UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: January 31, 2012

Item 1: Report to Shareholders.

Semi-Annual Report

January 31, 2012

Emerging Markets Opportunities Fund

European Focus Fund

Global Equity Income Fund

Global Leaders Fund

Global Technology Fund

International Opportunities Fund

Japan Focus Fund

Table of contents

| Letter to shareholders | 1 |

| Emerging Markets Opportunities Fund | |

| Commentary | 2 |

| Performance summary | 3 |

| European Focus Fund | |

| Commentary | 4 |

| Performance summary | 5 |

| Global Equity Income Fund | |

| Commentary | 6 |

| Performance summary | 7 |

| Global Leaders Fund | |

| Commentary | 8 |

| Performance summary | 9 |

| Global Technology Fund | |

| Commentary | 10 |

| Performance summary | 11 |

| International Opportunities Fund | |

| Commentary | 12 |

| Performance summary | 13 |

| Japan Focus Fund | |

| Commentary | 14 |

| Performance summary | 15 |

| Portfolios of investments | 16 |

| Statements of assets and liabilities | 34 |

| Statements of operations | 36 |

| Statements of changes in net assets | 38 |

| Statements of changes - capital stock activity | 45 |

| Financial highlights | 52 |

| Notes to financial statements | 62 |

| Other information | 76 |

International investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies, which typically involves greater risk than investing in larger companies. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition some of the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses.

Technology companies may react similarly to certain market pressure and events. This may be significantly affected by short product cycles, aggressive pricing of products and services, competition from new market entrants, and obsolescence of existing technology. As a result, the Global Technology Fund’s returns may be considerably more volatile than a fund that does not invest in technology companies.

The views in this report were those of the Funds’ portfolio Managers as of January 31, 2012, and may not reflect the views of the portfolio managers on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice.

This page intentionally left blank.

| Henderson Global Funds | Letter to shareholders |

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson Emerging Markets Opportunities, European Focus, Global Equity Income, Global Leaders, Global Technology, International Opportunities and Japan Focus Funds, which covers the six months ended January 31, 2012.

Markets were particularly volatile in 2011 as evidenced by an ongoing European debt crisis, uprisings in the Middle East, the devastating Japanese tsunami and the US losing its AAA credit rating. However, there were a few emerging bright spots toward the end of the year. Government easing in China restored some confidence in Asian equity markets, while stronger US figures on trade, manufacturing activity and consumer spending aided investor sentiment. In Europe, the eighth euro crisis summit of the year was held in December and resulted in the passing of new austerity measures and proposals for greater fiscal coordination in the region. Additionally, the European Central Bank (“ECB”) cut interest rates by 0.25% to 1.00% and announced unlimited three year funding for European banks, which it supplied with €489 billion of 3-year loans at an interest rate of just 1.00%.

Overall, in 2011 political risk seemed to dominate market sentiment and fundamentals played second fiddle. Risk aversion meant that most equity markets were either static or retreated during the year, despite rising earnings and strengthening corporate balance sheets on average.

Looking ahead, while 2012 is likely to bring further bouts of market volatility and may well include a recession in Europe, there are some grounds for optimism. January saw global equities moving higher throughout the month, driven by easing concerns over the Eurozone crisis as liquidity efforts by the ECB helped the peripheral European countries. Looser-than-expected global monetary policy, particularly in emerging economies, also boosted sentiment. Political uncertainty aside, corporate bond markets remain in good health and we find it difficult to foresee a sharp rise in default rates given the general health of company balance sheets.

The US economy and stock market has shown resilience relative to other developed markets, with signs of improvement in the labor market and retail sales defying the pessimists. However, a failure by Congress to reach agreement on a budget during an election year combined with rising energy prices could act as a drag on the economy, which would mean monetary policy would have to do the hard work.

Globally, we believe dividend payments are set to be higher in 2012, interest rates should remain very low in the developed world and we believe valuations should remain reasonable – and in fact equity markets (as measured by the MSCI World Index) were generally cheaper at the beginning of 2012 than 2011 on most valuation measures. However, political and central bank responses to the ongoing difficulties facing the global economy are expected to continue to dictate the direction of markets in the short term.

We realize that the prevailing environment presents a high level of uncertainty about market direction in the shorter term. However, at Henderson we believe that uncertain market environments can create investment opportunities for those who know where to look. We remain focused on seeking global investment opportunities with favorable, perhaps overlooked, valuations which allow us to build differentiated portfolios for our shareholders.

Thank you for investing in the Henderson Global Funds. It’s our goal to continue to serve your financial needs successfully in the years to come, and we appreciate your trust in and support of our Funds.

James G. O’Brien

President, Henderson Global Funds

| Henderson Global Funds | Commentary |

Emerging Markets Opportunities Fund

The second half of 2011 was dominated by events surrounding the Eurozone sovereign debt crisis. Markets finished the year on a relatively more positive tone as fears about the European financial crisis subsided somewhat. Then January saw an abrupt reversal in risk appetite. With the market reassured by European banks’ healthy uptake of the European Central Bank’s first Long Term Refinancing Operation auction in December, equities rallied, peripheral sovereign debt yields fell sharply and the euro climbed against the US dollar. After a very tough 2011, it has been pleasing to see significant outperformance over the past three months and a very good start to 2012.

Emerging Markets Opportunities Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| Tata Motors, Ltd., ADR | | | 3.5 | % | |

| Industrial & Commercial Bank of China, Ltd., Class H | | | 3.2 | | |

| CITIC Securities Co., Ltd., Class H | | | 3.0 | | |

| Citic Pacific, Ltd. | | | 2.8 | | |

| Robinson Department Store pcl | | | 2.8 | | |

| Cape Lambert Resources, Ltd. | | | 2.7 | | |

| Hyundai Motor Co. | | | 2.7 | | |

| Jubilant Foodworks, Ltd. | | | 2.7 | | |

| Baidu, Inc., ADR | | | 2.7 | | |

| Zhuzhou CSR Times Electric Co., Ltd., Class H | | | 2.7 | | |

For the six month period ended January 31, 2012, the Fund returned -13.87% (Class A at NAV) versus the benchmark MSCI Emerging Markets Index which posted a return of -9.47%. The Fund’s Asian sub-portfolio underperformed and acted as a drag on relative performance led by disappointing returns in both Asian Financials and Technology shares. In Latin America, the defensive bias of the sub-portfolio added value in the beginning of the period though finished the period roughly flat as equity markets rallied towards the end of the year. For most of the reporting period, investors avoided anything deemed to be a “risky asset” and a number of the Fund’s higher beta names were punished, in particular the procyclical names of the Europe, Middle East and Africa (EMEA) sub-portfolio. Satisfyingly these are the names that have powered upward performance towards the end of the period and helped to narrow the relative loss against the benchmark.

Throughout the period, the Fund maintained its allocation of an overweight to EMEA, underweight to Latin America and even-weight to Asia. In Asia, the Fund continues to have a strong bias to shares focused on the domestic consumer with companies such as: Malaysian airline AirAsia, South Korean smartphone game producer Gamevil, and ICICI Bank in India. In Latin America, the Fund increased its weighting in Mexico to an overweight and renewed focus on the Brazilian consumer. New holdings included Mexican pawn shop First Cash Financial Services, Panamanian airline Copa Holdings and Brazilian shopping mall operator BR Malls. In the EMEA sub-portfolio, no changes were made to the overall theme and the Fund remains overweight commodity related equities such as: International Petroleum in Kazakhstan and South African coal producer Ncondezi Coal.

Conditions witnessed during the final months of 2011 continued into 2012 and the outlook for the Fund appears to have improved. We believe valuations for stocks sensitive to global economic growth have become increasingly attractive, and the recent stabilization in global growth expectations, combined with an improvement in investor risk appetite, could lay the foundations for a period of sustained stronger performance.

Although financial risks have lessened somewhat as a result of central bank interventions they have not disappeared. Nevertheless, we believe many of the more defensive areas of global markets are already quite fully valued, and the more attractive risk/return opportunities are elsewhere in more ‘unloved’ areas of the market. As a result, the portfolio is exposed in these areas, particularly in Asia and EMEA.

| Henderson Global Funds | Performance summary |

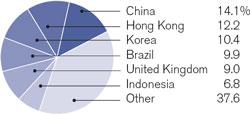

Emerging Markets Opportunities Fund

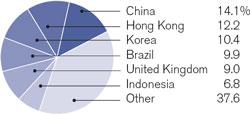

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Since inception (12/31/10) | |

| Class A | | | HEMAX | | | -13.87 | % | | -14.66 | % | | -14.92 | % |

| Class C | | | HEMCX | | | -14.27 | | | -15.40 | | | -15.60 | |

| Class I | | | HEMIX | | | -13.76 | | | -14.55 | | | -14.74 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -18.79 | % | | -19.57 | % | | -19.43 | % |

| Class C | | | | | | -15.27 | | | -15.40 | | | -15.60 | |

| Index | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -9.47 | % | | -6.35 | % | | -8.88 | % |

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 3.98%, 4.73% and 3.73%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.79%, 2.54% and 1.54% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

European Focus Fund

The reporting period proved to be volatile for risk assets which were dominated by worries about slowing global economic growth, particularly in China, and the sustainability of sovereign debt in the Eurozone. A raft of measures to deal with the crisis were announced in October by European politicians, including discounts to Greek bonds, recapitalization of the banks and a plan to leverage the European Financial Stability Facility. Contagion worries continued, however, and the ensuing political change saw new technocratic leaders emerge in Greece and Italy. December saw further steps towards fiscal integration in the Eurozone and US economic data showed improvements towards the back end of the fourth quarter. January saw an abrupt reversal in risk appetite. With the market reassured by European banks’ healthy uptake of the European Central Bank’s (ECB) first Long Term Refinancing Operation (LTRO) auction in December, equities rallied, European peripheral sovereign debt yields fell sharply and the euro climbed against the US dollar. In this ‘risk-on’ environment, European equities, especially those more cyclically sensitive, performed strongly.

European Focus Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| BP plc | | | 6.2 | % | |

| African Minerals, Ltd. | | | 4.7 | | |

| European Goldfields, Ltd. | | | 4.2 | | |

| Zhaikmunai LP, GDR | | | 3.9 | | |

| TUI AG | | | 3.5 | | |

| Sky Deutschland AG | | | 3.0 | | |

| Gulf Keystone Petroleum, Ltd. | | | 2.9 | | |

| Smith & Nephew plc | | | 2.8 | | |

| Amadeus IT Holding S.A., A Shares | | | 2.7 | | |

| Renault S.A. | | | 2.7 | | |

For the six month period ended January 31, 2012, the Fund returned -12.53% (Class A at NAV) versus the benchmark MSCI Europe Index, which posted a return of -11.51%. At the sector level the Fund benefitted from underweight positions in Financials and Healthcare and the overweight in Energy. Exposure to Materials and Information Technology proved to be the biggest drags. At the stock level, Gulf Keystone benefitted from improved sentiment towards oil and gas assets in Kurdistan. Sonova made significant gains after the US Food and Drug Administration gave the company approval to resume selling a key hearing implant that had been recalled from the market following product malfunctions. On the negative side, Sky Deutschland was the worst performer as investors overlooked operational progress and focused on the company’s potential funding requirements. Alcatel Lucent also struggled as an effective turnaround strategy proved elusive for CEO Ben Verwaayen amidst the market turmoil.

The Fund initiated a number of positions, including SAF Holland, an auto-parts specialist with a heavy customer exposure to North America and Europe. The Fund also took part in a secondary equity offering of Lenzing, a polymers and synthetic fibers company. Carphone Warehouse, the UK based cellphone retailer, was introduced as we see the company as offering value given the global growth prospects for their retail format. There was an exit from long term holding Vallourec where we felt analyst numbers were overestimating the company’s likely progress in the short term and sold the position in Imperial Tobacco due to our expectations of a more difficult trading environment in Spain amongst other countries.

2012 started very positively. The launch of the two-stage LTRO auction by the ECB has gone a long way towards removing the tail risk of a disorderly Eurozone breakup or a big European bank falling into serious liquidity issues. It has also created an easier funding environment, spurred interbank lending and has relieved some of the pressure on periphery European sovereign debt.

| Henderson Global Funds | Performance summary |

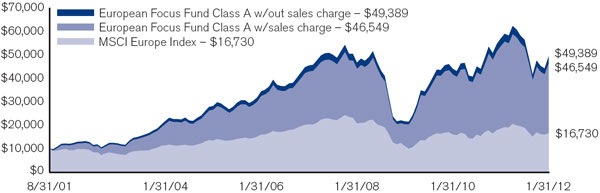

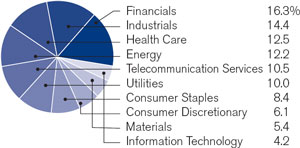

European Focus Fund

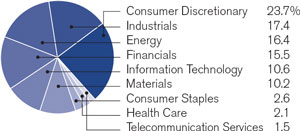

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Ten years* | | | Since inception (8/31/2001)* | |

| Class A | | | HFEAX | | | -12.53 | % | | -13.33 | % | | 31.55 | % | | 1.64 | % | | 15.10 | % | | 16.56 | % |

| Class B | | | HFEBX | | | -12.87 | | | -13.96 | | | 30.57 | | | 0.88 | | | 14.43 | | | 15.91 | |

| Class C | | | HFECX | | | -12.83 | | | -13.96 | | | 30.58 | | | 0.88 | | | 14.25 | | | 15.71 | |

| Class I** | | | HFEIX | | | -12.38 | | | -13.07 | | | 31.87 | | | 1.79 | | | 15.18 | | | 16.65 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -17.55 | % | | -18.32 | % | | 28.98 | % | | 0.45 | % | | 14.42 | % | | 15.90 | % |

| Class B | | | | | | -17.87 | | | -17.96 | | | 29.98 | | | 0.69 | | | 14.43 | | | 15.91 | |

| Class C | | | | | | -13.83 | | | -13.96 | | | 30.58 | | | 0.88 | | | 14.25 | | | 15.71 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | -11.51 | % | | -9.85 | % | | 14.62 | % | | -3.86 | % | | 5.94 | % | | 5.06 | % |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.54%, 2.29%, 2.29% and 1.29% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Equity Income Fund

Global equity markets fell strongly during 2011 amidst continued uncertainty surrounding possible solutions to the Eurozone sovereign debt crisis. At the end of the period, however, markets recovered some of their earlier losses and began to accelerate their gains in early 2012 as optimism grew that the 3-year Long Term Refinancing Operation announced by the European Central Bank had underpinned the European banking sector in the short term, even if the sovereign debt problems have yet to be resolved. Elsewhere, economic data in the US was encouraging, with the unemployment rate falling to 8.5%, and Asia showed signs of lower inflation and easing monetary policies with continued growth of over 8% in China.

Global Equity Income Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| ENI SpA | | | 3.2 | % | |

| Royal Dutch Shell plc, Class B | | | 3.1 | | |

| Scottish & Southern Energy plc | | | 2.8 | | |

| Siemens AG | | | 2.8 | | |

| Total S.A. | | | 2.5 | | |

| GlaxoSmithKline plc | | | 2.4 | | |

| Compass Group plc | | | 2.4 | | |

| BAE Systems plc | | | 2.3 | | |

| Vodafone Group plc | | | 2.3 | | |

| Unilever N.V. | | | 2.3 | | |

For the six month period ended January 31, 2012, the Fund returned -2.97% (Class A at NAV) versus the benchmark MSCI World Index which posted a return of -3.81%. The Fund also continued to meet its income objectives over the period. Strong relative performance was largely driven by positive stock selection in shares with a defensive bias and lower beta, which fared well during periods of high volatility and sharply declining markets. However, as equity markets bounced back from extremely oversold levels in January, the Fund lagged the broader market.

At the stock level, among the best performers during the period was Pfizer, a global pharmaceutical company, which announced an increase to its quarterly dividend and a new share repurchase program that was met with a positive reaction by the market. Also notable was integrated oil firm ENI, which benefitted from a large gas discovery in offshore Mozambique that will add to production over the long term.

The Fund’s geographic exposure varied throughout the period in accordance with the investment process and regional rotation strategy. During the period we took advantage of market volatility to reduce positions in holdings that had performed well and/or paid its annual dividend in order to invest in new positions where we saw the potential for better opportunities for income and capital growth over the medium term.

The Fund added a new position in Vale, the Brazilian miner (primarily iron ore), as we believe the valuation presents potential for upside, and has offered a high yield. A position was also added in RSA Insurance, as it remains on an attractive valuation with what we believe to be a high quality portfolio of assets.

Going into 2012, many of the companies held within the Fund are global leaders in their industries that we believe should continue to benefit from global economic growth. While there is ongoing uncertainty surrounding a resolution to the Eurozone crisis, we remain comfortable with the balance sheets and free cash flow generation of the companies held. Also, we have been encouraged by recent company earnings releases, many of which have increased their dividend and reported strong volume growth as a result of exposure to global economic growth. Despite the rally during January, valuations remain low relative to their historic average, and we continue to see value in the global equity markets.

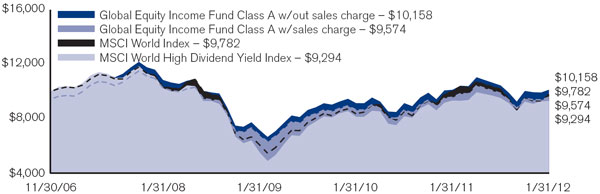

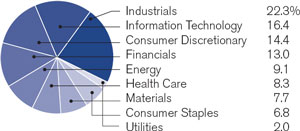

| Henderson Global Funds | Performance summary |

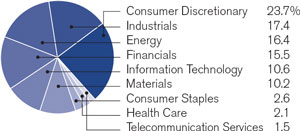

Global Equity Income Fund

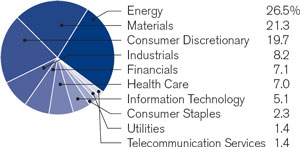

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Since inception (11/30/06)* | |

| Class A | | | HFQAX | | | -2.97 | % | | 0.05 | % | | 12.13 | % | | -0.28 | % | | 0.30 | % |

| Class C | | | HFQCX | | | -3.35 | | | -0.69 | | | 11.30 | | | -1.03 | | | -0.44 | |

| Class I** | | | HFQIX | | | -2.82 | | | 0.33 | | | 12.45 | | | -0.11 | | | 0.47 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -8.50 | % | | -5.74 | % | | 9.94 | % | | -1.45 | % | | -0.84 | % |

| Class C | | | | | | -4.35 | | | -0.69 | | | 11.30 | | | -1.03 | | | -0.44 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -3.81 | % | | -2.45 | % | | 17.11 | % | | -1.08 | % | | -0.43 | % |

| MSCI World High Dividend Yield Index | | | | | | -2.16 | | | 3.53 | | | 20.50 | | | -1.45 | | | -0.69 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.32%, 2.07% and 1.07%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within select MSCI World Index. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Leaders Fund

It was a volatile period for global equity markets. July’s initial optimism over generally solid corporate earnings was eroded by concerns over sovereign indebtedness in the Eurozone, where it was feared that a Greek default could lead to contagion spreading to the larger economies of Spain and Italy. Weak Chinese manufacturing contracted for a third consecutive month, leading to a sharp correction in emerging markets. In response, policy makers in Europe agreed to expand the European Financial Stability Facility and the US undertook ‘Operation Twist’, where it sold $400bn of short-term Treasury bonds and switched into longer-term debt in a move to ‘twist’ the yield curve and encourage investor flows into higher-yielding assets. The latter part of 2011 was characterized not just by sharp declines and rallies, but also by high levels of stock and market correlation. Global equities have started 2012 strongly, supported by increased confidence in a solution to the Eurozone debt issues and positive economic data from the US and China.

Global Leaders Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| Apple, Inc. | | | 5.1 | % | |

| American Tower Corp. | | | 3.9 | | |

| QUALCOMM, Inc. | | | 3.7 | | |

| United Parcel Service, Inc., Class B | | | 3.7 | | |

| Intuit, Inc. | | | 3.2 | | |

| Dollar General Corp. | | | 3.2 | | |

| Kansas City Southern | | | 3.1 | | |

| Praxair, Inc. | | | 3.1 | | |

| Anadarko Petroleum Corp. | | | 3.1 | | |

| Tempur-Pedic International, Inc. | | | 3.0 | | |

For the six month period ended January 31, 2012, the Fund returned -2.56% (Class A at NAV) versus the benchmark MSCI World Index, which posted a return of -3.81%. By sector, the overweight position in Information Technology added the most to returns and was bolstered by positive returns from exposure to Consumer Discretionary stocks. By region, exposure to North America and Europe was positive, while emerging markets selections detracted.

At the stock level, defensive holding US discount retail store Dollar General was the best performer over the period and railroad operator Kansas City Southern benefitted from an upbeat view of volume growth with solid margin expansion as US trade with Mexico increases. Within Information Technology, the Fund’s largest holding, Apple, continued to add value as the company reported record sales and profits. UK software company Autonomy benefitted from a takeover approach from Hewlett Packard. On the negative side, the weakness in Financials had a negative impact on Lazard as the initial public offering and merger and acquisitions advisory markets were slower than expected and Bank of China suffered from continued tightening in loan conditions by Chinese authorities and concerns over deteriorating non-performing loans in the banking system. Emerging market exposed companies were caught up in the risk-reduction, with Swiss luxury goods company Richemont and Hong Kong listed Prada both suffering.

During the period the Fund initiated a position in German software company SAP and also bought a stake in Chinese internet search engine Baidu to benefit from the growth in internet search and advertising in China. Our concerns over earnings growth led us to sell positions in 361 Degrees, the Chinese sportswear company, and Essar Energy, an Indian focused energy company.

We expect the volatility that was apparent in 2011 to continue into 2012 as the investment outlook remains uncertain. Undoubtedly, near term focus will continue to be on events in the eurozone, despite the improved banking liquidity. Additionally, economic data continues to be weak in Europe; however, US data continues to be on a more robust path and the Chinese authorities appear to be beginning to ease after their recent tightening fiscal stance. In this uncertain environment we continue to invest in companies that we believe can grow their earnings; and we believe that these companies’ stock prices can attract a premium.

| Henderson Global Funds | Performance summary |

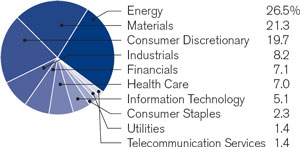

Global Leaders Fund

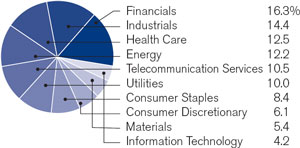

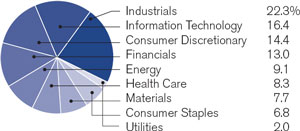

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Since inception (11/30/06)* | |

| Class A | | | HFPAX | | | -2.56 | % | | -2.47 | % | | 16.43 | % | | -0.81 | % | | 0.03 | % |

| Class C | | | HFPCX | | | -2.89 | | | -3.18 | | | 15.65 | | | -1.23 | | | -0.40 | |

| Class I** | | | HFPIX | | | -2.36 | | | -2.17 | | | 16.55 | | | -0.75 | | | 0.09 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -8.18 | % | | -8.09 | % | | 14.16 | % | | -1.98 | % | | -1.11 | % |

| Class C | | | | | | -3.89 | | | -3.18 | | | 15.65 | | | -1.23 | | | -0.40 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -3.81 | % | | -2.45 | % | | 17.11 | % | | -1.08 | % | | -0.43 | % |

* Average annual return

** Class I shares commenced operations on May 31, 2011. The performance for Class I shares for the period prior to May 31, 2011 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 2.09%, 2.84% and 1.84%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that the total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hender-songlobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. Effective June 1, 2011, the Henderson Global Opportunities Fund changed its name, investment objective and policies and became the Henderson Global Leaders Fund. The Fund’s historical performance may not represent current investment policies. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Technology Fund

The Technology sector, like most others, has been dominated by the macroeconomic environment and persisting market volatility due to stress in the banking system as well as concerns regarding the continuing European sovereign debt crisis. The global economic weakness did not help Technology stocks, particularly in October and November, although performance was better than other more cyclically exposed sectors. The US began to show promising growth at the end of 2011 and January saw an abrupt reversal in risk appetite as equity markets enjoyed a buoyant start to the year with a number of positive economic data points emerging, particularly from the US. With the market reassured by the healthy uptake of the European Central Bank’s first Long Term Refinancing Operation Auction in December, equities rallied and European peripheral sovereign debt yields fell sharply. In this ‘risk-on’ environment, equities, especially those more cyclically sensitive, performed strongly and Technology outperformed the wider market.

Global Technology Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| Apple, Inc. | | | 8.7 | % | |

| Check Point Software Technologies, Ltd. | | | 3.2 | | |

| Priceline.com, Inc. | | | 3.1 | | |

| EMC Corp. | | | 3.0 | | |

| Oracle Corp. | | | 3.0 | | |

| Microsoft Corp. | | | 3.0 | | |

| Analog Devices, Inc. | | | 2.9 | | |

| Google, Inc., Class A | | | 2.9 | | |

| Accenture plc, Class A | | | 2.9 | | |

| Baidu, Inc., ADR | | | 2.9 | | |

For the six month period ended January 31, 2012, the Fund returned -6.28% (Class A at NAV) versus the benchmark MSCI AC World IT Index, which posted a return of -2.48%. The Fund suffered from a number of significant headwinds, namely the relative underperformance of the International Technology Sector (where the Fund is significantly overweight our competitors) and the relative outperformance of mega cap technology (where the Fund is structurally underweight versus the index given the Fund’s index agnostic construction).

At the stock level, the worst performer was Netflix, which suffered after downgrading revenues based on weakness in the DVD subscriptions business. Shutterfly, a photo related E-Commerce business, also struggled on the back of fourth quarter earnings downgrades due to competitive discounting on its products. On a positive note, Apple continued to perform well; its strong market position attributable to the iPhone and iPad being early still in the adoption curve and significant recurring revenues from their App Store. F5 Networks benefitted from an increase in US corporate capital expenditure levels. Mercadolibre, the leading Latin American online trading site, held up well as valuations bounced upwards from strong fourth quarter results as growth reaccelerated following site improvements while the underlying E-Commerce trend in Latin America remained strong.

There were a number of new purchases along themed lines. MasterCard was purchased in conjunction with the new secular theme of Paperless Payments, where we see significant growth potential. Ebay was also purchased within the theme of E-Commerce. Its growth has accelerated due to new opportunities, attractive valuations and its payments system, PayPal, has grown at a phenomenal rate. We also added to the Data Storage theme with Fusion-IO and EMC, and have added two semiconductor businesses Altera and Lam Holdings. The Fund closed out a few positions, including Hiwin, the precision instruments company, Red Hat, the software company, and Skyworks, the semiconductor company.

Macroeconomic data in the US continues to improve and we are greatly encouraged that, in general, fourth quarter earnings for the Technology Sector have so far been quite robust, despite the poor macro picture over the quarter for both large and small cap companies. We believe this validates our belief that the Technology Sector is continuing to gain an increasing share of both corporate and consumer spending around the world.

| Henderson Global Funds | Performance summary |

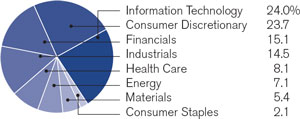

Global Technology Fund

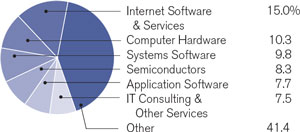

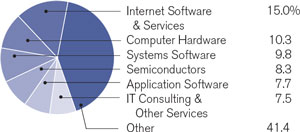

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by industry (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Ten years* | | | Since inception (8/31/01)* | |

| Class A | | | HFGAX | | | -6.28 | % | | -4.75 | % | | 27.51 | % | | 6.43 | % | | 6.85 | % | | 7.46 | % |

| Class B | | | HFGBX | | | -6.64 | | | -5.45 | | | 26.56 | | | 5.63 | | | 6.26 | | | 6.89 | |

| Class C | | | HFGCX | | | -6.60 | | | -5.46 | | | 26.56 | | | 5.63 | | | 6.07 | | | 6.68 | |

| Class I | | | HFGIX | | | -6.14 | | | -4.48 | | | 27.84 | | | 6.60 | | | 6.93 | | | 7.54 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -11.65 | % | | -10.21 | % | | 25.00 | % | | 5.18 | % | | 6.21 | % | | 6.85 | % |

| Class B | | | | | | -11.64 | | | -9.45 | | | 25.93 | | | 5.47 | | | 6.26 | | | 6.89 | |

| Class C | | | | | | -7.60 | | | -5.46 | | | 26.56 | | | 5.63 | | | 6.07 | | | 6.68 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | -2.48 | % | | -0.46 | % | | 23.80 | % | | 2.83 | % | | 2.71 | % | | 3.51 | % |

| S&P 500 | | | | | | 2.71 | | | 4.22 | | | 19.24 | | | 0.33 | | | 3.52 | | | 3.40 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.55%, 2.30%, 2.30% and 1.30%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

International Opportunities Fund

After a volatile 2011, equity markets began to find their footing late in the year. The market was weak in both August and September on concerns surrounding the European debt crisis. However, the European Central Bank cut interest rates twice and introduced the first Long Term Refinancing Operation, which appeared to put a stop to fears that there would be a further banking crisis, and equities then rallied strongly to the end of the period. Furthermore, US economic news improved and while European economies were generally weak, some of the numbers were not as bad as anticipated.

International Opportunities Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| Deutsche Post AG | | | 2.8 | % | |

| Fresenius SE & Co., KGaA | | | 2.7 | | |

| Renault S.A. | | | 2.7 | | |

| Continental AG | | | 2.7 | | |

| Essilor International S.A. | | | 2.6 | | |

| BAE Systems plc | | | 2.6 | | |

| Sodexo | | | 2.6 | | |

| BP plc | | | 2.5 | | |

| Roche Holding AG | | | 2.5 | | |

| Kuehne & Nagel International AG | | | 2.5 | | |

Elsewhere, Asian shares followed a similar pattern although there was more specific news from China that helped support equities. The Chinese economy grew by 8.9% in the fourth quarter. Although this was the slowest rate of growth in more than two years, it indicated that the country may be heading for a “soft landing.” In addition, lower inflation also allowed the authorities to start to ease monetary policy.

For the six month period ended January 31, 2012, the Fund returned -11.87% (Class A at NAV) versus the benchmark MSCI EAFE Index, which posted a return of -10.32%. The Fund’s performance was largely dragged lower by disappointing results from two European companies (Alcatel Lucent and Essar Energy) as well as poor stock selection in Asia. The largest single detractor to performance was Alcatel-Lucent. The most recent quarterly results were a disappointment and missed analysts’ expectations. The company also announced an additional cost cutting plan. Essar Energy was also very weak on continued concerns regarding a slowdown in the Indian economy. Guangzhou R&F and Shanghai Industrial were also detractors to performance as shares were very weak.

Over the period, the Fund made a number of small allocation shifts by moving assets from the Global Technology and European 2 sub-portfolios for the benefit of the Asia Pacific sub-portfolio. The move was made on the back of increased confidence that Chinese inflation would continue to turn down and that China may be close to the end of the tightening cycle. While the Fund remains overweight China, the Asia Pacific sub-portfolio reallocated some country specific risk by reducing the overweight for the benefit of a greater spread among regional countries, particularly Korea. We are optimistic about Korea as the currency (WON) has been weak, which has been supportive of exporters. Korea also has been experiencing a growing domestic consumer base, and the sub-portfolio reflects our bias to the domestic Korean consumer. New holdings include: Samsung Electronics, Shinhan Financial, Hyundai Department Stores and Korean Reinsurance.

Investors became nervous about the economic growth outlook in the last half of 2011 and this pessimism may have been somewhat overdone. European economies, barring a collapse of the euro, will probably muddle along as the core European economies grow offsetting the recession in the periphery. In addition, growth in China, while slowing, should remain robust. Stock markets have risen strongly from their lows in October and there is room for some profit-taking. However, markets seem likely to continue to rise in the medium term. There are a number of wild cards such as the current negotiation for Greek debt repayment, upcoming elections in France and continued tension in the Middle East.

| Henderson Global Funds | Performance summary |

International Opportunities Fund

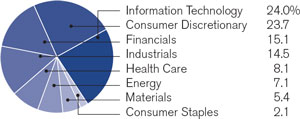

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Ten years* | | | Since inception (8/31/01)* | |

| Class A | | | HFOAX | | | -11.87 | % | | -10.47 | % | | 12.07 | % | | -1.99 | % | | 7.64 | % | | 8.87 | % |

| Class B | | | HFOBX | | | -12.24 | | | -11.17 | | | 11.21 | | | -2.72 | | | 7.02 | | | 8.26 | |

| Class C | | | HFOCX | | | -12.21 | | | -11.13 | | | 11.22 | | | -2.72 | | | 6.85 | | | 8.06 | |

| Class R** | | | HFORX | | | -12.07 | | | -10.74 | | | 11.75 | | | -2.23 | | | 7.37 | | | 8.60 | |

| Class I*** | | | HFOIX | | | -11.77 | | | -10.24 | | | 12.35 | | | -1.84 | | | 7.72 | | | 8.95 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -16.94 | % | | -15.63 | % | | 9.88 | % | | -3.14 | % | | 7.00 | % | | 8.25 | % |

| Class B | | | | | | -17.24 | | | -15.17 | | | 10.40 | | | -2.95 | | | 7.02 | | | 8.26 | |

| Class C | | | | | | -13.21 | | | -11.13 | | | 11.22 | | | -2.72 | | | 6.85 | | | 8.06 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI EAFE Index | | | | | | -10.32 | % | | -9.16 | % | | 13.90 | % | | -3.39 | % | | 6.25 | % | | 5.04 | % |

* Average annual return.

** Class I shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R shares commenced operations on September 30, 2005. The performance for Class R shares for the period prior to September 30, 2005 is based on the performance of Class A shares, adjusted for the higher expenses applicable to R shares. Class R shares are not subject to a front-end sales charge but are subject to a distribution fee of 0.50%.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Class R shares have no front-end sales charge or CDSC. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C, R and I shares are 1.44%, 2.19%, 2.19%, 1.69% and 1.19% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75%, 2.25% and 1.75% for Class A, B, C, R and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Japan Focus Fund

Japanese equities fared poorly over the period. While the political flux within Europe was the global focus of attention, Japan had its own issues to contend with. A stronger yen, especially against the euro, and floods in Thailand that disrupted production schedules, hit the economy just as recovery was underway following the devastating earthquake earlier in the year. As a result, the economy dragged in 2011; but on the bright side 2012 is looking much better with a recovery in activity being aided by an increase in government spending.

Japan Focus Fund

Top 10 long-term holdings

| Security | As a percentage of net assets | |

| Mitsubishi UFJ Financial Group, Inc. | | | 5.8 | % | |

| Sumitomo Mitsui Financial Group, Inc. | | | 4.8 | | |

| Yamada Denki Co., Ltd. | | | 4.7 | | |

| Rakuten, Inc. | | | 4.7 | | |

| Daiwa Securities Group, Inc. | | | 4.5 | | |

| Mizuho Financial Group, Inc. | | | 4.3 | | |

| Tokio Marine Holdings, Inc. | | | 4.2 | | |

| Keyence Corp. | | | 4.2 | | |

| Canon, Inc. | | | 3.9 | | |

| Mitsui OSK Lines, Ltd. | | | 3.3 | | |

For the six month period ended January 31, 2012, the Fund returned -5.07% (Class A at NAV) versus the benchmark MSCI Japan Index, which posted a return of -9.13%. Within the stockmarket defensive sectors typically fared better than the more cyclical areas as stock prices declined. Within the Fund, it was the emphasis on the Consumer Discretionary sector, which propelled relative outperformance. Credit Saison was among the strongest contributors which witnessed an improvement in the more problematic areas of its business while underlying demand began to recover. Hakuhodo benefitted from an upturn in corporate spending while contributions from Benesse and Oracle Japan were a further indication that domestic activity has begun to recover. Mitsui OSK, Nintendo and Daiwa Securities were among the worst performers as underlying business conditions deteriorated.

The Fund’s position in the more defensive areas of the market was further reduced on the premise that equities would enter an upward phase in the not too distant future. A couple of stock holdings that had held up relatively well were disposed of, including Takeda Pharmaceutical and NTT DoCoMo. Dai-ichi Life Insurance was sold as we believe exposure in the Financial sector can be better represented through other holdings such as the banks and brokers, which were increased. Oracle Japan was purchased replacing rival NSD as the former has expertise in the area of cloud computing which is a promising area. Overall, the Fund is structured with the belief that further slippage in the market may be limited and that risks are to the upside. The Fund retains a domestic bias favoring financials and services while being shy of the more export dependent commodity and industrial areas.

Global markets started 2012 in an upbeat mood extending gains made in previous months with fears over an impending European crisis trumped by political action and robust US economic data. The question is how long this recently acquired optimism can persist as the well-aired problems that beset the world have yet to find resolution. While markets remain firm, we believe Japanese equities can make up ground. From an economic standpoint Japan can claim advantage having largely completed its balance sheet restructuring whereas western economies continue to grapple with the effects of deleveraging after their own financial crises. Japanese companies are cash rich and the yen is high, reflecting the potential for mergers and acquisitions while vast tracts of the domestic economy neglected throughout the country’s deflationary period may attract attention as price declines abate. From here, we believe it is not about how much Japan can lose but how much can be gained from currently depressed levels.

| Henderson Global Funds | Performance summary |

Japan Focus Fund

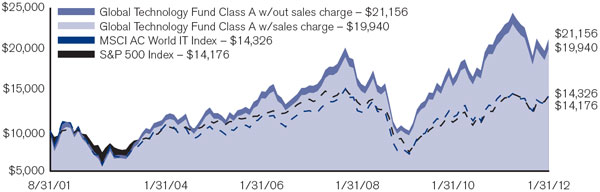

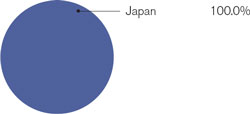

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| | |

|  |

Investment comparison

Value of $10,000

Total returns as of January 31, 2012

| | | | | | | | | | | | | | | | | | | | |

| At NAV | | | NASDAQ symbol | | | Six months | | | One year | | | Three years* | | | Five years* | | | Since inception (1/31/06)* | |

| Class A | | | HFJAX | | | -5.07 | % | | -4.08 | % | | 8.87 | % | | -4.96 | % | | -4.16 | % |

| Class C | | | HFJCX | | | -5.46 | | | -4.83 | | | 7.98 | | | -5.68 | | | -4.88 | |

| Class I** | | | HFJIX | | | -4.86 | | | -3.87 | | | 8.95 | | | -4.92 | | | -4.13 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -10.56 | % | | -9.58 | % | | 6.75 | % | | -6.08 | % | | -5.10 | % |

| Class C | | | | | | -6.46 | | | -4.83 | | | 7.98 | | | -5.68 | | | -4.88 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Japan Index | | | | | | -9.13 | % | | -10.42 | % | | 5.78 | % | | -5.76 | % | | -4.50 | % |

* Average annual return.

** Class I shares commenced operations on May 31, 2011. The performance for Class I shares for the period prior to May 31, 2011 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Class A, C and I shares are 1.79%, 2.54% and 1.54%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.35%, 2.10% and 1.10% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. Effective June 1, 2011, the Henderson Japan – Asia Focus Fund changed its name, investment objective and policies and became the Henderson Japan Focus Fund. The Fund’s historical performance may not represent current investment policies. The MSCI Japan Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance in Japan. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Portfolio of investments (unaudited) |

| | |

| Emerging Markets Opportunities Fund | |

| January 31, 2012 | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Common stocks - 89.64% | | | | |

| | | | Australia - 4.25% | | | | |

| | 370,234 | | African Petroleum | | | | |

| | | | Corp., Ltd. * | | $ | 192,599 | |

| | 564,480 | | Cape Lambert | | | | |

| | | | Resources, Ltd. (a)(b)* | | | 338,593 | |

| | | | | | | 531,192 | |

| | | | | | | | |

| | | | Brazil - 7.07% | | | | |

| | 9,500 | | BR Malls | | | | |

| | | | Participacoes S.A. | | | 103,689 | |

| | 26,000 | | CCR S.A. | | | 180,952 | |

| | 11,800 | | OGX Petroleo e Gas | | | | |

| | | | Participacoes S.A. * | | | 111,773 | |

| | 4,800 | | Petroleo Brasileiro | | | | |

| | | | S.A., ADR | | | 146,640 | |

| | 4,024 | | Tim Participacoes | | | | |

| | | | S.A., ADR | | | 116,093 | |

| | 8,900 | | Vale S.A., ADR | | | 225,170 | |

| | | | | | | 884,317 | |

| | | | | | | | |

| | | | Canada - 0.29% | | | | |

| | 169,161 | | Shamaran Petroleum | | | | |

| | | | Corp. * | | | 36,272 | |

| | | | | | | | |

| | | | Chile - 0.58% | | | | |

| | 4,800 | | Quadra FNX Mining, Ltd. * | | | 71,998 | |

| | | | | | | | |

| | | | China - 12.94% | | | | |

| | 2,616 | | Baidu, Inc., ADR * | | | 333,592 | |

| | 191,500 | | CITIC Securities Co., Ltd., | | | | |

| | | | Class H * | | | 378,294 | |

| | 7,200 | | Ctrip.com International, | | | | |

| | | | Ltd., ADR * | | | 180,360 | |

| | 561,530 | | Industrial & Commercial Bank | | | | |

| | | | of China, Ltd., Class H | | | 393,889 | |

| | 150,000 | | Zhuzhou CSR Times Electric | | | | |

| | | | Co., Ltd., Class H | | | 331,515 | |

| | | | | | | 1,617,650 | |

| | | | | | | | |

| | | | Colombia - 0.43% | | | | |

| | 2,600 | | Petrominerales, Ltd. | | | 54,271 | |

| | | | | | | | |

| | | | Hong Kong - 11.15% | | | | |

| | 270,000 | | Agile Property | | | | |

| | | | Holdings, Ltd. | | | 301,149 | |

| | 175,000 | | Ajisen China Holdings, Ltd. .. | | | 201,507 | |

| | 183,000 | | Citic Pacific, Ltd. | | | 350,648 | |

| | 111,000 | | CNOOC, Ltd. | | | 227,287 | |

| | 92,800 | | Sands China, Ltd. * | | | 312,911 | |

| | | | | | | 1,393,502 | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | | | India - 6.17% | | | | |

| | 17,539 | | Jubilant Foodworks, Ltd. * | | $ | 334,020 | |

| | 18,178 | | Tata Motors, Ltd., ADR | | | 437,726 | |

| | | | | | | 771,746 | |

| | | | Indonesia - 6.19% | | | | |

| | 1,085,000 | | PT Adaro Energy Tbk | | | $220,862 | |

| | 307,904 | | PT Bank Mandiri Tbk | | | 229,473 | |

| | 511,000 | | PT Mitra Adiperkasa Tbk | | | 323,993 | |

| | | | | | | 774,328 | |

| | | | | | | | |

| | | | Italy - 2.25% | | | | |

| | 58,900 | | Prada SpA * | | | 281,767 | |

| | | | | | | | |

| | | | Kazakhstan - 2.55% | | | | |

| | 796,299 | | International Petroleum, | | | | |

| | | | Ltd. (b)* | | | 173,305 | |

| | 13,346 | | Zhaikmunai LP, GDR * | | | 145,471 | |

| | | | | | | 318,776 | |

| | | | | | | | |

| | | | Korea - 9.53% | | | | |

| | 5,532 | | Gamevil, Inc. * | | | 314,187 | |

| | 1,766 | | Hyundai Glovis Co., Ltd. * | | | 302,626 | |

| | 1,700 | | Hyundai Motor Co. | | | 334,446 | |

| | 4,208 | | Seegene, Inc. * | | | 240,489 | |

| | | | | | | 1,191,748 | |

| | | | | | | | |

| | | | Malaysia - 2.48% | | | | |

| | 265,600 | | AirAsia Berhad | | | 309,954 | |

| | | | | | | | |

| | | | Mexico - 2.17% | | | | |

| | 2,350 | | Fomento Economico | | | | |

| | | | Mexicano, S.A.B de | | | | |

| | | | C.V., ADR | | | 165,722 | |

| | 26,300 | | Grupo Financiero Banorte | | | | |

| | | | S.A.B de C.V. | | | 104,925 | |

| | | | | | | 270,647 | |

| | | | | | | | |

| | | | Panama - 0.68% | | | | |

| | 1,250 | | Copa Holdings S.A., | | | | |

| | | | Class A | | | 85,175 | |

| | | | | | | | |

| | | | South Africa - 3.03% | | | | |

| | 57,826 | | Hummingbird | | | | |

| | | | Resources plc * | | | 143,517 | |

| | 123,923 | | Ncondezi Coal Co. * | | | 122,049 | |

| | 55,935 | | Petra Diamonds, Ltd. * | | | 113,704 | |

| | | | | | | 379,270 | |

| | | | | | | | |

| | | | Taiwan - 4.53% | | | | |

| | 62,677 | | Advanced Semiconductor | | | | |

| | | | Engineering, Inc., ADR | | | 330,308 | |

| | 14,400 | | HTC Corp. | | | 236,289 | |

| | | | | | | 566,597 | |

See notes to financial statements

| Henderson Global Funds | Portfolio of investments (unaudited) |

| | |

| Emerging Markets Opportunities Fund | |

| January 31, 2012 (continued) | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | | | Thailand - 2.80% | | | | |

| | 257,884 | | Robinson Department | | | | |

| | | | Store pcl | | $ | 350,239 | |

| | | | | | | | |

| | | | Ukraine - 1.09% | | | | |

| | 17,839 | | Avangardco Investments | | | | |

| | | | Public, Ltd. * | | | 135,576 | |

| | | | | | | | |

| | | | United Kingdom - 8.28% | | | | |

| | 34,083 | | African Minerals, Ltd. * | | | 269,883 | |

| | 140,603 | | Borders & Southern | | | | |

| | | | Petroleum * | | | 150,108 | |

| | 30,505 | | Exillon Energy plc * | | | 120,174 | |

| | 39,670 | | Gulf Keystone | | | | |

| | | | Petroleum, Ltd. * | | | 173,315 | |

| | 26,369 | | Inchcape plc | | | 141,610 | |

| | 71,838 | | InternetQ plc * | | | 179,992 | |

| | | | | | | 1,035,082 | |

| | | | | | | | |

| | | | United States - 1.18% | | | | |

| | 2,200 | | First Cash Financial | | | | |

| | | | Services, Inc. * | | | 88,550 | |

| | 2,950 | | NII Holdings, Inc. * | | | 59,324 | |

| | | | | | | 147,874 | |

| | | | | | | | |

| | | | Total common stocks | | | | |

| | | | (Cost $12,027,654) | | | 11,207,981 | |

| | | | | | | | |

| | Preferred stock - 2.01% | | | | |

| | | | | | | | |

| | | | Brazil - 2.01% | | | | |

| | 10,000 | | Alpargatas S.A.I.C | | | 80,415 | |

| | 8,500 | | Itau Unibanco | | | | |

| | | | Holding S.A. | | | 170,856 | |

| | | | | | | 251,271 | |

| | | | | | | | |

| | | | Total preferred stock | | | | |

| | | | (Cost $223,130) | | | 251,271 | |

| | | | | | | | |

| | | | Total long-term investments | | | | |

| | | | (Cost $12,250,784) | | | 11,459,252 | |

| | | | | | | | |

| | Short-term investment - 6.89% | | | | |

| | | | | | | | |

| | 861,741 | | Fidelity Institutional | | | | |

| | | | Treasury Portfolio | | | 861,741 | |

| | | | | | | | |

| | | | Total short-term investment | | | | |

| | | | (Cost $861,741) | | | 861,741 | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Total investments - 98.54% | | | | |

| | | | (Cost $13,112,525) | | $ | 12,320,993 | |

| | | | | | | | |

| | Net other assets | | | | |

| | | | and liabilities – 1.46% | | | 183,131 | |

| | | | | | | | |

| | Total net assets – 100.00% | | $ | 12,504,124 | |

| * | | Non income producing security |

| (a) | | Fair valued at January 31, 2012 as determined in good faith using procedures adopted by the Board of Trustees. |

| (b) | | This security has been deemed illiquid in accordance with the policies and procedures adopted by the Board of Trustees. |

| ADR | | American Depositary Receipts |

| GDR | | Global Depositary Receipts |

See notes to financial statements

| Henderson Global Funds | Portfolio of investments (unaudited) |

| | |

| Emerging Markets Opportunities Fund | |

| January 31, 2012 (continued) | |

Other information:

| | | | | |

| Industry concentration as | | | % of net |

| a percentage of net assets: | | | assets |

| Oil & Gas Exploration & Production | | | 11.07 | % |

| Diversified Banks | | | 7.19 | |

| Steel | | | 4.51 | |

| Restaurants | | | 4.28 | |

| Construction & Farm Machinery & | | | | |

| Heavy Trucks | | | 3.50 | |

| Airlines | | | 3.16 | |

| Precious Metals & Minerals | | | 3.07 | |

| Investment Banking & Brokerage | | | 3.03 | |

| Industrial Conglomerates | | | 2.81 | |

| Apparel Retail | | | 2.80 | |

| Coal & Consumable Fuels | | | 2.74 | |

| Automobile Manufacturers | | | 2.68 | |

| Internet Software & Services | | | 2.67 | |

| Electrical Components & Equipment | | | 2.65 | |

| Semiconductors | | | 2.64 | |

| General Merchandise Stores | | | 2.59 | |

| Home Entertainment Software | | | 2.51 | |

| Casinos & Gaming | | | 2.50 | |

| Air Freight & Logistics | | | 2.42 | |

| Real Estate Development | | | 2.41 | |

| Apparel, Accessories & Luxury Goods | | | 2.25 | |

| Biotechnology | | | 1.92 | |

| Communications Equipment | | | 1.89 | |

| Highways & Railtracks | | | 1.45 | |

| Hotels, Resorts & Cruise Lines | | | 1.44 | |

| Advertising | | | 1.44 | |

| Wireless Telecommunication Services | | | 1.40 | |

| Soft Drinks | | | 1.33 | |

| Integrated Oil & Gas | | | 1.17 | |

| Gold | | | 1.15 | |

| Distributors | | | 1.13 | |

| Packaged Foods & Meats | | | 1.09 | |

| Real Estate Operating Companies | | | 0.83 | |

| Consumer Finance | | | 0.71 | |

| Footwear | | | 0.64 | |

| Diversified Metals & Mining | | | 0.58 | |

| Long-Term Investments | | | 91.65 | |

| Short-Term Investment | | | 6.89 | |

| Total Investments | | | 98.54 | |

| Net Other Assets and Liabilities | | | 1.46 | |

| | | | 100.00 | % |

See notes to financial statements

| Henderson Global Funds | Portfolio of investments (unaudited) |

| | |

| European Focus Fund | |

| January 31, 2012 | |

| | | | | | | | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Common stocks - 92.43% | | | | |

| | | | | | | | |

| | | | Australia - 1.46% | | | | |

| | 13,552,214 | | African Petroleum | | | | |

| | | | Corp., Ltd. * | | $ | 7,049,977 | |

| | | | | | | | |

| | | | Austria - 1.04% | | | | |

| | 55,076 | | Lenzing AG | | | 5,042,950 | |

| | | | | | | | |

| | | | Belgium - 0.87% | | | | |

| | 452,602 | | Nyrstar * | | | 4,226,473 | |

| | | | | | | | |

| | | | France - 8.49% | | | | |

| | 2,631,722 | | Alcatel-Lucent * | | | 4,678,253 | |

| | 173,529 | | Alstom S.A. | | | 6,614,330 | |

| | 477,825 | | AXA S.A. | | | 7,253,343 | |

| | 307,066 | | Renault S.A. | | | 13,079,978 | |

| | 451,808 | | Vivendi S.A. | | | 9,455,796 | |

| | | | | | | 41,081,700 | |

| | | | | | | | |

| | | | Germany - 11.96% | | | | |

| | 161,293 | | Continental AG * | | | 12,884,503 | |

| | 66,349 | | Fresenius SE & Co., | | | | |

| | | | KGaA | | | 6,729,525 | |

| | 142,382 | | HeidelbergCement AG | | | 6,998,070 | |

| | 6,198,023 | | Sky Deutschland AG * | | | 14,560,749 | |

| | 2,300,105 | | TUI AG * | | | 16,734,119 | |

| | | | | | | 57,906,966 | |

| | | | | | | | |

| | | | Ireland - 1.51% | | | | |

| | 57,341,521 | | Petroceltic International plc *.. | | | 7,319,064 | |

| | | | | | | | |