UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2024

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) |

| Mairs & Power Growth Fund |  |

| MPGFX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Growth Fund | $33 | 0.62% |

Net Assets | $5,561,687,517 |

Number of Holdings | 48 |

Portfolio Turnover | 5% |

30-Day SEC Yield | 0.92% |

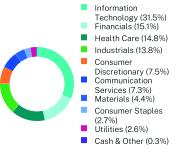

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

Top 10 Holdings | |

Microsoft Corp. | 10.6% |

NVIDIA Corp. | 7.8% |

Amazon.com, Inc. | 5.8% |

UnitedHealth Group, Inc. | 4.9% |

JPMorgan Chase & Co. | 4.6% |

Alphabet, Inc. | 4.5% |

Apple, Inc. | 3.6% |

QUALCOMM, Inc. | 2.9% |

Graco, Inc. | 2.9% |

Toro Co. | 2.9% |

Security Type | |

Common Stocks | 99.7% |

Short-Term Investments | 0.2% |

Cash & Other | 0.1% |

| Mairs & Power Growth Fund | PAGE 1 | TSR_SAR_89834G711 |

| Mairs & Power Growth Fund | PAGE 2 | TSR_SAR_89834G711 |

| Mairs & Power Balanced Fund |  |

| MAPOX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Balanced Fund | $36 | 0.70% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

Net Assets | $764,221,747 |

Number of Holdings | 264 |

Portfolio Turnover | 6% |

Weighted Average Maturity | 10.07 years |

Effective Duration | 5.39 years |

30-Day SEC Yield | 2.38% |

Average Credit Quality | BBB |

Top 10 Issuers | |

Microsoft Corp. | 4.1% |

Alphabet, Inc. | 4.0% |

JPMorgan Chase & Co. | 3.2% |

UnitedHealth Group, Inc. | 2.8% |

Fiserv, Inc. | 2.6% |

Texas Instruments, Inc. | 2.2% |

Toro Co. | 2.2% |

Ecolab, Inc. | 2.2% |

Motorola Solutions, Inc. | 2.2% |

United States Treasury Note/Bond | 2.1% |

Security Type | |

Common Stocks | 63.9% |

Corporate Bonds | 31.1% |

U.S. Treasury Securities | 2.1% |

Municipal Bonds | 1.0% |

Asset-Backed Securities | 0.8% |

Short-Term Investments | 0.6% |

Preferred Stocks | 0.1% |

Cash & Other | 0.4% |

| Mairs & Power Balanced Fund | PAGE 1 | TSR_SAR_89834G695 |

| Mairs & Power Balanced Fund | PAGE 2 | TSR_SAR_89834G695 |

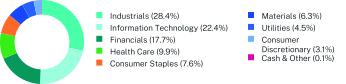

| Mairs & Power Small Cap Fund |  |

| MSCFX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Small Cap Fund | $47 | 0.93% |

Net Assets | $311,805,066 |

Number of Holdings | 39 |

Portfolio Turnover | 8% |

30-Day SEC Yield | 0.11% |

Top 10 Holdings | |

Casey’s General Stores, Inc. | 4.5% |

AAR Corp. | 4.1% |

Altair Engineering, Inc. | 4.1% |

Hub Group, Inc. | 4.0% |

Piper Sandler Cos. | 3.9% |

Medpace Holdings, Inc. | 3.7% |

Littelfuse, Inc. | 3.7% |

HB Fuller Co. | 3.7% |

John Bean Technologies Corp. | 3.7% |

AZEK Co., Inc. | 3.5% |

Security Type | |

Common Stocks | 99.9% |

Short-Term Investments | 0.2% |

Cash & Other | -0.1% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| Mairs & Power Small Cap Fund | PAGE 1 | TSR_SAR_89834G687 |

| Mairs & Power Minnesota Municipal Bond ETF |  |

| MINN (Principal U.S. Listing Exchange: CBOE) | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Minnesota Municipal Bond ETF | $12 | 0.25% |

Credit Breakdown | |

AAA | 22.4% |

AA | 54.5% |

A | 14.8% |

BBB & Lower | 5.2% |

Unrated | 1.4% |

Cash & Cash Equivalent | 1.7% |

Net Assets | $18,689,679 |

Number of Holdings | 97 |

Portfolio Turnover | 21% |

Weighted Average Maturity | 10.63 years |

Effective Duration | 6.02 years |

30-Day SEC Yield | 3.27% |

Average Credit Quality | AA |

Top 10 Issuers | |

State of Minnesota | 8.8% |

Anoka-Hennepin Independent School District No 11 | 4.1% |

First American Government Obligations Fund | 3.4% |

Minnesota Higher Education Facilities Authority | 3.4% |

Housing & Redevelopment Authority of The City of St Paul Minnesota | 2.7% |

Forest Lake Independent School District No 831 | 2.7% |

St Paul Independent School District No 625 | 2.6% |

University of Minnesota | 2.6% |

County of Wright MN | 2.6% |

Minneapolis-St Paul Metropolitan Airports Commission | 2.0% |

Security Type | |

Municipal Bonds | 98.3% |

Short-Term Investments | 3.4% |

Cash & Other | -1.7% |

| Mairs & Power Minnesota Municipal Bond ETF | PAGE 1 | TSR_SAR_89834G836 |

| Mairs & Power Minnesota Municipal Bond ETF | PAGE 2 | TSR_SAR_89834G836 |

| (b) | Not applicable. |

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

| (a) | Not applicable for semi-annual reports. |

| (b) | Not Applicable. |

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

| (b) | Not Applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) | |

Page | |||

Schedule of Investments | |||

Shares | Value | |||||

COMMON STOCKS - 99.7% | ||||||

Communication Services - 7.3% | ||||||

Alphabet, Inc. - Class C | 1,351,419 | $ 247,877,273 | ||||

Verizon Communications, Inc. | 3,821,000 | 157,578,040 | ||||

405,455,313 | ||||||

Consumer Discretionary - 7.5% | ||||||

Amazon.com, Inc.(a) | 1,672,000 | 323,114,000 | ||||

Best Buy Co., Inc. | 655,700 | 55,268,953 | ||||

Polaris, Inc. | 218,000 | 17,071,580 | ||||

Ulta Beauty, Inc.(a) | 55,900 | 21,570,133 | ||||

417,024,666 | ||||||

Consumer Staples - 2.7% | ||||||

Casey's General Stores, Inc. | 42,748 | 16,310,927 | ||||

Hormel Foods Corp. | 2,810,592 | 85,694,950 | ||||

Sysco Corp. | 555,000 | 39,621,450 | ||||

Target Corp. | 75,870 | 11,231,795 | ||||

152,859,122 | ||||||

Financials - 15.1% | ||||||

Charles Schwab Corp. | 820,000 | 60,425,800 | ||||

Fiserv, Inc.(a) | 989,000 | 147,400,560 | ||||

JPMorgan Chase & Co. | 1,263,000 | 255,454,380 | ||||

Piper Sandler Cos. | 168,000 | 38,668,560 | ||||

Principal Financial Group, Inc. | 655,000 | 51,384,750 | ||||

US Bancorp/MN | 3,117,000 | 123,744,900 | ||||

Visa, Inc. - Class A | 350,000 | 91,864,500 | ||||

Wells Fargo & Co. | 1,190,500 | 70,703,795 | ||||

839,647,245 | ||||||

Health Care - 14.8% | ||||||

Abbott Laboratories | 255,829 | 26,583,191 | ||||

Bio-Techne Corp. | 1,393,800 | 99,865,770 | ||||

Eli Lilly & Co. | 124,539 | 112,755,120 | ||||

Johnson & Johnson | 513,232 | 75,013,989 | ||||

Medtronic PLC | 1,760,000 | 138,529,600 | ||||

Roche Holding AG - ADR | 2,852,509 | 98,896,487 | ||||

UnitedHealth Group, Inc. | 531,000 | 270,417,060 | ||||

822,061,217 | ||||||

Industrials - 13.8% | ||||||

CH Robinson Worldwide, Inc. | 360,000 | 31,723,200 | ||||

Donaldson Co., Inc. | 673,613 | 48,203,746 | ||||

Fastenal Co. | 1,416,000 | 88,981,440 | ||||

Graco, Inc. | 2,044,774 | 162,109,683 | ||||

Honeywell International, Inc. | 195,594 | 41,767,143 | ||||

nVent Electric PLC | 1,318,919 | 101,042,384 | ||||

Rockwell Automation, Inc. | 250,000 | 68,820,000 | ||||

Tennant Co. | 669,300 | 65,885,892 | ||||

Toro Co. | 1,705,523 | 159,483,456 | ||||

768,016,944 | ||||||

1 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Information Technology - 31.5%(b) | ||||||

Apple, Inc. | 946,800 | $199,415,016 | ||||

Entegris, Inc. | 503,000 | 68,106,200 | ||||

Littelfuse, Inc. | 473,000 | 120,894,070 | ||||

Microsoft Corp. | 1,315,000 | 587,739,250 | ||||

Motorola Solutions, Inc. | 288,500 | 111,375,425 | ||||

NVIDIA Corp. | 3,523,061 | 435,238,956 | ||||

QUALCOMM, Inc. | 821,000 | 163,526,780 | ||||

Salesforce, Inc. | 114,000 | 29,309,400 | ||||

Workiva, Inc.(a) | 512,857 | 37,433,433 | ||||

1,753,038,530 | ||||||

Materials - 4.4% | ||||||

Ecolab, Inc. | 278,015 | 66,167,570 | ||||

HB Fuller Co. | 1,087,674 | 83,707,391 | ||||

Sherwin-Williams Co. | 315,000 | 94,005,450 | ||||

243,880,411 | ||||||

Utilities - 2.6% | ||||||

Alliant Energy Corp. | 2,872,000 | 146,184,800 | ||||

TOTAL COMMON STOCKS (Cost $2,495,698,679) | 5,548,168,248 | |||||

SHORT-TERM INVESTMENTS - 0.2% | ||||||

Money Market Funds - 0.2% | ||||||

First American Government Obligations Fund - Class X, 5.23%(c) | 9,963,463 | 9,963,463 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $9,963,463) | 9,963,463 | |||||

TOTAL INVESTMENTS - 99.9% (Cost $2,506,662,142) | $5,558,131,711 | |||||

Other Assets in Excess of Liabilities - 0.1% | 3,555,806 | |||||

TOTAL NET ASSETS - 100.0% | $5,561,687,517 | |||||

(a) | Non-income producing security. |

(b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

2 |

Shares | Value | |||||

COMMON STOCKS - 63.9% | ||||||

Communication Services - 5.2% | ||||||

Alphabet, Inc. - Class C | 167,810 | $ 30,779,710 | ||||

Walt Disney Co. | 92,000 | 9,134,680 | ||||

39,914,390 | ||||||

Consumer Discretionary - 1.0% | ||||||

Home Depot, Inc. | 22,702 | 7,814,936 | ||||

Consumer Staples - 5.9% | ||||||

Casey’s General Stores, Inc. | 21,000 | 8,012,760 | ||||

Hershey Co. | 47,283 | 8,692,034 | ||||

Hormel Foods Corp. | 306,943 | 9,358,692 | ||||

Procter & Gamble Co. | 37,000 | 6,102,040 | ||||

Sysco Corp. | 107,000 | 7,638,730 | ||||

Target Corp. | 36,000 | 5,329,440 | ||||

45,133,696 | ||||||

Financials - 11.4% | ||||||

American Express Co. | 26,574 | 6,153,210 | ||||

Ameriprise Financial, Inc. | 12,000 | 5,126,280 | ||||

Fiserv, Inc.(a) | 128,000 | 19,077,120 | ||||

JPMorgan Chase & Co. | 100,698 | 20,367,177 | ||||

Principal Financial Group, Inc. | 59,000 | 4,628,550 | ||||

US Bancorp/MN | 221,848 | 8,807,366 | ||||

Visa, Inc. - Class A | 57,000 | 14,960,790 | ||||

Wells Fargo & Co. | 139,089 | 8,260,496 | ||||

87,380,989 | ||||||

Health Care - 11.8% | ||||||

Abbott Laboratories | 120,843 | 12,556,796 | ||||

Bio-Techne Corp. | 91,000 | 6,520,150 | ||||

Eli Lilly & Co. | 17,475 | 15,821,516 | ||||

Johnson & Johnson | 73,092 | 10,683,127 | ||||

Medtronic PLC | 179,000 | 14,089,090 | ||||

Neogen Corp.(a) | 165,000 | 2,578,950 | ||||

Roche Holding AG - ADR | 197,000 | 6,829,990 | ||||

UnitedHealth Group, Inc. | 42,013 | 21,395,540 | ||||

90,475,159 | ||||||

Industrials - 10.2% | ||||||

3M Co. | 6,527 | 666,994 | ||||

Automatic Data Processing, Inc. | 39,000 | 9,308,910 | ||||

CH Robinson Worldwide, Inc. | 28,000 | 2,467,360 | ||||

Donaldson Co., Inc. | 59,000 | 4,222,040 | ||||

Fastenal Co. | 130,000 | 8,169,200 | ||||

Graco, Inc. | 135,915 | 10,775,341 | ||||

Honeywell International, Inc. | 37,500 | 8,007,750 | ||||

nVent Electric PLC | 71,000 | 5,439,310 | ||||

Rockwell Automation, Inc. | 25,000 | 6,882,000 | ||||

3 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Industrials - (Continued) | ||||||

Tennant Co. | 57,750 | $5,684,910 | ||||

Toro Co. | 170,323 | 15,926,904 | ||||

77,550,719 | ||||||

Information Technology - 12.7% | ||||||

Entegris, Inc. | 51,000 | 6,905,400 | ||||

Littelfuse, Inc. | 44,000 | 11,245,960 | ||||

Microsoft Corp. | 70,213 | 31,381,700 | ||||

Motorola Solutions, Inc. | 31,000 | 11,967,550 | ||||

QUALCOMM, Inc. | 66,494 | 13,244,275 | ||||

Salesforce, Inc. | 22,000 | 5,656,200 | ||||

Texas Instruments, Inc. | 86,000 | 16,729,580 | ||||

97,130,665 | ||||||

Materials - 4.4% | ||||||

Ecolab, Inc. | 69,000 | 16,422,000 | ||||

HB Fuller Co. | 98,205 | 7,557,857 | ||||

Sherwin-Williams Co. | 31,000 | 9,251,330 | ||||

33,231,187 | ||||||

Utilities - 1.3% | ||||||

Xcel Energy, Inc. | 184,700 | 9,864,827 | ||||

TOTAL COMMON STOCKS (Cost $262,659,866) | 488,496,568 | |||||

Par | ||||||

CORPORATE BONDS - 31.1% | ||||||

Communication Services - 0.8% | ||||||

AT&T, Inc., 4.50%, 05/15/2035 | $3,000,000 | 2,770,505 | ||||

Comcast Corp., 4.25%, 01/15/2033 | 2,000,000 | 1,874,199 | ||||

Netflix, Inc., 5.88%, 11/15/2028 | 1,688,000 | 1,740,666 | ||||

6,385,370 | ||||||

Consumer Discretionary - 3.6% | ||||||

Advance Auto Parts, Inc., 3.90%, 04/15/2030 | 2,000,000 | 1,810,110 | ||||

AutoNation, Inc., 3.80%, 11/15/2027 | 1,110,000 | 1,045,426 | ||||

Block Financial LLC | ||||||

5.25%, 10/01/2025 | 1,064,000 | 1,057,106 | ||||

3.88%, 08/15/2030 | 1,000,000 | 917,827 | ||||

Choice Hotels International, Inc. | ||||||

3.70%, 12/01/2029 | 1,000,000 | 898,776 | ||||

5.85%, 08/01/2034 | 750,000 | 740,920 | ||||

eBay, Inc., 6.30%, 11/22/2032 | 2,000,000 | 2,128,788 | ||||

Ford Motor Co. | ||||||

6.10%, 08/19/2032 | 500,000 | 500,522 | ||||

4.75%, 01/15/2043 | 1,000,000 | 812,509 | ||||

4 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Consumer Discretionary - (Continued) | ||||||

General Motors Co. | ||||||

4.20%, 10/01/2027 | $1,000,000 | $ 964,711 | ||||

5.15%, 04/01/2038 | 1,000,000 | 922,878 | ||||

Hasbro, Inc. | ||||||

3.90%, 11/19/2029 | 2,000,000 | 1,847,400 | ||||

5.10%, 05/15/2044 | 750,000 | 646,561 | ||||

Kohl’s Corp. | ||||||

4.63%, 05/01/2031 | 1,000,000 | 837,653 | ||||

6.88%, 12/15/2037 | 500,000 | 396,813 | ||||

5.55%, 07/17/2045 | 1,073,000 | 734,163 | ||||

Lear Corp., 3.80%, 09/15/2027 | 2,245,000 | 2,144,694 | ||||

Lowe’s Cos., Inc., 4.65%, 04/15/2042 | 880,000 | 772,954 | ||||

Mohawk Industries, Inc., 3.63%, 05/15/2030 | 2,000,000 | 1,835,940 | ||||

Polaris, Inc., 6.95%, 03/15/2029 | 1,806,000 | 1,890,333 | ||||

Starbucks Corp., 3.00%, 02/14/2032 | 1,000,000 | 868,683 | ||||

Tapestry, Inc. | ||||||

7.70%, 11/27/2030 | 500,000 | 522,963 | ||||

3.05%, 03/15/2032 | 500,000 | 404,193 | ||||

United Airlines 2014-2 Class A Pass Through Trust, Series A, 3.75%, 09/03/2026 | 365,690 | 352,160 | ||||

Whirlpool Corp. | ||||||

5.75%, 03/01/2034 | 1,000,000 | 1,000,810 | ||||

5.15%, 03/01/2043 | 1,100,000 | 978,011 | ||||

Wildlife Conservation Society, 3.41%, 08/01/2050 | 1,000,000 | 706,914 | ||||

27,739,818 | ||||||

Consumer Staples - 0.8% | ||||||

Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc., 4.70%, 02/01/2036 | 1,000,000 | 956,152 | ||||

Land O’ Lakes, Inc. | ||||||

7.25%, Perpetual(b) | 2,500,000 | 2,037,500 | ||||

7.00%, Perpetual(b) | 2,500,000 | 1,962,500 | ||||

Molson Coors Beverage Co., 4.20%, 07/15/2046 | 1,000,000 | 803,755 | ||||

Smithfield Foods, Inc., 3.00%, 10/15/2030(b) | 250,000 | 212,594 | ||||

5,972,501 | ||||||

Energy - 0.3% | ||||||

Boardwalk Pipelines LP, 4.95%, 12/15/2024 | 1,000,000 | 996,286 | ||||

Kinder Morgan, Inc., 5.30%, 12/01/2034 | 1,200,000 | 1,166,104 | ||||

Murphy Oil Corp., 5.88%, 12/01/2042 | 500,000 | 443,911 | ||||

2,606,301 | ||||||

Financials - 11.3% | ||||||

Allstate Corp., 5.25%, 03/30/2033 | 1,000,000 | 998,335 | ||||

American Express Co., 4.99% to 05/26/2032 then SOFR + 2.26%, 05/26/2033 | 500,000 | 482,790 | ||||

Ashtead Capital, Inc., 5.80%, 04/15/2034(b) | 1,000,000 | 994,807 | ||||

Associated Banc-Corp., 4.25%, 01/15/2025 | 1,627,000 | 1,610,001 | ||||

5 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Financials - (Continued) | ||||||

Assurant, Inc., 3.70%, 02/22/2030 | $2,300,000 | $ 2,081,500 | ||||

BAC Capital Trust XIV, 6.00% (3 mo. Term SOFR + 0.66%), Perpetual | 500,000 | 429,120 | ||||

Bank of America Corp. | ||||||

5.02% to 07/22/2032 then SOFR + 2.16%, 07/22/2033 | 1,000,000 | 981,575 | ||||

4.00%, 08/15/2034 | 538,000 | 477,420 | ||||

Bank of Montreal, 3.09% to 01/10/2032 then 5 yr. CMT Rate + 1.40%, 01/10/2037 | 2,150,000 | 1,762,813 | ||||

Bank of New York Mellon Corp., 3.75% to 12/20/2026 then 5 yr. CMT Rate + 2.63%, Perpetual | 2,000,000 | 1,850,609 | ||||

Blackstone Holdings Finance Co. LLC, 2.55%, 03/30/2032(b) | 1,000,000 | 833,182 | ||||

Capital One Financial Corp., 5.25% to 07/26/2029 then SOFR + 2.60%, 07/26/2030 | 4,000,000 | 3,933,462 | ||||

Charles Schwab Corp., 4.00% to 12/01/2030 then 10 yr. CMT Rate + 3.08%, Perpetual | 6,000,000 | 5,129,978 | ||||

Cincinnati Financial Corp., 6.13%, 11/01/2034 | 1,301,000 | 1,359,725 | ||||

Citigroup, Inc. | ||||||

4.00%, 08/05/2024 | 1,000,000 | 997,984 | ||||

3.07% to 02/24/2027 then SOFR + 1.28%, 02/24/2028 | 500,000 | 472,018 | ||||

CNA Financial Corp., 5.50%, 06/15/2033 | 2,000,000 | 1,999,728 | ||||

Farmers Exchange Capital, 7.05%, 07/15/2028(b) | 500,000 | 514,942 | ||||

Fiserv, Inc., 4.20%, 10/01/2028 | 1,000,000 | 961,961 | ||||

FMR LLC, 6.45%, 11/15/2039(b) | 1,141,000 | 1,246,119 | ||||

Ford Motor Credit Co. LLC, 3.63%, 06/17/2031 | 1,750,000 | 1,512,065 | ||||

Fulton Financial Corp., 3.75% to 03/15/2030 then 3 mo. Term SOFR + 2.70%, 03/15/2035 | 3,000,000 | 2,161,010 | ||||

General Motors Financial Co., Inc., 5.75%, 02/08/2031 | 500,000 | 501,867 | ||||

Goldman Sachs Group, Inc. | ||||||

4.25%, 11/15/2030 | 500,000 | 467,664 | ||||

4.00%, 02/15/2031 | 500,000 | 469,310 | ||||

2.65% to 10/21/2031 then SOFR + 1.26%, 10/21/2032 | 2,000,000 | 1,666,574 | ||||

4.30%, 12/15/2032 | 500,000 | 462,872 | ||||

HSBC Holdings PLC, 4.25%, 08/18/2025 | 2,000,000 | 1,964,852 | ||||

Huntington National Bank, 4.60%, 02/27/2025 | 1,050,000 | 1,036,938 | ||||

Janus Henderson US Holdings, Inc., 4.88%, 08/01/2025 | 2,000,000 | 1,979,885 | ||||

JPMorgan Chase & Co. | ||||||

3.65% to 06/01/2026 then 5 yr. CMT Rate + 2.85%, Perpetual | 3,000,000 | 2,844,644 | ||||

4.13%, 12/15/2026 | 1,000,000 | 974,420 | ||||

Kemper Corp., 4.35%, 02/15/2025 | 4,000,000 | 3,962,035 | ||||

Land O’ Lakes Capital Trust I, 7.45%, 03/15/2028(b) | 1,949,000 | 1,888,815 | ||||

Legg Mason, Inc. | ||||||

3.95%, 07/15/2024 | 3,088,000 | 3,085,922 | ||||

4.75%, 03/15/2026 | 1,520,000 | 1,511,382 | ||||

Liberty Mutual Insurance Co., 8.50%, 05/15/2025(b) | 250,000 | 254,985 | ||||

M&T Bank Corp., 5.13% to 11/01/2026 then 3 mo. Term SOFR + 3.78%, Perpetual | 2,500,000 | 2,378,953 | ||||

6 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Financials - (Continued) | ||||||

Mercury General Corp., 4.40%, 03/15/2027 | $4,000,000 | $ 3,860,021 | ||||

Morgan Stanley | ||||||

2.94% to 01/21/2032 then SOFR + 1.29%, 01/21/2033 | 1,700,000 | 1,448,045 | ||||

2.48% to 09/16/2031 then SOFR + 1.36%, 09/16/2036 | 750,000 | 594,450 | ||||

Old Republic International Corp. | ||||||

4.88%, 10/01/2024 | 2,000,000 | 1,994,050 | ||||

3.88%, 08/26/2026 | 790,000 | 763,947 | ||||

5.75%, 03/28/2034 | 1,000,000 | 1,000,023 | ||||

Park National Corp., 4.50% to 09/01/2025 then 3 mo. Term SOFR + 4.39%, 09/01/2030 | 500,000 | 470,675 | ||||

PNC Bank NA, 3.88%, 04/10/2025 | 1,000,000 | 985,572 | ||||

PNC Financial Services Group, Inc., 3.40% to 09/15/2026 then 5 yr. CMT Rate + 2.60%, Perpetual | 4,000,000 | 3,599,182 | ||||

Principal Financial Group, Inc., 4.35%, 05/15/2043 | 500,000 | 428,709 | ||||

Prudential Insurance Co. of America, 8.30%, 07/01/2025(b) | 1,000,000 | 1,022,000 | ||||

Synchrony Financial | ||||||

4.25%, 08/15/2024 | 3,000,000 | 2,992,913 | ||||

4.50%, 07/23/2025 | 1,000,000 | 984,048 | ||||

2.88%, 10/28/2031 | 2,000,000 | 1,607,631 | ||||

Unum Group, 7.25%, 03/15/2028 | 250,000 | 262,134 | ||||

US Bancorp, 5.85% to 10/21/2032 then SOFR + 2.09%, 10/21/2033 | 2,000,000 | 2,036,235 | ||||

Wells Fargo & Co., 4.10%, 06/03/2026 | 1,000,000 | 974,540 | ||||

Wintrust Financial Corp., 4.85%, 06/06/2029 | 3,500,000 | 3,201,264 | ||||

86,467,701 | ||||||

Health Care - 1.2% | ||||||

AbbVie, Inc., 3.80%, 03/15/2025 | 2,000,000 | 1,975,660 | ||||

Bristol-Myers Squibb Co. | ||||||

3.88%, 08/15/2025 | 43,000 | 42,320 | ||||

2.35%, 11/13/2040 | 1,500,000 | 1,002,098 | ||||

CVS Health Corp. | ||||||

4.78%, 03/25/2038 | 1,400,000 | 1,253,992 | ||||

2.70%, 08/21/2040 | 1,500,000 | 1,001,694 | ||||

Humana, Inc., 5.95%, 03/15/2034 | 1,000,000 | 1,025,590 | ||||

Quest Diagnostics, Inc., 6.40%, 11/30/2033 | 500,000 | 536,242 | ||||

Viatris, Inc., 2.30%, 06/22/2027 | 1,500,000 | 1,370,174 | ||||

Zimmer Biomet Holdings, Inc., 4.25%, 08/15/2035 | 700,000 | 613,655 | ||||

8,821,425 | ||||||

Industrials - 3.5% | ||||||

Eaton Corp., 4.00%, 11/02/2032 | 2,000,000 | 1,868,817 | ||||

Equifax, Inc., 7.00%, 07/01/2037 | 1,000,000 | 1,117,288 | ||||

FedEx Corp., 4.10%, 04/15/2043 | 1,000,000 | 808,318 | ||||

Flowserve Corp., 3.50%, 10/01/2030 | 1,000,000 | 892,168 | ||||

GATX Corp. | ||||||

4.90%, 03/15/2033 | 1,000,000 | 959,479 | ||||

7 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Industrials - (Continued) | ||||||

5.45%, 09/15/2033 | $1,000,000 | $ 989,525 | ||||

6.05%, 03/15/2034 | 500,000 | 512,555 | ||||

6.90%, 05/01/2034 | 500,000 | 545,888 | ||||

Hillenbrand, Inc., 3.75%, 03/01/2031 | 3,000,000 | 2,610,038 | ||||

Howmet Aerospace, Inc., 5.95%, 02/01/2037 | 1,000,000 | 1,029,892 | ||||

Kennametal, Inc., 4.63%, 06/15/2028 | 1,500,000 | 1,464,199 | ||||

Leidos Holdings, Inc., 5.95%, 12/01/2040 | 1,400,000 | 1,376,130 | ||||

Leidos, Inc., 5.50%, 07/01/2033 | 3,850,000 | 3,793,049 | ||||

nVent Finance Sarl, 5.65%, 05/15/2033 | 1,495,000 | 1,493,170 | ||||

Penske Truck Leasing Co. Lp / PTL Finance Corp. | ||||||

5.70%, 02/01/2028(b) | 500,000 | 504,902 | ||||

6.05%, 08/01/2028(b) | 500,000 | 512,414 | ||||

Steelcase, Inc., 5.13%, 01/18/2029 | 2,000,000 | 1,896,042 | ||||

Toro Co., 7.80%, 06/15/2027 | 500,000 | 532,784 | ||||

United Rentals North America, Inc., 3.75%, 01/15/2032 | 4,000,000 | 3,485,176 | ||||

26,391,834 | ||||||

Information Technology - 4.0% | ||||||

Analog Devices, Inc., 2.80%, 10/01/2041 | 1,000,000 | 708,685 | ||||

Arrow Electronics, Inc., 4.00%, 04/01/2025 | �� | 1,031,000 | 1,017,238 | |||

Autodesk, Inc., 2.40%, 12/15/2031 | 1,000,000 | 831,786 | ||||

Avnet, Inc. | ||||||

3.00%, 05/15/2031 | 2,000,000 | 1,684,051 | ||||

5.50%, 06/01/2032 | 1,000,000 | 969,280 | ||||

Broadcom, Inc. | ||||||

4.30%, 11/15/2032 | 1,000,000 | 936,917 | ||||

3.47%, 04/15/2034(b) | 1,000,000 | 854,796 | ||||

4.93%, 05/15/2037(b) | 1,500,000 | 1,414,993 | ||||

Cox Communications, Inc., 4.80%, 02/01/2035(b) | 1,880,000 | 1,705,231 | ||||

Dell, Inc., 5.40%, 09/10/2040 | 1,000,000 | 945,288 | ||||

Discovery Communications LLC, 4.95%, 05/15/2042 | 570,000 | 447,780 | ||||

Entegris, Inc., 4.75%, 04/15/2029(b) | 3,000,000 | 2,872,946 | ||||

Fortinet, Inc., 2.20%, 03/15/2031 | 2,000,000 | 1,650,462 | ||||

Hewlett Packard Enterprise Co., 4.90%, 10/15/2025 | 1,000,000 | 992,259 | ||||

HP, Inc. | ||||||

2.65%, 06/17/2031 | 1,000,000 | 849,188 | ||||

5.50%, 01/15/2033 | 2,000,000 | 2,017,550 | ||||

Micron Technology, Inc., 5.88%, 02/09/2033 | 1,000,000 | 1,023,583 | ||||

Motorola Solutions, Inc. | ||||||

4.60%, 02/23/2028 | 2,500,000 | 2,460,144 | ||||

5.50%, 09/01/2044 | 2,000,000 | 1,954,874 | ||||

Oracle Corp., 3.60%, 04/01/2040 | 3,000,000 | 2,316,195 | ||||

T-Mobile USA, Inc., 5.75%, 01/15/2034 | 2,000,000 | 2,060,826 | ||||

Warnermedia Holdings, Inc., 4.28%, 03/15/2032 | 1,000,000 | 874,384 | ||||

30,588,456 | ||||||

8 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Materials - 2.5% | ||||||

Albemarle Corp., 5.45%, 12/01/2044 | $325,000 | $ 298,567 | ||||

Albemarle Wodgina Pty Ltd., 3.45%, 11/15/2029 | 1,175,000 | 1,044,245 | ||||

Cabot Corp. | ||||||

3.40%, 09/15/2026 | 1,500,000 | 1,433,304 | ||||

4.00%, 07/01/2029 | 2,800,000 | 2,643,115 | ||||

Eastman Chemical Co. | ||||||

3.80%, 03/15/2025 | 756,000 | 746,304 | ||||

5.63%, 02/20/2034 | 1,000,000 | 996,038 | ||||

Freeport-McMoRan, Inc., 4.25%, 03/01/2030 | 3,000,000 | 2,836,636 | ||||

HB Fuller Co., 4.25%, 10/15/2028 | 3,200,000 | 3,033,071 | ||||

International Flavors & Fragrances, Inc. | ||||||

1.83%, 10/15/2027(b) | 486,000 | 434,348 | ||||

2.30%, 11/01/2030(b) | 1,200,000 | 1,001,895 | ||||

3.27%, 11/15/2040(b) | 1,000,000 | 710,376 | ||||

Mosaic Co., 5.45%, 11/15/2033 | 2,000,000 | 1,985,203 | ||||

Newmont Corp., 4.88%, 03/15/2042 | 1,000,000 | 927,294 | ||||

Steel Dynamics, Inc., 3.25%, 10/15/2050 | 250,000 | 166,144 | ||||

Union Carbide Corp., 7.50%, 06/01/2025 | 865,000 | 878,073 | ||||

19,134,613 | ||||||

Professional, Scientific, and Technical Services - 0.3% | ||||||

LPL Holdings, Inc., 6.00%, 05/20/2034 | 2,000,000 | 2,002,522 | ||||

Real Estate - 0.3% | ||||||

CBRE Services, Inc., 5.95%, 08/15/2034 | 2,000,000 | 2,029,891 | ||||

Utilities - 2.5% | ||||||

Alliant Energy Finance LLC, 3.60%, 03/01/2032(b) | 1,000,000 | 873,414 | ||||

Black Hills Corp. | ||||||

4.35%, 05/01/2033 | 1,000,000 | 904,129 | ||||

6.15%, 05/15/2034 | 2,000,000 | 2,043,954 | ||||

Duke Energy Carolinas LLC, 6.10%, 06/01/2037 | 1,000,000 | 1,033,943 | ||||

Duke Energy Progress LLC, 5.70%, 04/01/2035 | 1,165,000 | 1,174,148 | ||||

Interstate Power and Light Co., 6.25%, 07/15/2039 | 2,000,000 | 2,089,950 | ||||

National Fuel Gas Co. | ||||||

3.95%, 09/15/2027 | 2,000,000 | 1,913,394 | ||||

4.75%, 09/01/2028 | 1,000,000 | 973,705 | ||||

Niagara Mohawk Power Corp., 4.28%, 10/01/2034(b) | 2,000,000 | 1,782,591 | ||||

Northern Natural Gas Co., 4.10%, 09/15/2042(b) | 1,021,000 | 818,248 | ||||

Public Service Co. of Colorado, 6.50%, 08/01/2038 | 2,000,000 | 2,168,960 | ||||

Southwestern Public Service Co., 6.00%, 10/01/2036 | 1,000,000 | 993,608 | ||||

Toledo Edison Co., 2.65%, 05/01/2028(b) | 416,000 | 375,436 | ||||

Virginia Electric and Power Co., 6.35%, 11/30/2037 | 1,065,000 | 1,138,026 | ||||

Wisconsin Power and Light Co., 4.95%, 04/01/2033 | 1,000,000 | 970,074 | ||||

19,253,580 | ||||||

TOTAL CORPORATE BONDS (Cost $254,809,960) | $237,394,012 | |||||

9 |

Par | Value | |||||

U.S. TREASURY OBLIGATIONS - 2.1% | ||||||

United States Treasury Note/Bond | ||||||

0.75%, 03/31/2026 | $1,000,000 | $932,734 | ||||

0.75%, 04/30/2026 | 1,000,000 | 930,195 | ||||

1.13%, 10/31/2026 | 1,000,000 | 923,067 | ||||

2.63%, 05/31/2027 | 3,000,000 | 2,845,957 | ||||

1.25%, 06/30/2028 | 1,000,000 | 885,371 | ||||

1.00%, 07/31/2028 | 1,000,000 | 874,082 | ||||

1.25%, 09/30/2028 | 1,000,000 | 879,356 | ||||

2.63%, 02/15/2029 | 2,000,000 | 1,855,430 | ||||

1.38%, 11/15/2031 | 2,000,000 | 1,629,492 | ||||

2.88%, 05/15/2032 | 2,000,000 | 1,805,234 | ||||

3.25%, 05/15/2042 | 1,000,000 | 835,625 | ||||

3.00%, 02/15/2049 | 2,000,000 | 1,524,531 | ||||

TOTAL U.S. TREASURY OBLIGATIONS (Cost $17,202,417) | 15,921,074 | |||||

MUNICIPAL BONDS - 1.0% | ||||||

Borough of Naugatuck CT, 3.09%, 09/15/2046 | 1,000,000 | 712,810 | ||||

Crowley Independent School District, 3.01%, 08/01/2038 | 1,000,000 | 810,890 | ||||

DeKalb Kane & LaSalle Counties Etc Community College District No 523 Kishwaukee, 3.02%, 02/01/2036 | 500,000 | 404,644 | ||||

Desert Community College District, 2.46%, 08/01/2040 | 300,000 | 218,021 | ||||

Glendale Community College District/CA, 2.11%, 08/01/2031 | 650,000 | 547,220 | ||||

Idaho Bond Bank Authority, 2.35%, 09/15/2038 | 500,000 | 370,459 | ||||

Massachusetts Development Finance Agency, 2.55%, 05/01/2040 | 885,000 | 619,752 | ||||

Michigan State University, 4.50%, 08/15/2048 | 1,000,000 | 917,118 | ||||

Pierre School District No 32-2, 2.04%, 08/01/2033 | 920,000 | 749,638 | ||||

Redondo Beach Unified School District, 2.04%, 08/01/2034 | 500,000 | 380,505 | ||||

Socorro Independent School District, 2.13%, 08/15/2031 | 500,000 | 423,598 | ||||

Village of Ashwaubenon WI, 2.97%, 06/01/2040 | 505,000 | 386,750 | ||||

Woodbury County Law Enforcement Center Authority, 3.09%, 06/01/2040 | 750,000 | 583,215 | ||||

Worthington Independent School District No 518, 3.30%, 02/01/2039 | 850,000 | 704,280 | ||||

TOTAL MUNICIPAL BONDS (Cost $9,966,528) | 7,828,900 | |||||

ASSET-BACKED SECURITIES - 0.8% | ||||||

American Airlines Group, Inc. | ||||||

Series 2013-1, 3.95%, 11/15/2025 | 348,353 | 340,515 | ||||

Series 2014-1, 3.70%, 10/01/2026 | 982,467 | 941,940 | ||||

Series 2015-1, 3.38%, 05/01/2027 | 255,716 | 241,012 | ||||

Series 2015-2, 4.00%, 09/22/2027 | 388,754 | 365,429 | ||||

Series 2015-2, 3.60%, 09/22/2027 | 119,234 | 113,272 | ||||

Series 2016-3B, 3.75%, 10/15/2025 | 425,507 | 410,614 | ||||

Series 2017-1B, 4.95%, 02/15/2025 | 459,498 | 454,903 | ||||

10 |

Par | Value | |||||

ASSET-BACKED SECURITIES - (Continued) | ||||||

British Airways PLC, Series 2018-1, 4.13%, 09/20/2031(b) | $605,126 | $565,792 | ||||

Hawaiian Holdings, Inc., Series 2013-1, 3.90%, 01/15/2026 | 1,222,623 | 1,155,379 | ||||

Spirit Airlines, Inc., Series 2015-1, 4.10%, 04/01/2028 | 72,777 | 67,501 | ||||

United Airlines, Inc. | ||||||

Series A, 4.00%, 10/29/2024 | 888,824 | 886,601 | ||||

Series A, 4.30%, 08/15/2025 | 554,738 | 546,195 | ||||

Series A, 4.00%, 04/11/2026 | 435,176 | 422,391 | ||||

TOTAL ASSET-BACKED SECURITIES (Cost $6,734,647) | 6,511,544 | |||||

Shares | ||||||

PREFERRED STOCKS - 0.1% | ||||||

Financials - 0.1% | ||||||

Wells Fargo & Co, Series AA, 4.70%, Perpetual | 20,000 | 406,200 | ||||

TOTAL PREFERRED STOCKS (Cost $500,000) | 406,200 | |||||

SHORT-TERM INVESTMENTS - 0.6% | ||||||

Money Market Funds - 0.6% | ||||||

First American Government Obligations Fund - Class X, 5.23%(c) | 4,660,996 | 4,660,996 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $4,660,996) | 4,660,996 | |||||

TOTAL INVESTMENTS - 99.6% (Cost $556,534,414) | $761,219,294 | |||||

Other Assets in Excess of Liabilities - 0.4% | 3,002,453 | |||||

TOTAL NET ASSETS - 100.0% | $764,221,747 | |||||

(a) | Non-income producing security. |

(b) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $25,394,826 or 3.3% of the Fund’s net assets. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

11 |

Shares | Value | |||||

COMMON STOCKS - 99.9% | ||||||

Consumer Discretionary - 3.1% | ||||||

Gentherm, Inc.(a) | 137,380 | $ 6,775,581 | ||||

Polaris, Inc. | 38,400 | 3,007,104 | ||||

9,782,685 | ||||||

Consumer Staples - 7.6% | ||||||

Casey’s General Stores, Inc. | 36,603 | 13,966,241 | ||||

MGP Ingredients, Inc. | 128,210 | 9,538,824 | ||||

23,505,065 | ||||||

Financials - 17.7% | ||||||

Alerus Financial Corp. | 96,441 | 1,891,208 | ||||

Associated Banc-Corp. | 365,361 | 7,727,385 | ||||

Cullen/Frost Bankers, Inc. | 85,150 | 8,653,795 | ||||

Glacier Bancorp, Inc. | 192,420 | 7,181,114 | ||||

Piper Sandler Cos. | 53,100 | 12,222,027 | ||||

QCR Holdings, Inc. | 128,078 | 7,684,680 | ||||

Wintrust Financial Corp. | 99,146 | 9,771,830 | ||||

55,132,039 | ||||||

Health Care - 9.9% | ||||||

Bio-Techne Corp. | 98,000 | 7,021,700 | ||||

CVRx, Inc.(a) | 137,456 | 1,648,097 | ||||

Exact Sciences Corp.(a) | 37,700 | 1,592,825 | ||||

Inspire Medical Systems, Inc.(a) | 48,625 | 6,507,484 | ||||

Medpace Holdings, Inc.(a) | 28,370 | 11,684,185 | ||||

Neogen Corp.(a) | 151,100 | 2,361,693 | ||||

30,815,984 | ||||||

Industrials - 28.4%(b) | ||||||

AAR Corp.(a) | 175,361 | 12,748,745 | ||||

AZEK Co., Inc.(a) | 258,277 | 10,881,210 | ||||

Generac Holdings, Inc.(a) | 70,972 | 9,383,918 | ||||

Hub Group, Inc. - Class A | 288,320 | 12,412,176 | ||||

John Bean Technologies Corp. | 120,735 | 11,466,203 | ||||

nVent Electric PLC | 136,889 | 10,487,066 | ||||

Oshkosh Corp. | 39,750 | 4,300,950 | ||||

Tennant Co. | 84,064 | 8,275,260 | ||||

Toro Co. | 92,300 | 8,630,973 | ||||

88,586,501 | ||||||

Information Technology - 22.4% | ||||||

Altair Engineering, Inc. - Class A(a) | 128,850 | 12,637,608 | ||||

Clearfield, Inc.(a) | 275,893 | 10,638,434 | ||||

Entegris, Inc. | 74,507 | 10,088,248 | ||||

Jamf Holding Corp.(a) | 381,667 | 6,297,505 | ||||

Littelfuse, Inc. | 44,927 | 11,482,892 | ||||

Plexus Corp.(a) | 98,020 | 10,113,704 | ||||

12 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Information Technology - (Continued) | ||||||

SkyWater Technology, Inc.(a) | 166,390 | $1,272,884 | ||||

Workiva, Inc.(a) | 101,267 | 7,391,478 | ||||

69,922,753 | ||||||

Materials - 6.3% | ||||||

HB Fuller Co. | 149,109 | 11,475,428 | ||||

Knife River Corp.(a) | 114,650 | 8,041,551 | ||||

19,516,979 | ||||||

Utilities - 4.5% | ||||||

Black Hills Corp. | 136,200 | 7,406,556 | ||||

Northwestern Energy Group, Inc. | 132,600 | 6,640,608 | ||||

14,047,164 | ||||||

TOTAL COMMON STOCKS (Cost $225,213,494) | 311,309,170 | |||||

SHORT-TERM INVESTMENTS - 0.2% | ||||||

Money Market Funds - 0.2% | ||||||

First American Government Obligations Fund - Class X, 5.23%(c) | 688,351 | 688,351 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $688,351) | 688,351 | |||||

TOTAL INVESTMENTS - 100.1% (Cost $225,901,845) | $311,997,521 | |||||

Liabilities in Excess of Other Assets - (0.1)% | (192,455) | |||||

TOTAL NET ASSETS - 100.0% | $311,805,066 | |||||

(a) | Non-income producing security. |

(b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

13 |

Par | Value | |||||

MUNICIPAL BONDS - 98.3% | ||||||

Alden-Conger Independent School District No 242, 3.00%, 02/01/2027 | $330,000 | $ 323,389 | ||||

Alexandria Lake Area Sanitation District, 4.00%, 02/01/2036 | 150,000 | 152,132 | ||||

Anoka-Hennepin Independent School District No 11 | ||||||

4.00%, 02/01/2032 | 320,000 | 329,378 | ||||

3.00%, 02/01/2043 | 500,000 | 420,013 | ||||

Bold Independent School District No 2534, 5.00%, 02/01/2044 | 200,000 | 219,796 | ||||

City of Apple Valley MN, 4.00%, 09/01/2041 | 290,000 | 265,928 | ||||

City of Carver MN, 3.00%, 02/01/2032 | 195,000 | 185,019 | ||||

City of Center City MN | ||||||

4.00%, 11/01/2027 | 135,000 | 135,916 | ||||

4.50%, 11/01/2034 | 100,000 | 100,115 | ||||

City of Chaska MN Electric Revenue, 5.00%, 10/01/2025 | 140,000 | 143,100 | ||||

City of Coon Rapids MN, 2.50%, 02/01/2036 | 100,000 | 85,148 | ||||

City of Delano MN, 5.00%, 02/01/2038 | 250,000 | 276,858 | ||||

City of Elk River MN Electric Revenue, 3.00%, 08/01/2032 | 365,000 | 347,039 | ||||

City of Hanover MN, 3.30%, 02/01/2037 | 100,000 | 91,738 | ||||

City of Hutchinson MN, 2.00%, 02/01/2034 | 300,000 | 244,854 | ||||

City of Madelia MN, 2.00%, 02/01/2033 | 115,000 | 97,999 | ||||

City of Minneapolis MN | ||||||

5.00%, 11/15/2036 | 150,000 | 154,528 | ||||

4.00%, 11/15/2040 | 175,000 | 172,522 | ||||

City of New Prague MN, 4.00%, 02/01/2037 | 315,000 | 328,615 | ||||

City of Richfield MN, 4.00%, 02/01/2027 | 100,000 | 101,949 | ||||

City of Rochester MN, 5.00%, 02/01/2040 | 150,000 | 168,901 | ||||

City of Rosemount MN, 5.00%, 02/01/2037 | 250,000 | 280,286 | ||||

City of St Cloud MN, 2.00%, 02/01/2034 | 200,000 | 163,236 | ||||

City of St Paul MN, 2.00%, 05/01/2033 | 300,000 | 248,515 | ||||

City of St Paul MN Sales & Use Tax Revenue, 5.00%, 11/01/2026 | 100,000 | 100,523 | ||||

City of Wayzata MN, 3.00%, 12/01/2027 | 100,000 | 97,438 | ||||

County of Beltrami MN, 4.00%, 12/01/2042 | 250,000 | 255,315 | ||||

County of Carlton MN, 5.00%, 02/01/2042 | 250,000 | 278,427 | ||||

County of Itasca MN, 4.00%, 02/01/2044 | 200,000 | 200,002 | ||||

County of Koochiching MN, 5.00%, 02/01/2035 | 300,000 | 335,356 | ||||

County of Pennington MN, 2.38%, 02/01/2035 | 100,000 | 84,907 | ||||

County of St Louis MN, 2.00%, 12/01/2035 | 350,000 | 277,721 | ||||

County of Wright MN | ||||||

3.00%, 12/01/2038 | 295,000 | 256,924 | ||||

3.00%, 12/01/2039 | 250,000 | 216,873 | ||||

Crookston Independent School District No 593, 5.00%, 02/01/2029 | 250,000 | 270,238 | ||||

Dakota County Community Development Agency, 2.00%, 01/01/2032 | 65,000 | 55,933 | ||||

Duluth Independent School District No 709, 0.00%, 02/01/2031(a) | 200,000 | 147,338 | ||||

Eastern Carver County Schools Independent School District No 112, 4.00%, 02/01/2035 | 250,000 | 259,488 | ||||

Elk River Independent School District No 728, 4.00%, 02/01/2026 | 125,000 | 126,702 | ||||

Fergus Falls Independent School District No 544, 3.00%, 02/01/2037 | 225,000 | 195,281 | ||||

Forest Lake Independent School District No 831, 4.00%, 02/01/2039 | 500,000 | 510,787 | ||||

Hibbing Independent School District No 701, 3.00%, 03/01/2033 | 300,000 | 285,945 | ||||

14 |

Par | Value | |||||

MUNICIPAL BONDS - (Continued) | ||||||

Housing & Redevelopment Authority of The City of St Paul Minnesota | ||||||

3.50%, 09/01/2026 | $95,000 | $ 93,440 | ||||

4.00%, 10/01/2032 | 75,000 | 75,702 | ||||

3.13%, 11/15/2032 | 110,000 | 100,834 | ||||

4.00%, 10/01/2037 | 250,000 | 250,088 | ||||

Iron Range Resources & Rehabilitation Commissioner, 5.00%, 10/01/2035 | 220,000 | 254,607 | ||||

Mankato Independent School District No 77, 5.00%, 02/01/2026 | 200,000 | 205,695 | ||||

Metropolitan Council | ||||||

5.00%, 03/01/2026 | 100,000 | 103,035 | ||||

5.00%, 12/01/2028 | 100,000 | 108,193 | ||||

4.00%, 03/01/2030 | 140,000 | 143,108 | ||||

Minneapolis-St Paul Metropolitan Airports Commission | ||||||

5.00%, 01/01/2029 | 220,000 | 228,962 | ||||

5.00%, 01/01/2029 | 50,000 | 52,037 | ||||

5.00%, 01/01/2032 | 75,000 | 78,140 | ||||

5.00%, 01/01/2052 | 25,000 | 26,572 | ||||

Minnesota Agricultural & Economic Development Board, 5.00%, 01/01/2042 | 250,000 | 273,695 | ||||

Minnesota Higher Education Facilities Authority | ||||||

3.00%, 10/01/2036 | 200,000 | 179,807 | ||||

3.00%, 10/01/2041 | 400,000 | 341,277 | ||||

3.00%, 03/01/2043 | 125,000 | 103,382 | ||||

Minnesota Municipal Power Agency, 5.00%, 10/01/2047 | 85,000 | 85,798 | ||||

Minnesota State Colleges And Universities Foundation, 4.00%, 10/01/2029 | 200,000 | 200,076 | ||||

Minnetonka Independent School District No 276, 3.00%, 07/01/2036 | 150,000 | 139,282 | ||||

North St Paul-Maplewood-Oakdale Independent School District No 622, 2.00%, 02/01/2031 | 200,000 | 173,320 | ||||

Northfield Independent School District No 659, 5.00%, 02/01/2025 | 230,000 | 232,126 | ||||

Owatonna Independent School District No 761/MN, 4.00%, 02/01/2028 | 150,000 | 153,941 | ||||

Pelican Rapids Independent School District No 548, 2.15%, 02/01/2031 | 50,000 | 46,318 | ||||

Pine City Independent School District No 578, 2.00%, 04/01/2032 | 200,000 | 172,692 | ||||

Princeton Public Utilities Commission, 5.00%, 04/01/2031 | 100,000 | 108,727 | ||||

Rochester Independent School District No 535, 2.50%, 02/01/2039 | 250,000 | 197,962 | ||||

Rocori Area Schools Independent School District No 750, 4.00%, 02/01/2038 | 300,000 | 304,383 | ||||

Rosemount-Apple Valley-Eagan Independent School District No 196 | ||||||

5.00%, 04/01/2025 | 250,000 | 252,679 | ||||

1.30%, 04/01/2030 | 150,000 | 128,061 | ||||

Southern Plains Education Cooperative No 915, 3.00%, 02/01/2026 | 200,000 | 197,136 | ||||

St Cloud Housing & Redevelopment Authority | ||||||

2.00%, 02/01/2031 | 130,000 | 115,335 | ||||

2.00%, 02/01/2033 | 160,000 | 136,347 | ||||

St Cloud Independent School District No 742/MN, 5.00%, 02/01/2041 | 225,000 | 242,006 | ||||

St Francis Independent School District No 15, 4.00%, 02/01/2036 | 150,000 | 157,112 | ||||

St Paul Independent School District No 625 | ||||||

3.00%, 02/01/2033 | 200,000 | 193,461 | ||||

2.25%, 02/01/2035 | 100,000 | 83,031 | ||||

5.00%, 02/01/2042 | 200,000 | 222,976 | ||||

15 |

Par | Value | |||||

MUNICIPAL BONDS - (Continued) | ||||||

State of Minnesota | ||||||

5.00%, 08/01/2024 | $265,000 | $ 265,257 | ||||

5.00%, 08/01/2027 | 190,000 | 190,250 | ||||

5.00%, 08/01/2028 | 155,000 | 166,792 | ||||

5.00%, 08/01/2034 | 250,000 | 266,449 | ||||

5.00%, 08/01/2040 | 295,000 | 321,815 | ||||

5.00%, 08/01/2043 | 400,000 | 447,182 | ||||

Stillwater Independent School District No 834, 5.00%, 02/01/2040 | 250,000 | 276,295 | ||||

University of Minnesota | ||||||

5.00%, 12/01/2024 | 90,000 | 90,577 | ||||

5.00%, 10/01/2026 | 220,000 | 228,778 | ||||

5.00%, 04/01/2040 | 150,000 | 160,004 | ||||

Waconia Independent School District No 110, 3.00%, 02/01/2028 | 100,000 | 96,742 | ||||

Western Minnesota Municipal Power Agency | ||||||

5.00%, 01/01/2025 | 120,000 | 120,951 | ||||

5.00%, 01/01/2049 | 100,000 | 102,793 | ||||

Westonka Independent School District No 277, 4.00%, 02/01/2041 | 100,000 | 100,443 | ||||

Zumbro Education District | ||||||

4.00%, 02/01/2034 | 125,000 | 120,597 | ||||

4.00%, 02/01/2038 | 275,000 | 258,154 | ||||

TOTAL MUNICIPAL BONDS (Cost $19,649,630) | 18,366,594 | |||||

Shares | ||||||

SHORT-TERM INVESTMENTS - 3.4% | ||||||

Money Market Funds - 3.4% | ||||||

First American Government Obligations Fund - Class X, 5.23%(b) | 643,194 | 643,194 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $643,194) | 643,194 | |||||

TOTAL INVESTMENTS - 101.7% (Cost $20,292,824) | $19,009,788 | |||||

Liabilities in Excess of Other Assets - (1.7)% | (320,109) | |||||

TOTAL NET ASSETS - 100.0% | $18,689,679 | |||||

(a) | Zero coupon bonds make no periodic interest payments. |

(b) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

16 |

Mairs & Power Growth Fund | Mairs & Power Balanced Fund | Mairs & Power Small Cap Fund | Mairs & Power Minnesota Municipal Bond ETF | |||||||||

ASSETS | ||||||||||||

Investments, at fair value (Note 1)*: | $5,558,131,711 | $761,219,294 | $311,997,521 | $19,009,788 | ||||||||

Receivable for Fund shares sold | 2,219,529 | 885,119 | 66,927 | — | ||||||||

Receivable for securities sold | — | — | 324,345 | — | ||||||||

Dividends and interest receivable | 5,949,243 | 3,976,270 | 65,545 | 254,032 | ||||||||

Receivable from Adviser | — | — | — | 2,428 | ||||||||

Prepaid expenses and other assets | 36,297 | 18,098 | 21,815 | — | ||||||||

5,566,336,780 | 766,098,781 | 312,476,153 | 19,266,248 | |||||||||

LIABILITIES | ||||||||||||

Payable for Fund shares redeemed | 368,664 | 403,241 | 26,885 | — | ||||||||

Payable for securities purchased | — | 741,113 | 320,292 | 576,569 | ||||||||

Payable to Affiliates (Note 6) | 278,402 | 63,207 | 28,188 | — | ||||||||

Payable to ReFlow (Note 10) | 1,480,168 | 272,310 | 65,635 | — | ||||||||

Accrued investment management fees (Note 4) | 2,419,314 | 364,782 | 198,269 | — | ||||||||

Accrued audit and tax fees | 8,194 | 8,747 | 8,199 | — | ||||||||

Other accrued fees | 94,521 | 23,634 | 23,619 | — | ||||||||

4,649,263 | 1,877,034 | 671,087 | 576,569 | |||||||||

NET ASSETS | $5,561,687,517 | $764,221,747 | $311,805,066 | $18,689,679 | ||||||||

Net Assets Consists of: | ||||||||||||

Paid-in capital | $1,941,890,671 | $465,981,179 | $193,845,183 | $850 | ||||||||

Additional paid-in capital | — | — | — | 21,026,638 | ||||||||

Total distributable earnings/(accumulated loss) | 3,619,796,846 | 298,240,568 | 117,959,883 | (2,337,809) | ||||||||

Total net assets | $5,561,687,517 | $764,221,747 | $311,805,066 | $18,689,679 | ||||||||

Fund shares, par value | $0.01 | $0.01 | $0.01 | $0.001 | ||||||||

Authorized | unlimited | unlimited | unlimited | unlimited | ||||||||

Fund shares issued and outstanding | 33,205,380 | 7,199,108 | 10,466,508 | 850,000 | ||||||||

Net asset value per share | $167.49 | $106.16 | $29.79 | $21.99 | ||||||||

* Cost of investments | $2,505,662,142 | $556,534,414 | $225,901,845 | $20,292,824 | ||||||||

17 |

Mairs & Power Growth Fund | Mairs & Power Balanced Fund | Mairs & Power Small Cap Fund | Mairs & Power Minnesota Municipal Bond ETF | |||||||||

INVESTMENT INCOME | ||||||||||||

Income: | ||||||||||||

Dividends* | $42,012,317 | $4,373,179 | $1,737,693 | $— | ||||||||

Interest income | 330,362 | 6,363,898 | 18,466 | 257,967 | ||||||||

TOTAL INCOME | 42,342,679 | 10,737,077 | 1,756,159 | 257,967 | ||||||||

EXPENSES: | ||||||||||||

Investment management fees (Note 4) | 14,423,452 | 2,305,439 | 1,265,574 | 23,332 | ||||||||

Transfer agent fees (Note 6) | 759,672 | 133,918 | 81,676 | — | ||||||||

Fund administration fees (Note 6) | 379,998 | 67,064 | 30,890 | — | ||||||||

Fund accounting fees (Note 6) | 251,946 | 56,744 | 17,684 | — | ||||||||

ReFlow fees (Note 10) | 172,140 | 49,632 | 26,280 | — | ||||||||

Custodian fees (Note 6) | 127,762 | 21,762 | 9,898 | — | ||||||||

Printing and mailing fees | 54,838 | 12,988 | 8,324 | — | ||||||||

Legal and audit fees | 22,032 | 16,776 | 16,164 | — | ||||||||

Trustees’ fees | 13,426 | 13,426 | 13,426 | — | ||||||||

Chief Compliance Officer fees (Note 6) | 5,638 | 5,638 | 5,638 | — | ||||||||

Other fees | 49,708 | 21,120 | 18,374 | — | ||||||||

TOTAL EXPENSES | 16,260,612 | 2,704,507 | 1,493,928 | 23,332 | ||||||||

Less: Waivers by Adviser (Note 4) | (4,492) | (14,952) | (16,414) | — | ||||||||

NET EXPENSES | 16,256,120 | 2,689,555 | 1,477,514 | 23,332 | ||||||||

NET INVESTMENT INCOME | 26,086,559 | 8,047,522 | 278,645 | 234,635 | ||||||||

REALIZED AND UNREALIZED GAIN (LOSS) (Note 3) | ||||||||||||

Net realized gain (loss) on investments | 125,803,838 | 639,798 | 3,624,811 | (263,918) | ||||||||

Redemptions in-kind (Note 8, 10) | 112,039,122 | 31,032,326 | 10,967,657 | — | ||||||||

237,842,960 | 31,672,124 | 14,592,468 | (263,918) | |||||||||

Change in net unrealized appreciation/ depreciation on investments | 444,016,108 | 1,511,842 | (8,138,290) | (221,680) | ||||||||

NET GAIN (LOSS) ON INVESTMENTS | 681,859,068 | 33,183,966 | 6,454,178 | (485,598) | ||||||||

NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | $707,945,627 | $41,231,488 | $6,732,823 | $(250,963) | ||||||||

* Net of foreign taxes and fees withheld of: | $677,733 | $63,173 | $— | $— | ||||||||

18 |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |||||

OPERATIONS | ||||||

Net investment income | $26,086,559 | $41,537,892 | ||||

Net realized gain on investments sold | 237,842,960 | 375,703,830 | ||||

Net change in unrealized appreciation/depreciation of investments | 444,016,108 | 727,255,104 | ||||

NET INCREASE IN NET ASSETS FROM OPERATIONS | 707,945,627 | 1,144,496,826 | ||||

DISTRIBUTIONS TO SHAREHOLDERS | (24,350,445) | (116,601,518) | ||||

CAPITAL TRANSACTIONS | ||||||

Proceeds from shares sold | 187,359,801 | 396,029,979 | ||||

Reinvestment of distributions | 22,405,286 | 107,928,239 | ||||

Cost of shares redeemed(1) | (351,240,319) | (848,771,623) | ||||

DECREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS | (141,475,232) | (344,813,405) | ||||

TOTAL INCREASE IN NET ASSETS: | 542,119,950 | 683,081,903 | ||||

NET ASSETS | ||||||

Beginning of period/year | 5,019,567,567 | 4,336,485,664 | ||||

End of period/year | $5,561,687,517 | $5,019,567,567 | ||||

FUND SHARE TRANSACTIONS | ||||||

Shares sold | 1,188,147 | 2,989,298 | ||||

Shares issued for reinvested distributions | 133,859 | 750,132 | ||||

Shares redeemed | (2,227,948) | (6,379,102) | ||||

NET DECREASE IN FUND SHARES | (905,942) | (2,639,672) | ||||

(1) | Includes redemption in-kind transactions. See additional information contained in Note 10. |

19 |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |||||

OPERATIONS | ||||||

Net investment income | $8,047,522 | $16,001,964 | ||||

Net realized gain on investments sold | 31,672,124 | 67,987,343 | ||||

Net change in unrealized appreciation/depreciation of investments | 1,511,842 | 12,287,382 | ||||

NET INCREASE IN NET ASSETS FROM OPERATIONS | 41,231,488 | 96,276,689 | ||||

DISTRIBUTIONS TO SHAREHOLDERS | (7,730,303) | (28,567,755) | ||||

CAPITAL TRANSACTIONS | ||||||

Proceeds from shares sold | 46,933,922 | 90,864,435 | ||||

Reinvestment of distributions | 7,343,285 | 27,590,465 | ||||

Cost of shares redeemed(1) | (103,608,164) | (186,959,398) | ||||

DECREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS | (49,330,957) | (68,504,498) | ||||

TOTAL DECREASE IN NET ASSETS: | (15,829,772) | (795,564) | ||||

NET ASSETS | ||||||

Beginning of period/year | 780,051,519 | 780,847,083 | ||||

End of period/year | $764,221,747 | $780,051,519 | ||||

FUND SHARE TRANSACTIONS | ||||||

Shares sold | 449,839 | 942,266 | ||||

Shares issued for reinvested distributions | 68,951 | 280,748 | ||||

Shares redeemed | (993,611) | (1,939,662) | ||||

NET DECREASE IN FUND SHARES | (474,821) | (716,648) | ||||

(1) | Includes redemption in-kind transactions. See additional information contained in Note 10. |

20 |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |||||

OPERATIONS | ||||||

Net investment income | $278,645 | $543,198 | ||||

Net realized gain on investments sold | 14,592,468 | 18,060,116 | ||||

Net change in unrealized appreciation/depreciation of investments | (8,138,290) | 14,438,137 | ||||

NET INCREASE IN NET ASSETS FROM OPERATIONS | 6,732,823 | 33,041,451 | ||||

DISTRIBUTIONS TO SHAREHOLDERS | — | (2,235,597) | ||||

CAPITAL TRANSACTIONS | ||||||

Proceeds from shares sold | 21,595,537 | 39,771,850 | ||||

Reinvestment of distributions | — | 2,154,894 | ||||

Cost of shares redeemed(1)(2) | (48,015,669) | (78,441,654) | ||||

DECREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS | (26,420,132) | (36,514,910) | ||||

TOTAL DECREASE IN NET ASSETS: | (19,687,309) | (5,709,056) | ||||

NET ASSETS | ||||||

Beginning of period/year | 331,492,375 | 337,201,431 | ||||

End of period/year | $311,805,066 | $331,492,375 | ||||

FUND SHARE TRANSACTIONS | ||||||

Shares sold | 739,812 | 1,491,770 | ||||

Shares issued for reinvested distributions | — | 74,901 | ||||

Shares redeemed | (1,646,550) | (2,952,723) | ||||

NET DECREASE IN FUND SHARES | (906,738) | (1,386,052) | ||||

(1)Net of redemption fees of: | $2,172 | $2,980 | ||||

(2) | Includes redemption in-kind transactions. See additional information contained in Note 10. |

21 |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |||||

OPERATIONS | ||||||

Net investment income | $234,635 | $333,590 | ||||

Net realized loss on investments sold | (263,918) | (433,270) | ||||

Net change in unrealized appreciation/depreciation of investments | (221,680) | 1,027,136 | ||||

NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | (250,963) | 927,456 | ||||

DISTRIBUTIONS TO SHAREHOLDERS | (220,713) | (335,643) | ||||

CAPITAL TRANSACTIONS | ||||||

Proceeds from shares sold | 2,001,445 | 881,401 | ||||

Cost of shares redeemed | (1,311,264) | (443,918) | ||||

Transaction fees (Note 7) | 3,878 | (1,472) | ||||

INCREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS | 694,059 | 436,011 | ||||

TOTAL INCREASE IN NET ASSETS: | 222,383 | 1,027,824 | ||||

NET ASSETS | ||||||

Beginning of period/year | 18,467,296 | 17,439,472 | ||||

End of period/year | $18,689,679 | $18,467,296 | ||||

FUND SHARE TRANSACTIONS | ||||||

Shares sold | 90,000 | 40,000 | ||||

Shares redeemed | (60,000) | (20,000) | ||||

NET INCREASE IN FUND SHARES | 30,000 | 20,000 | ||||

22 |

Six Months Ended June 30, 2024(2) (Unaudited) | Year Ended December 31, | |||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||

Per Share | ||||||||||||||||||

Net asset value, beginning of year/period | $147.15 | $118.00 | $162.55 | $136.08 | $127.22 | $106.45 | ||||||||||||

Income from investmentoperations: | ||||||||||||||||||

Net investment income | 0.78(3) | 1.18(3) | 1.02(3) | 0.87 | 1.48 | 1.59 | ||||||||||||

Net realized and unrealized gain (loss) | 20.30 | 31.41 | (35.15) | 38.82 | 19.37 | 28.59 | ||||||||||||

Total from investment operations | 21.08 | 32.59 | (34.13) | 39.69 | 20.85 | 30.18 | ||||||||||||

Distributions to shareholders from: | ||||||||||||||||||

Net investment income | (0.74) | (1.22) | (1.01) | (0.91) | (1.45) | (1.58) | ||||||||||||

Net realized gains on investments sold | — | (2.22) | (9.41) | (12.31) | (10.54) | (7.83) | ||||||||||||

Total distributions | (0.74) | (3.44) | (10.42) | (13.22) | (11.99) | (9.41) | ||||||||||||

Net asset value, end of year/period | $167.49 | $147.15 | $118.00 | $162.55 | $136.08 | $127.22 | ||||||||||||

Total investment return (loss) | 14.32% | 27.70% | (21.07)% | 29.27% | 16.67% | 28.39% | ||||||||||||

Net assets, end of year/period, in thousands | $5,561,688 | $5,019,568 | $4,336,486 | $5,950,161 | $4,858,189 | $4,633,937 | ||||||||||||

Ratios/supplemental data: | ||||||||||||||||||

Ratio of expenses to average net assets | 0.62% | 0.64% | 0.63% | 0.61% | 0.64% | 0.65% | ||||||||||||

Ratio of net investment income to average net assets | 0.99 | 0.89 | 0.01 | 0.55 | 1.12(1) | 1.28 | ||||||||||||

Portfolio turnover rate | 5.28(4) | 13.45(4) | 11.04(4) | 13.17 | 14.52 | 10.77 | ||||||||||||

(1) | Ratio revised subsequent to the completion of the annual report dated December 31, 2020 to include immaterial reclass adjustments related to the Fund’s holding of real estate investment trusts. |

(2) | For the six months ended June 30, 2024, all ratios have been annualized except total investment return and portfolio turnover. |

(3) | Per share net investment income was calculated using average shares outstanding. |

(4) | Excludes in-kind transactions associated with redemptions of the Fund. |

23 |

Six Months Ended June 30, 2024(2) (Unaudited) | Year Ended December 31, | |||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||

Per Share | ||||||||||||||||||

Net asset value, beginning of year/period | $101.65 | $93.06 | $116.89 | $105.23 | $99.74 | $86.79 | ||||||||||||

Income from investment operations: | ||||||||||||||||||

Net investment income | 1.09(3) | 2.01(3) | 1.86(3) | 1.68 | 1.98 | 2.13 | ||||||||||||

Net realized and unrealized gain (loss) | 4.48 | 10.28 | (19.21) | 17.42 | 8.10 | 15.39 | ||||||||||||

Total from investment operations | 5.57 | 12.29 | (17.35) | 19.10 | 10.08 | 17.52 | ||||||||||||

Distributions toshareholders from: | ||||||||||||||||||

Net investment income | (1.06) | (2.07) | (1.86) | (1.68) | (1.99) | (2.12) | ||||||||||||

Net realized gains on investments sold | — | (1.63) | (4.62) | (5.76) | (2.60) | (2.45) | ||||||||||||

Total distributions | (1.06) | (3.70) | (6.48) | (7.44) | (4.59) | (4.57) | ||||||||||||

Net asset value, end of year/period | $106.16 | $101.65 | $93.06 | $116.89 | $105.23 | $99.74 | ||||||||||||

Total investment return (loss) | 5.48% | 13.39% | (14.91)% | 18.30% | 10.44% | 20.32% | ||||||||||||

Net assets, end of year/period, in thousands | $764,222 | $780,052 | $780,847 | $1,022,951 | $895,253 | $928,828 | ||||||||||||

Ratios/supplemental data: | ||||||||||||||||||

Ratio of expenses to average net assets | 0.70% | 0.71% | 0.69% | 0.69% | 0.71% | 0.71% | ||||||||||||

Ratio of net investment income to average net assets | 2.09 | 2.08 | 1.81 | 1.45 | 2.01(1) | 2.22 | ||||||||||||

Portfolio turnover rate | 5.77(4) | 11.74(4) | 9.68(4) | 13.00 | 15.96 | 13.60 | ||||||||||||

(1) | Ratio revised subsequent to the completion of the annual report dated December 31, 2020 to include immaterial reclass adjustments related to the Fund’s holding of real estate investment trusts. |

(2) | For the six months ended June 30, 2024, all ratios have been annualized except total investment return and portfolio turnover. |

(3) | Per share net investment income was calculated using average shares outstanding. |

(4) | Excludes in-kind transactions associated with redemptions of the Fund. |

24 |

Six Months Ended June 30, 2024(4) (Unaudited) | Year Ended December 31, | |||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||

Per Share | ||||||||||||||||||

Net asset value, beginning of year/period | $29.15 | $26.43 | $32.69 | $28.15 | $26.41 | $22.48 | ||||||||||||

Income from investment operations: | ||||||||||||||||||

Net investment income | 0.03(5) | 0.05(5) | 0.05(5) | 0.01 | 0.19 | 0.13 | ||||||||||||

Net realized and unrealized gain (loss) | 0.61 | 2.87 | (4.59) | 7.25 | 2.13 | 4.62 | ||||||||||||

Total from investment operations | 0.64 | 2.92 | (4.54) | 7.26 | 2.32 | 4.75 | ||||||||||||

Distributions to shareholders from: | ||||||||||||||||||

Net investment income | — | (0.06) | (0.05) | (0.01) | (0.17) | (0.11) | ||||||||||||

Net realized gains on investments sold | — | (0.14) | (1.67) | (2.71) | (0.41) | (0.71) | ||||||||||||

Redemption fees(1)(2) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

Total distributions | — | (0.20) | (1.72) | (2.72) | (0.58) | (0.82) | ||||||||||||

Net asset value, end of year/period | $29.79 | $29.15 | $26.43 | $32.69 | $28.15 | $26.41 | ||||||||||||

Total investment return (loss) | 2.20% | 11.04% | (13.93)% | 26.00% | 8.78% | 21.13% | ||||||||||||

Net assets, end of year/period, in thousands | $311,805 | $331,492 | $337,201 | $427,257 | $361,594 | $437,300 | ||||||||||||

Ratios/supplemental data: | ||||||||||||||||||

Ratio of net expenses to average net assets | ||||||||||||||||||

Before waivers and reimbursements of expenses | 0.93% | 0.94% | 0.92% | 0.95% | 1.04% | 1.05% | ||||||||||||

After waivers and reimbursements of expenses | 0.94 | 0.94 | 0.92 | 0.95 | 1.04 | 1.05 | ||||||||||||

Ratio of net investment income to average net assets | ||||||||||||||||||

Before waivers and reimbursements of expenses | 0.19 | 0.17 | 0.18 | 0.02 | 0.58(3) | 0.48 | ||||||||||||

After waivers and reimbursements of expenses | 0.18 | 0.17 | 0.18 | 0.02 | 0.58(3) | 0.48 | ||||||||||||

Portfolio turnover rate | 7.66(6) | 19.05(6) | 19.81(6) | 21.45 | 16.39 | 15.07 | ||||||||||||

(1) | The Fund charges a 1.00% redemption fee on shares held 180 days or less. |

(2) | Amount per share is less than $0.005. |

(3) | Ratio revised subsequent to the completion of the annual report dated December 31, 2020 to include immaterial reclass adjustments related to the Fund’s holding of real estate investment trusts. |

(4) | For the six months ended June 30, 2024, all ratios have been annualized except total investment return and portfolio turnover. |

(5) | Per share net investment income was calculated using average shares outstanding. |

(6) | Excludes in-kind transactions associated with redemptions of the Fund. |

25 |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, | Period Ended December 31, 2021(1) | ||||||||||

2023 | 2022 | |||||||||||

Per Share | ||||||||||||

Net asset value, beginning of year/period | $22.52 | $21.80 | $25.16 | $25.00 | ||||||||

Income from investment operations: | ||||||||||||

Net investment income(2) | 0.28 | 0.40 | 0.29 | 0.18 | ||||||||

Net realized and unrealized gain (loss) | (0.55) | 0.72 | (3.36) | 0.14 | ||||||||

Total from investment operations | (0.27) | 1.12 | (3.07) | 0.32 | ||||||||

Distributions to shareholders from: | ||||||||||||

Net investment income | (0.26) | (0.40) | (0.29) | (0.16) | ||||||||

Total distributions | (0.26) | (0.40) | (0.29) | (0.16) | ||||||||

Net asset value, end of year/period | $21.99 | $22.52 | $21.80 | $25.16 | ||||||||

Total investment return, at NAV(3)(4) | (1.22)% | 5.26% | (12.20)% | 1.29% | ||||||||

Total investment return, at Market(3)(4) | (1.41)% | 5.41% | (12.27)% | 1.32% | ||||||||

Net assets, end of year/period, in thousands | $18,690 | $18,467 | $17,439 | $ 18,619 | ||||||||

Ratios/supplemental data: | ||||||||||||

Ratio of expenses to average net assets(5) | 0.25% | 0.34%(6) | 0.39% | 0.39% | ||||||||

Ratio of net investment income to average net assets(5) | 2.51 | 1.85 | 1.33 | 0.88 | ||||||||

Portfolio turnover rate(4)(7) | 21.27 | 26.84 | 17.81 | 2.54 | ||||||||

(1) | The Fund commenced investment operations on March 11, 2021. |

(2) | Per share net investment income was calculated using average shares outstanding. |

(3) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(4) | Not annualized for periods less than one year. |

(5) | Annualized for periods less than one year. |

(6) | Effective September 1, 2023, the management fee was lowered to 0.25% from 0.39%. |

(7) | Excludes in-kind transations associated with creations and redemptions of the Fund. |

26 |

27 |

| Level 1 – | Quoted prices in active markets for identical securities. |

| Level 2 – | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

Growth Fund | Balanced Fund | Small Cap Fund | Minnesota ETF | |||||||||

Level 1* | $5,558,131,711 | $493,563,764 | $311,997,521 | $643,194 | ||||||||

Level 2** | — | 267,655,530 | — | 18,366,594 | ||||||||

Level 3 | — | — | — | — | ||||||||

Total | $5,558,131,711 | $761,219,294 | $311,997,521 | $19,009,788 | ||||||||

| * | All Level 1 investments are equity securities (common stocks and preferred stocks) and short-term investments. |

| ** | All Level 2 investments are fixed income securities. |

28 |

29 |

Growth Fund | Balanced Fund | Small Cap Fund | |||||||

Cost of investments | $2,407,786,979 | $572,740,255 | $238,366,281 | ||||||

Gross unrealized appreciation | $2,645,883,088 | $235,883,557 | $112,493,240 | ||||||

Gross unrealized depreciation | (37,429,627) | (32,711,525) | (19,133,639) | ||||||

Net unrealized appreciation | 2,608,453,461 | 203,172,032 | 93,359,601 | ||||||

Undistributed ordinary income | 651,937 | — | — | ||||||

Undistributed long-term capital gains | 53,329,948 | — | — | ||||||

Distributable earnings | 53,981,885 | — | — | ||||||

Other accumulated earnings | — | — | (301,170) | ||||||

Total distributable earnings | $2,662,435,346 | $203,172,032 | $93,058,431 | ||||||

Year ended December 31, 2023 Distributions paid from: | Growth Fund | Balanced Fund | Small Cap Fund | ||||||

Ordinary income | $41,862,078 | $16,211,476 | $642,561 | ||||||

Long-term capital gains | 74,739,440 | 12,356,279 | 1,593,036 | ||||||

Total distributions paid | $116,601,518 | $28,567,755 | $ 2,235,597 | ||||||

Year ended Dec ember 31, 2022 Distributions paid from: | Growth Fund | Balanced Fund | Small Cap Fund | ||||||

Ordinary income | $35,434,587 | $15,541,461 | $565,335 | ||||||

Long-term capital gains | 323,569,156 | 37,460,751 | 20,298,445 | ||||||

Total distributions paid | $359,003,743 | $53,002,212 | $20,863,780 | ||||||

30 |

Total Distributable Earnings | Paid in Capital | |||||

Growth Fund | $(273,766,318) | $273,766,318 | ||||

Balanced Fund | (61,567,351) | 61,567,351 | ||||

Small Cap Fund | (18,168,629) | 18,168,629 | ||||

Cost of investments for tax purposes | $19,296,939 | ||

Gross tax unrealized appreciation | $177,169 | ||

Gross tax unrealized depreciation | (1,238,525) | ||

Net tax unrealized depreciation | $(1,061,356) | ||

Undistributed ordinary income | $16,464 | ||

Other accumulated losses | (782,150) | ||

Unrealized depreciation on investments | (1,585,834) | ||

Total distributable earnings | $(2,351,520) | ||

Period ended November 30, 2023 Distributions paid from: | |||

Ordinary income | $13,386 | ||

Tax-exempt income | 299,990 | ||

Long-term capital gains | — | ||

Total distributions paid | $313,376 | ||

Period ended November 30, 2022 Distributions paid from: | |||

Ordinary income | $2,453 | ||

Tax-exempt income | 223,112 | ||

Long-term capital gains | — | ||

Total distributions paid | $225,565 | ||

31 |

Growth Fund | Balanced Fund | Small Cap Fund | |||||||

Up to $2.5 Billion | 0.60% | 0.60% | 0.80% | ||||||

Over $2.5 Billion | 0.50% | 0.60% | 0.80% | ||||||

32 |

Administration | Incurred | Owed | ||||

Mairs & Power Growth Fund | $379,998 | $92,007 | ||||

Mairs & Power Balanced Fund | 67,064 | 19,942 | ||||

Mairs & Power Small Cap Fund | 30,890 | 9,231 | ||||

Accounting | Incurred | Owed | ||||

Mairs & Power Growth Fund | $251,946 | $62,290 | ||||

Mairs & Power Balanced Fund | 56,744 | 17,785 | ||||

Mairs & Power Small Cap Fun | 17,684 | 5,629 | ||||

Transfer Agent | Incurred(1) | Owed | ||||

Mairs & Power Growth Fund | $394,422 | $92,397 | ||||

Mairs & Power Balanced Fund | 57,144 | 17,073 | ||||

Mairs & Power Small Cap Fund | 28,104 | 8,198 | ||||

(1) | These amounts do not include sub-transfer agency fees, therefore they do not agree to the amounts referenced on the Statement of Operations. |

Custody | Incurred | Owed | ||||

Mairs & Power Growth Fund | $127,762 | $29,816 | ||||

Mairs & Power Balanced Fund | 21,762 | 6,515 | ||||

Mairs & Power Small Cap Fund | 9,898 | 3,240 | ||||

Chief Compliance Officer | Incurred | Owed | ||||

Mairs & Power Growth Fund | $ 5,638 | $ 1,892 | ||||

Mairs & Power Balanced Fund | 5,638 | 1,892 | ||||

Mairs & Power Small Cap Fund | 5,638 | 1,890 | ||||

33 |

Purchases | Sales | |||||

Growth Fund | $278,463,240 | $295,051,286(a) | ||||

Balanced Fund | 44,041,113 | 53,283,830(a) | ||||

Small Cap Fund | 24,411,769 | 35,017,236(a) | ||||

Minnesota ETF | 4,136,699 | 3,843,097 | ||||

(a) | Sales exclude redemptions in-kind of $121,863,592, $38,202,435, and $15,561,650 for the Growth Fund, Balanced Fund and Small Cap Fund, respectively. See Note 10. |

34 |

Fund | Date Range | Value of Cash and Securities Sold | Shares Sold | ||||||

Growth Fund | January 2024-June 2024 | $121,863,592 | 803,026 | ||||||

Balanced Fund | January 2024-June 2024 | 38,202,435 | 375,504 | ||||||

Small Cap Fund | January 2024-June 2024 | 15,561,650 | 580,936 | ||||||

35 |

Record Date | Ex-Date | Reinvestment Date/Payable Date | Ordinary Income Rate | Ordinary Income Distribution Paid | ||||||||

7/25/2024 | 7/25/2024 | 7/31/2024 | $0.05447300 | $46,302 | ||||||||

8/26/2024 | 8/26/2024 | 8/30/2024 | $0.04394444 | $41,308 | ||||||||

36 |

(via Regular Mail) c/o U.S. Bancorp Fund Services, LLC 615 East Michigan Street P. O. Box 701 Milwaukee, WI 53201-0701 | (via Overnight or Express Mail) c/o U.S. Bancorp Fund Services, LLC 3rd Floor 615 East Michigan Street Milwaukee, WI 53202-0701 | ||

| (b) | Financial Highlights are included within the financial statements filed under Item 7(a) of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

This information is included within the financial statements filed under Item 7(a) of this Form.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s Principal Executive and Principal Financial Officer have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable

Item 19. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable. |

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant's securities are listed. Not applicable.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable.

(5) Change in the registrant’s independent public accountant. Provide the information called for by Item 4 of Form 8-K under the Exchange Act (17 CFR 249.308). Unless otherwise specified by Item 4, or related to and necessary for a complete understanding of information not previously disclosed, the information should relate to events occurring during the reporting period. Not applicable.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Trust for Professional Managers |

| By (Signature and Title)* | /s/ John Buckel | ||

| John Buckel, Principal Executive |

| Date | 8/29/2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ John Buckel | ||

| John Buckel, Principal Executive | |||

| Date | 8/29/2024 |

| By (Signature and Title)* | /s/ Jennifer Lima | ||

| Jennifer Lima, Principal Financial Officer |

| Date | 8/29/2024 |

* Print the name and title of each signing officer under his or her signature.