Pioneer Global High

Yield Fund

Semiannual Report | April 30, 2021

| A: PGHYX | C: PGYCX | Y: GHYYX |

Paper copies of the Fund’s shareholder reports are no longer sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports are available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-225-6292. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundi.com/us

| | |

| |

| 2 |

| | |

| 4 |

| | |

| 11 |

| | |

| 12 |

| | |

| 13 |

| | |

| 16 |

| | |

| 18 |

| | |

| 42 |

| | |

| 49 |

| | |

| 69 |

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 1

President’s LetterDear Shareholders,

With the first half of 2021 nearly over, we have seen some better news on the COVID-19 pandemic front. In the US, widespread distribution of the COVID-19 vaccines approved for emergency use late last year, and a general decline in both virus cases and related hospitalizations, have had a positive effect on overall market sentiment.

While there may finally be a light visible at the end of the pandemic tunnel, the long-term impact on the global economy from COVID-19, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others, and the markets, which do not thrive on uncertainty, have been volatile.

With that said, so far during 2021, we have seen investments typically associated with a higher degree of risk, such as equities and high-yield bonds, outperform investments regarded as less risky, such as government debt. In addition, cyclical stocks, or stocks of companies with greater exposure to the ebbs and flows of the economic cycle, have rallied this year after slumping during the height of the pandemic, as investors have appeared to embrace the potential for a more widespread reopening of the economy in the coming months. Additional fiscal stimulus from the US government in recent months has also helped provide some market momentum.

Despite the strong rebound from the March 2020 lows and positive market performance so far this year, several factors that could lead to increased volatility and weaker performance bear watching. These include: public-health issues such as potential surges in COVID-19 cases, particularly as “variants” of the virus have continued to arise; macroeconomic concerns (inflation, energy prices, sluggish employment figures); and changes to the US government’s fiscal policies, particularly the possibility of higher income tax rates on both individuals and businesses.

After leaving our offices in March of 2020 due to COVID-19, we have re-opened our US locations and have invited our employees to slowly return to the office. I am proud of the careful planning that has taken place. Our business has continued to operate without any disruption and we all look forward to regaining a bit of normalcy after 15 months of remote working.

Since 1928, Amundi US’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the risks during periods of market volatility.

2 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress.

As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

June 2021

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 3

Portfolio Management Discussion |

4/30/21 In the following interview, Andrew Feltus, Ken Monaghan, and Matt Shulkin discuss the factors that influenced the performance of Pioneer Global High Yield Fund during the six-month period ended April 30, 2021. Mr. Feltus, Managing Director, Co-Director of High Yield, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), is responsible for the day-to-day management of the Fund, along with Mr. Monaghan, Managing Director, Co-Director of High Yield, and a portfolio manager at Amundi US, and Mr. Shulkin, a senior vice president and a portfolio manager at Amundi US.

Q How did the Fund perform during the six-month period ended April 30, 2021?

A Pioneer Global High Yield Fund’s Class A shares returned 12.72% at net asset value during the six-month period ended April 30, 2021, while the Fund’s benchmarks, the Bloomberg Barclays Global High Yield Index (the Bloomberg Barclays Index) and the ICE Bank of America (ICE BofA) U.S. High Yield Index, returned 8.58% and 8.12%, respectively. During the same period, the average return of the 695 mutual funds in Morningstar’s High Yield Bond Funds category was 7.98%.

Q Could you please describe the market environment for global high-yield investors during the six-month period ended April 30, 2021?

A Entering the period in November 2020, markets had been focused on heightened risks revolving around three key areas: the continuing COVID-19 pandemic, the need for additional fiscal stimulus, and political risks, particularly the US elections. COVID-19 outbreaks at the time were ongoing and the lockdowns enacted earlier in 2020 to help slow the propagation of the virus, while relaxed in some areas, were economically costly nonetheless. After an initial wave of fiscal stimulus packages early on in the pandemic, additional legislation in both the US and Europe were proving difficult to enact. On the political front, arranging the final details of the Brexit deal in the United Kingdom were challenging, and signs had emerged that the US election results would be contested.

In December, the confirmation of November’s US election results helped reduce uncertainty and boosted market sentiment. That same month, the economic outlook received two “shots in the arm,” as a pair of COVID-19 vaccines received emergency-use authorization, and Congress finally reached agreement on a $900 billion COVID-19 relief package. Markets

4 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

viewed the vaccines as the proverbial “light at the end of the tunnel” for the pandemic, betting that widespread vaccinations would help alleviate public-health uncertainty and bring forward the timing of a return to economic normalcy. The additional fiscal stimulus measures were viewed as offering much needed support for many individuals and businesses.

As 2021 got underway, investors elected to focus their attention on those positive developments and looked beyond regional “surges” in COVID-19 cases, as well as select data that suggested a slowing in the rate of economic recovery. By late January, remaining political uncertainty had been removed as a new administration and Democrat-controlled House and Senate took office and almost immediately began discussions about even more fiscal stimulus, which resulted in passage of another $1.9 trillion COVID-19 relief package soon after. In response, riskier assets rallied and yields on high-quality sovereign debt moved higher in the first quarter of 2021.

US high-yield corporates generated positive returns every month during the six-month period, even as credit spreads tightened and Treasury bond yields rose. (Credit spreads are commonly defined as the differences in yield between Treasuries and other types of fixed-income securities with similar maturities.) European high-yield debt generated similar results in local currencies, but the euro appreciated over the period, due to the easy monetary stance of the US Federal Reserve (Fed), and that helped lift the total returns of non-US dollar (USD) high-yield bonds.

Despite strong performance at the end of 2020, emerging markets high-yield bonds have lagged other high-yield sectors so far in 2021, reflecting their longer duration as well as some idiosyncratic risk; for instance, the performance of Petrobras, a bond the Fund does not hold, weakened on news of the Brazilian government’s interference with company management. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed-income investment to a change in interest rates, expressed as a number of years.)

Q What were the principal factors that influenced the Fund’s benchmark-relative performance during the six-month period ended April 30, 2021?

A The Fund’s asset allocations led the positive contributors to benchmark-relative performance for the six-month period, while security selection also aided relative returns.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 5

In sector terms, the portfolio’s positioning in energy, transportation, and leisure were the top positive contributors to relative performance for the period. Those sectors have been rebounding as the global economy has gradually reopened. The Fund was overweight versus the benchmark to energy and transportation, and experienced strong security selection results in both sectors as well. The Fund’s relative performance also benefited from overweights to leisure, airlines, and other sectors that bore the brunt of the COVID-19 lockdowns, but that so far have bounced back strongly in 2021.

In terms of credit quality, the Fund benefited from being underweight to issues rated BB, and from an overweight to B-rated issues. Regionally, the portfolio’s overweight to North America and underweights to Europe and the emerging markets also aided the Fund’s relative results.

The largest detractor from relative performance from a positioning standpoint was the Fund’s cash allocation; we hold cash in the portfolio in an effort to ensure adequate liquidity as part of our investment strategy.

At the individual security level, the leading positive contributors to the Fund’s relative returns during the six-month period included positions in AMC Entertainment, the global movie theater chain; Baytex Energy, an exploration-and-production company focused on oil operations in Western Canada and the Eagle Ford field in Texas; and Shelf Drilling, an operator of shallow water jack-up drilling rigs outside of the US.

Leading detractors from the Fund’s relative performance among individual securities included underweights in Occidental Petroleum, the large global exploration-and-production company; Pemex, the Mexican state-owned oil company; and Bombardier, the manufacturer of regional jets for the airline industry.

Q Did the Fund have any exposure to derivative securities during the six-month period ended April 30, 2021? If so, did the derivatives have any effect on the Fund’s performance?

A Yes, we utilized index-based credit-default swaps in order to maintain the desired level of portfolio exposure to the high-yield market, and as a means of seeking to maintain sufficient liquidity to make opportunistic purchases and helping to meet any unanticipated redemption requests. We use the swap positions to increase the Fund’s market exposure at certain times, and to decrease market exposure at other times. During the six-month period, the use of credit-default swaps had a positive effect on the Fund’s performance. We also utilized forward foreign currency

6 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

contracts (currency forwards) and foreign exchange options during the six-month period, and those positions also had a positive impact on the Fund’s performance as the euro gained ground versus the USD.

Q Did the Fund’s distributions* to shareholders change during the six-month period ended April 30, 2021?

A The Fund’s monthly distributions remained relatively stable over the six months, despite volatility in both Treasury yields and credit spreads.

Q What is your investment outlook?

A The Fed has continued to message that it is willing to keep US monetary policy accommodative for an extended period of time. While “an extended period of time” seems to be a purposefully vague duration, public comments from members of the Federal Open Market Committee (FOMC) have suggested that they could be thinking the “extended period” equals at least one year. If the FOMC, as suggested, waits for a full year with Core PCE (personal consumption) inflation at more than 2% before tightening monetary policy, rate hikes could be off the table until 2023, in our opinion. That would be consistent with the Fed’s own “dot plot” projections. Market pricing, however, has reflected a somewhat faster pace for rate hikes, due in part to the possibility that the markets may not “buy” the Fed’s new operating framework. (The Fed’s “dot” plot/projection is a quarterly chart summarizing the outlook for the federal funds rate for each of the FOMC’s members.)

Given the likelihood of additional fiscal stimulus through a proposed infrastructure spending package and possibly other initiatives, and a more rapid US economic reopening, we have revised upwards our base-case 2021 US gross domestic product growth forecast. Meanwhile, Europe and the emerging markets are “earlier” in their economic recoveries, as vaccination efforts in those regions have been less effective than in the US. However, we believe those areas will eventually reopen and see accelerating expansions.

We think the demand-driven economic growth dynamic could be positive for corporate fundamentals and consumer balance sheets. In turn, solid issuer fundamentals and still-elevated investor cash balances (which are earning close to 0% yield) may support the performance of credit-sensitive securities going forward.

* Distributions are not guaranteed.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 7

We currently regard the risk of interest rates moving sharply higher as remote, but we are monitoring conditions closely as strong monthly economic data on the horizon could push Treasury yields higher in the coming months.

All in all, we believe the current backdrop is supportive for high-yield fundamentals. Strong growth and corporate profits have resulted in decreasing default rates. Markets are open and companies have good access to financing, in both the loan and bond markets.

Our main concern heading into the second half of the Fund’s fiscal year is valuations. High-yield spreads, at period-end, were in the lower quartile of historical ranges, but still appear attractive relative to other “spread assets,” such as investment-grade corporate bonds and government-backed mortgage bonds. Our base case is that default losses might be low, but that the level of valuations and rising Treasury yields could constrain total returns, even if high-yield securities continue to outperform other segments of the bond market.

8 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

Please refer to the Schedule of Investments on pages 18–41 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

Investments in high-yield or lower-rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.

When interest rates rise, the prices of fixed-income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed-income securities held by the Fund will generally rise.

Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, and economic and political conditions.

Prepayment risk is the chance that an issuer may exercise its right to repay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.

The Fund may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.

The Fund may use derivatives, such as options, futures, inverse floating rate obligations, swaps, and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Derivatives may have a leveraging effect on the Fund.

At times, the Fund’s investments may represent industries or industry sectors that are interrelated or have common risks, making the Fund more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 9

These risks may increase share price volatility.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Amundi Asset Management US, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

10 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

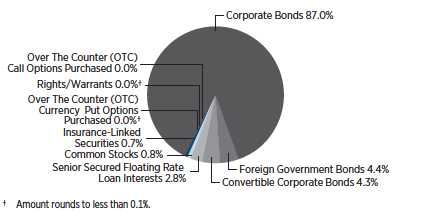

Portfolio Summary |

4/30/21 Portfolio Diversification

(As a percentage of total investments)*

Geographical Distribution

(As a percentage of total investments based on country of domicile)

| | | |

| 10 Largest Holdings | |

(As a percentage of total investments)* | |

| 1. | Ford Motor Credit Co. LLC, 4.125%, 8/17/27 | 1.18% |

| 2. | Pegasus Hava Tasimaciligi AS, 9.25%, 4/30/26 (144A) | 1.07 |

| 3. | Metinvest BV, 7.75%, 10/17/29 (144A) | 1.02 |

| 4. | MDC Partners, Inc., 7.5%, 5/1/24 (144A) | 0.94 |

| 5. | PowerTeam Services LLC, 9.033%, 12/4/25 (144A) | 0.91 |

| 6. | Atento Luxco 1 S.A., 8.0%, 2/10/26 (144A) | 0.84 |

| 7. | Ivory Coast Government International Bond, 4.875%, 1/30/32 (144A) | 0.83 |

| 8. | Garda World Security Corp., 9.5%, 11/1/27 (144A) | 0.82 |

| 9. | Mercer International, Inc., 5.125%, 2/1/29 (144A) | 0.78 |

| 10. | Tronox, Inc., 4.625%, 3/15/29 (144A) | 0.77 |

* Excludes temporary cash investments and all derivative contracts except for options purchased. |

| The Fund is actively managed, and current holdings may be different. The holdings listed should not |

| be considered recommendations to buy or sell any securities. |

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 11

Prices and Distributions |

4/30/21 | | | |

| Net Asset Value per Share | |

|

| Class | 4/30/21 | 10/31/20 |

A | $8.66 | $7.88 |

C | $8.65 | $7.87 |

Y | $8.49 | $7.73 |

| | | | |

| Distributions per Share: 11/1/20–4/30/21 | |

|

| Net Investment | Short-Term | Long-Term |

| Income | Capital Gains | Capital Gains |

A | $0.2148 | $ — | $ — |

C | $0.1761 | $ — | $ — |

Y | $0.2207 | $ — | $ — |

Index Definitions

The Bloomberg Barclays Global High Yield Index is an unmanaged index that provides a broad-based measure of the global high-yield fixed-income markets. The index represents the union of the Barclays U.S. High-Yield, Barclays Pan-European High-Yield, Barclays U.S. Emerging Markets High-Yield, and Barclays Pan-European Emerging Markets High-Yield Indices. The ICE BofA U.S. High Yield Index is an unmanaged, commonly accepted measure of the performance of high-yield securities. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

The indices defined here pertain to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts appearing on pages 13–15.

12 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | |

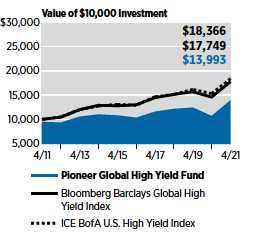

Performance Update | 4/30/21 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Global High Yield Fund at public offering price during the periods shown, compared to that of the Bloomberg Barclays Global High Yield Index and the ICE Bank of America (BofA) U.S. High Yield Index.

| | | | | |

| Average Annual Total Returns | |

(As of April 30, 2021) | | |

| | | BBG | ICE |

| | | Barclays | BofA

|

| Net | Public | Global | U.S. |

| Asset | Offering | High

| High |

| Value | Price | Yield | Yield |

| Period | (NAV) | (POP) | Index | Index |

10 years 3.89% | 3.42% | 5.91% | 6.27% |

5 years | 6.10 | 5.13 | 6.45 | 7.33 |

1 year | 30.08 | 24.23 | 21.80 | 20.10 |

| Expense Ratio | |

(Per prospectus dated March 1, 2021) |

| Gross | Net |

1.23% | 1.14% |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. POP returns reflect deduction of maximum 4.50% sales charge. NAV returns would have been lower had sales charge been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation in effect through March 1, 2022, for Class A shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 13

Performance Update | 4/30/21 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Global High Yield Fund during the periods shown, compared to that of the Bloomberg Barclays Global High Yield Index and the ICE Bank of America (BofA) U.S. High Yield Index.

| | | | | |

| Average Annual Total Returns | |

(As of April 30, 2021) | | |

| | | BBG | ICE |

| | | Barclays | BofA

|

| | | Global | U.S. |

| | | High | High |

| If | If | Yield | Yield |

| Period | Held | Redeemed | Index

| Index |

10 years | 3.13% | 3.13% | 5.91% | 6.27% |

5 years | 5.32 | 5.32 | 6.45 | 7.33 |

1 year | 28.95 | 28.95 | 21.80 | 20.10 |

| Expense Ratio |

(Per prospectus dated March 1, 2021) |

| Gross |

2.02% |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

14 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

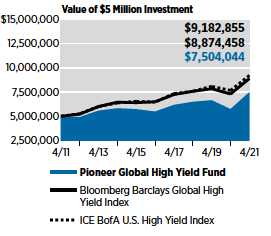

Performance Update | 4/30/21 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Global High Yield Fund during the periods shown, compared to that of the Bloomberg Barclays Global High Yield Index and the ICE Bank of America (BofA) U.S. High Yield Index.

| | | | |

| Average Annual Total Returns |

(As of April 30, 2021) | |

|

| | BBG | ICE |

| | Barclays | BofA

|

| Net | Global | U.S. |

| Asset | High | High |

| Value | Yield | Yield |

| Period | (NAV) | Index | Index |

10 years | 4.14% | 5.91% | 6.27% |

5 years | 6.36 | 6.45 | 7.33 |

1 year | 30.24 | 21.80 | 20.10 |

| | |

| Expense Ratio | |

(Per prospectus dated March 1, 2021) |

| Gross | Net |

0.96% | 0.90% |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation in effect through March 1, 2022, for Class Y shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 15

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

(1) | ongoing costs, including management fees, distribution and/or service |

| (12b-1) fees, and other Fund expenses; and |

|

(2) | transaction costs, including sales charges (loads) on purchase |

| payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| | |

(1) | Divide your account value by $1,000 |

| Example: an $8,600 account value ÷ $1,000 = 8.6 |

|

(2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

|

|

Expenses Paid on a $1,000 Investment in Pioneer Global High Yield Fund

Based on actual returns from November 1, 2020 through April 30, 2021.

| | | | |

| Share Class | A

| C

| Y

|

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 11/1/20 | | | |

Ending Account Value (after expenses) | $1,127.20 | $1,122.20 | $1,127.80 |

on 4/30/21 | | | |

Expenses Paid | $6.01 | $10.58 | $4.75 |

During Period* | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.14%, 2.01%, and 0.90% for Class A, Class C and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the partial year period).

16 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Global High Yield Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from November 1, 2020 through April 30, 2021.

| | | | |

| Share Class | A

| C

| Y

|

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 11/1/20 | | | |

Ending Account Value (after expenses) | $1,019.14 | $1,014.83 | $1,020.33 |

on 4/30/21 | | | |

Expenses Paid | $5.71 | $10.04 | $4.51 |

During Period* | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.14%, 2.01%, and 0.90% for Class A, |

| Class C and Class Y shares, respectively, multiplied by the average account value over the period, |

| multiplied by 181/365 (to reflect the partial year period). |

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 17

Schedule of Investments |

4/30/21 (unaudited)

| | | | |

| Shares | | | Value |

| | UNAFFILIATED ISSUERS — 94.4% | |

| | COMMON STOCKS — 0.7% of Net Assets

| |

| | | Energy Equipment & Services — 0.6% | |

| 44,927(a) | | FTS International, Inc. | $ 1,155,522 |

| 11,730^(a) | | Superior Energy Services, Inc. | 372,428 |

| | | Total Energy Equipment & Services | $ 1,527,950 |

| | | Household Durables — 0.0%† | |

| 1,443,476(a) | | Desarrolladora Homex SAB de CV | $ 1,853 |

| | | Total Household Durables | $ 1,853 |

| | | Oil, Gas & Consumable Fuels — 0.1% | |

| 25(a) | | Amplify Energy Corp. | $ 67 |

| 5,735,146^(a) | | Ascent CNR Corp. | 172,054 |

| | | Total Oil, Gas & Consumable Fuels | $ 172,121 |

| | | Paper & Forest Products — 0.0%† | |

| 459,481 | | Emerald Plantation Holdings, Ltd. | $ 7,352 |

| | | Total Paper & Forest Products | $ 7,352 |

| | | TOTAL COMMON STOCKS | |

| | (Cost $2,250,290) | $ 1,709,276 |

| Principal | | | |

| Amount | | | |

| USD ($) | | | |

| | | CONVERTIBLE CORPORATE BONDS — 4.1% | |

| | | of Net Assets | |

| | | Airlines — 1.0% | |

| 513,000 | | Air Canada, 4.0%, 7/1/25 (144A) | $ 786,942 |

| 700,000 | | GOL Equity Finance SA, 3.75%, 7/15/24 (144A) | 592,945 |

| 999,000 | | Spirit Airlines, Inc., 1.0%, 5/15/26 | 1,025,126 |

| | | Total Airlines | $ 2,405,013 |

| | | Banks — 0.1% | |

| IDR 11,178,198,000^ | | PT Bakrie & Brothers Tbk, 0.0%, 12/22/22 | $ 77,385 |

| | | Total Banks | $ 77,385 |

| | | Biotechnology — 0.3% | |

| 631,000 | | Insmed, Inc., 1.75%, 1/15/25 | $ 703,565 |

| | | Total Biotechnology | $ 703,565 |

| | | Entertainment — 0.5% | |

| 735,000(b) | | DraftKings, Inc., 3/15/28 (144A) | $ 701,558 |

| 520,000 | | IMAX Corp., 0.5%, 4/1/26 (144A) | 539,119 |

| | | Total Entertainment | $ 1,240,677 |

The accompanying notes are an integral part of these financial statements.

18 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Healthcare-Products — 0.1% | |

| 230,000 | | Integra LifeSciences Holdings Corp., 0.5%, 8/15/25 | $ 264,799 |

| | | Total Healthcare-Products | $ 264,799 |

| | | Leisure Time — 0.2% | |

| 315,000 | | Royal Caribbean Cruises, Ltd., 4.25%, 6/15/23 (144A) | $ 442,102 |

| | | Total Leisure Time | $ 442,102 |

| | | Media — 0.1% | |

| 237,000 | | DISH Network Corp., 3.375%, 8/15/26 | $ 249,442 |

| | | Total Media | $ 249,442 |

| | | Mining — 0.3% | |

| 510,000 | | Ivanhoe Mines, Ltd., 2.5%, 4/15/26 (144A) | $ 608,838 |

| | | Total Mining | $ 608,838 |

| | | Pharmaceuticals — 0.3% | |

| 455,000 | | Revance Therapeutics, Inc., 1.75%, 2/15/27 | $ 522,397 |

| 523,000 | | Tricida, Inc., 3.5%, 5/15/27 (144A) | 202,597 |

| | | Total Pharmaceuticals | $ 724,994 |

| | | REITs — 0.1% | |

| 274,000 | | Summit Hotel Properties, Inc., 1.5%, 2/15/26 | $ 296,742 |

| | | Total REITs | $ 296,742 |

| | | Software — 0.8% | |

| 1,005,000 | | Ceridian HCM Holding, Inc., 0.25%, 3/15/26 (144A) | $ 999,975 |

| 410,000(b) | | Everbridge, Inc., 3/15/26 (144A) | 416,150 |

| 540,000 | | Verint Systems, Inc., 0.25%, 4/15/26 (144A) | 544,551 |

| | | Total Software | $ 1,960,676 |

| | | Transportation — 0.3% | |

| 725,000 | | Golar LNG, Ltd., 2.75%, 2/15/22 | $ 707,122 |

| | | Total Transportation | $ 707,122 |

| | | TOTAL CONVERTIBLE CORPORATE BONDS | |

| | | (Cost $10,007,101) | $ 9,681,355 |

| | | CORPORATE BONDS — 82.1% of Net Assets | |

| | | Advertising — 1.6% | |

| 200,000 | | Clear Channel International BV, 6.625%, 8/1/25 (144A) | $ 209,000 |

| 465,000 | | Clear Channel Outdoor Holdings, Inc., 7.75%, | |

| | | 4/15/28 (144A) | 478,745 |

| 2,082,000(c) | | MDC Partners, Inc., 7.5%, 5/1/24 (144A) | 2,118,269 |

| 325,000 | | Outfront Media Capital LLC/Outfront Media Capital | |

| | | Corp., 4.25%, 1/15/29 (144A) | 322,891 |

| 720,000 | | Outfront Media Capital LLC/Outfront Media Capital | |

| | | Corp., 6.25%, 6/15/25 (144A) | 764,100 |

| | | Total Advertising | $ 3,893,005 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 19

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Agriculture — 0.3% | |

| 770,000 | | Kernel Holding SA, 6.5%, 10/17/24 (144A) | $ 806,575 |

| | Total Agriculture | $ 806,575 |

| | Airlines — 2.9% | |

| 765,000 | | Aerovias de Mexico SA de CV, 7.0%, 2/5/25 (144A) | $ 424,582 |

| 360,000 | | American Airlines, Inc./AAdvantage Loyalty IP, Ltd., | |

| | 5.5%, 4/20/26 (144A) | 378,000 |

| 300,000 | | American Airlines, Inc./AAdvantage Loyalty IP, Ltd., | |

| | 5.75%, 4/20/29 (144A) | 321,450 |

| 675,000 | | Gol Finance SA, 7.0%, 1/31/25 (144A) | 615,600 |

| 540,000 | | Gol Finance SA, 8.0%, 6/30/26 (144A) | 535,043 |

| 654,519 | | Mileage Plus Holdings LLC/Mileage Plus Intellectual | |

| | Property Assets, Ltd., 6.5%, 6/20/27 (144A) | 716,895 |

| 2,375,000 | | Pegasus Hava Tasimaciligi AS, 9.25%, 4/30/26 (144A) | 2,410,625 |

| EUR 1,300,000 | | Transportes Aereos Portugueses SA, 5.625%, | |

| | 12/2/24 (144A) | 1,293,925 |

| 225,000 | | United Airlines, Inc., 4.625%, 4/15/29 (144A) | 233,820 |

| | Total Airlines | $ 6,929,940 |

| | Auto Manufacturers — 2.2% | |

| 595,000 | | Ford Motor Credit Co. LLC, 3.815%, 11/2/27 | $ 610,006 |

| 2,545,000 | | Ford Motor Credit Co. LLC, 4.125%, 8/17/27 | 2,659,805 |

| 240,000 | | Ford Motor Credit Co. LLC, 5.113%, 5/3/29 | 262,128 |

| 1,545,000 | | JB Poindexter & Co., Inc., 7.125%, 4/15/26 (144A) | 1,631,906 |

| | Total Auto Manufacturers | $ 5,163,845 |

| | Auto Parts & Equipment — 1.7% | |

| 809,000 | | American Axle & Manufacturing, Inc., 6.25%, 3/15/26 | $ 830,742 |

| 515,000 | | Dana, Inc., 4.25%, 9/1/30 | 522,081 |

| 1,243,000 | | Dealer Tire LLC/DT Issuer LLC, 8.0%, 2/1/28 (144A) | 1,312,919 |

| 1,415,000 | | Iochpe-Maxion Austria GmbH/Maxion Wheels de | |

| | Mexico S de RL de CV, 5.0%, 5/7/28 (144A) | 1,384,153 |

| | Total Auto Parts & Equipment | $ 4,049,895 |

| | | Banks — 3.1% | |

| 700,000 | | Akbank T.A.S., 5.125%, 3/31/25 | $ 695,086 |

| 420,000 | | Akbank T.A.S., 6.8%, 2/6/26 (144A) | 434,162 |

| ARS 8,000,000(d) | | Banco de la Ciudad de Buenos Aires, 38.071% | |

| | | (BADLARPP + 399 bps), 12/5/22 | 75,177 |

| 1,180,000(e) | | Banco GNB Sudameris SA, 7.5% (5 Year CMT Index + | |

| | | 666 bps), 4/16/31 (144A) | 1,217,170 |

| 1,026,000(e)(f) | | Banco Mercantil del Norte SA, 6.75% (5 Year CMT | |

| | | Index + 497 bps) (144A) | 1,079,865 |

| 380,000(e)(f) | | Banco Mercantil del Norte SA, 8.375% (5 Year CMT | |

| | | Index + 776 bps) (144A) | 451,586 |

| 1,392,000 | | Freedom Mortgage Corp., 8.25%, 4/15/25 (144A) | 1,444,270 |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Banks — (continued) | |

| 1,122,000 | | Provident Funding Associates LP/PFG Finance Corp., | |

| | | 6.375%, 6/15/25 (144A) | $ 1,122,000 |

| 750,000(e)(f) | | Sovcombank Via SovCom Capital DAC, 7.75% (5 Year | |

| | | CMT Index + 638 bps) (144A) | 764,370 |

| 9,000(e) | | Turkiye Vakiflar Bankasi TAO, 8.0% (5 Year USD Swap | |

| | | Rate + 585 bps), 11/1/27 (144A) | 9,001 |

| | | Total Banks | $ 7,292,687 |

| | | Biotechnology — 0.5% | |

| EUR 790,000 | | Cidron Aida Finco S.a.r.l., 5.0%, 4/1/28 (144A) | $ 967,863 |

| GBP 220,000 | | Cidron Aida Finco S.a.r.l., 6.25%, 4/1/28 (144A) | 306,997 |

| | | Total Biotechnology | $ 1,274,860 |

| | | Building Materials — 0.8% | |

| 1,201,000 | | Koppers, Inc., 6.0%, 2/15/25 (144A) | $ 1,234,028 |

| 570,000 | | Patrick Industries, Inc., 4.75%, 5/1/29 (144A) | 571,596 |

| | | Total Building Materials | $ 1,805,624 |

| | | Chemicals — 2.8% | |

| 537,000 | | Hexion, Inc., 7.875%, 7/15/27 (144A) | $ 578,056 |

| 275,000 | | Kraton Polymers LLC/Kraton Polymers Capital Corp., | |

| | | 4.25%, 12/15/25 (144A) | 279,125 |

| 794,000 | | OCI NV, 4.625%, 10/15/25 (144A) | 829,524 |

| 1,108,000 | | Rain CII Carbon LLC/CII Carbon Corp., 7.25%, | |

| | | 4/1/25 (144A) | 1,142,647 |

| 1,280,000 | | Sasol Financing USA LLC, 5.5%, 3/18/31 | 1,311,616 |

| 815,000 | | Trinseo Materials Operating SCA/Trinseo Materials | |

| | | Finance, Inc., 5.125%, 4/1/29 (144A) | 827,225 |

| 1,705,000 | | Tronox, Inc., 4.625%, 3/15/29 (144A) | 1,741,231 |

| | | Total Chemicals | $ 6,709,424 |

| | | Coal — 0.4% | |

| 895,000 | | SunCoke Energy Partners LP/SunCoke Energy | |

| | | Partners Finance Corp., 7.5%, 6/15/25 (144A) | $ 932,160 |

| | | Total Coal | $ 932,160 |

| | | Commercial Services — 5.2% | |

| 505,000 | | Allied Universal Holdco LLC/Allied Universal Finance | |

| | | Corp., 6.625%, 7/15/26 (144A) | $ 534,038 |

| 1,345,000 | | Allied Universal Holdco LLC/Allied Universal Finance | |

| | | Corp., 9.75%, 7/15/27 (144A) | 1,476,137 |

| 680,000 | | APX Group, Inc., 6.75%, 2/15/27 (144A) | 731,224 |

| 1,746,000 | | Atento Luxco 1 SA, 8.0%, 2/10/26 (144A) | 1,895,361 |

| 1,435,000 | | Celestial-Saturn Merger Sub, Inc., 4.5%, 5/1/28 (144A) | 1,432,891 |

| 1,666,000 | | Garda World Security Corp., 9.5%, 11/1/27 (144A) | 1,836,765 |

| EUR 705,000 | | Loxam SAS, 6.0%, 4/15/25 (144A) | 856,906 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 21

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Commercial Services — (continued) | |

| 915,000 | | Prime Security Services Borrower LLC/Prime | |

| | Finance, Inc., 5.75%, 4/15/26 (144A) | $ 1,000,095 |

| 1,330,000 | | Prime Security Services Borrower LLC/Prime | |

| | Finance, Inc., 6.25%, 1/15/28 (144A) | 1,389,850 |

| 525,000 | | Sotheby’s, 7.375%, 10/15/27 (144A) | 565,845 |

| EUR 605,000 | | Verisure Holding AB, 3.25%, 2/15/27 (144A) | 729,694 |

| | Total Commercial Services | $ 12,448,806 |

| | Computers — 0.6% | |

| 595,000 | | Diebold Nixdorf, Inc., 8.5%, 4/15/24 | $ 607,644 |

| 110,000 | | Diebold Nixdorf, Inc., 9.375%, 7/15/25 (144A) | 122,512 |

| 455,000 | | NCR Corp., 5.0%, 10/1/28 (144A) | 468,650 |

| 225,000 | | NCR Corp., 5.25%, 10/1/30 (144A) | 232,875 |

| 110,000 | | NCR Corp., 8.125%, 4/15/25 (144A) | 119,900 |

| | Total Computers | $ 1,551,581 |

| | Diversified Financial Services — 5.6% | |

| 1,018,000 | | Alliance Data Systems Corp., 7.0%, 1/15/26 (144A) | $ 1,094,350 |

| 1,765,000 | | ASG Finance Designated Activity Co., 7.875%, | |

| | 12/3/24 (144A) | 1,693,848 |

| 400,000(g) | | Avation Capital SA, 8.25% (9.0% PIK 8.25% Cash), | |

| | 10/31/26 (144A) | 324,000 |

| 1,381,000 | | Credito Real SAB de CV SOFOM ER, 8.0%, | |

| | 1/21/28 (144A) | 1,341,296 |

| 665,000 | | Financiera Independencia SAB de CV SOFOM ENR, | |

| | 8.0%, 7/19/24 (144A) | 582,872 |

| EUR 300,000 | | Garfunkelux Holdco 3 SA, 6.75%, 11/1/25 (144A) | 374,216 |

| GBP 510,000 | | Garfunkelux Holdco 3 SA, 7.75%, 11/1/25 (144A) | 730,734 |

| 1,374,482(g) | | Global Aircraft Leasing Co., Ltd., 6.5% (7.25% PIK 6.5% | |

| | Cash), 9/15/24 (144A) | 1,374,482 |

| GBP 785,000 | | Jerrold Finco Plc, 5.25%, 1/15/27 (144A) | 1,112,583 |

| 680,000 | | Nationstar Mortgage Holdings, Inc., 5.5%, | |

| | 8/15/28 (144A) | 686,800 |

| 445,000 | | PHH Mortgage Corp., 7.875%, 3/15/26 (144A) | 453,887 |

| 1,416,000 | | Unifin Financiera SAB de CV, 8.375%, 1/27/28 (144A) | 1,333,900 |

| 740,000 | | United Wholesale Mortgage LLC, 5.5%, 4/15/29 (144A) | 727,257 |

| 1,535,000 | | VistaJet Malta Finance Plc/XO Management | |

| | Holding, Inc., 10.5%, 6/1/24 (144A) | 1,653,963 |

| | Total Diversified Financial Services | $ 13,484,188 |

| | Electric — 2.1% | |

| 470,000 | | Calpine Corp., 4.625%, 2/1/29 (144A) | $ 462,950 |

| 850,000 | | Cemig Geracao e Transmissao SA, 9.25%, | |

| | 12/5/24 (144A) | 980,475 |

| 610,000 | | Clearway Energy Operating LLC, 3.75%, | |

| | 2/15/31 (144A) | 601,271 |

The accompanying notes are an integral part of these financial statements.

22 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Electric — (continued) | |

| EUR 560,000 | | ContourGlobal Power Holdings SA, 2.75%, | |

| | | 1/1/26 (144A) | $ 676,237 |

| EUR 280,000 | | ContourGlobal Power Holdings SA, 3.125%, | |

| | | 1/1/28 (144A) | 339,482 |

| 1,120,000 | | Pampa Energia SA, 7.5%, 1/24/27 (144A) | 915,723 |

| 970,000 | | Talen Energy Supply LLC, 7.625%, 6/1/28 (144A) | 1,005,453 |

| | | Total Electric | $ 4,981,591 |

| | Electrical Components & Equipment — 0.6%

| |

| EUR 802,000 | | Belden, Inc., 3.875%, 3/15/28 (144A) | $ 1,002,072 |

| 335,000 | | WESCO Distribution, Inc., 7.25%, 6/15/28 (144A) | 371,850 |

| | | Total Electrical Components & Equipment | $ 1,373,922 |

| | | Engineering & Construction — 1.6% | |

| 967,000 | | Dycom Industries, Inc., 4.5%, 4/15/29 (144A) | $ 981,505 |

| 543,000 | | IHS Netherlands Holdco BV, 8.0%, 9/18/27 (144A) | 589,155 |

| 1,845,000 | | PowerTeam Services LLC, 9.033%, 12/4/25 (144A) | 2,045,644 |

| 1,000,709(h) | | Stoneway Capital Corp., 10.0%, 3/1/27 (144A) | 295,209 |

| | | Total Engineering & Construction | $ 3,911,513 |

| | | Entertainment — 3.4% | |

| 609,000 | | AMC Entertainment Holdings, Inc., 10.5%, | |

| | | 4/24/26 (144A) | $ 640,790 |

| 556,935(g) | | AMC Entertainment Holdings, Inc., 12.0% | |

| | | (12.0% PIK 10.0% | |

| | | Cash), 6/15/26 (144A) | 477,572 |

| 840,000 | | Caesars Entertainment, Inc., 8.125%, 7/1/27 (144A) | 933,391 |

| EUR 800,000 | | Gamma Bidco S.p.A., 5.125%, 7/15/25 (144A) | 972,901 |

| EUR 516,000 | | International Game Technology Plc, 2.375%, | |

| | | 4/15/28 (144A) | 603,016 |

| 245,000 | | International Game Technology Plc, 4.125%, | |

| | | 4/15/26 (144A) | 252,450 |

| 770,000 | | Lions Gate Capital Holdings LLC, 5.5%, 4/15/29 (144A) | 771,925 |

| 1,145,000 | | Mohegan Gaming & Entertainment, 8.0%, 2/1/26 (144A) | 1,162,060 |

| EUR 712,000 | | Scientific Games International, Inc., 5.5%, | |

| | | 2/15/26 (144A) | 860,318 |

| 955,000 | | Scientific Games International, Inc., 7.25%, | |

| | | 11/15/29 (144A) | 1,050,424 |

| 344,000 | | Scientific Games International, Inc., 8.25%, | |

| | | 3/15/26 (144A) | 370,660 |

| | | Total Entertainment | $ 8,095,507 |

| | | Environmental Control — 0.9% | |

| 965,000 | | Covanta Holding Corp., 5.0%, 9/1/30 | $ 990,331 |

| 310,000 | | GFL Environmental, Inc., 4.0%, 8/1/28 (144A) | 296,651 |

| 785,000 | | Tervita Corp., 11.0%, 12/1/25 (144A) | 889,013 |

| | | Total Environmental Control | $ 2,175,995 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 23

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Food — 2.6% | |

| 710,000 | | Aragvi Finance International DAC, 8.45%, | |

| | 4/29/26 (144A) | $ 730,015 |

| GBP 410,000 | | Bellis Acquisition Co. Plc, 3.25%, 2/16/26 (144A) | 567,689 |

| GBP 490,000 | | Boparan Finance Plc, 7.625%, 11/30/25 (144A) | 667,134 |

| 875,000 | | FAGE International SA/FAGE USA Dairy Industry, | |

| | Inc., 5.625%, 8/15/26 (144A) | 900,156 |

| 1,030,000 | | Minerva Luxembourg SA, 4.375%, 3/18/31 (144A) | 1,003,230 |

| 563,000 | | Minerva Luxembourg SA, 5.875%, 1/19/28 (144A) | 598,469 |

| EUR 655,000 | | Quatrim SASU, 5.875%, 1/15/24 (144A) | 820,976 |

| 321,000 | | Simmons Foods, Inc./Simmons Prepared Foods, | |

| | Inc./Simmons Pet Food, Inc./Simmons Feed,

| |

| | 4.625%, 3/1/29 (144A) | 323,475 |

| 675,000 | | US Foods, Inc., 4.75%, 2/15/29 (144A) | 680,906 |

| | Total Food | $ 6,292,050 |

| | Forest Products & Paper — 1.6% | |

| 725,000 | | Clearwater Paper Corp., 4.75%, 8/15/28 (144A) | $ 730,488 |

| 1,690,000 | | Mercer International, Inc., 5.125%, 2/1/29 (144A) | 1,747,038 |

| 809,000 | | Schweitzer-Mauduit International, Inc., 6.875%, | |

| | 10/1/26 (144A) | 855,517 |

| EUR 350,000 | | Spa Holdings, 3.625%, 2/4/28 (144A) | 426,566 |

| | Total Forest Products & Paper | $ 3,759,609 |

| | Healthcare-Products — 0.2% | |

| 375,000 | | Varex Imaging Corp., 7.875%, 10/15/27 (144A) | $ 418,538 |

| | Total Healthcare-Products | $ 418,538 |

| | Healthcare-Services — 2.5% | |

| 860,000 | | Auna SAA, 6.5%, 11/20/25 (144A) | $ 866,459 |

| EUR 420,000 | | CAB SELAS, 3.375%, 2/1/28 (144A) | 502,234 |

| 1,145,000 | | LifePoint Health, Inc., 5.375%, 1/15/29 (144A) | 1,145,229 |

| 690,000 | | Prime Healthcare Services, Inc., 7.25%, 11/1/25 (144A) | 742,219 |

| 1,484,000 | | Surgery Center Holdings, Inc., 10.0%, 4/15/27 (144A) | 1,627,290 |

| 250,000 | | US Acute Care Solutions LLC, 6.375%, 3/1/26 (144A) | 261,000 |

| 786,000 | | US Renal Care, Inc., 10.625%, 7/15/27 (144A) | 831,195 |

| | Total Healthcare-Services | $ 5,975,626 |

| | Home Builders — 1.7% | |

| 575,000 | | Beazer Homes USA, Inc., 5.875%, 10/15/27 | $ 606,625 |

| 579,000 | | Beazer Homes USA, Inc., 6.75%, 3/15/25 | 596,370 |

| 155,000 | | Beazer Homes USA, Inc., 7.25%, 10/15/29 | 172,050 |

| 659,000 | | Brookfield Residential Properties, Inc./Brookfield | |

| | Residential US Corp., 6.25%, 9/15/27 (144A) | 698,540 |

The accompanying notes are an integral part of these financial statements.

24 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Home Builders — (continued) | |

| 550,000 | | M/I Homes, Inc., 4.95%, 2/1/28 | $ 578,353 |

| 1,259,000 | | Taylor Morrison Communities, Inc., 5.875%, | |

| | 6/15/27 (144A) | 1,428,965 |

| | Total Home Builders | $ 4,080,903 |

| | Home Furnishings — 0.8% | |

| EUR 985,000 | | International Design Group S.p.A., 6.5%, 11/15/25 (144A) $ | 1,235,103 |

| 690,000 | | Tempur Sealy International, Inc., 4.0%, 4/15/29 (144A) | 698,853 |

| | Total Home Furnishings | $ 1,933,956 |

| | Housewares — 0.3% | |

| 790,000 | | Scotts Miracle-Gro Co., 4.0%, 4/1/31 (144A) | $ 782,100 |

| | Total Housewares | $ 782,100 |

| | Insurance — 0.4% | |

| GBP 585,000 | | Galaxy Bidco, Ltd., 6.5%, 7/31/26 (144A) | $ 855,379 |

| | Total Insurance | $ 855,379 |

| | Iron & Steel — 2.2% | |

| 1,050,000 | | Carpenter Technology Corp., 6.375%, 7/15/28 | $ 1,151,363 |

| 1,097,000 | | Cleveland-Cliffs, Inc., 6.75%, 3/15/26 (144A) | 1,190,245 |

| 670,000 | | Commercial Metals Co., 3.875%, 2/15/31 | 670,000 |

| 2,165,000 | | Metinvest BV, 7.75%, 10/17/29 (144A) | 2,305,076 |

| | Total Iron & Steel | $ 5,316,684 |

| | Leisure Time — 1.8% | |

| 130,000 | | Carnival Corp., 7.625%, 3/1/26 (144A) | $ 142,350 |

| EUR 170,000 | | Carnival Corp., 7.625%, 3/1/26 (144A) | 226,316 |

| 180,000 | | Carnival Corp., 10.5%, 2/1/26 (144A) | 212,157 |

| 780,000 | | NCL Corp., Ltd., 5.875%, 3/15/26 (144A) | 815,100 |

| 220,000 | | NCL Finance, Ltd., 6.125%, 3/15/28 (144A) | 231,730 |

| EUR 225,000 | | Pinnacle Bidco Plc, 5.5%, 2/15/25 (144A) | 274,378 |

| 410,000 | | Royal Caribbean Cruises, Ltd., 5.5%, 4/1/28 (144A) | 429,967 |

| 175,000 | | Royal Caribbean Cruises, Ltd., 9.125%, 6/15/23 (144A) | 193,193 |

| 407,000 | | Royal Caribbean Cruises, Ltd., 11.5%, 6/1/25 (144A) | 471,485 |

| 817,000 | | Viking Cruises, Ltd., 5.875%, 9/15/27 (144A) | 800,660 |

| 520,000 | | Viking Ocean Cruises Ship VII, Ltd., 5.625%, | |

| | 2/15/29 (144A) | 528,450 |

| | Total Leisure Time | $ 4,325,786 |

| | Lodging — 0.4% | |

| 590,000 | | Grupo Posadas SAB de CV, 7.875%, 6/30/22 (144A) | $ 321,792 |

| 550,000 | | Hilton Domestic Operating Co., Inc., 4.0%, 5/1/31 (144A) | 555,500 |

| | Total Lodging | $ 877,292 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 25

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Machinery-Construction & Mining — 0.2%

| |

| 580,000 | | Terex Corp., 5.0%, 5/15/29 (144A) | $ 603,200 |

| | Total Machinery-Construction & Mining | $ 603,200 |

| | Machinery-Diversified — 0.4% | |

| EUR 790,000 | | Sofima Holding SPA, 3.75%, 1/15/28 (144A) | $ 953,662 |

| | Total Machinery-Diversified | $ 953,662 |

| | Media — 2.9% | |

| 735,000 | | CCO Holdings LLC/CCO Holdings Capital Corp., | |

| | 4.5%, 6/1/33 (144A) | $ 740,748 |

| 1,125,000 | | Clear Channel Worldwide Holdings, Inc., 9.25%, 2/15/24 | 1,174,219 |

| 1,000,000 | | CSC Holdings LLC, 4.625%, 12/1/30 (144A) | 977,500 |

| 560,000 | | CSC Holdings LLC, 5.0%, 11/15/31 (144A) | 561,050 |

| 749,000 | | Diamond Sports Group LLC/Diamond Sports | |

| | Finance Co., 6.625%, 8/15/27 (144A) | 406,332 |

| 290,000 | | Entercom Media Corp., 6.75%, 3/31/29 (144A) | 298,700 |

| 425,000 | | News Corp., 3.875%, 5/15/29 (144A) | 433,279 |

| EUR 575,000 | | Virgin Media Finance Plc, 3.75%, 7/15/30 (144A) | 693,569 |

| GBP 425,000 | | Virgin Media Vendor Financing Notes III DAC, | |

| | 4.875%, 7/15/28 (144A) | 602,031 |

| EUR 855,000 | | Ziggo Bond Co. BV, 3.375%, 2/28/30 (144A) | 1,016,402 |

| | Total Media | $ 6,903,830 |

| | Mining — 2.1% | |

| 730,000 | | Coeur Mining, Inc., 5.125%, 2/15/29 (144A) | $ 707,888 |

| 705,000 | | First Quantum Minerals, Ltd., 6.875%, 3/1/26 (144A) | 740,250 |

| 665,000 | | First Quantum Minerals, Ltd., 6.875%, 10/15/27 (144A) | 730,469 |

| 200,000 | | First Quantum Minerals, Ltd., 7.5%, 4/1/25 (144A) | 207,750 |

| 675,000 | | FMG Resources August 2006 Pty, Ltd., 4.375%, | |

| | 4/1/31 (144A) | 701,156 |

| 424,000 | | Hudbay Minerals, Inc., 6.125%, 4/1/29 (144A) | 450,845 |

| 811,000 | | IAMGOLD Corp., 5.75%, 10/15/28 (144A) | 843,440 |

| 549,000 | | Joseph T Ryerson & Son, Inc., 8.5%, 8/1/28 (144A) | 606,618 |

| | Total Mining | $ 4,988,416 |

| | Oil & Gas — 7.4% | |

| 1,475,000 | | Aethon United BR LP/Aethon United Finance | |

| | Corp., 8.25%, 2/15/26 (144A) | $ 1,568,028 |

| 1,800,000 | | Baytex Energy Corp., 8.75%, 4/1/27 (144A) | 1,665,000 |

| 905,000 | | Cenovus Energy, Inc., 6.75%, 11/15/39 | 1,145,220 |

| 1,265,000 | | Colgate Energy Partners III LLC, 7.75%, 2/15/26 (144A) | 1,261,838 |

| 490,000 | | Hilcorp Energy I LP/Hilcorp Finance Co., 6.0%, | |

| | 2/1/31 (144A) | 504,700 |

| 735,000 | | Indigo Natural Resources LLC, 5.375%, 2/1/29 (144A) | 729,487 |

| 590,000 | | MEG Energy Corp., 5.875%, 2/1/29 (144A) | 604,750 |

| 1,100,000 | | MEG Energy Corp., 7.125%, 2/1/27 (144A) | 1,174,558 |

The accompanying notes are an integral part of these financial statements.

26 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Oil & Gas — (continued) | |

| 575,000 | | Murphy Oil Corp., 6.375%, 7/15/28 | $ 583,625 |

| 1,260,000 | | Neptune Energy Bondco Plc, 6.625%, 5/15/25 (144A) | 1,277,640 |

| 1,255,000 | | Occidental Petroleum Corp., 4.4%, 4/15/46 | 1,104,400 |

| 200,000 | | Occidental Petroleum Corp., 5.5%, 12/1/25 | 215,000 |

| 805,000 | | PBF Holding Co. LLC/PBF Finance Corp., 6.0%, 2/15/28 | 607,441 |

| 486,000 | | PBF Holding Co. LLC/PBF Finance Corp., 9.25%, | |

| | 5/15/25 (144A) | 509,085 |

| 760,000 | | Petroleos Mexicanos, 6.875%, 10/16/25 (144A) | 830,832 |

| 781,000 | | Shelf Drilling Holdings, Ltd., 8.25%, 2/15/25 (144A) | 593,560 |

| 615,000 | | Shelf Drilling Holdings, Ltd., 8.875%, 11/15/24 (144A) | 631,913 |

| 220,952 | | Transocean Sentry, Ltd., 5.375%, 5/15/23 (144A) | 209,352 |

| 1,220,000 | | Vine Energy Holdings LLC, 6.75%, 4/15/29 (144A) | 1,221,525 |

| 1,800,000 | | YPF SA, 6.95%, 7/21/27 (144A) | 1,107,000 |

| ARS 22,125,000 | | YPF SA, 16.5%, 5/9/22 (144A) | 193,923 |

| | Total Oil & Gas | $ 17,738,877 |

| | Oil & Gas Services — 1.0% | |

| 875,000 | | Archrock Partners LP/Archrock Partners Finance Corp., | |

| | 6.875%, 4/1/27 (144A) | $ 930,781 |

| 788,000 | | Exterran Energy Solutions LP/EES Finance Corp., 8.125%, | |

| | 5/1/25 | 709,200 |

| 715,000 | | TechnipFMC Plc, 6.5%, 2/1/26 (144A) | 763,201 |

| | Total Oil & Gas Services | $ 2,403,182 |

| | Packaging & Containers — 0.4% | |

| EUR 340,000 | | Ardagh Packaging Finance Plc/Ardagh Holdings USA, Inc., | |

| | 2.125%, 8/15/26 (144A) | $ 408,972 |

| 619,000 | | Greif, Inc., 6.5%, 3/1/27 (144A) | 654,552 |

| | Total Packaging & Containers | $ 1,063,524 |

| | Pharmaceuticals — 3.8% | |

| 368,000 | | Endo Dac/Endo Finance LLC/Endo Finco, Inc., | |

| | 6.0%, 6/30/28 (144A) | $ 279,680 |

| 391,000 | | Endo Dac/Endo Finance LLC/Endo Finco, Inc., | |

| | 9.5%, 7/31/27 (144A) | 414,460 |

| EUR 1,285,000 | | Gruenenthal GmbH, 3.625%, 11/15/26 (144A) | 1,572,966 |

| EUR 455,000 | | Gruenenthal GmbH, 4.125%, 5/15/28 (144A) | 557,714 |

| 600,000 | | Jazz Securities DAC, 4.375%, 1/15/29 (144A) | 613,500 |

| EUR 480,000 | | Organon Finance 1 LLC, 2.875%, 4/30/28 (144A) | 589,852 |

| 345,000 | | Organon Finance 1 LLC, 4.125%, 4/30/28 (144A) | 353,449 |

| 600,000 | | P&L Development LLC/PLD Finance Corp., | |

| | 7.75%, 11/15/25 (144A) | 637,500 |

| 1,008,000 | | Par Pharmaceutical, Inc., 7.5%, 4/1/27 (144A) | 1,060,920 |

| EUR 1,315,000 | | Rossini S.a.r.l., 6.75%, 10/30/25 (144A) | 1,669,957 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 27

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Pharmaceuticals — (continued) | |

| EUR 895,000 | | Teva Pharmaceutical Finance Netherlands II BV, | |

| | 1.625%, 10/15/28 | $ 959,037 |

| EUR 255,000 | | Teva Pharmaceutical Finance Netherlands II BV, | |

| | 6.0%, 1/31/25 | 333,802 |

| | Total Pharmaceuticals | $ 9,042,837 |

| | Pipelines — 2.9% | |

| 1,500,000 | | Delek Logistics Partners LP/Delek Logistics Finance | |

| | Corp., 6.75%, 5/15/25 | $ 1,526,250 |

| 1,165,000(e)(f) | | Energy Transfer LP, 7.125% (5 Year CMT Index + 531 bps) | 1,188,300 |

| 810,000 | | EnLink Midstream Partners LP, 4.15%, 6/1/25 | 816,990 |

| 665,000 | | EnLink Midstream Partners LP, 5.45%, 6/1/47 | 560,263 |

| 460,000 | | Genesis Energy LP/Genesis Energy Finance Corp., | |

| | 8.0%, 1/15/27 | 473,901 |

| 1,040,000 | | Harvest Midstream I LP, 7.5%, 9/1/28 (144A) | 1,120,600 |

| 1,130,000 | | Northriver Midstream Finance LP, 5.625%, | |

| | 2/15/26 (144A) | 1,165,313 |

| | Total Pipelines | $ 6,851,617 |

| | Real Estate — 0.5% | |

| EUR 270,000 | | Neinor Homes SA, 4.5%, 10/15/26 (144A) | $ 330,539 |

| EUR 610,000 | | Via Celere Desarrollos Inmobiliarios SA, 5.25%, 4/1/26 | |

| | (144A) | 767,352 |

| | Total Real Estate | $ 1,097,891 |

| | REITs — 1.7% | |

| 735,000 | | iStar, Inc., 4.25%, 8/1/25 | $ 744,849 |

| 741,000 | | iStar, Inc., 4.75%, 10/1/24 | 772,492 |

| 1,155,000 | | MPT Operating Partnership LP/MPT Finance Corp., | |

| | 3.5%, 3/15/31 | 1,152,367 |

| 531,000 | | Uniti Group LP/Uniti Fiber Holdings, Inc./CSL | |

| | Capital LLC, 7.875%, 2/15/25 (144A) | 572,153 |

| 780,000 | | Uniti Group LP/Uniti Group Finance, Inc./CSL | |

| | Capital LLC, 6.5%, 2/15/29 (144A) | 775,347 |

| | Total REITs | $ 4,017,208 |

| | Retail — 1.6% | |

| 970,000 | | AAG FH LP/AAG FH Finco, Inc., 9.75%, 7/15/24 (144A) | $ 945,782 |

| 670,000 | | Beacon Roofing Supply, Inc., 4.125%, 5/15/29 (144A) | 668,325 |

| 310,000 | | Ken Garff Automotive LLC, 4.875%, 9/15/28 (144A) | 312,712 |

| 325,000 | | L Brands, Inc., 6.625%, 10/1/30 (144A) | 374,550 |

| 527,000 | | Party City Holdings, Inc., 8.75%, 2/15/26 (144A) | 540,138 |

| 285,000 | | Petsmart, Inc., 7.75%, 2/15/29 (144A) | 308,997 |

| 557,000 | | Staples, Inc., 7.5%, 4/15/26 (144A) | 576,495 |

| | Total Retail | $ 3,726,999 |

The accompanying notes are an integral part of these financial statements.

28 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Semiconductors — 0.4% | |

| 845,000 | | Entegris, Inc., 3.625%, 5/1/29 (144A) | $ 857,675 |

| | | Total Semiconductors | $ 857,675 |

| | | Telecommunications — 3.7% | |

| 1,065,000 | | Altice France Holding SA, 6.0%, 2/15/28 (144A) | $ 1,057,805 |

| 280,000 | | Altice France SA, 5.125%, 1/15/29 (144A) | 280,703 |

| 1,165,000 | | Altice France SA, 5.125%, 7/15/29 (144A) | 1,166,584 |

| 724,079(g) | | Digicel International Finance, Ltd./Digicel international | |

| | Holdings, Ltd., 13.0% (7.0% PIK 6.0% Cash),

| |

| | | 12/31/25 (144A) | 733,130 |

| 1,090,000 | | LogMeIn, Inc., 5.5%, 9/1/27 (144A) | 1,136,064 |

| 1,055,000 | | Lumen Technologies, Inc., 4.5%, 1/15/29 (144A) | 1,039,175 |

| 765,000 | | Plantronics, Inc., 4.75%, 3/1/29 (144A) | 753,525 |

| 1,585,000 | | Total Play Telecomunicaciones SA de CV, 7.5%, | |

| | | 11/12/25 (144A) | 1,585,000 |

| 970,000 | | Windstream Escrow LLC/Windstream Escrow | |

| | | Finance Corp., 7.75%, 8/15/28 (144A) | 1,011,225 |

| | | Total Telecommunications | $ 8,763,211 |

| | | Transportation — 2.1% | |

| 825,000 | | Danaos Corp., 8.5%, 3/1/28 (144A) | $ 880,692 |

| 620,000 | | Hidrovias International Finance S.a.r.l., 4.95%, 2/8/31 | |

| | | (144A) | 629,300 |

| 900,000 | | Seaspan Corp., 6.5%, 4/29/26 | 906,750 |

| 1,115,000 | | Simpar Europe SA, 5.2%, 1/26/31 (144A) | 1,124,767 |

| 1,285,000 | | Western Global Airlines LLC, 10.375%, 8/15/25 (144A) | 1,456,869 |

| | | Total Transportation | $ 4,998,378 |

| | | Trucking & Leasing — 0.2% | |

| 435,000 | | Fortress Transportation & Infrastructure Investors LLC, | |

| | | 9.75%, 8/1/27 (144A) | $ 502,425 |

| | | Total Trucking & Leasing | $ 502,425 |

| | | TOTAL CORPORATE BONDS | |

| | | (Cost $192,422,679) | $196,011,973 |

| | FOREIGN GOVERNMENT BONDS — 4.2%

| |

| | | of Net Assets | |

| | | Argentina — 1.0% | |

| 1,794,500(c) | | Argentine Republic Government International Bond, | |

| | | 0.125%, 7/9/35 | $ 565,286 |

| 118,980 | | Argentine Republic Government International Bond, | |

| | | 1.0%, 7/9/29 | 44,822 |

| 2,000,000 | | Ciudad Autonoma De Buenos Aires, 7.5%, | |

| | | 6/1/27 (144A) | 1,540,020 |

| 167,560 | | Province of Salta Argentina, 9.5%, 3/16/22 (144A) | 149,128 |

| | Total Argentina | $ 2,299,256 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 29

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | Bahrain — 0.4% | |

| 780,000 | | Bahrain Government International Bond, 7.0%, | |

| | | 10/12/28 (144A) | $ 874,988 |

| | | Total Bahrain | $ 874,988 |

| | | Egypt — 0.4% | |

| 1,095,000 | | Egypt Government International Bond, 5.875%, | |

| | | 2/16/31 (144A) | $ 1,055,339 |

| | | Total Egypt | $ 1,055,339 |

| | | Ghana — 0.6% | |

| 385,000 | | Ghana Government International Bond, 7.875%, | |

| | | 2/11/35 (144A) | $ 378,671 |

| 1,000,000 | | Ghana Government International Bond, 8.627%, 6/16/49 | 970,000 |

| | | Total Ghana | $ 1,348,671 |

| | | Ivory Coast — 0.8% | |

| EUR 1,555,000 | | Ivory Coast Government International Bond, | |

| | | 4.875%, 1/30/32 (144A) | $ 1,876,419 |

| | | Total Ivory Coast | $ 1,876,419 |

| | | Oman — 0.2% | |

| 555,000 | | Oman Government International Bond, 6.25%, | |

| | | 1/25/31 (144A) | $ 596,625 |

| | | Total Oman | $ 596,625 |

| | | Ukraine — 0.8% | |

| EUR 855,000 | | Ukraine Government International Bond, | |

| | | 4.375%, 1/27/30 (144A) | $ 941,926 |

| 875,000 | | Ukraine Government International Bond, 8.994%, | |

| | | 2/1/24 (144A) | 961,362 |

| | | Total Ukraine | $ 1,903,288 |

| | | TOTAL FOREIGN GOVERNMENT BONDS | |

| | | (Cost $10,734,967) | $ 9,954,586 |

| | | INSURANCE-LINKED SECURITIES — 0.7% | |

| | | of Net Assets# | |

| | | Event Linked Bonds — 0.0%† | |

| | | Multiperil – U.S. — 0.0%† | |

| 500,000+(d) | | Caelus Re V, 0.508% (1 Month U.S. Treasury Bill + | |

| | | 50 bps), 6/5/24 (144A) | $ 44 |

| 250,000(d) | | Caelus Re V, 7.248% (3 Month U.S. Treasury Bill + | |

| | | 724 bps), 6/7/21 (144A) | 25 |

| | | | $ 69 |

| | | Total Event Linked Bonds | $ 69 |

The accompanying notes are an integral part of these financial statements.

30 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| Face | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Collateralized Reinsurance — 0.3% | |

| | | Multiperil – U.S. — 0.0%† | |

| 250,000+(i) | | Dingle Re 2019, 2/1/22 | $ 5,132 |

| | | Multiperil – Worldwide — 0.2% | |

| 600,000+(a)(i) | | Cypress Re 2017, 1/31/22 | $ 60 |

| 462,359+(a)(i) | | Dartmouth Re 2018, 1/31/22 | 97,604 |

| 389,876+(a)(i) | | Gloucester Re 2018, 2/28/22 | 68,618 |

| 12,000+(i) | | Limestone Re 2016-1, 8/31/21 | 1,000 |

| 12,000+(i) | | Limestone Re 2016-1, 8/31/21 | 1,000 |

| 277,770+(a)(i) | | Oyster Bay Re 2018, 1/31/22 | 252,104 |

| 400,000+(a)(i) | | Resilience Re, 10/6/21 | 40 |

| 283,700+(a)(i) | | Seminole Re 2018, 1/31/22 | 7,010 |

| 276,582+(a)(i) | | Walton Health Re 2018, 6/15/21 | 86,881 |

| | | | $ 514,317 |

| | | Windstorm – Florida — 0.1% | |

| 250,000+(a)(i) | | Formby Re 2018, 2/28/22 | $ 34,798 |

| 300,000+(a)(i) | | Portrush Re 2017, 6/15/21 | 191,430 |

| | | | $ 226,228 |

| | | Windstorm – U.S. Regional — 0.0%† | |

| 250,000+(a)(i) | | Oakmont Re 2017, 4/30/22 | $ 7,350 |

| | | Total Collateralized Reinsurance | $ 753,027 |

| | | Reinsurance Sidecars — 0.4% | |

| | | Multiperil – U.S. — 0.1% | |

| 800,000+(a)(i) | | Carnoustie Re 2017, 11/30/21 | $ 105,440 |

| 1,000,000+(a)(j) | | Harambee Re 2018, 12/31/21 | 3,500 |

| 695,349+(j) | | Harambee Re 2019, 12/31/22 | 5,841 |

| | | | $ 114,781 |

| | | Multiperil – Worldwide — 0.3% | |

| 3,037+(j) | | Alturas Re 2019-2, 3/10/22 | $ 8,066 |

| 490,000+(a)(i) | | Bantry Re 2016, 3/31/22 | 39,494 |

| 300,000+(a)(i) | | Bantry Re 2017, 3/31/22 | 17,532 |

| 250,000+(a)(i) | | Bantry Re 2018, 12/31/21 | 2,850 |

| 250,000+(a)(i) | | Bantry Re 2019, 12/31/22 | 8,491 |

| 1,422,258+(a)(i) | | Berwick Re 2018-1, 12/31/21 | 136,654 |

| 556,791+(a)(i) | | Berwick Re 2019-1, 12/31/22 | 66,537 |

| 250,000+(j) | | Blue Lotus Re 2018, 12/31/21 | 7,675 |

| 12,500+(i) | | Eden Re II, 3/22/22 (144A) | 10,188 |

| 22,500+(i) | | Eden Re II, 3/22/22 (144A) | 17,771 |

| 1,600,000+(a)(i) | | Gleneagles Re 2016, 11/30/21 | 49,920 |

| 250,000+(a)(i) | | Gleneagles Re 2018, 12/31/21 | 29,575 |

| 450,000+(a)(j) | | Lorenz Re 2018, 7/1/21 | 4,815 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 31

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | |

| Face | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Multiperil – Worldwide — (continued) | |

| 231,508+(a)(j) | | Lorenz Re 2019, 6/30/22 | $ 10,881 |

| 600,000+(a)(i) | | Merion Re 2018-2, 12/31/21 | 99,300 |

| 1,000,000+(i) | | Pangaea Re 2016-2, 11/30/21 | 1,783 |

| 300,000+(a)(i) | | Pangaea Re 2018-1, 12/31/21 | 6,316 |

| 300,000+(a)(i) | | Pangaea Re 2018-3, 7/1/22 | 6,223 |

| 245,774+(a)(i) | | Pangaea Re 2019-1, 2/1/23 | 5,121 |

| 220,594+(a)(i) | | Pangaea Re 2019-3, 7/1/23 | 7,935 |

| 500,000+(a)(i) | | St. Andrews Re 2017-1, 2/1/22 | 33,900 |

| 521,395+(a)(i) | | St. Andrews Re 2017-4, 6/1/21 | 51,305 |

| 250,000+(a)(j) | | Thopas Re 2018, 12/31/21 | 1,575 |

| 250,000+(a)(j) | | Thopas Re 2019, 12/31/22 | 10,450 |

| 300,000+(a)(i) | | Versutus Re 2018, 12/31/21 | 990 |

| 264,763+(i) | | Versutus Re 2019-A, 12/31/21 | 4,660 |

| 35,236+(i) | | Versutus Re 2019-B, 12/31/21 | 578 |

| 250,000+(a)(j) | | Viribus Re 2018, 12/31/21 | — |

| 106,153+(a)(j) | | Viribus Re 2019, 12/31/22 | 4,405 |

| 253,645+(a)(i) | | Woburn Re 2018, 12/31/21 | 18,618 |

| 244,914+(a)(i) | | Woburn Re 2019, 12/31/22 | 72,421 |

| | | | $ 736,029 |

| | | Total Reinsurance Sidecars | $ 850,810 |

| | | TOTAL INSURANCE-LINKED SECURITIES | |

| | (Cost $2,901,279) | $ 1,603,906 |

| Principal | | | |

| Amount | | | |

| USD ($) | | | |

| | | SENIOR SECURED FLOATING RATE LOAN | |

| | INTERESTS — 2.6% of Net Assets*(d)

| |

| | | Aerospace & Defense — 0.4% | |

| 715,000 | | Grupo Aeromexico, SAB de CV, DIP Tranche 1 | |

| | | Term Loan, 15.5% (LIBOR + 1,450 bps), 12/31/21 | $ 720,363 |

| 313,620 | | Grupo Aeromexico, SAB de CV, DIP Tranche 2 | |

| | | Term Loan, 11.0% (LIBOR + 900 bps), 12/31/21 | 321,852 |

| | | Total Aerospace & Defense | $ 1,042,215 |

| | Diversified & Conglomerate Service — 0.6%

| |

| 508,799 | | First Brands Group LLC, 2021 First Lien Term Loan, | |

| | | 9.0% (LIBOR + 800 bps), 3/30/27 | $ 516,431 |

| 1,070,067 | | Team Health Holdings, Inc., Initial Term Loan, 3.75% | |

| | (LIBOR + 275 bps), 2/6/24 | 1,001,850 |

| | Total Diversified & Conglomerate Service | $ 1,518,281 |

The accompanying notes are an integral part of these financial statements.

32 Pioneer Global High Yield Fund | Semiannual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Entertainment & Leisure — 0.7% | |

| 1,605,000 | | Enterprise Development Authority, Term B Loan, | |

| | | 6.0% (LIBOR + 500 bps), 2/28/28 | $ 1,611,019 |

| | | Total Entertainment & Leisure | $ 1,611,019 |

| | Healthcare, Education & Childcare — 0.4%

| |

| 609,020 | | Alliance HealthCare Services, Inc., First Lien Initial Term | |

| | | Loan, 5.0% (LIBOR + 425 bps), 10/24/23 | $ 577,332 |

| 316,800 | | Surgery Center Holdings, Inc., 2020 Incremental Term | |

| | | Loan, 3.75% (LIBOR + 275 bps), 9/3/24 | 324,456 |

| | | Total Healthcare, Education & Childcare | $ 901,788 |

| | | Hotel, Gaming & Leisure — 0.0%† | |

| 74,600 | | Spectacle Gary Holdings LLC, Delayed Draw Term | |

| | | Loan, 9.0% (LIBOR + 800 bps), 12/23/25 | $ 81,438 |

| | | Total Hotel, Gaming & Leisure | $ 81,438 |

| | | Securities & Trusts — 0.5% | |

| 1,030,100 | | Spectacle Gary Holdings LLC, Closing Date Term Loan, | |

| | | 11.0% (LIBOR + 900 bps), 12/23/25 | $ 1,124,526 |

| | | Total Securities & Trusts | $ 1,124,526 |

| | | TOTAL SENIOR SECURED FLOATING RATE LOAN INTERESTS | |

| | | (Cost $6,030,078) | $ 6,279,267 |

| Shares | | | |

| | | RIGHTS/WARRANTS — 0.0%† of Net Assets | |

| | | Metals & Mining — 0.0%† | |

| 318,254(k) | | ANR, Inc., 3/31/23 | $ 1,750 |

| | | Total Metals & Mining | $ 1,750 |

| | | Oil, Gas & Consumable Fuels — 0.0%† | |

| 61(a)(l) | | Alpha Metallurgical Resources, Inc., 7/26/23 | $ 162 |

| | | Total Oil, Gas & Consumable Fuels | $ 162 |

| | | TOTAL RIGHTS/WARRANTS | |

| | | (Cost $36,831) | $ 1,912 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global High Yield Fund | Semiannual Report | 4/30/21 33

Schedule of Investments | 4/30/21

(unaudited) (continued)

| | | | | | | | | |

| Number of | | | | | Strike | Expiration | | |

| Contracts | | Description | Counterparty | Amount

| Price | Date |

| Value

|

| | OVER THE COUNTER (OTC) CALL OPTIONS | | |

| | | PURCHASED — 0.0% | | | | |

| 297,012^(m) | | Desarrolladora

| Bank of

| | | | | |

| | | Homex | New York | | | | | |

| | | SAB de CV | Mellon Corp. | MXN — | MXN —(o)

| 10/23/22

| $

| —

|

| 297,012^(n) | | Desarrolladora

| Bank of

| | | | | |

| | | Homex | New York | | | | | |

| | | SAB de CV | Mellon Corp. | MXN — | MXN —(o)

| 10/23/22

| | — |

| | | | | | | | $ | —

|

| | | TOTAL OVER THE COUNTER (OTC) CALL | | | |

| | | OPTIONS PURCHASED | | | | | |

| | | (Premiums paid $0) | | | | $ — |

| | | OVER THE COUNTER (OTC) CURRENCY PUT | | |

| | | OPTIONS PURCHASED — 0.0%† | | | |

| 1,973,500 | | Put EUR | Bank of | | | | | |

| | | Call USD | America NA | EUR 32,660 | EUR 1.11 | 6/4/21 | $ — |

| 3,850,000 | | Put EUR | JPMorgan | | | | | |

| | | Call USD | Chase Bank NA

| EUR 24,986

| EUR 1.15 | 5/17/21 | | 4 |

| 2,000,000 | | Put EUR | JPMorgan | | | | | |

| | | Call USD | Chase Bank NA

| EUR 28,370

| EUR 1.17 | 2/4/22 | | 17,869 |

| | | | | | | | $ | 17,873

|