Washington, D.C. 20549

Item 1: Report to Shareholders.

Semi-Annual Report

January 31, 2011

Emerging Markets Opportunities Fund

European Focus Fund

Global Equity Income Fund

Global Opportunities Fund

Global Technology Fund

International Opportunities Fund

Japan-Asia Focus Fund

Table of contents

| 1 |

| EMERGING MARKETS OPPORTUNITIES FUND | |

| 2 |

| 3 |

| EUROPEAN FOCUS FUND | |

| 4 |

| 5 |

| GLOBAL EQUITY INCOME FUND | |

| 6 |

| 7 |

| GLOBAL OPPORTUNITIES FUND | |

| 8 |

| 9 |

| GLOBAL TECHNOLOGY FUND | |

| 10 |

| 11 |

| INTERNATIONAL OPPORTUNITIES FUND | |

| 12 |

| 13 |

| JAPAN-ASIA FOCUS FUND | |

| 14 |

| 15 |

| 16 |

| 34 |

| 36 |

| 38 |

| 45 |

| 52 |

| 62 |

| 77 |

International investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies, which typically involves greater risk than investing in larger companies. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition some of the funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses.

Technology companies may react similarly to certain market pressure and events. This may be significantly affected by short product cycles, aggressive pricing of products and services, competition from new market entrants, and obsolescence of existing technology. As a result, the Global Technology Fund’s returns may be considerably more volatile than a fund that does not invest in technology companies.

The views in this report were those of the Fund managers as of January 31, 2011, and may not reflect the views of the managers on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice.

The recent growth rate in the stock market has helped to produce short term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short term changes.

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson Emerging Markets Opportunities, European Focus, Global Equity Income, Global Opportunities, Global Technology, International Opportunities and Japan-Asia Focus Funds, which covers the six months ended January 31, 2011.

Global equities continued to make gains in the second half of 2010 on further evidence that the global economic recovery continues. There is a growing expectation that the more robust economic growth will be reflected in corporate earnings and analysts’ forecasts are being revised upwards. Equity valuations as a result remain either around fair value or even cheaper than average in most developed markets, which should offer the potential for good returns in line with earnings growth as we move through 2011.

Emerging markets performed very strongly last year (with the notable exceptions of China and Brazil) and, consequently, we have more concerns about valuation support in some emerging markets - particularly in light of increasing inflationary pressures and the likelihood of central bank actions to combat this. However, when it becomes clear that we are close to or at the end of the tightening cycle in emerging markets, this is an area that we believe will generate excellent returns over the long term.

The policy measures undertaken by global governments over the past three years will continue to have an impact on bond markets in 2011. European sovereign debt in particular is likely to remain hostage to investor confidence and political constraints. We therefore expect the avoidance of peripheral European exposure and the risk of contagion to be a continued theme for bond investors to navigate in 2011.

In other news, we are pleased to announce that on December 31, 2010 the Henderson Global Funds launched two new portfolios for our retail investors: Emerging Markets Opportunities Fund (HEMAX) and the International All Cap Equity Fund (HFNAX). The Emerging Markets Opportunities Fund seeks to participate in the long term growth of the developing economies and their capital markets. In addition, we expect the Fund to be a truly differentiated offering through its utilization of a specialized regional sub-portfolio structure with a strategic asset allocation overlay. The International All Cap Equity Fund has added retail share classes. The Fund’s Class I shares (HIEIX) were launched on January 31, 2008, the first Henderson mutual fund offered to US institutional investors. The Fund follows a bottom-up all cap growth strategy and focuses primarily on the developed markets of Europe, Australasia and the Far East. It has a different fiscal year end, as a result, is not included in this shareholder report.

We believe that these Funds are key additions to the Henderson Global Funds family as we seek to provide you with further options to diversify clients’ portfolios with Funds that are truly differentiated from the competition. It’s our goal to continue to serve your financial needs successfully in the years to come, and we appreciate your trust and support in our Funds.

James O’Brien

President, Henderson Global Funds

Emerging Markets Opportunities Fund

Inflationary pressures have started to impact the performance of many of the emerging equity markets leading to outperformance by the developed world for the first time in quite a while. This change in market leadership is mainly due to policy tightening in Asia and Latin America, which have added headwinds to further gains, at the same time as the growth outlook for developed markets improved.

| Emerging Markets Opportunities Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Perfect World Co., Ltd. | 3.0 | |

| Dongfeng Motor Group Co., Ltd., Class H | 3.0 | |

| Sands China, Ltd. | 2.9 | |

| Shinhan Financial Group Co., Ltd. | 2.8 | |

| Tata Steel, Ltd. | 2.8 | |

| LG Display Co., Ltd. | 2.8 | |

| Ping An Insurance (Group) Co. of China, Ltd., Class H | 2.7 | |

| Air China, Ltd., Class H | 2.7 | |

| Ctrip.com International, Ltd., ADR | 2.7 | |

| Hyundai Motor Co. | 2.7 | |

The Fund was successfully launched on December 31, 2010. With only one month of data to report, the Fund is off to a strong start relative to its benchmark. For the one month reporting period ended January 31, 2011, the Fund returned -1.70% (Class A shares at NAV) versus the benchmark, MSCI Emerging Markets Index, which posted a return of -2.69%. Performance was led by holdings in the Emerging Europe, Middle East and Africa (EMEA) sub-portfolio, where the Fund is overweight Emerging Europe, which has been driven by the improving macroeconomic picture in the region. The Fund also benefitted from an underweight position in the Latin American region.

The initial allocation to the sub-portfolios is as follows: overweight to EMEA, underweight to Latin America and broadly in line with the benchmark in Asia.

Holdings initiated in the EMEA sub-portfolio include energy companies Ncondezi Coal, Gulf Keystone Petroleum, Borders & Southern Petroleum, and miners Paragon Diamonds and Petra Diamonds. Demand has been strong for diamonds, driven by India and China. Supply has been fairly tight driven by decreasing productivity of several large mines globally, therefore we are seeing upward pressure on prices.

The Asia sub-portfolio purchased shares in companies that seek to benefit from a structural change from an export-driven growth model to one based increasingly on domestic consumption. New holdings include shares in automotive companies, Hyundai Motor and Dongfeng Motor; travel operators CTrip and Air China; and financial institutions Bank Mandiri and ICICI Bank.

In Latin America, the rise of the middle class and ongoing growth in commodities are current themes for investment. Shares were purchased in miners Vale and Quadra Mining. Companies purchased in an effort to seek value from the domestic consumer included: Diagnosticos Da America, airline Gol Linhas and Brazilian property developer PDG Realty.

While the secular outlook for emerging equities remains solid — strong growth potential, generally attractive demographics, healthy banking systems, sound fiscal policies — the outlook may be becoming more challenging, with strong economic growth and rising inflation pressures battling against increasingly tighter monetary policies. Brazil, India, and China, the three largest emerging economies, are all tightening monetary policy.

While the short term outlook is more uncertain and enthusiasm for the emerging markets has waned, we believe these challenging conditions often toss up opportunities for us to add value through opportunistic stock selection.

Emerging Markets Opportunities Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | Since | |

| | | NASDAQ | | inception | |

| At NAV | | symbol | | (12/31/10) | |

| Class A | | | HEMAX | | | -1.70 | % |

| Class C | | | HEMCX | | | -1.70 | |

| Class I | | | HEMIX | | | -1.60 | |

| With sales charge | | | | | | | |

| Class A | | | | | | -7.35 | % |

| Class C | | | | | | -2.70 | |

| Index | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -2.69 | % |

Performance data quoted represents past performance and is no guarantee of future results. The Fund may invest in shares of companies through initial public offerings (IPOs). IPOs have the potential to produce substantial gains and there is no assurance that the Fund will have continued access to profitable IPOs. As Fund assets grow, the impact of IPO investments on performance may decline. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 2.19%, 2.94% and 1.94%, respectively, for the Fund’s first fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.79%, 2.54% and 1.54% for Class A, C and I shares, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

European Focus Fund

Equity markets benefited from a positive backdrop during the third quarter 2010 owing to encouraging results from the bank stress tests, a strong company earnings season and the concerns of Europe’s sovereign debt waning among investors. Also, the US Federal Reserve announced that further deterioration in economic conditions could provide the backdrop for quantitative easing (QE2), news that was met with a positive market reaction. There was a sharp pull back at the end of November as the Eurozone crisis came to a head again with the bailout of Irish banks, however European exchanges ended the year in positive territory, despite continued sovereign debt concerns surrounding Spain and Portugal. Continued upbeat company outlooks and forecasts took precedence over an uncertain macroeconomic backdrop. Markets edged higher at the start of 2011 following the successful auction of Spanish and Portuguese bonds.

| European Focus Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| European Goldfields, Ltd. | 8.4 | |

| Essar Energy, Ltd. | 4.3 | |

| Zhaikmunai LP, GDR | 3.6 | |

| African Minerals, Ltd. | 3.6 | |

| BP plc | 3.1 | |

| Northland Resources S.A. | 2.9 | |

| Kalahari Minerals plc | 2.9 | |

| British Sky Broadcasting Group plc | 2.7 | |

| FirstGroup plc | 2.4 | |

| Gartmore Group, Ltd. | 2.3 | |

For the reporting period ended January 31, 2011, the Fund returned 26.29% (Class A shares at NAV) versus the benchmark, the MSCI Europe Index, which posted a return of 16.24%. Performance was led by the Fund’s holdings in the Materials and Energy sectors. European Goldfields, Kalahari Minerals, Exillion Energy, Zhaikmunai, Essar Energy and Gulf Keystone all performed well and benefitted from anticipation of further quantitative easing. Holdings in Consumer Cyclicals also performed well following positive contributions from Continental and Volkswagen. The Financials sector was the greatest detractor to Fund performance with Bank of Ireland being the biggest drag following the €85bn Irish bailout by the International Monetary Fund (IMF) and European Union. Lloyds Banking Group suffered and was sold after we became concerned about the group’s exposure to the softening UK real-estate market.

The Fund made a number of opportunistic purchases over the period. A position was initiated in insurance and asset manager Aviva as, in our view, the stock’s valuation discount had, in part, been justified by a weaker operational performance than its peers. The Fund bought a stake in Germany’s largest cable operator Kabel Deutschland during an equity placing which offered stock at a discount to the market price. The Fund took part in the initial public offering of London listed energy company Caparo Energy which is tapping into the growing wind power market in India. Within Materials, the Fund added both Vedanta Resources and Northland Resources, which is developing a significant iron ore asset in Finland.

We believe the sovereign debt concerns of peripheral Europe will continue during the year. We expect the performance differential between countries in the “two-speed” Europe that opened up markedly in the fourth quarter of 2010 to continue into the first half of the year, causing share prices to be volatile. However, overall we continue to remain positive on European equity markets in 2011 as we believe evidence of a corporate recovery is clear and we see good value in European equities.

European Focus Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | Five | | inception | |

| At NAV | | symbol | | months | | year | | years* | | years* | | (8/31/01)* | |

| Class A | | | HFEAX | | | 26.29 | % | | 29.10 | % | | 6.74 | % | | 10.59 | % | | 20.29 | % |

| Class B | | | HFEBX | | | 25.76 | | | 28.08 | | | 5.94 | | | 9.75 | | | 19.55 | |

| Class C | | | HFECX | | | 25.76 | | | 28.08 | | | 5.94 | | | 9.75 | | | 19.40 | |

| Class I** | | | HFEIX | | | 26.39 | | | 29.37 | | | 6.90 | | | 10.69 | | | 20.35 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 19.02 | % | | 21.66 | % | | 4.66 | % | | 9.29 | % | | 19.54 | % |

| Class B | | | | | | 20.76 | | | 24.08 | | | 5.04 | | | 9.62 | | | 19.55 | |

| Class C | | | | | | 24.76 | | | 28.08 | | | 5.94 | | | 9.75 | | | 19.40 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | 16.24 | % | | 15.44 | % | | -3.64 | % | | 2.94 | % | | 6.78 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.61%, 2.36%, 2.36% and 1.36% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Global Equity Income Fund

Global equity markets finished up strongly over the period, as positive macroeconomic data and above-consensus corporate earnings releases led to increased confidence in a global recovery. US equity markets rallied following higher than expected third and fourth quarter gross domestic product (GDP) figures, as well as improving jobless claims data, aiding cyclical sectors with a higher degree of economic sensitivity within their revenue streams. At the sector level, Energy stocks performed particularly well over the period, as oil prices rose and the prospects for a sustained cyclical recovery drove many share prices higher in stocks the Fund held such as PetroChina and ENI.

| Global Equity Income Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Royal Dutch Shell plc, | | |

| Class B | 3.8 | |

| GlaxoSmithKline plc | 3.1 | |

| Verizon Communications, Inc. | 3.0 | |

| Novartis AG | 2.8 | |

| Total S.A. | 2.6 | |

| Siemens AG | 2.6 | |

| Zurich Financial Services AG | 2.6 | |

| British American Tobacco plc | 2.6 | |

| Tesco plc | 2.4 | |

| Unilever N.V. | 2.3 | |

For the reporting period ended January 31, 2011, the Fund returned 10.68% (Class A shares at NAV) versus the benchmark, the MSCI World Index, which posted a return of 17.49%. The Fund also continued to meet its dividend income goals. Fund underperformance was on the back of a stock market rally that continued to be lead by pro-cyclical, earnings momentum-driven stocks, where the Fund, given its low-beta, more defensive positioning is often underweight. Among the best performing countries was Taiwan: HTC, for example, smartphone and communications provider, finished up strongly following consensus beating third quarter results leading to earnings upgrades. Also among the top contributors to performance were insurance providers, such as Aviva and Standard Life, which benefited from a trend of rising bond yields. The worst performers were those companies with more defensive revenue streams, such as Telecom firms Telefonica and Telstra.

Given the improving earnings and strong corporate balance sheets, the Fund increased its exposure to corporate, rather than consumer, spending. Microsoft, for example, was added since we believe it may be well positioned to benefit from a renewed corporate information technology (IT) cycle driven by the adoption of operating system Windows 7. UPS was also added as we believe demand may accelerate as freight and manufacturing activity improves. Positions were sold in SK Telecom, and the proceeds recycled into better opportunities for earnings growth elsewhere.

We remain optimistic for returns on the portfolio through 2011. This year should see the resumption of dividend growth for a number of the Fund’s holdings, aiding total returns as well as encouraging an asset allocation shift out of bonds towards higher yielding equities. We are also encouraged by the attractive valuations within the portfolio; as earnings growth accelerates at already low valuations, we expect share prices to move at least in-line with earnings. Finally, we expect 2011 to be a strong year for mergers and acquisitions and we believe the valuations of the Fund’s holdings make them prime acquisition candidates for companies with record-high cash balance sheets.

Global Equity Income Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | inception | |

| At NAV | | symbol | | months | | year | | years* | | (11/30/06)* | |

| Class A | | | HFQAX | | | 10.68 | % | | 10.66 | % | | -2.27 | % | | 0.37 | % |

| Class C | | | HFQCX | | | 10.31 | | | 9.73 | | | -3.00 | | | -0.38 | |

| Class I** | | | HFQIX | | | 10.96 | | | 10.92 | | | -2.08 | | | 0.50 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | 4.27 | % | | 4.24 | % | | -4.18 | % | | -1.05 | % |

| Class C | | | | | | 9.31 | | | 9.73 | | | -3.00 | | | -0.38 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 17.49 | % | | 19.83 | % | | -0.99 | % | | 0.06 | % |

| MSCI World High Dividend Yield Index | | | | | | 14.18 | % | | 14.67 | % | | -3.08 | % | | -1.68 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.37%, 2.12% and 1.12%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Global Opportunities Fund

Global equity markets made progress throughout the second half of 2010 following a further $600 billion of quantitative easing (QE2) and an extension of the tax cuts from the US. Macroeconomic data generally surprised on the upside, supporting the growth recovery theme and reducing fears over the double-dip scenario apparent in the second and third quarters. In Europe, Ireland required an international bailout for its indebted banks and the Japanese government intervened to weaken the yen. Asia-Pacific countries continued to be the pool into which excess liquidity is poured, with initial public offering’s many times over subscribed and governments further tightening fiscal and monetary policies to curb inflation. Continued positive economic data in January from the US, and a recovering Financials sector in Europe, underpinned regional returns for developed Western markets. These outperformed Asian and emerging markets, where rising inflation remained a concern.

| Global Opportunities Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Apple, Inc. | 4.6 | |

| Essar Energy plc | 2.9 | |

| Hess Corp. | 2.8 | |

| Sands China, Ltd. | 2.7 | |

| American Tower Corp., Class A | 2.7 | |

| Emerson Electric Co. | 2.5 | |

| United Parcel Service, Inc., Class B | 2.5 | |

| Makita Corp. | 2.4 | |

| Compagnie Financiere Richemont S.A. | 2.4 | |

| Kansas City Southern | 2.4 | |

For the reporting period ended January 31, 2011, the Fund returned 16.30% (Class A shares at NAV) versus the benchmark, the MSCI World Index, which posted a return of 17.49%. Disappointing stock performance within the Information Technology (IT), Financials and Consumer Staples sectors offset positive returns in Energy, Industrials and Consumer Discretionary.

IT positions Cisco and Keyence were the biggest detractors to performance. US data center operator Equinix and UK software house Autonomy also suffered after lowering earnings guidance. Concerns over rising inflation and increased reserve requirements held back positions in Indian bank Axis and Bank of China, both of which were subsequently sold on concerns over lending restrictions. On the positive side, the rising price of oil and gas led to strong performance from Energy related holdings, with Hess Corp, Anadarko, Essar Energy, Keppel Corp and Saipem all performing well. Within Industrials, positions in Makita, SMC and United Parcel Service, were also strong.

While our long-term outlook remains biased towards Asian and emerging markets growth, we are more cautious over valuations and the general “crowded consensus” nature of this positioning in the near-term and therefore we have tactically reduced exposure and increased exposure to growth companies in Japan and Europe. We have become more positive on companies in Japan where export oriented manufacturers increased profits significantly during 2010 but have underperformed industrials globally. Additionally, a strengthening US economy could lead to a weakening in the yen.

Equity markets remain attractive for several reasons: valuations versus bonds, rising inflation, asset allocation moves out of fixed income, and improving economic data. Additionally, companies are generally in robust financial health, earnings growth is strong, and visibility is improving with better economic data. Our expectation is for a broadening and normalisation of the economic recovery over the short to medium term, which should benefit late cyclical companies and developed markets, which have so far lagged the Asian and emerging markets rally.

Global Opportunities Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | inception | |

| At NAV | | symbol | | months | | year | | years* | | (11/30/06)* | |

| Class A | | | HFPAX | | | 16.30 | % | | 19.18 | % | | -2.01 | % | | 0.64 | % |

| Class C | | | HFPCX | | | 15.92 | | | 18.37 | | | -2.76 | | | 0.27 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | 9.63 | % | | 12.31 | % | | -3.92 | % | | -0.78 | % |

| Class C | | | | | | 14.92 | | | 18.37 | | | -2.76 | | | 0.27 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 17.49 | % | | 19.83 | % | | -0.99 | % | | 0.06 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. The Fund may invest in shares of companies through initial public offerings (IPOs). IPOs have the potential to produce substantial gains and there is no assurance that the Fund will have continued access to profitable IPOs. As Fund assets grow, the impact of IPO investments on performance may decline. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A and C shares are 2.27% and 3.02%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that the total ordinary operating expenses do not exceed 1.95% and 2.70% for Class A and C shares, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Global Technology Fund

Over the third quarter of 2010 the Technology market outperformed the general equity markets as both macroeconomic and company-specific information continued to surprise on the upside. During the final quarter of the year, the Technology sector outperformed the rise in general equity markets, benefitting from the ongoing expectations of a second phase of quantitative easing (QE2) from central banks and relatively strong quarterly results in the US. However, as macroeconomic concerns regarding the debt crisis in peripheral Europe came to the fore, enthusiasm for the Technology sector was somewhat dampened despite continued healthy quarterly results and economic data out of the US and around the globe. Markets generally had a lackluster start to 2011, however, the Technology sector did manage to outperform the broader market.

| Global Technology Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Apple, Inc. | 4.5 | |

| HTC Corp. | 3.4 | |

| QUALCOMM, Inc. | 3.0 | |

| Adobe Systems, Inc. | 3.0 | |

| Accenture plc, Class A | 2.9 | |

| Priceline.com, Inc. | 2.9 | |

| Oracle Corp. | 2.8 | |

| Microsoft Corp. | 2.8 | |

| Google, Inc., Class A | 2.8 | |

| Cognizant Technology Solutions Corp. | 2.8 | |

For the reporting period ended January 31, 2011, the Fund returned 25.59% (Class A shares at NAV) versus the benchmark, the MSCI AC World IT Index, which posted a return of 19.82%. The Fund benefited from the continued growth of the smartphone market via stocks such as HTC, handset manufacturer, and Skyworks, the supplier of power amplifiers into mobile devices. Internet retail stocks Amazon and Priceline also performed well. The portfolio was negatively impacted by holdings in the Solar sector, namely First Solar and JA Solar, where continued concerns on government subsidies in 2011 outweighed otherwise positive industry trends. Very disappointing guidance from Cisco caused the stock to underperform as the firm reset growth expectations downward and talked of challenging conditions, particularly in the public sector.

The Fund has maintained its exposure to those areas we believe offer the most attractive secular growth, namely, e-commerce, online advertising, data growth, connectivity and large cap value.

The Fund bought a stake in MakeMyTrip.com, the Indian online travel company and Teradata the US data warehousing solutions provider. The Fund bought into Taiwanese handset manufacturer HTC in place of Research In Motion as it has made encouraging inroads into the US market and is becoming the leading handset on the Android operating platform. The Fund initiated new positions in IT security provider, Checkpoint; telecommunications testing business, Spirent; PC and notebook manufacturer ASUSTek and Naspers, a South African based holding company with global interests in a range of media and internet businesses. Sales included First Solar after further evidence of pressures on the Solar sector; Ericsson due to concerns over slowing US wireless spending; Intel on concerns over their microchip architecture and Cisco and Autonomy due to concerns over their growth potential.

We remain cautiously optimistic on the outlook for equities in general and the Technology sector in particular. We continue to believe that the Technology sector is well placed to outperform relative to the rest of the economy as corporate spending continues to recover, prompting investment in technology. There are also a number of product cycles ongoing in both the corporate and consumer segments that should support growth.

Global Technology Fund

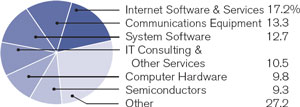

| Portfolio composition by country | | Portfolio composition by industry |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | Five | | inception | |

| At NAV | | symbol | | months | | year | | years* | | years* | | (8/31/01)* | |

| Class A | | | HFGAX | | | 25.59 | % | | 36.25 | % | | 10.54 | % | | 8.49 | % | | 8.84 | % |

| Class B | | | HFGBX | | | 25.10 | | | 35.12 | | | 9.70 | | | 7.66 | | | 8.20 | |

| Class C | | | HFGCX | | | 25.17 | | | 35.22 | | | 9.72 | | | 7.68 | | | 8.05 | |

| Class I** | | | HFGIX | | | 25.74 | | | 36.47 | | | 10.72 | | | 8.60 | | | 8.90 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 18.38 | % | | 28.38 | % | | 8.39 | % | | 7.22 | % | | 8.16 | % |

| Class B | | | | | | 20.10 | | | 31.12 | | | 8.86 | | | 7.51 | | | 8.20 | |

| Class C | | | | | | 24.17 | | | 35.22 | | | 9.72 | | | 7.68 | | | 8.05 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 19.82 | % | | 23.33 | % | | 4.93 | % | | 4.13 | % | | 3.94 | % |

| S&P 500 | | | | | | 17.93 | | | 22.19 | | | -0.05 | | | 2.23 | | | 3.32 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.64%, 2.39%, 2.39% and 1.39%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The MSCI AC World Info Tech Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

International Opportunities Fund

The final quarter of 2010 saw the reemergence of concerns about European debt as well as rising inflation in many Asian economies, which led to tightening of monetary policies. By contrast, economic statistics in Germany and the US improved. The key to the markets was when Ben Bernanke of the Federal Reserve announced a second round of quantitative easing (QE2) and the markets performed reasonably well from there.

| International Opportunities Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Essar Energy, Ltd. | 3.2 | |

| Alstom S.A. | 3.1 | |

| Tesco plc | 3.0 | |

| SAP AG | 3.0 | |

| Vivendi Universal S.A. | 3.0 | |

| Siemens AG | 2.8 | |

| AXA S.A. | 2.8 | |

| Alcatel-Lucent | 2.7 | |

| Deutsche Post AG | 2.7 | |

| BP plc | 2.6 | |

In Europe the news from Germany, Europe’s largest economy, showed that business confidence rose to its highest level since 1991, and Germany’s unemployment rate fell for the seventeenth straight month in November, reaching its lowest rate since 1992. In the UK, credible plans to reduce the budget deficit were announced, which gave investors some confidence.

Elsewhere, Japan made positive gains after the yen finally stopped rising. China continued to disappoint relative to the rest of Asia, primarily as a result of the strong measures Chinese policymakers are enforcing to curb inflation. We believe that these are necessary actions that the rest of the region will have to employ sooner or later to cool possibly overheated markets.

For the reporting period ended January 31, 2011, the Fund returned 12.92% (Class A Shares at NAV) versus the benchmark, MSCI EAFE Index, which posted a return of 16.20%. By sector, the underweight in Financials and Materials detracted from returns offsetting gains in Information Technology, Consumer Discretionary and Energy. By region, returns in Asia, primarily the Fund’s overweight in China, detracted from the positive returns in Europe.

Stock selection was strong in the European sub-portfolios where Volkswagen, Essar Energy, Siemens, BP and HeidlebergCement all contributed positively to performance. Companies that had the most drag on performance were ICICI Bank, Cisco Systems, PTT Public, and Capita Group.

The Fund made a significant allocation change during January, pulling approximately $100 million of the Asia Pacific sub-portfolio and redistributing it primarily to Japan. For the time being, the combination of rising inflation and tightening monetary policy in Asia is not conducive to strong markets, thus we prefer developed markets over emerging markets for next few months.

There is evidence that the US economy is beginning to improve and may be stronger than had been anticipated this year. We believe Japan may be a significant beneficiary of that improvement. Though tight fiscal policy is causing headwinds in Europe, the strong export sector is helping to keep Europe aloft.

Overall the emerging markets story is attractive in the long term, however inflation is rising strongly and the monetary authorities are reacting by pushing up interest rates. This is a necessary action to curb inflation but may be a headwind for emerging markets in the near term.

As far as developed markets are concerned, corporate earnings growth may experience another reasonable year in 2011 and monetary policy in western markets may remain loose. This backdrop should be a positive one for stock markets.

International Opportunities Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | Five | | inception | |

| At NAV | | symbol | | months | | year | | years* | | years* | | (8/31/01)* | |

| Class A | | | HFOAX | | | 12.92 | % | | 12.45 | % | | -1.59 | % | | 3.98 | % | | 11.15 | % |

| Class B | | | HFOBX | | | 12.44 | | | 11.58 | | | -2.32 | | | 3.20 | | | 10.47 | |

| Class C | | | HFOCX | | | 12.46 | | | 11.59 | | | -2.34 | | | 3.20 | | | 10.33 | |

| Class R** | | | HFORX | | | 12.69 | | | 12.16 | | | -1.83 | | | 3.73 | | | 10.88 | |

| Class I*** | | | HFOIX | | | 13.01 | | | 12.72 | | | -1.42 | | | 4.09 | | | 11.21 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 6.40 | % | | 5.98 | % | | -3.51 | % | | 2.76 | % | | 10.45 | % |

| Class B | | | | | | 7.44 | | | 7.58 | | | -3.38 | | | 3.02 | | | 10.47 | |

| Class C | | | | | | 11.46 | | | 11.59 | | | -2.34 | | | 3.20 | | | 10.33 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI EAFE Index | | | | | | 16.20 | % | | 15.87 | % | | -2.72 | % | | 2.19 | % | | 6.67 | % |

* Average annual return.

** Class R shares commenced operations on September 30, 2005. The performance for Class R shares for the period prior to September 30, 2005 is based on the performance of Class A shares, adjusted for the higher expenses applicable to R shares. Class R shares are not subject to a front-end sales charge but are subject to a distribution fee of 0.50%.

*** Class I shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Class R shares have no front-end sales charge or CDSC. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C, R and I shares are 1.49%, 2.24%, 2.24%, 1.74% and 1.24% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75%, 2.25% and 1.75% for Class A, B, C, R and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Japan-Asia Focus Fund

It was a polarized period for the Japanese equity market with initial stages being punctuated by a strengthening yen, lower bond yields and political disappointment despite victory by the ruling Democratic Party in the Upper House elections. It was only towards the end of the period that equities began to reverse their downward trend, which coincided with the weakening of both bond and currency markets. The equity market ended higher at the end of the period with gains in the currency enriching returns to foreign investors. Sector performance was mixed given how the profile of the market changed over the period although defensive issues tended to lag while commodity related stocks were strong.

| Japan-Asia Focus Fund | | |

| Top 10 long-term holdings | | |

| | | |

| | As a percentage | |

| Security | of net assets | |

| Mitsubishi UFJ Financial Group, Inc. | 4.6 | |

| INPEX Corp. | 3.8 | |

| Yamato Holdings Co., Ltd. | 3.6 | |

| Shin-Etsu Chemical Co., Ltd. | 3.5 | |

| Canon, Inc. | 3.5 | |

| Yamada Denki Co., Ltd. | 3.4 | |

| Sumitomo Mitsui Financial Group, Inc. | 3.4 | |

| Keyence Corp. | 3.2 | |

| Rakuten, Inc. | 3.2 | |

| Daiwa House Industry Co., Ltd. | 3.1 | |

For the reporting period ended January 31, 2011, the Fund returned 12.79% (Class A Shares at NAV) versus the benchmark MSCI Japan Index, which posted a return of 14.80%. There were a number of holdings in the portfolio that performed strongly. Murata Manufacturing, Credit Saison and INPEX were among the strongest gainers each for specific reasons; the price action being reflective of the diverse performance within the market. Several positions lagged with a number even falling in absolute terms including Benesse, Nintendo and Yamada Denki. Poor performance tended to emanate from the more defensive areas of the market where the Fund had already cut back exposure.

The Fund had moved to a more aggressive position during the early stages of the period in anticipation that the correction in the stock market had run its course. As other equity markets began to recover the expectation for Japan to follow suit looked promising.

While this move proved premature as the market initially failed to pick up, the Fund performed strongly once equities finally began to rise although by not enough to catch the overall market return. There were a number of individual stock changes to the portfolio. Complete sales included MS&AD and Xebio as the former faces a demanding 3-way merger hurdle whilst the latter faces a stagnant domestic sports environment. New positions included Tokio Marine where the company is competently expanding overseas and Rakuten given the company’s dominant position in the growing domestic marketplace. A position in Mitsui OSK has recently been established in anticipation of a recovery in shipping rates, which have plummeted over the past several months.

The recovery in Japan has been slow compared to the rest of Asia although the recent curtailment in currency appreciation and stirrings in domestic activity are encouraging. While global activity continues to expand the immediate outlook for Japanese equities should be viewed in a positive manner and any rise in inflationary expectations elsewhere should alleviate deflationary concerns at home. The prospect of policy normalization overseas should further the cause for Japan, which did not avail from the stimulatory measures so effectively employed elsewhere. The market remains cheap despite the recent rally and economic momentum should propel investor interest from current levels.

Japan-Asia Focus Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of January 31, 2011

| | | | | | | | | | | | | Since | |

| | | NASDAQ | | Six | | One | | Three | | Five | | inception | |

| At NAV | | symbol | | months | | year | | years* | | years* | | (1/31/06)* | |

| Class A | | | HFJAX | | | 12.79 | % | | 15.30 | % | | -1.87 | % | | -4.18 | % | | -4.18 | % |

| Class C | | | HFJCX | | | 12.18 | | | 14.42 | | | -2.59 | | | -4.89 | | | -4.89 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 6.29 | % | | 8.67 | % | | -3.79 | % | | -5.31 | % | | -5.31 | % |

| Class C | | | | | | 11.18 | | | 14.42 | | | -2.59 | | | -4.89 | | | -4.89 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Japan Index | | | | | | 14.80 | % | | 13.58 | % | | -2.92 | % | | -3.26 | % | | -3.26 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. The Fund may invest in shares of companies through initial public offerings (IPOs). IPOs have the potential to produce substantial gains and there is no assurance that the Fund will have continued access to profitable IPOs. As Fund assets grow, the impact of IPO investments on performance may decline. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Class A and C shares are 2.04% and 2.79%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, and 2.75% for Class A and C shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Japan Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance in Japan. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | (Unaudited) |

Emerging Markets Opportunities Fund

January 31, 2011

| | Shares | | | | | Value (note 2) | |

| | | | | | | | |

| | Common Stocks - 87.53% | | | |

| | | | | | | | |

| | | | Australia - 2.01% | | | | |

| | 150,000 | | Cape Lambert | | | | |

| | | | Resources, Ltd. | | $ | 91,184 | |

| | | | | | | | |

| | | | Brazil - 9.88% | | | | |

| | 2,600 | | Banco do Brasil S.A. | | | 46,418 | |

| | 3,200 | | Banco Santander Brasil | | | | |

| | | | S.A., ADS | | | 37,120 | |

| | 2,400 | | Cosan, Ltd., Class A | | | 31,152 | |

| | 3,300 | | Diagnosticos da | | | | |

| | | | America S.A. | | | 40,088 | |

| | 2,200 | | Gol Linhas Aereas | | | | |

| | | | Inteligentes S.A., ADR | | | 31,856 | |

| | 3,400 | | Hypermarcas S.A. * | | | 40,467 | |

| | 600 | | NII Holdings, Inc. * | | | 25,188 | |

| | 6,000 | | PDG Realty S.A. | | | 33,186 | |

| | 1,300 | | Petroleo Brasileiro | | | | |

| | | | S.A., ADR | | | 47,749 | |

| | 2,300 | | Porto Seguro S.A. * | | | 35,874 | |

| | 2,300 | | Vale S.A., ADR | | | 80,109 | |

| | | | | | | 449,207 | |

| | | | | | | | |

| | | | Chile - 0.65% | | | | |

| | 2,200 | | Quadra FNX Mining, Ltd. * | | | 29,660 | |

| | | | | | | | |

| | | | China - 14.11% | | | | |

| | 120,000 | | Air China, Ltd., Class H * | | | 123,592 | |

| | 3,000 | | Ctrip.com International, | | | | |

| | | | Ltd., ADR * | | | 123,480 | |

| | 76,000 | | Dongfeng Motor Group Co., | | | | |

| | | | Ltd., Class H | | | 134,519 | |

| | 5,886 | | Perfect World Co., Ltd. * | | | 136,673 | |

| | 12,500 | | Ping An Insurance (Group) Co. | | | | |

| | | | of China, Ltd., Class H | | | 123,851 | |

| | | | | | | 642,115 | |

| | | | | | | | |

| | | | Columbia - 1.03% | | | | |

| | 1,200 | | Petrominerales, Ltd. | | | 46,785 | |

| | | | | | | | |

| | | | Hong Kong – 5.41% | | | | |

| | 51,000 | | CNOOC, Ltd. | | | 112,641 | |

| | 54,000 | | Sands China, Ltd. * | | | 133,396 | |

| | | | | | | 246,037 | |

| | | | | | | | |

| | | | India - 2.64% | | | | |

| | 2,773 | | ICICI Bank, Ltd., ADR | | | 120,182 | |

| | | | | | | | |

| | | | Indonesia - 2.30% | | | | |

| | 197,500 | | PT Adaro Energy Tbk | | | 49,113 | |

| | 84,500 | | PT Bank Mandiri | | | 55,568 | |

| | | | | | | 104,681 | |

| | Shares | | | | | Value (note 2) | |

| | | | Iraq - 1.63% | | | | |

| | 29,150 | | Gulf Keystone | | | | |

| | | | Petroleum, Ltd. * | | $ | 74,243 | |

| | | | | | | | |

| | | | Kazakhstan - 3.05% | | | | |

| | 292,490 | | International | | | | |

| | | | Petroleum, Ltd. * | | | 69,955 | |

| | 5,600 | | Zhaikmunai LP, GDR * | | | 68,712 | |

| | | | | | | 138,667 | |

| | | | | | | | |

| | | | Korea - 10.87% | | | | |

| | 763 | | Hyundai Motor Co. | | | 121,802 | |

| | 3,668 | | LG Display Co., Ltd. | | | 124,796 | |

| | 674 | | NHN Corp. * | | | 120,218 | |

| | 2,888 | | Shinhan Financial Group | | | | |

| | | | Co., Ltd. * | | | 127,749 | |

| | | | | | | 494,565 | |

| | | | | | | | |

| | | | Malaysia - 1.12% | | | | |

| | 24,200 | | SP Setia Berhad | | | 50,748 | |

| | | | | | | | |

| | | | Mexico - 1.94% | | | | |

| | 850 | | Fomento Economico Mexicano, | | | | |

| | | | S.A.B de C.V. ADR | | | 45,109 | |

| | 1,800 | | Grupo Televisa S.A., ADR * | | | 43,308 | |

| | | | | | | 88,417 | |

| | | | | | | | |

| | | | Poland - 1.80% | | | | |

| | 3,565 | | Central European | | | | |

| | | | Distribution Corp. * | | | 81,781 | |

| | | | | | | | |

| | | | Singapore – 2.84% | | | | |

| | 45,000 | | Noble Group, Ltd. | | | 76,682 | |

| | 8,000 | | Singapore Exchange, Ltd. | | | 52,904 | |

| | | | | | | 129,586 | |

| | | | | | | | |

| | | | South Africa - 11.27% | | | | |

| | 13,900 | | African Minerals, Ltd. * | | | 110,215 | |

| | 91,500 | | African Petroleum | | | | |

| | | | Corp., Ltd. * | | | 86,625 | |

| | 35,370 | | Hummingbird | | | | |

| | | | Resources plc * | | | 92,918 | |

| | 29,750 | | Ncondezi Coal Co. * | | | 98,170 | |

| | 120,000 | | Paragon Diamonds, Ltd. * | | | 74,006 | |

| | 18,317 | | Petra Diamonds, Ltd. * | | | 50,760 | |

| | | | | | | 512,694 | |

See Notes to Financial Statements.

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

Emerging Markets Opportunities Fund

January 31, 2011 (continued)

| | Shares | | | | | Value (note 2) | |

| | | | | | | | |

| | | | Taiwan - 7.16% | | | | |

| | 18,700 | | Advanced Semiconductor | | | | |

| | | | Engineering, Inc., ADR | | $ | 114,444 | |

| | 8,000 | | MediaTek, Inc. | | | 107,969 | |

| | 129,000 | | Yuanta Financial Holding | | | | |

| | | | Co., Ltd. | | | 103,448 | |

| | | | | | | 325,861 | |

| | | | | | | | |

| | | | Thailand - 2.27% | | | | |

| | 10,300 | | Bangkok Bank Public | | | | |

| | | | Co., pcl | | | 50,175 | |

| | 4,900 | | PTT pcl | | | 53,131 | |

| | | | | | | 103,306 | |

| | | | | | | | |

| | | | Ukraine - 2.06% | | | | |

| | 4,950 | | Avangardco Investments | | | | |

| | | | Public, Ltd. * | | | 93,802 | |

| | | | | | | | |

| | | | United Kingdom - 3.49% | | | | |

| | 76,650 | | Borders & Southern | | | | |

| | | | Petroleum * | | | 77,353 | |

| | 13,700 | | Inchcape plc * | | | 81,615 | |

| | | | | | | 158,968 | |

| | | | | | | | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $4,025,494) | | | 3,982,489 | |

| | | | | | | | |

| | Warrants - 5.44% | | | |

| | | | | | | | |

| | | | India - 5.44% | | | | |

| | 9,178 | | Tata Steel, Ltd. | | | | |

| | | | Expires (12/21/15) (a) | | | 127,207 | |

| | 4,433 | | Maruti Suzuki India, Ltd. | | | | |

| | | | Expires (12/21/15) (a) | | | 120,334 | |

| | | | | | | | |

| | | | Total Warrants | | | | |

| | | | (Cost $274,642) | | | 247,541 | |

| | | | | | | | |

| | | | Total Long Term Investments | | | | |

| | | | (Cost $4,300,136) | | | 4,230,030 | |

| | | | | | | | |

| | Short Term Investment - 4.55% | | | |

| | 207,229 | | Fidelity Institutional Treasury | | | | |

| | | | Portfolio | | | 207,229 | |

| | | | | | | | |

| | | | Total Short Term Investment | | | | |

| | | | (Cost $207,229) | | | 207,229 | |

| | | | | | | | |

| | Total Investments - 97.52% | | | |

| | | | (Cost $4,507,365) | | | 4,437,259 | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Net Other Assets and | | | |

| | | | Liabilities – 2.48% | | $ | 112,819 | |

| | | | | | | | |

| | Total Net Assets – 100.00% | $ | 4,550,078 | |

| * | | Non income producing security |

| (a) | | This security has been deemed illiquid in accordance to the policies and procedures adopted by the Board of Trustees. |

| ADR | | American Depositary Receipts |

| ADS | | American Depositary Shares |

| GDR | | Global Depositary Receipts |

Other Information:

| Industry concentration as | % of net |

| a percentage of net assets: | assets |

| Oil & Gas Exploration & Production | 11.79 | % |

| Diversified Banks | 9.60 | |

| Automobile Manufacturers | 5.64 | |

| Diversified Capital Markets | 5.44 | |

| Precious Metals & Minerals | 5.17 | |

| Semiconductors | 4.89 | |

| Steel | 3.77 | |

| Airlines | 3.42 | |

| Coal & Consumable Fuels | 3.24 | |

| Home Entertainment Software | 3.00 | |

| Casinos & Gaming | 2.93 | |

| Packaged Foods & Meats | 2.75 | |

| Electronic Components | 2.74 | |

| Life & Health Insurance | 2.72 | |

| Hotels, Resorts & Cruise Lines | 2.71 | |

| Internet Software & Services | 2.64 | |

| Investment Banking & Brokerage | 2.27 | |

| Integrated Oil & Gas | 2.22 | |

| Gold | 2.04 | |

| Distillers & Vintners | 1.80 | |

| Distributors | 1.79 | |

| Trading Companies & Distributors | 1.69 | |

| Specialized Finance | 1.16 | |

| Real Estate Development | 1.12 | |

| Soft Drinks | 0.99 | |

| Broadcasting | 0.95 | |

| Personal Products | 0.89 | |

| Health Care Services | 0.88 | |

| Multi-line Insurance | 0.79 | |

| Homebuilding | 0.73 | |

| Diversified Metals & Mining | 0.65 | |

| Wireless Telecommunication Services | 0.55 | |

| Long Term Investments | 92.97 | |

| Short Term Investment | 4.55 | |

| Total Investments | 97.52 | |

| Net Other Assets and Liabilities | 2.48 | |

| | 100.00 | % |

See Notes to Financial Statements.

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

European Focus Fund

January 31, 2011

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Common Stocks - 95.42% | | | |

| | | | | | | | |

| | | | France - 9.00% | | | | |

| | 3,515,230 | | Alcatel-Lucent * | | $ | 11,743,423 | |

| | 196,561 | | Alstom S.A. | | | 10,970,740 | |

| | 477,825 | | AXA S.A. | | | 10,114,152 | |

| | 107,546 | | Vallourec S.A. | | | 11,682,548 | |

| | 275,000 | | Vivendi S.A. | | | 7,882,370 | |

| | | | | | | 52,393,233 | |

| | | | | | | | |

| | | | Germany - 8.10% | | | | |

| | 65,714 | | Axel Springer AG | | | 10,445,789 | |

| | 60,853 | | Brenntag AG * | | | 5,767,196 | |

| | 95,000 | | Continental AG * | | | 7,478,984 | |

| | 122,009 | | Fresenius SE & | | | | |

| | | | Co., KGaA | | | 10,637,659 | |

| | 135,509 | | HeidelbergCement AG | | | 8,855,451 | |

| | 78,928 | | Kabel Deutschland | | | | |

| | | | Holding AG * | | | 3,976,766 | |

| | | | | | | 47,161,845 | |

| | | | | | | | |

| | | | Ireland - 2.12% | | | | |

| | 141,512 | | CRH plc | | | 3,041,894 | |

| | 1,865,887 | | Ryanair Holdings plc | | | 9,288,815 | |

| | | | | | | 12,330,709 | |

| | | | | | | | |

| | | | Italy - 0.57% | | | | |

| | 316,000 | | Azimut Holding SpA | | | 3,318,437 | |

| | | | | | | | |

| | | | Kazakhstan - 4.84% | | | | |

| | 327,261 | | KazMunaiGas Exploration | | | | |

| | | | Production, GDR | | | 7,036,111 | |

| | 1,724,139 | | Zhaikmunai LP, GDR * | | | 21,155,186 | |

| | | | | | | 28,191,297 | |

| | | | | | | | |

| | | | Luxembourg - 3.93% | | | | |

| | 148,985 | | APERAM * | | | 6,109,287 | |

| | 5,437,200 | | Northland | | | | |

| | | | Resources S.A. * | | | 16,757,655 | |

| | | | | | | 22,866,942 | |

| | | | | | | | |

| | | | Netherlands - 0.43% | | | | |

| | 410,333 | | A&D Pharma Holding | | | | |

| | | | N.V., GDR (a) (b) | | | 2,528,134 | |

| | 414,902 | | Amtel Vredestein N.V., | | | | |

| | | | GDR (a) (b) * | | | — | |

| | | | | | | 2,528,134 | |

| | | | | | | | |

| | | | Norway - 0.55% | | | | |

| | 2,998,448 | | Sevan Marine ASA * | | | 3,174,760 | |

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | | | Portugal - 1.96% | | | | |

| | 557,532 | | Galp Energia, SGPS, S.A., | | | | |

| | | | B Shares | | $ | 11,381,476 | |

| | | | | | | | |

| | | | Spain - 2.13% | | | | |

| | 812,278 | | Grifols S.A. | | | 12,378,014 | |

| | | | | | | | |

| | | | Switzerland - 2.22% | | | | |

| | 304,249 | | GAM Holding, Ltd. * | | | 5,446,830 | |

| | 48,950 | | Roche Holding AG | | | 7,446,208 | |

| | | | | | | 12,893,038 | |

| | | | | | | | |

| | | | United Kingdom - 59.57% | | | | |

| | 700,000 | | Aero Inventory plc (a) (b) | | | — | |

| | 2,657,838 | | Afren plc * | | | 6,181,830 | |

| | 2,650,000 | | African Minerals, Ltd. * | | | 21,012,273 | |

| | 1,455,694 | | Aviva plc | | | 10,325,229 | |

| | 1,771,307 | | BAE Systems plc | | | 9,703,802 | |

| | 6,390,000 | | Borders & Southern | | | | |

| | | | Petroleum * | | | 6,448,569 | |

| | 2,297,116 | | BP plc | | | 17,840,717 | |

| | 1,294,648 | | British Sky Broadcasting | | | | |

| | | | Group plc | | | 15,657,435 | |

| | 3,236,119 | | BT Group plc | | | 9,097,532 | |

| | 4,350,000 | | Caparo Energy, Ltd. (a) * | | | 8,291,979 | |

| | 2,848,167 | | Cobham plc | | | 9,580,909 | |

| | 3,018,958 | | Essar Energy, Ltd. * | | | 25,122,600 | |

| | 3,183,689 | | European Goldfields, Ltd. * | | | 48,830,524 | |

| | 1,975,813 | | Exillon Energy plc * | | | 12,691,477 | |

| | 2,305,861 | | FirstGroup plc | | | 13,817,924 | |

| | 2,000,000 | | Game Group plc | | | 2,146,480 | |

| | 8,402,298 | | Gartmore Group, Ltd. * | | | 13,459,225 | |

| | 4,148,825 | | Gulf Keystone | | | | |

| | | | Petroleum, Ltd. * | | | 10,566,818 | |

| | 1,285,894 | | ICAP plc | | | 11,050,880 | |

| | 190,000 | | Imperial Tobacco Group plc | | | 5,429,632 | |

| | 6,832,267 | | ITV plc * | | | 8,503,698 | |

| | 2,467,498 | | Juridica Investments, | | | | |

| | | | Ltd. (a) * | | | 4,150,191 | |

| | 4,449,500 | | Kalahari Minerals plc * | | | 16,713,832 | |

| | 850,000 | | London Mining plc * | | | 4,956,125 | |

| | 1,203,455 | | National Grid plc | | | 10,650,846 | |

| | 1,778,212 | | Resolution, Ltd. | | | 7,445,795 | |

| | 156,588 | | Songbird Estates plc * | | | 351,162 | |

| | 1,782,111 | | Tesco plc | | | 11,495,778 | |

| | 2,400,000 | | The Sage Group plc | | | 11,344,946 | |

| | 193,918 | | Vedanta Resources plc | | | 7,057,460 | |

| | 2,304,642 | | William Hill plc | | | 6,700,421 | |

| | | | | | | 346,626,089 | |

| | | | | | | | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $452,857,252) | | | 555,243,974 | |

See Notes to Financial Statements.

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

European Focus Fund

January 31, 2011 (continued)

| | | | | | | Value | |

| | Shares | | | | | (note 2) | |

| | | | | | | | |

| | Preferred Stock - 1.28% | | | |

| | | | | | | | |

| | | | Germany - 1.28% | | | | |

| | 46,142 | | Volkswagen AG | | $ | 7,454,689 | |

| | | | | | | | |

| | | | Total Preferred Stock | | | | |

| | | | (Cost $4,122,298) | | | 7,454,689 | |

| | | | | | | | |

| | REITS - 0.98% | | | |

| | | | | | | | |

| | | | United Kingdom - 0.98% | | | | |

| | 810,000 | | Shaftesbury plc | | | 5,689,533 | |

| | | | | | | | |

| | | | Total REITS | | | | |

| | | | (Cost $3,795,845) | | | 5,689,533 | |

| | | | | | | | |

| | | | Total Long Term Investments | | | | |

| | | | (Cost $460,775,395) | | | 568,388,196 | |

| | | | | | | | |

| | Options Purchased - 0.12% | | | |

| | | | | | | | |

| | Contracts | | | | | | |

| | | | | | | | |

| | | | Norway - 0.12% | | | | |

| | 1,457,000 | | Statoil ASA, Call @ $145.00 | | | | |

| | | | Expires 3/18/11 | | | 668,534 | |

| | | | | | | | |

| | | | Total Options Purchased | | | | |

| | | | (Cost $930,193) | | | 668,534 | |

| | | | | | | | |

| | Shares | | | | | | |

| | | | | | | | |

| | Short Term Investment - 2.53% | | | |

| | | | | | | | |

| | 14,736,829 | | Fidelity Institutional Treasury | | | | |

| | | | Portfolio | | | 14,736,829 | |

| | | | | | | | |

| | | | Total Short Term Investment | | | | |

| | | | (Cost $14,736,829) | | | 14,736,829 | |

| | | | | | | | |

| | Total Investments - 100.33% | | | |

| | | | (Cost $476,442,417) | | | 583,793,559 | |

| | | | | | | | |

| | Net Other Assets and | | | |

| | | | Liabilities - (0.33)% | | | (1,919,022 | ) |

| | | | | | | | |

| | Total Net Assets - 100.00% | | $ | 581,874,537 | |

| * | | Non income producing security |

| (a) | | This security has been deemed illiquid in accordance to the policies and procedures adopted by the Board of Trustees. |

| (b) | | Fair valued at January 31, 2011 as determined in good faith using procedures adopted by Board of Trustees. |

| GDR | | Global Depositary Receipts |

| REIT | | Real Estate Investment Trust |

Other Information:

| Industry concentration as | % of net |

| a percentage of net assets: | assets |

| Oil & Gas Exploration & Production | 15.33 | % |

| Gold | 8.39 | |

| Diversified Metals & Mining | 6.96 | |

| Integrated Oil & Gas | 5.15 | |

| Asset Management & Custody Banks | 3.82 | |

| Precious Metals & Minerals | 3.61 | |

| Multi-line Insurance | 3.51 | |

| Cable & Satellite | 3.37 | |

| Aerospace & Defense | 3.32 | |

| Trucking | 2.38 | |

| Biotechnology | 2.13 | |

| Construction Materials | 2.04 | |

| Communications Equipment | 2.02 | |

| Industrial Machinery | 2.01 | |

| Food Retail | 1.98 | |

| Application Software | 1.95 | |

| Steel | 1.90 | |

| Investment Banking & Brokerage | 1.90 | |

| Heavy Electrical Equipment | 1.88 | |

| Multi-Utilities | 1.83 | |

| Health Care Equipment | 1.83 | |

| Publishing | 1.79 | |

| Airlines | 1.60 | |

| Integrated Telecommunication Services | 1.56 | |

| Broadcasting | 1.46 | |

Independent Power Producers & Energy Traders | 1.43 | |

| Movies & Entertainment | 1.35 | |

| Tires & Rubber | 1.29 | |

| Automobile Manufacturers | 1.28 | |

| Pharmaceuticals | 1.28 | |

| Life & Health Insurance | 1.28 | |

| Casinos & Gaming | 1.15 | |

| Trading Companies & Distributors | 0.99 | |

| Diversified REIT’s | 0.98 | |

| Tobacco | 0.93 | |

| Industrial Conglomerates | 0.71 | |

| Oil & Gas Equipment & Services | 0.55 | |

| Health Care Distributors | 0.43 | |

| Computer & Electronics Retail | 0.37 | |

| Real Estate Operating Companies | 0.06 | |

| Long Term Investments | 97.80 | |

| Short Term Investment | 2.53 | |

| Total Investments | 100.33 | |

| Net Other Assets and Liabilities | (0.33 | ) |

| | 100.00 | % |

See Notes to Financial Statements.

| Henderson Global Funds | Portfolio of Investments (Unaudited) |

Global Equity Income Fund

January 31, 2011

| | | | | | | Value | |