Dear Shareholders,

The new decade has arrived delivering a first quarter that will go down in the history books. The beginning of the year seemed to extend the positive market environment of 2019. Then, March roared in like a lion and the COVID-19 pandemic became a global crisis impacting lives and life as we know it. The impact on the global economy from the COVID-19 virus pandemic, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others. And the markets, which do not thrive on uncertainty, have been volatile. Our business continuity plan was implemented given the new COVID-19 guidelines, and most of our employees are working remotely. To date, our operating environment has faced no interruption. I am proud of the careful planning that has taken place and confident we can maintain this environment for as long as is prudent. History in the making for a company that first opened its doors way back in 1928.

Since 1928, Amundi Pioneer’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the potential risks during periods of market volatility. As the first several months of 2020 have reminded us, investment risk can arise from a number of factors in today’s global economy, including slower or stagnating growth, changing U.S. Federal Reserve policy, oil price shocks, political and geopolitical factors and, unfortunately, major public health concerns such as a viral pandemic.

At Amundi Pioneer, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyze each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

2 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial advisor to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We remain confident that the current crisis, like others in human history, will pass, and we greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of U.S.

Amundi Pioneer Asset Management USA, Inc.

April 30, 2020

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 3

Portfolio Management Discussion |

4/30/20 In the following interview, Andrew Feltus, Paresh Upadhyaya, and Bradley R. Komenda, discuss the factors that affected the performance of Pioneer Global Multisector Income Fund during the six-month period ended April 30, 2020. Mr. Feltus, CFA, Managing Director, Co-Director of High Yield, and a portfolio manager at Amundi Pioneer Asset Management, Inc. (Amundi Pioneer), Mr. Upadhyaya, Director of Currency Strategy, U.S., a senior vice president, and a portfolio manager at Amundi Pioneer, and Mr. Komenda, Deputy Director of Investment-Grade Corporates, a senior vice president, and a portfolio manager at Amundi Pioneer, are responsible for the day-to-day management of the Fund, along with Kenneth J. Taubes, Executive Vice President, Chief Investment Officer, U.S., and a portfolio manager at Amundi Pioneer.

Q How did the Fund perform during the six-month period ended April 30, 2020?

A Pioneer Global Multisector Income Fund’s Class A shares returned -6.41% at net asset value during the six-month period ended April 30, 2020, while the Fund’s benchmark, the Bloomberg Barclays Global Aggregate Bond Index (the Bloomberg Barclays Index), returned 1.45%. During the same period, the average return of the 217 mutual funds in Morningstar’s World Bond Funds category was -2.40%.

Q How would you describe the investment environment for fixed-income securities during the six-month period ended April 30, 2020?

A Global bond markets experienced significant upheaval over the past six months as investors reacted to the uncertainty created by the COVID-19 pandemic and the measures taken by authorities in an attempt to contain the spread of the virus. The six-month period began on a positive note in November 2019, with higher-risk market segments generally gaining ground from November right up through mid-February of 2020. During that time, the combination of steady economic growth and the supportive policies of the U.S. Federal Reserve (Fed) as well as other major central banks provided a firm tailwind for positive investor sentiment.

Market conditions changed abruptly in the second half of February once it became clear that the COVID-19 virus was evolving into a global pandemic. Governments across the world shut down large portions of their economies in an effort to contain the virus, causing estimates for economic growth and corporate earnings to plunge. Riskier assets sold off sharply in response, mostly in the month of March, while perceived “safe haven” assets such as U.S. Treasuries rallied. The downturn accelerated after Saudi Arabia and Russia failed to agree to cut crude oil production, which caused the price of the commodity to crater. That development weighed heavily on the

4 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

performance of securities with above-average sensitivity to oil prices, including high-yield corporates and issues from certain countries within the emerging markets.

The environment shifted once again in late March following the extraordinary stimulus measures enacted by the world’s governments and central banks. In the United States, for instance, the Fed cut the federal funds rate target range to zero and enacted multiple asset-purchase and other programs aimed at boosting fixed-income markets and improving liquidity conditions. Meanwhile, Congress and the White House agreed on a spending package worth more than $2 trillion. Those moves, combined with signs that COVID-19 cases had begun to level off in Asia, helped restore investor confidence and led to strong gains for the higher-risk areas of the bond market during the month of April.

Despite the late rally, the market’s credit-sensitive sectors – including investment-grade and high-yield corporates, emerging markets debt, and senior loans – all finished the six-month period with negative returns. In contrast, government bonds and the U.S. dollar (USD) both reaped sizable benefits from investors’ “flight to quality” over the last several weeks of the period.

Q What were the principal factors that affected the Fund’s benchmark-relative performance during the six-month period ended April 30, 2020?

A The Fund lagged the benchmark Bloomberg Barclays Index by a wide margin during the six-month period. The benchmark-relative underperformance was disappointing, but we continued to manage the Fund with our primary goal in mind, which is seeking to generate favorable results over the longer term, rather than during any particular six-month interval. As would be expected, the majority of the Fund’s performance shortfall relative to the Bloomberg Barclays Index occurred during the sell-off environment in February and March. The Fund recovered some of the lost ground in April, but the rebound was not enough to overcome the negative benchmark-relative returns accumulated during the market downturn.

Our emphasis on allocating the Fund’s investments to the credit-sensitive sectors was a key reason for the benchmark-underperformance during the six-month period. We saw greater total return potential in those areas of the market compared to government issues, due to the above-average yields available and the ability of issuers to potentially capitalize on the positive economic conditions that existed until mid-February. Our focus on the credit sectors led to a corresponding underweight in developed-market government bonds, where approximately two-thirds of the Bloomberg Barclays Index components reside, and where the Fund had a weighting of less than 30%. Given the substantial outperformance of government issues

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 5

during the six-month period, the Fund’s underweight was a notable detractor from benchmark-relative performance. On the positive side, the Fund’s allocation to Treasury inflation-protected securities (TIPS), which participated in the rally in the government-bond sectors, delivered solid gains and helped limit some of the volatility the portfolio experienced during the market sell-off.

Security selection was a further headwind for the Fund’s benchmark-relative results during the six-month period. The majority of the relative underperformance occurred in the emerging markets, where portfolio positions in countries most exposed to the collapse of oil prices lagged. Among the Fund’s underperformers were allocations to Angola, Gabon, Oman, Ghana, and Bahrain. A position in Sri Lanka, which lagged amid worries about its ability to finance its large budget deficit, was another notable detractor from the Fund’s benchmark-relative returns during the six-month period. The Fund also experienced underperformance in the investment-grade area of the market, due to the relative weakness of holdings within investment-grade corporates and securitized assets.

The Fund’s currency positioning also detracted from benchmark-relative returns. The portfolio had positions in the Australian dollar and Norwegian krone, as well as in emerging markets currencies such as the Indian rupee, Indonesian rupiah, and Brazilian real. All of those currencies declined in value against the USD during the six-month period, with the largest underperformance occurring in mid-March.

Finally, the Fund’s duration positioning was another headwind for benchmark-relative returns. We kept the portfolio’s duration below that of the Bloomberg Barclays Index during the six-month period, on the belief that the combination of low interest rates and positive economic growth had indicated little upside from having higher interest-rate exposure than the benchmark. Given the large decline in U.S. Treasury yields over the latter half of the six-month period, the portfolio’s lower-interest-rate sensitivity detracted from the Fund’s relative performance. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed income investment to a change in interest rates, expressed as a number of years.)

Q Did the Fund have any exposure to derivative securities during the six-month period ended April 30, 2020? If so, did the derivatives have a material impact on benchmark-relative performance?

A We invested the Fund in four types of derivatives during the six-month period: forward foreign currency transactions (forwards), foreign currency options, U.S. Treasury futures, and credit default swaps (CDS). Since we typically seek to achieve the Fund’s desired currency positioning with derivatives, the use of derivatives was a net negative for benchmark-relative

6 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

performance during the six-month period due to our bias toward a lower USD. We invested in Treasury futures to help manage the portfolio’s interest-rate risk, which was a positive contributor to relative returns.

Q Were there any changes in the Fund’s distributions* to shareholders during the six-month period ended April 30, 2020?

A The Fund’s yield/distributions increased over the six-month period compared to the level at the start of the period on November 1, 2019. The increase was largely a result of the higher yields available in the credit-sensitive sectors of the market.

Q How would you characterize your view on the markets as of April 30, 2020, and how was that view reflected in the Fund’s positioning?

A Although our emphasis on investments in the credit-sensitive sectors of the market detracted from the Fund’s benchmark-relative performance during the dramatic market sell-off in February and March, we did not make major changes to the portfolio’s broader positioning in response to the market disruptions. We expect that weak economic data and fears of a second wave of COVID-19 infections will create additional market volatility in the months to come, but we also have continued to see the most compelling longer-term opportunities in the credit-sensitive areas. Further, we think the massive fiscal and monetary stimulus measures will feed through to market performance once investors begin to see evidence that COVID-19 has begun to recede, whenever that may occur.

We did make a number of smaller changes to the portfolio during the six-month period, however. We gradually moved the Fund up in quality across the various credit sectors, with a focus on identifying value opportunities among bonds rated AAA and AA. As part of the process, we tilted the portfolio toward areas where we have seen a greater likelihood of a faster recovery, and away from those, such as energy and travel, where difficulties may persist. Additionally, we shifted the Fund’s positioning in the emerging markets by moving into countries with stronger fiscal positions. We believe that approach could allow the Fund to participate in the potential upside for credit-sensitive investments, while also guarding against the possibility of ongoing market volatility.

We also adjusted the Fund’s currency exposures by reducing the extent of the portfolio’s positions outside of the United States. We made the move to guard against the possibility that the USD would continue to benefit from a flight-to-quality market environment. On a longer-term basis, however, we believe the USD is overvalued and is likely to experience weaker performance than it did over the past six months. The key pillars

* Distributions are not guaranteed.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 7

supporting the USD in recent years – the stronger growth of the U.S. economy versus the rest of the developed world, and higher short-term interest rates compared to other developed economies – have dissipated due to the recent events related to COVID-19. We therefore expect to seek opportunities to add back to the Fund’s non-USD exposure once market conditions begin to normalize.

Another notable change was our decision to reduce the portfolio’s allocation to senior loans. Securities in the loan category typically offer floating rates, which has tended to spur demand when the Fed is tightening monetary policy, usually by increasing interest rates. Now that it appears the Fed is likely to keep rates near zero indefinitely, we anticipate weaker relative performance for loans.

Despite the Fund’s recent underperformance, we believe a flexible, selective approach that seeks to manage risk and capitalize on potential values remains essential in the current, uncertain investment environment.

Note to Shareholders: The Board of Trustees of Pioneer Global Multisector Income Fund have approved the liquidation of the Fund on or about August 28, 2020. All shares of the Fund that are outstanding on the liquidation date will be redeemed automatically as of the close of business on that date. Written notification of the Fund’s liquidation, including specific details about the transaction, has been mailed to all shareholders of the Fund. Please contact your investment advisor, or one of our Client Service Representatives should you have any questions (please see the “How to Contact Amundi Pioneer” page near the back of this report for the appropriate contact information).

Please refer to the Schedule of Investments on pages 17–39 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

8 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, and economic and political conditions.

When interest rates rise, the prices of fixed income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities held by the Fund will generally rise.

Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.

Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.

Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.

The Fund may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.

The securities issued by U.S. Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the U.S. Government.

Floating rate loans and similar instruments may be illiquid or less liquid than other instruments, and the value of any collateral can decline or be insufficient to meet the issuer’s obligations.

The value of municipal securities can be adversely affected by changes in financial condition of municipal issuers, lower revenues, and regulatory and political developments.

The Fund is subject to currency risk, meaning that the Fund could experience losses based on changes in the exchange rate between non-U.S. currencies and the U.S. dollar.

The Fund may use derivatives, such as options, futures, inverse floating rate obligations, swaps, and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Derivatives may have a leveraging effect on the Fund.

These risks may increase share price volatility.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Amundi Pioneer Asset Management, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 9

Portfolio Summary |

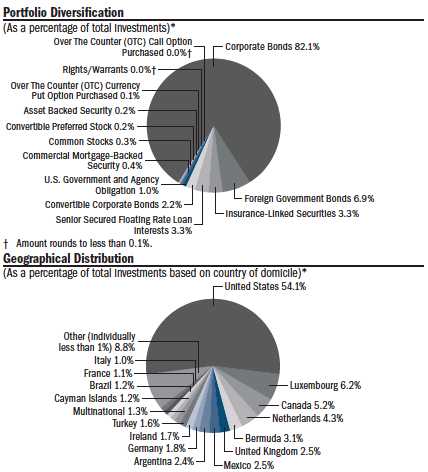

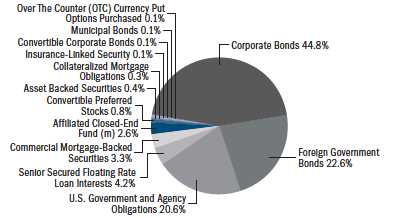

4/30/20Portfolio Diversification

(As a percentage of total investments)*

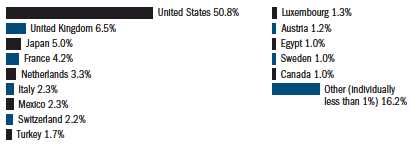

Geographical Distribution

(As a percentage of total investments based on country of domicile)

10 Largest Holdings

(As a percentage of total investments)*| | | |

| 1. | U.S. Treasury Bills, 5/12/20 | 3.80% |

| 2. | Fannie Mae, 4.0%, 5/1/49 (TBA) | 3.24 |

| 3. | Japan Government Twenty Year Bond, 0.6%, 12/20/37 | 2.94 |

| 4. | Pioneer ILS Interval Fund, 0.0% 12/30/99 | 2.62 |

| 5. | United Kingdom Gilt, 3.5%, 1/22/45 | 2.57 |

| 6. | Japan Government Thirty Year Bond, 0.8%, 12/20/47 | 2.09 |

| 7. | U.S. Treasury Inflation Indexed Bonds, 1.0%, 2/15/48 | 1.56 |

| 8. | U.S. Treasury Inflation Indexed Bonds, 0.875%, 2/15/47 | 1.37 |

| 9. | Mexican Bonos, 8.5%, 5/31/29 | 1.27 |

| 10. | U.S. Treasury Inflation Indexed Bonds, 1.0%, 2/15/49 | 0.86 |

* Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

(m) Pioneer ILS Interval Fund is an affiliated fund managed by Amundi Pioneer Asset Management, Inc., (the “Adviser”).

10 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

Prices and Distributions |

4/30/20Net Asset Value per Share

| Class | 4/30/20 | 10/31/19 |

| A | $9.53 | $10.32 |

| C | $9.56 | $10.35 |

| Y | $9.61 | $10.41 |

Distributions per Share: 10/31/19–4/30/20

| Net Investment | Short-Term | Long-Term |

| Class | Income | Capital Gains | Capital Gains |

| A | $0.1340 | $ — | $ — |

| C | $0.0929 | $ — | $ — |

| Y | $0.1479 | $ — | $ — |

Index Definitions

The Bloomberg Barclays Global Aggregate Bond Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts appearing on pages 12–14.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 11

| | |

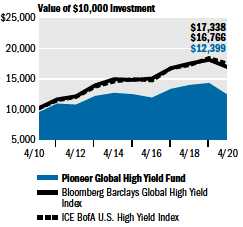

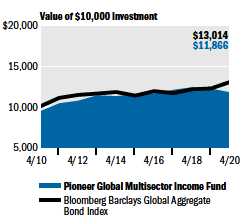

Performance Update | 4/30/20 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Global Multisector Income Fund at public offering price during the periods shown, compared to that of the Bloomberg Barclays Global Aggregate Bond Index.

| | | | |

| Average Annual Total Returns | |

(As of April 30, 2020) | | |

| | | BBG |

| | | Barclays |

| Net | Public | Global |

| Asset | Offering | Aggregate |

| Value | Price | Bond |

| Period | (NAV) | (POP) | Index |

10 years | 2.19% | 1.73% | 2.67% |

5 years | 0.40 | -0.52 | 2.82 |

1 year | -3.70 | -8.04 | 6.56 |

|

|

|

| Expense Ratio | | | |

(Per prospectus dated March 1, 2020) |

|

| Gross | Net | | |

2.37% | 1.08% | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. POP returns reflect deduction of maximum 4.50% sales charge. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2021, for Class A shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

12 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | |

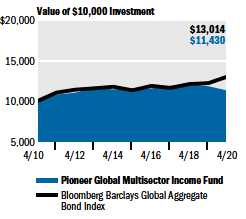

Performance Update | 4/30/20 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Global Multisector Income Fund during the periods shown, compared to that of the Bloomberg Barclays Global Aggregate Bond Index.

| | | | |

| Average Annual Total Returns | |

(As of April 30, 2020) | | |

| | | BBG |

| | | Barclays |

| | | Global |

| | | Aggregate |

| If | If | Bond |

| Period | Held | Redeemed | Index

|

10 years | 1.35% | 1.35% | 2.67% |

5 years | -0.44 | -0.44 | 2.82 |

1 year | -4.48 | -4.48 | 6.56 |

|

|

|

| Expense Ratio | | | |

(Per prospectus dated March 1, 2020) |

|

| Gross | Net | | |

2.57% | 1.98% | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2021, for Class C shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 13

| | |

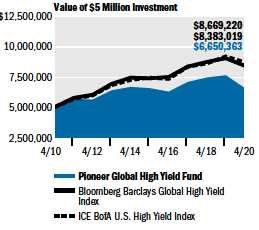

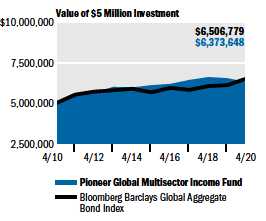

Performance Update | 4/30/20 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Global Multisector Income Fund during the periods shown, compared to that of the Bloomberg Barclays Global Aggregate Bond Index.

| | | |

| Average Annual Total Returns | |

(As of April 30, 2020) | |

| | BBG |

| | Barclays |

| Net | Global |

| Asset | Aggregate |

| Value | Bond |

| Period | (NAV) | Index |

10 years | 2.46% | 2.67% |

5 years | 0.63 | 2.82 |

1 year | -3.50 | 6.56 |

|

|

|

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

|

| Gross | Net | |

1.49% | 0.83 | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2021, for Class Y shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

14 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

(1) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and

(2) transaction costs, including sales charges (loads) on purchase payments.

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

(1) Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6

(2) Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses Paid on a $1,000 Investment in Pioneer Global Multisector Income Fund

Based on actual returns from November 1, 2019 through April 30, 2020.

| | | | |

| Share Class | A | C | Y |

Beginning Account Value on 11/1/19 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value (after expenses) | $935.90 | $932.30 | $936.80 |

on 4/30/20 | | | |

Expenses Paid During Period* | $4.81 | $8.60 | $3.61 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.00%, 1.79%, and 0.75% for Class A, Class C, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 15

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Global Multisector Income Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from November 1, 2019 through April 30, 2020.

| | | | |

| Share Class | A | C | Y |

Beginning Account Value on 11/1/19 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value (after expenses) | $1,019.89 | $1,015.96 | $1,021.13 |

on 4/30/20 | | | |

Expenses Paid During Period* | $5.02 | $8.97 | $3.77 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.00%, 1.79%, and 0.75% for Class A, Class C, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366.

16 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

Schedule of Investments |

4/30/20 (unaudited) | | | | |

| Shares | | | Value |

| | UNAFFILIATED ISSUERS — 97.8% | |

| | CONVERTIBLE PREFERRED STOCK — 0.8% | |

| | of Net Assets | |

| | Banks — 0.8% | |

| 211(a) | | Wells Fargo & Co., 7.5% | $ 295,155 |

| | Total Banks | $ 295,155 |

| | TOTAL CONVERTIBLE PREFERRED STOCK | |

| | (Cost $294,931) | $ 295,155 |

| Principal | | | |

| Amount USD ($) | | | |

| | ASSET BACKED SECURITIES — 0.4% | |

| | of Net Assets | |

| 68,950 | | Hardee’s Funding LLC, Series 2018-1A, Class A2II, | |

| | 4.959%, 6/20/48 (144A) | $ 63,955 |

| 100,000 | | Progress Residential Trust, Series 2017-SFR1, Class E, | |

| | 4.261%, 8/17/34 (144A) | 96,726 |

| | TOTAL ASSET BACKED SECURITIES | |

| | (Cost $168,949) | $ 160,681 |

| | COLLATERALIZED MORTGAGE OBLIGATIONS — | |

| | 0.3% of Net Assets | |

| 235(b) | | Alternative Loan Trust, Series 2003-14T1, Class A9, | |

| | 0.937% (1 Month USD LIBOR + 45 bps), 8/25/18 | $ 235 |

| 2,069(c) | | CHL Mortgage Pass-Through Trust, Series 2003-56, | |

| | Class 4A2, 4.166%, 12/25/33 | 1,816 |

| 3,155 | | Federal National Mortgage Association REMICS, Series | |

| | 2009-36, Class HX, 4.5%, 6/25/29 | 3,375 |

| 16,983 | | Government National Mortgage Association, Series 2005-61, | |

| | Class UZ, 5.25%, 8/16/35 | 18,090 |

| 14,413 | | Government National Mortgage Association, Series 2009-83, | |

| | Class EB, 4.5%, 9/20/39 | 16,246 |

| 277,287(d) | | Government National Mortgage Association, Series 2019-159, | |

| | Class CI, 3.5%, 12/20/49 | 31,813 |

| 32,748(b) | | Interstar Millennium Trust, Series 2003-3G, Class A2, | |

| | 1.767% (3 Month USD LIBOR + 50 bps), 9/27/35 | 30,369 |

| 68(b) | | RALI Trust, Series 2002-QS16, Class A2, 1.037% (1 Month | |

| | USD LIBOR + 55 bps), 10/25/17 | 68 |

| | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | |

| | (Cost $108,874) | $ 102,012 |

| | COMMERCIAL MORTGAGE-BACKED SECURITIES — | |

| | 3.3% of Net Assets | |

| 80,000 | | BANK, Series 2017-BNK5, Class AS, 3.624%, 6/15/60 | $ 81,316 |

| 45,450(d)(e) | | Bayview Commercial Asset Trust, Series 2007-2A, | |

| | Class IO, 0.0%, 7/25/37 (144A) | — |

| 100,000 | | BX Trust, Series 2019-OC11, Class A, 3.202%, | |

| | 12/9/41 (144A) | 99,558 |

| 100,000(c) | | Citigroup Commercial Mortgage Trust, Series 2014-GC19, | |

| | Class B, 4.805%, 3/10/47 | 102,529 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 17

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | COMMERCIAL MORTGAGE-BACKED | |

| | | SECURITIES — (continued) | |

| 75,000(c) | | Citigroup Commercial Mortgage Trust, Series 2014-GC25, | |

| | | Class B, 4.345%, 10/10/47 | $ 74,964 |

| 250,000 | | Citigroup Commercial Mortgage Trust, Series 2016-P5, | |

| | | Class D, 3.0%, 10/10/49 (144A) | 138,644 |

| 100,000(c) | | COMM Mortgage Trust, Series 2015-CR25, Class B, | |

| | | 4.691%, 8/10/48 | 99,321 |

| 236,107 | | COMM Mortgage Trust, Series 2016-CR28, Class AHR, | |

| | | 3.651%, 2/10/49 | 248,444 |

| 50,000(c) | | CSAIL Commercial Mortgage Trust, Series 2016-C5, | |

| | | Class C, 4.729%, 11/15/48 | 43,684 |

| 100,000(c) | | Fontainebleau Miami Beach Trust, Series 2019-FBLU, | |

| | | Class D, 4.095%, 12/10/36 (144A) | 83,240 |

| 50,000(c) | | FREMF Mortgage Trust, Series 2015-K51, Class B, 4.089%, | |

| | | 10/25/48 (144A) | 52,645 |

| 100,000(b) | | GS Mortgage Securities Corp. Trust, Series 2020-DUNE, | |

| | | Class E, 3.314% (1 Month USD LIBOR + | |

| | | 250 bps), 12/15/36 (144A) | 77,965 |

| 50,000(c) | | Morgan Stanley Bank of America Merrill Lynch Trust, Series | |

| | | 2015-C22, Class D, 4.368%, 4/15/48 (144A) | 35,362 |

| 105,000 | | Morgan Stanley Capital I Trust, Series 2016-UBS9, | |

| | | Class D, 3.0%, 3/15/49 (144A) | 65,121 |

| | TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | |

| | | (Cost $1,368,133) | $ 1,202,793 |

| | | CONVERTIBLE CORPORATE BOND — 0.1% | |

| | | of Net Assets | |

| | | Biotechnology — 0.1% | |

| 50,000 | | Exact Sciences Corp., 0.375%, 3/1/28 | $ 45,537 |

| | | Total Biotechnology | $ 45,537 |

| | | TOTAL CONVERTIBLE CORPORATE BOND | |

| | | (Cost $42,294) | $ 45,537 |

| | | CORPORATE BONDS — 44.9% of Net Assets | |

| | | Advertising — 0.1% | |

| 49,000 | | Interpublic Group of Cos., Inc., 4.75%, 3/30/30 | $ 50,736 |

| | | Total Advertising | $ 50,736 |

| | | Aerospace/Defense — 0.6% | |

| 134,000 | | Boeing Co., 3.75%, 2/1/50 | $ 107,110 |

| 60,000 | | Boeing Co., 5.805%, 5/1/50 | 60,000 |

| 40,000 | | United Technologies Corp., 4.125%, 11/16/28 | 46,425 |

| | | Total Aerospace/Defense | $ 213,535 |

| | | Agriculture — 0.7% | |

EUR | 100,000 | | BAT Capital Corp., 1.125%, 11/16/23 | $ 109,082 |

| | 25,000 | | Cargill, Inc., 2.125%, 4/23/30 (144A) | 25,352 |

EUR | 100,000 | | Imperial Brands Finance Plc, 2.25%, 2/26/21 | 110,259 |

| | | Total Agriculture | $ 244,693 |

The accompanying notes are an integral part of these financial statements.

18 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Auto Manufacturers — 0.5% | |

| | 110,000 | | Ford Motor Co., 4.346%, 12/8/26 | $ 87,175 |

| | 90,000 | | General Motors Co., 6.6%, 4/1/36 | 82,598 |

| | | | Total Auto Manufacturers | $ 169,773 |

| | | | Auto Parts & Equipment — 0.1% | |

| | 25,000 | | Lear Corp., 3.5%, 5/30/30 | $ 21,571 |

| | | | Total Auto Parts & Equipment | $ 21,571 |

| | | | Banks — 11.5% | |

| | 200,000 | | Access Bank Plc, 10.5%, 10/19/21 (144A) | $ 195,040 |

| | 42,000(c) | | Bank of America Corp., 4.083% (3 Month USD LIBOR + | |

| | | | 315 bps), 3/20/51 | 50,434 |

| | 60,000(a)(c) | | Bank of America Corp., 4.3% (3 Month USD LIBOR + 266 bps) | 53,925 |

EUR | 200,000(c) | | Barclays Plc, 2.625% (5 Year EUR Swap Rate + | |

| | | | 245 bps), 11/11/25 | 216,054 |

EUR | 150,000 | | BNP Paribas SA, 2.375%, 2/17/25 | 172,442 |

EUR | 200,000 | | BPCE SA, 2.875%, 4/22/26 | 237,084 |

| | 85,000(a)(c) | | Citigroup, Inc., 4.7% (SOFRRATE + 323 bps) | 73,950 |

| | 75,000 | | Cooperatieve Rabobank UA, 3.875%, 2/8/22 | 78,121 |

| | 200,000(a)(c) | | Credit Suisse Group AG, 5.1% (5 Year CMT Index + | |

| | | | 329 bps) (144A) | 179,000 |

| | 200,000(a)(c) | | Credit Suisse Group AG, 7.125% (5 Year USD Swap Rate + | |

| | | | 511 bps) | 201,204 |

| | 200,000(a)(c) | | Danske Bank AS, 6.125% (USD Swap Rate + 390 bps) | 189,000 |

EUR | 200,000(a)(c) | | Erste Group Bank AG, 8.875% (5 Year EUR Swap Rate + | |

| | | | 902 bps) | 225,829 |

| | 124,000 | | Freedom Mortgage Corp., 8.125%, 11/15/24 (144A) | 102,920 |

EUR | 100,000 | | Goldman Sachs Group, Inc., 1.625%, 7/27/26 | 112,220 |

| | 105,000(c) | | Goldman Sachs Group, Inc., 4.223% (3 Month USD LIBOR + | |

| | | | 130 bps), 5/1/29 | 116,561 |

EUR | 100,000 | | HSBC Holdings Plc, 0.875%, 9/6/24 | 110,440 |

EUR | 200,000(c) | | ING Groep NV, 3.0% (5 Year EUR Swap Rate + | |

| | | | 285 bps), 4/11/28 | 225,784 |

EUR | 200,000(a)(c) | | Intesa Sanpaolo S.p.A., 7.75% (5 Year EUR Swap | |

| | | | Rate + 719 bps) | 219,255 |

| | 126,000(a)(c) | | JPMorgan Chase & Co., 4.6% (SOFRRATE + 313 bps) | 113,022 |

| | 128,000(a)(c) | | JPMorgan Chase & Co., 5.0% (SOFRRATE + 338 bps) | 119,040 |

EUR | 200,000(a)(c) | | Lloyds Banking Group Plc, 6.375% (5 Year EUR Swap | |

| | | | Rate + 529 bps) | 212,185 |

EUR | 100,000(b) | | Mediobanca Banca di Credito Finanziario S.p.A., 0.387% | |

| | | | (3 Month EURIBOR + 80 bps), 5/18/22 | 106,872 |

EUR | 100,000 | | Nykredit Realkredit AS, 0.75%, 7/14/21 | 109,618 |

| | 200,000 | | QNB Finansbank AS, 4.875%, 5/19/22 (144A) | 196,040 |

| | 200,000(a)(c) | | Societe Generale SA, 7.375% (5 Year USD Swap Rate + | |

| | | | 624 bps) (144A) | 195,250 |

EUR | 200,000 | | UBS Group AG, 1.75%, 11/16/22 | 224,460 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 19

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Banks — (continued) | |

| | 200,000(a)(c) | | UBS Group AG, 7.0% (5 Year USD Swap Rate + | |

| | | | 434 bps) (144A) | $ 204,500 |

| | | | Total Banks | $ 4,240,250 |

| | | | Beverages — 0.7% | |

| | 115,000 | | Anheuser-Busch InBev Worldwide, Inc., 5.55%, 1/23/49 | $ 143,780 |

| | 100,000 | | Bacardi, Ltd., 5.3%, 5/15/48 (144A) | 112,186 |

| | | | Total Beverages | $ 255,966 |

| | | | Building Materials — 1.0% | |

EUR | 100,000 | | Buzzi Unicem S.p.A., 2.125%, 4/28/23 | $ 109,810 |

EUR | 100,000 | | HeidelbergCement AG, 2.25%, 6/3/24 | 111,920 |

EUR | 100,000 | | Holcim Finance Luxembourg SA, 2.25%, 5/26/28 | 113,378 |

| | 35,000 | | Martin Marietta Materials, Inc., 2.5%, 3/15/30 | 32,816 |

| | | | Total Building Materials | $ 367,924 |

| | | | Chemicals — 0.6% | |

EUR | 100,000 | | Arkema SA, 1.5%, 1/20/25 | $ 113,445 |

| | 28,000 | | CF Industries, Inc., 5.375%, 3/15/44 | 28,980 |

| | 51,000 | | NOVA Chemicals Corp., 5.25%, 6/1/27 (144A) | 40,800 |

| | 13,000 | | Sherwin-Williams Co., 3.3%, 5/15/50 | 13,303 |

| | 48,000 | | Tronox, Inc., 6.5%, 4/15/26 (144A) | 43,440 |

| | | | Total Chemicals | $ 239,968 |

| | | | Commercial Services — 0.6% | |

EUR | 100,000 | | Brisa Concessao Rodoviaria SA, 2.0%, 3/22/23 | $ 111,806 |

| | 133,000 | | Prime Security Services Borrower LLC/Prime Finance, Inc., | |

| | | | 6.25%, 1/15/28 (144A) | 118,011 |

| | | | Total Commercial Services | $ 229,817 |

| | | | Diversified Financial Services — 0.5% | |

| | 125,000 | | Capital One Financial Corp., 4.25%, 4/30/25 | $ 133,129 |

| | 40,000(a)(c) | | Charles Schwab Corp., 5.375% (5 Year CMT Index + 497 bps) | 40,950 |

| | | | Total Diversified Financial Services | $ 174,079 |

| | | | Electric — 2.7% | |

GBP | 125,000 | | Cadent Finance Plc, 2.125%, 9/22/28 | $ 162,935 |

EUR | 100,000 | | Coentreprise de Transport d’Electricite SA, 0.875%, 9/29/24 | 111,957 |

| | 79,000(a)(c) | | Dominion Energy, Inc., 4.65% (5 Year CMT Index + 299 bps) | 76,827 |

| | 23,000 | | Duke Energy Indiana LLC, 2.75%, 4/1/50 | 23,446 |

EUR | 100,000 | | EDP Finance BV, 1.875%, 9/29/23 | 113,980 |

GBP | 75,000 | | innogy Finance BV, 5.625%, 12/6/23 | 107,649 |

| | 31,000 | | New York State Electric & Gas Corp., 3.3%, 9/15/49 (144A) | 31,343 |

| | 85,000 | | NextEra Energy Capital Holdings, Inc., 3.55%, 5/1/27 | 93,537 |

| | 65,000 | | Sempra Energy, 3.4%, 2/1/28 | 68,407 |

| | 50,000 | | Southern California Edison Co., 3.65%, 2/1/50 | 54,355 |

| | 95,000 | | Vistra Operations Co. LLC, 3.7%, 1/30/27 (144A) | 93,471 |

| | | | Total Electric | $ 937,907 |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Electrical Components & Equipment — 0.7% | |

EUR | 100,000 | | Belden, Inc., 2.875%, 9/15/25 (144A) | $ 99,673 |

EUR | 100,000 | | Legrand SA, 1.875%, 7/6/32 | 121,828 |

| | | | Total Electrical Components & Equipment | $ 221,501 |

| | | | Electronics — 0.6% | |

| | 41,000 | | Amphenol Corp., 3.2%, 4/1/24 | $ 43,223 |

| | 63,000 | | Amphenol Corp., 4.35%, 6/1/29 | 70,858 |

| | 115,000 | | Flex, Ltd., 4.875%, 6/15/29 | 116,736 |

| | | | Total Electronics | $ 230,817 |

| | | | Engineering & Construction — 0.3% | |

EUR | 100,000(a)(c) | | Ferrovial Netherlands BV, 2.124% (5 Year EUR Swap | |

| | | | Rate + 213 bps) | $ 97,843 |

| | | | Total Engineering & Construction | $ 97,843 |

| | | | Entertainment — 0.1% | |

| | 27,000 | | Eldorado Resorts, Inc., 6.0%, 9/15/26 | $ 27,127 |

| | | | Total Entertainment | $ 27,127 |

| | | | Forest Products & Paper — 0.3% | |

| | 50,000 | | International Paper Co., 4.8%, 6/15/44 | $ 56,315 |

| | 5,000 | | International Paper Co., 6.0%, 11/15/41 | 6,337 |

| | 37,000 | | International Paper Co., 7.3%, 11/15/39 | 51,753 |

| | | | Total Forest Products & Paper | $ 114,405 |

| | | | Gas — 0.2% | |

| | 15,000 | | Boston Gas Co., 3.15%, 8/1/27 (144A) | $ 15,907 |

| | 75,540 | | Nakilat, Inc., 6.267%, 12/31/33 (144A) | 84,620 |

| | | | Total Gas | $ 100,527 |

| | | | Hand/Machine Tools — 0.0%† | |

| | 20,000(c) | | Stanley Black & Decker, Inc., 4.0% (5 Year CMT Index + | |

| | | | 266 bps), 3/15/60 | $ 19,375 |

| | | | Total Hand/Machine Tools | $ 19,375 |

| | | | Healthcare-Products — 0.1% | |

| | 24,000 | | Abbott Laboratories, 3.75%, 11/30/26 | $ 27,705 |

| | | | Total Healthcare-Products | $ 27,705 |

| | | | Healthcare-Services — 1.4% | |

| | 38,000 | | Anthem, Inc., 3.35%, 12/1/24 | $ 40,871 |

| | 40,000 | | Anthem, Inc., 3.65%, 12/1/27 | 43,681 |

| | 6,000 | | Anthem, Inc., 4.101%, 3/1/28 | 6,713 |

| | 114,000 | | Centene Corp., 3.375%, 2/15/30 (144A) | 114,855 |

| | 77,000 | | HCA, Inc., 3.5%, 9/1/30 | 73,601 |

| | 80,000 | | Humana, Inc., 3.95%, 3/15/27 | 87,682 |

EUR | 100,000 | | IQVIA, Inc., 2.875%, 9/15/25 (144A) | 109,191 |

| | 20,000 | | LifePoint Health, Inc., 6.75%, 4/15/25 (144A) | 20,608 |

| | | Total Healthcare-Services | $ 497,202 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 21

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Insurance — 4.5% | |

EUR | 100,000(a)(c) | | Allianz SE, 3.375% (10 Year EUAMDB + 320 bps) | $ 116,185 |

EUR | 200,000 | | Assicurazioni Generali S.p.A., 4.125%, 5/4/26 | 237,406 |

EUR | 100,000(c) | | Aviva Plc, 6.125% (5 Year EUR Swap Rate + | |

| | | | 513 bps), 7/5/43 | 123,790 |

EUR | 100,000(a)(c) | | AXA SA, 3.875% (EUR Swap Rate + 325 bps) | 118,415 |

| | 60,000 | | AXA SA, 8.6%, 12/15/30 | 83,311 |

| | 80,000 | | CNO Financial Group, Inc., 5.25%, 5/30/29 | 84,021 |

EUR | 100,000(c) | | CNP Assurances, 6.0% (3 Month EURIBOR + | |

| | | | 447 bps), 9/14/40 | 111,030 |

| | 20,000(c) | | Farmers Exchange Capital III, 5.454% (3 Month USD LIBOR + | |

| | | | 345 bps), 10/15/54 (144A) | 24,166 |

| | 100,000(c) | | Farmers Insurance Exchange, 4.747% (3 Month USD LIBOR + | |

| | | | 323 bps), 11/1/57 (144A) | 102,958 |

| | 100,000 | | Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) | 157,109 |

EUR | 100,000(c) | | Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, | |

| | | | 6.25% (3 Month EURIBOR + 495 bps), 5/26/42 | 121,078 |

| | 25,000 | | New York Life Insurance Co., 3.75%, 5/15/50 (144A) | 28,362 |

EUR | 100,000(a)(c) | | NN Group NV, 4.375% (3 Month EURIBOR + 390 bps) | 115,154 |

| | 27,000 | | Progressive Corp., 3.95%, 3/26/50 | 33,930 |

| | 78,000 | | Prudential Financial, Inc., 3.0%, 3/10/40 | 75,262 |

| | 100,000 | | Teachers Insurance & Annuity Association of America, 4.9%, | |

| | | | 9/15/44 (144A) | 127,786 |

| | 11,000 | | Willis North America, Inc., 2.95%, 9/15/29 | 11,178 |

| | | | Total Insurance | $ 1,671,141 |

| | | | Internet — 0.6% | |

| | 100,000 | | Booking Holdings, Inc., 4.625%, 4/13/30 | $ 111,017 |

| | 80,000 | | Expedia Group, Inc., 3.25%, 2/15/30 | 66,773 |

| | 50,000 | | Expedia Group, Inc., 3.8%, 2/15/28 | 43,373 |

| | | | Total Internet | $ 221,163 |

| | | | Lodging — 0.3% | |

EUR | 100,000 | | Accor SA, 1.25%, 1/25/24 | $ 103,036 |

| | 5,000 | | Marriott International, Inc., 5.75%, 5/1/25 | 5,225 |

| | | | Total Lodging | $ 108,261 |

| | | | Media — 1.6% | |

| | 50,000 | | CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, | |

| | | | 3/1/30 (144A) | $ 50,860 |

| | 60,000 | | Comcast Corp., 4.15%, 10/15/28 | 70,237 |

| | 200,000 | | CSC Holdings LLC, 5.375%, 2/1/28 (144A) | 205,500 |

| | 100,000 | | Diamond Sports Group LLC/Diamond Sports Finance Co., | |

| | | | 6.625%, 8/15/27 (144A) | 54,750 |

| | 70,000 | | Gray Television, Inc., 7.0%, 5/15/27 (144A) | 70,350 |

EUR | 150,000 | | Sky, Ltd., 1.5%, 9/15/21 | 166,127 |

| | | | Total Media | $ 617,824 |

The accompanying notes are an integral part of these financial statements.

22 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | Mining — 0.7% | |

EUR | 100,000 | | Anglo American Capital Plc, 3.25%, 4/3/23 | $ 115,332 |

| | 115,000 | | Freeport-McMoRan, Inc., 5.45%, 3/15/43 | 104,294 |

| | 50,000 | | Joseph T Ryerson & Son, Inc., 11.0%, 5/15/22 (144A) | 48,000 |

| | | | Total Mining | $ 267,626 |

| | | | Miscellaneous Manufacturers — 0.2% | |

| | 35,000 | | General Electric Co., 4.25%, 5/1/40 | $ 35,119 |

| | 40,000 | | General Electric Co., 4.35%, 5/1/50 | 40,304 |

| | | | Total Miscellaneous Manufacturers | $ 75,423 |

| | | | Multi-National — 1.9% | |

| | 200,000 | | African Export-Import Bank, 3.994%, 9/21/29 (144A) | $ 180,632 |

INR | 18,680,000

| | Asian Development Bank, 6.15%, 2/25/30 | 256,146 |

| | 200,000 | | Banque Ouest Africaine de Development, 4.7%, | |

| | | | 10/22/31 (144A) | 180,000 |

IDR

| 1,160,000,000 | | Inter-American Development Bank, 7.875%, 3/14/23 | 79,434 |

| | | | Total Multi-National | $ 696,212 |

| | | | Oil & Gas — 1.4% | |

| | 40,000 | | Apache Corp., 4.25%, 1/15/30 | $ 30,794 |

| | 65,000 | | Apache Corp., 4.375%, 10/15/28 | 51,732 |

| | 110,000 | | Cenovus Energy, Inc., 6.75%, 11/15/39 | 77,794 |

| | 80,000 | | Marathon Petroleum Corp., 5.375%, 10/1/22 | 80,242 |

| | 39,000 | | Petroleos Mexicanos, 5.35%, 2/12/28 | 29,055 |

EUR | 200,000(c) | | Repsol International Finance BV, 4.5% (EUR Swap Rate + | |

| | | | 420 bps), 3/25/75 | 216,762 |

| | 29,000 | | Valero Energy Corp., 6.625%, 6/15/37 | 34,608 |

ARS | 2,154,200 | | YPF SA, 16.5%, 5/9/22 (144A) | 16,776 |

| | | | Total Oil & Gas | $ 537,763 |

| | | | Pharmaceuticals — 1.3% | |

| | 62,000 | | AbbVie, Inc., 4.05%, 11/21/39 (144A) | $ 68,767 |

| | 23,000 | | Bausch Health Americas, Inc., 8.5%, 1/31/27 (144A) | 25,355 |

EUR | 100,000 | | Bausch Health Cos., Inc., 4.5%, 5/15/23 | 107,057 |

| | 15,000 | | Bausch Health Cos., Inc., 5.0%, 1/30/28 (144A) | 14,395 |

| | 10,000 | | Bausch Health Cos., Inc., 5.25%, 1/30/30 (144A) | 9,900 |

| | 22,000 | | Cardinal Health, Inc., 4.9%, 9/15/45 | 24,971 |

| 20,000 | | Cigna Corp., 3.4%, 3/15/50 | 20,985 |

| 10,845 | | CVS Pass-Through Trust, 5.773%, 1/10/33 (144A) | 11,950 |

| 200,000 | | Perrigo Finance Unlimited Co., 3.9%, 12/15/24 | 205,761 |

| | | Total Pharmaceuticals | $ 489,141 |

| | | Pipelines — 2.8% | |

| 19,000 | | Cameron LNG LLC, 3.302%, 1/15/35 (144A) | $ 18,889 |

| 43,000 | | Cameron LNG LLC, 3.402%, 1/15/38 (144A) | 38,724 |

| 100,000 | | Enable Midstream Partners LP, 4.4%, 3/15/27 | 77,495 |

| 75,000 | | Enable Midstream Partners LP, 4.95%, 5/15/28 | 57,634 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 23

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Pipelines — (continued) | |

| | 100,000 | | Energy Transfer Operating LP, 5.875%, 1/15/24 | $ 104,124 |

| | 50,000 | | Energy Transfer Operating LP, 6.0%, 6/15/48 | 47,060 |

| | 10,000 | | Energy Transfer Operating LP, 6.125%, 12/15/45 | 9,609 |

| | 110,000(a)(c) | | Energy Transfer Operating LP, 7.125% (5 Year CMT | |

| | | | Index + 531 bps) | 86,009 |

| | 155,000 | | EnLink Midstream Partners LP, 5.45%, 6/1/47 | 62,969 |

| | 39,000 | | EnLink Midstream Partners LP, 5.6%, 4/1/44 | 15,600 |

| | 10,000 | | Enterprise Products Operating LLC, 3.95%, 1/31/60 | 9,203 |

| | 125,000 | | MPLX LP, 4.875%, 12/1/24 | 124,193 |

| | 125,000 | | Phillips 66 Partners LP, 3.75%, 3/1/28 | 121,209 |

| | 60,000 | | Sabine Pass Liquefaction LLC, 5.0%, 3/15/27 | 61,505 |

| | 60,000 | | Sunoco Logistics Partners Operations LP, 6.1%, 2/15/42 | 58,144 |

| | 90,000 | | Texas Eastern Transmission LP, 3.5%, 1/15/28 (144A) | 88,178 |

| | 57,000 | | Williams Cos., Inc., 5.75%, 6/24/44 | 62,041 |

| | 13,000 | | Williams Cos., Inc., 7.75%, 6/15/31 | 15,427 |

| | | | Total Pipelines | $ 1,058,013 |

| | | | Real Estate — 0.9% | |

EUR | 100,000 | | Akelius Residential Property AB, 1.125%, 3/14/24 | $ 106,755 |

EUR | 100,000 | | Annington Funding Plc, 1.65%, 7/12/24 | 110,230 |

EUR | 100,000(a)(c) | | ATF Netherlands BV, 3.75% (5 Year EUR Swap Rate + 438 bps) | 107,658 |

| | | | Total Real Estate | $ 324,643 |

| | | | REITs — 2.0% | |

| | 23,000 | | Alexandria Real Estate Equities, Inc., 4.3%, 1/15/26 | $ 25,280 |

EUR | 200,000 | | GELF Bond Issuer I SA, 0.875%, 10/20/22 | 217,685 |

| | 30,000 | | GLP Capital LP/GLP Financing II, Inc., 4.0%, 1/15/30 | 26,475 |

| | 60,000 | | Healthcare Trust of America Holdings LP, 3.75%, 7/1/27 | 59,535 |

| | 35,000 | | Highwoods Realty LP, 3.625%, 1/15/23 | 35,826 |

| | 140,000 | | iStar, Inc., 4.25%, 8/1/25 | 110,600 |

EUR | 100,000 | | Merlin Properties Socimi SA, 2.225%, 4/25/23 | 109,740 |

| | 43,000 | | MPT Operating Partnership LP/MPT Finance Corp., | |

| | | | 4.625%, 8/1/29 | 42,758 |

| | 25,000 | | Simon Property Group LP, 3.25%, 9/13/49 | 20,736 |

| | 27,000 | | UDR, Inc., 4.0%, 10/1/25 | 28,218 |

| | 75,000 | | Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC, | |

| | | | 7.875%, 2/15/25 (144A) | 72,000 |

| | | | Total REITs | $ 748,853 |

| | | | Retail — 0.1% | |

| | 28,000 | | Starbucks Corp., 3.35%, 3/12/50 | $ 27,167 |

| | | | Total Retail | $ 27,167 |

| | | | Savings & Loans — 0.3% | |

EUR | 100,000 | | Leeds Building Society, 1.375%, 5/5/22 | $ 110,639 |

| | | | Total Savings & Loans | $ 110,639 |

The accompanying notes are an integral part of these financial statements.

24 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Semiconductors — 0.1% | |

| | 25,000 | | Broadcom, Inc., 5.0%, 4/15/30 (144A) | $ 28,120 |

| | | | Total Semiconductors | $ 28,120 |

| | | | Software — 0.4% | |

| | 135,000 | | Citrix Systems, Inc., 3.3%, 3/1/30 | $ 136,441 |

| | | | Total Software | $ 136,441 |

| | | | Sovereign — 0.2% | |

| | 200,000(f) | | Ecuador Social Bond S.a.r.l, 1/30/35 (144A) | $ 60,000 |

| | | | Total Sovereign | $ 60,000 |

| | | | Telecommunications — 1.8% | |

| | 200,000 | | Digicel, Ltd., 6.0%, 4/15/21 (144A) | $ 120,002 |

| | 40,000(g) | | Frontier Communications Corp., 7.125%, 1/15/23 | 10,788 |

GBP | 100,000 | | Koninklijke KPN NV, 5.0%, 11/18/26 | 143,561 |

EUR | 125,000(a)(c) | | Orange SA, 5.0% (5 Year EUR Swap Rate + 399 bps) | 156,606 |

| 31,000 | | Sprint Corp., 7.25%, 9/15/21 | 32,511 |

EUR | 100,000 | | Telekom Finanzmanagement GmbH, 3.5%, 7/4/23 | 120,221 |

| | 40,000 | | T-Mobile USA, Inc., 3.875%, 4/15/30 (144A) | 43,897 |

| | 20,000 | | T-Mobile USA, Inc., 4.5%, 4/15/50 (144A) | 23,408 |

| | | | Total Telecommunications | $ 650,994 |

| | | | Transportation — 0.2% | |

| | 70,000 | | Union Pacific Corp., 3.75%, 2/5/70 | $ 74,996 |

| | | | Total Transportation | $ 74,996 |

| | | | Water — 0.3% | |

EUR | 100,000 | | FCC Aqualia SA, 1.413%, 6/8/22 | $ 109,029 |

| | | | Total Water | $ 109,029 |

| | | | TOTAL CORPORATE BONDS | |

| | | | (Cost $17,536,628) | $ 16,496,170 |

| | | | FOREIGN GOVERNMENT BONDS — 22.7% | |

| | | | of Net Assets | |

| | | | Angola — 0.2% | |

| | 200,000 | | Angolan Government International Bond, 8.25%, | |

| | | | 5/9/28 (144A) | $ 87,008 |

| | | | Total Angola | $ 87,008 |

| | | | Argentina — 0.7% | |

| | 100,000 | | Argentine Republic Government International Bond, | |

| | | 6.875%, 1/26/27 | $ 25,001 |

| 300,000 | | Argentine Republic Government International Bond, | |

| | | 7.5%, 4/22/26 | 79,650 |

| 250,000 | | Ciudad Autonoma De Buenos Aires, 7.5%, 6/1/27 (144A) | 151,565 |

| | | Total Argentina | $ 256,216 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 25

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Austria — 0.3% | |

EUR | 50,000 | | Republic of Austria Government Bond, 4.15%, | |

| | | | 3/15/37 (144A) | $ 92,202 |

| | | | Total Austria | $ 92,202 |

| | | | Bahrain — 0.5% | |

| | 200,000 | | Bahrain Government International Bond, 7.0%, | |

| | | | 10/12/28 (144A) | $ 198,802 |

| | | | Total Bahrain | $ 198,802 |

| | | | Dominican Republic — 0.4% | |

DOP | 8,000,000 | | Dominican Republic International Bond, 8.9%, | |

| | | | 2/15/23 (144A) | $ 129,175 |

| | | | Total Dominican Republic | $ 129,175 |

| | | | Egypt — 1.0% | |

EGP | 1,754,000 | | Egypt Government Bond, 15.7%, 11/7/27 | $ 122,363 |

| | 269,000 | | Egypt Government International Bond, 7.6%, 3/1/29 (144A) | 254,988 |

| | | | Total Egypt | $ 377,351 |

| | | | Gabon — 0.4% | |

| | 200,000 | | Gabon Government International Bond, 6.625%, | |

| | | | 2/6/31 (144A) | $ 141,657 |

| | | | Total Gabon | $ 141,657 |

| | | | Ghana — 0.9% | |

| | 200,000 | | Ghana Government International Bond, 7.875%, | |

| | | | 2/11/35 (144A) | $ 150,300 |

GHS | 1,090,000 | | Republic of Ghana Government Bonds, 20.75%, 1/16/23 | 190,216 |

| | | | Total Ghana | $ 340,516 |

| | | | Indonesia — 0.6% | |

IDR

| 3,744,000,000 | | Indonesia Treasury Bond, 6.125%, 5/15/28 | $ 224,766 |

| | | | Total Indonesia | $ 224,766 |

| | | | Italy — 0.5% | |

EUR | 178,000 | | Italy Buoni Poliennali Del Tesoro, 1.35%, 4/1/30 | $ 187,525 |

| | | | Total Italy | $ 187,525 |

| | | | Ivory Coast — 0.3% | |

EUR | 110,000 | | Ivory Coast Government International Bond, 5.875%, | |

| | | | 10/17/31 (144A) | $ 97,738 |

| | | | Total Ivory Coast | $ 97,738 |

| | | | Japan — 5.1% | |

JPY

| 75,000,000 | | Japan Government Thirty Year Bond, 0.8%, 12/20/47 | $ 770,005 |

JPY

| 110,000,000 | | Japan Government Twenty Year Bond, 0.6%, 12/20/37 | 1,084,052 |

| | | | Total Japan | $ 1,854,057 |

| | | | Kenya — 0.5% | |

| | 200,000 | | Kenya Government International Bond, 7.25%, | |

| | | | 2/28/28 (144A) | $ 179,456 |

| | | | Total Kenya | $ 179,456 |

The accompanying notes are an integral part of these financial statements.

26 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | | Mexico — 2.2% | |

MXN

| 9,930,000

| | Mexican Bonos, 8.5%, 5/31/29 | $ 466,393 |

MXN | 3,696,540 | | Mexican Udibonos, 2.0%, 6/9/22 | 149,653 |

| | 200,000 | | Mexico Government International Bond, 5.0%, 4/27/51 | 191,500 |

| | | | Total Mexico | $ 807,546 |

| | | | Oman — 0.4% | |

| | 200,000 | | Oman Government International Bond, 5.625%, 1/17/28 | |

| | | | (144A) | $ 152,283 |

| | | | Total Oman | $ 152,283 |

| | | | Peru — 0.4% | |

| | 130,000 | | Peruvian Government International Bond, 2.783%, 1/23/31 | $ 134,030 |

| | | | Total Peru | $ 134,030 |

| | | | Portugal — 0.4% | |

EUR | 100,000 | | Portugal Obrigacoes do Tesouro OT, 4.95%, 10/25/23 (144A) | $ 128,072 |

| | | | Total Portugal | $ 128,072 |

| | | | Qatar — 0.6% | |

| | 200,000 | | Qatar Government International Bond, 3.75%, 4/16/30 (144A) $ | 218,352 |

| | | | Total Qatar | $ 218,352 |

| | | | Russia — 0.7% | |

RUB

| 17,256,000

| | Russian Federal Bond - OFZ, 8.15%, 2/3/27 | $ 264,025 |

| | | | Total Russia | $ 264,025 |

| | | | Senegal — 0.5% | |

| | 200,000 | | Senegal Government International Bond, 6.25%, | |

| | | | 5/23/33 (144A) | $ 175,140 |

| | | | Total Senegal | $ 175,140 |

| | | | Sri Lanka — 0.3% | |

| | 220,000 | | Sri Lanka Government International Bond, 7.55%, | |

| | | | 3/28/30 (144A) | $ 125,380 |

| | | | Total Sri Lanka | $ 125,380 |

| | | | Sweden — 0.7% | |

SEK | 2,300,000 | | Sweden Government Bond, 2.5%, 5/12/25 | $ 269,404 |

| | | | Total Sweden | $ 269,404 |

| | | | Turkey — 1.1% | |

| | 250,000 | | Turkey Government International Bond, 3.25%, 3/23/23 | $ 230,520 |

| | 200,000 | | Turkey Government International Bond, 5.6%, 11/14/24 | 190,500 |

| | | | Total Turkey | $ 421,020 |

| | | | Ukraine — 0.8% | |

EUR | 115,000 | | Ukraine Government International Bond, 4.375%, | |

| | | | 1/27/30 (144A) | $ 97,014 |

| | 200,000 | | Ukraine Government International Bond, 8.994%, | |

| | | | 2/1/24 (144A) | 194,746 |

| | | | Total Ukraine | $ 291,760 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 27

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | | United Kingdom — 2.6% | |

GBP | 450,000 | | United Kingdom Gilt, 3.5%, 1/22/45 | $ 945,944 |

| | | | Total United Kingdom | $ 945,944 |

| | | | Uruguay — 0.6% | |

UYU | 9,771,000 | | Uruguay Government International Bond, 9.875%, | |

| | | 6/20/22 (144A) | $ 216,801 |

| | | Total Uruguay | $ 216,801 |

| | | TOTAL FOREIGN GOVERNMENT BONDS | |

| | | (Cost $9,230,720) | $ 8,316,226 |

| Face | | | |

| Amount USD ($) | | | |

| | INSURANCE-LINKED SECURITIES — 0.1% | |

| | of Net Assets(h) | |

| | Reinsurance Sidecars — 0.1% | |

| | Multiperil – Worldwide — 0.1% | |

| 30,000+(i)(j) | | Lorenz Re 2018, 7/1/21 | $ 2,151 |

| 30,000+(k) | | Pangaea Re 2015-2, 5/29/20 | 45 |

| 30,000+(k) | | Pangaea Re 2016-1, 11/30/20 | 67 |

| 50,000+(j)(k) | | Pangaea Re 2017-1, 11/30/21 | 805 |

| 50,000+(j)(k) | | Pangaea Re 2018-1, 12/31/21 | 2,940 |

| 40,962+(j)(k) | | Pangaea Re 2019-1, 2/1/23 | 853 |

| 40,532+(j)(k) | | Pangaea Re 2020-1, 0.0%, 2/1/24 | 41,582 |

| | Total Reinsurance Sidecars | $ 48,443 |

| | TOTAL INSURANCE-LINKED SECURITIES | |

| | (Cost $68,740) | $ 48,443 |

| Principal | | | |

| Amount USD ($) | | | |

| | MUNICIPAL BOND — 0.1% of Net Assets(l) | |

| | Municipal General — 0.1% | |

| 30,000 | | Virginia Commonwealth Transportation Board, Transportation | |

| | | Capital Projects, 4.0%, 5/15/32 | $ 32,076 |

| | | Total Municipal General | $ 32,076 |

| | | TOTAL MUNICIPAL BOND | |

| | | (Cost $30,708) | $ 32,076 |

| | | SENIOR SECURED FLOATING RATE LOAN | |

| | | INTERESTS — 4.3% of Net Assets*(b) | |

| | | Automobile — 0.3% | |

| 74,298 | | American Axle & Manufacturing, Inc., Tranche B Term Loan, | |

| | | 3.0% (LIBOR + 225 bps), 4/6/24 | $ 64,670 |

| 66,658 | | CWGS Group LLC (aka Camping World, Inc.), Term Loan, | |

| | | 4.116% (LIBOR + 275 bps), 11/8/23 | 48,660 |

| | Total Automobile | $ 113,330 |

The accompanying notes are an integral part of these financial statements.

28 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | Broadcasting & Entertainment — 0.2% | |

| 97,975 | | Sinclair Television Group, Inc., Tranche B Term Loan, 0.41% | |

| | (LIBOR + 225 bps), 1/3/24 | $ 91,912 |

| | Total Broadcasting & Entertainment | $ 91,912 |

| | Chemicals, Plastics & Rubber — 0.1% | |

| 37,391 | | PQ Corp., Third Amendment Tranche B-1 Term Loan, 0.404% | |

| | (LIBOR + 225 bps), 2/7/27 | $ 35,868 |

| | Total Chemicals, Plastics & Rubber | $ 35,868 |

| | Computers & Electronics — 0.3% | |

| 25,628 | | Energy Acquisition LP, (aka Electrical Components | |

| | International), First Lien Initial Term Loan, | |

| | 0.404% (LIBOR + 425 bps), 6/26/25 | $ 18,580 |

| 122,500 | | Iron Mountain Information Management LLC, Incremental | |

| | Term B Loan, 0.404% (LIBOR + 175 bps), 1/2/26 | 115,456 |

| | Total Computers & Electronics | $ 134,036 |

| | Diversified & Conglomerate Service — 0.3% | |

| 49,020 | | DG Investment Intermediate Holdings 2, Inc. (aka Convergint | |

| | Technologies Holdings LLC), First Lien Initial | |

| | Term Loan, 0.75% (LIBOR + 300 bps), 2/3/25 | $ 42,831 |

| 73,688 | | West Corp., Incremental Term B-1 Loan, 1.45% (LIBOR + | |

| | 350 bps), 10/10/24 | 57,502 |

| | Total Diversified & Conglomerate Service | $ 100,333 |

| | Electric & Electrical — 0.0%† | |

| 7,838 | | Rackspace Hosting, Inc., First Lien Term B Loan, 1.763% | |

| | (LIBOR + 300 bps), 11/3/23 | $ 7,393 |

| | Total Electric & Electrical | $ 7,393 |

| | Electronics — 0.1% | |

| 49,000 | | Scientific Games International, Inc., Initial Term B-5 Loan, | |

| | 3.521% (LIBOR + 275 bps), 8/14/24 | $ 40,817 |

| | Total Electronics | $ 40,817 |

| | Environmental Services — 0.2% | |

| 78,556 | | GFL Environmental, Inc., Effective Date Incremental Term | |

| | Loan, 4.0% (LIBOR + 300 bps), 5/30/25 | $ 77,336 |

| | Total Environmental Services | $ 77,336 |

| | Financial Services — 0.0%† | |

| 8,287 | | RPI Intermediate Finance Trust, Term B-1 Term Facility, | |

| | 0.404% (LIBOR + 175 bps), 2/11/27 | $ 8,069 |

| | Total Financial Services | $ 8,069 |

| | Healthcare & Pharmaceuticals — 0.3% | |

| 97,250 | | Endo Luxembourg Finance Co. I S.a.r.l., Initial Term Loan, | |

| | 0.75% (LIBOR + 425 bps), 4/29/24 | $ 89,421 |

| | Total Healthcare & Pharmaceuticals | $ 89,421 |

| | Healthcare, Education & Childcare — 0.5% | |

| 48,982 | | ATI Holdings Acquisition, Inc., First Lien Initial Term | |

| | Loan, 1.072% (LIBOR + 350 bps), 5/10/23 | $ 41,513 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 29

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | Healthcare, Education & Childcare — (continued) | |

| 48,386 | | KUEHG Corp. (fka KC MergerSub, Inc.) (aka KinderCare), | |

| | Term B-3 Loan, 5.2% (LIBOR + 375 bps), 2/21/25 | $ 39,617 |

| 97,744 | | Life Time Fitness, Inc., 2017 Refinancing Term Loan, | |

| | 1.613% (LIBOR + 275 bps), 6/10/22 | 83,785 |

| | Total Healthcare, Education & Childcare | $ 164,915 |

| | Hotel, Gaming & Leisure — 0.1% | |

| 41,313 | | 1011778 B.C. Unlimited Liability Co. (New Red Finance, Inc.) | |

| | (aka Burger King/Tim Hortons), Term B-4 Loan, | |

| | 0.404% (LIBOR + 175 bps), 11/19/26 | $ 39,058 |

| | Total Hotel, Gaming & Leisure | $ 39,058 |

| | Insurance — 0.3% | |

| 45,424 | | Asurion LLC (fka Asurion Corp.), New B-7 Term Loan, | |

| | 0.404% (LIBOR + 300 bps), 11/3/24 | $ 43,636 |

| 33,504 | | Integro Parent, Inc., First Lien Initial Term Loan, 6.75% | |

| | (LIBOR + 575 bps), 10/31/22 | 32,667 |

| 48,995 | | USI, Inc. (fka Compass Investors, Inc.), 2017 New Term | |

| | Loan, 0.404% (LIBOR + 300 bps), 5/16/24 | 46,137 |

| | Total Insurance | $ 122,440 |

| | Leasing — 0.5% | |

| 52,524 | | Avolon TLB Borrower 1 (US) LLC, Term B-3 Loan, 0.75% | |

| | (LIBOR + 175 bps), 1/15/25 | $ 49,649 |

| 63,558 | | Avolon TLB Borrower 1 (US) LLC, Term B-4 Loan, 0.75% | |

| | (LIBOR + 150 bps), 2/12/27 | 59,283 |

| 73,500 | | IBC Capital I, Ltd. (aka Goodpack, Ltd.), First Lien Tranche | |

| | B-1 Term Loan, 0.889% (LIBOR + 375 bps), 9/11/23 | 64,496 |

| | Total Leasing | $ 173,428 |

| | Manufacturing — 0.2% | |

| 61,194 | | Aristocrat Leisure, Ltd., Term B-3 Loan, 2.859% (LIBOR + | |

| | 175 bps), 10/19/24 | $ 58,338 |

| | Total Manufacturing | $ 58,338 |

| | Media — 0.2% | |

| 31,376 | | CSC Holdings LLC (fka CSC Holdings, Inc. (Cablevision)), | |

| | October 2018 Incremental Term Loan, 0.814% (LIBOR | |

| | + 225 bps), 1/15/26 | $ 30,033 |

| 49,252 | | CSC Holdings LLC (fka CSC Holdings, Inc. (Cablevision)), | |

| | September 2019 Initial Term Loan, 0.814% (LIBOR + | |

| | 250 bps), 4/15/27 | 47,322 |

| | Total Media | $ 77,355 |

| | Metals & Mining — 0.2% | |

| 46,310 | | Atkore International, Inc., First Lien Initial Incremental | |

| | Term Loan, 1.27% (LIBOR + 275 bps), 12/22/23 | $ 44,617 |

| 29,560 | | Zekelman Industries, Inc. (fka JMC Steel Group, Inc.), 2020 | |

| | Term Loan, 0.57% (LIBOR + 225 bps), 1/24/27 | 28,082 |

| | Total Metals & Mining | $ 72,699 |

The accompanying notes are an integral part of these financial statements.

30 Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20

| | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | Professional & Business Services — 0.3% | |

| 98,250 | | Lamar Media Corp., Term B Loan, 0.982% (LIBOR + | |

| | 150 bps), 2/5/27 | $ 94,750 |

| | Total Professional & Business Services | $ 94,750 |

| | Securities & Trusts — 0.1% | |

| 50,587 | | Stonepeak Lonestar Holdings LLC, Initial Term Loan, 1.135% | |

| | (LIBOR + 450 bps), 10/19/26 | $ 43,842 |

| | Total Securities & Trusts | $ 43,842 |

| | Telecommunications — 0.1% | |

| 18,280 | | Go Daddy Operating Co. LLC (GD Finance Co., Inc.), Tranche | |

| | B-2 Term Loan, 2.154% (LIBOR + 175 bps), 2/15/24 | $ 17,763 |

| | Total Telecommunications | $ 17,763 |

| | TOTAL SENIOR SECURED FLOATING RATE LOAN INTERESTS | |

| | (Cost $1,722,455) | $ 1,563,103 |

| | U.S. GOVERNMENT AND AGENCY OBLIGATIONS — 20.7% | |

| | of Net Assets | |

| 16,973 | | Fannie Mae, 3.0%, 5/1/31 | $ 18,102 |

| 33,311 | | Fannie Mae, 3.0%, 2/1/43 | 35,832 |

| 22,494 | | Fannie Mae, 3.0%, 3/1/43 | 24,197 |

| 21,716 | | Fannie Mae, 3.0%, 5/1/43 | 23,426 |

| 24,278 | | Fannie Mae, 3.0%, 5/1/43 | 25,943 |

| 24,947 | | Fannie Mae, 3.0%, 6/1/45 | 26,904 |

| 18,534 | | Fannie Mae, 3.0%, 9/1/46 | 19,636 |

| 37,196 | | Fannie Mae, 3.0%, 10/1/46 | 39,397 |

| 52,390 | | Fannie Mae, 3.0%, 11/1/46 | 55,474 |

| 36,490 | | Fannie Mae, 3.0%, 1/1/47 | 39,634 |

| 30,196 | | Fannie Mae, 3.0%, 3/1/47 | 31,953 |

| 192,000 | | Fannie Mae, 3.0%, 5/1/49 (TBA) | 202,687 |

| 37,397 | | Fannie Mae, 3.5%, 6/1/42 | 40,706 |

| 97,585 | | Fannie Mae, 3.5%, 9/1/42 | 105,607 |

| 78,707 | | Fannie Mae, 3.5%, 5/1/44 | 85,043 |

| 24,595 | | Fannie Mae, 3.5%, 2/1/45 | 26,913 |

| 67,335 | | Fannie Mae, 3.5%, 2/1/45 | 74,032 |

| 15,844 | | Fannie Mae, 3.5%, 6/1/45 | 17,037 |

| 30,278 | | Fannie Mae, 3.5%, 8/1/45 | 32,540 |

| 16,254 | | Fannie Mae, 3.5%, 9/1/45 | 17,871 |

| 51,294 | | Fannie Mae, 3.5%, 9/1/45 | 55,628 |

| 72,364 | | Fannie Mae, 3.5%, 10/1/45 | 77,815 |

| 28,032 | | Fannie Mae, 3.5%, 1/1/47 | 30,135 |

| 35,576 | | Fannie Mae, 3.5%, 1/1/47 | 38,699 |

| 36,313 | | Fannie Mae, 3.5%, 1/1/47 | 38,705 |

| 140,000 | | Fannie Mae, 3.5%, 5/1/48 (TBA) | 147,931 |

| 28,479 | | Fannie Mae, 4.0%, 10/1/40 | 32,160 |

The accompanying notes are an integral part of these financial statements.

Pioneer Global Multisector Income Fund | Semiannual Report | 4/30/20 31

Schedule of Investments | 4/30/20 (unaudited) (continued)

| | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

| | U.S. GOVERNMENT AND AGENCY | |

| | OBLIGATIONS — (continued) | |

| 56,593 | | Fannie Mae, 4.0%, 1/1/42 | $ 61,922 |

| 11,343 | | Fannie Mae, 4.0%, 2/1/42 | 12,411 |

| 19,709 | | Fannie Mae, 4.0%, 5/1/42 | 21,562 |

| 31,851 | | Fannie Mae, 4.0%, 11/1/43 | 35,405 |

| 24,545 | | Fannie Mae, 4.0%, 6/1/46 | 26,479 |

| 18,737 | | Fannie Mae, 4.0%, 11/1/46 | 20,177 |

| 18,055 | | Fannie Mae, 4.0%, 4/1/47 | 19,590 |

| 29,047 | | Fannie Mae, 4.0%, 4/1/47 | 31,516 |

| 1,120,000 | | Fannie Mae, 4.0%, 5/1/49 (TBA) | 1,192,930 |

| 9,797 | | Fannie Mae, 4.5%, 4/1/41 | 10,885 |

| 7,377 | | Fannie Mae, 4.5%, 5/1/41 | 8,246 |

| 19,946 | | Fannie Mae, 4.5%, 11/1/43 | 22,149 |

| 24,212 | | Fannie Mae, 4.5%, 2/1/44 | 26,859 |

| 29,774 | | Fannie Mae, 4.5%, 2/1/44 | 33,063 |

| 100,000 | | Fannie Mae, 4.5%, 5/1/49 (TBA) | 107,813 |

| 22,804 | | Fannie Mae, 5.0%, 8/1/31 | 24,971 |

| 10,260 | | Fannie Mae, 5.0%, 6/1/40 | 11,714 |

| 6,780 | | Fannie Mae, 5.5%, 10/1/35 | 7,749 |

| 10,411 | | Federal Home Loan Mortgage Corp., 3.0%, 9/1/42 | 11,233 |

| 12,473 | | Federal Home Loan Mortgage Corp., 3.0%, 1/1/43 | 13,459 |

| 23,731 | | Federal Home Loan Mortgage Corp., 3.0%, 2/1/43 | 25,608 |

| 27,586 | | Federal Home Loan Mortgage Corp., 3.0%, 4/1/43 | 29,640 |

| 46,390 | | Federal Home Loan Mortgage Corp., 3.0%, 4/1/43 | 50,059 |

| 13,231 | | Federal Home Loan Mortgage Corp., 3.0%, 5/1/43 | 14,216 |

| 18,255 | | Federal Home Loan Mortgage Corp., 3.0%, 9/1/46 | 19,351 |

| 18,676 | | Federal Home Loan Mortgage Corp., 3.0%, 12/1/46 | 19,780 |

| 55,934 | | Federal Home Loan Mortgage Corp., 3.0%, 2/1/47 | 59,205 |

| 12,948 | | Federal Home Loan Mortgage Corp., 3.5%, 10/1/42 | 14,098 |

| 66,304 | | Federal Home Loan Mortgage Corp., 3.5%, 6/1/45 | 72,172 |

| 81,702 | | Federal Home Loan Mortgage Corp., 3.5%, 11/1/45 | 87,857 |

| 60,280 | | Federal Home Loan Mortgage Corp., 3.5%, 7/1/46 | 66,298 |

| 24,987 | | Federal Home Loan Mortgage Corp., 3.5%, 8/1/46 | 27,130 |

| 68,414 | | Federal Home Loan Mortgage Corp., 3.5%, 8/1/46 | 73,813 |