |

| | Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material. |

| B. | Investment Income and Transactions |

| | Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities where the ex-dividend date may have passed are recorded as soon as the Fund becomes aware of the ex-dividend data in the exercise of reasonable diligence. |

| | Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. |

34Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| | Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. |

| | Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. |

| C. | Foreign Currency Translation |

| | The books and records of the Fund are maintained in U.S. dollars. Amounts denominated in foreign currencies are translated into U.S. dollars using current exchange rates. |

| | Net realized gains and losses on foreign currency transactions, if any, represent, among other things, the net realized gains and losses on foreign currency exchange contracts, disposition of foreign currencies and the difference between the amount of income accrued and the U.S. dollars actually received. Further, the effects of changes in foreign currency exchange rates on investments are not segregated on the Statement of Operations from the effects of changes in the market prices of those securities, but are included with the net realized and unrealized gain or loss on investments. |

| D. | Federal Income Taxes |

| | It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its shareholders. Therefore, no provision for federal income taxes is required. As of April 30, 2024, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities. |

| | The amount and character of income and capital gain distributions to shareholders are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences. |

Pioneer CAT Bond Fund | Semiannual Report | 4/30/2435

| | The tax character of distributions paid during the period ended October 31, 2023 was as follows: |

| | 2023 |

| Distributions paid from: | |

| Ordinary income | $ — |

| Total | $— |

The following shows the components of distributable earnings (losses) on a federal income tax basis at October 31, 2023:

| | 2023 |

| Distributable earnings/(losses): | |

| Undistributed ordinary income | $6,145,519 |

| Capital loss carryforward | (2,992) |

| Net unrealized depreciation | (139,601) |

| Total | $ 6,002,926 |

The difference between book-basis and tax-basis net unrealized depreciation is attributable to the tax adjustments relating to ILS securities and the mark-to-market of foreign currency contracts.

| E. | Fund Shares |

| | The Fund records sales and repurchases of its shares as of trade date. The Distributor did not earn underwriting commissions on the sale of Class A shares during the six months ended April 30, 2024. |

| F. | Class Allocations |

| | Income, common expenses and realized and unrealized gains and losses are calculated at the Fund level and allocated daily to each class of shares based on its respective percentage of adjusted net assets at the beginning of the day. |

| | Distribution fees are calculated based on the average daily net asset value attributable to Class A shares of the Fund (see Note 5). Class K and Class Y shares do not pay distribution fees. All expenses and fees paid to the Fund's transfer agent for its services are allocated among the classes of shares based on the number of accounts in each class and the ratable allocation of related out-of-pocket expenses (see Note 4). |

| | The Fund generally pays dividends from any net investment income in December. Short- and long-term capital gain distributions are paid in November. Distributions to shareowners are recorded as of the ex-dividend date. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner and at the same time, |

36Pioneer CAT Bond Fund | Semiannual Report | 4/30/24

| | except that net investment income dividends to Class A, Class K and Class Y shares can reflect different transfer agent and distribution expense rates. |

| G. | Risks |

| | The value of securities held by the Fund may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, the spread of infectious illness or other public health issues, inflation, changes in interest rates, armed conflict such as between Russia and Ukraine or in the Middle East, sanctions against Russia, other nations or individuals or companies and possible countermeasures, lack of liquidity in the bond markets or adverse investor sentiment. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. Inflation and interest rates have increased and may rise further. These circumstances could adversely affect the value and liquidity of the Fund’s investments and negatively impact the Fund’s performance. |

| | The long-term impact of the COVID-19 pandemic and its subsequent variants on economies, markets, industries and individual issuers, are not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets, reduced liquidity of many instruments, increased government debt, inflation, and disruptions to supply chains, consumer demand and employee availability, may continue for some time. Following Russia’s invasion of Ukraine, Russian securities lost all, or nearly all, their market value. Other securities or markets could be similarly affected by past or future political, geopolitical or other events or conditions. |

| | Governments and central banks, including the U.S. Federal Reserve, have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. These actions have resulted in significant expansion of public debt, including in the U.S. The consequences of high public debt, including its future impact on the economy and securities markets, may not be known for some time. |