Rockefeller Equity Allocation Fund

Rockefeller Core Taxable Bond Fund

Rockefeller Intermediate Tax Exempt

National Bond Fund

Rockefeller Intermediate Tax Exempt

New York Bond Fund

Semi-Annual Report

May 31, 2021

Investment Adviser

Rockefeller & Co. LLC

45 Rockefeller Plaza, 5th Floor

New York, New York 10111

Table of Contents

LETTER TO SHAREHOLDERS | | | 3 |

| | | | |

EXPENSE EXAMPLES | | | 7 |

| | | | |

INVESTMENT HIGHLIGHTS | | | 9 |

| | | | |

SCHEDULES OF INVESTMENTS | | | 19 |

| | | | |

STATEMENTS OF ASSETS AND LIABILITIES | | | 38 |

| | | | |

STATEMENTS OF OPERATIONS | | | 40 |

| | | | |

STATEMENTS OF CHANGES IN NET ASSETS | | | 42 |

| | | | |

FINANCIAL HIGHLIGHTS | | | 46 |

| | | | |

NOTES TO FINANCIAL STATEMENTS | | | 54 |

| | | | |

STATEMENT REGARDING LIQUIDITY RISK MANAGEMENT | | | 65 |

| | | | |

NOTICE OF PRIVACY POLICY & PRACTICES | | | 66 |

| | | | |

ADDITIONAL INFORMATION | | | 67 |

Dear Shareholder:

Over the past six months, global equities, as represented by the MSCI ACWI Index, returned 16.10%. As countries across the world raced to distribute vaccines, investors pivoted with the same haste out of both ‘stay-at-home’ and less cyclical stocks in favor of more economically sensitive Energy and Financials sectors. The results of the Georgia State Senate run-off elections added fuel to the fire as investors welcomed the outcome’s potential for enabling additional stimulus, with control of spending now under one political party. Increasing globalization has clearly created certain challenges that have become more visible as we surpassed the one-year mark of the COVID-19 pandemic. There is now a heightened sense of fragility given the interconnectedness of global supply chains, as recently evidenced by the ability of a mere gust of wind and a large container ship in the Suez Canal to shut down one of the world’s largest trade routes and disrupt multiple global supply chains. Perhaps fiscal and monetary stimulus cannot solve all the world’s problems.

Global Economy

The rapid rollout of vaccinations in the U.S. and parts of Europe has led to some level of normalization, with Asia now feeling the impact of a slower vaccine rollout, and contending with the Delta variant, which is hampering a full reopening of economies. This has led to divergence in terms of economic growth, and performance of equity markets too, as Asian markets lagged European and U.S. markets. The world is also contending with heightened inflationary pressures, driven in part by the significant stimulus efforts to temper the negative impact from the pandemic, but also supply chain issues, and labor shortages. The bond markets have largely brushed this off, with the rise in inflation was dismissed as ‘transitory’ in nature.

Rockefeller Core Taxable Bond Fund:

For the six months ended May 31, 2021, the Institutional Class shares of the Rockefeller Core Taxable Bond Fund had a return of -2.40% (net), underperforming the Bloomberg Barclays Aggregate Bond Index benchmark, which returned -2.16%. The Fund’s modestly longer duration profile detracted from relative returns along with sector overweight to corporates. However, the sector overweight to taxable municipals contributed positively to relative performance.

Rockefeller Intermediate Tax-Exempt National Bond Fund:

For the six months ended May 31, 2021, the Institutional Class shares of the Rockefeller Intermediate Tax-Exempt National Bond Fund had a return of +0.69% (net), while the Bloomberg Barclays Managed Money Short/Intermediate Municipal Index returned -0.07%. A longer maturity profile and duration was a positive contributor along with the Fund’s overweight exposure to lower rated credits.

Rockefeller Intermediate Tax-Exempt New York Bond Fund:

For the six months ended May 31, 2021, the Institutional Class shares of the Rockefeller Intermediate Tax-Exempt New York Bond Fund had a return of +1.35% (net), while the Bloomberg Barclays Managed Money Short/Intermediate Municipal Index returned -0.07%. A longer maturity profile and duration was a positive contributor along with the Fund’s overweight exposure to lower rated credits.

Rockefeller Equity Allocation Fund:

For the six months ended May 31, 2021, the Institutional Class shares of the Rockefeller Equity Allocation Fund returned +16.11% (net) vs. 16.10% for the MSCI ACWI Index. Industrials was the largest contributing sector, while shares of Deutsche Post were the largest contributor: the company has benefitted from strong business to consumer volumes, in addition to higher pricing due to tightness in the availability of cargo space. Real Estate was the largest detracting sector, as Vonovia, a German residential landlord,

detracted from relative performance. The shares were negatively impacted by the company announcing a planned acquisition of their largest competitor, Deutsche Wohnen. We continue to hold the shares as we believe there is still a long-term growth opportunity for the company to raise rents through renovation of their underlying properties.

Looking Forward

We believe the rotation out of value stocks and into growth will reverse. We remain positioned in stocks that are positively exposed to rising inflation and higher rates, along with exposure to names we believe stand to profit from new infrastructure initiatives, especially those required to transition to a lower carbon economy. This should benefit a number of our Industrial holdings, where an uptick in infrastructure spending could result in meaningful earnings growth. The positive evidence surrounding the efficacy of the vaccine against serious illness should also benefit several of our holdings as economies reopen, including some of our Asia domiciled companies, and our life insurance holdings.

Federal Reserve Policy and the Bond Market:

As the world slowly emerges from the COVID crisis, the aftershock to the global economy is becoming increasingly evident, as cross currents have become more apparent across geographical regions. Overall, the global economy remains on a path to recovery, but the performance of individual economies is varied. The U.S. economy continues to lead other developed markets and economic data remains encouraging with growth expectations for 2021 remaining very elevated in the +6-8% range, with large fiscal stimulus and a big bounce in consumer spending driving growth as pandemic related restrictions ease. Year-over-year Inflation numbers are distorted due to the base effects from the pandemic-depressed 2020 numbers. However, the Fed views the current increase in inflation as transitory and expects it to recede as supply chain disruptions and base effect distortions ease over the next couple of quarters. Despite this view on inflation from the Fed, the FOMC at the June meeting raised its inflation forecast considerably for 2021, with most members believing the risks to inflation are skewed to the upside. Concurrently, 7 of the 18 committee members expect that the fed funds rate will be higher at the end of next year, and 13 members look for a higher fed funds rate at the end of 2023. The shift in the “dot plot” indicates that members have brought forward their expectations for an eventual tightening of monetary policy. The FOMC did maintain the current pace of asset purchases which leaves its balance sheet approximately twice as large as compared to pre-pandemic levels. However, market participants are increasingly focused on the timing of an eventual “tapering” of asset purchases. In our view, Fed policy makers have begun signaling that tapering is coming and we believe it will be formally communicated in the relatively near-term.

After a significant and rapid increase in 1Q21, long-term interest rates have moved materially lower of late as the bond market has begun to price in the view that the U.S. is past peak growth, inflation, monetary and fiscal support. Coincidentally the 10-year U.S. Treasury peaked at the end of 1Q21 at 1.74% and has now declined by approximately 40bps to yield 1.35%.

Sincerely,

David P. Harris, CFA

Chief Investment Officer

Rockefeller Asset Management

Opinions expressed are those of Rockefeller Asset Management and are subject to change, are not guaranteed and should not be considered investment advice. Rockefeller Asset Management is a division of Rockefeller & Co. LLC, the investment adviser to the Rockefeller Funds.

Must be preceded or accompanied by a current prospectus.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Funds are susceptible to adverse economic, political, tax, or regulatory changes which may magnify other risks. Income from tax-exempt funds may become subject to state and local taxes and a portion of income may be subject to the federal alternative minimum tax for certain investors. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Funds in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investing in the municipal securities market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic development. The Funds may invest in restricted securities or “private placement” transactions. Private placement securities are not registered under the Securities Act of 1933, as amended, and are subject to restrictions on resale. As such they are often both difficult to sell and to value. The Funds may invest in exchange traded funds (“ETFs”) which are subject to additional risks, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Rockefeller Intermediate Tax-Exempt New York Bond Fund is non-diversified, meaning it concentrates its assets in fewer individual holdings than a diversified fund, specifically in the State of New York issues. The Rockefeller Equity Allocation Fund is subject to small- and medium-capitalization company risks, which tend to have limited liquidity and greater price volatility than large-capitalization companies. The Rockefeller Equity Allocation Fund and Rockefeller Core Taxable Bond Fund also invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Investing in commodities may subject a Fund to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. Master limited partnerships (“MLPs”) in which the Rockefeller Equity Allocation Fund may invest are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. Earnings growth is not representative of the Fund’s future performance.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Bloomberg Barclays Aggregate Bond Index is an unmanaged index which is widely regarded as a standard for measuring U.S. investment grade bond market performance.

The Bloomberg Barclays Managed Money Short/Intermediate Index is the 1-10 year component of the Barclays Managed Money Index, which is a rules-based, market-value-weighted index engineered for the tax-exempt municipal bond market.

The MSCI All Country World Index (Net Dividends) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

One cannot invest directly in an index.

Basis point (bp) is a unit equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. The curve is used to predict changes in economic output and growth.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. See the schedule of investments for complete holdings.

Gross domestic product (“GDP”) for a country is a monetary measure of the value of all final goods and services produced by the country in a specified period.

The Rockefeller Funds are distributed by Quasar Distributors, LLC.

Rockefeller Funds

Expense Examples

(Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (12/1/20 – 5/31/21).

Actual Expenses

The first line of each of the following tables provides information about actual account values and actual expenses. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. Individual Retirement Accounts will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of exchange-traded funds or other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Examples. The Examples include, but are not limited to, management fees, fund administration fees and accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each of the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Rockefeller Funds

Expense Examples (Continued)

(Unaudited)

Rockefeller Equity Allocation Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/20 | 5/31/21 | 12/1/20 – 5/31/21* |

| Actual | $1,000.00 | $1,161.10 | $6.68 |

Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,018.75 | $6.24 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.24%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Rockefeller Core Taxable Bond Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/20 | 5/31/21 | 12/1/20 – 5/31/21* |

| Actual | $1,000.00 | $ 976.00 | $3.45 |

Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.44 | $3.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.70%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Rockefeller Intermediate Tax Exempt National Bond Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/20 | 5/31/21 | 12/1/20 – 5/31/21* |

| Actual | $1,000.00 | $1,006.90 | $3.35 |

Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.59 | $3.38 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.67%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Rockefeller Intermediate Tax Exempt New York Bond Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/20 | 5/31/21 | 12/1/20 – 5/31/21* |

| Actual | $1,000.00 | $1,013.50 | $3.92 |

Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.04 | $3.93 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Rockefeller Equity Allocation Fund

Investment Highlights

(Unaudited)

The Fund seeks to achieve its investment objective of long-term total return from capital appreciation and income by investing its assets globally in a range of equity asset classes and, to a lesser extent, in fixed-income securities, real estate and commodity linked equities (such as real estate investment trusts and master limited partnerships), and currencies. Rockefeller & Co. LLC (the “Adviser”) will allocate the Fund’s assets across asset classes taking into consideration both the Adviser’s longer-term strategic outlook as well as tactical views as to potential near-term opportunities. The Adviser considers a number of factors when making allocation decisions, including relative attractiveness among equity market capitalizations and geographic regions, inflation risks and factors that influence commodity prices.

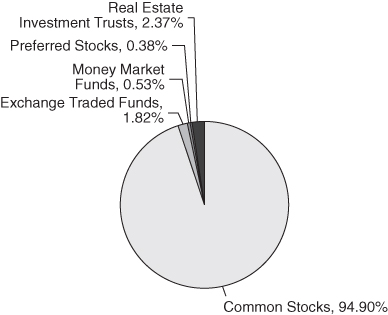

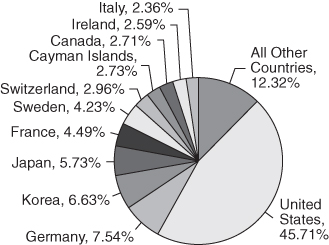

Allocation of Portfolio Holdings as of May 31, 2021*

(% of Investments)

| * | For additional details on allocation of portfolio holdings by industry, please see the Schedule of Investments. |

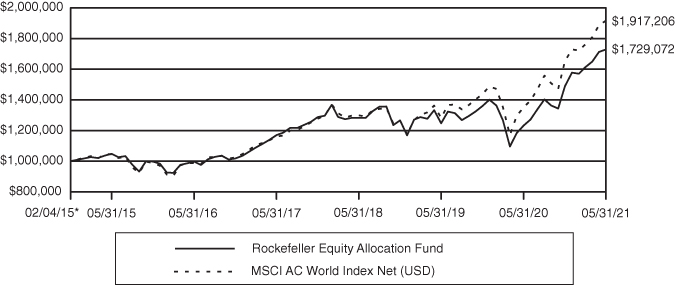

Average Annual Returns as of May 31, 2021

| | Rockefeller | MSCI All Country |

| | Equity Allocation | World Index |

| | Fund | (Net Dividends) |

| 1 Year | 40.27% | 41.85% |

| 5 Year | 11.64% | 14.18% |

| Since Inception (2/4/15) | 9.05% | 10.85% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 855-369-6209.

Continued

Rockefeller Equity Allocation Fund

Investment Highlights (Continued)

(Unaudited)

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The MSCI All Country World Index (Net Dividends) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reflect the reinvestment of dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Growth of $1,000,000 Investment

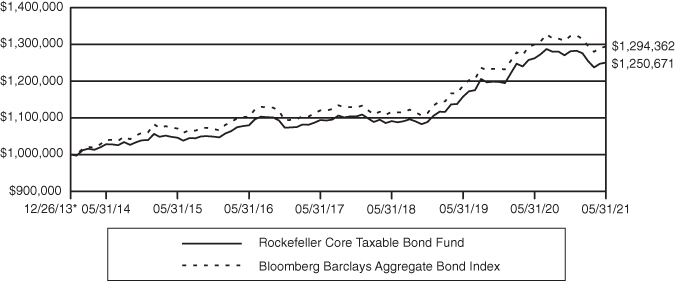

Rockefeller Core Taxable Bond Fund

Investment Highlights

(Unaudited)

The Fund seeks to achieve its investment objective to generate current income consistent with the preservation of capital by investing under normal market conditions at least 80% of its net assets (plus any borrowings for investment purposes) in taxable fixed-income securities. “Fixed-income securities” include corporate, government and municipal bonds, asset-backed and mortgage-backed securities, other investment companies and ETFs that will invest in fixed-income securities, and other fixed-income instruments. The Fund invests primarily in investment grade fixed-income securities. Investment grade securities are fixed-income securities rated in the top four ratings categories by independent rating organizations such as Standard & Poor’s Ratings Group (“S&P”) and Moody’s Investors Service, Inc. (“Moody’s”) or another nationally recognized statistical rating organization (“NRSRO”), or deemed by the Adviser to be of comparable quality. The Adviser anticipates the Fund’s weighted average duration will be more than three years but less than ten years.

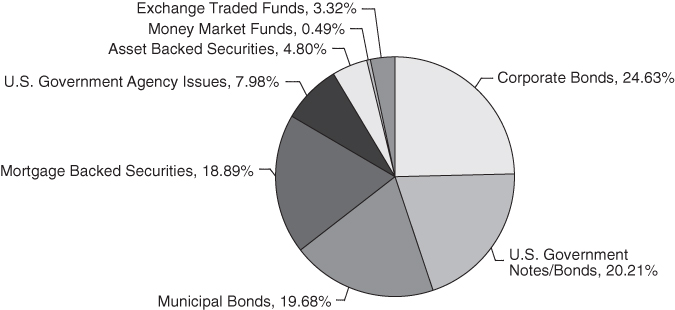

Allocation of Portfolio Holdings as of May 31, 2021

(% of Investments)

Average Annual Returns as of May 31, 2021

| | | Bloomberg |

| | Rockefeller | Barclays |

| | Core Taxable | Aggregate |

| | Bond Fund | Bond Index |

| 1 Year | -0.93% | -0.40% |

| 5 Year | 2.98% | 3.25% |

| Since Inception (12/26/13) | 3.06% | 3.53% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 855-369-6209.

Continued

Rockefeller Core Taxable Bond Fund

Investment Highlights (Continued)

(Unaudited)

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The Bloomberg Barclays Aggregate Bond Index is an unmanaged index which is widely regarded as a standard for measuring U.S. investment grade bond market performance. An index is unmanaged and cannot be invested in directly.

Growth of $1,000,000 Investment

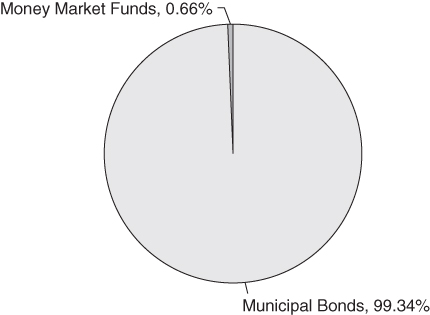

Rockefeller Intermediate Tax Exempt National Bond Fund

Investment Highlights

(Unaudited)

The Fund seeks to achieve its investment objective to generate current income that is exempt from federal personal income tax consistent with the preservation of capital by investing under normal market conditions at least 80% of its net assets (plus any borrowings for investment purposes) in municipal bonds and other fixed-income securities that generate income exempt from regular federal income tax, including the federal alternative minimum tax (“AMT”). The Fund may invest in all types of municipal bonds, including, but not limited to, general obligation bonds and industrial development bonds. The Fund may also invest in asset-backed and mortgage-backed securities, other investment companies, ETFs and the obligations of other issuers that pay interest that is exempt from regular federal income taxes. While the Fund will invest primarily in tax exempt securities, it is possible that up to 20% of the Fund’s total assets may be invested in fixed-income securities that generate income that is not exempt from regular federal income tax, including the federal AMT. The Fund invests primarily in investment grade municipal bonds and other types of fixed-income securities. Investment grade securities are fixed-income securities rated in the top four ratings categories by independent rating organizations such as S&P and Moody’s or another NRSRO, or, if unrated, deemed by the Adviser to be of comparable quality. While the Fund may invest in securities of any duration, the Adviser anticipates the weighted average duration of the Fund’s portfolio will be more than three years but less than ten years.

Allocation of Portfolio Holdings as of May 31, 2021

(% of Investments)

Continued

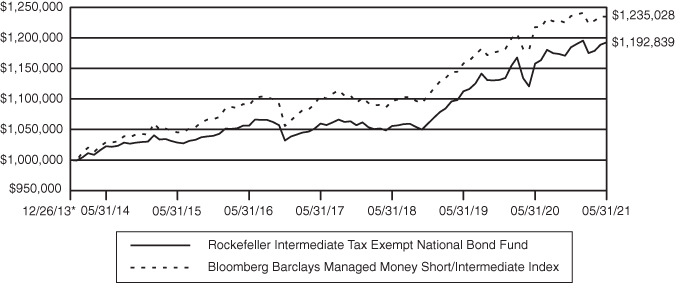

Rockefeller Intermediate Tax Exempt National Bond Fund

Investment Highlights (Continued)

(Unaudited)

Average Annual Returns as of May 31, 2021

| | Rockefeller | Bloomberg |

| | Intermediate Tax | Barclays Managed |

| | Exempt National | Money Short/ |

| | Bond Fund | Intermediate Index |

| 1 Year | 3.01% | 1.41% |

| 5 Year | 2.46% | 2.54% |

| Since Inception (12/26/13) | 2.40% | 2.88% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-369-6209.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The Bloomberg Barclays Managed Money Short/Intermediate Index is the 1-10 year component of the Barclays Managed Money Index, which is a rules-based, market-value-weighted index engineered for the tax-exempt municipal bond market.

Continued

Rockefeller Intermediate Tax Exempt National Bond Fund

Investment Highlights (Continued)

(Unaudited)

Growth of $1,000,000 Investment

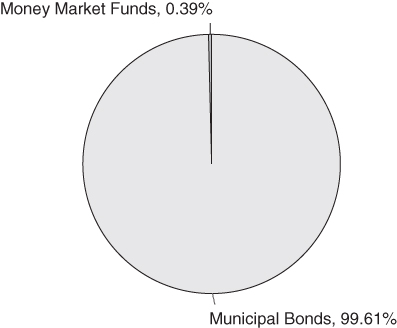

Rockefeller Intermediate Tax Exempt New York Bond Fund

Investment Highlights

(Unaudited)

The Fund seeks to achieve its investment objective to generate current income that is exempt from federal, New York State and New York City personal income tax consistent with the preservation of capital by investing under normal market conditions at least 80% of its net assets (plus any borrowings for investment purposes) in municipal bonds and other fixed-income securities that generate income exempt from regular federal, New York State and New York City personal income tax, including the federal AMT. The Fund may invest in all types of municipal bonds, including, but not limited to, general obligation bonds, industrial development bonds, and other obligations issued by the State of New York, its subdivisions, authorities, instrumentalities and corporations. The Fund may also invest in asset-backed and mortgage-backed securities, other investment companies, ETFs and the obligations of other issuers that pay interest that is exempt from regular federal and New York State and New York City personal income tax. While the Fund will invest primarily in tax exempt securities, it is possible that up to 20% of the Fund’s total assets may be invested in fixed-income securities that generate income that is not exempt from regular federal income tax, New York State and New York City personal income tax, including the federal AMT. The Fund invests primarily in investment grade fixed-income securities rated in the top four ratings categories by independent rating organizations such as S&P and Moody’s or another NRSRO, or deemed by the Adviser to be of comparable quality. While the Fund may invest in securities of any duration, the Adviser anticipates the weighted average duration of the Fund’s portfolio will be more than three years but less than ten years. The Fund is non-diversified.

Allocation of Portfolio Holdings as of May 31, 2021

(% of Investments)

Continued

Rockefeller Intermediate Tax Exempt New York Bond Fund

Investment Highlights (Continued)

(Unaudited)

Average Annual Returns as of May 31, 2021

| | Rockefeller | Bloomberg |

| | Intermediate Tax | Barclays Managed |

| | Exempt New York | Money Short/ |

| | Bond Fund | Intermediate Index |

| 1 Year | 3.65% | 1.41% |

| 5 Year | 2.20% | 2.54% |

| Since Inception (12/26/13) | 2.14% | 2.88% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 855-369-6209.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

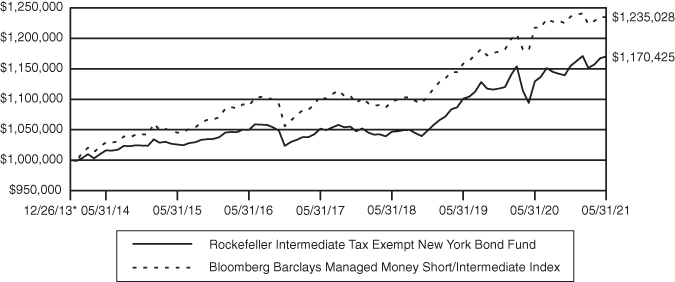

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The Bloomberg Barclays Managed Money Short/Intermediate Index is the 1-10 year component of the Barclays Managed Money Index, which is a rules-based, market-value-weighted index engineered for the tax-exempt municipal bond market.

Continued

Rockefeller Intermediate Tax Exempt New York Bond Fund

Investment Highlights (Continued)

(Unaudited)

Growth of $1,000,000 Investment

Rockefeller Equity Allocation Fund

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks – 93.66% | | | | | | |

| Air Freight & Logistics – 2.70% | | | | | | |

| Deutsche Post AG (a) | | | 33,845 | | | $ | 2,298,967 | |

| | | | | | | | | |

| | | | | | | | | |

| Application Software – 0.04% | | | | | | | | |

| Outset Medical, Inc. (b) | | | 679 | | | | 32,775 | |

| | | | | | | | | |

| | | | | | | | | |

| Auto Components – 2.64% | | | | | | | | |

| Continental AG (a) | | | 7,464 | | | | 1,106,686 | |

| Denso Corp. (a) | | | 10,900 | | | | 744,009 | |

| Gentherm, Inc. (b) | | | 2,125 | | | | 154,126 | |

| Hankook Tire & Technology Co. Ltd. (a) | | | 4,590 | | | | 198,679 | |

| Standard Motor Products, Inc. | | | 1,003 | | | | 45,155 | |

| | | | | | | | 2,248,655 | |

| | | | | | | | | |

| Banks – 10.01% | | | | | | | | |

| Comerica, Inc. | | | 1,055 | | | | 82,807 | |

| First Horizon National Corp. | | | 66,175 | | | | 1,261,957 | |

| ICICI Bank Ltd. – ADR (a)(b) | | | 85,955 | | | | 1,548,050 | |

| KB Financial Group, Inc. – ADR (a)(b) | | | 5,052 | | | | 260,127 | |

| KB Financial Group, Inc. (a) | | | 12,725 | | | | 651,975 | |

| Lloyds Banking Group PLC (a) | | | 2,044,862 | | | | 1,445,922 | |

| Oversea-Chinese Banking Corp Ltd. (a) | | | 92,400 | | | | 872,850 | |

| Svenska Handelsbanken AB (a) | | | 118,004 | | | | 1,349,290 | |

| Swedbank AB (a) | | | 57,443 | | | | 1,054,518 | |

| | | | | | | | 8,527,496 | |

| | | | | | | | | |

| Biotechnology – 3.15% | | | | | | | | |

| Alnylam Pharmaceuticals, Inc. (b) | | | 3,159 | | | | 448,546 | |

| BioMarin Pharmaceutical, Inc. (b) | | | 6,070 | | | | 469,211 | |

| Bridgebio Pharma, Inc. (b) | | | 6,449 | | | | 381,781 | |

| Ionis Pharmaceuticals, Inc. (b) | | | 10,723 | | | | 399,432 | |

| Neurocrine Biosciences, Inc. (b) | | | 4,951 | | | | 476,385 | |

| Regeneron Pharmaceuticals, Inc. (b) | | | 1,017 | | | | 510,971 | |

| | | | | | | | 2,686,326 | |

| | | | | | | | | |

| Building Products – 3.20% | | | | | | | | |

| AAON, Inc. | | | 1,251 | | | | 82,879 | |

| Carrier Global Corp. | | | 18,873 | | | | 866,837 | |

| Cie de Saint-Gobain (a) | | | 21,917 | | | | 1,471,222 | |

| Lennox International, Inc. | | | 319 | | | | 111,628 | |

| Simpson Manufacturing Co., Inc. | | | 1,603 | | | | 180,049 | |

| | | | | | | | 2,712,615 | |

| | | | | | | | | |

| Chemicals – 0.81% | | | | | | | | |

| Air Liquide SA (a) | | | 4,080 | | | | 693,871 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Commercial Services & Supplies – 0.41% | | | | | | |

| Healthcare Services Group, Inc. | | | 2,577 | | | $ | 77,284 | |

| Stericycle, Inc. (b) | | | 1,527 | | | | 119,961 | |

| Tetra Tech, Inc. | | | 1,293 | | | | 154,475 | |

| | | | | | | | 351,720 | |

| | | | | | | | | |

| Construction & Engineering – 0.19% | | | | | | | | |

| Quanta Services, Inc. | | | 1,215 | | | | 115,850 | |

| WillScot Mobile Mini Holdings Corp. (b) | | | 1,651 | | | | 47,879 | |

| | | | | | | | 163,729 | |

| | | | | | | | | |

| Construction Materials – 3.03% | | | | | | | | |

| HeidelbergCement AG (a) | | | 17,825 | | | | 1,629,185 | |

| Martin Marietta Materials, Inc. | | | 2,611 | | | | 949,490 | |

| | | | | | | | 2,578,675 | |

| | | | | | | | | |

| Consumer Finance – 2.85% | | | | | | | | |

| Discover Financial Services | | | 18,988 | | | | 2,226,533 | |

| FirstCash, Inc. | | | 1,021 | | | | 81,394 | |

| SLM Corp. | | | 5,683 | | | | 115,081 | |

| | | | | | | | 2,423,008 | |

| | | | | | | | | |

| Diversified Financial Services – 0.12% | | | | | | | | |

| FactSet Research Systems, Inc. | | | 314 | | | | 104,989 | |

| | | | | | | | | |

| | | | | | | | | |

| Diversified Telecommunication Services – 0.47% | | | | | | | | |

| KT Corp. – ADR (a)(b) | | | 14,624 | | | | 220,969 | |

| KT Corp. (a) | | | 2,555 | | | | 77,469 | |

| ORBCOMM, Inc. (b) | | | 8,827 | | | | 98,774 | |

| | | | | | | | 397,212 | |

| | | | | | | | | |

| Electric Utilities – 2.33% | | | | | | | | |

| Enel S.p.A. (a) | | | 200,250 | | | | 1,985,946 | |

| | | | | | | | | |

| | | | | | | | | |

| Electrical Equipment – 2.43% | | | | | | | | |

| ABB Ltd. – ADR (a) | | | 4,022 | | | | 137,311 | |

| Array Technologies, Inc. (b) | | | 5,590 | | | | 91,117 | |

| Schneider Electric SE (a) | | | 8,038 | | | | 1,279,328 | |

| TPI Composites, Inc. (b) | | | 2,986 | | | | 144,224 | |

| Vestas Wind Systems A/S (a) | | | 10,760 | | | | 420,638 | |

| | | | | | | | 2,072,618 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components – 4.35% | | | | | | | | |

| Badger Meter, Inc. | | | 1,197 | | | | 114,397 | |

| Cognex Corp. | | | 612 | | | | 48,587 | |

| Hitachi Ltd. (a) | | | 17,100 | | | | 900,985 | |

| II-VI, Inc. (b) | | | 5,875 | | | | 395,799 | |

| IPG Photonics Corp. (b) | | | 835 | | | | 174,732 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Electronic Equipment, Instruments & Components – 4.35% (Continued) | | | | | | |

| Keysight Technologies, Inc. (b) | | | 4,338 | | | $ | 617,644 | |

| Littelfuse, Inc. | | | 783 | | | | 204,551 | |

| Samsung SDI Co. Ltd. (a) | | | 115 | | | | 66,006 | |

| TE Connectivity Ltd. – ADR (a) | | | 7,083 | | | | 961,022 | |

| Trimble, Inc. (b) | | | 2,808 | | | | 218,434 | |

| | | | | | | | 3,702,157 | |

| | | | | | | | | |

| Entertainment – 0.87% | | | | | | | | |

| Nintendo Co. Ltd. (a) | | | 1,200 | | | | 743,059 | |

| | | | | | | | | |

| | | | | | | | | |

| Food & Staples Retailing – 0.11% | | | | | | | | |

| Albertsons Cos, Inc. | | | 4,750 | | | | 91,152 | |

| | | | | | | | | |

| | | | | | | | | |

| Food Products – 0.09% | | | | | | | | |

| Utz Brands, Inc. | | | 3,479 | | | | 80,365 | |

| | | | | | | | | |

| | | | | | | | | |

| Health Care Equipment & Supplies – 5.14% | | | | | | | | |

| ABIOMED, Inc. (b) | | | 511 | | | | 145,420 | |

| Alcon, Inc. – ADR (a) | | | 1 | | | | 70 | |

| Becton Dickinson & Co. | | | 6,433 | | | | 1,556,079 | |

| Edwards Lifesciences Corp. (b) | | | 983 | | | | 94,270 | |

| Inogen, Inc. (b) | | | 1,156 | | | | 71,452 | |

| Insulet Corp. (b) | | | 709 | | | | 191,196 | |

| Integer Holdings Corp. (b) | | | 1,056 | | | | 95,536 | |

| Koninklijke Philips NV (a) | | | 16,535 | | | | 934,336 | |

| Masimo Corp. (b) | | | 482 | | | | 103,919 | |

| Medtronic PLC – ADR | | | 6,787 | | | | 859,167 | |

| Merit Medical Systems, Inc. (b) | | | 3,060 | | | | 184,640 | |

| ResMed, Inc. | | | 713 | | | | 146,771 | |

| | | | | | | | 4,382,856 | |

| | | | | | | | | |

| Health Care Providers & Services – 0.26% | | | | | | | | |

| Chemed Corp. | | | 382 | | | | 187,691 | |

| Guardant Health, Inc. (b) | | | 238 | | | | 29,541 | |

| | | | | | | | 217,232 | |

| | | | | | | | | |

| Health Care Technology – 0.39% | | | | | | | | |

| Omnicell, Inc. (b) | | | 1,696 | | | | 235,744 | |

| Vocera Communications, Inc. (b) | | | 2,773 | | | | 93,506 | |

| | | | | | | | 329,250 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure – 0.08% | | | | | | | | |

| Compass Group PLC (a) | | | 1 | | | | 23 | |

| Wyndham Hotels & Resorts, Inc. | | | 869 | | | | 65,227 | |

| | | | | | | | 65,250 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Household Durables – 2.62% | | | | | | |

| Panasonic Corp. (a) | | | 70,300 | | | $ | 798,444 | |

| Sony Corp. (a) | | | 14,400 | | | | 1,431,887 | |

| | | | | | | | 2,230,331 | |

| | | | | | | | | |

| Industrial Conglomerates – 1.41% | | | | | | | | |

| LG Corp. (a) | | | 11,930 | | | | 1,144,020 | |

| LX Holdings Corp. (a)(b) | | | 5,785 | | | | 63,543 | |

| | | | | | | | 1,207,563 | |

| | | | | | | | | |

| Insurance – 9.16% | | | | | | | | |

| Aflac, Inc. | | | 17,561 | | | | 995,357 | |

| Arch Capital Group Ltd. – ADR (a)(b) | | | 23,945 | | | | 955,166 | |

| BRP Group, Inc. (b) | | | 3,179 | | | | 78,140 | |

| Globe Life, Inc. | | | 11,164 | | | | 1,176,909 | |

| Intact Financial Corp. (a)(b) | | | 7,247 | | | | 984,063 | |

| Progressive Corp. | | | 599 | | | | 59,349 | |

| Reinsurance Group of America, Inc. | | | 15,050 | | | | 1,896,752 | |

| SCOR SE (a) | | | 10,205 | | | | 332,211 | |

| Willis Towers Watson Plc – ADR (a) | | | 5,042 | | | | 1,317,777 | |

| | | | | | | | 7,795,724 | |

| | | | | | | | | |

| Interactive Media & Services – 0.21% | | | | | | | | |

| Tencent Holdings Ltd. (a) | | | 2,300 | | | | 179,816 | |

| | | | | | | | | |

| | | | | | | | | |

| Internet & Catalog Retail – 0.98% | | | | | | | | |

| Amazon.com, Inc. (b) | | | 260 | | | | 837,998 | |

| | | | | | | | | |

| | | | | | | | | |

| Internet & Direct Marketing Retail – 0.19% | | | | | | | | |

| Trip.com Group Ltd. – ADR (b) | | | 3,831 | | | | 160,327 | |

| | | | | | | | | |

| | | | | | | | | |

| Internet Software & Services – 4.54% | | | | | | | | |

| Alibaba Group Holding, Ltd. – ADR (a)(b) | | | 7,770 | | | | 1,662,469 | |

| Facebook, Inc. – Class A (b) | | | 6,691 | | | | 2,199,533 | |

| | | | | | | | 3,862,002 | |

| | | | | | | | | |

| IT Services – 2.40% | | | | | | | | |

| Fidelity National Information Services, Inc. | | | 7,251 | | | | 1,080,254 | |

| Visa, Inc. – Class A | | | 4,238 | | | | 963,297 | |

| | | | | | | | 2,043,551 | |

| | | | | | | | | |

| Machinery – 2.53% | | | | | | | | |

| Deere & Co. | | | 4,543 | | | | 1,640,478 | |

| Doosan Bobcat, Inc. (a)(b) | | | 4,127 | | | | 187,073 | |

| Epiroc AB (a) | | | 8,041 | | | | 183,421 | |

| Kubota Corp. (a) | | | 4,400 | | | | 101,216 | |

| Mueller Industries, Inc. | | | 916 | | | | 42,530 | |

| | | | | | | | 2,154,718 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Metals & Mining – 1.71% | | | | | | |

| Agnico Eagle Mines Ltd. – ADR (a) | | | 15,998 | | | $ | 1,147,856 | |

| Grupo Mexico SAB de CV (a) | | | 32,633 | | | | 156,628 | |

| Pan American Silver Corp. – ADR (a) | | | 4,448 | | | | 149,631 | |

| | | | | | | | 1,454,115 | |

| | | | | | | | | |

| Multiline Retail – 0.86% | | | | | | | | |

| Kohl’s Corp. | | | 13,231 | | | | 734,188 | |

| | | | | | | | | |

| | | | | | | | | |

| Pharmaceuticals – 2.69% | | | | | | | | |

| Eli Lilly and Co. | | | 4,115 | | | | 821,930 | |

| Novo Nordisk A/S – ADR (a) | | | 943 | | | | 74,403 | |

| Roche Holdings AG (a) | | | 3,976 | | | | 1,391,805 | |

| | | | | | | | 2,288,138 | |

| | | | | | | | | |

| Professional Services – 0.04% | | | | | | | | |

| Mistras Group, Inc. (b) | | | 3,444 | | | | 35,852 | |

| | | | | | | | | |

| | | | | | | | | |

| Real Estate Management & Development – 1.53% | | | | | | | | |

| Vonovia SE (a) | | | 20,706 | | | | 1,299,703 | |

| | | | | | | | | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment – 5.37% | | | | | | | | |

| Applied Materials, Inc. | | | 8,734 | | | | 1,206,427 | |

| First Solar, Inc. (b) | | | 3,739 | | | | 284,575 | |

| Samsung Electronics Co. Ltd. (a) | | | 34,881 | | | | 2,503,767 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. – ADR (a) | | | 4,550 | | | | 533,988 | |

| Tokyo Electron Ltd. (a) | | | 100 | | | | 43,875 | |

| | | | | | | | 4,572,632 | |

| | | | | | | | | |

| Software – 4.27% | | | | | | | | |

| Everbridge, Inc. (b) | | | 1,195 | | | | 140,413 | |

| Microsoft Corp. | | | 11,794 | | | | 2,944,726 | |

| New Relic, Inc. (b) | | | 5,973 | | | | 374,388 | |

| PROS Holdings, Inc. (b) | | | 1,668 | | | | 74,009 | |

| Varonis Systems, Inc. (b) | | | 2,168 | | | | 104,714 | |

| | | | | | | | 3,638,250 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals – 1.30% | | | | | | | | |

| Apple, Inc. | | | 8,542 | | | | 1,064,418 | |

| Stratasys Ltd. – ADR (a)(b) | | | 1,963 | | | | 45,326 | |

| | | | | | | | 1,109,744 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods – 1.41% | | | | | | | | |

| Carter’s, Inc. | | | 1,469 | | | | 150,191 | |

| Ralph Lauren Corp. (b) | | | 6,059 | | | | 751,800 | |

| Shenzhou International Group Holdings Ltd. (a) | | | 11,200 | | | | 295,237 | |

| | | | | | | | 1,197,228 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| Trading Companies & Distributors – 1.04% | | | | | | |

| Ashtead Group Plc (a) | | | 1,736 | | | $ | 126,637 | |

| Herc Holdings, Inc. (b) | | | 843 | | | | 96,962 | |

| United Rentals, Inc. (b) | | | 1,970 | | | | 657,901 | |

| | | | | | | | 881,500 | |

| | | | | | | | | |

| Transportation Infrastructure – 0.93% | | | | | | | | |

| Airports of Thailand PCL (a) | | | 337,500 | | | | 671,828 | |

| Grupo Aeroportuario del Sureste SAB de CV – ADR (a)(b) | | | 681 | | | | 120,285 | |

| | | | | | | | 792,113 | |

| | | | | | | | | |

| Wireless Telecommunication Services – 2.80% | | | | | | | | |

| China Mobile Ltd. (a) | | | 214,055 | | | | 1,359,003 | |

| KDDI Corp. (a) | | | 1,600 | | | | 54,542 | |

| Tele2 AB (a) | | | 71,142 | | | | 969,020 | |

| | | | | | | | 2,382,565 | |

| Total Common Stocks (Cost $53,080,939) | | | | | | | 79,747,981 | |

| | | | | | | | | |

| Exchange Traded Funds – 1.80% | | | | | | | | |

| iShares Core MSCI EAFE ETF | | | 9,971 | | | | 765,773 | |

| iShares Core S&P 500 ETF | | | 1,817 | | | | 766,138 | |

| Total Exchange Traded Funds (Cost $1,494,982) | | | | | | | 1,531,911 | |

| | | | | | | | | |

| Preferred Stocks – 0.38% | | | | | | | | |

| Banks – 0.15% | | | | | | | | |

| Itau Unibanco Holding SA (a)(c), 2.06% (d) | | | 21,731 | | | | 123,867 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment – 0.23% | | | | | | | | |

| Samsung Electronics Co. Ltd. (a)(c), 4.15% (d) | | | 3,041 | | | | 196,739 | |

| Total Preferred Stocks (Cost $210,779) | | | | | | | 320,606 | |

| | | | | | | | | |

| Real Estate Investment Trusts – 2.34% | | | | | | | | |

| Healthcare REIT – 1.01% | | | | | | | | |

| Medical Properties Trust, Inc. | | | 40,729 | | | | 862,233 | |

| | | | | | | | | |

| Industrials REIT – 0.06% | | | | | | | | |

| Rexford Industrial Realty, Inc. | | | 938 | | | | 51,806 | |

| | | | | | | | | |

| Residential REIT – 0.06% | | | | | | | | |

| American Campus Communities, Inc. | | | 1,105 | | | | 52,112 | |

| | | | | | | | | |

| Retails REIT – 1.12% | | | | | | | | |

| CapitaLand Mall Trust (a) | | | 615,000 | | | | 952,178 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Equity Allocation Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| Specialized REIT – 0.09% | | | | | | |

| Iron Mountain, Inc. | | | 1,723 | | | $ | 75,019 | |

| Total Real Estate Investment Trusts (Cost $1,829,288) | | | | | | | 1,993,348 | |

| | | | | | | | | |

| Money Market Funds – 0.52% | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds – | | | | | | | | |

| Treasury Portfolio – Institutional Class, 0.010% (e) | | | 441,406 | | | | 441,406 | |

| Total Money Market Funds (Cost $441,406) | | | | | | | 441,406 | |

| Total Investments (Cost $57,057,394) – 98.70% | | | | | | | 84,035,252 | |

| Other Assets in Excess of Liabilities – 1.30% | | | | | | | 1,104,684 | |

| Total Net Assets – 100.00% | | | | | | $ | 85,139,936 | |

Percentages are stated as a percent of net assets.

ADR American Depository Receipt.

REIT Real Estate Investment Trust.

| (a) | Foreign issued security. |

| (b) | Non-income producing security. |

| (c) | Perpetual preferred stock with no stated maturity. |

| (d) | Dividend yield; the rate shown represents the rate at May 31, 2021. |

| (e) | Seven day yield; the rate shown represents the rate at May 31, 2021. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

Rockefeller Core Taxable Bond Fund

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Asset Backed Securities – 4.78% | | | | | | |

| GM Financial Consumer Automobile Receivables Trust 2019-3 | | | | | | |

| A-3, 2.180%, 04/16/2024 | | $ | 569,188 | | | $ | 576,373 | |

| Nissan Auto Receivables 2020-B Owner Trust | | | | | | | | |

| 2020-B, 0.470%, 10/17/2022 | | | 366,750 | | | | 367,009 | |

| Verizon Owner Trust | | | | | | | | |

| 2019-B, 2.330%, 12/20/2023 | | | 2,410,000 | | | | 2,440,722 | |

| Total Asset Backed Securities (Cost $3,352,691) | | | | | | | 3,384,104 | |

| | | | | | | | | |

| Corporate Bonds – 24.51% | | | | | | | | |

| Aerospace & Defense – 1.00% | | | | | | | | |

| The Boeing Co. | | | | | | | | |

| 2.196%, 02/04/2026 | | | 705,000 | | | | 708,254 | |

| | | | | | | | | |

| | | | | | | | | |

| Diversified Banks – 5.76% | | | | | | | | |

| Bank of America Corp. | | | | | | | | |

| 4.244% (3 Month LIBOR USD + 1.814%), 04/24/2038 (a) | | | 790,000 | | | | 924,223 | |

| Citigroup, Inc. | | | | | | | | |

| 3.980% (3 Month LIBOR USD + 1.338%), 03/20/2030 (a) | | | 1,154,000 | | | | 1,299,947 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.493% (SOFR + 3.790%), 03/24/2031 (a) | | | 1,587,000 | | | | 1,852,558 | |

| | | | | | | | 4,076,728 | |

| | | | | | | | | |

| Health Care Services – 2.57% | | | | | | | | |

| CVS Health Corp. | | | | | | | | |

| 3.250%, 08/15/2029 | | | 1,693,000 | | | | 1,823,035 | |

| | | | | | | | | |

| | | | | | | | | |

| Home Improvement Retail – 2.76% | | | | | | | | |

| The Home Depot, Inc. | | | | | | | | |

| 5.875%, 12/16/2036 | | | 1,402,000 | | | | 1,952,430 | |

| | | | | | | | | |

| | | | | | | | | |

| Homebuilding – 2.00% | | | | | | | | |

| NVR, Inc. | | | | | | | | |

| 3.950%, 09/15/2022 | | | 1,365,000 | | | | 1,413,640 | |

| | | | | | | | | |

| | | | | | | | | |

| Integrated Telecommunication Services – 2.00% | | | | | | | | |

| Verizon Communications, Inc. | | | | | | | | |

| 5.250%, 03/16/2037 | | | 1,107,000 | | | | 1,414,343 | |

| | | | | | | | | |

| | | | | | | | | |

| Investment Banking & Brokerage – 2.63% | | | | | | | | |

| Morgan Stanley | | | | | | | | |

| 4.431% (3 Month LIBOR USD + 1.628%), 01/23/2030 (a) | | | 803,000 | | | | 931,934 | |

| The Goldman Sachs Group, Inc. | | | | | | | | |

| 4.223% (3 Month LIBOR USD + 1.301%), 05/01/2029 (a) | | | 818,000 | | | | 929,303 | |

| | | | | | | | 1,861,237 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Core Taxable Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Regional Banks – 3.14% | | | | | | |

| BB&T Corp. | | | | | | |

| 3.750%, 12/06/2023 | | $ | 2,058,000 | | | $ | 2,225,146 | |

| | | | | | | | | |

| Systems Software – 2.65% | | | | | | | | |

| Microsoft Corp. | | | | | | | | |

| 3.500%, 02/12/2035 | | | 1,660,000 | | | | 1,875,383 | |

| Total Corporate Bonds (Cost $16,752,723) | | | | | | | 17,350,196 | |

| | | | | | | | | |

| Mortgage Backed Securities – 18.80% | | | | | | | | |

| Fannie Mae Pool | | | | | | | | |

| 2.500%, 07/01/2023 | | | 65,416 | | | | 68,291 | |

| 3.000%, 04/01/2032 | | | 765,259 | | | | 809,564 | |

| 2.000%, 12/01/2035 | | | 514,883 | | | | 534,808 | |

| 4.000%, 10/01/2048 | | | 1,451,205 | | | | 1,588,132 | |

| 3.500%, 05/01/2049 | | | 646,304 | | | | 688,572 | |

| 4.500%, 07/01/2049 | | | 918,969 | | | | 996,717 | |

| 2.500%, 01/01/2050 | | | 103,542 | | | | 107,374 | |

| 2.000%, 09/01/2050 | | | 1,679,030 | | | | 1,702,949 | |

| 2.500%, 11/01/2050 | | | 326,492 | | | | 339,079 | |

| 2.500%, 02/01/2051 | | | 1,683,970 | | | | 1,746,642 | |

| 3.000%, 04/01/2051 | | | 795,986 | | | | 841,885 | |

| 2.000%, 05/01/2051 | | | 522,539 | | | | 528,735 | |

| 3.000%, 05/01/2051 | | | 534,085 | | | | 561,644 | |

| Freddie Mac Pool | | | | | | | | |

| 2.500%, 10/01/2032 | | | 646,043 | | | | 680,196 | |

| 2.500%, 10/01/2040 | | | 433,100 | | | | 450,426 | |

| 3.500%, 08/01/2049 | | | 359,723 | | | | 383,303 | |

| 2.500%, 07/01/2050 | | | 1,227,027 | | | | 1,275,850 | |

| Total Mortgage Backed Securities (Cost $13,153,452) | | | | | | | 13,304,167 | |

| | | | | | | | | |

| Municipal Bonds – 19.58% | | | | | | | | |

| California – 1.48% | | | | | | | | |

| Contra Costa Community College District | | | | | | | | |

| 6.504%, 08/01/2034 | | | 750,000 | | | | 1,046,038 | |

| | | | | | | | | |

| | | | | | | | | |

| Colorado – 0.70% | | | | | | | | |

| Regional Transportation District Sales Tax Revenue | | | | | | | | |

| 2.337%, 11/01/2036 | | | 500,000 | | | | 494,764 | |

| | | | | | | | | |

| | | | | | | | | |

| Hawaii – 1.43% | | | | | | | | |

| State of Hawaii | | | | | | | | |

| 2.065%, 08/01/2035 | | | 1,045,000 | | | | 1,013,021 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Core Taxable Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Iowa – 0.29% | | | | | | |

| Iowa Finance Authority | | | | | | |

| 1.980%, 07/01/2022 | | $ | 205,000 | | | $ | 208,451 | |

| | | | | | | | | |

| | | | | | | | | |

| Maryland – 1.52% | | | | | | | | |

| City of Baltimore MD | | | | | | | | |

| 2.814%, 07/01/2040 | | | 1,070,000 | | | | 1,076,971 | |

| | | | | | | | | |

| | | | | | | | | |

| New York – 4.46% | | | | | | | | |

| Metropolitan Transportation Authority | | | | | | | | |

| 6.734%, 11/15/2030 | | | 870,000 | | | | 1,127,126 | |

| New York State Dormitory Authority | | | | | | | | |

| 4.850%, 07/01/2048 | | | 1,065,000 | | | | 1,218,248 | |

| Port Authority of New York & New Jersey | | | | | | | | |

| 2.799%, 10/15/2021 | | | 800,000 | | | | 807,577 | |

| | | | | | | | 3,152,951 | |

| | | | | | | | | |

| North Carolina – 1.97% | | | | | | | | |

| University of North Carolina at Chapel Hill | | | | | | | | |

| 3.327%, 12/01/2036 | | | 1,240,000 | | | | 1,391,205 | |

| | | | | | | | | |

| | | | | | | | | |

| Ohio – 0.55% | | | | | | | | |

| Ohio Housing Finance Agency | | | | | | | | |

| 2.650%, 11/01/2041 | | | 378,000 | | | | 389,944 | |

| | | | | | | | | |

| | | | | | | | | |

| Oregon – 1.48% | | | | | | | | |

| State of Oregon | | | | | | | | |

| 3.975%, 05/01/2038 | | | 950,000 | | | | 1,049,058 | |

| | | | | | | | | |

| | | | | | | | | |

| Texas – 5.70% | | | | | | | | |

| North Texas Tollway Authority | | | | | | | | |

| 3.011%, 01/01/2043 | | | 575,000 | | | | 576,070 | |

| Permanent University Fund – Texas A&M University System | | | | | | | | |

| 3.660%, 07/01/2047 | | | 2,500,000 | | | | 2,714,210 | |

| Texas Transportation Commission | | | | | | | | |

| 2.562%, 04/01/2042 | | | 750,000 | | | | 746,065 | |

| | | | | | | | 4,036,345 | |

| Total Municipal Bonds (Cost $13,368,076) | | | | | | | 13,858,748 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Core Taxable Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| U.S. Government Agency Issues – 7.95% | | | | | | |

| Federal Home Loan Banks | | | | | | |

| 0.625%, 11/27/2024 | | $ | 2,110,000 | | | $ | 2,110,029 | |

| 1.020%, 05/19/2026 | | | 1,440,000 | | | | 1,440,234 | |

| Ginnie Mae II Pool | | | | | | | | |

| 3.000%, 08/20/2045 | | | 681,793 | | | | 723,457 | |

| 3.500%, 03/20/2047 | | | 798,418 | | | | 847,782 | |

| 4.000%, 12/20/2047 | | | 468,694 | | | | 502,699 | |

| Total U.S. Government Agency Issues (Cost $5,502,513) | | | | | | | 5,624,201 | |

| | | | | | | | | |

| U.S. Government Notes/Bonds – 20.12% | | | | | | | | |

| United States Treasury Note/Bond | | | | | | | | |

| 2.625%, 03/31/2025 | | | 2,980,000 | | | | 3,220,030 | |

| 1.625%, 09/30/2026 | | | 3,273,000 | | | | 3,400,084 | |

| 2.750%, 02/15/2028 | | | 3,298,000 | | | | 3,631,021 | |

| 2.500%, 02/15/2045 | | | 2,479,000 | | | | 2,590,700 | |

| 1.250%, 05/15/2050 | | | 1,795,000 | | | | 1,395,858 | |

| Total U.S. Government Notes/Bonds (Cost $13,580,677) | | | | | | | 14,237,693 | |

| | | | | | | | | |

| | | Shares | | | | | |

| Exchange Traded Funds – 3.30% | | | | | | | | |

| Vanguard Mortgage-Backed Securities ETF | | | 43,689 | | | | 2,335,395 | |

| Total Exchange Traded Funds (Cost $2,355,073) | | | | | | | 2,335,395 | |

| | | | | | | | | |

| Money Market Funds – 0.48% | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds – | | | | | | | | |

| Treasury Portfolio – Institutional Class, 0.010% (b) | | | 341,633 | | | | 341,633 | |

| Total Money Market Funds (Cost $341,633) | | | | | | | 341,633 | |

| Total Investments (Cost $68,406,838) – 99.52% | | | | | | | 70,436,137 | |

| Other Assets in Excess of Liabilities – 0.48% | | | | | | | 339,780 | |

| Total Net Assets – 100.00% | | | | | | $ | 70,775,917 | |

Percentages are stated as a percent of net assets.

| (a) | Variable rate security; the rate shown represents the rate at May 31, 2021. |

| (b) | The rate shown represents the seven day yield as of May 31, 2021. |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt National Bond Fund

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Municipal Bonds – 99.09% | | | | | | |

| Alabama – 2.54% | | | | | | |

| Southeast Energy Authority A Cooperative District | | | | | | |

| 4.000%, 11/01/2051 (a) | | $ | 2,000,000 | | | $ | 2,379,434 | |

| | | | | | | | | |

| | | | | | | | | |

| Alaska – 3.45% | | | | | | | | |

| Alaska Housing Finance Corp. | | | | | | | | |

| 5.000%, 12/01/2033 | | | 2,590,000 | | | | 3,236,177 | |

| | | | | | | | | |

| | | | | | | | | |

| Arizona – 2.17% | | | | | | | | |

| Salt River Project Agricultural Improvement & Power District | | | | | | | | |

| 5.000%, 01/01/2032 | | | 625,000 | | | | 785,469 | |

| 5.000%, 01/01/2036 | | | 1,000,000 | | | | 1,246,395 | |

| | | | | | | | 2,031,864 | |

| | | | | | | | | |

| Colorado – 2.36% | | | | | | | | |

| Colorado Educational & Cultural Facilities Authority | | | | | | | | |

| 5.000%, 03/01/2035 | | | 1,610,000 | | | | 2,211,009 | |

| | | | | | | | | |

| | | | | | | | | |

| Connecticut – 0.52% | | | | | | | | |

| Connecticut Housing Finance Authority | | | | | | | | |

| 2.850%, 11/15/2026 | | | 465,000 | | | | 486,162 | |

| | | | | | | | | |

| | | | | | | | | |

| Florida – 2.42% | | | | | | | | |

| Florida Housing Finance Corp. | | | | | | | | |

| 3.200%, 07/01/2030 | | | 545,000 | | | | 565,784 | |

| Florida’s Turnpike Enterprise | | | | | | | | |

| 4.000%, 07/01/2033 | | | 1,500,000 | | | | 1,699,003 | |

| | | | | | | | 2,264,787 | |

| | | | | | | | | |

| Illinois – 10.72% | | | | | | | | |

| Chicago O’Hare International Airport | | | | | | | | |

| 5.000%, 01/01/2033 | | | 775,000 | | | | 895,416 | |

| 5.000%, 01/01/2036 | | | 2,000,000 | | | | 2,444,440 | |

| 5.000%, 01/01/2036 | | | 1,015,000 | | | | 1,204,482 | |

| Illinois Finance Authority | | | | | | | | |

| 5.000%, 07/01/2036 | | | 1,300,000 | | | | 1,691,440 | |

| Illinois Finance Authority – Ascension Health Credit Group | | | | | | | | |

| 4.000%, 02/15/2033 | | | 2,550,000 | | | | 2,913,531 | |

| State of Illinois | | | | | | | | |

| 4.000%, 03/01/2022 | | | 875,000 | | | | 899,076 | |

| | | | | | | | 10,048,385 | |

| | | | | | | | | |

| Kansas – 1.62% | | | | | | | | |

| State of Kansas Department of Transportation | | | | | | | | |

| 5.000%, 09/01/2030 | | | 1,210,000 | | | | 1,516,916 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt National Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Massachusetts – 7.81% | | | | | | |

| Commonwealth of Massachusetts | | | | | | |

| 4.000%, 11/01/2035 | | $ | 2,000,000 | | | $ | 2,484,806 | |

| Massachusetts Development Finance Agency | | | | | | | | |

| 5.000%, 07/01/2050 (a) | | | 750,000 | | | | 979,421 | |

| Massachusetts Development Finance Agency – | | | | | | | | |

| Dana-Farber Cancer Obligation | | | | | | | | |

| 5.000%, 12/01/2032 | | | 430,000 | | | | 519,689 | |

| Massachusetts Development Finance Agency – | | | | | | | | |

| Partners HealthCare System | | | | | | | | |

| 5.000%, 07/01/2030 | | | 2,660,000 | | | | 3,336,860 | |

| | | | | | | | 7,320,776 | |

| | | | | | | | | |

| Minnesota – 1.89% | | | | | | | | |

| Minneapolis-St. Paul Metropolitan Airports Commission | | | | | | | | |

| 5.000%, 01/01/2026 | | | 550,000 | | | | 616,138 | |

| 5.000%, 01/01/2030 | | | 1,040,000 | | | | 1,160,205 | |

| | | | | | | | 1,776,343 | |

| | | | | | | | | |

| Nebraska – 0.84% | | | | | | | | |

| Nebraska Investment Finance Authority | | | | | | | | |

| 3.350%, 09/01/2028 | | | 765,000 | | | | 783,751 | |

| | | | | | | | | |

| | | | | | | | | |

| Nevada – 4.48% | | | | | | | | |

| Clark County Water Reclamation District | | | | | | | | |

| 4.000%, 07/01/2034 | | | 1,175,000 | | | | 1,349,493 | |

| County of Clark Department of Aviation | | | | | | | | |

| 5.000%, 07/01/2033 | | | 1,770,000 | | | | 2,010,710 | |

| Las Vegas Valley Water District | | | | | | | | |

| 5.000%, 06/01/2030 | | | 700,000 | | | | 844,315 | |

| | | | | | | | 4,204,518 | |

| | | | | | | | | |

| New Jersey – 1.96% | | | | | | | | |

| New Jersey Turnpike Authority | | | | | | | | |

| 5.000%, 01/01/2036 | | | 1,500,000 | | | | 1,835,457 | |

| | | | | | | | | |

| | | | | | | | | |

| New York – 16.23% | | | | | | | | |

| City of New York, NY | | | | | | | | |

| 5.000%, 12/01/2034 | | | 500,000 | | | | 634,429 | |

| Metropolitan Transportation Authority | | | | | | | | |

| 5.000%, 09/01/2022 | | | 2,000,000 | | | | 2,117,701 | |

| 5.000%, 11/15/2027 | | | 1,795,000 | | | | 2,119,643 | |

| 4.000%, 11/15/2035 | | | 1,000,000 | | | | 1,141,954 | |

| New York City Transitional Finance Authority | | | | | | | | |

| Future Tax Secured Revenue | | | | | | | | |

| 5.000%, 02/01/2036 | | | 1,695,000 | | | | 2,237,488 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt National Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| New York – 16.23% (Continued) | | | | | | |

| New York State Dormitory Authority | | | | | | |

| 5.000%, 02/15/2033 | | $ | 1,090,000 | | | $ | 1,267,405 | |

| New York State Urban Development Corp. | | | | | | | | |

| 5.000%, 03/15/2029 | | | 750,000 | | | | 812,936 | |

| Port Authority of New York & New Jersey | | | | | | | | |

| 5.000%, 11/15/2033 | | | 1,490,000 | | | | 1,861,363 | |

| State of New York Mortgage Agency | | | | | | | | |

| 2.750%, 10/01/2028 | | | 400,000 | | | | 428,915 | |

| 3.125%, 10/01/2032 | | | 970,000 | | | | 1,035,321 | |

| Triborough Bridge & Tunnel Authority | | | | | | | | |

| 5.000%, 11/15/2030 | | | 1,255,000 | | | | 1,555,181 | |

| | | | | | | | 15,212,336 | |

| | | | | | | | | |

| Ohio – 3.41% | | | | | | | | |

| Ohio Water Development Authority | | | | | | | | |

| 5.000%, 06/01/2028 | | | 750,000 | | | | 933,115 | |

| 5.000%, 12/01/2030 | | | 1,835,000 | | | | 2,262,833 | |

| | | | | | | | 3,195,948 | |

| | | | | | | | | |

| Pennsylvania – 9.33% | | | | | | | | |

| Commonwealth of Pennsylvania | | | | | | | | |

| 3.250%, 08/15/2026 | | | 1,560,000 | | | | 1,732,762 | |

| Pennsylvania Economic Development Financing Authority | | | | | | | | |

| 5.000%, 02/01/2033 | | | 1,130,000 | | | | 1,281,275 | |

| 4.000%, 11/15/2035 | | | 1,480,000 | | | | 1,723,318 | |

| Pennsylvania Housing Finance Agency | | | | | | | | |

| 2.375%, 10/01/2027 | | | 510,000 | | | | 535,861 | |

| 3.200%, 10/01/2031 | | | 2,065,000 | | | | 2,179,041 | |

| Pennsylvania Turnpike Commission | | | | | | | | |

| 5.000%, 12/01/2035 | | | 1,040,000 | | | | 1,296,311 | |

| | | | | | | | 8,748,568 | |

| | | | | | | | | |

| Texas – 15.56% | | | | | | | | |

| Aldine Independent School District | | | | | | | | |

| 5.000%, 02/15/2028 | | | 1,000,000 | | | | 1,161,957 | |

| Arlington Higher Education Finance Corp. – | | | | | | | | |

| A.W. Brown Fellowship Leader | | | | | | | | |

| 5.000%, 08/15/2024 | | | 315,000 | | | | 356,233 | |

| City of Houston, TX Combined Utility System Revenue | | | | | | | | |

| 1.862%, 12/01/2028 (b) | | | 1,290,000 | | | | 1,188,152 | |

| 5.000%, 11/15/2033 | | | 825,000 | | | | 1,103,347 | |

| Clifton Higher Education Finance Corp. | | | | | | | | |

| 4.000%, 08/15/2032 | | | 1,000,000 | | | | 1,212,978 | |

| Dallas Independent School District | | | | | | | | |

| 5.000%, 02/15/2036 (a) | | | 5,000 | | | | 5,171 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt National Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Texas – 15.56% (Continued) | | | | | | |

| North Texas Tollway Authority | | | | | | |

| 3.990%, 09/01/2037 (b) | | $ | 2,035,000 | | | $ | 1,134,201 | |

| San Antonio Independent School District/TX | | | | | | | | |

| 4.000%, 08/15/2035 | | | 500,000 | | | | 619,995 | |

| State of Texas | | | | | | | | |

| 5.000%, 10/01/2034 | | | 1,250,000 | | | | 1,555,035 | |

| Tarrant Regional Water District | | | | | | | | |

| 5.000%, 03/01/2029 | | | 2,050,000 | | | | 2,392,192 | |

| Tarrant Regional Water District Water Supply System Revenue | | | | | | | | |

| 5.000%, 03/01/2032 | | | 350,000 | | | | 420,173 | |

| Texas Municipal Gas Acquisition and Supply Corp I | | | | | | | | |

| 6.250%, 12/15/2026 | | | 2,930,000 | | | | 3,435,851 | |

| | | | | | | | 14,585,285 | |

| | | | | | | | | |

| Virginia – 1.66% | | | | | | | | |

| FHLMC Multifamily VRD Certificates | | | | | | | | |

| 2.550%, 06/15/2035 | | | 1,475,000 | | | | 1,556,202 | |

| | | | | | | | | |

| | | | | | | | | |

| Washington – 6.26% | | | | | | | | |

| Central Puget Sound Regional Transit Authority | | | | | | | | |

| 5.000%, 11/01/2030 | | | 750,000 | | | | 917,320 | |

| State of Washington | | | | | | | | |

| 5.000%, 07/01/2029 | | | 1,545,000 | | | | 1,852,374 | |

| 5.000%, 06/01/2032 | | | 1,300,000 | | | | 1,701,044 | |

| Washington State Housing Finance Commission | | | | | | | | |

| 3.000%, 12/01/2031 | | | 1,325,000 | | | | 1,396,883 | |

| | | | | | | | 5,867,621 | |

| Wisconsin – 3.86% | | | | | | | | |

| State of Wisconsin | | | | | | | | |

| 5.000%, 05/01/2032 | | | 1,015,000 | | | | 1,148,142 | |

| 5.000%, 11/01/2032 | | | 1,000,000 | | | | 1,235,089 | |

| Wisconsin Department of Transportation | | | | | | | | |

| 5.000%, 07/01/2028 | | | 1,085,000 | | | | 1,238,288 | |

| | | | | | | | 3,621,519 | |

| Total Municipal Bonds (Cost $88,406,529) | | | | | | | 92,883,058 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt National Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Shares | | | Value | |

| Money Market Funds – 0.66% | | | | | | |

| Morgan Stanley Institutional Liquidity Funds – | | | | | | |

| Treasury Portfolio – Institutional Class, 0.010% (c) | | | 615,735 | | | $ | 615,735 | |

| Total Money Market Funds (Cost $615,735) | | | | | | | 615,735 | |

| Total Investments (Cost $89,022,264) – 99.75% | | | | | | | 93,498,793 | |

| Other Assets in Excess of Liabilities – 0.25% | | | | | | | 235,727 | |

| Total Net Assets – 100.00% | | | | | | $ | 93,734,520 | |

Percentages are stated as a percent of net assets.

| (a) | Adjustable rate security; the rate is determined by a Remarketing Agreement. |

| (b) | Zero coupon bond; effective yield is shown. |

| (c) | The rate shown represents the seven day yield as of May 31, 2021. |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt New York Bond Fund

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| Municipal Bonds – 98.76% | | | | | | |

| Georgia – 2.94% | | | | | | |

| City of Atlanta GA Airport Passenger Facility Charge | | | | | | |

| 5.000%, 07/01/2035 | | $ | 1,130,000 | | | $ | 1,445,858 | |

| | | | | | | | | |

| | | | | | | | | |

| Illinois – 1.35% | | | | | | | | |

| State of Illinois | | | | | | | | |

| 4.000%, 03/01/2024 | | | 605,000 | | | | 662,648 | |

| | | | | | | | | |

| | | | | | | | | |

| New York – 87.28% | | | | | | | | |

| City of New York, NY | | | | | | | | |

| 4.000%, 08/01/2034 | | | 740,000 | | | | 852,782 | |

| 5.000%, 12/01/2035 | | | 1,230,000 | | | | 1,556,699 | |

| City of Yonkers, NY | | | | | | | | |

| 4.000%, 05/01/2035 | | | 750,000 | | | | 887,690 | |

| County of Dutchess, NY | | | | | | | | |

| 4.000%, 03/01/2032 | | | 500,000 | | | | 582,953 | |

| County of Westchester, NY | | | | | | | | |

| 4.000%, 07/01/2022 | | | 5,000 | | | | 5,016 | |

| 4.000%, 12/01/2029 | | | 650,000 | | | | 764,514 | |

| Metropolitan Transportation Authority | | | | | | | | |

| 5.000%, 11/15/2026 | | | 1,190,000 | | | | 1,272,121 | |

| 5.000%, 11/15/2028 | | | 355,000 | | | | 447,434 | |

| 5.000%, 11/15/2029 | | | 1,000,000 | | | | 1,068,534 | |

| 4.000%, 11/15/2032 | | | 1,000,000 | | | | 1,155,366 | |

| 4.000%, 11/15/2035 | | | 750,000 | | | | 856,466 | |

| New York City Housing Development Corp. | | | | | | | | |

| 1.850%, 05/01/2026 | | | 250,000 | | | | 260,702 | |

| 2.850%, 11/01/2031 | | | 1,130,000 | | | | 1,198,577 | |

| New York City Transitional Finance Authority Building Aid Revenue | | | | | | | | |

| 5.000%, 07/15/2030 | | | 1,465,000 | | | | 1,729,321 | |

| New York City Transitional Finance Authority | | | | | | | | |

| Future Tax Secured Revenue | | | | | | | | |

| 5.000%, 02/01/2034 | | | 1,000,000 | | | | 1,224,654 | |

| 5.000%, 02/01/2036 | | | 1,000,000 | | | | 1,320,052 | |

| New York City Water & Sewer System | | | | | | | | |

| 5.000%, 06/15/2031 | | | 500,000 | | | | 623,405 | |

| 4.000%, 06/15/2036 | | | 1,190,000 | | | | 1,421,960 | |

| New York State Dormitory Authority | | | | | | | | |

| 5.000%, 10/01/2032 | | | 1,000,000 | | | | 1,211,553 | |

| 4.000%, 03/15/2034 | | | 2,000,000 | | | | 2,448,378 | |

| 5.000%, 07/01/2034 | | | 1,000,000 | | | | 1,174,502 | |

| 5.000%, 03/15/2035 | | | 2,000,000 | | | | 2,363,367 | |

The accompanying notes are an integral part of these financial statements.

Rockefeller Intermediate Tax Exempt New York Bond Fund

| Schedule of Investments (Continued) |

May 31, 2021 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| New York – 87.28% (Continued) | | | | | | |

| New York State Dormitory Authority – New York University | | | | | | |

| 5.000%, 07/01/2033 | | $ | 1,090,000 | | | $ | 1,281,653 | |

| New York State Dormitory Authority – State University of New York | | | | | | | | |

| 5.000%, 07/01/2031 | | | 1,105,000 | | | | 1,370,670 | |

| New York State Housing Finance Agency | | | | | | | | |

| 2.125%, 11/01/2023 | | | 400,000 | | | | 404,607 | |

| 2.900%, 11/01/2025 | | | 190,000 | | | | 200,883 | |

| 3.050%, 11/01/2027 | | | 1,000,000 | | | | 1,021,177 | |

| New York State Thruway Authority | | | | | | | | |

| 5.000%, 01/01/2032 | | | 1,020,000 | | | | 1,177,305 | |

| 5.000%, 01/01/2035 | | | 1,000,000 | | | | 1,189,210 | |

| New York State Thruway Authority Highway & Bridge Trust Fund | | | | | | | | |

| 5.000%, 04/01/2032 | | | 750,000 | | | | 779,451 | |

| Port Authority of New York & New Jersey | | | | | | | | |

| 5.000%, 10/15/2033 | | | 1,250,000 | | | | 1,485,699 | |

| 5.000%, 11/15/2033 | | | 700,000 | | | | 874,466 | |

| Sales Tax Asset Receivable Corp. | | | | | | | | |

| 5.000%, 10/15/2028 | | | 1,490,000 | | | | 1,715,386 | |

| 5.000%, 10/15/2029 | | | 695,000 | | | | 799,878 | |

| State of New York Mortgage Agency | | | | | | | | |

| 2.300%, 10/01/2027 | | | 700,000 | | | | 728,189 | |

| 2.650%, 04/01/2029 | | | 500,000 | | | | 529,098 | |

| Triborough Bridge & Tunnel Authority | | | | | | | | |

| 5.000%, 11/15/2029 | | | 425,000 | | | | 526,876 | |

| 2.795%, 11/15/2032 (a) | | | 865,000 | | | | 687,163 | |

| 5.000%, 11/15/2034 | | | 1,000,000 | | | | 1,270,667 | |

| Utility Debt Securitization Authority | | | | | | | | |

| 5.000%, 12/15/2028 | | | 835,000 | | | | 1,000,134 | |

| 5.000%, 12/15/2034 | | | 1,125,000 | | | | 1,361,499 | |

| | | | | | | | 42,830,057 | |

| | | | | | | | | |

| Texas – 7.19% | | | | | | | | |