UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: December 31

Date of reporting period: June 30, 2010

Item 1: Report to Shareholders.

Semi-Annual Report

June 30, 2010

International Equity Fund

| Table of contents | |

| | |

| LETTER TO SHAREHOLDERS. | 1 |

| INTERNATIONAL EQUITY FUND | |

| Commentary | 2 |

| Performance summary | 3 |

| PORTFOLIO OF INVESTMENTS | 4 |

| STATEMENT OF ASSETS AND LIABILITIES | 7 |

| STATEMENT OF OPERATIONS | 8 |

| STATEMENT OF CHANGES IN NET ASSETS | 9 |

| STATEMENT OF CHANGES - CAPITAL STOCK ACTIVITY | 10 |

| FINANCIAL HIGHLIGHTS | 11 |

| NOTES TO FINANCIAL STATEMENTS | 13 |

| OTHER INFORMATION | 19 |

International investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial insolvency, lack of timely or reliable financial information, possible imposition of foreign withholding tax or unfavorable political or legal developments. The Fund may invest in securities issued by smaller companies and less seasoned issuers, which typically involves greater risk than investing in larger companies. Also, the Fund may invest in limited geographic areas and/or sectors which may result in greater losses and market volatility. In addition, the Fund is non-diversified meaning it may invest in a smaller number of issuers. As such, investing in the Fund may involve greater risk and volatility than investing in a more diversified fund.

The views in this report were those of the Fund manager as of June 30, 2010, and may not reflect the views of the manager on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Fund in understanding their investment in the Fund and do not constitute investment advice.

| | |

| Henderson Global Funds | Letter to shareholders |

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson International Equity Fund, which covers the six months ended June 30, 2010.

Despite a strong corporate results season and good economic data releases in the US and Far East, a global flight to quality gathered pace in the second quarter as markets became preoccupied with concerns over the health of the Eurozone economies. Greece’s economic woes made headlines around the world, and the €720 billion international rescue package for the Eurozone only partially stemmed fears of sovereign debt contagion.

The UK market faced additional troubles following the unexpected collapse of BP’s oil rig in the Gulf of Mexico, and US equities also fell steeply amidst growing fears that Europe’s debt crisis and a slowing Chinese economy could place the US recovery in jeopardy. However, leading indicators of US economic growth continue to point to solid underlying demand within the economy.

In Asia, Chinese authorities’ efforts to reduce growth to more sustainable levels and growing tensions between North and South Korea added to anxiety levels, which translated into increased market volatility. However, in Japan, economic data pointed to recovery as the economy expanded at an annualized rate of 4.9% in the first quarter.

Despite continued improvement in the labor markets, global economic growth looks likely to ease in the second half of 2010 as fiscal policy begins to tighten and some central banks normalize interest rates. The Bank of Canada became the first G7 central bank to begin normalizing rates as it hiked its target interest rate 0.25% to 0.5% in early June. Eurozone, UK and US interest rates could begin rising by the fourth quarter, although it is looking increasingly likely that rate hikes will be delayed by market volatility.

Looking forward, there are some positives we can glean from this sequence of events. Despite the overarching nervousness in global equity markets, economic and earnings data has largely continued to improve, the US economy is adding jobs, and companies are growing revenues and profits. Although investors have become nervous about sovereign risk, the underlying global economy remains in reasonable health and is seeing signs of improvement in demand. These positive developments could be derailed if the European fiscal crisis persists, but policymakers appear to be committed to avoiding such an outcome.

Overall, it is undeniable that the prevailing environment presents a high level of uncertainty for the weeks and months ahead. However, at Henderson we believe that uncertain market environments can create investment opportunities for those who know where to look. We will continue to utilize our bottom-up investment process to seek differentiated investment ideas that can bring value to our clients’ portfolios. We look forward to the opportunities that lie ahead and to serving your financial needs in the years to come, and we appreciate your trust and support in our Funds.

Sean Dranfield

President, Henderson Global Funds

1

| | |

| Henderson Global Funds | Commentary |

International Equity Fund

Fears over how the global economy would cope with the twin headwinds of government retrenchment in the West and tightening measures in the East (ex-Japan) led to increased investor nervousness during the first half of the year. Governments wound down stimulus packages (US), announced fiscal austerity measures (Europe), and implemented tightening policies to curb inflation (China), leading to heightened concerns over the sustainability and trajectory of economic growth for the remainder of 2010. Currencies were also very volatile as the yen and US dollar benefited from the weakness in the Euro.

By sector, Information Technology and Industrials performed the best as capital expenditure by cash rich corporates picked up, albeit from very depressed levels, while Financials suffered from concerns over government debt exposure and increased regulation, while the Energy sector was negatively impacted by the prospect of tighter drilling controls following BP’s Gulf of Mexico oil disaster. At the stock level, companies generally continued their trend of delivering positive results, driven by both bottom- and top-line growth: unlike 2009, companies surpassed analysts’ estimates on revenues as well as margins; a sign that demand has increased.

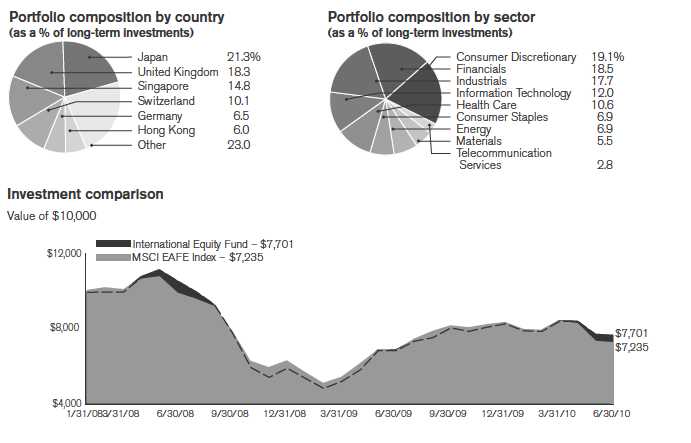

For the six months ended June 30, 2010 the International Equity Fund returned -7.60% versus the benchmark, the MSCI EAFE Index return of -12.93%. By sector, stock selection in Energy, Consumer Discretionary and Financials added the most to returns, offsetting some weakness in the Consumer Staples sector. By region, positive stock selection in Asia (ex-Japan), the UK and Continental Europe added the most to returns.

Within the Energy sector, the Fund participated in the initial public offering of Essar Energy, the UK-listed Indian energy/power company, which entered the FTSE 100 Index after a successful debut. A position in Cairn Energy was also positive as the company increased its earnings guidance. Not owning any of the large integrated oil companies was also positive due to BP’s woes. Within the Financials sector, not owning any European banks and a bias towards Asia were positives. Within Consumer Discretionary, a position in 361 Degrees, a Chinese sportswear manufacturer, added value as the company continued to report strong earnings and same-store sales growth. The position in Sands China also continued to be positive. A position in Hon Hai, however, had a negative impact as the company increased wages in China leading to concerns over margin cont raction.

The Fund continued to maintain a broadly defensive stance in Western economies, where it is underweight across Europe, although we have taken the opportunity to add some selective holdings during the recent weakness. We continue to favor Asia-Pacific and Emerging Markets and the Fund remains close to neutral in Japan.

We remain positive on the Corporate sector, buoyed by rising margins, solid balance sheets, and easy monetary policy. However, visibility in economic growth remains difficult due to fiscal retrenchment and continued deleveraging in the West, and with tightening policies in Asia beginning to take effect. We continue to favor Asia-Pacific and Emerging Markets, which should benefit from rising consumption, strong balance sheets and long-term secular growth, while remaining underweight in Europe due to growth concerns. However, in the latter region we are looking for attractive growth opportunities at the stock level given the region’s underperformance.

| International Equity Fund | |

| Top 10 long term holdings | |

| | as a percentage |

| Security | of net assets |

| Fresenius SE | 2.8% |

| Sands China, Ltd. | 2.5 |

| Roche Holding AG | 2.5 |

| Essar Energy, plc | 2.4 |

| 361 Degrees | | |

| International, Ltd. | 2.4 |

| UBS AG | 2.3 |

| Keyence Corp. | 2.2 |

| Tesco plc | 2.0 |

| Tiger Airways | | |

| Holdings, Ltd. | 1.9 |

| United Overseas Bank, Ltd. | 1.9 |

| | |

2

| | |

| Henderson Global Funds | Performance summary |

International Equity Fund

| | | | | | | | | | | |

| Total returns as of June 30, 2010 | | | | | | | | | | |

| | | | | | | | | | Since | |

| | NASDAQ | | Six | | | One | | | inception | |

| With Cap No Load | symbol | Class | months | | | year | | | (1/31/08)* | |

| International Equity Fund | HIEIX | Class I | | -7.60 | % | | | 11.22 | % | | | -10.26 | % |

| Index | | | | | | | | | | | | | |

| MSCI EAFE Index | | | | -12.93 | % | | | 6.38 | % | | | -12.55 | % |

* Average Annual Return

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.32%. However, the Fund’s adviser has agreed to voluntarily waive a portion of its fees and or reimburse expenses such that total operating expenses do not exceed 1.15% which is in effect until July 31, 2020. Had certain expenses not been waived or reimbursed during the period, total returns would have been lower. For most recent month end performance, please call 1.800.657.1493.

Returns include reinvestment of dividend and capital gains. Performance results reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index is a capitalization-weighted index that monitors the performance of stocks from Europe, Australasia and The Far East. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

| | |

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

International Equity Fund

June 30, 2010

| | | | | | |

| | | | | Value | |

| Shares | | | | (note 2) | |

| Common Stocks – 85.81% | | | |

| | | Austria – 1.71% | | | |

| | 17,661 | | Andritz AG | | $ | 988,246 | |

| | 11,872 | | Schoeller-Bleckmann Oilfield | | | | |

| | | | Equipment AG | | | 539,343 | |

| | | | | | | 1,527,589 | |

| | | | Belgium – 2.28% | | | | |

| | 29,341 | | Anheuser-Busch InBev N.V. | | | 1,409,365 | |

| | 15,544 | | EVS Broadcast | | | | |

| | | | Equipment, S.A. | | | 624,840 | |

| | | | | | | 2,034,205 | |

| | | | Brazil – 0.69% | | | | |

| | 60,005 | | Banco Santander Brasil S.A. | | | 616,007 | |

| | | | China – 3.99% | | | | |

| | 1,810,000 | | Bank of China, Ltd., Class H | | | 913,125 | |

| | 23,700 | | Ctrip.com International, | | | | |

| | | | Ltd., ADR * | | | 890,172 | |

| | 117,800 | | Ping An Insurance (Group) Co. | | | | |

| | | | of China, Ltd., Class H (a) | | | 949,609 | |

| | 830,000 | | Yingde Gases Group Co. * | | | 818,756 | |

| | | | | | | 3,571,662 | |

| | | | France – 1.32% | | | | |

| | 5,964 | | Compagnie Generale des | | | | |

| | | | Etablissements Michelin, | | | | |

| | | | Class B | | | 415,734 | |

| | 22,842 | | Eutelsat Communications | | | 763,120 | |

| | | | | | | 1,178,854 | |

| | | | Germany – 2.98% | | | | |

| | 13,331 | | Bauer AG | | | 452,625 | |

| | 14,678 | | Bilfinger Berger AG | | | 810,177 | |

| | 23,645 | | Gerresheimer AG * | | | 752,639 | |

| | 76,552 | | Wirecard AG | | | 651,148 | |

| | | | | | | 2,666,589 | |

| | | | Hong Kong – 5.28% | | | | |

| | 2,972,000 | | 361 Degrees International, Ltd. 2,110,820 | |

| | 186,000 | | China Overseas Land & | | | | |

| | | | Investment, Ltd. | | | 346,473 | |

| | 1,544,400 | | Sands China, Ltd. * | | | 2,267,028 | |

| | | | | | | 4,724,321 | |

| | | | India – 1.77% | | | | |

| | 60,550 | | Axis Bank, Ltd. GDR | | | 1,580,604 | |

| | | | Israel – 1.40% | | | | |

| | 24,059 | | Teva Pharmaceutical | | | | |

| | | | Industries, Ltd., ADR | | | 1,250,827 | |

| | | | | | |

| | | | | Value | |

| Shares | | | | (note 2) | |

| | | Italy – 2.72% | | | |

| | 89,975 | | Autogrill SpA * | | $ | 1,077,303 | |

| | 44,429 | | Saipem SpA | | | 1,350,234 | |

| | | | | | | 2,427,537 | |

| | | | Japan – 18.88% | | | | |

| | 29,300 | | Canon, Inc. | | | 1,092,394 | |

| | 22,000 | | Cocokara Fine Holdings, Inc. | | | 396,515 | |

| | 20,600 | | H.I.S. Co., Ltd. | | | 412,552 | |

| | 22,300 | | Hikari Tsushin, Inc. | | | 397,476 | |

| | 55,800 | | HOYA Corp. | | | 1,184,853 | |

| | 30,800 | | IT Holdings Corp. | | | 365,943 | |

| | 113,000 | | Itoham Foods, Inc. | | | 424,518 | |

| | 8,500 | | Keyence Corp. | | | 1,955,328 | |

| | 18,700 | | Kissei Pharmaceutical | | | | |

| | | | Co., Ltd. | | | 391,680 | |

| | 131,000 | | Kubota Corp. | | | 1,000,368 | |

| | 48,700 | | Makita Corp. | | | 1,299,150 | |

| | 30,900 | | Sanei-International Co., Ltd. | | | 356,961 | |

| | 57,400 | | Showa Shell Sekiyu K.K. | | | 396,301 | |

| | 8,200 | | SMC Corp. | | | 1,094,753 | |

| | 243,000 | | The Bank of Yokohama, Ltd. | | | 1,109,526 | |

| | 579 | | The Dai-ichi Life Insurance | | | | |

| | | | Co., Ltd. | | | 796,265 | |

| | 42,400 | | Tokio Marine Holdings, Inc. | | | 1,110,651 | |

| | 6,070 | | USS Co., Ltd. | | | 433,268 | |

| | 19,400 | | Xebio Co., Ltd. | | | 363,292 | |

| | 19,530 | | Yamada Denki Co., Ltd. | | | 1,274,928 | |

| | 77,900 | | Yamaha Motor Co., Ltd. * | | | 1,028,210 | |

| | | | | | | 16,884,932 | |

| | | | Luxembourg – 0.85% | | | | |

| | 9,369 | | Millicom International | | | | |

| | | | Cellular S.A. | | | 759,545 | |

| | | | Netherlands – 1.26% | | | | |

| | 28,557 | | Randstad Holding N.V. * | | | 1,124,035 | |

| | | | Singapore – 13.07% | | | | |

| | 461,500 | | Capitaland, Ltd. | | | 1,176,722 | |

| | 985,000 | | CapitaMalls Asia, Ltd. | | | 1,466,237 | |

| | 1,628,626 | | Genting Singapore plc * | | | 1,348,792 | |

| | 41,800 | | K-Green Trust * | | | 31,366 | |

| | 209,000 | | Keppel Corp., Ltd. | | | 1,259,331 | |

| | 515,000 | | Overseas Union | | | | |

| | | | Enterprise, Ltd. * | | | 987,404 | |

| | 534,000 | | SC Global Developments, Ltd. | | | 606,328 | |

| | 1,284,000 | | Tiger Airways Holdings, Ltd. * | | | 1,662,062 | |

| | 119,336 | | United Overseas Bank, Ltd. | | | 1,657,826 | |

| | 365,000 | | Wilmar International, Ltd. | | | 1,493,593 | |

| | | | | | | 11,689,661 | |

See Notes to Financial Statements.

4

| | |

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

International Equity Fund

June 30, 2010 (continued)

| | | | | | |

| | | | | Value | |

| Shares | | | | (note 2) | |

| | | Sweden – 0.47% | | | |

| | 38,371 | | Telefonaktiebolaget LM | | | |

| | | | Ericsson, ADR | | $ | 422,848 | |

| | | | Switzerland – 8.97% | | | | |

| | 83,470 | | ABB, Ltd. * | | | 1,450,461 | |

| | 28,797 | | Credit Suisse Group AG | | | 1,082,299 | |

| | 16,494 | | Roche Holding AG | | | 2,265,016 | |

| | 835 | | SGS S.A. | | | 1,124,223 | |

| | 158,421 | | UBS AG * | | | 2,099,959 | |

| | | | | | | 8,021,958 | |

| | | | Taiwan – 1.99% | | | | |

| | 45,574 | | Epistar Corp., GDR *(a) (b) | | | 589,402 | |

| | 338,350 | | HON HAI Precision | | | | |

| | | | Industry Co., Ltd. * | | | 1,188,326 | |

| | | | | | | 1,777,728 | |

| | | | United Kingdom – 16.18% | | | | |

| | 58,047 | | African Barrick Gold, Ltd. * | | | 546,167 | |

| | 40,292 | | Autonomy Corp., plc * | | | 1,087,409 | |

| | 159,462 | | Cairn Energy plc * | | | 975,621 | |

| | 362,749 | | Eros International plc * | | | 1,006,658 | |

| | 305,740 | | Essar Energy plc * | | | 2,170,744 | |

| | 102,021 | | ICAP plc | | | 611,536 | |

| | 36,468 | | Rio Tinto plc | | | 1,595,833 | |

| | 130,518 | | Serco Group plc | | | 1,136,937 | |

| | 63,260 | | Shire plc | | | 1,285,835 | |

| | 76,534 | | Spectris plc | | | 881,442 | |

| | 312,796 | | Tesco plc | | | 1,761,191 | |

| | 15,977 | | Vedanta Resources plc | | | 502,751 | |

| | 68,744 | | Xstrata plc | | | 900,640 | |

| | | | | | | 14,462,764 | |

| | | | Total Common Stock | | | 76,721,666 | |

| | | | (Cost $78,689,011) | | | | |

| | | | | | |

| | | | | Value | |

| Shares | | | | (note 2) | |

| Preferred Stock – 2.76% | | | |

| | | Germany – 2.76% | | | |

| | 37,352 | | Fresenius SE | | $ | 2,469,839 | |

| | | | Total Preferred Stock | | | 2,469,839 | |

| | | | (Cost $2,273,713) | | | | |

| | | | Total Long Term | | | | |

| | | | Investments | | | 79,191,505 | |

| | | | (Cost $80,962,724) | | | | |

| Short Term Investment – 2.18% | | | | |

| | 1,950,340 | | Fidelity Institutional | | | | |

| | | | Treasury Portfolio | | | 1,950,340 | |

| | | | Total Short Term | | | | |

| | | | Investment | | | 1,950,340 | |

| | | | (Cost $1,950,340) | | | | |

| Total Investments – 90.75% | | | 81,141,845 | |

| | | | (Cost $82,913,064) | | | | |

| Net Other Assets and | | | | |

| | | | Liabilities – 9.25% | | | 8,267,454 | |

| Total Net Assets – 100.00% | | | 89,409,299 | |

| * | Non income producing security | |

| (a) | Fair valued at June 30, 2010 as determined in good |

| | faith using procedures approved by the Board of |

| | Trustees. | |

| (b) | Restricted security, purchased under Rule 144A, |

| | section 4(2)g which is exempt registration under the |

| | securities Act of 1933 as amended. At June 30, 2010 |

| | this security had an aggregate value of $589,402, |

| | which represents 0.7% of net assets. |

| ADR | American Depositary Receipts | |

| GDR | Global Depositary Receipts | |

See Notes to Financial Statements.

5

| | |

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

International Equity Fund

June 30, 2010 (continued)

Other Information:

| | | |

| Industry concentration as | % of Net | |

| a percentage of net assets: | Assets | |

| Pharmaceuticals | | 5.81 | % |

| Casinos & Gaming | | 4.04 | |

| Industrial Machinery | | 3.78 | |

| Diversified Banks | | 3.56 | |

| Diversified Capital Markets | | 3.56 | |

| Oil & Gas Exploration & Production | | 3.52 | |

| Diversified Metals & Mining | | 3.35 | |

| Electronic Equipment & Instruments | | 3.18 | |

| Regional Banks | | 3.01 | |

| Health Care Equipment | | 2.76 | |

| Apparel, Accessories & Luxury Goods | | 2.76 | |

| Hotels, Resorts & Cruise Lines | | 2.55 | |

| Oil & Gas Equipment & Services | | 2.11 | |

| Industrial Conglomerates | | 2.10 | |

| Food Retail | | 1.97 | |

| Life & Health Insurance | | 1.95 | |

| Computer & Electronics Retail | | 1.87 | |

| Airlines | | 1.86 | |

| Agricultural Products | | 1.67 | |

| Integrated Telecommunication Services | | 1.64 | |

| Heavy Electrical Equipment | | 1.62 | |

| Brewers | | 1.58 | |

| Construction & Engineering | | 1.41 | |

| Electronic Manufacturing Services | | 1.33 | |

| Electronic Components | | 1.33 | |

| Diversified Real Estate Activities | | 1.32 | |

| Environmental & Facilities Services | | 1.27 | |

| Research & Consulting Services | | 1.26 | |

| Human Resource & Employment Services | | 1.26 | |

| Property & Casualty Insurance | | 1.24 | |

| Office Electronics | | 1.22 | |

| | | |

| Industry concentration as | % of Net | |

| a percentage of net assets: | Assets | |

| Application Software | | 1.22 | % |

| Restaurants | | 1.21 | |

| Communications Equipment | | 1.17 | |

| Motorcycle Manufacturers | | 1.15 | |

| Movies & Entertainment | | 1.13 | |

| Construction & Farm Machinery & | | | |

| Heavy Trucks | | 1.12 | |

| Real Estate Development | | 1.07 | |

| Industrial Gases | | 0.92 | |

| Cable & Satellite | | 0.85 | |

| Wireless Telecommunication Services | | 0.85 | |

| Life Sciences Tools & Services | | 0.84 | |

| Data Processing & Outsourced Services | | 0.73 | |

| Investment Banking & Brokerage | | 0.68 | |

| Gold | | 0.61 | |

| Automotive Retail | | 0.48 | |

| Packaged Foods & Meats | | 0.48 | |

| Tires & Rubber | | 0.47 | |

| Drug Retail | | 0.44 | |

| Oil & Gas Refining & Marketing | | 0.44 | |

| IT Consulting & Other Services | | 0.41 | |

| Specialty Stores | | 0.41 | |

| Long Term Investments | | 88.57 | |

| Short Term Investment | | 2.18 | |

| Total Investments | | 90.75 | |

| Net Other Assets and Liabilities | | 9.25 | |

| | | 100.00 | % |

See Notes to Financial Statements.

6

| | |

| Henderson Global Funds | Financial Statements (Unaudited) |

Statement of Assets and Liabilities

June 30, 2010

| | | |

| | International | |

| | Equity | |

| | Fund | |

| ASSETS: | | |

| Investments, at value | | |

| Securities | $ | 79,191,505 | |

| Short Term investments | | 1,950,340 | |

Total investments, at value | | 81,141,845 | |

| Foreign cash, at value | | 739,446 | |

| Dividends and interest receivable | | 115,685 | |

| Receivable for investment securities sold | | 1,920 | |

| Receivable for fund shares sold | | 8,004,780 | |

| Prepaid expenses and other assets | | 8,042 | |

Total Assets | | 90,011,718 | |

| LIABILITIES: | | | |

| Payable for investment securities purchased | | 485,743 | |

| Payable for fund shares redeemed | | 1,820 | |

| Payable to investment adviser | | 58,279 | |

| Accrued expenses and other payables | | 56,577 | |

Total Liabilities | | 602,419 | |

| NET ASSETS | $ | 89,409,299 | |

| NET ASSETS consist of: | | | |

| Paid-in capital | $ | 93,746,546 | |

| Accumulated undistributed net investment income | | 303,028 | |

| Accumulated net realized loss on investments and foreign currency transactions | | (2,862,582 | ) |

| Net unrealized appreciation/(depreciation) of investments and foreign currencies | | (1,777,693 | ) |

| | $ | 89,409,299 | |

| NET ASSETS: | | | |

| Class I Shares | $ | 89,409,299 | |

| SHARES OUTSTANDING: | | | |

| Class I Shares (unlimited number of shares authorized) | | 12,269,606 | |

| CLASS I SHARES: | | | |

| Net asset value and redemption price per share | $ | 7.29 | |

| Investments, at cost | $ | 82,913,064 | |

| Foreign cash, at cost | $ | 745,327 | |

See Notes to Financial Statements.

7

| | |

| Henderson Global Funds | Financial Statements (Unaudited) |

Statement of Operations

For the six months ended June 30, 2010

| | | |

| | International | |

| | Equity | |

| | Fund | |

| INVESTMENT INCOME: | | |

| Dividends | $ | 885,370 | |

| Foreign taxes withheld | | (82,729 | ) |

| Total Investment Income | | 802,641 | |

| EXPENSES: | | | |

| Investment advisory fees | | 321,785 | |

| Custodian fees | | 48,911 | |

| Accounting fees | | 24,681 | |

| Audit fees | | 22,007 | |

| Registration and filing fees | | 14,719 | |

| Administrative fees | | 10,379 | |

| Printing and postage fees | | 7,401 | |

| Legal fees | | 7,120 | |

| Transfer agent fees | | 3,936 | |

| Trustees’ fees and expenses | | 1,719 | |

| Compliance Officer fees | | 1,199 | |

| Miscellaneous fees | | 3,171 | |

| Total Expenses | | 467,028 | |

| Fees waived and expenses reimbursed by investment adviser | | (36,539 | ) |

| Net Expenses | | 430,489 | |

| NET INVESTMENT INCOME | | 372,152 | |

| NET REALIZED AND UNREALIZED LOSS: | | | |

| Net realized loss from : | | | |

| Investment transactions | | (553,236 | ) |

| Foreign currency transactions | | (21,013 | ) |

| Net change in unrealized appreciation/(depreciation) of: | | | |

| Investments | | (5,919,646 | ) |

| Translation of other assets and liabilities | | (4,537 | ) |

| Net Realized and Unrealized Loss | | (6,498,432 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (6,126,280 | ) |

See Notes to Financial Statements.

8

| | |

| Henderson Global Funds | Financial Statements (Unaudited) |

Statement of Changes in Net Assets

International Equity Fund

| | | | | |

| | Six Months Ended | | Year Ended | |

| | June 30,

2010 | | December 31, 2009 | |

| Net investment income | $ | 372,152 | | $ | 5,878 | |

| Net realized loss on investments and foreign currency transactions | | (574,249 | ) | | (777,368 | ) |

| Net change in unrealized appreciation/(depreciation) of investments | | | | | | |

| and foreign currency translations | | (5,924,183 | ) | | 4,890,388 | |

| Net increase/(decrease) in net assets resulting from operations | | (6,126,280 | ) | | 4,118,898 | |

| Distributions to shareholders from net investment income: | | | | | | |

| Class I Shares | | — | | | (54,276 | ) |

| | | — | | | (54,276 | ) |

| Net increase in Fund share transactions: | | | | | | |

| Class I Shares | | 26,034,148 | | | 63,658,147 | |

| | | 26,034,148 | | | 63,658,147 | |

| Net increase in net assets | | 19,907,868 | | | 67,722,769 | |

| NET ASSETS: | | | | | | |

| Beginning of period | | 69,501,431 | | | 1,778,662 | |

| End of period | $ | 89,409,299 | | $ | 69,501,431 | |

| Accumulated undistributed net investment income/(loss) | $ | 303,028 | | $ | (69,124 | ) |

See Notes to Financial Statements.

9

| | |

| Henderson Global Funds | Financial Statements

(Unaudited) |

Statement of Changes - Capital Stock Activity

International Equity Fund

| | | | | |

| | Six Months Ended | | Year Ended | |

| | June 30,

2010 | | December 31, 2009 | |

| Amount | | | | |

| Class I Shares: | | | | |

| Sold | $ | 27,391,361 | | $ | 64,595,673 | |

| Issued as reinvestment of dividends | | — | | | 24,296 | |

| Redeemed | | (1,357,213 | ) | | (961,822 | )* |

| Net increase | $ | 26,034,148 | | $ | 63,658,147 | |

| Shares | | | | | | |

| Class I Shares: | | | | | | |

| Sold | | 3,640,922 | | | 8,625,861 | |

| Issued as reinvestment of dividends | | — | | | 3,079 | |

| Redeemed | | (183,687 | ) | | (130,288 | ) |

| Net increase | | 3,457,235 | | | 8,498,652 | |

| | | | | | | |

| *Amounts shown are inclusive of redemption fees. | | | | | | |

See Notes to Financial Statements.

10

| | |

| Henderson Global Funds | Financial Highlights (Unaudited) |

For a Share Outstanding Throughout the Periods Indicated

| | | | | | | | | | | | | | | | | | | | | |

| | | | | Income (loss) from investment operations: | | | Less distributions | | | | |

| | | | | | | | Net | | | | | | Dividends | | | Distributions | | | | |

| | Net asset | | | | | | realized and | | | Total | | | from | | | from net | | | | |

| | value, | | | Net | | | unrealized | | | from | | | net | | | realized | | | | |

| | beginning | | | investment | | | gain (loss) on | | | investment | | | investment | | | capital | | | Total | |

| | of period | | | income (b) | | | investments | | | operations | | | income | | | gains | | | distributions | |

| International Equity Fund | | | | | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | | | | | |

| Period Ended 6/30/2010 | $ | 7.89 | | | | 0.04 | | | | (0.64 | ) | | | (0.60 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Year Ended 12/31/2009 | $ | 5.67 | | | | 0.00 | * | | | 2.23 | | | | 2.23 | | | | (0.01 | ) | | | 0.00 | | | | (0.01 | ) |

| Year Ended 12/31/2008 (a) | $ | 10.00 | | | | 0.11 | | | | (4.13 | ) | | | (4.02 | ) | | | (0.31 | ) | | | 0.00 | | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | The Fund commenced operations on January 31, 2008. |

| (b) | Per share data was calculated using average shares outstanding during the period. |

| (c) | Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods of less than one year are not annualized. |

| * | Amount represents less than $0.01. |

See Notes to Financial Statements.

11

| | |

| Henderson Global Funds | Financial Highlights (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Ratios to average net assets: | | | |

| | | | | | | | | | | | | | | | | | | Annualized ratio of | | | | |

| | | | | | | | | | | | | Annualized | | | Annualized | | | operating expenses | | | | |

| | | | | | | | | | | | | ratio of | | | ratio of | | | to average net | | | | |

| | | | Net asset | | | | | | Net assets, | | | operating | | | net investment | | | assets without | | | | |

| | | | value, | | | | | | end of | | | expenses to | | | income/(loss) | | | waivers and/or | | | Portfolio | |

| Redemption | | | end of | | | Total | | | period | | | average | | | to average | | | expenses | | | Turnover | |

| Fees | | | period | | | return(c) | | | (000) | | | net assets | | | net assets | | | reimbursed | | | rate | |

| | 0.00 | | | $ | 7.29 | | | | (7.60 | )% | | $ | 89,409 | | | | 1.15 | % | | | 0.98 | % | | | 1.23 | % | | | 17 | % |

| | 0.00 | * | | $ | 7.89 | | | | 39.26 | % | | $ | 69,501 | | | | 1.15 | % | | | 0.03 | % | | | 2.31 | % | | | 64 | % |

| | 0.00 | | | $ | 5.67 | | | | (40.15 | )% | | $ | 1,779 | | | | 1.15 | % | | | 1.36 | % | | | 6.40 | % | | | 114 | % |

See Notes to Financial Statements.

12

| | |

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

Note 1. Organization

Henderson Global Funds (the “Trust”) was organized on May 11, 2001 as a Delaware business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust has an unlimited number of authorized shares that are divided among nine series: Henderson European Focus Fund, Henderson Global Equity Income Fund, Henderson Global Opportunities Fund, Henderson Global Technology Fund, Henderson International Opportunities Fund, Henderson Japan-Asia Focus Fund, Henderson Money Market Fund and Henderson Worldwide Income Fund are included in separate shareholder reports and may have different fiscal year ends and the Henderson International Equity Fund (the “Fund”) is the only series included in this report. The Fund is non-diversified and offe rs Class I shares.

Note 2. Significant Accounting Policies

Security Valuation

Securities traded on a recognized exchange or market are generally valued at the last reported sale price or at the official closing price. Listed securities for which no sale was reported on that date and other securities traded in the over-the-counter market are valued at the mean between the last bid and asked prices.

Debt securities are valued at the last sales price or market value by independent pricing services approved by the Trustees of the Trust. If the pricing services are unable to provide valuations, the securities are valued at the mean between the last bid and asked prices or if no ask is available, then the last bid price obtained from one or more broker dealers. Such pricing services may use various pricing techniques, which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes.

Short-term investments purchased with an original or remaining maturity of 60 days or less are valued at amortized cost, which approximates market value.

If market quotations are not readily available, or if the investment adviser determines that a quotation of a security does not represent a fair value, then the security is valued at a fair value as determined in good faith using procedures approved by the Trustees of the Trust. The Board of Trustees of the Trust, or its designee, may establish fair value using a wide variety of market data including yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. The Trust has retained an inde pendent statistical fair value pricing service to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign exchange and the time at which Fund shares are priced. If a security is valued at a “fair value”, that value may be different from the last quoted market price for the security. As a result, it is possible that fair value prices will be used by the Fund.

The Fund adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 820 Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value generally accepted accounting principles (“GAAP”) and expands disclosure about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. ASC 820 established a three-tier hierarchy of inputs to establish classification of fair value measurements for disclosure purposes. These inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The inputs used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| · | Level 1 – quoted prices in active markets for identical investments |

| · | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

On January 21, 2010, the FASB issued an ASU, Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements which provides guidance on how investment assets and liabilities are to be valued and disclosed. Specifically, the amendment requires reporting entities to disclose i) the input and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements, for Level 2 or Level 3 positions ii) transfers between all levels (including Level 1 and Level 2) will be required to be disclosed on a gross basis (i.e. transfers out must be disclosed separately from transfers in) as well as the reason(s) for the transfer and iii) purchases,

13

| | |

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

sales, issuances and settlements must be shown on a gross basis in the Level 3 rollforward rather than as one net number. The effective date of the amendment is for interim and annual periods beginning after December 15, 2009 however, the requirement to provide the Level 3 activity for purchases, sales, issuances and settlements on a gross basis will be effective for interim and annual periods beginning after December 15, 2010. At this time the Fund has implemented parts (i) and (ii) and is evaluating the implications of part (iii) of ASU 820 and the impact to the financial statements.

The following is a summary of the inputs used as of June 30, 2010 in valuing the Fund’s investments carried at value:

| | Quoted Prices | | | | | | | | | |

| | | in Active | | Significant | | | | | | | |

| | Markets for | | Other | | | Significant | | | | |

| | Identical | | Observable | | | Unobservable | | | | |

| | | Assets | | Inputs | | | Inputs | | | | |

| Description | | (Level 1) | | (Level 2) | | | (Level 3) | | | Total | |

| Common Stocks | | | | | | | | | |

| Austria | | $ | — | | $ | 1,527,589 | | | $ | — | | | $ | 1,527,589 | |

| Belgium | | | — | | | 2,034,205 | | | | — | | | | 2,034,205 | |

| Brazil | | | 616,007 | | | — | | | | — | | | | 616,007 | |

| China | | | 890,172 | | | 1,731,881 | | | | 949,609 | | | | 3,571,662 | |

| France | | | — | | | 1,178,854 | | | | — | | | | 1,178,854 | |

| Germany | | | — | | | 2,666,589 | | | | — | | | | 2,666,589 | |

| Hong Kong | | | — | | | 4,724,321 | | | | — | | | | 4,724,321 | |

| India | | | — | | | 1,580,604 | | | | — | | | | 1,580,604 | |

| Israel | | | 1,250,827 | | | — | | | | — | | | | 1,250,827 | |

| Italy | | | — | | | 2,427,537 | | | | — | | | | 2,427,537 | |

| Japan | | | — | | | 16,884,932 | | | | — | | | | 16,884,932 | |

| Luxembourg | | | 759,545 | | | — | | | | — | | | | 759,545 | |

| Netherlands | | | — | | | 1,124,035 | | | | — | | | | 1,124,035 | |

| | | | | | | | | | | | |

| | | | | Significant | | | | | | | |

| | Markets for | | | Other | | | Significant | | | | |

| | Identical | | | Observable | | | Unobservable | | | | |

| | Assets | | | Inputs | | | Inputs | | | | |

| Description | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

| Common Stocks (continued) | | | | | | | |

| Singapore | $ | — | | | $ | 11,689,661 | | | $ | — | | | $ | 11,689,661 | |

| Sweden | | 422,848 | | | | — | | | | — | | | | 422,848 | |

| Switzerland | | — | | | | 8,021,958 | | | | — | | | | 8,021,958 | |

| Taiwan | | — | | | | 1,777,728 | | | | — | | | | 1,777,728 | |

| United | | | | | | | | | | | | | | | |

| Kingdom | | — | | | | 14,462,764 | | | | — | | | | 14,462,764 | |

| Total Common | | | | | | | | | | | | | |

| Stock | | 3,939,399 | | | | 71,832,658 | | | | 949,609 | | | | 76,721,666 | |

| Preferred Stock | | | | | | | | | | | | | |

| Germany | | — | | | | 2,469,839 | | | | — | | | | 2,469,839 | |

| Total Preferred | | | | | | | | | | | | | |

| Stock | | — | | | | 2,469,839 | | | | — | | | | 2,469,839 | |

| Short Term | | | | | | | | | | | | | | | |

| Investment | | 1,950,340 | | | | — | | | | — | | | | 1,950,340 | |

| Total | | | | | | | | | | | | | | | |

| Investments | $ | 5,889,739 | | | $ | 74,302,497 | | | $ | 949,609 | | | $ | 81,141,845 | |

As of the period ending June 30, 2010, securities with a total value of $61,482,828 transferred from Level 1 to Level 2 due to the application of fair value adjustments for securities principally traded in foreign markets. A security with a total value of $949,609 transferred from Level 1 to Level 3 as a result of the fair value pricing procedures utilized by the Fund. The Fund recognizes transfers between the levels as of the end of the period.

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | |

| | | | | | | | | | | Ending |

| | | | | | | | | | | Unrealized |

| | | | | | | | | | | Appreciation |

| | | | | | | | | | | (Depreciation) |

| | | | | | | | | | | from |

| | | | | Change in | | | Net | Net | Balance | Investments |

| | Balance as of | Accrued | | Unrealized | | | transfers | transfers | as of | held at |

| Investments in | January 1, | Discounts/ | Realized | Appreciation | Net | Net | in to | out of | June 30, | June 30, |

| Securities | 2010 | Premiums | Gain/(Loss) | (Depreciation) | Purchases | Sales | Level 3 | Level 3 | 2010 | 2010 |

| Common Stock | | | | | | | | | | |

| China | | | | | | | | | | |

| Ping An Insurance | | | | | | | | | | |

| (Group) Co. of China, | | | | | | | | | | |

| Ltd. Class H | $0 | $0 | $0 | $0 | $0 | $0 | $949,609 | $0 | $949,609 | ($53,876) |

| Total | $0 | $0 | $0 | $0 | $0 | $0 | $949,609 | $0 | $949,609 | ($53,876) |

14

| | |

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

Security Transactions and Investment Income

Investment transactions are accounted for on trade date. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Bond premium is amortized and discount is accreted over the expected life of each applicable security. Corporate actions involving foreign securities, including dividends, are recorded as soon as the information becomes available. Withholding taxes on foreign dividends are accrued in accordance with the applicable country’s tax rules and rates. Securities gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Foreign Currency Translation

Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments on the Statement of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

Indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnifications to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet been asserted.

Use of Estimates

The preparation of financial statements, in conformity with United States generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

Derivative Instruments

The Funds adopted FASB Accounting Standards Codification Topic ASC 815, Derivatives and Hedging (“ASC 815”). ASC 815 requires enhanced disclosures about (a) how an entity uses derivatives instruments (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect the Fund’s financial position and financial performance. This includes qualitative and quantitative disclosures on derivative positions existing at period end and the affect of using derivatives during the reporting period. The Fund did not invest in derivative instruments or engage in related hedging activities during the six months ended June 30, 2010.

Forward Foreign Currency Contracts

The Fund may enter into forward foreign currency contracts primarily to hedge against foreign currency exchange rate risks on their non-U.S. dollar denominated investment securities. When entering into forward foreign currency contracts, the Fund agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. Realized gains or losses on forwards include net gains or losses on contracts that have matured or which the Fund has terminated by entering into offsetting closing transactions. Forward foreign currency contracts are valued daily and the unrealized appreciation or depreciation is included in the Statements of Assets and Liabilities. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statements of Operations. These risks aris e from the possible inability of counterparties to meet the terms of their contracts and from unfavorable currency fluctuations. The Fund did not engage in any forward currency contracts during the six months ended June 30, 2010.

Securities Loans

The Fund may make secured loans of its portfolio securities amounting to not more than 33 1/3% of its total assets (taken at market value at the time of such loan), thereby realizing additional income. The risks in lending portfolio securities, as with other extensions of credit, consist of possible delay in recovery of the securities, or possible loss of rights in the collateral should the borrower fail financially. Securities loans are made to banks and broker-dealers, via State Street Bank and Trust Company as lending agent, pursuant to agreements requiring that loans be continuously secured by collateral at least equal at all times to the value of the securities on loan. Collateral is invested in a money market fund. The borrower pays to the Fund an amount equal to any dividends or interest received on securities lent. The Fund

15

| | |

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

receives a fee from the borrower or retains all or a portion of the interest received on investment of cash collateral. Income earned from securities lending is reflected as Net securities lending income on the Statement of Operations. The Fund may call such loans in order to sell the securities involved. During the six months ended June 30, 2010, the Fund had no transactions in securities lending.

Expenses

Expenses are recorded on an accrual basis. Expenses of the Trust that are directly attributable to a specific Fund are charged to that Fund. Other expenses are allocated proportionately among each Fund within the Trust based on average daily net assets or on another reasonable basis.

Federal Income Taxes

The Trust’s policy is that the Fund continue to comply with the requirements of Subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all its taxable income to shareholders. Therefore, no federal income tax provision is required. Management has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Management of the Fund is also not aware of any tax provisions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund intends to file tax returns with the U.S. Internal Revenue Service and various states. Generally, the tax authorities can examine all tax returns filed for the last three years.

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for eight years following the year of loss and offset such losses against any future realized capital gains. At December 31, 2009 the Fund had the following capital loss carryforwards:

| | Expiring on | | Expiring on | |

| | December 31, | | December 31, | |

| | 2016 | | 2017 | |

| International Equity Fund | $ | 335,950 | | $ | 1,519,304 | |

At December 31, 2009, the Fund had the following deferred post-October losses which will be recognized on the first day of the following year:

| | Capital loss |

| | deferred |

| International Equity Fund | $331,251 |

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from United States generally accepted accounting principles. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, they are reclassified within the capital accounts based on their federal tax-basis treatment.

The tax character of distributions paid during the year ended December 31, 2009 were as follows:

| Year ended | Ordinary |

| December 31, 2009 | income |

| International Equity Fund | $54,279 |

As of December 31, 2009, the components of distributable earnings on a tax basis were as follows:

| | Undistributed | |

| | ordinary | Unrealized |

| | income | appreciation |

| International Equity Fund | $130,639 | $3,847,185 |

Ordinary income and net realized gains/losses may differ for book and tax basis reporting purposes due to post-October losses, which are not recognized for tax purposes until the first day of the following fiscal year, tax deferral on wash sales and PFIC transactions.

16

| | |

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

Note 3. Investment Advisory Fees and Other Transactions with Affiliates

Pursuant to an Investment Advisory Agreement, Henderson Global Investors (North America) Inc. (“HGINA”) acts as the Fund’s investment adviser. HGINA is an indirect wholly owned subsidiary of Henderson Group plc. HGINA supervises the investments of the Fund and receives a management fee for such services, based on the Fund’s average daily net assets as set forth below.

| International Equity Fund | First $250 million | 0.85% |

| | Next $250 million | 0.80% |

| | Next $500 million | 0.75% |

| | Over $1 billion | 0.65% |

Pursuant to a separate contractual Expense Limitation Agreement, HGINA has agreed to waive or limit its advisory fee and, if necessary, to reimburse other operating expenses of the Fund in order to limit total annual expenses, less distribution and service fees, to 1.15% of average daily net assets. This agreement is effective through July 31, 2020.

Henderson Investment Management Limited (“HIML”) is the sub-adviser for the Fund pursuant to a Sub-Advisory Agreement. HIML is also an indirect wholly owned subsidiary of Henderson Group plc.

HIML receives a fee for its services, paid by HGINA from its management fee, based on the Fund’s average daily net assets as set forth below:

| International Equity Fund | First $250 million | 0.35% |

| | Next $250 million | 0.30% |

| | Next $500 million | 0.25% |

| | Over $1 billion | 0.25% |

At June 30, 2010, HGINA owned the following number of shares in the Fund:

| | % | Shares |

| International Equity Fund | 0.9 | 105,633 |

Note 4. Compensation of Trustees and Officers

Certain officers and trustees of the Trust are also officers of HGINA. None of the Trust’s officers, other than the compliance officers are compensated by the Trust. The Trust makes no direct payment to trustees affiliated with HGINA. Fees paid to Trustees are reflected as Trustees’ fees and expenses in the Statements of Operations.

The Fund bears a portion of the compensation paid to the compliance officers who perform services for the Trust. This compensation is reflected as Compliance Officer fees in the Statements of Operations.

Note 5. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments and U.S. government securities, for the Fund during the six months ended June 30, 2010, were as follows:

| | Purchases | Sales |

| International Equity Fund | $31,419,697 | $12,801,133 |

The U.S. federal income tax basis of the Fund’s investments excluding foreign currency and foreign currency contracts at June 30, 2010, and the gross unrealized appreciation and depreciation, were as follows:

| | International | |

| | Equity | |

| Cost | $ | 82,993,473 | |

| Gross unrealized appreciation | | 3,711,555 | |

| Gross unrealized depreciation | | (5,563,183 | ) |

| Net unrealized depreciation | | (1,851,628 | ) |

Identified cost may differ for book and tax basis reporting purposes primarily due to tax deferral of losses on wash sales, PFIC transactions and amortization of premiums reflected as of June 30, 2010.

Note 6. Significant Concentrations

The Fund invests a substantial percentage of its assets in securities of foreign issuers. These investments may involve certain considerations and risks not typically associated with investments in the United States as a result of, among other factors, the possibility of future political and economic developments and the level of governmental supervision and regulation of securities markets in the respective countries. Some countries in which the Fund invests may require government approval for repatriation of investment income, capital or the proceeds for sales of securities by foreign investors. In addition, if there is deterioration in a country’s balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. In addition, changes in currency exchange rates will affect the value of investments denominated in a foreign currency, as well as investment income derived from those securities.

17

| Henderson Global Funds | Notes to Financial Statements (Unaudited) |

The Fund may invest a high percentage of its net assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the economic, political and regulatory developments in a particular sector of the market, positive or negative, have a greater impact on a Fund’s net assets and will cause the value of its shares to fluctuate more than if the Fund did not concentrate its investments in a particular sector.

Note 7. Borrowing Arrangements

The Trust has a $100 million credit facility that was entered on June 25, 2010 to facilitate portfolio liquidity. Interest is charged to each participating fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 1.25%. In addition, a commitment fee of 0.125% per annum is accrued and apportioned among the participating funds. The commitment fee is included in Miscellaneous fees on the Statement of Operations. No amounts were borrowed under this facility during the six months ended June 30, 2010.

Note 8. Redemption Fee

During the period, the Fund imposed a redemption fee of 2.00% on certain shares redeemed within 30 days of purchase. The fee, which is not a sales charge, is retained by the Fund and not paid to HGINA or its affiliates. Redemption fees are included in Amount Redeemed on the Statements of Changes – Capital Stock Activity. There were no redemption fees charged during the six months ended June 30, 2010. The redemption fee was eliminated effective July 1, 2010.

Note 9. Subsequent Events

In accordance with the provisions set forth in FASB Accounting Standards Codification Topic 855, Subsequent Events (“ASC 855”), management has evaluated the possibility of subsequent events existing in the Fund’s financial statements. Management has determined that there are no material events that would require adjustment to our disclosure in the Fund’s financial statements through this date, which is the date the financial statements were issued.

18

| | |

| Henderson Global Funds | Other Information (Unaudited) |

Proxy Voting Policies

The Funds have filed with the Securities and Exchange Commission their proxy voting records for the twelve months ended June 30, 2010 on Form N-PX, which must be filed each year by August 31. Form N-PX is available on the Securities and Exchange Commission’s website at www.sec.gov. The Funds’ proxy voting records and proxy voting policies and procedures are also available without charge, upon request, by calling 866.443.6337 or by visiting the Funds’ website at www.henderson.com.

Quarterly Portfolio of Investments

A Portfolio of Investments is filed as of the end of the first and third quarter of each fiscal year on Form N-Q. The Fund has filed with the Securities and Exchange Commission the Form N-Q and it is available on the Securities and Exchange Commission’s website at www.sec.gov. Additionally, the Portfolio of Investments may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1.800.SEC.0330. The quarterly Portfolio of Investments are also available without charge, upon request, by calling 866.443.6337 or by visiting the Funds’ website at www.henderson.com.

Approval of Continuation of Investment Advisory Agreement

The Board of Trustees of Henderson Global Funds oversees the management of the Fund and, as required by law, the investment advisory and the sub-advisory agreement for the Fund.

In connection with their consideration of those agreements for the Fund, the Trustees received and reviewed a substantial amount of information provided by Henderson Global Investors (North America) Inc. (the “Adviser”) and Henderson Investment Management Limited (the “Sub-adviser”) in response to detailed requests of the Independent Trustees and their independent legal counsel. The Trustees also discussed with representatives of management the operations of the Fund and the nature and quality of the advisory and other services provided to the Fund by the Adviser and the Sub-adviser. The Independent Trustees also received and reviewed a memorandum from their counsel regarding their responsibilities in considering continuation of the agreements. Throughout their consideration of the agreements the Independent Trustees were ad vised by their independent legal counsel. The Independent Trustees met with management to consider the agreements, and at that meeting they also met separately in executive session with their counsel.

At a meeting held on June 15, 2010, based on their evaluation of the information provided by the Adviser and the Sub-adviser and other information, the Trustees determined that the overall arrangements between the Fund and the Adviser and the Sub-adviser were fair and reasonable in light of the nature and quality of the services provided by the Adviser and the Subadviser, the fees charged for those services, and other matters that the Trustees considered relevant in the exercise of their business judgment. At that meeting the Trustees, including all of the Independent Trustees, unanimously approved the continuation of the investment advisory agreement and the sub-advisory agreement through August 30, 2011, subject to earlier termination as provided in each agreement.

In considering the agreements, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors described below, none of which by itself was considered paramount or dispositive and each Trustee may have weighed the information differently. However, the material factors and conclusions that formed the basis for the Trustees’ determination to approve the agreements are discussed separately below.

Nature, Extent and Quality of Services

The Trustees reviewed and considered the nature, extent and quality of the services provided to the Fund by the Adviser and the Subadviser, taking into account the investment objective and strategy of the Fund and the knowledge they had gained from their regular meetings with management on at least a quarterly basis. In addition, the Trustees reviewed the resources and key personnel of the Adviser and the Subadviser, especially the personnel who provide investment management services to the Fund. The Trustees also considered other services provided to the Fund by the Adviser and the Subadviser, such as managing the execution of portfolio transactions and the selection of broker-dealers for those transactions, monitoring adherence to the Fund’s investment restrictions, producing shareholder reports, providing support services for the Trustees and Trustee committees and overseeing the activities of other service providers, including monitoring compliance with various policies and procedures of the Fund and with applicable securities laws and regulations.

The Trustees concluded that the nature and extent of the services provided to the Fund by the Adviser and the Subadviser were appropriate and consistent with the terms of the advisory agreement, that the quality of those services had been consistent with or superior to quality norms in the industry and that the Fund was likely to benefit from the continued provision of those services. They also concluded that the Adviser and the Subadviser had sufficient personnel,

19

| Henderson Global Funds | Other Information (Unaudited) |

with the appropriate education and experience to serve the Fund effectively and had demonstrated their continuing ability to attract and retain well-qualified personnel.

Performance of the Fund

The Trustees considered the Fund’s investment performance over various time periods. They reviewed information comparing the Fund’s performance with the performance of the Fund’s benchmark and with the performance of comparable funds and peer groups identified by Lipper Inc. (“Lipper”), an independent provider of investment company data. They concluded that the performance of the Fund met or exceeded acceptable levels and that the Fund and its shareholders were benefiting from the current management of the Fund.

Costs of Services Provided and Profits Realized by the Adviser

The Trustees examined information on the fees and other expenses paid by the Fund in comparison to information for other comparable funds as provided by Lipper. They discussed the contractual rate of management fees for the Fund before fee waivers, and the Fund’s total expense ratio, as compared to the mean management fee rate and expense ratio of the peer group of funds selected by Lipper.

The Trustees considered the methodology used by the Adviser and the Subadviser in determining compensation payable to portfolio managers, the very competitive environment for investment management talent and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed the management fees of the Adviser and the Subadviser for certain separate accounts. Although in some instances the fee rates were lower than management fees for the Fund the Trustees noted that the Adviser and the Subadviser perform significant additional services for the Fund that they do not provide to those other clients, including administrative services, oversight of the Fund’s other service providers, trustee support, regulatory compliance and numerous other services and that, in serving the Fund, the Adviser assumes many legal risks and responsibilities that it does not assume in serving its other clients.

The Trustees reviewed information on the profitability of (or loss) to the Adviser and its affiliates of their relationships with the Fund, as well as an explanation of the methodology the Adviser utilizes in allocating various expenses among the Fund and other clients. The Trustees also reviewed the financial statements of the Adviser and financial information related to its parent company and its corporate structure. In their review, the Trustees considered whether the Adviser and the Subadviser receive adequate incentives to manage the Fund effectively. The Trustees recognized that profitability comparisons among fund managers are difficult because very little comparative information is publicly available and profitability of any manager is affected by numerous factors, including the organizational structure of the particular manager, the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses and the manager’s capital structure and cost of capital. However, based on the information available and taking those factors into account, the Trustees concluded that the Adviser’s profitability with respect to the Fund in relation to the services rendered was not unreasonable. Finally, the Trustees considered the financial condition of the Adviser and the Subadviser, which they found to be sound.

The Trustees concluded that the management fees and other compensation payable by the Fund to the Adviser, as well as the fees paid by the Adviser to the Subadviser, were reasonable in relation to the nature and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies and the fees the Adviser and the Subadviser charge to other clients. The Trustees also concluded that the overall expense ratio of the Fund was reasonable, taking into account the size of the Fund, the quality of services provided by the Adviser and the Sub-adviser, the investment performance of the Fund and the expense limitations agreed to by the Adviser.

Economies of Scale

The Trustees received and considered information about the potential of the Adviser to experience economies of scale as the assets of the Fund increase. They noted that by virtue of the expense limitations, the Adviser is subsidizing the Fund because it has not reached adequate scale. The Trustees also noted that the advisory agreement included breakpoints in the fee schedule for the Fund, thereby sharing more economies of scale with the Fund if the assets of the Fund increase significantly. Based on all of the information they reviewed, the Trustees concluded that the current fee structure of the Fund was reasonable and that those rates of fees do reflect a sharing between the Adviser and the Fund of economies of scale at the current asset level of the Fund.

Other Benefits to the Adviser

The Trustees also considered benefits that accrue to the Adviser and the Subadviser from their relationship with the Fund and their use of commissions paid on portfolio brokerage transactions of the Fund to obtain research products and services benefiting the Fund and/or other

20

| | |

| Henderson Global Funds | Other Information (Unaudited) |

clients. The Trustees concluded that the use by the Adviser and the Subadviser of commissions paid by the Fund to obtain research products and services was consistent with regulatory requirements and was likely to benefit the Fund.

After full consideration of the above factors as well as other factors that were instructive in analyzing the management arrangements, the Trustees, including all of the Independent Trustees, concluded that the continuation of the investment advisory and sub-advisory agreement for the Fund was in the best interest of the Fund and its shareholders.

Federal Tax Information

Certain tax information for the Funds is required to be provided to shareholders based on the Fund’s income and distributions for the taxable year ending December 31, 2010. In February 2011, shareholders will receive Form 1099-DIV which will include their share of foreign tax credit, qualified dividends and capital gains distributed during the calendar year 2010. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

Shareholder Expense

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees and (2) ongoing costs, including management fees, distribution (12b-1) fees, shareholder services fees and other Fund expenses. The example in Table 1 and Table 2 is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period ended June 30, 2010.

Actual Expenses

Table 1 provides information about actual account values and actual expenses. You may use the information in this line, together with the amount invested, to estimate the expenses that you incurred over the period. Simply divide your account value at the end of the period by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

Table 2 provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus you should not use the hypothetical account values and expenses to estimate your actual ending account balance or the expense attributable to your investment during the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses paid during the period include amounts reflected in the Fund Statement of Operations net of reimbursements by the investment advisor. The annualized expense ratios used in the example are as follows:

| | Class I |

| International Equity | 1.15% |

Please note that the expenses do not reflect shareowner transaction costs such as front end sales charges and redemption fees. These fees are described for each Fund and share class in the Performance summary of this report on page 3. Table 2 is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

21

| Henderson Global Funds | Other Information (Unaudited) |

| Table 1 | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses |

| | Value | Value | Paid |

| | January 1, | June 30, | During |

| Actual | 2010 | 2010 | the Period* |

| International | | | |

| Equity | | | |

| Class I | $1,000.00 | $924.00 | $5.49 |

| Table 2 | | | |

| Hypothetical | Beginning | Ending | |

| (assuming a | Account | Account | Expenses |

| 5% return | Value | Value | Paid |

| before | January 1, | June 30, | During |

| expenses) | 2010 | 2010 | the Period* |

| International | | | |

| Equity | | | |

| Class I | $1,000.00 | $1,019.30 | $5.76 |

| * | Expenses are equal to the Funds Class I shares annualized net expense ratio multiplied by the average account value over the period multiplied by 181 days in the period, and divided by 365 (to reflect the one-half year period). |

22

Henderson Global Funds

| | |

Trustees C. Gary Gerst, Chairman Roland C. Baker Faris F. Chesley Sean Dranfield | Investment Adviser Henderson Global Investors (North America) Inc. 737 North Michigan Avenue, Suite 1700 Chicago, IL 60611 Transfer Agent |

Officers Sean Dranfield, President Alanna P. Nensel, Vice President Scott E. Volk, Vice President Christopher K. Yarbrough, Secretary Kenneth A. Kalina, Chief Compliance Officer Troy M. Statczar, Treasurer Richard J. Mitchell, Assistant Treasurer | State Street Bank & Trust Company State Street Financial Center One Lincoln Street Boston, MA 02111 For More Information Please call 1.800.657.1493 or visit our website: www.henderson.com |

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change hereafter. This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Henderson Global Investors is the name under which various subsidiaries of Henderson Group plc, a UK limited company, provide investment products and services.

Foreside Fund Services, LLC, Distributor (August, 2010)

23

Privacy Notice

Henderson Global Funds

This notice describes the privacy practices followed by Henderson Global Funds.

Your privacy is our top priority. Our policy is to respect the privacy of current and former shareholders and to protect personal information entrusted to us. We do not share any nonpublic personal information of shareholders or former shareholders with any nonaffiliated third parties, except as permitted by law or as authorized by our shareholders.

In the course of providing products and services to you, we collect nonpublic personal information about you from various sources such as account applications or agreements, other account forms, transactions in your account, and from information captured on our website, including any information captured through our use of “cookies.” Such information may include your name, address, account or tax identification number, the types and amounts of investments, and bank account information. More detailed information about our Internet policy is available on our website, www.henderson.com.